Dohan Song, Ph.D.

Director of Financial Research Unit

NongHyup Economic Research Institute

Seoul, Korea

About the Crop Insurance Program

In Korea, the Crop Insurance Program (here after, CIP) was first introduced in 2001 in an attempt to compensate farmers from possible catastrophic losses, thus stabilizing their production activities, using the insurance principle. Unlike a conventional disaster subsidy designed to provide a minimal level of standard of living, the CIP aims is to help farmers engage in sustainable operation through the process of reproducing agricultural goods.

Taking a look at the history of introducing the crop insurance in Korea, the National Association of Cooperative Federation (here after NACF) and the Korean government recognized the importance of coping with the disasters, deciding to introduce the CIP in 1978. In the following year, the NACF as an insurer started to conduct three years of validity test for the CIP in 1979 and established the set of statistics in order to design the demo business for the rice CIP in 1982. Since 1982, a sequence of preparation procedures for the rice CIP had been stopped over about two decades for various reasons. However, due to typhoon ‘Olga’ striking the entire agricultural industry in 1999, the Korean government formed the committee and the task force team to complete the specific procedures for introducing the CIP. Eventually, the CIP had been launched with some demo businesses (i.e., apple and pear), as the CIP act and the enforcement ordinance for the CIP was established in 2001. As farmers began to recognize the important role played by the CIP in farming over time, the CIP market in Korea has been gradually developed with a growing number of agricultural products covered by the insurance program, including peach, grape, sweet persimmon, and mandarin. As of 2013, a total of 40 agricultural products are insured by the current CIP and are further expected to keep increasing.

With regard to the business structure of the CIP, once the Ministry of Agriculture, Food and Rural Affairs (MAFRA) establishes the basic plan for target crops, support conditions, and subsidy rates, the NACF as a CIP insurer submits the specific implementation plan (i.e., premium and insurance policy conditions) to the MAFRA. Then, the NACF signs a sales consignment agreement with regional cooperative associations and then provides them with educational services required for operating the CIP. To encourage farmers’ participation in the CIP, the government helps to reduce farmers’ financial burdens by providing them with the types of subsidies. Specifically, the government contributes to the CIP by supporting a 50% of the insurance premium, all of the operating expenses, and statistical management costs associated with the program.

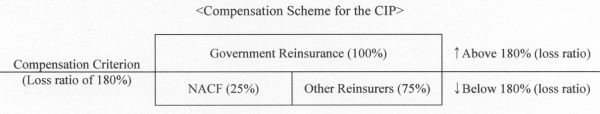

When it comes to the risk-return structure of the CIP, the different compensation mechanisms can be applied to the insurance benefits depending on the size of damages. When the estimated loss ratio is expected to be greater than 180%, the government needs to cover the entire insurance benefits since the individual insurers are not able to deal with such catastrophic damages. Thus, the government needs to play an important role in maintaining the CIP, though the NACF as an individual insurer manages the CIP. On the other hand, when a loss ratio is less than 180%, the crop damages will be covered by the individual insurers, or the NACF and other reinsurers. Specifically, the NACF will cover 25% of damages, and other reinsurers will take care of 75% of the crop damages, as shown in the figure below.

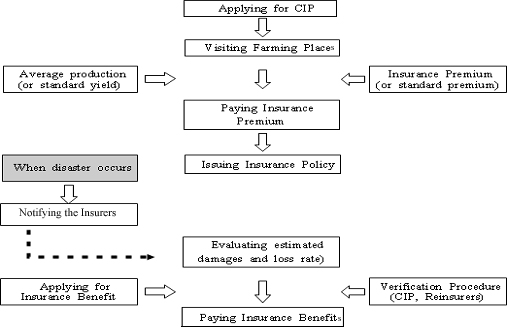

The practical steps to the CIP procedures are summarized in the figure below. Once individual farmers apply for the CIP with particular crops, then the NACF as an insurer visits farming places to evaluate insurance premia based on the estimated normal production. In cases where crop damages occur, farmers are required to report crop damages to the insurer, then the NACF engages in the verification process of evaluating estimated losses. Such a loss assessment would be performed by individual appraisers and regional farmers, who participate in the insurance program. These farmers are viewed as effective appraisers since they have expert knowledge on farming and regional economic conditions.

