ABSTRACT

Rice production plays an important role in Vietnam’s agricultural development. In recent years, although rice cultivation area maintains stable, the yield still keeps increasing year by year. This growth brings higher output, which does not only guarantee national food security but also strengthens Vietnam’s position in the rice international market. These achievements resulted from Vietnam government’s innovation in management mechanism and support policy for the rice sector, such as rice variety support, production support, irrigation construction, charge exemption for irrigation usage, production cooperation in large-scale field… However, there are still some shortcomings in the policy system, causing overlap and ineffectiveness.

This article focuses on reviewing Vietnam‘s rice policies and has recommended some policy implications for sustainable development in the rice sector.

OVERVIEW ON VIETNAM PADDY RICE DEVELOPMENT

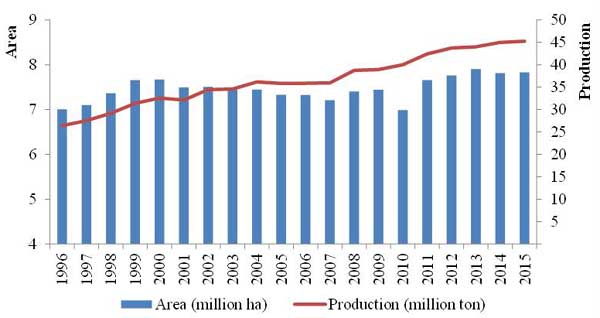

Vietnam’s paddy area is usually kept around 4.0 million ha, accounting for 40% of agricultural production land. During 1986 – 2014, Vietnam’s paddy area increased by 39% and the yield rose twice. Although Vietnam’s rice yield was only equivalent to 75% - 77% of China’s yield, it still took the highest ranking among Southeast Asian countries. Thanks to this high yield, Vietnam’s rice output rose by 2.75 times from 16 million tons in 1986 to 44 million tons in 2013. Rice production currently contributes 30% of the production value of Vietnam’s cultivation sector (MARD, 2014).

Fig. 1. Vietnam rice area and output during 1996 – 2015

Source: Ministry of Agriculture and Rural Development (MARD)

There are more than 9 million rice households, accounting for 70% of rural households. Rice-planting is the main livelihood of local people in areas which have advantages in terms of rice production for export. This has become the method for maintaining food security in remote, mountainous areas. Thus, achievement in rice production also contributes to poverty reduction in Vietnam. During economic crisis, positive trend of rice production enables Vietnam to control its food price and reduce inflation. The Mekong River Delta (MRD) is the largest rice production region in Vietnam, contributing 55% of national rice output and 90% of rice exports. The MRD average yield is 58.1 quintal/ha (GSO[1], 2014). Vietnam rice is mainly produced during winter and spring seasons, accounting for 40% of annual output, while this summer-autumn season contributes 32% and autumn winter 22%. Quality of winter spring rice is the highest, leading to the highest price among these rice varieties; while quality of the summer-autumn rice is the lowest with high risk in large-scale production.

The increase of rice yield mainly results from the intensive variety support. According to an IPSARD study on rice variety structure in the six main provinces that represents the main rice production regions in 2013[2], 86% of the national rice area was planted with inbred varieties while the application of hybrid variety had been significantly increased, especially in Northern provinces. Hybrid rice took 14% of the national rice area, 8% higher than 2006. According to the Department of Cultivation, during 2007 – 2011, rice variety structure considerably changed: application of high-quality varieties highly increased, specifically the high-quality hybrid varieties rice increased from 23% to 48% while inbred ones from 34% to 52%.

One of the main factors resulted in higher rice yield is the government’s large investment in irrigation. According to the World Bank, Vietnam owns the highest irrigated agricultural land in Southeast Asia; specifically during 2007 – 2009, Vietnam’s irrigated agricultural land took 73.1% of total agricultural land, while average rate of Southeast Asia was only about 33.3%, Thailand 42.1%, Myanmar 20.9% and Philippines 28.3%. 86% of Vietnam’s rice area was applied with active irrigation drainage system, highly increasing from 70% in 2006. Irrigation charges are exempted for Vietnam farmers. However, they still have to pay irrigation service costs (including fuel, labor) for service providers or contribute to construct flood control dikes, especially in MRD (Agrocensus 2011).

Domestic rice consumption increases at 1.1%/year on average. Although rice consumption per capita decreases, domestic market is still a potential what with Vietnam being the 13th largest population in the world (over 93 million people), changes in consumer’s tastes due to urbanization, young population and increasing income. According to food consumption survey conducted by IPSARD in 2011, urban consumers tend to consume less quantity but higher quality of rice. The National rice consumption rate is 4.7 kg/person/month on average. Hanoi’s consumption is higher than Ho Chi Minh, specifically 5.35 kg/person/month and 4.07 kg/person/month (IPSARD, 2014).

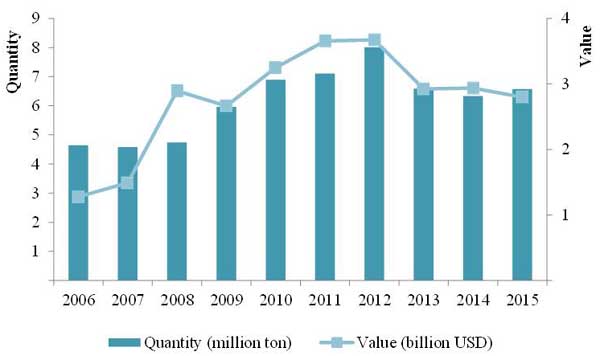

Fig. 2. Quantity and value of Vietnam’s rice export during 2006 – 2015

Fig. 2. Quantity and value of Vietnam’s rice export during 2006 – 2015

Source: General Department of Vietnam Customs

Rice export in 2015 reached 6.59 million tons with US$2.8 billion, 4% of quantity higher but 4.5% of value lower than 2014. Average rice export price was US$425.6/ton in 2015, 8.2% decrease compared to 2014. China was still the largest importer of Vietnam rice with 30.65% of market share; in 2015, China imported 4.8% of quantity higher but 3.6% of value lower than 2014. Some countries increased their market share compared to 2014, including: Indonesia reaching the 3rd position (9.5% of marker share) among the top rice export markets of Vietnam with 2.05 times of quantity and 77.1% of value higher in 2015; Ghana increased 13.6% of quantity and 5.2% of value; Ivory Coast increased 19.6% of quantity and 10.4% of value; United Arab Emirates increased 26.4% of quantity and 14.2% of value. On the contrary, some countries decreased their market share compared to 2014, including: Philippines (decreased 14.1% of quantity and 21.9% of value), Singapore (32.6% of quantity and 31.9% of value), Hong Kong (26.9% of quantity and 35.2% of value) and The U.S (26.3% of quantity and 21.7% of value) (MARD, 2015).

