ABSTRACT

Indonesia is ranked third after China and India among the ten biggest producing countries of tomatoes in the Asia Pacific region. In the last five years, the production of Indonesia’s tomatoes increased by about 4.60% per year i.e., from 976,790 tons in 2018 to 1,168,743 in 2022. However, Indonesia is a net imprter of tomatoes, in particular as processed products. There is a need to develop the tomato industry in Indonesia by providing the availability of good quality seeds and promoting investments. The government institutions and private sectors in Indonesia have released several superior and good tomato varieties. The government has also shown interest in promoting agricultural development and offering policy support to attract investments. Investing in tomatoes in Indonesia can be a lucrative venture; therefore, staying informed about government regulations and incentives for agriculture in Indonesia is crucial for a successful venture.

Keywords: tomatoes, seeds, investments, development, Indonesia

INTRODUCTION

Background

Tomato (Lycopersicum esculentum Mill) is part of the horticultural commodity that plays several significant roles in the country’s agricultural and economic landscape. This commodity is a staple in Indonesian cuisine and is used in a wide variety of dishes, including sambal (a spicy condiment), soups, salads, and various traditional dishes. They are a key ingredient in many Indonesian recipes, making them a crucial part of the country’s food production.

While tomato is not the largest agricultural crop in Indonesia, the role of this commodity reflects its significance in terms of food, income, employment, and agricultural diversity in the country. Therefore, the development of this commodity is essential based on its characteristics such as production, variety, and other related supporting aspects. This paper discusses the performance and development of tomatoes in Indonesia.

PERFORMANCE

Production

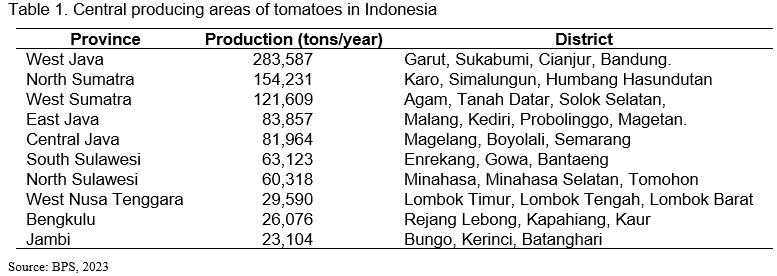

Tomatoes can be grown in all regions of Indonesia. The central producing areas of this commodity are located in 10 provinces. The largest and the smallest productions were West Java and Jambi provinces, respectively (Table 1).

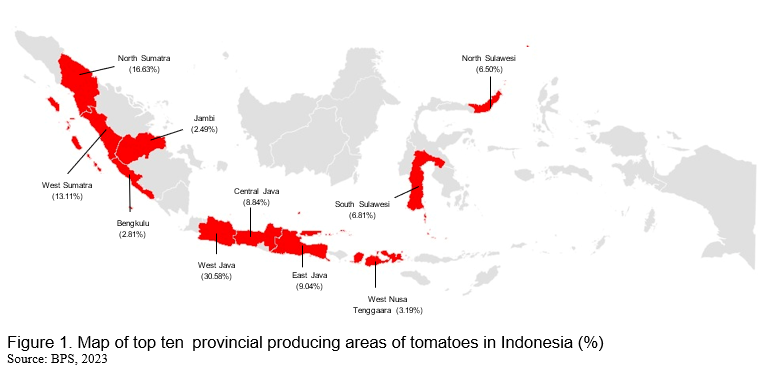

The top ten provincial producing areas of tomatoes contributed to about 86.43% of the total national production. In aggregate, the contribution of outer Java Island was a little bit greater than that of Java Island i.e., 44.55% vs. 41.88% (Figure 1). The producing areas in Java Island comprise the provinces of West Java, East Java, and Central Java. Meanwhile, the producing areas in outer Java Island consist of western region (North Sumatra, West Sumatra, Jambi, and Bengkulu provinces), central region (West Nusa Tenggara province), and eastern region (South Sulawesi and North Sulawesi province.

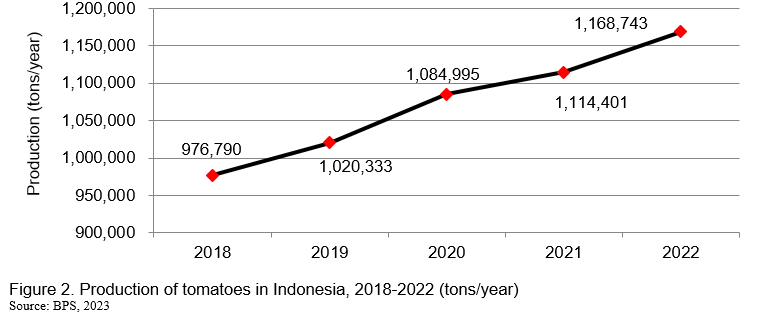

During the last five years (2018-2023), the production of tomatoes increased by about 4.60% per year i.e., from 976,790 tons in 2018 to 1,168,743 in 2022 (Figure 2).

