As the frequency of extreme weather events has substantially increased owing to global climate change in recent decades, how to slow down the pace of global warming has become an important public issue. Research has shown that the livestock sector is one of the primary contributors of greenhouse gas emissions (Garnett 2009; Herrero et al., 2016). Consequently, in the recent decade, there has been a call for the reduction of animal meat consumption, and great attention has been received in the use of plant-based meat products to replace traditional meat.

Taiwan, serving approximately 3 million vegetarians, has a long history of vegetarianism and has developed a technology that replicates the texture and taste of animal meat using plant-based ingredients. Given the large vegetarian population in Taiwan and the increased demand for plant-based food products globally, the development of Taiwan’s plant-based industry appears promising. However, to the best of our knowledge, no study has investigated the development and competitiveness of Taiwan’s plant-based meat industry.

This study investigates the relevant regulations, agricultural policies, technology development, and marketing profiles of the plant-based meat industry in Taiwan. We also discuss the competitiveness and challenges faced by Taiwan’s plant-based meat producers.

Taiwan has approximately 3 million vegetarians, and many of them have a special vegetarian diet for various reasons. For example, some Buddhists exclude the “five pungent vegetables” from their diets: onions, garlic, chives, green onions, and leeks. To prevent vegetarians from eating non-vegetarian food and food companies from selling non-vegetarian food as vegetarian, Taiwan has implemented a five-category labeling system for packaged vegetarian foods since 2009, under the Act Governing Food Safety and Sanitation. According to the law, all packaged vegetarian foods are no longer allowed to simply be labeled as “edible for vegetarians” and must clearly indicate the type of vegetarian ingredients (Table 1).

Food labeled as Vegan refers to pure vegetarian food that contains no animal products or by-products, and none of the vegetables in the Allium family; food labeled as Ovo, Lacto, or Ovo-lacto refers to Vegan food that contains eggs, dairy products, or both, respectively. Food labeled with the five pungent vegetables refers to vegetable food that contains onions, garlic, chives, green onions, or leeks. Additionally, the item allows the use of dairy products or eggs but needs to be marked on the label. It is noteworthy that the authority does not strictly require manufacturers to use separate equipment or production lines to produce vegetarian food. However, this is required under certain regulations (e.g., Good Manufacturing Practice certification).

Although plant-based meat products have existed in Taiwan for several years, there is no official definition or regulation for such products. The lack of official standards governing plant-based foods can lead to several issues. For example, there can be discrepancies in the perception and understanding of plant-based foods between consumers and producers (foodNEXT 2022a). Some plant-based meat products contain additives made from animal by-products and are, therefore, not labeled vegetarian food. However, consumers may simply perceive plant-based meat products as purely vegetarian food, and mistakenly consume non-vegetarian food. Therefore, there is a need to develop a more appropriate food labeling system.

Despite the gradually increasing popularity of plant-based foods in Taiwan, the government has paid little attention to the plant-based meat market. Nevertheless, some agricultural policies have promoted the cultivation of raw materials for plant-based meat substitutes. These policies are likely to have a direct impact on the supply of raw materials.

Historically, Taiwan has had a low self-sufficiency rate for mixed staple crops, such as soybean, wheat, and corn, especially since it joined the World Trade Organization (WTO) in 2002. For example, Taiwan’s soybean production was 4,773 tons in 2020, accounting for less than 2% of the annual soybean consumption.[1] According to an annual report by the COA (2017), the overall domestic production of major mixed crops accounts for only 6% of imports, suggesting that Taiwan heavily relies on imports to cover consumption needs.

The COA implemented the Big Granary Project in 2016 to increase the country’s self-sufficiency rate in mixed staple crops. The project initiated a series of measures with a focus on promoting the conversion of production of rice paddy to that of mixed staple crops (National Science and Technology Council 2021), including:

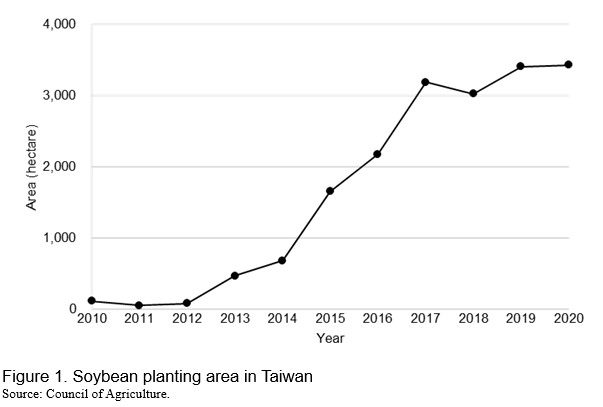

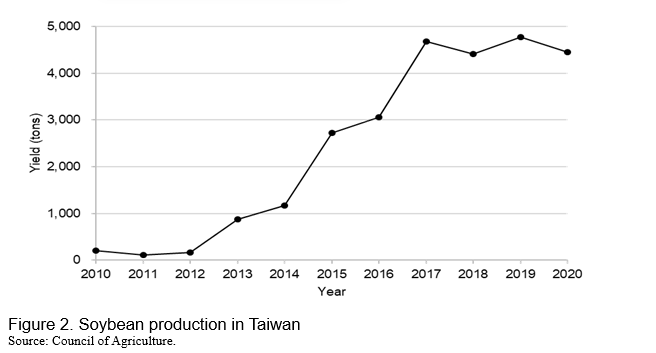

With active promotion by the COA, there has been a substantial increase in mixed-staple crop production. Taking the example of soybeans, about 115 hectares of land were devoted to soybean cultivation in 2010, which increased substantially to 3,431 hectares in 2020. Figure 1 presents the trend in area used for soybean cultivation in Taiwan over time. Simultaneously, there was a substantial increase in soybean production. As shown in Figure 2, soybean production increased from 204 tons in 2010 to 4,447 tons in 2020. Although there was an increase in plantation area for other mixed crops, the scale remained small.

