ABSTRACT

There is a saying in Myanmar that “Rice, Edible oil and Salt” are the three essential food items for living. This highlights the imperative role that edible oil self-sufficient plays in Myanmar people’s daily consumption. To meet the increasing demand of qualified edible oil, it is necessary to conduct market research based on types, brands, prices and consumer preferences. All types of markets such as urban wet market, village wet market and shopping centers can be easily found within Nay Pyi Taw, the focal market area of the Myanmar. Therefore, this research aims to investigate different types and brands of edible oils in the market with their current prices in Nay Pyi Taw and to find out the most popular edible oil types and brands in Nay Pyi Taw in terms of quality and price. To get the required market information from the selected markets, both sellers and buyers were asked a structural questionnaire by using simple random sampling method. Based on types of edible oils, eleven types of edible oils in total including domestic and international products can be found in the markets. Based on brands of edible oils, there are seven local brands and one traditionally grounded oil without brand for domestically produced peanut oil, one domestic brand, one imported brand and one traditionally grounded oil with untitled brand for sesame oil, eight different brands for imported sunflower oil and one traditionally grounded sunflower oil, three brands for imported soybean oil, five various brands for imported vegetable oil and seven brands with labels for imported palm oil in both wet market and supermarket. Prices can be varied from US$1.19/kg to US$ 3.72/kg (1viss=1.63kg) for the common types and brands of edible oils in the market. In addition to this major types and brands of edible oils in Nay Pyi Taw, minor imported edible oil types such as canola oil, corn oil, grape oil, coconut oil and olive oil with different brands can also be seen in the supermarket with higher prices rather than ever. Surprisingly, in the wet market, different proportions of mixed palm oil with other unknown edible oil within a container without describing any label and quality contents are available and become major consumption type based on its affordable price. However, domestically produced peanut and sesame oils are the most popular edible oil types among the consumers in terms of quality and health. This study strongly recommended to continue a nationwide edible oil market research that would help the authorities to make effective trade policies and to enhance strict rules and regulations on quality control leading to a straightforward movement of edible oil sector in Myanmar.

Keywords: edible oil, market, types, brands, prices, consumer preference, Nay Pyi Taw

INTRODUCTION

Overview of Myanmar’s edible oil market

In Myanmar, several types of cooking oil have been sold and bought in the market with different brands, various colors, flavors and quality and diverse prices. This is because edible oil is the second most important food item after rice for various purposes such as cooking, frying, sautéing, dressing and so on according to the daily consumption pattern of the people in Myanmar. Some of the edible oils in different types of markets are domestically produced but some are imported ones from foreign countries.

