Yutsai Huang, Ph.D.

Director, Food and Fertilizer Technology Center

As a result of climate change, rainfall patterns shift or extreme events such as drought and floods become more frequent. Crop insurance is therefore a key in assisting farmers lessen the negative financial impact or income instability of these adverse natural disasters.

In Korea, crop insurance program was introduced in 2001 with the enactment of the Crop Disaster Insurance Act. The crop insurance program is handled by a public private partnership and is heavily supported by the government.

The crop insurance scheme is managed by the National Agriculture Cooperative Federation (NACF). The NACF is reinsured on a quota-share basis with 6 local reinsurers. Only the liability in excess of 110% local market loss ratio and up to 180% local market loss ratio (150% after 2013) is transferred to the international reinsurance market. The government acts as reinsurer of last resort for all the liability in excess of a 180% local market loss ratio (150% after 2013).

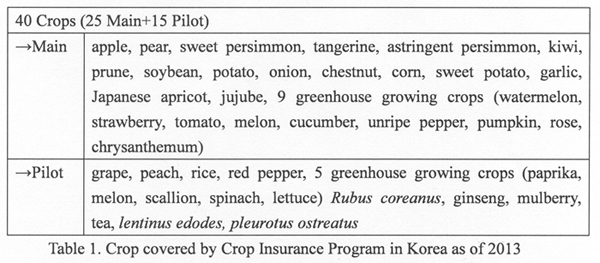

When the program was launched in 2001, only apples and pears were covered. As of 2013, 40 crops were covered. (Table 1)

Corp insurance is offered through named-peril and multi-peril crop insurance policies. Apple, pear, peach, grape, sweet persimmon, tangerine, and astringent persimmon are covered through the named-peril policy. Basis risks covered under this policy are hail and typhoon. In addition, farmers have the option to purchase insurance for spring frost and freezing, fall frost and freezing, excessive rain (torrential rain), and fruit tree damage.

Korean crop insurance program has gone through two crises so far. The first crisis happened in 2002. Severe loss (Loss to Risk premium, L/R, was 435%) occurred due to super typhoon “Rusa”. Reinsurance companies requested high rate increase, but was rejected by the government because of budget constraint. Withdrawal of participating reinsurance companies left NACF’s NHPCI alone which retained the whole risk and experienced severe loss for two consecutive years (2003 and 2004).

Korean government indemnified NHPCI for the major portion of the loss in 2003 through special account. A Public-Private Task Force Team was organized to restore the program in 2004. Results of the first reform are: (1) Premium rate raised by 50%, (2) Government reinsurance: government pays all losses over L/R 180%. (3) two-step step claim handling.

Private reinsurance companies re-entered the Crop Insurance Program in 2005.

The second crisis occurred in 2012. Reasons for the second crisis:

1. Due to (1) Good loss results: L/R 44% (2005), L/R 37% (2006), L/R 45% (2008) and (2) Exclusion of catastrophe pricing after 2005, premium rates steadily decreased from 2005 level to the pre-2005 level;

2. Unexpected losses during 2009-2011;

3. Severe losses (L/R 357%) due to super typhoon “Bolauen”.

Lessons from the 2nd crisis: For the survival of the program over a long haul, fundamentals such as catastrophic losses, moral and adverse selection cannot be ignored.

Renewal of the Crop Insurance Program started in 2013, with the following reforms:

1. Premium rate increased by 33% (introduction of the Cat model into the program);

2. Government reinsurance (Stop Loss): L/R 150%. Stop Loss Cost: 5.5% of Gross Premium;

3. Created new claim organization with 200 persons for claim handling.

Korean crop insurance program is heavily supported by the government in four different ways:

1. The Central government provides 50% premium subsidies;

2. The Central government also acts as a reinsurer of last resort for the liability in excess of 180% local market loss ratio (150% after 2013);

3. 100% of the NACF’S crop insurance operational expenses are subsidized by the central government budget;

4. The Central government, through the Ministry of Agriculture, has an active participation in product research and development.

As of 2013, there are 40 crops covered by the program. The Penetration Ratio (%, area-based) of major five crops (apple, pear, tangerine, sweet persimmon and astringent persimmon, 86% of total insured risk premium in 2013) is 47%. The total risk premium is 215 million USD.

Korean Crop Insurance Program is an interesting case and was presented in the 17th East Asian Actuarial Conference in 2013.

Besides Crop Insurance Program, the Korean government has Public Disaster Assistance Programs, by the Act on Agricultural and Fishery Disasters enacted in 1995, it stipulates financial support against disasters affecting agriculture and fishery, such as damages from disease, harmful pests, and drought.

References:

1. Mahul, O., and C. Stutley. 2010. Overview on Agricultural Insurance: South Korea in Government Support to Agricultural Insurance (2010) p. 214-p. 218. World Bank.

2. 2013 ” Korean Crop Insurance Program”, Nong Hyup Property Casualty Insurance Co., Ltd. Briefing Material.