Current Status of the Crop Insurance Program in Korea

The Korean government plans to promote the CIP by expanding the basket of target items into a wide range of agricultural products. The CIP have currently covered about 40 agricultural products that are classified into the two categories: the main business category and the demo project category. The crop in the demo category will be advanced to the main business a couple of years later. Specifically, the numbers of the target items have rapidly grown over several years, which are amount to 20 items in 2009, 25 items in 2010, 30 items in 2011, 35 items in 2012, and 40 items in 2013. As of 2013, the target items included in the insurance program are as follows:

-

Main business (16 items): apple, pear, sweet persimmon, mandarin, astringent persimmon, kiwi, prune, bean, potato, onion, chestnut, rice, sweet potato, corn, garlic, plum

-

Demo project (24 items): peach, grape, hot pepper, jujube, rubus coreanus, strawberries, mulberry, green tea, ginseng, watermelon, cucumber, tomato, oriental melon, green chilli, pumpkin, rose, melon, lattice, chrysanthemum, paprika, spinach, mushroom, chives

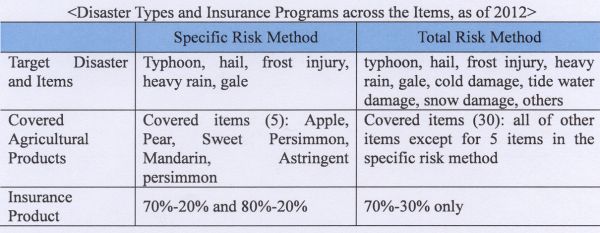

In the CIP, the disaster type is divided into a specific risk method and a total risk method across the items, as shown in the table below. In particular, the CIP, with a specific risk method, provides both the 70% insured product (30% deductible) and the 80% insured product (20% deductible), while the CIP, with a total risk method, provides the 70% insured product only. In addition, the CIP, under the specific risk method only, covers 5 agricultural products, including apple, pear, sweet persimmon, mandarin, and astringent persimmon. All of other items will be covered under the total risk method.

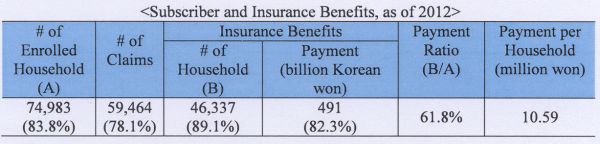

As of 2012, a total of 74,983 farming households participated in the CIP, and their corresponding farmland areas covered by the program are 108,373 hectares. The insurance program has covered about 45% of the agricultural goods produced in Korea. In 2012, the insurance benefits were paid to farmers under the CIP, comprising 89% (46,337 households) of the participants in the insurance programs. As an aside, the CIP alone covers 78% (76,172 claims) of the total disaster claims occurring in Korea during the period of 2012. The summary statistics for the farmers’ participation in the program and insurance benefits paid to the farmers are reported in the table below. In 2012, a total of 491 billion Korean won were paid to the farmers, and on average, the insurance program paid 10.6 million won to individual households as a compensation for crop damages. These statistics indicate the importance of the CIP in stabilizing farming business in Korea.

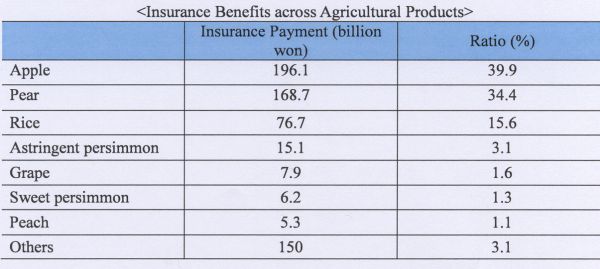

When taking a close look at the insurance payment across the items, the CIP distributes more than 90% of the total damage compensations to the three agricultural products (apple, pear, and rice). Specifically, a share of compensation for application is 39.9%, and these are 34.4% and 15.6% for pear and rice, respectively. On the other hand, the total amount of insurance benefits distributed to the rest of the agricultural products is less than 10%. As shown in the table below, insurance benefits tend to be heavily concentrated on the particular agricultural products (i.e., apply, pear, and rice). As an aside, 71.8% of crop damages are related to typhoon alone, which is considered to be a major disaster causing the majority of the crop damages in Korea.

