ABSTRACT

China is one of the traditional and important markets for Malaysia's fruits. Previously, the export of fruits to China was through Hong Kong. The government of China has approved seven fruits from Malaysia to enter China directly in the form of fresh, dried-frozen, and processed products (paste) in 2021. Malaysia has to compete with other producing countries such as Thailand, Vietnam, the Philippines, and Myanmar in China markets. In general, Malaysia's fruits are competitive and well accepted by consumers. Malaysia exports fruits that meet the consumers' preferences and needs. Consumers also like fruits from Malaysia because of their better taste and quality. To sustain itself in China markets, Malaysia needs to export more fruits and maintain the quality of its products. This strategy is important because other countries also look at China as their potential market for their products.

Keywords: competitiveness, tropical fruits, China markets, export markets

INTRODUCTION

Malaysia is one of the leading producers of tropical fruits in the world. Every year Malaysia produces more than one million tons of tropical fruits. In 2020, Malaysia produced more than 1.55 million tons of tropical fruits. Durian has the largest production (390,635 tons), followed by pineapples (323,420 tons), banana (313,811 tons), and watermelon (134,225 tons) in 2020. Malaysia also produces papaya, jack fruits, starfruits, mangosteen, and guava, but on a smaller scale. In general, the production of tropical fruits is more than sufficient for local consumption. Malaysia exports its fruits to many countries, especially in the Asian region. Malaysia's total exports were valued at more than RM1.40 (US$0.33) billion in 2020. Malaysia plans to strengthen its traditional markets and, at the same time, explore new markets. By implementing these strategies, Malaysia aspires to enhance the fruit industry and increase the revenue from export markets.

The traditional markets of Malaysian tropical fruits are Singapore, China, and Southeast Asian countries. China is the second-largest export market for Malaysian fruits after Singapore. Fruit exports to China (including Hong Kong) accounted for 11.7% of the total export amounting to US$0.164 billion, an increase of 5.9% over 2015. At the same time, Malaysia is one of the significant sources of tropical fruits in China, such as mangosteen, rambutan, watermelon, and durian (MATRADE, 2016). Durian fruit from Malaysia is the primary fruit of choice for consumers in China because it tastes better and satisfies their tastes.

China has the highest population density in the world, with a population of over 1.40 billion (2020) and is projected to reach 1.42 billion by 2025. Rapid and developed economic growth made China a country with strong economic influence in Asia at the time. The Report of Tropical Fruit Circulation 2022 revealed that tropical fruits are the most popular fruits in China. The overall sales of tropical fruits grew more than 30% compared to the previous year. Banana, mangoes, longan, and pineapple are four major fruits in higher demand in China. The report also revealed that the northern regions of China have a more robust market for tropical fruits.

China is also a producer of tropical fruits. However, high demand resulted in an insufficient supply of fruits. Therefore, China imports fruits from nearby countries such as Thailand, the Philippines, Indonesia, Vietnam, and Malaysia. During the five years between 2015 and 2020, China’s value of fruit imports has increased by 9.9% per annum. Awareness of the importance of fruits in supplying essential nutrients to the body is one factor that increases the consumption of tropical fruits. The per capita consumption of fruits in China has risen from 46 kg in 2016 to 75 kg in 2020. The per capita consumption increased the fruit market by 37% from 2016 to 2020.

Several countries in Southeast Asia, such as Thailand, Indonesia, Myanmar, and Vietnam, are competitors for tropical fruits in China market. Therefore, it is appropriate to evaluate the competitiveness of fruits from Malaysia compared to its competitors and determine strategies to ensure that consumers accept fruits from Malaysia. The concepts of comparative advantage and competitiveness have been widely used in many economic studies to assess trade patterns and a country's specialization in commodities for which it is competitive (Erkan & Saricoban, 2014). At the international level, competitiveness is defined as the ability of an economy to attract investments to increase exports and supply and demand. Export activity is one of the methods of assessing the competitiveness of products from a country. Theoretically, an increase in export performance indicates an increase in competitiveness. Comparative export performance (CEP) analysis is used to measure the level of competitiveness of a country. An index above 1.0 indicates high competitiveness, while an index below 1.0 indicates the opposite impact on the market. This paper discusses the competitiveness of tropical fruits from Malaysia compared to other countries in China markets. This paper aims to identify factors that contributed to the competitiveness of the Malaysian fruits and the strategies implemented to enhance its position in the traditional market.

EXPORT OF FRUITS TO CHINA

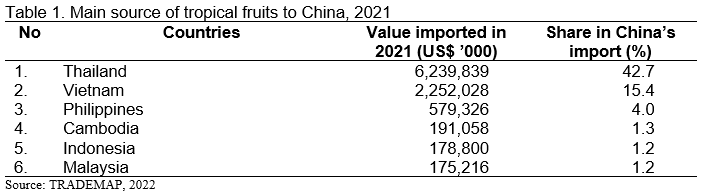

China is one of the world's major importers of fruits. China's customs statistics indicated that fruit imports exceeded US$10.00 billion for the first time in 2020, reaching a total value of US$10.26 billion – around an 8% increase over the previous year. The top nine fruits in order of import volume were durian, cherries, banana, mangosteen, grapes, dragon fruit, longan, kiwifruit, and oranges. In general, sources of fruit imports to China in 2021 are Thailand (42.7%), Chile (15.4%), Vietnam (6.6%), the United States of America (5.1%), the Philippines (9.6%), and Australia (3.9%). In terms of tropical fruits, the main suppliers of the commodity are presented in Table 1.

Thailand is the main supplier of tropical fruits to China, followed by Vietnam, the Philippines, Cambodia and Indonesia. Malaysia’s position was dropped from number five in 2018 to number six in 2021. Malaysia’s share, however, has increased from 0.27% in 2018 to 1.2% in 2021.