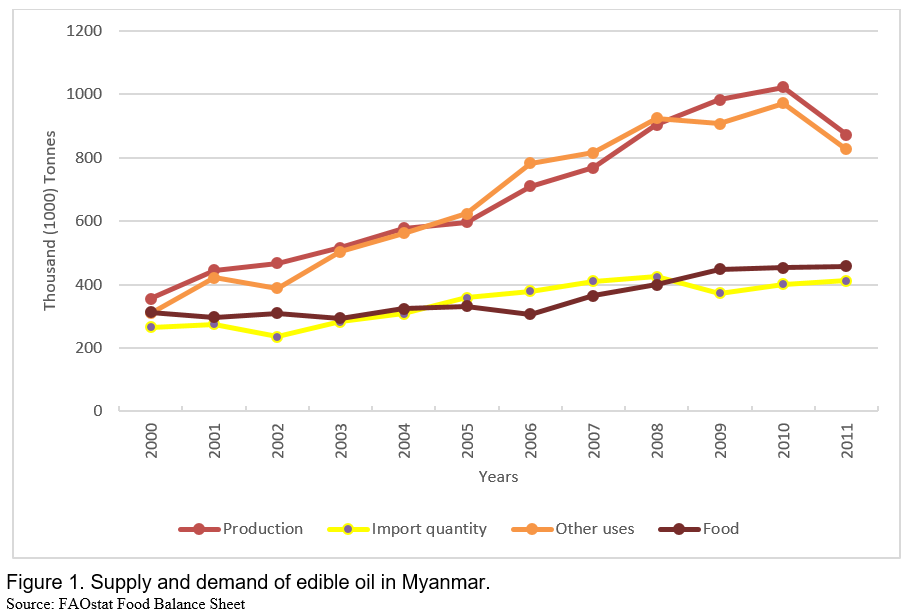

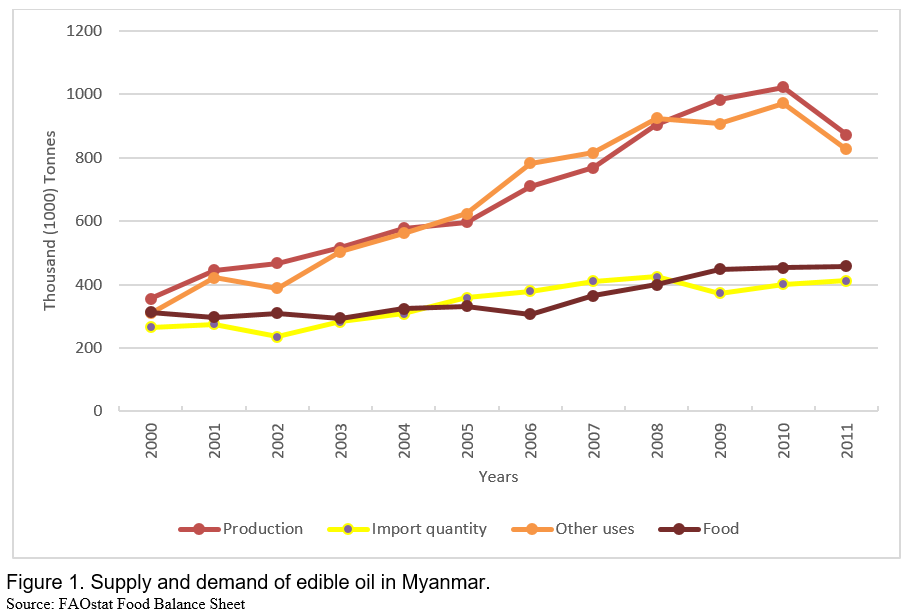

Domestically produced edible oils in Myanmar mainly come from groundnuts, sesame seeds and sunflower seeds that help supply for local consumption (Wijnands J.H.M. et al., 2014). Groundnut and sesame are the most popular oilseed crops in the central dry zone and other parts of the country, and it takes almost 73 % and 16 % of total oil seed crop production in Myanmar, respectively (DOA, 2020). However, the local demand for edible oil has been increasing yearly and there is a need to import different types of edible oils to meet the national edible oil requirement. It can be clearly seen in Figure 1 that the production and importation of edible oils had almost doubled from 2000 to 2011 and also the consumption had gradually increased during the period.

Among the imported edible oils, palm oil accounts for the largest share in the edible oil market in Myanmar. Other types of oils are also imported but plays a minor role. Cheaper palm oil is imported from neighboring countries, mainly from Malaysia (Thaung, 2011). According to the average world import prices 2011-2013, peanut oil is twice, and sesame oil is even four times higher than the palm oil price in the world market. In other words, two tons of palm oil can be imported for each ton of exported groundnut oil and four tons of palm oil can be imported for each ton of exported sesame oil, respectively (Wijnands J.H.M. et al., 2014). Therefore, how many types of edible oils are in the market and how much individual brand and type cost become an interesting issue in Myanmar that is why there is a need to do market research for edible oils in Nay Pyi Taw as a preliminary study.

Objectives of the Study

- To investigate different types and brands of edible oils in the market with their current prices in Nay Pyi Taw, Myanmar.

- To find out the most popular edible oil types and brands in Nay Pyi Taw in terms of consumer preferences.

METHODOLOGY

Selection of study area

Types, brands, and market prices of edible oils can differ from each state and region in Myanmar. In this study, Nay Pyi Taw was selected as the preliminary survey area since it is the central market area of Myanmar. Logistics and transportation systems of goods and services in that area is unique streaming from having different modes of transport that lead to availability of a wide range of edible oil types and brands at reasonable price ratio. Additionally, there are different types of households such as urban and rural households which could be representative of the whole study area.

Sampling method

The whole study was based on primary data by conducting market survey. Simple random sampling method was used to collect the required market information from the selected markets in Nay Pyi Taw. Yezin Agricultural University research team had interviewed with various sellers and buyers to get the information about different types of edible oils in the market, their brand names and packaging, current unit price and their popularity among the consumers by using a structured questionnaire. The selected markets were divided into two types such as conventional market, namely, Thapyaykone urban wet market and Yezin village wet market and supermarket, namely, Ocean shopping center.