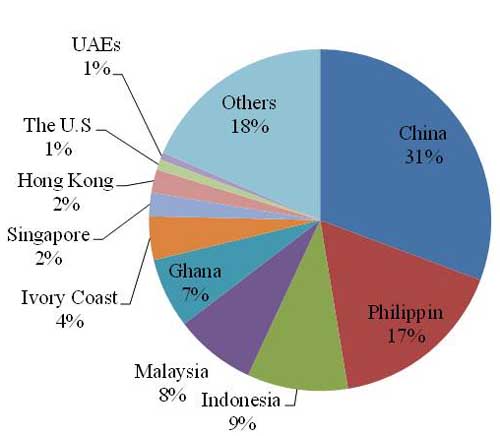

Fig. 3. Vietnam rice export markets in 2015

Source: Ministry of Agriculture and Rural Development

In recent years, the government has issued a number of support policies to improve this sector. However, rice sector still has to face with a number of obstacles and unsustainable development as: (i) small-scale production; (ii) unfair distribution of profit in the value chain, leading to lack of production cooperation; (iii) lack of high-tech application results in ineffectiveness and huge loss in post-harvest process; (iv) and ineffective logistic activities.

Policy review

Vietnam’s rice sector are resulted from different factors in which policy support plays a crucial role. In recent years, the Vietnam government has issued a number of policies and orientations for innovating and promoting the rice sector.

Paddy land planning and master plan for rice development

One of the most important policies which had great influence on Vietnam’s rice sector is Resolution 63/NQ-CP on food security, which stipulates that by 2020, Vietnam will maintain 3.8 million ha of rice land The expected output will be 41 – 43 million tons for both supplying enough to domestic consumers and exporting the annual quantity of 4 million tons.

Aiming at improving rice productivity, quality and effiency of rice business/production, MARD issued Decision 2765/QD-BNN-KHCN approving a Master plan for developing national products in which rice is the main commodity. The priorities for rice focus on new rice variety appplication, high-tech development and mechanization and improvement of post-harvest losses, organization of rice production, trademark development and market expansion. This plan is based on positive results of applying technical improvements as 3 Decrease 3 Increase, 1 MUST 5 Decrease, SRI, IPM... in MRD. Besides, MARD just issued Decision 1898/QD-BNN-TT dated May 23, 2016 on “Restructuring strategy for Vietnam‘s rice sector up to 2020 and vision to 2030“. This is very comprehensive strategy for the rice sector in Vietnam in which policies on production organization, value chain improvement, science and technology, environmental sustainability are recomended.

Domestic support policies

Decree 20/2011/ND-CP on 23/3/2011 guiding Decree 55/2010/QH12 on exemption and reduction of agriculture land tax (Effective duration of Decree 55 was from 01/01/2011 to 31/12/2020). Content of this policy is to reduce 50% of land tax for agriculture enterprises. This policy aims at supporting enterprises to invest in agriculture and encouraging land accumulation for production.

Decree 42/2012/ND-CP and Circular 205/2012/TT-BTC on guiding implementation of Decree 42 regulated supports the protection and development of rice land as cash support based on rice area and reclaimed land, input support and support in case of natural disasters.

+ In emergency cases: According to Decision 49/2012/QD-TTg amending Decision 142/2009/QD-TTg dated Dec 31, 2009 on policy and mechanism support for cultivation, livestock and fishery varieties which are damaged by natural disasters and epidemics, it was mentioned that (i) support for 70% damaged inbred rice plants were 2 million VND/ha, while 30-70% around 1 million VND/ha; (ii) support for 70% damaged young plants of inbred rice were 20 million VND/ha, while 30-70% around 10 million VND/ha; (iii) support for 70% damaged hybrid rice plants were 3 million VND/ha, while 30-70% around 1.5 million VND/ha; (iv) support for 70% damaged young plants of hybrid rice were 30 million VND/ha, while 30-70% around 15 million VND/ha.

+ Support for implementing agricultural development orientation and planning:

According to Circular 205/2012/TT-BTC dated Jan 10th 2013 and aims to implement guidance for Decree 42/2012/ND-CP on rice land management and use, annual governmental budget for supporting rice producers is 500,000 VND per ha per year for organizations, households or individuals producing rice on wet-rice farming land and 100,000 VND per ha per year for other rice land (except for upland rice land which is spontaneously expanded and plans on rice-farming land use). The Circular 205/2012/TT-BTC also mentions that rice producers should take advantages of the support for improving the effectiveness of rice production as increasing yield, quality by applying high-tech, new production practices and input investment. In 2015, Decree 42/2012/ND-CP was replaced by Decree 35/2015/ND-CP in which support for farmers was increasing. According to 35/2015/ND-CP, supporting rice producers is increasing to 1000,000 VND per ha of water paddy land per year and 500,000 VND per ha per year for other rice land.

According to Decision 497/QD-TTg dated 17/4/2009 and Decision 2213/QD-TTg dated 21/12/2009 amending Decision 497/QD-TTg, rice farmers are credit-supported with inputs as fertilizers, pesticides. The maximum credit is equal to 100% of input value (not exceeding 7 million VND/ha) with 4% of interest rate. Besides, farmers are also supported in buying machines, equipment for agricultural production with preferential interest rate at a maximum of 24 months.

Credit for purchasing rice temporary storage is mentioned in Decision 311/2013/QD-TTg and Circular 50/2013/TT-BTC; of which, purchasers will be supported with 100% interest rate at a maximum of 3 months from 20/2/2013 to 20/5/2013. The shortcoming of this policy is lacking of strong tools for controlling purchasers, who already received credit support, to commit with the suitable purchasing price while trading with farmers. In actual, even some large companies purchase at lower price than their commitment, causing loss for farmers.

Thanks to the support policy and budget of the national and local government for agricultural extension, the number of farmers joining the technical training courses have gradually increased.