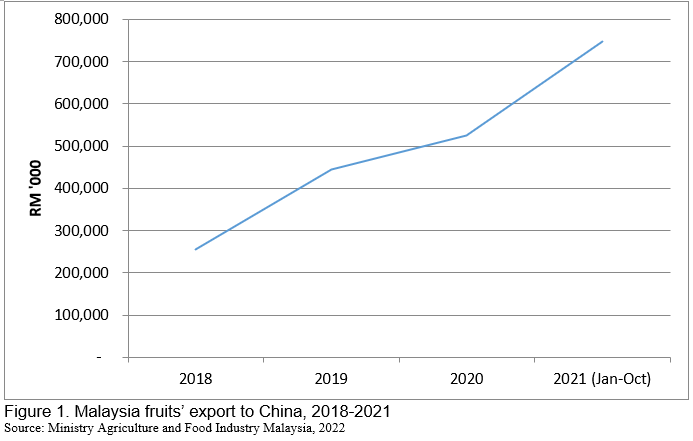

Malaysia remains one of the leading tropical fruit suppliers to the China Market. Malaysia exports more than 40,000 tons of tropical fruits to China yearly, valued at more than US$175.20 million. The trend is predicted to increase consistently in the next ten years. The export of fruits from Malaysia to China was through Hong Kong previously. Recently, Malaysia received the approval to export its tropical fruits to China directly in the form of fresh, minimally processed, dried, or processed products. The fruits are coconut, durian, mangosteen, watermelon, jackfruit, papaya, pineapple, and rambutan. The Chinese government approved the access of fresh pineapple fruits in May 2017 and the frozen whole durian in October 2018. Durian is exported as frozen and processed (paste), while mangosteen is exported in the freeze-dried and fresh form. Watermelon, coconut, and papaya account for less than 1% of total exports. Generally, fruit exports from Malaysia are increasing from 2018 to 2020 (Figure 1).

Every country imposes import protocol and special requirements for exporters to trade with them. Most export destinations require phytosanitary protocols, except for the European market, Hong Kong, Middle Eastern countries, and Singapore. Meanwhile, negotiations to obtain market access are subject to strict compliance with the importing countries' Sanitary and Phytosanitary Regulations (SPS). To ensure that fruit exports comply with the prescribed conditions, the Department of Agriculture (DOA) is responsible for ensuring that fruit production at the farm level is MyGAP accredited. After that, the packaging and processing must follow the Good Manufacturing Process (GMP), obtain the Hazard Analysis Critical Control Point (HACCP) certification, and provide export documentation that meets the prescribed standards and regulations of the importing country.

China also imposed particular import protocols and requirements for Malaysia's fruits to access its markets. The fruits to be exported to China shall comply with plant quarantine laws, regulations, and sanitary safety standards in China. They shall be considered free from quarantine pests in China (Phytophthora palmivora, Capnodium Moniliforme, Colletotrichum sp., Rhizopus artocarpi, and Rigidoporus lignosus). The fruit supply orchards of frozen durian to be exported to China must adhere to or follow the Good Agriculture Practices (GAP) as well as Integrated Pest Management (IPM) to minimize and avoid the occurrence of pests and to comply with the application of agricultural chemicals and pesticide residues. In orchards, durian should be prevented from falling to the ground by constructing a netting structure or using a string to tie the fruit to a branch. Fruits should not be in contact with soil and plant debris, nor can they be damaged or bruised during harvest and post-harvest treatment.

The processing facility where the frozen durian will be processed must follow the Good Manufacturing Practice (GMP) registered with MAFI and evaluated and approved by the General Administration of Customs of The People's Republic of China (GACC). Farmers selected the durian manually to eliminate any defective or rotten fruits and ensure the fruits were free from insects, mites, leaves, twigs, and soil. After the ripe durian is graded and classified, the durian will be cleaned with pressurized water or compressed air flow and treated with fungicides or sanitizing agents when necessary. The processing facility must be kept clean and in a good sanitary condition, following the guidelines of GMP. The specific treatment stated in the protocol for the export of frozen whole durian, where the durian pulp and paste (without shell) are required to freeze at -30°C or lower for 30 minutes. Meanwhile, for the whole durian fruit (with cover), fruits must be frozen between -80°C to -110°C for at least 1 hour. These products should be stored and transported at -18°C or below.

The frozen durian exported to China must be packed in new and clean packaging materials, which must meet China's phytosanitary requirements and safety hygiene standards. Each carton and a retail box of frozen durian to be exported to China must have the following information in both English and Chinese: name of goods, place and state of production, country of origin, name and address of processing facility and exporter, date of packaging, date of minimum durability, net weight, etc. Each pallet shall have the following Chinese words displayed: "本产品输往中华人民共和国" (for the People's Republic of China).

Malaysian durian is usually not displayed openly in retail because of the need to preserve the -18°C condition of the frozen durian because compromizing the temperature can affect the eating quality of the fruit. Retailers often use online platforms to direct sell and deliver the fruits straight to the customer from the warehouse.

The following are the types of fruits along with the phytosanitary requirements for export to China:

Table 2. Phytosanitary requirements for Malaysian fruits to China

|

No

|

Fruits

|

Product category

|

HS Code

|

Phytosanitary requirement

|

|

1.

|

Coconut

|

Fresh

|

08011990

|

1. Obtained the Phytosanitary Certificate;

2. No treatment is required but must be free from any plant pests and diseases; and

3. Packing house must be registered with DOA Malaysia.

|

|

2.

|

Durian

|

Freeze dried

|

08119090

|

4. Obtained the Phytosanitary Certificate and must declared that it is freeze-dry production; and

2. Products must meet the Administration of Quality Supervision, Inspection and Quarantine of the People’s Republic of China (AQSIQ) standard.

|

|

|

|

Frozen- whole fruit

|

|

1. Obtained the Phytosanitary Certificate;

2. Whole fruit must be frozen at -80°C to -110°C not less than 1 hour and must be stored and exported at -18°C or less;

3. Fruits must be sourced from farms that are registered with DOA Malaysia and audited by AQSIQ;

4. The farm should be accredited with MyGAP and implement the integrated pest management (IPM) to control plant pests and diseases;

