Introduction

China's economy has entered into an era of “New Normal”. The supply-side structural reform was proposed to cut excessive industrial capacity, destock, de-leverage, lower corporate costs and improve weak links. And the 2016 Central Rural Work Conference confirmed that the focus of agricultural and rural work would be on promoting the supply-side structural reform in agriculture. However, the pressure of de-stocking is still severe, especially for corn. This article will take corn as an example to analyze reasons for high stocks, challenges of de-stocking and feasible strategic choices.

Reasons for corn’s high stocks in China

Looking from the balance sheet, stocks equal to supply (production plus import) subtracting consumption (domestic consumption plus export). De-stocking shall be considered from this point.

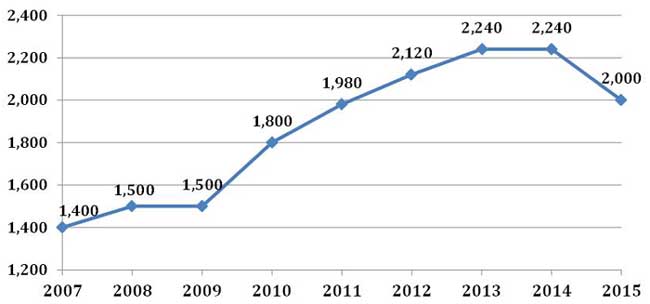

The main reason for corn’s high stocks in China is that every attribute in the balance sheet is changed by essential changes in price relations. China started the corn temporary purchase and storage policy in 2007. The price of purchasing corn for temporary storage increased every year, even when the price of global agri-products experienced sharp drop after 2012 (Fig. 1). It led to the price reversion and the domestic price started to surpass the global price. The domestic price relation showed price inversion between origination and consumption market, as well as between raw material and final product, and the domestic corn market turned out to be policy driven. This shall be the root cause of high stocks of corn. China has started to adjust the temporary purchase and storage policy, lowering the purchasing price to ¥2000/t, even though the price is still the highest in the market, which is 43% higher than in 2007. The temporary purchase and storage is experiencing the largest scale in history and continuous increasing stocks. In 2016, China proceeded the market-oriented reform for corn temporary purchase and storage policy, based on the principle of “pricing by market and separating pricing from subsidies”. The government no longer purchases corn for temporary storage, instead of giving subsidies to corn growers directly. The result is the increase in the cessation of corn stocks, but the problem of aggregated high inventory is still severe, which brings serious financial burden that needs immediate resolution.

Fig. 1. Corn temporary purchasing price (RMB/t)

Note: The figure above shows the purchasing price in Jilin province, which is ¥20/t higher than that of Heilongjiang province, and ¥20/t lower than that of Liaoning and Inner Mongolia.

Source: National Development and Reform Commission

Consumption growth slowdown, and export being contained

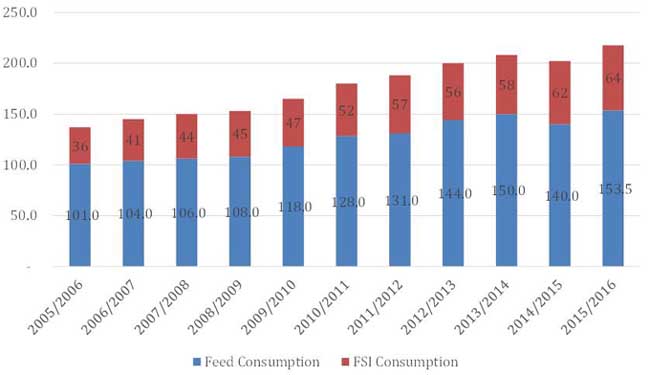

As China's economy has entered into “the New Normal” and consumption growth slows down, corn consumption including feed and industrial consumption, is experiencing the trend of slow growth (Fig. 2). The consumption of fuel ethanol in industrial consumption receives much blame when the global grain price booms. Actually, the corn-made fuel ethanol policy in China was formed in 2004, a small amount of new capacity was added afterwards, and there was no additional capacity after 2010. So the annual corn consumption for fuel ethanol is basically stable at 5 MMT. In corn industrial consumption, some products, such as citric acid and lysine, are affected by global and domestic price inversion, which leads to the slowdown growth of the export of corn processing products.