Data collection and data analysis

The market survey data were collected on 22nd June in 2021. Face to face interview method was used during the survey for individual edible oil sellers and buyers. A structured questionnaire was used for the market survey in order to get complete set of information. To meet the objective (1) the survey questionnaire included edible oil types, specific brand names and current market price. To investigate the objective (2) the information like origin of the product (e.g, domestically produced edible oil or imported edible oil) and consumer preference were surveyed. For data analysis, the collected data were digitally aggregated and analyzed via Microsoft Excel to get the results. It is notable that the unit price for edible oil market study is shown as US$/kg to meet international unit system. The average exchange rate of during the study period is 1,650 MMK/US$.

RESULTS AND DISCUSSION

Types and brands of edible oils in different markets in Nay Pyi Taw

According to market survey for edible oils in Nay Pyi Taw, there are 11 types of edible oils in total with different brands (Table 1). Most of them are imported from other countries. Only three types of domestically produced edible oils including peanut oil, sesame oil and sunflower oil can be found in both wet market and supermarket with different brand names. Among them, peanut oil can be assumed as the most common one for local edible oil mills because it is the only domestically produced edible oil type that can be found widely in the market – eight peanut oil brands in total - four brands in the conventional market and four brands in the supermarket. A May Htwar brand is the most popular brand selling in both types of market, but other remaining brands are not of the same availability. Consumers can also buy traditionally grounded peanut oil as domestically produced peanut oil, which is called “Sone Si” in Myanmar language, only in the wet market with no brand, no label and no quality checking. Buying and selling of it is only based on trust. However, there is no imported peanut oil in these two types of market.

As for domestically produced sesame oil, there is only traditionally grounded sesame oil with no brand and no label in the wet market and only one local brand, Yangon pure sesame oil in the supermarket. There is only one imported pure sesame oil to Myanmar called “Woh Hup” commercially which is a product of Singapore. For sunflower oil type, traditionally grounded sunflower oil with no brand and no packaging can only be bought in the wet market and no local brand can be found in the supermarket. On the other hand, several brands of imported sunflower oil from different origins can be seen in the market as shown in Table 1. Meizan, Cook and Sunar brands are three common brands that are available in both wet market and supermarket.

For soybean oil, vegetable oil and palm oil, these are well-known edible oil types in the Myanmar edible oil market. Surprisingly, there is no domestically produced oil for these types of edible oils in both wet markets and supermarkets. However, it could easily be found for imported soybean oil, vegetable oil and palm oil in the market with several brands, logo, and packaging styles to attract more consumers aiming to get a high sale. For imported soybean oil, two brands in the wet market and three brands in the supermarket are obtainable. As for imported vegetable oil, five brands in total can be seen in the wet market, but there are only two brands of that type of oil in the supermarket. As for imported palm oil, it is the most common edible oil type in the wet market that counts for six brands with systematic packaging style with labels and FDA certificate. In addition to branded palm oil, some shops are selling and buying palm oil without any brand in the wet market which are mixed with other unknown edible oils at different ratio within a container without any product description, label, and quality contents. Plastic bags and plastic bottles are the main packaging tools and traditional measuring cups (based on tical) are common one for selling it. In supermarkets, only two brands of palm oil are available including proper labeling methods.

The remaining five types of edible oil, namely, canola oil, corn oil, grape oil, coconut oil and olive oil are minor imported edible oil types. They are hardly ever seen in the wet market. They are all imported from foreign countries in different brand names and could be found in the supermarket only.

Prices of edible oil in different markets in Nay Pyi Taw

Price is assumed as one of the important factors that can affect the market demand of edible oil. Different types of edible oil prices can be varied because of cost of production, quality of product, packaging style and place of each market. For peanut oil, there is no foreign brand to compare the price with domestically produced peanut oil in the market. In both types of market, the highest price among local edible oil product for peanut oil is A May Htwar, but the price of it in supermarket is US$0.15/kg higher than it in the wet market. Other brands in the supermarket have a little price variation compared to other brands, but in the wet market, prices of individual brand are significantly diverse ranging from US$1.49/kg to US$3.57/kg. Traditionally grounded peanut oil that can only be found in the wet market is the second highest price.

For domestically produced sesame oil, only traditionally grounded oil is found in the wet market and that price is higher than the local branded sesame oil in the supermarket. No imported sesame oil can be found in the wet market, but in supermarkets, there is the only one imported brand from Singapore. The price of that brand is almost three times higher than the domestically produced sesame oil may be because of its unique quality. For sunflower oil, in local, even though traditionally grounded sunflower oil with no brand and labels is the only one which is available in the wet market, the price of it is the highest among all domestically produced edible oil types US$3.72/kg. On the other side, for imported sunflower oil, the price can be ranged from US$2.60/kg to US$2.98/kg for five brands in the wet market and from US$2.71/kg to US$3.35/kg for six brands in the shopping center.

