ABSTRACT

The COVID-19 pandemic shakes nearly all industries and sectors across the globe. The very reason that the agricultural and food sector is recognized as the essential business also make it comparatively vulnerable to the strike of the pandemic that requires limited movement regulation and stringent social distancing measure to contain the spread of virus. This paper attempts to provide a bird’s-eye view of the trends and evolution in the agriculture and food market as well as the impacted stakeholders along the supply chain under the pandemic in the United States and the European Union. Focus industries include dairy, meat, fruits, vegetables, and wine. We present various policy responses and implementations across these two continents on the same page in this article, parallel with the fluctuations in the marketplace, which aim to help correct or adjust both the short-run and structural issues facing producers, distributors, retailers, and consumers. We expect to bring in further discussions and reflections on the market dynamics and shed lights on both developed and under-developed effective strategies used to revive and sustain the economy, within and beyond the agri-food sector.

Keyword: COVID-19, agricultural production, supply chain, meat, produce, wine, policy response

INTRODUCTION

The COVID-19 pandemic has drastically changed the way the society and economy function. And the Corona virus does not spare any nation and industry, even the highly developed countries with predictably the most resources and capital to tackle this urgent issue. In essence, the COVID-19 pandemic differs from financial crisis in 2008-09 and Great depression back in the 1930s. The nearly unstoppable spread of SARS-Cov-2 and the consequent lockdown order on large swath of areas hit almost every aspect of lives and business operations, imposing challenges on food service and processing sector that require face-to-face contact. This article focuses on the impacts of COVID-19 on agricultural and food sector in the United States and European Union, where its well-developed service sector grounds to a halt that further influences the upstream agricultural production and downstream food provision and availability.

Facing the ongoing and imminent living threats posed by the virus, various interventions such as social-distancing practices, facial mask wearing, shelter-in-place or lockdown, suspension of all non-essential businesses and social activities, and international travel bans are used by governments and public sectors as their best attempt to relieve the stress on the health care systems as well as mitigating the associated significant economic and societal losses. Here we briefly categorize the chain effects of COVID-19 on food and agriculture into two likely channels: The strict top-down regulations and orders to flatten the curve hit the food retail and service sector and consumers first. Then it ripples out to the relevant agricultural production environment. Second, the labor supply shortage and working environment inducing high transmission risks facing agricultural producers also weigh in at the beginning, resulting in the disruption in food supply and the availability for consumers at the later stage. Impacted dimension across production, processing, and retail includes issues and public discourse in food security and safety, food distribution and logistics, changes in consumer behavior, as well as food loss and waste.

The sharply dropped air and sea cargo that arises after January in 2020 poses unpredictable challenges on the food supply chain (OECD, 2020). Delays in handling and transporting bring additional layer of logistics concerns to ensure the safety of food and agricultural products where sanitary and phytosanitary standards are required. Intention of several Central Asia and Southeast Asia countries to enforce export restrictions of key commodities including rice raises fear and influences the expectation among the international markets. The global staple crop markets remain relatively stable and optimistic while the perishable produce is more vulnerable to such trade flow restrictions (AMIS, 2020). Likely disruptions to labor and input supply such as seeds and fertilizers could have significant impacts on the crop production and farm management well into the next year, therefore increasing the uncertainty in the sufficiency of food availability.

Two specialized supply chains constitute the downstream of the food industry: One serves households. Another reaches the food-service industry. When the shelter-in-place order makes restaurants close business and most people begin to work from home, both the food and agricultural system experienced unprecedented disruptions. The collapse in demand from institutions including restaurants, schools, hospitals, and hotels shocks the produce and dairy supply. The supply chains in these two dimensions are also very much specialized that it’s challenging to convert the tremendous losses from food service industry into the potential gains which might possibly be fully absorbed by the grocery store chain, which would also help sustain the production capacity without being forced to dump the excess supply (Norwood and Peel, 2020).

