ABSTRACT

Crop insurance program becomes an important farm financial support for farm operators in Korea. Understanding behavior changes of farms in response to the participation in crop insurance program is critical to identify the ability of the policy to meet its goals. This study examines the effect of crop insurance participation on farm debt use, one of the key financial decisions made by farm operators. Utilizing farm level panel data and a dynamic panel generalized method of moments estimator, we find no significant relationship between crop insurance participation and farm debt uses, and the result is robust across the different methodologies. This result represents no risk balancing behavior in Korea, which indicates that an increase in debt use may be a threat to the financial health of the farm operators. In addition, the risk facing by debt use may be higher than the decline in risk provided by crop insurance program.

Keywords: farm debt use, crop insurance, risk balancing, dynamic panel

INTRODUCTION

Crop insurance program in Korea has become an important farm financial support for many crop producers. Like other farm support programs, the crop insurance program potentially influences program participants’ behaviors in various ways. Understanding behavior changes of program participants can provide important implications for the ability of the policy to meet its stated goals. Furthermore, this can help mitigate potential adverse impacts of the policy. Various research has been studied to examine the relationship between insurance program and participants’ behavior, including adverse selection and moral hazard (Just et al., 1999), farm structure (O’Donoghue et al., 2009), land use decisions (Claassen et al., 2011), and land values (Ifft et al., 2014).

Participating in crop insurance program could influence financial decisions of program participants since it can affect farm income and income variability (Ifft et al., 2014). Despite that participation in crop insurance program could affect financial decisions of program participants, there is limited empirical research on this relationship. Ifft et al. (2014) first examined the relationship between crop insurance participation and farm debt use, one of the key financial decisions made by farm operators. Using data from Agricultural Resource Management Survey and a propensity score matching method, the study investigates the impact of crop insurance program on various farm debt uses. They found crop insurance program participation is positively associated with an increase in use of short-term farm debt, which is consistent with risk balancing behavior. To fill the void of the relationship between crop insurance policy and farm financial behavior, this study examines the effect of crop insurance program on farm financial behavior in Korea and add the empirical findings of the relationship to the literature. Particularly, this study uses a dynamic panel generalized method of moments estimator to reduce selection bias of crop insurance program participation.

The rest of the paper is organized as follows. In Section 2, we provide a brief policy background. In section 3, we provide an overview of the data. We show our empirical strategy to identify the effect of crop insurance on farm debt use in section 4. We provide the estimation results in section 5. In Section 6, we provide a conclusion of the paper.

POLICY BACKGROUND

To protect agricultural producers from various risks, the South Korean government first introduced (yield-based) crop insurance program in 2001. The program’s scope has consistently been increased to mitigate losses from unexpected natural disasters. Since crop insurance was established for apples and pears in 2001, the scope of coverage has continuously increased and, in 2020, the South Korean (yield-based) crop insurance program covered 67 products.

In addition to the program’s increased scope, the number of (yield-based) insured farms has also expanded from 12,000 households in 2001 to 442,000 households in 2020. The (yield-based) insured area gradually increased from 4,000 hectares in 2001 to 555,000 hectares in 2020. Despite the significant growth in the insured area, the (yield-based) crop insurance participation rate has constantly increased from 17.5% in 2001 to 45.0% in 2020. Specifically, the proportion of total 4 types of fruits (apples, pears, sweet persimmons, and bitter persimmons) covered by (yield-based) crop insurance was 61.7%, paddy crops 54.3%, special crops 48.0%, forest products 41.1%, and vegetables 22.3% in 2020.

The Ministry of Agriculture, Food and Rural Affairs operates the crop insurance program including subsidizing crop insurance premiums, choosing crop insurance operators, operating national reinsurance, and managing and supervising the insurance business. The government subsidizes 50% of the insurance program and 100% of the administrative and operative costs, while local governments provide 30~50% of the subsidy. After the financial supports from the central and local governments on crop insurance premiums, it is found that, in 2017, agricultural producers paid about 18.3% of the total crop insurance premiums on average. Agricultural policy insurance and finance service manages and supervises company operations, undertake product research and distribution, educate the public to encourage crop insurance participation, and produce and manage statistics regarding crop insurance. Nonghyup Property and Casualty Insurance sells crop insurance policies, develops new products, and pays indemnity to producers. The Korea insurance development institute sets crop insurance premium rates.