The remaining types of edible oil such as soybean oil, vegetable oil, palm oil and other minor oil types are imported from foreign countries and their prices differ from each other according to the brands and other factors. Two brands of soybean oil prices in the wet market are around US$2.60/kg while three different brands of that prices in the supermarket are quite varied as low price US$2.34/kg, medium price US$2.57/kg and high price US$2.83/kg, respectively. Other types of commercially imported edible oil in Nay Pyi Taw are vegetable oil and palm oil because of their inexpensive price in the market. They are notably cheaper compared to other commercial brands and types of edible oils, and they are widely found only in the wet market. In terms of average price in both types of market, vegetable oil in the market is US$0.89/kg cheaper than peanut oil, US$1.26/kg cheaper than sesame oil, US$0.93/kg cheaper than sunflower oil, US$0.54/kg cheaper than soybean oil. Similarly, for palm oil, in terms of average price in both types of markets, the price of it is US$1.38/kg cheaper than peanut oil, US$1.76/kg cheaper than sesame oil, US$1.43/kg cheaper than sunflower oil, US$1.04/kg cheaper than soybean oil, US$0.49/kg cheaper than vegetable oil.

Continuously, the individual price of minor imported edible oils with few brands in the market except canola oil and corn oil are considerably higher than the major cooking oil types. Price of canola oil is almost the same compared to domestically produced sunflower oil while corn oil is almost the same price to domestically produced peanut oil and sesame oil. In contrast, grape oil is nearly twice of the domestically produced sesame oil price while coconut oil price is three times higher than the domestically produced sunflower oil price. Last but not the least, olive oil price is almost four times of imported vegetable oil supermarket price.

All in all, in edible oil market in Myanmar, the average price of sesame oil is the highest whereas the average price of palm oil is the lowest compared to the common types and brands. Nevertheless, there may have been some variations of price resulting from the quality, packaging style and place of market whether in the wet market or supermarket in Nay Pyi Taw.

Consumer Preference in Terms of Quality and Price on Different Types of Edible Oil

Investigating consumer preferences is one of the essential indicators in the market survey of edible oil. Different types of consumers have their own behavior and preferences on different types and brands of edible oil based on quality and prices of the product. Generally, these choices are rooted from whether consumers have basic health care knowledge about current edible oil consumption or not and whether current price of edible oil prices are reasonable or not for individual household.

In this study in Nay Pyi Taw, nearly half of the household members who take main responsibility for meals in the survey area would like to choose the domestically produced peanut oil for its better taste and good health. This means the domestically produced peanut oil is the most preferable edible oil in terms of quality among consumers and it accounts for almost 55% in total. However, not all the people who love using peanut oil as a cooking oil can afford to buy because of its premium price. Only 36% could meet the demand for the domestically produced edible oil. The rest of them have been relying on imported vegetable oil and palm oil in terms of affordable price resulting from their income.

CONCLUSION AND RECOMMENDATION

This study tries to approach the current edible oil market condition in Nay Pyi Taw by finding out a wide variety of edible oil with different brands including local and international brands with their relative prices in June 2021. The market survey resulted in the information that the community in the study area has been facing insufficient edible oil based on their preferences though there are sufficient edible oilseed crops sowing areas across the country. They all have to mainly depend on imported oils such as vegetable oil and palm oil in terms of price though they would like to consume the domestically produced peanut oil and sesame oil in terms of quality. In addition, some types of imported oil, especially palm oil has been sold mixing with unknown edible oils at different ratio in the wet market without any brand and quality information. Most of the respondents who come from low-income families are consuming such types of mixed palm oil in the wet market as daily cooking oil. Some of them are making a choice more than one type of edible, for example, using both peanut oil and palm oil as a cooking oil within a household. However, the domestically produced peanut oil is the priority among the government staff in Nay Pyi Taw.

