ABSTRACT

Japan has a unique (and complicated) pork import tariff system, called the gate price system. Under this system, importers can minimize their tariff payments by combining high-price (and high-quality) pork with low-price (and low-quality) pork to set the CIF price at 524 yen per kilogram (approximately 4.7 US dollars by converted at the 2018 average exchange rate). This puts US pork exporters at a disadvantage because the US is particularly strong worldwide in offering low-grade pork at a lower price but weak in offering high-quality pork that merits a higher price. This disadvantage was exacerbated after Japanese customs strengthened its inspections for tariff evasion in 2012. As a result, in contrast with other major pork exporters, US exports to Japan have been decreasing.

Keywords: gate price system, combination-type imports, tariff evasion, gray zone

INTRODUCTION

Japan’s share of world pork imports is almost 15%, and it is the second biggest world pork importer[i]. In addition, Japan’s self-sufficiency in pork is gradually declining, which reflects the poor condition of pork supply in the country[ii].

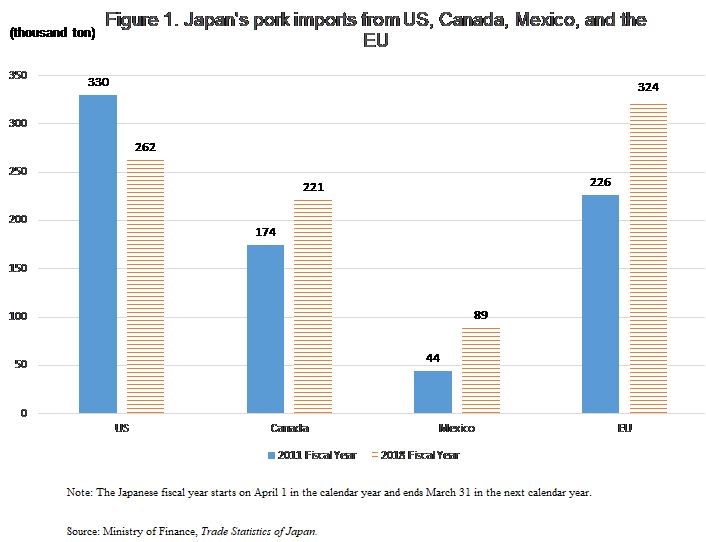

The US is the biggest exporter of pork to Japan[iii]. However, in contrast with other major pork exporters such as Canada, Mexico, and the EU, the US has been decreasing its exports to Japan since 2011 (Figure 1). What happened after 2011? Will the US keep declining its share in Japanese pork market? This paper aims to describe the technical problems of importing pork from the US to Japan and thereby, shed light on these questions.

For the reason of readability, this paper uses only Japanese yen for measuring values. The average exchange rate for 2018 is 1 US dollar = 110.5 yen.

JAPAN’S PORK TARIFF SYSTEM

Japan has a unique tariff system for pork imports, called the gate price system. The system is complicated, but its essence can be summarized by the following two points[iv]:

- If an importer reports the CIF price of pork as 524 yen per kilogram or higher at customs, customs collects a tariff of 4.3% of the CIF price.

- If an importer reports the CIF price of pork as 524 yen per kilogram or lower at customs, customs collects the gap between 546.53 yen per kilogram (546.53 = 1.043*524) and the CIF price per kilogram as a tariff (for example, if the CIF price is 300 yen per kilogram, customs collect 246.53 yen per kilogram as a tariff).

The CIF price of 524 yen per kilogram is called the gate price, where the tariff payment becomes the smallest (22.53 yen per kilogram). This system creates a troubling problem for importers because pork price differs according to the type of meat. Let us assume the following two cases[v].

Case A: an importer purchased a container of 1,000 kilograms of tenderloin pork at a CIF price of 800 yen per kilogram and a container of 1,000 kilograms of shoulder picnic at a CIF price of 248 yen per kilogram separately.