Most of the crop insurance products in South Korea are based on yield-based protection. For yield-based protection, a producer can be compensated if the producer’s production falls short on their historical yield. For revenue-based protection, a producer can receive an indemnity when crop revenue (actual yield times harvest price) is less than historical crop revenue. In South Korea, the revenue-based crop insurance was initiated in 2015. The participation rate has gradually decreased and it is 4.2% in 2020.

DATA

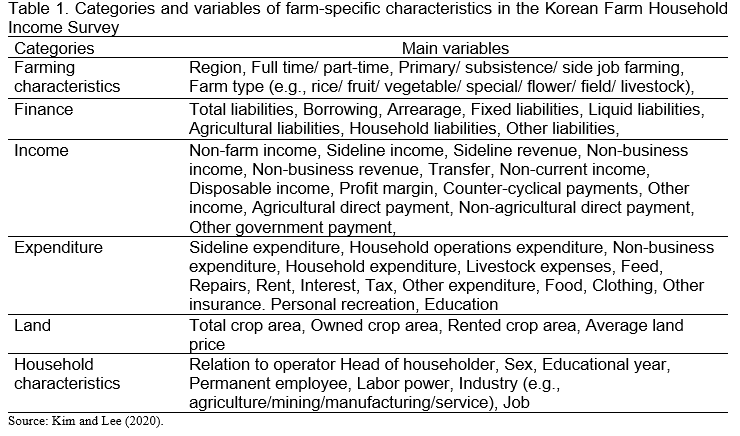

We analyze the relationship between crop insurance and farm debt use using recent data from a farm-level panel dataset, the Korean Farm Household Economic Survey. The Korean Farm Household Economic Survey collects detailed information on demographic and other economic characteristics of an individual farm household such as receipts, expenses, labor-hours, and assets. This information can be classified as farming characteristics, finance, income, expenditure, land, and household characteristics, which are shown in Table 1. The stratified sampling method was applied to the Korean Farm Household Economic Survey for the continuity and accuracy of survey results. The Korean Farm Household Economic Survey is an annual survey and the sample households have been altered every five years since its redesign in 2003. We use the most recent 5-year panel; 2013-2017.

In this paper, we restrict our sample to full-time farm households since, among different types of farm groups, full-time farm households in South Korea are known as key active groups for investment by scaling up farm size and raising efficiency. Following Lee and Jung (2014), we define a farm as an insured farm if it is found that, in the Korean Farm Household Income Survey, the farm paid an insurance premium in the agricultural sector.

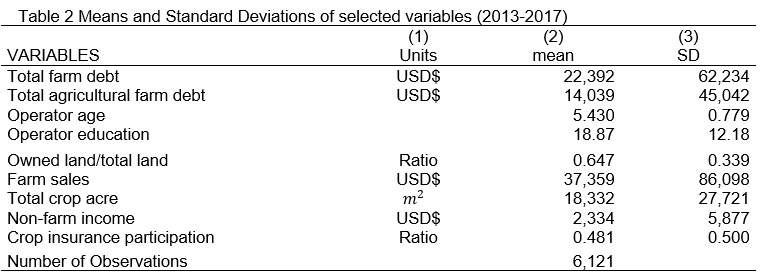

Table 2 shows the descriptive statistics of the selected variables from 2013 to 2017. The average of total farm debt and agricultural farm debt is about $22,392 and $14,039, respectively. The share of the insured farm over total farms is about 0.481.

We use a set of control variables that are known to demonstrate a statistically significant relationship with crop insurance. These are farm acreage (Sherrick et al., 2004, Kim et al., 2020), the ratio of owned to total operated acres (Velandia et al., 2009; Mishra and El-Osta, 2002; Sherrick et al., 2005), off-farm income (Velandia et al., 2009; Kim et al., 2020). In addition, we also control for operator age (Sherrick et al., 2005), operator education (Sherrick et al., 2005), and their associated term squared terms.

