ABSTRACT

The Chinese government suspended releasing some important data on its pig industry, such as the total number of pigs, for October 2019 and thereafter. As a result, an investigation of the Chinese pig industry became more difficult. However, it is believed that the Chinese pig industry is on its way to a drastic change, following the outbreak of African Swine Fever in August 2018. By collecting and organizing available information, this paper describes the current situation of the Chinese pig industry. The most important finding of this paper is that advanced-type pig farmers, who have an advantage in protecting pigs from African Swine Fever, are now increasing their pork production rapidly by depriving traditional-type pig farmers of their market share. This also affects the feeds market because the main component of feeds for advanced-type pig farmers is corn, while that for traditional-type pig farmers is leftovers from human meals. China’s demands for feed corn are now skyrocketing.

INTRODUCTION

China is the biggest consumer, importer, and producer in the world pork market[1]. One of the biggest concerns in China’s pig industry is the spread of African Swine Fever (ASF). After China’s first case of ASF-infection which appeared in August 2018, ASF has been spreading at an extremely high rate nationwide[2]. Thus, the Chinese pig industry has been attracting increased attention from food business people and researchers worldwide.

However, the Chinese government is now more reluctant to release information about its pork supply-demand conditions. In particular, the Chinese government suspended publicizing important data on the pig industry such as the total number of pigs for October 2019 and thereafter.

This does not mean that information on the Chinese pig industry is completely inaccessible. Because Takahashi (one of this paper’s authors) is fluent in Mandarin and has been engaged in the pork business for years, Takahashi has two advantages in accessing data on the Chinese pig industry: one is his personal business network in China and the other is a deep knowledge of various documents (including those written in Mandarin), some of which are unfamiliar to most academicians in spite of their usefulness. Based on these documents, this paper aims to provide up-to-date information on the Chinese pig industry.

TWO TYPES OF CHINA’S PIG FARMERS

There are two types of Chinese pig farmers: traditional type (small-sized) and advanced type (large-sized)[3]. A traditional-type pig farmer grows various crops (and sometimes other livestock, such as chickens, cows, and goats) besides raising pigs on a small farmland and open space around his or her house (pig raising is only a part of their agricultural activities). He or she feeds a small number of pigs mainly on leftovers from people’s meals. Generally, traditional-type farmers are old-fashioned and, therefore, often ignore the Chinese government’s regulations on the shipping of pigs and maintaining hygiene of pigpens.

By contrast, advanced-type pig farmers are at the cutting edge in pig raising worldwide. Advanced-type pig farmers have large-size factory-style pigpens and they are serious about keeping pigs isolated from pathogenic bacteria and viruses[4]. Pigs at advanced-type pig farmers are mainly fed with corn[5], not leftovers from people’s meals. Advanced-type pig farmers are so conspicuous that they cannot avoid the Chinese government’s regulations.

In order to improve the pig industry and the pork market, the Chinese government promotes advanced-type pig farmers to replace the traditional-type pig farmers. If a pig farm satisfies the following four conditions, it is called a “model pig farm” and receives subsidies from the Chinese government[6]: (1) the total number of sows is 300 or more, (2) the total number of pigs shipped to slaughterhouses in a year is 5,000 or more, (3) the farm is strict in monitoring regulations on pig raising, and (4) there have been no cases of serious pig diseases on the farm in the past two years.

Notes: Within parentheses is percentage to the total.

Source: Xinhua News Agency http://www.xinhuanet.com/fortune/2019-09/03/c_1124952603.htm

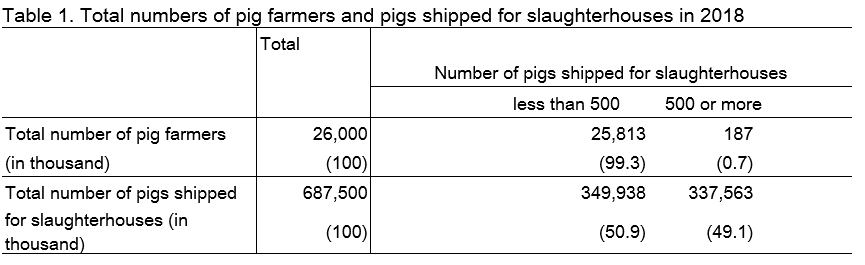

Table 1 shows the total number of pig farmers and the total number of pigs shipped to slaughterhouses by the two types of scale (measured according to whether the total number of pigs shipped to slaughterhouses in a year is over 499) as of 2018. It is impossible for a traditional-type pig farmer to ship more than 499 pigs in a year. Thus, all the pig farmers in the larger size group in Table 1 are considered to be advanced-type pig farmers while the smaller size group consists of both advanced-type and traditional-type pig farmers. As can be seen in Table 1, the larger size group shares 49.1% of pork production while they share only 0.7% of the total number of farmers.