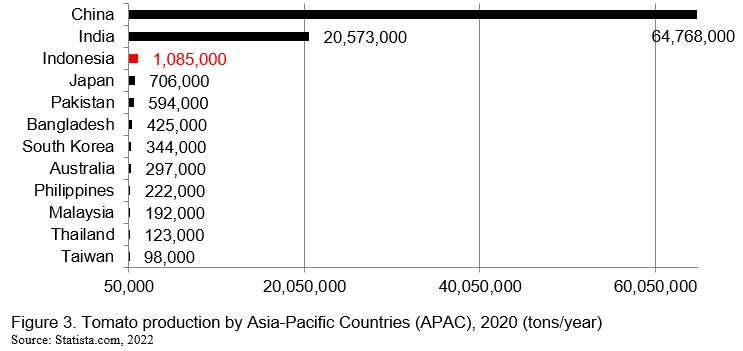

In 2020, Indonesia ranked third among the Asia-Pacific producing countries of tomatoes. The first and the second ranks were China and India (Figure 3). The contribution of Indonesia (1.21%) was much lower than that of China (72.43%) and India (23.01%).

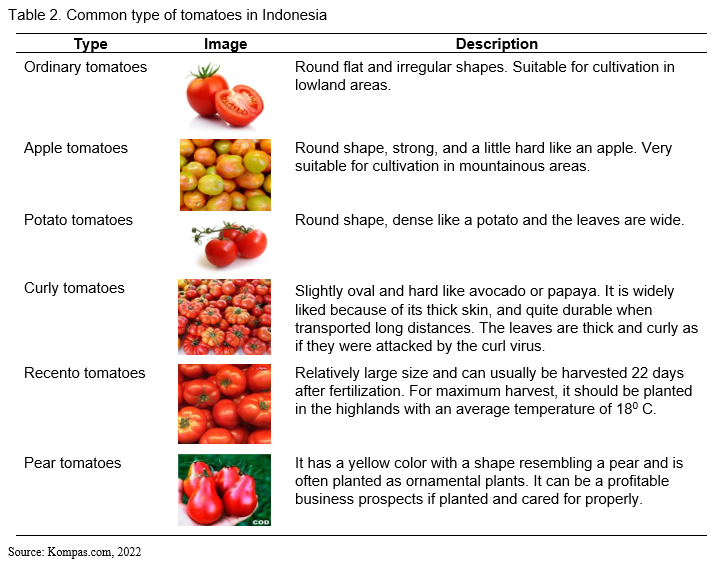

Types and varieties

Based on its appearance, six types of commercial tomatoes are commonly found in Indonesia. It includes: (1) Ordinary tomatoes; (2) Apple tomatoes; (3) Potato tomatoes; (4) Curly tomatoes; (5) Recento tomatoes; and (6) Pear tomatoes (Table 2).

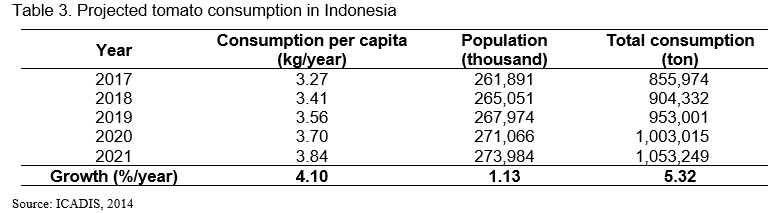

Consumption

Tomatoes are a type of fruit vegetable that contains nutrients including protein, carbohydrates, fats, minerals, and vitamins. Therefore, this commodity has good prospects in agribusiness development.

From 2017 up to 2021, it is projected that tomato consumption will increase by about 4.10% while the population is estimated to increase with an average growth of 1.13% per year. Thus, the total consumption of tomatoes during those periods was projected to increase with an average growth of 5.32% per year (Table 3).

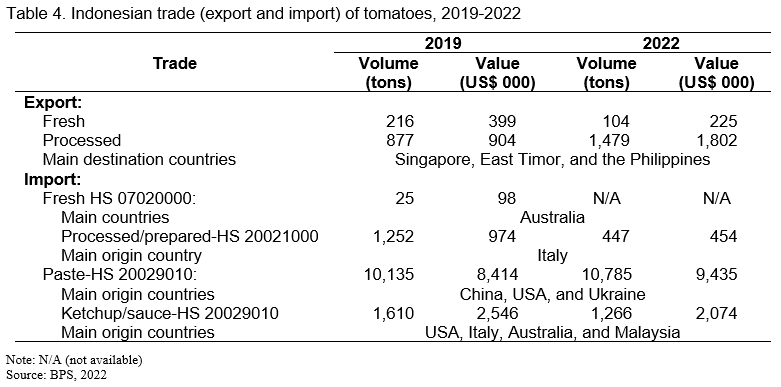

Export and import

Indonesia has a trade balance of tomatoes of about US$259,000 (OEC, 2022). In 2021, Indonesia exported US$280,000 in tomatoes, making it the 82nd largest exporter of tomatoes in the world. In the same year, tomatoes were the 963rd most exported product in Indonesia. The main destination of tomatoes exported from Indonesia is Singapore, Maldives, Malaysia, Nepal, and Qatar. The fastest-growing export markets for tomatoes in Indonesia between 2020 and 2021 were Maldives, Nepal, and Qatar.

On the other hand, the country imported US$21,000 in tomatoes, becoming the 158th largest importer of tomatoes in the world. In the same year, tomatoes were the 1187th most imported product in Indonesia. Indonesia imports tomatoes primarily from Singapore, Japan, Australia, Russia, and Oman. The fastest-growing import markets in tomatoes for Indonesia between 2020 and 2021 were Singapore, Japan, and Russia.

