Ph.D Tran Cong Thang and Dinh Thi Bao Linh[1]

ABSTRACT

This paper aims to provide an opportunity to improve understanding of Vietnamese relevants and foreign partners of its agricultural policies, including eight policy groups including (i) trade liberalization countermeasures, (ii) agricultural land policies, (iii) social security policies for farmers, (iv) agricultural disaster insurance; (v) food security and safety, (vi) production and marketing policies, (vii) agricultural science policies and technology development and (viii) environment and natural resources. Thanks to remarkable reforms in agricultural sector, both in term of production and trade since the Renovation of the economy in 1986, Vietnam has become of one of biggest exporters of several agricultural products. The paper finds out that stronger and efficient policies include production supporting, agricultural infrastructure building, credit support, policies on science and technology; policies for creating real incentives for farmers and producers are policies on linkages between production and business and policies on institutional reform are still inedaquate. Main reasons for limitations in these policies consist in the lack of reasoning in policy making, typically in implementing policies on farmers and institution building; lack of monitoring and evaluation of policies impact, lack of mechanisms to collect policy feedback from beneficiaries. In the coming time Vietnam need new and stronger efforts to accelerate the agricultural restructuring, focusing on innovating the system of institutions and improving R&D and trade promotion instead of giving cash to farmers and traders.

Key words: Vietnam agricultural policies, Vietnam Customs, Renovation, Resolution 26/NQ-TW, Decision No 899/QD-TTg.

INTRODUCTION

Topic statement:

Since the Renovation (Doi moi) in 1986, Vietnam has carried out remarkable reforms in agricultural sector, both in term of production and trade. From a backward agricultural economy in 1980s, after 30 years, Vietnam is now one of biggest agricultural exporters in the world. Vietnam has enjoyed trade surplus in agriculture for many years and the high GDP growth of agriculture has played an important role in the economic development of the economy.

Despite these successes, the major concern of the country is the unsustainable development of the agriculture. With the growth in width rather than in depth, the competitiveness of Vietnamese agriculture is low and relies in the low labor cost and natural advantages while added value is limited. Agricultural production and trade faces now big challenges including the high dependence on some traditional export markets, polluted agricultural environment due to the abuse of chemical inputs, unskilled and unstable labor force and the erosion of resources for the agriculture production.

To handle with these problems, the country needs more policy efforts to restructure the agriculture, in order to maintain growth, raising efficiency and competitive capacity through productivity, quality and value addition, to boost export and the sustainable development.

A brief review on agricultural policies in Vietnam will provide some inputs for the policy making in the agricultural sector of Vietnam and for decision on investing in Vietnamese agricultural sector of domestic business and foreign investors.

Objectives:

This assignment aims to:

(i) Provide a brief review on the situation of agriculture and agricultural policies in Vietnam.

(ii) Identify key policy and regulatory gaps and further task of agricultural policy of Vietnam in order to obtain a sustainable growth and improve the competitiveness of Vietnamese agricultural products.

Scope and Methodology of policy review

The policy review will focus on the policies issued from the Resolution 26/NQ-TW of the Communist Party of Vietnam (dated August, 2008). This Resolution is recommended as a big breakthrough policy which creates a “triangle pillars position” of policies on Agriculture, Farmer and Rural, that we call “Tam nong Resolution”. In term of agricultural sector only, the policies are grouped and reviewed according to eight main groups including:

(i) trade liberalization countermeasures,

(ii) agricultural land policies,

(iii) social security policies for farmers,

(iv) agricultural disaster insurance

(v) food security and safety,

(vi) production and marketing policies,

(vii) agricultural science policies and technology development,

(viii) environment and natural resources.

The review of each specific policy will include the context, objectives, main content, pros and cons and some effects on main relevant.

Before the detailed analysis, in order to display a historical perspective and change of agricultural policy of Vietnam, a brief review of the agricultural sector and agricultural policy from the Doi moi (in 1986) is carried out, focusing on the reform in agricultural land use, the relationships between main stakeholders (the state, farmer and private business) and key incentives for enhancing the international integration of Vietnamese agriculture.

Due to the limitation of time, the review can not cover all policies in the agricultural sectors of Vietnam. Policy assessment is only qualitative while a quantitative analysis may offer specific evidences on the effectiveness of issued policies.

AGRICULTURE AND AGRICULTURAL POLICIES IN VIETNAM

1. Situation of agriculture in Vietnam

1.1. Agricultural production

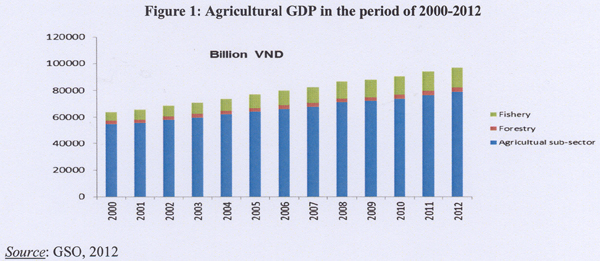

According to statistics of Vietnamese General Statistic Office (GSO), GDP of agricultural sector has been increasing during the period of 2000 to 2012. Its growth rate, however, has experienced a downward trend: 3.81%/year during 2000-2006 compared to 3.26%/year during 2007-2012. The average annual growth rate of GDP of the fishery sector was higher than that of the agricultural sector: 10.4% in 2000-2006 and 4.19% during 2007-2012 and vice versa for the forestry sector: 0.97% during the 5 years before 2007 and 3.24% during the 5 recent years.

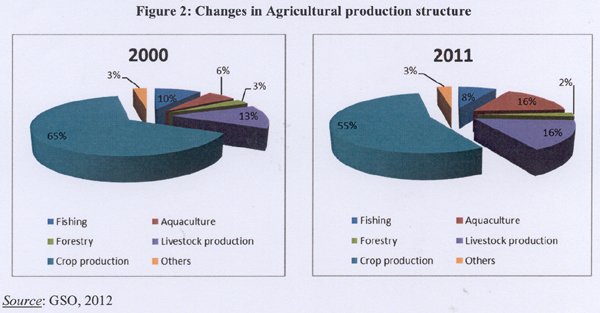

According to IPSARD (2013), a structural change has been seen in agricultural sector for the last decade with the increasing proportion of fishery and forestry sectors and the decreasing proportion of agricultural sub-sector. Fishery sector accounted for 21% in 2011 of total agricultural GDP, an increase from 16% in 2000 thanks to the increase in the production value of aquaculture though the land for aquaculture decreased slightly recently. In contrast, the proportion of crop production sector decreased from 62% in 2000 to 56% in 2011. The proportion of industrial and fruit crops tends to increase and accounts for one third of the total production value of the cultivation sector.

1.2. Agricultural TradeSource: GSO, 2012

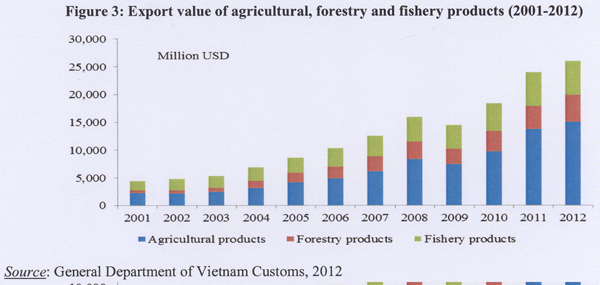

The contribution of agricultural products accounts to the total exports of Vietnam keeps increasing over time, from 49% in 2001 to 57.7% in 2012. However, the export of aquatic products shown a smaller proportion of total exports, from 40.8% in 2001 to 23.4% in 2012.

The export value of agricultural sector has significantly increased since 2000 (except 2009) but growth rate has reduced, from 18.4% during 2000-2007 to 15.6% in the 5 recent years. ,

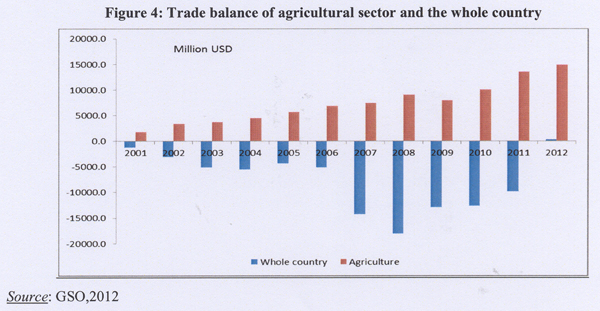

While the total trade balance of Vietnam remains deficit over time, it is noteworthy that agricultural trade is always surplus. This fact associated with high GDP growth rate of agricultural sector analyzed above have proved for the key role of the agricultural sector to the whole economy.

