INTRODUCTION

Since 2011, Korea’s Ministry of Agriculture, Food and Rural Affairs (MAFRA) has conducted the “Consumer Attitude Survey for Processed Food (CASPF)” to identify processed food consumers’ awareness, purchasing behavior, and lifestyle in a systematic way. The purpose of this survey is to provide a set of players in the food industry including food companies and policymakers with basic information on food consumer and market that will help them to make better decisions in terms of policy improvement, investments and marketing. The CASPF was designated as a nationally approved statistic in 2016. And since 2018, the Korea Rural Economic Institute (KREI), which is designated as the implementing agency for food industry information analysis (AFIA) project initiated by MAFRA, has been in charge of implementation and analysis of the CASPF survey.

The CASPF in 2018 consisted of survey for main food purchasers, survey for household members (i.e., general questionnaire), and the main purchaser’s household accountant survey. The general questionnaire was conducted online for 2,174 individuals including youth. Among the total respondents, 27.8 % were from the single-person household, followed by 27.1 % from 4-person household, and 20.2 % from 3-person household. The proportion of male was nearly half (50.7 %) and 77.5 %of the total respondents were the college (2~4 years) graduates. In terms of age, the highest proportion was found in those in their 40s (20.9 %), followed by those in their 50s (20.0 %), those in their 30s (17.7 %, and those in their 20s (15.8 %).

Acquisition of information on processed foods

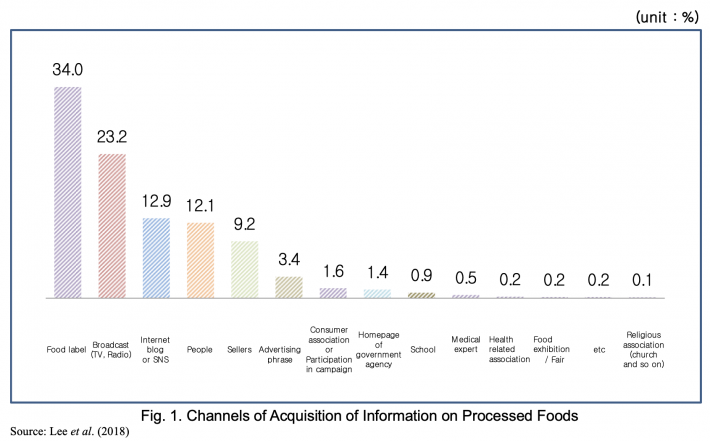

Consumers obtain information on processed foods mainly through ‘food labeling (34.0 %)’, followed by ‘TV or radio broadcasting (23.2 %)’, and also through ‘internet blog or social network service (SNS) (12.9 %).’ By considering the fact that the food labels are attached directly to the food products, we confirm that the influence of broadcasting and online media in providing information on processed foods is considerable (Figure 1).

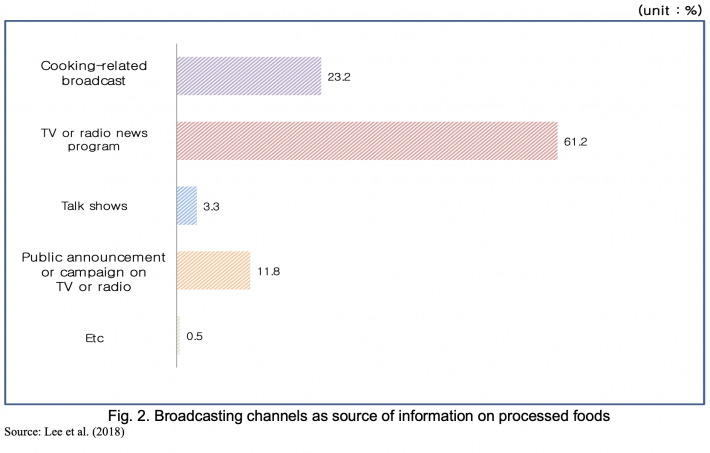

Consumers who responded that they obtained information on processed foods from broadcasting are shown that they obtained the information mainly from ‘TV or radio news programs (61.2 %).’ Proportion of consumers who responded that they obtained the information from ‘cooking-related broadcasting (23.2 %)’ is also high (Figure 2), thus we concluded that the influence of those programs continues to expand.

Perception on prices of processed foods

■ Perception on fluctuation in prices of processed foods

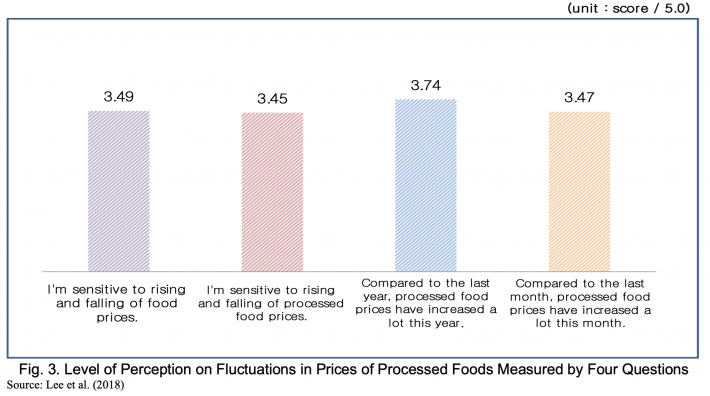

Consumer perception on fluctuation in prices of processed foods was captured based on four questions. The level of agreement with the statement of ‘the prices of processed foods increased more this year compared to the previous year’ is 3.74 points (out of 5 points), which was relatively higher than the rest of the questions with the level ranging from 3.45 to 3.49 points (Figure 3). It is concluded that this reflects consumers’ feeling or perception on rising prices of processed foods as well as fresh foods observed for this year.