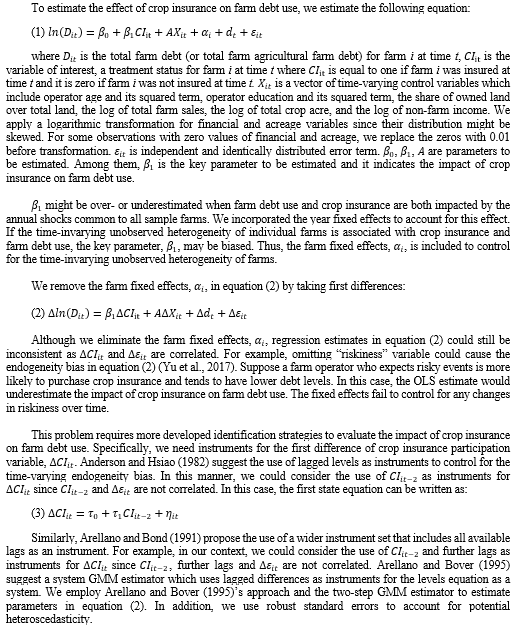

ESTIMATION STRATEGY

Our goal is to estimate the impact of crop insurance on farm debt use. One main challenge of identifying the effect of crop insurance on farm debt use is that crop insurance participation is endogenously determined. Without a developed identification strategy, the impact of crop insurance could be over or underestimated. To mitigate this endogeneity bias in estimating the impact of crop insurance, we use a dynamic panel GMM (generalized method of moments) estimator which is proposed by Arellano and Bond (1991). In a nutshell, fixed effects estimates and OLS (ordinary least square) estimates could be biased and the GMM estimates could mitigate this problem by using lagged levels as instruments. We will explain the approach in detail.

ESTIMATION RESULTS

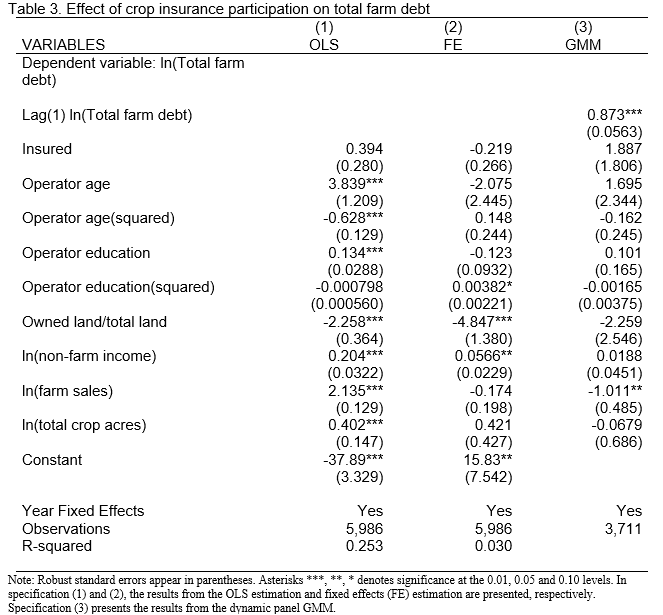

We show estimation results for equation (1) where the dependent variable is total farm debt. Estimation results are reported in Table 3. Each column shows the effect of crop insurance on total farm debt under different specifications. Column (1) reports the estimation result from OLS. Column (2) reports the estimation results from FE controlling for the time-invarying unobserved heterogeneity. In column (3), we report our main estimate, the results from the dynamic GMM controlling for potential bias. In column (3), we include the first lagged dependent variable. In columns (1), (2), and (3), we include the year fixed effects to account for the annual shocks common to all farms. We report robust standard errors for each specification.

We compare estimates of the coefficients on crop insurance among OLS, fixed effects, and dynamic GMM. The OLS estimate is 0.394 and the fixed effects estimate is -0.219, while the dynamic GMM estimate is 1.887. We find that the use of instruments leads to a significantly larger estimate of the coefficient on crop insurance in absolute terms. Nevertheless, none of the coefficients on crop insurance are not statistically different from zero. In addition, the estimates of the crop insurance flip the sign across different specifications.