The Indonesian trade (export and import) of tomatoes from 2019 to 2022 can be seen in Table 4. The export comprises fresh and processed tomatoes. The value of fresh tomato decreased by about 43.61% while the value of processed tomatoes increase about 99.34%. Meanwhile, the imported paste-HS 20029010 increased about 12.13%. However, the imported value of processed tomatoes especially ketchup/sauce-HS 20029010 was quite high. However, the imported value of processed tomatoes especially ketchup/sauce-HS 20029010 was quite high (Table 4).

DEVELOPMENT

Essentially, there are two crucial factors to support the development of tomatoes in Indonesia. They are seeds provision and investments promotion.

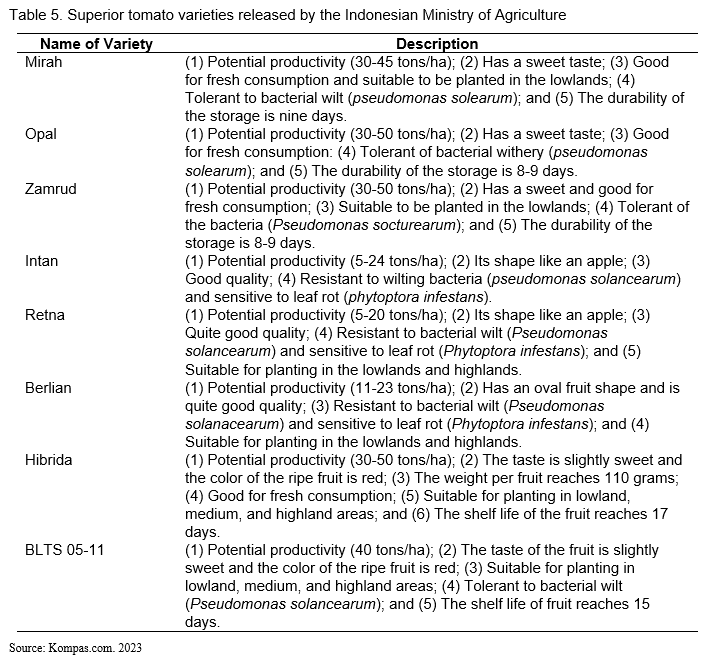

Seeds provision

The choice of tomato seeds is a critical decision for tomato farmers because it directly impacts the quality, yield, and success of their crops. The selection of appropriate seeds allows farmers to tailor fit their tomato production to specific needs, environmental conditions, and market demands, ultimately contributing to the overall success and sustainability of their farming operations. The Ministry of Agriculture has released several superior varieties of tomatoes in Indonesia. They are Mirah, Opal, Zamrud, Intan, Retna, Berlian, Hibrida varieties, and BLTS 05-11 as described in Table 5.

Apart from government institutions, members of the private sectors also release some good tomato varieties. It includes: (1) Servo, Agatha, Ultima, Permata, Gustavi, Gummara, Optima, Bareto, and Tymoti varieties from PT East West Seed Indonesia; (2) (TM Elisha variety from PT Tani Murni Indonesia; and (3) TO ASA 304 variety from PT Aditya Sentana Agro (Asbesindo, 2023).

Horticulture development must start with the use of quality seeds of superior varieties. The Indonesian Minister of Agriculture has issued Horticultural Seed Regulations (DHS, 2015) and Guidelines for Registration of Horticultural Varieties (DHS, 2019)[1]. These regulations are intended as a basis for implementing variety registration activities to protect consumers from acquiring seeds whose performance/variety diversity does not match the description. The scope of this regulation includes breeding, registration requirements, and procedures, launching varieties, and monitoring registration marks.

Considering that the characters in the variety description will be used as a reference in testing the truth of the variety, understanding of the terms in the description must be the same. The procedures are as follows: (1) Testing the superiority of varieties; (2) Testing procedures (criteria, advantages, test implementation, resistance to plant pest organisms, consumer preference testing, expiry date of test result data, and preparation of test results); (3) Testing the correctness of varieties and its conditions; (4) Testing agencies (appointed by the Minister of Agriculture i.e., plant seeds certification agency, university, agricultural research and development agency, and business actors); and (5) Special identifier and naming.

Horticultural companies

In 2022, there were 217 horticultural companies in Indonesia. This number has increased by 88.70% i.e., 102 companies in the previous year (BPS, 2022). The majority of the horticultural companies are located on Java Island (68.20%) comprising East Java (25.32%), West Java (22.58%), and Central Java (20.28%). These companies cultivate fruits (31.73%), mixed crops (23.75%), vegetables (21.60%), ornamental plants (20.22%), and biopharmaceuticals (2.70%).

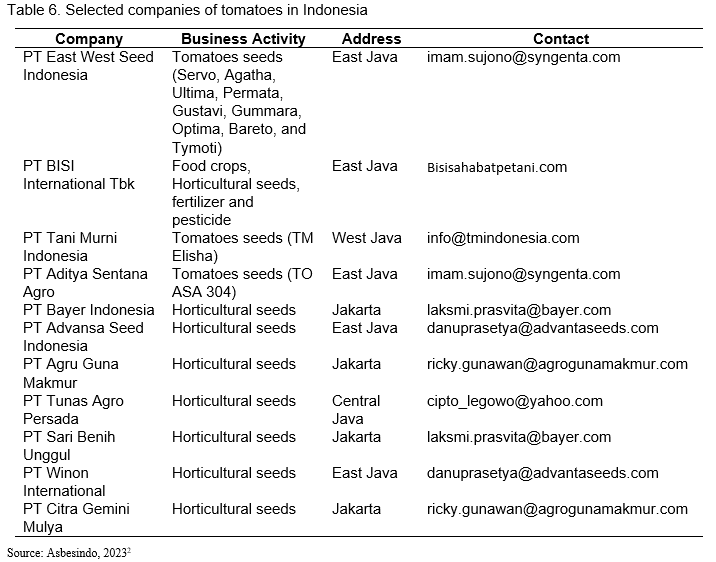

Indonesia has also an Indonesian Seed Association (Asbesindo) with 72 registered memberships. It includes 62 national private companies, two state-owned enterprises (BUMN), and eight multi-national companies. Among other Asbesindo members, some companies are operating in the tomato sector (Table 6).

