ABSTRACT

In the period of 2016 - 2019, the export turnover of vegetables and fruits and the number of Vietnamese enterprises exporting to Japan has increased significantly. Vietnam's pineapple, corn, lychee, and soybean have a good competitive advantage when exporting to Japan due to the DRC/SER coefficient being all lower than 1. However, Japan's process of importing fruits and vegetables is very strict. Therefore, in order to effectively promote the export of vegetables and fruits to this market, the article proposes some solutions: (1) Improve the legal environment for fruits and vegetables export promotion to Japan; (2) Promote negotiations in fruits and vegetables export with Japan; (3) Strengthen policies to support and remove obstacles in trade promotion for exporters; (4) Improve the ability to analyze and forecast the market; (5) Develop a logistics system for the fruits and vegetables industry and its ancillary industries for fruits and vegetables export; and (6) Improve the quality and reduce the cost of export products.

Keywords: Vegetables, export efficiency, Japan, Vietnam.

INTRODUCTION

Vietnam's fruits and vegetables group is one of the items with a rapid increase in export turnover over the years, reaching US$2.40 billion in 2016 and increasing to US$3.74 billion in 2019. The contribution of vegetables and fruits in the total export turnover of agricultural products is not high, but Vietnam's vegetables and fruits exports still have a large space. According to the Vietnam Fruit and Vegetable Association (2019), during the period 2016-2019, the world's fruits and vegetables consumption demand continues to increase from 3.0% to 3.5%, while the output of produced vegetables and fruits only increases by 2.8%. This supply shortage will create favorable conditions for Vietnam to export to the international market.

Japan is a potential import market, but the total value of Vietnam's fruits and vegetables exports to this market is quite modest, increasing from US$75.2 million (2014) to US$122.34 million (2019). Vietnam's fruit and vegetable export turnover to this market only accounts for about 1.2%, although it is always in the top 5 fruits and vegetables export markets of Vietnam (Vietnam Fruit and Vegetable Association, 2019). According to USDA (2020), Japan's demand for fresh fruits increases among the elderly as they tend to prefer fruits that are sweet, easy to peel and easy to prepare. This is an opportunity for Vietnam's tropical fruits, especially bananas, mangoes, dragon fruit, lychee, to be allowed to be exported to Japan. In addition, Japan has a stable political system, people with high incomes are willing to pay for good quality products. Moreover, Japan and Vietnam have geographical proximity, similarity in culture and consumption habits, which creates more favorable conditions for Vietnam to increase the export of vegetables and fruits to Japan (Vietnam Fruit and Vegetable Association, 2019).

Thus, Vietnam’s fruit and vegetable export turnover to the Japanese market is still very low, not commensurate with the potential and advantages of Vietnam. This article focuses on analyzing the export efficiency of some main Vietnamese fruits and vegetables products to Japan and proposing some solutions to promote the export of vegetables and fruits to Japan in the near future.

RESEARCH OVERVIEW AND RESEARCH HYPOTHESIS

Studies on the competitiveness of fruit and vegetable products

According to Ninh Duc Hung (2011), improving the competitiveness of Vietnam's fruits and vegetables industry is the process of improving capacity of private investors and improving public service delivery in the region to ensure that the fruits and vegetables industry is increasingly competitive and sustainable. The study also shows reasonable planning for the development of fruits and vegetables growing areas to maximize the comparative advantage, improve technology capacity, develop product diversity, enhance the role of state management, and promote public investment in infrastructure development.

Ngo Thi Tuyet Mai (2007) uses the data for the period of 1996 ‒ 2006 to show the competitiveness of Vietnam's agricultural sector. Vietnam's agricultural exports are still low due to the low quality of the products, monotonous categories, not rich designs, etc. However, the method used in the research simply did not go into depth to clarify the competitiveness of Vietnamese agricultural products.

Fruit and vegetable industry of Vietnam does not yet have a sustainable brand name, or international certifications such as GlobalGAP, to show its geographical origin. The industry has not stood firm in the market because its quality is equated with other products, and its brand reputation is affected (Phuong Oanh, 2016). Research by Nguyen Thi Thuy Hong (2014) and Pham Cong Doan (2003) identified the need to promote trade and promote Vietnam's agricultural exports to take full advantage of its competitive and comparative advantages.

Thus, there is a lack of studies evaluating the effectiveness of Vietnam's fruit and vegetable exports to a specific country in bilateral trade like Japan. This limits information and solutions for exporting agricultural products to the Japanese market in the future.

RESEARCH METHODS

Data collection methods

Secondary data: The study uses data on the export of Vietnamese fruits and vegetables to the Japanese market from the sources of the General Department of Customs and the trade map website (ITC).

Primary data was collected from 73 Vietnamese enterprises participating in fruits and vegetables export provided by the General Department of Customs. These 73 businesses need to meet the following 4 criteria: (i) have vegetable products to export to Japan; (ii) have clear, accessible business address; (iii) give priority to enterprises located in 8 provinces (Bac Giang, Ninh Thuan, An Giang, Hai Duong, Lam Dong, Binh Phuoc, Gia Lai, Ninh Binh) of selected research or neighboring areas, linked in production (production), consumption, and raw material areas in the above 8 provinces; (iv) includes manufacturing, primary processing, processing, and service enterprises. For each enterprise, persons who are involved in the export of vegetables and fruits to the Japanese market were interviewed, including the Director; Deputy Director of sales, or technical in charge of fruit and vegetable export activities of enterprises in general or in charge of the Japanese market in particular; and 3 staff members directly related to fruits and vegetables export activities to Japan (Japanese market sales staff, technical staff, technical supervision of raw material areas; supervisor or staff; or other relevant employees). The method used for information collection is a combination of face-to-face interviews and sending questionnaires to enterprises to ask for opinions of enterprises according to the prepared contents. The total number of valid votes for the analysis was 308 votes.

Methods to evaluate the competitive advantage of fruits and vegetables

The study uses the Domestic Resource Costs (DRC) coefficient to evaluate the competitive advantages of some strong Vietnamese vegetables and fruits in 8 provinces. Specifically, fresh lychees and processed lychees in Bac Giang province; dragon fruit in Ninh Thuan province; vegetables exported to Japan in An Giang, Hai Duong and Lam Dong provinces; bananas and vegetables in Binh Phuoc province; processed passion fruit and vegetables in Gia Lai province; vegetables and pineapples in Ninh Binh province. DRC is quite commonly used in assessing the comparative advantage of a product in international trade to determine potential. Some studies have used this coefficient such as Rashid et al. (2017), Vasilii et al. (2020). According to Tsakok (1990), DRC is calculated as follows:

|

DRCi =

|

∑nj=k+1 ajSj

|

|

(P - ∑kj=1 bj Pj)

|

In which: aj [(k + 1) ÷ n]: Volume of domestic input j used to produce the product, including domestic resources (land, labor, capital) and the number of factors produced domestically (not imported). imports, including those of production households) used to produce products;

+ Sj[(k+1)÷ n]: The social price of domestic j input used to produce the product;

+ P: Unit price of export output (FOB price) in local currency;

+ bj [j=1 ÷ k]: Volume of input j imported to produce products;

+ Pj [j=1 ÷ k]: Input import price j (CIF price) converted to local currency.