■ Recognition on place to purchase processed foods at the lowest prices

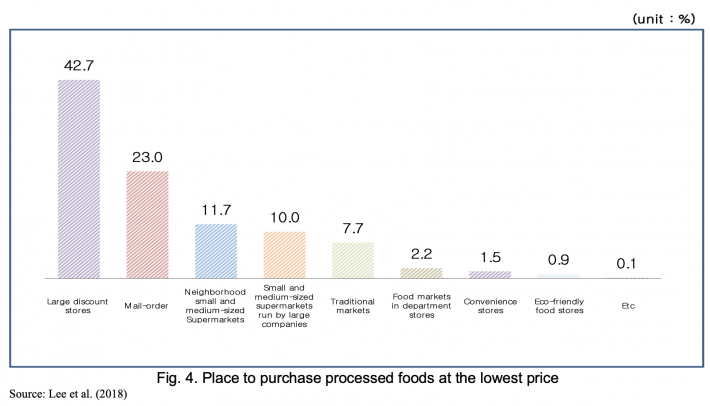

42.7% of the entire respondents perceived ‘large discount store’ as the place where processed foods can be purchased at the lowest prices, followed by ‘mail order (online) (23.0%)’, ‘neighborhood small- and medium-sized supermarkets (11.7%)’, and then ‘small- and medium-sized supermarkets operated by major food companies (10.0%).’ (Figure 4) Looking at it by consumer group, the percentage of respondents who answered that ‘mail order (online)’ is the place to purchase processed foods at the lowest price is higher for 30-40 age groups (26.1%, 28.9%). For those in their 60s-70s, the percentage for ‘traditional market’ was relatively higher (10.3% and 22.2%, respectively). The percentage of ‘large discount store’ was higher for married people than single people (45.7% vs. 38.2%). The higher the income, the higher the percentage of ‘large discount stores’ the respondents said.

■ Evaluation on price change in the last year by food category

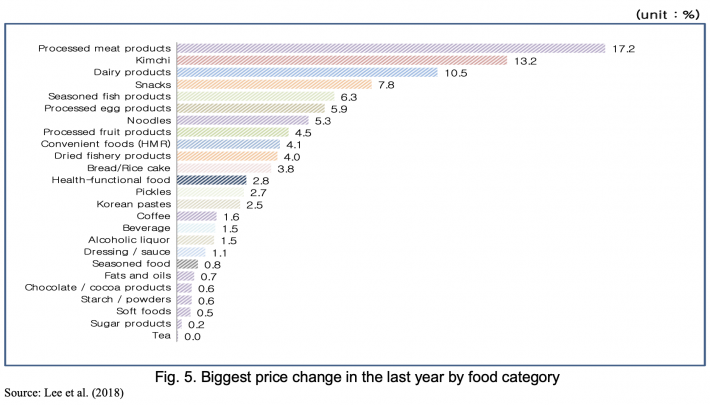

The top 3 food categories for which the respondents thought the price fluctuation was the most severe over the last year were ‘processed meat products (17.2 %)’ including sausage, ham and bacon, followed by ‘kimchi (13.2 %)’, ‘dairy products (10.5 %)’, and ‘snacks (7.8 %).’ The lowest ranked food categories were tea, sugar products, and soft foods (Figure 5).

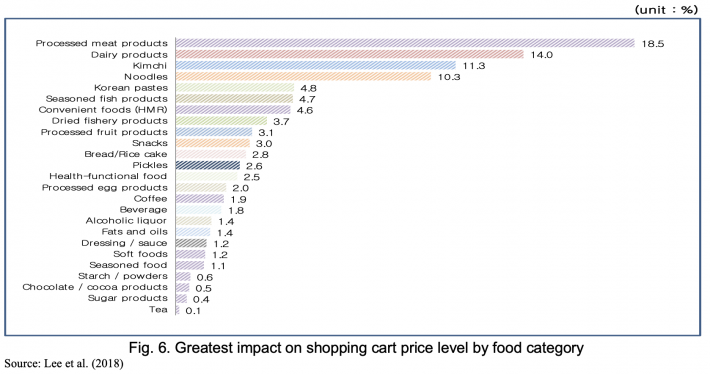

■ Recognition on food categories that has the greatest influence on the shopping cart price

As a result of surveying the food categories that have the greatest influence on the shopping cart price, the top three categories were found as follows: ‘Processed meat product’ was the most influential category with 18.5%, followed by ‘dairy products (14.0%)’, ‘kimchi (11.3%)’, and ‘noodles (10.3%).’ (Figure 6) It was found that food categories with higher demand had in general a greater impact, while those food categories with a relatively small proportion of purchases did not have a significant impact on the shopping cart prices, such as tea, sugar products, and chocolate/cocoa products.