This paper is structured by examining the impacts through several layer of lens on key commodities or crops and the stakeholders along the value chain. Agricultural production includes crops, livestock, and fishery as well as the impacts on labor market. Food industry dimension will take a closer look at the evolution of the marketplace under the pandemic. Combining the production and value chain perspectives towards the current situation of agricultural and food markets in U.S. and Europe, we also aim to highlight potential development in the future and implications for Asian countries.

OBSERVATIONS AND POLICY RESPONSES IN THE U.S.

Treating April as the cut-off period to look at the pattern of labor disruption, from February to April, the unemployment rate in food services and processing sector increases nearly 30% and 4.4% respectively. While after May, all the food services, food processing, and food production sector rebound with decrease in unemployment rate at 13.5%, 4.4%, and 0.9% respectively. Shipments of fresh produce for food services could be reduced up to the level of 50%. Panic shopping due to the fear of shortage leads to grocery spending rising for more than 50%. (Pena-Levano, 2020). Such emotion-driven purchasing behavior also leads to the unavailability of some food items for consumers in their regular shopping: 13% say they “often” found that foods are out-of-stock while 44% say they “sometimes” (Norwood and Peel, 2020).

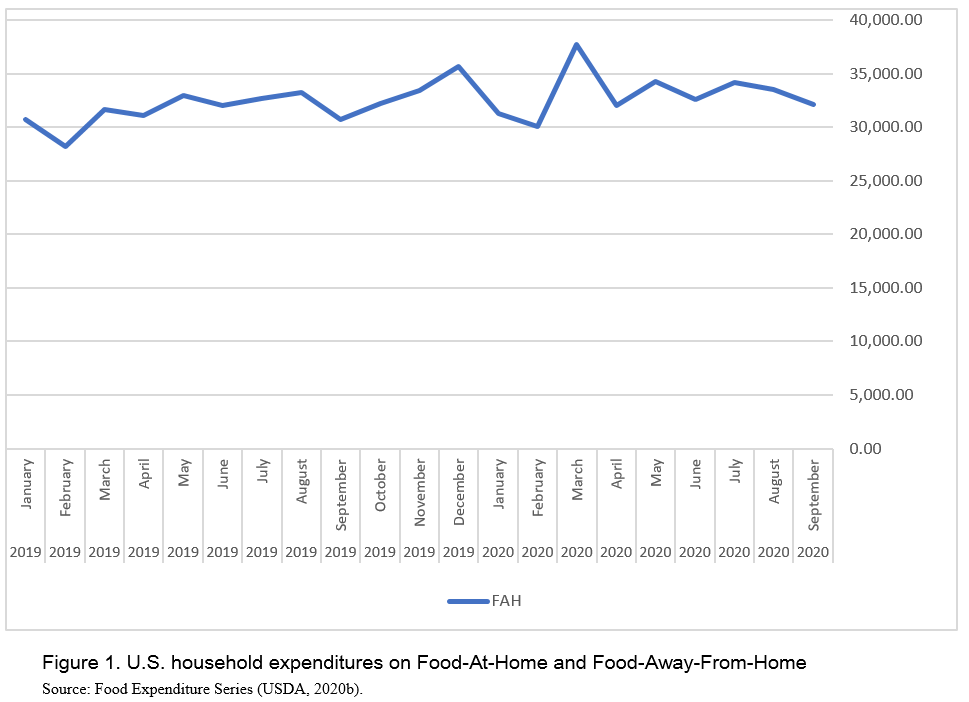

In terms of value for all purchases across different outlets, more of overall food expenditures go to grocery stores and other similar outlets which makes up the bulk share of food-at-home spending, compared to that goes to restaurants, drinking places, and schools. The difference is approximately $50 billion dollars, as shown in Figure 1 (USDA, 2020b). The long-lasting impact on the consumer side could be the shift in their preference and purchase willingness further toward safety and local food attributes (Melo, 2020).