Case B (called ‘combination-type import’): an importer purchased a container of 2,000 kilograms of pork, which consists of 1,000 kilograms of tenderloin and 1,000 kilograms of shoulder picnic, at a CIF price of 524 yen per kilogram.

For both cases, the total value of pork (CIF-base) is 1,048,000 yen (1,0480,000 = 800*1,000 + 248*1,000 = 524*2,000). However, the total tariff payment differs between the two cases. An importer must pay 332,930 yen (332,930 = 800*1000*0.043 + (482.5-300)*1000) as tariff for Case A, while the tariff for Case B is only 45,064 yen (45,064 = 0.043*524*2,000). If an importer tries to reduce tariff payment by disguising Case A as Case B (which is referred to as ‘disguised combination-type imports’), this would be a case of tariff evasion.

It need not be said that a sense of respect for the law is important. However, it is also true that there are many ways of generating disguised combination-type imports, which are difficult for customs to detect. For example, by using an intermediary in a foreign country who purchases tenderloin and shoulder picnic separately and sells them to the importer, the importer can disguise Case A as Case B. Of course, customs are authorized to ask a court of law for a warrant to search a dubious importer and its related companies and investigate details of their businesses. However, this type of investigation consumes considerable resources. Thus, unless customs has a special reason to try to identify tariff evasion (for example, because customs already found convincing evidence of tariff evasion), it is generally expected that customs forces are cautious in embarking on serious investigation on a particular case of pork imports[vi].

In fact, most pork imports are reported at the CIF price of just under 524 yen per kilogram, which minimalizes the tariff payment (Figure 2). Considering the wide (and unpredictable) price fluctuations in the global pork market, achieving this level of stability of the CIF price is difficult, unless importers adopt some method of generating disguised combination-type imports. In real business practices, there are many cases that fall in a gray area between Case A and Case B. Many pork importers conduct their businesses in a gray zone.

.png)

DOTANI AND SHIBATA’S PORK TARIFF EVASION SCANDAL

On March 7, 2012, a major case of pork tariff evasion was uncovered. Namely, Kunihiro Dotani and Kenji Shibata were accused of evading 14 billion yen in tariffs for their pork imports. Their modus operandi is that, using foreign intermediaries, they procured foreign pork at around 300 yen per kilogram and disguised its price as 524 yen per kilogram at Japanese customs. This means that Dotani and Shibata evaded nearly 200 yen per kilogram of tariff for their pork imports.

Dotani and Shibata’s case is different from the case of disguised combination-type imports in the sense that Dotani and Shibata’s pork contained only cheap pork (i.e., worth less than 524 yen per kilogram). This type of tariff evasion is called ‘disguised non-combination-type imports’.

For years up until the exposure of this scandal, Dotani and Shibata’s companies had shared more than 10% of Japan’s total pork imports. Thus, mass media sensationalized this scandal. This incited some consumer groups and political parties to conduct their own investigations into pork importers, and they argued that many other pork importers were also doing disguised non-combination-type imports to escape customs’ detection of tariff evasion. It is not the authors’ intention to affirm that disguised non-combination-type imports were (and still are) rampant in Japan. Indeed, considering that pork importers are involved in various types of deals in multi-layered business networks, there is a large gray zone between a disguised price and a fair price. However, it is also true that the demand on behalf of Japanese ham and sausage makers for low-price pork was strong. Dotani and Shibata supplied to this demand but it is reasonable to hypothesize that there were many pork importers who were importing low-price pork in similar ways. This paper calls these imports ‘gray non-combination-type imports’ hereafter.

THE MINISTRY OF FINANCE’S CIRCULAR NOTICE TO CUSTOMS

Dotani and Shibata’s scandal led citizens to begin to distrust customs. As one of a number of remedial measures, on April 4, 2012, the Ministry of Finance issued a circular notice that customs should strengthen their investigations of pork imports. This paper calls this notice ‘the 2012 MOF notice’ hereafter.

