Coffee has become one of the key agricultural exports of Vietnam, bringing to the country billions of dollars each year. But benefit from coffee export has been much lower than its potential requiring big efforts to be in a higher position in consumers in the world.

Vietnam coffee is now exported to more than 80 countries around the world. In 2016, Vietnam exported nearly 1.8 million tons of coffee, accounting for 15% of the global market share. At present, Vietnam is the biggest coffee producer and ranks second in the coffee bean exports of the world.

However, while export quantiy was about 27,500 bags (60kg/bags) in 2016, only after Brazil (45,400 bags), Vietnam’s export value was much lower, and even lower than that of Colombia, which exported only 12,500 bags last year.

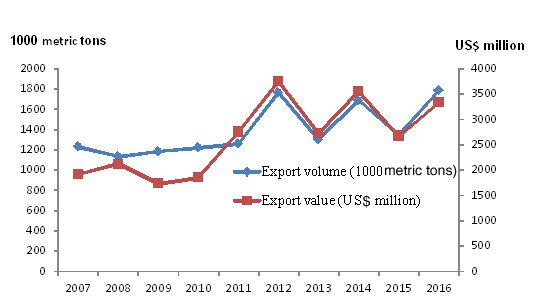

Fig. 1. Vietnam coffee export (2007-2016)

Source: General Customs office of Vietnam (GSO)

According to the Vietnam Coffee and Cacao Association (VICOFA), bean exports have been one of main reasons for the low competitiveness and low profit of the coffee industry in recent years. Most Vietnamese companies have to sell to 26 intermediares and foreign companies to export their products, instead of trading directly with big coffee roasters. Deep coffee processing system in Vietnam is still underdeveloped. This is contraditory with Germany and Switzerland who are bean coffee importers but they are the top two biggest processed coffee exporters in the world. Germany and USA continued to be the biggest importers of coffee bean from Vietnam but the export has grown strongly in Belgium, UK and Algeria.

Shortage of brand name is also a limitation of Vietnam’s coffee industry. Only a few local companies have started to build their own brand name due to limited financial shortage but promotion of their brands to the international market is very limited.

Bright spots to be seen

General Customs office of Vietnam has reported that the country exported a total of 680,000 tons of coffee ( US$648 millions) in the first two months of 2017, decreased 2.6% in volume but increased 28.8% in value in comparison with the same period last year. Average export price has gone up by 30.2% to 2,257 USD/ton in the same period. Experts explained the change of product structure analysis. Processed coffee tends to increase its share in the total export quantity and value. G7, a brand of Trung Nguyen coffee company, now meets strict requirements of Walmart to be sold in this group’ supermarket systems in Chile, Brazil, Mexico and China. In 2016, Vinacafe shipped 2,000 tons of instant coffee to 70 countries and territories. A Thai coffee company exported more than 2,000 tons of refined coffee.

In Dak Lak the largest coffee province of Vietnam, about 28,000 tons of coffee were deeply processed in 2016, including 23,000 tons of coffee powder and 5,000 tons of instant coffee. Of this, 4,520 tons were exported in 2016, instant coffee accounted for 7.5% of the total coffee exported value of the province. Dak Lak set target to increase the deeply processing rate to 15% of the total coffee bean quantity by 2020, and to 30% by 2030.

More efforts are needed

Along with the strong wave of investments in coffee processing and businesses in Vietnam, coffee export is predicted to grow in the future. Nestlé group funded nearly US$300 million in instant coffee processing in Dong Nai province. Local companies like Trung Nguyen, Me Trang, Vinacafe and some others are expanding their production scale to catch up opportunities from high quality and instant products segments.

In addition to this trend, bilateral and multilateral free trade agreements (FTAs) have been forged. Vietnam as a member is promising to enhance the processed coffee export of Vietnam. In fact, before FTAs, only coffee beans from Vietnam benefited from the import tariff of 0% while processed products suffered higher tariff of 15-20%. Now the tariff is reduced to 0-5% for all processed Vietnam’ coffee when being imported into FTAs’ members.

The coffee industry in Vietnam is on its way of restructuring to have higher value added and create sustainable development. The some important targets reflecting this direction include the 30 % processed coffee by 2020, annual export value from US$3.8 to 4.2.