Regaring support for training agriculture enteprise‘s workers: Decree No 61/2010/ND-CP regulates that there are three support levels based on production scale: Micro small enterprises are supported by 100% training cost, small enterpises 70%, small and medium enteprises 50%. The support is only 1 time/labor for a maximum of 6 months. Decree 210/2013/ND-CP on supporting enteprises to invest in agriculture mentions the support of 70% cost, 1 time/labor and maximum of 6 months. Untrained labor in special use forest is supported with 3 million/month/labor.

Besides, some enteprises also gain benefits from Scheme 1956 as well as other projects on vocational training support for agriculture and rural labor. These projects contribute to improved labor quality for some agriculture enterprises.

- Input support (irrigation fee, varieties, fertilizer...)

Resolution 55/2010/QH12 on agricultural land use tax exemption and reduction, Decree 20/2011/ND-CP on detailed regulation and implementation guidance for Resolution 55/2010/QH12; Decree 115/2008/ND-CP regulated that irrigation charges are exempted for households, individuals using their land/water surface for agricultural production; Circular 41/2013/TT-BTC on implementation guidance for Decree 67/2012/ND-CP and amending some Articles of Decree 143/2003/ND-CP issued by The Government; Decision 1580/2009/QD-TTg on financial support of water pumping and slapping for preventing foods for some provinces in the Mekong River Delta.

Decree 209/2013/ND-CP dated 18/12/2013 guiding some Articles of Law on Value -dded Tax, Cicurlar 219/2013/TT-BTC guiding implementation of the Decree for reducing value-added tax down to 5% for key inputs as fertilizers, pesticides, stimulant drugs, livestock and fishery feed; Circular 02/VBHN-BCT dated 23/1/2014 of Ministry of Trade and Industry replaces Circular 07/2004/TT-BTM dated 26/8/2004 of Ministry of Commerce on import tax exemption towards production materials, imported inputs for agro-forestry-fishery and salt production, artificial variety production, imported plant and livestock varieties.

- VGAP, GAP support production

Government supports farmers in applying VietGap as regulated in the following documents: Decision 01/2012/QD-TTg on support policy for applying the method of good agricultural practices (GAP) to agriculture, silviculture, and aquaculture (replacing Decision 107/2008/QD-TTg dated 30/7/2008); Circular 42/2013/TTLT-BNNPTNT-BTC-BKHDT; Circular 53/2012/TT-BNNPTNT issuing List of agriculture, fishery products supported by Decision 01/2012/QD-TTg.

These polices mention that farmers are supported with 100% cost of the fundamental investigation, topographic surveys, analysis of soil, water, and air; supported with infrastructure construction and improvement for GAP production, training, technology application (IPM, ICM), cost of certification, and trade promotion.

- Crop insuarance: To share risk to rice farmers, the Vietnam government issued decision 315 QD/TTg to implement a pilot program for agricultural commodity insurance, including rice. The program started in 2011 and lasted for three years from 2011 to 2014. According to the Decision 315 QD/TTg, the poor and nearly poor rice farmers are subsidized 100% and 90% of premium, respectively.

Post-haverst and post-processing loss reduction

To reduce post-harvest losses, improve production effectiveness, support livelihood and income for farmers, reduce negative influence of market volatility, government issued Resolution 48/2009/NQ on mechanism and policies contributing to reduce post-harvest losses of agro-commodity products. After that, government issued Decision 68/2013/QD-TTg dated 14/11/2013 on supportive policies for reducing losses in agriculture (replacing previous policies including Decision 63/2010/QD-TTg and 65/2010/QD-TTg). Decision 68/2013/QD-TTg issued a number of support policies for companies, cooperatives, households, individuals participating in agricultural production, such as: maximum loan of 100% product value, 100% interest rate in the first two years and 50% in the third year. However, lending process is quite slow because of complicated evaluation and credit-granting procedures in local areas. By 30/4/2013, total loan (for supporting this activity) of the four largest banks reached 699 billion VND. Although considered as the leading agriculture sector in loss reduction, the rice sector can only limit the losses from 13% to 10%.

In recent years, rice-processing activities have been further invested and improved, thanks to governmental support as Decision 497/QD-TTg dated 17/4/2009 on credit support for buying agricultural machines, equipment (except for supports regulated by Decision 131/QD-TTg dated 23/1/2009 and Decision 443/QD-TTg). These polices enable Vietnam’s rice processors to produce high-ranking products as 2% and 5% broken rice. Besides, rice color separation technology in processing has also been applied for improving rice-processing capacity and producing good quality kinds, which can meet the demand of importers. Some rice processors also succeed in establishing quality management system based on HACCP Standard.

In addition, Decree 109/2010/ND-CP on rice export business contributes to motivate rice companies to further invest in processing. Specifically, the Decree regulates conditions for rice export companies as follows: owing at least 1 (one) warehouse which can store at least 5,000 (five thousand) tons of paddies and meets general regulations promulgated by MARD; owning at least 1 (one) rice mill with an hourly capacity of at least 10 tons of paddies which meets general regulations promulgated by MARD; the rice warehouse and mill must be owned by the trader and located in a province or central city which has export commodity rice or an international seaport with rice export activities at the time the trader applies for a certificate. By May 2015, there were 144 companies satisfying all of the above conditions for rice export (higher than 177 ones in 2012).

Value chain improvement

In order to strengthen cooperation between companies and farmers, in Oct 2013, Prime Minister issued Decision 62/2013/QD-TTg on encouraging large-scale fields and connection between production and consumption of agricultural products. This Decision mentions that domestic companies, households, individuals, large farms, cooperatives are encouraged to cooperate with others for enhancing connection along the agro-commodity value chain from production to consumption; of which, agro-commodity consumption originated from large-scale fields projects are highly supported. Before this policy was officially issued, MRD provinces already participated in large-scale projects that highly attracted the investment of companies. By 2014, direct quantity traded between farmers and companies reached 4%. This low rate was a result of unsuitability of some regulations from Decision 62 as land support conditions, training cost and conditions for participating in temporary storage activities. In fact, companies need other support as long-term capital, good infrastructure and logistic conditions rather than above incentives.

Trade and investment incentives

Decree 210/2013/ND-CP regulated large support in tax, fee, and high-tech, land lease, worker training and trade promotion for encouraging companies to invest in agriculture and rural development.

