African swine fever (ASF) is a major risk factor for both national and global economies impacting animal health and welfare, food security, livelihood, rural development in many countries. While ASF is not harmful to human health, it is considered a serious disease in pigs due to its high mortality rate which goes up to 100% mortality. The virus is durable in the environment. People can be carriers and spread this virus through clothing, boots, cars, and can also be contaminated in pork products such as sausages, ham, bacon, etc. Importantly, there is not an effective vaccine against ASF. The outbreak control management must focus on biosecurity (OIE, 2019). ASF outbreaks occur in several countries in Sub-Saharan Africa, Europe, and Asia. In Asia, the outbreak started in China and was officially announced on August 3, 2018. After that, outbreaks were reported in several countries including Mongolia, Vietnam, Cambodia, Korea (Dem. People's Rep.) Loas, Philippines, Myanmar, Korea (Rep. of), Timor-Leste, Indonesia, Papua New Guinea, India, Malaysia, Bhutan, and Thailand (FAO, 2022). In Thailand, the Department of Livestock Development (DLD) officially confirmed ASF on 11 January 2022 (Figure 1).

In response to the growth rate of pork consumption demand, the pig production industry relies on many factors including resource and environmental management in the face of competition in the use of natural resources such as land and water. Use of technology for the development of nutritional feed, breeding and disease outbreak prevention and control (Thornton, 2010). In addition, human health concerns and international trade conditions must be taken into account in pig production, which negatively affects pig farmers (FAO, 2016). It is imperative that Thailand formulates measures in order to optimize the management of ASF problems.

1. To provide the situation of the Thai swine industry before and after the official ASF outbreak

2. To propose revitalizing solutions for the Thai swine industry

This paper provided a descriptive analysis based on secondary data such as production, marketing, and price data from reports from the Office of Agricultural Economics (OAE), Department of Livestock Development (DLD) and the Swine Raisers Association of Thailand (SRAT) website from 2008 to 2022 to analyze the situation of the Thai swine industry. Moreover, data also collected from academic articles related to the ASF outbreak in Asia to propose revitalizing solutions for the Thai swine industry.

The Thai swine industry focuses on production for domestic consumption. Thailand's pig production capacity is likely to increase since 2009 by an average of 4.16% per year. The maximum capacity of fattening pig production was 22.82 million heads in 2018 and dropped to 19.28 million heads by 2021 (Figure 2). The fattening farm gate price during 2008-2018 was in the range of 1.51 to 1.81 US$/kg[1]. In 2018, pig production was oversupplied, causing the farm gate price of fattening pig to the lowest of 1.67 US$/kg. After that, prices tend to increase steadily between 2019 and 2021. This was the period when Thailand exported live pigs and produce to foreign countries such as Vietnam and Cambodia.

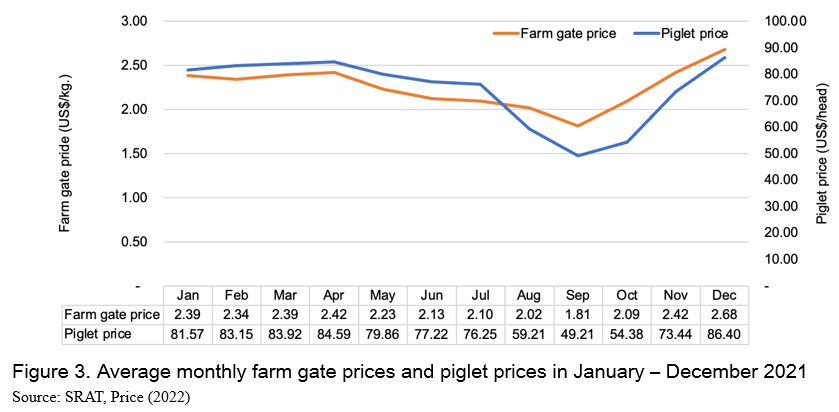

According to the 2019 outbreak in China and several Asian countries, the Cabinet approved the African Swine Fever Plan in Thailand, as proposed by the Department of Livestock Development and an animal epidemic prevention and control expert group. There was no ASF outbreak that had been officially detected. The control and prevention of ASF outbreaks in Thailand before 2022 was therefore voluntary. For example, the private sectors, including The Swine Raisers Association of Thailand, Charoen Pokphand Food Public Co., Ltd. (CPF), Betagro group, and Thai Food Group Public Co., Ltd. (TFG), jointly built the center of cleaning and disinfecting vehicles for transporting livestock in five locations at the quarantine animal checkpoint in areas at risk zone on the borders of neighboring countries in Nong Khai, Chiang Rai, Mukdahan, Nakhon Phanom and Sa Kaeo provinces (SART, Epidemic news, 2019). However, prevention management was not as strict as it should have been. As the results showed in 2021, the price of live fattening pigs at the farm gate was very volatile. During January – April, the average monthly price was in the range of 2.32 – 2.41 US$/kg, piglet price (16 kg), average 81.57 – 84.59 US$/head, after that the farm gate price had dropped to the lowest at 60 THB/kg and piglet price 49.21 US$/head in September. Then, the price continued to increase during October – December (Figure 3). The price continued to increase until the last week of 2021. Live pig price at the farm gate was 100 THB/kg and piglet price was 96.67 US$/head, which was the highest price of 2021 (SRAT, Price, 2022).

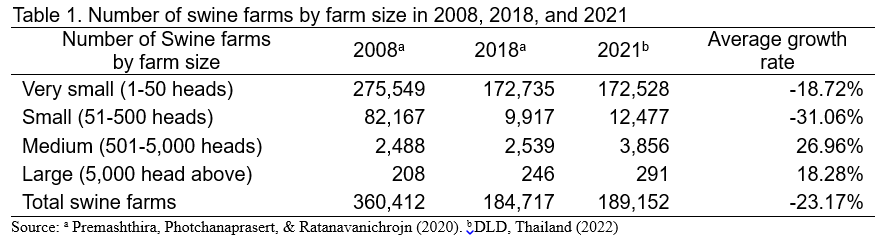

Between 2008 and 2021, the decline in the total number of farms averaged 23.17%. Small farm sizes (51 - 500 heads) had the largest decrease of 31.06%, followed by an average decrease of 18.72% for very small farm sizes (<50 heads). While medium farm size (501-5,000 heads) increased by an average of 26.96% and large farm size (> 5,001 heads) increased by 18.28% (Table 1). It can be seen that the proportion of small-scale farms changed to medium- and large-scale farms increased. The proportion of contract manufacturing and sales has grown from 25% to 45% over the decade (Mekhora, Ronachai, & Suwannamek, 2011; Premashthira, Photchanaprasert & Ratanavanichrojn, 2020).

