Vietnam's Coffee Policy Review

ABSTRACT

Coffee is one of the most important agro-commodities of Vietnam. In recent years, this sector has obtained a number of remarkable achievements in export, contributing to the rapid export growth of Vietnam’s agro-commodities. As a result, Vietnam’s position in the coffee international market was significantly strengthened: Vietnam’s share in global coffee export gradually increased from 15% (2005) to 22% (2015). Despite this success, the coffee sector still has to face considerable challenges in order to sustainable development as plant senescence, uncontrollable expansion of coffee area, lack of labor especially during harvest time and small-scale production…, which causes unexpected cost to coffee growers. In order to help the coffee sector to overcome these obstacles, Vietnam’s government has issued a number of innovative support policies and programs, which surely create motivation for sustainable development and be suitable for governmental future orientation. However, the policy implementation has not been effective enough; due to lack of suitable sanctions for controlling failure to comply with planning permission, delayed support for rejuvenation, lack of guidance for production cooperation; complicated administrative procedures…

This article would like to present some aspects of Vietnam’s coffee policy review and some policy recommendations for sustainable development of the coffee sector in Vietnam.

Overview of Vietnam‘s coffee sector

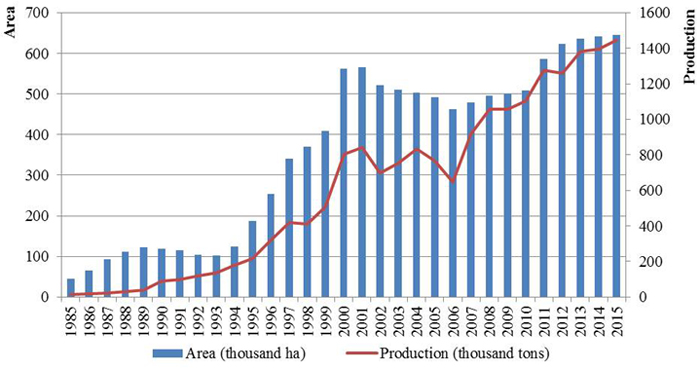

Estimated by the Ministry of Agriculture and Rural Development (MARD), Vietnam’s coffee area in 2014/15 was 641,700 ha, 0.7% higher than 2014. However, it is still rumored that actual area must reach 650,000 ha. Regarding coffee kinds, robusta takes the No. 1 position, accounting for 93.3%, while arabica 6.1% and liberica 0.06%. Five provinces of the Central Highlands accounted for 90% of the total coffee area. In the recent six years, the coffee area has gradually expanded, thus producing higher output. Five main reasons for this output trend are[2]: (i) obviously, coffee area expansion; (ii) favorable weather (especially in autumn 2013); (iii) farmer’s higher investments especially in sustainable coffee production; (iv) rapid increase of coffee rejuvenation area; (v) high and stable price from 2014 till begnning of 2015, which creates motivation for farmers to replace old coffee plants and expand their current area.

Fig. 1. Vietnam’s coffee area and output during 1985 – 2015

Source: General Statistics Office of Vietnam[3]

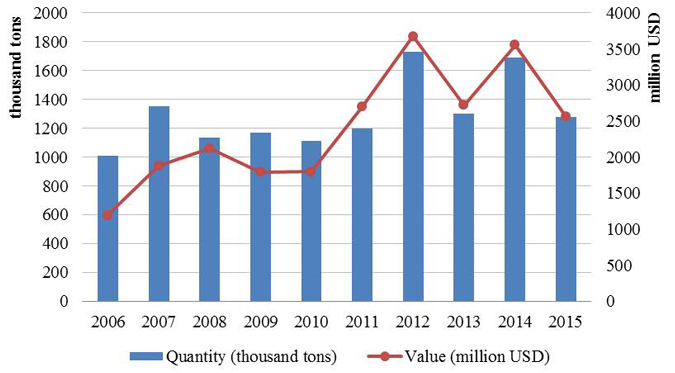

Vietnam’s coffee export in 2015 reached 1.34 million tons in terms of volume and earned $US2.67 billion. Germany and The US were the largest importers of Vietnam’s coffee in 2015 with a market share of 13.4% and 11.7%. Except for Japan (11% increase of quantity and 0.6% of value), the top 10 coffee export destinations decreased in 2015 compared to 2014. In Dec 2015, robusta green coffee of The Central Highlands decreased from 2,500 – 2,700 VND/kg to 30,300 – 30,800 VND/kg. After harvest time, farmer‘s coffee stocks are usually high. These stocks will be released into the market when Tet holiday comes nearer, although London coffee price during this time is usually quite low. The reason for this strange movement is that Vietnam farmers need cash for preparing for their Tet holiday.

Fig. 2. Quantity and value of Vietnam’s coffee export during 2006 – 2015

Source: General Department of Vietnam Customs

In 2015, there were 170 coffee exporters, of which 25 were foreign direct investment (FDI) enterprises. There are 50 enteprises exporting over 3,000 tons per year. Market share of FDI companies raised from 20% of total national export in 2008/09 to 38% in 2014/15. Green coffee export reduced from 95 – 97% in 2010 to 85 – 88% in 2015, which proved the higher investment in coffee processing.