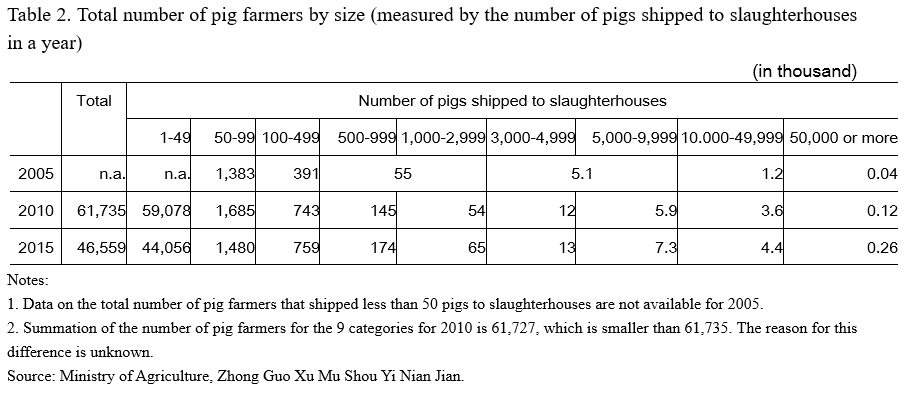

Table 2 shows that extremely large-size pig farmers who are increasing quickly while their share of the total number of pig farmers is still small. Considering the strong supply ability (as implied in Table 1) of large-size farmers, all of whom are advanced-type pig farmers, it is safe to say that extremely large-size pig farmers are in a leading position in the Chinese pig industry.

In Table 2, it should be safe to assume all the traditional-type pig farmers are included in the group of “pig farmers who shipped less than 50 pigs to slaughterhouses” and no advanced-type pig farmers are included in this category. Thus, Table 2 shows that the total number of traditional-type pig farmers started declining even before the outbreak of ASF. The ASF pandemic can be seen as a powerful accelerator for this decline.

SPREAD OF AFRICAN SWINE FEVER IN CHINA

ASF is a communicable disease among pigs and boars (ASF does not affect human beings). It spreads by oral and nasal infection (ticks can be a vector). The ASF virus persists in pork products, such as sausage and ham. If pigs eat ASF-infected pork products in leftovers from people’s meals, the ASF virus will be transmitted. Thus, the risk of ASF infection is much higher for traditional-type pig farmers than for advanced-type pig farmers.

Once infected, the mortality rate is quite high (almost 100%). The first case of ASF-infection in China was in a pig farm in Liaoning Province on August 3, 2018. Within only nine months, ASF spread to all of the provinces, autonomous districts, and direct-controlled cities in China[7].

Pig farmers in China are obliged to report to the Chinese government if they find any suspicious cases of ASF infection. If infection is verified, all the pigs in the farm should be immediately culled in order to exterminate the virus and the Chinese government pays financial compensation to the farmer. However, this system does not work well because the coverage of the Chinese government’s compensation is often insufficient. In addition, the Chinese government does not have sufficient surveillance over traditional-type pig farmers. As a result, a traditional-type farmer who finds a suspicious case in his (or her) pigpens tends to conceal the fact and quickly ships his or her pigs (including piglets) to slaughterhouses and/or other pig farmers. This is alleged to be one of the major reasons for the high rate of spread of ASF in China.