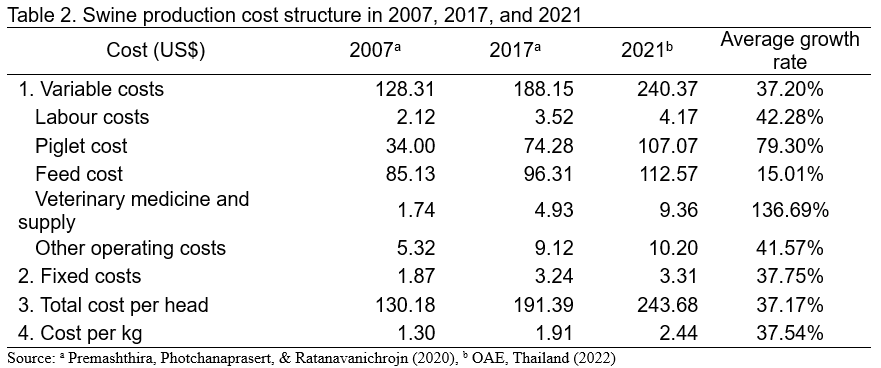

For the cost structure change of swine production, comparing 2007, 2017 and 2021, total production costs increased by 37.17% per year, with total variable costs increasing by an average of 37.20% per year. Veterinary medicine and supply costs were the largest increase of 136.69% per year, followed by the cost of animal breeding, an increase of 79.30% per year, while animal feed costs were the least increase, averaging 15.01% per year (Table 2). It demonstrated that the cost of veterinary medicines and supplies increased dramatically in 2021 as farms concentrated on ASF outbreak prevention measures, resulting in a corresponding increase in the cost of breeding animals. As a result, the ratio of breeding cost to total production cost had increased from 38.81% in 2017 to 42.71% in 2021, with the ratio of animal cost to total production cost still the largest at 46.20%, down from 50.32% in 2017.

Consumption

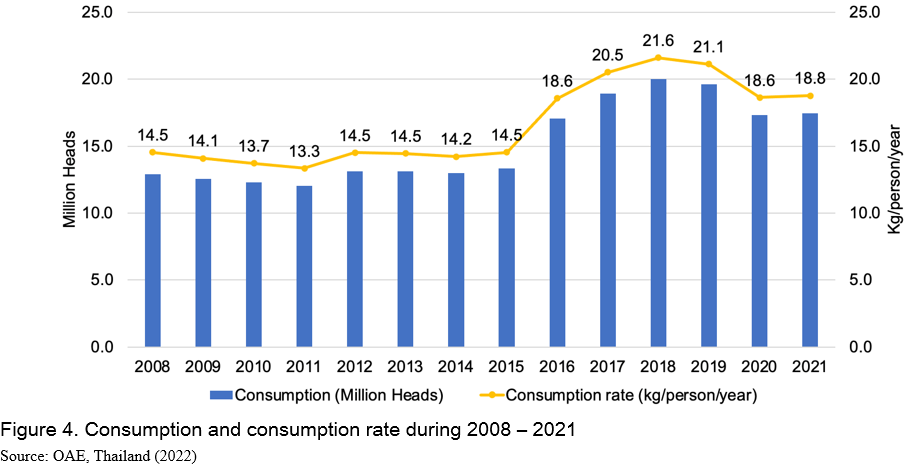

The pork consumption rate during 2008-2015 averaged 14.2 kg/person/year. After that, the consumption rate has increased rapidly. The highest consumption rate was 21.16 kg/person/year in 2018. The self-sufficiency ratio (SSR) averaged 106.5, indicating that pig production was sufficient to meet the demand of the population in the country. However, according to COVID-19 outbreaks between 2020 and 2021, the government implemented lockdown measures, social distancing, and work-from-home schemes to prevent the spread of COVID-19. These caused the tourism and service sectors to slow down, affecting pork demand. But the price was increased because of the growth of live pig and pork export, especially in 2019 and 2020. (Figure 2 and Table 3). As a result, swine consumption was reduced to approximately 17.3 million heads (18.6 kg/person/year) in 2020 and 17.5 million heads (18.8 kg/person/year) in 2021, respectively (Figure 4).

Export and Import

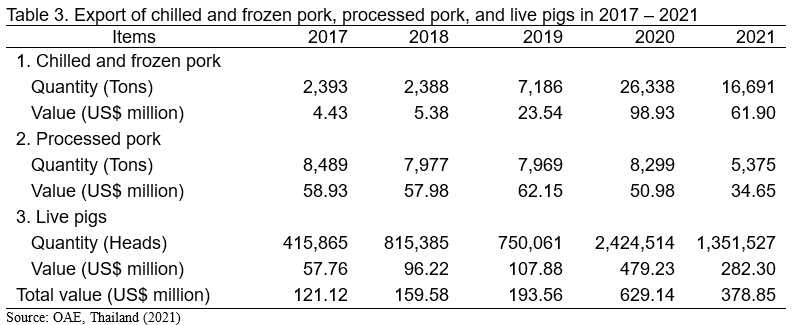

During 2020 and 2021, Thailand's swine production industry experienced an oversupply of approximately 3 million heads. According to ASF outbreak in Asia, in 2020, total value of exported live pigs, pork and products was US$ 629.14 million, which incrased by 225.0% from 2019. The volume of frozen pork exports was approximately 26,338 tons, or a value of US$98.92 million, with the main market being Hong Kong, Laos, Myanmar, and Cambodia. The export volume of processed pork was 8,299 tons, valued at US$50.98 million, with the main export markets being Japan, Hong Kong, and Singapore. The export volume of breeding and live pigs totaled 2,424,514 heads, valued at US$569.86 million, with the main export markets being Vietnam, Cambodia, Myanmar, and Laos. In 2021, export value decreased by 39.8% from 2020. The export volume of breeding pigs and live pigs was 1,351,527 heads, valued at US$282.30 million, decreasing from the year 2020 by 44.26% and 41.90%, respectively. Export volume of chilled and frozen pork was reduced to 16,691 tons, valued at US$61.90 million. Processed pork export volume decreased to 5,375 tons, valued at US$34.65 million (Table 3) (OAE, 2021).

In terms of imports, Thailand imported other edible parts of pigs (skin, liver, and other offals) from Germany, Italy, the Netherlands, and Denmark. In 2020, the import volume was 26,755 tons, worth US$14.75 million, and in 2021, the import volume was 30,632 tons, worth US$18.23 million (OAE, 2021).

However, the management of Thai pig farms could control the epidemic well. Thai swine production also faced other swine epidemics such as Porcine Epidemic Diarrhea (PED) and Porcine Reproductive and Respiratory Syndrome (PRRS). It was another limitation of the export of slaughtered and processed pork to foreign countries. Improving farm biosecurity for disease surveillance and prevention, particularly ASF, has resulted in higher production costs for farmers as discussed above. Nevertheless, with a weak defense, limited budget, and unclear surveillance policies making Thailand one of the countries that encountered the ASF outbreak, which was officially announced in January 2022.

