ABSTRACT

Demand for specialty rice among Malaysians shows an increasing trend in recent years. The consumption of high quality rice has increased due to higher living standards and health reason. To meet the demand, most of the quality rice was imported from various rice producing countries. The study was done to identify local consumer preferences towards specialty rice. It also aims to reveal the differences of preferences among the consumers between local specialty rice compared to imported rice. Generally, specialty rice produced by MARDI can be divided into three categories such as fragrant, colored and glutinous rice. The fragrance rice itself can be categorized into three types according to their characteristics like Basmathi, Jasmine and Normal types. From the survey, the results showed that 78% of the respondents who consumed white rice were willing to change their preference towards MARDI specialty rice especially the fragrant rice of the Jasmine type. In the case of colored rice, imported colored rice was most preferred by local consumers as compared to the local variety. Meanwhile Imported glutinous rice was more favored but locally produced black glutinous rice was well acceptable by the local consumers. It could be concluded that the consumer preferences towards local fragrance rice was mostly due to its physical characteristics and the aroma which is equivalent to the imported fragrant rice. Therefore, it is a great potential to produce fragrant rice locally using MARDI’s varieties which is economically viable in the present local rice market.

Keywords: Consumer preferences, local specialty rice, physical characteristics and aromatic rice.

INTRODUCTION

The demand for specialty rice or high quality rice is showing an increasing trend that indicates that there are changes in the living standard and lifestyle of the Malaysian consumers. Moreover, their perception is more towards healthy and safety products while consuming rice in their daily diets (Hanis, A. et al., 2012). Malaysia has always been a net importer of rice with a self-sufficiency level of 72% in 2015. The national per capita consumption was at 88 kg in 2015. From 2010 to 2015, the trend was in a decreasing mode at -0.11%. Hence, the changes in consumers taste to high quality rice (High Quality Rice - HQR) require the country to import rice from the world HQR producer to meet the local demands.

Malaysia’s total rice production in 2015 is about 1.756 million metric tons. This amount could not fulfil the Malaysian consumption which was at 2,716 million metric tons in the same year. Therefore, the deficit of rice was imported from world-producing countries, especially from Thailand, Vietnam, Pakistan and Cambodia with total imports of 0.96 million ton valued at RM1, 740.3 million in 2015.

Table 1 shows the total amount of rice imports according to the types of rice. It showed that an average annual growth rate had increased by 0.49% in a period of 2010 to 2015. Rice importation in Malaysia can be divided according to the types of rice with the following distribution: 80% for white rice with balance of 20% for specialty rice. The import of specialty rice was for fragrant rice (11%), glutinous rice (4%), basmathi rice (3%) and others (2%) known as Japonica and red rice (BERNAS, 2017). With the demand of HQR showing an increasing trend at 1.27% cumulative annual growth rate (CAGR), hence the chances of planting the HQR in Malaysia could be crucial in the future. As compared with other HQR types, CAGR of fragrant rice was the highest at 3.9%. The HQR was demanded by the consumers which could be attributed to higher income, lifestyle as well as health awareness.

Table 1. Total Malaysian rice imports by type of rice (tons)

|

Year/Type of rice

|

Fragrant

|

Basmathi

|

White rice

|

Others

|

Total

|

Total specialty rice

|

|

2010

|

83,946

|

49,919

|

754,407

|

44,170

|

932,442

|

178,035

|

|

2011

|

73,123

|

21,259

|

919,311

|

47,113

|

1,060,806

|

141,495

|

|

2012

|

107,607

|

28,084

|

816,148

|

26,783

|

978,622

|

162,474

|

|

2013

|

120,002

|

30,718

|

658,331

|

38,035

|

847,086

|

188,755

|

|

2014

|

97,273

|

26,529

|

707,440

|

53,058

|

884,300

|

176,860

|

|

2015

|

105,600

|

28,300

|

768,000

|

57,600

|

960,000

|

192,000

|

|

CAGR

(2010-2015)

|

3.90%

|

-9.03%

|

0.30%

|

4.52%

|

0.49%

|

1.27%

|

Source: BERNAS and DOA, 2015.

In order to fulfill the farmers’ needs in producing the local specialty rice, MARDI produced three categories of HQR. These are fragrant, colored and glutinous rice. The fragrant rice itself can be categorized according to their characteristics like Basmathi, Jasmine and Normal types. Four fragrant rice varieties was named as MRQ 50, MARDI Wangi 74, MARDI Wangi 76 and MARDI Wangi 88. The various varieties came with a different

The first fragrant rice varieties known as MRQ 50 was launched by MARDI in 1999. However, it not really accepted by farmers because of its low yield. The second variety was MARDI Wangi 74 (also known as Mas Wangi) which was released in 2005. This variety is good for health especially for diabetic’s dietary requirement because its characteristics was similar to the basmathi types. MARDI Wangi 76, which was launched in 2011, has characteristics which is comparable to the jasmine types. The latest variety was MARDI Wangi 88, which was launched in 2016. MARDI Wangi 88 can be promoted as fragrant rice with white rice characteristic especially among consumers who prefer medium soft rice (Mohamad Najib et al, 2016). The latest specialty rice that was launched in early 2018 was a colored rice named as MARDI Warna 98. This colored rice had high antioxidant content according to their color characteristics. This variety was made as a substitute or varied the choice of the Sarawak traditional colored rice variety. This colored rice can easily be found in the Sarawak daily market and was produced as a niche product.

