ABSTRACT

Responding to changes in global consumption habits such as markets and consumer choices, the food industry has to promptly adjust the marketing strategies for the structure and development of agricultural production needs. In Taiwan, the barriers of high production and marketing costs have caused agricultural productions to lose their competitiveness in the international market. Therefore, the Council of Agriculture (COA) seeks to restructure Taiwan's agricultural production system by developing high-value agricultural materials and integrating industry. The COA also hopes to stabilize farmers’ income and creates a positive cycle in the supply chain by speeding up the development of emerging agricultural materials, accelerating their application in related industry chains, establishing effective verification mechanisms, and promoting cooperation among the farmers' groups. In this article, we would introduce a shikuwasa case to illustrate how the COA successfully promotes value-added agriculture ingredients.

Keywords: Value-added, agricultural ingredients, supply chain, Taiwan

INTRODUCTION

Due to changes in global consumption habits, improvements in living standards and education levels, and the rising awareness of environmental and food safety issues, consumers now emphasize sanitation, safety, and quality of agricultural materials. The industry structure and development model of agricultural productions have to adapt promptly to these changes in the consumer market and international trends. According to the market survey conducted by the Agricultural Technology Research Institute (ATRI), 80.6% of Taiwanese consumers buy health foods at least one time every 6 months, and 78.6% use external skin care products at least once a day. These survey data indicate that the market demand for functional processed products has great potential nowadays. However, the aging agricultural population in Taiwan has led to a decline in productivity, and the natural environment has limited the scale of agricultural production. These causes also resulted in Taiwan's high agricultural production and marketing costs and consistent loss in global competitiveness.

To regain its competitive edge in the agriculture sector, the Taiwan government tries to improve the agricultural industry structure, increase the added-value of agricultural ingredients, find out the industry gap and fill it, explore the developing potential of various crops, and coordinate with the participants in the supply chain to build a complete production system. Only by changing the production model from traditional to market-oriented, the participants in the supply chain can turn their profits and have more opportunities to expand the domestic and overseas markets. Therefore, the Council of Agriculture (COA) has implemented the "Building New Agricultural Business Models, Shaping Multi-Values and the New Agricultural Innovation Promotion Programs." The strategies of these programs include:

- developing agricultural materials with functional ingredients to meet consumer needs,

- applying intelligent technologies to enhance breeding techniques for producing plants with functional ingredients,

- researching cultivars and enhancing active ingredients to increase the added-value of processed products, and

- transforming domestic agricultural ingredients production systems to scale them up to the level of industrial production.

After researching and identifying the problems of developing the emerging agricultural ingredients industry, the COA found that sufficient incentives would be essential to encourage companies to join the supply chains. The main point of integrating the supply chain is the companies' willingness to invest. That depends on whether the characters of the emerging agricultural ingredients are special enough to create a new market.

Furthermore, before the companies invest in the supply chain of emerging agricultural ingredients, they need to evaluate four indicators, including industry regulations and policies, commercialization potential, production capacity, and products competitiveness. If one of these indicators failed to meet the criterion, industrial-scale production could be difficult and challenging to happen. As examples, production capacity relates to the supply stability and price volatility of materials, which can significantly affect a company's willingness to undertake investment projects. The next consideration is compliance with the safety and utilization regulations of the local market. If the regulation barrier is too high to cross, the industry would be difficult to develop—moreover, the technical advantages and consumption trends strongly influence the willingness of the companies to invest.

To respond to the market demand and build the business ecosystem for developing emerging products and technologies, the COA has to support the R&D activities, establish the industry standards, encourage investments, and provide industry consulting services to small and medium enterprises. In the following paragraphs, we will use the case of shikuwasa (Citrus depressa) fruit as an example to introduce how the COA promotes value-added agricultural ingredients.

