ABSTRACT

Indonesia is the eighth top tea-producing country in the world. The central tea-producing areas are 10 provinces among 34 provinces in the country. Recently, the domestic tea industry of Indonesia is facing problems in terms of decreasing planted area, lacking technology application, trifling productivity, consumption, and selling price, decreasing export, and increasing import. Therefore, it is recommended that the Indonesian tea industry should be developed through the introduction of high yield variety towards geographical indication requirements, implementing precision agriculture, campaigning for tea consumption, providing incentives for the domestic market, and escalating tea export promotion. These should be in line with the development of policies that would include protecting the national production, securing the domestic market, improving the quality requirements, formulating the price, and strengthening the farmer institution to achieve efficient and effective tea development programs in the country.

Keywords: tea, outlook, perspective, development, Indonesia

INTRODUCTION

Indonesia is an agriculture-based country that has nature land prosperity and richness of biodiversity. As a tropical region with a constant temperature and humidity, including in highland areas, Indonesia ideally grows a wide variety of plants. One of them is the tea plant (Camellia sinensis).

Originally tea plant was derived from China. It was introduced to Indonesia in 1684 and massively planted in 1828 along with the implementation of Cultuurstelsel, or enforcement cultivation system by Dutch colonialism. In the early 20th century, tea from Indonesia was exported to Europe and gained popularity for its high premium quality. Nowadays, the tea industry in Indonesia keeps growing and makes the country as one of the top tea producers in the world. This fact plays an essential role in the economy (RITC, 2021).

As classified as part of spice and fresher commodities in the Indonesian nomenclature; therefore, it is necessary to increase the quantity and quality of tea exports to maintain international market share and penetrate emerging markets (MoA, 2013). The development of tea carries out with rehabilitation and intensification supported by the provision of high-quality seeds and other production facilities that can produce tea from plantations with high standards.

The objective of this article is to review the perspective of tea commodity development in Indonesia. It initially entails the tea performance including planted area, production, and consumption; market outlook which comprises of the domestic and foreign markets; and perspective of tea development in Indonesia. Finally, the article provides some conclusions and recommendations.

INDONESIAN TEA PERFORMANCE

Since the tea plant comes from sub-tropics, it is suitable for planting in mountainous areas with an appropriate condition related to climate and soil compatibility (ICECRD, 2010). It requires air temperature ranging from 13-15 0C, relative humidity during the day more than 70%, annual rainfall of not less than 2,000 millimeters, and soil contains a lot of organic matter with an acidity degree of 4.5 to 5.6. The effect of air temperature is very influential on the growth of tea plants so that the production quality depends on where it is grown. The aroma of tea produced in high areas is generally better than in low areas. Therefore, tea plantations in Indonesia are found at a reasonably wide elevation range, around 400-2,000 meters above sea level.

Planted area

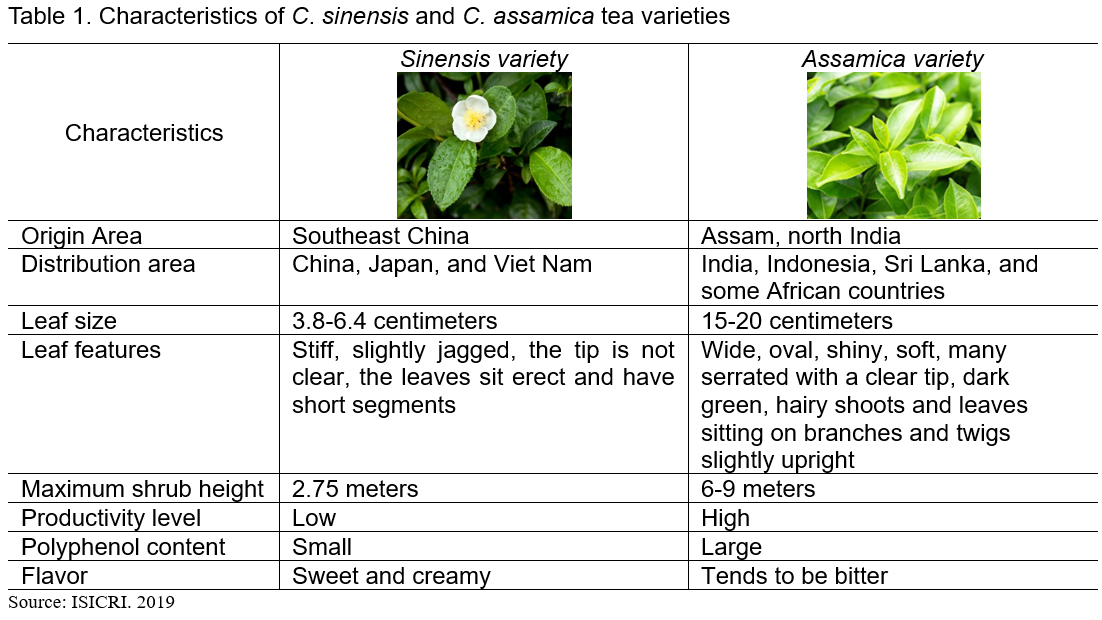

There are two main varieties of tea (Camellia sinensis) that are commercially cultivated in Indonesia, namely the C. sinensis variety and the C. assamica variety. The small-leaf teas, which have incomparable aromas and a hardiness that allows them to adapt to harsher climates belong to the sinensis strain. Meanwhile, the large-leaf teas come from the assamica strain. The Indonesian sinensis variety was derived from Japan and introduced in Indonesia in 1684, while assamica variety was imported from Sri Lanka and planted in Indonesia in 1877. The different characteristics of these varieties can be seen in Table 1).

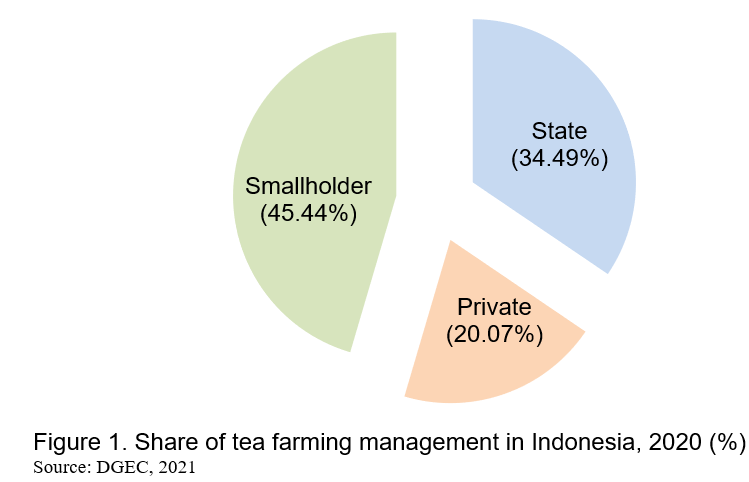

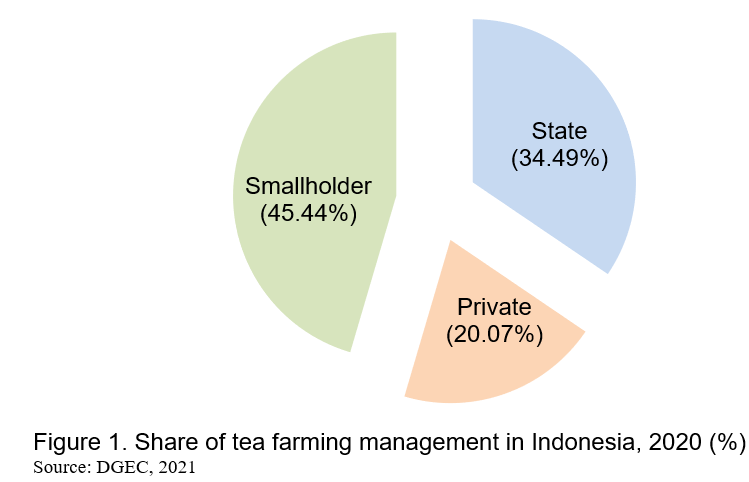

The tea plant in Indonesia is cultivated by two management systems, namely estate crops company and smallholder tea farming. Estate crops company is a company in the form of a legal business entity which is engaged in the cultivation of estate crops on land controlled for economic/commercial purposes and obtains a business permit from the competent agency in granting estate crops business license. This estate crops management comprises of state-owned and private companies. Moreover, smallholder farming is managed by households and is not in the form of a legal business entity. The highest planted area of tea farming in Indonesia was smallholders, followed by state-owned enterprises and private companies (Figure 1).