According to the results of the market study, Myanmar’s edible oil market should be developed in many ways. First, the existing laws related to trading should be reinforced and new rules and regulations for quality control and checking should be enhanced so that edible oil consumers would get the exact quality that they have bought from the market with the representative prices. Second, it is also responsible to deliver health education about production and consumption of edible oil to producers, distributors and consumers concerning quality control and its related issues of edible oil. Third, all authorities not only from agricultural institutions but also from other related organizations should put a collective effort to produce healthy and safe domestic edible oil using systematic procedure and protocol. Fourth, farmers should be supported with good quality seeds, high-yielding, and climate resilient varieties of edible oilseed crops in order to fulfill the local requirement of edible oil. Besides the major oilseed crops such as groundnut and sesame, the cultivation area for other promising edible oilseed crops such as soybean, sunflower, niger, mustard, safflower and palm tree should also be increased leading to edible oil self-sufficiency in Myanmar. Last but not the least, there is a need to carry out government intervention for attaining raw materials, for running the factory and milling industry with required facilities, equipment, and updated technologies for distributing and transporting the final product into the market according to the Food and Drug Administration Law. Therefore, all stakeholders in Myanmar’s edible oil sector should be all inclusive for accomplishing the domestic edible oil requirement in the future.

To conclude, the government and all stakeholders in Myanmar’s edible oilseed crops production, value-addition and distribution sector should pay attention to the current circumstances of edible oil market conditions in Nay Pyi Taw and take actions for better improvement. On the other hand, nationwide edible oil market research is deeply recommended for obtaining strong and valid results that can help support in the decision-making process for the development of Myanmar’s edible oil sector.

REFERENCES

DOA. 2020, Data Records from Department of Agriculture (DOA), Ministry of Agriculture, Livestock and Irrigation, Nay Pyi Taw, Myanmar.

Thaung, N. N, 2011, Integration of Myanmar Domestic Agricultural Marketing into ASEAN. Journal of Management Policy and Practice: Vol-12(5), 99-101.

Wijnands J.H.M., J. Biersteker, L.F. Hagedoorn and J. Louisse, 2014, Business opportunities and food safety of the Myanmar edible oil sector, Wageningen, LEI Wageningen UR (University & Research centre), LEI Report 2014-036. 94 pp, 26 fig, 31 tab, 55 ref, 1 map

Edible oil in the Market, Nay Pyi Taw, Myanmar: Types, Brands, Market Prices and Consumer Preferences

ABSTRACT

There is a saying in Myanmar that “Rice, Edible oil and Salt” are the three essential food items for living. This highlights the imperative role that edible oil self-sufficient plays in Myanmar people’s daily consumption. To meet the increasing demand of qualified edible oil, it is necessary to conduct market research based on types, brands, prices and consumer preferences. All types of markets such as urban wet market, village wet market and shopping centers can be easily found within Nay Pyi Taw, the focal market area of the Myanmar. Therefore, this research aims to investigate different types and brands of edible oils in the market with their current prices in Nay Pyi Taw and to find out the most popular edible oil types and brands in Nay Pyi Taw in terms of quality and price. To get the required market information from the selected markets, both sellers and buyers were asked a structural questionnaire by using simple random sampling method. Based on types of edible oils, eleven types of edible oils in total including domestic and international products can be found in the markets. Based on brands of edible oils, there are seven local brands and one traditionally grounded oil without brand for domestically produced peanut oil, one domestic brand, one imported brand and one traditionally grounded oil with untitled brand for sesame oil, eight different brands for imported sunflower oil and one traditionally grounded sunflower oil, three brands for imported soybean oil, five various brands for imported vegetable oil and seven brands with labels for imported palm oil in both wet market and supermarket. Prices can be varied from US$1.19/kg to US$ 3.72/kg (1viss=1.63kg) for the common types and brands of edible oils in the market. In addition to this major types and brands of edible oils in Nay Pyi Taw, minor imported edible oil types such as canola oil, corn oil, grape oil, coconut oil and olive oil with different brands can also be seen in the supermarket with higher prices rather than ever. Surprisingly, in the wet market, different proportions of mixed palm oil with other unknown edible oil within a container without describing any label and quality contents are available and become major consumption type based on its affordable price. However, domestically produced peanut and sesame oils are the most popular edible oil types among the consumers in terms of quality and health. This study strongly recommended to continue a nationwide edible oil market research that would help the authorities to make effective trade policies and to enhance strict rules and regulations on quality control leading to a straightforward movement of edible oil sector in Myanmar.

Keywords: edible oil, market, types, brands, prices, consumer preference, Nay Pyi Taw

INTRODUCTION

Overview of Myanmar’s edible oil market

In Myanmar, several types of cooking oil have been sold and bought in the market with different brands, various colors, flavors and quality and diverse prices. This is because edible oil is the second most important food item after rice for various purposes such as cooking, frying, sautéing, dressing and so on according to the daily consumption pattern of the people in Myanmar. Some of the edible oils in different types of markets are domestically produced but some are imported ones from foreign countries.