There are many rice brands in Malaysia market based by types of rice. Types of rice differ based on their physical characteristics and quality. However, information on consumer preferences towards what types of rice preferred by consumers is still lacking. This information is important to the breeder and stakeholders so that the it was accepted in the market and suits consumers’ preference as well. Local specialty rice was produced with the goal to reduce the import of HQR, especially the fragrant rice. In general, the objective of this study was to reveal the differences of preferences among the consumers between local specialty rice compared to imported rice.

METHODOLOGY

A study on consumer perception and preferences of specialty rice was conducted to identify the characteristics of the specialty rice chosen by Malaysians. The study involved a few surveys which were conducted at different pre-selected sites in Malaysia. A total of 400 respondents was surveyed in Klang Valley and 600 respondents at another six zones in Malaysia including Sabah and Sarawak. Besides that, the study also reviewed and analyzed data from past studies for comparison.

RICE CONSUMPTION PATTERNS AMONG MALAYSIAN CONSUMER

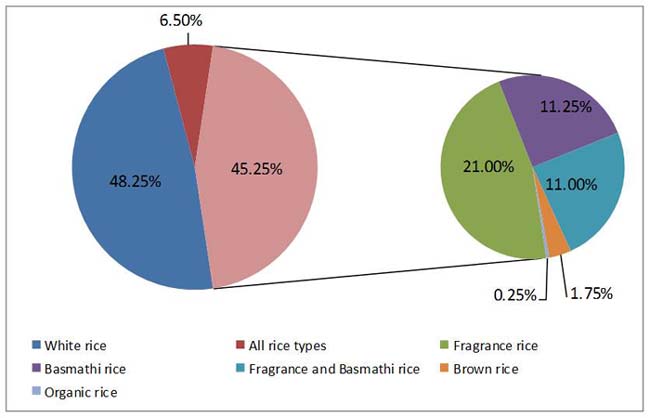

White rice is the main staple food commonly consumed by most people in Malaysia. There was a variation of pattern in the daily consumption among Malaysians. Figure 1 below shows the rice consumption patterns which indicates that 45% of the respondents consumed specialty rice as part of their daily diets. From that, 21% of those consumed was fragrant rice, 11.25% are basmathi rice, 11% of those consumed are both of the fragrant and basmathi rice. The rest 1.75% are brown rice consumers.

Fig. 1. Rice consumption among respondents

A study by Wong et al. (1992) and Syahrin et al. (2015) indicated that Malaysian consumers most preferred rice that contained more head rice, lower amylose content and long shape characteristic. Others studies concluded that the most important attribute of rice consumption was food safety, taste and size of grain (Ahmad Hanis, I.A.H et al (2012). Besides that, Syahrin, et al. (2008) found that 79% of the respondents who consumed white rice were willing to change their preference towards MARDI fragrant rice of Basmathi type, which were non-sticky and had low starch. Hence, this could be a substitute to imported Basmathi and Ponny rice. Consumers were also willing to pay a premium price for the demanded attributes. Hence, the high-quality rice needs to fulfill the characteristics and attributes that consumers preferred to make sure that the specialty rice can be able to gain market access at a premium price.

CONSUMER PREFERENCES TOWARDS SPECIALTY RICE

Consumer preferences for rice varieties vary according to their tastes and purchasing power. The quality of rice was subjected to a battery of tests on grain length, translucency, whiteness, aroma, stickiness and softness. These characteristics were mostly what the Malaysian consumers preferred. A survey was conducted among 400 consumers in Klang Valley to evaluate consumer preferences on local specialty rice as compared to white rice. The result revealed that the respondents preferred MARDI Wangi 76 more compared to other fragrant rice and white rice. The mean score for MARDI Wangi 76 are over 6.5 for all of characteristics (Table 2).

Table 2. Means Score of Consumer preferences on local specialty rice characteristics compared to white rice

|

Characteristics

|

White rice

(MR284)

|

MARDI Wangi 74

|

MARDI Wangi 76

|

MARDI Wangi 88

|

|

Grain length

|

6.34

|

5.41

|

6.78

|

5.81

|

|

Transparency

|

6.24

|

5.68

|

6.83

|

5.90

|

|

Whiteness

|

6.53

|

5.82

|

6.84

|

5.84

|

|

Aroma

|

5.63

|

6.44

|

6.75

|

5.68

|

|

Starchiness

|

5.52

|

6.72

|

6.66

|

5.70

|

|

Softness

|

6.07

|

6.17

|

6.74

|

6.17

|

Source: Data survey 2017

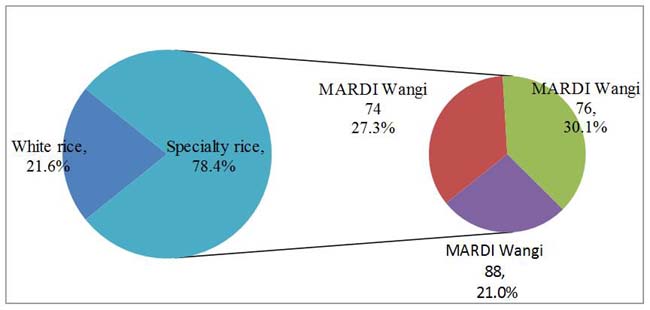

Fig. 2 shows that 78% of the respondents who consumed white rice are willing to change their daily rice consumption to MARDI specialty rice. About 30% of the respondents most preferred MARDI Wangi 76, followed by MARDI Wangi 74 (27%) and 21% preferred MARDI Wangi 88. These results show the potential of producing specialty rice locally to meet the demands of the people. In addition, the government can reduce the import of specialty rice as well.

Fig. 2. Consumers’ preferences towards local specialty rice.