In spite of the 2012 MOF notice, there have been no significant changes in the average CIF price for pork (i.e., it remains relatively constant at nearly 524 yen per kilogram) (Figure 2). Thus, the authors hypothesize that the meaning of the 2012 MOF notice is that customs should be more serious in preventing disguised (or gray) non-combination-type imports, while customs need not to change its attitudes towards the gray zone between Case A and Case B.

If the authors’ hypothesis is correct, the 2012 MOF notice gave strong motivation for those who were doing disguised (or gray) non-combination-type imports to replace their practice by combination-type imports. To do so, those importers need to purchase high-price (that is, high-grade) pork in addition to low-price pork in order to achieve a CIF price of 524 yen per kilogram. However, compared with other pork exporting countries, the US does not have the ability to produce high-price, high-grade pork. By contrast, the EU countries have name-brand pork such as Iberico pork, which wealthy families in Japan purchase at high prices as top-level pork. Mexico is a strong supplier of high-price high-grade dressed meat because Mexico has a large population of skilled craftsmen in the meat packing industry. Canada, which is much less populated than the US and, therefore, does not have as strong a demand for pork domestically, takes a more strategic approach to promoting high-quality high-price table pork at high-end Japanese supermarkets than the US.

In addition, the US pork market is so well-organized that price information is easy to obtain even for foreigners (including Japanese customs). Those who continue disguised (or gray) non-combination-type imports may prefer purchasing pork in some other country than the US, where price information is more difficult to obtain for foreigners (including Japanese customs), in order to minimize the risk of being accused of tariff evasion.

In sum, after the 2012 MOF notice, Japan’s pork tariff system became less favorable to US pork exporters. Importantly, this is not a matter of the US government and/or US market conditions. Only the Japanese government can change this situation.

CONCLUSION

The US is the top pork exporter in the world. The US is particularly strong in offering low-grade pork at a low price in the world export market. Japan has earnest demands for low-grade pork. However, Japan’s unique system for pork imports, known as the gate price system, favors combination-type imports: i.e., by importing a mix of high-price, high-grade pork and low-price, low-grade pork, importers can save payments on tariffs. After the exposure of Dotani and Shibata tariff evasion scandal in 2012, the tariff saving effect of mixed imports, which is a legal gray zone, became more attractive for importers. As a result, many Japanese pork importers have shifted from US pork to other countries, which are also able to supply high-price, high-grade pork, unlike the US. Currently, there are no signs that the Japanese government intends to change its pork import policy. Thus, it seems unlikely that the US share in Japan’s pork market will return to the pre-2012 level.

|

Date submitted: Jun. 24, 2019

Reviewed, edited and uploaded: Jun. 28, 2019

|

[i] For 2018, the United States Department of Agriculture (USDA) estimates the total world pork imports as 7.9 million tons (carcass weight equivalent); Japan imported 1.5 million tons. Further Details of the USDA’s estimates are available at Foreign Agriculture Service, Livestock and Poultry: World Markets and Trade, April 9, 2019.

[iii] The Japanese Ministry of Finance estimates Japan’s total pork imports for 2017 amounted to 931.2 thousand tons. Among them, 267.2 thousand tons were from the US. Further details of the Japanese Ministry of Finance’s estimates are available at Ministry of Finance, Japan Exports and Imports (downloadable at http://www.customs.go.jp/toukei/info/index_e.htm ).

[iv] This paper gives only a rough outline of the gate price system. Its details are given at Godo, Yoshihisa “The Gate Price System for Japan’s Pork Imports,” FFTC Agricultural Policy Platform (Food and Fertilizer Technology Center for the Asian and Pacific Region) March 28, 2014 (downloadable at http://ap.fftc.agnet.org/ap_db.php?id=217), and Godo, Yoshihisa, and Hiroshi Takahashi, “Japan's Pork Imports: New Agreement in the Trans-Pacific Partnership Free Trade Negotiations,” FFTC Agricultural Policy Platform (Food and Fertilizer Technology Center for the Asian and Pacific Region) March 1, 2016 (downloadable at http://ap.fftc.agnet.org/ap_db.php?id=586).