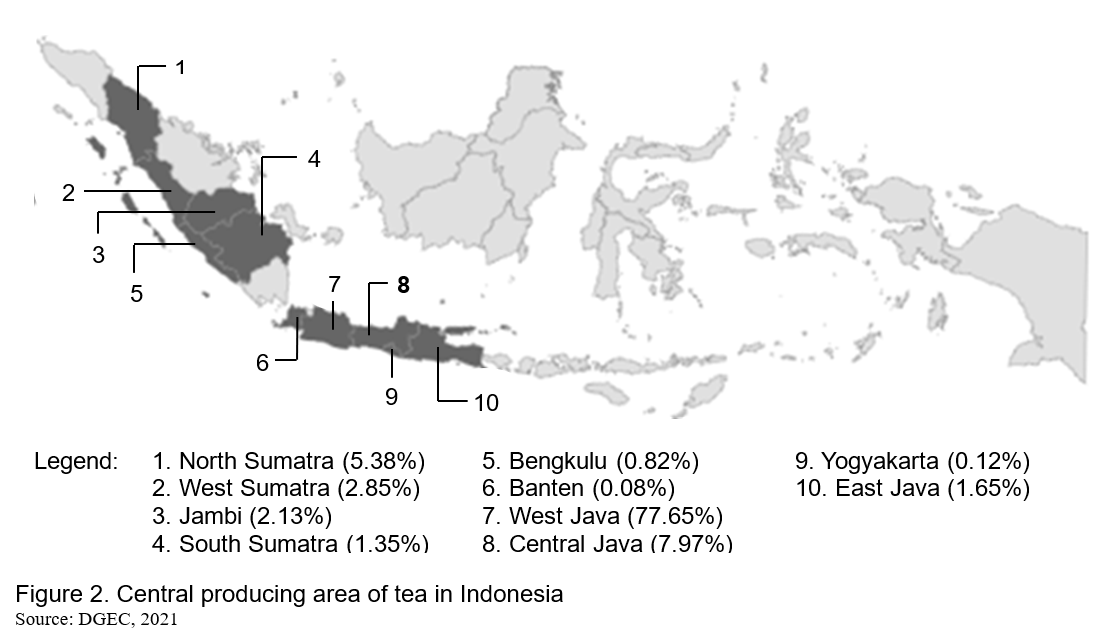

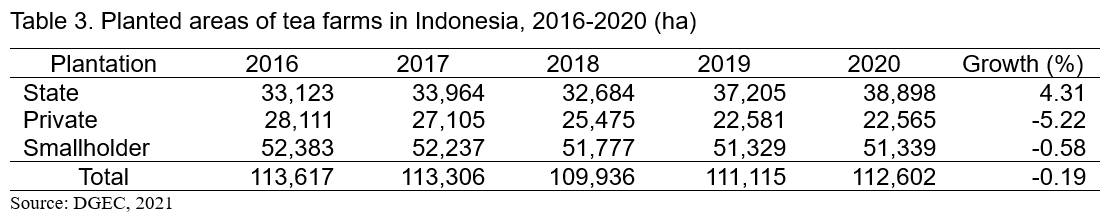

In the last five-years (2016-2020), the planted area of tea had slightly decreased about 0.19% annually. The planted area of state enterprises increased by about 4.31% per year, while private and smallholder farms decreased by 5.22% and 0.58% per year, respectively (Table 3). The planted areas of tea in Indonesia are concentrated in the islands of Java (87.47%) and Sumatra (12.53%). It comprises of five provinces in Java (Banten, West Java, Central Java, Yogyakarta, and East Java) and another five provinces in Sumatra (North Sumatra, West Sumatra, Jambi, South Sumatra, and Bengkulu). The highest share of tea planted area was West Java, while the lowest was Banten, i.e., 77.65% and 0.08%, respectively (Figure 2).

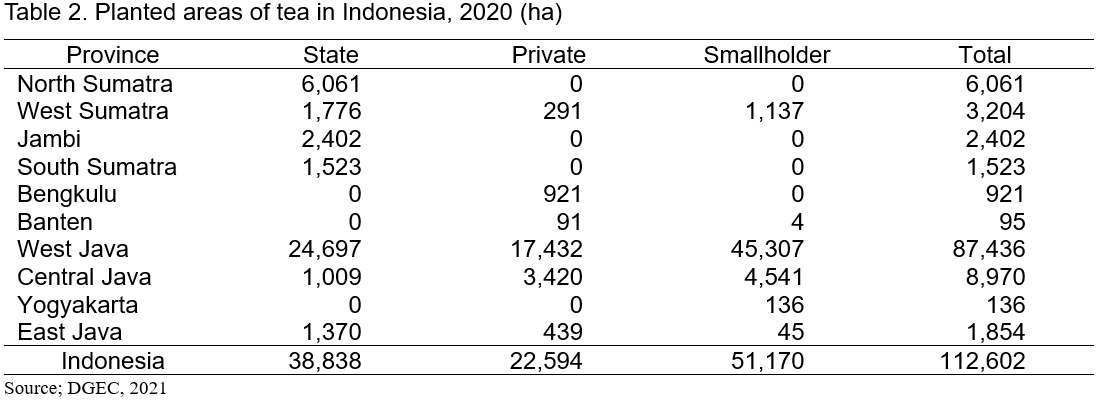

In 2020, the total planted area of tea in Indonesia was 112,602 hectares comprising state owned farms (38,838 ha), private farms (22,594 hectares), and smallholder farms (51,170 ha). The smallholder farm was only found in six provinces, namely West Sumatra, Banten, West Java, Central Java, Yogyakarta, and East Java (Table 2).

From 2016 to 2020, the trend of tea farms was slightly decreased by about 0.19% annually. It was due to decreasing planted areas of private and smallholder farms, i.e., 5.22% and 0.58% per year, respectively. However, the growth trend of state farms was increased by about 4.31% per year (Table 3).

Production

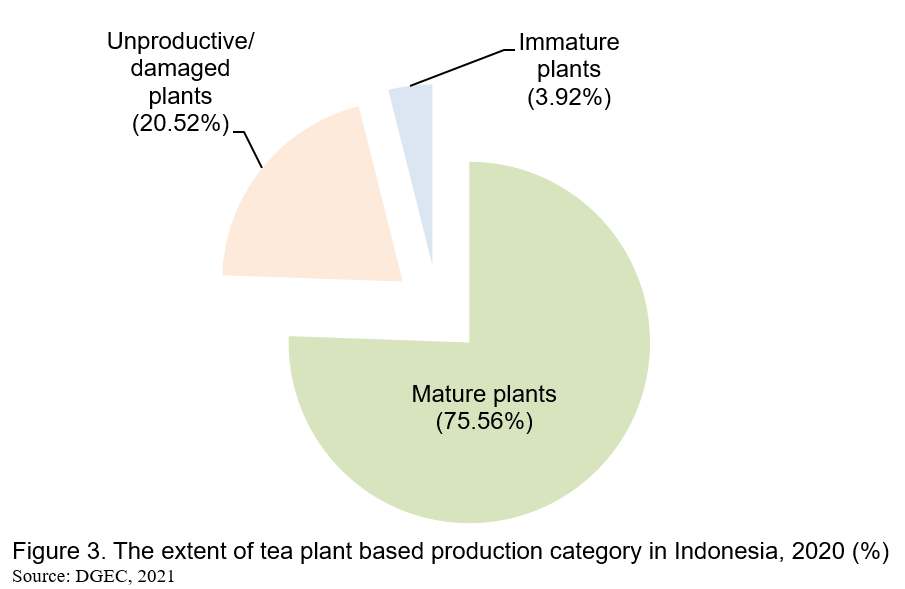

There are three production categories of tea crops in Indonesia, namely: (1) Mature crops; (2) Unproductive/damaged crops; and (3) Immature crops. Most of tea crops in the country were under the mature category; however, the unproductive/damaged crops category was still quite high (Figure 3).

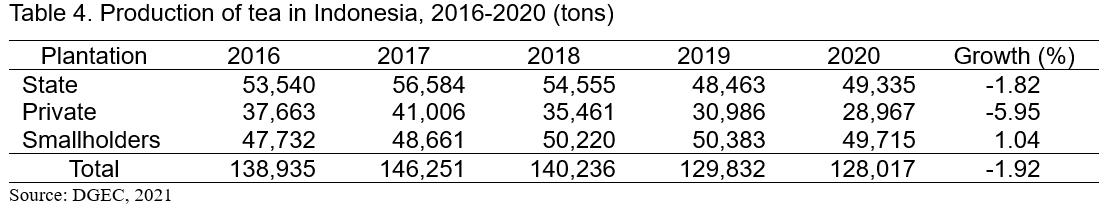

The production of Indonesian tea in the last five years (2016-2020) slightly decreased by about 1.92% per year, namely from 138,935 tons in 2016 to 128,017 tons in 2020 (Table 4). The production growth trend of smallholder farms positively increased by about 1.04%. Meanwhile, the production growth trends of state and private farms respectively decreased (-1.82% and -5.95%).

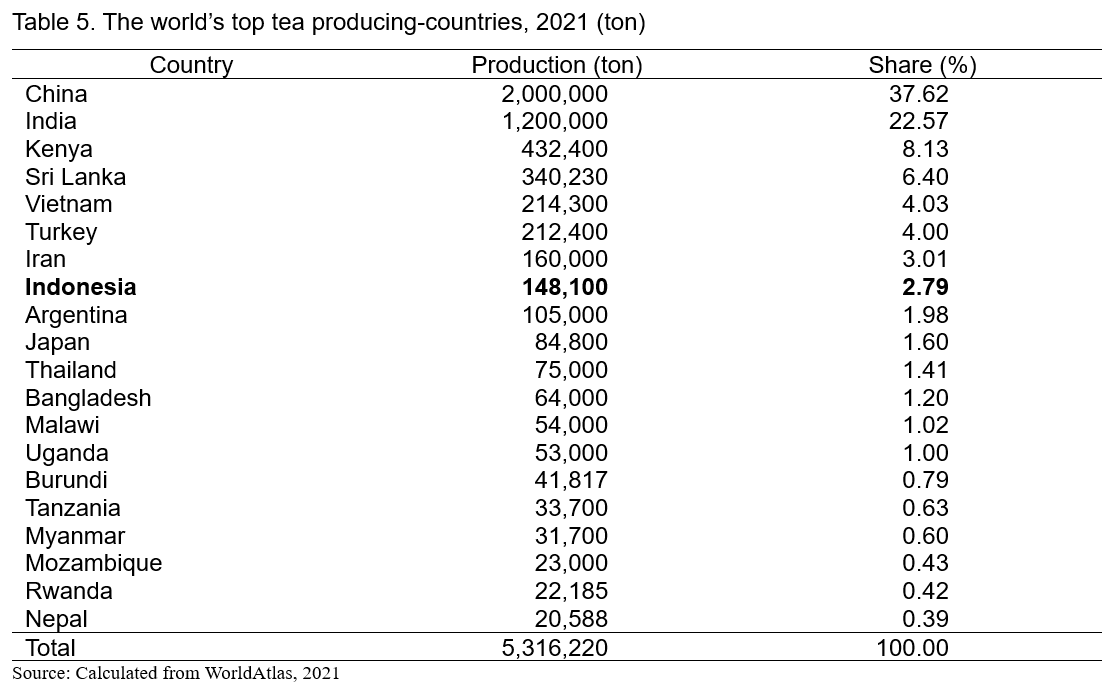

Indonesia has been recorded as the 8th largest tea production globally. The prominent world’s tea-producing countries can be seen in Table 5. The contribution of Indonesia to the world’s tea production was about 2.79%. Regionally, Indonesia is the second-largest tea production in ASEAN countries, after Vietnam.

