Korea's food exports are constantly increasing. As the Korean Wave culture spreads around the world, interest in Korea increases, and the excellence of Korean food is more known worldwide, Korea's food exports have increased for more than 20 years since 2000. First, this study analyzes the trend of food exports in Korea and major food exporters and export foods. As a result, it can be seen that Korea has mainly exported food to Japan, China, the United States, and Vietnam. And the main exports were laver (seaweed), tuna, beverage, ramyeon, and ginseng. Second, we also investigated the policies related to food export promotion implemented by the Korean government. The policy consists of: 1) export information and consulting, 2) development and discovery of export items, 3) support for safety and quality control, 4) support for customs clearance and logistics, 5) developing local distribution networks, and 6) financing for supporting exports.

Keywords: Food export, Food export policy, Food market

INTRODUCTION

In South Korea, Korea's food exports are growing rapidly. By achieving US$11.37 billion in exports in 2021, it recorded more than US$10 billion for the first time, and is expected to surpass US$12 billion in 2022, given continuing its growth. This corresponds to a figure that has more than quadrupled compared to the amount of exports in 2000. Behind this growth lies the globalization of culture such as Korean dramas, eating shows, and Korean pop songs. Large-scale food manufacturers in Korea are expanding their export markets to numerous countries that have not previously been exported. In line with the increasing trend of exports, the government is also implementing various support policies.

TRENDS IN EXPORT CHANGES IN THE KOREAN FOOD MARKET

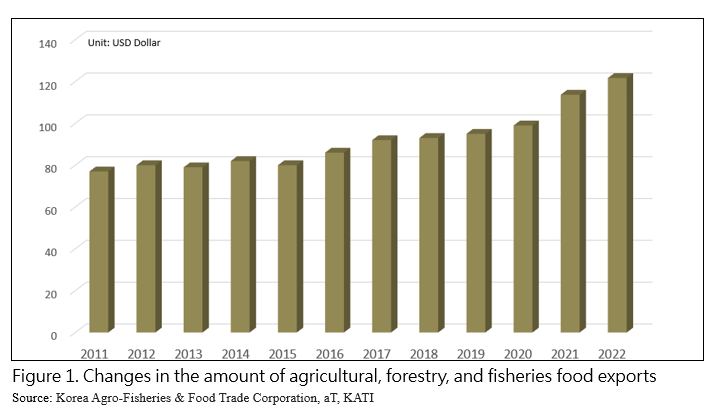

Korea's food exports have continued to increase from 2000 to 2022, with exports of US$11.37 billion in 2021. Assuming that this trend continues, exports of US$12.16 billion will be achieved in 2022, which is more than quadrupled compared to the exports in 2000.

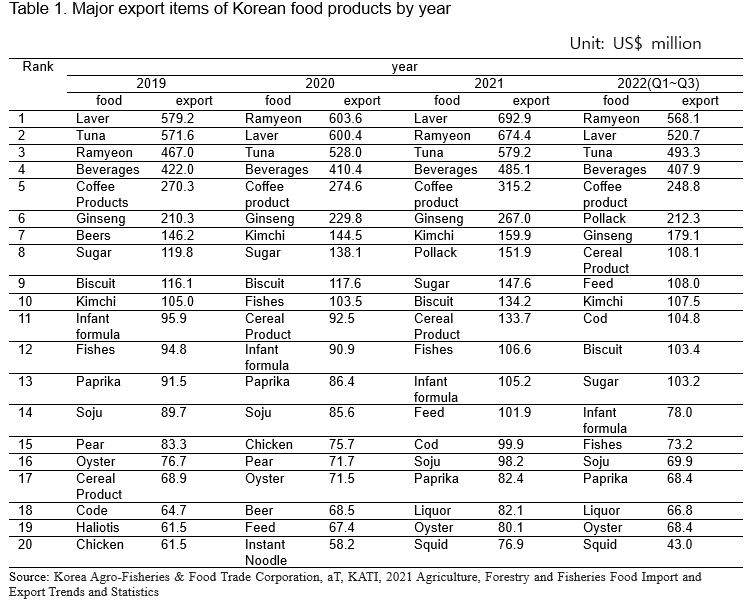

Korea's export food items have remained generally constant from 2016 to the first three quarters of 2022. From 2016 to the first to third quarters of 2022, exports have been mainly focused on tuna, ramyeon, laver (seaweed), beverages, coffee products, and ginseng. In the case of laver, exports have exploded recently. Korea accounts for 57% of the world's production, and in 2019, it recorded more exports than tuna, which was ranked No. 1 in 50 years among Korea's seafood exports. Exporting countries have also expanded to more than 110 countries, including the United States, France, Thailand, Singapore and Russia, in addition to seaweed-consuming countries such as China and Japan.