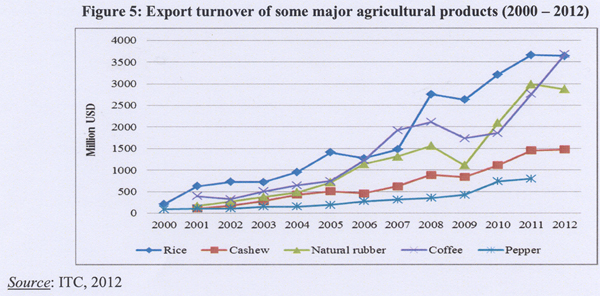

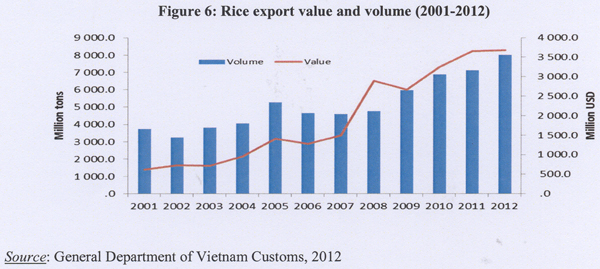

Growth in exports of agricultural sector bases mainly on export of 5 major commodities including rice, coffee, pepper, cashew and rubber. The rice export turnover keeps on increasing for a long time and has rocketed since 2007, reaching the peak in 2012. The exports of coffee and rubber have also increased rapidly since 2009 as illustrated below.

However, it should be noted that low starting points (export turnover of less than 2000 million USD in 2000) partly leads to the high growth rates. Moreover, high growth rates are resulted from quantity increases instead of unit price increases, proving the decrease in competitiveness and low value added of agricultural products.

For instance, exporting turnover of rice in 2012 increased by only 0.4% while its exporting quantity increased by 12.7%. Similarly, coffee exporting turnover in 2012 saw an increase of 33.4% while the export volume rose by 37.8%, reflecting decreases in unit prices which should receive high attention.

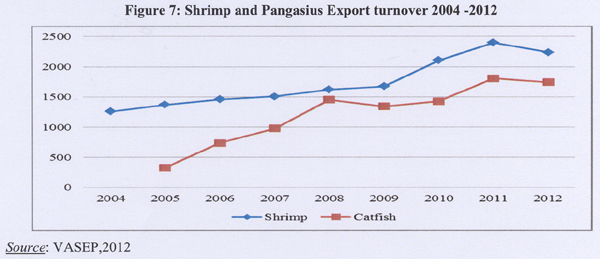

Furthermore, some sub-sectors which are considered as high competitiveness such as pangasius or shrimp are now experiencing a decreasing trend of export turnover because of lower export prices. The export turnover of pangasius in the period 2005-2012, for example, dramatically increased at the rate of 23% annually compared to only 10.4%/year of aquaculture sector. However, export turnover of pangasius in 2012 saw a sharp decline though Vietnam has an absolute advantage in producing this commodity and is the world biggest exporter of pangasius, accounting for 98% of the world market. Similar trend is occurring with shrimp export.

2. Historical perspectives and change of agricultural policy

2.1. A brief review of historical agricultural policy since Doimoi (1986)

The key reform in agricultural policy of Vietnam dated in the late of 1980s, after the Doi moi of the economy, with the enactment of the Directive No. 10. This directive enacted in April 1988, replaced the “Contract 100 systems” with the new “Contract 10 System”.

In order to create motivation to promote agricultural production, especially rice production, in 31st Jan, 1981, the Secretariat of Party Central Committee issued the directive No.100 CT/TW of on “Innovate policy to ensure equality between workers and groups in agricultural cooperatives”. Then the directive No.10 of Politburo (April, 5th 1988) and Land law (June, 1993) have pointed innovation in agriculture. Land law (1993) regulated the authorities ‘responsibilities at levels in managing land use purposes. When the farmers wanted to converse the purpose of land use, they had to be permitted by provincial People's Committee with the area less than 2ha. This regulation helped to minimize the risks of rice land conversion by urbanization and industrialization in the provinces. The Directive No.10 (popularly known as Contract 10 or Khoan Muoi)) including new bill to replace the compulsory quota system with a land tax indexed to productivity, has created big incentives to agricultural producers because it recognize farming families as the main units of agricultural production instead of maintaining the central role of ineffective cooperatives and state farms. This reform enabled Vietnam from a rice deficit country to become on of largest rice exporters today.

According to Dang Kim Son and Nguyen Do Anh Tuan (2011), reforms in land policy has become the center of economic recovery. The Communist Party and the State of Vietnam have issued hundreds of documents and policies related to land. Land allocation to households has been among key incentives for enhancing productivity, thereby contributed to ending widespread food shortages. This policy combined with new efforts in production and trade reform has created higher agricultural growth, rising incomes and welfare of farmers. In addition, agricultural land conversion to inefficient agricultural land has contributed provide a foundation for growth and prosperity.

However, even after the “Contract 10”, land use rights for each farmer household were limit to 03 hectare size. The land tenure continued to hinder the development of production on large scale. A significant amount of resources for agricultural production has been wasted due to land reallocation for industrialization. The imbalance between rural and urban public investment makes the income gap expanding. Limitation in the land redistribution right of farmers is among reasons for lower agricultural growth than potential. In fact, growth rate of agricultural production in the 2009-2013 period was lower than the previous 5 years. The export value of agricultural products were also lower than potential due to the rigid use of agricultural land. The environmental management has been neglected, leading to the pollution and erosion of land.

In term of administrative management, the Government reduced direct control of its central institutions and of some local authorities over agricultural production decisions and management and cooperatives in the whole country were forced to reform their organization and activities. Many of SOEs have been equitized, in order to become more competitive and efficient.

Regarding trade liberalization, Vietnam has become ASEAN’s member in 1996, then WTO’s member in 2007. Several bilateral and multilateral FTAs have been signed since the Doi moi and have been affected the economy. Trade liberalization countermeasures have been gradually taken to protect the domestic market, respecting however international commitments.

2.2. Main groups of agricultural policies in Vietnam

As stated above, this section will focus on policies issued from 2008. However, some typical and important polices, which were issued before but are still effective are mentioned also.

2.2.1. Trade liberalization countermeasures:

According to WTO (2013)[2], in the process of economic restructuring and comprehensive international integration, the Vietnamese Government is strongly committed to the multilateral trading system and considers it main focus of Vietnam’s economic integration policies. Since its adhesion in WTO. Vietnam has continued to complete its trade policies and engage with trading partners to recognize Vietnam as a market economy. In early 2013, nearly 40 countries[3] has recognized Vietnam’s market economy status.

Since the objectives of this report, the research team reviews the trade policies of Vietnam in four main groups including (i) export and import management which influences on the export and import of input and output of agricultural production; (ii) export subsidies and export promotion and marketing assistance, which shall enhancing export of agricultural products; (iii) Customs reform and border trade policy which affect the transparency and efficiency of agricultural trade with foreign partner; (iv) price management policy which regulates a list of agricultural products under the price stabilization schemes.

a) Measures directly affecting imports:

Import procedure and requirement

Customs clearance documentation and procedures for imports and exports generally have been in essence unchanged since 2009 and implemented on the basis of a circular of the Ministry of Finance. The action has been taken to streamline the process of establishing a business and goods import into Vietnam.

Ordinary customs duties:

In Vietnam, the customs tariff is generally issued annually in the form of a decision or circular from the Ministry of Finance[4].

Exemption from import duty: From the date 07th Feb, 2014, production materials and supplies imported for agricultural farming, forestry, fisheries, salt, artificial seed production, crop varieties and breeds new livestock in investment projects in the field of special investment incentives (Section A - Annex 1 of the Decree No 108/2006/ND-CP) will be exempt from import duties under the Circular No. 02/VBHN- BCT dated 23rd January, 2014 of the Ministry of Industry and Trade)

Progress of tariff reduction commitments has been made either in accordance with the Schedule or faster than scheduled. For agricultural products, the tariff reductions had to be made from 22.4% to 20.9%. For seafood, approximately 75% of the total number of applied tariffs are lower than the WTO commitments, the remaining tariff lines is at equivalent levels of commitments. The system of import and export duties policies on agricultural products traded with the bordering country is also further reformed in accordance with international commitments. The duty-free and reduction of import duties and other taxes for border residents has been adjusted to appropriate living conditions, production of border residents. Tax collection procedures, deductions, exemptions, tax refund, taxpayer rights are established more clearly. The difference between bound and currently applied MFN rates leave some scope for flexibility in the Vietnam‘s tariff policy.