To maintain a high position in the export market and improve the name of Vietnamese coffee in the world, Vietnam needs to improve its production and distribution system. In addition, the quality and food safety control should also be implemented efficiently in all steps of the supply chain, so that only good quality coffee is distributed to the consumers.

|

Date submitted: June 5, 2017

Reviewed, edited and uploaded: June 12, 2017

|

Vietnams’ Coffee Exports: Big Efforts Still Needed for a Higher Position in the World

Coffee has become one of the key agricultural exports of Vietnam, bringing to the country billions of dollars each year. But benefit from coffee export has been much lower than its potential requiring big efforts to be in a higher position in consumers in the world.

Vietnam coffee is now exported to more than 80 countries around the world. In 2016, Vietnam exported nearly 1.8 million tons of coffee, accounting for 15% of the global market share. At present, Vietnam is the biggest coffee producer and ranks second in the coffee bean exports of the world.

However, while export quantiy was about 27,500 bags (60kg/bags) in 2016, only after Brazil (45,400 bags), Vietnam’s export value was much lower, and even lower than that of Colombia, which exported only 12,500 bags last year.

Fig. 1. Vietnam coffee export (2007-2016)

Source: General Customs office of Vietnam (GSO)

According to the Vietnam Coffee and Cacao Association (VICOFA), bean exports have been one of main reasons for the low competitiveness and low profit of the coffee industry in recent years. Most Vietnamese companies have to sell to 26 intermediares and foreign companies to export their products, instead of trading directly with big coffee roasters. Deep coffee processing system in Vietnam is still underdeveloped. This is contraditory with Germany and Switzerland who are bean coffee importers but they are the top two biggest processed coffee exporters in the world. Germany and USA continued to be the biggest importers of coffee bean from Vietnam but the export has grown strongly in Belgium, UK and Algeria.

Shortage of brand name is also a limitation of Vietnam’s coffee industry. Only a few local companies have started to build their own brand name due to limited financial shortage but promotion of their brands to the international market is very limited.

Bright spots to be seen

General Customs office of Vietnam has reported that the country exported a total of 680,000 tons of coffee ( US$648 millions) in the first two months of 2017, decreased 2.6% in volume but increased 28.8% in value in comparison with the same period last year. Average export price has gone up by 30.2% to 2,257 USD/ton in the same period. Experts explained the change of product structure analysis. Processed coffee tends to increase its share in the total export quantity and value. G7, a brand of Trung Nguyen coffee company, now meets strict requirements of Walmart to be sold in this group’ supermarket systems in Chile, Brazil, Mexico and China. In 2016, Vinacafe shipped 2,000 tons of instant coffee to 70 countries and territories. A Thai coffee company exported more than 2,000 tons of refined coffee.

In Dak Lak the largest coffee province of Vietnam, about 28,000 tons of coffee were deeply processed in 2016, including 23,000 tons of coffee powder and 5,000 tons of instant coffee. Of this, 4,520 tons were exported in 2016, instant coffee accounted for 7.5% of the total coffee exported value of the province. Dak Lak set target to increase the deeply processing rate to 15% of the total coffee bean quantity by 2020, and to 30% by 2030.

More efforts are needed

Along with the strong wave of investments in coffee processing and businesses in Vietnam, coffee export is predicted to grow in the future. Nestlé group funded nearly US$300 million in instant coffee processing in Dong Nai province. Local companies like Trung Nguyen, Me Trang, Vinacafe and some others are expanding their production scale to catch up opportunities from high quality and instant products segments.

In addition to this trend, bilateral and multilateral free trade agreements (FTAs) have been forged. Vietnam as a member is promising to enhance the processed coffee export of Vietnam. In fact, before FTAs, only coffee beans from Vietnam benefited from the import tariff of 0% while processed products suffered higher tariff of 15-20%. Now the tariff is reduced to 0-5% for all processed Vietnam’ coffee when being imported into FTAs’ members.

The coffee industry in Vietnam is on its way of restructuring to have higher value added and create sustainable development. The some important targets reflecting this direction include the 30 % processed coffee by 2020, annual export value from US$3.8 to 4.2.

To maintain a high position in the export market and improve the name of Vietnamese coffee in the world, Vietnam needs to improve its production and distribution system. In addition, the quality and food safety control should also be implemented efficiently in all steps of the supply chain, so that only good quality coffee is distributed to the consumers.

Date submitted: June 5, 2017

Reviewed, edited and uploaded: June 12, 2017