Investments promotion

Investments are crucial for the development of Indonesia’s tomato industry because they can drive modernization, increase productivity, improve quality, and create employment opportunities. By investing in various aspects of the tomato value chain, Indonesia can develop a more robust and competitive tomato sector that could benefit both farmers and consumers while contributing to the country’s overall economic growth.

The government of Indonesia has shown interest in promoting agricultural development and offering policy support to attract investments. Table 7 shows regulations to support agricultural investments in the country.

It is important to note that the tomato industry is one of the employment sources for many people, especially in rural areas. Thus, the presence of investments can create job opportunities and contribute to economic development.

In recent years, many young people have emerged who have taken up professions in the agricultural sector by entering the upstream and downstream sectors. The majority of them choose commodities that are commercial and have high economic value such as horticulture, livestock, and forestry. By utilizing information and communication technology and various applications in the Industrial Revolution 4.0 era, young farmers are now starting to enter the realm of managing and marketing agricultural products more easily, quickly, and widely (Wati, et al., 2021). This is a good opportunity to develop tomato farming, especially in the context of the generation of farmers in Indonesia.

It was noted that some agricultural market initiatives have been set based on investment in non-government institutions (private sector). Among other things were 8Villages, CI-Agriculture, Crowded, Eragano, Habibi Garden, iGrow, Karsa, Kecipir, Limakilo, Pandawa Putra, PanenID, Pantau Harga, Petani, SayurBox, Sikumis, Simba, and Tanihub, which generally managed by youth based-agribusiness applications (Figures 4 and 5).

Regulation

Above all, the government of Indonesia has issued regulations that require clarity in the obligations and authority on the rights and obligations of stakeholders toward developing horticulture in the country. It includes:

- Law Number 13/2010 concerning Horticulture (GoI, 2010).

- Minister of Agriculture Regulation Number 38/2011 concerning Registration of Horticultural Plant Varieties (MoA, 2011a).

- Minister of Agriculture Regulation Number 76/2012 concerning the Importation and Export of Horticultural Seeds (MoA, 2012).

- Minister of Agriculture Regulation Number 120/2012 concerning Production, Certification, and Supervision of Horticultural Seed Distribution (MoA, 2012).

- Decree of the Minister of Agriculture Number 511/2006 concerning Types of Plant Commodities Assisted by the Directorate General of Plantations, Directorate General of Food Crops, and Directorate General of Horticulture (MoA, 2006).

- Decree of the Minister of Agriculture Number 510/2011 concerning Types of Horticultural Plants Excluded from the Variety Test (MoA, 2011b).

- Decree of the Minister of Agriculture Number 720/2011 concerning Horticultural Variety Registration Assessment Team (MoA, 2011c).

CONCLUSION AND RECOMMENDATION

Two crucial factors to support the development of the tomato industry in Indonesia are the availability of good-quality seeds and the presence of investments. The former is important since it directly impacts the quantity and quality of tomatoes’ productivity, while the latter is essential to boost the performance of the tomato industry.

Investing in tomatoes in Indonesia can be a lucrative venture due to the country’s growing population and increasing demand for fresh produce. However, like any investment, it comes with risks and requires careful planning. Staying informed about government regulations and incentives for agriculture in Indonesia is crucial for a successful venture.

REFERENCES

Agfundernews.com. 2021. Indonesian farmer platform TaniHub raises $66m. Retrieved from: https://agfundernews.com/tanihub-raises-66m-for-its-farmer-fintech-e-commerce-platform (7 November 2023). Jakarta.

Asbesindo. 2023. Anggota Asosiasi Perbenihan Indonesia (Member of the Indonesian Seed Association). Retrieved from: https://asbenindo.org/anggota/ (26 October 2023). Jakarta.

BPS. 2022. Statistik Perdagangan Luar Negeri Indonesia Impor Jilid I (Indonesian Foreign Trade Import Statistics Volume I). Badan Pusat statistic (Indonesian Central Bureau of Statistics). Jakarta.

BPS. 2023. Produksi Tanaman Sayuran 2018-2022 (Vegetable Crop Production 2018-2022). Badan Pusat statistic (Indonesian Central Bureau of Statistics). Jakarta.

DHS. 2015. Peraturan Perbenihan Hortikultura (Horticultural Seed Regulations). Direktorat Perbenihan Hortikultura (Directorate of Horticultural Seeds). Indonesian Ministry of Agriculture. Jakarta.

DHS. 2019. Pedoman Pendaftaran Varietas Hortikultura (Guidelines for Registration of Horticultural Varieties). Direktorat Perbenihan Hortikultura (Directorate of Horticultural Seeds). Indonesian Ministry of Agriculture. Jakarta.

GoI, 2010. Undang-undang Nomor 13 Tahun 2010 tentang Hortikultura (Law Number 13/2010 concerning Horticulture). Government of Indonesia. Jakarta.