Tariff quotas and tariff exemption

In Vietnam, tariff quotas are applicable for eggs, refined and raw sugar, tobacco materials and salts. The size of the annual import quotas is fixed by the Ministry of Industry and trade, whereas the tariff rate for out-of-quota imports are determined by the Ministry of Finance.

With respect to tariff exemption, Vietnam exempts various goods from customs duties pursuant to the Law on Import Tax and Export Tax (Law No.45/2005/QH11 of 14th June, 2005).

In addition to humanitarian aid and non-refundable aid, goods in transit and goods imported to free zones, Article 16 of the Law No.45/2005/QH11 enumerates other import duty exemptions, including fro movable assets, goods imported temporarily for re-export, fixed assets imported for projects entitled to investment incentives, specially encouraged or funded through official development assistance programs. Tax exemption for investment projects extends to equipment and machinery.

While the tariff quotas has been maintained for years, there are not notable and official effectiveness evaluation of current tariff quota for agricultural products, both in term of domestic production support and domestic market stabilization. It is advised to review the effectiveness evaluation of maintaining quotas for agricultural commodities and to combine quotas with technical barriers in order to restrict imports of commodities (e.g. eggs) in the period when the domestic production

Right to import

Vietnam has committed to grant full import trading rights on par with Vietnamese traders to foreign individuals and FIEs from 1 January, 2007 excepts for some products for which full import trading rights were to be granted 1st January, 2008 and other would remain under permanent exception.

Legal documents on trading right include Decree No.23/2007/NĐ-CP implementing the Commercial Laws regarding trading and distribution activities by FIEs in Vietnam; Decision No.10/2007/QD-BTM publicizing roadmaps for goods trading and directly related activities; Circular No. 09/2007/TT-BTM providing guidance on the Decree No.23/2007/ND-CP; the Circular No.06/2008/TT-BTC amending and supplementing the Circular No.09/2007; Decree No.90/2007/NĐ-CP ; Circular No.08/2013/TT-BTC providing guidelines on the import, export and distribution of goods by foreign-invested enterprises (FIEs) in Vietnam.

The requirements to be a registered exporter are essentially the same as the requirements to be a registered importer.

Since its WTO’s accession, Vietnam has adopted several legislation acts to open the trading right. Legal documents issued by the Government are in accordance with international commitments. With respect to regulation on the rice exporting right, conditions on the provision capacity of exporter of agricultural products (e.g. rice) in order to enhance the overall competitiveness of agricultural products in Vietnam.

Standards, technical requirements and conformity assessment

In general, Vietnam has built the valid technical barriers and conformity assessment in accordance with international commitments. In respect to technical barriers to trade, Vietnam undertook to comply with the obligations of the TBT Agreement from the date of its adhesion to WTO. Regarding sanitary and phytosanitary measures, Vietnam respects requirements of the SPS Agreement. The country has made 42 regular notifications to the SPS Committee in the WTO; included the Law on Food Safety (Law No 55/2010/QH12) and a draft Law on Plant Protection and Quarantine.

Since WTO’s accession, Vietnam has sent 33 TBT notifications of regular measures covering a variety of products. At the end of 2012, Vietnam had 6800 Vietnamese standards (TCVNs) in effect, of which 40% were harmonized with international, regional and foreign standards (up from 25% in 2005). The Sanitary and Phytosanitary Measures is enhancing the ability to control the quality, hygiene and food safety for agricultural imports.

However the implementation and issuance of legal documents on technical barriers in trade of Vietnam has been limited due to the starting point of the economy at a low level.

In addition, the relevant authorities are still puzzled because the majority of the legal documents is complex, the policy accessibility of the corporate policy is limited. For example, the list of animals and plants to meet national requirements shall be published on the website of the Quality Assurance Department of Agriculture and Forestry and Fishery.

Rule of origin:

Firstly, Vietnam implements ASEAN preferential rules of origin. Importers required to submit certificates of origin (form D) either satisfying the wholly obtained criterion or proving minimum 40% of ASEAN cumulative origin for goods imported into Vietnam under the AFTA. ASEAN free trade agreements with other partners such as China, Korea, Japan (ASEAN +3), Australia/New Zealand and India are also based on the wholly obtained criterion or substantial transformation involving a change in tariff heading and allowing for regional cumulative origin.

Anti-dumping, countervailing duty and safeguarded regimes:

Regarding anti-dumping, the Ordinance No.20/2004/PL-UBTVQH11 sets out the framework for the filing of complaints, the initiation and conduct of an anti-dumping investigation, consultation with the parties, confidentiality, preliminary and final determinations, the application of anti-dumping measures review, complaints, then the handling of violations. Then detailed provisions to the Ordinance No.20 were contained in the Decree No.90/2005/ND-CP of the Government.

Countervailing measures are regulated in this above Ordinance on Anti-subsidy for imports into Vietnam. Detailed provisions including the establishment of an Anti-subsidy commission and the conduct of investigations are laid down in the Decree No.89/2005/ND-CP of the Government.

Safeguards in the Import of foreign goods into Vietnam are contained in the Ordinance No. 42/2002/PL-UBTVQH10 in 2002 then the Decree. No. 150/2003/ND-CP provides detailed regulations for the implementation of the ordinance.

b) Measures directly affecting exports:

Export procedures and requirements

The requirements to be a registered exporter are essentially the same as the requirements to be a registered importer. i.e domestic investors need a valid business registration certificate whereas a foreign investor must hold a valid investment certificate. The export rights of foreign-invested enterprises in Vietnam are regulated in the Decree No. 23/2007/ND-CP while the rights of foreign traders without a physical presence in Vietnam are regulated in accordance with the Decree No. 90/2007/ND-CP.

Recently, in order to enhance the competitiveness and bargain power of Vietnamese rice exporters in comparison to foreign partners and competitors, the Government has added the regulation on rice exporting right. According to the Decision No. 109/2010/NĐ-CP, rice exporter has to meet the following conditions: (i) At least one specialized store with minimum capacity of 5,000 (five thousand) tons of paddy, in accordance with common standards issued by the Ministry of Agriculture and rural development. (ii) At least one grinding grain, rice factory with minimum capacity of 10 tons of paddy per hour, in accordance with common standards issued by the Ministry of Agriculture and rural development.

Export taxes, fee, charges for services rendered and internal taxes on exports

While removed export duties on most of exported products, Vietnam remain export duties on certain products including raw hides and skin and wood products, in accordance with the Law on Export and Import Duties, in effect since 1st January, 2006.

Export subsidies

Vietnam has abolished all kinds of export subsidies for agricultural products. However, in accordance with the Agreement of Agriculture, Vietnam is still able to reserve two forms of exports subsidies permitted by WTO to developing countries to reduce costs of marketing agricultural exports and the costs of international transport and freight.

The Vietnam Development bank (VDB) provides export credits, investment credit guarantees and export project performance securities. But no export guarantee schemes are operated by the Government. Export credits guaranteed by banks, are governed by the Circular No. 28/2012/TT-NHNN of 3rdOctober, 2012. No preferential treatment is accorded to export credit guarantee activities.

c) Other trade liberalizations countervailing measures:

Customs reform and border trade policy:

The Government adopted in 2001 the “ Strategy for Customs development through 2020” which sets the overall objectives for Vietnam Customs to become by the year 2020 a modern customs administrations that meet standards equivalent to those of customs administration of the developed countries.

Vietnam was in full compliance with the WTO rules on customs charges, the principles for determining the customs value under the Customs Valuation Agreement of the WTO; simplify and harmonize customs procedures to facilitate chemical trade, including agricultural trade.

As a large amount of agricultural products are exported and imported through border trade between Vietnam and China, Laos and Cambodia, the modernization of customs procedures in border trade has also been pushed up in recent years.

In the coming time, the Government and competent government agencies should review, amend and supplement a number of inappropriate legal documents on border trade, mostly which ones relating to trade through the sub-border gate between Vietnam and bordering countries.

Price management:

Price stabilization:

The price management mechanism has been gradually improved in a way consistent with the movement of the market economy.

Until nearly 2013, the basic principles of price management in Vietnam were laid down in the Ordinance on Price, in effect sin 01st July, 2012 and the Decree No. 170/2003/ND-CP, as amended in 2008. Then the Ordinance on Price was replaced by the Law on Price No. 11/2012/QH12 in effect since 01st January, 2013.

On 14th November, 2013, the Government adopted the Decree No. 177/2013 ND-CP detailing and guiding the implementation of some articles of the Law on price, accordingly, a number of agricultural products and agricultural materials are added to the list of price stabilization including Urea, NPK, medicine and plant protection (pesticides, fungicides, herbicides); disease vaccine for cattle, poultry, salt, Paddy, ordinary rice. All ministries set prices for some goods and services related to the field of each ministry. MARD, cooperated with MOF, stabilize goods and services on the list under Law on Price. The Ministry of Agriculture and Rural Development in coordination with the Ministry of Finance guides the stabilization of commodity prices of fertilizer, plant protection drugs, vaccines disease prevention for livestock, poultry, paddy, ordinary rice, suitable for each certain period.