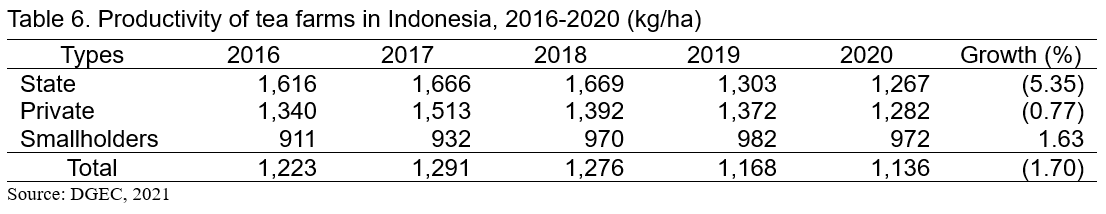

The average productivity of tea in Indonesia was 1,136 kilograms per hectare in 2020. This productivity was slightly decreased by about 1.70% per year, namely from 1,223 kilograms in 2016. In aggregate, the productivity of state farm (1,504 kg/ha) was higher than that of private farms (1,380 kg/ha). The lowest productivity was smallholder farms, namely 953 kilograms per hectare. However, the growth trend of smallholder farms from 2016 to 2020 had increased by about 1.63%. The smallholder farms were slightly better than private and state farms, which was negative during the same period. Detailed productivity of tea in Indonesia can be seen in Table 6.

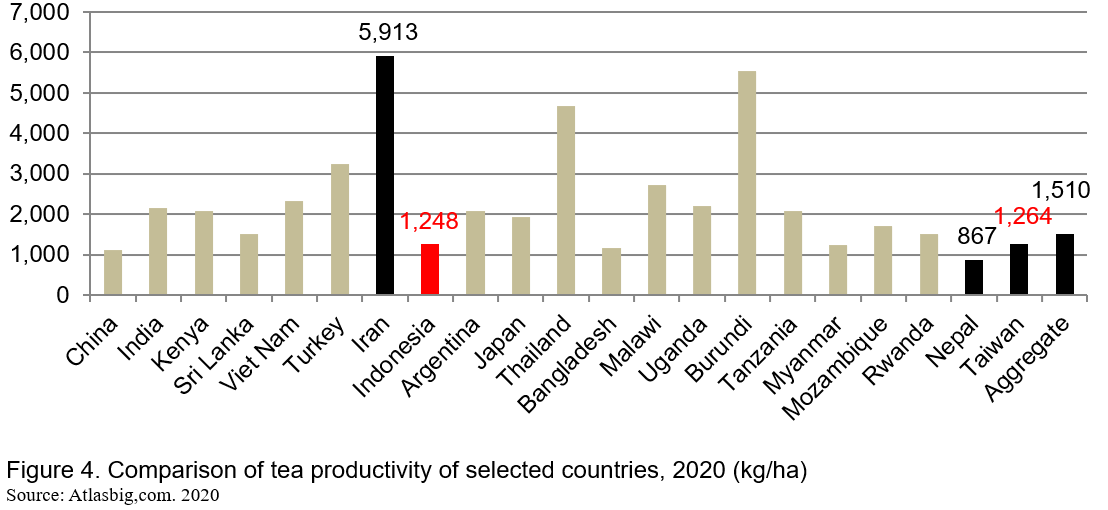

According to Atlasbig.com (2020), the productivity of Indonesian tea (1,248 kg/ha) was lower than the world’s selected tea-productivity countries (1,510 kg/ha). The highest tea productivity was in Iran (5,913 kg/ha), and the lowest was in Nepal (867 kg/ha). Refer to figure 4, it notes that the productivity of tea in Indonesia was relatively similar to that of Taiwan (1,264 kg/ha).

Consumption

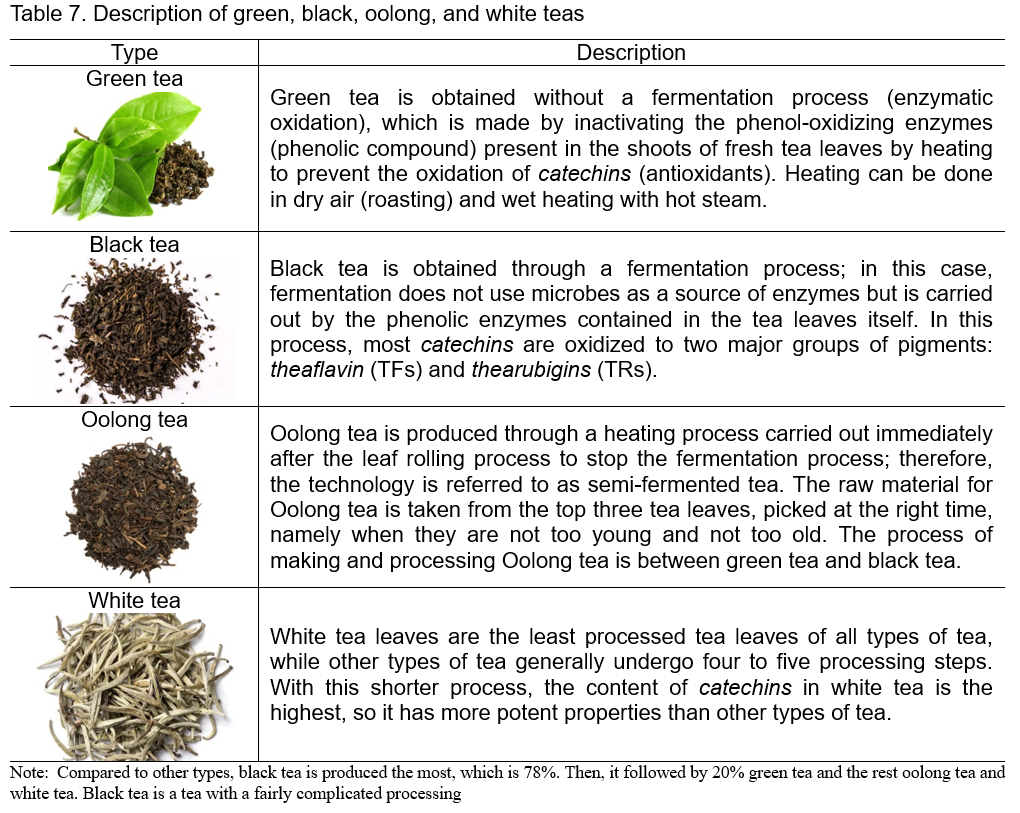

As an aromatic beverage, tea is consumed by people in many countries globally. Tea is produced from the young shoots of the tea crops. Tea leaf products can be different from each other because of diverse processing methods. When the dried tea leaves are brewed with hot water, it will cause a different distinctive aroma and taste. Therefore, based on post-harvest handling, tea products are classified into four types, namely: (1) Green tea; (2) Black tea; (3) Oolong tea; and (4) White tea (Table 7).

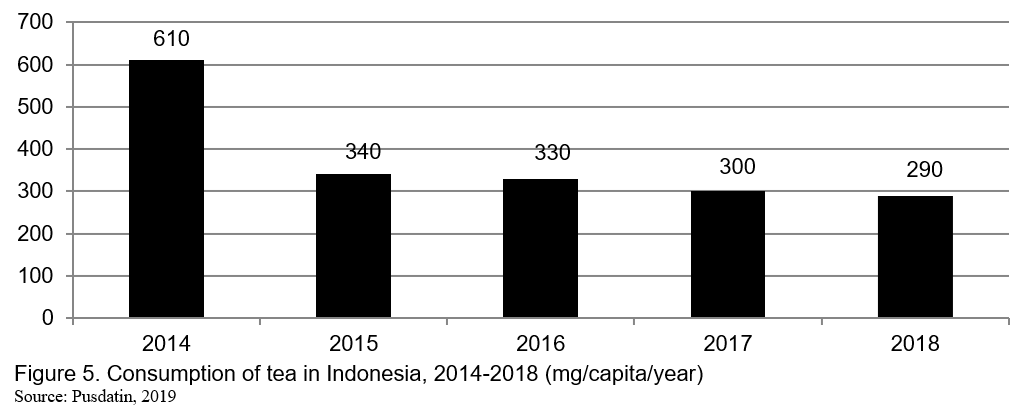

The average consumption of tea in Indonesia was about 370 milligrams per capita per year (Figure 5). The country’s consumption tended to decrease by about 14.91% per year, namely 610 milligrams per capita in 2014 to 290 milligrams per capita in 2018. The Indonesian tea consumption was lower than average global tea consumption (750 mg/capita/year).

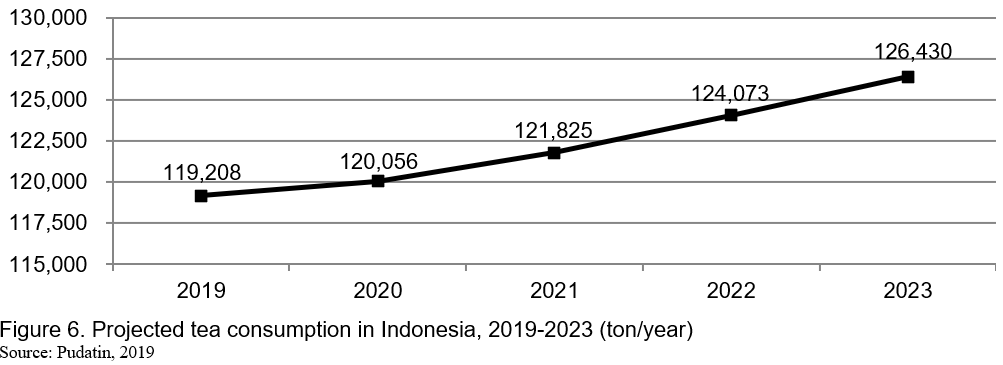

Due to lower consumption of tea in Indonesia (compared to the global tea consumption), the government of Indonesia (GoI) has projected to increase tea consumption in the country. The projection of tea consumption will be aggregately increase by about 1.40% per year, namely form 119,208 tons in 2019 to 126,430 tons in 2023 (Figure 6).

INDONESIAN TEA MARKET OUTLOOK

Tea has an important role in the national economy, generating employment, farmers' income, and foreign exchange, encouraging agroindustry, and conserving the environment. Apart from increasing export opportunities, the domestic tea market is still quite promising, although it has not been explored optimally. By diversifying tea products, there will be a potential market following the lifestyles and tastes of people. Tea is not only for drinks but also for cosmetics, health products and other purposes.

Domestic market

Most of Indonesia's tea production is exported to foreign countries and the rest is marketed domestically. The majority of the tea exported to overseas countries is of high-quality tea leaves, therefore leaving only medium to low-quality tea leaves for the domestic market.