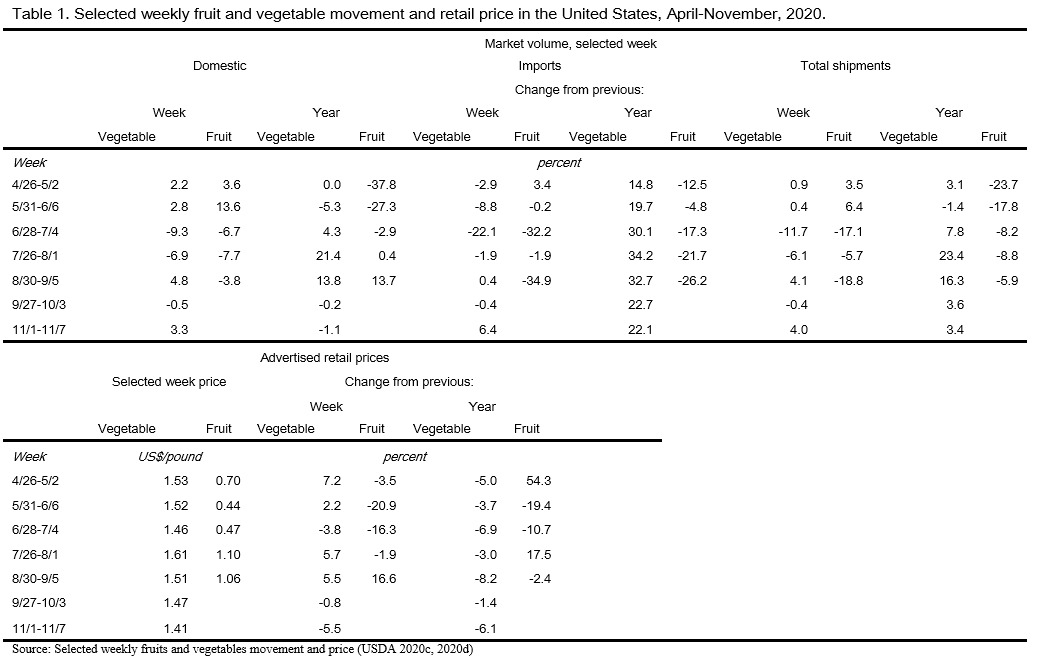

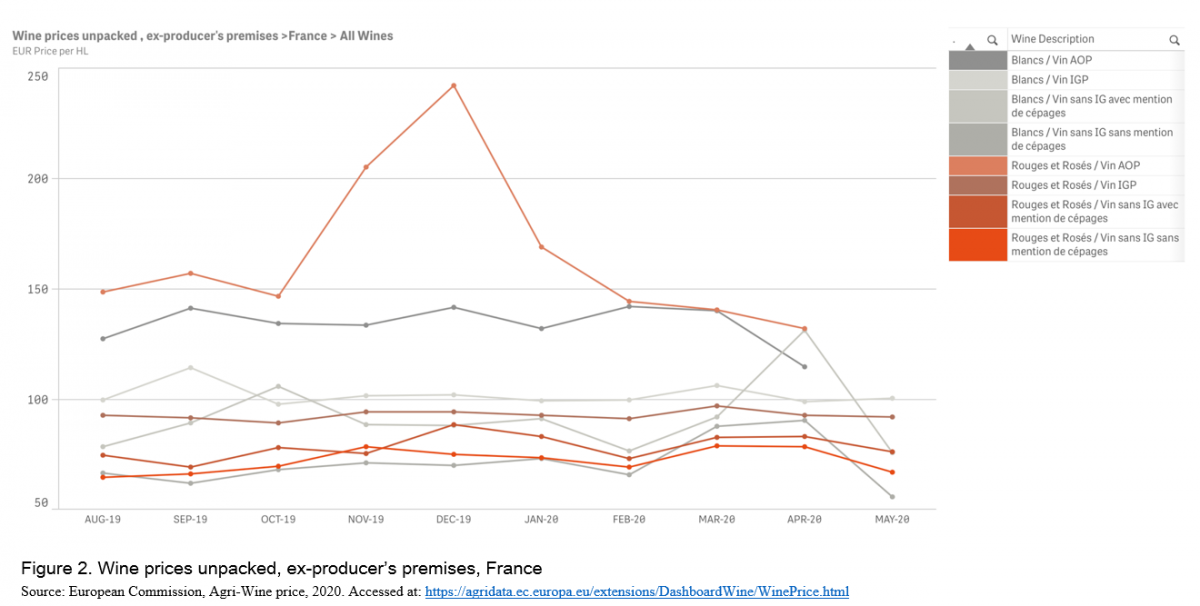

This article takes deeper look into certain crop and food markets while those that are not covered here are still worthwhile for further examination. Table 2 shows the price and shipment movement of aggregated fruit and vegetable crops. In vegetable markets, for selected weeks from April to November, the total shipments including domestic and imports increase between 15-25% in July and August while around 3.5% since September compared to the same week in the last year. The price declines between 3-8% since April and reaches the greatest difference at 8.2% compared to the last-year level. In fruit markets, the change in total shipment shows a negative direction compared to the level last year but the gap reduces from April to August. At the peak of pandemic, the fruit price increases by more than 50% at the end of April compared to the same period last year while decreases by more than 10% in the beginning of June and July. One recent empirical study estimates the impact of COVID-19 on fruit and vegetable production due to the pandemic-induced disruption in the labor market. Major crop losses are taking place in main production states such as California, Arizona, Washington, and Florida and the crop-specific losses range from $5 million for apples to $16 million for lettuce (Ridley and Devadoss, 2020).

For the livestock and meat sector, the broiler industry is less affected by the COVID-19 compared to pork and beef. The daily processing capacity for beef and pork was 40% lower than the prior year level at the end of April (Lusk et al., 2020). However, there is one key policy difference facing different livestock and meat industry: Producers of cattle and hogs receive direct payments based on actual losses while poultry producers do not receive such relief since they don’t own the birds themselves and do not have full control of the bird management system (Maple et al., 2020).