The promulgation of the Decree No. 75/2008/ND-CP of the Government which details the implementation of the Ordinance on Prices clearly reflected the changes in the price management in the areas of price evaluation, stabilization, registration and declaration where the Government has gradually granted the price valuation rights to enterprises.

Since 01stJanuary, 2013, the Ordinance on Prices has been replaced by the Law on Price 2012, since the scope and circumstances for application of price registration and declaration has significant been narrowed down. Respecting the market mechanism and the right of business to determine prices, the State may exercise price regulation to stabilize prices or to protect the legitimate interest of business entities, and consumers or the national interest.

While the price stabilization scheme has been governed by the Government for years, there have not been sustainable resources for maintaining it (e.g. financial support for foods providers in order to stabilize foods price).

In some periods, the rigid price stabilization based on the inexact prediction of market trend has distorted the supply-demand balance and caused difficulties to the import and export of agricultural products, e.g. refined sugar, rice.

Other limitations should be considered as follows:

-

Costly for local budget (tax concession and interest rate subsidies)

-

Low impact on price stabilization

-

Creating two-price system.

-

Ineffectiveness for the poor.

-

Supermarkets account for small share of total domestic trade (less than 15%)

-

Supermarkets concentrate in big cities

-

Customers mainly are the middle class

-

Increase in food price reduces the welfare of low - middle income group in urban areas.

In order to create better input for the price stabilization scheme, the Government should invest more on the market analysis and supply-demand prediction. The price stabilization should be more transparent in order to avoid the influence of “group interest” in price management. New policy to create sustainable resources for the stabilization instead of relying on the budget of central state should be also considered, mostly in the current context of tightened fiscal policy in Vietnam.

2.2.2. Agricultural land policies

Land is the main natural resources for agricultural production. Agricultural land in Vietnam accounts for 75% of the total land area of the country, of which paddy land comprises of only 16% of the total agricultural land and has shown a decreasing trend recently. Paddy land lost in the last 10 years is the most fertile and suitable land for rice production. From 2005 to 2007, paddy land reduced by 34,330 ha and 79% of which is land in Red River Delta (8,000 ha) and Mekong River Delta (15,000 ha), the two biggest regions for rice production[5]. Therefore, the issue of agricultural land, especially paddy land has received great attention of policy makers, demonstrated in a large variety of current policies as follows: Land Law No. 13/2003/2011 dated 26/11/03; the Revised Land Law (adopted version Nov, 2013); Resolution No. 63/NQ-CP dated 23/12/2009 on ensuring national food security; Resolution No. 17/2011/QH13 dated 22/11/2011 on land plan towards 2020 and the national 5 year land use plan for 2011-2015; Decision No. 124/QĐ-TTg dated 2/2/2012 on master plan for the development of agricultural production towards 2020 and 2030 visioning; Decision No. 432/QĐ-TTg dated 12/4/2012 on sustainable development strategy for 2011-2020; Decree No. 42/2012/NĐCP dated 11/5/2012 on paddy land use and management[6].

The focus of the policies is firstly on ensuring the proper use and management of paddy land. The government has set the goal to keep 3.8 million ha of paddy land to ensure paddy production of 41-43 million tons that meets the domestic demand and ensures the export volume of 4 million tons per year. The 7th Resolution of the Communist Party also sets the goal for Vietnam agriculture to maintain the current paddy land area and ensure national food security in medium and long term. Beside, the Government also pays attention to promoting land exchange and accumulation because small scale production is a serious obstacle to agricultural production. It is important to finish the process of land accumulation with the aim to establish large and modern commercial production areas to replace the small-scale household production. In addition, there are also policies to protect and enlarge paddy land which include support policies for regions or provinces where have favorable conditions for rice production and those for rice farmers.

By issuing Resolution No.63/NQ-CP (December, 23rd 2009) on ensuring national food security, the Government has reached the goal of keeping 3.8 million ha of rice land to ensure production of 41-43 million tons for domestic demand and ensure 4 million rice tons per year for export. Resolution No 7 of the Communist Party also set the goal of Vietnam’s agriculture is to maintain rice land area and ensure National Food Security in medium and long-term.

Therefore, the purpose of rice land protection policies is to ensure National Food Security through planning and strict protection of rice land. The target to 2020, rice land area will reach 3.8 million hectares, wet rice land area which grows two rice seasons every year reaches 3.2 million hectares. These policies become more and more important when the agricultural land affected by the market economy factors, pressures from the process of industrialization and urbanization which lead to conversion of agricultural land and rice land for other purposes.

Small scale production is a serious obstacle to agricultural production. To resolve this issue, in the Decree 150/2005/QD-TTg issued on June 20th, 2005, the Prime Minister urged land accumulation to be finished early with the aim to establish large and modern commercial production areas to replace the small-scale household production. Despite the Prime Minister’s will, the land accumulation process is still slow and does not meet the expectation. The lack of policy on long-term and stable land allocation, land transfer procedures are still complicated and the lack of community consultation are the reasons for the land exchange and accumulation to be in trouble.

Land is the most important factor for agricultural production, so land tenure system in Vietnam is of paramount importance. In November 2013, the National Assembly conducted the amendment of Land Law. Accordingly, land-use contracts to households and individuals are extended from 20 years to 50 years. The extension could be seen as incentives for individuals or entities to invest in agriculture in a long-term manner. In addition, the new Law focuses on maintaining land for paddy production. Specifically, individuals or entities that are allocated land for non-agricultural purposes from paddy land have to pay a lump sum.

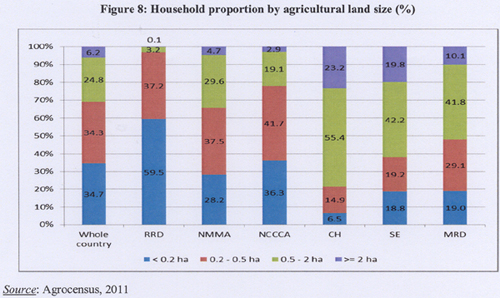

The problem is that due to the increase in rural population and the land inheritance policy, agricultural land has become more and more fragmented in accordance with international standards. Around 34.7% of rural households have less than 0.2 ha of agricultural production land while only 6.2% owns more than 2 ha. Land fragmentation is more serious in the North than in the South. Around 45.1% of total rural households having less than 0.2 ha and 0.1% of total rural households having more than 2 ha are located in RRD whereas that figures in MRD are 19% and 10.1% respectively.

Land fragmentation is reflected not only by small land size but also by numbers of plots per household, especially in RRD and Northern Midland and Mountainous Area (NMMA). In 2012, each household owns about 4.3 plots, a slight fall from 4.9 plots in 2006. Another problem is land degradation, especially in the North mountainous area and mangrove forest land. There are many reasons for this problem including land erosion in the North mountainous area, forest land clearing without crop rotation, and conversion of poor quality forest land into agricultural production land in more profitable but unsustainable manner.

In order to innovate the land policy system, in 2013, the National Assembly approved the Revised Land Law (adopted version Nov, 2013)[7] extending agricultural land tenure for household to 50 years from the previous 20 years. For paddy land, the State supports infrastructure investment, science and modern technology application for the paddy rice to increase yield and quality. Individuals or organizations who are allocated land for non-agricultural purposes from land used for growing rice have to pay a sum of money to supplement land for rice cultivation or to increase efficiency paddy land under the provisions of the Government.

Despite recent changes in land use regulation, the size of agricultural land is still small and does not support the production on large scale as follows:

+ Limits of annual crop land allocated for each household/individual, aquaculture land, salt land <=03ha for each type of land in provinces and cities in the North Southeast region and in the Mekong delta region; <=02ha in other provinces and cities

+ Limits of perennial crop land per household: <=10 ha in the plains; <=30ha in the mid-land and mountainous region

+ Limit of forest land: <=30ha for protection forest land; Production forest land.

+ Limit of aquaculture land, salt land <=03ha

2.2.3. Social security policies for farmers

Better provision of social security and social welfare is always a major policy of the Communist Party and the Vietnamese State because of its important role to the social and political stability and sustainable development of the nation.

Policies of social security and social welfare are more compatible and streamlined in such areas as poverty reduction, job creation, development of insurance system, preferential treatment to people who greatly devoted to the nation, social aid, expansion of public social services, better provision of cultural, medical and educational services for people, mostly farmers because they accounts for more than 60% of population of Vietnam and they are more vulnerable.

