ABSTRACT

Myanmar’s rubber industry has a huge natural rubber market demand from neighboring countries and rubber is also the second-most agricultural export item following the pluses which is the first rank of export items. Myanmar became one of the largest rubber producers around the world which is taking the 6th place of exporting countries in the world rubber market in 2018. The major rubber producing areas are Mon State, Tanintharyi Region and Bago Region which largely contributie to the country’s rubber planting areas as well as rubber production and export value. The study was conducted to identify critical intervention areas of rubber marketing and to advise alternative policies based on the participation of middlemen and traders to improve competitiveness of Myanmar’s rubber industry. Stakeholders' participation approach was used by collecting the information about rubber processing and marketing sectors using Focus Group Discussion (FGD). The selected key stakeholders were middlemen and traders for the marketing sector. The study emphasized on Mudon Township, Mon State and Myeik Township, Tanintharyi Region. In the marketing and trade sector, high market demand, good market mechanism, transparent price information, and storable product were the strength factors. The weaknesses were middlemen had more bargaining power, limited alternative buyers, limited price information creating low level of trust between rubber buyers and sellers. The opportunity was sustainable and gradually increasing rubber demand. Conversely, increased world and domestic rubber production, limited markets for high quality rubber and mainly relying on the China market were threatening factors for marketing and trade sector. Additionally, domestic rubber price was weakly correlated with world rubber price and mainly depended on regional events or celebrations. Critical intervention areas of rubber marketing and trade sector were potential international markets and the domestic market efficiency. To improve the competitiveness and sustainable development of the rubber industry, the recommendations for rubber marketing sector are quality control policy should be specific for rubber products and the rubber industry database and market information service policy for business and research requirements.

Keywords: key stakeholder, participatory, policy, marketing, middlemen, rubber

INTRODUCTION

Introduction

Myanmar’s rubber industry had about 0.65 million hectares plantation which had huge natural rubber market demand of neighboring countries. Moreover, rubber is also the second-most agricultural export item following beans and pluses.

Additionally, the strategy of rubber products sector held significant promise in terms of contributing to the export performance of Myanmar, while it also was driving improvements across the sector’s export value chain. The rubber products sector also had the potential to develop as a key industry to support the automobile industry in Myanmar in the future (Odaka, 2015). Among the top ten exporting countries, Myanmar became one of the largest rubber producers around the world which is taking the place of the 6th exporting country in the world rubber market in 2018 (Workman, 2019).

According to the report of Van, Htoo, & Dorosh, 2017, Myanmar could become an important rubber exporter in the rubber producing countries with the movement away from rubber production in Malaysia and Singapore and limited scope for rubber expansion in Indonesia. Actually, Singapore developed an important rubber packing as well as a rubber milling center to serve the plantations in Malaysia and Indonesia for almost 80 years. Rubber trade was one of the most important industries in early Singapore as rubber produced by “estates” was processed and packed on site and transported to Singapore for shipment to London to be sold and distributed to rubber manufacturers in Europe and the USA. The financial requirements for the buying and holding of rubber during the processing and selling of the processed rubber for shipment was significant as volume grew.

The major rubber producing areas in Myanmar are Mon State, Tanintharyi Region and Bago Region which are largely contributing to the country’s rubber planting area as well as rubber production and export value. However, the export destinations and types of rubber products of these areas were much different. Most of the farmers from the Mon State produced low-grade rubber and their exportable demand mainly depends on the China market. Contrastively, farmers from Tanintharyi and Bago Regions mostly produced higher quality rubber and their exporting destinations were Thailand and Malaysia.

Objectives of the study

- To identify critical intervention areas of rubber marketing by SWOT analysis

- To advise alternative policies based on the participation of middlemen and traders for improved competitiveness of Myanmar’s rubber industry for future development.

METHODOLOGY

Stakeholders' participation approach was used by collecting the information about rubber processing and marketing sectors using Focus Group Discussion (FGD). The selected key stakeholders were middlemen and traders for the marketing sector. After conducting FGD, the current situation of the rubber marketing and trade was explored based on internal and external factors by SWOT analysis. The results from SWOT analysis were used to formulate the specific strategies and identify the critical intervention areas for the rubber industry.