Domestically produced edible oils in Myanmar mainly come from groundnuts, sesame seeds and sunflower seeds that help supply for local consumption (Wijnands J.H.M. et al., 2014). Groundnut and sesame are the most popular oilseed crops in the central dry zone and other parts of the country, and it takes almost 73 % and 16 % of total oil seed crop production in Myanmar, respectively (DOA, 2020). However, the local demand for edible oil has been increasing yearly and there is a need to import different types of edible oils to meet the national edible oil requirement. It can be clearly seen in Figure 1 that the production and importation of edible oils had almost doubled from 2000 to 2011 and also the consumption had gradually increased during the period.

Among the imported edible oils, palm oil accounts for the largest share in the edible oil market in Myanmar. Other types of oils are also imported but plays a minor role. Cheaper palm oil is imported from neighboring countries, mainly from Malaysia (Thaung, 2011). According to the average world import prices 2011-2013, peanut oil is twice, and sesame oil is even four times higher than the palm oil price in the world market. In other words, two tons of palm oil can be imported for each ton of exported groundnut oil and four tons of palm oil can be imported for each ton of exported sesame oil, respectively (Wijnands J.H.M. et al., 2014). Therefore, how many types of edible oils are in the market and how much individual brand and type cost become an interesting issue in Myanmar that is why there is a need to do market research for edible oils in Nay Pyi Taw as a preliminary study.

Objectives of the Study

METHODOLOGY

Selection of study area

Types, brands, and market prices of edible oils can differ from each state and region in Myanmar. In this study, Nay Pyi Taw was selected as the preliminary survey area since it is the central market area of Myanmar. Logistics and transportation systems of goods and services in that area is unique streaming from having different modes of transport that lead to availability of a wide range of edible oil types and brands at reasonable price ratio. Additionally, there are different types of households such as urban and rural households which could be representative of the whole study area.

Sampling method

The whole study was based on primary data by conducting market survey. Simple random sampling method was used to collect the required market information from the selected markets in Nay Pyi Taw. Yezin Agricultural University research team had interviewed with various sellers and buyers to get the information about different types of edible oils in the market, their brand names and packaging, current unit price and their popularity among the consumers by using a structured questionnaire. The selected markets were divided into two types such as conventional market, namely, Thapyaykone urban wet market and Yezin village wet market and supermarket, namely, Ocean shopping center.

Data collection and data analysis

The market survey data were collected on 22nd June in 2021. Face to face interview method was used during the survey for individual edible oil sellers and buyers. A structured questionnaire was used for the market survey in order to get complete set of information. To meet the objective (1) the survey questionnaire included edible oil types, specific brand names and current market price. To investigate the objective (2) the information like origin of the product (e.g, domestically produced edible oil or imported edible oil) and consumer preference were surveyed. For data analysis, the collected data were digitally aggregated and analyzed via Microsoft Excel to get the results. It is notable that the unit price for edible oil market study is shown as US$/kg to meet international unit system. The average exchange rate of during the study period is 1,650 MMK/US$.

RESULTS AND DISCUSSION

Types and brands of edible oils in different markets in Nay Pyi Taw

According to market survey for edible oils in Nay Pyi Taw, there are 11 types of edible oils in total with different brands (Table 1). Most of them are imported from other countries. Only three types of domestically produced edible oils including peanut oil, sesame oil and sunflower oil can be found in both wet market and supermarket with different brand names. Among them, peanut oil can be assumed as the most common one for local edible oil mills because it is the only domestically produced edible oil type that can be found widely in the market – eight peanut oil brands in total - four brands in the conventional market and four brands in the supermarket. A May Htwar brand is the most popular brand selling in both types of market, but other remaining brands are not of the same availability. Consumers can also buy traditionally grounded peanut oil as domestically produced peanut oil, which is called “Sone Si” in Myanmar language, only in the wet market with no brand, no label and no quality checking. Buying and selling of it is only based on trust. However, there is no imported peanut oil in these two types of market.

As for domestically produced sesame oil, there is only traditionally grounded sesame oil with no brand and no label in the wet market and only one local brand, Yangon pure sesame oil in the supermarket. There is only one imported pure sesame oil to Myanmar called “Woh Hup” commercially which is a product of Singapore. For sunflower oil type, traditionally grounded sunflower oil with no brand and no packaging can only be bought in the wet market and no local brand can be found in the supermarket. On the other hand, several brands of imported sunflower oil from different origins can be seen in the market as shown in Table 1. Meizan, Cook and Sunar brands are three common brands that are available in both wet market and supermarket.