In the case of ramyeon industry, it enjoyed the biggest boom due to COVID-19, but since 2021, domestic profitability has declined due to a sharp rise in raw material prices such as palm oil and flour and various costs such as sea freight costs. However, exports have increased significantly, thanks to popular singers, dramas and movies, and most ramyeon makers are making up for their losses in Korea by targeting the overseas markets.

Tuna achieved US$580 million in exports this year. Korea began exporting tuna to Japan for the first time in 1963, building a large fleet based on bold investment by companies and government support, and continuously securing fishing grounds overseas to stabilize the export base. Worth focusing on among the key export foods is feed. Feed was not in the top 20 major export items until 2019. However, it ranked 19th in exports in 2020, 14th in 2021, and 9th in exports between the first and third quarters of 2022. And beer exports, which were located in the top 10 until 2019, recorded the highest exports in 2018 and then entered a decline. In addition, in 2020, when COVID-19 occurred, exports of US$59.98 million, less than 50% of exports in 2019, entered a sharp decline starting in 2020. Beer exports in 2021 were US$46.84 million, the lowest in 11 years (Table 1).

TOP EXPORT COUNTRIES AND MAJOR EXPORT ITEMS BY COUNTRY

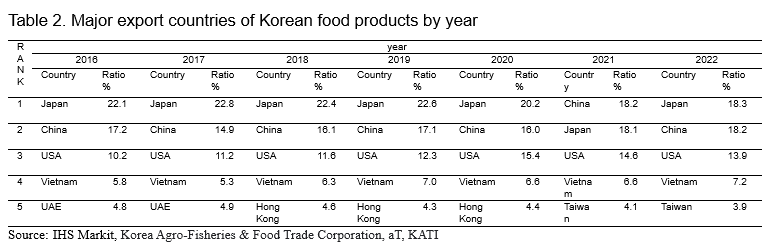

Japan, China, the United States, Vietnam, and Taiwan are among the top five export countries of Korean food products. In general, Japan, China, and the United States maintained the top 1st to 3rd place in exports. Vietnam, Hong Kong and Taiwan came in fourth and fifth. As such, Korean food is exported to most Asian countries except for the United States among major export countries. Uniquely, as of 2020, the proportion of exports to Japan decreased and the proportion of exports to China increased.

MAJOR EXPORT FOODS BY EXPORT COUNTRIES

Among the major export countries, export items to the United States, Japan, and China are shown in the figure below. First of all, in the case of the United States, the items with a high proportion of exports were laver (9.9%), beverages (5.5%), ramyeon (5.1%), cereal products (3.3%), and ginseng (1.9%). Next, in the case of Japan, tuna (9.1%), seaweed (5.8%), paprika (3.4%), kimchi (2.9%), and ramyeon (2.9%) are the most exported. In the case of exports to China, a lot of exports are made in the order of pollack (11.9%), ramyeon (8.0%), seaweed (4.8%), beverages (3.6%), and ginseng (3.5%) (Figure 2).

SEARCH FOR FOOD EXPORTS BASED ON SEARCH VOLUME TRENDS

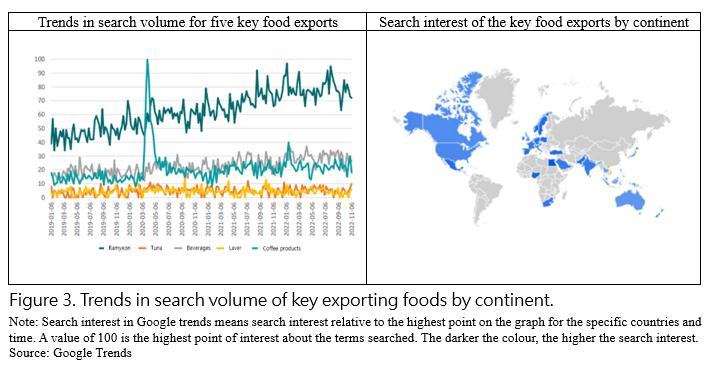

In the case of domestic food exports, it shows an increasing pattern as Korean culture has recently become globalized. In line with this, if you look at Google’s trend search volume for five major export items in Korea (ramyeon, tuna, beverage, seaweed, and coffee products), you can see that the search volume has increased since 2019. This search record was especially high in North America, Australia, Northern Europe, and the Middle East. Accordingly, it can be seen that interest in Korean food is high internationally. Unlike in the past, when exports were mainly done in Asia, interest in Korean food is now increasing not only in Asia but also in Western countries, and the status of Korean food can be interpreted as gradually rising around the world (Figure 3).

EXPORT PROMOTION POLICY

In Korea, the Ministry of Agriculture, Food and Rural Affairs (MAFRA) and the Korea Agro-Fisheries and Food Trade Corporation (aT) have established and implemented agricultural export support projects (policy) every year. As of 2022, the agri-food export support project consists of: 1) providing export information and consultation, 2) fostering and discovering export items, 3) supporting safety and quality management, 4) supporting customs clearance and logistics, 5) exploring local distribution networks, and 6) financing for export support.

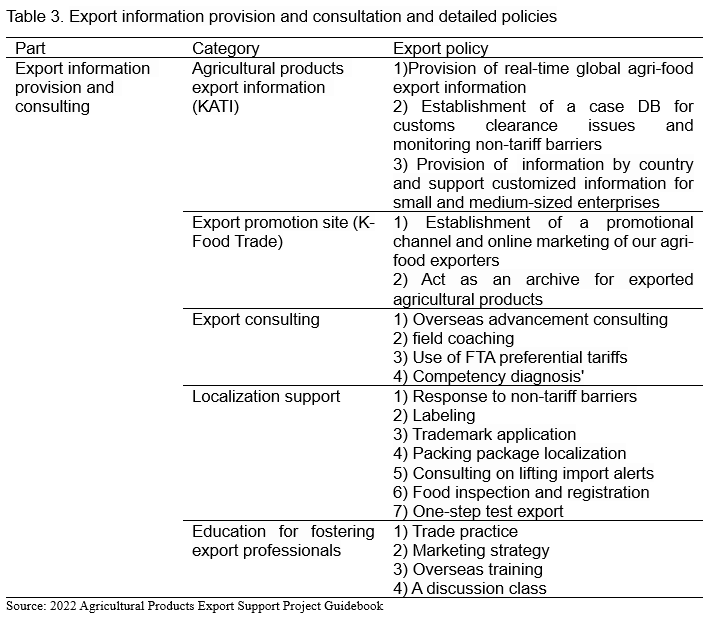

Export information provision and consultation consist of: 1) agri-food export information (KATI), 2) export promotion site (K-Food Trade), 3) export consultation, 4) localization support, and 5) education to foster export professionals (Table 3). KATI is a website that specializes in agricultural export information of domestic benefits and provides export-related information free of charge through the Internet and mobile. The site provides integrated statistics, news, and data on major exports and imported items, and also supports services that provide customized information when exporters request specific information. In the case of K-Food Trade, it plays the role of an online permanent transaction mediation and promotion site that matches overseas buyers, export products, and exporters and links them with export support projects. Export consultation is a policy to expand exports by commercializing exports of domestic companies and exploring new markets for existing exporters by providing consulting services using experts for agri-food companies. This policy selects companies eligible for support after evaluating sales and exports. Localization support supports the development of the agri-food export market by resolving customs difficulties for exporters and import buyers in major export countries and responding to non-tariff barriers by country. The policy aims to foster agricultural export experts by providing agricultural food-specialized trade practice education opportunities for agricultural food export industry officials and lay the foundation for export expansion.

Next, the export item development and discovery policy consists of detailed policies such as fostering export integrated organizations, supporting export commercialization, supporting global brand development, and supporting excellent agri-food packages (Table 4). First, fostering an integrated export organization supports the development of a phased export integrated organization involving national export farmers and exporters considering the characteristics of each item of fresh agricultural products. It consists of support for infrastructure development projects and support for incentives to promote exports. Next, export commercialization support supports costs related to local settlement of products such as promising food development and overseas marketing. In addition, support for global brand development is a policy to support brand consulting, promotion, and advertising with the aim of expanding exports by fostering export brands and raising awareness of foreign countries by small and medium-sized agri-food companies in Korea.

Finally, excellent agricultural and food package backup supports consumer-centered packages that allow business consumers to choose the support projects they want for export beginners and small and medium-sized companies with basic agricultural export capabilities and growth potential.