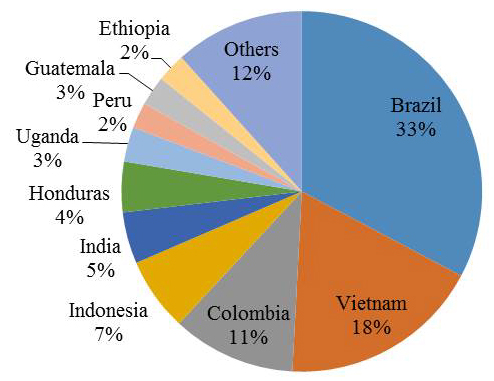

Fig. 3. Vietnam coffee export markets

Source: ICO

Vietnam’s position in international coffee market was strengthened during 2005 – 2015, specifically Vietnam’s coffee market share gradually increased from 15% to 22%. This positive achievement resulted from succesful overcome against the weaknesses of Vietnam’s coffee sector such as processing and lacking of cooperation between enterprises and farmers to produce sustainable coffee.

Although Vietnam’s coffee sector reached a number of achievements in recent years, the sector still has to face with these following challenges:

- Plant senescence, expansion without control; estimated by VICOFA[4] that 45% of 600,000 ha of coffee was planted before 1993, which need to be rejuvenated in next time for maintaining the stable coffee output;

- Lack of labor, increasing cost; on average, it needs 300 – 400 labor for working on 1 ha of Vietnam’s coffee field, of which 50% for harvest time. Lack of labor in harvest time affects negatively to harvest process and coffee quality; and

- Small-scale production; there are about 500,000 coffee households with average prodution scale of around 0.5 – 2 ha (approximately 600 thousand ha of coffee area in total), which brings difficulties in applying morden techniques to production

Policy review

In recent years, the Vietnam government has issued a number of policies and orientation for innovating and promoting the coffee sector as follows:

Coffee production planning

Vietnam government has issued a number of orientation/planning documents in order to improve Vietnam’s competitive capacity towards sustainable development and added value. Specifically, MARD approved the Plan for developing Vietnam’s coffee sector till 2020 and vision to 2030 (21/5/2015); Plan for increasing added value by process improvement and reducing post-harvest loss to agro-commodities (13/5/2014); Plan for developing sustainable coffee till 2020 (1/8/2014); Plan for coffe rejuvenation in The Central Highlands in 2014 – 2020 (21/10/2014). Besides, The Government approved Plan for agricultural restructuring (10/6/2013), emphasizing that coffee is one of the strategic commodities needed to be restructured soon.

Plan for developing sustainable coffee till 2020: 80% of 600,000 ha is sustainably planted, yield of around 2.7 tons/ha, output around 1.6 million tons/year, output value of about 120 million VND/ha; 30% of coffee wet-processed; instant and roasted coffee around 25% of total output; export about $US3.8 – 4.2 billion/year.

Plan for developing Vietnam’s coffee sector till 2020 and vision to 2030: coffee area in 2020 is expected to reach 500,000 thousand ha, till 2030 around 477,000 ha; 2020 output about 1.1 million tons, processed capacity about 125,000 tons and 2030 about 135,000 tons; export value of about $US2.1-2.2 billion and 2030 is higher than $US2.2 billion..

Domestic support policies

Decree 20/2011/ND-CP on 23/3/2011 guiding Decree 55/2010/QH12 on exemption and reduction of agriculture land tax (Effective duration of Decree 55 was from 01/01/2011 to 31/12/2020). Content of this policy is to reduce 50% of land tax for agriculture enterprises. This policy aims to support enterprises to invest in agriculture and encourage land accumulation for production…

Regarding support for natural disasters and epidemics, the Vietnam government issued Decision 142/2009/QD-TTg dated 31/12/2009 on policy and mechanism support for cultivation, livestock and fishery varieties which are damaged by natural disasters and epidemics. This document mentioned that support for 70% of damaged perennial trees were 2 million VND/ha, while 30-70% around 1 million VND/ha. However, after two years of implementation, The Government issued Decision 49/2012/QD-TTg dated 8/11/2012 amending Article 3 of Decision 142/2009/QD-TTg, mentioning that the support would be improved to be suitable to increace of actual price. Specifically, support for 70% of damaged perennial trees were 4 million VND/ha, while 30-70% around 2 million VND/ha.

- Credit policy (including credit for rejuvenation program)

A number of policies were issued for supporting coffee rejuvenation activities in two recent years: Process of robusta coffee rejuvenation regulated in Decision 273/QD-TT-CCN dated 03/7/2013 issued by Department of Cultivation; Economic-technical norms for robusta coffee rejuvenation regulated in Decision 340/QD-BNN-TT dated 23/2/2013 by MARD; State Budget of Vietnam approved 12,000 billion VND for supporting 5 provinces of The Central Highlands to carry out coffee rejuvenation program; Vietnam Coffee Rejuvenation Board was established (Decision 2927/QD-BNN-TCCB on 11/12/2013); Coffee Rejuvenation Plan for The Central Highland in 2014 – 2020; Document 1685/VPCP-KTTH dated 12/3/2015 of Government Office guiding the credit lending for coffee rejuvenation in The Central Highlands. Recently, the Governor of the State Bank of Vietnam issued Document 3227/NHNN-TD guiding Vietnam Bank for Agriculture and Rural Development to implement lending policy for coffee rejuvenation in The Central Highlands in 2014 – 2020 and Document 3228/NHNN-TD for implementing lending policy for coffee rejuvenation in The Central Highlands in 2014 – 2020.