GoI. 2020. Undang-Undang Republik Indonesia Nomor 11 Tahun 2020 tentang Cipta Kerja (Law of the Republic of Indonesia Number 11/2020 concerning Job Creation). Government of Indonesia. Jakarta.

GoI. 2021a. Peraturan Pemerintah Republik Indonesia Nomor 5 Tahun 2021 tentang Penyelengaraan Perizinan Berusaha Berbasis Risiko (Government Regulation of the Republic of Indonesia Number 5/2021 concerning Implementation of Risk-Based Business Licensing). Government of Indonesia. Jakarta.

GoI. 2021b. Peraturan Presiden Republik Indonesia Nomor 49 Tahun 2021 tentang Bidang Usaha Penanaman Modal (Presidential Regulation of the Republic of Indonesia Number 49/2021 concerning the Investment Business Sector). Government of Indonesia. Jakarta.

IFC. 2020. Digital Marketplace Keeps Indonesian Farmers in Business. Retrieved from: https://www.ifc.org/ en/stories/2020/tanihub-indonesia (7 November 2023). International Finance Corporation. Jakarta.

Kompas.com. 2022. Enam jenis tomat komersil yang mudah dijumpai (Six types of commercial tomatoes that are easy to find). Retrieved from: https://agri.kompas.com/read/2022/12/20/ 120144784/5-jenis-tomat-komersil-yang-mudah-dijumpai (26 October 2023). Jakarta.

Kompas.com. 2023. Mengenal tujuh varietas tomat unggul, hasilkan panen buah melimpah (Recognizing seven superior tomato varieties, produce abundant fruit harvests). Retrieved from: https://agri.kompas.com/read/2023/02/24/102859884/mengenal-8-varietas-tomat-unggul-hasilkan-panen-buah-melimpah?page=all (26 October 2023).

MoA. 2006. Keputusan Menteri Pertanian Nomor 511 Tahun 2006 tentang Jenis Komoditi Tanaman Binaan Direktorat Jenderal Perkebunan, Direktorat Jenderal Tanaman Pangan dan Direktorat Jenderal Hortikultura (Decree of the Minister of Agriculture Number 511/2006 concerning Types of Plant Commodities Assisted by the Directorate General of Plantations, Directorate General of Food Crops, and Directorate General of Horticulture). Indonesian Ministry of Agriculture. Jakarta.

MoA. 2011a. Peraturan Menteri Pertanian Nomor 38 Tahun 2011 tentang Pendaftaran Varietas Tanaman Hortikultura. (Regulation of Ministry of Agriculture Number 38/2011 concerning Registration of Horticultural Plant Varieties). Indonesian Ministry of Agriculture. Jakarta.

MoA. 2011b. Keputusan Menteri Pertanian Nomor 510 Tahun 2011 tentang Jenis Tanaman Hortikultura yang Dikecualikan dari Uji Kebenaran Varietas (Decree of the Minister of Agriculture Number 510/2011 concerning Types of Horticultural Plants Excluded from the Variety Truth Test). Indonesian Ministry of Agriculture. Jakarta.

MoA. 2011c. Keputusan Menteri Pertanian Nomor 720 Tahun 2011 tentang Tim Penilai Pendaftaran Varietas Hortikultura (Decree of the Minister of Agriculture Number 720/2011 concerning Horticultural Variety Registration Assessment Team). Indonesian Ministry of Agriculture. Jakarta.

MoA. 2013. Peraturan Menteri Pertanian Nomor 76 Tahun 2013 tentang Pemasukan dan Pengeluaran Benih Hortikultura (Regulation of Ministry of Agriculture Number 76/2012 concerning Importation and Export of Horticultural Seeds). Indonesian Ministry of Agriculture. Jakarta.

OEC. 2022. Tomatoes in Indonesia. Retrieved from https://oec.world/en/profile/bilateral-product/tomatoes/ reporter/idn#:~:text=Imports%20In%202021%2C%20Indonesia%20imported,of%20Tomatoes%20in%20the%20world (28 October 2023). The Observatory of Economic Complexity.

Statsita.com. 2022. Tomato production in the Asia-Pacific region. Retrieved from: https://www.statista.com/ statistics/682055/asia-pacific-tomato-production-by-country/ (29 October 2023).

Wati, R. I., Subejo, Y. F. Maulida, E. A. Gagaria, R. A. Ramdhani, and K. Izroil. 2021. Problematika, Pola, dan Strategi Petani dalam Mempersiapkan Regenerasi di Provinsi Daerah Istimewa Yogyakarta untuk Mewujudkan Ketahanan Pangan Wilayah (Farmers’ Problems, Patterns, and Strategies in Preparing for Regeneration in the Special Region of Yogyakarta Province to Achieve Regional Food Security). Jurnal Ketahanan Nasional (Journal of National Resilience), Vol. 27, No. 2, August 2021: 187-207. Yogyakarta.