Surveys were also conducted to identify consumers' preferences on local specialty rice compared to imported rice. Table 3 shows the means score of fragrant rice characteristics compared to imported rice. The result revealed that local fragrant rice (Jasmine type) was more preferred by consumers with mean (score=6.85) compared to the imported fragrant rice 1 (score=6.67) and imported fragrance rice 2 (score=6.16).

Table 3. Means of score fragrant rice characteristic between local and imported

|

Characteristics

|

Local

|

Import 1

|

Import 2

|

|

Grain length

|

5.76

|

6.68

|

6.41

|

|

Transparency

|

6.34

|

6.54

|

5.94

|

|

Whiteness

|

6.96

|

6.44

|

5.75

|

|

Aromatic

|

6.55

|

6.72

|

5.98

|

|

Stickiness

|

6.50

|

6.38

|

6.04

|

|

Softness

|

6.93

|

6.53

|

6.23

|

Source: Data survey 2014

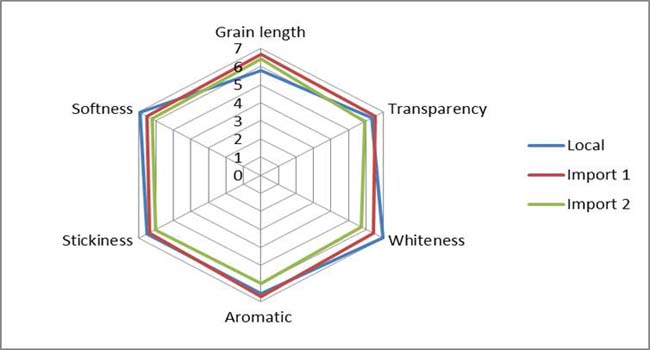

Fig. 3 shows consumer preferences towards local specialty rice compared to two types of imported rice in the market. The characteristics of local specialty rice was preferred by the consumers are whiteness (score = 6.96), softness (score = 6.93) and stickiness (score = 6.50), while physical characteristics such as long grain (score = 6.68), translucency (score = 6.54) and aroma (score = 6.72).

Fig. 3. Consumer Preferences towards Specialty rice compared to imported rice.

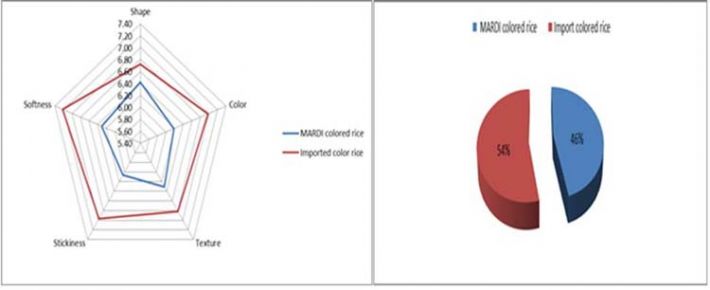

Fig. 4 shows the consumer preferences towards local colored rice compared to the imported type. The study stated that 54% of respondents most preferred the imported colored rice as compared to the local ones. The overall mean score for imported colored rice was higher at (score=6.99) compared to the local ones with mean (score=6.65). The mean score for every characteristic also shows that the imported red rice was higher than the local one in such characteristics as grain shape (6.70), color (6.89), texture (6.83), stickiness (6.92) and softness (7.13). This result indicated that research and development for improving this variety is a need especially in terms of characteristics preferred by the consumers.

Fig. 4. Consumer preferences to local colored rice compared to imported

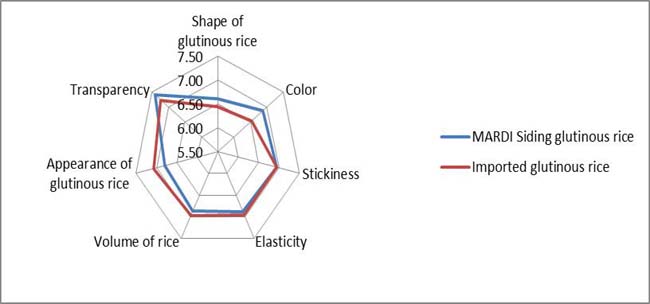

Fig. 5 shows the consumer preferences on local glutinous rice Siding as compared to the imported type. Majority of the consumers preferred the local type as such characteristic as shiny glutinous rice siding (7.41), color (6.88) and grain shape (6.62).. Meanwhile, shape for imported glutinous rice after cooking were more likely to be like the local type with a score of=7.07, elongation after cooked (score=6.97) and chewy (score=6.95). However, both local and imported glutinous rice have same score for stickiness with (score=6.95).

Fig. 5. Consumer preferences to local glutinous rice compared to imported

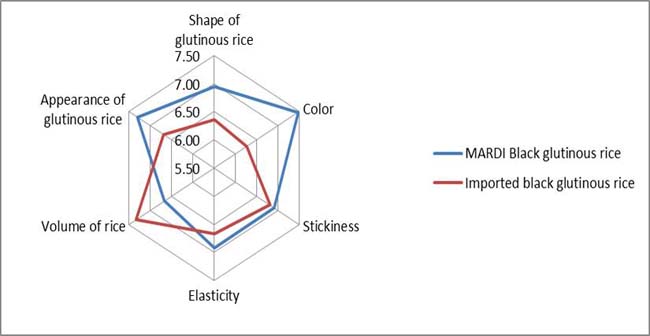

For black glutinous rice, majority of the consumers preferred the local black glutinous type. This indicates that all of the characteristics was better than the imported glutinous rice except for “elongation after cooked”.. The mean score for grain shape (score=6.94), color (score=7.48), stickiness (score=6.91), chewy (score=6.92) and shape after cooked (score=7.31) which was way better than the imported glutinous rice (Figure 6). Overall, imported glutinous rice was more favored with mean (score=7.13) compared to local (score=7.04). But locally produced black glutinous rice was well accepted by local consumers (score=7.46) compared to imported black glutinous (score=7.03) (Fig. 6).