DRC reflects the real CP that society must pay in producing an order of a good. The DRC is compared to the official exchange rate (OER) and the fuzzy exchange rate (SER) to calculate the DRC/SER index. If:

+ DRCI/SER<1: Product i has a competitive advantage.

+ DRCI/SER>1: Product i has no competitive advantage.

RESEARCH RESULTS AND DISCUSSION

The process of exporting Vietnamese fruits and vegetables to the Japanese market

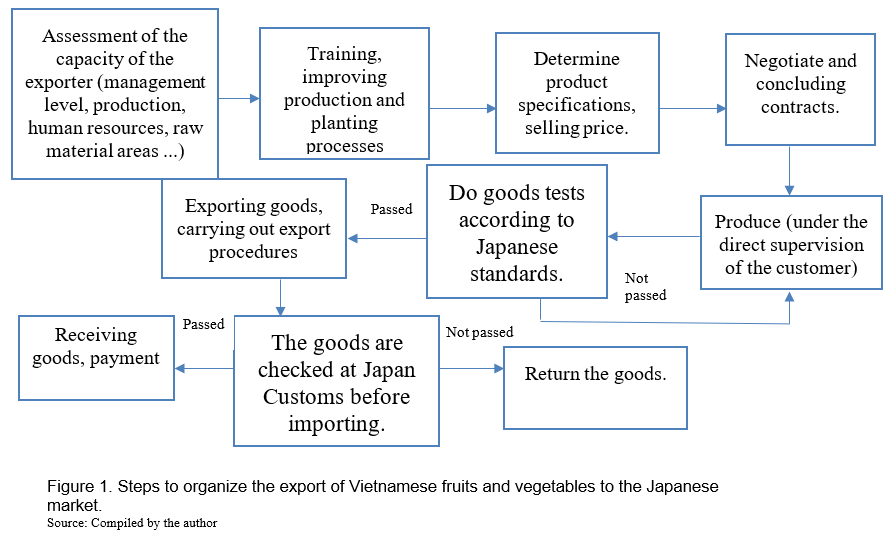

In the process of exporting Vietnamese fruits and vegetables to Japan, the first steps are to meet and work with Japanese partners. For businesses that have experience in exporting to Japan, this step is often faster and more convenient. Meanwhile, new businesses will choose to approach Japanese partners through fairs and trade promotion activities to exchange and work.

The difference when carrying out procedures for exporting vegetables and fruits to the Japanese market compared to the US and EU markets is that Japanese partners often do not care about standard certifications and standard production processes (GlobalGAP, VietGAP...). They will be the ones to directly check, monitor and evaluate whether the actual quality of the products has met the standards or not. Specifically, Japanese enterprises will directly inspect the source of raw materials, preliminary processing, processing and production processes and supervise the implementation of those processes in Vietnam. After confirming the entire process to ensure its conformance with the regulations of Japan and in accordance with the records of enterprises declared with the Japanese side, the import contract will be signed (Figure 1). Thus, for Vietnamese enterprises to approach and work with new Japanese partners, it usually takes 3-5 years. However, Japanese partners are often very reputable and trusted, and they actively support and accompany Vietnamese enterprises.

In Japan, regulations on import control of vegetables and fruits are implemented under the tariff-rate quota system. Importers need to apply to the Department of International Economic Affairs, Department of International Affairs, Ministry of Agriculture, Forestry and Fisheries on the Japanese side to receive the quota in the preferential tariff rate. At the same time, importers must meet all mandatory conditions such as having experience in performing import clearance for different types of products.

According to the Plant Protection Law, the importation of large quantities of fresh vegetables and fruits in Japan can only be carried out at certain airports or seaports where plant protection measures are available to prevent diseases and pests from entering. Therefore, the importing party needs to determine the suitable seaport or airport for unloading before the goods are shipped from the exporting country. Documents for the quarantine of goods at the Quarantine Stations must be submitted immediately after the goods arrive at the port. If, after the quarantine, the goods are refused to be imported due to the detection of diseases or pests, the competent authorities will take measures to disinfect or other treatment measures. In addition, the Japanese Government promulgates a pesticide list management system to limit foods containing excess pesticide residues. In fact, Japanese frozen fruit and vegetable importers often provide quality control conditions right from the stage of fruit and vegetable growing in the country of origin. Therefore, to export fresh and processed vegetables and fruits to Japan, foreign manufacturers must provide pesticide residue test results and production chain diagrams.

Vietnamese export enterprises must prepare registration dossiers for food hygiene and safety quarantine to submit to the imported food supervision department at Quarantine Stations under the Ministry of Health, Labor and Welfare. The food hygiene and safety quarantine will be conducted after the dossier is approved. If the dossier is checked and the quarantine is carried out to meet food hygiene and safety, the registration dossier for quarantine will be confirmed and returned to the applicant to bring along with other customs documents during the clearance process. If the consignment is not eligible for import, the competent authority shall take measures to destroy the goods or return the goods to the shipper.

After the fruits and vegetables products meet the standards of quarantine, and food hygiene and safety, the importers or customs experts and authorized customs brokers shall make the import declaration and submit it to the customs office in charge of the unloading area. After the goods meet the inspection and quarantine process and pay all kinds of customs fees or domestic consumption tax, the importer will receive an import license.

Currently, Vietnamese fruits and vegetables products exported to Japan have two main forms: (i) Fresh fruits and vegetables products that meet Japan's quality standards and are on the list of products exported to Japan that will be exported to Japan, packed and frozen for export by ship or by plane through intermediaries or exporters of Japan, or other countries; (ii) Fruits and vegetables products processed by freezing, drying, concentrating or processing into fruits and vegetable juices for export to Japan. Thus, well-implemented steps to organize the export of Vietnamese vegetables and fruits to the Japanese market will contribute to increasing export efficiency.

Efficiency of exporting Vietnamese fruits and vegetables to Japan market

According to calculations from the database of ITC Trade map (2019), the average export unit price of fresh and frozen vegetables from Vietnam to Japan is US$1.87/kg, lower than the unit price of Korea (US$2.00/kg), Philippines (US$3.98/kg). However, this unit price is higher than China ‒ the country that exported the most vegetables to the Japanese market in 2017 was only US$1.37/kg; The unit price of the US ‒ the second largest vegetable exporter to Japan is US$1.45/kg, Thailand is US$1.77 /kg.