[v] In real business practices, a volume of pork container is usually 10 ton or more. This paper uses 1,000 kilograms just for simplicity of explanation.

[vi] Some political pundits speculate that, if a pork importer takes a defiant attitude to the authorities (including customs), they will receive a severe investigation on custom formalities. When under scrutiny, they can be arrested based on an exaggeration of any simple mistake, which can build up to a weighty criminal practice such as tariff evasion. It is not the authors’ intention to support this speculation. However, it is also true that the customs formalities under the gate price system are so complicated that critics can identify various complaints. If the Japanese government were to replace the gate price system with a fixed ad valorem rate for the tariff system (as is the case for Japan’s beef imports), custom formalities will be simpler and transparent.

Technical problems on Japan’s pork imports from the US

ABSTRACT

Japan has a unique (and complicated) pork import tariff system, called the gate price system. Under this system, importers can minimize their tariff payments by combining high-price (and high-quality) pork with low-price (and low-quality) pork to set the CIF price at 524 yen per kilogram (approximately 4.7 US dollars by converted at the 2018 average exchange rate). This puts US pork exporters at a disadvantage because the US is particularly strong worldwide in offering low-grade pork at a lower price but weak in offering high-quality pork that merits a higher price. This disadvantage was exacerbated after Japanese customs strengthened its inspections for tariff evasion in 2012. As a result, in contrast with other major pork exporters, US exports to Japan have been decreasing.

Keywords: gate price system, combination-type imports, tariff evasion, gray zone

INTRODUCTION

Japan’s share of world pork imports is almost 15%, and it is the second biggest world pork importer[i]. In addition, Japan’s self-sufficiency in pork is gradually declining, which reflects the poor condition of pork supply in the country[ii].

The US is the biggest exporter of pork to Japan[iii]. However, in contrast with other major pork exporters such as Canada, Mexico, and the EU, the US has been decreasing its exports to Japan since 2011 (Figure 1). What happened after 2011? Will the US keep declining its share in Japanese pork market? This paper aims to describe the technical problems of importing pork from the US to Japan and thereby, shed light on these questions.

For the reason of readability, this paper uses only Japanese yen for measuring values. The average exchange rate for 2018 is 1 US dollar = 110.5 yen.

JAPAN’S PORK TARIFF SYSTEM

Japan has a unique tariff system for pork imports, called the gate price system. The system is complicated, but its essence can be summarized by the following two points[iv]:

The CIF price of 524 yen per kilogram is called the gate price, where the tariff payment becomes the smallest (22.53 yen per kilogram). This system creates a troubling problem for importers because pork price differs according to the type of meat. Let us assume the following two cases[v].

Case A: an importer purchased a container of 1,000 kilograms of tenderloin pork at a CIF price of 800 yen per kilogram and a container of 1,000 kilograms of shoulder picnic at a CIF price of 248 yen per kilogram separately.

Case B (called ‘combination-type import’): an importer purchased a container of 2,000 kilograms of pork, which consists of 1,000 kilograms of tenderloin and 1,000 kilograms of shoulder picnic, at a CIF price of 524 yen per kilogram.

For both cases, the total value of pork (CIF-base) is 1,048,000 yen (1,0480,000 = 800*1,000 + 248*1,000 = 524*2,000). However, the total tariff payment differs between the two cases. An importer must pay 332,930 yen (332,930 = 800*1000*0.043 + (482.5-300)*1000) as tariff for Case A, while the tariff for Case B is only 45,064 yen (45,064 = 0.043*524*2,000). If an importer tries to reduce tariff payment by disguising Case A as Case B (which is referred to as ‘disguised combination-type imports’), this would be a case of tariff evasion.

It need not be said that a sense of respect for the law is important. However, it is also true that there are many ways of generating disguised combination-type imports, which are difficult for customs to detect. For example, by using an intermediary in a foreign country who purchases tenderloin and shoulder picnic separately and sells them to the importer, the importer can disguise Case A as Case B. Of course, customs are authorized to ask a court of law for a warrant to search a dubious importer and its related companies and investigate details of their businesses. However, this type of investigation consumes considerable resources. Thus, unless customs has a special reason to try to identify tariff evasion (for example, because customs already found convincing evidence of tariff evasion), it is generally expected that customs forces are cautious in embarking on serious investigation on a particular case of pork imports[vi].