THAI SWINE INDUSTRY SITUATION AFTER ASF OUTBREAK

According to DLD report in January 2022, during 10 January to 9 February 2022, Thailand declared ASF outbreaks in 24 provinces, namely Nakhon Pathom, Nakhon Nayok, Suphan Buri, Phatthalung, Nakhon Ratchasima, Maha Sarakram, Nong Bua Lamphu, Krabi, Nakhon Si Thammarat, Mae Hong Son, Ubon Ratchathani, Khon Kaen, Nan, Roi Et, Chaiyaphum, Buriram, Ratchaburi, Chumphon, Prachuap Khiri Khan, Si Pang Ket, and Bangkok. Swine number in total was 10.84 million heads declining 11.81% from total number of average swine production in 2021, comprising 49,000 breeding pigs, 979,000 sows, and 9.56 million fattening pigs (SRAT, Pig Production and Trade News, 2022). When considering sow production at the livestock region level, it was found that swine production in the Western region (Regional Livestock 7; i.e., Ratchaburi, Nakhon Pathom, Supanburi and Kanchanaburi) had the largest decrease of sows by 30%, followed by the Eastern region (Regional Livestock 2 i.e., Chonburi, Chachoengsao, Rayong) decreased by 20%, while many areas had more sow rearing, including Chainat, Nakhon Sawan, Uthai Thani, Kamphaeng Phet and Phetchabun. Owing to ASF outbreak, various farmers adapted by upgrading and adjusting the raising system to Good Farm Management (GFM) and expanding the farming size including moving the pig production base to a more secure area. According to DLD survey in January 2022, there were 106,495 farmers, declining by 43.35% from 2021. Most of the loss were very small farms and the number of these farms decreased by 52.64%. Whereas small farms increased by 52.49%. Medium farms were up by 24.97% and large farms increased by 223.71%.

The farm gate price increased by 25% within a month (from 2.47 US$/kg in the first week of December 2021 to 3.32 US$/kg in January 2022). The piglet price increased up to 111.78 US$/head and the pork price increased in the same direction from 4.83 US$/kg to 6.19 US$/kg (pasasut.com, 2022). The dramatic price increase reflected pig supply shortage in swine industry in Thailand leading to shock in Thai economy.

Consumers were shocked by the price at 6.19 US$/kg (highest of the history). They reduced their pork consumption and turned to increasing meat substitutes such as chicken, eggs, and fish, resulting in higher meat substitute prices. SRAT estimated that highest pork price in January leading to shock in pork demand down to 50% approximately. Owing to rapidly rising meat and food prices, the government responded by asking the Department of Internal Trade, Thailand (DIT) to cooperate with the DLD to inspect pork stocks in cold storage. About 25 million kilograms of chilled and frozen pork were found, which could be consumed for no more than 1 week. As a result of the price shock and inspection, brokers and trader delayed and declined buying live pigs. The number of pigs slaughtered in January 2022 was 1.357 million heads, a decrease of 0.136 million heads from January 2021 (DLD, 2022). These were the key factors that pressure the farm gate price fell in the last week of January dropped by 0.12 – 0.18 US$/kg and continued to decline during February. The farm gate price was 84 THB/kg and piglet price was 2,700 THB/head (pasusart.com, 2022). Swine price volatility during January and February 2022 affected the entire supply chain. Government sectors must closely monitor the situation and prepare plans to deal with the uncertainties that may arise in the future.

Consistent wih the ASF outbreak, numerous farmers of all sizes decided to stop pig production by default, especially small and medium farms in Western and Eestern regions. Some farmers decided to produce again but all pigs in the farm died another wave because ASF was not cleared. Thai swine production in 2022 will be difficult to predict due to the dynamic activities of pig raising, replacement rates of sows, and continuity in birth. This included the number of fattening farms and farrow-to-finish swine farms, both small and medium sizes that were affected and halted by the ASF attack. Sow replacement since mating, gestation, nursery, and fattening took approximately 12 months. The return of the Thai swine industry, therefore, depends mainly on government policy. To deal with ASF effectively, it requires alertness, cooperation, and transparency. Since 2019, Thailand's ASF defense operations have mainly been operated by the private sector, whereby the government does not have a clear policy and action. Nevertheless, there was some budget allocated for expenses for the control and prevention of DLD about US$30.21 million from April 2019 to July 2021 (Poapongsakorn, Kunawongkit, & Jantarasiri, 2022). Consistent with this, Beek (2022), editor of Pig Progress, mentioned Thai government response to ASF, that “response in Thailand was slow; there was no communication about it, and for a long time, no (international) cooperation occurred”.

Lesson learned from China, Vietnam, and the Philippines showed that ASF pattern will return because it is difficult to clear out the virus once it has spread widely over the country, especially backyard pigs (Mason-D’Croz et al., 2020; Beek, 2022). Moreover, one major weakness of the Thai pig production industry is that there was no real-time data and information system to track the situation closely, resulting in a delayed response and actions against the outbreak. When pre-migration infection testing for pigs was not rigorous due to limited testing facilities and high testing costs, pigs were sold freely to the market including carrier pigs. Moreover, other vectors such as farm workers, vehicles, and slaughterhouses transferred the virus to key swine-producing areas in the western and eastern regions.

REVITALIZING THE THAI SWINE INDUSTRY AFTER ASF OUTBREAK

After the official ASF outbreak was reported, the first government act was a national emergency meeting. Warrooms were established at district and provincial levels across the country to coordinate and report the situation, including the registration of pig farmers and the number of pigs, risk assessment, sharing the right information guide to farmers to improve biosecurity, and promote Good Agricultural Management (GFM). Then, the cabinet announced about 9 schemes: 1) Refrain from exporting live pigs for three months; 2) Help feed prices for farmers; 3) Provide special loans for farmers by financial institutions so that they could come back to raise again; 4) Fix the selling price in accordance with the cost; 5) Increase the production of replacement sows; 6) Promote the production of maize; 7) Accelerate the study of drugs and immunomodulators for epidemics; 8) Raise farmers' farm standards to prevent epidemics; and 9) Promote the improvement of farms with disease prevention systems. However, the measures mentioned above were broad and lack practical details, which would make the outbreak management ineffective. All schemes should therefore be expedited to formulate clear action plans.

After the government announced the above schemes, there were efforts on the academic side and private sector organizing brainstorming sessions to propose more concrete solutions. For example, the Thailand Development Research Institute (TDRI) invited stakeholders and experts such as pig raisers, veterinarians, and economistsall of whom brainstormed to propose more concrete policies and measures to deal with the outbreak on 19 January 2022 (Poapongsakorn et al., 2022). The forum requested the government set up an independent committee to recommend guidelines and measures to tackle the problem.

Then, the Agricultural Research Development Agency (ARDA) and FAO together with experts, brainstormed ideas to create an Evidence Needs Map to enhance the management of ASF problems in Thailand on 14-15 February 2022. Overall brainstorming concluded that current disease control measures were unable to cope with the outbreak of ASF; it is therefore imperative to adjust disease control measures that require transparency and build confidence in all relevant sectors. They suggested longterm solutions that would require massive research and improved management systems. ASF Research direction was proposed for ARDA, which requested field experiments and funding in the next budget. However, government response to the ASF outbreak will still be slow, as Beek stated. The DLD will still be the main authority to act as before. It has led to increased stress among swine raisers that they may not be revitalized from the outbreak.