Crop Insurance Program Across the Countries

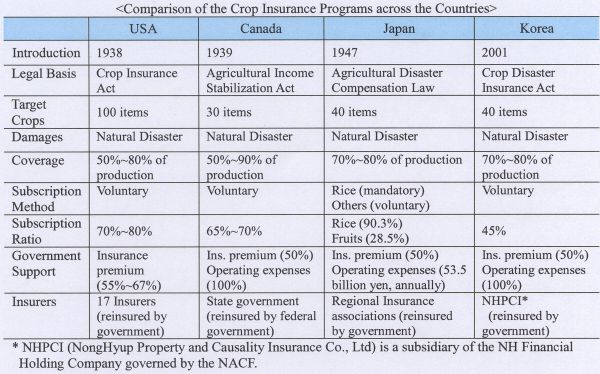

While the Korean government has a relatively short experience in operating the CIP, which was launched in 2001, some countries like USA, Japan, and Canada have more than 50 years of experiences in managing the crop insurance programs. With regard to the insurance programs, these countries have similar characteristics in terms of the operating systems, subscription rates, and government support for the programs. It seems to be surprising that the CIP in Korea has covered 40 agricultural products within such a short-time period, as compared with 40 items for Japan and 30 items for Canada. The cross-country comparison in the crop insurance programs, the differences and similarities among the four countries, are reported in the table below.

Improvement Plan for the CIP

Although the Korean government has successfully stabilized the CIP within a short period of time, there still exists many problems that need to be resolved over time. First, considering the income level of the agricultural industry and the seasonality of income stream, most of the farmers in Korea tend to perceive an insurance premium (a lump-sum payment) to be relatively high, thus, serving as a burden to increase a subscription rate of the CIP. For farmers, an average insurance premium of 750,000 per ha may not be affordable, eventually discouraging them to participate in the program. To solve such problem, both the government and regional states should play an important role in lowering farmers’ financial burdens by increasing a share of contribution to the insurance premium.

Second, one of the most significant problems associated with the CIP is that the farmers’ participation in the insurance program have not been improved for recent several years, as indicated by a subscription rate of 45% (as of 2012). That is, more than half of the entire farming households have not been enrolled in the CIP since these farmers still doubt on the possible impacts that the CIP may have on their farming business. The government has attempted to facilitate the insurance program by focusing on increasing the numbers of the target products. As a result, the target items in the CIP have grown rapidly at the increasing rate, rising from 20 items in 2009 to 40 items in 2012. However, the quality of the program is likely to depend more on the accurate estimation of insurance demands for the particular products, farmers’ views on the CIP, or affordable insurance premia, not on the range of products covered by the CIP.

Third, the compensation scheme for crop damages has a tendency to underestimate the value of crops since it does not reflect on the market conditions. As indicated by the decrease in the damage approval ratio from 80% in 2010 and to 50% in 2012, farmers under the CIP are not able to fully recover from the financial losses incurred. Such a problem provides some implications applicable to policymakers. The CIP should be viewed as policy insurance though the NACF as an individual insurer has worked for the program. To maintain the soundness and sustainability of the CIP, the government needs to fill the gap existing between the insurance market and policy goals.

Fourth, the quantitative measures of crop losses are compensated under the current CIP, but most of the farmers are still exposed to the price risk, which is not covered by the program. From farmers’ perspectives, both the production and price risks should be simultaneously treated to stabilize their farming business. To achieve such a policy goal, the government should improve the current program by linking the CIP to the types of their income insurance.

Finally, the loss assessment has been performed by local farmers living in regional areas, but these farmers, participating in the CIP as the appraisers, do not possess expert knowledge on the damage assessment. To obtain the valid and reliable statistics for loss evaluation, the government needs to establish the systematic and comprehensive assessment procedures, including the professional training program, statistical database associated with the loss appraisal, and the monitoring system.

|

Date submitted: November 27, 2013

Reviewed, edited and uploaded: November 27, 2013

|

A Brief Review of the Crop Insurance Program in Korea

Dohan Song, Ph.D.

Director of Financial Research Unit

NongHyup Economic Research Institute

Seoul, Korea

About the Crop Insurance Program

In Korea, the Crop Insurance Program (here after, CIP) was first introduced in 2001 in an attempt to compensate farmers from possible catastrophic losses, thus stabilizing their production activities, using the insurance principle. Unlike a conventional disaster subsidy designed to provide a minimal level of standard of living, the CIP aims is to help farmers engage in sustainable operation through the process of reproducing agricultural goods.