Law on Enterprise Income Tax 14/2008/QH12 (amending by Law 32/2013/QH13 on amending some Article of Law on Enterprise Income Tax and Law 71/2014/QH13 on amending some Article of Law on amendments to tax law) regulated that:

+ Enterprise income tax is exempted in case: incomes from farming, livestock and fishery in disadvantageous areas; income from catching fishery.

+ The income tax is reduced to 10% for enterprises having income from planting, cultivating, and protecting forests; from agriculture, forestry, and aquaculture in localities facing socio-economic difficulties; from the production, multiplication, and cross-breeding plants and animals; from the production, extraction, and refinement of salt, except for the production of salt; from investments in post-harvest preservation of agriculture products, aquaculture products, and food.

Law on Personal Income Tax 04/2007/QH12 (amending by Law 26/2012/QH13 on amending some Articles of Law on Personal Income Tax and Law 71/2014/QH13 on amending some Articles of Law on amendments to tax law) regulated that:

Personal income tax is exempted in case: incomes of households and individuals directly engaged in agricultural or forest production, salt making, aquaculture, fishing and trading of aquatic resources are not yet processed into other products or preliminarily processed aquatic products; incomes from conversion of agricultural land are allocated by the Government to households and individuals for production.

Law on Value Added Tax 13/2008/QH12 (amending by Law 31/2013/QH13 on amending some Articles of Law on Value Added Tax andLaw 71/2014/QH13 on amending some Articles of Law on amendments to tax law) regulated that:

Some non-taxable objects includes: (i) farming, breeding, aquaculture produce that have not been processed into other products or have only been preliminary processed by the manufacturers or catchers when they are sold and imported. Enterprises and cooperatives buying farming, breeding, aquaculture produce that have not been processed into other products or have only been preliminary processed and sold to other enterprises or cooperatives are not required to declare and pay VAT but may deduct input VAT; (ii) fertilizers, specialized machinery and equipment serving agricultural production; offshore fishing vessels; feed for cattle, poultry, and other animals; (iii) Salt products made of seawater, natural rock salt, refined salt, iodized salt of which the primary constituent is sodium chloride (NaCl);

On 30/9/2015, Prime Minister issued Decision 1684/QD-TTg approving “economic integration strategy for agriculture and rural development“ that focues on key agro-commodities as rice, vegetable, fishery, coffee, tea, rubber, cashew, pepper, wood, livestock; of which, mentioning general and specific measures for improving major markets of these commodities.

According to Document 430/TTg-KTN dated March 12th 2010, companies are required to purchase rice at controlled price range for guaranteeing 30% of profit to farmers. After calculated by MARD, the Ministry of Finance (based on production cost announced by local authorities), the floor price for rice-purchasing shall be published, then implemented and inspected by companies and local authorities.

- Rice branding development

To develop rice branding, on 21 May 2015, Vietnam governement issued Decision 706/QD-TTg for approving Vietnam’s Rice Branding Strategy to 2020 and vision to 2030. Rice Branding Strategy aims at 50% of exported rice with Vietnamese brand in which 30% of the total rice export is of the aromatic and special brand.

Recently, government is editing a new Decree on attracting foreign investments in agriculture with 4 main major groups: (i) (plant and livestock) variety production and development; (ii) auxiliary material production for creating higher added value; (iii) processing improvement and raw material area development; (iv) pesticides and veterinary medicine production. Foreign investors may get a number of prorities as tax exemption, land use/rentfee exemption.

Institutional, scientific and technological innovation

To promote high-tech application in agriculture, The Government issued Decision 1895/QD-TTg on approving a program to promote high-tech application development in agricultural sector as a part of national program to promote high-tech application development till 2020. According to this, The Government will promote the development and effective application of high technology in the agricultural sector; contribute to build a comprehensively-developed agriculture in the direction of modernization, large-scale commodity production, high productivity, quality, efficiency and competitiveness, which brings about achievement of at least 3.5% annual growth rate; contribute to assure food security in both short and long terms.

Infrastructure investments

After Decision 800/QD-TTg dated June 4th 2010 approving the national target program on building a new countryside during 2010 – 2020 was issued, rural infrastructure has been largely improved, especially infield transport; inter-communal, inter-districtal and inter-provincial road system.

Decree 210/2013/ND-CP on supporting enteprises to invest in agriculture: (1) investors having investment projects in establishments of drying rice, corn, sweet potato, cassava, aquatic by-products or processing coffee under wet method shall be supported by the state budgets as follows: i) To support two billion VND/project for drying rice, corn, sweet potato, cassava; drying aquatic by-products, for building infrastructures on traffic, power, water, factories and equipment procurement; ii) To support three billion VND/project on processing coffee under wet method for building infrastructures on traffic, power, water, factories, waste treatment and equipment procurement; (2) investors having investment projects in factories or establishments that preserve, process agricultural, forestry and fishery products; establishments of producing auxiliary products; fabricate mechanical equipment for preserving, processing agricultural, forestry and fishery products shall be supported by the state budget as follows: i) A support of not more than 60% of costs and the total support must not exceed 5 billion VND/project to build infrastructure on waste treatment, traffic, power, water, factories and equipment procurement in the project fence; ii) A support of not more than 70% of waste treatment costs for factories processing agricultural, forestry and fishery products with big scale, invested, used many laborers, having big impact on the local economy and society.

In order to encourge companies to establish warehouses, and create a method for keeping agro-products in good quality, Government also issued Decision 57/2010/QD-TTg for exempting land-use charges for projects constructing rice or maize warehouses with capacity of 4 million tons, cold storgage for fishery, vegetable or coffee warehouse as planned. The exemption period is within five years. However, the policy still lacks condition for assessing effectiveness of the support.

CONCLUSION

Since economic reform, the rice sector in Vietnam has developed significantly. Rice growth ensures domestic demand and creates big surplus for exports. Vietnam exported 7-8 million tons of rice per annum. Even having a stable growth and high export, Vietnam rice sector is facing many issues including small farm size, low income earned by farmers, inconsistent quality/no brand of exported rice, weak link in value chain, bad impact of climate change.