There has been an increased demand from Indonesia’s domestic market in recent years, especially from the beverage industry where packaged and ready-to-serve tea are quite popular among the country’s youth. According to the Indonesian Tea Association (ATI), the total sales of domestic processed tea products reached an average of IDR10 billion (US$74,427) on a yearly basis which is five times higher than that of exports (GBG, 2016).

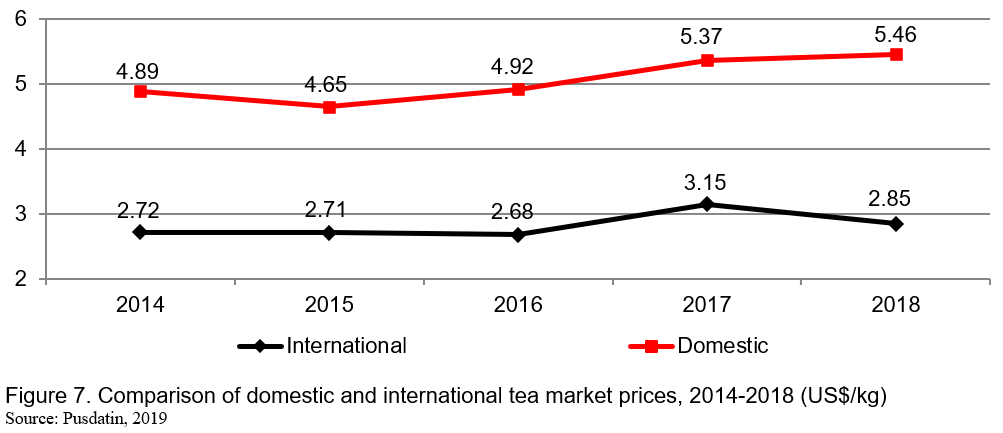

Domestic market of tea is still not evenly distributed throughout Indonesia, since the shipping costs from the central producing areas (Java and Sumatra) are relatively high. Consequently, the aggregate nationwide price of domestic tea was quite expensive. It was higher than the average of international tea price (Figure 7).

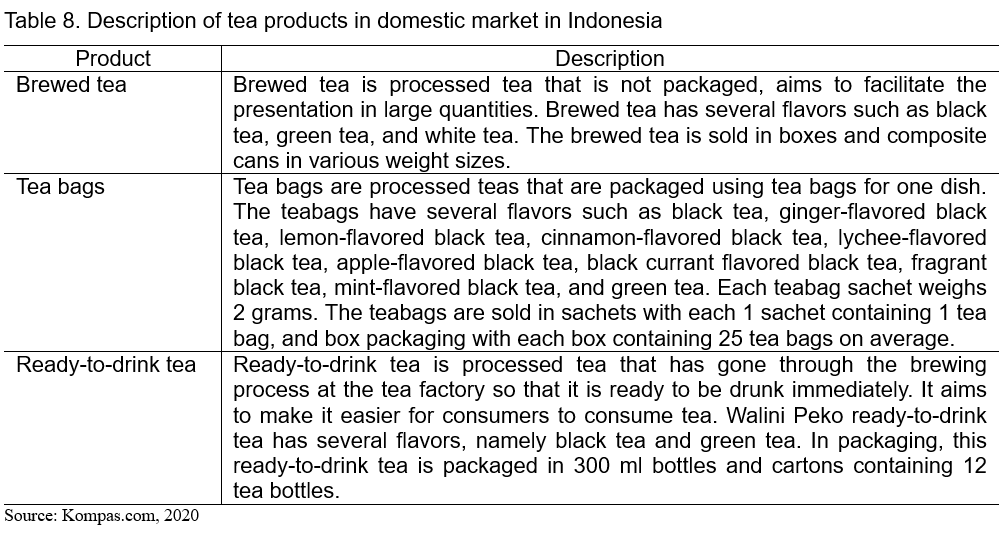

There are three tea products that are commonly marketed in Indonesia. It includes brewed tea, tea bags, and ready-to-drink tea. The description of each product is presented in Table 8.

Indonesian tea is used as a mixture or blend, not yet known as a single-origin tea which has its own characteristics. Indonesian tea for the local market is dominated by low-quality tea with very low selling prices from farmers. In general, public knowledge about the quality of tea and good brewing methods for consuming tea is still low. Based on the Indonesian stereotypes, tea is perceived to be under the cheap drink category. Currently, however, the use of brewed tea tends to decrease and is being replaced by tea bags and ready-to-drink tea and, then the choice of tea substitute drinks is increasing.

It notes that there has been an increased demand from Indonesia’s domestic market in recent years, especially from the beverage industry where packaged, ready-to-serve tea drinks have been quite popular among the country’s youth. Unfortunately, the lack of supply has forced the domestic downstream industry to import to keep up with the ever-increasing demand.

Export and import

Indonesia’s tea export and import comprise of green tea leaves, and fermented black tea with specific Harmonized Commodity Description and Coding System (HS Code). The classification of tea export and import based on HS Code description is presented in Table 9.

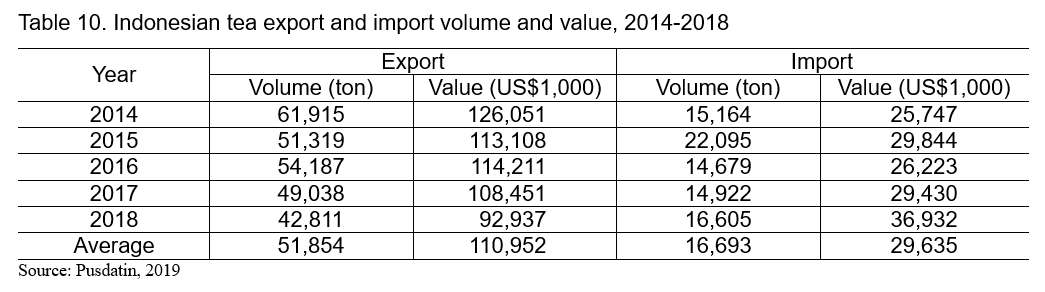

The tea export from Indonesia was higher than that of import (Table 10). Comparatively, the respective ratio of Indonesia tea export and import was 65%, and 35% per year (2014-2018), the growth trend of export tended to decrease by about 7.80% per year. Conversely, the growth trend of imports was increased by about 8.32% annually. It is because the price of imported tea was cheaper than domestic tea price. Among other things, it is inseparable from the low import duty rates for tea imports.

The import duty on tea to Indonesia is only 20%, much lower than the 40% standard set by the World Trade Organization (WTO). Comparatively, other countries in Asia, such as Vietnam implement import duty rates of up to 50%. Moreover, India and China 114% and 100% of tea imports, respectively (Kompas.id, 2020).

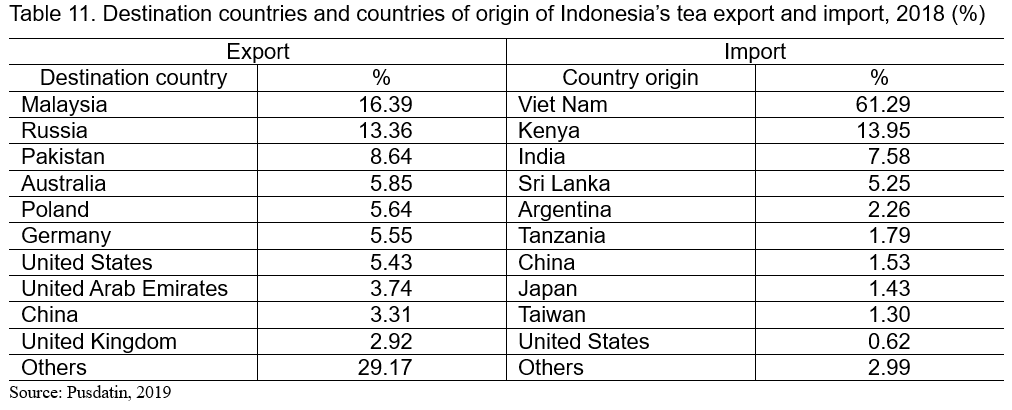

The destination and origin countries of Indonesian tea export and import can be seen in Table 11. The highest tea export was to Malaysia, while the largest tea import was from Vietnam. Almost one-fifth of Indonesian tea exports to Malaysia and more than half of imported tea in Indonesia derive from Vietnam.

PERSPECTIVE OF INDONESIAN TEA DEVELOPMENT

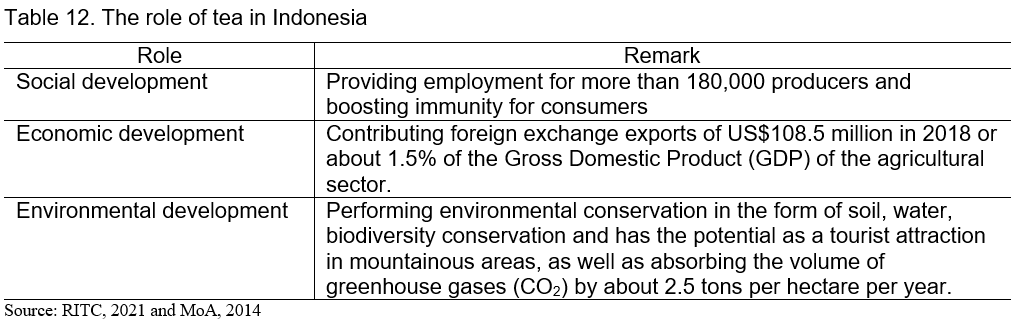

Tea is one of the leading spice and refreshment commodities in Indonesia. The development of tea is strategically implemented in order to fulfill domestic and international markets through improving the quantity and quality of its production. This is based on sustainable production in line with equitable, viable, and bearable socioeconomic and environmental developments. It is reasonable since the existence of tea is essential in line with generating the employment and income sources especially for farmers, encouraging the agroindustry and agribusiness both at the local and national level, enhancing the foreign exchange from import, and maintaining the environment. The role of tea in Indonesia is presented in Table 12.

Challenges

The challenges of tea development in Indonesia can be analyzed through three approaches, namely: (1) On-farm approach (farm production); (2) Off-farm approach (beyond the farm), and (3) Non-farm approach (outside the farm). Each approach has a specific depiction as discussed below.