Fig. 6. Consumer preferences to local black glutinous rice compared to imported

PRICE DETERMINATION FOR SPECIALTY RICE

Specialty rice is well-known to have higher nutrients and vitamins than regular white rice. It is suitable being used as a dietary supplement. Specialty rice is differentiated in terms of fragrant, soft, starchy, sticky and length. Hence, the price of specialty rice in the market was higher and varies according to the quality, grade and brand. Price of specialty rice in market was influenced by characteristics of rice itself. The study conducted by Syahrin et al. (2015) on 35 types of fragrant rice and 17 types of basmathi rice in the market found that the price of specialty rice was highly influenced by the physical-chemical characteristics.

The physical-chemical characteristics of rice in the market were analyzed and compared to MARDI Wangi 76 and MARDI Wangi 74. The characteristic was important in order to identify the rice that were comparable in the existing market. The MARDI Wangi 76 was shortest and tapered compared to the other fragrant rice in the market. The value of alkali spreading gave a wide range of result and this indicates that the fragrant rice in the market were mixed from various imported countries and packed into one brand.

Table 3 shows the comparison of the characteristics and price of fragrant rice in the market. The characteristics of MARDI Wangi 76 rice are comparable to the fragrant rice in the market except for grain length and translucency. Besides that, the price of rice were varies according to their quality characteristics of the rice. A study by Syahrin et al. (2015) found that the price of fragrant rice in the market were most influenced by rice shape and higher alkali spreading value and lower amylose content. This study then evaluated the price of MARDI Wangi 74 that consumers were willing to buy at US$1.60/kg. This finding also parallelled with another study by Wong et al. (1992) and found that the price of fragrant rice in the market was heavily influenced by the shape, higher value of alkali spreading and lower amylose content.

Table 3. Comparison of the characteristics and price of fragrant rice

|

Brands

|

Head

rice (%)

|

Broken

rice (%)

|

Grain

length (mm)

|

Grain

width (mm)

|

Ratio

L/W

|

Amylose (%)

|

Amylose

(%)

category

|

Alkali

spreading

|

Actual

price (US$)

|

MSRP

(US$)

|

|

Fragrant A

|

68.26

|

31.74

|

7.4

|

1.71

|

4.33

|

14.8

|

Low

|

4(1),5(2),

6(3),7(4)

|

1.75

|

2.45

|

|

Fragrant B

|

96.76

|

3.24

|

7.23

|

2.13

|

3.39

|

14.8

|

Low

|

5.9

|

1.45

|

1.74

|

|

Fragrant C

|

98.78

|

1.22

|

7.42

|

2.12

|

3.50

|

15.0

|

Low

|

6.5

|

1.40

|

1.73

|

|

MARDI Wangi 76

|

|

|

6.59

|

1.99

|

3.31

|

15.1

|

Low

|

4

|

|

1.60

|

|

Fragrant D

|

66.57

|

32.43

|

7.33

|

1.7

|

4.31

|

15.3

|

Low

|

6.6

|

1.25

|

2.45

|

|

Fragrant E

|

99.38

|

0.62

|

7.26

|

2.04

|

3.56

|

15.5

|

Low

|

5.2

|

1.49

|

1.58

|

|

Fragrant F

|

96.01

|

3.99

|

7.34

|

2.9

|

3.77

|

15.5

|

Low

|

6.3

|

1.45

|

1.72

|

Source: Syahrin, et al. (2015). Currency conversion rate at MYR 1 equal to US$ 0.25

Table 4 shows the comparison of the characteristic and price of MARDI Wangi 74 with multiple basmathi types in market. MARDI Wangi 74 rice was more short and oval than other basmathi rice in the market. The price of basmathi rice in the market was influenced by the long grain of rice. Hence, the suggested retail price for MARDI Wangi 74 was determined at US$1.40/kg based on their characteristics preferred by consumers. Consumers were also willing to pay at premium prices for the demanded attributes.

However, for colored rice, it was categorized as a niche market and the price was floated according to grade and quality. The price of colored rice in the market especially in Sarawak in average was in the range of US$1.75 - US$2.75/ kg.

Table 4. Comparison of the characteristics and price of Basmathi rice

|

Brands

|

Head

rice

(%)

|

Broken

rice

(%)

|

Grain

length (mm)

|

Grain

width (mm)

|

Ratio

L/W

|

Amylose (%)

|

Amylose (%)

category

|

Alkali

spreading

|

Actual

price (RM)

|

MSRP

(RM)

|

|

Basmathi A

|

62.30

|

37.70

|

5.4

|

1.79

|

3.02

|

24.8

|

Intermediate

|

6

|

1.87

|

1.88

|

|

Basmathi B

|

99.40

|

0.60

|

8.3

|

1.84

|

4.51

|

25.3

|

High

|

7

|

3.00

|

3.20

|

|

Basmathi C

|

99.46

|

0.54

|

7.51

|

1.83

|

4.10

|

25.9

|

High

|

7

|

1.85

|

2.50

|

|

MARDI Wangi 74

|

|

|

6.49

|

1.77

|

3.67

|

26.5

|

High

|

5

|

|

|

|

Basmathi D

|

99.00

|

1.00

|

7.43

|

1.71

|

4.35

|

26.8

|

High

|

6.7

|

1.48

|

2.25

|

|

Basmathi E

|

72.81

|

27.19

|

7.39

|

1.58

|

4.68

|

26.9

|

High

|

6.9

|

1.85

|

2.13

|

|

Basmathi F

|

99.18

|

0.82

|

7.73

|

1.86

|

4.16

|

27.1

|

High

|

6.4

|

1.39

|

1.95

|

Source: Syahrin, et al. (2015). Currency conversion rate at MYR 1 equal to US$ 0.25