For soybean oil, vegetable oil and palm oil, these are well-known edible oil types in the Myanmar edible oil market. Surprisingly, there is no domestically produced oil for these types of edible oils in both wet markets and supermarkets. However, it could easily be found for imported soybean oil, vegetable oil and palm oil in the market with several brands, logo, and packaging styles to attract more consumers aiming to get a high sale. For imported soybean oil, two brands in the wet market and three brands in the supermarket are obtainable. As for imported vegetable oil, five brands in total can be seen in the wet market, but there are only two brands of that type of oil in the supermarket. As for imported palm oil, it is the most common edible oil type in the wet market that counts for six brands with systematic packaging style with labels and FDA certificate. In addition to branded palm oil, some shops are selling and buying palm oil without any brand in the wet market which are mixed with other unknown edible oils at different ratio within a container without any product description, label, and quality contents. Plastic bags and plastic bottles are the main packaging tools and traditional measuring cups (based on tical) are common one for selling it. In supermarkets, only two brands of palm oil are available including proper labeling methods.

The remaining five types of edible oil, namely, canola oil, corn oil, grape oil, coconut oil and olive oil are minor imported edible oil types. They are hardly ever seen in the wet market. They are all imported from foreign countries in different brand names and could be found in the supermarket only.

Prices of edible oil in different markets in Nay Pyi Taw

Price is assumed as one of the important factors that can affect the market demand of edible oil. Different types of edible oil prices can be varied because of cost of production, quality of product, packaging style and place of each market. For peanut oil, there is no foreign brand to compare the price with domestically produced peanut oil in the market. In both types of market, the highest price among local edible oil product for peanut oil is A May Htwar, but the price of it in supermarket is US$0.15/kg higher than it in the wet market. Other brands in the supermarket have a little price variation compared to other brands, but in the wet market, prices of individual brand are significantly diverse ranging from US$1.49/kg to US$3.57/kg. Traditionally grounded peanut oil that can only be found in the wet market is the second highest price.

For domestically produced sesame oil, only traditionally grounded oil is found in the wet market and that price is higher than the local branded sesame oil in the supermarket. No imported sesame oil can be found in the wet market, but in supermarkets, there is the only one imported brand from Singapore. The price of that brand is almost three times higher than the domestically produced sesame oil may be because of its unique quality. For sunflower oil, in local, even though traditionally grounded sunflower oil with no brand and labels is the only one which is available in the wet market, the price of it is the highest among all domestically produced edible oil types US$3.72/kg. On the other side, for imported sunflower oil, the price can be ranged from US$2.60/kg to US$2.98/kg for five brands in the wet market and from US$2.71/kg to US$3.35/kg for six brands in the shopping center.

The remaining types of edible oil such as soybean oil, vegetable oil, palm oil and other minor oil types are imported from foreign countries and their prices differ from each other according to the brands and other factors. Two brands of soybean oil prices in the wet market are around US$2.60/kg while three different brands of that prices in the supermarket are quite varied as low price US$2.34/kg, medium price US$2.57/kg and high price US$2.83/kg, respectively. Other types of commercially imported edible oil in Nay Pyi Taw are vegetable oil and palm oil because of their inexpensive price in the market. They are notably cheaper compared to other commercial brands and types of edible oils, and they are widely found only in the wet market. In terms of average price in both types of market, vegetable oil in the market is US$0.89/kg cheaper than peanut oil, US$1.26/kg cheaper than sesame oil, US$0.93/kg cheaper than sunflower oil, US$0.54/kg cheaper than soybean oil. Similarly, for palm oil, in terms of average price in both types of markets, the price of it is US$1.38/kg cheaper than peanut oil, US$1.76/kg cheaper than sesame oil, US$1.43/kg cheaper than sunflower oil, US$1.04/kg cheaper than soybean oil, US$0.49/kg cheaper than vegetable oil.

Continuously, the individual price of minor imported edible oils with few brands in the market except canola oil and corn oil are considerably higher than the major cooking oil types. Price of canola oil is almost the same compared to domestically produced sunflower oil while corn oil is almost the same price to domestically produced peanut oil and sesame oil. In contrast, grape oil is nearly twice of the domestically produced sesame oil price while coconut oil price is three times higher than the domestically produced sunflower oil price. Last but not the least, olive oil price is almost four times of imported vegetable oil supermarket price.