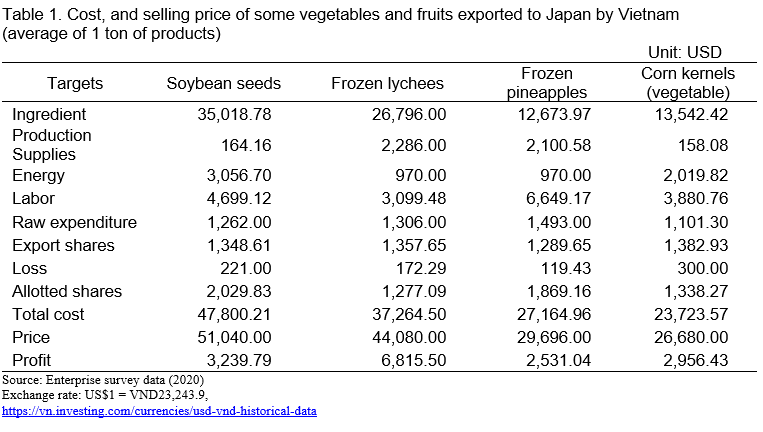

According to the survey results, the cost of some vegetables and fruits mainly exported to Japan is still quite high (Table 1). Specifically, the total cost per ton of soybeans, frozen lychees, frozen pineapples and corn kernels (vegetables) is US$2,056.45, US$1,600.42, US$1,165.90 and US$1,019.62, respectively. The cost of the above products is formed from costs such as raw materials, production materials, energy, labor, etc. In which, raw materials usually account for the highest proportion 73.3% (Soybean seeds), 71.9% (Frozen lychee), 46.6% (Frozen pineapple) and 57.0% (Corn kernels). In addition, among these items, frozen pineapple has the highest labor cost of 24.4%. Table 1 shows that the total cost per ton of soybean seeds is the highest, followed by frozen lychee, the lowest is corn kernels (vegetables), but the profit of frozen lychees is the highest at US$292.55/ton, the second is soybean seeds with US$137.67/ton, and the lowest is corn kernels (vegetables) at US$124.76/ton. (The providing conversion rate: US$1 = VND23,243.9, 2020)

The unit price of fruit and vegetable exports to Japan depends mainly on factors such as the supply of vegetables and fruits of Vietnam (the time of export is pest and disease season, product quality), and the market's ability to supply vegetables and fruits, Japanese domestic market, Japanese fruits and vegetables consumption tastes, relationships with Japanese fruit and vegetable importers, and competitors (country) exporting vegetables and fruits to Japan. The unit price of Vietnamese fruit and vegetable exports to Japan is higher than the unit price of other products of the same type from countries such as China, the US, Korea, New Zealand, etc. These are the countries with market share of Japan's largest fruits and vegetables import market. The fruits and vegetables products of these countries are often diverse in type, of good quality and branded, so it is difficult for Vietnam's vegetables and fruits to compete in price. The cost of vegetables and fruits in Vietnam is higher than in other countries mainly due to logistics factors.

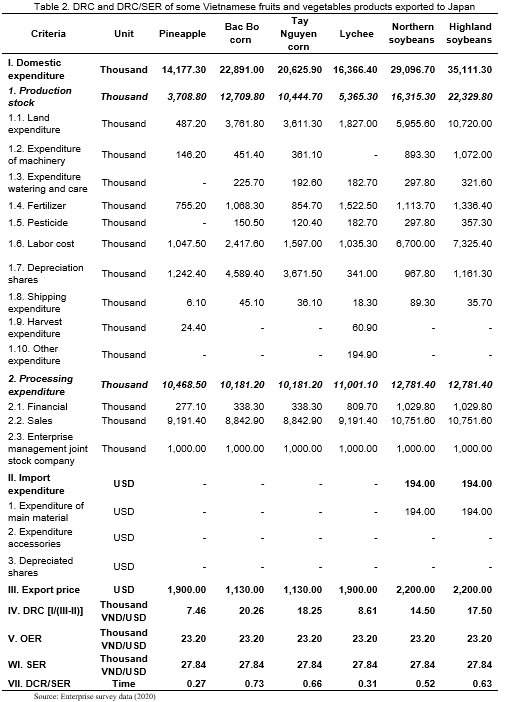

The DRC and DRC/SER values of several Vietnamese fruits and vegetables products exported to the Japanese market are presented in Table 2. Domestic CP targets are calculated and aggregated from production costs and processing costs, in which production costs include land preparation costs, transportation costs, depreciation costs, etc. In particular, Northern soybeans and Central Highlands soybeans have to pay for imported raw materials, while other products do not have to import input materials.

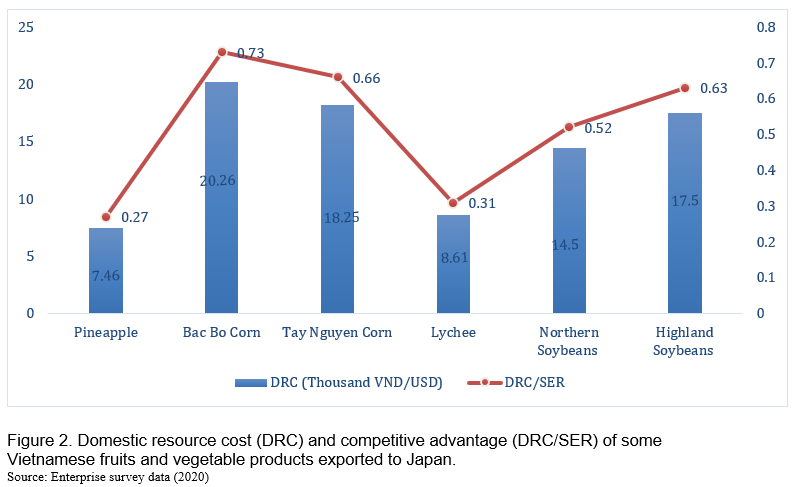

Currently, the domestic resource cost (DRC) of some Vietnamese fruits and vegetables products exported to Japan (pineapple, corn produced in the North and Central Highlands, lychee and soybean produced in the North and Central Highlands) are low, but much higher than the exchange rate, and the DRC/SER coefficients of these items from 0.27 to 0.73 are all lower than 1. This shows that Vietnam's fruits and vegetables products exported to Japan are growing rapidly, and they have a very high competitive advantage (Figure 2). However, the production cost of fruits and vegetables is high, so to improve the efficiency of Vietnamese fruits and vegetables exports to the Japanese market, there should be specific solutions to support export enterprises.

CONCLUSIONS AND RECOMMENDATIONS

Japan is a market with great potential for fruits and vegetables, but this is also a country with a strict fruits and vegetables import process, so taking steps in the export organization will enhance the promotion of Vietnamese fruits and vegetables exports into the Japanese market. The factors constituting the cost of exporting Vietnamese fruits and vegetables to Japan are very diverse, depending mainly on the supply of vegetables and fruits of Vietnam, the ability to supply vegetables and fruits of the Japanese market, the consumer tastes of vegetables and fruits of the country, competitiveness with other countries exporting to Japan, export time, product quality and relationship with Japanese fruit and vegetable importers. The unit price of Vietnamese fruits and vegetables exports to Japan is higher than the unit price of products of the same level from countries that hold a large share of Japan's fruits and vegetables export market. The DRC of some Vietnamese fruits and vegetables products exported to Japan is much lower than the exchange rate, and the DRC/SER coefficient of all items is lower than 1 (from 0.27 to 0.73), showing that Vietnamese fruit and vegetable products exported to Japan have a very high competitive advantage. Therefore, to improve the efficiency of exporting Vietnamese fruits and vegetables to the Japanese market, it is necessary to simultaneously implement the following solutions:

First, improve the legal environment for fruits and vegetables export promotion to Japan.