CONCLUSION

Malaysian consumers most preferred the local fragrant rice with jasmine type due to its physical characteristics and sense of aroma which is equivalent to the imported fragrant rice. Meanwhile, consumers most preferred to buy imported glutinous rice compared to the local type. However, majority of consumers most preferred the local black glutinous rice for its characteristic except for its elongation after being cooked. Therefore, it is a great potential to produce fragrant rice locally using MARDI’s varieties which is economically viable in the present local rice market. As for local fragrant rice, it can be market to local store as well and can be competitive to the imports if the price was reasonable.

REFERENCES

Anon, _____. Malaysian Paddy Statistic, 2015. Jabatan Pertanian Malaysia (DOA).

Ahmad Hanis, I.A.H, Jinap, S., Mad Nasir, S., Alis, R. and Muhammad Shahrim, A.K. (2012). Consumer’s demand and Willingness to pay for rice attributes in Malaysia. International Food Research Journal 19(1): pg. 363-369.

BERNAS, 2017. Personel Comminication with BERNAS officer.

Mohamad Najib, M.Y., Asfaliza, R. dan Shamsul, A.S., 2016. Market Potential of paddy and Rice for export. Paperworks was presented in workshop of Implementation Plan Potential Specialty Rice for export., 23-25 Nov. 2016, Langkawi, Malaysia.

Syahrin, S., Hazirah, Y., Rosnani, H., Asfaliza, R., Mohammad Zulkifly, Z., Noor Hayati, H., Heriyanto, M., Hasnul, H. and Mohd. Amirul Mukmin, A.W. (2015). Consumers Perception and Acceptance towards Specialty Rice. Socio-Economic Report, Economic and Technology Management Research Centre, MARDI.

Syahrin, S., Mohd. Rashid, R., Abu Kasim, A., Tapsir, S. and Ahmad Shokri, O. (2008). Consumer perseption and willingness to pay Maswangi MRQ 74. Economic and Technology Management Review, Vo. 3: pg. 47-56.

Wong, L.C.Y., Husain, A.N., Ali, A. and Ithnin, B. (1992). Understanding Grain Quality in the Malaysian Rice Industry. In Consumer Demand for Grain Quality, International Rice Research Institute (IRRI), Manila, Philippines.

|

(Submitted as a paper for the International Seminar on “Promoting Rice Farmers’ Market through value-adding Activities”, June 6-7, 2018, Kasetsart University, Thailand)

|

Consumer Preferences on Malaysia’s Specialty Rice

ABSTRACT

Demand for specialty rice among Malaysians shows an increasing trend in recent years. The consumption of high quality rice has increased due to higher living standards and health reason. To meet the demand, most of the quality rice was imported from various rice producing countries. The study was done to identify local consumer preferences towards specialty rice. It also aims to reveal the differences of preferences among the consumers between local specialty rice compared to imported rice. Generally, specialty rice produced by MARDI can be divided into three categories such as fragrant, colored and glutinous rice. The fragrance rice itself can be categorized into three types according to their characteristics like Basmathi, Jasmine and Normal types. From the survey, the results showed that 78% of the respondents who consumed white rice were willing to change their preference towards MARDI specialty rice especially the fragrant rice of the Jasmine type. In the case of colored rice, imported colored rice was most preferred by local consumers as compared to the local variety. Meanwhile Imported glutinous rice was more favored but locally produced black glutinous rice was well acceptable by the local consumers. It could be concluded that the consumer preferences towards local fragrance rice was mostly due to its physical characteristics and the aroma which is equivalent to the imported fragrant rice. Therefore, it is a great potential to produce fragrant rice locally using MARDI’s varieties which is economically viable in the present local rice market.

Keywords: Consumer preferences, local specialty rice, physical characteristics and aromatic rice.

INTRODUCTION

The demand for specialty rice or high quality rice is showing an increasing trend that indicates that there are changes in the living standard and lifestyle of the Malaysian consumers. Moreover, their perception is more towards healthy and safety products while consuming rice in their daily diets (Hanis, A. et al., 2012). Malaysia has always been a net importer of rice with a self-sufficiency level of 72% in 2015. The national per capita consumption was at 88 kg in 2015. From 2010 to 2015, the trend was in a decreasing mode at -0.11%. Hence, the changes in consumers taste to high quality rice (High Quality Rice - HQR) require the country to import rice from the world HQR producer to meet the local demands.

Malaysia’s total rice production in 2015 is about 1.756 million metric tons. This amount could not fulfil the Malaysian consumption which was at 2,716 million metric tons in the same year. Therefore, the deficit of rice was imported from world-producing countries, especially from Thailand, Vietnam, Pakistan and Cambodia with total imports of 0.96 million ton valued at RM1, 740.3 million in 2015.