Although in Vietnam, there is not retirement mechanism for farmers, the Government have issued and carried out various policies, programs, projects, and mobilized resources of society to assure the livelihood for farmers. Policies and solutions for poverty reduction have been carried out simultaneously in three aspects: (i) creating better access to public services such as health care, education, vocational training, legal assistance, housing and clean water for the poor; (ii) providing production development assistance in forms of policy on land, concessionary credits, promotion of agricultural, forestry and fishery production, development of trades; (iii) developing necessary infrastructure for communes, villages and hamlets located in remote and difficult areas. Efforts in poverty reduction has attained outstanding results which received strong support and high appreciation from the people and international community. The number of poor households was reduced from 29% in 2002 to about 10% in 2010. The gap of living standard between urban and rural areas was reduced from 2.3 fold in 1999 to 2 fold in 2008. Up to 2011, about 96.1% households in rural areas has used electricity from national network while 82.5% of rural households is supplied with clean water; 86.9% of those households has televisions; and 97% of rural communes has road for automobile connecting to the centre of commune and 90% of communes has built post and cultural offices.

However, the implementation of social security and social welfare policy for farmers still faces weaknesses and mismatch. In several regions, farmer’s livelihood is not sustainable. Farmers especially in mountainous and remote areas, remains difficult and income gap between people groups becomes wider. The underemployment in rural and newly urbanized areas and unemployment in cities and towns are common phenomena. Most of funds for ensuring social security and social welfare comes from state budget. Insurance products falls behind people’s needs. Quality of public services remains low and troublesome due to the lack of pervasive systems of social security and social welfare operated under active and sustainable mechanism.

2.2.4. Agricultural disaster insurance

Vietnam has piloted the agro-insurance program under the Decision No. 315/2011/QD-TTg (dated 01st March, 2011). The pilot program has implemented in 21 provinces with numerous subjects (i.e. rice, buffalo, cows, pigs, poultry, pangasius and shrimps) and various risks (e.g. storms, foods, blue-ear pig disease and foot-and-mouth disease) for the two-year period (2011-2013).The Decision No. 315/2011/QD-TTg supports 80% of the premium. Afterwards, the Prime Minister issued the Decision No. 358/2013/QD-TTg to raise the support to 90% of premium on 27th February 2013. Moreover, the Prime Minister also issued some other Decisions like Decision No. 719/QD-TTg, Decision No. 1442/QD-TTg, Decision No. 142/2009/QD-TTg and Decision No. 49/2012/QD-TTg. MARD also introduced Circular No. 47/2011/TT-NNPTNT to list natural disasters and diseases that are insured for each type of agricultural product. It is responsible for presenting eligibility criteria for participation in the pilot agro-insurance program and reporting to MOF about the implementation quarterly. MOF stipulates involved insurance enterprises, premium, financial assistance and other related issues. VNRC (Vietnam National Reinsurance Corporation) re-insures the agro-insurance.

These policies assist beneficiaries in eliminating damages in agricultural production, so encouraging them to invest more in agriculture. The pilot program has attracted 316,545 households with the premium worth around 3339.5 billion VND and total indemnity of 588.5 billion VND. It is the pilot program that cannot avoid some limitations such as shortage of clear guidance on measuring the extent of damage, lack of regulations on preventing moral hazard and adverse selection in insurance and insufficiency of support for insurance companies to participate in this much risky deal.

2.2.5. Food security and safety

2.2.5.1. Food security:

Vietnam has issued many policies to protect and maintain the natural resources as well as policies on enhancing the infrastructure for agricultural production and other policies in order to ensure the food security in Vietnam.

In order to ensure national food security, on 23rd December, 2009, the Government issued the Resolution No. 63/NQ-CP to ensure national food security. The Resolution offers a package of measures to meet the target: “By 2020, protecting 3.8 million hectares of rice land to yield 41-43 million tons of rice, covering all the demand for domestic consumption, exporting about 4 million ton of rice per year; increasing corn acreage to 1.3 million hectares and the quantity of corn up to 7.5 million tons; ensuring fruit trees planted area of 1.2 million hectares to yield 12 million tons of fruits; 1.2 million ha of vegetables to yield 20 million tons of vegetable, producing 8 million tons livestock meat; 1 million tons of fresh milk, 14 billion unit of poultry’s eggs”

This policy supports the production of rice and other agricultural production in order to assure the food security. In addition, it provides important measures to reduce production costs, increase incomes for rice farmer, ensuring the profit from rice production of over 30% compared to the cost of production.

While policies on food security contribute to raising the role and supporting agricultural production, a number of policy gaps is hindering sustainable development of the agriculture and the improvement of the added value of agricultural products due to the lack of link between the food security’s target and the food safety ‘s target and the lack of link between the target of food security and the target of improving the added value of agricultural products.

2.2.5.2. Food safety:

In addition to the food security, food Safety has been a major concern for the Government of Vietnam in recent years. As the umbrella law guiding food safety in Vietnam, the Law on food safety (FSL) was signed by Former President Nguyen Minh Triet on June 28, 2010, approved by the National Assembly in 17th June, 2010 and entered into force on July 1, 2011[8]. The law provides organizations and individuals with rights and obligations to ensure food safety; conditions for food safety; food production and trading; food import and export; food advertisement and labeling; food testing; food risk analysis; prevention and dealing with food safety incidents; information, education and communication on food safety; and state management of food safety. Specific guidelines, and implementing regulations for the FSL continue to be developed by the Office of the Government, MARD, MOIT, and MOH.

On 4th Jan, 2012, the Prime Minister approved a National Food Safety Strategy for the period, 2011-2020, for which Vietnam has set targets for compliances with food safety regulations, completion of food safety management plans in all central cities and provinces, and reductions in acute food poisoning cases.

On 25th April, 2012, the Prime Minister Nguyen Tan Dung signed the Decree No 38/2012/ND-CP detailing implementation of some articles of FSL. This Decree is based on three important laws including the Law on Food Safety (17th June, 2010), the Law on Standards and Technical Regulations (29th June, 2006) and the Law on Product quality (21st November, 2007). The Decree guides MARD, MOIT and MOH on implementing provisions of the FSL, including (i) Declaration of Conformity to Technical Regulations for FS regulations, (ii) Safety requirements for genetically modified foods (iii) Granting and withdrawing FS certificates for establishments that meet food safety requirements; (iv) State inspection on food safety for imported and exported foods; (v) Labeling of food products; and (iv) Delegation of responsibilities for state management of food safety to the relevant Ministries including MOH, MARD, and MOIT. Before the official issuance, Vietnam notified the Decree No.38 to the WTO SPS Committee on 25th March, 2011 (G/SPS/N/VMN/27). The Decree entered into force on 11th June, 2012. Three ministries (MOIT, MOH and MARD) are currently developing Circulars and Technical Regulations to enforce sections of the Decree.

To concretize the objectives and measures to achieve food safety objectives for the period 2012-2015, on 9th July, 2012, the Prime Minister signed the Decision No. 1228/QD-TTg approving the national target program on food hygiene and safety during 2012-2015. The main targets of the Program include: To test the conditions ensuring food safety of 100 % of the business and producers of agricultural products, the rate of violated samples is under 6% of total number of samples tested; 80% of local department of quality assurance in the agricultural sector are invested infrastructure. To accomplish these targets, the project has six components, including 5 projects to ensure food safety in agriculture, forestry and fisheries.

While there are a variety of legal documents on food safety (about 400 documents issued by the Central Government and ministries and about 1000 documents issued by local governments), many of them overlap and lack of clear focus. To enable the food regulators to ensure food safety, there is an ongoing need to strengthen the capacity of policy making and implementation. It is very necessary to find out the important link between stakeholders in the food supply chain to assure the food safety in the whole supply chain. Legal violations wouldn’t be only administrative sanctions but also civil prosecution.

2.2.6. Production and marketing policies

a) Production policies

In respect of production policies, the review focus on 4 sub-groups, including (i) support to maintain and develop paddy land and paddy production, (ii) support to reduce production inputs; (iii) support to develop infrastructure and irrigation for agricultural production, (iv) credit support to agricultural producers.

Support to maintain and develop paddy land and paddy production

The government support to paddy farmers 500,000VND/ha/year for land specializing in paddy production and 100,000 VND/ha/year for other paddy land. (the Decree No. 42/2012/ND-CP on 11th May 2012 by the government on management and use of paddy land aims to maintain agricultural land, which would contribute to exporting rice, ensuring food security and raising farmers income and the Circular No. 205/2012/TT-BTC on 23rd November, 2012 by MOF on implementation of policies to protect and support the development of paddy land). While the objective of these policies is to protect and develop paddy land, it is difficult to identify upland rice area in land use planning and the support has low effectiveness because income of paddy farmers is not improved significantly. In recent years, several farmers have switched to other crops or to non-farm activities.

