ABSTRACT

Since Taiwan has officially submitted a CPTPP application letter to New Zealand, the depositary country of the CPTPP Agreement, on September 22, 2021, trade will be more liberalized in the future. In addition to facing short-term and long-term risks and challenges such as aging, lack of successors, shortage of workers, deterioration of the business environment, lack of animal welfare concept, rising feeds and transportation costs, COVID-19, the Russia-Ukraine war, Highly Pathogenic Avian Influenza (HPAI), climate change, and so on, Taiwan's Japanese quail egg industry faces production and export challenges. However, the past literature has not yet explored and analyzed the current production and sales channels of Taiwan's Japanese quail egg industry, and how the government assists the quail industry in gradually constructing a complete quail egg industry chain structure to enhance its production, processing, sales efficiency, and production value. Therefore, the purpose of this study is to analyze the current production, sale channel and continuously update export situation of Taiwan's Japanese quail egg industry and explain government policies.

Keywords: sales channel, Japanese quail egg, government policies

INTRODUCTION

In 2022, Taiwan's Japanese quail egg industry's overall output value was approximately US$19.82 million, with an export performance of US$1.89 million. To legalize its development, the Ministry of Agriculture (MOA) announced that Japanese quail will be included in the poultry designated by the Livestock Law from January 2022, and the industry also designated that year as the "First Year of Japanese Quail" in Taiwan. The traceability management and food processing of Japanese quail eggs were also strengthened to promote domestic sales.

Through government guidance and industry self-improvement, effective integration of upstream and downstream sectors is achieved, gradually establishing a complete quail egg industry chain structure. However, Taiwan's quail egg industry faces various challenges in production, including traditional high-density farming, small-scale operations, difficulty in land acquisition, high input costs for feeds, labor, and transportation, labor shortages, aging workforce, challenges in obtaining livestock farm registration, processing plant registration, related certifications, equipment subsidies, and concerns over food safety in processing plants (Chen, 2019; Yang, 2021). Moreover, in recent years, COVID-19, the Russia-Ukraine war, HPAI, and climate change, etc. have imposed an impact on the production and export performance of Taiwan's quail egg industry. The following provides an overview of the current production and export status of Taiwan's Japanese quail egg industry, along with government policies.