Table 1 shows the total amount of rice imports according to the types of rice. It showed that an average annual growth rate had increased by 0.49% in a period of 2010 to 2015. Rice importation in Malaysia can be divided according to the types of rice with the following distribution: 80% for white rice with balance of 20% for specialty rice. The import of specialty rice was for fragrant rice (11%), glutinous rice (4%), basmathi rice (3%) and others (2%) known as Japonica and red rice (BERNAS, 2017). With the demand of HQR showing an increasing trend at 1.27% cumulative annual growth rate (CAGR), hence the chances of planting the HQR in Malaysia could be crucial in the future. As compared with other HQR types, CAGR of fragrant rice was the highest at 3.9%. The HQR was demanded by the consumers which could be attributed to higher income, lifestyle as well as health awareness.

Table 1. Total Malaysian rice imports by type of rice (tons)

Year/Type of rice

Fragrant

Basmathi

White rice

Others

Total

Total specialty rice

2010

83,946

49,919

754,407

44,170

932,442

178,035

2011

73,123

21,259

919,311

47,113

1,060,806

141,495

2012

107,607

28,084

816,148

26,783

978,622

162,474

2013

120,002

30,718

658,331

38,035

847,086

188,755

2014

97,273

26,529

707,440

53,058

884,300

176,860

2015

105,600

28,300

768,000

57,600

960,000

192,000

CAGR

(2010-2015)

3.90%

-9.03%

0.30%

4.52%

0.49%

1.27%

Source: BERNAS and DOA, 2015.

In order to fulfill the farmers’ needs in producing the local specialty rice, MARDI produced three categories of HQR. These are fragrant, colored and glutinous rice. The fragrant rice itself can be categorized according to their characteristics like Basmathi, Jasmine and Normal types. Four fragrant rice varieties was named as MRQ 50, MARDI Wangi 74, MARDI Wangi 76 and MARDI Wangi 88. The various varieties came with a different

The first fragrant rice varieties known as MRQ 50 was launched by MARDI in 1999. However, it not really accepted by farmers because of its low yield. The second variety was MARDI Wangi 74 (also known as Mas Wangi) which was released in 2005. This variety is good for health especially for diabetic’s dietary requirement because its characteristics was similar to the basmathi types. MARDI Wangi 76, which was launched in 2011, has characteristics which is comparable to the jasmine types. The latest variety was MARDI Wangi 88, which was launched in 2016. MARDI Wangi 88 can be promoted as fragrant rice with white rice characteristic especially among consumers who prefer medium soft rice (Mohamad Najib et al, 2016). The latest specialty rice that was launched in early 2018 was a colored rice named as MARDI Warna 98. This colored rice had high antioxidant content according to their color characteristics. This variety was made as a substitute or varied the choice of the Sarawak traditional colored rice variety. This colored rice can easily be found in the Sarawak daily market and was produced as a niche product.

There are many rice brands in Malaysia market based by types of rice. Types of rice differ based on their physical characteristics and quality. However, information on consumer preferences towards what types of rice preferred by consumers is still lacking. This information is important to the breeder and stakeholders so that the it was accepted in the market and suits consumers’ preference as well. Local specialty rice was produced with the goal to reduce the import of HQR, especially the fragrant rice. In general, the objective of this study was to reveal the differences of preferences among the consumers between local specialty rice compared to imported rice.

METHODOLOGY

A study on consumer perception and preferences of specialty rice was conducted to identify the characteristics of the specialty rice chosen by Malaysians. The study involved a few surveys which were conducted at different pre-selected sites in Malaysia. A total of 400 respondents was surveyed in Klang Valley and 600 respondents at another six zones in Malaysia including Sabah and Sarawak. Besides that, the study also reviewed and analyzed data from past studies for comparison.

RICE CONSUMPTION PATTERNS AMONG MALAYSIAN CONSUMER

White rice is the main staple food commonly consumed by most people in Malaysia. There was a variation of pattern in the daily consumption among Malaysians. Figure 1 below shows the rice consumption patterns which indicates that 45% of the respondents consumed specialty rice as part of their daily diets. From that, 21% of those consumed was fragrant rice, 11.25% are basmathi rice, 11% of those consumed are both of the fragrant and basmathi rice. The rest 1.75% are brown rice consumers.

Fig. 1. Rice consumption among respondents

A study by Wong et al. (1992) and Syahrin et al. (2015) indicated that Malaysian consumers most preferred rice that contained more head rice, lower amylose content and long shape characteristic. Others studies concluded that the most important attribute of rice consumption was food safety, taste and size of grain (Ahmad Hanis, I.A.H et al (2012). Besides that, Syahrin, et al. (2008) found that 79% of the respondents who consumed white rice were willing to change their preference towards MARDI fragrant rice of Basmathi type, which were non-sticky and had low starch. Hence, this could be a substitute to imported Basmathi and Ponny rice. Consumers were also willing to pay a premium price for the demanded attributes. Hence, the high-quality rice needs to fulfill the characteristics and attributes that consumers preferred to make sure that the specialty rice can be able to gain market access at a premium price.

CONSUMER PREFERENCES TOWARDS SPECIALTY RICE

Consumer preferences for rice varieties vary according to their tastes and purchasing power. The quality of rice was subjected to a battery of tests on grain length, translucency, whiteness, aroma, stickiness and softness. These characteristics were mostly what the Malaysian consumers preferred. A survey was conducted among 400 consumers in Klang Valley to evaluate consumer preferences on local specialty rice as compared to white rice. The result revealed that the respondents preferred MARDI Wangi 76 more compared to other fragrant rice and white rice. The mean score for MARDI Wangi 76 are over 6.5 for all of characteristics (Table 2).