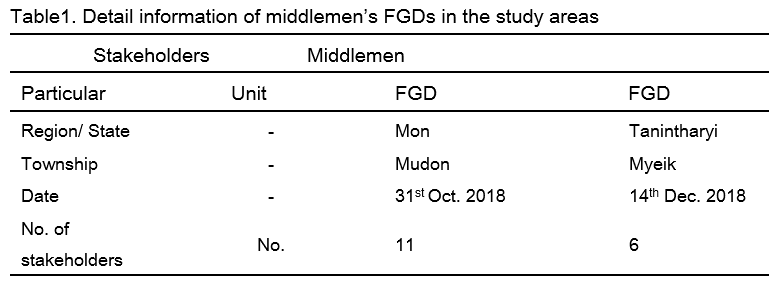

The study emphasized on Mudon Township, Mon State and Myeik Township, Tanintharyi Region where the focal market center of the rubber industry in Myanmar was and most of the rubber wholesalers and exporter were presented. Detailed information of middlemen FGDs were presented in Table 1.

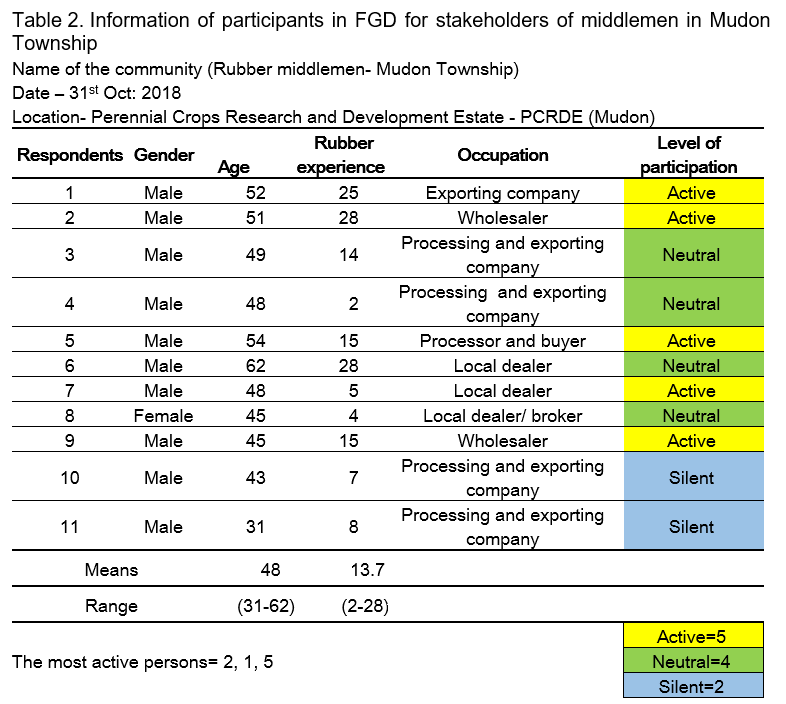

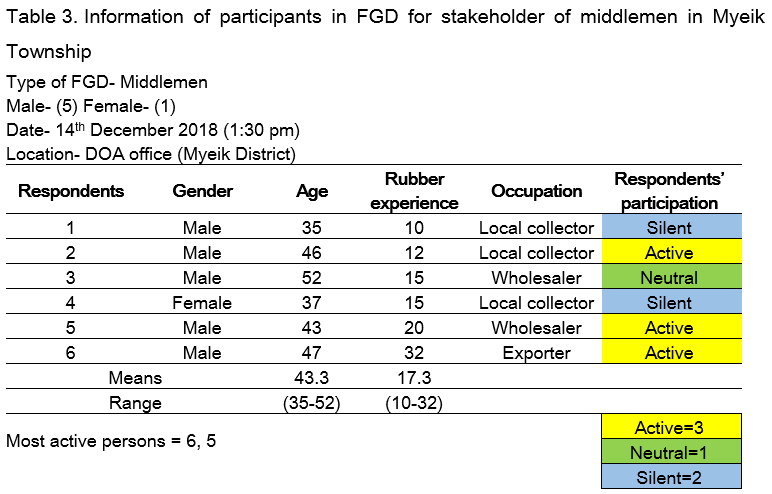

Two FGDs were conducted to analyze key stakeholders' perception of the rubber production. In this study, FGD was used as a qualitative approach to gain an in-depth understanding of the strengths, weaknesses , opportunities and threats (SWOT) of rubber marketing. The participants were identified through DOA extension networks by using purposive sampling. In this regards, middlemen included brokers, local collectors, wholesalers, exporters and processing factory managers. It was because the FGD mainly relies on the ability and capacity of participants to provide relevant information about the rubber industry. The detailed information of middlemen participated in FGD are shown in Table 2.

In data collection, as FGD required a team consisting of a skilled facilitator and assistants, two facilitators and six note-takers were organized. Two locations were chosen for focus group meetings in the study areas. It was set-up about 60 to 120 minutes for the duration of the meetings. The facilitators and assistants team were arranged including the discussion topics; these would be relevant discussions themes for SWOT analysis.

RESULTS AND DISCUSSION

SWOT analysis of the rubber marketing sector

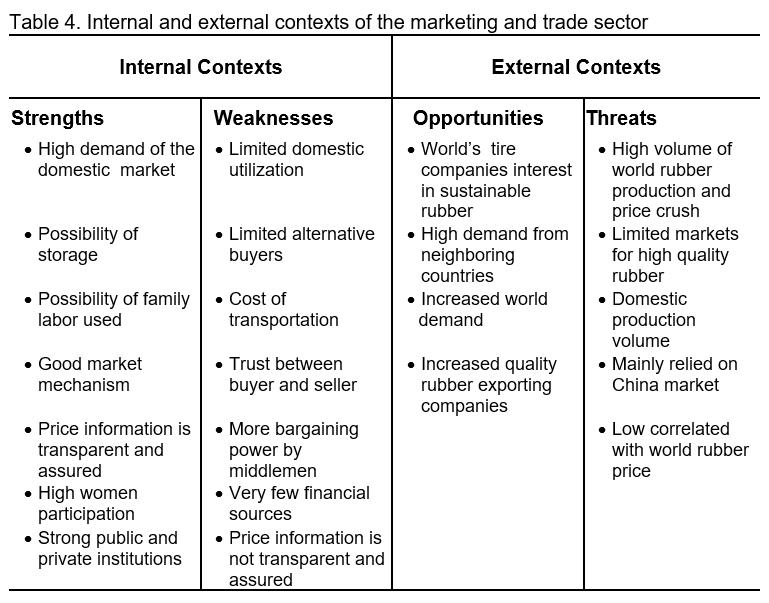

Marketing and trade sector was also important in the consideration of the further expansion of the rubber plantation areas. There were a number of strengths and potential opportunities that were helpful and weaknesses and threats that were harmful for the development of the rubber marketing and trade sector.

In the marketing and trade sector, high market demand, good market mechanism and transparent price information were the strength factors. Moreover, most of the rubber products were possible to store and wait for better prices. However, the marketing and trade sector faced the weaknesses factors of more bargaining power by middlemen due to limited alternative buyers in some areas. In some areas, there was a weakness in price information and it was not transparent. Therefore, it caused a low level of trust between rubber buyers and sellers.

The opportunity in the marketing and trade was that there was sustainable rubber demand by the world’s tire companies and also demand from neighboring countries. Moreover, world rubber demand was gradually increasing year by year and quality rubber exporting companies also increased in the country. Therefore, it was creating the potential to export to the world market. Conversely, increased world and domestic rubber production volume, limited markets for high quality rubber and main reliance on the China market were threatening factors for marketing and trade sector. Additionally, domestic rubber price was weakly correlated with world rubber price and was mainly depend on regional event or celebration. Table 4 describes the internal and external contexts of marketing and the trade sector.