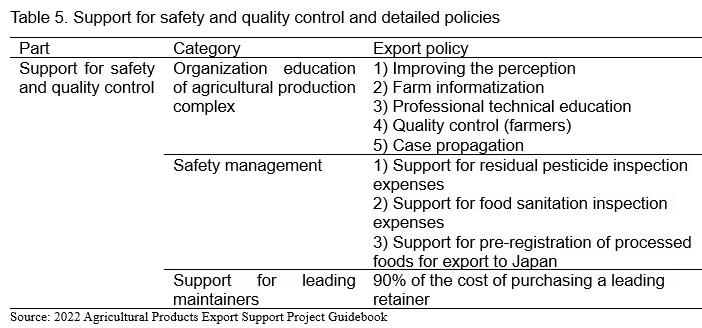

The safety and quality management support policy consist of education on the organization of agricultural production complexes, safety management, and support for leading maintenance (Table 5). First of all, in the case of organized education of agricultural production complexes, the policy aims to improve the human resource capacity of farms and complexes and strengthen the quality and safety of agricultural export products through customized support reflecting the on-site demand of government-designated agricultural production complexes. This is characterized by supporting 90% of the required budget, such as improving farm awareness, informatization of farms, professional technology education, and quality management. Next, in the case of safety management, the policy aims to create an export environment by providing residual pesticides and food hygiene inspection costs to export farmers and exporters to secure safety from the domestic production stage of exported agricultural and food products. It supports inspection fees for residual pesticides, food hygiene inspections, and pre-registration of processed foods exported to Japan. Next, in the case of supporting the forward maintenance system, it is a project that supports the purchase of the forward maintenance system to enhance the marketability of fresh agricultural products and expand exports, and it is a policy to support 90% of the cost of purchasing the forward maintenance system.

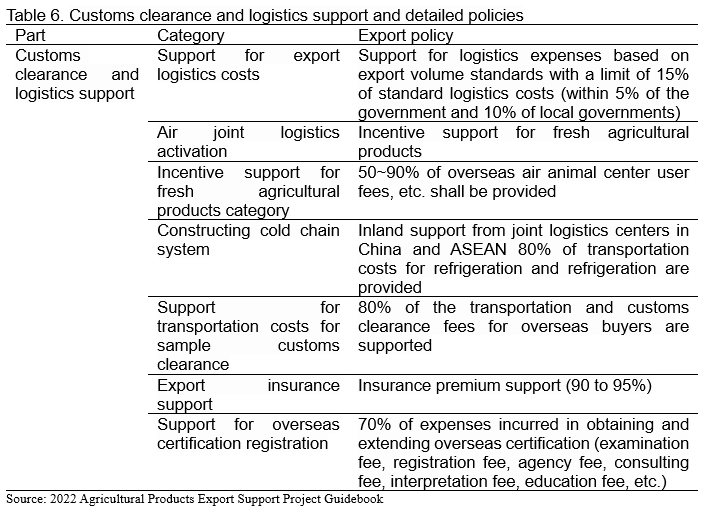

Customs and logistics support consist of support for export logistics costs, activation of air joint logistics and air animals center, overseas air and air logistics centers, cold chain construction, sample customs transportation costs, export insurance support, and overseas certification registration support (Table 6). In the case of supporting export logistics costs, it is a policy to partially support export logistics costs to the agri-food sector, which is burdened with logistics costs such as packaging and transportation. In other words, it supports logistics costs according to export volume standards with a limit of 15% of standard logistics costs. Next, in the case of activation of air-borne animals related logistics, the purpose is to support the development of new markets and reduce export logistics through the activation of long-distance aviation of fresh agricultural products. It supports incentives for fresh produce. Next, in the case of overseas air and animal distribution centers, the goal is to support the improvement of quality, price, competitiveness, and the development of new distribution networks by supporting overseas logistics of agri-food export (storage, fulfillment, etc.). This is a policy that supports 50 to 90% of the usage fees for overseas joint logistics centers (e.g., storage fees, warehousing fees, and fulfillment, etc. Next, the cold chain construction project is a policy to strengthen the development of the Korean fresh agri-food market by supporting the construction of cold chains inland in China or ASEAN markets, which lack frozen and refrigerated logistics infrastructure. Therefore, this policy supports 80% of the cost of freezing and refrigerating inland transportation departing from joint logistics centers in China or ASEAN. Next, the support for sample customs clearance transportation costs is a policy to expand the potential export market by supporting customs and transportation costs required for sample provision and test export for new overseas markets and buyers. Accordingly, this policy supports 80% of sample delivery, transportation, and customs clearance costs for overseas buyers. Export insurance support supports stable management of exporters by supporting foreign exchange fluctuation insurance and short-term export insurance subscription fees. Accordingly, this policy supports more than 90% of the insurance premiums for foreign exchange fluctuation insurance and short-term export insurance for agricultural and livestock food exporters.

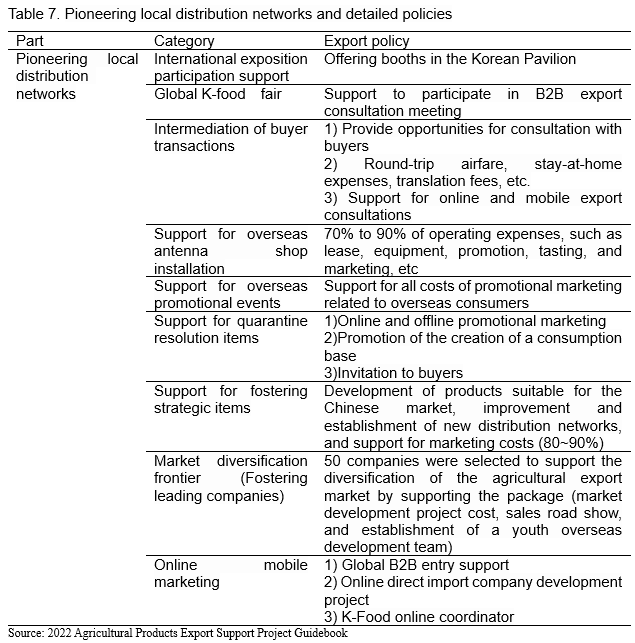

Detailed policies related to local distribution network development consist of international fair participation, global K-food fair, buyer transaction arrangement, overseas antenna shop installation support, overseas promotion support, quarantine resolution support, strategic item development support, market diversification frontiers (leading companies) and online mobile marketing (Table 7). First, the participation support for the international fair supports the formation of a Korean pavilion at major overseas food fairs to enhance export capabilities and expand exports of domestic small and medium-sized agri-food exporters. Global K-Food Fair aims to create a Korean agri-food export network and expand the base of local consumption by promoting integrated marketing that combines B2B export consultations and B2C consumer events in major overseas export hub cities. Accordingly, this policy supports participation in B2B export consultations. Next, buyer transaction arrangement aims to expand exports by inviting overseas branches of the Korea Agro-Fishery Food Trade Corporation (aT) and excellent buyers recommended for overseas space to support large-scale export consultations with domestic exporters. Accordingly, it provides exporters with opportunities to consult with various buyers. The support for the installation of overseas Antenna shops is a policy to support overseas antenna shop operation costs suitable for local conditions in order to explore the possibility of new markets and entry of Korean agricultural products. Accordingly, 70-90% of operating expenses such as rental and equipment costs, promotion costs, tasting, and marketing will be supported. Next, support for overseas promotional events aims to expand the presence of Korean agricultural and fishery products and raise consumer awareness through promotional events linked to large overseas distribution stores and online malls (tasting, promotion, etc.). Therefore, this policy supports all costs related to promotional marketing activities in overseas consumption sites. The support for quarantine relief items is a policy that supports entry into the market of items that have been difficult to export due to the inability to export by country or difficult quarantine conditions. Therefore, this includes activities such as supporting promotional marketing through online and offline, and inviting buyers. In the case of strategic item development support, it is a policy that focuses on finding export strategy (or promising) items and customized marketing. It is a policy aimed at expanding agricultural exports by discovering new private-led business models. The policy supports 80% to 90% of product development, improvement and new distribution networks for the Chinese market, and marketing costs. Support for fostering market diversification frontier is a policy aimed at expanding exports and securing stable export conditions through diversification of the Korean agri-food export market.

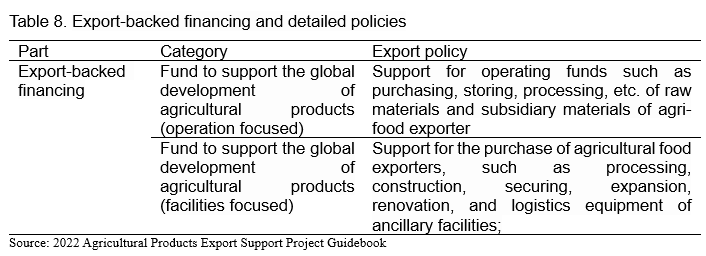

Lastly, export-backed financing consists of fund to support the global development of agricultural products(operation or facilities) (Table 8). In case of operation, support for operating funds such as purchasing, storing, processing, etc. of raw materials and subsidiary materials of agri-food exporter is the detailed export policy. In case of facilities focused, support for the purchase of agricultural food exporters, such as processing, construction, securing, expansion, renovation, and logistics equipment of ancillary facilities is the very export policy.

CONCLUSION

This study investigates which countries and items Korea's food exports are mainly conducted in. In the process, it also analyzes how major export items or exporting countries change. Korea generally exports tuna, laver (seaweed), beverages, ramyeon, and ginseng, while major export countries were China, Japan, the United States, and Vietnam. The rankings of these countries have changed little by little over the past seven years, but generally, the countries are always at the top. The study also examined the global interest in Korean food through search volume analysis, and finally analyzed in detail what policies the Korean government takes in relation to the promotion of Korean food exports and what detailed policies there are. Accordingly, based on this study, it is expected that domestic food companies will be able to grasp the current status of food exports and check what policy benefits they can receive.

REFERENCES

Global Trade Atlas(ISH Markit). <webpage: https://www.spglobal.com/>

Google Trendshttps://trends.google.com/

2022 Agricultural Products Export Support Project Guidebook

Korea Agro-Fisheries & Food Trade Corporation, aT, KATI(webpage: https://www.kati.net/index.do)

2021 Agriculture, Forestry and Fisheries Food Import and Export Trends and Statistics

Agri-Food Export Promoting Policy in Korea and Current Issues

ABSTRACT

Korea's food exports are constantly increasing. As the Korean Wave culture spreads around the world, interest in Korea increases, and the excellence of Korean food is more known worldwide, Korea's food exports have increased for more than 20 years since 2000. First, this study analyzes the trend of food exports in Korea and major food exporters and export foods. As a result, it can be seen that Korea has mainly exported food to Japan, China, the United States, and Vietnam. And the main exports were laver (seaweed), tuna, beverage, ramyeon, and ginseng. Second, we also investigated the policies related to food export promotion implemented by the Korean government. The policy consists of: 1) export information and consulting, 2) development and discovery of export items, 3) support for safety and quality control, 4) support for customs clearance and logistics, 5) developing local distribution networks, and 6) financing for supporting exports.

Keywords: Food export, Food export policy, Food market

INTRODUCTION

In South Korea, Korea's food exports are growing rapidly. By achieving US$11.37 billion in exports in 2021, it recorded more than US$10 billion for the first time, and is expected to surpass US$12 billion in 2022, given continuing its growth. This corresponds to a figure that has more than quadrupled compared to the amount of exports in 2000. Behind this growth lies the globalization of culture such as Korean dramas, eating shows, and Korean pop songs. Large-scale food manufacturers in Korea are expanding their export markets to numerous countries that have not previously been exported. In line with the increasing trend of exports, the government is also implementing various support policies.

TRENDS IN EXPORT CHANGES IN THE KOREAN FOOD MARKET

Korea's food exports have continued to increase from 2000 to 2022, with exports of US$11.37 billion in 2021. Assuming that this trend continues, exports of US$12.16 billion will be achieved in 2022, which is more than quadrupled compared to the exports in 2000.

Korea's export food items have remained generally constant from 2016 to the first three quarters of 2022. From 2016 to the first to third quarters of 2022, exports have been mainly focused on tuna, ramyeon, laver (seaweed), beverages, coffee products, and ginseng. In the case of laver, exports have exploded recently. Korea accounts for 57% of the world's production, and in 2019, it recorded more exports than tuna, which was ranked No. 1 in 50 years among Korea's seafood exports. Exporting countries have also expanded to more than 110 countries, including the United States, France, Thailand, Singapore and Russia, in addition to seaweed-consuming countries such as China and Japan.

In the case of ramyeon industry, it enjoyed the biggest boom due to COVID-19, but since 2021, domestic profitability has declined due to a sharp rise in raw material prices such as palm oil and flour and various costs such as sea freight costs. However, exports have increased significantly, thanks to popular singers, dramas and movies, and most ramyeon makers are making up for their losses in Korea by targeting the overseas markets.

Tuna achieved US$580 million in exports this year. Korea began exporting tuna to Japan for the first time in 1963, building a large fleet based on bold investment by companies and government support, and continuously securing fishing grounds overseas to stabilize the export base. Worth focusing on among the key export foods is feed. Feed was not in the top 20 major export items until 2019. However, it ranked 19th in exports in 2020, 14th in 2021, and 9th in exports between the first and third quarters of 2022. And beer exports, which were located in the top 10 until 2019, recorded the highest exports in 2018 and then entered a decline. In addition, in 2020, when COVID-19 occurred, exports of US$59.98 million, less than 50% of exports in 2019, entered a sharp decline starting in 2020. Beer exports in 2021 were US$46.84 million, the lowest in 11 years (Table 1).

TOP EXPORT COUNTRIES AND MAJOR EXPORT ITEMS BY COUNTRY

Japan, China, the United States, Vietnam, and Taiwan are among the top five export countries of Korean food products. In general, Japan, China, and the United States maintained the top 1st to 3rd place in exports. Vietnam, Hong Kong and Taiwan came in fourth and fifth. As such, Korean food is exported to most Asian countries except for the United States among major export countries. Uniquely, as of 2020, the proportion of exports to Japan decreased and the proportion of exports to China increased.

MAJOR EXPORT FOODS BY EXPORT COUNTRIES

Among the major export countries, export items to the United States, Japan, and China are shown in the figure below. First of all, in the case of the United States, the items with a high proportion of exports were laver (9.9%), beverages (5.5%), ramyeon (5.1%), cereal products (3.3%), and ginseng (1.9%). Next, in the case of Japan, tuna (9.1%), seaweed (5.8%), paprika (3.4%), kimchi (2.9%), and ramyeon (2.9%) are the most exported. In the case of exports to China, a lot of exports are made in the order of pollack (11.9%), ramyeon (8.0%), seaweed (4.8%), beverages (3.6%), and ginseng (3.5%) (Figure 2).

SEARCH FOR FOOD EXPORTS BASED ON SEARCH VOLUME TRENDS

In the case of domestic food exports, it shows an increasing pattern as Korean culture has recently become globalized. In line with this, if you look at Google’s trend search volume for five major export items in Korea (ramyeon, tuna, beverage, seaweed, and coffee products), you can see that the search volume has increased since 2019. This search record was especially high in North America, Australia, Northern Europe, and the Middle East. Accordingly, it can be seen that interest in Korean food is high internationally. Unlike in the past, when exports were mainly done in Asia, interest in Korean food is now increasing not only in Asia but also in Western countries, and the status of Korean food can be interpreted as gradually rising around the world (Figure 3).

EXPORT PROMOTION POLICY

In Korea, the Ministry of Agriculture, Food and Rural Affairs (MAFRA) and the Korea Agro-Fisheries and Food Trade Corporation (aT) have established and implemented agricultural export support projects (policy) every year. As of 2022, the agri-food export support project consists of: 1) providing export information and consultation, 2) fostering and discovering export items, 3) supporting safety and quality management, 4) supporting customs clearance and logistics, 5) exploring local distribution networks, and 6) financing for export support.

Export information provision and consultation consist of: 1) agri-food export information (KATI), 2) export promotion site (K-Food Trade), 3) export consultation, 4) localization support, and 5) education to foster export professionals (Table 3). KATI is a website that specializes in agricultural export information of domestic benefits and provides export-related information free of charge through the Internet and mobile. The site provides integrated statistics, news, and data on major exports and imported items, and also supports services that provide customized information when exporters request specific information. In the case of K-Food Trade, it plays the role of an online permanent transaction mediation and promotion site that matches overseas buyers, export products, and exporters and links them with export support projects. Export consultation is a policy to expand exports by commercializing exports of domestic companies and exploring new markets for existing exporters by providing consulting services using experts for agri-food companies. This policy selects companies eligible for support after evaluating sales and exports. Localization support supports the development of the agri-food export market by resolving customs difficulties for exporters and import buyers in major export countries and responding to non-tariff barriers by country. The policy aims to foster agricultural export experts by providing agricultural food-specialized trade practice education opportunities for agricultural food export industry officials and lay the foundation for export expansion.

Next, the export item development and discovery policy consists of detailed policies such as fostering export integrated organizations, supporting export commercialization, supporting global brand development, and supporting excellent agri-food packages (Table 4). First, fostering an integrated export organization supports the development of a phased export integrated organization involving national export farmers and exporters considering the characteristics of each item of fresh agricultural products. It consists of support for infrastructure development projects and support for incentives to promote exports. Next, export commercialization support supports costs related to local settlement of products such as promising food development and overseas marketing. In addition, support for global brand development is a policy to support brand consulting, promotion, and advertising with the aim of expanding exports by fostering export brands and raising awareness of foreign countries by small and medium-sized agri-food companies in Korea.

Finally, excellent agricultural and food package backup supports consumer-centered packages that allow business consumers to choose the support projects they want for export beginners and small and medium-sized companies with basic agricultural export capabilities and growth potential.

The safety and quality management support policy consist of education on the organization of agricultural production complexes, safety management, and support for leading maintenance (Table 5). First of all, in the case of organized education of agricultural production complexes, the policy aims to improve the human resource capacity of farms and complexes and strengthen the quality and safety of agricultural export products through customized support reflecting the on-site demand of government-designated agricultural production complexes. This is characterized by supporting 90% of the required budget, such as improving farm awareness, informatization of farms, professional technology education, and quality management. Next, in the case of safety management, the policy aims to create an export environment by providing residual pesticides and food hygiene inspection costs to export farmers and exporters to secure safety from the domestic production stage of exported agricultural and food products. It supports inspection fees for residual pesticides, food hygiene inspections, and pre-registration of processed foods exported to Japan. Next, in the case of supporting the forward maintenance system, it is a project that supports the purchase of the forward maintenance system to enhance the marketability of fresh agricultural products and expand exports, and it is a policy to support 90% of the cost of purchasing the forward maintenance system.

Customs and logistics support consist of support for export logistics costs, activation of air joint logistics and air animals center, overseas air and air logistics centers, cold chain construction, sample customs transportation costs, export insurance support, and overseas certification registration support (Table 6). In the case of supporting export logistics costs, it is a policy to partially support export logistics costs to the agri-food sector, which is burdened with logistics costs such as packaging and transportation. In other words, it supports logistics costs according to export volume standards with a limit of 15% of standard logistics costs. Next, in the case of activation of air-borne animals related logistics, the purpose is to support the development of new markets and reduce export logistics through the activation of long-distance aviation of fresh agricultural products. It supports incentives for fresh produce. Next, in the case of overseas air and animal distribution centers, the goal is to support the improvement of quality, price, competitiveness, and the development of new distribution networks by supporting overseas logistics of agri-food export (storage, fulfillment, etc.). This is a policy that supports 50 to 90% of the usage fees for overseas joint logistics centers (e.g., storage fees, warehousing fees, and fulfillment, etc. Next, the cold chain construction project is a policy to strengthen the development of the Korean fresh agri-food market by supporting the construction of cold chains inland in China or ASEAN markets, which lack frozen and refrigerated logistics infrastructure. Therefore, this policy supports 80% of the cost of freezing and refrigerating inland transportation departing from joint logistics centers in China or ASEAN. Next, the support for sample customs clearance transportation costs is a policy to expand the potential export market by supporting customs and transportation costs required for sample provision and test export for new overseas markets and buyers. Accordingly, this policy supports 80% of sample delivery, transportation, and customs clearance costs for overseas buyers. Export insurance support supports stable management of exporters by supporting foreign exchange fluctuation insurance and short-term export insurance subscription fees. Accordingly, this policy supports more than 90% of the insurance premiums for foreign exchange fluctuation insurance and short-term export insurance for agricultural and livestock food exporters.

Detailed policies related to local distribution network development consist of international fair participation, global K-food fair, buyer transaction arrangement, overseas antenna shop installation support, overseas promotion support, quarantine resolution support, strategic item development support, market diversification frontiers (leading companies) and online mobile marketing (Table 7). First, the participation support for the international fair supports the formation of a Korean pavilion at major overseas food fairs to enhance export capabilities and expand exports of domestic small and medium-sized agri-food exporters. Global K-Food Fair aims to create a Korean agri-food export network and expand the base of local consumption by promoting integrated marketing that combines B2B export consultations and B2C consumer events in major overseas export hub cities. Accordingly, this policy supports participation in B2B export consultations. Next, buyer transaction arrangement aims to expand exports by inviting overseas branches of the Korea Agro-Fishery Food Trade Corporation (aT) and excellent buyers recommended for overseas space to support large-scale export consultations with domestic exporters. Accordingly, it provides exporters with opportunities to consult with various buyers. The support for the installation of overseas Antenna shops is a policy to support overseas antenna shop operation costs suitable for local conditions in order to explore the possibility of new markets and entry of Korean agricultural products. Accordingly, 70-90% of operating expenses such as rental and equipment costs, promotion costs, tasting, and marketing will be supported. Next, support for overseas promotional events aims to expand the presence of Korean agricultural and fishery products and raise consumer awareness through promotional events linked to large overseas distribution stores and online malls (tasting, promotion, etc.). Therefore, this policy supports all costs related to promotional marketing activities in overseas consumption sites. The support for quarantine relief items is a policy that supports entry into the market of items that have been difficult to export due to the inability to export by country or difficult quarantine conditions. Therefore, this includes activities such as supporting promotional marketing through online and offline, and inviting buyers. In the case of strategic item development support, it is a policy that focuses on finding export strategy (or promising) items and customized marketing. It is a policy aimed at expanding agricultural exports by discovering new private-led business models. The policy supports 80% to 90% of product development, improvement and new distribution networks for the Chinese market, and marketing costs. Support for fostering market diversification frontier is a policy aimed at expanding exports and securing stable export conditions through diversification of the Korean agri-food export market.

Lastly, export-backed financing consists of fund to support the global development of agricultural products(operation or facilities) (Table 8). In case of operation, support for operating funds such as purchasing, storing, processing, etc. of raw materials and subsidiary materials of agri-food exporter is the detailed export policy. In case of facilities focused, support for the purchase of agricultural food exporters, such as processing, construction, securing, expansion, renovation, and logistics equipment of ancillary facilities is the very export policy.

CONCLUSION

This study investigates which countries and items Korea's food exports are mainly conducted in. In the process, it also analyzes how major export items or exporting countries change. Korea generally exports tuna, laver (seaweed), beverages, ramyeon, and ginseng, while major export countries were China, Japan, the United States, and Vietnam. The rankings of these countries have changed little by little over the past seven years, but generally, the countries are always at the top. The study also examined the global interest in Korean food through search volume analysis, and finally analyzed in detail what policies the Korean government takes in relation to the promotion of Korean food exports and what detailed policies there are. Accordingly, based on this study, it is expected that domestic food companies will be able to grasp the current status of food exports and check what policy benefits they can receive.

REFERENCES

Global Trade Atlas(ISH Markit). <webpage: https://www.spglobal.com/>

Google Trendshttps://trends.google.com/

2022 Agricultural Products Export Support Project Guidebook

Korea Agro-Fisheries & Food Trade Corporation, aT, KATI(webpage: https://www.kati.net/index.do)

2021 Agriculture, Forestry and Fisheries Food Import and Export Trends and Statistics