To overcome problems, the Minister of Agriculture and Rural Development approved Vietnam‘s Rice Restructure Strategy issued Decision 1898/QĐ-BNN-TT on May 23rd 2016 to aprrove the restructuring strategy for rice sector in Vietnam. This is a comprehensive strategy in which it focuses on different solutions as follows:

- Restructuring production stage: land flexibility, land consolidation, rice variety improvement, cultivation practice improvement, machinization enhancement

- Institutional reform: improving vertical and horizonal linkages, developing the cooperative systems, enhancing capacity of associations

- Post harvest development and trade facilitation

- Market development

- Reducing climate change impact and improve risk management

- Protecting natural resource, environment and rice inherit

The set of policies is very comprehensive. However it needs a detailed programs/projects and actions. This strategy will support to improve productivity and quality of Vietnam rice. Hopefully, this strategy will also improve the rice farmers‘ incomes, paddy rice quality, reputation of Vietnam‘s rice in the international market and develop the sustainable production of rice.

REFERENCES

Thang, Tran Cong et al. (2015), “Policy research and measures for improving effectiveness of rice and pork value chain”. Ministry-level scientific research of MARD

Vietnam Prime Minister (2011), Strategy for importing and exporting commodities during 2011 – 2020 and orientation to 20130

IPSARD (2014), Policy review on agriculture, farmers and rural areas

General Statistics Office Of Vietnam (2015), Annual national statistics

[1] General Statistics Office of Vietnam

[2]Thang, Tran Cong (2013), Institute of Policy and Strategy for Agriculture and Rural Development (IPSARD), “Assessing current situation of technology application in agriculture from the view of farmers”

|

Date submitted: Oct. 27, 2016

Reviewed, edited and uploaded: Oct. 31, 2016

|

Vietnam’s Rice Policy Review

ABSTRACT

Rice production plays an important role in Vietnam’s agricultural development. In recent years, although rice cultivation area maintains stable, the yield still keeps increasing year by year. This growth brings higher output, which does not only guarantee national food security but also strengthens Vietnam’s position in the rice international market. These achievements resulted from Vietnam government’s innovation in management mechanism and support policy for the rice sector, such as rice variety support, production support, irrigation construction, charge exemption for irrigation usage, production cooperation in large-scale field… However, there are still some shortcomings in the policy system, causing overlap and ineffectiveness.

This article focuses on reviewing Vietnam‘s rice policies and has recommended some policy implications for sustainable development in the rice sector.

OVERVIEW ON VIETNAM PADDY RICE DEVELOPMENT

Vietnam’s paddy area is usually kept around 4.0 million ha, accounting for 40% of agricultural production land. During 1986 – 2014, Vietnam’s paddy area increased by 39% and the yield rose twice. Although Vietnam’s rice yield was only equivalent to 75% - 77% of China’s yield, it still took the highest ranking among Southeast Asian countries. Thanks to this high yield, Vietnam’s rice output rose by 2.75 times from 16 million tons in 1986 to 44 million tons in 2013. Rice production currently contributes 30% of the production value of Vietnam’s cultivation sector (MARD, 2014).

Fig. 1. Vietnam rice area and output during 1996 – 2015

Source: Ministry of Agriculture and Rural Development (MARD)

There are more than 9 million rice households, accounting for 70% of rural households. Rice-planting is the main livelihood of local people in areas which have advantages in terms of rice production for export. This has become the method for maintaining food security in remote, mountainous areas. Thus, achievement in rice production also contributes to poverty reduction in Vietnam. During economic crisis, positive trend of rice production enables Vietnam to control its food price and reduce inflation. The Mekong River Delta (MRD) is the largest rice production region in Vietnam, contributing 55% of national rice output and 90% of rice exports. The MRD average yield is 58.1 quintal/ha (GSO[1], 2014). Vietnam rice is mainly produced during winter and spring seasons, accounting for 40% of annual output, while this summer-autumn season contributes 32% and autumn winter 22%. Quality of winter spring rice is the highest, leading to the highest price among these rice varieties; while quality of the summer-autumn rice is the lowest with high risk in large-scale production.

The increase of rice yield mainly results from the intensive variety support. According to an IPSARD study on rice variety structure in the six main provinces that represents the main rice production regions in 2013[2], 86% of the national rice area was planted with inbred varieties while the application of hybrid variety had been significantly increased, especially in Northern provinces. Hybrid rice took 14% of the national rice area, 8% higher than 2006. According to the Department of Cultivation, during 2007 – 2011, rice variety structure considerably changed: application of high-quality varieties highly increased, specifically the high-quality hybrid varieties rice increased from 23% to 48% while inbred ones from 34% to 52%.

One of the main factors resulted in higher rice yield is the government’s large investment in irrigation. According to the World Bank, Vietnam owns the highest irrigated agricultural land in Southeast Asia; specifically during 2007 – 2009, Vietnam’s irrigated agricultural land took 73.1% of total agricultural land, while average rate of Southeast Asia was only about 33.3%, Thailand 42.1%, Myanmar 20.9% and Philippines 28.3%. 86% of Vietnam’s rice area was applied with active irrigation drainage system, highly increasing from 70% in 2006. Irrigation charges are exempted for Vietnam farmers. However, they still have to pay irrigation service costs (including fuel, labor) for service providers or contribute to construct flood control dikes, especially in MRD (Agrocensus 2011).

Domestic rice consumption increases at 1.1%/year on average. Although rice consumption per capita decreases, domestic market is still a potential what with Vietnam being the 13th largest population in the world (over 93 million people), changes in consumer’s tastes due to urbanization, young population and increasing income. According to food consumption survey conducted by IPSARD in 2011, urban consumers tend to consume less quantity but higher quality of rice. The National rice consumption rate is 4.7 kg/person/month on average. Hanoi’s consumption is higher than Ho Chi Minh, specifically 5.35 kg/person/month and 4.07 kg/person/month (IPSARD, 2014).

Source: General Department of Vietnam Customs

Rice export in 2015 reached 6.59 million tons with US$2.8 billion, 4% of quantity higher but 4.5% of value lower than 2014. Average rice export price was US$425.6/ton in 2015, 8.2% decrease compared to 2014. China was still the largest importer of Vietnam rice with 30.65% of market share; in 2015, China imported 4.8% of quantity higher but 3.6% of value lower than 2014. Some countries increased their market share compared to 2014, including: Indonesia reaching the 3rd position (9.5% of marker share) among the top rice export markets of Vietnam with 2.05 times of quantity and 77.1% of value higher in 2015; Ghana increased 13.6% of quantity and 5.2% of value; Ivory Coast increased 19.6% of quantity and 10.4% of value; United Arab Emirates increased 26.4% of quantity and 14.2% of value. On the contrary, some countries decreased their market share compared to 2014, including: Philippines (decreased 14.1% of quantity and 21.9% of value), Singapore (32.6% of quantity and 31.9% of value), Hong Kong (26.9% of quantity and 35.2% of value) and The U.S (26.3% of quantity and 21.7% of value) (MARD, 2015).