Safety awareness on processed foods

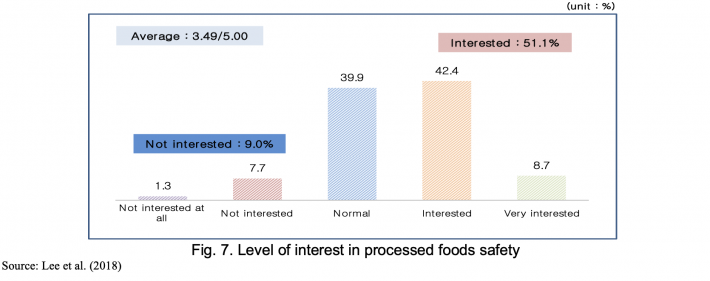

■ Level of interest in safety for processed food

Consumers are generally interested in processed food safety. Approximately 50 % of entire respondents said they were interested in processed food safety, while only 9.0% said they were not. Measuring five-point scale, the average score of the level of interest was 3.49 points (Figure 7). Consumers in their 50s-60s (3.66, 3.72), housewife (3.75), married (3.63), income over $5,000 (3.61), and college graduates (3.68) have relatively higher interest in processed food safety.

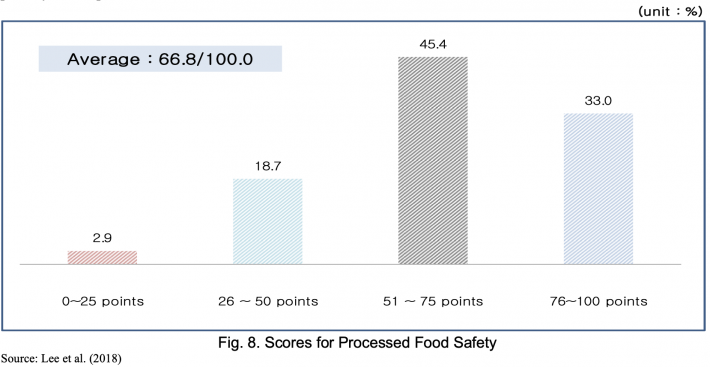

■ Evaluation on food safety for processed foods

Approximately half (45.4%) of the respondents evaluated the safety of processed food as 51 ~ 75 points out of 100 points, followed by 33.0% of respondents as 76 ~ 100 points. As a result of calculating the average evaluation out of 100 points, the score is 66.8 (Figure 8), so the evaluation on food safety for processed foods was not reached to 70 points yet in Republic of Korea.

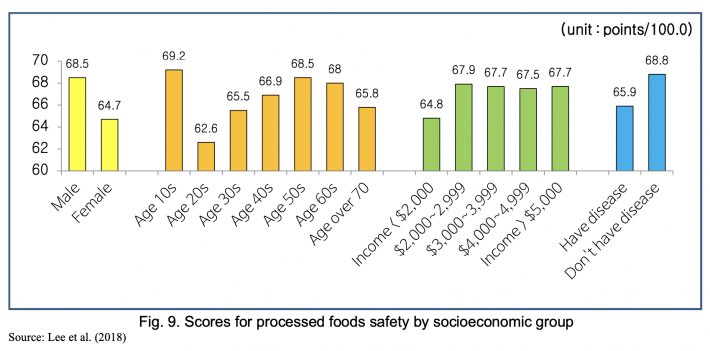

The average evaluation on food safety for processed foods was 3.8 points higher for male (68.5 points) than that of the female (64.7 points). By the age group, teenagers rated the highest score at 69.2 points, and until age 50s, the evaluation on processed food safety tended to increase with age, and then decrease after age 50s. The safety evaluation was relatively higher for consumers with no disease. Moreover, for consumers with their income level less than $2,000, the safety evaluation was about 3.0 points lower than that of the other income groups (Figure 9).

■ Willingness to pay for safer processed foods

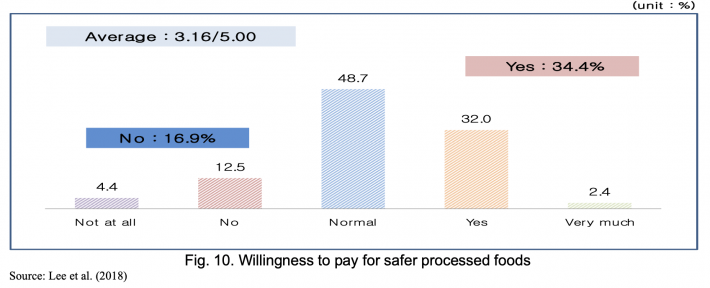

One-third (34.4%) of all respondents said they were willing to pay more for safe processed foods, while 16.9% said that they were not willing to pay for it. Out of five-point scale, it turned out that the additional payment intention is 3.16 points, which is not that high (Figure 10). It can be interpreted that the safety of processed food in Korea is not that serious, or that the reflection of consumers' perception estimates that efforts to improve the safety of processed food (producer or government) are difficult to trust.