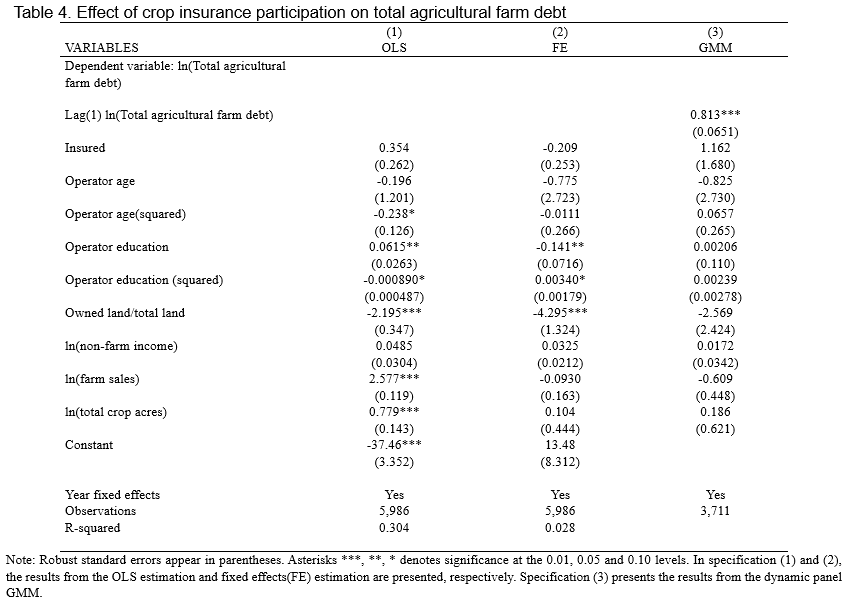

To check whether the estimates of crop insurance are not statistically significant with a different type of debt use, we also estimate the equation (1) where the dependent variable is total agricultural farm debt use. We report the estimation results in Table 4. Similar to table 3, we provide the estimation results from OLS, FE, and dynamic GMM in columns (1), (2), and (3), respectively. The results are consistent with Table 3. The estimates are not significantly different from zero. Also, the estimates of the crop insurance flip the sign across different specifications: OLS, FE, and GMM.

Overall, we find that crop insurance participation does not have a statistically significant impact on farm debt use. Our results are not consistent with risk-balancing behavior and contradict with Ifft et al. (2014). In other words, while crop insurance participation decreases yield risk faced by farm households, farm households do not increase their financial risk or debt use in response to risk reduction by crop insurance participation. This result is consistent with the fact that, in South Korea, agricultural fixed assets have been stagnant and the government-led capital investment has been shrinking, which worsens investment conditions in the agricultural sectors. Also, another possible explanation for our finding might be that Korean farm households are aging and almost half of the total farm households are elderly 65-year-olds. This group shows a weak propensity to make investments compared to younger-aged farm households and it results in an overall low investment propensity. Given the low revenue-based crop insurance participation rates in South Korea, it seems that crop insurance participation is not enough for agricultural producers to increase their financial risk by increasing their debt use since yield-based crop insurance does not cover their price risk. Therefore, farm households are less likely to increase their financial risks by increasing their farm debt despite decreased farm risk through crop insurance participation.

CONCLUSION

This study examined the effect of crop insurance participation on farm financial behavior in Korea. In particular, we have investigated the relationship between crop insurance participation and farm debt use using the dynamic panel generalized method of moments. To check whether our results are consistent, different methodologies (i.e., OLS, FE model) were also used in the study. We found no significant relationship between crop insurance participation and farm debt uses, and this result is consistent across the different methodologies. This result is different from risk-balancing behavior which explains a positive relationship between insurance policy participation and debt uses. The result represents that Korean farms may not increase their debt uses when their business risk or farm financial risk is reduced by the crop insurance program, which indicates that risk facing by debt use could be higher than risk reduction provided by crop insurance program.

Our findings have implications for crop insurance programs in South Korea. While Ifft et al. (2014) show the positive relationship between crop insurance and debt use, our results do not. One potential reason for this difference is that Ifft et al (2014) do not control for time-varying confounding factors as they use data from the 2011 Agricultural Resource Management Survey (ARMS) data while this paper controls for time-varying confounding factors by exploiting 5-year panel dataset. Another plausible explanation for this difference is that revenue-based policies are the primary crop insurance program in the U.S. while the participation rates in the revenue-based policy are very low in South Korea. In other words, while the U.S. crop insurance program covers both yield and price risk, the South Korea’s crop insurance program is likely to cover yield risk only. Our finding may highlight the importance of expanding revenue-based crop insurance policies in South Korea in terms of promoting agricultural investments in South Korea, as well as farm management stability.