Possible specific strategies of marketing and trade sector by the combination of SWOT

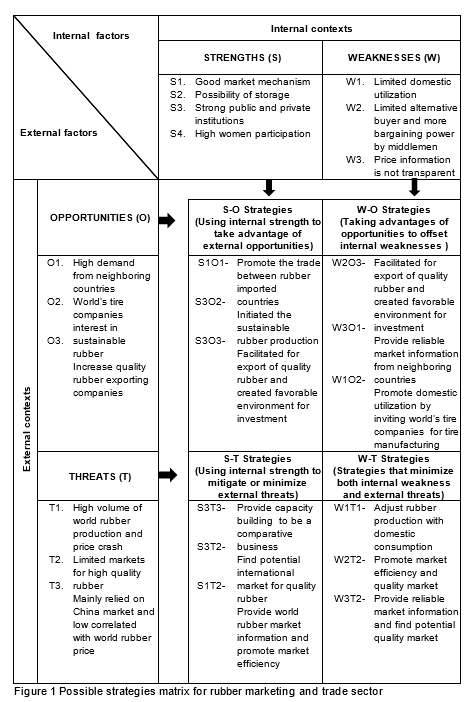

According to the methodology, possible specific strategies of rubber production sector were formulated by a combination of SWOT factors using strategies matrix. Figure 1 presented possible strategies matrix for the rubber production sector.

Critical intervention areas of the rubber marketing sector

- International market

Accessibility of alternatives for the international markets was important for the rubber marketing and trade sector’s competitiveness. Therefore, trade promotion should be prepared for the international market for rubber and rubber products by related public and private institutions.

- Domestic market

In some study areas, the price signals and market information for the rubber market were not reliable and transparent. Consequently, domestic market efficiency was lower in some rubber producing areas. Therefore, it was required to provide reliable market information to improve efficiency that is critical required for competitiveness of the rubber marketing and trade sector.

The study revealed that there are critical intervention areas for rubber marketing and trade sectors of Myanmar’s rubber industry. These areas are required to intervene by related public and private institutes to improve competitiveness of the rubber industry.

Alternative rubber policies via key stakeholder participatory approach with farmers

Rubber industry quality control policy would be an essential alternative policy for improved competitiveness and the development of the rubber industry. It should be focused on rubber clones, seedlings, nurseries as well as rubber and rubber products.

Moreover, the policies that should be promoted include the production of quality rubber and creating the international markets to enhance competitiveness in the marketing and trade sector. It required the cooperation of public and private sectors for the preparation and standardization of rubber quality standards. It had also been designated in marketing, value-added processing and export policy of MOALI launched in 2017.

Regarding the results of the study, all kinds of stakeholders pointed out that there were few research and development activities for rubber marketing and trade sectors. It was created as the important constraints for the rubber industry development and the critical interventions were required in respective sectors to gain better competitiveness. The rubber industry’s research and development policy should be emphasized not only on production and processing but also in terms of market, supply and demand estimation of rubber and rubber products to enhance competitiveness of the rubber industry.

Regarding the interventions to improve competitiveness of the rubber industry, the policy should be in line with research, development and extension policy of MOALI launched in 2017. It proposed to encourage the private sector involvement in the research and development activities and to establish cooperation and collaboration with the international organizations that were critically needed in the rubber industry’s competitiveness and development.

Myanmar’s rubber industry had potential in the domestic and international markets. The market and price information were very important for an efficient market mechanism and improve competitiveness in rubber marketing and the trade sector. To intervene in these areas, database and market information service policy would be required to create international demand and provide reliable and transparent market information.

The rubber industry database and market information service policy should be outlined for the ways of data addition, accessing, updating and removal of data concerning rubber markets information for better competitiveness. It should also be referred to as marketing, value-added processing and export strategic policy of MOALI launched in 2017. The policy stated that it required to encourage mutual consensus between trading partners of government; internal and external market information dissemination; and issuance of relevant certificates by using advanced information technology.