Indonesian tea has been developed since Dutch colonialism around 18th century, and smallholder plantations began to develop in the 1980s. Due to a relative lack of development attention, the productivity of national tea tends to decrease. It was in line with declining planted areas and existing old/damaged tea plants in the country (Pusdatin, 2019). Refer to Table 6; the average productivity level for tea of smallholders is only around 900 kilogram/hectare, far below the ideal figure of 2,500 kilograms per hectare. Moreover, the average land ownership of each smallholder is comparatively low at only 0.6 hectares per household (GBG, 2016).

The conversion of tea land has triggered a decline in smallholder, state, and private farms with an average of 1,113 hectares per year. As a result, tea plantations in Indonesia have decreased significantly over the last five years. Some farmers prefer to grow horticulture products which are more profitable than growing tea. On the other hand, domestic tea production costs are also quite high (Kompas.id, 2020).

Apart from declining planted area and productivity, the Indonesian tea farms lack the use of good seed quality and the implementation of good agricultural practices. Generally, tea seed derives from the Research Institute for Tea and Cinchona (RITC) which has slightly different characteristics among regions in terms of geographical indications[1].

Off-farm

As the 8th tea-producing country in the world, Indonesia has actually recorded the least amount of tea consumption in the world. The average daily drink of tea is only half a cup per person. In comparison, Turkey is ranked the 6th among the global tea-producing countries; the Turkish consumes 10 times more than Indonesians. In Turkey, the average person drinks five cups of tea a day (Liputan6.com, 2021).

The extent of tea consumption in Indonesia tends to be stuck namely in the middle position globally. Indonesian tea is used as a mixture or blend, not yet known as a single-origin tea which has its own branded characteristics. Tea for the local market is dominated by low-quality tea with cheap selling prices from farmers (Kompas.id, 2021).

Above all, lack of promotion is one of the main factors for low tea consumption in Indonesia. The promotion has been carried out in an unsystematic way in terms of strategic planning and implementation programs. It is still managed by individuals and companies that have packaged tea products.

Non-farm

The Indonesian tea price is lower because a large proportion of tea products are sold unbranded; moreover, high-intensity rainfall has also reduced their taste and quality. The lack of skilled human resources with knowledge of best agricultural practices as well as technology has resulted in poor quality products. That is why Indonesian tea prices, especially from smallholder farms are cheaper (GBG, 2016).

Recently, the export trend of tea from Indonesia tends to decrease. In the last 18 years, the volume of exports has decreased by more than half, namely from 105,581 tons in 2000 to 49,038 tons in 2017 (-3.1%/year). This situation caused the share of Indonesia's bulk tea export volume in the world market to decrease from 8% in 2000 to only 1.6% in 2018. On the other hand, the export share of other producing countries such as Kenya and Sri Lanka continue to increase by about 16.4% to 21.0% and 18.2% to 21.0%, respectively. This situation reflects the weakening competitiveness of Indonesian tea in the world market. Another problem is that Indonesian tea exports to Europe are still constrained by the strict requirements.

On the contrary, the tea import trend of Indonesia tends to increase due to low import duty rates. In fact, according to the Indonesian Tea Council, about 90% of tea imports are low-quality tea. Many consumers and beverage processors in Indonesia prefer the low quality and cheap price of tea (Kompas.id, 2020).

According to RPN (2021), tea consumption in the domestic market increased quite significantly. However, the area, production, and export of tea plantations in Indonesia have decreased while import has increased substantially (Box 1).

|

Box 1

Policy Priority for Indonesian Tea

During 2005-2018, tea consumption in the domestic market increased quite significantly by 4% per year, so that in 2018 tea consumption in Indonesia reached 105,000 tons or around 75% of the total national tea production. This should be a driving factor for improving the performance of national tea agribusiness, including the performance of the on-farm tea. However, it is required to secure the national tea farms. The area, production, and exports have decreased while imports have increased. If there were no specific policy, the Indonesian tea farms would remain in name or history in 2050.

To secure the national tea farms, there is a need to implement the priority policies. First, input subsidy policy, especially for superior seeds and urea fertilizer. Second, the policy to reduce the rate of tea imports through increasing import tariffs from 20% to 40% for industrial raw materials in accordance with the tariff bounding permitted by the World Trade Organization (WTO), and more than 40% for retail tea products, as well as the application of non-tariff measures, including halal certificate and organoleptic quality requirements, application of the mandatory Indonesian National Standard (SNI) for tea, Maximum Residue Limit (SNI 7313-2008), and firm application of rules for Indonesian tea origin. In addition, for countries that have already signed a Free Trade Area (FTA) agreement such as Vietnam, Thailand, and India with the ASEAN – India Free Trade Area (AIFTA), which has been effective since 1st January 2010 and with China in the Regional Comprehensive the Economic Partnership (RCEP) which was signed on 15th November 2020, with tariffs that are still not harmonious for tea commodities, needs to be reviewed on the application of safeguard instruments. The implementation of non-harmonized import tariffs for tea commodities in the FTA will result in a flood of tea products from Vietnam, India, Thailand, and China. In 2018, tea imports from these four countries reached 73.3% of Indonesia's total tea imports.

|

Opportunities

By facing the above-mentioned problems, it is quite possible to revive the Indonesian tea industry to be able to compete in the global market since the country has a good quality and a distinctive aroma of teas. The global market demand will continue to increase, along with the increase in people's incomes, the growth of healthy lifestyles, and the diversification of tea production that is increasingly diverse and attractive.

Up to 2027, black tea production is projected to grow by an average of 2.2% per year to reach 4.42 million tons in 2027. Green tea grows an average of 7.5% annually and will reach 3.65 million tons in 2027. Tea exports are also projected to increase. Black and green teas are respectively estimated to reach 1.66 million tons and 605,455 tons in 2027 (Kompas.id, 2020).

Specifically, Indonesian tea can be developed based on its insight and outlook as presented in Box 2. Tea is widely consumed by people in the world. Along with the COVID-19 pandemic, in particular, there is a tendency that people attempt to improve their immunity by altering lifestyle-based-health through drinking habits. The study of Ekasari (2021) reveals that the majority (53.85%) of respondents confirmed that they were more concerned about the health benefits of the drinks they consumed. It seems that the change in consumption patterns has had a positive impact on efforts to revive Indonesian tea. The results of market observations, consumer research, and experience in the artisan tea business show certain trends.

|

Box 2

Indonesia tea 2022 insight and outlook: What’s in your cup-pa?

Trend 1: Artisan tea

Artisan tea includes tea (Camellia sinensis) mixed with other natural ingredients, used essential flavors and fragrances of certain types of fruit or flowers to enhance taste and aroma, other dry natural brewed ingredients of tea (tisane) such as several types of flowers (rose, lavender, jasmine, etc.); herbs (ginger, turmeric, lemongrass, betel leaf, sour soup leaf, etc.), and spices (wooden nut, star anise, black pepper, etc.).The existence of an online platform facilitates the market penetration of this artisan tea. Several young entrepreneurs who are engaged in coffee have also begun to taunt to introduce their creative concoctions to consumers, both in their cafés and in their online stores.

Trend 2: Delicious and healthy

Consumers tend to seek and select tea with certain functional benefits such as for weight loss and sleep as well as for other purposes related to a well-being lifestyle.

Trend 3: Coffee and Tea Café

More and more café entrepreneurs are realizing that the coffee market is getting saturated and their consumers want other types of drinks that are also premium class, such as specialty coffee that has become popular in the community. These young people diligently attend tea education classes to be able to serve artisan tea in their café.

Trend 4: Natural, artistic, and non-alcohol

Tea offers another advantage to generate the interest of café entrepreneurs and consumers. For instance, mocktail tea with the artistic beauty of colorful glasses provides creative space for baristas, instagrammable artistic beauty, and taste adventures for millennial and Gen Z consumers. Educational classes for tea mocktail are always full of enthusiasts. Another advantage is mocktail tea is non-alcoholic which safe for all ages and fulfills the rules of Islam, the religion of the majority of Indonesian.

Trend 5: Destinations

Tea is a pillar of a special place for establishing several startup outlets. These outlets generally offer a warm atmosphere, comfortable to chat, as well as furniture and light space ambiance. So that consumers feel at home to linger there. The products offered are a variety of teas in a warm dish or in the form of a tea mocktail.

|

CONCLUSIONS AND RECOMMENDATIONS

As the eighth top ten tea-producing countries in the world, the performance of domestic tea in Indonesia faces several problems. It includes the decreasing planted areas, lack of technology implementation, and low productivity. Moreover, the consumption of tea was lower than that of the international level. The tea export tended to decrease, while the import of tea has a tendency to increase.

It is recommended that the Indonesian tea industry should be developed through introducing high yield variety towards geographical indications requirement, implementing precision agriculture, campaigning for tea consumption, providing incentives for the domestic market, and escalating tea export promotion. The introduction of geographical indications; however, must be followed by facilitating incentives particularly for tea producers. These should be in line with the development of policies that would include protecting the national production, securing the domestic market, improving the quality requirements, formulating the price, and strengthening the farmer institution to achieve efficient and effective tea development programs in the country.

REFERENCES

Atlasbig.com. 2020. World tea production by country. Retrieved from: https://www.atlasbig.com/en-us/countries-by-tea-production (25 November 2021). United States.

BPS. 2019. Statistik Teh Indonesia 2019 (Indonesian Tea Statistics 2019). Badan Pusat Statistik Indonesia (Indonesian Bureau of Statistics). Jakarta.

DGEC. 2021. Statistik Perkebunan Unggulan Nasional 2019-2021 (Statistical of National Leading Estate Crops Commodity). Direktorat Jenderal Perkebunan (Directorate General of Estate Crops). Indonesian Ministry of Agriculture. Jakarta

Ekasari, I. 2021. Indonesia Tea 2022 Insight and Outlook: What’s in Your Cup-pa? Thought Leader, Pioneer, and Champion of Indonesian Artisan Tea. Bogor.

GBG. 2016. Indonesia’s Tea Industry: Bitter Supply amid Sweet Demand. Retrieved from: http://www.gbgindonesia.com/en/agriculture/article/2016/indonesia_s_tea_... (25 November 2021). Global Business Guide Indonesia. Jakarta.

ICECRD. 2010. Budidaya dan Pascapanen Teh (Tea Cultivation and Postharvest) Pusat Penelitian dan Pengembangan Perkebunan (Indonesian Center for Estate Crops Research and Development). Bogor.