- Training and education for farmers

Thanks to the support policy and budget of national and local government for agricultural extension, the number of farmers joining technical training courses have gradually increased. Innovation of training methodology, curricula, and organization brings effectiveness to training courses. In recent years, 4C standard is usually trained for farmers to meet customer‘s requirements of coffee products. Regaring support for training agriculture enteprise‘s workers: Decree No 61/2010/ND-CP regulates that there are three support levels based on production scale: Micro small enterprises are supported 100% training cost, small enterpises 70%, small and medium enteprises 50%. The support is only one time/labor and maximum of six months. Decree 210/2013/ND-CP on supporting enteprises to invest in agriculture mention the support of 70% cost, one time/labor and maximum of six months. Untrained labor in special use forest is supported with three million/month/labor.

Besides, some enteprises also gain benefits from Scheme 1956 as well as other projects on vocational training support for agriculture and rural labor. These projects contribute to improve labor quality for some agriculture enterprises.

- Input support (irrigation fee, varieties, fertilizer...)

Resolution 55/2010/QH12 on agricultural land use tax exemption and reduction, Decree 20/2011/ND-CP on detailed regulation and implementation guidance for Resolution 55/2010/QH12; Decree 115/2008/ND-CP regulated that irrigation charges are exempted for households, individiuals using their land/water surface for agricultural production; Circular 41/2013/TT-BTC on implementation guidance for Decree 67/2012/ND-CP and amending some Articles of Decree 143/2003/ND-CP issued by The Government; Circular 41/2013/TT-BTC guiding some articles of Decree 67/2012/ND-CP dated 10/9/2012 amending and revising some Articles of Decree 143/2003/ND-CP dated 28/11/2003; Decision 1580/2009/QD-TTg on financial support of water pumping and slapping for preventing foods for some provinces in Mekong River Delta.

Decree 209/2013/ND-CP dated 18/12/2013 guiding some Articles of Law on Value Added Tax, Cicular 219/2013/TT-BTC guiding implementation of the Decree for reducing value added tax down to 5% for key inputs as fertilizer, pesticide, stimulant drugs, livestock and fishery feed; Circular 02/VBHN-BCT dated 23/1/2014 of Ministry of Trade and Industry replaces Circular 07/2004/TT-BTM dated 26/7/2004 of Ministry of Commerce on import tax exemption towards production materials, imported inputs for agro-forestry-fishery and salt production, artificial variety production, imported plant and livestock varieties.

Decision 1258/QD-BNN-KHCN on June 4, 2013 approving List of major extension program in 2013 – 2020, of which, there is development program on applying Vietgap for coffee cultivation.

- VGAP, GAP support production

Vietnam government supports to apply UTZ, 4C, GAP production standard… and other standards mentioned in some legislative documents as Circular 75/2009/TT-BNNPTNT on food safety and hygiene standards of agricultural production; Decision 86/2007/QD-BNN on national standard TCVN 4193:2005 for examining quality of imported green coffee; Circular 03/2010/TT-BNNPTNT on national standard TCVN 4193:2005 for green coffee; Decision 1415/QD-BKHCN dated 12/6/2014 on national standard TCVN 4193:2014 for green coffee; Decision 01/2012/QD-TTg on support policy for applying the method of good agricultural practices (GAP) to agriculture, silviculture, and aquaculture; Directive 1311/CT-BNN-TT in 2012 of MARD on promoting application of GAP; Circular 54/2014/TT-BNNPTNT, Joint Circular 42/2013/TTLT-BNNPTNT-BTC-BKHDT, Circular 53/2012/TT-BNNPTNT are all issued for promoting GAP application in agriculture.

Post-harvest and post-processing loss reduction

Decision 68/2013/QD-TTg dated 14/11/2013, Circular 13/2014/TT-NHNN, Circular 08/2014/BNN on supporting post-harvest loss reduction, Plan for increasing added value by improving processing stage and reducing post-harvest loss for agro-commodities (13/5/2014).

Support for reducing post-harvest loss are also mentioned in Decision 497/2009/QD-TTg and Decision 2213/2009/QD-TTg, Circular 09/2009/TT-NHNN, Circular 02/2010/TT-NHNN, Decision 329/2010/QD-NHNN on interest rate support for purchasing new production machine and equipment, Circular 188/2012/TT-BTC, Circular 89/2014/TT-BTC on preferential interest rate on supporting post-harvest reduction policy.

Value chain effectiveness improvement

Decision 62/2013/QD-TTg dated 25/11/2013 issued some incentive policies for cooperation promotion, production linkage between production and consumption, planning for sustainable development, water-saving, safe production based on certified standards, variety restructuring, semi-process, large field production, land rent/use exemption, priority for joining contract farming and temporary storage program, financial support for field construction, electricity and irrigation, supporting 50 – 100% farmer traing cost, 30% variety cost, 100% storage cost up to three months.