Green Environment Benefit Project

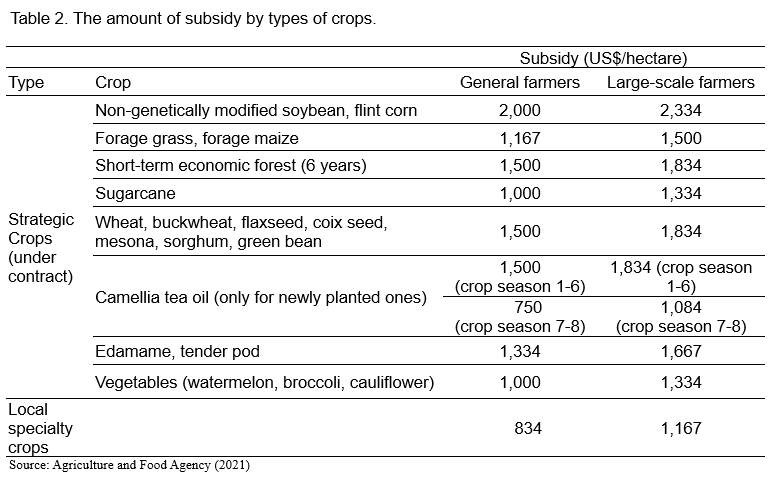

In addition to the Big Granary Project, the COA launched the Green Environment Benefit Project in 2018 to adjust the structure of the rice industry and increase the supply of mixed-staple crops. This project encourages farmers to grow competitive crops with higher economic value, such as import substitution, export-oriented crops, and main-point development crops under contract, by providing direct subsidies. Table 2 presents the amount of subsidy by crop type in 2022. Contract farmers who grow strategic crops are able to receive a subsidy of US$750-2,334 per hectare, depending on the type of crops and scale of farming. The COA also subsidizes farmers who grow local specialty crops for US$800 per hectare.

PRODUCTION PROCESS

Raw material and semi-finished products (intermediate goods): category, type, source, specification, food additives

A variety of raw materials are used in the production of plant-based meat, including plant proteins, binding and texturizing agents, fats, water, and other additives (e.g., coloring agents and flavors) (Kyriakopoulou et al., 2021). Among these materials, plant proteins play the most important role in determining the quality of plant-based meat as they form its main structure. The major plant proteins include soybean, pea, wheat, and rice proteins, the characteristics and applications of which are significantly different. Currently, soybean protein is pre-dominant in Taiwan’s plant-based meat industry primarily because of its high protein content. It also has beneficial nutritional properties and excellent processing properties, such as good gelation and water retention; however, there is a noticeable beany flavor in some products and a concern for soybean allergy. In contrast, pea, wheat, and rice proteins account for less than 10% of the market share. Although wheat protein does not have a beany flavor, it has a low protein content, and some populations are allergic to wheat and gluten. Pea protein has a less beany flavor and low allergenicity, but it has relatively weak heat-induced gelling ability. For a detailed comparison of different vegetable proteins, see Zhao et al., (2022).

Industrial technology: development path, mainstream technology

Various techniques have been developed in the food industry to produce vegetarian and plant-based foods, such as extrusion technology, shear cell technology, mixing of proteins and hydrocolloids, freeze structuring, and 3D printing (Dekkers et al., 2018). Among these techniques, extrusion processing technology is the predominant method used in the plant-based meat industry (Dekkers et al., 2018; Kazir and Livney 2021). During the extrusion process, high temperature and shear pressure can cause the raw materials to undergo structural modifications and affect the product properties (Beck et al., 2018). Manufacturers can adjust product properties (e.g., appearance and texture) by altering the extrusion conditions.

Moreover, extrusion processing technology can be divided into two classes: low-moisture, and high-moisture extrusion (Dekkers et al., 2018; The Good Food Institute, 2019). In low-moisture extrusion, raw materials are generally processed into texturized vegetable proteins without the addition of fats; these are then passed through a dryer. The resulting dry texturized vegetable proteins contained moisture content below 30 wt.%. In high-moisture extrusion, raw materials are processed into texturized vegetable proteins, with fat introduced during the extrusion process. The amount of water added during the extrusion process is higher than that in low-moisture extrusion. The resulting wet texturized vegetable proteins contains moisture content above 50 wt.%.

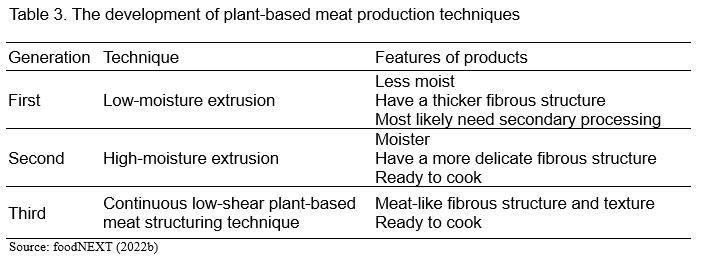

Taiwan’s vegetarian food producers are no strangers to these techniques (Table 3). In response to the increased popularity of vegetarian meat (e.g., vegetarian ham) in the U.S. and Japan during the 1990s, they have already developed and experienced the low-moisture extrusion technique, which is noted as the first-generation technology in FoodNEXT (2022b). Dry-texturized vegetable proteins produced by low-moisture extrusion have several desirable properties. For example, they are easier to transport and store, and have a longer shelf-life. However, a major problem is that they lack a natural meat-like flavor and texture after being hydrated and cooked. Additionally, some products have an unpleasant flavor.

With advancements in food technology, food producers have developed a second-generation technology, i.e., the high-moisture extrusion technique (FoodNEXT, 2022b). The wet texturized vegetable proteins produced by high-moisture extrusion possess significant advantages over the dry texturized vegetable proteins in terms of texture and flavor. Specifically, they are moister, and more likely to have a meat-like fibrous and springy texture. However, because wet texturized vegetable proteins have higher moisture content, they are more difficult to store and need to be shipped in temperature-controlled environments, leading to higher costs (FoodNEXT, 2022b).

According to a report by foodNEXT (2022b), many food producers in Taiwan still use low-moisture extrusion in their production, but others have begun to switch to high-moisture extrusion in response to the increased demand for wet texturized vegetable proteins. Recently, Taiwan’s Food Industry Research and Development Institute (FIRDI) has developed a third-generation technology, the continuous low-shear plant-based meat structuring technique. This new technique uses a combination of twin-screw extruders and simple shear devices to produce plant-based meat. The resulting meat products are reported to have better quality in terms of taste, texture, and flavor than those produced using the first- and second-generation technologies. For more details about this new technique, see a recent report by FIRDI (2020).