Accordingly, to achieve the best outcomes and to gain competitiveness from the policy, it should also follow the strategic thrust of marketing, value-added processing and export proposed by MOALI launched in 2017. The strategic thrust supported in time access to sufficient local and international market information about local and external trade, the updated situation on supply and demand, prices fluctuation and market information.

CONCLUSION

Critical intervention areas of rubber marketing and trade sector were to find the potential international markets, to promote the domestic market efficiency and to improve competitiveness of rubber industry value chain. To improve the competitiveness and sustainable development of the rubber industry, it was required to overcome weaknesses and threats as well as to intervene in critically needed areas. Therefore, the study wants to provide the recommendations to implement empirical-based alternative policies for the rubber marketing sector which include the rubber industry quality control policy should be specific for rubber products and the rubber industry database and market information service policy which would create the international price and demand for business and research requirements.

REFERENCES

Odaka, K. 2015. Setting the Conditions for Stable Economic Development- Reflections on the Outcomes of an Economic Policy Support Project for Myanmar. The Program for Economic Development in Myanmar, FINAL REPORT, pp 21-43.

Van Asselt, J., Htoo, K., & Dorosh, P. A. 2017. Prospects for the Myanmar rubber sector: an analysis of the viability of smallholder production in Mon State (Vol. 1610): Intl Food Policy Res Inst.

Workman, D. 2019. Natural Rubber Exports by Country. Retrieved from http:// www.worldstopexports.com/natural-rubber-exports-country.

Key Stakeholder Participatory Approach with Middlemen and Traders in Myanmar’s Natural Rubber Policy Forward

ABSTRACT

Myanmar’s rubber industry has a huge natural rubber market demand from neighboring countries and rubber is also the second-most agricultural export item following the pluses which is the first rank of export items. Myanmar became one of the largest rubber producers around the world which is taking the 6th place of exporting countries in the world rubber market in 2018. The major rubber producing areas are Mon State, Tanintharyi Region and Bago Region which largely contributie to the country’s rubber planting areas as well as rubber production and export value. The study was conducted to identify critical intervention areas of rubber marketing and to advise alternative policies based on the participation of middlemen and traders to improve competitiveness of Myanmar’s rubber industry. Stakeholders' participation approach was used by collecting the information about rubber processing and marketing sectors using Focus Group Discussion (FGD). The selected key stakeholders were middlemen and traders for the marketing sector. The study emphasized on Mudon Township, Mon State and Myeik Township, Tanintharyi Region. In the marketing and trade sector, high market demand, good market mechanism, transparent price information, and storable product were the strength factors. The weaknesses were middlemen had more bargaining power, limited alternative buyers, limited price information creating low level of trust between rubber buyers and sellers. The opportunity was sustainable and gradually increasing rubber demand. Conversely, increased world and domestic rubber production, limited markets for high quality rubber and mainly relying on the China market were threatening factors for marketing and trade sector. Additionally, domestic rubber price was weakly correlated with world rubber price and mainly depended on regional events or celebrations. Critical intervention areas of rubber marketing and trade sector were potential international markets and the domestic market efficiency. To improve the competitiveness and sustainable development of the rubber industry, the recommendations for rubber marketing sector are quality control policy should be specific for rubber products and the rubber industry database and market information service policy for business and research requirements.

Keywords: key stakeholder, participatory, policy, marketing, middlemen, rubber

INTRODUCTION

Introduction

Myanmar’s rubber industry had about 0.65 million hectares plantation which had huge natural rubber market demand of neighboring countries. Moreover, rubber is also the second-most agricultural export item following beans and pluses.

Additionally, the strategy of rubber products sector held significant promise in terms of contributing to the export performance of Myanmar, while it also was driving improvements across the sector’s export value chain. The rubber products sector also had the potential to develop as a key industry to support the automobile industry in Myanmar in the future (Odaka, 2015). Among the top ten exporting countries, Myanmar became one of the largest rubber producers around the world which is taking the place of the 6th exporting country in the world rubber market in 2018 (Workman, 2019).