Support to reduce production inputs:

Since 2008 the government has issued a wide range of policies to support agricultural materials and services via measures which include: paying inputs cost for farmers on paddy reclaimed land, in case of disasters and diseases; supporting fuel, machinery and communication devices for offshore fishermen.

According to the Decree No. 42/2012/ND-CP which solely focuses on rice production, farmers are supported 50-70% of the cost of agricultural materials based on the extent of damage caused by diseases and natural disasters, 70% of land reclamation costs, and 100% of costs of rice seeds on reclaimed land in the first year, and 70% of costs of rice seeds on paddy land converted from other land in the first year. MARD is in charge of developing paddy land, organizing rice production and adjusting structural crops. Provincial People’s Committees directly give this support, provided by MOF, to farmers and report to MARD and Ministry of Natural Resources and Environment (MONRE) about paddy land’s usage and management annually. However, it is more necessary to provide farmers with indirect support (e.g. advanced farming technique and market development). Therefore, the adjustment of the Decree No. 42/2012/ND-CP is considered in the orientation of structural shift of crops, investment in agricultural infrastructure and other indirect support.

In general, these policies have gradually improved agricultural input market both in term of price stability and quality/food safety management and has helped to reduce influences of price shock on farmers’ production and livelihood. Support for inputs has grown in importance in the context of rising price of major inputs. In fact, during 2007-2012, prices of major inputs, namely fertilizers and pesticides for crop production and feed for livestock production fluctuated, posing threat to agricultural production. For example, prices of nitrogenous and potash fertilizers increased by 12.6% and 3% per year respectively over the last 6 years. In the meantime, prices of rice bran and soybean rose by 13.2%/year and 5%/year respectively. Therefore, about 45.5% of communes considered price volatility as the second biggest obstacle, followed by lack of capital.

To facilitate the recovery of agricultural production (i.e. crop production, livestock production and aquaculture) after disease outbreak and natural disasters, the Prime Minister signed the Decision No. 142/2009/QD-TTg on 31stDecember, 2009 and the Decision No. 49/2012/QD-TTg on 8th November, 2012 amending the Decision No. 142/2009/QD-TTg. The state budget supports up to 80% of input cost for farmers in mountainous provinces and the Central Highlands, and up to 70% for farmers in other provinces and cities. The level of support is based on the damaged planted area, the number of damaged livestock and the extent of damage. The remaining part is supplied from provincial budget. The implementation of these policies involves MARD, MOF and provincial People’s Committees. MARD lists natural disasters and diseases that are supported. MOF provides funds from state budget. Provincial People’s Committees implement the support and actively use local funds.

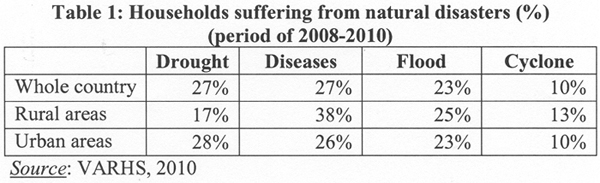

The necessity of these supports stemmed from the fact that rural households faced more weather risks than those in urban areas and weather risks are quite diverse, asking for different adaptation measures. About 53% of surveyed households were affected by natural disasters over the previous 3 years and droughts, diseases and floods are the most popular events (VARHS, 2010).

However, the support is based only on the quantity of inputs rather than on the quality and efficiency of inputs.

Regarding the livestock production, the government introduced two policies to control disease outbreak and to reduce costs of preventing and curing diseases, namely the Decision No. 1681/QD-TTg on 11th September, 2010 on supplying germicide from national reserves for local areas to handle blue-ear pig disease and the Decision No. 1791/QD-TTg on 15thOctober, 2011 on mechanism and policy to support vaccines for blue-ear pig disease and hog cholera in order to boost livestock production, ensure supply and stabilize market prices. They provide veterinary medicines, for example blue-ear pig and hog cholera vaccines, in response to animal diseases. MARD provides vaccines to deal with diseases with the funds of MOF. Provincial People’s Committees implement the support at local level.

To support fuel, machinery and communication devices for offshore fishermen, in 2010, the Prime Minister signed the Decision No. 48/2010/QD-TTg on encouraging and supporting aquaculture and marine services operators for offshore fishermen. The supporting amount ranges from 18,000,000-60,000,000 VND depending on fishermen’s vessel capacity. It also includes support for costs of hull insurance, accident insurance for seafarers and for purchase of communication equipment for ships. This policy has supported fishermen from 1365 ships of 90CV, with the total the amount of about 1,300 billion, and installed 7,000 lookouts receiver for fishermen. At the end of 2013, a satellite device was installed to connect 1,150 vessels and to provide associated devices (chips) for 3000 fishing vessels to collect signals from the satellite. However, administrative procedures for access to support are very complicated and inadequate. The level of support is not adequate with the real fuel consumption and there is not differences between ships large capacity and small capacity vessels Fishermen with low education level cannot meet requirements of complex report schedule, so many of them cannot access the support package. The policy only supports for offshore fishing ships, not for fleets providing logistic services for offshore vessels, so it did not improve the whole supply chain. The main responsible agency is local departments of agriculture and rural development which receive request from fishermen and submit to provincial People’s Committees. MARD and MOF cooperate to provide funds.

Furthermore, the National Assembly passed the Law No. 32/2013/QH13 on 19th June 2013 on amending and supplementing a number of articles of the Law on Corporate Income Tax. The policy aims to encourage enterprises producing agricultural machinery, thereby enhancing mechanization, improving productivity and quality of agricultural products and raising farmers' income. It provides preferential tax rate of 20% in 10 years, the maximum tax-free for 2 years and a 50% decrease of the total tax for the next 4 years for enterprises producing machinery and equipment for agriculture, forestry, fishery and salt production. However, there have been insufficient legal documents guiding the implementation of the Law No. 32/2013/QH13.

The limitation of the support is that it still based only on the quantity of inputs but not yet on the quality and the efficiency of the input support and lack of regulation for assuring the transparency, the equality of the support. In addition, direct supply (by cash and in kind) to reduce input cost instead of indirect support (e.g. training, technology and market development) led to heavy burden on the Government. Some other limitations should be considered as follows:

-

Administrative procedures for accessing support are very complicated and inadequate.

-

The level of support is not consistent with the real fuel consumption and there is not differences between large capacity and small capacity vessels

-

Fishermen with low education level cannot meet requirement of complex report schedule, so that many of them cannot access the support package.

-

The policy only supports for offshore fishing boats, not to fleet providing logistic services for offshore vessels, so that cannot push up the whole supply chain.

Support to develop infrastructure and irrigation for agricultural production

Infrastructures:

In addition to support provided to producers individually, the government also assist the agricultural production through public financing on infrastructure building and encouraging the private sector to invest in infrastructure in rural areas.

It is obvious that the government has made every effort to develop infrastructure in rural areas, especially facilities serving agricultural production. One of the most important facilities is canals and inter- and intra-village roads. According to the Decision No. 13/2009/QD-TTg (on 21st January 2009), rural infrastructure shall be continuously funded by state budget through Vietnam Development Bank (VDB) with the amount in 2009 being 4000 billion VND and those from 2010 onwards 2000 billion VND. After that, the Prime Minister amended the Decree No. 13/2009/QD-TTg by the Decision No. 56/2009/QD-TTg which pays additional focus on water stations in rural areas. To facilitate the credit provision, MOF introduced two policies including the Circular No. 156/2009/TT-BTC on 3rd August 2009, the Decision No. 1058/QD-BTC on 8th May 2013.

Agricultural production infrastructure has been seen as the major concern of the government for a long time. There were two major policies to develop infrastructure a decade ago, namely the Decision No. 66/2000/QD-TTg and the Decision No. 132/2001/QD-TTg. Their focal point was to build, maintain and concrete canals and rural roads.

In order to encourage enterprises to invest in agriculture and do it themselves infrastructure for their project, in 2013, the Government issued the Decree No.210/2013/ND-CP (dated 19 December, 2013) replacing the Decree No. 61/2010/ND-CP on policy for encouraging investment on agriculture and rural. The Government supports 20% of land rent, water rent in the first 5 years after the basic construction, contribute to improving infrastructure for agricultural production and encouraging investors to build infrastructure for agricultural production.