CURRENT PRODUCTION SITUATION OF JAPANESE QUAIL EGGS IN TAIWAN

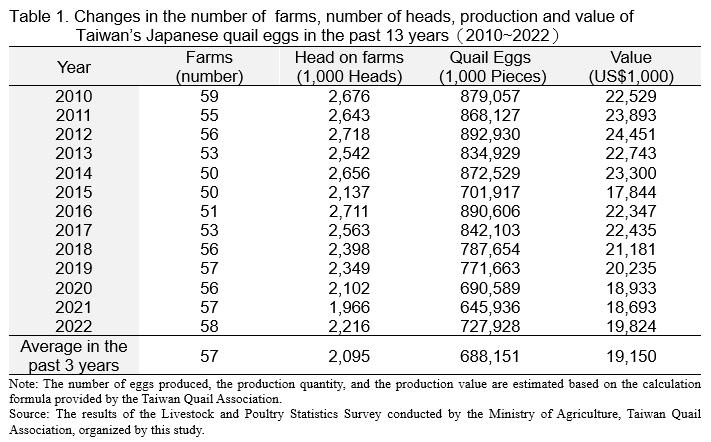

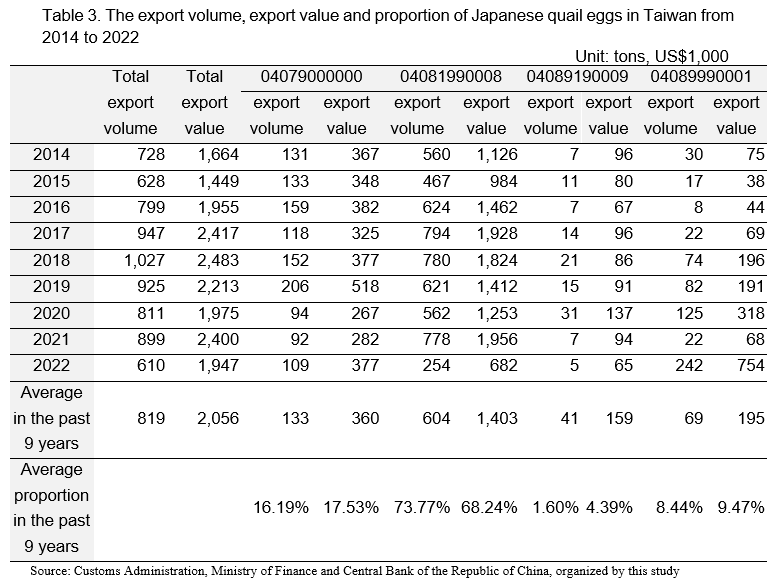

Based on the Livestock and Poultry Statistics Survey conducted by the MOA, the trends in the number of farms, head on farms, production, and value of Taiwan’s Japanese quail egg in the past 13 years (2010~2022) are as follows:

Number of farms

Over the past 13 years (2010-2022), the number of quail farms in Taiwan has slightly decreased from 59 in 2010 to 50 in 2014. Subsequently, there was a slight increase from 51 in 2016 to 58 in 2022. Over the recent 3 years (2020-2022), the average number of quail farms was 57 (Table 1).

Head on farms

Over the past 13 years (2010-2022), the number of Japanese quails raised in Taiwan has shown a decreasing trend year by year. It decreased from 2.676 million in 2010 to 2.642 million in 2011, slightly increased to 2.718 million in 2012, decreased to 2.541 million in 2013, increased to 2.656 million in 2014, decreased to 2.136 million in 2015, increased to 2.711 million in 2016, and then gradually decreased to 1.966 million in 2021. In 2022, there was a slight increase to 2.216 million, up 12.69% compared to the previous year. The average number of quails raised over the recent 3 years (2020-2022) was 2.095 million.

According to the calculation formula provided by the Taiwan Quail Association for estimating the number of eggs produced, production, and production value of Japanese quails, it is evident that there is a very close relationship between the estimated number of eggs produced, production, and production value, and the number of quails raised. In Taiwan, Japanese quails can start laying eggs at around 35 days of age, with an egg-laying lifespan of about 1 year. Their egg-laying rate is approximately 88% to 90%. We calculated the number of eggs produced by multiplying the number of quails raised by the egg-laying rate. Each egg weighs about 10 grams. During the regular period of 11 months (a total of 335 days), the price of a quail egg is approximately US$0.027 per egg, while during the Lunar New Year period of 1 month (a total of 30 days), the price is approximately US$0.031 per egg. Therefore, the annual production value of quail eggs in Taiwan is calculated by summing the production value during regular periods and the production value during the Lunar New Year period, namely, Annual production value of quail eggs = number of quails raised * egg-laying rate * US$0.027 per egg * 335 days + number of quails raised * egg-laying rate * US$0.031 per egg * 30 days. Based on this, the trends in the number of eggs produced, production, and production value of Japanese quails in Taiwan over the past 13 years (2010-2022) are detailed in Table 1.

Quail eggs

The number of quail eggs in Taiwan has shown a decreasing trend year by year. It decreased from 879 million eggs in 2010 to 868 million eggs in 2011, slightly increased to 893 million eggs in 2012, decreased to 835 million eggs in 2013, increased to 873 million eggs in 2014, decreased to 702 million eggs in 2015, increased to 891 million eggs in 2016, and then decreased annually to 646 million eggs in 2021. In 2022, there was a slight increase to 728 million eggs, representing a 12.69% increase compared to the previous year. The average egg production over the past 3 years (2020-2022) was 688 million eggs.

Production value

The production value of quail eggs in Taiwan has shown a decreasing trend year by year, dropping slightly from US$22,529 thousand in 2010 to US$19,824 thousand in 2022. Over the past 3 years (2020-2022), the average production value of quail eggs in Taiwan was US$19,150 thousand.

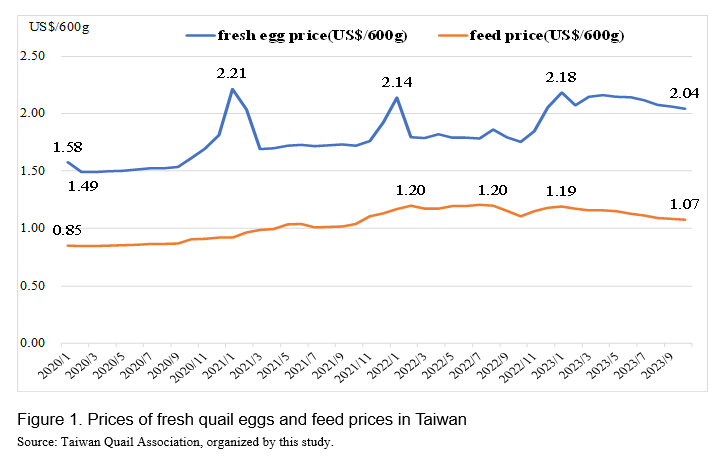

Fresh quail egg prices and feed prices

According to data provided by the Taiwan Quail Association, over the past four years (2020-2023), the price of fresh quail eggs in Taiwan has shown a monthly growth trend, except for significant increases observed in January 2021, January 2022, and January to February 2023 during the Lunar New Year period. The price has increased from US$1.58 per 600 grams in January 2020 to US$2.04 per 600 grams in October 2023, showing a positive correlation with the continuous rise in domestic feed prices. Over the same period (2020-2023), domestic feed prices have been on a monthly growth trend due to the impact of rising international grain prices, increasing from US$0.85 per 600 grams in January 2020 to US$1.07 per 600 grams in October 2023, as shown in Figure 1.

Primary production regions

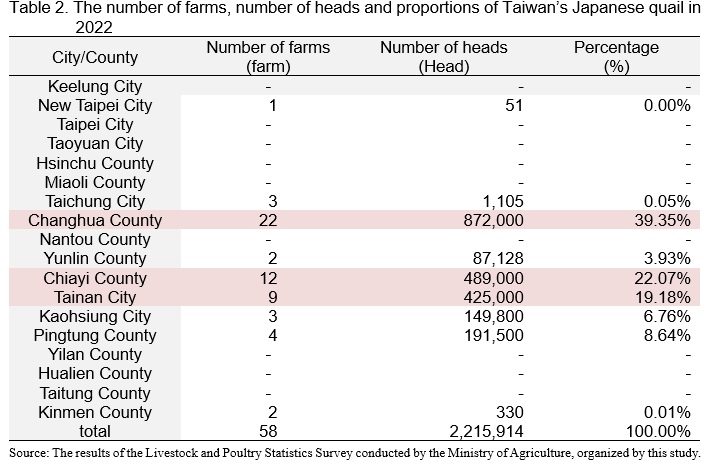

In 2022, the primary production regions for quail eggs in Taiwan were Changhua County, Chiayi County, and Tainan City, accounting for 39.35%, 22.07%, and 19.18% of the total number of heads, respectively. Together, they account for 80.60% of the total number of heads, with a total of 1.786 million heads, as detailed in Table 2.

Product types

Japanese quail eggs are categorized according to the following product types: fresh; boiled; century; and salted.

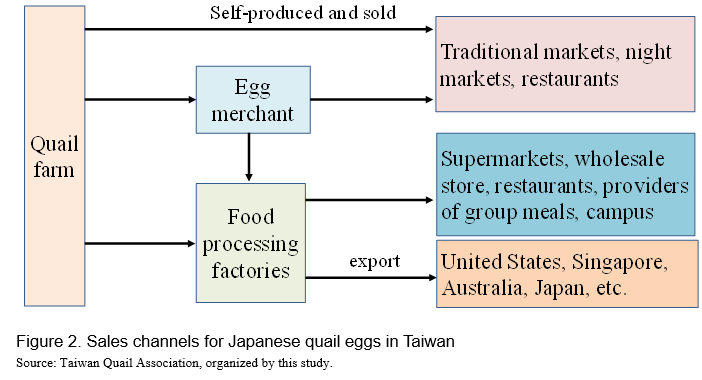

Sales channels

According to the data provided by the Taiwan Quail Association, the sales channels for quail eggs in our country are as shown in Figure 2:

1.Quail farms directly provide their products to traditional markets, night markets, and restaurants through self-marketing.

2.Quail farms supply quail eggs to egg merchants, who then distribute them to traditional markets, night markets, and restaurants.

3.Quail farms provide fresh quail eggs to food processing factories, which then supply them to supermarkets, wholesale stores, restaurants, providers of group meals, and campuses.

4.Food processing factories either directly export or supply to export traders, who export to markets such as the United States, Singapore, Australia, Japan, and others.

CURRENT EXPORT SITUATION OF JAPANESE QUAIL EGGS IN TAIWAN

Current export situation

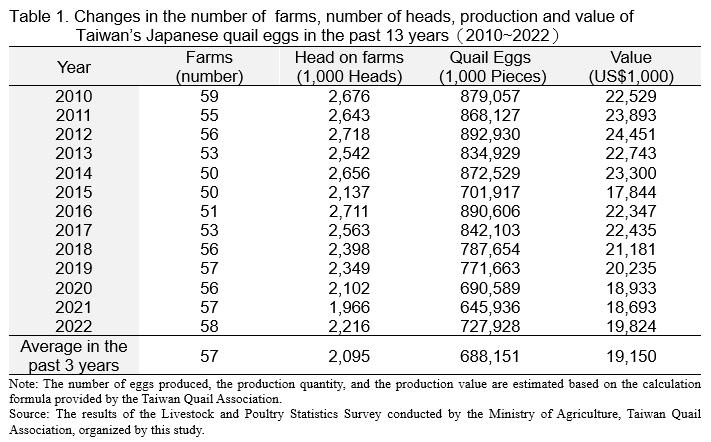

Owing to the current low output value and export value of Japanese quail eggs in Taiwan compared to other poultry products and the fact that the four H.S. Codes for Japanese quail eggs also include duck eggs and other poultry egg products, there is no independent code to directly clarify and obtain its export data. Therefore, on May 9, 2023, the author of this study requested that the MOA assist in collecting the export volume, export value, and exporting countries of Japanese quail eggs in Taiwan from the Customs Administration, Ministry of Finance, in the past nine years (2014-2022). The H.S. Code for export quantity, value, and exporting countries are 04079900000 (Birds' eggs, in shell, preserved or cooked), 0408919009 (Other birds' eggs, not in shell, dried), 04081990008 (Other similar articles), and 040899990001 (Other similar articles), respectively.

In the past nine years, the export volume of quail eggs in Taiwan accounted for 10.64% of its domestic production, and the export value accounted for 9.94% of its domestic output value. In the past eight years, the export volume of quail eggs in Taiwan has been the highest among other similar articles (04081990008), accounting for 73.77% of the total export volume, followed by the categories of birds' eggs, in shell, preserved or cooked (0407900000), accounting for 16.19%, the other similar articles (04089990001), accounting for 8.44%, and other birds' eggs, not in shell, dried (04089190009), accounting for 1.60%, as shown in Table 3.

Situation of major exporting countries

(1) Birds' eggs, in shell, preserved or cooked (040790000): Singapore (89%), Australia (4%), United States (4%).

(2) Other birds' eggs, not in shell, dried (0408919009): United States (56%), Hong Kong (45%), Australia (3%), Singapore (2%).

(3) Other similar articles (04081990008): United States (80%), Australia (11%), Canada (6%), United Arab Emirates (2%).

(4) Other similar articles (04081990008): United States (80%), Australia (11%), Canada (6%), United Arab Emirates (2%).

Import tariffs of major export markets

(1) Birds' eggs, in shell, preserved or cooked (040790000): MFN tariffs in Singapore and Australia are zero, while in the United States, they are 2.8 cents per dozen.

(2) Other birds' eggs, not in shell, dried (04089190009): The MFN tariff in the United States is 47.6 cents per kilogram, whereas Hong Kong, Australia, and Singapore have zero tariff.

(3) Other similar articles (04081990008): The MFN tariffs in the United States and Canada are US$1.14/kg and US$9.7/kg, respectively. The MFN tariff for the United Arab Emirates is 5%, while Australia has a zero tariff. In addition, according to the CPTPP tariff reduction schedule, Australia has a zero tariff, while Canada adopts a tariff quota with zero in-quota tariff and US$1.14/kg out-of-quota tariff.

(4) Other similar articles (040899990001): The MFN tariffs of the United States and Canada are US$1.14/kg and US$9.7/kg, respectively. The MFN tariff in the United Arab Emirates is 5%, and Australia has a zero tariff.

GOVERNMENT POLICIES

There are various challenges in Japanese quail egg production, such as high traditional breeding density, lack of animal welfare concepts, small scale, difficulty in land acquisition, high input costs for feed, labor, and transportation, labor shortage, aging workforce, inadequate disease control and management techniques, poor farming environment, inadequate utilization of quail manure, and difficulties in applying for livestock farm registration, as well as facing issues in processing such as processing plant registration, relevant certifications, and equipment subsidies, as well as concerns regarding food safety and product quality in processing plants, and encountering challenges in trade such as liberalization, low-price competition in export markets and insufficient understanding of import regulations.

Since the inclusion of quails under the Livestock Law in 2022, the MOA has established a dedicated team to address these aforementioned challenges, this team is executing a policy assessment plan for the quail industry, with tasks including investigating and collecting breeding and farming data related to quail farms, gathering domestic and international farming information to establish suitable quail farming models and patterns, analyzing methods for utilizing quail manure, compiling standard domestic quail farming manuals, enhancing the quail product supply chain and value-added products, understanding the current situation and issues of the quail industry, establishing development information for quail egg farms, managing production risks, conducting food safety and biosecurity education and training, collecting policies to enhance the competitiveness of the industry supply chain in response to liberalization from major quail egg-producing countries, collecting information on the current situation and challenges of the quail industry in Japan and drawing lessons from its industry responses.

These efforts aim to provide reference for agricultural authorities, quail associations, breeders, and processors. They also involve improving processing techniques, product quality, and diversification, providing technical consulting and guidance for industry organizations, and offering preferential agricultural low-interest loans to assist industry transformation and upgrading, covering aspects from farming, processing, marketing to export.

Additionally, the ministry offers preferential agricultural loans to assist industry development. Furthermore, to ensure the safety of quail eggs, the MOA has implemented a traceability system for domestically produced quail eggs since 2020. It also supports the introduction of domestic traceable ingredients into school meals in accordance with the " Three logos and one QR code " policy, providing nutritional supplements for school children.

CONCLUSIONS

The MOA has achieved notable effectiveness in improving the production, processing, and export of Taiwan’s Japanese quail egg industry through the implementation of the quail industry policy assessment plan by dedicated teams and field visits by expert teams. In terms of production, there have been improvements in quail breeding and hatching rates, enhancement of quail farm environments, increased biosecurity measures, adoption of smart farming management practices, increased production volume and value, improvement of animal welfare, the feasibility of converting quail manure into organic fertilizer, the establishment of domestic standard quail farming manuals (for meat production), and overall enhancement of the quail industry's productivity. In processing, expert consultations and diagnoses have led to improvements in product processing techniques, product quality, and diversification. Regarding trade, understanding import regulations and encountered issues in export markets are crucial to reducing risks and losses in export operations and providing guidance for existing exporters to expand into diverse international markets, as well as for new exporters to explore international opportunities.

Moving forward, efforts should focus on continuously strengthening the resilience of production, processing, and export supply chains, enhancing the quality and diversity of quail egg processing products, and assisting businesses in expanding domestic and international markets. Additionally, the MOA will also pursue continuous promotion of quail egg safety through CAS (Certified Agricultural Standards) and traceability certification to enhance quality and management.

REFERENCES

Chen, Y. H., 2019, the annual output value of Taiwan's quail industry is nearly one billion, and there is an urgent need to establish a sound management system. The current situation and future prospects of Taiwan's quail industry, Harvest Magazine, Department of Animal Science and Biotechnology, Tunghai University. https://www.agriharvest.tw/archives/10908.

Yang, L. L., 2021, Current status and future of Taiwan's quail industry development, Livestock Report, Issue 237, pp. 26-29.

The Current Production and Export Situation of Japanese Quail Egg Industry in Taiwan and Government Policies

ABSTRACT

Since Taiwan has officially submitted a CPTPP application letter to New Zealand, the depositary country of the CPTPP Agreement, on September 22, 2021, trade will be more liberalized in the future. In addition to facing short-term and long-term risks and challenges such as aging, lack of successors, shortage of workers, deterioration of the business environment, lack of animal welfare concept, rising feeds and transportation costs, COVID-19, the Russia-Ukraine war, Highly Pathogenic Avian Influenza (HPAI), climate change, and so on, Taiwan's Japanese quail egg industry faces production and export challenges. However, the past literature has not yet explored and analyzed the current production and sales channels of Taiwan's Japanese quail egg industry, and how the government assists the quail industry in gradually constructing a complete quail egg industry chain structure to enhance its production, processing, sales efficiency, and production value. Therefore, the purpose of this study is to analyze the current production, sale channel and continuously update export situation of Taiwan's Japanese quail egg industry and explain government policies.

Keywords: sales channel, Japanese quail egg, government policies

INTRODUCTION

In 2022, Taiwan's Japanese quail egg industry's overall output value was approximately US$19.82 million, with an export performance of US$1.89 million. To legalize its development, the Ministry of Agriculture (MOA) announced that Japanese quail will be included in the poultry designated by the Livestock Law from January 2022, and the industry also designated that year as the "First Year of Japanese Quail" in Taiwan. The traceability management and food processing of Japanese quail eggs were also strengthened to promote domestic sales.

Through government guidance and industry self-improvement, effective integration of upstream and downstream sectors is achieved, gradually establishing a complete quail egg industry chain structure. However, Taiwan's quail egg industry faces various challenges in production, including traditional high-density farming, small-scale operations, difficulty in land acquisition, high input costs for feeds, labor, and transportation, labor shortages, aging workforce, challenges in obtaining livestock farm registration, processing plant registration, related certifications, equipment subsidies, and concerns over food safety in processing plants (Chen, 2019; Yang, 2021). Moreover, in recent years, COVID-19, the Russia-Ukraine war, HPAI, and climate change, etc. have imposed an impact on the production and export performance of Taiwan's quail egg industry. The following provides an overview of the current production and export status of Taiwan's Japanese quail egg industry, along with government policies.

CURRENT PRODUCTION SITUATION OF JAPANESE QUAIL EGGS IN TAIWAN

Based on the Livestock and Poultry Statistics Survey conducted by the MOA, the trends in the number of farms, head on farms, production, and value of Taiwan’s Japanese quail egg in the past 13 years (2010~2022) are as follows:

Number of farms

Over the past 13 years (2010-2022), the number of quail farms in Taiwan has slightly decreased from 59 in 2010 to 50 in 2014. Subsequently, there was a slight increase from 51 in 2016 to 58 in 2022. Over the recent 3 years (2020-2022), the average number of quail farms was 57 (Table 1).

Head on farms

Over the past 13 years (2010-2022), the number of Japanese quails raised in Taiwan has shown a decreasing trend year by year. It decreased from 2.676 million in 2010 to 2.642 million in 2011, slightly increased to 2.718 million in 2012, decreased to 2.541 million in 2013, increased to 2.656 million in 2014, decreased to 2.136 million in 2015, increased to 2.711 million in 2016, and then gradually decreased to 1.966 million in 2021. In 2022, there was a slight increase to 2.216 million, up 12.69% compared to the previous year. The average number of quails raised over the recent 3 years (2020-2022) was 2.095 million.

According to the calculation formula provided by the Taiwan Quail Association for estimating the number of eggs produced, production, and production value of Japanese quails, it is evident that there is a very close relationship between the estimated number of eggs produced, production, and production value, and the number of quails raised. In Taiwan, Japanese quails can start laying eggs at around 35 days of age, with an egg-laying lifespan of about 1 year. Their egg-laying rate is approximately 88% to 90%. We calculated the number of eggs produced by multiplying the number of quails raised by the egg-laying rate. Each egg weighs about 10 grams. During the regular period of 11 months (a total of 335 days), the price of a quail egg is approximately US$0.027 per egg, while during the Lunar New Year period of 1 month (a total of 30 days), the price is approximately US$0.031 per egg. Therefore, the annual production value of quail eggs in Taiwan is calculated by summing the production value during regular periods and the production value during the Lunar New Year period, namely, Annual production value of quail eggs = number of quails raised * egg-laying rate * US$0.027 per egg * 335 days + number of quails raised * egg-laying rate * US$0.031 per egg * 30 days. Based on this, the trends in the number of eggs produced, production, and production value of Japanese quails in Taiwan over the past 13 years (2010-2022) are detailed in Table 1.

Quail eggs

The number of quail eggs in Taiwan has shown a decreasing trend year by year. It decreased from 879 million eggs in 2010 to 868 million eggs in 2011, slightly increased to 893 million eggs in 2012, decreased to 835 million eggs in 2013, increased to 873 million eggs in 2014, decreased to 702 million eggs in 2015, increased to 891 million eggs in 2016, and then decreased annually to 646 million eggs in 2021. In 2022, there was a slight increase to 728 million eggs, representing a 12.69% increase compared to the previous year. The average egg production over the past 3 years (2020-2022) was 688 million eggs.

Production value

The production value of quail eggs in Taiwan has shown a decreasing trend year by year, dropping slightly from US$22,529 thousand in 2010 to US$19,824 thousand in 2022. Over the past 3 years (2020-2022), the average production value of quail eggs in Taiwan was US$19,150 thousand.

Fresh quail egg prices and feed prices

According to data provided by the Taiwan Quail Association, over the past four years (2020-2023), the price of fresh quail eggs in Taiwan has shown a monthly growth trend, except for significant increases observed in January 2021, January 2022, and January to February 2023 during the Lunar New Year period. The price has increased from US$1.58 per 600 grams in January 2020 to US$2.04 per 600 grams in October 2023, showing a positive correlation with the continuous rise in domestic feed prices. Over the same period (2020-2023), domestic feed prices have been on a monthly growth trend due to the impact of rising international grain prices, increasing from US$0.85 per 600 grams in January 2020 to US$1.07 per 600 grams in October 2023, as shown in Figure 1.

Primary production regions

In 2022, the primary production regions for quail eggs in Taiwan were Changhua County, Chiayi County, and Tainan City, accounting for 39.35%, 22.07%, and 19.18% of the total number of heads, respectively. Together, they account for 80.60% of the total number of heads, with a total of 1.786 million heads, as detailed in Table 2.

Product types

Japanese quail eggs are categorized according to the following product types: fresh; boiled; century; and salted.

Sales channels

According to the data provided by the Taiwan Quail Association, the sales channels for quail eggs in our country are as shown in Figure 2:

1.Quail farms directly provide their products to traditional markets, night markets, and restaurants through self-marketing.

2.Quail farms supply quail eggs to egg merchants, who then distribute them to traditional markets, night markets, and restaurants.

3.Quail farms provide fresh quail eggs to food processing factories, which then supply them to supermarkets, wholesale stores, restaurants, providers of group meals, and campuses.

4.Food processing factories either directly export or supply to export traders, who export to markets such as the United States, Singapore, Australia, Japan, and others.

CURRENT EXPORT SITUATION OF JAPANESE QUAIL EGGS IN TAIWAN

Current export situation

Owing to the current low output value and export value of Japanese quail eggs in Taiwan compared to other poultry products and the fact that the four H.S. Codes for Japanese quail eggs also include duck eggs and other poultry egg products, there is no independent code to directly clarify and obtain its export data. Therefore, on May 9, 2023, the author of this study requested that the MOA assist in collecting the export volume, export value, and exporting countries of Japanese quail eggs in Taiwan from the Customs Administration, Ministry of Finance, in the past nine years (2014-2022). The H.S. Code for export quantity, value, and exporting countries are 04079900000 (Birds' eggs, in shell, preserved or cooked), 0408919009 (Other birds' eggs, not in shell, dried), 04081990008 (Other similar articles), and 040899990001 (Other similar articles), respectively.

In the past nine years, the export volume of quail eggs in Taiwan accounted for 10.64% of its domestic production, and the export value accounted for 9.94% of its domestic output value. In the past eight years, the export volume of quail eggs in Taiwan has been the highest among other similar articles (04081990008), accounting for 73.77% of the total export volume, followed by the categories of birds' eggs, in shell, preserved or cooked (0407900000), accounting for 16.19%, the other similar articles (04089990001), accounting for 8.44%, and other birds' eggs, not in shell, dried (04089190009), accounting for 1.60%, as shown in Table 3.

Situation of major exporting countries

(1) Birds' eggs, in shell, preserved or cooked (040790000): Singapore (89%), Australia (4%), United States (4%).

(2) Other birds' eggs, not in shell, dried (0408919009): United States (56%), Hong Kong (45%), Australia (3%), Singapore (2%).

(3) Other similar articles (04081990008): United States (80%), Australia (11%), Canada (6%), United Arab Emirates (2%).

(4) Other similar articles (04081990008): United States (80%), Australia (11%), Canada (6%), United Arab Emirates (2%).

Import tariffs of major export markets

(1) Birds' eggs, in shell, preserved or cooked (040790000): MFN tariffs in Singapore and Australia are zero, while in the United States, they are 2.8 cents per dozen.

(2) Other birds' eggs, not in shell, dried (04089190009): The MFN tariff in the United States is 47.6 cents per kilogram, whereas Hong Kong, Australia, and Singapore have zero tariff.

(3) Other similar articles (04081990008): The MFN tariffs in the United States and Canada are US$1.14/kg and US$9.7/kg, respectively. The MFN tariff for the United Arab Emirates is 5%, while Australia has a zero tariff. In addition, according to the CPTPP tariff reduction schedule, Australia has a zero tariff, while Canada adopts a tariff quota with zero in-quota tariff and US$1.14/kg out-of-quota tariff.

(4) Other similar articles (040899990001): The MFN tariffs of the United States and Canada are US$1.14/kg and US$9.7/kg, respectively. The MFN tariff in the United Arab Emirates is 5%, and Australia has a zero tariff.

GOVERNMENT POLICIES

There are various challenges in Japanese quail egg production, such as high traditional breeding density, lack of animal welfare concepts, small scale, difficulty in land acquisition, high input costs for feed, labor, and transportation, labor shortage, aging workforce, inadequate disease control and management techniques, poor farming environment, inadequate utilization of quail manure, and difficulties in applying for livestock farm registration, as well as facing issues in processing such as processing plant registration, relevant certifications, and equipment subsidies, as well as concerns regarding food safety and product quality in processing plants, and encountering challenges in trade such as liberalization, low-price competition in export markets and insufficient understanding of import regulations.

Since the inclusion of quails under the Livestock Law in 2022, the MOA has established a dedicated team to address these aforementioned challenges, this team is executing a policy assessment plan for the quail industry, with tasks including investigating and collecting breeding and farming data related to quail farms, gathering domestic and international farming information to establish suitable quail farming models and patterns, analyzing methods for utilizing quail manure, compiling standard domestic quail farming manuals, enhancing the quail product supply chain and value-added products, understanding the current situation and issues of the quail industry, establishing development information for quail egg farms, managing production risks, conducting food safety and biosecurity education and training, collecting policies to enhance the competitiveness of the industry supply chain in response to liberalization from major quail egg-producing countries, collecting information on the current situation and challenges of the quail industry in Japan and drawing lessons from its industry responses.

These efforts aim to provide reference for agricultural authorities, quail associations, breeders, and processors. They also involve improving processing techniques, product quality, and diversification, providing technical consulting and guidance for industry organizations, and offering preferential agricultural low-interest loans to assist industry transformation and upgrading, covering aspects from farming, processing, marketing to export.

Additionally, the ministry offers preferential agricultural loans to assist industry development. Furthermore, to ensure the safety of quail eggs, the MOA has implemented a traceability system for domestically produced quail eggs since 2020. It also supports the introduction of domestic traceable ingredients into school meals in accordance with the " Three logos and one QR code " policy, providing nutritional supplements for school children.

CONCLUSIONS

The MOA has achieved notable effectiveness in improving the production, processing, and export of Taiwan’s Japanese quail egg industry through the implementation of the quail industry policy assessment plan by dedicated teams and field visits by expert teams. In terms of production, there have been improvements in quail breeding and hatching rates, enhancement of quail farm environments, increased biosecurity measures, adoption of smart farming management practices, increased production volume and value, improvement of animal welfare, the feasibility of converting quail manure into organic fertilizer, the establishment of domestic standard quail farming manuals (for meat production), and overall enhancement of the quail industry's productivity. In processing, expert consultations and diagnoses have led to improvements in product processing techniques, product quality, and diversification. Regarding trade, understanding import regulations and encountered issues in export markets are crucial to reducing risks and losses in export operations and providing guidance for existing exporters to expand into diverse international markets, as well as for new exporters to explore international opportunities.

Moving forward, efforts should focus on continuously strengthening the resilience of production, processing, and export supply chains, enhancing the quality and diversity of quail egg processing products, and assisting businesses in expanding domestic and international markets. Additionally, the MOA will also pursue continuous promotion of quail egg safety through CAS (Certified Agricultural Standards) and traceability certification to enhance quality and management.

REFERENCES

Chen, Y. H., 2019, the annual output value of Taiwan's quail industry is nearly one billion, and there is an urgent need to establish a sound management system. The current situation and future prospects of Taiwan's quail industry, Harvest Magazine, Department of Animal Science and Biotechnology, Tunghai University. https://www.agriharvest.tw/archives/10908.

Yang, L. L., 2021, Current status and future of Taiwan's quail industry development, Livestock Report, Issue 237, pp. 26-29.