Immediate acts

What Thai Government and DLD should urgently do:

1) Cooperate with all relevant sectors and take urgent action, formulate eradication plans and measures to control the outbreak and prevent re-emergence in the same area or spread to other areas. Government sectors need to formulate incentive measures for farmers to cooperate in disease control and prevention, for example: adjusting compensation conditions efficiently and quickly. The current compensation program took more than six months to process and transfer the money to farmers. The rate of compensation was set at the maximum number of 500 pigs and paid 75% of market price when DLD approved. However, only 9,796 farmers for 301,532 pigs had been paid since 2019 for US$34.25 million (US$113.59/head). The government's compensation program must motivate and promptly allow swine raisers to cooperate in notifying officers as soon as possible when ASF enters (Nguyen-Thai et al. 2021). For example, farmers who report faster will get paid earlier.

2) Manage information, knowledge on risks and appropriate biosecurity system based on farm structure and condition. Effective communication in public will inform pig farmers and the public to understand thoroughly.

3) Increase the budget for infection detection and diagnosis that is appropriate and acceptable, and allow standardized testing and diagnostic centers of educational institutions and private sectors to be able to detect the infection. There should be a policy to allow veterinary labs of universities to freely disclose examination results to the public by protecting the owner's information.

4) Collaborate with financial institutions to restructure debts for pig farms damaged by the epidemic. Including financial measures to support the improvement of farm biosecurity system to prevent and control outbreaks in swine farms.

5) Establish Standard Operating Procedures (SOPs) for outbreak management and rehabilitation; i.e. total or partial culling of sick animals, farm restoration, and returning to produce pigs.

The next steps

To revitalize and upgrade the whole swine industry, effectively manage ASF problems, and raise the level of small-scale pig farming and commercial farming in Thailand to be accepted by both domestic and international consumers. The government should:

1) Determine clear and effective disease control policies and measures to improve the diversified pig farming system. The outbreak assessment should be conducted in terms of social and economic impacts along the value chain in order to rehabilitate Thai swine industry.

2) Study the cost and effectiveness of measures, methods for improving farms with an emphasis on biosecurity in ASF endemic situations aiming to disease-free status or maintain disease-free status in commercial farming systems.

3) Improve the current rules and laws that are problematic or hinder disease control operations. Serious epidemics need practical and effective regulations to facilitate prevention and control based on academic principles and scientific evidence. Law enforcement in disease prevention and control must be transparent to build trust among stakeholders cooperating in the outbreak.

4) Cooperate with the private sector to develop real-time monitoring systems for farm registration, number of animals, and tracking of pigs, carcasses, and pork movements throughout the whole supply chain. Moreover, a system of animal health insurance and compensation should be developed in accordance with farm registration, which can collect fees for raising pigs according to farm size. In the beginning, states may have motivated pig raisers to provide incentives for registration. This will be of great benefit to traceability and monitoring of production to control of swine disease in the future.

5) Support budget for ASF research and development such as, vaccines, antiviral drugs, laboratory algorithm, sampling protocol to prevention and control of disease outbreaks suitable for a variety of pig farming systems. Breeding and feeding formulas that increase the immunity of pigs should be conducted as well.

6) Provide partial subsidies to improve slaughterhouses and meat processing plants so that they can have disease testing laboratories to control disease in the midstream of the supply chain and build consumer confidence.

7) Study the cost-effectiveness of investments in rendering plants of various sizes, including sustainable plant management mechanisms. The results will inform investment decisions in key livestock areas to reduce the loss and economic impact of ASF or other serious outbreaks in the future.

CONCLUSION

The ASF epidemic made pigs sick and dying in large numbers, damaging their livelihoods, food security leading to economic losses at all levels, including households, local, regional, national, and global levels consistent with Woonwong, Tien, & Thanawongnuwech (2020) forecast. To eliminate the losses and revitalize swine raisers, controling and preventing ASF epidemic must be quick and rely on cooperation from all involved parties to manage disease control and prevention. Defining roles and duty protocol must be clear on what each party must do and how to manage it. DLD communication must be alerted, clear, consistent, and simplified to avoid confusion and reduce conflicts. It will support the cooperation between pig farmers and all parties involved in preventing the spread of the outbreak. In managing the ASF outbreak, it is necessary to build trust by using empirical evidence from scientific based on the field of animal epidemic control, society, and economy. Thus, the Thai government policy must formulate and implement measures for disease prevention based on transparency aligned with global ASF statement control. It is the key to effectively revitalize the Thai swine industry from the ASF.

REFERENCES

Bank of Thailand. (2022). Foreign Exchange rate. Retrieved March 9, 2022, from Bank of Thailand: https://www.bot.or.th/english/_layouts/application/exchangerate/exchange...

Beek, V. t. 2022. ASF Dominican Republic: A ticking time bomb. Pig Progress. Retrieved February 14, 2022.

Berthe, F. 2020. The Global Economic Impact of ASF. Retrieved February 7, 2022, from World Organisation for Animal Health: https://oiebulletin.f

DLD (Department of Livestock Developemnt). 2022. Pig Production Report. Bangkok: Department of Livestock Development.

FAO. 2016. How does agricultural trade impact food security? Trade policy briefs: Trade & Food Security 17. Rome: Food and Agriculture Organization of the United Nations.

FAO. 2022. ASF situation in Asia & Pacific update. Retrieved February 9, from Agriculture and Consumer Protection Department : Animal Production and Health: https://www.fao.org/ag/againfo/programmes/en/empres/ASF/situation_update...

FAO. 2022. Animal Production and Health. Retrieved Ferruary 17, 2022, from Food and Agriculture Organization of the United Nations: https://www.fao.org/ag/againfo/programmes/en/empres/ASF/situation_update...

Mason-D’Croz, D., Bogard, J. R., Herrero, M., Robinson, S., Sulser, T. B., Wiebe, K., . . . Godfray, H. J. 2020. Modelling the global economic consequences of a major African swine fever outbreak in China. Nature Food, pp 221-228.

Mekhora, T., Ronachai, S., & Suwannamek, O. 2011. Supply chain of pork in Thailand and its reference price model. Bangkok: Thailand Research Fund.

Nguyen-Thi, T., Pham-Thi-Ngoc, L., Nguyen-Ngoc, Q., Dang-Xuan, S., Lee, H. S., Nguyen-Viet, H., . . . Rich, K. M. 2021. An Assessment of the Economic Impacts of the 2019 African Swine Fever Outbreaks in Vietnam. Frontiers in Veterinary Science, 8, 686038.

OAE (Office of Agricultural Economics). 2021. Agricultural Situation and Trend in 2022. Agricultural Research Institution, Office of Agricultural Economics. Bangkok: Office of Agricultural Economics.

OIE. 2019. African swine fever. Retrieved February 2022, from World Organization for Animal Health: https://www.oie.int/en/disease/african-swine-fever/

Pasusart.com. (2022, February 15). Price and Situation. Retrieved February 2022, from Pasusart News: https://pasusart.com/ราคาแะสถานการณ์/

Poapongsakorn, N., Kunawongkit, A., & Jantarasiri, U. 2022. ข้อเสนอแนวทางการรับมือกับปัญหาการระบาดของโรคอหิวาต์แอฟริกาในสุกรในประเทศไทย. Retrieved February 2022, from TDRI Thailand Development Research Institute: https://tdri.or.th/2022/02/afs-recommendations-prevention-control/

Premashthira, A., Photchanaprasert, N., & Ratanavanichrojn, N. (2020). Changes in production, values, and marketing margins of Thailand pork industry. KHON KAEN AGR, 48(5), pp 1142-1161.