All in all, in edible oil market in Myanmar, the average price of sesame oil is the highest whereas the average price of palm oil is the lowest compared to the common types and brands. Nevertheless, there may have been some variations of price resulting from the quality, packaging style and place of market whether in the wet market or supermarket in Nay Pyi Taw.

Consumer Preference in Terms of Quality and Price on Different Types of Edible Oil

Investigating consumer preferences is one of the essential indicators in the market survey of edible oil. Different types of consumers have their own behavior and preferences on different types and brands of edible oil based on quality and prices of the product. Generally, these choices are rooted from whether consumers have basic health care knowledge about current edible oil consumption or not and whether current price of edible oil prices are reasonable or not for individual household.

In this study in Nay Pyi Taw, nearly half of the household members who take main responsibility for meals in the survey area would like to choose the domestically produced peanut oil for its better taste and good health. This means the domestically produced peanut oil is the most preferable edible oil in terms of quality among consumers and it accounts for almost 55% in total. However, not all the people who love using peanut oil as a cooking oil can afford to buy because of its premium price. Only 36% could meet the demand for the domestically produced edible oil. The rest of them have been relying on imported vegetable oil and palm oil in terms of affordable price resulting from their income.

CONCLUSION AND RECOMMENDATION

This study tries to approach the current edible oil market condition in Nay Pyi Taw by finding out a wide variety of edible oil with different brands including local and international brands with their relative prices in June 2021. The market survey resulted in the information that the community in the study area has been facing insufficient edible oil based on their preferences though there are sufficient edible oilseed crops sowing areas across the country. They all have to mainly depend on imported oils such as vegetable oil and palm oil in terms of price though they would like to consume the domestically produced peanut oil and sesame oil in terms of quality. In addition, some types of imported oil, especially palm oil has been sold mixing with unknown edible oils at different ratio in the wet market without any brand and quality information. Most of the respondents who come from low-income families are consuming such types of mixed palm oil in the wet market as daily cooking oil. Some of them are making a choice more than one type of edible, for example, using both peanut oil and palm oil as a cooking oil within a household. However, the domestically produced peanut oil is the priority among the government staff in Nay Pyi Taw.

According to the results of the market study, Myanmar’s edible oil market should be developed in many ways. First, the existing laws related to trading should be reinforced and new rules and regulations for quality control and checking should be enhanced so that edible oil consumers would get the exact quality that they have bought from the market with the representative prices. Second, it is also responsible to deliver health education about production and consumption of edible oil to producers, distributors and consumers concerning quality control and its related issues of edible oil. Third, all authorities not only from agricultural institutions but also from other related organizations should put a collective effort to produce healthy and safe domestic edible oil using systematic procedure and protocol. Fourth, farmers should be supported with good quality seeds, high-yielding, and climate resilient varieties of edible oilseed crops in order to fulfill the local requirement of edible oil. Besides the major oilseed crops such as groundnut and sesame, the cultivation area for other promising edible oilseed crops such as soybean, sunflower, niger, mustard, safflower and palm tree should also be increased leading to edible oil self-sufficiency in Myanmar. Last but not the least, there is a need to carry out government intervention for attaining raw materials, for running the factory and milling industry with required facilities, equipment, and updated technologies for distributing and transporting the final product into the market according to the Food and Drug Administration Law. Therefore, all stakeholders in Myanmar’s edible oil sector should be all inclusive for accomplishing the domestic edible oil requirement in the future.

To conclude, the government and all stakeholders in Myanmar’s edible oilseed crops production, value-addition and distribution sector should pay attention to the current circumstances of edible oil market conditions in Nay Pyi Taw and take actions for better improvement. On the other hand, nationwide edible oil market research is deeply recommended for obtaining strong and valid results that can help support in the decision-making process for the development of Myanmar’s edible oil sector.

REFERENCES

DOA. 2020, Data Records from Department of Agriculture (DOA), Ministry of Agriculture, Livestock and Irrigation, Nay Pyi Taw, Myanmar.

Thaung, N. N, 2011, Integration of Myanmar Domestic Agricultural Marketing into ASEAN. Journal of Management Policy and Practice: Vol-12(5), 99-101.

Wijnands J.H.M., J. Biersteker, L.F. Hagedoorn and J. Louisse, 2014, Business opportunities and food safety of the Myanmar edible oil sector, Wageningen, LEI Wageningen UR (University & Research centre), LEI Report 2014-036. 94 pp, 26 fig, 31 tab, 55 ref, 1 map