Trade and investment incentive

In recent years, Vietnam government also pays attention to processing and trading activities. There are a number of support polices as: three billion for each processing project relating to infrastructure construction as roads, electricity, irrigation, waste disposal system, equipment purchasing; time loan is extented to 36 months (maximum) for coffee export; 100% support for purchasing post-harvest loss reduction machine, equipment; 100% interest rate for the first and second year, then 50% for third year; removing 5% VAT for some commodities including coffee; managing procurement system; semi-processing technology improvement; establishing modern coffee consumption promotion system (coffee exchange centers), which facilitates the domestic market development; agro-commodity information promotion and forecast; trade promotion. Some typical policies as Decree 210/2013/ND-CP on supporting enteprises to invest in agriculture, Decree 209/2013/ND-CP regulating, guiding some articles of Law on Value Added Tax, Decree 133/2013/ND-CP on amending Decree 54/2013/ND-CP on investments and export credits, Decision 57/2010/QD-TTg on land tax exemption for (coffee) temporary storage construction project, Decision 3848/2010/QD-BCT on providing market information serving agriculture consumption, Scheme for coffee sustainable development until 2020.

Law on Enterprise Income Tax 14/2008/QH12 (amending by Law 32/2013/QH13 on amending some Article of Law on Enterprise Income Tax and Law 71/2014/QH13 on amending some Article of Law on amendments to tax law) regulated that:

- Enterprise income tax is exempted in case: incomes from farming, livestock and fishery in disadvantageous areas; income from sea fishery.

- The tax rate of 10% for enterprises having income from planting, cultivating, and protecting forests; from agriculture, forestry, and aquaculture in localities facing socio-economic difficulties; from the production, multiplication, and cross-breeding of plants and animals; from the production, extraction, and refinement of salt, except for the production of salt; from investment in post-harvest preservation of agriculture products, aquaculture products, and food.

Law on Personal Income Tax 04/2007/QH12 (amending by Law 26/2012/QH13 on amending some Articles of Law on Personal Income Tax and Law 71/2014/QH13on amending some Articles of Law on amendments to tax law) regulated that:

Personal income tax is exempted in case: incomes of households and individuals directly engaged in agricultural or forest production, salt making, aquaculture, fishing and trading of aquatic resources not yet processed into other products or preliminarily processed aquatic products; incomes from conversion of agricultural land allocated by the Government to households and individuals for production.

Law on Value Added Tax 13/2008/QH12 (amending by Law 31/2013/QH13on amending some Articles of Law on Value Added Tax andLaw 71/2014/QH13 on amending some Articles of Law on amendments to tax law) regulated that:

Some non-taxable objects includes: (i) farming, breeding, aquaculture products that have not been processed into other products or have only been preliminary processed by the manufacturers or catchers when they are sold and imported. Enterprises and cooperatives buying farming, breeding, aquaculture produces that have not been processed into other products or have only been preliminary processed and selling them to other enterprises or cooperatives are not required to declare and pay VAT but may deduct input VAT; (ii) fertilizers, specialized machinery and equipment serving agricultural production; offshore fishing vessels; feed for cattle, poultry, and other animals; (iii) Salt products made of seawater, natural rock salt, refined salt, iodized salt of which the primary constituent is sodium chloride (NaCl);...

On 30/9/2015, Prime Minister issued Decision 1684/QD-TTg approving “economic integration strategy for agriculture and rural development“ that focues on key agro-commodities as rice, vegetable, fishery, coffee, tea, rubber, cashew, pepper, wood, livestock...; of which, mentioning general and specific measures for improving major markets of these commodities.

On 14/10/2005, National Office of Intellectual Property issued Decision 806/QD – SHTT, national registeration No 00004, recognizing monopoly protection of geographical indications Buon Ma Thuot coffee for Dak Lak province.

Recently, government is editing a new Decree on attracting foreign investments in agriculture with four main major groups: (i) (plant and livestock) variety production and development; (ii) auxiliary material production for creating higher added value; (iii) processing improvement and raw material area development; (iv) pesticide and veterinary medicine production. Foreign investors may get a number of prorities as tax exemption, land use/rentfee exemption...

Institutional, scientific and technological innovation

To promote high-tech application in agriculture, The Government issued Decision 1895/QD-TTg on approving a program to promote high-tech application in the development of the agricultural sector as part of the national program to promote high-tech application development till 2020. According to this, the Government will promote the development and effective application of high technology in the agricultural sector; contribute to build a comprehensively-developed agriculture in the direction of modernization, large-scale commodity production, high productivity, quality, efficiency and competitiveness, which brings about achievement of at least 3.5% annual growth rate; contribute to assure food security in both short and long terms.

Institutional reform is one of The Government’s priorities in recent years and also largely contributes to sustainable development of coffee sector. Some achievements are: (1) establishing Vietnam Coffee Coordinating Board (Decision 1729/QD-BNN-TCCB dated 30/7/2013); (2) establishing coffee production associations in some provinces; (3) restructuring state enterprises, improving the competitiveness of domestic enterprises; (4) strenthening cooperative model of The Central Highlands (Decision 710/QD-BNN-KTHT dated 10/4/2014 and 1443/QD-BNN dated 27/6/2014); (5) piloting PPP in variety production, irrigation and processing; (6) variety research, selection and application; water-saving system; studying the current situation and reasons for death trees after replanted; establishing the rejuvenation process, GAP intensive cultivation process (Decision 986/QD-BNN-KHCN dated 09/05/2014 on promoting high-tech research and applicationin agricultural restructuring).