SRAT (Swine Raisers Association of Thailand). 2019. Epidemic news. Retrieved February 21, 2022, from The Swine Raisers Association of Thailand: https://www.swinethailand.com/17076293/สมาคมผู้เลี้ยงสุกรแห่งชาติ-ผนึกกำลัง-ซีพีเอฟ-เบทาโกร-ไทยฟู้ดส์-ป้องอหิวาต์แอฟริกาในสุกร

SRAT (Swine Raisers Association of Thailand). 2022. Price. Retrieved Febuary 8, from The Swine Raisers Association of Thailand: https://www.swinethailand.com/16866405/5ราคาสุกรขุน-ปี-2561-2565

SRAT (Swine Raisers Association of Thailand). 2022. Pig Production and Trade News. Retrieved February 2022, from The Swine Raisers Association of Thailand: https://www.swinethailand.com/17332752/live-pig-pork-price-decline-?fbclid=IwAR1HQC4Vbz4Xnf0-aXrh-d8eBfKqYreNM7hK2bysV_CkZ5Ug7P4pbmzvjeA

Thornton, P. K. 2010. Livestock Production: Recent Treands, Future Prospects. Philosophical Transactions of The Royal Society B, 365, pp 2853 - 2867.

Woonwong, Y., Tien, D. D., & Thanawongnuwech, R. 2020. The Future of the Pig Industry After the Introduction of African Swine Fever into Asia. Animal Frontiers, 10(4), pp 30-37.

[1] The exchange rate on 8 March 2022 is THB 33.1 = US$1. Source: Bank of Thailand (2022)

Thai Swine Industry during African Swine Fever Outbreak in Asia

ABSTRACT

In Thailand, African Swine Fever (ASF) outbreak resulted in a 43.35% reduction in swine raisers, especially the very small farm sizes in January 2022. Pig and pork prices rose sharply within a month and the price of meat substitutes rose in the same direction leading to a lack of meat availability and affordability in low-income households. The stakeholders were trying to propose guidelines for the control and prevention of ASF outbreaks across the country, stating that the government must be alert and rely on the cooperation of all parties involved in disease control and prevention. Defining roles and responsibilities must be clear about what each party is doing and how to manage them. Communication in the Department of Livestock Development (DLD) must be alerted, clear, consistent, and simplified to avoid confusion and minimize conflicts. It is important to build trust by using scientific evidence based on animal, social and economic epidemic control. Therefore, Thai government policy must establish and implement disease prevention measures in a transparent manner. This will crack the AFS outbreak and revitalize the Thai swine industry effectively.

Keywords: African Swine Fever (ASF), Swine Industry, Thailand

INTRODUCTION

African swine fever (ASF) is a major risk factor for both national and global economies impacting animal health and welfare, food security, livelihood, rural development in many countries. While ASF is not harmful to human health, it is considered a serious disease in pigs due to its high mortality rate which goes up to 100% mortality. The virus is durable in the environment. People can be carriers and spread this virus through clothing, boots, cars, and can also be contaminated in pork products such as sausages, ham, bacon, etc. Importantly, there is not an effective vaccine against ASF. The outbreak control management must focus on biosecurity (OIE, 2019). ASF outbreaks occur in several countries in Sub-Saharan Africa, Europe, and Asia. In Asia, the outbreak started in China and was officially announced on August 3, 2018. After that, outbreaks were reported in several countries including Mongolia, Vietnam, Cambodia, Korea (Dem. People's Rep.) Loas, Philippines, Myanmar, Korea (Rep. of), Timor-Leste, Indonesia, Papua New Guinea, India, Malaysia, Bhutan, and Thailand (FAO, 2022). In Thailand, the Department of Livestock Development (DLD) officially confirmed ASF on 11 January 2022 (Figure 1).

According to Nguyen-Thi et al. (2021), the ASF outbreak has both direct and indirect impacts on food and feed markets at the farm, local and national levels. Low-income households have difficulties on food supply availability and afforadable food price, impacting on their dietary needs (Mason-D’Croz et al., 2020). The outbreak has affected the country's food security to the point that a number of policies have been implemented that do not comply with Free Trade policies for domestic protection, such as the prohibition of importation of pork and products from endemic countries. Direct compensation subsidies for pig farmers to improve farms including subsidies for pork prices to alleviate the consumers (Nguyen-Thi et al., 2021). In Thailand, current disease control measures are not suitable for diversified pig farming systems. Practical disease control approaches are not effective. Meanwhile, the growth rate of meat consumption is likely to recover in 2022.

In response to the growth rate of pork consumption demand, the pig production industry relies on many factors including resource and environmental management in the face of competition in the use of natural resources such as land and water. Use of technology for the development of nutritional feed, breeding and disease outbreak prevention and control (Thornton, 2010). In addition, human health concerns and international trade conditions must be taken into account in pig production, which negatively affects pig farmers (FAO, 2016). It is imperative that Thailand formulates measures in order to optimize the management of ASF problems.

Objectives of this article

1. To provide the situation of the Thai swine industry before and after the official ASF outbreak

2. To propose revitalizing solutions for the Thai swine industry

METHOGOLOGY

This paper provided a descriptive analysis based on secondary data such as production, marketing, and price data from reports from the Office of Agricultural Economics (OAE), Department of Livestock Development (DLD) and the Swine Raisers Association of Thailand (SRAT) website from 2008 to 2022 to analyze the situation of the Thai swine industry. Moreover, data also collected from academic articles related to the ASF outbreak in Asia to propose revitalizing solutions for the Thai swine industry.

THAI SWINE INDUSTRY SITUATION BEFORE ASF OUTBREAK

Production

The Thai swine industry focuses on production for domestic consumption. Thailand's pig production capacity is likely to increase since 2009 by an average of 4.16% per year. The maximum capacity of fattening pig production was 22.82 million heads in 2018 and dropped to 19.28 million heads by 2021 (Figure 2). The fattening farm gate price during 2008-2018 was in the range of 1.51 to 1.81 US$/kg[1]. In 2018, pig production was oversupplied, causing the farm gate price of fattening pig to the lowest of 1.67 US$/kg. After that, prices tend to increase steadily between 2019 and 2021. This was the period when Thailand exported live pigs and produce to foreign countries such as Vietnam and Cambodia.

According to the 2019 outbreak in China and several Asian countries, the Cabinet approved the African Swine Fever Plan in Thailand, as proposed by the Department of Livestock Development and an animal epidemic prevention and control expert group. There was no ASF outbreak that had been officially detected. The control and prevention of ASF outbreaks in Thailand before 2022 was therefore voluntary. For example, the private sectors, including The Swine Raisers Association of Thailand, Charoen Pokphand Food Public Co., Ltd. (CPF), Betagro group, and Thai Food Group Public Co., Ltd. (TFG), jointly built the center of cleaning and disinfecting vehicles for transporting livestock in five locations at the quarantine animal checkpoint in areas at risk zone on the borders of neighboring countries in Nong Khai, Chiang Rai, Mukdahan, Nakhon Phanom and Sa Kaeo provinces (SART, Epidemic news, 2019). However, prevention management was not as strict as it should have been. As the results showed in 2021, the price of live fattening pigs at the farm gate was very volatile. During January – April, the average monthly price was in the range of 2.32 – 2.41 US$/kg, piglet price (16 kg), average 81.57 – 84.59 US$/head, after that the farm gate price had dropped to the lowest at 60 THB/kg and piglet price 49.21 US$/head in September. Then, the price continued to increase during October – December (Figure 3). The price continued to increase until the last week of 2021. Live pig price at the farm gate was 100 THB/kg and piglet price was 96.67 US$/head, which was the highest price of 2021 (SRAT, Price, 2022).

Between 2008 and 2021, the decline in the total number of farms averaged 23.17%. Small farm sizes (51 - 500 heads) had the largest decrease of 31.06%, followed by an average decrease of 18.72% for very small farm sizes (<50 heads). While medium farm size (501-5,000 heads) increased by an average of 26.96% and large farm size (> 5,001 heads) increased by 18.28% (Table 1). It can be seen that the proportion of small-scale farms changed to medium- and large-scale farms increased. The proportion of contract manufacturing and sales has grown from 25% to 45% over the decade (Mekhora, Ronachai, & Suwannamek, 2011; Premashthira, Photchanaprasert & Ratanavanichrojn, 2020).

For the cost structure change of swine production, comparing 2007, 2017 and 2021, total production costs increased by 37.17% per year, with total variable costs increasing by an average of 37.20% per year. Veterinary medicine and supply costs were the largest increase of 136.69% per year, followed by the cost of animal breeding, an increase of 79.30% per year, while animal feed costs were the least increase, averaging 15.01% per year (Table 2). It demonstrated that the cost of veterinary medicines and supplies increased dramatically in 2021 as farms concentrated on ASF outbreak prevention measures, resulting in a corresponding increase in the cost of breeding animals. As a result, the ratio of breeding cost to total production cost had increased from 38.81% in 2017 to 42.71% in 2021, with the ratio of animal cost to total production cost still the largest at 46.20%, down from 50.32% in 2017.

Consumption

The pork consumption rate during 2008-2015 averaged 14.2 kg/person/year. After that, the consumption rate has increased rapidly. The highest consumption rate was 21.16 kg/person/year in 2018. The self-sufficiency ratio (SSR) averaged 106.5, indicating that pig production was sufficient to meet the demand of the population in the country. However, according to COVID-19 outbreaks between 2020 and 2021, the government implemented lockdown measures, social distancing, and work-from-home schemes to prevent the spread of COVID-19. These caused the tourism and service sectors to slow down, affecting pork demand. But the price was increased because of the growth of live pig and pork export, especially in 2019 and 2020. (Figure 2 and Table 3). As a result, swine consumption was reduced to approximately 17.3 million heads (18.6 kg/person/year) in 2020 and 17.5 million heads (18.8 kg/person/year) in 2021, respectively (Figure 4).

Export and Import

During 2020 and 2021, Thailand's swine production industry experienced an oversupply of approximately 3 million heads. According to ASF outbreak in Asia, in 2020, total value of exported live pigs, pork and products was US$ 629.14 million, which incrased by 225.0% from 2019. The volume of frozen pork exports was approximately 26,338 tons, or a value of US$98.92 million, with the main market being Hong Kong, Laos, Myanmar, and Cambodia. The export volume of processed pork was 8,299 tons, valued at US$50.98 million, with the main export markets being Japan, Hong Kong, and Singapore. The export volume of breeding and live pigs totaled 2,424,514 heads, valued at US$569.86 million, with the main export markets being Vietnam, Cambodia, Myanmar, and Laos. In 2021, export value decreased by 39.8% from 2020. The export volume of breeding pigs and live pigs was 1,351,527 heads, valued at US$282.30 million, decreasing from the year 2020 by 44.26% and 41.90%, respectively. Export volume of chilled and frozen pork was reduced to 16,691 tons, valued at US$61.90 million. Processed pork export volume decreased to 5,375 tons, valued at US$34.65 million (Table 3) (OAE, 2021).

In terms of imports, Thailand imported other edible parts of pigs (skin, liver, and other offals) from Germany, Italy, the Netherlands, and Denmark. In 2020, the import volume was 26,755 tons, worth US$14.75 million, and in 2021, the import volume was 30,632 tons, worth US$18.23 million (OAE, 2021).

However, the management of Thai pig farms could control the epidemic well. Thai swine production also faced other swine epidemics such as Porcine Epidemic Diarrhea (PED) and Porcine Reproductive and Respiratory Syndrome (PRRS). It was another limitation of the export of slaughtered and processed pork to foreign countries. Improving farm biosecurity for disease surveillance and prevention, particularly ASF, has resulted in higher production costs for farmers as discussed above. Nevertheless, with a weak defense, limited budget, and unclear surveillance policies making Thailand one of the countries that encountered the ASF outbreak, which was officially announced in January 2022.

THAI SWINE INDUSTRY SITUATION AFTER ASF OUTBREAK

According to DLD report in January 2022, during 10 January to 9 February 2022, Thailand declared ASF outbreaks in 24 provinces, namely Nakhon Pathom, Nakhon Nayok, Suphan Buri, Phatthalung, Nakhon Ratchasima, Maha Sarakram, Nong Bua Lamphu, Krabi, Nakhon Si Thammarat, Mae Hong Son, Ubon Ratchathani, Khon Kaen, Nan, Roi Et, Chaiyaphum, Buriram, Ratchaburi, Chumphon, Prachuap Khiri Khan, Si Pang Ket, and Bangkok. Swine number in total was 10.84 million heads declining 11.81% from total number of average swine production in 2021, comprising 49,000 breeding pigs, 979,000 sows, and 9.56 million fattening pigs (SRAT, Pig Production and Trade News, 2022). When considering sow production at the livestock region level, it was found that swine production in the Western region (Regional Livestock 7; i.e., Ratchaburi, Nakhon Pathom, Supanburi and Kanchanaburi) had the largest decrease of sows by 30%, followed by the Eastern region (Regional Livestock 2 i.e., Chonburi, Chachoengsao, Rayong) decreased by 20%, while many areas had more sow rearing, including Chainat, Nakhon Sawan, Uthai Thani, Kamphaeng Phet and Phetchabun. Owing to ASF outbreak, various farmers adapted by upgrading and adjusting the raising system to Good Farm Management (GFM) and expanding the farming size including moving the pig production base to a more secure area. According to DLD survey in January 2022, there were 106,495 farmers, declining by 43.35% from 2021. Most of the loss were very small farms and the number of these farms decreased by 52.64%. Whereas small farms increased by 52.49%. Medium farms were up by 24.97% and large farms increased by 223.71%.

The farm gate price increased by 25% within a month (from 2.47 US$/kg in the first week of December 2021 to 3.32 US$/kg in January 2022). The piglet price increased up to 111.78 US$/head and the pork price increased in the same direction from 4.83 US$/kg to 6.19 US$/kg (pasasut.com, 2022). The dramatic price increase reflected pig supply shortage in swine industry in Thailand leading to shock in Thai economy.

Consumers were shocked by the price at 6.19 US$/kg (highest of the history). They reduced their pork consumption and turned to increasing meat substitutes such as chicken, eggs, and fish, resulting in higher meat substitute prices. SRAT estimated that highest pork price in January leading to shock in pork demand down to 50% approximately. Owing to rapidly rising meat and food prices, the government responded by asking the Department of Internal Trade, Thailand (DIT) to cooperate with the DLD to inspect pork stocks in cold storage. About 25 million kilograms of chilled and frozen pork were found, which could be consumed for no more than 1 week. As a result of the price shock and inspection, brokers and trader delayed and declined buying live pigs. The number of pigs slaughtered in January 2022 was 1.357 million heads, a decrease of 0.136 million heads from January 2021 (DLD, 2022). These were the key factors that pressure the farm gate price fell in the last week of January dropped by 0.12 – 0.18 US$/kg and continued to decline during February. The farm gate price was 84 THB/kg and piglet price was 2,700 THB/head (pasusart.com, 2022). Swine price volatility during January and February 2022 affected the entire supply chain. Government sectors must closely monitor the situation and prepare plans to deal with the uncertainties that may arise in the future.

Consistent wih the ASF outbreak, numerous farmers of all sizes decided to stop pig production by default, especially small and medium farms in Western and Eestern regions. Some farmers decided to produce again but all pigs in the farm died another wave because ASF was not cleared. Thai swine production in 2022 will be difficult to predict due to the dynamic activities of pig raising, replacement rates of sows, and continuity in birth. This included the number of fattening farms and farrow-to-finish swine farms, both small and medium sizes that were affected and halted by the ASF attack. Sow replacement since mating, gestation, nursery, and fattening took approximately 12 months. The return of the Thai swine industry, therefore, depends mainly on government policy. To deal with ASF effectively, it requires alertness, cooperation, and transparency. Since 2019, Thailand's ASF defense operations have mainly been operated by the private sector, whereby the government does not have a clear policy and action. Nevertheless, there was some budget allocated for expenses for the control and prevention of DLD about US$30.21 million from April 2019 to July 2021 (Poapongsakorn, Kunawongkit, & Jantarasiri, 2022). Consistent with this, Beek (2022), editor of Pig Progress, mentioned Thai government response to ASF, that “response in Thailand was slow; there was no communication about it, and for a long time, no (international) cooperation occurred”.

Lesson learned from China, Vietnam, and the Philippines showed that ASF pattern will return because it is difficult to clear out the virus once it has spread widely over the country, especially backyard pigs (Mason-D’Croz et al., 2020; Beek, 2022). Moreover, one major weakness of the Thai pig production industry is that there was no real-time data and information system to track the situation closely, resulting in a delayed response and actions against the outbreak. When pre-migration infection testing for pigs was not rigorous due to limited testing facilities and high testing costs, pigs were sold freely to the market including carrier pigs. Moreover, other vectors such as farm workers, vehicles, and slaughterhouses transferred the virus to key swine-producing areas in the western and eastern regions.

REVITALIZING THE THAI SWINE INDUSTRY AFTER ASF OUTBREAK

After the official ASF outbreak was reported, the first government act was a national emergency meeting. Warrooms were established at district and provincial levels across the country to coordinate and report the situation, including the registration of pig farmers and the number of pigs, risk assessment, sharing the right information guide to farmers to improve biosecurity, and promote Good Agricultural Management (GFM). Then, the cabinet announced about 9 schemes: 1) Refrain from exporting live pigs for three months; 2) Help feed prices for farmers; 3) Provide special loans for farmers by financial institutions so that they could come back to raise again; 4) Fix the selling price in accordance with the cost; 5) Increase the production of replacement sows; 6) Promote the production of maize; 7) Accelerate the study of drugs and immunomodulators for epidemics; 8) Raise farmers' farm standards to prevent epidemics; and 9) Promote the improvement of farms with disease prevention systems. However, the measures mentioned above were broad and lack practical details, which would make the outbreak management ineffective. All schemes should therefore be expedited to formulate clear action plans.

After the government announced the above schemes, there were efforts on the academic side and private sector organizing brainstorming sessions to propose more concrete solutions. For example, the Thailand Development Research Institute (TDRI) invited stakeholders and experts such as pig raisers, veterinarians, and economistsall of whom brainstormed to propose more concrete policies and measures to deal with the outbreak on 19 January 2022 (Poapongsakorn et al., 2022). The forum requested the government set up an independent committee to recommend guidelines and measures to tackle the problem.

Then, the Agricultural Research Development Agency (ARDA) and FAO together with experts, brainstormed ideas to create an Evidence Needs Map to enhance the management of ASF problems in Thailand on 14-15 February 2022. Overall brainstorming concluded that current disease control measures were unable to cope with the outbreak of ASF; it is therefore imperative to adjust disease control measures that require transparency and build confidence in all relevant sectors. They suggested longterm solutions that would require massive research and improved management systems. ASF Research direction was proposed for ARDA, which requested field experiments and funding in the next budget. However, government response to the ASF outbreak will still be slow, as Beek stated. The DLD will still be the main authority to act as before. It has led to increased stress among swine raisers that they may not be revitalized from the outbreak.

Immediate acts

What Thai Government and DLD should urgently do:

1) Cooperate with all relevant sectors and take urgent action, formulate eradication plans and measures to control the outbreak and prevent re-emergence in the same area or spread to other areas. Government sectors need to formulate incentive measures for farmers to cooperate in disease control and prevention, for example: adjusting compensation conditions efficiently and quickly. The current compensation program took more than six months to process and transfer the money to farmers. The rate of compensation was set at the maximum number of 500 pigs and paid 75% of market price when DLD approved. However, only 9,796 farmers for 301,532 pigs had been paid since 2019 for US$34.25 million (US$113.59/head). The government's compensation program must motivate and promptly allow swine raisers to cooperate in notifying officers as soon as possible when ASF enters (Nguyen-Thai et al. 2021). For example, farmers who report faster will get paid earlier.

2) Manage information, knowledge on risks and appropriate biosecurity system based on farm structure and condition. Effective communication in public will inform pig farmers and the public to understand thoroughly.

3) Increase the budget for infection detection and diagnosis that is appropriate and acceptable, and allow standardized testing and diagnostic centers of educational institutions and private sectors to be able to detect the infection. There should be a policy to allow veterinary labs of universities to freely disclose examination results to the public by protecting the owner's information.

4) Collaborate with financial institutions to restructure debts for pig farms damaged by the epidemic. Including financial measures to support the improvement of farm biosecurity system to prevent and control outbreaks in swine farms.

5) Establish Standard Operating Procedures (SOPs) for outbreak management and rehabilitation; i.e. total or partial culling of sick animals, farm restoration, and returning to produce pigs.

The next steps

To revitalize and upgrade the whole swine industry, effectively manage ASF problems, and raise the level of small-scale pig farming and commercial farming in Thailand to be accepted by both domestic and international consumers. The government should:

1) Determine clear and effective disease control policies and measures to improve the diversified pig farming system. The outbreak assessment should be conducted in terms of social and economic impacts along the value chain in order to rehabilitate Thai swine industry.

2) Study the cost and effectiveness of measures, methods for improving farms with an emphasis on biosecurity in ASF endemic situations aiming to disease-free status or maintain disease-free status in commercial farming systems.

3) Improve the current rules and laws that are problematic or hinder disease control operations. Serious epidemics need practical and effective regulations to facilitate prevention and control based on academic principles and scientific evidence. Law enforcement in disease prevention and control must be transparent to build trust among stakeholders cooperating in the outbreak.

4) Cooperate with the private sector to develop real-time monitoring systems for farm registration, number of animals, and tracking of pigs, carcasses, and pork movements throughout the whole supply chain. Moreover, a system of animal health insurance and compensation should be developed in accordance with farm registration, which can collect fees for raising pigs according to farm size. In the beginning, states may have motivated pig raisers to provide incentives for registration. This will be of great benefit to traceability and monitoring of production to control of swine disease in the future.

5) Support budget for ASF research and development such as, vaccines, antiviral drugs, laboratory algorithm, sampling protocol to prevention and control of disease outbreaks suitable for a variety of pig farming systems. Breeding and feeding formulas that increase the immunity of pigs should be conducted as well.

6) Provide partial subsidies to improve slaughterhouses and meat processing plants so that they can have disease testing laboratories to control disease in the midstream of the supply chain and build consumer confidence.

7) Study the cost-effectiveness of investments in rendering plants of various sizes, including sustainable plant management mechanisms. The results will inform investment decisions in key livestock areas to reduce the loss and economic impact of ASF or other serious outbreaks in the future.

CONCLUSION

The ASF epidemic made pigs sick and dying in large numbers, damaging their livelihoods, food security leading to economic losses at all levels, including households, local, regional, national, and global levels consistent with Woonwong, Tien, & Thanawongnuwech (2020) forecast. To eliminate the losses and revitalize swine raisers, controling and preventing ASF epidemic must be quick and rely on cooperation from all involved parties to manage disease control and prevention. Defining roles and duty protocol must be clear on what each party must do and how to manage it. DLD communication must be alerted, clear, consistent, and simplified to avoid confusion and reduce conflicts. It will support the cooperation between pig farmers and all parties involved in preventing the spread of the outbreak. In managing the ASF outbreak, it is necessary to build trust by using empirical evidence from scientific based on the field of animal epidemic control, society, and economy. Thus, the Thai government policy must formulate and implement measures for disease prevention based on transparency aligned with global ASF statement control. It is the key to effectively revitalize the Thai swine industry from the ASF.

REFERENCES

Bank of Thailand. (2022). Foreign Exchange rate. Retrieved March 9, 2022, from Bank of Thailand: https://www.bot.or.th/english/_layouts/application/exchangerate/exchange...

Beek, V. t. 2022. ASF Dominican Republic: A ticking time bomb. Pig Progress. Retrieved February 14, 2022.

Berthe, F. 2020. The Global Economic Impact of ASF. Retrieved February 7, 2022, from World Organisation for Animal Health: https://oiebulletin.f

DLD (Department of Livestock Developemnt). 2022. Pig Production Report. Bangkok: Department of Livestock Development.

FAO. 2016. How does agricultural trade impact food security? Trade policy briefs: Trade & Food Security 17. Rome: Food and Agriculture Organization of the United Nations.

FAO. 2022. ASF situation in Asia & Pacific update. Retrieved February 9, from Agriculture and Consumer Protection Department : Animal Production and Health: https://www.fao.org/ag/againfo/programmes/en/empres/ASF/situation_update...

FAO. 2022. Animal Production and Health. Retrieved Ferruary 17, 2022, from Food and Agriculture Organization of the United Nations: https://www.fao.org/ag/againfo/programmes/en/empres/ASF/situation_update...

Mason-D’Croz, D., Bogard, J. R., Herrero, M., Robinson, S., Sulser, T. B., Wiebe, K., . . . Godfray, H. J. 2020. Modelling the global economic consequences of a major African swine fever outbreak in China. Nature Food, pp 221-228.

Mekhora, T., Ronachai, S., & Suwannamek, O. 2011. Supply chain of pork in Thailand and its reference price model. Bangkok: Thailand Research Fund.

Nguyen-Thi, T., Pham-Thi-Ngoc, L., Nguyen-Ngoc, Q., Dang-Xuan, S., Lee, H. S., Nguyen-Viet, H., . . . Rich, K. M. 2021. An Assessment of the Economic Impacts of the 2019 African Swine Fever Outbreaks in Vietnam. Frontiers in Veterinary Science, 8, 686038.

OAE (Office of Agricultural Economics). 2021. Agricultural Situation and Trend in 2022. Agricultural Research Institution, Office of Agricultural Economics. Bangkok: Office of Agricultural Economics.

OIE. 2019. African swine fever. Retrieved February 2022, from World Organization for Animal Health: https://www.oie.int/en/disease/african-swine-fever/

Pasusart.com. (2022, February 15). Price and Situation. Retrieved February 2022, from Pasusart News: https://pasusart.com/ราคาแะสถานการณ์/

Poapongsakorn, N., Kunawongkit, A., & Jantarasiri, U. 2022. ข้อเสนอแนวทางการรับมือกับปัญหาการระบาดของโรคอหิวาต์แอฟริกาในสุกรในประเทศไทย. Retrieved February 2022, from TDRI Thailand Development Research Institute: https://tdri.or.th/2022/02/afs-recommendations-prevention-control/

Premashthira, A., Photchanaprasert, N., & Ratanavanichrojn, N. (2020). Changes in production, values, and marketing margins of Thailand pork industry. KHON KAEN AGR, 48(5), pp 1142-1161.

SRAT (Swine Raisers Association of Thailand). 2019. Epidemic news. Retrieved February 21, 2022, from The Swine Raisers Association of Thailand: https://www.swinethailand.com/17076293/สมาคมผู้เลี้ยงสุกรแห่งชาติ-ผนึกกำลัง-ซีพีเอฟ-เบทาโกร-ไทยฟู้ดส์-ป้องอหิวาต์แอฟริกาในสุกร

SRAT (Swine Raisers Association of Thailand). 2022. Price. Retrieved Febuary 8, from The Swine Raisers Association of Thailand: https://www.swinethailand.com/16866405/5ราคาสุกรขุน-ปี-2561-2565

SRAT (Swine Raisers Association of Thailand). 2022. Pig Production and Trade News. Retrieved February 2022, from The Swine Raisers Association of Thailand: https://www.swinethailand.com/17332752/live-pig-pork-price-decline-?fbclid=IwAR1HQC4Vbz4Xnf0-aXrh-d8eBfKqYreNM7hK2bysV_CkZ5Ug7P4pbmzvjeA

Thornton, P. K. 2010. Livestock Production: Recent Treands, Future Prospects. Philosophical Transactions of The Royal Society B, 365, pp 2853 - 2867.

Woonwong, Y., Tien, D. D., & Thanawongnuwech, R. 2020. The Future of the Pig Industry After the Introduction of African Swine Fever into Asia. Animal Frontiers, 10(4), pp 30-37.

[1] The exchange rate on 8 March 2022 is THB 33.1 = US$1. Source: Bank of Thailand (2022)