REFERENCES

Sherrick, B. J., Barry, P. J., Ellinger, P. N., & Schnitkey, G. D. (2004). Factors influencing farmers' crop insurance decisions. American journal of agricultural economics, 103-114.

Velandia, M., Rejesus, R. M., Knight, T. O., & Sherrick, B. J. (2009). Factors affecting farmers' utilization of agricultural risk management tools: the case of crop insurance, forward contracting, and spreading sales. Journal of agricultural and applied economics, 41(1), 107-123.

Mishra, A. K., & El‐Osta, H. S. (2002). Managing risk in agriculture through hedging and crop insurance: what does a national survey reveal?. Agricultural Finance Review.

Kim, Y., Yu, J., & Pendell, D. L. (2020). Effects of crop insurance on farm disinvestment and exit decisions. European Review of Agricultural Economics, 47(1), 324-347.

Kim, Y., & Lee, H. (2020). The relationship between farm characteristics and farm productivity. Korean Journal of Agricultural Economics, 61(3), 181-205.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The review of economic studies, 58(2), 277-297.

Ifft, J. E., Kuethe, T., & Morehart, M. (2015). Does federal crop insurance lead to higher farm debt use? Evidence from the Agricultural Resource Management Survey (ARMS). Agricultural Finance Review, 75(3), 349-367.

Just, R.E., Calvin, L. and Quiggin, J. (1999), Adverse selection in crop insurance: actuarial and asymmetric information incentives, American Journal of Agricultural Economics, 81(4), 834-849.

O’Donoghue, E.J., Roberts, M.J. and Key, N. (2009), Did the Federal Crop Insurance Reform Act increase farm enterprise diversification?, Journal of Agricultural Economics, 60(1), 80-104.

Claassen, R., Carriazo, F., Cooper, J.C., Hellerstein, D. and Ueda, K. (2011), Grassland to cropland conversion in the Northern Plains, Economic Research Report No. 120, Economic Research Service, US Department of Agriculture, Washington, DC.

Ifft, J., Novini, A. and Patrick, K. (2014), “Debt use by US farm businesses”, USDA-ERS Economic Information Bulletin, (103), USDA-ERS Economic Information Bulletin (122).

Yu, J., Smith, A., & Sumner, D. A. (2018). Effects of crop insurance premium subsidies on crop acreage. American Journal of Agricultural Economics, 100(1), 91-114.

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of econometrics, 68(1), 29-51.

Lee, J, & Jung, J. H. (2014). Adverse Selection and Moral Hazard in the Korean Crop Insurance Market. Korean Journal of Agricultural Economics, 55(1), 29-47.

AUTHOR'S CONTRIBUTIONS

Author Contributions: Y.K. designed research; J.Y.L. preformed research; Y.K., J.Y.L. contributed analytic tools; Y.K. analyzed data; and Y.K., J.Y.L. wrote the paper.

COMPETING INTERESTS

YK and JYL declare that they have no conflict of interests.

Does Crop Insurance Participation Influence Risk Balancing Behavior?: The Case of Korea

ABSTRACT

Crop insurance program becomes an important farm financial support for farm operators in Korea. Understanding behavior changes of farms in response to the participation in crop insurance program is critical to identify the ability of the policy to meet its goals. This study examines the effect of crop insurance participation on farm debt use, one of the key financial decisions made by farm operators. Utilizing farm level panel data and a dynamic panel generalized method of moments estimator, we find no significant relationship between crop insurance participation and farm debt uses, and the result is robust across the different methodologies. This result represents no risk balancing behavior in Korea, which indicates that an increase in debt use may be a threat to the financial health of the farm operators. In addition, the risk facing by debt use may be higher than the decline in risk provided by crop insurance program.

Keywords: farm debt use, crop insurance, risk balancing, dynamic panel

INTRODUCTION

Crop insurance program in Korea has become an important farm financial support for many crop producers. Like other farm support programs, the crop insurance program potentially influences program participants’ behaviors in various ways. Understanding behavior changes of program participants can provide important implications for the ability of the policy to meet its stated goals. Furthermore, this can help mitigate potential adverse impacts of the policy. Various research has been studied to examine the relationship between insurance program and participants’ behavior, including adverse selection and moral hazard (Just et al., 1999), farm structure (O’Donoghue et al., 2009), land use decisions (Claassen et al., 2011), and land values (Ifft et al., 2014).