CREATING A PRODUCTION SYSTEM IN RESPONSE TO MARKET DEMAND-A CASE STUDY OF THE SHIKUWASA (CITRUS DEPRESSA) INDUSTRY

Shikuwasa (Citrus depressa) is a native citrus species in Taiwan and Okinawa of Japan, and its fruits have the characters of rich citrus flavor and sour taste. The shikuwasa fruits are usually processed into a special sauce for the Hakka dishes in Taiwan, but the distribution channels of its processing products were limited. Since the shikuwasa fruits can be seen as a healthy food in Okinawa and became popular in recent years, their related applications and products have raised customers' attention in Taiwan. Under the promotion of local governemnt, the contracted farming area for shikuwasa increased from 280 hectares in 2019 to 312 hectares in 2020, and more than 150 farmers have been contracted to row shikuwasa. Even though shikuwasa has been large-scale produced in Taiwan, it didn't have enough competitiveness in the fresh edible fruits market due to its unique taste. Therefore, the product type of processed juice became the leading product in the consumer market in Taiwan.

Meanwhile, consumers still have few cognitions about this crop; the lack of consumer awareness in the domestic market has restricted the development of distribution channels. Nevertheless, this fruit has abundant functional ingredients, and studies about its function have been reported in the past years. Several primary processing companies are already involved in producing related products, and the industry also attracted biotech companies to join it and develop high value-added products.

As the shikuwasa case showed, the four indicators discussed above are essential. This is another factor that is crucial as the above indicators show the consensus of participants in the supply chain. The COA deligated the ATRI to build a High Value-Added Products Consultant Service Team (hereinafter referred to as "consultant service team") to provide consultant service for companies that produce high value-added products. The consultant service team also helps the participants in the supply chain to form an industry alliance for maintaining consensus and encouraging cooperation among industry players. In this way, we can create a demand-driven production system, which can also balance the needs of both supply and demand sides. Furthermore, the regional and local agricultural clusters will form and develop a virtuous cycle of regional agricultural activities.

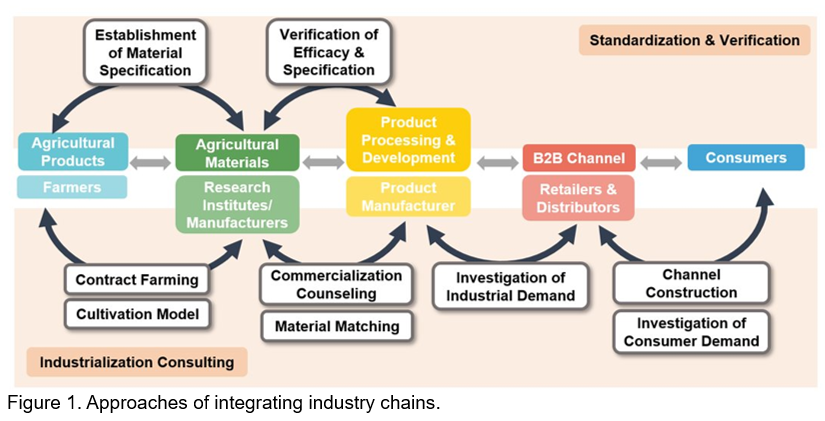

The consultant service team provided four major services, including "market evaluation and benchmark analysis," "industry research and development consulting services," "industry integration and guidance for enterprises," and "performance promotion and information distrubution" to create a production system based on market demand (Fig.1).

Market assessment and benchmark analysis

The consultant service team started with a questionnaire survey to learn about consumer preferences. The results showed that consumers readily accept ingredients such as lemon, shikuwasa, and tangerine, and they exhibited high confidence in health products and skincare products that contain such ingredients. According to the product trend analysis for the Asia Pacific, the primary market of shikuwasa currently lies in Japan. There is great potential for developing functional food products, beverages, and cosmetic products. The patent analysis also shows that shikuwasa has made significant progress in these three major sectors. In addition to using shikuwasa in general food and beverage products, its claimed functions in health products and skincare products have also been recognized by companies and consumers. Therefore, we have established the competitive niches of shikuwasa in health and skincare products in the market opportunity analysis.

Industry research and development consulting services

To understand the healthy effect of shikuwasa ingredients on humans, the consultant service team cooperated with the COA's research institutes to evaluate functional components (e.g., nobiletin, tangeretin, hesperidin, etc.) of shikuwasa to blood lipid and blood pressure modulation in animals. The evaluations help increase the opportunities for shikuwasa to become a novel raw material for high-end manufacturing products. For expanding the product diversification of shikuwasa, the consultant service team also bridged the Kaohsiung District Agricultural Research and Extension Station (KDARES) of the COA to cooperate with the Shikuwasa Cooperative for developing three types of innovative products, including the "shikuwasa RTD beverage," "shikuwasa popcorn," and "shikuwasa sparkling water." Other than general food, we also helped two other biotechnology companies invest in developing prototype products such as the "shikuwasa dietary supplements" and "shikuwasa shower gel and body lotion" and expanded diverse distribution channels for domestic shikuwasa.