Fig. 2. China's corn consumption (in MMT)

Source: USDA

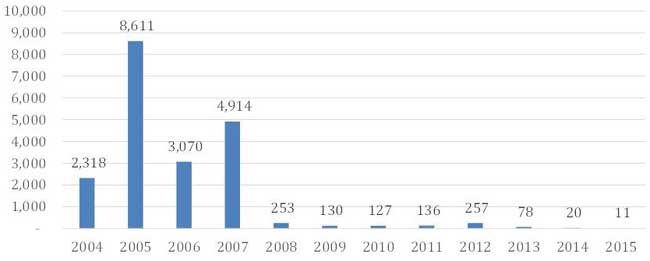

Given that the domestic price is higher than that of the global price, corn export comes to a standstill (Fig. 3).

Fig. 3. China Corn Export (in thousand tons)

Source: General Administration of Customs of P.R.C

Production exceeds consumption motivated by high prices

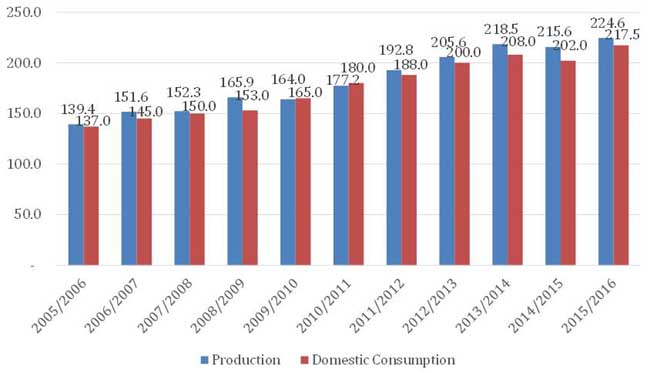

Motivated by high prices, domestic corn production has been increased substantially. Even under the circumstances of weak demand, the amount of production has been exceeding that of consumption since 2011 and the surplus goes into national storage. Between 2011 and 2015, production was 41,662 tons higher than consumption (Fig. 4).

Fig. 4. China's corn production and consumption (in MMT)

Source: USDA, National Bureau of Statistics of P.R.C

Import replaces domestic corn also motivated by high prices

The import of corn substitutes caused by higher domestic price compared to the global price is also the main reason for stocks buildup. The import of corn is constrained by import tariff quota, however, corn substitutes, such as sorghum, barley and cassava, by-products like DDGS and product substitutes like cassava starch do not have the constraint. As a result, products mentioned above directly replace domestic-produced corn. From 2012 to 2015, the volume of imported corn was 15,799 tons, 14,046 tons higher than that of 2011, and the volume of imported corn substitutes and by-products was 95,410 tons, 86,204 tons higher than that of 2011.

Change of market subject behavior pattern results in government’s high stocks

The high stocks for corn in China is better explained by the high stocks held by the government. Normally, the stocks include government, commercial and farmer stocks. However, in the temporary purchase and storage system, the market subject behavior pattern was changed dramatically. Due to the price inversion, manufacturing and trade companies, suffering hard operation, cannot build up stocks for business. In addition, growers are more willing to sell corn to the government in order to get more profit and do not hold stocks anymore. So both commercial and farmer stocks turned out to be government stocks.

Challenges for corn de-stocking and feasible strategic choices

Given the sufficient global supply and weak demand, as well as Chinese corn’s low competitive advantage, the export of corn in China experiences difficulty and limited space. The feed consumption for corn is determined by animal protein consumption, however, it cannot increase in a short period of time due to the inelastic animal protein demand. Therefore, de-stocking could be applied by reducing domestic production, constraining imported substitutes and increasing industrial consumption.

Promote market-oriented reform, adjust planting structure and reduce corn planting area

The main reason for the increase of corn production, even exceeding domestic consumption, is that the higher purchasing price, caused benefit on corn higher than other crops such as soybean. Therefore, reducing corn’s planting area shall be focused on applying price leverage. Via market-oriented reform, price relations between different crops shall be rationalized eventually. The central government has proceeded the market-oriented reform towards the temporary purchase and storage policy. Only through this method, the problem of corn’s high stocks could be solved fundamentally.

Promote market-oriented reform and reduce import of substitutes

Reducing the import of corn substitutes is influenced by two factors. First, promoting the market-oriented reform could rationalize price relations and reduce the price gap between domestic and global market. It is the method to reduce the import of substitutes from the root. In 2016, the import of some agricultural-products decreased sharply. Between January and November of 2016, the import of barley was 4,600 tons, decreased by 55% year on year, and the import of sorghum was 6,451 tons, decreased by 35% year on year. The reason for the reduction is that the decrease of domestic corn price from¥2000/t to ¥1,700/t makes the economic benefit of substitutes declining at the same time.