Taking a look at the history of introducing the crop insurance in Korea, the National Association of Cooperative Federation (here after NACF) and the Korean government recognized the importance of coping with the disasters, deciding to introduce the CIP in 1978. In the following year, the NACF as an insurer started to conduct three years of validity test for the CIP in 1979 and established the set of statistics in order to design the demo business for the rice CIP in 1982. Since 1982, a sequence of preparation procedures for the rice CIP had been stopped over about two decades for various reasons. However, due to typhoon ‘Olga’ striking the entire agricultural industry in 1999, the Korean government formed the committee and the task force team to complete the specific procedures for introducing the CIP. Eventually, the CIP had been launched with some demo businesses (i.e., apple and pear), as the CIP act and the enforcement ordinance for the CIP was established in 2001. As farmers began to recognize the important role played by the CIP in farming over time, the CIP market in Korea has been gradually developed with a growing number of agricultural products covered by the insurance program, including peach, grape, sweet persimmon, and mandarin. As of 2013, a total of 40 agricultural products are insured by the current CIP and are further expected to keep increasing.

With regard to the business structure of the CIP, once the Ministry of Agriculture, Food and Rural Affairs (MAFRA) establishes the basic plan for target crops, support conditions, and subsidy rates, the NACF as a CIP insurer submits the specific implementation plan (i.e., premium and insurance policy conditions) to the MAFRA. Then, the NACF signs a sales consignment agreement with regional cooperative associations and then provides them with educational services required for operating the CIP. To encourage farmers’ participation in the CIP, the government helps to reduce farmers’ financial burdens by providing them with the types of subsidies. Specifically, the government contributes to the CIP by supporting a 50% of the insurance premium, all of the operating expenses, and statistical management costs associated with the program.

When it comes to the risk-return structure of the CIP, the different compensation mechanisms can be applied to the insurance benefits depending on the size of damages. When the estimated loss ratio is expected to be greater than 180%, the government needs to cover the entire insurance benefits since the individual insurers are not able to deal with such catastrophic damages. Thus, the government needs to play an important role in maintaining the CIP, though the NACF as an individual insurer manages the CIP. On the other hand, when a loss ratio is less than 180%, the crop damages will be covered by the individual insurers, or the NACF and other reinsurers. Specifically, the NACF will cover 25% of damages, and other reinsurers will take care of 75% of the crop damages, as shown in the figure below.

The practical steps to the CIP procedures are summarized in the figure below. Once individual farmers apply for the CIP with particular crops, then the NACF as an insurer visits farming places to evaluate insurance premia based on the estimated normal production. In cases where crop damages occur, farmers are required to report crop damages to the insurer, then the NACF engages in the verification process of evaluating estimated losses. Such a loss assessment would be performed by individual appraisers and regional farmers, who participate in the insurance program. These farmers are viewed as effective appraisers since they have expert knowledge on farming and regional economic conditions.

Current Status of the Crop Insurance Program in Korea

The Korean government plans to promote the CIP by expanding the basket of target items into a wide range of agricultural products. The CIP have currently covered about 40 agricultural products that are classified into the two categories: the main business category and the demo project category. The crop in the demo category will be advanced to the main business a couple of years later. Specifically, the numbers of the target items have rapidly grown over several years, which are amount to 20 items in 2009, 25 items in 2010, 30 items in 2011, 35 items in 2012, and 40 items in 2013. As of 2013, the target items included in the insurance program are as follows:

In the CIP, the disaster type is divided into a specific risk method and a total risk method across the items, as shown in the table below. In particular, the CIP, with a specific risk method, provides both the 70% insured product (30% deductible) and the 80% insured product (20% deductible), while the CIP, with a total risk method, provides the 70% insured product only. In addition, the CIP, under the specific risk method only, covers 5 agricultural products, including apple, pear, sweet persimmon, mandarin, and astringent persimmon. All of other items will be covered under the total risk method.