These policies are contributing to improving infrastructure for agricultural production and to maintaining agriculture production. On another hand, a major risk of this support is the inefficient management of resources and infrastructure because in some localities, the infrastructure management may be loosed in order to attract business and investment. In contrast, localities lack of incentives (tax, management mechanism) for the socialization of infrastructure investment and management (the participation of private investors is still limited).

Irrigation

To assure the water for agricultural production, Vietnamese government has provided strong support for irrigation programmes. The government adopted the Decree No. 67/2012/ND-CP on 10th September 2012 to amend the Decree No. 143/2003 and replace the Decree No.115/2008/ND-CP. The Decree No. 67/2012/ND-CP exempts individuals and households from irrigation fee if they use water surface for agricultural purpose. This means a reduction of about 5-10% of production cost for farmers. MARD and MOF submit financial proposal for irrigation fee support and in some occasions put forward irrigation fee recommendation to the Prime Minister for approval. Annually state budget spends 3000 billion VND and provincial budget 3400 billion VND to compensate for irrigation fee’s exemption. Other policies related to irrigation consist of the Decision No. 1580/QD-TTg and the Circular No. 41/2013/TT-BTC guiding implementation of the Decree No. 67/2012/ND-CP.

From 2006 to 2012, total investment in irrigation in the Mekong Delta for the whole period was about 14,870 billion VND (equivalent to around 2,200 billion VND per year). Of which, budget under management MARD is 4,970 billion VND and the remaining is under the local management. The fund was chiefly used for construction of new facilities rather than maintenance.

However irrigation projects are inconsistent and overlapping. The mobilization of private investment in irrigation is limited. Making irrigation free leads to several problems that farmers and business have wasted water resources and some businesses have not had incentives to improve quality of publicly-subsidized irrigation service.

Credit support for agricultural producers:

There have been numerous policies related to preferential interest rates for agricultural production.

Credit for reducing losses in agricultural production

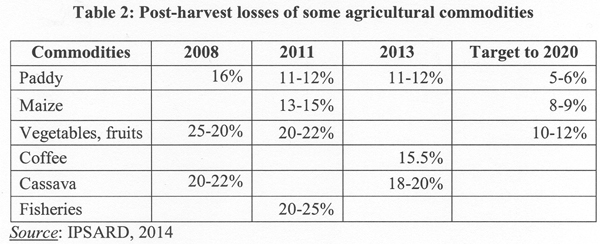

In order to reduce post-harvest losses in agricultural production, the government enacted the following policies: the Resolution No. 48/2009/NQ-CP on 23rd September 2009 and the Decision No. 68/2013/QD-TTg on 14th November 2013 on supporting the reduction of losses after harvest in agricultural production, which replaces the Decision No. 63/2010/QD-TTg on 15th October 2010 and Decision No. 65/2011/QD-TTg on 2nd December 2011.

The policies focus on all participants in agricultural production, including businesses, cooperatives, households and individuals. In order to be eligible for the support, cooperatives, households and individuals’ direct engagement in crop production, livestock production, aquaculture, fishing, agricultural processing and agricultural mechanical services have to be substantiated by commune People’s Committees. As for enterprises, they have to sign contracts for production linkages, consumption of agricultural products and usage of agricultural mechanical services with cooperatives, households and individuals. With regard to projects, they have to be approved by competent agencies and have not funded by other policies. Many ministries and ministry-level agencies take the responsibility for implementing the policies. MARD re-plans the storage system and lists machines that will be supported by funds from MOF. MPI presents mechanism to attract foreign investment in machine manufacturing. MOIT orders factories to manufacture machines to serve agricultural production. SBV guides commercial banks to perform the credit support in accordance to these policies.

In addition, SBV introduced the Circular 22/2012/TT-NHNN on 22nd June 2012 to guide the implementation of the Decision No. 63/2010/QD-TTg and Decision No. 65/2011/QD-TTg in financial aspect. The support amount are distributed through five designated state-owned commercial banks, namely Vietnam Bank for Agriculture and Rural Development, Mekong Housing Bank, Joint Stock Commercial Bank for Investment and Development of Vietnam, Vietnam Joint Stock Commercial Bank for Industry and Trade and Joint Stock Commercial Bank for Foreign Trade of Vietnam.

These policies provided preferential loans to buy machinery and equipment to reduce post-harvest losses. The loans could be up to 100% of the price of machines. The interest payment on loans was waived in the first two years and halved in the third year of the loan term.

As of April, 2013, the total preferential interest loans provided by four commercial banks reached only 699 billion VND, which was too small in comparison with the post-harvest losses nationwide. Some major limitations may be unrealistic domestic ratio of machinery production, insufficient medium- and long-term capital, unusually high investment credit interest rate and excessively focus on Mekong River Delta (MRD). As of April, 2013, the total preferential interest loans provided by four commercial banks reached only 699 billion VND, which was too small in comparison with the post-harvest losses nationwide. Some major limitations may be unrealistic domestic ratio of machinery production, insufficient medium- and long-term capital, unusually high investment credit interest rate and excessively focus on Mekong River Delta (MRD). Mechanization in agricultural production has been at low level and different among various production units, including enterprises, cooperatives and households. In case of paddy production, ploughing, watering and transportation have higher extent of mechanization than drying and sowing. In addition, enterprises have the highest level of mechanization, followed by cooperatives and households. About 14.8% of enterprises own tractors and ploughs, 74 times as high as the average of agricultural sector (0.2%). Meanwhile, the figures with regard to engines & generators and water pumps & pesticide sprayers are from 9 to 38 and from 6 to 17 times. The level of mechanization of cooperatives is also higher than the agricultural average. However, the level of mechanization in agricultural production in Vietnam remains low due to large proportion of small size households.

To improve the credit support for reducing lossess in agricultural production, the Decision No. 68/2013/QD-TTg was introduced to replace the Decision No. 63/2010/QD-TTg and Decision No. 65/2011/QD-TTg. MARD is now editing the Circular guiding the implementation of the Decision No. 68/2013/QD-TTg. Machines stipulated in the Clause 2 of the Article 1 under the Decision No. 68/2013/QD-TTg must be new and legally standard. They also offer preferential loans to develop projects of production and storage facilities for such purpose. The loans could be up to 70% of project value and last at most 12 years. The support is the difference of payment between interest rate of commercial loans and that of state credit for development (currently 10.8%/year

[9]).

Credit for purchasing inputs.

Most polices on purchasing inputs for agricultural production (the Decision No. 497/2009/QĐ-TTg on 17th April 2009, the Decision No. 2213/QĐ-TTg on 21st December 2009 amending the Decision No. 497/2009/QĐ-TTg, the Circular No. 09/2009/TT-NHNN on 5th May 2009 and the Circular No. 02/2010/TT-NHNN on 22nd January 2010) are now expired because they provided only temporary support that often lasted over the year of policy enactment.

The policies supported credit access and interest rate to producers to buy agricultural inputs. As for machines, the loans could be equal to 100% of the value of goods, but not exceeding 5 million VND in the case of computers. They are exempt from interest payment for at most 24 months. With regard to fertilizers and pesticides, the loans could be also equal to 100% of the value of goods, but not exceeding 7 million VND/ha. The interest rate of the loan would be 4% lower than that of commercial loans. The preferential support lasts for at most 12 months. SBV, MOF, MOIT and MARD guide the implementation and report to the Prime Minister. Provincial People’s Committees perform the support and actively use local budget. In reality, they were not as effective as anticipated in many areas. Numerous farmers cannot access the credit support due to procedural issues. For example, the requirement of submitting bill prescribed by the MOF or ex-warehouse is inappropriate. Requirement of local content of 40% or more of machines is not realistic because of the practical low level of local content. For businesses, the policy requires registration together with the listed price while market prices always fluctuate.

In the coming time, the government should continue credit support for agricultural inputs (e.g. machines, varieties, fertilizers and pesticides) but with the guarantee of input qualilty.

b) Marketing policies

Support to access and develop market:

In recent times, the Government has launched some new measures to facilitate the access to commodity markets and support producers, business in term of trade promotion, According to the Decree No.210/2013/NĐ-CP ( issued in 19th Dec, 2013 and effective from 01st Jan, 2014)) replacing the Decree No 61/2010/NĐ-CP on policy for encouraging investment on agriculture and rural, the Government will support 50% of the cost of advertising on the mass media; 50% of cost for fair exhibitors in the country; 50% of cost for market information and service fees from trade promotion agency of the State; encouraging investment on agricultural through incentives on advertising, market information access and service from trade promotion agency. However, the policy lacks of powerful regulation on supporting producers and/or business of safe/organic or agricultural products based on standards of sustainable production to access markets.