Stimulate corn industrial consumption by nationwide spread of fuel ethanol

Feasibility analysis

The demand for feed consumption is highly inelastic, as well as deep-processing corn products, no matter for food industry or for export, which are hard to expect a sharp increase in the future. The elastic demand for corn consumption comes from the fuel ethanol consumption. Based on the data from the National Bureau of Statistics and General Administration of Customs, in 2015, domestic-produced crude oil volume reached 215 MMT and net import volume reached 333 MMT, with the extent of reliance on global market reaching 60.77%. Increasing fuel ethanol consumption, which partially replaces petroleum consumption, could be realized through decreasing import of petroleum. China’s apparent consumption of gasoline exceeds 115 MMT. If fuel ethanol could be spread nationwide and the mixing ratio could be set to 10%, the demand for fuel ethanol will reach 11.5 MMT, 9.2 MMT higher than the use of 2.3 MMT of nowadays. As 3.1 tons of corn can produce 1 ton of ethanol, 28.5 MMT of extra corn consumption will be expected.

From the perspective of economic feasibility, when the cost of corn in ethanol production is no higher than ¥1600/t and global crude oil price is no less than $40/barrel, domestic ethanol could gain breakeven and does not need the government's subsidy. The current global crude oil price stays around $55/barrel, so the production of fuel ethanol has a good economic benefit. After the corn price market-oriented reform, and in the background of low global price, there is a high probability of domestic corn price not exceeding¥1600/t. Hence, promoting fuel ethanol in the coming future is economically feasible.

Besides, promoting fuel ethanol could be linked with the de-stocking of corn with low quality and the effective reduction of greenhouse gas emission. De-stocking, maintaining food safety and promoting environment improvement can all be achieved at the same time.

Risk prevention

One point is to prevent risk that affects food security. First of all, raw materials used to produce fuel ethanol shall stick to low-quality grains. The majority of grains used in the production of fuel ethanol are moldy and aging grains, with grains containing excess heavy metals, which are not edible for humans and animals. So using low-quality grains to produce fuel ethanol will not affect food security. Second, the capacity of ethanol production could be controlled. Even if the supply is tight again in the future, grain security can be ensured by reducing ethanol mixing ratio.

The other point is to prevent the risk of over-capacity. In principle, new companies doing fuel ethanol business are not going to be added, instead the excess ethanol capacity shall be used. So far, domestic ethanol has big overcapacity, with utilization rate of 50%. Technology improvement is expected to meet the demand for ethanol production.

The last point is to prevent insufficient raw materials. If extra capacity of fuel ethanol is surely needed, the way to choose raw materials has to be flexible. On the one hand, the layout could be set along the coast or the Yangtze River in order to take advantage of imported raw materials. On the other hand, by optimizing the manufacturing techniques, the flexible usage of corn, rice and cassava can be achieved.

Conclusion

Corn's high stocks in China are mainly caused by higher domestic purchasing prices, lower global prices, record level of production, slowdown of consumption growth, significant increase of imported substitutes and sharp reduction of commercial and farmer stocks. Through market-oriented reform, de-stocking could be applied by reducing domestic production, constraining imported substitutes and increasing industrial consumption, particularly promoting fuel ethanol production to cut low quality corn stocks.

PS: There is no reference except for the data the sources of which has already been noted in the text.

|

Date submitted: Feb. 6, 2017

Reviewed, edited and uploaded: Feb. 6, 2017

|

China’s De-stocking Strategy for Grains – taking Corn as the Example

Introduction

China's economy has entered into an era of “New Normal”. The supply-side structural reform was proposed to cut excessive industrial capacity, destock, de-leverage, lower corporate costs and improve weak links. And the 2016 Central Rural Work Conference confirmed that the focus of agricultural and rural work would be on promoting the supply-side structural reform in agriculture. However, the pressure of de-stocking is still severe, especially for corn. This article will take corn as an example to analyze reasons for high stocks, challenges of de-stocking and feasible strategic choices.

Reasons for corn’s high stocks in China

Looking from the balance sheet, stocks equal to supply (production plus import) subtracting consumption (domestic consumption plus export). De-stocking shall be considered from this point.