5. Fruits must be processed at processing facilities registered with DOA Malaysia and audited by AQSIQ; and

6. Processing facilities should be accredited with GMP from Ministry of Health (MOH) Malaysia;

|

|

|

|

Frozen – pulp and paste

|

|

1. Obtained the Phytosanitary Certificate;

2. Obtained Health Certificate (produced by MOH Malaysia);

3. Loose pulp must be frozen at -30°C for 30 minutes and must be stored and exported at -18°C or less;

4. Fruits must be sourced from farms that are registered with DOA Malaysia and audited by AQSIQ;

5. The farm should be accredited with MyGAP and implement integrated pest management (IPM) to control plant pests and diseases;

6. Fruits must be processed at processing facilities registered with DOA Malaysia and audited by AQSIQ;

7. Processing facilities should be accredited with GMP from MOH Malaysia; and

8. Approved processing facilities as of 1st January 2022

|

|

3.

|

Watermelon

|

Fresh

|

08071100

|

1. Obtained the Phytosanitary Certificate;

2. No treatment is required but must be free from any plant pest and disease; and

3. Ventilation holes on packing boxes must be covered with size 32 mesh wire netting.

|

|

4.

|

Pineapple

|

Fresh

|

|

1. Obtained the Phytosanitary Certificate;

2. Fruits must be sourced from farms that are registered with DOA Malaysia and approved by The General Administration of Customs of the People’s Republic of China (GACC);

3. The farm should be accredited with MyGAP and implement IPM to control plant pest and disease;

4. Fruits must be processed at processing facilities registered with DOA Malaysia and approved by GACC;

5. Export license must be obtained from Malaysia Pineapple Industry Board (MPIB);

6. Fruit is treated with 48 g/m3 of ethyl formate for 4 hours, followed by cold treatment with a temperature below 7°C for 10 days; and

7. Approved processing facilities as of 1st January 2022

|

|

5.

|

Jackfruit

|

Freeze dried

|

091090130

|

1. Obtained the Phytosanitary Certificate and must declared that it is freeze- dried production; and

2. Products must meet the GACC’s standard.

|

|

6.

|

Mangosteen

|

Freeze dried

|

08045030

|

1. Obtained the Phytosanitary Certificate and must declare that it is freeze- dried production;

2. Products must meet the GACC’s standard.

|

|

|

|

Fresh

|

|

1. Obtained the Phytosanitary Certificate;

2. Packing house must be registered with DOA Malaysia;

3. Ventilation holes on packing boxes must be covered with size 32 mesh wire netting; and

4. No treatment is required but must be free from any plant pest and disease.

|

|

7.

|

Papaya

|

Fresh

|

08072000

|

1. Obtained the Phytosanitary Certificate;

2. Fruit must be free from all stages of fruit fly;

3. Farm must be registered with DOA Malaysia and audited by the GACC;

4. The fruit is treated using Hot Water Treatment (HWT) at core temperature of 46.5°C for 10 minutes at the treatment center registered with DOA Malaysia and approved by the GACC;

5. Ventilation holes on packing boxes must be covered with size 32 mesh wire netting; and

6. As of 1st January 2022, one premise is approved by the GACC to treat and pack papaya to China.

|

|

8.

|

Rambutan

|

Fresh

|

08109040

|

1. Obtained the Phytosanitary Certificate;

2. No treatment is required but must be free from any plant pest and disease;

3. Ventilation holes on packing boxes must be covered with size 32 mesh wire netting; and

4. Packing house must be registered with DOA Malaysia.

|

|

|

|

Freeze dried

|

|

1. Obtained the Phytosanitary Certificate and stated freeze-dry production;

2. Products must meet GACC’s standard.

|

Source: Department of Agriculture, 2022

COMPETITIVENESS OF MALAYSIA’S FRUIT

Comparison with other countries

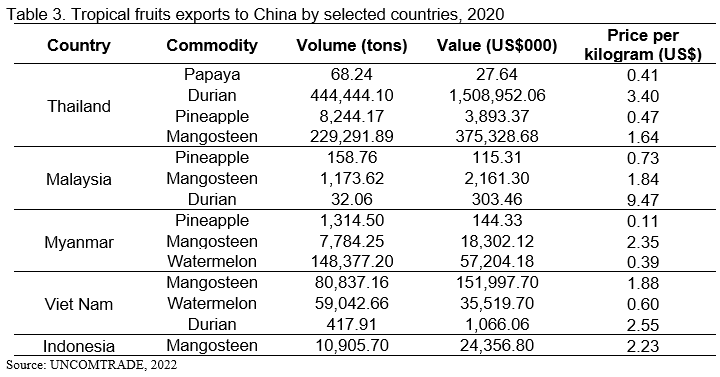

Malaysia is in the top five of tropical fruit exporters to China. A comparison of the competitiveness of fruits from Malaysia with Thailand, Vietnam, the Philippines, and Myanmar were analyzed. These countries are the main competitors of Malaysian fruits in China market. Malaysia’s fruits are still competitive in China compared to competing countries such as Thailand, Vietnam, the Philippines, and Myanmar. However, Malaysia's fruits' competitiveness is lower than those countries. Thailand is a significant competitor in the durian, papaya, mangosteen, and pineapple markets. Durian exported by Thailand is in the fresh form, while durian from Malaysia is in the form of frozen semi-processed or puree. Malaysia ranks first for jackfruit exports and fourth for pineapple. The competitiveness of papaya from Malaysia is ranked third. Malaysia's jackfruit and papaya competitors in China are the Philippines, Taiwan, and Thailand. On the other hand, Malaysia's fresh watermelon was ranked number fifth, with Vietnam and Myanmar as the leading competitors.

Consumer preferences toward tropical fruits

China is a developing country, but it has been experiencing rapid economic growth and progress. The country has seen tremendous industrialization, urbanization, and modernization in the past few decades. It is an emerging market because of its large population and relatively low per capita income. China's gross domestic product (GDP) ranks second in the world after the US. China ranks first in both total exports and total imports.

Socioeconomic factors and consumer preferences for fruits are essential to enable exporters to determine appropriate strategies to market fruits in China market. The increase in income and awareness of the importance of fruit in health has prompted the purchase of fruit.

Roughly 60% of China's population lives in urban areas. In 2021, China's per capita disposable income hit RMB35,128 (US$5,226.15), growing 8.1 % year-on-year after adjustment for inflation, according to the Chinese National Bureau of Statistics (NBS). In general, income was significantly skewed toward a few provinces. This income skew was especially true for Beijing and Shanghai, where real per capita household disposable income was around RMB48,000 (US$7,141.18) or about four times the lowest income regions.

The demand for fresh fruits in China is led by steady economic growth as there was a substantial increase in household income. Imported fruits in China are expected to be varied, convenient, and of high-quality. Chinese citizens now demand year-round availability of freshly produced fruits. According to the Euromonitor report, consumers in China spend on average US$4,251.00 every year, of which US$113 is on fruit and fruit products, a 69% increase over 2014. Increasingly consumers have now become more demanding of a large variety of fresh fruit imports, especially in the tropical category. This increase in fruit consumption among Chinese citizens indicates many opportunities for fresh fruit exporters interested in exporting fresh fruits to China.

Consumers in China generally purchase fruits from wet markets, followed by wholesale markets, retail stores, and supermarkets. A study by Suhana (2018) revealed that four main factors were identified as influencing consumers in China when buying fruit:

- Internal factors (freshness, quality, pulp texture, aroma, and taste).

- Health and certification (good for health, nutrition, pesticide use, organic, and certification).

- Consumption and marketing (culinary use, uniqueness, price, and packaging), and

- Extrinsic factors (size, shape, skin color, pulp color, pulp thickness, and seed quantity).

A growing segment of the population has become more concerned with food safety standards of domestically grown fruits as they are widely considered to be of lower quality and have fewer safety standards than foreign imported fruit. Most consumers understand the essential health benefits of eating fruits with their understanding of what they should eat regularly.

Consumers in China also tend to choose fruits based on external and internal characteristics. For example, consumers in China like to buy medium-sized watermelons (1-4 kg), round in shape, have a dark green striped skin color, and thin skin. Consumers also love moderately crunchy watermelons, which have reddish flesh, and taste sweet and juicy. The characteristics of the fruit preferred by Chinese consumers align with the attributes of watermelon exported by Malaysia. This situation makes watermelons from Malaysia highly competitive in the China market. More than 33% of Malaysia's watermelon was exported to China (Suhana, 2018).

The Chinese government only allows durian from Malaysia to be marketed in frozen and paste (puree) forms. The most popular durian varieties in China are Musang King and D24. Among the durian that consumers prefer are medium-sized fruit (weight 1.5 to 2.0 kg), medium-thick pulp, yellow in color, sweet taste, and juicy. The prospect of durian fruit from Malaysia is good and has a high demand because many Chinese consumers have eaten durian while visiting Malaysia. Chinese consumers consider durian from Malaysia to be of better quality. As the fresh fruit market access to China has not yet been approved, the Ministry of Tourism and Culture Malaysia has prepared a Durian Tourism program by bringing Chinese tourists to eat durian in Malaysia. The program is very effective as the number of tourists is increasing yearly.

China was once the primary market for papaya from Malaysia. Total papaya exports to China declined in early 2012 when papaya production farms in Malaysia were attacked by papaya dieback disease. Since then, papaya exports to China have decreased significantly. Consumers in China prefer medium-sized papayas (weight 1.0-5.0 kg), medium-oval in shape, yellow skin color, orange-yellow pulp, medium texture, and sweet taste. Malaysia still exports exotic medium-sized papaya (1.0-1.2 kg), which has a medium-fine texture and is very sweet. Papaya from Malaysia is very popular with Chinese consumers and has high competitiveness. However, the lack of production has resulted in low papaya exports to China.

MALAYSIA’S STRATEGIES TO INCREASE EXPORT IN CHINA’S MARKET

Malaysia aspires to sustain China as its traditional and important market for fruits. Malaysia also plans to enhance the competitiveness of its fruits in this market as it promises a good return to Malaysia’s economy. Thus, the government sets strategies to increase the export of fruits to China as follows:

1) Increase volume and quality of fruits export

Malaysia's name for quality and good fruits has remained in China for some years. Musang King durian and mangosteen marketing have firmly allocated the fruits for premium fruits. In a stiff competition among neighborhood countries, Malaysia has an advantage over China's marketing strategies. Therefore, the encouragement of a larger planting area for export market has started since previous Malaysian Agricultural Policy 1.0 and 2.0. Malaysia also needs to have a good diplomatic relationship to strengthen business and marketing influence between the government and industrial players in both countries.

2) Focusing on target market: premium and quality

Generally, an enormous volume to satisfy the needs of every export market in the world is a big challenge to the farmers. China's disposable income per capita increased by around 700%, led by the rapid income increase. The income factor is correlated significantly with fruits purchase. Therefore, to increase sales and export demand, Malaysian products are suggested to aim for premium retail sales in the selected market. Fruits exported must be packed with attractive packaging and labeling. It will add value to sales and indirectly profit the business.

CONCLUSION

Malaysia has a moderately competitive advantage in China market. As for durian and mangosteen, Malaysia's competitiveness is equal to or better than its competitors, especially in quality and taste. Among the factors that need to be emphasized are the freshness, quality, texture and taste, and the certification for safety issues. Additionally, marketing factors like uniqueness, pricing, packaging, and labeling must be consistently interesting in attracting new market segments and customers. The purchasing power of consumers has significantly been correlated with the fruit purchase decision. The increase in households’ income encourages buying more fruits. In addition, it is also driven by health awareness and nutritious food, particularly for the middle-high income group. Therefore, to dominate the market share in China, Malaysian tropical fruits must comply with the importing country's requirements, including export approval protocols and phytosanitary requirements.

REFERENCE

Erkan, B. & Saricoban, K.,(2014). Comparative analysis of the competitiveness in the export of science-based goods regarding Turkey and the EU+13 Countries. Vol 5. No 8 (1)

Department of Agriculture Malaysia (2022). Phytosanitary requirements for exportation of horticulture produce from Malaysia

Malaysia External Trade Development Corporation (MATRADE). (2016). Laporan berkala -: China’s Fruits Market – MATRADE BEIJING

Ministry Agrobased and Food Industry Malaysia (2022). Internal fruits export database

Razali, N.A., Wan Ibrahim, W.M., Safari, S., Rosly, N.K., Hamzah, F.A. Wan

Husin, W.M.R.I. (2022). Cryogenic freezing preserves the quality of whole durian fruit for the export market. Food Research 6 (3). 360-364 . DOI :https://doi.org/10.26656/fr.2017.6(3).428

Suhana, S. (2018). Kajian daya saing pasaran eksport buah-buahan premium di China. Buku Laporan Projek Sosioekonomi 2017. MARDI: Malaysia

TRADEMAP (2022). Available at https://www.trademap.org/Index.aspx

UNCOMTRADE (2020). Available at https://comtrade.un.org

Competitiveness of Malaysia’s Tropical Fruits in China Markets

ABSTRACT

China is one of the traditional and important markets for Malaysia's fruits. Previously, the export of fruits to China was through Hong Kong. The government of China has approved seven fruits from Malaysia to enter China directly in the form of fresh, dried-frozen, and processed products (paste) in 2021. Malaysia has to compete with other producing countries such as Thailand, Vietnam, the Philippines, and Myanmar in China markets. In general, Malaysia's fruits are competitive and well accepted by consumers. Malaysia exports fruits that meet the consumers' preferences and needs. Consumers also like fruits from Malaysia because of their better taste and quality. To sustain itself in China markets, Malaysia needs to export more fruits and maintain the quality of its products. This strategy is important because other countries also look at China as their potential market for their products.

Keywords: competitiveness, tropical fruits, China markets, export markets

INTRODUCTION

Malaysia is one of the leading producers of tropical fruits in the world. Every year Malaysia produces more than one million tons of tropical fruits. In 2020, Malaysia produced more than 1.55 million tons of tropical fruits. Durian has the largest production (390,635 tons), followed by pineapples (323,420 tons), banana (313,811 tons), and watermelon (134,225 tons) in 2020. Malaysia also produces papaya, jack fruits, starfruits, mangosteen, and guava, but on a smaller scale. In general, the production of tropical fruits is more than sufficient for local consumption. Malaysia exports its fruits to many countries, especially in the Asian region. Malaysia's total exports were valued at more than RM1.40 (US$0.33) billion in 2020. Malaysia plans to strengthen its traditional markets and, at the same time, explore new markets. By implementing these strategies, Malaysia aspires to enhance the fruit industry and increase the revenue from export markets.

The traditional markets of Malaysian tropical fruits are Singapore, China, and Southeast Asian countries. China is the second-largest export market for Malaysian fruits after Singapore. Fruit exports to China (including Hong Kong) accounted for 11.7% of the total export amounting to US$0.164 billion, an increase of 5.9% over 2015. At the same time, Malaysia is one of the significant sources of tropical fruits in China, such as mangosteen, rambutan, watermelon, and durian (MATRADE, 2016). Durian fruit from Malaysia is the primary fruit of choice for consumers in China because it tastes better and satisfies their tastes.

China has the highest population density in the world, with a population of over 1.40 billion (2020) and is projected to reach 1.42 billion by 2025. Rapid and developed economic growth made China a country with strong economic influence in Asia at the time. The Report of Tropical Fruit Circulation 2022 revealed that tropical fruits are the most popular fruits in China. The overall sales of tropical fruits grew more than 30% compared to the previous year. Banana, mangoes, longan, and pineapple are four major fruits in higher demand in China. The report also revealed that the northern regions of China have a more robust market for tropical fruits.

China is also a producer of tropical fruits. However, high demand resulted in an insufficient supply of fruits. Therefore, China imports fruits from nearby countries such as Thailand, the Philippines, Indonesia, Vietnam, and Malaysia. During the five years between 2015 and 2020, China’s value of fruit imports has increased by 9.9% per annum. Awareness of the importance of fruits in supplying essential nutrients to the body is one factor that increases the consumption of tropical fruits. The per capita consumption of fruits in China has risen from 46 kg in 2016 to 75 kg in 2020. The per capita consumption increased the fruit market by 37% from 2016 to 2020.

Several countries in Southeast Asia, such as Thailand, Indonesia, Myanmar, and Vietnam, are competitors for tropical fruits in China market. Therefore, it is appropriate to evaluate the competitiveness of fruits from Malaysia compared to its competitors and determine strategies to ensure that consumers accept fruits from Malaysia. The concepts of comparative advantage and competitiveness have been widely used in many economic studies to assess trade patterns and a country's specialization in commodities for which it is competitive (Erkan & Saricoban, 2014). At the international level, competitiveness is defined as the ability of an economy to attract investments to increase exports and supply and demand. Export activity is one of the methods of assessing the competitiveness of products from a country. Theoretically, an increase in export performance indicates an increase in competitiveness. Comparative export performance (CEP) analysis is used to measure the level of competitiveness of a country. An index above 1.0 indicates high competitiveness, while an index below 1.0 indicates the opposite impact on the market. This paper discusses the competitiveness of tropical fruits from Malaysia compared to other countries in China markets. This paper aims to identify factors that contributed to the competitiveness of the Malaysian fruits and the strategies implemented to enhance its position in the traditional market.

EXPORT OF FRUITS TO CHINA

China is one of the world's major importers of fruits. China's customs statistics indicated that fruit imports exceeded US$10.00 billion for the first time in 2020, reaching a total value of US$10.26 billion – around an 8% increase over the previous year. The top nine fruits in order of import volume were durian, cherries, banana, mangosteen, grapes, dragon fruit, longan, kiwifruit, and oranges. In general, sources of fruit imports to China in 2021 are Thailand (42.7%), Chile (15.4%), Vietnam (6.6%), the United States of America (5.1%), the Philippines (9.6%), and Australia (3.9%). In terms of tropical fruits, the main suppliers of the commodity are presented in Table 1.

Thailand is the main supplier of tropical fruits to China, followed by Vietnam, the Philippines, Cambodia and Indonesia. Malaysia’s position was dropped from number five in 2018 to number six in 2021. Malaysia’s share, however, has increased from 0.27% in 2018 to 1.2% in 2021.

Malaysia remains one of the leading tropical fruit suppliers to the China Market. Malaysia exports more than 40,000 tons of tropical fruits to China yearly, valued at more than US$175.20 million. The trend is predicted to increase consistently in the next ten years. The export of fruits from Malaysia to China was through Hong Kong previously. Recently, Malaysia received the approval to export its tropical fruits to China directly in the form of fresh, minimally processed, dried, or processed products. The fruits are coconut, durian, mangosteen, watermelon, jackfruit, papaya, pineapple, and rambutan. The Chinese government approved the access of fresh pineapple fruits in May 2017 and the frozen whole durian in October 2018. Durian is exported as frozen and processed (paste), while mangosteen is exported in the freeze-dried and fresh form. Watermelon, coconut, and papaya account for less than 1% of total exports. Generally, fruit exports from Malaysia are increasing from 2018 to 2020 (Figure 1).

Every country imposes import protocol and special requirements for exporters to trade with them. Most export destinations require phytosanitary protocols, except for the European market, Hong Kong, Middle Eastern countries, and Singapore. Meanwhile, negotiations to obtain market access are subject to strict compliance with the importing countries' Sanitary and Phytosanitary Regulations (SPS). To ensure that fruit exports comply with the prescribed conditions, the Department of Agriculture (DOA) is responsible for ensuring that fruit production at the farm level is MyGAP accredited. After that, the packaging and processing must follow the Good Manufacturing Process (GMP), obtain the Hazard Analysis Critical Control Point (HACCP) certification, and provide export documentation that meets the prescribed standards and regulations of the importing country.

China also imposed particular import protocols and requirements for Malaysia's fruits to access its markets. The fruits to be exported to China shall comply with plant quarantine laws, regulations, and sanitary safety standards in China. They shall be considered free from quarantine pests in China (Phytophthora palmivora, Capnodium Moniliforme, Colletotrichum sp., Rhizopus artocarpi, and Rigidoporus lignosus). The fruit supply orchards of frozen durian to be exported to China must adhere to or follow the Good Agriculture Practices (GAP) as well as Integrated Pest Management (IPM) to minimize and avoid the occurrence of pests and to comply with the application of agricultural chemicals and pesticide residues. In orchards, durian should be prevented from falling to the ground by constructing a netting structure or using a string to tie the fruit to a branch. Fruits should not be in contact with soil and plant debris, nor can they be damaged or bruised during harvest and post-harvest treatment.

The processing facility where the frozen durian will be processed must follow the Good Manufacturing Practice (GMP) registered with MAFI and evaluated and approved by the General Administration of Customs of The People's Republic of China (GACC). Farmers selected the durian manually to eliminate any defective or rotten fruits and ensure the fruits were free from insects, mites, leaves, twigs, and soil. After the ripe durian is graded and classified, the durian will be cleaned with pressurized water or compressed air flow and treated with fungicides or sanitizing agents when necessary. The processing facility must be kept clean and in a good sanitary condition, following the guidelines of GMP. The specific treatment stated in the protocol for the export of frozen whole durian, where the durian pulp and paste (without shell) are required to freeze at -30°C or lower for 30 minutes. Meanwhile, for the whole durian fruit (with cover), fruits must be frozen between -80°C to -110°C for at least 1 hour. These products should be stored and transported at -18°C or below.

The frozen durian exported to China must be packed in new and clean packaging materials, which must meet China's phytosanitary requirements and safety hygiene standards. Each carton and a retail box of frozen durian to be exported to China must have the following information in both English and Chinese: name of goods, place and state of production, country of origin, name and address of processing facility and exporter, date of packaging, date of minimum durability, net weight, etc. Each pallet shall have the following Chinese words displayed: "本产品输往中华人民共和国" (for the People's Republic of China).

Malaysian durian is usually not displayed openly in retail because of the need to preserve the -18°C condition of the frozen durian because compromizing the temperature can affect the eating quality of the fruit. Retailers often use online platforms to direct sell and deliver the fruits straight to the customer from the warehouse.

The following are the types of fruits along with the phytosanitary requirements for export to China:

Table 2. Phytosanitary requirements for Malaysian fruits to China

No

Fruits

Product category

HS Code

Phytosanitary requirement

1.

Coconut

Fresh

08011990

1. Obtained the Phytosanitary Certificate;

2. No treatment is required but must be free from any plant pests and diseases; and

3. Packing house must be registered with DOA Malaysia.

2.

Durian

Freeze dried

08119090

4. Obtained the Phytosanitary Certificate and must declared that it is freeze-dry production; and

2. Products must meet the Administration of Quality Supervision, Inspection and Quarantine of the People’s Republic of China (AQSIQ) standard.

Frozen- whole fruit

1. Obtained the Phytosanitary Certificate;

2. Whole fruit must be frozen at -80°C to -110°C not less than 1 hour and must be stored and exported at -18°C or less;

3. Fruits must be sourced from farms that are registered with DOA Malaysia and audited by AQSIQ;

4. The farm should be accredited with MyGAP and implement the integrated pest management (IPM) to control plant pests and diseases;

5. Fruits must be processed at processing facilities registered with DOA Malaysia and audited by AQSIQ; and

6. Processing facilities should be accredited with GMP from Ministry of Health (MOH) Malaysia;

Frozen – pulp and paste

1. Obtained the Phytosanitary Certificate;

2. Obtained Health Certificate (produced by MOH Malaysia);

3. Loose pulp must be frozen at -30°C for 30 minutes and must be stored and exported at -18°C or less;

4. Fruits must be sourced from farms that are registered with DOA Malaysia and audited by AQSIQ;

5. The farm should be accredited with MyGAP and implement integrated pest management (IPM) to control plant pests and diseases;

6. Fruits must be processed at processing facilities registered with DOA Malaysia and audited by AQSIQ;

7. Processing facilities should be accredited with GMP from MOH Malaysia; and

8. Approved processing facilities as of 1st January 2022

3.

Watermelon

Fresh

08071100

1. Obtained the Phytosanitary Certificate;

2. No treatment is required but must be free from any plant pest and disease; and

3. Ventilation holes on packing boxes must be covered with size 32 mesh wire netting.

4.

Pineapple

Fresh

1. Obtained the Phytosanitary Certificate;

2. Fruits must be sourced from farms that are registered with DOA Malaysia and approved by The General Administration of Customs of the People’s Republic of China (GACC);

3. The farm should be accredited with MyGAP and implement IPM to control plant pest and disease;

4. Fruits must be processed at processing facilities registered with DOA Malaysia and approved by GACC;

5. Export license must be obtained from Malaysia Pineapple Industry Board (MPIB);

6. Fruit is treated with 48 g/m3 of ethyl formate for 4 hours, followed by cold treatment with a temperature below 7°C for 10 days; and

7. Approved processing facilities as of 1st January 2022

5.

Jackfruit

Freeze dried

091090130

1. Obtained the Phytosanitary Certificate and must declared that it is freeze- dried production; and

2. Products must meet the GACC’s standard.

6.

Mangosteen

Freeze dried

08045030

1. Obtained the Phytosanitary Certificate and must declare that it is freeze- dried production;

2. Products must meet the GACC’s standard.

Fresh

1. Obtained the Phytosanitary Certificate;

2. Packing house must be registered with DOA Malaysia;

3. Ventilation holes on packing boxes must be covered with size 32 mesh wire netting; and

4. No treatment is required but must be free from any plant pest and disease.

7.

Papaya

Fresh

08072000

1. Obtained the Phytosanitary Certificate;

2. Fruit must be free from all stages of fruit fly;

3. Farm must be registered with DOA Malaysia and audited by the GACC;

4. The fruit is treated using Hot Water Treatment (HWT) at core temperature of 46.5°C for 10 minutes at the treatment center registered with DOA Malaysia and approved by the GACC;

5. Ventilation holes on packing boxes must be covered with size 32 mesh wire netting; and

6. As of 1st January 2022, one premise is approved by the GACC to treat and pack papaya to China.

8.

Rambutan

Fresh

08109040

1. Obtained the Phytosanitary Certificate;

2. No treatment is required but must be free from any plant pest and disease;

3. Ventilation holes on packing boxes must be covered with size 32 mesh wire netting; and

4. Packing house must be registered with DOA Malaysia.

Freeze dried

1. Obtained the Phytosanitary Certificate and stated freeze-dry production;

2. Products must meet GACC’s standard.

Source: Department of Agriculture, 2022

COMPETITIVENESS OF MALAYSIA’S FRUIT

Comparison with other countries

Malaysia is in the top five of tropical fruit exporters to China. A comparison of the competitiveness of fruits from Malaysia with Thailand, Vietnam, the Philippines, and Myanmar were analyzed. These countries are the main competitors of Malaysian fruits in China market. Malaysia’s fruits are still competitive in China compared to competing countries such as Thailand, Vietnam, the Philippines, and Myanmar. However, Malaysia's fruits' competitiveness is lower than those countries. Thailand is a significant competitor in the durian, papaya, mangosteen, and pineapple markets. Durian exported by Thailand is in the fresh form, while durian from Malaysia is in the form of frozen semi-processed or puree. Malaysia ranks first for jackfruit exports and fourth for pineapple. The competitiveness of papaya from Malaysia is ranked third. Malaysia's jackfruit and papaya competitors in China are the Philippines, Taiwan, and Thailand. On the other hand, Malaysia's fresh watermelon was ranked number fifth, with Vietnam and Myanmar as the leading competitors.

Consumer preferences toward tropical fruits

China is a developing country, but it has been experiencing rapid economic growth and progress. The country has seen tremendous industrialization, urbanization, and modernization in the past few decades. It is an emerging market because of its large population and relatively low per capita income. China's gross domestic product (GDP) ranks second in the world after the US. China ranks first in both total exports and total imports.

Socioeconomic factors and consumer preferences for fruits are essential to enable exporters to determine appropriate strategies to market fruits in China market. The increase in income and awareness of the importance of fruit in health has prompted the purchase of fruit.

Roughly 60% of China's population lives in urban areas. In 2021, China's per capita disposable income hit RMB35,128 (US$5,226.15), growing 8.1 % year-on-year after adjustment for inflation, according to the Chinese National Bureau of Statistics (NBS). In general, income was significantly skewed toward a few provinces. This income skew was especially true for Beijing and Shanghai, where real per capita household disposable income was around RMB48,000 (US$7,141.18) or about four times the lowest income regions.

The demand for fresh fruits in China is led by steady economic growth as there was a substantial increase in household income. Imported fruits in China are expected to be varied, convenient, and of high-quality. Chinese citizens now demand year-round availability of freshly produced fruits. According to the Euromonitor report, consumers in China spend on average US$4,251.00 every year, of which US$113 is on fruit and fruit products, a 69% increase over 2014. Increasingly consumers have now become more demanding of a large variety of fresh fruit imports, especially in the tropical category. This increase in fruit consumption among Chinese citizens indicates many opportunities for fresh fruit exporters interested in exporting fresh fruits to China.

Consumers in China generally purchase fruits from wet markets, followed by wholesale markets, retail stores, and supermarkets. A study by Suhana (2018) revealed that four main factors were identified as influencing consumers in China when buying fruit:

A growing segment of the population has become more concerned with food safety standards of domestically grown fruits as they are widely considered to be of lower quality and have fewer safety standards than foreign imported fruit. Most consumers understand the essential health benefits of eating fruits with their understanding of what they should eat regularly.

Consumers in China also tend to choose fruits based on external and internal characteristics. For example, consumers in China like to buy medium-sized watermelons (1-4 kg), round in shape, have a dark green striped skin color, and thin skin. Consumers also love moderately crunchy watermelons, which have reddish flesh, and taste sweet and juicy. The characteristics of the fruit preferred by Chinese consumers align with the attributes of watermelon exported by Malaysia. This situation makes watermelons from Malaysia highly competitive in the China market. More than 33% of Malaysia's watermelon was exported to China (Suhana, 2018).

The Chinese government only allows durian from Malaysia to be marketed in frozen and paste (puree) forms. The most popular durian varieties in China are Musang King and D24. Among the durian that consumers prefer are medium-sized fruit (weight 1.5 to 2.0 kg), medium-thick pulp, yellow in color, sweet taste, and juicy. The prospect of durian fruit from Malaysia is good and has a high demand because many Chinese consumers have eaten durian while visiting Malaysia. Chinese consumers consider durian from Malaysia to be of better quality. As the fresh fruit market access to China has not yet been approved, the Ministry of Tourism and Culture Malaysia has prepared a Durian Tourism program by bringing Chinese tourists to eat durian in Malaysia. The program is very effective as the number of tourists is increasing yearly.

China was once the primary market for papaya from Malaysia. Total papaya exports to China declined in early 2012 when papaya production farms in Malaysia were attacked by papaya dieback disease. Since then, papaya exports to China have decreased significantly. Consumers in China prefer medium-sized papayas (weight 1.0-5.0 kg), medium-oval in shape, yellow skin color, orange-yellow pulp, medium texture, and sweet taste. Malaysia still exports exotic medium-sized papaya (1.0-1.2 kg), which has a medium-fine texture and is very sweet. Papaya from Malaysia is very popular with Chinese consumers and has high competitiveness. However, the lack of production has resulted in low papaya exports to China.

MALAYSIA’S STRATEGIES TO INCREASE EXPORT IN CHINA’S MARKET

Malaysia aspires to sustain China as its traditional and important market for fruits. Malaysia also plans to enhance the competitiveness of its fruits in this market as it promises a good return to Malaysia’s economy. Thus, the government sets strategies to increase the export of fruits to China as follows:

1) Increase volume and quality of fruits export

Malaysia's name for quality and good fruits has remained in China for some years. Musang King durian and mangosteen marketing have firmly allocated the fruits for premium fruits. In a stiff competition among neighborhood countries, Malaysia has an advantage over China's marketing strategies. Therefore, the encouragement of a larger planting area for export market has started since previous Malaysian Agricultural Policy 1.0 and 2.0. Malaysia also needs to have a good diplomatic relationship to strengthen business and marketing influence between the government and industrial players in both countries.

2) Focusing on target market: premium and quality

Generally, an enormous volume to satisfy the needs of every export market in the world is a big challenge to the farmers. China's disposable income per capita increased by around 700%, led by the rapid income increase. The income factor is correlated significantly with fruits purchase. Therefore, to increase sales and export demand, Malaysian products are suggested to aim for premium retail sales in the selected market. Fruits exported must be packed with attractive packaging and labeling. It will add value to sales and indirectly profit the business.

CONCLUSION

Malaysia has a moderately competitive advantage in China market. As for durian and mangosteen, Malaysia's competitiveness is equal to or better than its competitors, especially in quality and taste. Among the factors that need to be emphasized are the freshness, quality, texture and taste, and the certification for safety issues. Additionally, marketing factors like uniqueness, pricing, packaging, and labeling must be consistently interesting in attracting new market segments and customers. The purchasing power of consumers has significantly been correlated with the fruit purchase decision. The increase in households’ income encourages buying more fruits. In addition, it is also driven by health awareness and nutritious food, particularly for the middle-high income group. Therefore, to dominate the market share in China, Malaysian tropical fruits must comply with the importing country's requirements, including export approval protocols and phytosanitary requirements.

REFERENCE

Erkan, B. & Saricoban, K.,(2014). Comparative analysis of the competitiveness in the export of science-based goods regarding Turkey and the EU+13 Countries. Vol 5. No 8 (1)

Department of Agriculture Malaysia (2022). Phytosanitary requirements for exportation of horticulture produce from Malaysia

Malaysia External Trade Development Corporation (MATRADE). (2016). Laporan berkala -: China’s Fruits Market – MATRADE BEIJING

Ministry Agrobased and Food Industry Malaysia (2022). Internal fruits export database

Razali, N.A., Wan Ibrahim, W.M., Safari, S., Rosly, N.K., Hamzah, F.A. Wan

Husin, W.M.R.I. (2022). Cryogenic freezing preserves the quality of whole durian fruit for the export market. Food Research 6 (3). 360-364 . DOI :https://doi.org/10.26656/fr.2017.6(3).428

Suhana, S. (2018). Kajian daya saing pasaran eksport buah-buahan premium di China. Buku Laporan Projek Sosioekonomi 2017. MARDI: Malaysia

TRADEMAP (2022). Available at https://www.trademap.org/Index.aspx

UNCOMTRADE (2020). Available at https://comtrade.un.org