[1] It can be accessed on the Horticultural Seed Directorate website

http://ditseed.horticulture.deptan.go.id

[2] See completely in https://asbenindo.org/anggota/

The Performance and Development of Indonesian Tomatoes

ABSTRACT

Indonesia is ranked third after China and India among the ten biggest producing countries of tomatoes in the Asia Pacific region. In the last five years, the production of Indonesia’s tomatoes increased by about 4.60% per year i.e., from 976,790 tons in 2018 to 1,168,743 in 2022. However, Indonesia is a net imprter of tomatoes, in particular as processed products. There is a need to develop the tomato industry in Indonesia by providing the availability of good quality seeds and promoting investments. The government institutions and private sectors in Indonesia have released several superior and good tomato varieties. The government has also shown interest in promoting agricultural development and offering policy support to attract investments. Investing in tomatoes in Indonesia can be a lucrative venture; therefore, staying informed about government regulations and incentives for agriculture in Indonesia is crucial for a successful venture.

Keywords: tomatoes, seeds, investments, development, Indonesia

INTRODUCTION

Background

Tomato (Lycopersicum esculentum Mill) is part of the horticultural commodity that plays several significant roles in the country’s agricultural and economic landscape. This commodity is a staple in Indonesian cuisine and is used in a wide variety of dishes, including sambal (a spicy condiment), soups, salads, and various traditional dishes. They are a key ingredient in many Indonesian recipes, making them a crucial part of the country’s food production.

While tomato is not the largest agricultural crop in Indonesia, the role of this commodity reflects its significance in terms of food, income, employment, and agricultural diversity in the country. Therefore, the development of this commodity is essential based on its characteristics such as production, variety, and other related supporting aspects. This paper discusses the performance and development of tomatoes in Indonesia.

PERFORMANCE

Production

Tomatoes can be grown in all regions of Indonesia. The central producing areas of this commodity are located in 10 provinces. The largest and the smallest productions were West Java and Jambi provinces, respectively (Table 1).

The top ten provincial producing areas of tomatoes contributed to about 86.43% of the total national production. In aggregate, the contribution of outer Java Island was a little bit greater than that of Java Island i.e., 44.55% vs. 41.88% (Figure 1). The producing areas in Java Island comprise the provinces of West Java, East Java, and Central Java. Meanwhile, the producing areas in outer Java Island consist of western region (North Sumatra, West Sumatra, Jambi, and Bengkulu provinces), central region (West Nusa Tenggara province), and eastern region (South Sulawesi and North Sulawesi province.

During the last five years (2018-2023), the production of tomatoes increased by about 4.60% per year i.e., from 976,790 tons in 2018 to 1,168,743 in 2022 (Figure 2).

In 2020, Indonesia ranked third among the Asia-Pacific producing countries of tomatoes. The first and the second ranks were China and India (Figure 3). The contribution of Indonesia (1.21%) was much lower than that of China (72.43%) and India (23.01%).

Types and varieties

Based on its appearance, six types of commercial tomatoes are commonly found in Indonesia. It includes: (1) Ordinary tomatoes; (2) Apple tomatoes; (3) Potato tomatoes; (4) Curly tomatoes; (5) Recento tomatoes; and (6) Pear tomatoes (Table 2).

Consumption

Tomatoes are a type of fruit vegetable that contains nutrients including protein, carbohydrates, fats, minerals, and vitamins. Therefore, this commodity has good prospects in agribusiness development.

From 2017 up to 2021, it is projected that tomato consumption will increase by about 4.10% while the population is estimated to increase with an average growth of 1.13% per year. Thus, the total consumption of tomatoes during those periods was projected to increase with an average growth of 5.32% per year (Table 3).

Export and import

Indonesia has a trade balance of tomatoes of about US$259,000 (OEC, 2022). In 2021, Indonesia exported US$280,000 in tomatoes, making it the 82nd largest exporter of tomatoes in the world. In the same year, tomatoes were the 963rd most exported product in Indonesia. The main destination of tomatoes exported from Indonesia is Singapore, Maldives, Malaysia, Nepal, and Qatar. The fastest-growing export markets for tomatoes in Indonesia between 2020 and 2021 were Maldives, Nepal, and Qatar.

On the other hand, the country imported US$21,000 in tomatoes, becoming the 158th largest importer of tomatoes in the world. In the same year, tomatoes were the 1187th most imported product in Indonesia. Indonesia imports tomatoes primarily from Singapore, Japan, Australia, Russia, and Oman. The fastest-growing import markets in tomatoes for Indonesia between 2020 and 2021 were Singapore, Japan, and Russia.

The Indonesian trade (export and import) of tomatoes from 2019 to 2022 can be seen in Table 4. The export comprises fresh and processed tomatoes. The value of fresh tomato decreased by about 43.61% while the value of processed tomatoes increase about 99.34%. Meanwhile, the imported paste-HS 20029010 increased about 12.13%. However, the imported value of processed tomatoes especially ketchup/sauce-HS 20029010 was quite high. However, the imported value of processed tomatoes especially ketchup/sauce-HS 20029010 was quite high (Table 4).

DEVELOPMENT

Essentially, there are two crucial factors to support the development of tomatoes in Indonesia. They are seeds provision and investments promotion.

Seeds provision

The choice of tomato seeds is a critical decision for tomato farmers because it directly impacts the quality, yield, and success of their crops. The selection of appropriate seeds allows farmers to tailor fit their tomato production to specific needs, environmental conditions, and market demands, ultimately contributing to the overall success and sustainability of their farming operations. The Ministry of Agriculture has released several superior varieties of tomatoes in Indonesia. They are Mirah, Opal, Zamrud, Intan, Retna, Berlian, Hibrida varieties, and BLTS 05-11 as described in Table 5.