The wine market experiences a surge in demand at the off-premise stores and direct-to-consumer channels during the pandemic times (McDonald, 2020). To begin with the price evolution, the average price per 750 ML at direct-to-consumer shipment is lower throughout this year compared to the last-year level: In October, the price is at US$45.67, around US$5 lower than the level last October. The decline in retail prices is caused by the much smaller increase in shipment value than the increase in volume (9L cases). In April, the shipment value is 18% higher and the volume is 45% higher compared to its counterpart last year. The story is different in the price evolution in the retail off-premise channel. The price is higher this year and the gap in price between this and last year gets larger as the season moves into Winter. At the end of October, the off-premise price is US$11.33, greater than the last year price by less than US$1. The value and volume at retail off-premise channel reach its peak in May this year, one month later compared to that observed within the direct-to-consumer channel, along with the 34% and 29% greater in the magnitude than the performance last year.

USDA provides two platforms for all the stakeholders along the food supply chain including consumers to tackle consequent food and agricultural sectoral problems during the pandemic. One designates FAQ sections for the timely policy responses to several key aspects including Farmer Resources, Food Assistance, Loans, School Meals, Food Supply Chain, Animals and Plants, and National Forests. Another one sketches out more focused themes, particularly the Farmer Resources, on current USDA flexibilities and programs including Coronavirus Food Assistance Program (CFAP), Dumped milk, Crop insurance flexibilities, Farm loan and Commodity loan flexibilities, Crop acreage reporting, Animal mortality, as well as Small Business Administration Programs for Farmers (USDAa, 2020). Here we present the takeaway messages for selected programs in both platforms.