Table 2. Means Score of Consumer preferences on local specialty rice characteristics compared to white rice

Characteristics

White rice

(MR284)

MARDI Wangi 74

MARDI Wangi 76

MARDI Wangi 88

Grain length

6.34

5.41

6.78

5.81

Transparency

6.24

5.68

6.83

5.90

Whiteness

6.53

5.82

6.84

5.84

Aroma

5.63

6.44

6.75

5.68

Starchiness

5.52

6.72

6.66

5.70

Softness

6.07

6.17

6.74

6.17

Source: Data survey 2017

Fig. 2 shows that 78% of the respondents who consumed white rice are willing to change their daily rice consumption to MARDI specialty rice. About 30% of the respondents most preferred MARDI Wangi 76, followed by MARDI Wangi 74 (27%) and 21% preferred MARDI Wangi 88. These results show the potential of producing specialty rice locally to meet the demands of the people. In addition, the government can reduce the import of specialty rice as well.

Fig. 2. Consumers’ preferences towards local specialty rice.

Surveys were also conducted to identify consumers' preferences on local specialty rice compared to imported rice. Table 3 shows the means score of fragrant rice characteristics compared to imported rice. The result revealed that local fragrant rice (Jasmine type) was more preferred by consumers with mean (score=6.85) compared to the imported fragrant rice 1 (score=6.67) and imported fragrance rice 2 (score=6.16).

Table 3. Means of score fragrant rice characteristic between local and imported

Characteristics

Local

Import 1

Import 2

Grain length

5.76

6.68

6.41

Transparency

6.34

6.54

5.94

Whiteness

6.96

6.44

5.75

Aromatic

6.55

6.72

5.98

Stickiness

6.50

6.38

6.04

Softness

6.93

6.53

6.23

Source: Data survey 2014

Fig. 3 shows consumer preferences towards local specialty rice compared to two types of imported rice in the market. The characteristics of local specialty rice was preferred by the consumers are whiteness (score = 6.96), softness (score = 6.93) and stickiness (score = 6.50), while physical characteristics such as long grain (score = 6.68), translucency (score = 6.54) and aroma (score = 6.72).

Fig. 3. Consumer Preferences towards Specialty rice compared to imported rice.

Fig. 4 shows the consumer preferences towards local colored rice compared to the imported type. The study stated that 54% of respondents most preferred the imported colored rice as compared to the local ones. The overall mean score for imported colored rice was higher at (score=6.99) compared to the local ones with mean (score=6.65). The mean score for every characteristic also shows that the imported red rice was higher than the local one in such characteristics as grain shape (6.70), color (6.89), texture (6.83), stickiness (6.92) and softness (7.13). This result indicated that research and development for improving this variety is a need especially in terms of characteristics preferred by the consumers.

Fig. 4. Consumer preferences to local colored rice compared to imported

Fig. 5 shows the consumer preferences on local glutinous rice Siding as compared to the imported type. Majority of the consumers preferred the local type as such characteristic as shiny glutinous rice siding (7.41), color (6.88) and grain shape (6.62).. Meanwhile, shape for imported glutinous rice after cooking were more likely to be like the local type with a score of=7.07, elongation after cooked (score=6.97) and chewy (score=6.95). However, both local and imported glutinous rice have same score for stickiness with (score=6.95).

Fig. 5. Consumer preferences to local glutinous rice compared to imported

For black glutinous rice, majority of the consumers preferred the local black glutinous type. This indicates that all of the characteristics was better than the imported glutinous rice except for “elongation after cooked”.. The mean score for grain shape (score=6.94), color (score=7.48), stickiness (score=6.91), chewy (score=6.92) and shape after cooked (score=7.31) which was way better than the imported glutinous rice (Figure 6). Overall, imported glutinous rice was more favored with mean (score=7.13) compared to local (score=7.04). But locally produced black glutinous rice was well accepted by local consumers (score=7.46) compared to imported black glutinous (score=7.03) (Fig. 6).

Fig. 6. Consumer preferences to local black glutinous rice compared to imported

PRICE DETERMINATION FOR SPECIALTY RICE

Specialty rice is well-known to have higher nutrients and vitamins than regular white rice. It is suitable being used as a dietary supplement. Specialty rice is differentiated in terms of fragrant, soft, starchy, sticky and length. Hence, the price of specialty rice in the market was higher and varies according to the quality, grade and brand. Price of specialty rice in market was influenced by characteristics of rice itself. The study conducted by Syahrin et al. (2015) on 35 types of fragrant rice and 17 types of basmathi rice in the market found that the price of specialty rice was highly influenced by the physical-chemical characteristics.

The physical-chemical characteristics of rice in the market were analyzed and compared to MARDI Wangi 76 and MARDI Wangi 74. The characteristic was important in order to identify the rice that were comparable in the existing market. The MARDI Wangi 76 was shortest and tapered compared to the other fragrant rice in the market. The value of alkali spreading gave a wide range of result and this indicates that the fragrant rice in the market were mixed from various imported countries and packed into one brand.

Table 3 shows the comparison of the characteristics and price of fragrant rice in the market. The characteristics of MARDI Wangi 76 rice are comparable to the fragrant rice in the market except for grain length and translucency. Besides that, the price of rice were varies according to their quality characteristics of the rice. A study by Syahrin et al. (2015) found that the price of fragrant rice in the market were most influenced by rice shape and higher alkali spreading value and lower amylose content. This study then evaluated the price of MARDI Wangi 74 that consumers were willing to buy at US$1.60/kg. This finding also parallelled with another study by Wong et al. (1992) and found that the price of fragrant rice in the market was heavily influenced by the shape, higher value of alkali spreading and lower amylose content.