Fig. 3. Vietnam rice export markets in 2015

Source: Ministry of Agriculture and Rural Development

In recent years, the government has issued a number of support policies to improve this sector. However, rice sector still has to face with a number of obstacles and unsustainable development as: (i) small-scale production; (ii) unfair distribution of profit in the value chain, leading to lack of production cooperation; (iii) lack of high-tech application results in ineffectiveness and huge loss in post-harvest process; (iv) and ineffective logistic activities.

Policy review

Vietnam’s rice sector are resulted from different factors in which policy support plays a crucial role. In recent years, the Vietnam government has issued a number of policies and orientations for innovating and promoting the rice sector.

Paddy land planning and master plan for rice development

One of the most important policies which had great influence on Vietnam’s rice sector is Resolution 63/NQ-CP on food security, which stipulates that by 2020, Vietnam will maintain 3.8 million ha of rice land The expected output will be 41 – 43 million tons for both supplying enough to domestic consumers and exporting the annual quantity of 4 million tons.

Aiming at improving rice productivity, quality and effiency of rice business/production, MARD issued Decision 2765/QD-BNN-KHCN approving a Master plan for developing national products in which rice is the main commodity. The priorities for rice focus on new rice variety appplication, high-tech development and mechanization and improvement of post-harvest losses, organization of rice production, trademark development and market expansion. This plan is based on positive results of applying technical improvements as 3 Decrease 3 Increase, 1 MUST 5 Decrease, SRI, IPM... in MRD. Besides, MARD just issued Decision 1898/QD-BNN-TT dated May 23, 2016 on “Restructuring strategy for Vietnam‘s rice sector up to 2020 and vision to 2030“. This is very comprehensive strategy for the rice sector in Vietnam in which policies on production organization, value chain improvement, science and technology, environmental sustainability are recomended.

Domestic support policies

Decree 20/2011/ND-CP on 23/3/2011 guiding Decree 55/2010/QH12 on exemption and reduction of agriculture land tax (Effective duration of Decree 55 was from 01/01/2011 to 31/12/2020). Content of this policy is to reduce 50% of land tax for agriculture enterprises. This policy aims at supporting enterprises to invest in agriculture and encouraging land accumulation for production.

Decree 42/2012/ND-CP and Circular 205/2012/TT-BTC on guiding implementation of Decree 42 regulated supports the protection and development of rice land as cash support based on rice area and reclaimed land, input support and support in case of natural disasters.

+ In emergency cases: According to Decision 49/2012/QD-TTg amending Decision 142/2009/QD-TTg dated Dec 31, 2009 on policy and mechanism support for cultivation, livestock and fishery varieties which are damaged by natural disasters and epidemics, it was mentioned that (i) support for 70% damaged inbred rice plants were 2 million VND/ha, while 30-70% around 1 million VND/ha; (ii) support for 70% damaged young plants of inbred rice were 20 million VND/ha, while 30-70% around 10 million VND/ha; (iii) support for 70% damaged hybrid rice plants were 3 million VND/ha, while 30-70% around 1.5 million VND/ha; (iv) support for 70% damaged young plants of hybrid rice were 30 million VND/ha, while 30-70% around 15 million VND/ha.

+ Support for implementing agricultural development orientation and planning:

According to Circular 205/2012/TT-BTC dated Jan 10th 2013 and aims to implement guidance for Decree 42/2012/ND-CP on rice land management and use, annual governmental budget for supporting rice producers is 500,000 VND per ha per year for organizations, households or individuals producing rice on wet-rice farming land and 100,000 VND per ha per year for other rice land (except for upland rice land which is spontaneously expanded and plans on rice-farming land use). The Circular 205/2012/TT-BTC also mentions that rice producers should take advantages of the support for improving the effectiveness of rice production as increasing yield, quality by applying high-tech, new production practices and input investment. In 2015, Decree 42/2012/ND-CP was replaced by Decree 35/2015/ND-CP in which support for farmers was increasing. According to 35/2015/ND-CP, supporting rice producers is increasing to 1000,000 VND per ha of water paddy land per year and 500,000 VND per ha per year for other rice land.

According to Decision 497/QD-TTg dated 17/4/2009 and Decision 2213/QD-TTg dated 21/12/2009 amending Decision 497/QD-TTg, rice farmers are credit-supported with inputs as fertilizers, pesticides. The maximum credit is equal to 100% of input value (not exceeding 7 million VND/ha) with 4% of interest rate. Besides, farmers are also supported in buying machines, equipment for agricultural production with preferential interest rate at a maximum of 24 months.

Credit for purchasing rice temporary storage is mentioned in Decision 311/2013/QD-TTg and Circular 50/2013/TT-BTC; of which, purchasers will be supported with 100% interest rate at a maximum of 3 months from 20/2/2013 to 20/5/2013. The shortcoming of this policy is lacking of strong tools for controlling purchasers, who already received credit support, to commit with the suitable purchasing price while trading with farmers. In actual, even some large companies purchase at lower price than their commitment, causing loss for farmers.

Thanks to the support policy and budget of the national and local government for agricultural extension, the number of farmers joining the technical training courses have gradually increased.

Regaring support for training agriculture enteprise‘s workers: Decree No 61/2010/ND-CP regulates that there are three support levels based on production scale: Micro small enterprises are supported by 100% training cost, small enterpises 70%, small and medium enteprises 50%. The support is only 1 time/labor for a maximum of 6 months. Decree 210/2013/ND-CP on supporting enteprises to invest in agriculture mentions the support of 70% cost, 1 time/labor and maximum of 6 months. Untrained labor in special use forest is supported with 3 million/month/labor.

Besides, some enteprises also gain benefits from Scheme 1956 as well as other projects on vocational training support for agriculture and rural labor. These projects contribute to improved labor quality for some agriculture enterprises.

Resolution 55/2010/QH12 on agricultural land use tax exemption and reduction, Decree 20/2011/ND-CP on detailed regulation and implementation guidance for Resolution 55/2010/QH12; Decree 115/2008/ND-CP regulated that irrigation charges are exempted for households, individuals using their land/water surface for agricultural production; Circular 41/2013/TT-BTC on implementation guidance for Decree 67/2012/ND-CP and amending some Articles of Decree 143/2003/ND-CP issued by The Government; Decision 1580/2009/QD-TTg on financial support of water pumping and slapping for preventing foods for some provinces in the Mekong River Delta.

Decree 209/2013/ND-CP dated 18/12/2013 guiding some Articles of Law on Value -dded Tax, Cicurlar 219/2013/TT-BTC guiding implementation of the Decree for reducing value-added tax down to 5% for key inputs as fertilizers, pesticides, stimulant drugs, livestock and fishery feed; Circular 02/VBHN-BCT dated 23/1/2014 of Ministry of Trade and Industry replaces Circular 07/2004/TT-BTM dated 26/8/2004 of Ministry of Commerce on import tax exemption towards production materials, imported inputs for agro-forestry-fishery and salt production, artificial variety production, imported plant and livestock varieties.

Government supports farmers in applying VietGap as regulated in the following documents: Decision 01/2012/QD-TTg on support policy for applying the method of good agricultural practices (GAP) to agriculture, silviculture, and aquaculture (replacing Decision 107/2008/QD-TTg dated 30/7/2008); Circular 42/2013/TTLT-BNNPTNT-BTC-BKHDT; Circular 53/2012/TT-BNNPTNT issuing List of agriculture, fishery products supported by Decision 01/2012/QD-TTg.

These polices mention that farmers are supported with 100% cost of the fundamental investigation, topographic surveys, analysis of soil, water, and air; supported with infrastructure construction and improvement for GAP production, training, technology application (IPM, ICM), cost of certification, and trade promotion.

Post-haverst and post-processing loss reduction

To reduce post-harvest losses, improve production effectiveness, support livelihood and income for farmers, reduce negative influence of market volatility, government issued Resolution 48/2009/NQ on mechanism and policies contributing to reduce post-harvest losses of agro-commodity products. After that, government issued Decision 68/2013/QD-TTg dated 14/11/2013 on supportive policies for reducing losses in agriculture (replacing previous policies including Decision 63/2010/QD-TTg and 65/2010/QD-TTg). Decision 68/2013/QD-TTg issued a number of support policies for companies, cooperatives, households, individuals participating in agricultural production, such as: maximum loan of 100% product value, 100% interest rate in the first two years and 50% in the third year. However, lending process is quite slow because of complicated evaluation and credit-granting procedures in local areas. By 30/4/2013, total loan (for supporting this activity) of the four largest banks reached 699 billion VND. Although considered as the leading agriculture sector in loss reduction, the rice sector can only limit the losses from 13% to 10%.

In recent years, rice-processing activities have been further invested and improved, thanks to governmental support as Decision 497/QD-TTg dated 17/4/2009 on credit support for buying agricultural machines, equipment (except for supports regulated by Decision 131/QD-TTg dated 23/1/2009 and Decision 443/QD-TTg). These polices enable Vietnam’s rice processors to produce high-ranking products as 2% and 5% broken rice. Besides, rice color separation technology in processing has also been applied for improving rice-processing capacity and producing good quality kinds, which can meet the demand of importers. Some rice processors also succeed in establishing quality management system based on HACCP Standard.

In addition, Decree 109/2010/ND-CP on rice export business contributes to motivate rice companies to further invest in processing. Specifically, the Decree regulates conditions for rice export companies as follows: owing at least 1 (one) warehouse which can store at least 5,000 (five thousand) tons of paddies and meets general regulations promulgated by MARD; owning at least 1 (one) rice mill with an hourly capacity of at least 10 tons of paddies which meets general regulations promulgated by MARD; the rice warehouse and mill must be owned by the trader and located in a province or central city which has export commodity rice or an international seaport with rice export activities at the time the trader applies for a certificate. By May 2015, there were 144 companies satisfying all of the above conditions for rice export (higher than 177 ones in 2012).

Value chain improvement

In order to strengthen cooperation between companies and farmers, in Oct 2013, Prime Minister issued Decision 62/2013/QD-TTg on encouraging large-scale fields and connection between production and consumption of agricultural products. This Decision mentions that domestic companies, households, individuals, large farms, cooperatives are encouraged to cooperate with others for enhancing connection along the agro-commodity value chain from production to consumption; of which, agro-commodity consumption originated from large-scale fields projects are highly supported. Before this policy was officially issued, MRD provinces already participated in large-scale projects that highly attracted the investment of companies. By 2014, direct quantity traded between farmers and companies reached 4%. This low rate was a result of unsuitability of some regulations from Decision 62 as land support conditions, training cost and conditions for participating in temporary storage activities. In fact, companies need other support as long-term capital, good infrastructure and logistic conditions rather than above incentives.

Trade and investment incentives

Decree 210/2013/ND-CP regulated large support in tax, fee, and high-tech, land lease, worker training and trade promotion for encouraging companies to invest in agriculture and rural development.

Law on Enterprise Income Tax 14/2008/QH12 (amending by Law 32/2013/QH13 on amending some Article of Law on Enterprise Income Tax and Law 71/2014/QH13 on amending some Article of Law on amendments to tax law) regulated that:

+ Enterprise income tax is exempted in case: incomes from farming, livestock and fishery in disadvantageous areas; income from catching fishery.

+ The income tax is reduced to 10% for enterprises having income from planting, cultivating, and protecting forests; from agriculture, forestry, and aquaculture in localities facing socio-economic difficulties; from the production, multiplication, and cross-breeding plants and animals; from the production, extraction, and refinement of salt, except for the production of salt; from investments in post-harvest preservation of agriculture products, aquaculture products, and food.

Law on Personal Income Tax 04/2007/QH12 (amending by Law 26/2012/QH13 on amending some Articles of Law on Personal Income Tax and Law 71/2014/QH13 on amending some Articles of Law on amendments to tax law) regulated that:

Personal income tax is exempted in case: incomes of households and individuals directly engaged in agricultural or forest production, salt making, aquaculture, fishing and trading of aquatic resources are not yet processed into other products or preliminarily processed aquatic products; incomes from conversion of agricultural land are allocated by the Government to households and individuals for production.

Law on Value Added Tax 13/2008/QH12 (amending by Law 31/2013/QH13 on amending some Articles of Law on Value Added Tax andLaw 71/2014/QH13 on amending some Articles of Law on amendments to tax law) regulated that:

Some non-taxable objects includes: (i) farming, breeding, aquaculture produce that have not been processed into other products or have only been preliminary processed by the manufacturers or catchers when they are sold and imported. Enterprises and cooperatives buying farming, breeding, aquaculture produce that have not been processed into other products or have only been preliminary processed and sold to other enterprises or cooperatives are not required to declare and pay VAT but may deduct input VAT; (ii) fertilizers, specialized machinery and equipment serving agricultural production; offshore fishing vessels; feed for cattle, poultry, and other animals; (iii) Salt products made of seawater, natural rock salt, refined salt, iodized salt of which the primary constituent is sodium chloride (NaCl);

On 30/9/2015, Prime Minister issued Decision 1684/QD-TTg approving “economic integration strategy for agriculture and rural development“ that focues on key agro-commodities as rice, vegetable, fishery, coffee, tea, rubber, cashew, pepper, wood, livestock; of which, mentioning general and specific measures for improving major markets of these commodities.

According to Document 430/TTg-KTN dated March 12th 2010, companies are required to purchase rice at controlled price range for guaranteeing 30% of profit to farmers. After calculated by MARD, the Ministry of Finance (based on production cost announced by local authorities), the floor price for rice-purchasing shall be published, then implemented and inspected by companies and local authorities.

To develop rice branding, on 21 May 2015, Vietnam governement issued Decision 706/QD-TTg for approving Vietnam’s Rice Branding Strategy to 2020 and vision to 2030. Rice Branding Strategy aims at 50% of exported rice with Vietnamese brand in which 30% of the total rice export is of the aromatic and special brand.

Recently, government is editing a new Decree on attracting foreign investments in agriculture with 4 main major groups: (i) (plant and livestock) variety production and development; (ii) auxiliary material production for creating higher added value; (iii) processing improvement and raw material area development; (iv) pesticides and veterinary medicine production. Foreign investors may get a number of prorities as tax exemption, land use/rentfee exemption.

Institutional, scientific and technological innovation

To promote high-tech application in agriculture, The Government issued Decision 1895/QD-TTg on approving a program to promote high-tech application development in agricultural sector as a part of national program to promote high-tech application development till 2020. According to this, The Government will promote the development and effective application of high technology in the agricultural sector; contribute to build a comprehensively-developed agriculture in the direction of modernization, large-scale commodity production, high productivity, quality, efficiency and competitiveness, which brings about achievement of at least 3.5% annual growth rate; contribute to assure food security in both short and long terms.

Infrastructure investments

After Decision 800/QD-TTg dated June 4th 2010 approving the national target program on building a new countryside during 2010 – 2020 was issued, rural infrastructure has been largely improved, especially infield transport; inter-communal, inter-districtal and inter-provincial road system.

Decree 210/2013/ND-CP on supporting enteprises to invest in agriculture: (1) investors having investment projects in establishments of drying rice, corn, sweet potato, cassava, aquatic by-products or processing coffee under wet method shall be supported by the state budgets as follows: i) To support two billion VND/project for drying rice, corn, sweet potato, cassava; drying aquatic by-products, for building infrastructures on traffic, power, water, factories and equipment procurement; ii) To support three billion VND/project on processing coffee under wet method for building infrastructures on traffic, power, water, factories, waste treatment and equipment procurement; (2) investors having investment projects in factories or establishments that preserve, process agricultural, forestry and fishery products; establishments of producing auxiliary products; fabricate mechanical equipment for preserving, processing agricultural, forestry and fishery products shall be supported by the state budget as follows: i) A support of not more than 60% of costs and the total support must not exceed 5 billion VND/project to build infrastructure on waste treatment, traffic, power, water, factories and equipment procurement in the project fence; ii) A support of not more than 70% of waste treatment costs for factories processing agricultural, forestry and fishery products with big scale, invested, used many laborers, having big impact on the local economy and society.

In order to encourge companies to establish warehouses, and create a method for keeping agro-products in good quality, Government also issued Decision 57/2010/QD-TTg for exempting land-use charges for projects constructing rice or maize warehouses with capacity of 4 million tons, cold storgage for fishery, vegetable or coffee warehouse as planned. The exemption period is within five years. However, the policy still lacks condition for assessing effectiveness of the support.

CONCLUSION

Since economic reform, the rice sector in Vietnam has developed significantly. Rice growth ensures domestic demand and creates big surplus for exports. Vietnam exported 7-8 million tons of rice per annum. Even having a stable growth and high export, Vietnam rice sector is facing many issues including small farm size, low income earned by farmers, inconsistent quality/no brand of exported rice, weak link in value chain, bad impact of climate change.

To overcome problems, the Minister of Agriculture and Rural Development approved Vietnam‘s Rice Restructure Strategy issued Decision 1898/QĐ-BNN-TT on May 23rd 2016 to aprrove the restructuring strategy for rice sector in Vietnam. This is a comprehensive strategy in which it focuses on different solutions as follows:

The set of policies is very comprehensive. However it needs a detailed programs/projects and actions. This strategy will support to improve productivity and quality of Vietnam rice. Hopefully, this strategy will also improve the rice farmers‘ incomes, paddy rice quality, reputation of Vietnam‘s rice in the international market and develop the sustainable production of rice.

REFERENCES

Thang, Tran Cong et al. (2015), “Policy research and measures for improving effectiveness of rice and pork value chain”. Ministry-level scientific research of MARD

Vietnam Prime Minister (2011), Strategy for importing and exporting commodities during 2011 – 2020 and orientation to 20130

IPSARD (2014), Policy review on agriculture, farmers and rural areas

General Statistics Office Of Vietnam (2015), Annual national statistics

[1] General Statistics Office of Vietnam

[2]Thang, Tran Cong (2013), Institute of Policy and Strategy for Agriculture and Rural Development (IPSARD), “Assessing current situation of technology application in agriculture from the view of farmers”

Date submitted: Oct. 27, 2016

Reviewed, edited and uploaded: Oct. 31, 2016