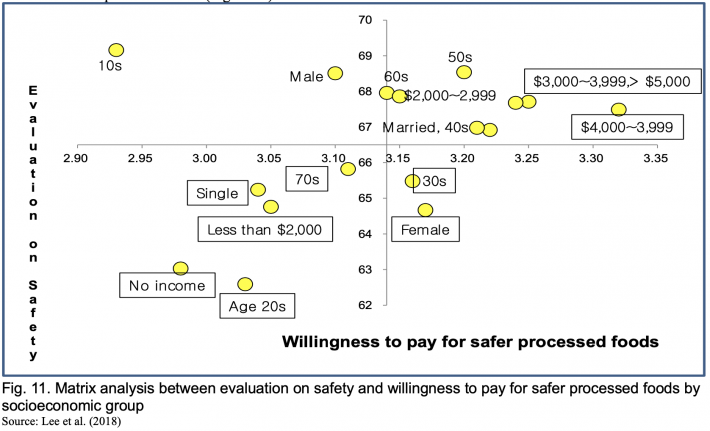

As a result of matrix analysis with evaluation of processed food safety and additional payment intention response, the safety evaluation of processed foods was relatively high in the case of US$3000 to US$5000 or more, in the 40s to 50s or married persons. And the intention of additional payment was also highly analyzed. However, in the case of no income, less than US$2000, and in the 20s and 70s, both the willingness to pay and safety evaluation were low for the processed foods (Figure 11).

■ Recognition of importance of safety management for processed foods by subjects

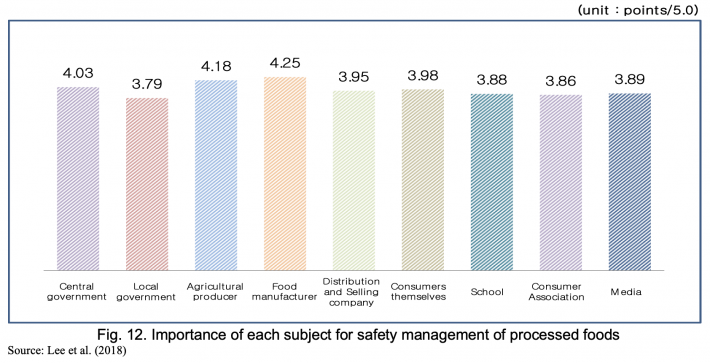

As a result of questionnaire survey, the producers (Agricultural producers, food manufacturers) were perceived the most important safety management subject (4.18 points, 4.25 points respectively). The central government also was score of 4.03 (Figure 12), showing the consumer's perception that the central government should play an important role in the safety management of processed foods.

Checking and trusting food labels

■ Degree to which the food labels are checked when purchasing processed foods

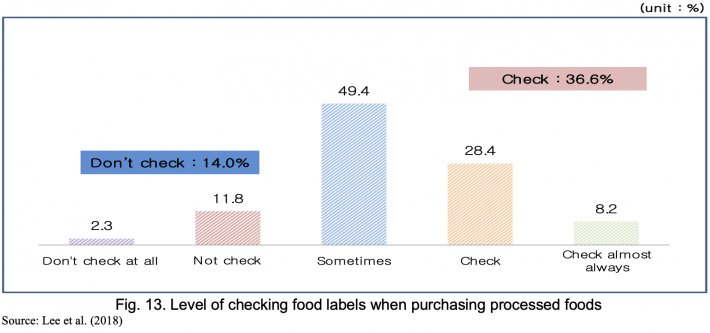

Out of the total respondents, 36.6% replied that they confirmed the contents of the food when they purchased processed foods, while 14.0% did not. The percentage of consumers who answered that they sometimes have a view or sometimes not is half (49.4%) (Figure 13), and it shows that there is room for improvement in the utilization of food labels. Food labels are socially desirable because the more consumers check it, the more effectively they can perform the role of information.

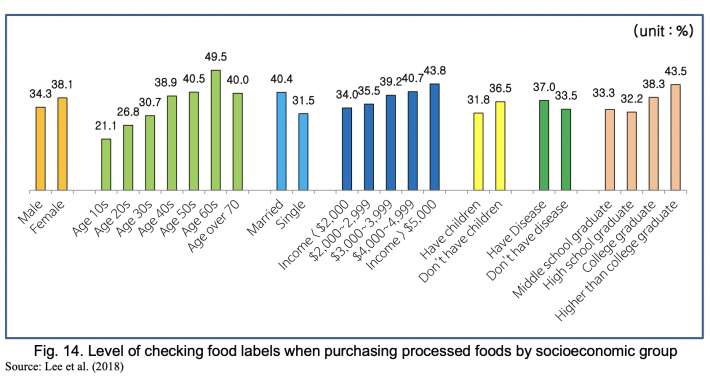

We looked what kind of consumers check the food labels when purchasing foods, the percentage of consumers who check the food labels is higher as the consumers’ age is older. Female consumers are higher than male consumers (38.1% vs. 34.3%) and married people are higher than unmarried ones (40.4% vs. 31.5%) (Figure 14). In the case there is any household member who has illness in the family, the higher the level of education and income, the higher the percentage of checking the food labels relatively.

■ Whether to check food labels

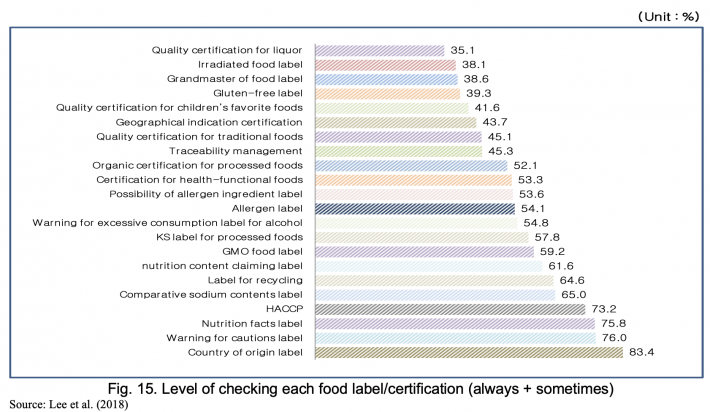

As a result of survey whether to check each label in the food labels of processed food when purchasing, 83.4% of the respondents said "Sometimes or always check Country of origin label." Next, the check rate of ‘warning for cautions label (76.0%)’ and ‘nutrition facts label (75.8%)’, ‘HACCP (73.2%)’ was high at 70% or higher. ‘Quality certification for liquor (35.1%)’, ‘Irradiated food label (38.1%)’, ‘Grandmaster of food label (38.6%)’, and ‘Gluten-free label (39.3%)’ are relatively rarely checked (Figure 15), possibly because these are labeled for relatively limited kind of products in the market.

■ Whether to recognize food labels

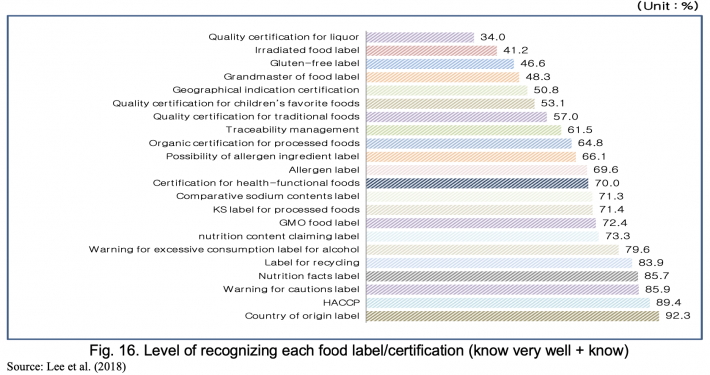

As a result of survey on whether or not labels for processed foods were recognized, 92.3% of the respondents said that they knew or heard about ‘Country of origin label’ in the highest percentage. Next, ‘HACCP (89.4%)’, ‘Warning for cautions label (85.9%)’, ‘Nutrition facts label (85.7%)’ and ‘Label for recycling (83.9%)’ were recognized for more than 80% of consumers. Similar to the level of checking food labels, less-recognized food labels include ‘Quality certification for liquor (34.0%)’, ‘Irradiated food label (41.2%)’, ‘Grandmaster of food label (48.3%)’, and ‘Gluten-free label (46.6%).’ (Figure 16)

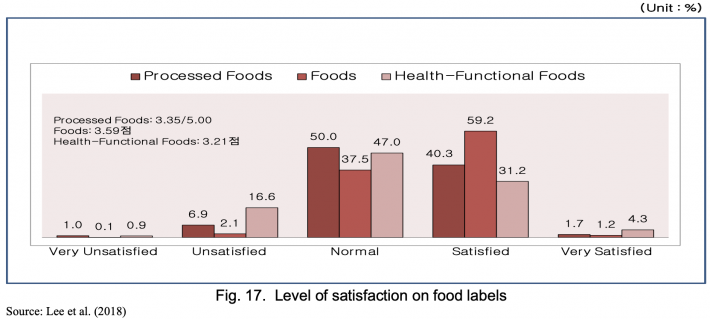

■ Satisfaction, reliability and reason not to trust food labels

As a result of calculating the satisfaction with the food labels out of 5 points, the satisfaction rate of the labels of foods overall was 3.59 (2018 food consumption behavior survey), satisfaction with labels of processed food was 3.35, which is lower by 0.24 points than those of foods overall. Satisfaction with labels of health-functional foods was 3.21 points (Figure 17). The low level of satisfaction with processed food labels may be explained in various ways, such as the fact that the text is small or contains too much information, but further analysis is necessary to determine the exact reason. However, it should be noted that respondents who answered "normal" in the survey on the satisfaction of the foods labels on foods overall showed a much lower proportion, which means they had held their judgment.

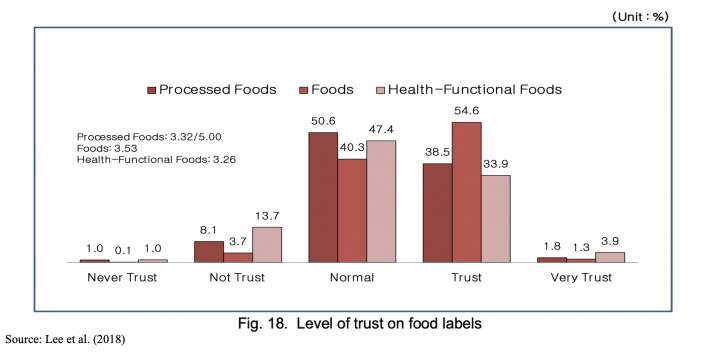

The reliability of the food labels was evaluated out of 5 points. The reliability of the food labels on overall food was 3.53 (2018 consumption behavior survey for food), and it was 3.32 for the food labels for processed foods, which is lower by 0.21. The reliability of the food labels on health-functional foods was 3.26 points out of 5.0 (Figure 18). In the survey, the percentage of consumers who held judgment by responding “normal” was low when surveying general food products. Perhaps this may be due to the fact that they were asked about the ‘whole food’ category, which is somewhat broader category and thus more difficult to recall specific foods than the processed foods or health-functional foods.

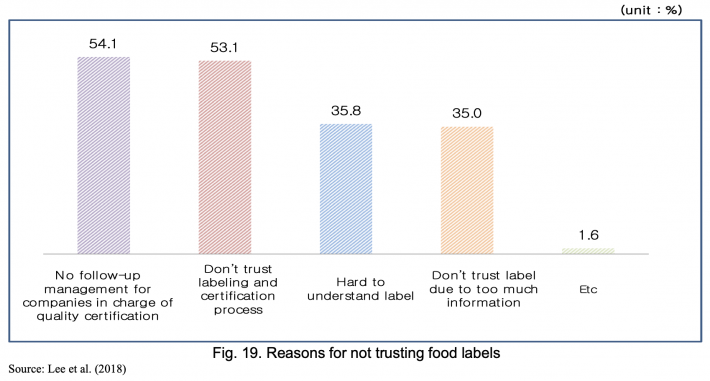

As a result of survey, the reasons for not trusting the food labels, 54.1% of the respondents agreed that ‘no follow-up management for companies in charge of quality certification.’ The percentage of respondents who agreed to ‘Don’t trust the labeling and certification process’ was also high at 53.1%. Next, more than one-third of consumers agree that ‘hard to understand label’ or ‘Don’t trust label due to too much information (Figure 19).’

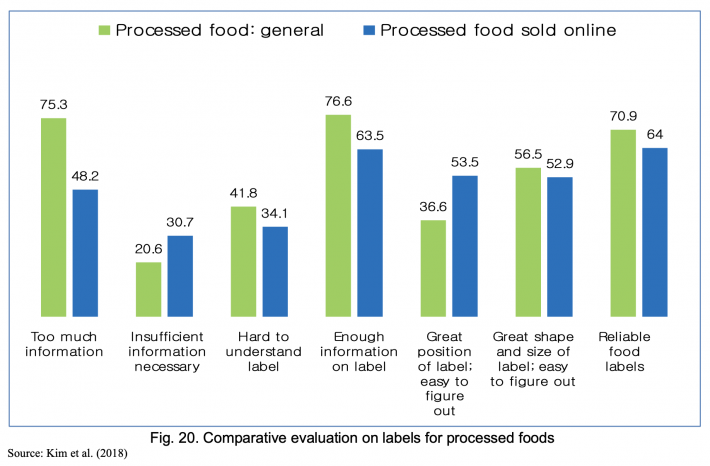

■ Evaluation of food labels on processed foods

Consumers also evaluated the food labels on general processed food as well as the processed foods sold on-line, respectively. In the case of general processed foods, ‘enough information on label (76.6%)’, ‘too much information (75.3%)’, and ‘reliable food labels (70.9%)’ are the mostly agreed statements with the level of agreement exceeding 70 percent. On the other hand, the level of consent for ‘Insufficient information necessary’ was very low at 20.6%, implying that consumers generally evaluated that enough information was provided for general processed foods. In the case of processed foods sold online, the agreement level was 48.2% for ‘Too much information’, which was approximately 30 % point lower than that of general processed food (75.3%). For the level of consent for ‘Enough information on label (63.5%)’, the agreement level was 13.1 % point lower than that of general processed food (Figure 20). This is linked to the fact that ‘the label is in a conspicuous position’ or ‘the shape or size of the label is visible’ in the relatively lower agreement level for processed foods sold on-line.

REFERENCES

Sang-Hyo Kim, Kyei-Im Lee, Yeon-a Hong, Seong-Yoon Heo. 2018. “National Agri-food Labeling and Improvement of Consumers’ Utilization”. Korea Rural Economic Institute.

Kyei-Im Lee, Mi-Sung Park, Sang-Hyo Kim, Seong-Yoon Heo. 2018. “2018 Consumer Attitude Survey for Processed Food: In-depth analysis report”. Korea Rural Economic Institute. Ministry of Agriculture, Foods and Rural Affairs.

Date submitted: October 8, 2019

Reviewed, edited and uploaded: November 8, 2019 |

Consumer Awareness and Evaluation on Processed Foods: A National Survey for Consumption of Processed Foods in Korea

INTRODUCTION

Since 2011, Korea’s Ministry of Agriculture, Food and Rural Affairs (MAFRA) has conducted the “Consumer Attitude Survey for Processed Food (CASPF)” to identify processed food consumers’ awareness, purchasing behavior, and lifestyle in a systematic way. The purpose of this survey is to provide a set of players in the food industry including food companies and policymakers with basic information on food consumer and market that will help them to make better decisions in terms of policy improvement, investments and marketing. The CASPF was designated as a nationally approved statistic in 2016. And since 2018, the Korea Rural Economic Institute (KREI), which is designated as the implementing agency for food industry information analysis (AFIA) project initiated by MAFRA, has been in charge of implementation and analysis of the CASPF survey.

The CASPF in 2018 consisted of survey for main food purchasers, survey for household members (i.e., general questionnaire), and the main purchaser’s household accountant survey. The general questionnaire was conducted online for 2,174 individuals including youth. Among the total respondents, 27.8 % were from the single-person household, followed by 27.1 % from 4-person household, and 20.2 % from 3-person household. The proportion of male was nearly half (50.7 %) and 77.5 %of the total respondents were the college (2~4 years) graduates. In terms of age, the highest proportion was found in those in their 40s (20.9 %), followed by those in their 50s (20.0 %), those in their 30s (17.7 %, and those in their 20s (15.8 %).

Acquisition of information on processed foods

Consumers obtain information on processed foods mainly through ‘food labeling (34.0 %)’, followed by ‘TV or radio broadcasting (23.2 %)’, and also through ‘internet blog or social network service (SNS) (12.9 %).’ By considering the fact that the food labels are attached directly to the food products, we confirm that the influence of broadcasting and online media in providing information on processed foods is considerable (Figure 1).

Consumers who responded that they obtained information on processed foods from broadcasting are shown that they obtained the information mainly from ‘TV or radio news programs (61.2 %).’ Proportion of consumers who responded that they obtained the information from ‘cooking-related broadcasting (23.2 %)’ is also high (Figure 2), thus we concluded that the influence of those programs continues to expand.

Perception on prices of processed foods

■ Perception on fluctuation in prices of processed foods

Consumer perception on fluctuation in prices of processed foods was captured based on four questions. The level of agreement with the statement of ‘the prices of processed foods increased more this year compared to the previous year’ is 3.74 points (out of 5 points), which was relatively higher than the rest of the questions with the level ranging from 3.45 to 3.49 points (Figure 3). It is concluded that this reflects consumers’ feeling or perception on rising prices of processed foods as well as fresh foods observed for this year.

■ Recognition on place to purchase processed foods at the lowest prices

42.7% of the entire respondents perceived ‘large discount store’ as the place where processed foods can be purchased at the lowest prices, followed by ‘mail order (online) (23.0%)’, ‘neighborhood small- and medium-sized supermarkets (11.7%)’, and then ‘small- and medium-sized supermarkets operated by major food companies (10.0%).’ (Figure 4) Looking at it by consumer group, the percentage of respondents who answered that ‘mail order (online)’ is the place to purchase processed foods at the lowest price is higher for 30-40 age groups (26.1%, 28.9%). For those in their 60s-70s, the percentage for ‘traditional market’ was relatively higher (10.3% and 22.2%, respectively). The percentage of ‘large discount store’ was higher for married people than single people (45.7% vs. 38.2%). The higher the income, the higher the percentage of ‘large discount stores’ the respondents said.

■ Evaluation on price change in the last year by food category

The top 3 food categories for which the respondents thought the price fluctuation was the most severe over the last year were ‘processed meat products (17.2 %)’ including sausage, ham and bacon, followed by ‘kimchi (13.2 %)’, ‘dairy products (10.5 %)’, and ‘snacks (7.8 %).’ The lowest ranked food categories were tea, sugar products, and soft foods (Figure 5).

■ Recognition on food categories that has the greatest influence on the shopping cart price

As a result of surveying the food categories that have the greatest influence on the shopping cart price, the top three categories were found as follows: ‘Processed meat product’ was the most influential category with 18.5%, followed by ‘dairy products (14.0%)’, ‘kimchi (11.3%)’, and ‘noodles (10.3%).’ (Figure 6) It was found that food categories with higher demand had in general a greater impact, while those food categories with a relatively small proportion of purchases did not have a significant impact on the shopping cart prices, such as tea, sugar products, and chocolate/cocoa products.

Safety awareness on processed foods

■ Level of interest in safety for processed food

Consumers are generally interested in processed food safety. Approximately 50 % of entire respondents said they were interested in processed food safety, while only 9.0% said they were not. Measuring five-point scale, the average score of the level of interest was 3.49 points (Figure 7). Consumers in their 50s-60s (3.66, 3.72), housewife (3.75), married (3.63), income over $5,000 (3.61), and college graduates (3.68) have relatively higher interest in processed food safety.

■ Evaluation on food safety for processed foods

Approximately half (45.4%) of the respondents evaluated the safety of processed food as 51 ~ 75 points out of 100 points, followed by 33.0% of respondents as 76 ~ 100 points. As a result of calculating the average evaluation out of 100 points, the score is 66.8 (Figure 8), so the evaluation on food safety for processed foods was not reached to 70 points yet in Republic of Korea.

The average evaluation on food safety for processed foods was 3.8 points higher for male (68.5 points) than that of the female (64.7 points). By the age group, teenagers rated the highest score at 69.2 points, and until age 50s, the evaluation on processed food safety tended to increase with age, and then decrease after age 50s. The safety evaluation was relatively higher for consumers with no disease. Moreover, for consumers with their income level less than $2,000, the safety evaluation was about 3.0 points lower than that of the other income groups (Figure 9).

■ Willingness to pay for safer processed foods

One-third (34.4%) of all respondents said they were willing to pay more for safe processed foods, while 16.9% said that they were not willing to pay for it. Out of five-point scale, it turned out that the additional payment intention is 3.16 points, which is not that high (Figure 10). It can be interpreted that the safety of processed food in Korea is not that serious, or that the reflection of consumers' perception estimates that efforts to improve the safety of processed food (producer or government) are difficult to trust.

As a result of matrix analysis with evaluation of processed food safety and additional payment intention response, the safety evaluation of processed foods was relatively high in the case of US$3000 to US$5000 or more, in the 40s to 50s or married persons. And the intention of additional payment was also highly analyzed. However, in the case of no income, less than US$2000, and in the 20s and 70s, both the willingness to pay and safety evaluation were low for the processed foods (Figure 11).

■ Recognition of importance of safety management for processed foods by subjects

As a result of questionnaire survey, the producers (Agricultural producers, food manufacturers) were perceived the most important safety management subject (4.18 points, 4.25 points respectively). The central government also was score of 4.03 (Figure 12), showing the consumer's perception that the central government should play an important role in the safety management of processed foods.

Checking and trusting food labels

■ Degree to which the food labels are checked when purchasing processed foods

Out of the total respondents, 36.6% replied that they confirmed the contents of the food when they purchased processed foods, while 14.0% did not. The percentage of consumers who answered that they sometimes have a view or sometimes not is half (49.4%) (Figure 13), and it shows that there is room for improvement in the utilization of food labels. Food labels are socially desirable because the more consumers check it, the more effectively they can perform the role of information.

We looked what kind of consumers check the food labels when purchasing foods, the percentage of consumers who check the food labels is higher as the consumers’ age is older. Female consumers are higher than male consumers (38.1% vs. 34.3%) and married people are higher than unmarried ones (40.4% vs. 31.5%) (Figure 14). In the case there is any household member who has illness in the family, the higher the level of education and income, the higher the percentage of checking the food labels relatively.

■ Whether to check food labels

As a result of survey whether to check each label in the food labels of processed food when purchasing, 83.4% of the respondents said "Sometimes or always check Country of origin label." Next, the check rate of ‘warning for cautions label (76.0%)’ and ‘nutrition facts label (75.8%)’, ‘HACCP (73.2%)’ was high at 70% or higher. ‘Quality certification for liquor (35.1%)’, ‘Irradiated food label (38.1%)’, ‘Grandmaster of food label (38.6%)’, and ‘Gluten-free label (39.3%)’ are relatively rarely checked (Figure 15), possibly because these are labeled for relatively limited kind of products in the market.

■ Whether to recognize food labels

As a result of survey on whether or not labels for processed foods were recognized, 92.3% of the respondents said that they knew or heard about ‘Country of origin label’ in the highest percentage. Next, ‘HACCP (89.4%)’, ‘Warning for cautions label (85.9%)’, ‘Nutrition facts label (85.7%)’ and ‘Label for recycling (83.9%)’ were recognized for more than 80% of consumers. Similar to the level of checking food labels, less-recognized food labels include ‘Quality certification for liquor (34.0%)’, ‘Irradiated food label (41.2%)’, ‘Grandmaster of food label (48.3%)’, and ‘Gluten-free label (46.6%).’ (Figure 16)

■ Satisfaction, reliability and reason not to trust food labels

As a result of calculating the satisfaction with the food labels out of 5 points, the satisfaction rate of the labels of foods overall was 3.59 (2018 food consumption behavior survey), satisfaction with labels of processed food was 3.35, which is lower by 0.24 points than those of foods overall. Satisfaction with labels of health-functional foods was 3.21 points (Figure 17). The low level of satisfaction with processed food labels may be explained in various ways, such as the fact that the text is small or contains too much information, but further analysis is necessary to determine the exact reason. However, it should be noted that respondents who answered "normal" in the survey on the satisfaction of the foods labels on foods overall showed a much lower proportion, which means they had held their judgment.

The reliability of the food labels was evaluated out of 5 points. The reliability of the food labels on overall food was 3.53 (2018 consumption behavior survey for food), and it was 3.32 for the food labels for processed foods, which is lower by 0.21. The reliability of the food labels on health-functional foods was 3.26 points out of 5.0 (Figure 18). In the survey, the percentage of consumers who held judgment by responding “normal” was low when surveying general food products. Perhaps this may be due to the fact that they were asked about the ‘whole food’ category, which is somewhat broader category and thus more difficult to recall specific foods than the processed foods or health-functional foods.

As a result of survey, the reasons for not trusting the food labels, 54.1% of the respondents agreed that ‘no follow-up management for companies in charge of quality certification.’ The percentage of respondents who agreed to ‘Don’t trust the labeling and certification process’ was also high at 53.1%. Next, more than one-third of consumers agree that ‘hard to understand label’ or ‘Don’t trust label due to too much information (Figure 19).’

■ Evaluation of food labels on processed foods

Consumers also evaluated the food labels on general processed food as well as the processed foods sold on-line, respectively. In the case of general processed foods, ‘enough information on label (76.6%)’, ‘too much information (75.3%)’, and ‘reliable food labels (70.9%)’ are the mostly agreed statements with the level of agreement exceeding 70 percent. On the other hand, the level of consent for ‘Insufficient information necessary’ was very low at 20.6%, implying that consumers generally evaluated that enough information was provided for general processed foods. In the case of processed foods sold online, the agreement level was 48.2% for ‘Too much information’, which was approximately 30 % point lower than that of general processed food (75.3%). For the level of consent for ‘Enough information on label (63.5%)’, the agreement level was 13.1 % point lower than that of general processed food (Figure 20). This is linked to the fact that ‘the label is in a conspicuous position’ or ‘the shape or size of the label is visible’ in the relatively lower agreement level for processed foods sold on-line.

REFERENCES

Sang-Hyo Kim, Kyei-Im Lee, Yeon-a Hong, Seong-Yoon Heo. 2018. “National Agri-food Labeling and Improvement of Consumers’ Utilization”. Korea Rural Economic Institute.

Kyei-Im Lee, Mi-Sung Park, Sang-Hyo Kim, Seong-Yoon Heo. 2018. “2018 Consumer Attitude Survey for Processed Food: In-depth analysis report”. Korea Rural Economic Institute. Ministry of Agriculture, Foods and Rural Affairs.

Reviewed, edited and uploaded: November 8, 2019