The main reason for corn’s high stocks in China is that every attribute in the balance sheet is changed by essential changes in price relations. China started the corn temporary purchase and storage policy in 2007. The price of purchasing corn for temporary storage increased every year, even when the price of global agri-products experienced sharp drop after 2012 (Fig. 1). It led to the price reversion and the domestic price started to surpass the global price. The domestic price relation showed price inversion between origination and consumption market, as well as between raw material and final product, and the domestic corn market turned out to be policy driven. This shall be the root cause of high stocks of corn. China has started to adjust the temporary purchase and storage policy, lowering the purchasing price to ¥2000/t, even though the price is still the highest in the market, which is 43% higher than in 2007. The temporary purchase and storage is experiencing the largest scale in history and continuous increasing stocks. In 2016, China proceeded the market-oriented reform for corn temporary purchase and storage policy, based on the principle of “pricing by market and separating pricing from subsidies”. The government no longer purchases corn for temporary storage, instead of giving subsidies to corn growers directly. The result is the increase in the cessation of corn stocks, but the problem of aggregated high inventory is still severe, which brings serious financial burden that needs immediate resolution.

Fig. 1. Corn temporary purchasing price (RMB/t)

Note: The figure above shows the purchasing price in Jilin province, which is ¥20/t higher than that of Heilongjiang province, and ¥20/t lower than that of Liaoning and Inner Mongolia.

Source: National Development and Reform Commission

Consumption growth slowdown, and export being contained

As China's economy has entered into “the New Normal” and consumption growth slows down, corn consumption including feed and industrial consumption, is experiencing the trend of slow growth (Fig. 2). The consumption of fuel ethanol in industrial consumption receives much blame when the global grain price booms. Actually, the corn-made fuel ethanol policy in China was formed in 2004, a small amount of new capacity was added afterwards, and there was no additional capacity after 2010. So the annual corn consumption for fuel ethanol is basically stable at 5 MMT. In corn industrial consumption, some products, such as citric acid and lysine, are affected by global and domestic price inversion, which leads to the slowdown growth of the export of corn processing products.

Fig. 2. China's corn consumption (in MMT)

Source: USDA

Given that the domestic price is higher than that of the global price, corn export comes to a standstill (Fig. 3).

Fig. 3. China Corn Export (in thousand tons)

Source: General Administration of Customs of P.R.C

Production exceeds consumption motivated by high prices

Motivated by high prices, domestic corn production has been increased substantially. Even under the circumstances of weak demand, the amount of production has been exceeding that of consumption since 2011 and the surplus goes into national storage. Between 2011 and 2015, production was 41,662 tons higher than consumption (Fig. 4).

Fig. 4. China's corn production and consumption (in MMT)

Source: USDA, National Bureau of Statistics of P.R.C

Import replaces domestic corn also motivated by high prices

The import of corn substitutes caused by higher domestic price compared to the global price is also the main reason for stocks buildup. The import of corn is constrained by import tariff quota, however, corn substitutes, such as sorghum, barley and cassava, by-products like DDGS and product substitutes like cassava starch do not have the constraint. As a result, products mentioned above directly replace domestic-produced corn. From 2012 to 2015, the volume of imported corn was 15,799 tons, 14,046 tons higher than that of 2011, and the volume of imported corn substitutes and by-products was 95,410 tons, 86,204 tons higher than that of 2011.

Change of market subject behavior pattern results in government’s high stocks

The high stocks for corn in China is better explained by the high stocks held by the government. Normally, the stocks include government, commercial and farmer stocks. However, in the temporary purchase and storage system, the market subject behavior pattern was changed dramatically. Due to the price inversion, manufacturing and trade companies, suffering hard operation, cannot build up stocks for business. In addition, growers are more willing to sell corn to the government in order to get more profit and do not hold stocks anymore. So both commercial and farmer stocks turned out to be government stocks.

Challenges for corn de-stocking and feasible strategic choices

Given the sufficient global supply and weak demand, as well as Chinese corn’s low competitive advantage, the export of corn in China experiences difficulty and limited space. The feed consumption for corn is determined by animal protein consumption, however, it cannot increase in a short period of time due to the inelastic animal protein demand. Therefore, de-stocking could be applied by reducing domestic production, constraining imported substitutes and increasing industrial consumption.