Industry integration and guidance for enterprises

At the same time of developing new products of shikuwasa fruits, the consultant service team reviewed the industry's requirements and discussed with more than nine companies, clarifying the standards and specifications for accepting shikuwasa health products. On the other side, the team successfully helped domestic shikuwasa farmer cooperatives to produce fresh and frozen shikuwasa peel materials that meet the standards for biotechnology companies. The biotechnology companies also established a Certificate of Analysis (CoA) system and facilitated more than 300kg of compliant materials into their products. In this case, the cooperative and its contracted farmers obtained at least NT$260,000 (eqivalent to US$9,286) in profits in the collaborative procurement, which was expected to create the output value of at least 1,000 bottles of shikuwasa dietary supplements.

Performance promotion and information dissemination

For promoting the research achievements of shikuwasa fruits, the COA held a press conference, “Healthy Shikuwasa Product — Producer and Government Partnership Create New Opportunities,” to display the products developed in these programs. It showcased more than ten prototype products, including concentrated shikuwasa powder, pure shikuwasa juice, shikuwasa candy, and shikuwasa tea. The event also included demonstrating the processing technology and healthy and natural diets to attract more partners or production resources (Fig.3). The promoting event has contributed to the expansion of 12 online and physical channels of domestic and overseas markets for shikuwasa products, which have created more than NT$3.96 million (eqivalent to US$141,429) in economic benefits.

CONCLUSION

Taiwan is endowed with abundant agricultural resources. In addition to shikuwasa, crops such as mango, Chinese yam, and black soybean have great potential for becoming important benchmark crops. However, the lack of platforms and mechanisms for integration in the industry has confined such resources. With the help from the consultant service team, Taiwan’s shikuwasa industry has created more comprehensive procurement and verification mechanisms. This industry has included several OEM manufacturers for fresh fruit, bottled juice, and shikuwasa powder products to provide support, and it continues to develop additional distribution channels. By establishing the guidance of this industry, the unit value of shikuwasa fruits increased by approximately 20 times after they were processed into ingredients, and the final product is expected to be 75 times more valuable. The industry chain optimization has enhanced the output of the shikuwasa fruits, developed various natural and healthy products for customers, and encouraged consumption. It has powered the multiple developments of future products and led the domestic agricultural ingredient industry into a new era.

REFERENCES

Cheng C.Y., Chang C.C., Lin, S.S., Chang L.C., Lin Y.T., Lin H.S. (2020, December 2) Promote the industrialization of agricultural materials, construct high-value agricultural materials development and industrial chain. Global Views Monthly. https://www.gvm.com.tw/article/76114

The Value-Added Agricultural Ingredients Development Strategies in Taiwan

ABSTRACT

Responding to changes in global consumption habits such as markets and consumer choices, the food industry has to promptly adjust the marketing strategies for the structure and development of agricultural production needs. In Taiwan, the barriers of high production and marketing costs have caused agricultural productions to lose their competitiveness in the international market. Therefore, the Council of Agriculture (COA) seeks to restructure Taiwan's agricultural production system by developing high-value agricultural materials and integrating industry. The COA also hopes to stabilize farmers’ income and creates a positive cycle in the supply chain by speeding up the development of emerging agricultural materials, accelerating their application in related industry chains, establishing effective verification mechanisms, and promoting cooperation among the farmers' groups. In this article, we would introduce a shikuwasa case to illustrate how the COA successfully promotes value-added agriculture ingredients.

Keywords: Value-added, agricultural ingredients, supply chain, Taiwan

INTRODUCTION

Due to changes in global consumption habits, improvements in living standards and education levels, and the rising awareness of environmental and food safety issues, consumers now emphasize sanitation, safety, and quality of agricultural materials. The industry structure and development model of agricultural productions have to adapt promptly to these changes in the consumer market and international trends. According to the market survey conducted by the Agricultural Technology Research Institute (ATRI), 80.6% of Taiwanese consumers buy health foods at least one time every 6 months, and 78.6% use external skin care products at least once a day. These survey data indicate that the market demand for functional processed products has great potential nowadays. However, the aging agricultural population in Taiwan has led to a decline in productivity, and the natural environment has limited the scale of agricultural production. These causes also resulted in Taiwan's high agricultural production and marketing costs and consistent loss in global competitiveness.