MARKETING

Consumer attitudes

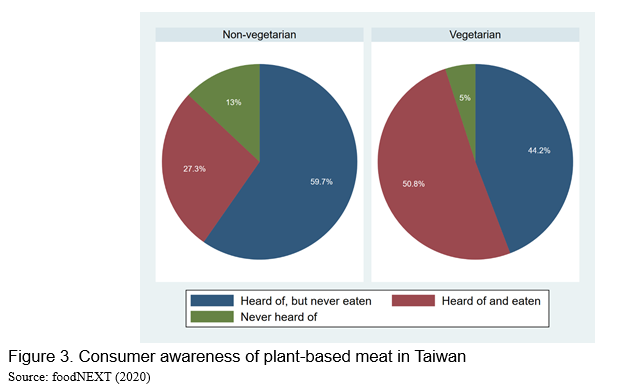

We first study consumer attitudes towards plant-based meat using recent surveys, conducted by foodNEXT (2020), GO SURVEY (2021) and the Asian Institute for Impact Measurement and Management (AIIMM, 2021). Figure 3 presents consumer awareness of plant-based meat and shows that most people are aware of plant-based meat. The ratio was higher for vegetarians (95%) than for non-vegetarians (87%). Moreover, half of the vegetarians had eaten plant-based meat products, suggesting that vegetarians pay more attention to vegetarian foods and are more willing to try plant-based meat products. On the other hand, although 87% of non-vegetarians had heard of plant-based meat, only 27.3% of them had eaten plant-based meat. This suggests that more effort is needed to make meat alternatives more appealing to non-vegetarian consumers.

foodNEXT (2020) also asked a follow-up question regarding the willingness to try plant-based meat products among respondents who reported hearing about but not eating it and those who reported never having heard about it. Nearly 90% of these people are willing to try plant-based meat, suggesting a potential marketing opportunity for plant-based meat. These results are consistent with those of a recent survey conducted by GO SURVEY (2021).

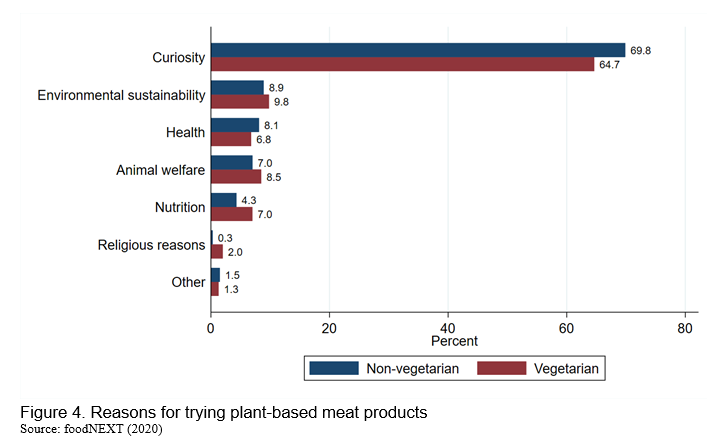

Next, we show the reasons for using plant-based meat products in Figure 4. The primary reason for this is curiosity, which is consistent with results in other countries. Additionally, the ratio is higher for non-vegetarians (69.8%) than for vegetarians (64.7%). Secondary motivations include environmental sustainability, health, animal welfare, and nutrition. Surprisingly, less than 2% of consumers reported religious reasons as the primary reason for trying plant-based meat products. Similar findings have been reported by GO SURVEY (2021). In their analysis, more than 60% of the respondents cited curiosity as the primary reason for trying plant-based meat products across different age cohorts, followed by environmental protection, meat substitutes, and animal welfare.

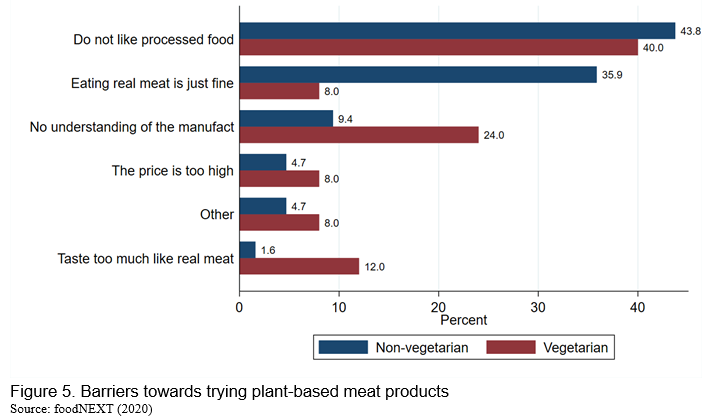

The barriers to using plant-based meat products are presented in Figure 5. For both non-vegetarian and vegetarian people, “dislike of processed foods” is the leading barrier (more than 40%). This result is consistent with GO SURVEY (2021), whose results also indicate that “dislike of overly processed foods” or “dislike of foods with many additives” as the primary barriers. Secondary barriers include the price and knowledge of the manufacturing process and ingredients of plant-based meat. Interestingly, the results were quite different between non-vegetarians and vegetarians. While 35.9% of non-vegetarians viewed “eating real meat is just fine” as a barrier for trying plant-based meat products, only 8% of vegetarian reported so. Additionally, vegetarians were more concerned about their knowledge of plant-based meat. 24% of them reported having no or insufficient understanding of the manufacturing process or ingredients as the primary barrier, whereas only 9.4% of non-vegetarian reported this.

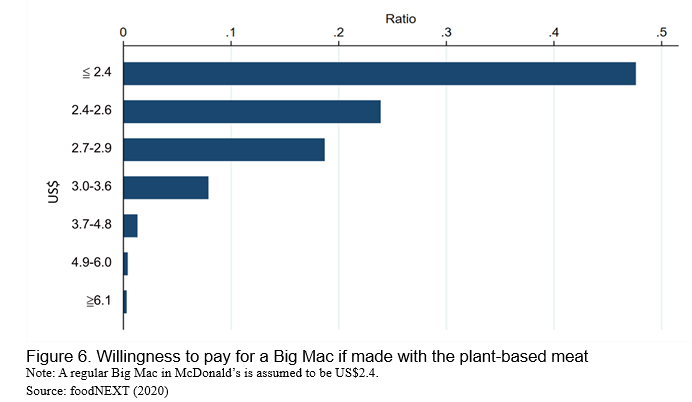

Given that plant-based meat products are relatively more expensive than traditional animal meat products, foodNEXT (2020) further investigated consumer willingness to pay for plant-based meat products. Assuming that a regular Big Mac in McDonald’s is US$2.4, they asked consumers how much they are willing to pay if the beef patty was replaced by the plant-based patty. As expected, price plays an important role in consumers’ purchasing decisions. Nearly half of the consumers were only willing to pay US$2.4 or less for a plant-based burger. About 40% of consumers were willing to pay a low premium (less than US$0.5) for meat substitutes, and less than 10% of consumers were willing to pay a higher premium. Similar findings have been reported by GO SURVEY (2021) and AIIMM (2021).

Sales channels and volumes

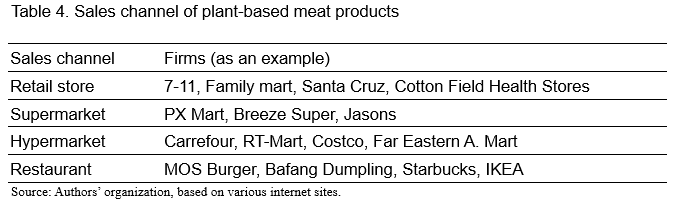

Plant-based meat products are widely available on the market in Taiwan. Consumers can order meals in restaurants and buy ready-to-eat or ready-to-cook items in leading convenience stores, retail stores, supermarkets, and hypermarkets (Table 4). As for purchase location preferences, Hsieh (2021) finds that vegetarian specialty stores are the primary locations. Over 60% of the consumers reported that they had purchased plant-based foods at vegetarian specialty stores. Traditional markets and supermarkets are also popular, with approximately 25% of consumers purchasing plant-based foods.