Apart from government institutions, members of the private sectors also release some good tomato varieties. It includes: (1) Servo, Agatha, Ultima, Permata, Gustavi, Gummara, Optima, Bareto, and Tymoti varieties from PT East West Seed Indonesia; (2) (TM Elisha variety from PT Tani Murni Indonesia; and (3) TO ASA 304 variety from PT Aditya Sentana Agro (Asbesindo, 2023).

Horticulture development must start with the use of quality seeds of superior varieties. The Indonesian Minister of Agriculture has issued Horticultural Seed Regulations (DHS, 2015) and Guidelines for Registration of Horticultural Varieties (DHS, 2019)[1]. These regulations are intended as a basis for implementing variety registration activities to protect consumers from acquiring seeds whose performance/variety diversity does not match the description. The scope of this regulation includes breeding, registration requirements, and procedures, launching varieties, and monitoring registration marks.

Considering that the characters in the variety description will be used as a reference in testing the truth of the variety, understanding of the terms in the description must be the same. The procedures are as follows: (1) Testing the superiority of varieties; (2) Testing procedures (criteria, advantages, test implementation, resistance to plant pest organisms, consumer preference testing, expiry date of test result data, and preparation of test results); (3) Testing the correctness of varieties and its conditions; (4) Testing agencies (appointed by the Minister of Agriculture i.e., plant seeds certification agency, university, agricultural research and development agency, and business actors); and (5) Special identifier and naming.

Horticultural companies

In 2022, there were 217 horticultural companies in Indonesia. This number has increased by 88.70% i.e., 102 companies in the previous year (BPS, 2022). The majority of the horticultural companies are located on Java Island (68.20%) comprising East Java (25.32%), West Java (22.58%), and Central Java (20.28%). These companies cultivate fruits (31.73%), mixed crops (23.75%), vegetables (21.60%), ornamental plants (20.22%), and biopharmaceuticals (2.70%).

Indonesia has also an Indonesian Seed Association (Asbesindo) with 72 registered memberships. It includes 62 national private companies, two state-owned enterprises (BUMN), and eight multi-national companies. Among other Asbesindo members, some companies are operating in the tomato sector (Table 6).

Investments promotion

Investments are crucial for the development of Indonesia’s tomato industry because they can drive modernization, increase productivity, improve quality, and create employment opportunities. By investing in various aspects of the tomato value chain, Indonesia can develop a more robust and competitive tomato sector that could benefit both farmers and consumers while contributing to the country’s overall economic growth.

The government of Indonesia has shown interest in promoting agricultural development and offering policy support to attract investments. Table 7 shows regulations to support agricultural investments in the country.

It is important to note that the tomato industry is one of the employment sources for many people, especially in rural areas. Thus, the presence of investments can create job opportunities and contribute to economic development.

In recent years, many young people have emerged who have taken up professions in the agricultural sector by entering the upstream and downstream sectors. The majority of them choose commodities that are commercial and have high economic value such as horticulture, livestock, and forestry. By utilizing information and communication technology and various applications in the Industrial Revolution 4.0 era, young farmers are now starting to enter the realm of managing and marketing agricultural products more easily, quickly, and widely (Wati, et al., 2021). This is a good opportunity to develop tomato farming, especially in the context of the generation of farmers in Indonesia.

It was noted that some agricultural market initiatives have been set based on investment in non-government institutions (private sector). Among other things were 8Villages, CI-Agriculture, Crowded, Eragano, Habibi Garden, iGrow, Karsa, Kecipir, Limakilo, Pandawa Putra, PanenID, Pantau Harga, Petani, SayurBox, Sikumis, Simba, and Tanihub, which generally managed by youth based-agribusiness applications (Figures 4 and 5).

Regulation

Above all, the government of Indonesia has issued regulations that require clarity in the obligations and authority on the rights and obligations of stakeholders toward developing horticulture in the country. It includes:

CONCLUSION AND RECOMMENDATION

Two crucial factors to support the development of the tomato industry in Indonesia are the availability of good-quality seeds and the presence of investments. The former is important since it directly impacts the quantity and quality of tomatoes’ productivity, while the latter is essential to boost the performance of the tomato industry.

Investing in tomatoes in Indonesia can be a lucrative venture due to the country’s growing population and increasing demand for fresh produce. However, like any investment, it comes with risks and requires careful planning. Staying informed about government regulations and incentives for agriculture in Indonesia is crucial for a successful venture.

REFERENCES

Agfundernews.com. 2021. Indonesian farmer platform TaniHub raises $66m. Retrieved from: https://agfundernews.com/tanihub-raises-66m-for-its-farmer-fintech-e-commerce-platform (7 November 2023). Jakarta.

Asbesindo. 2023. Anggota Asosiasi Perbenihan Indonesia (Member of the Indonesian Seed Association). Retrieved from: https://asbenindo.org/anggota/ (26 October 2023). Jakarta.

BPS. 2022. Statistik Perdagangan Luar Negeri Indonesia Impor Jilid I (Indonesian Foreign Trade Import Statistics Volume I). Badan Pusat statistic (Indonesian Central Bureau of Statistics). Jakarta.

BPS. 2023. Produksi Tanaman Sayuran 2018-2022 (Vegetable Crop Production 2018-2022). Badan Pusat statistic (Indonesian Central Bureau of Statistics). Jakarta.

DHS. 2015. Peraturan Perbenihan Hortikultura (Horticultural Seed Regulations). Direktorat Perbenihan Hortikultura (Directorate of Horticultural Seeds). Indonesian Ministry of Agriculture. Jakarta.