To regain its competitive edge in the agriculture sector, the Taiwan government tries to improve the agricultural industry structure, increase the added-value of agricultural ingredients, find out the industry gap and fill it, explore the developing potential of various crops, and coordinate with the participants in the supply chain to build a complete production system. Only by changing the production model from traditional to market-oriented, the participants in the supply chain can turn their profits and have more opportunities to expand the domestic and overseas markets. Therefore, the Council of Agriculture (COA) has implemented the "Building New Agricultural Business Models, Shaping Multi-Values and the New Agricultural Innovation Promotion Programs." The strategies of these programs include:

After researching and identifying the problems of developing the emerging agricultural ingredients industry, the COA found that sufficient incentives would be essential to encourage companies to join the supply chains. The main point of integrating the supply chain is the companies' willingness to invest. That depends on whether the characters of the emerging agricultural ingredients are special enough to create a new market.

Furthermore, before the companies invest in the supply chain of emerging agricultural ingredients, they need to evaluate four indicators, including industry regulations and policies, commercialization potential, production capacity, and products competitiveness. If one of these indicators failed to meet the criterion, industrial-scale production could be difficult and challenging to happen. As examples, production capacity relates to the supply stability and price volatility of materials, which can significantly affect a company's willingness to undertake investment projects. The next consideration is compliance with the safety and utilization regulations of the local market. If the regulation barrier is too high to cross, the industry would be difficult to develop—moreover, the technical advantages and consumption trends strongly influence the willingness of the companies to invest.

To respond to the market demand and build the business ecosystem for developing emerging products and technologies, the COA has to support the R&D activities, establish the industry standards, encourage investments, and provide industry consulting services to small and medium enterprises. In the following paragraphs, we will use the case of shikuwasa (Citrus depressa) fruit as an example to introduce how the COA promotes value-added agricultural ingredients.

CREATING A PRODUCTION SYSTEM IN RESPONSE TO MARKET DEMAND-A CASE STUDY OF THE SHIKUWASA (CITRUS DEPRESSA) INDUSTRY

Shikuwasa (Citrus depressa) is a native citrus species in Taiwan and Okinawa of Japan, and its fruits have the characters of rich citrus flavor and sour taste. The shikuwasa fruits are usually processed into a special sauce for the Hakka dishes in Taiwan, but the distribution channels of its processing products were limited. Since the shikuwasa fruits can be seen as a healthy food in Okinawa and became popular in recent years, their related applications and products have raised customers' attention in Taiwan. Under the promotion of local governemnt, the contracted farming area for shikuwasa increased from 280 hectares in 2019 to 312 hectares in 2020, and more than 150 farmers have been contracted to row shikuwasa. Even though shikuwasa has been large-scale produced in Taiwan, it didn't have enough competitiveness in the fresh edible fruits market due to its unique taste. Therefore, the product type of processed juice became the leading product in the consumer market in Taiwan.

Meanwhile, consumers still have few cognitions about this crop; the lack of consumer awareness in the domestic market has restricted the development of distribution channels. Nevertheless, this fruit has abundant functional ingredients, and studies about its function have been reported in the past years. Several primary processing companies are already involved in producing related products, and the industry also attracted biotech companies to join it and develop high value-added products.

As the shikuwasa case showed, the four indicators discussed above are essential. This is another factor that is crucial as the above indicators show the consensus of participants in the supply chain. The COA deligated the ATRI to build a High Value-Added Products Consultant Service Team (hereinafter referred to as "consultant service team") to provide consultant service for companies that produce high value-added products. The consultant service team also helps the participants in the supply chain to form an industry alliance for maintaining consensus and encouraging cooperation among industry players. In this way, we can create a demand-driven production system, which can also balance the needs of both supply and demand sides. Furthermore, the regional and local agricultural clusters will form and develop a virtuous cycle of regional agricultural activities.

The consultant service team provided four major services, including "market evaluation and benchmark analysis," "industry research and development consulting services," "industry integration and guidance for enterprises," and "performance promotion and information distrubution" to create a production system based on market demand (Fig.1).