Table 3. Comparison of the characteristics and price of fragrant rice

Brands

Head

rice (%)

Broken

rice (%)

Grain

length (mm)

Grain

width (mm)

Ratio

L/W

Amylose (%)

Amylose

(%)

category

Alkali

spreading

Actual

price (US$)

MSRP

(US$)

Fragrant A

68.26

31.74

7.4

1.71

4.33

14.8

Low

4(1),5(2),

6(3),7(4)

1.75

2.45

Fragrant B

96.76

3.24

7.23

2.13

3.39

14.8

Low

5.9

1.45

1.74

Fragrant C

98.78

1.22

7.42

2.12

3.50

15.0

Low

6.5

1.40

1.73

MARDI Wangi 76

6.59

1.99

3.31

15.1

Low

4

1.60

Fragrant D

66.57

32.43

7.33

1.7

4.31

15.3

Low

6.6

1.25

2.45

Fragrant E

99.38

0.62

7.26

2.04

3.56

15.5

Low

5.2

1.49

1.58

Fragrant F

96.01

3.99

7.34

2.9

3.77

15.5

Low

6.3

1.45

1.72

Source: Syahrin, et al. (2015). Currency conversion rate at MYR 1 equal to US$ 0.25

Table 4 shows the comparison of the characteristic and price of MARDI Wangi 74 with multiple basmathi types in market. MARDI Wangi 74 rice was more short and oval than other basmathi rice in the market. The price of basmathi rice in the market was influenced by the long grain of rice. Hence, the suggested retail price for MARDI Wangi 74 was determined at US$1.40/kg based on their characteristics preferred by consumers. Consumers were also willing to pay at premium prices for the demanded attributes.

However, for colored rice, it was categorized as a niche market and the price was floated according to grade and quality. The price of colored rice in the market especially in Sarawak in average was in the range of US$1.75 - US$2.75/ kg.

Table 4. Comparison of the characteristics and price of Basmathi rice

Brands

Head

rice

(%)

Broken

rice

(%)

Grain

length (mm)

Grain

width (mm)

Ratio

L/W

Amylose (%)

Amylose (%)

category

Alkali

spreading

Actual

price (RM)

MSRP

(RM)

Basmathi A

62.30

37.70

5.4

1.79

3.02

24.8

Intermediate

6

1.87

1.88

Basmathi B

99.40

0.60

8.3

1.84

4.51

25.3

High

7

3.00

3.20

Basmathi C

99.46

0.54

7.51

1.83

4.10

25.9

High

7

1.85

2.50

MARDI Wangi 74

6.49

1.77

3.67

26.5

High

5

Basmathi D

99.00

1.00

7.43

1.71

4.35

26.8

High

6.7

1.48

2.25

Basmathi E

72.81

27.19

7.39

1.58

4.68

26.9

High

6.9

1.85

2.13

Basmathi F

99.18

0.82

7.73

1.86

4.16

27.1

High

6.4

1.39

1.95

Source: Syahrin, et al. (2015). Currency conversion rate at MYR 1 equal to US$ 0.25

CONCLUSION

Malaysian consumers most preferred the local fragrant rice with jasmine type due to its physical characteristics and sense of aroma which is equivalent to the imported fragrant rice. Meanwhile, consumers most preferred to buy imported glutinous rice compared to the local type. However, majority of consumers most preferred the local black glutinous rice for its characteristic except for its elongation after being cooked. Therefore, it is a great potential to produce fragrant rice locally using MARDI’s varieties which is economically viable in the present local rice market. As for local fragrant rice, it can be market to local store as well and can be competitive to the imports if the price was reasonable.

REFERENCES

Anon, _____. Malaysian Paddy Statistic, 2015. Jabatan Pertanian Malaysia (DOA).

Ahmad Hanis, I.A.H, Jinap, S., Mad Nasir, S., Alis, R. and Muhammad Shahrim, A.K. (2012). Consumer’s demand and Willingness to pay for rice attributes in Malaysia. International Food Research Journal 19(1): pg. 363-369.

BERNAS, 2017. Personel Comminication with BERNAS officer.

Mohamad Najib, M.Y., Asfaliza, R. dan Shamsul, A.S., 2016. Market Potential of paddy and Rice for export. Paperworks was presented in workshop of Implementation Plan Potential Specialty Rice for export., 23-25 Nov. 2016, Langkawi, Malaysia.

Syahrin, S., Hazirah, Y., Rosnani, H., Asfaliza, R., Mohammad Zulkifly, Z., Noor Hayati, H., Heriyanto, M., Hasnul, H. and Mohd. Amirul Mukmin, A.W. (2015). Consumers Perception and Acceptance towards Specialty Rice. Socio-Economic Report, Economic and Technology Management Research Centre, MARDI.

Syahrin, S., Mohd. Rashid, R., Abu Kasim, A., Tapsir, S. and Ahmad Shokri, O. (2008). Consumer perseption and willingness to pay Maswangi MRQ 74. Economic and Technology Management Review, Vo. 3: pg. 47-56.

Wong, L.C.Y., Husain, A.N., Ali, A. and Ithnin, B. (1992). Understanding Grain Quality in the Malaysian Rice Industry. In Consumer Demand for Grain Quality, International Rice Research Institute (IRRI), Manila, Philippines.

(Submitted as a paper for the International Seminar on “Promoting Rice Farmers’ Market through value-adding Activities”, June 6-7, 2018, Kasetsart University, Thailand)