Participating in crop insurance program could influence financial decisions of program participants since it can affect farm income and income variability (Ifft et al., 2014). Despite that participation in crop insurance program could affect financial decisions of program participants, there is limited empirical research on this relationship. Ifft et al. (2014) first examined the relationship between crop insurance participation and farm debt use, one of the key financial decisions made by farm operators. Using data from Agricultural Resource Management Survey and a propensity score matching method, the study investigates the impact of crop insurance program on various farm debt uses. They found crop insurance program participation is positively associated with an increase in use of short-term farm debt, which is consistent with risk balancing behavior. To fill the void of the relationship between crop insurance policy and farm financial behavior, this study examines the effect of crop insurance program on farm financial behavior in Korea and add the empirical findings of the relationship to the literature. Particularly, this study uses a dynamic panel generalized method of moments estimator to reduce selection bias of crop insurance program participation.

The rest of the paper is organized as follows. In Section 2, we provide a brief policy background. In section 3, we provide an overview of the data. We show our empirical strategy to identify the effect of crop insurance on farm debt use in section 4. We provide the estimation results in section 5. In Section 6, we provide a conclusion of the paper.

POLICY BACKGROUND

To protect agricultural producers from various risks, the South Korean government first introduced (yield-based) crop insurance program in 2001. The program’s scope has consistently been increased to mitigate losses from unexpected natural disasters. Since crop insurance was established for apples and pears in 2001, the scope of coverage has continuously increased and, in 2020, the South Korean (yield-based) crop insurance program covered 67 products.

In addition to the program’s increased scope, the number of (yield-based) insured farms has also expanded from 12,000 households in 2001 to 442,000 households in 2020. The (yield-based) insured area gradually increased from 4,000 hectares in 2001 to 555,000 hectares in 2020. Despite the significant growth in the insured area, the (yield-based) crop insurance participation rate has constantly increased from 17.5% in 2001 to 45.0% in 2020. Specifically, the proportion of total 4 types of fruits (apples, pears, sweet persimmons, and bitter persimmons) covered by (yield-based) crop insurance was 61.7%, paddy crops 54.3%, special crops 48.0%, forest products 41.1%, and vegetables 22.3% in 2020.

The Ministry of Agriculture, Food and Rural Affairs operates the crop insurance program including subsidizing crop insurance premiums, choosing crop insurance operators, operating national reinsurance, and managing and supervising the insurance business. The government subsidizes 50% of the insurance program and 100% of the administrative and operative costs, while local governments provide 30~50% of the subsidy. After the financial supports from the central and local governments on crop insurance premiums, it is found that, in 2017, agricultural producers paid about 18.3% of the total crop insurance premiums on average. Agricultural policy insurance and finance service manages and supervises company operations, undertake product research and distribution, educate the public to encourage crop insurance participation, and produce and manage statistics regarding crop insurance. Nonghyup Property and Casualty Insurance sells crop insurance policies, develops new products, and pays indemnity to producers. The Korea insurance development institute sets crop insurance premium rates.

Most of the crop insurance products in South Korea are based on yield-based protection. For yield-based protection, a producer can be compensated if the producer’s production falls short on their historical yield. For revenue-based protection, a producer can receive an indemnity when crop revenue (actual yield times harvest price) is less than historical crop revenue. In South Korea, the revenue-based crop insurance was initiated in 2015. The participation rate has gradually decreased and it is 4.2% in 2020.

DATA

We analyze the relationship between crop insurance and farm debt use using recent data from a farm-level panel dataset, the Korean Farm Household Economic Survey. The Korean Farm Household Economic Survey collects detailed information on demographic and other economic characteristics of an individual farm household such as receipts, expenses, labor-hours, and assets. This information can be classified as farming characteristics, finance, income, expenditure, land, and household characteristics, which are shown in Table 1. The stratified sampling method was applied to the Korean Farm Household Economic Survey for the continuity and accuracy of survey results. The Korean Farm Household Economic Survey is an annual survey and the sample households have been altered every five years since its redesign in 2003. We use the most recent 5-year panel; 2013-2017.