In fact, most pork imports are reported at the CIF price of just under 524 yen per kilogram, which minimalizes the tariff payment (Figure 2). Considering the wide (and unpredictable) price fluctuations in the global pork market, achieving this level of stability of the CIF price is difficult, unless importers adopt some method of generating disguised combination-type imports. In real business practices, there are many cases that fall in a gray area between Case A and Case B. Many pork importers conduct their businesses in a gray zone.

DOTANI AND SHIBATA’S PORK TARIFF EVASION SCANDAL

On March 7, 2012, a major case of pork tariff evasion was uncovered. Namely, Kunihiro Dotani and Kenji Shibata were accused of evading 14 billion yen in tariffs for their pork imports. Their modus operandi is that, using foreign intermediaries, they procured foreign pork at around 300 yen per kilogram and disguised its price as 524 yen per kilogram at Japanese customs. This means that Dotani and Shibata evaded nearly 200 yen per kilogram of tariff for their pork imports.

Dotani and Shibata’s case is different from the case of disguised combination-type imports in the sense that Dotani and Shibata’s pork contained only cheap pork (i.e., worth less than 524 yen per kilogram). This type of tariff evasion is called ‘disguised non-combination-type imports’.

For years up until the exposure of this scandal, Dotani and Shibata’s companies had shared more than 10% of Japan’s total pork imports. Thus, mass media sensationalized this scandal. This incited some consumer groups and political parties to conduct their own investigations into pork importers, and they argued that many other pork importers were also doing disguised non-combination-type imports to escape customs’ detection of tariff evasion. It is not the authors’ intention to affirm that disguised non-combination-type imports were (and still are) rampant in Japan. Indeed, considering that pork importers are involved in various types of deals in multi-layered business networks, there is a large gray zone between a disguised price and a fair price. However, it is also true that the demand on behalf of Japanese ham and sausage makers for low-price pork was strong. Dotani and Shibata supplied to this demand but it is reasonable to hypothesize that there were many pork importers who were importing low-price pork in similar ways. This paper calls these imports ‘gray non-combination-type imports’ hereafter.

THE MINISTRY OF FINANCE’S CIRCULAR NOTICE TO CUSTOMS

Dotani and Shibata’s scandal led citizens to begin to distrust customs. As one of a number of remedial measures, on April 4, 2012, the Ministry of Finance issued a circular notice that customs should strengthen their investigations of pork imports. This paper calls this notice ‘the 2012 MOF notice’ hereafter.

In spite of the 2012 MOF notice, there have been no significant changes in the average CIF price for pork (i.e., it remains relatively constant at nearly 524 yen per kilogram) (Figure 2). Thus, the authors hypothesize that the meaning of the 2012 MOF notice is that customs should be more serious in preventing disguised (or gray) non-combination-type imports, while customs need not to change its attitudes towards the gray zone between Case A and Case B.

If the authors’ hypothesis is correct, the 2012 MOF notice gave strong motivation for those who were doing disguised (or gray) non-combination-type imports to replace their practice by combination-type imports. To do so, those importers need to purchase high-price (that is, high-grade) pork in addition to low-price pork in order to achieve a CIF price of 524 yen per kilogram. However, compared with other pork exporting countries, the US does not have the ability to produce high-price, high-grade pork. By contrast, the EU countries have name-brand pork such as Iberico pork, which wealthy families in Japan purchase at high prices as top-level pork. Mexico is a strong supplier of high-price high-grade dressed meat because Mexico has a large population of skilled craftsmen in the meat packing industry. Canada, which is much less populated than the US and, therefore, does not have as strong a demand for pork domestically, takes a more strategic approach to promoting high-quality high-price table pork at high-end Japanese supermarkets than the US.