DHS. 2019. Pedoman Pendaftaran Varietas Hortikultura (Guidelines for Registration of Horticultural Varieties). Direktorat Perbenihan Hortikultura (Directorate of Horticultural Seeds). Indonesian Ministry of Agriculture. Jakarta.

GoI, 2010. Undang-undang Nomor 13 Tahun 2010 tentang Hortikultura (Law Number 13/2010 concerning Horticulture). Government of Indonesia. Jakarta.

GoI. 2020. Undang-Undang Republik Indonesia Nomor 11 Tahun 2020 tentang Cipta Kerja (Law of the Republic of Indonesia Number 11/2020 concerning Job Creation). Government of Indonesia. Jakarta.

GoI. 2021a. Peraturan Pemerintah Republik Indonesia Nomor 5 Tahun 2021 tentang Penyelengaraan Perizinan Berusaha Berbasis Risiko (Government Regulation of the Republic of Indonesia Number 5/2021 concerning Implementation of Risk-Based Business Licensing). Government of Indonesia. Jakarta.

GoI. 2021b. Peraturan Presiden Republik Indonesia Nomor 49 Tahun 2021 tentang Bidang Usaha Penanaman Modal (Presidential Regulation of the Republic of Indonesia Number 49/2021 concerning the Investment Business Sector). Government of Indonesia. Jakarta.

IFC. 2020. Digital Marketplace Keeps Indonesian Farmers in Business. Retrieved from: https://www.ifc.org/ en/stories/2020/tanihub-indonesia (7 November 2023). International Finance Corporation. Jakarta.

Kompas.com. 2022. Enam jenis tomat komersil yang mudah dijumpai (Six types of commercial tomatoes that are easy to find). Retrieved from: https://agri.kompas.com/read/2022/12/20/ 120144784/5-jenis-tomat-komersil-yang-mudah-dijumpai (26 October 2023). Jakarta.

Kompas.com. 2023. Mengenal tujuh varietas tomat unggul, hasilkan panen buah melimpah (Recognizing seven superior tomato varieties, produce abundant fruit harvests). Retrieved from: https://agri.kompas.com/read/2023/02/24/102859884/mengenal-8-varietas-tomat-unggul-hasilkan-panen-buah-melimpah?page=all (26 October 2023).

MoA. 2006. Keputusan Menteri Pertanian Nomor 511 Tahun 2006 tentang Jenis Komoditi Tanaman Binaan Direktorat Jenderal Perkebunan, Direktorat Jenderal Tanaman Pangan dan Direktorat Jenderal Hortikultura (Decree of the Minister of Agriculture Number 511/2006 concerning Types of Plant Commodities Assisted by the Directorate General of Plantations, Directorate General of Food Crops, and Directorate General of Horticulture). Indonesian Ministry of Agriculture. Jakarta.

MoA. 2011a. Peraturan Menteri Pertanian Nomor 38 Tahun 2011 tentang Pendaftaran Varietas Tanaman Hortikultura. (Regulation of Ministry of Agriculture Number 38/2011 concerning Registration of Horticultural Plant Varieties). Indonesian Ministry of Agriculture. Jakarta.

MoA. 2011b. Keputusan Menteri Pertanian Nomor 510 Tahun 2011 tentang Jenis Tanaman Hortikultura yang Dikecualikan dari Uji Kebenaran Varietas (Decree of the Minister of Agriculture Number 510/2011 concerning Types of Horticultural Plants Excluded from the Variety Truth Test). Indonesian Ministry of Agriculture. Jakarta.

MoA. 2011c. Keputusan Menteri Pertanian Nomor 720 Tahun 2011 tentang Tim Penilai Pendaftaran Varietas Hortikultura (Decree of the Minister of Agriculture Number 720/2011 concerning Horticultural Variety Registration Assessment Team). Indonesian Ministry of Agriculture. Jakarta.

MoA. 2013. Peraturan Menteri Pertanian Nomor 76 Tahun 2013 tentang Pemasukan dan Pengeluaran Benih Hortikultura (Regulation of Ministry of Agriculture Number 76/2012 concerning Importation and Export of Horticultural Seeds). Indonesian Ministry of Agriculture. Jakarta.

OEC. 2022. Tomatoes in Indonesia. Retrieved from https://oec.world/en/profile/bilateral-product/tomatoes/ reporter/idn#:~:text=Imports%20In%202021%2C%20Indonesia%20imported,of%20Tomatoes%20in%20the%20world (28 October 2023). The Observatory of Economic Complexity.

Statsita.com. 2022. Tomato production in the Asia-Pacific region. Retrieved from: https://www.statista.com/ statistics/682055/asia-pacific-tomato-production-by-country/ (29 October 2023).

Wati, R. I., Subejo, Y. F. Maulida, E. A. Gagaria, R. A. Ramdhani, and K. Izroil. 2021. Problematika, Pola, dan Strategi Petani dalam Mempersiapkan Regenerasi di Provinsi Daerah Istimewa Yogyakarta untuk Mewujudkan Ketahanan Pangan Wilayah (Farmers’ Problems, Patterns, and Strategies in Preparing for Regeneration in the Special Region of Yogyakarta Province to Achieve Regional Food Security). Jurnal Ketahanan Nasional (Journal of National Resilience), Vol. 27, No. 2, August 2021: 187-207. Yogyakarta.

[1] It can be accessed on the Horticultural Seed Directorate website http://ditseed.horticulture.deptan.go.id

[2] See completely in https://asbenindo.org/anggota/