In this paper, we restrict our sample to full-time farm households since, among different types of farm groups, full-time farm households in South Korea are known as key active groups for investment by scaling up farm size and raising efficiency. Following Lee and Jung (2014), we define a farm as an insured farm if it is found that, in the Korean Farm Household Income Survey, the farm paid an insurance premium in the agricultural sector.

Table 2 shows the descriptive statistics of the selected variables from 2013 to 2017. The average of total farm debt and agricultural farm debt is about $22,392 and $14,039, respectively. The share of the insured farm over total farms is about 0.481.

We use a set of control variables that are known to demonstrate a statistically significant relationship with crop insurance. These are farm acreage (Sherrick et al., 2004, Kim et al., 2020), the ratio of owned to total operated acres (Velandia et al., 2009; Mishra and El-Osta, 2002; Sherrick et al., 2005), off-farm income (Velandia et al., 2009; Kim et al., 2020). In addition, we also control for operator age (Sherrick et al., 2005), operator education (Sherrick et al., 2005), and their associated term squared terms.

ESTIMATION STRATEGY

Our goal is to estimate the impact of crop insurance on farm debt use. One main challenge of identifying the effect of crop insurance on farm debt use is that crop insurance participation is endogenously determined. Without a developed identification strategy, the impact of crop insurance could be over or underestimated. To mitigate this endogeneity bias in estimating the impact of crop insurance, we use a dynamic panel GMM (generalized method of moments) estimator which is proposed by Arellano and Bond (1991). In a nutshell, fixed effects estimates and OLS (ordinary least square) estimates could be biased and the GMM estimates could mitigate this problem by using lagged levels as instruments. We will explain the approach in detail.

ESTIMATION RESULTS

We show estimation results for equation (1) where the dependent variable is total farm debt. Estimation results are reported in Table 3. Each column shows the effect of crop insurance on total farm debt under different specifications. Column (1) reports the estimation result from OLS. Column (2) reports the estimation results from FE controlling for the time-invarying unobserved heterogeneity. In column (3), we report our main estimate, the results from the dynamic GMM controlling for potential bias. In column (3), we include the first lagged dependent variable. In columns (1), (2), and (3), we include the year fixed effects to account for the annual shocks common to all farms. We report robust standard errors for each specification.

We compare estimates of the coefficients on crop insurance among OLS, fixed effects, and dynamic GMM. The OLS estimate is 0.394 and the fixed effects estimate is -0.219, while the dynamic GMM estimate is 1.887. We find that the use of instruments leads to a significantly larger estimate of the coefficient on crop insurance in absolute terms. Nevertheless, none of the coefficients on crop insurance are not statistically different from zero. In addition, the estimates of the crop insurance flip the sign across different specifications.

To check whether the estimates of crop insurance are not statistically significant with a different type of debt use, we also estimate the equation (1) where the dependent variable is total agricultural farm debt use. We report the estimation results in Table 4. Similar to table 3, we provide the estimation results from OLS, FE, and dynamic GMM in columns (1), (2), and (3), respectively. The results are consistent with Table 3. The estimates are not significantly different from zero. Also, the estimates of the crop insurance flip the sign across different specifications: OLS, FE, and GMM.

Overall, we find that crop insurance participation does not have a statistically significant impact on farm debt use. Our results are not consistent with risk-balancing behavior and contradict with Ifft et al. (2014). In other words, while crop insurance participation decreases yield risk faced by farm households, farm households do not increase their financial risk or debt use in response to risk reduction by crop insurance participation. This result is consistent with the fact that, in South Korea, agricultural fixed assets have been stagnant and the government-led capital investment has been shrinking, which worsens investment conditions in the agricultural sectors. Also, another possible explanation for our finding might be that Korean farm households are aging and almost half of the total farm households are elderly 65-year-olds. This group shows a weak propensity to make investments compared to younger-aged farm households and it results in an overall low investment propensity. Given the low revenue-based crop insurance participation rates in South Korea, it seems that crop insurance participation is not enough for agricultural producers to increase their financial risk by increasing their debt use since yield-based crop insurance does not cover their price risk. Therefore, farm households are less likely to increase their financial risks by increasing their farm debt despite decreased farm risk through crop insurance participation.