Most recently, the Government has approved the Resolution No.01/NQ-CP (dated 2nd Jan, 2014) on the tasks and solutions to implementation of plans of economic and social development and state budget. This Resolution gives more priorities for trade promotion activities, especially export promotion of key agricultural commodities such as rice, coffee, pepper, cashew nuts, seafood, fruits to potential markets.

These above policies are encouraging investment on agricultural through incentives on advertising, market information access and service from trade promotion agency. However, it lack of powerful regulation on supporting producers and/or business of safe/organic or agricultural products based on standards of sustainable production to access markets. Market access ability of farmers and small producers is still weak in compared to business.

Regarding export promotion and marketing assistance, Vietnam promulgated a national trade promotion programme through the Decision No. 279/2005/QD-TTg of 3th November 2005. At present, the national trade promotion programme is implemented according to the Decision No. 72/2010/QD-TTg of 14th November, 2010. Since 2007, some policies which are not prohibited in the WTO as subsidies have still promoted structural adjustment in agricultural.

The national trade promotion programme granted funds for trade promotion activities, such as the hiring of domestic and foreign experts for advice and assistance on export development or product quality improvements; the organization of trade fairs, exhibitions. The enterprises were sponsored to participate in several trade events in Vietnam and abroad and to carrying out surveys or market investigation. The stated fund cover 100% of the expenses for the construction and decoration of pavilions at trade fairs but the hiring fee of consultants or participation at overseas fairs required co-funding (50%) by the beneficiary enterprises.

However, Vietnam lacks of legal guidance for exports subsidies permitted by WTO to developing countries to reduce costs of marketing agricultural exports and the costs of international transport and freight. The export promotion for agricultural products is still small in comparison to the requirement of the sector. In addition, trade promotion activities have not been really efficient and in some case, the irrational trade promotion even caused the confusion for the agricultural producers. The planning for the annual trade promotion has not been associated with the agricultural production plan and with the real production capacity.

In order to support the domestic production while respecting all commitment with WTO, Vietnam should add policies on benefiting from exports subsidies permitted by WTO to developing countries to reduce costs of marketing agricultural exports and the costs of international transport and freight.

2.2.7. Agricultural science policies and technology development

Vietnam has introduced different policies to develop research and development activities in agriculture, which is consistent with the goal of modernization of the agricultural sector. First of all, the National Assembly enacted the Resolution No. 26/2012/QH13 on continuously raising the effectiveness and efficiency of public investment for agriculture, farmers and rural areas. Its main focus is on identifying prioritized agricultural investment portfolio. To be more concise, the priority is science and technology in biotechnology, post-harvest processing, crop seeds, livestock and fishery breeds.

According to the Decree No. 210/2013/ND-CP (dated 19th December, 2013), the government provides enterprises 70% of support for research or purchase of new agricultural technologies and 30% of support for pilot production. The Decision No. 01/2012/QD-TTg on 9th January 2012 supports the adoption of Viet GAP in agriculture, forestry and fisheries (replacing the Decision No. 107/2008/QD-TTg on 30th July 2008), contributing to increasing productivity and output, changing farming technique and raising agricultural value added by over 30%. The government supports all costs associated with baseline surveys, topographical surveys, soil analysis, water sampling and air sampling to determine the production area for applying Viet GAP while provincial authorities act as the main actor in this activity. From 2008 to 2013, the total fund for R&D transfer was about 3.9 trillion VND. MARD issued the Circular No. 53/2012/TT-BNNPTNT on the list of agricultural products pursuant to Decision No. 01/2012/QD-TTg. The ministry certified 162 technological processes and applications of crop cultivation and 266 Vietnamese standards for producing agricultural, aquacultural and forest products.

Research on seeds and breeds is also of great importance. The Prime Minister approved the proposal to develop agro-forestry seeds, and livestock and fishery breeds toward 2020 on 25th December 2009 (the Decision No. 2194/QD-TTg). It focuses on: (i) improvement of the system of research, production and seed supply from the central to local levels, (ii) investment in research on seeds, (iii) credit support from state and local budgets and (iv) state-owned commercial banks’ favourable lending conditions for entities and individuals engaged in seed and breed production.

Overall, these policies have brought about some success. Over the last 5 years, more than 4,380 research projects and pilot production were developed in agriculture. The application of science and technology in agriculture has contributed much to the development of productivity and value added for agricultural commodities. The contribution of science and technology was estimated at about 35% of agricultural GDP from 2001 to 2011. There have been significant improvements in productivity of many crops and livestock like rice, coffee, cashew, pigs and chickens.

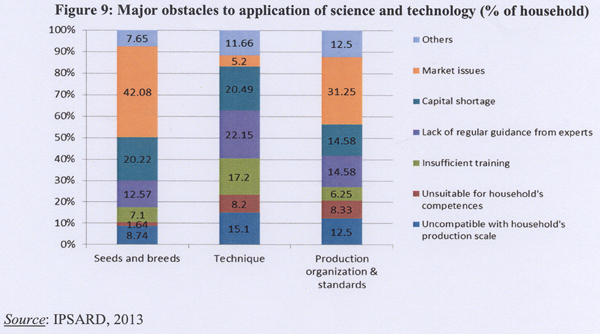

However, the application of advanced technology in improving the quality, efficiency and competitiveness of agricultural products has been limited. As reported in a field survey by IPSARD in 2013, technology transfer has been improved much especially those related to cultivating, tending and harvesting practices. Specifically, 60% of agricultural households received training in new seeds technology, 20% in breeds and about 40% in pesticide usage.

Main reason for unfeasible projects is that the research was not based on practical requirements. In fact, most research is carried out by the state research agencies, with limited fund (inadequate fund), so that it cannot meet the practical requirements of farmers, business and science. The rigid application of common policies and technologies in a number of localities without considering their real conditions has not only wasted financial and human resources, but also lead to gaps in the shift production. Policies to facilitate the autonomy of institutes are still weak, so do not create incentives for scientific research personnel, leading to serious brain drain in many research institutes in Vietnam.

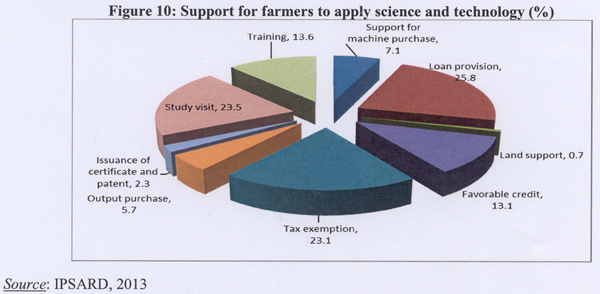

The support for large scale agricultural production has been improved but still insufficient. Among many support for farmers to apply science and technology, loan provision reached the highest level but only 26% of surveyed households received loans.

2.2.8. Environment and natural resources

Vietnam has paid more attention to environmental issues in agricultural production. It is generally the main focus of many agricultural policies, but not all of them mention specific measures and strategies.

- Policy measures encouraging farmers to apply proper environment farm management

In response to the increasing pollution in agriculture and rural after several years of abusing chemical substances in production, in 2009, the government issued the Resolution No. 27/2009/NQ-CP about some urgent measures in the management of state resources and the environment. Under this Resolution, environment measures include regulations on the handling and destruction of plant protection products in expired drugs of unknown origin and handling of contaminated sites of plant protection drug residues; building warehouse for plant protection products to avoid polluting the environment. The Resolution guides the reasonable use of fertilizers, plant protection products, destruction of livestock and poultry in case of disease. There are also guidelines on protecting environment in concentrated production areas in professional villages.

- Measures to improve water management:

According to Vietnam Development Report – Natural Resources Management (World Bank, 2011), the total water demand of Vietnam is 80 billion m3 annually of which 11% for aquaculture and 82% for irrigation, equivalent to 74.4 million m3. The demand for water will increase because of the increase in population and the speeding up of urbanization process. Though the demand is high, extreme weather events such as droughts in dry season and floods in rainy season stress more on the issue of efficient water use. Additionally, loss of mangrove forest land caused by economic activities and climate change poses greater challenge to domestic fresh water resources. For these reasons, domestic water management becomes an urgent task of Vietnam.

Since the importance of water to agricultural production, the Government issued the Resolution No. 27/2009/NQ-CP dated 12th June 2009 on water management. The policy’s major measures, designated to relevant ministries, mostly MONRE, is to introduce regulations on handling expired and unknown pesticides and spots polluted by pesticide residue, guidance on usage of fertilizers and pesticides, and to plan manufacturing zones in handicraft villages. The implementation of this policy involves the participation of three main ministries. MONRE monitors water quality and water extraction, propose water use planning. MARD regulates water use for agriculture. MOIT handles businesses causing water contamination, researches and applies technological treatment of sewage and industrial waste.

- Forest protection and development: