ABSTRACT

Corn is one of the main ingredients for animal feeds, and this commodity supports the development of livestock industry in Malaysia. However, corn is a small industry and the local production could not meet the demand by the animal feed millers. As a result, Malaysia depends on its corn supply from global markets. Malaysia plans to revitalize its corn industry to reduce the dependency on the imported produce. Malaysia has studied the competitiveness of the Indonesian corn industry and is now ready to learn from it. Malaysia benchmarks the Indonesian corn industry and tries to replicate policies and strategies that could be used for the development of a corn industry in Malaysia. A study visit to Indonesia was carried out by a team of officers to understand the industry scenario in 2018. The three factors that Malaysia could learn from Indonesia are the comprehensive farmers friendly policies, the development of hybrid seeds that could improve the productivity and quality of corn, and the R&D activities related to corn and the speed of technology transfer from laboratory to farmers. Malaysia is optimistic that the development of a grain corn industry would reduce the dependency on imported commodity and hence, improve the food sovereignty in Malaysia.

Keywords: Grain corn, grain corn industry, benchmark, livestock industry

INTRODUCTION

Corn is an important commodity for livestock industry in Malaysia. Corn is the main ingredient for animal feeds, besides cereal grains, protein meals (vegetable protein and animal protein), fats and oils, minerals and vitamins, and other raw materials. Corn provides between 40% and 60% of energy source for animals. More than 85% of feed ingredients are imported, while another 15% are produced locally, such as rice bran, palm oil and palm kernel cake. Feed imports have risen from RM2.47 (US$0.60) billionin 2004 to RM4.40 (US$1.07) billion in 2009 and more than RM6.70 (US$1.63) billion in 2017 (DoS, 2018). At the same time, Malaysia produces more than six million tons of animal feeds valued at more than RM9.00 (US$2.18) billion every year. The local feed industry is heavily dependent on imported feed ingredients and feed supplements.

The grain corn industry is relatively small in Malaysia. Malaysia produces around 80,000 metric tons (MT) of corn every year, as compared to around 3.70 million MT demanded by local consumers. As a result, Malaysia imports almost 100% of its corn requirements every year. Malaysia imports corn primarily from Argentina and Brazil, and relatively small quantity from USA, Thailand, Myanmar, Pakistan and Indonesia. Malaysia imported around 3.7 million MT of grain corn valued about RM3.00 (US$0.73) billion in 2017.

The value of imported grain corn is increasing every year and effected the balance of trade. Malaysia imported more than RM46.74 (US$11.32) billion of food products, and animal feeds contributes about 14.7% of the value, in 2017. The dependency on imported grain corn becomes a main concern to the government. The Ministry of Agriculture and Food Industries (MAFI) plans to reduce the dependency by increasing the local production. Malaysia needs to revitalize the industry and develop a new grain corn industry. In order to speed up the process, Malaysia is willing to learn from other countries such as Thailand and Indonesia. The MAFI sent a research team to Indonesia in 2018, to understand the industry scenario and learn how Indonesia developed its grain corn industry. By understanding the industry and the strategies, Malaysia aims to develop its grain corn industry to support the livestock industry. This paper provides an overview of the grain corn industry in Indonesia in comparison with Malaysia. This paper also discusses the initiatives and action plans that could be implemented in the near future.

GRAIN CORN INDUSTRY IN MALAYSIA

Corn is one of the traditional crops in Malaysia. It was brought into Malaysia by the Portuguese colonialists in the 16th century, and became one of the important crops. Since it was introduced to this country, corn is mostly grown for fresh consumption. Corn varieties are used for food and animal feeds or processed to make food (such as breakfast cereals, corn starch, sweeteners (high-fructose corn syrup) and feed ingredients, cooking oil or industrial products such as ethanol and polylactic acid (PLA). Despite many types of corn being cultivated in the world, there are two varieties of corn popularly cultivated in Malaysia, which is the grain corn and sweet corn.

Corn is relatively a small industry in Malaysia. The government has tried to develop this industry in the early 1980s, but the effort has failed. Some factors that have contributed to the industry’s failure are the higher cost of production, low productivity and these resulted in low return of investment (ROI) especially when it is compared with other crops, such as pineapple and oil palm. At that time, the price of imported grain corn is relatively cheaper than the cost of production in Malaysia.

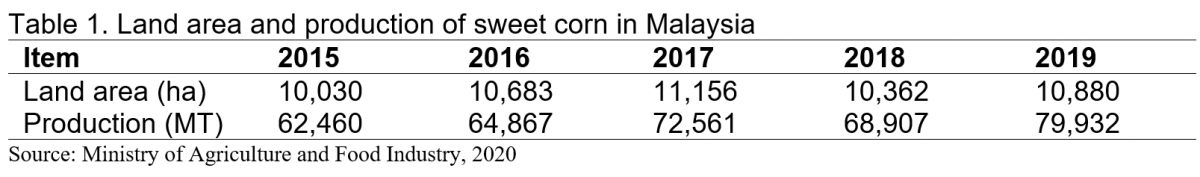

Currently, around 10,880 hectares of land are cultivated to corn, and are producing nearly 80,000 MT of the commodity. The land area has increased from 10,030 hectares in 2015 to 10,683 hectares (2016) and further increased to 10,880 hectares due to higher demand from consumers. Perak, Johor and Sarawak are the main producers of corn in Malaysia. Corn is cultivated in small areas by small farmers. The average size of farm is 2.5 hectares. However, more than 95% of the land is cultivated with sweet corn. The production of grain corn has been reduced and are replaced by sweet corn because the price of the latter is very much better and has higher demand by consumers. The land area and production of corn are presented in Table 1.

Starting from early 1980s, the number of farmers cultivating grain corn has reduced significantly because they are not interested to cultivate the crop. There are many factors that hindered farmers from cultivating grain corn, such as high production cost, low price offered by consumers due to cheaper imported corn, and lack of government support. No incentive was given by the government that could encourage farmers to cultivate grain corn because Malaysia does not have a competitive advantage. The government believes that it is cheaper to import, rather than to produce grain corn locally. Malaysia depends on its grain corn from the world markets. At that time, Malaysia was only able to produce around 3% of its local requirements.

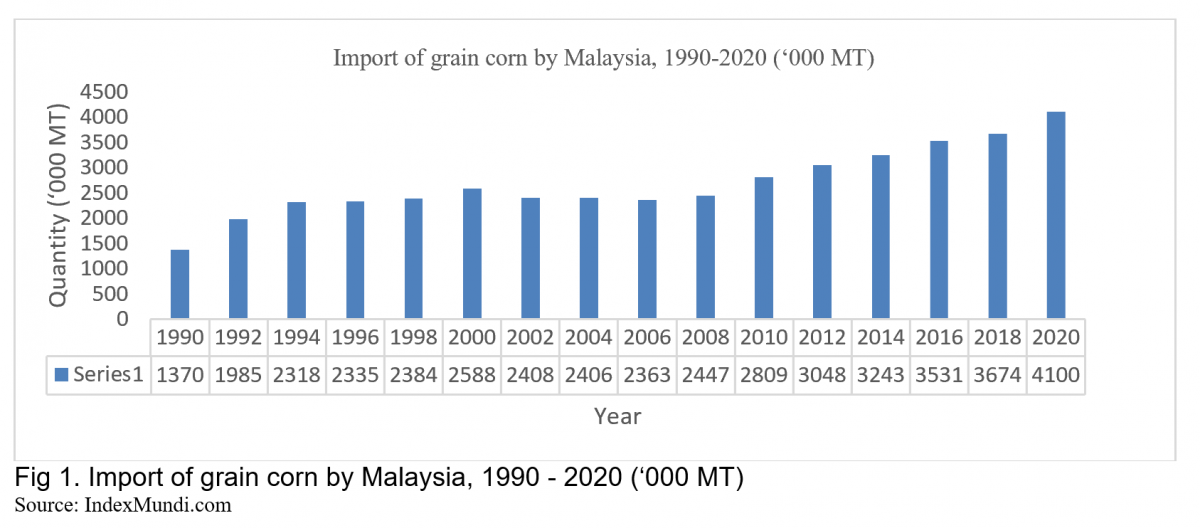

Currently, Malaysia imports almost all of its grain corn requirements. The quantity and value of import have increased every year due to increase in the production of animal feeds and the depreciation of Malaysian Ringgit (MR). For example, the import has increased from 1.37 million tons in 1990 to 2.59 million tons in 2000 and 4.10 million tons in 2020, with a growth rate around 8.1% annually. At the same time, the depreciation of the Malaysian Ringgit has increased the value of import. For example, the value the Malaysian Ringgit has depreciated from RM2.12 for one US dollar in 1980 to RM4.10 in 2021. As a result, Malaysia pays more for one unit kilogram of grain corn. In other words, the value of import has increased in terms of quantity as well as value.

The amount of imports are determined by the production of feed meals. Around 46.56% of corn is used for broiler feed, 27.58% for layer feed and 25.86% for swine feed. Despite the fact that the livestock industry is totally dependent on imported grain corn, Malaysia is a net exporter of broiler and eggs, since 2000. Malaysia produced more than 5.5 million broilers, 334,000 layers and 1.47 million pigs every year. The number of animals is increasing every year due to increase in population. Hence, the demand for feed meals is increasing every year. The import of grain corn by Malaysia is presented in Figure 1.

In the past, research and development (R&D) for corn was focused on the development of new varieties of sweet corn. No emphasis was given to grain corn breeding and production over the last three decades. There was no incentive provided by the government to encourage domestic grain corn production, although poultry meat is a very important source of animal protein. Feed grain production may not be competitive as plantation crops or farmers may get better return from other cash crops. Until now, government agencies in Malaysia only produced one grain corn variety, which is known as Putra J-58 by the University Putra Malaysia. At the same time, the Malaysian Agricultural Research and Development Institute (MARDI) has produced five varieties of sweet corn. The private sector produced more than ten varieties and used by farmers. The main producers of grain corn seeds in Malaysia are Green World Genetic (GWG), Charoen Pokphan (CP) and Monsanto.

The government plans to revitalize the corn industry. The Ministry of Agriculture and Food Industry (MAFI) plans to develop a grain corn industry as a strategy to reduce its dependency on imported produce. This is because the demand of grain corn in the world market has increased tremendously due to the higher demand for animal feeds and for bio-diesel ethanol. The higher demand has resulted in higher price of grain corn. For example, the price has increased from RM249 (US$60.35) per MT in 1985 to RM588 (US$142.50) per MT in 2018. The highest price was recorded in 2012, which is RM841(US$203.80) per MT. The government is expected that the price will continue to rise in the future. The then Agriculture Minister, Ahmad Shabery Cheek was very focused on publicly promoting the idea of achieving, what he called “food sovereignty” for Malaysia, in 2016. According to the Minister, “food sovereignty” is a policy of strategic importance for Malaysia to produce our own food to feed our population to not become dependent on imported food supplies.

The MAFI has conducted many researches and carried out pilot projects in many states in Malaysia to understand the issues and challenges before it embarks on a grand project. The MAFI also evaluated grain corn industries in other countries such as in Thailand, the Philippines, Indonesia and tries to follow their strategies. A team of researchers had visited Indonesia in 2018 to understand the production of grain corn. Indonesia was selected because it is the largest producer of grain corn in South-East Asia. Indonesia produces more than 12.00 million MT of grain corn in 2020, followed by the Philippine (8.80 million MT), Thailand (5.50 million MT) and Vietnam (4.54 million MT) (World Agriculture Production, 2021).

CORN INDUSTRY IN INDONESIA

Grain corn is the second largely cultivated crop in Indonesia, after paddy. More than three million hectares of land are cultivated with this commodity, making Indonesia the 7th world grain corn producer in the world. The government efforts to increase grain corn production by establishing a floor price scheme and by providing subsidized seeds and fertilizers have increased harvested land area. For example, the production area has increased from 3.65 million hectares in 2017 to 3.70 million hectares (2017) and 3.90 million hectares in 2020. Farmers are interested to cultivate grain corn because this crop is more profitable relative to other crops.

This commodity plays a big strategic role in the development of the agriculture sector in Indonesia. It creates employment for people, especially in the rural areas, generates incomes for the farmers and profits from the export markets. More than 7.6 million farmers are involved in cultivating corn. Indonesia produces more than ten million MT of grain corn every year, and it is a net exporter. East Java is the largest contributor to the national production of corn in Indonesia, followed by Central Java, Lampung, North Sumatra, South Sulawesi, West Nusa Tenggara, West Java, North Sulawesi, Gorontalo, and South Sumatra. The National corn production with a moisture content of 15% in 2020 reached 12.0 million MT (USDA, 2019).

Corn cultivation is carried out by small farmers, and the average farm size is one hectare. In general, farmers cultivate their corn twice a year, in which every cycle covers around 110 days. The average yield of corn is 5.25 MT per hectare, while in Lamongan, a district in West Java Province, is 9.30 MT per hectare. Farmers obtain their seeds from the government under a subsidy scheme. The government also plays a big role in the development of the grain corn industry. Many incentives and policies were introduced to support the industry. For example, despite the fact that the price of dried corn is determined by market demand and supply, the government sets a floor price of corn, to ensure that farmers receive a reasonable price and make some profit from the cultivation activities. The market price is between Rp4,600 (US$0.32) and Rp4,700 (US$0.33) per kilogram, while the floor price set by the government is Rp3,150 (US$0.22) per kilogram should the price of the world market drops.

Around 58% of corn are used for animal feeds, 30% for fresh consumption and the balance are for processing industries. The demand for corn is increasing every year, especially for animal feeds. Currently, no crops could be used to replace corn as the main ingredients for animal feeds. Corn production has reached nearly 12 million MT in 2020, as government incentives to expand production in the non-traditional regions continue to yield results. The increase in the production of grain corn in Indonesia is contributed by several factors that include:

Large scale grain corn production in Lamongan, East Java

Lamongan is a district in the East Java Province. It was recognized as the Iowa of Indonesia because it is the main production area for grain corn. The production is carried out in large-scale and involves many farmers. The large-scale cultivation of grain corn started in 2016 when the local government provided a strong support to the development of the grain corn industry. The governor of the Province who has visited Iowa State in 2016, followed and replicated the strategies implemented in that state, especially the application of machinery and automation along the supply chain of grain corn production. The local government has introduced a special program called Facilitation of Modern Corn (FJM) and has attracted farmers to participate in this program. Under the FJM, the local government implemented a sub-program called Inovasi Pertanian Jagung or literally translated as Innovation of Agricultural Corn. As a result, the land area cultivated with grain corn has increased from 43,000 hectares in 2016, to more than 60,000 hectares in 2017 and more than 71,000 hectares in 2018. This area produced high quality produce and higher yield per hectare.

Many rural innovations were introduced to improve the productivity and quality of corn. The application of technology, such as semi-automatic tractors, quality hybrid seeds and the application of home-made fertilizers have increased the yield from 5.5 MT/ha to 10 MT/ha. Technology has played a huge part in the ability to increase the production. The selection of hybrid seeds was carried out to determine the best and suitable one for each location. In other words, different area uses different seeds, which is suitable with the ecosystem and land fertility. In some areas, the yield has increased up to 14.0 MT per hectare. The production of grain corn in the Lamongan district has increased from 372,160 MT in 2015, to 571,080 MT in 2017 and 928,000 MT in 2018. This region contributes around 15% of the total national production. The local government has projected that the production will increase to more than one million MT in 2020. The increase in production has increased the profit and socioeconomic well-being of farmers in Lamongan.

The production of hybrid seeds by private sector

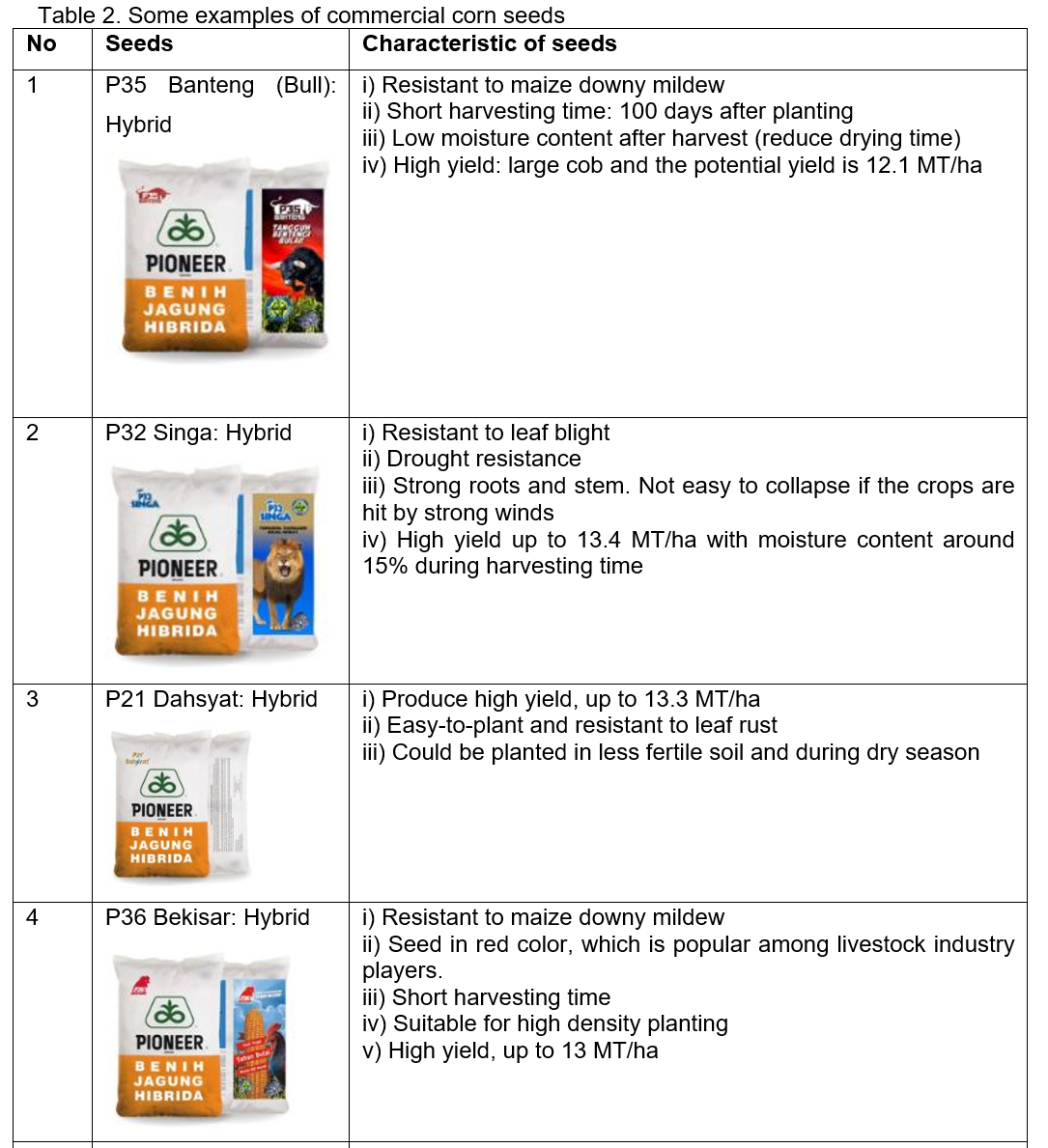

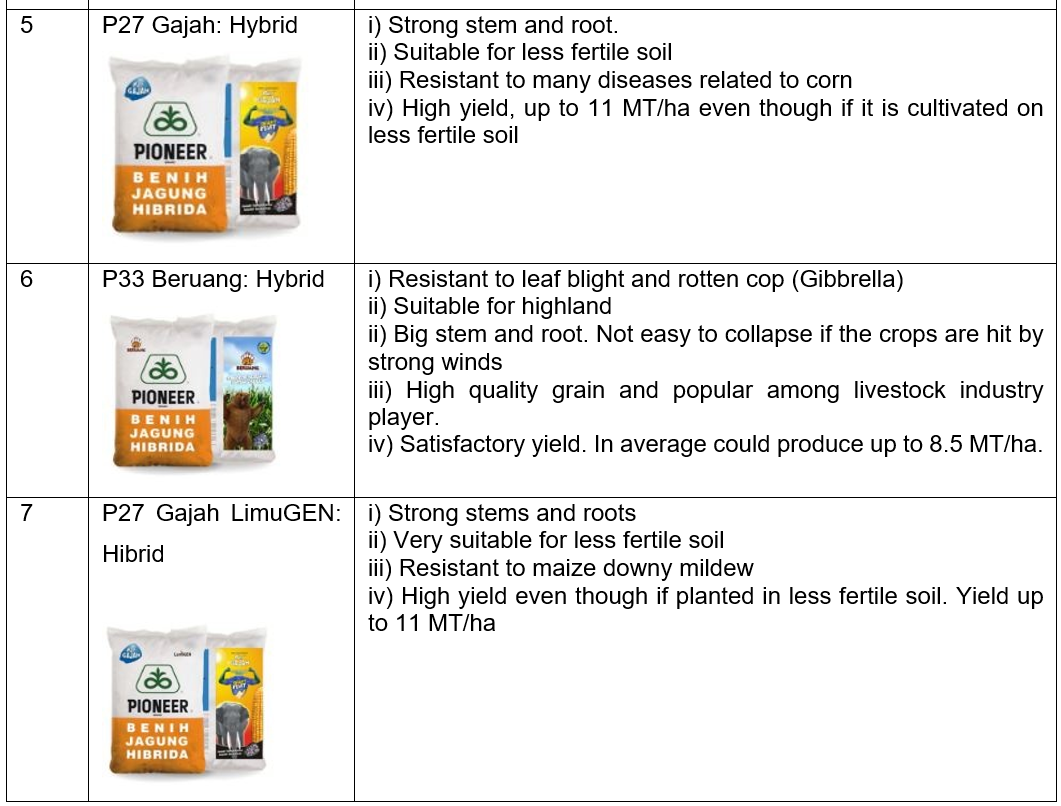

High-quality seeds is one of the factors for higher productivity and better quality of grain corn. Indonesia has the capability in producing high-quality seeds for different locations and soil fertility. The production of high-quality seeds is carried out by government agencies as well as private sector. Corteva Agriscience Indonesia (CAI) is one of the biggest seed producing companies in Indonesia. This company is a merger between two big seed producing companies in the world; Dow and Dupont. This company invented high-quality seeds and subsequently produced high quality and yield of grain corn. The seeds produced by the CAI are complied with the good agriculture practice (GAP) and suitable for different locations. In other words, the seeds are produced in accordance with the agro-climatic environment. The seeds are also resistant to many pests and diseases that could lead to a low farm management cost. The seeds are also suitable for high density planting that could result in higher yield per hectare. Some examples of commercial corn seeds available in Indonesia markets are as in Table 2.

Research and development of grain corn

The Indonesian government has established one research and development (R&D) institution that focuses on cereals, including grain corn. The Indonesian Cereals Research Institute (ICERI) is one of the technical implementation units on crop R&D under the coordination of the Indonesian Center for Food Crops Research and Development (ICFORD). ICERI carried out research of corn, sorghum, wheat and other potential cereal crops.

The research is focused on genetic modification, plant breeding, seedling and germplasm, morphology, physiology, ecology and entomology of crops. The Institute provides information and technical services to farmers and entrepreneurs. Since its establishment, the achievement of the ICERI included the production of 41 varieties of hybrid grain corn that have been transferred and used by farmers. Most of the varieties have shorter harvesting time, and thus shorten the production cycle. The new varieties are also resistant to pest and diseases, and produce higher yield per hectare. The examples of new varieties of grain corn invented by the ICERI are as in Table 3.

Benchmarking the Indonesian grain corn industry

Indonesia is one of the largest producers of grain corn in the world. Indonesia has its competitive advantage in terms of land area suitable for grain corn cultivation, abundance of resources, especially its cheap labor and good agroclimatic environment. Its relatively low humidity helps the industry to dry the corn, and reduce the effect of fungus during harvesting. The industry was established long time ago and has already matured. In comparison, despite a traditional crop, grain corn is relatively a dying industry in Malaysia. The Malaysian government plans to revitalize this industry as a strategy to reduce the dependence on imported commodity. This is important because the animal feeds industry is fully supported by the livestock industry. The MAFI plans to cultivate more than 80,000 hectares of grain corn in 2025 and 300,000 hectares in 2032.

The Malaysian government recognizes the competitiveness of the grain industry in Indonesia, and is ready to learn from them. The MAFI sent a team of officers who are representing researchers, economists, extension officers, engineers and breeders to Indonesia in 2018. The mission was to explore the industry and to learn from the experts and industry players how Malaysia could develop its grain industry in a short time. Malaysia has benchmarked the Indonesian grain industry and plans to replicate some strategies, whichever is relevant to the Malaysian environment. In general, the comparison between grain corn industry in Malaysia and Indonesia is presented in Table 4.

Table 4. Comparison between grain corn industry in Malaysia and Indonesia

|

No

|

Items

|

Malaysia

|

Indonesia

|

|

Indicator 1: General information

|

|

1

|

Climate

|

28 - 350C

|

28 - 350C

|

|

2

|

Moisture (%)

|

81%

|

48%

|

|

3

|

Cultivated area

|

10,880 ha (Department of Agriculture, 2019)

|

3.7 million ha (Ministry of Agriculture, 2019)

|

|

4

|

Self Sufficient Level (SSL) (%): 2018

|

5%

|

100%

|

|

5

|

New variety

|

Developed by government: 1variety (Developed by University Putra Malaysia: (Putra J-58 UPM)

Developed by private sector: >10 varieties

|

Developed by government agency: 41 varieties

Developed by private sector: >10 varieties

|

|

6

|

Seed producers

|

Green World Genetic (GWG), Charoen Pokphan (CP), Monsanto, Syngenta

|

Corteva Agriscience, Bisi Indonesia, Monsanto, Syngenta

|

|

7

|

Average yield (ton/ha):

|

Experimental plot:

5.3 MT/ha (DOA, 2017)

6.0 MT/ha (MARDI, 2019)

|

National average: 5.25 MT/ha

Lamongan: 9.3 MT/ha

|

|

8

|

Production

|

79,300 MT (DOA, 2019)

|

12.0 million MT (USDA, 2020)

|

|

9

|

Position in world market

|

Not listed

|

9th (FAO, 2013)

7th (FAO, 2017)

|

|

10

|

Number of farmers

|

7,500 people

|

7,600,000 people (Badan Pusat Statistik, 2011)

|

|

11

|

Average farm size

|

2.5 ha

|

0.5 - 1.0 ha (Dinas Pertanian, 2019)

|

|

12

|

Production cycle

|

3 time per year

|

2 time per year

|

|

13

|

Harvesting period

|

110 days/cycle

|

<110 days/cycle

|

|

14

|

Moisture content during harvesting time

|

30%

|

<20%

|

|

Indicator 2: Production cost

|

|

15

|

Land preparation and cultivation (US$/ha)

|

Plowing: RM 975/ha (US$237)

Planting: RM350/ha (US$85)

Total: RM1,325/ha (US$322)

|

Semi mechanization: Rp 1,200, 000/ha (US$84.44)

Conventional (manual): = Rp 400, 000/ha (US$28.14)

|

|

16

|

Price of corn seed (RM/kg)

|

RM300/ha (US$73/ha)

(20kg x RM15/kg)

|

Subsidy by government

Rp75,000-Rp85,000 (US$5.27 -5.98)

|

|

17

|

Farm price (RM/kg)

|

RM0.90/kg (US$0.218) (Moisture content - 14%)

|

Dried corn:

Rp4,600-4,700/kg (US$0.32 - 0.33)

|

|

18

|

Production cost per season (RM/kg)

|

At experimental plot:

RM0.71/kg (US$0.17) (DoA, 2018)

RM0.83/kg (US$0.2) (MARDI, 2019)

|

Rp1,362 (US$0.095/kg)

(DoA, 2019)

|

|

19

|

Production cost per season (RM/ha)

|

RM3,800 (US$923.51) (DoA, 2017)

RM5,024 (US$1,221) (MARDI, 2019)

|

Rp14,717,500 (US$1,036/ha)

(DoA, 2019)

|

|

20

|

Net profit (RM/ha) per season

|

RM970 (US$235) (DoA, 2017)

RM376 (US$91.37) (MARDI, 2019)

|

Rp25,242,500 (US$1,777)

(DoA, 2019)

|

|

21

|

Labor cost

|

RM1000-1500/month (US$243 - 364.5)

|

Rp2.6 million/month (US$183.0/month)

|

|

Indicator 3: Financial

|

|

22

|

Credit financing

|

Bank: Agrobank

Government agency: TEKUN

|

Farmers cooperative movement

|

|

23

|

Price policy

|

No policy. Price is determined by world market

|

No policy. Price is determined by world market

|

|

24

|

Government support

|

No

|

The government sets floor price at Rp3,150/kg (US$0.22/kg) should the price at world market dropped below that price

|

|

Indicator 4: Agricultural practice

|

|

25

|

Source of seeds

|

Government: DOA

Private sector: GWG, Charoen Pokphan (CP), Monsanto, Syngenta

|

Government: National Seed Board

Private sector: Corteva Agriscience, Bisi Indonesia, Monsanto, Syngenta

|

|

26

|

Fertilizer

|

Organic and Chemical

|

Organic and Chemical

|

|

27

|

Plant population/ha

|

66,666 plant/ha

|

72,000 plant/ha

|

|

28

|

Agricultural activities

|

Weeding

Fertilizing

Pests and diseases management

Irrigation management

|

Weeding

Fertilizing

Pests and diseases management

Irrigation management

|

|

39

|

Accreditation

|

MyGap

|

-Nil-

|

|

30

|

Disease

|

i) Helminthosporium maydis

ii) Helminthosporium turcicum

iii) Curvularia Lunata

iv) Puccinia polysora

v) Thanatephorus cucumeris

vi) Parenosclerospora sp.

vii) Erwinia caratovora

viii) Earth pathogen

|

i) Maize downy mildew

ii) Leaf rust

iii) Southern leaf blight

iv) Northern leaf blight

v) Sheath blight

vi) Rotten corn stalks

vii) Rotten corn cobs

viii) Corn smut

ix) Maize dwarf mosaic virus

|

|

31

|

Pest

|

i) Army worm (Spodoptera frugiperda)

ii) Stalk caterpillars (Busseola fusca)

iii) Boar, monkey and rat

|

i) Ostrinia furnacalis

ii) Altherigona spp

iii) Lepidiota stigma

iv) Earthworms

vi) Helicoverpa armigera

vii) Locusta migratoria

viii) Rat

ix) Sitophilus zeamais

x) Sitotroga

|

|

32

|

Government incentives

|

Pilot project (not started)

|

Seed subsidy to produce >10 tan/ha value (US$105.4/ha)

Fertilizer subsidy

|

|

Indicator 6: Technology application and innovation

|

|

33

|

Cultivation and harvesting

|

Fully mechanized from land preparation until harvesting (Combine harvester)

|

Semi mechanized

Harvesting using Combine harvester

|

|

34

|

Processing

|

Fully mechanized (corn threshing machine)

|

Fully mechanized (corn threshing machine)

|

|

35

|

Drying

|

Mobile dryer

|

Solar drying

Drying machine

|

Table 4 shows that Indonesia has a high comparative advantage in grain corn production as compared to Malaysia. Indonesia has abundant natural sources such as large land area, fertile soil and better climate that are suitable for grain corn cultivation and cheap labor. Indonesia is more advanced in all aspects of the supply chain, from production to marketing of grain corn. Cost of production per unit kilogram and hectare is relatively cheaper than in Malaysia. As a result, grain corn cultivation is more profitable and attracted farmers to participate in the industry. There are three factors that Malaysia could benchmark Indonesia for the development of grain industry.

Strong policy and direction on grain corn

Indonesia has a very comprehensive policy on cereal crops, including grain corn. Government efforts to increase corn production by establishing a minimum selling price and by providing subsidized seeds and fertilizers have increased the harvested area. For example, the harvested area of corn has increased from 3.65 million hectares in 2017 to reach 3.70 million hectares in 2019 and further expand to 3.90 million hectares in 2020 as farmers consider corn is more profitable relative to other crops. Farmers have been growing more corn when the Ministry of Agriculture implemented a program of providing subsidized seeds, fertilizers, and farming equipment. Additionally, the regulation no. 96/2018 on Reference Price issued in September 2018, setting the minimum buying price of corn with 15% moisture content at the farm level at Rp. 3,150/kg (US$221/MT), has further motivated farmers to grow corn.

The government also introduced import restriction only for feed use. For example, in 2018, Indonesia allowed imports of corn for feeds to around 850,000 MT. The import of grain corn must also be carried out away from the harvesting period, so that the imported commodity will not compete with the local produce.

The outcome of these policies has encouraged farmers throughout Indonesia to cultivate more corn. In Sulawesi, farmers are reported to receive higher margins from corn compared to traditional crops such as coconut or cocoa, leading many to switch to planting corn or to inter-crop corn with coconut trees. In 2017, farmers in North Sulawesi harvested corn on150,000 hectares, but that area has increased to an estimated 320,000 hectares in 2018, and further increase to 340,000 hectares in 2019. Farmers in South Sulawesi are switching from growing teak and cocoa to corn, farmers in Lampung (Sumatra) have begun to favor corn over cassava, and farmers in Java continue to opt to grow corn over soybeans due to higher margins. In addition, farmers in Central Java are switching from rice to corn in rain-fed areas. In other words, a comprehensive and farmer friendly policy has encouraged farmers to cultivate grain corn which eventually led to increase the local production.

Strong research and development (R&D) on grain corn

Indonesia has established a research institute that is dedicated to the development of cereal commodities, including grain corn. The Institute has strengthened the various components of R&D efforts, enabling them to develop, test, multiply, and release high-yielding corn cultivars to farmers. The function of the research institute includes to build a sustainable corn breeding effort that can reliably provide varieties to an emerging seed industry, to build a cooperative network, including farmers, and grain corn users. The Institute also developed cultivars that are targeted for organic needs and adapted for seed production and grain production under organic conditions through on-farm testing, stress nurseries, and grain quality testing. The outcome of the R&D was disseminated to farmers through farmers meetings, seminars, booklets, scholarly publications, and by putting the information on the Internet.

The transfer of technologies from laboratories to farms has speed up the development of grain corn industry in Indonesia. Most of the technologies were adopted and used by farmers. For example, different varieties of seed were used for different location, and this practice has improved the local production because the seeds are suitable for certain agro-climatic environment.

Advanced local high quality hybrid seeds

The development of high-quality hybrid seeds is important as a strategy to increase productivity and quality of corn. The development of hybrid corn has led to major changes in how farming was done. The hybrid seeds are more tolerant to diseases and more efficient towards less fertile soil. The size of corn is also bigger than the traditional varieties and thus, produce higher yield. The Ministry of Agriculture has developed the seeds of 14 high-yielding corn varieties to help increase the national corn production. These varieties have the potential to produce more than 11 MT/ha, compared to 6.4 MT/ha of traditional corn productivity. Each variety has its own specialty and weather preferences. Hence, corn farmers should choose the right seed for their farm conditions. Currently, the hybrid seed corn prices range between Rp. 80,000 and Rp. 100,000 per kilogram (US$ 5.62-7.02/kg), an average increase of Rp. 5,000 – Rp. 10,000 per kg (US$0.35-0.70/kg) from year 2018. Better yield is expected to be achieved as well as fewer pest and disease incidence.

In 2020, Indonesia exported 14 MT of hybrid seeds to Thailand, valued more than US$ 56,000. The export proves that the seeds produced by Indonesia are capable of competing with developed countries. This also shows that hybrid seeds by the Indonesian laboratories are well accepted by the world markets.

WAY FORWARD

The government of Malaysia believes that the development of a grain corn industry is important and critical for the survival of the livestock industry. However, many obstacles must be addressed by the government before the project could be implemented. For example, currently, few areas are suitable for grain corn cultivation. The humid weather could lead to affect the quality of the corn and higher cost of production does not attractive to investors. At the same time, the seeds supplied by the private sector could only produce between three and six MT per hectare. The experimental plot carried out by DOA and MARDI produced a better result of between five and six MT per hectare. The low productivity per hectare is not feasible for the cultivation of grain corn in Malaysia.

Learning from Indonesia, the government has set a new direction for the grain corn industry in Malaysia. Malaysia plans to produce at least 30% of its grain corn requirements by 2032. The Ministry of Agriculture and Food Industry (MAFI) plans to open new land area specifically for grain corn production. This could be done by increasing the land area to around 30,000 hectares. This will result with the production of around 1.4 million MT of grain corn. The production of grain corn will be carried out in the areas that have a long dry season, low humidity and flat land such as in Chuping in Perak, Seberang Prai in Penang and Bachok in Kelantan. The project was started in 2020 as a pilot project. The cultivation of grain corn will be carried out five cycle in two years. The commercial scale production of minimum 1,000 hectare in one area will use appropriate technologies along the supply chain, from production until marketing. MARDI has been mandated to examine some varieties from Indonesia and test its suitability in Malaysia climate. New variety of corn that could produce higher yield will be cultivated. The use of a better corn variety that produce between ten and twelve MT per hectare, and the application of technologies will reduce the cost of production and as a result, will make the investment more feasible. At the same time, the plant will be used as silage for ruminant. MARDI has invented new machine and new formulation for silage production. This new technology will add value of the grain corn cultivation and increase the income of the farmers.

The DOA will identify interested parties from private sector, cooperative and small and medium enterprises to participate in the project. The ministry will request the state government to provide suitable land for the cultivation of grain corn in a commercial scale. In Malaysia, the land matter is under the purview of the state government. The government will provide some incentives such as grant and tax incentive, technical supports and guaranteed price. The government will also intensify the R&D activities that could generate better hybrid seeds that tolerant to pests and diseases and has the potential to produce higher yield. MARDI will conduct research on seed technology, cultivation, production, processing as well as mechanization and automation. MARDI will collaborate with the Indonesian Cereals Research Institute (ICERI) on the development of new technologies related to corn. Some hybrid seeds invented by the ICERI will be tested in Malaysia. The government will also cooperate with local seed companies and abroad to invent new hybrid seed suitable with the Malaysian agro-climatic environment.

Application of technology along the supply chain of grain corn production will be intensified. This includes the application of hybrid seeds, mechanization and automation, pests and diseases management, postharvest management and logistic management. The use of drown or satellite will help farmers in collecting data related to soil fertility and farm management. The data can also tell where, and why, their crop is under stress and helps them diagnose the source. The next step is to correctly apply the treatment. Malaysia will intensify the use of precision farming. Critical to the success of precision farming is sophisticated equipment called “variable-rate technologies.” These devices are mounted on tractors and programmed to control the dispersion of water and chemicals based upon the information gained from the remote sensors. Now being able to target and limit inputs – such as fertilizers, seeds, water, pesticides, or herbicides – to precisely where and how much is needed, so that farmers are putting less on the landscape. This can mean less chemical runoff from farms to negatively impact the environment. By using the tools of precision farming, growers can specifically target areas of need within their fields and apply just the right amounts of chemicals where and when they are needed, saving both time and money and minimizing their impact on the environment. As a result, it will reduce the cost of production and increase the yield per hectare.

CONCLUSION

Indonesia has established its grain corn industry and became one of the big players in the world. Indonesia has developed its grain corn industry and created its competitive advantage through the support of the government, the cooperation among the farmers' community and the roles played by the private sector. The farmers friendly policies undertaken by the government have encouraged farmers to cultivate grain corn and enhance the industry. The willingness of the grain corn community to adopt the technologies and share the information among them is a factor that helped the industry to grow.

Indonesia enhanced its grain corn industry by learning from Iowa State in the USA. Indonesia replicated the strategies and adapted the technologies used in Iowa with the Indonesian agro-climatic environment. Malaysia, on the other hand, learns from Indonesia and adopts some of the strategies, which are suitable with Malaysian environment. Malaysia is a small country, and thus, unable to cultivate corn in a very large area. Malaysia could focus on the development of new hybrid seeds suitable for Malaysia, invent more machine and automation devices for planting, operating farm management, harvesting and processing the seeds to become feed meals.

Malaysia is looking forward to developing its grain corn industry. It is not too late to revitalize the corn industry in Malaysia and becomes one of the grain corn players in the world.

REFERENCES

Corteva Agriscience Indonesia (2019). www.corteva.id

Dinas Pertanian Lamongan, Jawa Timur (2019).

Food and Agriculture Organisation (2017). www.fao.org

Jabatan Perkhidmatan Veterinar (2018). www.dvs.gov.my

Kasryno F, Pasandaran E dan Fagi A.M. (2008). Ekonomi Jagung Indonesia. Jakarta: Badan Penelitian dan Pengembangan Pertanian. Deptan. p37-72.

Kementerian Pertanian dan Industri Makanan (2016). www.moa.gov.my

Kementerian Pertanian dan Industri Makanan (2018). www.moa.gov.my

Kementerian Pertanian Republika Indonesia (2019). www.pertanian.go.id

Perangkaan Agromakanan Negara (2018). Kementerian Pertanian dan Industri Makanan (MOA). www.moa.gov.my

Redaksi, 2019 Level Mekanisasi Pertanian Indonesia Naik 236% http://agroindonesia.co.id/2019/05/level-mekanisasi-pertanian-indonesia-naik-236/

Balai Penelitian Lahan Rawa(2019), Mekanisasi untuk Tingkatkan Produksi Jagung

USDA(2019). Indonesia Grain and Feed Annual Report 2019. downloadreportbyfilename (usda.gov)

Corn Production by Country (2021). World Agricultural Production 2020/2021. www.worldagricultureproduction.com

USDA (20200. Grain and feed update. www.usda.gov.

Benchmarking Indonesia for the Development of the Grain Corn Industry in Malaysia

ABSTRACT

Corn is one of the main ingredients for animal feeds, and this commodity supports the development of livestock industry in Malaysia. However, corn is a small industry and the local production could not meet the demand by the animal feed millers. As a result, Malaysia depends on its corn supply from global markets. Malaysia plans to revitalize its corn industry to reduce the dependency on the imported produce. Malaysia has studied the competitiveness of the Indonesian corn industry and is now ready to learn from it. Malaysia benchmarks the Indonesian corn industry and tries to replicate policies and strategies that could be used for the development of a corn industry in Malaysia. A study visit to Indonesia was carried out by a team of officers to understand the industry scenario in 2018. The three factors that Malaysia could learn from Indonesia are the comprehensive farmers friendly policies, the development of hybrid seeds that could improve the productivity and quality of corn, and the R&D activities related to corn and the speed of technology transfer from laboratory to farmers. Malaysia is optimistic that the development of a grain corn industry would reduce the dependency on imported commodity and hence, improve the food sovereignty in Malaysia.

Keywords: Grain corn, grain corn industry, benchmark, livestock industry

INTRODUCTION

Corn is an important commodity for livestock industry in Malaysia. Corn is the main ingredient for animal feeds, besides cereal grains, protein meals (vegetable protein and animal protein), fats and oils, minerals and vitamins, and other raw materials. Corn provides between 40% and 60% of energy source for animals. More than 85% of feed ingredients are imported, while another 15% are produced locally, such as rice bran, palm oil and palm kernel cake. Feed imports have risen from RM2.47 (US$0.60) billionin 2004 to RM4.40 (US$1.07) billion in 2009 and more than RM6.70 (US$1.63) billion in 2017 (DoS, 2018). At the same time, Malaysia produces more than six million tons of animal feeds valued at more than RM9.00 (US$2.18) billion every year. The local feed industry is heavily dependent on imported feed ingredients and feed supplements.

The grain corn industry is relatively small in Malaysia. Malaysia produces around 80,000 metric tons (MT) of corn every year, as compared to around 3.70 million MT demanded by local consumers. As a result, Malaysia imports almost 100% of its corn requirements every year. Malaysia imports corn primarily from Argentina and Brazil, and relatively small quantity from USA, Thailand, Myanmar, Pakistan and Indonesia. Malaysia imported around 3.7 million MT of grain corn valued about RM3.00 (US$0.73) billion in 2017.

The value of imported grain corn is increasing every year and effected the balance of trade. Malaysia imported more than RM46.74 (US$11.32) billion of food products, and animal feeds contributes about 14.7% of the value, in 2017. The dependency on imported grain corn becomes a main concern to the government. The Ministry of Agriculture and Food Industries (MAFI) plans to reduce the dependency by increasing the local production. Malaysia needs to revitalize the industry and develop a new grain corn industry. In order to speed up the process, Malaysia is willing to learn from other countries such as Thailand and Indonesia. The MAFI sent a research team to Indonesia in 2018, to understand the industry scenario and learn how Indonesia developed its grain corn industry. By understanding the industry and the strategies, Malaysia aims to develop its grain corn industry to support the livestock industry. This paper provides an overview of the grain corn industry in Indonesia in comparison with Malaysia. This paper also discusses the initiatives and action plans that could be implemented in the near future.

GRAIN CORN INDUSTRY IN MALAYSIA

Corn is one of the traditional crops in Malaysia. It was brought into Malaysia by the Portuguese colonialists in the 16th century, and became one of the important crops. Since it was introduced to this country, corn is mostly grown for fresh consumption. Corn varieties are used for food and animal feeds or processed to make food (such as breakfast cereals, corn starch, sweeteners (high-fructose corn syrup) and feed ingredients, cooking oil or industrial products such as ethanol and polylactic acid (PLA). Despite many types of corn being cultivated in the world, there are two varieties of corn popularly cultivated in Malaysia, which is the grain corn and sweet corn.

Corn is relatively a small industry in Malaysia. The government has tried to develop this industry in the early 1980s, but the effort has failed. Some factors that have contributed to the industry’s failure are the higher cost of production, low productivity and these resulted in low return of investment (ROI) especially when it is compared with other crops, such as pineapple and oil palm. At that time, the price of imported grain corn is relatively cheaper than the cost of production in Malaysia.

Currently, around 10,880 hectares of land are cultivated to corn, and are producing nearly 80,000 MT of the commodity. The land area has increased from 10,030 hectares in 2015 to 10,683 hectares (2016) and further increased to 10,880 hectares due to higher demand from consumers. Perak, Johor and Sarawak are the main producers of corn in Malaysia. Corn is cultivated in small areas by small farmers. The average size of farm is 2.5 hectares. However, more than 95% of the land is cultivated with sweet corn. The production of grain corn has been reduced and are replaced by sweet corn because the price of the latter is very much better and has higher demand by consumers. The land area and production of corn are presented in Table 1.

Starting from early 1980s, the number of farmers cultivating grain corn has reduced significantly because they are not interested to cultivate the crop. There are many factors that hindered farmers from cultivating grain corn, such as high production cost, low price offered by consumers due to cheaper imported corn, and lack of government support. No incentive was given by the government that could encourage farmers to cultivate grain corn because Malaysia does not have a competitive advantage. The government believes that it is cheaper to import, rather than to produce grain corn locally. Malaysia depends on its grain corn from the world markets. At that time, Malaysia was only able to produce around 3% of its local requirements.

Currently, Malaysia imports almost all of its grain corn requirements. The quantity and value of import have increased every year due to increase in the production of animal feeds and the depreciation of Malaysian Ringgit (MR). For example, the import has increased from 1.37 million tons in 1990 to 2.59 million tons in 2000 and 4.10 million tons in 2020, with a growth rate around 8.1% annually. At the same time, the depreciation of the Malaysian Ringgit has increased the value of import. For example, the value the Malaysian Ringgit has depreciated from RM2.12 for one US dollar in 1980 to RM4.10 in 2021. As a result, Malaysia pays more for one unit kilogram of grain corn. In other words, the value of import has increased in terms of quantity as well as value.

The amount of imports are determined by the production of feed meals. Around 46.56% of corn is used for broiler feed, 27.58% for layer feed and 25.86% for swine feed. Despite the fact that the livestock industry is totally dependent on imported grain corn, Malaysia is a net exporter of broiler and eggs, since 2000. Malaysia produced more than 5.5 million broilers, 334,000 layers and 1.47 million pigs every year. The number of animals is increasing every year due to increase in population. Hence, the demand for feed meals is increasing every year. The import of grain corn by Malaysia is presented in Figure 1.

In the past, research and development (R&D) for corn was focused on the development of new varieties of sweet corn. No emphasis was given to grain corn breeding and production over the last three decades. There was no incentive provided by the government to encourage domestic grain corn production, although poultry meat is a very important source of animal protein. Feed grain production may not be competitive as plantation crops or farmers may get better return from other cash crops. Until now, government agencies in Malaysia only produced one grain corn variety, which is known as Putra J-58 by the University Putra Malaysia. At the same time, the Malaysian Agricultural Research and Development Institute (MARDI) has produced five varieties of sweet corn. The private sector produced more than ten varieties and used by farmers. The main producers of grain corn seeds in Malaysia are Green World Genetic (GWG), Charoen Pokphan (CP) and Monsanto.

The government plans to revitalize the corn industry. The Ministry of Agriculture and Food Industry (MAFI) plans to develop a grain corn industry as a strategy to reduce its dependency on imported produce. This is because the demand of grain corn in the world market has increased tremendously due to the higher demand for animal feeds and for bio-diesel ethanol. The higher demand has resulted in higher price of grain corn. For example, the price has increased from RM249 (US$60.35) per MT in 1985 to RM588 (US$142.50) per MT in 2018. The highest price was recorded in 2012, which is RM841(US$203.80) per MT. The government is expected that the price will continue to rise in the future. The then Agriculture Minister, Ahmad Shabery Cheek was very focused on publicly promoting the idea of achieving, what he called “food sovereignty” for Malaysia, in 2016. According to the Minister, “food sovereignty” is a policy of strategic importance for Malaysia to produce our own food to feed our population to not become dependent on imported food supplies.

The MAFI has conducted many researches and carried out pilot projects in many states in Malaysia to understand the issues and challenges before it embarks on a grand project. The MAFI also evaluated grain corn industries in other countries such as in Thailand, the Philippines, Indonesia and tries to follow their strategies. A team of researchers had visited Indonesia in 2018 to understand the production of grain corn. Indonesia was selected because it is the largest producer of grain corn in South-East Asia. Indonesia produces more than 12.00 million MT of grain corn in 2020, followed by the Philippine (8.80 million MT), Thailand (5.50 million MT) and Vietnam (4.54 million MT) (World Agriculture Production, 2021).

CORN INDUSTRY IN INDONESIA

Grain corn is the second largely cultivated crop in Indonesia, after paddy. More than three million hectares of land are cultivated with this commodity, making Indonesia the 7th world grain corn producer in the world. The government efforts to increase grain corn production by establishing a floor price scheme and by providing subsidized seeds and fertilizers have increased harvested land area. For example, the production area has increased from 3.65 million hectares in 2017 to 3.70 million hectares (2017) and 3.90 million hectares in 2020. Farmers are interested to cultivate grain corn because this crop is more profitable relative to other crops.

This commodity plays a big strategic role in the development of the agriculture sector in Indonesia. It creates employment for people, especially in the rural areas, generates incomes for the farmers and profits from the export markets. More than 7.6 million farmers are involved in cultivating corn. Indonesia produces more than ten million MT of grain corn every year, and it is a net exporter. East Java is the largest contributor to the national production of corn in Indonesia, followed by Central Java, Lampung, North Sumatra, South Sulawesi, West Nusa Tenggara, West Java, North Sulawesi, Gorontalo, and South Sumatra. The National corn production with a moisture content of 15% in 2020 reached 12.0 million MT (USDA, 2019).

Corn cultivation is carried out by small farmers, and the average farm size is one hectare. In general, farmers cultivate their corn twice a year, in which every cycle covers around 110 days. The average yield of corn is 5.25 MT per hectare, while in Lamongan, a district in West Java Province, is 9.30 MT per hectare. Farmers obtain their seeds from the government under a subsidy scheme. The government also plays a big role in the development of the grain corn industry. Many incentives and policies were introduced to support the industry. For example, despite the fact that the price of dried corn is determined by market demand and supply, the government sets a floor price of corn, to ensure that farmers receive a reasonable price and make some profit from the cultivation activities. The market price is between Rp4,600 (US$0.32) and Rp4,700 (US$0.33) per kilogram, while the floor price set by the government is Rp3,150 (US$0.22) per kilogram should the price of the world market drops.

Around 58% of corn are used for animal feeds, 30% for fresh consumption and the balance are for processing industries. The demand for corn is increasing every year, especially for animal feeds. Currently, no crops could be used to replace corn as the main ingredients for animal feeds. Corn production has reached nearly 12 million MT in 2020, as government incentives to expand production in the non-traditional regions continue to yield results. The increase in the production of grain corn in Indonesia is contributed by several factors that include:

Large scale grain corn production in Lamongan, East Java

Lamongan is a district in the East Java Province. It was recognized as the Iowa of Indonesia because it is the main production area for grain corn. The production is carried out in large-scale and involves many farmers. The large-scale cultivation of grain corn started in 2016 when the local government provided a strong support to the development of the grain corn industry. The governor of the Province who has visited Iowa State in 2016, followed and replicated the strategies implemented in that state, especially the application of machinery and automation along the supply chain of grain corn production. The local government has introduced a special program called Facilitation of Modern Corn (FJM) and has attracted farmers to participate in this program. Under the FJM, the local government implemented a sub-program called Inovasi Pertanian Jagung or literally translated as Innovation of Agricultural Corn. As a result, the land area cultivated with grain corn has increased from 43,000 hectares in 2016, to more than 60,000 hectares in 2017 and more than 71,000 hectares in 2018. This area produced high quality produce and higher yield per hectare.

Many rural innovations were introduced to improve the productivity and quality of corn. The application of technology, such as semi-automatic tractors, quality hybrid seeds and the application of home-made fertilizers have increased the yield from 5.5 MT/ha to 10 MT/ha. Technology has played a huge part in the ability to increase the production. The selection of hybrid seeds was carried out to determine the best and suitable one for each location. In other words, different area uses different seeds, which is suitable with the ecosystem and land fertility. In some areas, the yield has increased up to 14.0 MT per hectare. The production of grain corn in the Lamongan district has increased from 372,160 MT in 2015, to 571,080 MT in 2017 and 928,000 MT in 2018. This region contributes around 15% of the total national production. The local government has projected that the production will increase to more than one million MT in 2020. The increase in production has increased the profit and socioeconomic well-being of farmers in Lamongan.

The production of hybrid seeds by private sector

High-quality seeds is one of the factors for higher productivity and better quality of grain corn. Indonesia has the capability in producing high-quality seeds for different locations and soil fertility. The production of high-quality seeds is carried out by government agencies as well as private sector. Corteva Agriscience Indonesia (CAI) is one of the biggest seed producing companies in Indonesia. This company is a merger between two big seed producing companies in the world; Dow and Dupont. This company invented high-quality seeds and subsequently produced high quality and yield of grain corn. The seeds produced by the CAI are complied with the good agriculture practice (GAP) and suitable for different locations. In other words, the seeds are produced in accordance with the agro-climatic environment. The seeds are also resistant to many pests and diseases that could lead to a low farm management cost. The seeds are also suitable for high density planting that could result in higher yield per hectare. Some examples of commercial corn seeds available in Indonesia markets are as in Table 2.

Research and development of grain corn

The Indonesian government has established one research and development (R&D) institution that focuses on cereals, including grain corn. The Indonesian Cereals Research Institute (ICERI) is one of the technical implementation units on crop R&D under the coordination of the Indonesian Center for Food Crops Research and Development (ICFORD). ICERI carried out research of corn, sorghum, wheat and other potential cereal crops.

The research is focused on genetic modification, plant breeding, seedling and germplasm, morphology, physiology, ecology and entomology of crops. The Institute provides information and technical services to farmers and entrepreneurs. Since its establishment, the achievement of the ICERI included the production of 41 varieties of hybrid grain corn that have been transferred and used by farmers. Most of the varieties have shorter harvesting time, and thus shorten the production cycle. The new varieties are also resistant to pest and diseases, and produce higher yield per hectare. The examples of new varieties of grain corn invented by the ICERI are as in Table 3.

Benchmarking the Indonesian grain corn industry

Indonesia is one of the largest producers of grain corn in the world. Indonesia has its competitive advantage in terms of land area suitable for grain corn cultivation, abundance of resources, especially its cheap labor and good agroclimatic environment. Its relatively low humidity helps the industry to dry the corn, and reduce the effect of fungus during harvesting. The industry was established long time ago and has already matured. In comparison, despite a traditional crop, grain corn is relatively a dying industry in Malaysia. The Malaysian government plans to revitalize this industry as a strategy to reduce the dependence on imported commodity. This is important because the animal feeds industry is fully supported by the livestock industry. The MAFI plans to cultivate more than 80,000 hectares of grain corn in 2025 and 300,000 hectares in 2032.

The Malaysian government recognizes the competitiveness of the grain industry in Indonesia, and is ready to learn from them. The MAFI sent a team of officers who are representing researchers, economists, extension officers, engineers and breeders to Indonesia in 2018. The mission was to explore the industry and to learn from the experts and industry players how Malaysia could develop its grain industry in a short time. Malaysia has benchmarked the Indonesian grain industry and plans to replicate some strategies, whichever is relevant to the Malaysian environment. In general, the comparison between grain corn industry in Malaysia and Indonesia is presented in Table 4.

Table 4. Comparison between grain corn industry in Malaysia and Indonesia

No

Items

Malaysia

Indonesia

Indicator 1: General information

1

Climate

28 - 350C

28 - 350C

2

Moisture (%)

81%

48%

3

Cultivated area

10,880 ha (Department of Agriculture, 2019)

3.7 million ha (Ministry of Agriculture, 2019)

4

Self Sufficient Level (SSL) (%): 2018

5%

100%

5

New variety

Developed by government: 1variety (Developed by University Putra Malaysia: (Putra J-58 UPM)

Developed by private sector: >10 varieties

Developed by government agency: 41 varieties

Developed by private sector: >10 varieties

6

Seed producers

Green World Genetic (GWG), Charoen Pokphan (CP), Monsanto, Syngenta

Corteva Agriscience, Bisi Indonesia, Monsanto, Syngenta

7

Average yield (ton/ha):

Experimental plot:

5.3 MT/ha (DOA, 2017)

6.0 MT/ha (MARDI, 2019)

National average: 5.25 MT/ha

Lamongan: 9.3 MT/ha

8

Production

79,300 MT (DOA, 2019)

12.0 million MT (USDA, 2020)

9

Position in world market

Not listed

9th (FAO, 2013)

7th (FAO, 2017)

10

Number of farmers

7,500 people

7,600,000 people (Badan Pusat Statistik, 2011)

11

Average farm size

2.5 ha

0.5 - 1.0 ha (Dinas Pertanian, 2019)

12

Production cycle

3 time per year

2 time per year

13

Harvesting period

110 days/cycle

<110 days/cycle

14

Moisture content during harvesting time

30%

<20%

Indicator 2: Production cost

15

Land preparation and cultivation (US$/ha)

Plowing: RM 975/ha (US$237)

Planting: RM350/ha (US$85)

Total: RM1,325/ha (US$322)

Semi mechanization: Rp 1,200, 000/ha (US$84.44)

Conventional (manual): = Rp 400, 000/ha (US$28.14)

16

Price of corn seed (RM/kg)

RM300/ha (US$73/ha)

(20kg x RM15/kg)

Subsidy by government

Rp75,000-Rp85,000 (US$5.27 -5.98)

17

Farm price (RM/kg)

RM0.90/kg (US$0.218) (Moisture content - 14%)

Dried corn:

Rp4,600-4,700/kg (US$0.32 - 0.33)

18

Production cost per season (RM/kg)

At experimental plot:

RM0.71/kg (US$0.17) (DoA, 2018)

RM0.83/kg (US$0.2) (MARDI, 2019)

Rp1,362 (US$0.095/kg)

(DoA, 2019)

19

Production cost per season (RM/ha)

RM3,800 (US$923.51) (DoA, 2017)

RM5,024 (US$1,221) (MARDI, 2019)

Rp14,717,500 (US$1,036/ha)

(DoA, 2019)

20

Net profit (RM/ha) per season

RM970 (US$235) (DoA, 2017)

RM376 (US$91.37) (MARDI, 2019)

Rp25,242,500 (US$1,777)

(DoA, 2019)

21

Labor cost

RM1000-1500/month (US$243 - 364.5)

Rp2.6 million/month (US$183.0/month)

Indicator 3: Financial

22

Credit financing

Bank: Agrobank

Government agency: TEKUN

Farmers cooperative movement

23

Price policy

No policy. Price is determined by world market

No policy. Price is determined by world market

24

Government support

No

The government sets floor price at Rp3,150/kg (US$0.22/kg) should the price at world market dropped below that price

Indicator 4: Agricultural practice

25

Source of seeds

Government: DOA

Private sector: GWG, Charoen Pokphan (CP), Monsanto, Syngenta

Government: National Seed Board

Private sector: Corteva Agriscience, Bisi Indonesia, Monsanto, Syngenta

26

Fertilizer

Organic and Chemical

Organic and Chemical

27

Plant population/ha

66,666 plant/ha

72,000 plant/ha

28

Agricultural activities

Weeding

Fertilizing

Pests and diseases management

Irrigation management

Weeding

Fertilizing

Pests and diseases management

Irrigation management

39

Accreditation

MyGap

-Nil-

30

Disease

i) Helminthosporium maydis

ii) Helminthosporium turcicum

iii) Curvularia Lunata

iv) Puccinia polysora

v) Thanatephorus cucumeris

vi) Parenosclerospora sp.

vii) Erwinia caratovora

viii) Earth pathogen

i) Maize downy mildew

ii) Leaf rust

iii) Southern leaf blight

iv) Northern leaf blight

v) Sheath blight

vi) Rotten corn stalks

vii) Rotten corn cobs

viii) Corn smut

ix) Maize dwarf mosaic virus

31

Pest

i) Army worm (Spodoptera frugiperda)

ii) Stalk caterpillars (Busseola fusca)

iii) Boar, monkey and rat

i) Ostrinia furnacalis

ii) Altherigona spp

iii) Lepidiota stigma

iv) Earthworms

vi) Helicoverpa armigera

vii) Locusta migratoria

viii) Rat

ix) Sitophilus zeamais

x) Sitotroga

32

Government incentives

Pilot project (not started)

Seed subsidy to produce >10 tan/ha value (US$105.4/ha)

Fertilizer subsidy

Indicator 6: Technology application and innovation

33

Cultivation and harvesting

Fully mechanized from land preparation until harvesting (Combine harvester)

Semi mechanized

Harvesting using Combine harvester

34

Processing

Fully mechanized (corn threshing machine)

Fully mechanized (corn threshing machine)

35

Drying

Mobile dryer

Solar drying

Drying machine

Table 4 shows that Indonesia has a high comparative advantage in grain corn production as compared to Malaysia. Indonesia has abundant natural sources such as large land area, fertile soil and better climate that are suitable for grain corn cultivation and cheap labor. Indonesia is more advanced in all aspects of the supply chain, from production to marketing of grain corn. Cost of production per unit kilogram and hectare is relatively cheaper than in Malaysia. As a result, grain corn cultivation is more profitable and attracted farmers to participate in the industry. There are three factors that Malaysia could benchmark Indonesia for the development of grain industry.

Strong policy and direction on grain corn

Indonesia has a very comprehensive policy on cereal crops, including grain corn. Government efforts to increase corn production by establishing a minimum selling price and by providing subsidized seeds and fertilizers have increased the harvested area. For example, the harvested area of corn has increased from 3.65 million hectares in 2017 to reach 3.70 million hectares in 2019 and further expand to 3.90 million hectares in 2020 as farmers consider corn is more profitable relative to other crops. Farmers have been growing more corn when the Ministry of Agriculture implemented a program of providing subsidized seeds, fertilizers, and farming equipment. Additionally, the regulation no. 96/2018 on Reference Price issued in September 2018, setting the minimum buying price of corn with 15% moisture content at the farm level at Rp. 3,150/kg (US$221/MT), has further motivated farmers to grow corn.