ISICRI. 2019. Perbedaan Teh Varietas Assamica dan Sinensis (Difference between Assamica and Sinensis Tea Varieties. Info Teknology (Technology Info). Indonesian Industry and Freshener Crops Research Institute. Bogor.

Kompas.com. 2017. Kenapa Teh Indonesia Kalah Terkenal di Dunia daripada Kopinya? (Why is Indonesian tea less famous in the world than its coffee?). Retrieved from: https://travel.kompas.com/read/2017/12/06/07 1000127/kenapa-teh-indonesia-kalah-terkenal-di-dunia-daripada-kopinya- (24 November 2021). Kompas. Jakarta.

Kompas.com. 2020. Melihat Peluang Industri Teh Indonesia pada Masa Pandemi (Seeing the Opportunities of the Indonesian Tea Industry during the Pandemic). Retrieved from: https://www.kompas.com/food/read/2020/07/01/130700975/melihat-peluang-in... (24 November 2021). Kompas. Jakarta.

Kompas.id. 2020. Pasang Surut Teh Indonesia di Kancah Dunia (The Ups and Downs of Indonesian Tea in the World). Retrieved from: https://jelajah.kompas.id/ekspedisi-teh-nusantara/baca/pasang-surut-teh-indonesia-di-kancah-dunia/ (24 November 2021). Kompas. Jakarta.

Liputan6.com. 2021. Ironi Teh Indonesia, Produsen Terbesar tapi Konsumsinya Terendah di Dunia (The Irony of Indonesian Tea, the Largest Producer but the Lowest Consumption in the World). Retrieved from: https://www.liputan6.com/lifestyle/read/4563500/ironi-teh-indonesia-prod... (24 November 2021). Liputan 6. Jakarta.

MoA. 2013. Peraturan Menteri Pertanian Nomor 11 Tahun 2013 tentang Pedoman Teknis Pembangunan Kebun Perbanyakan Sumber Benih Teh (Regulation of the Minister of Agriculture Number 11/2013 concerning Technical Guidelines for the Development of Tea Seed Propagation Plantations). Indonesian Ministry of Agriculture. Jakarta.

MoA. 2014. Peraturan Menteri Pertanian Nomor 50 Tahun 2014 tentang Pedoman Teknis Budidaya Teh yang Baik (Regulation of the Ministry of Agriculture Number 50/2014 concerning Technical Guideline on Good Agriculture Practices for Tea). Indonesian Ministry of Agriculture. Jakarta.

MoLHR. 2019. Peraturan Menteri Hukum dan Hak Asasi Manusia Republik Indonesia Nomor 12 tahun 2019 tentang Indikasi Geografis (Regulation of the Minister of Law and Human Rights Number 12/2019 concerning Geographical Indications). Indonesian Ministry of Law and Human Rights. Jakarta.

Pusdatin. 2019. Outlook Komoditas Perkebunan Teh (Estate Crops Tea Commodity Outlook). Pusat Data dan Informasi Pertanian (Center for Agricultural Data and Information System). Indonesian Ministry of Agriculture. Jakarta.

RITC. 2021. Analisis Kinerja dan Prospek Komoditas Teh (Performance and Prospect of Tea Analysis). Radar: Opini dan Analisis Perkebunan (Radar: Opinion and Estate Crops Analysis), Volume 2, 1 January 2021. Pusat Penelitian Teh dan Kina (Research Institute for Tea and Cinchona). Riset Perkebunan Nusantara (Nusantara Estate Crops Research). Bandung.

RPN. 2021. Prioritas Kebijakan Komoditas Teh untuk Penyelamatan Perkebunan Teh Nasional (Tea Commodity Policy Priority for Securing National Tea Plantation). RADAR: Opini dan Analisis Perkebunan (RADAR: Plantation Opinion and Analysis), Vol. 2, No. 2 February 2021. Riset Perkebunan Nusantara (Nusantara Plantation Research). Bogor.

WCO. 2021. Nomenclature and Classification of Goods. World Customs Organization. Brussels.

[1] Geographical Indications (GIs) indicate the area of origin of an item and product in line with geographical, environmental factors, including natural factors, human factors, or combining these two factors provides a certain reputation, quality, and characteristics to the goods and products produced. It is an exclusive right granted to the holders of registered GI, as long as the reputation, quality, and characteristics that are the basis for protecting the GIs still exist (MoLHR, 2019).

Indonesian Tea Development Outlook: Challenges and Opportunities

ABSTRACT

Indonesia is the eighth top tea-producing country in the world. The central tea-producing areas are 10 provinces among 34 provinces in the country. Recently, the domestic tea industry of Indonesia is facing problems in terms of decreasing planted area, lacking technology application, trifling productivity, consumption, and selling price, decreasing export, and increasing import. Therefore, it is recommended that the Indonesian tea industry should be developed through the introduction of high yield variety towards geographical indication requirements, implementing precision agriculture, campaigning for tea consumption, providing incentives for the domestic market, and escalating tea export promotion. These should be in line with the development of policies that would include protecting the national production, securing the domestic market, improving the quality requirements, formulating the price, and strengthening the farmer institution to achieve efficient and effective tea development programs in the country.

Keywords: tea, outlook, perspective, development, Indonesia

INTRODUCTION

Indonesia is an agriculture-based country that has nature land prosperity and richness of biodiversity. As a tropical region with a constant temperature and humidity, including in highland areas, Indonesia ideally grows a wide variety of plants. One of them is the tea plant (Camellia sinensis).

Originally tea plant was derived from China. It was introduced to Indonesia in 1684 and massively planted in 1828 along with the implementation of Cultuurstelsel, or enforcement cultivation system by Dutch colonialism. In the early 20th century, tea from Indonesia was exported to Europe and gained popularity for its high premium quality. Nowadays, the tea industry in Indonesia keeps growing and makes the country as one of the top tea producers in the world. This fact plays an essential role in the economy (RITC, 2021).

As classified as part of spice and fresher commodities in the Indonesian nomenclature; therefore, it is necessary to increase the quantity and quality of tea exports to maintain international market share and penetrate emerging markets (MoA, 2013). The development of tea carries out with rehabilitation and intensification supported by the provision of high-quality seeds and other production facilities that can produce tea from plantations with high standards.

The objective of this article is to review the perspective of tea commodity development in Indonesia. It initially entails the tea performance including planted area, production, and consumption; market outlook which comprises of the domestic and foreign markets; and perspective of tea development in Indonesia. Finally, the article provides some conclusions and recommendations.

INDONESIAN TEA PERFORMANCE

Since the tea plant comes from sub-tropics, it is suitable for planting in mountainous areas with an appropriate condition related to climate and soil compatibility (ICECRD, 2010). It requires air temperature ranging from 13-15 0C, relative humidity during the day more than 70%, annual rainfall of not less than 2,000 millimeters, and soil contains a lot of organic matter with an acidity degree of 4.5 to 5.6. The effect of air temperature is very influential on the growth of tea plants so that the production quality depends on where it is grown. The aroma of tea produced in high areas is generally better than in low areas. Therefore, tea plantations in Indonesia are found at a reasonably wide elevation range, around 400-2,000 meters above sea level.

Planted area

There are two main varieties of tea (Camellia sinensis) that are commercially cultivated in Indonesia, namely the C. sinensis variety and the C. assamica variety. The small-leaf teas, which have incomparable aromas and a hardiness that allows them to adapt to harsher climates belong to the sinensis strain. Meanwhile, the large-leaf teas come from the assamica strain. The Indonesian sinensis variety was derived from Japan and introduced in Indonesia in 1684, while assamica variety was imported from Sri Lanka and planted in Indonesia in 1877. The different characteristics of these varieties can be seen in Table 1).

The tea plant in Indonesia is cultivated by two management systems, namely estate crops company and smallholder tea farming. Estate crops company is a company in the form of a legal business entity which is engaged in the cultivation of estate crops on land controlled for economic/commercial purposes and obtains a business permit from the competent agency in granting estate crops business license. This estate crops management comprises of state-owned and private companies. Moreover, smallholder farming is managed by households and is not in the form of a legal business entity. The highest planted area of tea farming in Indonesia was smallholders, followed by state-owned enterprises and private companies (Figure 1).

In the last five-years (2016-2020), the planted area of tea had slightly decreased about 0.19% annually. The planted area of state enterprises increased by about 4.31% per year, while private and smallholder farms decreased by 5.22% and 0.58% per year, respectively (Table 3). The planted areas of tea in Indonesia are concentrated in the islands of Java (87.47%) and Sumatra (12.53%). It comprises of five provinces in Java (Banten, West Java, Central Java, Yogyakarta, and East Java) and another five provinces in Sumatra (North Sumatra, West Sumatra, Jambi, South Sumatra, and Bengkulu). The highest share of tea planted area was West Java, while the lowest was Banten, i.e., 77.65% and 0.08%, respectively (Figure 2).

In 2020, the total planted area of tea in Indonesia was 112,602 hectares comprising state owned farms (38,838 ha), private farms (22,594 hectares), and smallholder farms (51,170 ha). The smallholder farm was only found in six provinces, namely West Sumatra, Banten, West Java, Central Java, Yogyakarta, and East Java (Table 2).

From 2016 to 2020, the trend of tea farms was slightly decreased by about 0.19% annually. It was due to decreasing planted areas of private and smallholder farms, i.e., 5.22% and 0.58% per year, respectively. However, the growth trend of state farms was increased by about 4.31% per year (Table 3).

Production

There are three production categories of tea crops in Indonesia, namely: (1) Mature crops; (2) Unproductive/damaged crops; and (3) Immature crops. Most of tea crops in the country were under the mature category; however, the unproductive/damaged crops category was still quite high (Figure 3).

The production of Indonesian tea in the last five years (2016-2020) slightly decreased by about 1.92% per year, namely from 138,935 tons in 2016 to 128,017 tons in 2020 (Table 4). The production growth trend of smallholder farms positively increased by about 1.04%. Meanwhile, the production growth trends of state and private farms respectively decreased (-1.82% and -5.95%).

Indonesia has been recorded as the 8th largest tea production globally. The prominent world’s tea-producing countries can be seen in Table 5. The contribution of Indonesia to the world’s tea production was about 2.79%. Regionally, Indonesia is the second-largest tea production in ASEAN countries, after Vietnam.

The average productivity of tea in Indonesia was 1,136 kilograms per hectare in 2020. This productivity was slightly decreased by about 1.70% per year, namely from 1,223 kilograms in 2016. In aggregate, the productivity of state farm (1,504 kg/ha) was higher than that of private farms (1,380 kg/ha). The lowest productivity was smallholder farms, namely 953 kilograms per hectare. However, the growth trend of smallholder farms from 2016 to 2020 had increased by about 1.63%. The smallholder farms were slightly better than private and state farms, which was negative during the same period. Detailed productivity of tea in Indonesia can be seen in Table 6.

According to Atlasbig.com (2020), the productivity of Indonesian tea (1,248 kg/ha) was lower than the world’s selected tea-productivity countries (1,510 kg/ha). The highest tea productivity was in Iran (5,913 kg/ha), and the lowest was in Nepal (867 kg/ha). Refer to figure 4, it notes that the productivity of tea in Indonesia was relatively similar to that of Taiwan (1,264 kg/ha).

Consumption

As an aromatic beverage, tea is consumed by people in many countries globally. Tea is produced from the young shoots of the tea crops. Tea leaf products can be different from each other because of diverse processing methods. When the dried tea leaves are brewed with hot water, it will cause a different distinctive aroma and taste. Therefore, based on post-harvest handling, tea products are classified into four types, namely: (1) Green tea; (2) Black tea; (3) Oolong tea; and (4) White tea (Table 7).

The average consumption of tea in Indonesia was about 370 milligrams per capita per year (Figure 5). The country’s consumption tended to decrease by about 14.91% per year, namely 610 milligrams per capita in 2014 to 290 milligrams per capita in 2018. The Indonesian tea consumption was lower than average global tea consumption (750 mg/capita/year).

Due to lower consumption of tea in Indonesia (compared to the global tea consumption), the government of Indonesia (GoI) has projected to increase tea consumption in the country. The projection of tea consumption will be aggregately increase by about 1.40% per year, namely form 119,208 tons in 2019 to 126,430 tons in 2023 (Figure 6).

INDONESIAN TEA MARKET OUTLOOK

Tea has an important role in the national economy, generating employment, farmers' income, and foreign exchange, encouraging agroindustry, and conserving the environment. Apart from increasing export opportunities, the domestic tea market is still quite promising, although it has not been explored optimally. By diversifying tea products, there will be a potential market following the lifestyles and tastes of people. Tea is not only for drinks but also for cosmetics, health products and other purposes.

Domestic market

Most of Indonesia's tea production is exported to foreign countries and the rest is marketed domestically. The majority of the tea exported to overseas countries is of high-quality tea leaves, therefore leaving only medium to low-quality tea leaves for the domestic market.

There has been an increased demand from Indonesia’s domestic market in recent years, especially from the beverage industry where packaged and ready-to-serve tea are quite popular among the country’s youth. According to the Indonesian Tea Association (ATI), the total sales of domestic processed tea products reached an average of IDR10 billion (US$74,427) on a yearly basis which is five times higher than that of exports (GBG, 2016).

Domestic market of tea is still not evenly distributed throughout Indonesia, since the shipping costs from the central producing areas (Java and Sumatra) are relatively high. Consequently, the aggregate nationwide price of domestic tea was quite expensive. It was higher than the average of international tea price (Figure 7).

There are three tea products that are commonly marketed in Indonesia. It includes brewed tea, tea bags, and ready-to-drink tea. The description of each product is presented in Table 8.

Indonesian tea is used as a mixture or blend, not yet known as a single-origin tea which has its own characteristics. Indonesian tea for the local market is dominated by low-quality tea with very low selling prices from farmers. In general, public knowledge about the quality of tea and good brewing methods for consuming tea is still low. Based on the Indonesian stereotypes, tea is perceived to be under the cheap drink category. Currently, however, the use of brewed tea tends to decrease and is being replaced by tea bags and ready-to-drink tea and, then the choice of tea substitute drinks is increasing.

It notes that there has been an increased demand from Indonesia’s domestic market in recent years, especially from the beverage industry where packaged, ready-to-serve tea drinks have been quite popular among the country’s youth. Unfortunately, the lack of supply has forced the domestic downstream industry to import to keep up with the ever-increasing demand.

Export and import

Indonesia’s tea export and import comprise of green tea leaves, and fermented black tea with specific Harmonized Commodity Description and Coding System (HS Code). The classification of tea export and import based on HS Code description is presented in Table 9.

The tea export from Indonesia was higher than that of import (Table 10). Comparatively, the respective ratio of Indonesia tea export and import was 65%, and 35% per year (2014-2018), the growth trend of export tended to decrease by about 7.80% per year. Conversely, the growth trend of imports was increased by about 8.32% annually. It is because the price of imported tea was cheaper than domestic tea price. Among other things, it is inseparable from the low import duty rates for tea imports.

The import duty on tea to Indonesia is only 20%, much lower than the 40% standard set by the World Trade Organization (WTO). Comparatively, other countries in Asia, such as Vietnam implement import duty rates of up to 50%. Moreover, India and China 114% and 100% of tea imports, respectively (Kompas.id, 2020).

The destination and origin countries of Indonesian tea export and import can be seen in Table 11. The highest tea export was to Malaysia, while the largest tea import was from Vietnam. Almost one-fifth of Indonesian tea exports to Malaysia and more than half of imported tea in Indonesia derive from Vietnam.

PERSPECTIVE OF INDONESIAN TEA DEVELOPMENT

Tea is one of the leading spice and refreshment commodities in Indonesia. The development of tea is strategically implemented in order to fulfill domestic and international markets through improving the quantity and quality of its production. This is based on sustainable production in line with equitable, viable, and bearable socioeconomic and environmental developments. It is reasonable since the existence of tea is essential in line with generating the employment and income sources especially for farmers, encouraging the agroindustry and agribusiness both at the local and national level, enhancing the foreign exchange from import, and maintaining the environment. The role of tea in Indonesia is presented in Table 12.

Challenges

The challenges of tea development in Indonesia can be analyzed through three approaches, namely: (1) On-farm approach (farm production); (2) Off-farm approach (beyond the farm), and (3) Non-farm approach (outside the farm). Each approach has a specific depiction as discussed below.

Indonesian tea has been developed since Dutch colonialism around 18th century, and smallholder plantations began to develop in the 1980s. Due to a relative lack of development attention, the productivity of national tea tends to decrease. It was in line with declining planted areas and existing old/damaged tea plants in the country (Pusdatin, 2019). Refer to Table 6; the average productivity level for tea of smallholders is only around 900 kilogram/hectare, far below the ideal figure of 2,500 kilograms per hectare. Moreover, the average land ownership of each smallholder is comparatively low at only 0.6 hectares per household (GBG, 2016).

The conversion of tea land has triggered a decline in smallholder, state, and private farms with an average of 1,113 hectares per year. As a result, tea plantations in Indonesia have decreased significantly over the last five years. Some farmers prefer to grow horticulture products which are more profitable than growing tea. On the other hand, domestic tea production costs are also quite high (Kompas.id, 2020).

Apart from declining planted area and productivity, the Indonesian tea farms lack the use of good seed quality and the implementation of good agricultural practices. Generally, tea seed derives from the Research Institute for Tea and Cinchona (RITC) which has slightly different characteristics among regions in terms of geographical indications[1].

Off-farm

As the 8th tea-producing country in the world, Indonesia has actually recorded the least amount of tea consumption in the world. The average daily drink of tea is only half a cup per person. In comparison, Turkey is ranked the 6th among the global tea-producing countries; the Turkish consumes 10 times more than Indonesians. In Turkey, the average person drinks five cups of tea a day (Liputan6.com, 2021).

The extent of tea consumption in Indonesia tends to be stuck namely in the middle position globally. Indonesian tea is used as a mixture or blend, not yet known as a single-origin tea which has its own branded characteristics. Tea for the local market is dominated by low-quality tea with cheap selling prices from farmers (Kompas.id, 2021).

Above all, lack of promotion is one of the main factors for low tea consumption in Indonesia. The promotion has been carried out in an unsystematic way in terms of strategic planning and implementation programs. It is still managed by individuals and companies that have packaged tea products.

Non-farm

The Indonesian tea price is lower because a large proportion of tea products are sold unbranded; moreover, high-intensity rainfall has also reduced their taste and quality. The lack of skilled human resources with knowledge of best agricultural practices as well as technology has resulted in poor quality products. That is why Indonesian tea prices, especially from smallholder farms are cheaper (GBG, 2016).

Recently, the export trend of tea from Indonesia tends to decrease. In the last 18 years, the volume of exports has decreased by more than half, namely from 105,581 tons in 2000 to 49,038 tons in 2017 (-3.1%/year). This situation caused the share of Indonesia's bulk tea export volume in the world market to decrease from 8% in 2000 to only 1.6% in 2018. On the other hand, the export share of other producing countries such as Kenya and Sri Lanka continue to increase by about 16.4% to 21.0% and 18.2% to 21.0%, respectively. This situation reflects the weakening competitiveness of Indonesian tea in the world market. Another problem is that Indonesian tea exports to Europe are still constrained by the strict requirements.

On the contrary, the tea import trend of Indonesia tends to increase due to low import duty rates. In fact, according to the Indonesian Tea Council, about 90% of tea imports are low-quality tea. Many consumers and beverage processors in Indonesia prefer the low quality and cheap price of tea (Kompas.id, 2020).

According to RPN (2021), tea consumption in the domestic market increased quite significantly. However, the area, production, and export of tea plantations in Indonesia have decreased while import has increased substantially (Box 1).

Box 1

Policy Priority for Indonesian Tea

During 2005-2018, tea consumption in the domestic market increased quite significantly by 4% per year, so that in 2018 tea consumption in Indonesia reached 105,000 tons or around 75% of the total national tea production. This should be a driving factor for improving the performance of national tea agribusiness, including the performance of the on-farm tea. However, it is required to secure the national tea farms. The area, production, and exports have decreased while imports have increased. If there were no specific policy, the Indonesian tea farms would remain in name or history in 2050.