- Ensure the State's unified management of trade information and export promotion activities in Vietnam.

- On the website of the Ministry of Industry and Trade, it is necessary to put information on introducing Vietnamese fruits and vegetables products to Japanese importers; Clearly introduce the process of importing vegetables and fruits of Japan so that enterprises participating in fruits and vegetables export understand and limit risks for enterprises.

- Cooperate closely with the Japan External Trade Organization JETRO to use Japanese funding sources to support the promotion of fruits and vegetables products into Japan.

Second, promote negotiations in fruits and vegetables export with Japan. Currently, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) has helped break down barriers to tariffs and regulations so that Vietnamese vegetables and fruits have more opportunities to penetrate the Japanese market. However, so far, Vietnam has only had 4 types of fresh fruit licensed to export to Japan, including: mango, banana, dragon fruit, and lychee. Meanwhile, Japan also has a huge import demand for other fruits such as pineapple, passion fruit, avocado, durian, longan, etc. These are Vietnam's fruits with highly competitive advantages and has the ability to organize large-volume production with fruit quality in line with the tastes of Japanese consumers. Therefore, functional agencies, especially the Ministry of Agriculture and Rural Development, and the Ministry of Industry and Trade should actively promote negotiations with Japan to promote removal of technical barriers on quarantine for fruits and vegetables to allow these Vietnam's fresh plant products be exported to Japan.

For processed fruit and vegetable products that are being exported to Japan, Vietnam is subject to a higher import tax rate than some ASEAN countries, such as the tax rate of processed pineapples is 17.2%, while other countries have tax rates of 4.5%-9.0%. Therefore, the negotiation is very necessary for the Japanese side to facilitate the reduction of import tax on processed pineapple products and other Vietnamese fruits and vegetables products in general.

Third, strengthen policies to support and remove obstacles in trade promotion for export enterprises. The Trade Promotion Agency needs to collect necessary information about the Japanese market, importers, potential products and can provide paid commercial information to Vietnamese enterprises; Coordinate with other organizations to organize and support Vietnamese enterprises to participate in specialized food fairs such as FOODEX to facilitate trade promotion and market expansion.

Fourth, improve the ability to analyze and forecast the market. Analysis and forecast of Japan's market demand on such contents as: types of vegetables and fruits, volume of vegetables and fruits, grade and quality of each fruit and vegetable product, the most appropriate time to introduce each type of fruit and vegetable to enter the Japanese market. This is extremely necessary information for any enterprise in building a business strategy, so the Government needs market forecasting centers to periodically issue forecasts on the above contents.

Fifth, develop a logistics system for the fruits and vegetables industry and its ancillary industries for fruits and vegetables export. Establish logistics centers for agricultural products in regions and localities with developed infrastructure and transport hubs to connect with fruits and vegetables production centers for unified product quality management and reduce the cost of circulating goods. Therefore, the State needs to: (i) Promote investments in the development of infrastructure, power supply, water supply, irrigation system and connection of transportation system, wharves and warehouses to attract foreign investors and social resources to invest in developing the logistics system according to the value chain from production, processing to consumption of fruits and vegetables; (ii) Attract businesses to invest in developing cold supply chains: Invest in building large cold storages with advanced loading and unloading technology at distribution centers, wholesale markets for vegetables and fruits, and at ports and International Airports; (iii) Focus on developing supporting industries to serve the fruits and vegetables industry in the direction of promoting research, design, manufacturing, and domestic production of machinery and equipment suitable to the scale of large, medium and small processing enterprises; (iv) Packaging for fresh fruits and vegetables and processed products should be environmentally friendly; and (v) Food additives, fruit and vegetable preservatives to ensure food safety.

Sixth, improve the quality and lower the cost of export products. Currently, the quality of Vietnamese fruits and vegetables products is not guaranteed, and the price is still high. The reason is that the fruit and vegetable production process of the Vietnamese people is still limited and has not met the export requirements. The production system of good quality and disease-free varieties of vegetables and fruit trees into production still faces many difficulties, many varieties have to be imported such as MD2 pineapple, spinach, vegetable soybean, sweet corn, etc., so the production cost is increased, reducing the competitiveness of the product. In addition, processing, preliminary processing, and irradiation factories in Vietnam use outdated machinery and technology, which have not yet been automated, is also one of the reasons. Therefore, to reduce product costs and improve product quality, specific measures should be taken such as:

- Good implementation of zoning and management of zoning areas for fruit and vegetable production and processing for export:

Based on Japan's product quality standards right from the planting stage, Vietnam needs to perfect the planning and standards of the material growing area. Planning must be based on market research and analysis based on production and market requirements. The planning area needs to meet the concentration of specialized cultivation, the correct application of requirements on care techniques, especially the use of plant protection drugs. Ensure conditions for large-scale and all year-round production. Vietnam should plan concentrated planting areas in provinces such as: Lam Dong (Da Lat), Kon Tum, Gia Lai, etc. and apply scientific advances to production so that the product is truly competitive with other countries in the region. Strengthen inspection to detect and strictly handle cases of planning disruption to solve the problem of supply-demand imbalance and create concentrated and large-scale cultivation areas and areas to increase quality and reduce the cost of agricultural products for export.

- Invest in scientific research, improve and modernize breeding centers and research institutes.

It is necessary to form national research and selection centers to research and propagate plants of good quality, high yield, suitable to the weather conditions of the three regions of Vietnam and transfer them to other localities of Vietnam with suitable climatic and soil conditions. The varieties that are favored by the world and Japan today that need to be developed are MD2 pineapple, Alphonso mango (a very valuable mango variety, originating from India). In addition, it is necessary to research early and off-season varieties so that they can take advantage of the high demand for seasonal foods while the supply capacity of the Japanese domestic market is low. Specifically, the production of spinach in Japan decreased significantly from April to September, while the demand for this vegetable in Japan is year-round. This is a great advantage for Vietnam because the harvest time of our country's heat-resistant spinach variety is currently right in this period. In addition, it is also necessary to research, preserve and develop traditional and special varieties that are only available in Vietnam and develop Vietnam's strong vegetables and fruits to export to Japan such as lychee, mango, pineapple, dragon fruit, etc.

REFERENCES

Bach Thu Cuong (2002),'Talk about global competition'. News Publishing House, Hanoi.

Do Quang Giam & Tran Quang Trung, (2013),'Connecting the production of farmers with the market in the midland and mountainous areas of northeastern Vietnam', Summary report on science and technology at ministerial level, Ministry of Education and Training, Hanoi.