CONCLUSION

Coffee production in Vietnam has achieved great sucess with stable growth. The rapid expansion of the coffee sector has made Vietnam become the largest robusta coffee in the world. However, the coffee sector in Vietnam is facing problems such as high percentage of old trees, water shortage for coffee, lack of brand, among others. The above review reveals that it is necessary to adjust or develop other support policies focusing on sustainable production, rejuvenation promotion, processing and trading for Vietnam coffee, including:

- To promote coffee rejuvenation process by establishing sanctions for controlling failure to comply with planning permission; promoting rejuvenation activities; supporting varieties for rejuvenation; promoting large field production for coffee production; promoting credit programs of State Bank of Vietnam for rejuvenation; establishing accessible mechanisms (simple procedures for mortgaged property, low interest rate application...), which facilitates farmers to receive credit easily

- To promote the water-saving technique in coffee production

- To enhance training on sustainable production for farmers. Besides direct training for farmers, training of trainers (TOT) and support to enteprises (for training farmers) should be all combined together.

- To support enterprises in processing and trading coffee by: removing enteprise’s difficulty relating to VAT reimbursement procedures; establishing accessible mechanisms on credit, post-harvest loss reduction based on Decision 68/2013/QD-TTG for supporting farmers and enterprises; supporting enterprises in trade promotion and finding new market

- To enhance cooperation among stakeholders joining coffee value chain; to develop farmer associations, especially cooperatives and production groups.

REFERENCES

MARD (2010), Commodity import export strategy in 2011 – 2020 and vision to 2030, Hanoi, Vietnam.

IPSARD (2014), Study report on Vietnam coffee rejuvenation – Major issues and measures, Hanoi, Vietnam

MARD (2014), Impact assessment on implementing WTO and regional commitments relating to agriculture and rural development, Hanoi, Vietnam

Luu Duc Khai (2013), The impact of Vietnam committment with WTO and regions on agricultural enteprises

GSO (2015), Macroeconomic report in 2014, Statistical publishing House, Hanoi, Vietnam.

|

Date submitted: June 27, 2016

Reviewed, edited and uploaded: July 21, 2016

|

[1] Institute of Policy and Strategy for Agriculture and Rural Development

Vietnam’s Coffee Policy Review

Vietnam's Coffee Policy Review

ABSTRACT

Coffee is one of the most important agro-commodities of Vietnam. In recent years, this sector has obtained a number of remarkable achievements in export, contributing to the rapid export growth of Vietnam’s agro-commodities. As a result, Vietnam’s position in the coffee international market was significantly strengthened: Vietnam’s share in global coffee export gradually increased from 15% (2005) to 22% (2015). Despite this success, the coffee sector still has to face considerable challenges in order to sustainable development as plant senescence, uncontrollable expansion of coffee area, lack of labor especially during harvest time and small-scale production…, which causes unexpected cost to coffee growers. In order to help the coffee sector to overcome these obstacles, Vietnam’s government has issued a number of innovative support policies and programs, which surely create motivation for sustainable development and be suitable for governmental future orientation. However, the policy implementation has not been effective enough; due to lack of suitable sanctions for controlling failure to comply with planning permission, delayed support for rejuvenation, lack of guidance for production cooperation; complicated administrative procedures…

This article would like to present some aspects of Vietnam’s coffee policy review and some policy recommendations for sustainable development of the coffee sector in Vietnam.

Overview of Vietnam‘s coffee sector

Estimated by the Ministry of Agriculture and Rural Development (MARD), Vietnam’s coffee area in 2014/15 was 641,700 ha, 0.7% higher than 2014. However, it is still rumored that actual area must reach 650,000 ha. Regarding coffee kinds, robusta takes the No. 1 position, accounting for 93.3%, while arabica 6.1% and liberica 0.06%. Five provinces of the Central Highlands accounted for 90% of the total coffee area. In the recent six years, the coffee area has gradually expanded, thus producing higher output. Five main reasons for this output trend are[2]: (i) obviously, coffee area expansion; (ii) favorable weather (especially in autumn 2013); (iii) farmer’s higher investments especially in sustainable coffee production; (iv) rapid increase of coffee rejuvenation area; (v) high and stable price from 2014 till begnning of 2015, which creates motivation for farmers to replace old coffee plants and expand their current area.

Fig. 1. Vietnam’s coffee area and output during 1985 – 2015

Source: General Statistics Office of Vietnam[3]

Vietnam’s coffee export in 2015 reached 1.34 million tons in terms of volume and earned $US2.67 billion. Germany and The US were the largest importers of Vietnam’s coffee in 2015 with a market share of 13.4% and 11.7%. Except for Japan (11% increase of quantity and 0.6% of value), the top 10 coffee export destinations decreased in 2015 compared to 2014. In Dec 2015, robusta green coffee of The Central Highlands decreased from 2,500 – 2,700 VND/kg to 30,300 – 30,800 VND/kg. After harvest time, farmer‘s coffee stocks are usually high. These stocks will be released into the market when Tet holiday comes nearer, although London coffee price during this time is usually quite low. The reason for this strange movement is that Vietnam farmers need cash for preparing for their Tet holiday.

Fig. 2. Quantity and value of Vietnam’s coffee export during 2006 – 2015

Source: General Department of Vietnam Customs

In 2015, there were 170 coffee exporters, of which 25 were foreign direct investment (FDI) enterprises. There are 50 enteprises exporting over 3,000 tons per year. Market share of FDI companies raised from 20% of total national export in 2008/09 to 38% in 2014/15. Green coffee export reduced from 95 – 97% in 2010 to 85 – 88% in 2015, which proved the higher investment in coffee processing.

Fig. 3. Vietnam coffee export markets

Source: ICO

Vietnam’s position in international coffee market was strengthened during 2005 – 2015, specifically Vietnam’s coffee market share gradually increased from 15% to 22%. This positive achievement resulted from succesful overcome against the weaknesses of Vietnam’s coffee sector such as processing and lacking of cooperation between enterprises and farmers to produce sustainable coffee.

Although Vietnam’s coffee sector reached a number of achievements in recent years, the sector still has to face with these following challenges:

Policy review

In recent years, the Vietnam government has issued a number of policies and orientation for innovating and promoting the coffee sector as follows:

Coffee production planning

Vietnam government has issued a number of orientation/planning documents in order to improve Vietnam’s competitive capacity towards sustainable development and added value. Specifically, MARD approved the Plan for developing Vietnam’s coffee sector till 2020 and vision to 2030 (21/5/2015); Plan for increasing added value by process improvement and reducing post-harvest loss to agro-commodities (13/5/2014); Plan for developing sustainable coffee till 2020 (1/8/2014); Plan for coffe rejuvenation in The Central Highlands in 2014 – 2020 (21/10/2014). Besides, The Government approved Plan for agricultural restructuring (10/6/2013), emphasizing that coffee is one of the strategic commodities needed to be restructured soon.

Plan for developing sustainable coffee till 2020: 80% of 600,000 ha is sustainably planted, yield of around 2.7 tons/ha, output around 1.6 million tons/year, output value of about 120 million VND/ha; 30% of coffee wet-processed; instant and roasted coffee around 25% of total output; export about $US3.8 – 4.2 billion/year.

Plan for developing Vietnam’s coffee sector till 2020 and vision to 2030: coffee area in 2020 is expected to reach 500,000 thousand ha, till 2030 around 477,000 ha; 2020 output about 1.1 million tons, processed capacity about 125,000 tons and 2030 about 135,000 tons; export value of about $US2.1-2.2 billion and 2030 is higher than $US2.2 billion..

Domestic support policies

Decree 20/2011/ND-CP on 23/3/2011 guiding Decree 55/2010/QH12 on exemption and reduction of agriculture land tax (Effective duration of Decree 55 was from 01/01/2011 to 31/12/2020). Content of this policy is to reduce 50% of land tax for agriculture enterprises. This policy aims to support enterprises to invest in agriculture and encourage land accumulation for production…

Regarding support for natural disasters and epidemics, the Vietnam government issued Decision 142/2009/QD-TTg dated 31/12/2009 on policy and mechanism support for cultivation, livestock and fishery varieties which are damaged by natural disasters and epidemics. This document mentioned that support for 70% of damaged perennial trees were 2 million VND/ha, while 30-70% around 1 million VND/ha. However, after two years of implementation, The Government issued Decision 49/2012/QD-TTg dated 8/11/2012 amending Article 3 of Decision 142/2009/QD-TTg, mentioning that the support would be improved to be suitable to increace of actual price. Specifically, support for 70% of damaged perennial trees were 4 million VND/ha, while 30-70% around 2 million VND/ha.

A number of policies were issued for supporting coffee rejuvenation activities in two recent years: Process of robusta coffee rejuvenation regulated in Decision 273/QD-TT-CCN dated 03/7/2013 issued by Department of Cultivation; Economic-technical norms for robusta coffee rejuvenation regulated in Decision 340/QD-BNN-TT dated 23/2/2013 by MARD; State Budget of Vietnam approved 12,000 billion VND for supporting 5 provinces of The Central Highlands to carry out coffee rejuvenation program; Vietnam Coffee Rejuvenation Board was established (Decision 2927/QD-BNN-TCCB on 11/12/2013); Coffee Rejuvenation Plan for The Central Highland in 2014 – 2020; Document 1685/VPCP-KTTH dated 12/3/2015 of Government Office guiding the credit lending for coffee rejuvenation in The Central Highlands. Recently, the Governor of the State Bank of Vietnam issued Document 3227/NHNN-TD guiding Vietnam Bank for Agriculture and Rural Development to implement lending policy for coffee rejuvenation in The Central Highlands in 2014 – 2020 and Document 3228/NHNN-TD for implementing lending policy for coffee rejuvenation in The Central Highlands in 2014 – 2020.

Thanks to the support policy and budget of national and local government for agricultural extension, the number of farmers joining technical training courses have gradually increased. Innovation of training methodology, curricula, and organization brings effectiveness to training courses. In recent years, 4C standard is usually trained for farmers to meet customer‘s requirements of coffee products. Regaring support for training agriculture enteprise‘s workers: Decree No 61/2010/ND-CP regulates that there are three support levels based on production scale: Micro small enterprises are supported 100% training cost, small enterpises 70%, small and medium enteprises 50%. The support is only one time/labor and maximum of six months. Decree 210/2013/ND-CP on supporting enteprises to invest in agriculture mention the support of 70% cost, one time/labor and maximum of six months. Untrained labor in special use forest is supported with three million/month/labor.

Besides, some enteprises also gain benefits from Scheme 1956 as well as other projects on vocational training support for agriculture and rural labor. These projects contribute to improve labor quality for some agriculture enterprises.

Resolution 55/2010/QH12 on agricultural land use tax exemption and reduction, Decree 20/2011/ND-CP on detailed regulation and implementation guidance for Resolution 55/2010/QH12; Decree 115/2008/ND-CP regulated that irrigation charges are exempted for households, individiuals using their land/water surface for agricultural production; Circular 41/2013/TT-BTC on implementation guidance for Decree 67/2012/ND-CP and amending some Articles of Decree 143/2003/ND-CP issued by The Government; Circular 41/2013/TT-BTC guiding some articles of Decree 67/2012/ND-CP dated 10/9/2012 amending and revising some Articles of Decree 143/2003/ND-CP dated 28/11/2003; Decision 1580/2009/QD-TTg on financial support of water pumping and slapping for preventing foods for some provinces in Mekong River Delta.

Decree 209/2013/ND-CP dated 18/12/2013 guiding some Articles of Law on Value Added Tax, Cicular 219/2013/TT-BTC guiding implementation of the Decree for reducing value added tax down to 5% for key inputs as fertilizer, pesticide, stimulant drugs, livestock and fishery feed; Circular 02/VBHN-BCT dated 23/1/2014 of Ministry of Trade and Industry replaces Circular 07/2004/TT-BTM dated 26/7/2004 of Ministry of Commerce on import tax exemption towards production materials, imported inputs for agro-forestry-fishery and salt production, artificial variety production, imported plant and livestock varieties.

Decision 1258/QD-BNN-KHCN on June 4, 2013 approving List of major extension program in 2013 – 2020, of which, there is development program on applying Vietgap for coffee cultivation.

Vietnam government supports to apply UTZ, 4C, GAP production standard… and other standards mentioned in some legislative documents as Circular 75/2009/TT-BNNPTNT on food safety and hygiene standards of agricultural production; Decision 86/2007/QD-BNN on national standard TCVN 4193:2005 for examining quality of imported green coffee; Circular 03/2010/TT-BNNPTNT on national standard TCVN 4193:2005 for green coffee; Decision 1415/QD-BKHCN dated 12/6/2014 on national standard TCVN 4193:2014 for green coffee; Decision 01/2012/QD-TTg on support policy for applying the method of good agricultural practices (GAP) to agriculture, silviculture, and aquaculture; Directive 1311/CT-BNN-TT in 2012 of MARD on promoting application of GAP; Circular 54/2014/TT-BNNPTNT, Joint Circular 42/2013/TTLT-BNNPTNT-BTC-BKHDT, Circular 53/2012/TT-BNNPTNT are all issued for promoting GAP application in agriculture.

Post-harvest and post-processing loss reduction

Decision 68/2013/QD-TTg dated 14/11/2013, Circular 13/2014/TT-NHNN, Circular 08/2014/BNN on supporting post-harvest loss reduction, Plan for increasing added value by improving processing stage and reducing post-harvest loss for agro-commodities (13/5/2014).

Support for reducing post-harvest loss are also mentioned in Decision 497/2009/QD-TTg and Decision 2213/2009/QD-TTg, Circular 09/2009/TT-NHNN, Circular 02/2010/TT-NHNN, Decision 329/2010/QD-NHNN on interest rate support for purchasing new production machine and equipment, Circular 188/2012/TT-BTC, Circular 89/2014/TT-BTC on preferential interest rate on supporting post-harvest reduction policy.

Value chain effectiveness improvement

Decision 62/2013/QD-TTg dated 25/11/2013 issued some incentive policies for cooperation promotion, production linkage between production and consumption, planning for sustainable development, water-saving, safe production based on certified standards, variety restructuring, semi-process, large field production, land rent/use exemption, priority for joining contract farming and temporary storage program, financial support for field construction, electricity and irrigation, supporting 50 – 100% farmer traing cost, 30% variety cost, 100% storage cost up to three months.

Trade and investment incentive

In recent years, Vietnam government also pays attention to processing and trading activities. There are a number of support polices as: three billion for each processing project relating to infrastructure construction as roads, electricity, irrigation, waste disposal system, equipment purchasing; time loan is extented to 36 months (maximum) for coffee export; 100% support for purchasing post-harvest loss reduction machine, equipment; 100% interest rate for the first and second year, then 50% for third year; removing 5% VAT for some commodities including coffee; managing procurement system; semi-processing technology improvement; establishing modern coffee consumption promotion system (coffee exchange centers), which facilitates the domestic market development; agro-commodity information promotion and forecast; trade promotion. Some typical policies as Decree 210/2013/ND-CP on supporting enteprises to invest in agriculture, Decree 209/2013/ND-CP regulating, guiding some articles of Law on Value Added Tax, Decree 133/2013/ND-CP on amending Decree 54/2013/ND-CP on investments and export credits, Decision 57/2010/QD-TTg on land tax exemption for (coffee) temporary storage construction project, Decision 3848/2010/QD-BCT on providing market information serving agriculture consumption, Scheme for coffee sustainable development until 2020.

Law on Enterprise Income Tax 14/2008/QH12 (amending by Law 32/2013/QH13 on amending some Article of Law on Enterprise Income Tax and Law 71/2014/QH13 on amending some Article of Law on amendments to tax law) regulated that:

Law on Personal Income Tax 04/2007/QH12 (amending by Law 26/2012/QH13 on amending some Articles of Law on Personal Income Tax and Law 71/2014/QH13on amending some Articles of Law on amendments to tax law) regulated that:

Personal income tax is exempted in case: incomes of households and individuals directly engaged in agricultural or forest production, salt making, aquaculture, fishing and trading of aquatic resources not yet processed into other products or preliminarily processed aquatic products; incomes from conversion of agricultural land allocated by the Government to households and individuals for production.

Law on Value Added Tax 13/2008/QH12 (amending by Law 31/2013/QH13on amending some Articles of Law on Value Added Tax andLaw 71/2014/QH13 on amending some Articles of Law on amendments to tax law) regulated that:

Some non-taxable objects includes: (i) farming, breeding, aquaculture products that have not been processed into other products or have only been preliminary processed by the manufacturers or catchers when they are sold and imported. Enterprises and cooperatives buying farming, breeding, aquaculture produces that have not been processed into other products or have only been preliminary processed and selling them to other enterprises or cooperatives are not required to declare and pay VAT but may deduct input VAT; (ii) fertilizers, specialized machinery and equipment serving agricultural production; offshore fishing vessels; feed for cattle, poultry, and other animals; (iii) Salt products made of seawater, natural rock salt, refined salt, iodized salt of which the primary constituent is sodium chloride (NaCl);...

On 30/9/2015, Prime Minister issued Decision 1684/QD-TTg approving “economic integration strategy for agriculture and rural development“ that focues on key agro-commodities as rice, vegetable, fishery, coffee, tea, rubber, cashew, pepper, wood, livestock...; of which, mentioning general and specific measures for improving major markets of these commodities.

On 14/10/2005, National Office of Intellectual Property issued Decision 806/QD – SHTT, national registeration No 00004, recognizing monopoly protection of geographical indications Buon Ma Thuot coffee for Dak Lak province.

Recently, government is editing a new Decree on attracting foreign investments in agriculture with four main major groups: (i) (plant and livestock) variety production and development; (ii) auxiliary material production for creating higher added value; (iii) processing improvement and raw material area development; (iv) pesticide and veterinary medicine production. Foreign investors may get a number of prorities as tax exemption, land use/rentfee exemption...

Institutional, scientific and technological innovation

To promote high-tech application in agriculture, The Government issued Decision 1895/QD-TTg on approving a program to promote high-tech application in the development of the agricultural sector as part of the national program to promote high-tech application development till 2020. According to this, the Government will promote the development and effective application of high technology in the agricultural sector; contribute to build a comprehensively-developed agriculture in the direction of modernization, large-scale commodity production, high productivity, quality, efficiency and competitiveness, which brings about achievement of at least 3.5% annual growth rate; contribute to assure food security in both short and long terms.

Institutional reform is one of The Government’s priorities in recent years and also largely contributes to sustainable development of coffee sector. Some achievements are: (1) establishing Vietnam Coffee Coordinating Board (Decision 1729/QD-BNN-TCCB dated 30/7/2013); (2) establishing coffee production associations in some provinces; (3) restructuring state enterprises, improving the competitiveness of domestic enterprises; (4) strenthening cooperative model of The Central Highlands (Decision 710/QD-BNN-KTHT dated 10/4/2014 and 1443/QD-BNN dated 27/6/2014); (5) piloting PPP in variety production, irrigation and processing; (6) variety research, selection and application; water-saving system; studying the current situation and reasons for death trees after replanted; establishing the rejuvenation process, GAP intensive cultivation process (Decision 986/QD-BNN-KHCN dated 09/05/2014 on promoting high-tech research and applicationin agricultural restructuring).

CONCLUSION

Coffee production in Vietnam has achieved great sucess with stable growth. The rapid expansion of the coffee sector has made Vietnam become the largest robusta coffee in the world. However, the coffee sector in Vietnam is facing problems such as high percentage of old trees, water shortage for coffee, lack of brand, among others. The above review reveals that it is necessary to adjust or develop other support policies focusing on sustainable production, rejuvenation promotion, processing and trading for Vietnam coffee, including:

REFERENCES

MARD (2010), Commodity import export strategy in 2011 – 2020 and vision to 2030, Hanoi, Vietnam.

IPSARD (2014), Study report on Vietnam coffee rejuvenation – Major issues and measures, Hanoi, Vietnam

MARD (2014), Impact assessment on implementing WTO and regional commitments relating to agriculture and rural development, Hanoi, Vietnam

Luu Duc Khai (2013), The impact of Vietnam committment with WTO and regions on agricultural enteprises

GSO (2015), Macroeconomic report in 2014, Statistical publishing House, Hanoi, Vietnam.

Date submitted: June 27, 2016

Reviewed, edited and uploaded: July 21, 2016

[1] Institute of Policy and Strategy for Agriculture and Rural Development

[2] www.vietrade.gov.vn

[3]https://www.gso.gov.vn/Default.aspx?tabid=706&ItemID=13412

[4] Vietnam Coffee – Cocoa Association, http://www.vicofa.org.vn/