The government also introduced import restriction only for feed use. For example, in 2018, Indonesia allowed imports of corn for feeds to around 850,000 MT. The import of grain corn must also be carried out away from the harvesting period, so that the imported commodity will not compete with the local produce.

The outcome of these policies has encouraged farmers throughout Indonesia to cultivate more corn. In Sulawesi, farmers are reported to receive higher margins from corn compared to traditional crops such as coconut or cocoa, leading many to switch to planting corn or to inter-crop corn with coconut trees. In 2017, farmers in North Sulawesi harvested corn on150,000 hectares, but that area has increased to an estimated 320,000 hectares in 2018, and further increase to 340,000 hectares in 2019. Farmers in South Sulawesi are switching from growing teak and cocoa to corn, farmers in Lampung (Sumatra) have begun to favor corn over cassava, and farmers in Java continue to opt to grow corn over soybeans due to higher margins. In addition, farmers in Central Java are switching from rice to corn in rain-fed areas. In other words, a comprehensive and farmer friendly policy has encouraged farmers to cultivate grain corn which eventually led to increase the local production.

Strong research and development (R&D) on grain corn

Indonesia has established a research institute that is dedicated to the development of cereal commodities, including grain corn. The Institute has strengthened the various components of R&D efforts, enabling them to develop, test, multiply, and release high-yielding corn cultivars to farmers. The function of the research institute includes to build a sustainable corn breeding effort that can reliably provide varieties to an emerging seed industry, to build a cooperative network, including farmers, and grain corn users. The Institute also developed cultivars that are targeted for organic needs and adapted for seed production and grain production under organic conditions through on-farm testing, stress nurseries, and grain quality testing. The outcome of the R&D was disseminated to farmers through farmers meetings, seminars, booklets, scholarly publications, and by putting the information on the Internet.

The transfer of technologies from laboratories to farms has speed up the development of grain corn industry in Indonesia. Most of the technologies were adopted and used by farmers. For example, different varieties of seed were used for different location, and this practice has improved the local production because the seeds are suitable for certain agro-climatic environment.

Advanced local high quality hybrid seeds

The development of high-quality hybrid seeds is important as a strategy to increase productivity and quality of corn. The development of hybrid corn has led to major changes in how farming was done. The hybrid seeds are more tolerant to diseases and more efficient towards less fertile soil. The size of corn is also bigger than the traditional varieties and thus, produce higher yield. The Ministry of Agriculture has developed the seeds of 14 high-yielding corn varieties to help increase the national corn production. These varieties have the potential to produce more than 11 MT/ha, compared to 6.4 MT/ha of traditional corn productivity. Each variety has its own specialty and weather preferences. Hence, corn farmers should choose the right seed for their farm conditions. Currently, the hybrid seed corn prices range between Rp. 80,000 and Rp. 100,000 per kilogram (US$ 5.62-7.02/kg), an average increase of Rp. 5,000 – Rp. 10,000 per kg (US$0.35-0.70/kg) from year 2018. Better yield is expected to be achieved as well as fewer pest and disease incidence.

In 2020, Indonesia exported 14 MT of hybrid seeds to Thailand, valued more than US$ 56,000. The export proves that the seeds produced by Indonesia are capable of competing with developed countries. This also shows that hybrid seeds by the Indonesian laboratories are well accepted by the world markets.

WAY FORWARD

The government of Malaysia believes that the development of a grain corn industry is important and critical for the survival of the livestock industry. However, many obstacles must be addressed by the government before the project could be implemented. For example, currently, few areas are suitable for grain corn cultivation. The humid weather could lead to affect the quality of the corn and higher cost of production does not attractive to investors. At the same time, the seeds supplied by the private sector could only produce between three and six MT per hectare. The experimental plot carried out by DOA and MARDI produced a better result of between five and six MT per hectare. The low productivity per hectare is not feasible for the cultivation of grain corn in Malaysia.

Learning from Indonesia, the government has set a new direction for the grain corn industry in Malaysia. Malaysia plans to produce at least 30% of its grain corn requirements by 2032. The Ministry of Agriculture and Food Industry (MAFI) plans to open new land area specifically for grain corn production. This could be done by increasing the land area to around 30,000 hectares. This will result with the production of around 1.4 million MT of grain corn. The production of grain corn will be carried out in the areas that have a long dry season, low humidity and flat land such as in Chuping in Perak, Seberang Prai in Penang and Bachok in Kelantan. The project was started in 2020 as a pilot project. The cultivation of grain corn will be carried out five cycle in two years. The commercial scale production of minimum 1,000 hectare in one area will use appropriate technologies along the supply chain, from production until marketing. MARDI has been mandated to examine some varieties from Indonesia and test its suitability in Malaysia climate. New variety of corn that could produce higher yield will be cultivated. The use of a better corn variety that produce between ten and twelve MT per hectare, and the application of technologies will reduce the cost of production and as a result, will make the investment more feasible. At the same time, the plant will be used as silage for ruminant. MARDI has invented new machine and new formulation for silage production. This new technology will add value of the grain corn cultivation and increase the income of the farmers.

The DOA will identify interested parties from private sector, cooperative and small and medium enterprises to participate in the project. The ministry will request the state government to provide suitable land for the cultivation of grain corn in a commercial scale. In Malaysia, the land matter is under the purview of the state government. The government will provide some incentives such as grant and tax incentive, technical supports and guaranteed price. The government will also intensify the R&D activities that could generate better hybrid seeds that tolerant to pests and diseases and has the potential to produce higher yield. MARDI will conduct research on seed technology, cultivation, production, processing as well as mechanization and automation. MARDI will collaborate with the Indonesian Cereals Research Institute (ICERI) on the development of new technologies related to corn. Some hybrid seeds invented by the ICERI will be tested in Malaysia. The government will also cooperate with local seed companies and abroad to invent new hybrid seed suitable with the Malaysian agro-climatic environment.

Application of technology along the supply chain of grain corn production will be intensified. This includes the application of hybrid seeds, mechanization and automation, pests and diseases management, postharvest management and logistic management. The use of drown or satellite will help farmers in collecting data related to soil fertility and farm management. The data can also tell where, and why, their crop is under stress and helps them diagnose the source. The next step is to correctly apply the treatment. Malaysia will intensify the use of precision farming. Critical to the success of precision farming is sophisticated equipment called “variable-rate technologies.” These devices are mounted on tractors and programmed to control the dispersion of water and chemicals based upon the information gained from the remote sensors. Now being able to target and limit inputs – such as fertilizers, seeds, water, pesticides, or herbicides – to precisely where and how much is needed, so that farmers are putting less on the landscape. This can mean less chemical runoff from farms to negatively impact the environment. By using the tools of precision farming, growers can specifically target areas of need within their fields and apply just the right amounts of chemicals where and when they are needed, saving both time and money and minimizing their impact on the environment. As a result, it will reduce the cost of production and increase the yield per hectare.

CONCLUSION

Indonesia has established its grain corn industry and became one of the big players in the world. Indonesia has developed its grain corn industry and created its competitive advantage through the support of the government, the cooperation among the farmers' community and the roles played by the private sector. The farmers friendly policies undertaken by the government have encouraged farmers to cultivate grain corn and enhance the industry. The willingness of the grain corn community to adopt the technologies and share the information among them is a factor that helped the industry to grow.

Indonesia enhanced its grain corn industry by learning from Iowa State in the USA. Indonesia replicated the strategies and adapted the technologies used in Iowa with the Indonesian agro-climatic environment. Malaysia, on the other hand, learns from Indonesia and adopts some of the strategies, which are suitable with Malaysian environment. Malaysia is a small country, and thus, unable to cultivate corn in a very large area. Malaysia could focus on the development of new hybrid seeds suitable for Malaysia, invent more machine and automation devices for planting, operating farm management, harvesting and processing the seeds to become feed meals.

Malaysia is looking forward to developing its grain corn industry. It is not too late to revitalize the corn industry in Malaysia and becomes one of the grain corn players in the world.

REFERENCES

Corteva Agriscience Indonesia (2019). www.corteva.id

Dinas Pertanian Lamongan, Jawa Timur (2019).

Food and Agriculture Organisation (2017). www.fao.org

Jabatan Perkhidmatan Veterinar (2018). www.dvs.gov.my

Kasryno F, Pasandaran E dan Fagi A.M. (2008). Ekonomi Jagung Indonesia. Jakarta: Badan Penelitian dan Pengembangan Pertanian. Deptan. p37-72.

Kementerian Pertanian dan Industri Makanan (2016). www.moa.gov.my

Kementerian Pertanian dan Industri Makanan (2018). www.moa.gov.my

Kementerian Pertanian Republika Indonesia (2019). www.pertanian.go.id

Perangkaan Agromakanan Negara (2018). Kementerian Pertanian dan Industri Makanan (MOA). www.moa.gov.my

Redaksi, 2019 Level Mekanisasi Pertanian Indonesia Naik 236% http://agroindonesia.co.id/2019/05/level-mekanisasi-pertanian-indonesia-naik-236/

Balai Penelitian Lahan Rawa(2019), Mekanisasi untuk Tingkatkan Produksi Jagung

USDA(2019). Indonesia Grain and Feed Annual Report 2019. downloadreportbyfilename (usda.gov)

Corn Production by Country (2021). World Agricultural Production 2020/2021. www.worldagricultureproduction.com

USDA (20200. Grain and feed update. www.usda.gov.