3. Lessons Learned from the Crop Insurance Program in Korea. 2013. 17th East Asian Actuarial Conference. 15-18, Oct. 2013. Singapore.

|

Date submitted: November 27, 2013

Reviewed, edited and uploaded: November 28, 2013

|

Crop Insurance Program in Korea

Yutsai Huang, Ph.D.

Director, Food and Fertilizer Technology Center

As a result of climate change, rainfall patterns shift or extreme events such as drought and floods become more frequent. Crop insurance is therefore a key in assisting farmers lessen the negative financial impact or income instability of these adverse natural disasters.

In Korea, crop insurance program was introduced in 2001 with the enactment of the Crop Disaster Insurance Act. The crop insurance program is handled by a public private partnership and is heavily supported by the government.

The crop insurance scheme is managed by the National Agriculture Cooperative Federation (NACF). The NACF is reinsured on a quota-share basis with 6 local reinsurers. Only the liability in excess of 110% local market loss ratio and up to 180% local market loss ratio (150% after 2013) is transferred to the international reinsurance market. The government acts as reinsurer of last resort for all the liability in excess of a 180% local market loss ratio (150% after 2013).

When the program was launched in 2001, only apples and pears were covered. As of 2013, 40 crops were covered. (Table 1)

Corp insurance is offered through named-peril and multi-peril crop insurance policies. Apple, pear, peach, grape, sweet persimmon, tangerine, and astringent persimmon are covered through the named-peril policy. Basis risks covered under this policy are hail and typhoon. In addition, farmers have the option to purchase insurance for spring frost and freezing, fall frost and freezing, excessive rain (torrential rain), and fruit tree damage.

Korean crop insurance program has gone through two crises so far. The first crisis happened in 2002. Severe loss (Loss to Risk premium, L/R, was 435%) occurred due to super typhoon “Rusa”. Reinsurance companies requested high rate increase, but was rejected by the government because of budget constraint. Withdrawal of participating reinsurance companies left NACF’s NHPCI alone which retained the whole risk and experienced severe loss for two consecutive years (2003 and 2004).

Korean government indemnified NHPCI for the major portion of the loss in 2003 through special account. A Public-Private Task Force Team was organized to restore the program in 2004. Results of the first reform are: (1) Premium rate raised by 50%, (2) Government reinsurance: government pays all losses over L/R 180%. (3) two-step step claim handling.

Private reinsurance companies re-entered the Crop Insurance Program in 2005.

The second crisis occurred in 2012. Reasons for the second crisis:

1. Due to (1) Good loss results: L/R 44% (2005), L/R 37% (2006), L/R 45% (2008) and (2) Exclusion of catastrophe pricing after 2005, premium rates steadily decreased from 2005 level to the pre-2005 level;

2. Unexpected losses during 2009-2011;

3. Severe losses (L/R 357%) due to super typhoon “Bolauen”.

Lessons from the 2nd crisis: For the survival of the program over a long haul, fundamentals such as catastrophic losses, moral and adverse selection cannot be ignored.

Renewal of the Crop Insurance Program started in 2013, with the following reforms:

1. Premium rate increased by 33% (introduction of the Cat model into the program);

2. Government reinsurance (Stop Loss): L/R 150%. Stop Loss Cost: 5.5% of Gross Premium;

3. Created new claim organization with 200 persons for claim handling.

Korean crop insurance program is heavily supported by the government in four different ways:

1. The Central government provides 50% premium subsidies;

2. The Central government also acts as a reinsurer of last resort for the liability in excess of 180% local market loss ratio (150% after 2013);

3. 100% of the NACF’S crop insurance operational expenses are subsidized by the central government budget;

4. The Central government, through the Ministry of Agriculture, has an active participation in product research and development.

As of 2013, there are 40 crops covered by the program. The Penetration Ratio (%, area-based) of major five crops (apple, pear, tangerine, sweet persimmon and astringent persimmon, 86% of total insured risk premium in 2013) is 47%. The total risk premium is 215 million USD.

Korean Crop Insurance Program is an interesting case and was presented in the 17th East Asian Actuarial Conference in 2013.

Besides Crop Insurance Program, the Korean government has Public Disaster Assistance Programs, by the Act on Agricultural and Fishery Disasters enacted in 1995, it stipulates financial support against disasters affecting agriculture and fishery, such as damages from disease, harmful pests, and drought.

References:

1. Mahul, O., and C. Stutley. 2010. Overview on Agricultural Insurance: South Korea in Government Support to Agricultural Insurance (2010) p. 214-p. 218. World Bank.

2. 2013 ” Korean Crop Insurance Program”, Nong Hyup Property Casualty Insurance Co., Ltd. Briefing Material.

3. Lessons Learned from the Crop Insurance Program in Korea. 2013. 17th East Asian Actuarial Conference. 15-18, Oct. 2013. Singapore.

Date submitted: November 27, 2013

Reviewed, edited and uploaded: November 28, 2013