As of 2012, a total of 74,983 farming households participated in the CIP, and their corresponding farmland areas covered by the program are 108,373 hectares. The insurance program has covered about 45% of the agricultural goods produced in Korea. In 2012, the insurance benefits were paid to farmers under the CIP, comprising 89% (46,337 households) of the participants in the insurance programs. As an aside, the CIP alone covers 78% (76,172 claims) of the total disaster claims occurring in Korea during the period of 2012. The summary statistics for the farmers’ participation in the program and insurance benefits paid to the farmers are reported in the table below. In 2012, a total of 491 billion Korean won were paid to the farmers, and on average, the insurance program paid 10.6 million won to individual households as a compensation for crop damages. These statistics indicate the importance of the CIP in stabilizing farming business in Korea.

When taking a close look at the insurance payment across the items, the CIP distributes more than 90% of the total damage compensations to the three agricultural products (apple, pear, and rice). Specifically, a share of compensation for application is 39.9%, and these are 34.4% and 15.6% for pear and rice, respectively. On the other hand, the total amount of insurance benefits distributed to the rest of the agricultural products is less than 10%. As shown in the table below, insurance benefits tend to be heavily concentrated on the particular agricultural products (i.e., apply, pear, and rice). As an aside, 71.8% of crop damages are related to typhoon alone, which is considered to be a major disaster causing the majority of the crop damages in Korea.

Crop Insurance Program Across the Countries

While the Korean government has a relatively short experience in operating the CIP, which was launched in 2001, some countries like USA, Japan, and Canada have more than 50 years of experiences in managing the crop insurance programs. With regard to the insurance programs, these countries have similar characteristics in terms of the operating systems, subscription rates, and government support for the programs. It seems to be surprising that the CIP in Korea has covered 40 agricultural products within such a short-time period, as compared with 40 items for Japan and 30 items for Canada. The cross-country comparison in the crop insurance programs, the differences and similarities among the four countries, are reported in the table below.

Improvement Plan for the CIP

Although the Korean government has successfully stabilized the CIP within a short period of time, there still exists many problems that need to be resolved over time. First, considering the income level of the agricultural industry and the seasonality of income stream, most of the farmers in Korea tend to perceive an insurance premium (a lump-sum payment) to be relatively high, thus, serving as a burden to increase a subscription rate of the CIP. For farmers, an average insurance premium of 750,000 per ha may not be affordable, eventually discouraging them to participate in the program. To solve such problem, both the government and regional states should play an important role in lowering farmers’ financial burdens by increasing a share of contribution to the insurance premium.

Second, one of the most significant problems associated with the CIP is that the farmers’ participation in the insurance program have not been improved for recent several years, as indicated by a subscription rate of 45% (as of 2012). That is, more than half of the entire farming households have not been enrolled in the CIP since these farmers still doubt on the possible impacts that the CIP may have on their farming business. The government has attempted to facilitate the insurance program by focusing on increasing the numbers of the target products. As a result, the target items in the CIP have grown rapidly at the increasing rate, rising from 20 items in 2009 to 40 items in 2012. However, the quality of the program is likely to depend more on the accurate estimation of insurance demands for the particular products, farmers’ views on the CIP, or affordable insurance premia, not on the range of products covered by the CIP.

Third, the compensation scheme for crop damages has a tendency to underestimate the value of crops since it does not reflect on the market conditions. As indicated by the decrease in the damage approval ratio from 80% in 2010 and to 50% in 2012, farmers under the CIP are not able to fully recover from the financial losses incurred. Such a problem provides some implications applicable to policymakers. The CIP should be viewed as policy insurance though the NACF as an individual insurer has worked for the program. To maintain the soundness and sustainability of the CIP, the government needs to fill the gap existing between the insurance market and policy goals.

Fourth, the quantitative measures of crop losses are compensated under the current CIP, but most of the farmers are still exposed to the price risk, which is not covered by the program. From farmers’ perspectives, both the production and price risks should be simultaneously treated to stabilize their farming business. To achieve such a policy goal, the government should improve the current program by linking the CIP to the types of their income insurance.

Finally, the loss assessment has been performed by local farmers living in regional areas, but these farmers, participating in the CIP as the appraisers, do not possess expert knowledge on the damage assessment. To obtain the valid and reliable statistics for loss evaluation, the government needs to establish the systematic and comprehensive assessment procedures, including the professional training program, statistical database associated with the loss appraisal, and the monitoring system.

Date submitted: November 27, 2013

Reviewed, edited and uploaded: November 27, 2013