CONCLUSION

This study examined the effect of crop insurance participation on farm financial behavior in Korea. In particular, we have investigated the relationship between crop insurance participation and farm debt use using the dynamic panel generalized method of moments. To check whether our results are consistent, different methodologies (i.e., OLS, FE model) were also used in the study. We found no significant relationship between crop insurance participation and farm debt uses, and this result is consistent across the different methodologies. This result is different from risk-balancing behavior which explains a positive relationship between insurance policy participation and debt uses. The result represents that Korean farms may not increase their debt uses when their business risk or farm financial risk is reduced by the crop insurance program, which indicates that risk facing by debt use could be higher than risk reduction provided by crop insurance program.

Our findings have implications for crop insurance programs in South Korea. While Ifft et al. (2014) show the positive relationship between crop insurance and debt use, our results do not. One potential reason for this difference is that Ifft et al (2014) do not control for time-varying confounding factors as they use data from the 2011 Agricultural Resource Management Survey (ARMS) data while this paper controls for time-varying confounding factors by exploiting 5-year panel dataset. Another plausible explanation for this difference is that revenue-based policies are the primary crop insurance program in the U.S. while the participation rates in the revenue-based policy are very low in South Korea. In other words, while the U.S. crop insurance program covers both yield and price risk, the South Korea’s crop insurance program is likely to cover yield risk only. Our finding may highlight the importance of expanding revenue-based crop insurance policies in South Korea in terms of promoting agricultural investments in South Korea, as well as farm management stability.

REFERENCES

Sherrick, B. J., Barry, P. J., Ellinger, P. N., & Schnitkey, G. D. (2004). Factors influencing farmers' crop insurance decisions. American journal of agricultural economics, 103-114.

Velandia, M., Rejesus, R. M., Knight, T. O., & Sherrick, B. J. (2009). Factors affecting farmers' utilization of agricultural risk management tools: the case of crop insurance, forward contracting, and spreading sales. Journal of agricultural and applied economics, 41(1), 107-123.

Mishra, A. K., & El‐Osta, H. S. (2002). Managing risk in agriculture through hedging and crop insurance: what does a national survey reveal?. Agricultural Finance Review.

Kim, Y., Yu, J., & Pendell, D. L. (2020). Effects of crop insurance on farm disinvestment and exit decisions. European Review of Agricultural Economics, 47(1), 324-347.

Kim, Y., & Lee, H. (2020). The relationship between farm characteristics and farm productivity. Korean Journal of Agricultural Economics, 61(3), 181-205.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The review of economic studies, 58(2), 277-297.

Ifft, J. E., Kuethe, T., & Morehart, M. (2015). Does federal crop insurance lead to higher farm debt use? Evidence from the Agricultural Resource Management Survey (ARMS). Agricultural Finance Review, 75(3), 349-367.

Just, R.E., Calvin, L. and Quiggin, J. (1999), Adverse selection in crop insurance: actuarial and asymmetric information incentives, American Journal of Agricultural Economics, 81(4), 834-849.

O’Donoghue, E.J., Roberts, M.J. and Key, N. (2009), Did the Federal Crop Insurance Reform Act increase farm enterprise diversification?, Journal of Agricultural Economics, 60(1), 80-104.

Claassen, R., Carriazo, F., Cooper, J.C., Hellerstein, D. and Ueda, K. (2011), Grassland to cropland conversion in the Northern Plains, Economic Research Report No. 120, Economic Research Service, US Department of Agriculture, Washington, DC.

Ifft, J., Novini, A. and Patrick, K. (2014), “Debt use by US farm businesses”, USDA-ERS Economic Information Bulletin, (103), USDA-ERS Economic Information Bulletin (122).

Yu, J., Smith, A., & Sumner, D. A. (2018). Effects of crop insurance premium subsidies on crop acreage. American Journal of Agricultural Economics, 100(1), 91-114.

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of econometrics, 68(1), 29-51.

Lee, J, & Jung, J. H. (2014). Adverse Selection and Moral Hazard in the Korean Crop Insurance Market. Korean Journal of Agricultural Economics, 55(1), 29-47.

AUTHOR'S CONTRIBUTIONS

Author Contributions: Y.K. designed research; J.Y.L. preformed research; Y.K., J.Y.L. contributed analytic tools; Y.K. analyzed data; and Y.K., J.Y.L. wrote the paper.

COMPETING INTERESTS

YK and JYL declare that they have no conflict of interests.