According to the report of Van, Htoo, & Dorosh, 2017, Myanmar could become an important rubber exporter in the rubber producing countries with the movement away from rubber production in Malaysia and Singapore and limited scope for rubber expansion in Indonesia. Actually, Singapore developed an important rubber packing as well as a rubber milling center to serve the plantations in Malaysia and Indonesia for almost 80 years. Rubber trade was one of the most important industries in early Singapore as rubber produced by “estates” was processed and packed on site and transported to Singapore for shipment to London to be sold and distributed to rubber manufacturers in Europe and the USA. The financial requirements for the buying and holding of rubber during the processing and selling of the processed rubber for shipment was significant as volume grew.

The major rubber producing areas in Myanmar are Mon State, Tanintharyi Region and Bago Region which are largely contributing to the country’s rubber planting area as well as rubber production and export value. However, the export destinations and types of rubber products of these areas were much different. Most of the farmers from the Mon State produced low-grade rubber and their exportable demand mainly depends on the China market. Contrastively, farmers from Tanintharyi and Bago Regions mostly produced higher quality rubber and their exporting destinations were Thailand and Malaysia.

Objectives of the study

METHODOLOGY

Stakeholders' participation approach was used by collecting the information about rubber processing and marketing sectors using Focus Group Discussion (FGD). The selected key stakeholders were middlemen and traders for the marketing sector. After conducting FGD, the current situation of the rubber marketing and trade was explored based on internal and external factors by SWOT analysis. The results from SWOT analysis were used to formulate the specific strategies and identify the critical intervention areas for the rubber industry.

The study emphasized on Mudon Township, Mon State and Myeik Township, Tanintharyi Region where the focal market center of the rubber industry in Myanmar was and most of the rubber wholesalers and exporter were presented. Detailed information of middlemen FGDs were presented in Table 1.

Two FGDs were conducted to analyze key stakeholders' perception of the rubber production. In this study, FGD was used as a qualitative approach to gain an in-depth understanding of the strengths, weaknesses , opportunities and threats (SWOT) of rubber marketing. The participants were identified through DOA extension networks by using purposive sampling. In this regards, middlemen included brokers, local collectors, wholesalers, exporters and processing factory managers. It was because the FGD mainly relies on the ability and capacity of participants to provide relevant information about the rubber industry. The detailed information of middlemen participated in FGD are shown in Table 2.

In data collection, as FGD required a team consisting of a skilled facilitator and assistants, two facilitators and six note-takers were organized. Two locations were chosen for focus group meetings in the study areas. It was set-up about 60 to 120 minutes for the duration of the meetings. The facilitators and assistants team were arranged including the discussion topics; these would be relevant discussions themes for SWOT analysis.

RESULTS AND DISCUSSION

SWOT analysis of the rubber marketing sector

Marketing and trade sector was also important in the consideration of the further expansion of the rubber plantation areas. There were a number of strengths and potential opportunities that were helpful and weaknesses and threats that were harmful for the development of the rubber marketing and trade sector.

In the marketing and trade sector, high market demand, good market mechanism and transparent price information were the strength factors. Moreover, most of the rubber products were possible to store and wait for better prices. However, the marketing and trade sector faced the weaknesses factors of more bargaining power by middlemen due to limited alternative buyers in some areas. In some areas, there was a weakness in price information and it was not transparent. Therefore, it caused a low level of trust between rubber buyers and sellers.

The opportunity in the marketing and trade was that there was sustainable rubber demand by the world’s tire companies and also demand from neighboring countries. Moreover, world rubber demand was gradually increasing year by year and quality rubber exporting companies also increased in the country. Therefore, it was creating the potential to export to the world market. Conversely, increased world and domestic rubber production volume, limited markets for high quality rubber and main reliance on the China market were threatening factors for marketing and trade sector. Additionally, domestic rubber price was weakly correlated with world rubber price and was mainly depend on regional event or celebration. Table 4 describes the internal and external contexts of marketing and the trade sector.

Possible specific strategies of marketing and trade sector by the combination of SWOT

According to the methodology, possible specific strategies of rubber production sector were formulated by a combination of SWOT factors using strategies matrix. Figure 1 presented possible strategies matrix for the rubber production sector.

