INTRODUCTION

The domestic price of chemical fertilizers had experienced a significant increase during 2011-2013 while the price of agricultural products was declining. As a consequence, farmers’ incomes and living standards were negatively affected. In this context, the government and the Ministry of Finance proposed to exempt VAT for chemical fertilizers to stabilize the market price and to reduce production cost for farmers. The Law of VAT exemption was approved in November 2014. This report aims to provide rationale and evidence to show the impact of VAT elimination on the fertilizer market and farmers’ benefits. To do that, this report will focus on reviewing the structure of fertilizer sectors; analyzing rationale, enforcement and monitoring mechanism of the VAT exemption Law; and assessing how removing VAT can affect the market price of fertilizers, farmers and manufacturers.

THE FERTILIZER MARKET

In 2014 – 2015, along with the growth of demand for fertilizers in the world, the domestic fertilizer demand reached 10.83 million tons. Besides that, the quantity of fertilizers produced in Vietnam increased by leaps and bounds, with the average growth rate of 8.6% per year during 2010 - 2015 (MARD, 2016). This dramatic change was due to seasonal economic prospects, the expansion of global agricultural market and new achievements in transforming production technologies of chemical fertilizers into the most advanced forms as well. However, owing to the decrease in price of fertilizers worldwide as well as the upward movement of input material costs, revenue growth of the fertilizer sector is predicted to slow down but still remain positive.

Accordingly, the most striking risk was the oversupply in 2014 – 2015, in which nutrient supply by component is calculated to rise by almost 4%. Meanwhile, demand declined just over 2% (AGROINFO, 2016 & 2015). Even though the fertilizer supply was rising, it still cannot meet the equivalent amount of domestic demand. This is caused by numerous contributing factors, consisting of government’s policies, prices of other inputs and agricultural products.

Supply and manufacturers

The domestic supply of fertilizers in Vietnam has been increasing recently but only meets 80% of the demand. From 2009 to 2015, Vietnamese fertilizer production increased with an average annual growth of about 8%. In 2014, total fertilizer output was estimated to be more than 8 million tons, of which 3.8 million tons of NPK, 1.8 million tons of Phosphate, 2.4 million tons of Urea and 330,000 tons of DAP (MARD, 2016). Prior to 2012, Urea and NPK production did not meet the demand but domestic manufacturers are able to completely provide Urea and NPK since 2013. From an importing country, Vietnam has been moving into a period of fertilizer oversupply of Urea and NPK. However, Vietnam manufacturers are unable to produce K and SA fertilizers so that all K and SA, which is used in the local market, must be imported (Vinachem, 2016).

.jpg)

Fig. 1. Supply and demand of fertilizer in million tons

Source: MARD, 2015

Currently, the fertilizer market in Vietnam has been driven by 16 large fertilizer providers in which nine big companies are subsidiaries of the Vietnam Chemical Corporation (Vinachem) and two companies are subsidiaries of the Oil and Gas Corporation (PetroVietnam). Both Corporations shared 95% of the Vietnam fertilizers market in 2014 (Vinachem, 2016).

NPK manufacturing

NPK is the highest demanded fertilizer by the farmers (44% with 3.5m tons). There are five major fertilizer plants and more than 200 small companies sharing the NPK market. Cost of NPK production depends largely on those three components. While N can be purchased domestically, P can be produced in house, K must be imported (Vinachem, 2016).

Urea manufacturing

Each year, Vietnam needs around two million tons of urea for agriculture. Urea is produced domestically by four main plants, including Petro Vietnam Fertilizer and Chemical JSC (DPM with designed capacity of 800,000 tons per year), Ca Mau Fertilizer Plant (designed capacity of 800,000 tons per year), Ha Bac fertilizer plant (designed capacity of 190,000 tons per year) and Ninh Binh Fertilizer Plant (designed capacity of 560,000 tons per year) (Vinachem, 2016).

With the full operation of these plants, from 2013 onwards, the urea market in Vietnam becomes less dependent on imports. However, when domestic supply far exceeds domestic demand, fertilizer companies will find it more difficult to market their products. Market share will experience many changes as the competition on price and products quality will be larger in extent.

Phosphate manufacturing

Vietnam’s demand for phosphate is estimated at 1.8 million each year. Four big plants in Vietnam with high designed capacity sufficiently satisfy the domestic demand. Then, phosphate is supplied 100% from local factories (Vinachem, 2016).

DAP fertilizer is produced by mixing sulphate with superphosphate amon. It contains large portion of phosphate, therefore it is suitable for using on alkaline soils, or basalt. Currently, DAP 1 with the designed capacity of 330,000 tons per year and DAP 2 with same designed productivity make DAP demand fulfilled.

Demand

Urea, DAP, NPK are mainly used in the Vietnamese market. While demand for urea, phosphate, K has experienced a stable demand or a slight decrease, quantity of NPK and DAP used has increased. According to the Vietnam Fertilizer Association, domestic consumption of fertilizers in Vietnam is about 10 million tons, of which 3.8 million tons are of NPK, 2 million tons are of urea, 1.8 million tons are of phosphate, 950,000 tons are of K, 900,000 tons are of DAP, and 850,000 tons are of SA. Demand for fertilizers is affected by arable land, food demand, type of crops, cropping season, and fertilizer using habit (AGROINFO, 2016 & 2015).

.jpg)

Fig. 2. The percentage of fertilizer used by types in 2015

Source: MARD, 2015

Types of fertilizers vary depending on the cultivated area, crops and climate. Presently, the efficiency of using urea has only reached 30-45%, phosphate 40-45% and potash 40-50%, according to a recent report by the FAO.

Regarding type of crops, the largest market for the fertilizer industry goes for the rice segment, which accounts for 65% of total fertilizer demand. This is understandable because Vietnam is the second largest rice exporter in the world and rice is the most important food in the Vietnamese meal. Corn ranks second in total fertilizer demand with 9% of total demand; rubber and coffee follow by 8% and 5% of total demand, respectively (MARD, 2015).

Three main cropping seasons in Vietnam includes winter-spring, summer-autumn and winter. This explains the fluctuations in fertilizer demand during the year. According to MARD (2015), the fertilizer demand for winter spring season is the highest, accounting for 49% of total demand, followed by summer-autumn and winter crop with 25% and 27% of total demand, respectively.

Import

Despite accounting for nearly 20% of total fertilizer demand, Vietnam still needs to import 100% of its total SA and K demand, and 65% of its total DAP demand from other countries. In 2015, the import volume and value of fertilizers were about 4.56 million tons and US$1.43 million, increasing by 20.2% of volume and 15% of value, respectively. Each year, about 1.5 to 1.8 million tons of K and SA are imported to meet the local demand. Despite of adequate local supply of URE and NPK, about 650,000 tons of urea and 600,000 tons of NPK were imported in Vietnam in 2015 due to high competition of its neighboring countries (MARD, 2016). However, the quantity of fertilizers imported tends to decrease because of the expansion of local manufacturing and import tax.

Vietnam’s imported fertilizers are mainly from China, which accounts for around 47% of total imported amount. China has a competitive advantage related to high production capacity of 61 million tons per year. Chinese fertilizers are sold at VND 500-1000/kg lower than Vietnam’s fertilizers (AGROINFO, 2016 & 2015). Indonesia, Russia, Japan, Israel and Middle East countries are also top fertilizer exporters to Vietnam. Middle East countries with an advantage of cheap natural gas and oil resulting in low production cost have strong power in fertilizer price determination.

.jpg)

Fig. 3. Volume and value of imported fertilizers

Source: MARD

THE POLICY ON VAT EXEMPTION

Before 01 Jan 2015, under the regulations of VAT Law (Law 13/2008/QH12) imported fertilizer products to be used in Vietnam applied the VAT rate of 5%. Enterprises may declare VAT deduction and refund after finishing tax claim procedure. Farmers have to pay 5% of VAT when using fertilizers without refunding while firms enjoy VAT’s deduction in using these fertilizers. Therefore, it is likely to be unfair for farmers due to the same output price in the market. Removing VAT would help reduce the cost of production and improve farmers’ income. On November 26, 2014, the Vietnamese National Assembly (NA) approved Law 71/2014/QH13, which eliminates the VAT for fertilizers, offshore fishing boats, and animal feed products. Law 71/2014/QH13 applies to both imported and domestically produced fertilizers.

To implement the revised Law, Decree 12/2015/ND-CP was approved on February 12, 2015 to promulgate Regulations on the Implementation of some Revised Provisions of Laws on Taxations; and the Amendment and Supplement of some Provisions of the Decrees on Taxation. According to Clause 1, Article 3 of Decree 12/2015 fertilizers are not subject to VAT.

On 27 February 2015, the Ministry of Finance issued Circular number 26/2015/TT-BTC to instruct the implementation of Decree 12/2015/ND-CP in terms of VAT and tax management. On 15 June 2015, Circular number 92/2015/TT-BTC was promulgated to add and supplement some regulations for Law 71 and Decree 12/2015/ND-CP on tax and tax management.

IMPACT OF THE VAT EXEMPTION POLICY

Impact on market price

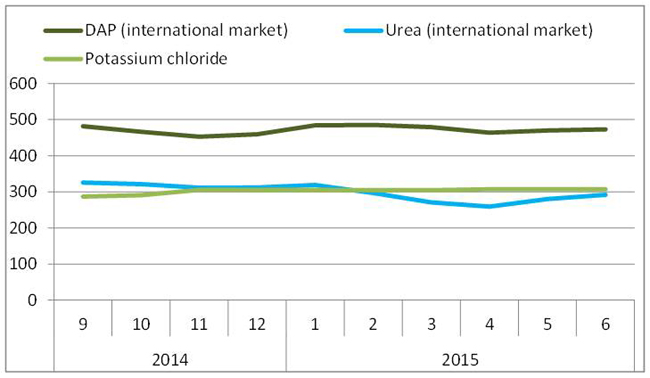

Compared with 2010, the Price Index of fertilizers (2010=100) shows an increase of 42.5% in 2011. During 2013, there was a 17% decline in the fertilizer price index, and an additional decrease of almost 13% in 2014 and 5% in 2015. During the first six months of 2015, there was an opposite trend between DAP price and urea price while the price of Potassium chloride was quite stable. According to the World Bank, downward trend of fertilizer prices in the global market are driven by weak demand, rising supply capacity, and destocking (WB, 2016).

Fig. 4. Fertilizer prices in the international market (USD/ton)

Source: WB, 2016

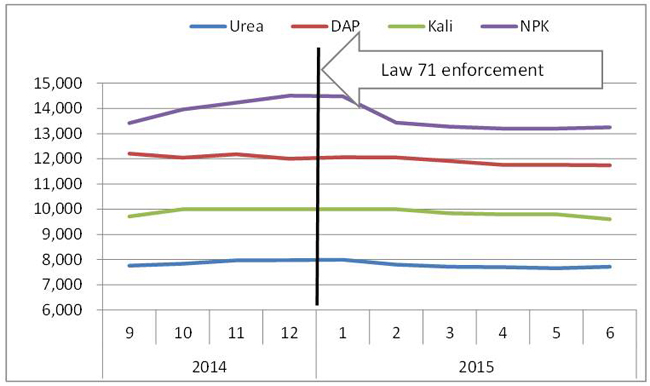

It can be seen that there is a similar trend of fertilizer price in Vietnam and the global market. During 2011-2012, market price was in high level, increasing about 40% compared to 2010. Fertilizer price in Vietnam has witnessed a downward trend from 2013, particularly from the time of Law 71/2014/QH13 enforcement. After the enforcement of the VAT elimination Law, the fertilizer price continued to decline, of which NPK shows a substantial decrease. In the first half of 2015, price of NPK, Urea, DAP and Kali declined by 7.06%, 2.63%, 1.01% and 1.6% respectively in comparison to price in Dec 2014. There might be many factors that affect the decrease of fertilizer prices in Vietnam but VAT exemption seems to be one of the key factors.

Fig. 5. Fertilizer price in Vietnam (VND/kg)

Source: AgroInfor, 2016

However, comparing to the local market, in the first half of 2015, fertilizer price in the global market had experienced a larger decrease. The price of urea in the global market fell by 8.3 % compared to its price in December 2014 while the decrease level in the domestic market was 7.06%. In terms of DAP price, there was the same decline level in the global and domestic markets, falling about 2% at the same time. These can be explained that DAP has not been produced by domestic manufacturers so its price trend has followed the global trends. Urea, however, is mostly manufactured by domestic firms. According to Law 71, VAT for fertilizer products (both imported and domestically produced) is eliminated but VAT for materials used in producing fertilizers is still charged. Therefore, domestic fertilizer manufacturers claimed that their production cost has been increased due to the loss of VAT input materials. That is the reason why the price of fertilizers has not reduced as much as government’s expectation.

The decrease of domestic price of fertilizers, nevertheless, is partly due to other reasons such as the expansion of domestic production of urea and NPK and reports from other countries, which caused an oversupply of urea and NPK in Vietnam. For example, urea production increased from 2.4 million tons in 2014 to 2.66 tons in 2015 while the urea demand was about 2.4 million tons. In terms of NPK, the supply was about 5 million tons compared to 3.8 million tons of demand in 2015 (Baoviet, 2015). In addition, demand for fertilizers seems to be weakly reduced because of climate change impact (disasters, floods, etc.) and farmers’ behavior (to high quality and safety product). In 2015 and in the first six months of 2016, a series of bad weather occurred in Vietnam such as drought in Central Highland, flood in the North and saltwater intrusion in Mekong River Delta, which caused negative impact on farmers’ cultivation thereby, decreasing fertilizer demand.

Impact on fertilizer producers

The fertilizer prices had not reduced as exactly as the VAT reduction due to some reasons. Fertilizer producers claim that the removal of VAT (if keeping the selling price unchanged), would decrease profit as enterprises are unable to seek VAT rebate[1] for VAT(s) associated with materials used for fertilizer production such as electricity, coal, natural gas, water, agricultural services and facility rental costs.

The Ministry of Finance (MOF), Tax agencies and Vietnam Fertilizer Association conducted a survey to review fertilizer enterprises on business situation and benefit in 2015. According to this survey, the proportion of input related VAT in revenue before tax is 5.71%. So, in case of VAT tax exemption for the fertilizer product, the loss from VAT input’s rebate is actually higher than the VAT exempted (by 0.71%). In other words, to cover the VAT inputs that would not be compensated, fertilizer enterprises have to increase its price by at least 0.71% in the wholesale price, rather than decrease as policy’s target.

Impact to production cost of farmer

By the Law 71/2014/QH13, fertilizers are not subjected to VAT in importing, manufacturing and also in wholesaling and retailing. At wholesale and retail, VAT accounts for 1% of revenue per each stage. The increase by 0.71% of manufacturers’ fertilizer price is therefore lower than the decrease level (2%) of market price that farmers receive due to VAT exemption in both wholesale and retail stages. It means that if input VAT is added in fertilizer prices, the net benefit of manufacturers remains unchanged while farmers received benefit.

Annually, farmers spend a huge amount of money on fertilizers. Rice farmers in Mekong River Delta use an average of 250 kg fertilizer per ha per season (SCAP, 2013). According to research result of Can Tho University (2015), cost for fertilizers is nearly 6 million VND per ha per season, accounting for 32.7% of rice production cost. In the coffee sector, the proportion of fertilizer cost is estimated to be about 40% of total production cost.

Though the price of fertilizer increased by 0.71% due to the recovery of input VAT (as analyzed in previous session) but the farmers still enjoy VAT exemption (about 2%) at wholesale and retail stages. The average decrease of fertilizer price in 2015 was about 140 VND per kilogram compared to 2014’s, so the rice farmers who have one hectare of land and cultivates two seasons per year would save around 70,000 – 100,000 VND depending on the quantity of fertilizers applied. Coffee farmers will have higher savings, of about 700,000 VND/hectare/year due to fertilizer price reduction. Every year, Vietnam has more than 2 million ha of rice production and about 640,000 ha for coffee. With simple estimation, each year about 140 - 200 billion VND and 44.8 billion VND will be saved for rice and coffee farmers, respectively, due to this policy.

CONCLUSION

It is clear that the VAT exemption policy has positive impact on stabilizing and reducing market price of chemical fertilizers and reducing production cost while its impact on manufacturers’ benefit has been controversial. The profits of fertilizer manufacturers seem to decrease due to their being unable to seek VAT rebate for purchasing materials. It is recommended that the Law 71/2014/QH13 needs to be amended so that fertilizer manufacturers should get or be charged 10% VAT, instead of exemption, to achieve the goals of the policy of stabilizing price, increasing farmers’ income and developing the domestic fertilizer industry.

REFERENCES

AGROINFO, 2015, Fertilizer market report in 2014 and outlook for 2015

AGROINFO, 2016, Fertilizer market report in 2015 and outlook for 2016

Baoviet, 2015, Fertilizer sector report.

Dispatch no 10867/BTC-CST date 10/8/2015 of Ministry of Finance on VAT policy of fertilizer and animal feed.

General Statistics Office, 2012, Results of the 2011 Rural, Agricultural and Fishery Census.

MARD, 2015, Annual report of Agriculture sector and rural development in 2014

MARD, 2016, Annual report of Agriculture sector and rural development in 2015

Nguyen, TD and Le, KN, 2015, Factors affecting economic efficiency in rice producing of rice farming households in Can Tho city, Can Tho University.

SCAP, 2013, Material technical solutions for rice in Mekong River Delta and coffee in Central Highland.

USDA, 2015, World grain and livestock market

Vinachem, 2016, Fertilizer sector report

World Bank, 2016, Commodity market outlook: Resource development in an era of cheap commodities.

Websites:

http://www.moj.gov.vn/vbpq/lists/vn%20bn%20php%20lut/view_detail.aspx?itemid=29846

http://www.vietdvm.com/cafe/tin-tuc-heo/352.html

http://enternews.vn/khong-de-sot-dn-kinh-doanh-phan-bon-chui.html

http://enternews.vn/uu-ai-dn-ngoai-nguoc-dai-dn-noi.html

[1]Before January 1, 2015, if the total VAT of input items is greater than the total VAT collected from selling fertilizers, the fertilizer manufacturers were eligible for getting compensation from the Government in the form of a VAT rebate.

|

Date submitted: May 3, 2017

Reviewed, edited and uploaded: June 7, 2017

|

Impact of VAT Exemption Policy for Chemical Fertilizers on Farmers and Domestic Manufacturers in Vietnam

INTRODUCTION

The domestic price of chemical fertilizers had experienced a significant increase during 2011-2013 while the price of agricultural products was declining. As a consequence, farmers’ incomes and living standards were negatively affected. In this context, the government and the Ministry of Finance proposed to exempt VAT for chemical fertilizers to stabilize the market price and to reduce production cost for farmers. The Law of VAT exemption was approved in November 2014. This report aims to provide rationale and evidence to show the impact of VAT elimination on the fertilizer market and farmers’ benefits. To do that, this report will focus on reviewing the structure of fertilizer sectors; analyzing rationale, enforcement and monitoring mechanism of the VAT exemption Law; and assessing how removing VAT can affect the market price of fertilizers, farmers and manufacturers.

THE FERTILIZER MARKET

In 2014 – 2015, along with the growth of demand for fertilizers in the world, the domestic fertilizer demand reached 10.83 million tons. Besides that, the quantity of fertilizers produced in Vietnam increased by leaps and bounds, with the average growth rate of 8.6% per year during 2010 - 2015 (MARD, 2016). This dramatic change was due to seasonal economic prospects, the expansion of global agricultural market and new achievements in transforming production technologies of chemical fertilizers into the most advanced forms as well. However, owing to the decrease in price of fertilizers worldwide as well as the upward movement of input material costs, revenue growth of the fertilizer sector is predicted to slow down but still remain positive.

Accordingly, the most striking risk was the oversupply in 2014 – 2015, in which nutrient supply by component is calculated to rise by almost 4%. Meanwhile, demand declined just over 2% (AGROINFO, 2016 & 2015). Even though the fertilizer supply was rising, it still cannot meet the equivalent amount of domestic demand. This is caused by numerous contributing factors, consisting of government’s policies, prices of other inputs and agricultural products.

Supply and manufacturers

The domestic supply of fertilizers in Vietnam has been increasing recently but only meets 80% of the demand. From 2009 to 2015, Vietnamese fertilizer production increased with an average annual growth of about 8%. In 2014, total fertilizer output was estimated to be more than 8 million tons, of which 3.8 million tons of NPK, 1.8 million tons of Phosphate, 2.4 million tons of Urea and 330,000 tons of DAP (MARD, 2016). Prior to 2012, Urea and NPK production did not meet the demand but domestic manufacturers are able to completely provide Urea and NPK since 2013. From an importing country, Vietnam has been moving into a period of fertilizer oversupply of Urea and NPK. However, Vietnam manufacturers are unable to produce K and SA fertilizers so that all K and SA, which is used in the local market, must be imported (Vinachem, 2016).

Fig. 1. Supply and demand of fertilizer in million tons

Source: MARD, 2015

Currently, the fertilizer market in Vietnam has been driven by 16 large fertilizer providers in which nine big companies are subsidiaries of the Vietnam Chemical Corporation (Vinachem) and two companies are subsidiaries of the Oil and Gas Corporation (PetroVietnam). Both Corporations shared 95% of the Vietnam fertilizers market in 2014 (Vinachem, 2016).

NPK manufacturing

NPK is the highest demanded fertilizer by the farmers (44% with 3.5m tons). There are five major fertilizer plants and more than 200 small companies sharing the NPK market. Cost of NPK production depends largely on those three components. While N can be purchased domestically, P can be produced in house, K must be imported (Vinachem, 2016).

Urea manufacturing

Each year, Vietnam needs around two million tons of urea for agriculture. Urea is produced domestically by four main plants, including Petro Vietnam Fertilizer and Chemical JSC (DPM with designed capacity of 800,000 tons per year), Ca Mau Fertilizer Plant (designed capacity of 800,000 tons per year), Ha Bac fertilizer plant (designed capacity of 190,000 tons per year) and Ninh Binh Fertilizer Plant (designed capacity of 560,000 tons per year) (Vinachem, 2016).

With the full operation of these plants, from 2013 onwards, the urea market in Vietnam becomes less dependent on imports. However, when domestic supply far exceeds domestic demand, fertilizer companies will find it more difficult to market their products. Market share will experience many changes as the competition on price and products quality will be larger in extent.

Phosphate manufacturing

Vietnam’s demand for phosphate is estimated at 1.8 million each year. Four big plants in Vietnam with high designed capacity sufficiently satisfy the domestic demand. Then, phosphate is supplied 100% from local factories (Vinachem, 2016).

DAP fertilizer is produced by mixing sulphate with superphosphate amon. It contains large portion of phosphate, therefore it is suitable for using on alkaline soils, or basalt. Currently, DAP 1 with the designed capacity of 330,000 tons per year and DAP 2 with same designed productivity make DAP demand fulfilled.

Demand

Urea, DAP, NPK are mainly used in the Vietnamese market. While demand for urea, phosphate, K has experienced a stable demand or a slight decrease, quantity of NPK and DAP used has increased. According to the Vietnam Fertilizer Association, domestic consumption of fertilizers in Vietnam is about 10 million tons, of which 3.8 million tons are of NPK, 2 million tons are of urea, 1.8 million tons are of phosphate, 950,000 tons are of K, 900,000 tons are of DAP, and 850,000 tons are of SA. Demand for fertilizers is affected by arable land, food demand, type of crops, cropping season, and fertilizer using habit (AGROINFO, 2016 & 2015).

Fig. 2. The percentage of fertilizer used by types in 2015

Source: MARD, 2015

Types of fertilizers vary depending on the cultivated area, crops and climate. Presently, the efficiency of using urea has only reached 30-45%, phosphate 40-45% and potash 40-50%, according to a recent report by the FAO.

Regarding type of crops, the largest market for the fertilizer industry goes for the rice segment, which accounts for 65% of total fertilizer demand. This is understandable because Vietnam is the second largest rice exporter in the world and rice is the most important food in the Vietnamese meal. Corn ranks second in total fertilizer demand with 9% of total demand; rubber and coffee follow by 8% and 5% of total demand, respectively (MARD, 2015).

Three main cropping seasons in Vietnam includes winter-spring, summer-autumn and winter. This explains the fluctuations in fertilizer demand during the year. According to MARD (2015), the fertilizer demand for winter spring season is the highest, accounting for 49% of total demand, followed by summer-autumn and winter crop with 25% and 27% of total demand, respectively.

Import

Despite accounting for nearly 20% of total fertilizer demand, Vietnam still needs to import 100% of its total SA and K demand, and 65% of its total DAP demand from other countries. In 2015, the import volume and value of fertilizers were about 4.56 million tons and US$1.43 million, increasing by 20.2% of volume and 15% of value, respectively. Each year, about 1.5 to 1.8 million tons of K and SA are imported to meet the local demand. Despite of adequate local supply of URE and NPK, about 650,000 tons of urea and 600,000 tons of NPK were imported in Vietnam in 2015 due to high competition of its neighboring countries (MARD, 2016). However, the quantity of fertilizers imported tends to decrease because of the expansion of local manufacturing and import tax.

Vietnam’s imported fertilizers are mainly from China, which accounts for around 47% of total imported amount. China has a competitive advantage related to high production capacity of 61 million tons per year. Chinese fertilizers are sold at VND 500-1000/kg lower than Vietnam’s fertilizers (AGROINFO, 2016 & 2015). Indonesia, Russia, Japan, Israel and Middle East countries are also top fertilizer exporters to Vietnam. Middle East countries with an advantage of cheap natural gas and oil resulting in low production cost have strong power in fertilizer price determination.

Fig. 3. Volume and value of imported fertilizers

Source: MARD

THE POLICY ON VAT EXEMPTION

Before 01 Jan 2015, under the regulations of VAT Law (Law 13/2008/QH12) imported fertilizer products to be used in Vietnam applied the VAT rate of 5%. Enterprises may declare VAT deduction and refund after finishing tax claim procedure. Farmers have to pay 5% of VAT when using fertilizers without refunding while firms enjoy VAT’s deduction in using these fertilizers. Therefore, it is likely to be unfair for farmers due to the same output price in the market. Removing VAT would help reduce the cost of production and improve farmers’ income. On November 26, 2014, the Vietnamese National Assembly (NA) approved Law 71/2014/QH13, which eliminates the VAT for fertilizers, offshore fishing boats, and animal feed products. Law 71/2014/QH13 applies to both imported and domestically produced fertilizers.

To implement the revised Law, Decree 12/2015/ND-CP was approved on February 12, 2015 to promulgate Regulations on the Implementation of some Revised Provisions of Laws on Taxations; and the Amendment and Supplement of some Provisions of the Decrees on Taxation. According to Clause 1, Article 3 of Decree 12/2015 fertilizers are not subject to VAT.

On 27 February 2015, the Ministry of Finance issued Circular number 26/2015/TT-BTC to instruct the implementation of Decree 12/2015/ND-CP in terms of VAT and tax management. On 15 June 2015, Circular number 92/2015/TT-BTC was promulgated to add and supplement some regulations for Law 71 and Decree 12/2015/ND-CP on tax and tax management.

IMPACT OF THE VAT EXEMPTION POLICY

Impact on market price

Compared with 2010, the Price Index of fertilizers (2010=100) shows an increase of 42.5% in 2011. During 2013, there was a 17% decline in the fertilizer price index, and an additional decrease of almost 13% in 2014 and 5% in 2015. During the first six months of 2015, there was an opposite trend between DAP price and urea price while the price of Potassium chloride was quite stable. According to the World Bank, downward trend of fertilizer prices in the global market are driven by weak demand, rising supply capacity, and destocking (WB, 2016).

Fig. 4. Fertilizer prices in the international market (USD/ton)

Source: WB, 2016

It can be seen that there is a similar trend of fertilizer price in Vietnam and the global market. During 2011-2012, market price was in high level, increasing about 40% compared to 2010. Fertilizer price in Vietnam has witnessed a downward trend from 2013, particularly from the time of Law 71/2014/QH13 enforcement. After the enforcement of the VAT elimination Law, the fertilizer price continued to decline, of which NPK shows a substantial decrease. In the first half of 2015, price of NPK, Urea, DAP and Kali declined by 7.06%, 2.63%, 1.01% and 1.6% respectively in comparison to price in Dec 2014. There might be many factors that affect the decrease of fertilizer prices in Vietnam but VAT exemption seems to be one of the key factors.

Fig. 5. Fertilizer price in Vietnam (VND/kg)

Source: AgroInfor, 2016

However, comparing to the local market, in the first half of 2015, fertilizer price in the global market had experienced a larger decrease. The price of urea in the global market fell by 8.3 % compared to its price in December 2014 while the decrease level in the domestic market was 7.06%. In terms of DAP price, there was the same decline level in the global and domestic markets, falling about 2% at the same time. These can be explained that DAP has not been produced by domestic manufacturers so its price trend has followed the global trends. Urea, however, is mostly manufactured by domestic firms. According to Law 71, VAT for fertilizer products (both imported and domestically produced) is eliminated but VAT for materials used in producing fertilizers is still charged. Therefore, domestic fertilizer manufacturers claimed that their production cost has been increased due to the loss of VAT input materials. That is the reason why the price of fertilizers has not reduced as much as government’s expectation.

The decrease of domestic price of fertilizers, nevertheless, is partly due to other reasons such as the expansion of domestic production of urea and NPK and reports from other countries, which caused an oversupply of urea and NPK in Vietnam. For example, urea production increased from 2.4 million tons in 2014 to 2.66 tons in 2015 while the urea demand was about 2.4 million tons. In terms of NPK, the supply was about 5 million tons compared to 3.8 million tons of demand in 2015 (Baoviet, 2015). In addition, demand for fertilizers seems to be weakly reduced because of climate change impact (disasters, floods, etc.) and farmers’ behavior (to high quality and safety product). In 2015 and in the first six months of 2016, a series of bad weather occurred in Vietnam such as drought in Central Highland, flood in the North and saltwater intrusion in Mekong River Delta, which caused negative impact on farmers’ cultivation thereby, decreasing fertilizer demand.

Impact on fertilizer producers

The fertilizer prices had not reduced as exactly as the VAT reduction due to some reasons. Fertilizer producers claim that the removal of VAT (if keeping the selling price unchanged), would decrease profit as enterprises are unable to seek VAT rebate[1] for VAT(s) associated with materials used for fertilizer production such as electricity, coal, natural gas, water, agricultural services and facility rental costs.

The Ministry of Finance (MOF), Tax agencies and Vietnam Fertilizer Association conducted a survey to review fertilizer enterprises on business situation and benefit in 2015. According to this survey, the proportion of input related VAT in revenue before tax is 5.71%. So, in case of VAT tax exemption for the fertilizer product, the loss from VAT input’s rebate is actually higher than the VAT exempted (by 0.71%). In other words, to cover the VAT inputs that would not be compensated, fertilizer enterprises have to increase its price by at least 0.71% in the wholesale price, rather than decrease as policy’s target.

Impact to production cost of farmer

By the Law 71/2014/QH13, fertilizers are not subjected to VAT in importing, manufacturing and also in wholesaling and retailing. At wholesale and retail, VAT accounts for 1% of revenue per each stage. The increase by 0.71% of manufacturers’ fertilizer price is therefore lower than the decrease level (2%) of market price that farmers receive due to VAT exemption in both wholesale and retail stages. It means that if input VAT is added in fertilizer prices, the net benefit of manufacturers remains unchanged while farmers received benefit.

Annually, farmers spend a huge amount of money on fertilizers. Rice farmers in Mekong River Delta use an average of 250 kg fertilizer per ha per season (SCAP, 2013). According to research result of Can Tho University (2015), cost for fertilizers is nearly 6 million VND per ha per season, accounting for 32.7% of rice production cost. In the coffee sector, the proportion of fertilizer cost is estimated to be about 40% of total production cost.

Though the price of fertilizer increased by 0.71% due to the recovery of input VAT (as analyzed in previous session) but the farmers still enjoy VAT exemption (about 2%) at wholesale and retail stages. The average decrease of fertilizer price in 2015 was about 140 VND per kilogram compared to 2014’s, so the rice farmers who have one hectare of land and cultivates two seasons per year would save around 70,000 – 100,000 VND depending on the quantity of fertilizers applied. Coffee farmers will have higher savings, of about 700,000 VND/hectare/year due to fertilizer price reduction. Every year, Vietnam has more than 2 million ha of rice production and about 640,000 ha for coffee. With simple estimation, each year about 140 - 200 billion VND and 44.8 billion VND will be saved for rice and coffee farmers, respectively, due to this policy.

CONCLUSION

It is clear that the VAT exemption policy has positive impact on stabilizing and reducing market price of chemical fertilizers and reducing production cost while its impact on manufacturers’ benefit has been controversial. The profits of fertilizer manufacturers seem to decrease due to their being unable to seek VAT rebate for purchasing materials. It is recommended that the Law 71/2014/QH13 needs to be amended so that fertilizer manufacturers should get or be charged 10% VAT, instead of exemption, to achieve the goals of the policy of stabilizing price, increasing farmers’ income and developing the domestic fertilizer industry.

REFERENCES

AGROINFO, 2015, Fertilizer market report in 2014 and outlook for 2015

AGROINFO, 2016, Fertilizer market report in 2015 and outlook for 2016

Baoviet, 2015, Fertilizer sector report.

Dispatch no 10867/BTC-CST date 10/8/2015 of Ministry of Finance on VAT policy of fertilizer and animal feed.

General Statistics Office, 2012, Results of the 2011 Rural, Agricultural and Fishery Census.

MARD, 2015, Annual report of Agriculture sector and rural development in 2014

MARD, 2016, Annual report of Agriculture sector and rural development in 2015

Nguyen, TD and Le, KN, 2015, Factors affecting economic efficiency in rice producing of rice farming households in Can Tho city, Can Tho University.

SCAP, 2013, Material technical solutions for rice in Mekong River Delta and coffee in Central Highland.

USDA, 2015, World grain and livestock market

Vinachem, 2016, Fertilizer sector report

World Bank, 2016, Commodity market outlook: Resource development in an era of cheap commodities.

Websites:

http://www.moj.gov.vn/vbpq/lists/vn%20bn%20php%20lut/view_detail.aspx?itemid=29846

http://www.vietdvm.com/cafe/tin-tuc-heo/352.html

http://enternews.vn/khong-de-sot-dn-kinh-doanh-phan-bon-chui.html

http://enternews.vn/uu-ai-dn-ngoai-nguoc-dai-dn-noi.html

[1]Before January 1, 2015, if the total VAT of input items is greater than the total VAT collected from selling fertilizers, the fertilizer manufacturers were eligible for getting compensation from the Government in the form of a VAT rebate.

Date submitted: May 3, 2017

Reviewed, edited and uploaded: June 7, 2017