Market assessment and benchmark analysis

The consultant service team started with a questionnaire survey to learn about consumer preferences. The results showed that consumers readily accept ingredients such as lemon, shikuwasa, and tangerine, and they exhibited high confidence in health products and skincare products that contain such ingredients. According to the product trend analysis for the Asia Pacific, the primary market of shikuwasa currently lies in Japan. There is great potential for developing functional food products, beverages, and cosmetic products. The patent analysis also shows that shikuwasa has made significant progress in these three major sectors. In addition to using shikuwasa in general food and beverage products, its claimed functions in health products and skincare products have also been recognized by companies and consumers. Therefore, we have established the competitive niches of shikuwasa in health and skincare products in the market opportunity analysis.

Industry research and development consulting services

To understand the healthy effect of shikuwasa ingredients on humans, the consultant service team cooperated with the COA's research institutes to evaluate functional components (e.g., nobiletin, tangeretin, hesperidin, etc.) of shikuwasa to blood lipid and blood pressure modulation in animals. The evaluations help increase the opportunities for shikuwasa to become a novel raw material for high-end manufacturing products. For expanding the product diversification of shikuwasa, the consultant service team also bridged the Kaohsiung District Agricultural Research and Extension Station (KDARES) of the COA to cooperate with the Shikuwasa Cooperative for developing three types of innovative products, including the "shikuwasa RTD beverage," "shikuwasa popcorn," and "shikuwasa sparkling water." Other than general food, we also helped two other biotechnology companies invest in developing prototype products such as the "shikuwasa dietary supplements" and "shikuwasa shower gel and body lotion" and expanded diverse distribution channels for domestic shikuwasa.

Industry integration and guidance for enterprises

At the same time of developing new products of shikuwasa fruits, the consultant service team reviewed the industry's requirements and discussed with more than nine companies, clarifying the standards and specifications for accepting shikuwasa health products. On the other side, the team successfully helped domestic shikuwasa farmer cooperatives to produce fresh and frozen shikuwasa peel materials that meet the standards for biotechnology companies. The biotechnology companies also established a Certificate of Analysis (CoA) system and facilitated more than 300kg of compliant materials into their products. In this case, the cooperative and its contracted farmers obtained at least NT$260,000 (eqivalent to US$9,286) in profits in the collaborative procurement, which was expected to create the output value of at least 1,000 bottles of shikuwasa dietary supplements.

Performance promotion and information dissemination

For promoting the research achievements of shikuwasa fruits, the COA held a press conference, “Healthy Shikuwasa Product — Producer and Government Partnership Create New Opportunities,” to display the products developed in these programs. It showcased more than ten prototype products, including concentrated shikuwasa powder, pure shikuwasa juice, shikuwasa candy, and shikuwasa tea. The event also included demonstrating the processing technology and healthy and natural diets to attract more partners or production resources (Fig.3). The promoting event has contributed to the expansion of 12 online and physical channels of domestic and overseas markets for shikuwasa products, which have created more than NT$3.96 million (eqivalent to US$141,429) in economic benefits.

CONCLUSION

Taiwan is endowed with abundant agricultural resources. In addition to shikuwasa, crops such as mango, Chinese yam, and black soybean have great potential for becoming important benchmark crops. However, the lack of platforms and mechanisms for integration in the industry has confined such resources. With the help from the consultant service team, Taiwan’s shikuwasa industry has created more comprehensive procurement and verification mechanisms. This industry has included several OEM manufacturers for fresh fruit, bottled juice, and shikuwasa powder products to provide support, and it continues to develop additional distribution channels. By establishing the guidance of this industry, the unit value of shikuwasa fruits increased by approximately 20 times after they were processed into ingredients, and the final product is expected to be 75 times more valuable. The industry chain optimization has enhanced the output of the shikuwasa fruits, developed various natural and healthy products for customers, and encouraged consumption. It has powered the multiple developments of future products and led the domestic agricultural ingredient industry into a new era.

REFERENCES

Cheng C.Y., Chang C.C., Lin, S.S., Chang L.C., Lin Y.T., Lin H.S. (2020, December 2) Promote the industrialization of agricultural materials, construct high-value agricultural materials development and industrial chain. Global Views Monthly. https://www.gvm.com.tw/article/76114