Promote market-oriented reform, adjust planting structure and reduce corn planting area

The main reason for the increase of corn production, even exceeding domestic consumption, is that the higher purchasing price, caused benefit on corn higher than other crops such as soybean. Therefore, reducing corn’s planting area shall be focused on applying price leverage. Via market-oriented reform, price relations between different crops shall be rationalized eventually. The central government has proceeded the market-oriented reform towards the temporary purchase and storage policy. Only through this method, the problem of corn’s high stocks could be solved fundamentally.

Promote market-oriented reform and reduce import of substitutes

Reducing the import of corn substitutes is influenced by two factors. First, promoting the market-oriented reform could rationalize price relations and reduce the price gap between domestic and global market. It is the method to reduce the import of substitutes from the root. In 2016, the import of some agricultural-products decreased sharply. Between January and November of 2016, the import of barley was 4,600 tons, decreased by 55% year on year, and the import of sorghum was 6,451 tons, decreased by 35% year on year. The reason for the reduction is that the decrease of domestic corn price from¥2000/t to ¥1,700/t makes the economic benefit of substitutes declining at the same time.

Stimulate corn industrial consumption by nationwide spread of fuel ethanol

Feasibility analysis

The demand for feed consumption is highly inelastic, as well as deep-processing corn products, no matter for food industry or for export, which are hard to expect a sharp increase in the future. The elastic demand for corn consumption comes from the fuel ethanol consumption. Based on the data from the National Bureau of Statistics and General Administration of Customs, in 2015, domestic-produced crude oil volume reached 215 MMT and net import volume reached 333 MMT, with the extent of reliance on global market reaching 60.77%. Increasing fuel ethanol consumption, which partially replaces petroleum consumption, could be realized through decreasing import of petroleum. China’s apparent consumption of gasoline exceeds 115 MMT. If fuel ethanol could be spread nationwide and the mixing ratio could be set to 10%, the demand for fuel ethanol will reach 11.5 MMT, 9.2 MMT higher than the use of 2.3 MMT of nowadays. As 3.1 tons of corn can produce 1 ton of ethanol, 28.5 MMT of extra corn consumption will be expected.

From the perspective of economic feasibility, when the cost of corn in ethanol production is no higher than ¥1600/t and global crude oil price is no less than $40/barrel, domestic ethanol could gain breakeven and does not need the government's subsidy. The current global crude oil price stays around $55/barrel, so the production of fuel ethanol has a good economic benefit. After the corn price market-oriented reform, and in the background of low global price, there is a high probability of domestic corn price not exceeding¥1600/t. Hence, promoting fuel ethanol in the coming future is economically feasible.

Besides, promoting fuel ethanol could be linked with the de-stocking of corn with low quality and the effective reduction of greenhouse gas emission. De-stocking, maintaining food safety and promoting environment improvement can all be achieved at the same time.

Risk prevention

One point is to prevent risk that affects food security. First of all, raw materials used to produce fuel ethanol shall stick to low-quality grains. The majority of grains used in the production of fuel ethanol are moldy and aging grains, with grains containing excess heavy metals, which are not edible for humans and animals. So using low-quality grains to produce fuel ethanol will not affect food security. Second, the capacity of ethanol production could be controlled. Even if the supply is tight again in the future, grain security can be ensured by reducing ethanol mixing ratio.

The other point is to prevent the risk of over-capacity. In principle, new companies doing fuel ethanol business are not going to be added, instead the excess ethanol capacity shall be used. So far, domestic ethanol has big overcapacity, with utilization rate of 50%. Technology improvement is expected to meet the demand for ethanol production.

The last point is to prevent insufficient raw materials. If extra capacity of fuel ethanol is surely needed, the way to choose raw materials has to be flexible. On the one hand, the layout could be set along the coast or the Yangtze River in order to take advantage of imported raw materials. On the other hand, by optimizing the manufacturing techniques, the flexible usage of corn, rice and cassava can be achieved.

Conclusion

Corn's high stocks in China are mainly caused by higher domestic purchasing prices, lower global prices, record level of production, slowdown of consumption growth, significant increase of imported substitutes and sharp reduction of commercial and farmer stocks. Through market-oriented reform, de-stocking could be applied by reducing domestic production, constraining imported substitutes and increasing industrial consumption, particularly promoting fuel ethanol production to cut low quality corn stocks.

PS: There is no reference except for the data the sources of which has already been noted in the text.

Date submitted: Feb. 6, 2017

Reviewed, edited and uploaded: Feb. 6, 2017