There are no official statistics regarding the sales volumes of plant-based meat in Taiwan, so we rely on a statistical report by Euromonitor International (2022) to provide an overview of trends in the sales of plant-based food. In 2017, retail sales of plant-based foods amounted to US$26.8 million. Despite the COVID-19 outbreak in 2020, the retail sales continued to grow and increased to US$36.0 million in 2021. It is expected that the growth will continue over the next five years, with retail sales of plant-based food forecasted to increase by 8% from US$34.2 million in 2022 to US$46.5 million in 2026. Chilled meat and seafood substitutes have the highest sales throughout the study period; however, frozen and shelf-stable meat and seafood sub-stitutes are expected to catch up by 2026.

CHALLENGES AND COMPETITIVENESS OF THE PLANT-BASED MEAT INDUSTRY

As discussed in the previous section, plant-based meat is a relatively new concept, and its development is in its early stages. Thus, to gain a better understanding of the development and marketing of the plant-based meat industry in Taiwan, we conducted in-depth interviews with managers and experts at leading plant-based meat companies. We summarize the challenges and competitiveness of the plant-based meat industry in Taiwan, based on the views expressed by company managers and experts, as follows.

Challenges

- Reliance on imports for raw materials for meat substitutes

Taiwan’s raw materials for meat substitutes rely heavily on imports (primarily from the U.S.), such as soy protein, wheat protein or gluten, and canola oil or rapeseed oil. Although Taiwan has promoted the cultivation of mixed staple crops, its production remains insufficient, and their price can be twice as much as that of imports. Additionally, the production of plant-based meat requires raw materials that are of better quality because the use of cheaper but inferior materials will result in low-quality foods, such as beany flavor and poor texture. As a result, the cost of plant-based meat products is higher than that of traditional meat products; thus, the price is not competitive.

- Strict regulations

A primary challenge in promoting plant-based meat products in Taiwan is the strict food labelling regulations. Specifically, domestic food products are required by law to list all ingredients and food additives. In case of ingredients that are a mix of liquid and solid materials, the respective constituents should also be listed. However, imported food products only need to list the ingredients and food additives, and there is no need to list the detailed contents of the ingredients. This practice may mistakenly provide consumers with the impression that domestic food products use more food additives than imported ones, affecting their willingness to buy them.

- Small-scale business

Although producers in Taiwan have excellent techniques to produce plant-based meat products, their scale is relatively small; thus, they face many constraints. For example, they have limited ability to compete in the market and influence relevant policies. To increase competitiveness in the international market, it is recommended that producers form strategic alliances to integrate resources. It is also recommended for them to identify and seek strategic partners with deep knowledge of the target area and sales channels.

- Lack of marketing skills and brand image-building

Because of the growing interest in plant-based food worldwide, food producers around the world have expanded their business in this new market, leading to intense competition in the plant-based industry. Although producers in Taiwan have been able to produce high-quality plant-based meat products, they generally lack effective marketing skills and possess low brand awareness. Though some producers have received positive feedback from international food exhibitions, they have not received many orders. To enter the international market, companies in Taiwan must establish their brand identity and differentiate brands and products from the competition in the market.

Competitiveness

- Technology maturity

Upstream producers in Taiwan have accumulated years of experience and expertise in raw material processing and are able to provide customized products according to customer needs. They are also able to maintain consistent food quality. This is particularly important because the quality of raw materials (agricultural products) depends on climatic conditions. Only experienced producers can adjust their manufacturing processes accordingly. Many entrant firms eventually exited the market because they were unable to do so.

- Assorted products

As discussed earlier, food producers in Taiwan have a long history of making vegetarian foods and have developed excellent techniques to produce plant-based meat products. They have developed assorted products and can provide customized items. For example, Taiwan’s food producers created the first plant-based fish fillet. They have also launched plant-based seafood alternatives such as vegetarian tuna salads and vegetarian shrimps. Currently, there are more than 100 items in the market.

- Wide sales channels

Plant-based meat in Taiwan is available for sale through many different channels. Food producers have partnered with convenience stores, restaurants, retail stores, and supermarkets, and have developed many ready-to-eat products. The weekly demand for plant-based meat is more than ten tons from this channel. Items in small packages have also been developed for sale in the traditional markets. Furthermore, online retail sales are available and are expected to grow at a faster rate.

CONCLUSION

We conclude our study by summarizing and discussing our findings. First, although Taiwan has a well-defined labeling system for packaged vegetarian foods, there is no official definition or regulation for plant-based products. A potential problem arising from the lack of official standards is the discrepancy in the perception and understanding of plant-based foods between consumers and producers. A plant-based meat product cannot be labeled as vegetarian if its ingredients contain animal by-products. However, it has been pointed out that consumers may simply perceive plant-based meat products as pure vegetarian food and mistakenly consume non-vegetarian food. Therefore, it is necessary to develop regulations for plant-based meat. Second, Taiwan relies heavily on imports for raw materials to produce plant-based meat. Although the domestic supply has increased substantially, thanks to policy support, production remains low and far from sufficient for production needs. Moreover, the government heavily subsidizes the cultivation of mixed staples. It is unclear whether such a cultivation plan is sustainable if the subsidy is no longer available. Third, while most consumers are aware of, and express interest in, plant-based meat products, they face many barriers. ‘Dislike of processed foods’ is the leading factor, followed by ‘eating real meat is just fine’ and ‘insufficient knowledge about the manufacturing process and ingredients of plant-based meat.’ Producers may need to reduce the use of additives in their products to make plant-based meat more attractive. However, doing so, while maintaining flavor/taste, can be challenging. Additionally, consumers also express limited willingness to pay for plant-based meat products. About half of the consumers are not willing to pay a higher price for a plant-based burger than for a regular one.

REFERENCES

Agriculture and Food Agency. 2021. 3.2. Green Environment Benefit Project. https://www.afa.gov.tw/upload/cht/attachment/0871ac2fc5f1504372d037d34ba.... Last accessed October 10, 2022.

Asian Institute for Impact Measurement and Management. 2021. https://business.uupon.com/insights/introduce_5.html.Last accessed October 27, 2022.

Beck, S. M., Knoerzer, K., Foerster, M., Mayo, S., Philipp, C., & Arcot, J. (2018). Low moisture extrusion of pea protein and pea fibre fortified rice starch blends. Journal of Food Engineering, 231, 61-71.