Vietnam Fruit and Vegetable Association (2019),'Report on the potential and advantages of developing Vietnam's vegetables and fruits for export'. Ho Chi Minh City.

ITC Trademap (2019). Import and Export Trade of Fruits and Vegetables to Japan. Retrieved from https://www.trademap.org/Country_SelProductCountry_TS.aspx?nvpm on 20/03/2020.

Ninh Duc Hung & Do Kim Chung (2011),'Enhancing the competitiveness of the fruit and vegetable industry', Journal of Economic Research number 347: 51-58.

Ngo Thi Tuyet Mai (2007),'Improving the competitiveness of Vietnam's agricultural products in the context of international economic integration', Doctoral Thesis, National Economics University, Hanoi.

Nguyen Luong Long (2020),'Enhancing the competitiveness of Vietnam's export tea industry in the period of international integration', Doctoral Thesis in Economics, Academy of Social Sciences, Vietnam Academy of Social Sciences, Hanoi

Nguyen Thi Thuy Hong (2014),'Policies to promote Vietnam's goods exports to the EU market in terms of joining WTO', Doctoral Thesis in Economics, National Economics University, Hanoi.

World Bank, (2016),'Transforming Vietnam's Agriculture: adding value, reducing inputs, Vietnam Development Report 2016', Hong Duc Publishing House. Ho Chi Minh City.

Pham Cong Doan (2003),'Orientation and solutions for the export of agricultural products of Vietnamese enterprises in the coming years',Trade Magazine number 48: 45 – 51

Phuong Oanh, (2016),'Brand building and development - the salvation for Vietnamese agricultural products',Information Science and Technology Vinh Long, number 4: 19 - 24

Rashid M. A., M. A. Monayem Miah & T. M. B. Hossain (2017), ‘Import a nd Export Parity Price Analyses Of Selected Vegetables And Spices In Bangladesh’, Bangladesh J. Agril. Res. 42(2): 321-341.

General Department of Customs (2020), ‘Export data of Vietnam's agricultural products in the period of 2015 - 2019', Hanoi.

TsakokI. (1990), ‘Agricultural price policy: a practitioner's guide to partial equilibrium analysis’, Cornell University Press. New York, USA.

USDA (2020), ‘World fruit and vegetable market report năm 2019’, New York, US.

VasiliiE., D. Li & D. Peiran (2020), ‘Sustainability-Related Implications of Competitive Advantages in Agricultural Value Chains: Evidence from Central Asia—China Trade and Investment’, Sustainability 2020, 12(3), 1117. https://doi.org/10.3390/su12031117.

Vo Van Quyen (2012), ‘Msome solutions to improve competitiveness and expand the market for Vietnamese agricultural products',Gold Field Conference of Economic and Forecasting Journal, Institute of Strategy and Development, Ministry of Planning and Investment, July 18, 2012, Hanoi

Vu Tri Tue (2013),'The role of the state in improving the competitiveness of Vietnam's coffee industry', Journal of European Studies, number 5:17 – 21.

Efficiency of Exporting Vietnamese Vegetables to Japan Market

ABSTRACT

In the period of 2016 - 2019, the export turnover of vegetables and fruits and the number of Vietnamese enterprises exporting to Japan has increased significantly. Vietnam's pineapple, corn, lychee, and soybean have a good competitive advantage when exporting to Japan due to the DRC/SER coefficient being all lower than 1. However, Japan's process of importing fruits and vegetables is very strict. Therefore, in order to effectively promote the export of vegetables and fruits to this market, the article proposes some solutions: (1) Improve the legal environment for fruits and vegetables export promotion to Japan; (2) Promote negotiations in fruits and vegetables export with Japan; (3) Strengthen policies to support and remove obstacles in trade promotion for exporters; (4) Improve the ability to analyze and forecast the market; (5) Develop a logistics system for the fruits and vegetables industry and its ancillary industries for fruits and vegetables export; and (6) Improve the quality and reduce the cost of export products.

Keywords: Vegetables, export efficiency, Japan, Vietnam.

INTRODUCTION

Vietnam's fruits and vegetables group is one of the items with a rapid increase in export turnover over the years, reaching US$2.40 billion in 2016 and increasing to US$3.74 billion in 2019. The contribution of vegetables and fruits in the total export turnover of agricultural products is not high, but Vietnam's vegetables and fruits exports still have a large space. According to the Vietnam Fruit and Vegetable Association (2019), during the period 2016-2019, the world's fruits and vegetables consumption demand continues to increase from 3.0% to 3.5%, while the output of produced vegetables and fruits only increases by 2.8%. This supply shortage will create favorable conditions for Vietnam to export to the international market.

Japan is a potential import market, but the total value of Vietnam's fruits and vegetables exports to this market is quite modest, increasing from US$75.2 million (2014) to US$122.34 million (2019). Vietnam's fruit and vegetable export turnover to this market only accounts for about 1.2%, although it is always in the top 5 fruits and vegetables export markets of Vietnam (Vietnam Fruit and Vegetable Association, 2019). According to USDA (2020), Japan's demand for fresh fruits increases among the elderly as they tend to prefer fruits that are sweet, easy to peel and easy to prepare. This is an opportunity for Vietnam's tropical fruits, especially bananas, mangoes, dragon fruit, lychee, to be allowed to be exported to Japan. In addition, Japan has a stable political system, people with high incomes are willing to pay for good quality products. Moreover, Japan and Vietnam have geographical proximity, similarity in culture and consumption habits, which creates more favorable conditions for Vietnam to increase the export of vegetables and fruits to Japan (Vietnam Fruit and Vegetable Association, 2019).

Thus, Vietnam’s fruit and vegetable export turnover to the Japanese market is still very low, not commensurate with the potential and advantages of Vietnam. This article focuses on analyzing the export efficiency of some main Vietnamese fruits and vegetables products to Japan and proposing some solutions to promote the export of vegetables and fruits to Japan in the near future.

RESEARCH OVERVIEW AND RESEARCH HYPOTHESIS

Studies on the competitiveness of fruit and vegetable products

According to Ninh Duc Hung (2011), improving the competitiveness of Vietnam's fruits and vegetables industry is the process of improving capacity of private investors and improving public service delivery in the region to ensure that the fruits and vegetables industry is increasingly competitive and sustainable. The study also shows reasonable planning for the development of fruits and vegetables growing areas to maximize the comparative advantage, improve technology capacity, develop product diversity, enhance the role of state management, and promote public investment in infrastructure development.

Ngo Thi Tuyet Mai (2007) uses the data for the period of 1996 ‒ 2006 to show the competitiveness of Vietnam's agricultural sector. Vietnam's agricultural exports are still low due to the low quality of the products, monotonous categories, not rich designs, etc. However, the method used in the research simply did not go into depth to clarify the competitiveness of Vietnamese agricultural products.

Fruit and vegetable industry of Vietnam does not yet have a sustainable brand name, or international certifications such as GlobalGAP, to show its geographical origin. The industry has not stood firm in the market because its quality is equated with other products, and its brand reputation is affected (Phuong Oanh, 2016). Research by Nguyen Thi Thuy Hong (2014) and Pham Cong Doan (2003) identified the need to promote trade and promote Vietnam's agricultural exports to take full advantage of its competitive and comparative advantages.

Thus, there is a lack of studies evaluating the effectiveness of Vietnam's fruit and vegetable exports to a specific country in bilateral trade like Japan. This limits information and solutions for exporting agricultural products to the Japanese market in the future.

RESEARCH METHODS

Data collection methods

Secondary data: The study uses data on the export of Vietnamese fruits and vegetables to the Japanese market from the sources of the General Department of Customs and the trade map website (ITC).

Primary data was collected from 73 Vietnamese enterprises participating in fruits and vegetables export provided by the General Department of Customs. These 73 businesses need to meet the following 4 criteria: (i) have vegetable products to export to Japan; (ii) have clear, accessible business address; (iii) give priority to enterprises located in 8 provinces (Bac Giang, Ninh Thuan, An Giang, Hai Duong, Lam Dong, Binh Phuoc, Gia Lai, Ninh Binh) of selected research or neighboring areas, linked in production (production), consumption, and raw material areas in the above 8 provinces; (iv) includes manufacturing, primary processing, processing, and service enterprises. For each enterprise, persons who are involved in the export of vegetables and fruits to the Japanese market were interviewed, including the Director; Deputy Director of sales, or technical in charge of fruit and vegetable export activities of enterprises in general or in charge of the Japanese market in particular; and 3 staff members directly related to fruits and vegetables export activities to Japan (Japanese market sales staff, technical staff, technical supervision of raw material areas; supervisor or staff; or other relevant employees). The method used for information collection is a combination of face-to-face interviews and sending questionnaires to enterprises to ask for opinions of enterprises according to the prepared contents. The total number of valid votes for the analysis was 308 votes.

Methods to evaluate the competitive advantage of fruits and vegetables

The study uses the Domestic Resource Costs (DRC) coefficient to evaluate the competitive advantages of some strong Vietnamese vegetables and fruits in 8 provinces. Specifically, fresh lychees and processed lychees in Bac Giang province; dragon fruit in Ninh Thuan province; vegetables exported to Japan in An Giang, Hai Duong and Lam Dong provinces; bananas and vegetables in Binh Phuoc province; processed passion fruit and vegetables in Gia Lai province; vegetables and pineapples in Ninh Binh province. DRC is quite commonly used in assessing the comparative advantage of a product in international trade to determine potential. Some studies have used this coefficient such as Rashid et al. (2017), Vasilii et al. (2020). According to Tsakok (1990), DRC is calculated as follows:

DRCi =

∑nj=k+1 ajSj

(P - ∑kj=1 bj Pj)

In which: aj [(k + 1) ÷ n]: Volume of domestic input j used to produce the product, including domestic resources (land, labor, capital) and the number of factors produced domestically (not imported). imports, including those of production households) used to produce products;

+ Sj[(k+1)÷ n]: The social price of domestic j input used to produce the product;

+ P: Unit price of export output (FOB price) in local currency;

+ bj [j=1 ÷ k]: Volume of input j imported to produce products;

+ Pj [j=1 ÷ k]: Input import price j (CIF price) converted to local currency.

DRC reflects the real CP that society must pay in producing an order of a good. The DRC is compared to the official exchange rate (OER) and the fuzzy exchange rate (SER) to calculate the DRC/SER index. If:

+ DRCI/SER<1: Product i has a competitive advantage.

+ DRCI/SER>1: Product i has no competitive advantage.

RESEARCH RESULTS AND DISCUSSION

The process of exporting Vietnamese fruits and vegetables to the Japanese market

In the process of exporting Vietnamese fruits and vegetables to Japan, the first steps are to meet and work with Japanese partners. For businesses that have experience in exporting to Japan, this step is often faster and more convenient. Meanwhile, new businesses will choose to approach Japanese partners through fairs and trade promotion activities to exchange and work.

The difference when carrying out procedures for exporting vegetables and fruits to the Japanese market compared to the US and EU markets is that Japanese partners often do not care about standard certifications and standard production processes (GlobalGAP, VietGAP...). They will be the ones to directly check, monitor and evaluate whether the actual quality of the products has met the standards or not. Specifically, Japanese enterprises will directly inspect the source of raw materials, preliminary processing, processing and production processes and supervise the implementation of those processes in Vietnam. After confirming the entire process to ensure its conformance with the regulations of Japan and in accordance with the records of enterprises declared with the Japanese side, the import contract will be signed (Figure 1). Thus, for Vietnamese enterprises to approach and work with new Japanese partners, it usually takes 3-5 years. However, Japanese partners are often very reputable and trusted, and they actively support and accompany Vietnamese enterprises.

In Japan, regulations on import control of vegetables and fruits are implemented under the tariff-rate quota system. Importers need to apply to the Department of International Economic Affairs, Department of International Affairs, Ministry of Agriculture, Forestry and Fisheries on the Japanese side to receive the quota in the preferential tariff rate. At the same time, importers must meet all mandatory conditions such as having experience in performing import clearance for different types of products.

According to the Plant Protection Law, the importation of large quantities of fresh vegetables and fruits in Japan can only be carried out at certain airports or seaports where plant protection measures are available to prevent diseases and pests from entering. Therefore, the importing party needs to determine the suitable seaport or airport for unloading before the goods are shipped from the exporting country. Documents for the quarantine of goods at the Quarantine Stations must be submitted immediately after the goods arrive at the port. If, after the quarantine, the goods are refused to be imported due to the detection of diseases or pests, the competent authorities will take measures to disinfect or other treatment measures. In addition, the Japanese Government promulgates a pesticide list management system to limit foods containing excess pesticide residues. In fact, Japanese frozen fruit and vegetable importers often provide quality control conditions right from the stage of fruit and vegetable growing in the country of origin. Therefore, to export fresh and processed vegetables and fruits to Japan, foreign manufacturers must provide pesticide residue test results and production chain diagrams.

Vietnamese export enterprises must prepare registration dossiers for food hygiene and safety quarantine to submit to the imported food supervision department at Quarantine Stations under the Ministry of Health, Labor and Welfare. The food hygiene and safety quarantine will be conducted after the dossier is approved. If the dossier is checked and the quarantine is carried out to meet food hygiene and safety, the registration dossier for quarantine will be confirmed and returned to the applicant to bring along with other customs documents during the clearance process. If the consignment is not eligible for import, the competent authority shall take measures to destroy the goods or return the goods to the shipper.

After the fruits and vegetables products meet the standards of quarantine, and food hygiene and safety, the importers or customs experts and authorized customs brokers shall make the import declaration and submit it to the customs office in charge of the unloading area. After the goods meet the inspection and quarantine process and pay all kinds of customs fees or domestic consumption tax, the importer will receive an import license.

Currently, Vietnamese fruits and vegetables products exported to Japan have two main forms: (i) Fresh fruits and vegetables products that meet Japan's quality standards and are on the list of products exported to Japan that will be exported to Japan, packed and frozen for export by ship or by plane through intermediaries or exporters of Japan, or other countries; (ii) Fruits and vegetables products processed by freezing, drying, concentrating or processing into fruits and vegetable juices for export to Japan. Thus, well-implemented steps to organize the export of Vietnamese vegetables and fruits to the Japanese market will contribute to increasing export efficiency.

Efficiency of exporting Vietnamese fruits and vegetables to Japan market

According to calculations from the database of ITC Trade map (2019), the average export unit price of fresh and frozen vegetables from Vietnam to Japan is US$1.87/kg, lower than the unit price of Korea (US$2.00/kg), Philippines (US$3.98/kg). However, this unit price is higher than China ‒ the country that exported the most vegetables to the Japanese market in 2017 was only US$1.37/kg; The unit price of the US ‒ the second largest vegetable exporter to Japan is US$1.45/kg, Thailand is US$1.77 /kg.

According to the survey results, the cost of some vegetables and fruits mainly exported to Japan is still quite high (Table 1). Specifically, the total cost per ton of soybeans, frozen lychees, frozen pineapples and corn kernels (vegetables) is US$2,056.45, US$1,600.42, US$1,165.90 and US$1,019.62, respectively. The cost of the above products is formed from costs such as raw materials, production materials, energy, labor, etc. In which, raw materials usually account for the highest proportion 73.3% (Soybean seeds), 71.9% (Frozen lychee), 46.6% (Frozen pineapple) and 57.0% (Corn kernels). In addition, among these items, frozen pineapple has the highest labor cost of 24.4%. Table 1 shows that the total cost per ton of soybean seeds is the highest, followed by frozen lychee, the lowest is corn kernels (vegetables), but the profit of frozen lychees is the highest at US$292.55/ton, the second is soybean seeds with US$137.67/ton, and the lowest is corn kernels (vegetables) at US$124.76/ton. (The providing conversion rate: US$1 = VND23,243.9, 2020)

The unit price of fruit and vegetable exports to Japan depends mainly on factors such as the supply of vegetables and fruits of Vietnam (the time of export is pest and disease season, product quality), and the market's ability to supply vegetables and fruits, Japanese domestic market, Japanese fruits and vegetables consumption tastes, relationships with Japanese fruit and vegetable importers, and competitors (country) exporting vegetables and fruits to Japan. The unit price of Vietnamese fruit and vegetable exports to Japan is higher than the unit price of other products of the same type from countries such as China, the US, Korea, New Zealand, etc. These are the countries with market share of Japan's largest fruits and vegetables import market. The fruits and vegetables products of these countries are often diverse in type, of good quality and branded, so it is difficult for Vietnam's vegetables and fruits to compete in price. The cost of vegetables and fruits in Vietnam is higher than in other countries mainly due to logistics factors.

The DRC and DRC/SER values of several Vietnamese fruits and vegetables products exported to the Japanese market are presented in Table 2. Domestic CP targets are calculated and aggregated from production costs and processing costs, in which production costs include land preparation costs, transportation costs, depreciation costs, etc. In particular, Northern soybeans and Central Highlands soybeans have to pay for imported raw materials, while other products do not have to import input materials.

Currently, the domestic resource cost (DRC) of some Vietnamese fruits and vegetables products exported to Japan (pineapple, corn produced in the North and Central Highlands, lychee and soybean produced in the North and Central Highlands) are low, but much higher than the exchange rate, and the DRC/SER coefficients of these items from 0.27 to 0.73 are all lower than 1. This shows that Vietnam's fruits and vegetables products exported to Japan are growing rapidly, and they have a very high competitive advantage (Figure 2). However, the production cost of fruits and vegetables is high, so to improve the efficiency of Vietnamese fruits and vegetables exports to the Japanese market, there should be specific solutions to support export enterprises.

CONCLUSIONS AND RECOMMENDATIONS

Japan is a market with great potential for fruits and vegetables, but this is also a country with a strict fruits and vegetables import process, so taking steps in the export organization will enhance the promotion of Vietnamese fruits and vegetables exports into the Japanese market. The factors constituting the cost of exporting Vietnamese fruits and vegetables to Japan are very diverse, depending mainly on the supply of vegetables and fruits of Vietnam, the ability to supply vegetables and fruits of the Japanese market, the consumer tastes of vegetables and fruits of the country, competitiveness with other countries exporting to Japan, export time, product quality and relationship with Japanese fruit and vegetable importers. The unit price of Vietnamese fruits and vegetables exports to Japan is higher than the unit price of products of the same level from countries that hold a large share of Japan's fruits and vegetables export market. The DRC of some Vietnamese fruits and vegetables products exported to Japan is much lower than the exchange rate, and the DRC/SER coefficient of all items is lower than 1 (from 0.27 to 0.73), showing that Vietnamese fruit and vegetable products exported to Japan have a very high competitive advantage. Therefore, to improve the efficiency of exporting Vietnamese fruits and vegetables to the Japanese market, it is necessary to simultaneously implement the following solutions:

First, improve the legal environment for fruits and vegetables export promotion to Japan.

Second, promote negotiations in fruits and vegetables export with Japan. Currently, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) has helped break down barriers to tariffs and regulations so that Vietnamese vegetables and fruits have more opportunities to penetrate the Japanese market. However, so far, Vietnam has only had 4 types of fresh fruit licensed to export to Japan, including: mango, banana, dragon fruit, and lychee. Meanwhile, Japan also has a huge import demand for other fruits such as pineapple, passion fruit, avocado, durian, longan, etc. These are Vietnam's fruits with highly competitive advantages and has the ability to organize large-volume production with fruit quality in line with the tastes of Japanese consumers. Therefore, functional agencies, especially the Ministry of Agriculture and Rural Development, and the Ministry of Industry and Trade should actively promote negotiations with Japan to promote removal of technical barriers on quarantine for fruits and vegetables to allow these Vietnam's fresh plant products be exported to Japan.

For processed fruit and vegetable products that are being exported to Japan, Vietnam is subject to a higher import tax rate than some ASEAN countries, such as the tax rate of processed pineapples is 17.2%, while other countries have tax rates of 4.5%-9.0%. Therefore, the negotiation is very necessary for the Japanese side to facilitate the reduction of import tax on processed pineapple products and other Vietnamese fruits and vegetables products in general.

Third, strengthen policies to support and remove obstacles in trade promotion for export enterprises. The Trade Promotion Agency needs to collect necessary information about the Japanese market, importers, potential products and can provide paid commercial information to Vietnamese enterprises; Coordinate with other organizations to organize and support Vietnamese enterprises to participate in specialized food fairs such as FOODEX to facilitate trade promotion and market expansion.

Fourth, improve the ability to analyze and forecast the market. Analysis and forecast of Japan's market demand on such contents as: types of vegetables and fruits, volume of vegetables and fruits, grade and quality of each fruit and vegetable product, the most appropriate time to introduce each type of fruit and vegetable to enter the Japanese market. This is extremely necessary information for any enterprise in building a business strategy, so the Government needs market forecasting centers to periodically issue forecasts on the above contents.

Fifth, develop a logistics system for the fruits and vegetables industry and its ancillary industries for fruits and vegetables export. Establish logistics centers for agricultural products in regions and localities with developed infrastructure and transport hubs to connect with fruits and vegetables production centers for unified product quality management and reduce the cost of circulating goods. Therefore, the State needs to: (i) Promote investments in the development of infrastructure, power supply, water supply, irrigation system and connection of transportation system, wharves and warehouses to attract foreign investors and social resources to invest in developing the logistics system according to the value chain from production, processing to consumption of fruits and vegetables; (ii) Attract businesses to invest in developing cold supply chains: Invest in building large cold storages with advanced loading and unloading technology at distribution centers, wholesale markets for vegetables and fruits, and at ports and International Airports; (iii) Focus on developing supporting industries to serve the fruits and vegetables industry in the direction of promoting research, design, manufacturing, and domestic production of machinery and equipment suitable to the scale of large, medium and small processing enterprises; (iv) Packaging for fresh fruits and vegetables and processed products should be environmentally friendly; and (v) Food additives, fruit and vegetable preservatives to ensure food safety.

Sixth, improve the quality and lower the cost of export products. Currently, the quality of Vietnamese fruits and vegetables products is not guaranteed, and the price is still high. The reason is that the fruit and vegetable production process of the Vietnamese people is still limited and has not met the export requirements. The production system of good quality and disease-free varieties of vegetables and fruit trees into production still faces many difficulties, many varieties have to be imported such as MD2 pineapple, spinach, vegetable soybean, sweet corn, etc., so the production cost is increased, reducing the competitiveness of the product. In addition, processing, preliminary processing, and irradiation factories in Vietnam use outdated machinery and technology, which have not yet been automated, is also one of the reasons. Therefore, to reduce product costs and improve product quality, specific measures should be taken such as:

Based on Japan's product quality standards right from the planting stage, Vietnam needs to perfect the planning and standards of the material growing area. Planning must be based on market research and analysis based on production and market requirements. The planning area needs to meet the concentration of specialized cultivation, the correct application of requirements on care techniques, especially the use of plant protection drugs. Ensure conditions for large-scale and all year-round production. Vietnam should plan concentrated planting areas in provinces such as: Lam Dong (Da Lat), Kon Tum, Gia Lai, etc. and apply scientific advances to production so that the product is truly competitive with other countries in the region. Strengthen inspection to detect and strictly handle cases of planning disruption to solve the problem of supply-demand imbalance and create concentrated and large-scale cultivation areas and areas to increase quality and reduce the cost of agricultural products for export.

It is necessary to form national research and selection centers to research and propagate plants of good quality, high yield, suitable to the weather conditions of the three regions of Vietnam and transfer them to other localities of Vietnam with suitable climatic and soil conditions. The varieties that are favored by the world and Japan today that need to be developed are MD2 pineapple, Alphonso mango (a very valuable mango variety, originating from India). In addition, it is necessary to research early and off-season varieties so that they can take advantage of the high demand for seasonal foods while the supply capacity of the Japanese domestic market is low. Specifically, the production of spinach in Japan decreased significantly from April to September, while the demand for this vegetable in Japan is year-round. This is a great advantage for Vietnam because the harvest time of our country's heat-resistant spinach variety is currently right in this period. In addition, it is also necessary to research, preserve and develop traditional and special varieties that are only available in Vietnam and develop Vietnam's strong vegetables and fruits to export to Japan such as lychee, mango, pineapple, dragon fruit, etc.

REFERENCES

Bach Thu Cuong (2002),'Talk about global competition'. News Publishing House, Hanoi.

Do Quang Giam & Tran Quang Trung, (2013),'Connecting the production of farmers with the market in the midland and mountainous areas of northeastern Vietnam', Summary report on science and technology at ministerial level, Ministry of Education and Training, Hanoi.

Vietnam Fruit and Vegetable Association (2019),'Report on the potential and advantages of developing Vietnam's vegetables and fruits for export'. Ho Chi Minh City.

ITC Trademap (2019). Import and Export Trade of Fruits and Vegetables to Japan. Retrieved from https://www.trademap.org/Country_SelProductCountry_TS.aspx?nvpm on 20/03/2020.

Ninh Duc Hung & Do Kim Chung (2011),'Enhancing the competitiveness of the fruit and vegetable industry', Journal of Economic Research number 347: 51-58.

Ngo Thi Tuyet Mai (2007),'Improving the competitiveness of Vietnam's agricultural products in the context of international economic integration', Doctoral Thesis, National Economics University, Hanoi.

Nguyen Luong Long (2020),'Enhancing the competitiveness of Vietnam's export tea industry in the period of international integration', Doctoral Thesis in Economics, Academy of Social Sciences, Vietnam Academy of Social Sciences, Hanoi

Nguyen Thi Thuy Hong (2014),'Policies to promote Vietnam's goods exports to the EU market in terms of joining WTO', Doctoral Thesis in Economics, National Economics University, Hanoi.

World Bank, (2016),'Transforming Vietnam's Agriculture: adding value, reducing inputs, Vietnam Development Report 2016', Hong Duc Publishing House. Ho Chi Minh City.

Pham Cong Doan (2003),'Orientation and solutions for the export of agricultural products of Vietnamese enterprises in the coming years',Trade Magazine number 48: 45 – 51

Phuong Oanh, (2016),'Brand building and development - the salvation for Vietnamese agricultural products',Information Science and Technology Vinh Long, number 4: 19 - 24

Rashid M. A., M. A. Monayem Miah & T. M. B. Hossain (2017), ‘Import a nd Export Parity Price Analyses Of Selected Vegetables And Spices In Bangladesh’, Bangladesh J. Agril. Res. 42(2): 321-341.

General Department of Customs (2020), ‘Export data of Vietnam's agricultural products in the period of 2015 - 2019', Hanoi.

TsakokI. (1990), ‘Agricultural price policy: a practitioner's guide to partial equilibrium analysis’, Cornell University Press. New York, USA.

USDA (2020), ‘World fruit and vegetable market report năm 2019’, New York, US.

VasiliiE., D. Li & D. Peiran (2020), ‘Sustainability-Related Implications of Competitive Advantages in Agricultural Value Chains: Evidence from Central Asia—China Trade and Investment’, Sustainability 2020, 12(3), 1117. https://doi.org/10.3390/su12031117.

Vo Van Quyen (2012), ‘Msome solutions to improve competitiveness and expand the market for Vietnamese agricultural products',Gold Field Conference of Economic and Forecasting Journal, Institute of Strategy and Development, Ministry of Planning and Investment, July 18, 2012, Hanoi

Vu Tri Tue (2013),'The role of the state in improving the competitiveness of Vietnam's coffee industry', Journal of European Studies, number 5:17 – 21.