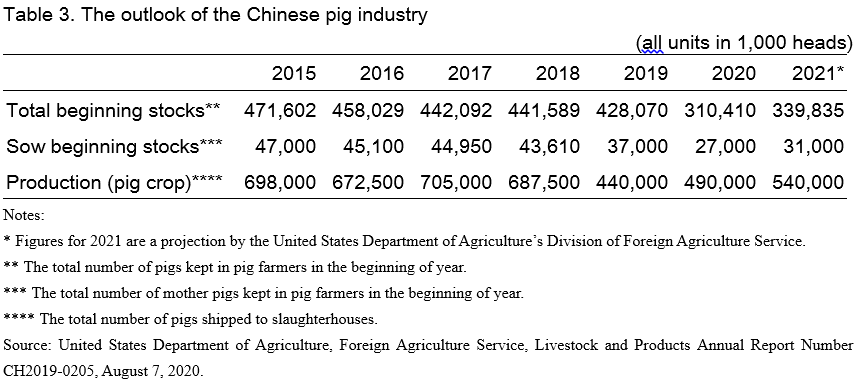

The United States Department of Agriculture (USDA) provides its own estimates on China’s pig industry, as shown in Table 3 (USDA does not provide detailed information on methodologies and data sources of these estimates). There, the total number of sows (kept in pig farms) declined by nearly 15 % between 2018 and 2019. This means that many pig farmers gave up raising pigs in 2018, probably because of the outbreak of ASF. Interestingly, in the USDA’s prospect, the Chinese pig industry hit its bottom in 2019 and is now on its way to a sharp recovery.

RECENT INFORMATION ON CHINA’S PIG INDUSTRY

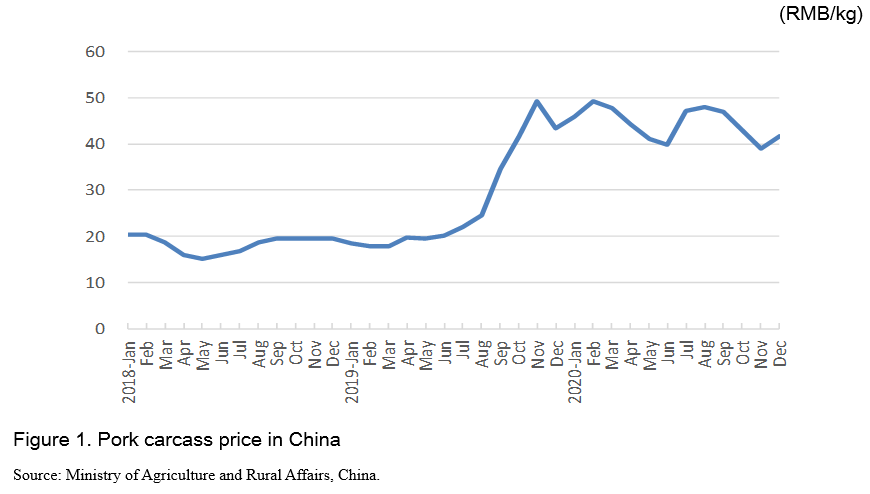

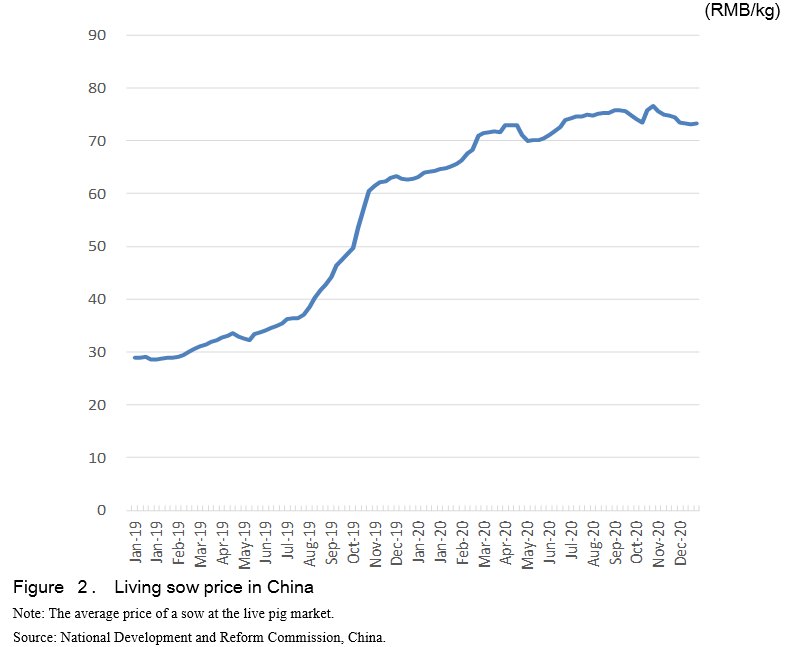

As mentioned above, the Chinese government became more secretive about the information on the pig industry in October 2019. Nevertheless, we can find data on the average price of pork carcasses and the average price of a sow (at the live pig market), as can be seen in Figures 1 and 2, respectively. As a result of the spread of ASF, traditional-type pig farmers became hastier in shipping pigs (including sows) to slaughterhouses because they feared having their pigs infected by ASF. This pork supply increase should be called a short-term effect because it will die out over time. Simultaneously, the acceleration of shipping pigs (including sows) to slaughterhouses killed the ability of further pig production. Because these two factors canceled each other out, pork carcass prices remained stable until July 2019, as can be seen in Figure 1. However, since then, the carcass price has been at a high level. This means that the abovementioned short-run effect died out around July 2019. This pattern is also observable in Figure 2. While the total number of sows decreased, the price of sows was stable until around July 2019. This is because, based on the spread of ASF, the number of those who quit raising pigs increased, which meant a decline in the demand for sows. This exit effect also died out around July 2019. Since then, the price of sows has been at a high level.

MARKET PROSPECTS

Since the current carcass price is at a high level, our interviews with Chinese business people proved that advanced-type pig farmers’ willingness to increase their production is strong. However, this does not mean their production will increase immediately. It takes nearly eight months from the birth of a female pig to get the first fertilization. As a gestation period, sows need two months to give birth (on average, a sow has 7 piglets per pregnancy). Next, another six months are necessary for fattening before their shipment to slaughterhouses. Even if an advanced-type farmer wants to increase their shipment of pigs to slaughterhouses, it takes at least 16 months to do so.

In addition, there are two more hurdles for increasing pig production. First, in order to minimize the risk of ASF (and other diseases), professional training for workers and installment of special facilities are necessary. Second, the Chinese government’s requirements for environmental protection on pig farms are getting stricter.

The exit of traditional-type pig farmers from pig raising will also continue. Accordingly, it is expected that the carcass price will stay at a high level for a while in spite of advanced-type pig farmers’ strong willingness to increase their production.

In the long run, the number of pigs in the advanced-type pig farms will keep increasing while that in traditional-type pig farms will keep decreasing. This induces a transition of the type of feeds for pork. Specifically, corn is now taking the place of leftovers from people’s meals as the primary type of feeds. As can be seen in Figure 3, corn prices in the Chinese domestic market started increasing in July 2020 and have continued to increase.

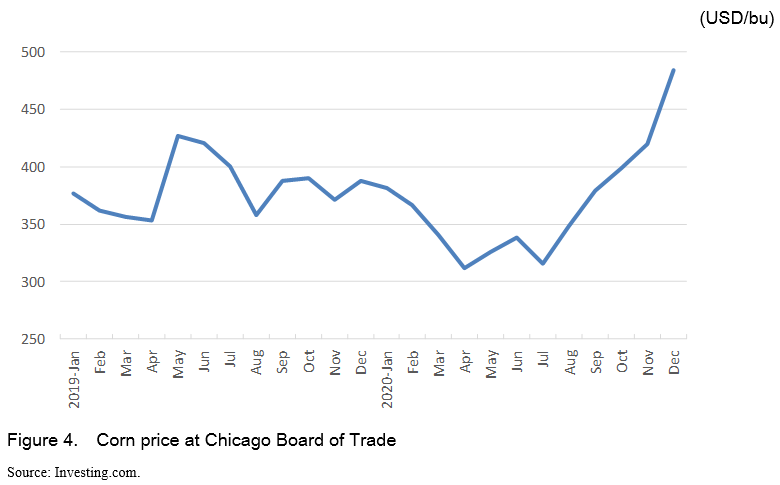

Until 2015, China’s self-sufficiency in corn had been almost 100%[8]. However, according to the increasing feed corn demands, China is now showing strong demands for corn in the international market. As can be seen in Figure 4, corn prices in the international market also started rising in July 2020[9]. Consequently, China will become a major importer of corn in the international market[10].

CONCLUSION

China is a mammoth player in the international pork market. After the outbreak of ASF in China, a drastic structural change has been taking place in the Chinese pig industry, that is, the rapid replacement of traditional-type pig farmers with advanced-type pig farmers. Since advanced-type pig farmers mainly feed pigs with corn, feed corn demands are skyrocketing. As a result, China is also going to be a mammoth player in the international corn market[11].

REFERENCES

Mihara, W. and M. Isa, “Chugoku no Yoton wo Meguru Doko to Kankyo Kisei Kyoka no Eikyo (The Current Situation of the Chinese Pig Industry and the Impacts of the New Regulations for Environmental Protection),” Chikusan no Joho (Agriculture & Livestock Industries Corporation) April 2018.

Ministry of Agriculture, Forestry, and Fisheries, Minister's Secretariat, International Policy Planning Division, Japan “Chugoku no Shokryo Anzdn Hosho Seisaku to Shokuryo Yunyu (Food Security Policy and Food Imports in China),” March 2016.

Shen, J., “Changes after Import Liberalization and the Future of China’s Soybean,” The Natural Resource Economics Review (Kyoto University) 19, March 2014.

Takahashi, H. and Y. Godo, “Technical Problems on Japan’s Pork Imports from the US,” FFTC Agricultural Policy Database (Food & Fertilizer Technology Center for the Asian and Pacific Region) June 28, 2019.

United States Department of Agriculture (USDA). Foreign Agriculture Service, Livestock and Poultry: World Markets and Trade, October 2020.

[1] According to USDA (2020), China shares 38.8%, 43.8%, and 44.4 % of the world pork production, consumption, and imports, respectively, in 2018.

[2] Takahashi and Godo (2019) provide details about how ASF spread in China.

[3] The Chinese government does not draw a clear boarder line between the two types of pig farmers. There are cases that fall in the gray zone between the two types (for example, in some cases, while a number of pigs is small, a farmer feed them with commercial feeds). However, in order to simplify discussion, this paper focuses on only the two types.

[4] For example, every time workers enter pigpens, they have to receive disinfection. Workers’ shoes, apparel, and instruments are also under strict hygiene maintenance

[5] Commercial feeds for pigs contain not only corn but also other crops such as soybeans. However, corn is the most popular as the chief ingredient of feeds for pigs. In fact, the Chinese government uses the ratio between pig carcass price and corn price as one of the most important indicators in policymaking for the pig industry (for example, see https://www.ceicdata.com/zh-hans/china/livestock-breeding-condition/cn-pig-to-feedstuff-ratio). This is why this paper focuses on corn instead of other ingredients for feeds.

[6] Mihara and Isa (2018) discuss more on the system of the “model pig farm.”

[7] On April 23, 2019, ASF-infected pigs were found in Hainan Province, which had been the only ASF-free province in China.

[8] USDA, FAS, PSD Online

[9] The international soybean price also started rising in July 2020. A part of this rise should be attributable to the increase of demands for feeds for pigs. However, it should be noted that the soybean price reflects lots of factors such as demands for cooking oil and that the portion of soybeans in feeds for pigs is much smaller than that of corn.

[10] In fact, China has previously presented a similar performance for soybeans. Until 1995, China had been almost self-sustaining in terms of soybeans. However, after the liberalization of soybean imports in 1996, China’s soybean imports increased drastically. In the middle of the 2010s, China’s self-sufficiency in soybeans was around 10 % and China shares nearly 60 % in the world soybean imports. See Shen (2014) and Ministry of Agriculture, Forestry and Fisheries (2016). According to estimates of the Chinese Academy of Agricultural Science, China’s self-sufficiency for corn for 2019 was 99 % (https://finance.sina.com.cn/money/future/agri/2020-06-05/doc-iirczymk539...). However, China is turning to rely on corn imports recently. According to FAS, USDA, China corn imports for 2020/21 (October-September) are estimated to be 17.5 million tons, the second largest after the European Union (https://apps.fas.usda.gov/psdonline/circulars/grain.pdf).

[11] It is alleged that corn prices and wheat prices synchronize at the international market. If so, China’s pig industry would affect the world wheat market too.

Structural Changes in the Chinese Pig Industry after the Outbreak of African Swine Fever

ABSTRACT

The Chinese government suspended releasing some important data on its pig industry, such as the total number of pigs, for October 2019 and thereafter. As a result, an investigation of the Chinese pig industry became more difficult. However, it is believed that the Chinese pig industry is on its way to a drastic change, following the outbreak of African Swine Fever in August 2018. By collecting and organizing available information, this paper describes the current situation of the Chinese pig industry. The most important finding of this paper is that advanced-type pig farmers, who have an advantage in protecting pigs from African Swine Fever, are now increasing their pork production rapidly by depriving traditional-type pig farmers of their market share. This also affects the feeds market because the main component of feeds for advanced-type pig farmers is corn, while that for traditional-type pig farmers is leftovers from human meals. China’s demands for feed corn are now skyrocketing.

INTRODUCTION

China is the biggest consumer, importer, and producer in the world pork market[1]. One of the biggest concerns in China’s pig industry is the spread of African Swine Fever (ASF). After China’s first case of ASF-infection which appeared in August 2018, ASF has been spreading at an extremely high rate nationwide[2]. Thus, the Chinese pig industry has been attracting increased attention from food business people and researchers worldwide.

However, the Chinese government is now more reluctant to release information about its pork supply-demand conditions. In particular, the Chinese government suspended publicizing important data on the pig industry such as the total number of pigs for October 2019 and thereafter.

This does not mean that information on the Chinese pig industry is completely inaccessible. Because Takahashi (one of this paper’s authors) is fluent in Mandarin and has been engaged in the pork business for years, Takahashi has two advantages in accessing data on the Chinese pig industry: one is his personal business network in China and the other is a deep knowledge of various documents (including those written in Mandarin), some of which are unfamiliar to most academicians in spite of their usefulness. Based on these documents, this paper aims to provide up-to-date information on the Chinese pig industry.

TWO TYPES OF CHINA’S PIG FARMERS

There are two types of Chinese pig farmers: traditional type (small-sized) and advanced type (large-sized)[3]. A traditional-type pig farmer grows various crops (and sometimes other livestock, such as chickens, cows, and goats) besides raising pigs on a small farmland and open space around his or her house (pig raising is only a part of their agricultural activities). He or she feeds a small number of pigs mainly on leftovers from people’s meals. Generally, traditional-type farmers are old-fashioned and, therefore, often ignore the Chinese government’s regulations on the shipping of pigs and maintaining hygiene of pigpens.

By contrast, advanced-type pig farmers are at the cutting edge in pig raising worldwide. Advanced-type pig farmers have large-size factory-style pigpens and they are serious about keeping pigs isolated from pathogenic bacteria and viruses[4]. Pigs at advanced-type pig farmers are mainly fed with corn[5], not leftovers from people’s meals. Advanced-type pig farmers are so conspicuous that they cannot avoid the Chinese government’s regulations.

In order to improve the pig industry and the pork market, the Chinese government promotes advanced-type pig farmers to replace the traditional-type pig farmers. If a pig farm satisfies the following four conditions, it is called a “model pig farm” and receives subsidies from the Chinese government[6]: (1) the total number of sows is 300 or more, (2) the total number of pigs shipped to slaughterhouses in a year is 5,000 or more, (3) the farm is strict in monitoring regulations on pig raising, and (4) there have been no cases of serious pig diseases on the farm in the past two years.

Notes: Within parentheses is percentage to the total.

Source: Xinhua News Agency http://www.xinhuanet.com/fortune/2019-09/03/c_1124952603.htm

Table 1 shows the total number of pig farmers and the total number of pigs shipped to slaughterhouses by the two types of scale (measured according to whether the total number of pigs shipped to slaughterhouses in a year is over 499) as of 2018. It is impossible for a traditional-type pig farmer to ship more than 499 pigs in a year. Thus, all the pig farmers in the larger size group in Table 1 are considered to be advanced-type pig farmers while the smaller size group consists of both advanced-type and traditional-type pig farmers. As can be seen in Table 1, the larger size group shares 49.1% of pork production while they share only 0.7% of the total number of farmers.

Table 2 shows that extremely large-size pig farmers who are increasing quickly while their share of the total number of pig farmers is still small. Considering the strong supply ability (as implied in Table 1) of large-size farmers, all of whom are advanced-type pig farmers, it is safe to say that extremely large-size pig farmers are in a leading position in the Chinese pig industry.

In Table 2, it should be safe to assume all the traditional-type pig farmers are included in the group of “pig farmers who shipped less than 50 pigs to slaughterhouses” and no advanced-type pig farmers are included in this category. Thus, Table 2 shows that the total number of traditional-type pig farmers started declining even before the outbreak of ASF. The ASF pandemic can be seen as a powerful accelerator for this decline.

SPREAD OF AFRICAN SWINE FEVER IN CHINA

ASF is a communicable disease among pigs and boars (ASF does not affect human beings). It spreads by oral and nasal infection (ticks can be a vector). The ASF virus persists in pork products, such as sausage and ham. If pigs eat ASF-infected pork products in leftovers from people’s meals, the ASF virus will be transmitted. Thus, the risk of ASF infection is much higher for traditional-type pig farmers than for advanced-type pig farmers.

Once infected, the mortality rate is quite high (almost 100%). The first case of ASF-infection in China was in a pig farm in Liaoning Province on August 3, 2018. Within only nine months, ASF spread to all of the provinces, autonomous districts, and direct-controlled cities in China[7].

Pig farmers in China are obliged to report to the Chinese government if they find any suspicious cases of ASF infection. If infection is verified, all the pigs in the farm should be immediately culled in order to exterminate the virus and the Chinese government pays financial compensation to the farmer. However, this system does not work well because the coverage of the Chinese government’s compensation is often insufficient. In addition, the Chinese government does not have sufficient surveillance over traditional-type pig farmers. As a result, a traditional-type farmer who finds a suspicious case in his (or her) pigpens tends to conceal the fact and quickly ships his or her pigs (including piglets) to slaughterhouses and/or other pig farmers. This is alleged to be one of the major reasons for the high rate of spread of ASF in China.

The United States Department of Agriculture (USDA) provides its own estimates on China’s pig industry, as shown in Table 3 (USDA does not provide detailed information on methodologies and data sources of these estimates). There, the total number of sows (kept in pig farms) declined by nearly 15 % between 2018 and 2019. This means that many pig farmers gave up raising pigs in 2018, probably because of the outbreak of ASF. Interestingly, in the USDA’s prospect, the Chinese pig industry hit its bottom in 2019 and is now on its way to a sharp recovery.

RECENT INFORMATION ON CHINA’S PIG INDUSTRY

As mentioned above, the Chinese government became more secretive about the information on the pig industry in October 2019. Nevertheless, we can find data on the average price of pork carcasses and the average price of a sow (at the live pig market), as can be seen in Figures 1 and 2, respectively. As a result of the spread of ASF, traditional-type pig farmers became hastier in shipping pigs (including sows) to slaughterhouses because they feared having their pigs infected by ASF. This pork supply increase should be called a short-term effect because it will die out over time. Simultaneously, the acceleration of shipping pigs (including sows) to slaughterhouses killed the ability of further pig production. Because these two factors canceled each other out, pork carcass prices remained stable until July 2019, as can be seen in Figure 1. However, since then, the carcass price has been at a high level. This means that the abovementioned short-run effect died out around July 2019. This pattern is also observable in Figure 2. While the total number of sows decreased, the price of sows was stable until around July 2019. This is because, based on the spread of ASF, the number of those who quit raising pigs increased, which meant a decline in the demand for sows. This exit effect also died out around July 2019. Since then, the price of sows has been at a high level.

MARKET PROSPECTS

Since the current carcass price is at a high level, our interviews with Chinese business people proved that advanced-type pig farmers’ willingness to increase their production is strong. However, this does not mean their production will increase immediately. It takes nearly eight months from the birth of a female pig to get the first fertilization. As a gestation period, sows need two months to give birth (on average, a sow has 7 piglets per pregnancy). Next, another six months are necessary for fattening before their shipment to slaughterhouses. Even if an advanced-type farmer wants to increase their shipment of pigs to slaughterhouses, it takes at least 16 months to do so.

In addition, there are two more hurdles for increasing pig production. First, in order to minimize the risk of ASF (and other diseases), professional training for workers and installment of special facilities are necessary. Second, the Chinese government’s requirements for environmental protection on pig farms are getting stricter.

The exit of traditional-type pig farmers from pig raising will also continue. Accordingly, it is expected that the carcass price will stay at a high level for a while in spite of advanced-type pig farmers’ strong willingness to increase their production.

In the long run, the number of pigs in the advanced-type pig farms will keep increasing while that in traditional-type pig farms will keep decreasing. This induces a transition of the type of feeds for pork. Specifically, corn is now taking the place of leftovers from people’s meals as the primary type of feeds. As can be seen in Figure 3, corn prices in the Chinese domestic market started increasing in July 2020 and have continued to increase.

Until 2015, China’s self-sufficiency in corn had been almost 100%[8]. However, according to the increasing feed corn demands, China is now showing strong demands for corn in the international market. As can be seen in Figure 4, corn prices in the international market also started rising in July 2020[9]. Consequently, China will become a major importer of corn in the international market[10].

CONCLUSION

China is a mammoth player in the international pork market. After the outbreak of ASF in China, a drastic structural change has been taking place in the Chinese pig industry, that is, the rapid replacement of traditional-type pig farmers with advanced-type pig farmers. Since advanced-type pig farmers mainly feed pigs with corn, feed corn demands are skyrocketing. As a result, China is also going to be a mammoth player in the international corn market[11].

REFERENCES

Mihara, W. and M. Isa, “Chugoku no Yoton wo Meguru Doko to Kankyo Kisei Kyoka no Eikyo (The Current Situation of the Chinese Pig Industry and the Impacts of the New Regulations for Environmental Protection),” Chikusan no Joho (Agriculture & Livestock Industries Corporation) April 2018.

Ministry of Agriculture, Forestry, and Fisheries, Minister's Secretariat, International Policy Planning Division, Japan “Chugoku no Shokryo Anzdn Hosho Seisaku to Shokuryo Yunyu (Food Security Policy and Food Imports in China),” March 2016.

Shen, J., “Changes after Import Liberalization and the Future of China’s Soybean,” The Natural Resource Economics Review (Kyoto University) 19, March 2014.

Takahashi, H. and Y. Godo, “Technical Problems on Japan’s Pork Imports from the US,” FFTC Agricultural Policy Database (Food & Fertilizer Technology Center for the Asian and Pacific Region) June 28, 2019.

United States Department of Agriculture (USDA). Foreign Agriculture Service, Livestock and Poultry: World Markets and Trade, October 2020.

[1] According to USDA (2020), China shares 38.8%, 43.8%, and 44.4 % of the world pork production, consumption, and imports, respectively, in 2018.

[2] Takahashi and Godo (2019) provide details about how ASF spread in China.

[3] The Chinese government does not draw a clear boarder line between the two types of pig farmers. There are cases that fall in the gray zone between the two types (for example, in some cases, while a number of pigs is small, a farmer feed them with commercial feeds). However, in order to simplify discussion, this paper focuses on only the two types.

[4] For example, every time workers enter pigpens, they have to receive disinfection. Workers’ shoes, apparel, and instruments are also under strict hygiene maintenance

[5] Commercial feeds for pigs contain not only corn but also other crops such as soybeans. However, corn is the most popular as the chief ingredient of feeds for pigs. In fact, the Chinese government uses the ratio between pig carcass price and corn price as one of the most important indicators in policymaking for the pig industry (for example, see https://www.ceicdata.com/zh-hans/china/livestock-breeding-condition/cn-pig-to-feedstuff-ratio). This is why this paper focuses on corn instead of other ingredients for feeds.

[6] Mihara and Isa (2018) discuss more on the system of the “model pig farm.”

[7] On April 23, 2019, ASF-infected pigs were found in Hainan Province, which had been the only ASF-free province in China.

[8] USDA, FAS, PSD Online

[9] The international soybean price also started rising in July 2020. A part of this rise should be attributable to the increase of demands for feeds for pigs. However, it should be noted that the soybean price reflects lots of factors such as demands for cooking oil and that the portion of soybeans in feeds for pigs is much smaller than that of corn.

[10] In fact, China has previously presented a similar performance for soybeans. Until 1995, China had been almost self-sustaining in terms of soybeans. However, after the liberalization of soybean imports in 1996, China’s soybean imports increased drastically. In the middle of the 2010s, China’s self-sufficiency in soybeans was around 10 % and China shares nearly 60 % in the world soybean imports. See Shen (2014) and Ministry of Agriculture, Forestry and Fisheries (2016). According to estimates of the Chinese Academy of Agricultural Science, China’s self-sufficiency for corn for 2019 was 99 % (https://finance.sina.com.cn/money/future/agri/2020-06-05/doc-iirczymk539...). However, China is turning to rely on corn imports recently. According to FAS, USDA, China corn imports for 2020/21 (October-September) are estimated to be 17.5 million tons, the second largest after the European Union (https://apps.fas.usda.gov/psdonline/circulars/grain.pdf).

[11] It is alleged that corn prices and wheat prices synchronize at the international market. If so, China’s pig industry would affect the world wheat market too.