Council of Agriculture. 2017. COA Annual Report. https://eng.coa.gov.tw/ws.php?id=2505539. Last accessed October 10, 2022.

Council of Agriculture. 2020. Agriculture Policy & Review (339). https://www.coa.gov.tw/ws.php?id=2511460. Last accessed October 10, 2022.

Dekkers, B. L., Boom, R. M., & van der Goot, A. J. (2018). Structuring processes for meat analogues. Trends in Food Science & Technology, 81, 25-36.

Euromonitor International. 2021. Processed meat, seafood and alternatives to meat in Taiwan. https://www.euromonitor.com/processed-meat-seafood-and-alternatives-to-m.... Last accessed October 27, 2022.

Food and Drug Administration, Ministry of Health and Welfare. 2008. Regulations Governing the Labeling of Packaged Vegetarian Foods. https://www.bsmi.gov.tw/wSite/public/Data/f1247018671891.pdf. Last accessed November 10, 2022.

Food Industry Research and Development Institute. 2020. Annual report. https://www.firdi.org.tw/PageData/Reports/109%E5%B9%B4/pdf/en.pdf. Last accessed November 11, 2022.

foodNEXT. 2020. https://www.foodnext.net/issue/5852508246. Last accessed October 27, 2022.

foodNEXT. 2022a. https://www.foodnext.net/science/additives/preservative/paper/5098686529. Last accessed November 11, 2022.

foodNEXT. 2022b. https://www.foodnext.net/science/machining/paper/5593686979. Last accessed November 11, 2022.

Garnett, T. (2009). Livestock-related greenhouse gas emissions: impacts and options for policy makers. Environmental science & policy, 12(4), 491-503.

GO SURVEY. 2021. https://www.gosurvey.com.tw/uploads/insight/tw/gosurveyinsight_20211020.pdf. Last accessed October 27, 2022.

Herrero, M., Henderson, B., Havlík, P., Thornton, P. K., Conant, R. T., Smith, P., ... & Stehfest, E. (2016). Greenhouse gas mitigation potentials in the livestock sector. Nature Climate Change, 6(5), 452-461.

Hsieh, C. F. 2021. The Study of the Plant-Based Meat Industry Analysis and Consumer Behavior. Master Thesis, Executive Master Program in Business Administration, National Yunlin University of Science & Technology.

Kazir, M., & Livney, Y. D. (2021). Plant-based seafood analogs. Molecules, 26(6), 1559.

Klink-Lehmann, J., & Simons, J. 2022. Marketing strategy of plant-based meat alternatives in Germany. Unpublished manuscript.

Kyriakopoulou, K., Keppler, J. K., & van der Goot, A. J. (2021). Functionality of ingredients and additives in plant-based meat analogues. Foods, 10(3), 600.

National Science and Technology Council. 2021. National Science and Technology Development Plan during 2021-2024. https://www.nstc.gov.tw/nstc/attachments/d855609b-9390-49f3-8499-490fcee.... Last accessed October 15, 2022.

The Good Food Institute. 2019. Plant-based meat manufacturing by extrusion. https://gfi.org/wp-content/uploads/2021/01/Plant-Based-Meat-Manufacturin.... Last accessed November 11, 2022.

Zhao, D., Huang, L., Li, H., Ren, Y., Cao, J., Zhang, T., & Liu, X. (2022). Ingredients and Process Affect the Structural Quality of Recombinant Plant-Based Meat Alternatives and Their Components. Foods, 11(15), 2202.

[1] The annual consumption volume of soybeans in Taiwan is 10 kilograms per person, totaling about 230,000 tons (COA 2020)

Marketing Strategy of Plant-based Meat Alternatives in Taiwan

ABSTRACT

Taiwan has a long history of vegetarian food production, and its food producers have specialized expertise in producing vegetarian food. As the demand for meat alternatives grows rapidly worldwide due to nutritional and environmental concerns, food producers have switched their focus to plant-based meat and have developed technologies wherein plant-based ingredients are used to replicate meat-like flavor attributes. In this study, we investigate the relevant regulations, agricultural policies, technology development, and marketing profiles of the plant-based meat industry in Taiwan. We also discuss the competitiveness of, and challenges faced by Taiwan’s plant-based meat producers.

Keywords: meat alternatives, plant-based meat; textured vegetable protein; consumer attitude; market development

INTRODUCTION

As the frequency of extreme weather events has substantially increased owing to global climate change in recent decades, how to slow down the pace of global warming has become an important public issue. Research has shown that the livestock sector is one of the primary contributors of greenhouse gas emissions (Garnett 2009; Herrero et al., 2016). Consequently, in the recent decade, there has been a call for the reduction of animal meat consumption, and great attention has been received in the use of plant-based meat products to replace traditional meat.

Taiwan, serving approximately 3 million vegetarians, has a long history of vegetarianism and has developed a technology that replicates the texture and taste of animal meat using plant-based ingredients. Given the large vegetarian population in Taiwan and the increased demand for plant-based food products globally, the development of Taiwan’s plant-based industry appears promising. However, to the best of our knowledge, no study has investigated the development and competitiveness of Taiwan’s plant-based meat industry.

This study investigates the relevant regulations, agricultural policies, technology development, and marketing profiles of the plant-based meat industry in Taiwan. We also discuss the competitiveness and challenges faced by Taiwan’s plant-based meat producers.

REGULATIONS GOVERNING THE LABELING OF PACKAGED VEGETARIAN FOODS

Taiwan has approximately 3 million vegetarians, and many of them have a special vegetarian diet for various reasons. For example, some Buddhists exclude the “five pungent vegetables” from their diets: onions, garlic, chives, green onions, and leeks. To prevent vegetarians from eating non-vegetarian food and food companies from selling non-vegetarian food as vegetarian, Taiwan has implemented a five-category labeling system for packaged vegetarian foods since 2009, under the Act Governing Food Safety and Sanitation. According to the law, all packaged vegetarian foods are no longer allowed to simply be labeled as “edible for vegetarians” and must clearly indicate the type of vegetarian ingredients (Table 1).

Food labeled as Vegan refers to pure vegetarian food that contains no animal products or by-products, and none of the vegetables in the Allium family; food labeled as Ovo, Lacto, or Ovo-lacto refers to Vegan food that contains eggs, dairy products, or both, respectively. Food labeled with the five pungent vegetables refers to vegetable food that contains onions, garlic, chives, green onions, or leeks. Additionally, the item allows the use of dairy products or eggs but needs to be marked on the label. It is noteworthy that the authority does not strictly require manufacturers to use separate equipment or production lines to produce vegetarian food. However, this is required under certain regulations (e.g., Good Manufacturing Practice certification).

Although plant-based meat products have existed in Taiwan for several years, there is no official definition or regulation for such products. The lack of official standards governing plant-based foods can lead to several issues. For example, there can be discrepancies in the perception and understanding of plant-based foods between consumers and producers (foodNEXT 2022a). Some plant-based meat products contain additives made from animal by-products and are, therefore, not labeled vegetarian food. However, consumers may simply perceive plant-based meat products as purely vegetarian food, and mistakenly consume non-vegetarian food. Therefore, there is a need to develop a more appropriate food labeling system.

AGRICULTURAL POLICY WITH INDIRECT INFLUENCE ON THE RAW MATERIAL MARKET

Despite the gradually increasing popularity of plant-based foods in Taiwan, the government has paid little attention to the plant-based meat market. Nevertheless, some agricultural policies have promoted the cultivation of raw materials for plant-based meat substitutes. These policies are likely to have a direct impact on the supply of raw materials.

Big Granary Project

Historically, Taiwan has had a low self-sufficiency rate for mixed staple crops, such as soybean, wheat, and corn, especially since it joined the World Trade Organization (WTO) in 2002. For example, Taiwan’s soybean production was 4,773 tons in 2020, accounting for less than 2% of the annual soybean consumption.[1] According to an annual report by the COA (2017), the overall domestic production of major mixed crops accounts for only 6% of imports, suggesting that Taiwan heavily relies on imports to cover consumption needs.

The COA implemented the Big Granary Project in 2016 to increase the country’s self-sufficiency rate in mixed staple crops. The project initiated a series of measures with a focus on promoting the conversion of production of rice paddy to that of mixed staple crops (National Science and Technology Council 2021), including:

With active promotion by the COA, there has been a substantial increase in mixed-staple crop production. Taking the example of soybeans, about 115 hectares of land were devoted to soybean cultivation in 2010, which increased substantially to 3,431 hectares in 2020. Figure 1 presents the trend in area used for soybean cultivation in Taiwan over time. Simultaneously, there was a substantial increase in soybean production. As shown in Figure 2, soybean production increased from 204 tons in 2010 to 4,447 tons in 2020. Although there was an increase in plantation area for other mixed crops, the scale remained small.

Green Environment Benefit Project

In addition to the Big Granary Project, the COA launched the Green Environment Benefit Project in 2018 to adjust the structure of the rice industry and increase the supply of mixed-staple crops. This project encourages farmers to grow competitive crops with higher economic value, such as import substitution, export-oriented crops, and main-point development crops under contract, by providing direct subsidies. Table 2 presents the amount of subsidy by crop type in 2022. Contract farmers who grow strategic crops are able to receive a subsidy of US$750-2,334 per hectare, depending on the type of crops and scale of farming. The COA also subsidizes farmers who grow local specialty crops for US$800 per hectare.

PRODUCTION PROCESS

Raw material and semi-finished products (intermediate goods): category, type, source, specification, food additives

A variety of raw materials are used in the production of plant-based meat, including plant proteins, binding and texturizing agents, fats, water, and other additives (e.g., coloring agents and flavors) (Kyriakopoulou et al., 2021). Among these materials, plant proteins play the most important role in determining the quality of plant-based meat as they form its main structure. The major plant proteins include soybean, pea, wheat, and rice proteins, the characteristics and applications of which are significantly different. Currently, soybean protein is pre-dominant in Taiwan’s plant-based meat industry primarily because of its high protein content. It also has beneficial nutritional properties and excellent processing properties, such as good gelation and water retention; however, there is a noticeable beany flavor in some products and a concern for soybean allergy. In contrast, pea, wheat, and rice proteins account for less than 10% of the market share. Although wheat protein does not have a beany flavor, it has a low protein content, and some populations are allergic to wheat and gluten. Pea protein has a less beany flavor and low allergenicity, but it has relatively weak heat-induced gelling ability. For a detailed comparison of different vegetable proteins, see Zhao et al., (2022).

Industrial technology: development path, mainstream technology

Various techniques have been developed in the food industry to produce vegetarian and plant-based foods, such as extrusion technology, shear cell technology, mixing of proteins and hydrocolloids, freeze structuring, and 3D printing (Dekkers et al., 2018). Among these techniques, extrusion processing technology is the predominant method used in the plant-based meat industry (Dekkers et al., 2018; Kazir and Livney 2021). During the extrusion process, high temperature and shear pressure can cause the raw materials to undergo structural modifications and affect the product properties (Beck et al., 2018). Manufacturers can adjust product properties (e.g., appearance and texture) by altering the extrusion conditions.

Moreover, extrusion processing technology can be divided into two classes: low-moisture, and high-moisture extrusion (Dekkers et al., 2018; The Good Food Institute, 2019). In low-moisture extrusion, raw materials are generally processed into texturized vegetable proteins without the addition of fats; these are then passed through a dryer. The resulting dry texturized vegetable proteins contained moisture content below 30 wt.%. In high-moisture extrusion, raw materials are processed into texturized vegetable proteins, with fat introduced during the extrusion process. The amount of water added during the extrusion process is higher than that in low-moisture extrusion. The resulting wet texturized vegetable proteins contains moisture content above 50 wt.%.

Taiwan’s vegetarian food producers are no strangers to these techniques (Table 3). In response to the increased popularity of vegetarian meat (e.g., vegetarian ham) in the U.S. and Japan during the 1990s, they have already developed and experienced the low-moisture extrusion technique, which is noted as the first-generation technology in FoodNEXT (2022b). Dry-texturized vegetable proteins produced by low-moisture extrusion have several desirable properties. For example, they are easier to transport and store, and have a longer shelf-life. However, a major problem is that they lack a natural meat-like flavor and texture after being hydrated and cooked. Additionally, some products have an unpleasant flavor.

With advancements in food technology, food producers have developed a second-generation technology, i.e., the high-moisture extrusion technique (FoodNEXT, 2022b). The wet texturized vegetable proteins produced by high-moisture extrusion possess significant advantages over the dry texturized vegetable proteins in terms of texture and flavor. Specifically, they are moister, and more likely to have a meat-like fibrous and springy texture. However, because wet texturized vegetable proteins have higher moisture content, they are more difficult to store and need to be shipped in temperature-controlled environments, leading to higher costs (FoodNEXT, 2022b).

According to a report by foodNEXT (2022b), many food producers in Taiwan still use low-moisture extrusion in their production, but others have begun to switch to high-moisture extrusion in response to the increased demand for wet texturized vegetable proteins. Recently, Taiwan’s Food Industry Research and Development Institute (FIRDI) has developed a third-generation technology, the continuous low-shear plant-based meat structuring technique. This new technique uses a combination of twin-screw extruders and simple shear devices to produce plant-based meat. The resulting meat products are reported to have better quality in terms of taste, texture, and flavor than those produced using the first- and second-generation technologies. For more details about this new technique, see a recent report by FIRDI (2020).

MARKETING

Consumer attitudes

We first study consumer attitudes towards plant-based meat using recent surveys, conducted by foodNEXT (2020), GO SURVEY (2021) and the Asian Institute for Impact Measurement and Management (AIIMM, 2021). Figure 3 presents consumer awareness of plant-based meat and shows that most people are aware of plant-based meat. The ratio was higher for vegetarians (95%) than for non-vegetarians (87%). Moreover, half of the vegetarians had eaten plant-based meat products, suggesting that vegetarians pay more attention to vegetarian foods and are more willing to try plant-based meat products. On the other hand, although 87% of non-vegetarians had heard of plant-based meat, only 27.3% of them had eaten plant-based meat. This suggests that more effort is needed to make meat alternatives more appealing to non-vegetarian consumers.

foodNEXT (2020) also asked a follow-up question regarding the willingness to try plant-based meat products among respondents who reported hearing about but not eating it and those who reported never having heard about it. Nearly 90% of these people are willing to try plant-based meat, suggesting a potential marketing opportunity for plant-based meat. These results are consistent with those of a recent survey conducted by GO SURVEY (2021).

Next, we show the reasons for using plant-based meat products in Figure 4. The primary reason for this is curiosity, which is consistent with results in other countries. Additionally, the ratio is higher for non-vegetarians (69.8%) than for vegetarians (64.7%). Secondary motivations include environmental sustainability, health, animal welfare, and nutrition. Surprisingly, less than 2% of consumers reported religious reasons as the primary reason for trying plant-based meat products. Similar findings have been reported by GO SURVEY (2021). In their analysis, more than 60% of the respondents cited curiosity as the primary reason for trying plant-based meat products across different age cohorts, followed by environmental protection, meat substitutes, and animal welfare.

The barriers to using plant-based meat products are presented in Figure 5. For both non-vegetarian and vegetarian people, “dislike of processed foods” is the leading barrier (more than 40%). This result is consistent with GO SURVEY (2021), whose results also indicate that “dislike of overly processed foods” or “dislike of foods with many additives” as the primary barriers. Secondary barriers include the price and knowledge of the manufacturing process and ingredients of plant-based meat. Interestingly, the results were quite different between non-vegetarians and vegetarians. While 35.9% of non-vegetarians viewed “eating real meat is just fine” as a barrier for trying plant-based meat products, only 8% of vegetarian reported so. Additionally, vegetarians were more concerned about their knowledge of plant-based meat. 24% of them reported having no or insufficient understanding of the manufacturing process or ingredients as the primary barrier, whereas only 9.4% of non-vegetarian reported this.

Given that plant-based meat products are relatively more expensive than traditional animal meat products, foodNEXT (2020) further investigated consumer willingness to pay for plant-based meat products. Assuming that a regular Big Mac in McDonald’s is US$2.4, they asked consumers how much they are willing to pay if the beef patty was replaced by the plant-based patty. As expected, price plays an important role in consumers’ purchasing decisions. Nearly half of the consumers were only willing to pay US$2.4 or less for a plant-based burger. About 40% of consumers were willing to pay a low premium (less than US$0.5) for meat substitutes, and less than 10% of consumers were willing to pay a higher premium. Similar findings have been reported by GO SURVEY (2021) and AIIMM (2021).

Sales channels and volumes

Plant-based meat products are widely available on the market in Taiwan. Consumers can order meals in restaurants and buy ready-to-eat or ready-to-cook items in leading convenience stores, retail stores, supermarkets, and hypermarkets (Table 4). As for purchase location preferences, Hsieh (2021) finds that vegetarian specialty stores are the primary locations. Over 60% of the consumers reported that they had purchased plant-based foods at vegetarian specialty stores. Traditional markets and supermarkets are also popular, with approximately 25% of consumers purchasing plant-based foods.

There are no official statistics regarding the sales volumes of plant-based meat in Taiwan, so we rely on a statistical report by Euromonitor International (2022) to provide an overview of trends in the sales of plant-based food. In 2017, retail sales of plant-based foods amounted to US$26.8 million. Despite the COVID-19 outbreak in 2020, the retail sales continued to grow and increased to US$36.0 million in 2021. It is expected that the growth will continue over the next five years, with retail sales of plant-based food forecasted to increase by 8% from US$34.2 million in 2022 to US$46.5 million in 2026. Chilled meat and seafood substitutes have the highest sales throughout the study period; however, frozen and shelf-stable meat and seafood sub-stitutes are expected to catch up by 2026.

CHALLENGES AND COMPETITIVENESS OF THE PLANT-BASED MEAT INDUSTRY

As discussed in the previous section, plant-based meat is a relatively new concept, and its development is in its early stages. Thus, to gain a better understanding of the development and marketing of the plant-based meat industry in Taiwan, we conducted in-depth interviews with managers and experts at leading plant-based meat companies. We summarize the challenges and competitiveness of the plant-based meat industry in Taiwan, based on the views expressed by company managers and experts, as follows.

Challenges

Taiwan’s raw materials for meat substitutes rely heavily on imports (primarily from the U.S.), such as soy protein, wheat protein or gluten, and canola oil or rapeseed oil. Although Taiwan has promoted the cultivation of mixed staple crops, its production remains insufficient, and their price can be twice as much as that of imports. Additionally, the production of plant-based meat requires raw materials that are of better quality because the use of cheaper but inferior materials will result in low-quality foods, such as beany flavor and poor texture. As a result, the cost of plant-based meat products is higher than that of traditional meat products; thus, the price is not competitive.

A primary challenge in promoting plant-based meat products in Taiwan is the strict food labelling regulations. Specifically, domestic food products are required by law to list all ingredients and food additives. In case of ingredients that are a mix of liquid and solid materials, the respective constituents should also be listed. However, imported food products only need to list the ingredients and food additives, and there is no need to list the detailed contents of the ingredients. This practice may mistakenly provide consumers with the impression that domestic food products use more food additives than imported ones, affecting their willingness to buy them.

Although producers in Taiwan have excellent techniques to produce plant-based meat products, their scale is relatively small; thus, they face many constraints. For example, they have limited ability to compete in the market and influence relevant policies. To increase competitiveness in the international market, it is recommended that producers form strategic alliances to integrate resources. It is also recommended for them to identify and seek strategic partners with deep knowledge of the target area and sales channels.

Because of the growing interest in plant-based food worldwide, food producers around the world have expanded their business in this new market, leading to intense competition in the plant-based industry. Although producers in Taiwan have been able to produce high-quality plant-based meat products, they generally lack effective marketing skills and possess low brand awareness. Though some producers have received positive feedback from international food exhibitions, they have not received many orders. To enter the international market, companies in Taiwan must establish their brand identity and differentiate brands and products from the competition in the market.