In addition, the US pork market is so well-organized that price information is easy to obtain even for foreigners (including Japanese customs). Those who continue disguised (or gray) non-combination-type imports may prefer purchasing pork in some other country than the US, where price information is more difficult to obtain for foreigners (including Japanese customs), in order to minimize the risk of being accused of tariff evasion.

In sum, after the 2012 MOF notice, Japan’s pork tariff system became less favorable to US pork exporters. Importantly, this is not a matter of the US government and/or US market conditions. Only the Japanese government can change this situation.

CONCLUSION

The US is the top pork exporter in the world. The US is particularly strong in offering low-grade pork at a low price in the world export market. Japan has earnest demands for low-grade pork. However, Japan’s unique system for pork imports, known as the gate price system, favors combination-type imports: i.e., by importing a mix of high-price, high-grade pork and low-price, low-grade pork, importers can save payments on tariffs. After the exposure of Dotani and Shibata tariff evasion scandal in 2012, the tariff saving effect of mixed imports, which is a legal gray zone, became more attractive for importers. As a result, many Japanese pork importers have shifted from US pork to other countries, which are also able to supply high-price, high-grade pork, unlike the US. Currently, there are no signs that the Japanese government intends to change its pork import policy. Thus, it seems unlikely that the US share in Japan’s pork market will return to the pre-2012 level.

Date submitted: Jun. 24, 2019

Reviewed, edited and uploaded: Jun. 28, 2019

[i] For 2018, the United States Department of Agriculture (USDA) estimates the total world pork imports as 7.9 million tons (carcass weight equivalent); Japan imported 1.5 million tons. Further Details of the USDA’s estimates are available at Foreign Agriculture Service, Livestock and Poultry: World Markets and Trade, April 9, 2019.

[ii] The Japanese Ministry of Agriculture, Forestry, and Fisheries (MAFF) estimates that Japan’s self-sufficiency for pork was 49% for 2017. This is 5 points lower than the 2013 figure. More details regarding MAFF’s estimates are available at http://www.maff.go.jp/j/zyukyu/zikyu_ritu/012.html and http://www.maff.go.jp/j/zyukyu/zikyu_ritu/attach/pdf/012-11.pdf.

[iii] The Japanese Ministry of Finance estimates Japan’s total pork imports for 2017 amounted to 931.2 thousand tons. Among them, 267.2 thousand tons were from the US. Further details of the Japanese Ministry of Finance’s estimates are available at Ministry of Finance, Japan Exports and Imports (downloadable at http://www.customs.go.jp/toukei/info/index_e.htm ).

[iv] This paper gives only a rough outline of the gate price system. Its details are given at Godo, Yoshihisa “The Gate Price System for Japan’s Pork Imports,” FFTC Agricultural Policy Platform (Food and Fertilizer Technology Center for the Asian and Pacific Region) March 28, 2014 (downloadable at http://ap.fftc.agnet.org/ap_db.php?id=217), and Godo, Yoshihisa, and Hiroshi Takahashi, “Japan's Pork Imports: New Agreement in the Trans-Pacific Partnership Free Trade Negotiations,” FFTC Agricultural Policy Platform (Food and Fertilizer Technology Center for the Asian and Pacific Region) March 1, 2016 (downloadable at http://ap.fftc.agnet.org/ap_db.php?id=586).

[v] In real business practices, a volume of pork container is usually 10 ton or more. This paper uses 1,000 kilograms just for simplicity of explanation.

[vi] Some political pundits speculate that, if a pork importer takes a defiant attitude to the authorities (including customs), they will receive a severe investigation on custom formalities. When under scrutiny, they can be arrested based on an exaggeration of any simple mistake, which can build up to a weighty criminal practice such as tariff evasion. It is not the authors’ intention to support this speculation. However, it is also true that the customs formalities under the gate price system are so complicated that critics can identify various complaints. If the Japanese government were to replace the gate price system with a fixed ad valorem rate for the tariff system (as is the case for Japan’s beef imports), custom formalities will be simpler and transparent.