To secure the national tea farms, there is a need to implement the priority policies. First, input subsidy policy, especially for superior seeds and urea fertilizer. Second, the policy to reduce the rate of tea imports through increasing import tariffs from 20% to 40% for industrial raw materials in accordance with the tariff bounding permitted by the World Trade Organization (WTO), and more than 40% for retail tea products, as well as the application of non-tariff measures, including halal certificate and organoleptic quality requirements, application of the mandatory Indonesian National Standard (SNI) for tea, Maximum Residue Limit (SNI 7313-2008), and firm application of rules for Indonesian tea origin. In addition, for countries that have already signed a Free Trade Area (FTA) agreement such as Vietnam, Thailand, and India with the ASEAN – India Free Trade Area (AIFTA), which has been effective since 1st January 2010 and with China in the Regional Comprehensive the Economic Partnership (RCEP) which was signed on 15th November 2020, with tariffs that are still not harmonious for tea commodities, needs to be reviewed on the application of safeguard instruments. The implementation of non-harmonized import tariffs for tea commodities in the FTA will result in a flood of tea products from Vietnam, India, Thailand, and China. In 2018, tea imports from these four countries reached 73.3% of Indonesia's total tea imports.

Opportunities

By facing the above-mentioned problems, it is quite possible to revive the Indonesian tea industry to be able to compete in the global market since the country has a good quality and a distinctive aroma of teas. The global market demand will continue to increase, along with the increase in people's incomes, the growth of healthy lifestyles, and the diversification of tea production that is increasingly diverse and attractive.

Up to 2027, black tea production is projected to grow by an average of 2.2% per year to reach 4.42 million tons in 2027. Green tea grows an average of 7.5% annually and will reach 3.65 million tons in 2027. Tea exports are also projected to increase. Black and green teas are respectively estimated to reach 1.66 million tons and 605,455 tons in 2027 (Kompas.id, 2020).

Specifically, Indonesian tea can be developed based on its insight and outlook as presented in Box 2. Tea is widely consumed by people in the world. Along with the COVID-19 pandemic, in particular, there is a tendency that people attempt to improve their immunity by altering lifestyle-based-health through drinking habits. The study of Ekasari (2021) reveals that the majority (53.85%) of respondents confirmed that they were more concerned about the health benefits of the drinks they consumed. It seems that the change in consumption patterns has had a positive impact on efforts to revive Indonesian tea. The results of market observations, consumer research, and experience in the artisan tea business show certain trends.

Box 2

Indonesia tea 2022 insight and outlook: What’s in your cup-pa?

Trend 1: Artisan tea

Artisan tea includes tea (Camellia sinensis) mixed with other natural ingredients, used essential flavors and fragrances of certain types of fruit or flowers to enhance taste and aroma, other dry natural brewed ingredients of tea (tisane) such as several types of flowers (rose, lavender, jasmine, etc.); herbs (ginger, turmeric, lemongrass, betel leaf, sour soup leaf, etc.), and spices (wooden nut, star anise, black pepper, etc.).The existence of an online platform facilitates the market penetration of this artisan tea. Several young entrepreneurs who are engaged in coffee have also begun to taunt to introduce their creative concoctions to consumers, both in their cafés and in their online stores.

Trend 2: Delicious and healthy

Consumers tend to seek and select tea with certain functional benefits such as for weight loss and sleep as well as for other purposes related to a well-being lifestyle.

Trend 3: Coffee and Tea Café

More and more café entrepreneurs are realizing that the coffee market is getting saturated and their consumers want other types of drinks that are also premium class, such as specialty coffee that has become popular in the community. These young people diligently attend tea education classes to be able to serve artisan tea in their café.

Trend 4: Natural, artistic, and non-alcohol

Tea offers another advantage to generate the interest of café entrepreneurs and consumers. For instance, mocktail tea with the artistic beauty of colorful glasses provides creative space for baristas, instagrammable artistic beauty, and taste adventures for millennial and Gen Z consumers. Educational classes for tea mocktail are always full of enthusiasts. Another advantage is mocktail tea is non-alcoholic which safe for all ages and fulfills the rules of Islam, the religion of the majority of Indonesian.

Trend 5: Destinations

Tea is a pillar of a special place for establishing several startup outlets. These outlets generally offer a warm atmosphere, comfortable to chat, as well as furniture and light space ambiance. So that consumers feel at home to linger there. The products offered are a variety of teas in a warm dish or in the form of a tea mocktail.

CONCLUSIONS AND RECOMMENDATIONS

As the eighth top ten tea-producing countries in the world, the performance of domestic tea in Indonesia faces several problems. It includes the decreasing planted areas, lack of technology implementation, and low productivity. Moreover, the consumption of tea was lower than that of the international level. The tea export tended to decrease, while the import of tea has a tendency to increase.

It is recommended that the Indonesian tea industry should be developed through introducing high yield variety towards geographical indications requirement, implementing precision agriculture, campaigning for tea consumption, providing incentives for the domestic market, and escalating tea export promotion. The introduction of geographical indications; however, must be followed by facilitating incentives particularly for tea producers. These should be in line with the development of policies that would include protecting the national production, securing the domestic market, improving the quality requirements, formulating the price, and strengthening the farmer institution to achieve efficient and effective tea development programs in the country.

REFERENCES

Atlasbig.com. 2020. World tea production by country. Retrieved from: https://www.atlasbig.com/en-us/countries-by-tea-production (25 November 2021). United States.

BPS. 2019. Statistik Teh Indonesia 2019 (Indonesian Tea Statistics 2019). Badan Pusat Statistik Indonesia (Indonesian Bureau of Statistics). Jakarta.

DGEC. 2021. Statistik Perkebunan Unggulan Nasional 2019-2021 (Statistical of National Leading Estate Crops Commodity). Direktorat Jenderal Perkebunan (Directorate General of Estate Crops). Indonesian Ministry of Agriculture. Jakarta

Ekasari, I. 2021. Indonesia Tea 2022 Insight and Outlook: What’s in Your Cup-pa? Thought Leader, Pioneer, and Champion of Indonesian Artisan Tea. Bogor.

GBG. 2016. Indonesia’s Tea Industry: Bitter Supply amid Sweet Demand. Retrieved from: http://www.gbgindonesia.com/en/agriculture/article/2016/indonesia_s_tea_... (25 November 2021). Global Business Guide Indonesia. Jakarta.

ICECRD. 2010. Budidaya dan Pascapanen Teh (Tea Cultivation and Postharvest) Pusat Penelitian dan Pengembangan Perkebunan (Indonesian Center for Estate Crops Research and Development). Bogor.

ISICRI. 2019. Perbedaan Teh Varietas Assamica dan Sinensis (Difference between Assamica and Sinensis Tea Varieties. Info Teknology (Technology Info). Indonesian Industry and Freshener Crops Research Institute. Bogor.

Kompas.com. 2017. Kenapa Teh Indonesia Kalah Terkenal di Dunia daripada Kopinya? (Why is Indonesian tea less famous in the world than its coffee?). Retrieved from: https://travel.kompas.com/read/2017/12/06/07 1000127/kenapa-teh-indonesia-kalah-terkenal-di-dunia-daripada-kopinya- (24 November 2021). Kompas. Jakarta.

Kompas.com. 2020. Melihat Peluang Industri Teh Indonesia pada Masa Pandemi (Seeing the Opportunities of the Indonesian Tea Industry during the Pandemic). Retrieved from: https://www.kompas.com/food/read/2020/07/01/130700975/melihat-peluang-in... (24 November 2021). Kompas. Jakarta.

Kompas.id. 2020. Pasang Surut Teh Indonesia di Kancah Dunia (The Ups and Downs of Indonesian Tea in the World). Retrieved from: https://jelajah.kompas.id/ekspedisi-teh-nusantara/baca/pasang-surut-teh-indonesia-di-kancah-dunia/ (24 November 2021). Kompas. Jakarta.

Liputan6.com. 2021. Ironi Teh Indonesia, Produsen Terbesar tapi Konsumsinya Terendah di Dunia (The Irony of Indonesian Tea, the Largest Producer but the Lowest Consumption in the World). Retrieved from: https://www.liputan6.com/lifestyle/read/4563500/ironi-teh-indonesia-prod... (24 November 2021). Liputan 6. Jakarta.

MoA. 2013. Peraturan Menteri Pertanian Nomor 11 Tahun 2013 tentang Pedoman Teknis Pembangunan Kebun Perbanyakan Sumber Benih Teh (Regulation of the Minister of Agriculture Number 11/2013 concerning Technical Guidelines for the Development of Tea Seed Propagation Plantations). Indonesian Ministry of Agriculture. Jakarta.

MoA. 2014. Peraturan Menteri Pertanian Nomor 50 Tahun 2014 tentang Pedoman Teknis Budidaya Teh yang Baik (Regulation of the Ministry of Agriculture Number 50/2014 concerning Technical Guideline on Good Agriculture Practices for Tea). Indonesian Ministry of Agriculture. Jakarta.

MoLHR. 2019. Peraturan Menteri Hukum dan Hak Asasi Manusia Republik Indonesia Nomor 12 tahun 2019 tentang Indikasi Geografis (Regulation of the Minister of Law and Human Rights Number 12/2019 concerning Geographical Indications). Indonesian Ministry of Law and Human Rights. Jakarta.

Pusdatin. 2019. Outlook Komoditas Perkebunan Teh (Estate Crops Tea Commodity Outlook). Pusat Data dan Informasi Pertanian (Center for Agricultural Data and Information System). Indonesian Ministry of Agriculture. Jakarta.

RITC. 2021. Analisis Kinerja dan Prospek Komoditas Teh (Performance and Prospect of Tea Analysis). Radar: Opini dan Analisis Perkebunan (Radar: Opinion and Estate Crops Analysis), Volume 2, 1 January 2021. Pusat Penelitian Teh dan Kina (Research Institute for Tea and Cinchona). Riset Perkebunan Nusantara (Nusantara Estate Crops Research). Bandung.

RPN. 2021. Prioritas Kebijakan Komoditas Teh untuk Penyelamatan Perkebunan Teh Nasional (Tea Commodity Policy Priority for Securing National Tea Plantation). RADAR: Opini dan Analisis Perkebunan (RADAR: Plantation Opinion and Analysis), Vol. 2, No. 2 February 2021. Riset Perkebunan Nusantara (Nusantara Plantation Research). Bogor.

WCO. 2021. Nomenclature and Classification of Goods. World Customs Organization. Brussels.

[1] Geographical Indications (GIs) indicate the area of origin of an item and product in line with geographical, environmental factors, including natural factors, human factors, or combining these two factors provides a certain reputation, quality, and characteristics to the goods and products produced. It is an exclusive right granted to the holders of registered GI, as long as the reputation, quality, and characteristics that are the basis for protecting the GIs still exist (MoLHR, 2019).