Competitiveness

Upstream producers in Taiwan have accumulated years of experience and expertise in raw material processing and are able to provide customized products according to customer needs. They are also able to maintain consistent food quality. This is particularly important because the quality of raw materials (agricultural products) depends on climatic conditions. Only experienced producers can adjust their manufacturing processes accordingly. Many entrant firms eventually exited the market because they were unable to do so.

As discussed earlier, food producers in Taiwan have a long history of making vegetarian foods and have developed excellent techniques to produce plant-based meat products. They have developed assorted products and can provide customized items. For example, Taiwan’s food producers created the first plant-based fish fillet. They have also launched plant-based seafood alternatives such as vegetarian tuna salads and vegetarian shrimps. Currently, there are more than 100 items in the market.

Plant-based meat in Taiwan is available for sale through many different channels. Food producers have partnered with convenience stores, restaurants, retail stores, and supermarkets, and have developed many ready-to-eat products. The weekly demand for plant-based meat is more than ten tons from this channel. Items in small packages have also been developed for sale in the traditional markets. Furthermore, online retail sales are available and are expected to grow at a faster rate.

CONCLUSION

We conclude our study by summarizing and discussing our findings. First, although Taiwan has a well-defined labeling system for packaged vegetarian foods, there is no official definition or regulation for plant-based products. A potential problem arising from the lack of official standards is the discrepancy in the perception and understanding of plant-based foods between consumers and producers. A plant-based meat product cannot be labeled as vegetarian if its ingredients contain animal by-products. However, it has been pointed out that consumers may simply perceive plant-based meat products as pure vegetarian food and mistakenly consume non-vegetarian food. Therefore, it is necessary to develop regulations for plant-based meat. Second, Taiwan relies heavily on imports for raw materials to produce plant-based meat. Although the domestic supply has increased substantially, thanks to policy support, production remains low and far from sufficient for production needs. Moreover, the government heavily subsidizes the cultivation of mixed staples. It is unclear whether such a cultivation plan is sustainable if the subsidy is no longer available. Third, while most consumers are aware of, and express interest in, plant-based meat products, they face many barriers. ‘Dislike of processed foods’ is the leading factor, followed by ‘eating real meat is just fine’ and ‘insufficient knowledge about the manufacturing process and ingredients of plant-based meat.’ Producers may need to reduce the use of additives in their products to make plant-based meat more attractive. However, doing so, while maintaining flavor/taste, can be challenging. Additionally, consumers also express limited willingness to pay for plant-based meat products. About half of the consumers are not willing to pay a higher price for a plant-based burger than for a regular one.

REFERENCES

Agriculture and Food Agency. 2021. 3.2. Green Environment Benefit Project. https://www.afa.gov.tw/upload/cht/attachment/0871ac2fc5f1504372d037d34ba.... Last accessed October 10, 2022.

Asian Institute for Impact Measurement and Management. 2021. https://business.uupon.com/insights/introduce_5.html.Last accessed October 27, 2022.

Beck, S. M., Knoerzer, K., Foerster, M., Mayo, S., Philipp, C., & Arcot, J. (2018). Low moisture extrusion of pea protein and pea fibre fortified rice starch blends. Journal of Food Engineering, 231, 61-71.

Council of Agriculture. 2017. COA Annual Report. https://eng.coa.gov.tw/ws.php?id=2505539. Last accessed October 10, 2022.

Council of Agriculture. 2020. Agriculture Policy & Review (339). https://www.coa.gov.tw/ws.php?id=2511460. Last accessed October 10, 2022.

Dekkers, B. L., Boom, R. M., & van der Goot, A. J. (2018). Structuring processes for meat analogues. Trends in Food Science & Technology, 81, 25-36.

Euromonitor International. 2021. Processed meat, seafood and alternatives to meat in Taiwan. https://www.euromonitor.com/processed-meat-seafood-and-alternatives-to-m.... Last accessed October 27, 2022.

Food and Drug Administration, Ministry of Health and Welfare. 2008. Regulations Governing the Labeling of Packaged Vegetarian Foods. https://www.bsmi.gov.tw/wSite/public/Data/f1247018671891.pdf. Last accessed November 10, 2022.

Food Industry Research and Development Institute. 2020. Annual report. https://www.firdi.org.tw/PageData/Reports/109%E5%B9%B4/pdf/en.pdf. Last accessed November 11, 2022.

foodNEXT. 2020. https://www.foodnext.net/issue/5852508246. Last accessed October 27, 2022.

foodNEXT. 2022a. https://www.foodnext.net/science/additives/preservative/paper/5098686529. Last accessed November 11, 2022.

foodNEXT. 2022b. https://www.foodnext.net/science/machining/paper/5593686979. Last accessed November 11, 2022.

Garnett, T. (2009). Livestock-related greenhouse gas emissions: impacts and options for policy makers. Environmental science & policy, 12(4), 491-503.

GO SURVEY. 2021. https://www.gosurvey.com.tw/uploads/insight/tw/gosurveyinsight_20211020.pdf. Last accessed October 27, 2022.

Herrero, M., Henderson, B., Havlík, P., Thornton, P. K., Conant, R. T., Smith, P., ... & Stehfest, E. (2016). Greenhouse gas mitigation potentials in the livestock sector. Nature Climate Change, 6(5), 452-461.

Hsieh, C. F. 2021. The Study of the Plant-Based Meat Industry Analysis and Consumer Behavior. Master Thesis, Executive Master Program in Business Administration, National Yunlin University of Science & Technology.

Kazir, M., & Livney, Y. D. (2021). Plant-based seafood analogs. Molecules, 26(6), 1559.

Klink-Lehmann, J., & Simons, J. 2022. Marketing strategy of plant-based meat alternatives in Germany. Unpublished manuscript.

Kyriakopoulou, K., Keppler, J. K., & van der Goot, A. J. (2021). Functionality of ingredients and additives in plant-based meat analogues. Foods, 10(3), 600.

National Science and Technology Council. 2021. National Science and Technology Development Plan during 2021-2024. https://www.nstc.gov.tw/nstc/attachments/d855609b-9390-49f3-8499-490fcee.... Last accessed October 15, 2022.

The Good Food Institute. 2019. Plant-based meat manufacturing by extrusion. https://gfi.org/wp-content/uploads/2021/01/Plant-Based-Meat-Manufacturin.... Last accessed November 11, 2022.

Zhao, D., Huang, L., Li, H., Ren, Y., Cao, J., Zhang, T., & Liu, X. (2022). Ingredients and Process Affect the Structural Quality of Recombinant Plant-Based Meat Alternatives and Their Components. Foods, 11(15), 2202.

[1] The annual consumption volume of soybeans in Taiwan is 10 kilograms per person, totaling about 230,000 tons (COA 2020)