Critical intervention areas of the rubber marketing sector

Accessibility of alternatives for the international markets was important for the rubber marketing and trade sector’s competitiveness. Therefore, trade promotion should be prepared for the international market for rubber and rubber products by related public and private institutions.

In some study areas, the price signals and market information for the rubber market were not reliable and transparent. Consequently, domestic market efficiency was lower in some rubber producing areas. Therefore, it was required to provide reliable market information to improve efficiency that is critical required for competitiveness of the rubber marketing and trade sector.

The study revealed that there are critical intervention areas for rubber marketing and trade sectors of Myanmar’s rubber industry. These areas are required to intervene by related public and private institutes to improve competitiveness of the rubber industry.

Alternative rubber policies via key stakeholder participatory approach with farmers

Rubber industry quality control policy would be an essential alternative policy for improved competitiveness and the development of the rubber industry. It should be focused on rubber clones, seedlings, nurseries as well as rubber and rubber products.

Moreover, the policies that should be promoted include the production of quality rubber and creating the international markets to enhance competitiveness in the marketing and trade sector. It required the cooperation of public and private sectors for the preparation and standardization of rubber quality standards. It had also been designated in marketing, value-added processing and export policy of MOALI launched in 2017.

Regarding the results of the study, all kinds of stakeholders pointed out that there were few research and development activities for rubber marketing and trade sectors. It was created as the important constraints for the rubber industry development and the critical interventions were required in respective sectors to gain better competitiveness. The rubber industry’s research and development policy should be emphasized not only on production and processing but also in terms of market, supply and demand estimation of rubber and rubber products to enhance competitiveness of the rubber industry.

Regarding the interventions to improve competitiveness of the rubber industry, the policy should be in line with research, development and extension policy of MOALI launched in 2017. It proposed to encourage the private sector involvement in the research and development activities and to establish cooperation and collaboration with the international organizations that were critically needed in the rubber industry’s competitiveness and development.

Myanmar’s rubber industry had potential in the domestic and international markets. The market and price information were very important for an efficient market mechanism and improve competitiveness in rubber marketing and the trade sector. To intervene in these areas, database and market information service policy would be required to create international demand and provide reliable and transparent market information.

The rubber industry database and market information service policy should be outlined for the ways of data addition, accessing, updating and removal of data concerning rubber markets information for better competitiveness. It should also be referred to as marketing, value-added processing and export strategic policy of MOALI launched in 2017. The policy stated that it required to encourage mutual consensus between trading partners of government; internal and external market information dissemination; and issuance of relevant certificates by using advanced information technology.

Accordingly, to achieve the best outcomes and to gain competitiveness from the policy, it should also follow the strategic thrust of marketing, value-added processing and export proposed by MOALI launched in 2017. The strategic thrust supported in time access to sufficient local and international market information about local and external trade, the updated situation on supply and demand, prices fluctuation and market information.

CONCLUSION

Critical intervention areas of rubber marketing and trade sector were to find the potential international markets, to promote the domestic market efficiency and to improve competitiveness of rubber industry value chain. To improve the competitiveness and sustainable development of the rubber industry, it was required to overcome weaknesses and threats as well as to intervene in critically needed areas. Therefore, the study wants to provide the recommendations to implement empirical-based alternative policies for the rubber marketing sector which include the rubber industry quality control policy should be specific for rubber products and the rubber industry database and market information service policy which would create the international price and demand for business and research requirements.

REFERENCES

Odaka, K. 2015. Setting the Conditions for Stable Economic Development- Reflections on the Outcomes of an Economic Policy Support Project for Myanmar. The Program for Economic Development in Myanmar, FINAL REPORT, pp 21-43.

Van Asselt, J., Htoo, K., & Dorosh, P. A. 2017. Prospects for the Myanmar rubber sector: an analysis of the viability of smallholder production in Mon State (Vol. 1610): Intl Food Policy Res Inst.

Workman, D. 2019. Natural Rubber Exports by Country. Retrieved from http:// www.worldstopexports.com/natural-rubber-exports-country.