Included in the CFPA in Phase I, USDA had planned to procure an estimated $3 billion in fresh fruits & vegetables, dairy, and meat products to distribute to food pantries and food banks to ensure the sufficient food available for disadvantaged communities. Several food and nutritional programs have been implemented underway to guarantee the secure and healthy status for American families (FNS, 2020): States provide free meals for children, SNAP benefits increase along with expanded access to buy online, and state and local agencies provide food directly to households under disaster household distribution program. Coronavirus Food Assistance Program was renewed in September into its second phase (CFAP 2) with additional US$14 billion dollars to assist producers to overcome the associated adjustment and marketing costs resulting from the market disruptions such as abrupt reduction in demand and short-run oversupply. CFAP 2 supports row crops, livestock, specialty crops, dairy, and aquaculture, which are then categorized into three broader groups receiving payments based on different criteria through Farm Service Agency (FSA).

Price trigger commodities are major commodities that met a minimum 5% price decline over the specified period, including barley, corn, sorghum, soybeans, sunflowers, upland cotton, wheat, broilers, eggs, milk, and livestock. For commodities, the payment is based on the 2020 planted acres multiplied by either $15/acre or by the adjustment of crop-specific rate and approved yield from the individual- or county-level production history. For broilers and eggs, payments are based on 75% of last year production. Payments for dairy and livestock are based on actual production and maximum own inventory between this April and August, respectively. Flat-rate crops are those which do not encounter such trigger-level price decline or do not have available data. Including alfalfa, extra long staple cotton, oats, peanuts, rice, hemp, millet, mustard, safflower, sesame, triticale, rapeseed, this category receives payments based on 2020 acres and rate at US$15/acre. The third category, Sales Commodities, includes specialty crops, aquaculture, nursery crops, floriculture, and other commodities not included in the first two categories. Payment calculation uses a sales-based approach, associated with 2019 sales.

For crop insurance program, several flexibilities are provided in response to the COVID-19, including allowing the electronic submission of reports and notifications, production date extension, extended time for premium payment and acreage reports, and allowing alternative transaction format for 2021 crop year sales. Risk Management Agency also works closely with approved insurance provider (API) to introduce more flexibilities for certain crop industry such as dairy, nursery, perennial crop, and organic acreage report. Dumped milk is counted as milk marketing for Dairy Revenue Protection or actual marketing for Livestock Gross Margin for Dairy programs. Farmers will not be inappropriately penalized by the dumping behavior; the insurance indemnity and payment schedule will not be affected by this type of non-natural disaster leading to production losses.

Regarding loan flexibility programs, USDA’s Farm Service Agency is providing farmers more credit options to sustain, particularly in tough times, annual operating and living expenses, term investments, emergency needs, and stable cash flow. Deadlines are extended for producers who have to respond to application for direct loans. Foreclosure or eviction is temporarily suspended. More flexibility in servicing guaranteed loans now allow Standard Eligible Lenders and Certified Lender Program to certify that they have met the requirement for emergency advances and FSA written approval is no longer needed.

OBSERVATIONS AND POLICY RESPONSES IN E.U.

In the Europe, the supply side of the agricultural market stays comparatively resilient despite the drastic drop in the retailing and food service sector. However, risk remains. Restrictions on the mobility of the seasonal workers dampen the prospects of good harvest for horticultural crops and the processing capacity in the packing facilities for the meat products. Cramped working and living environment and condition for seasonal and migrant workers pose challenges as the tasks required for their jobs would be the least possible to fully enforce social-distancing and good hygiene practices. We use the European Commission Agri-Food Data Portal (European Commission, 2020) for the following analysis across various sectors.

In the dairy sector, raw milk price in EU at the beginning of this year is as strong as the level in 2019, at about €35 per 100kg. All the main production countries, Germany, France, Italy, Netherlands, and Poland, including EU as a whole experience the drop in milk prices starting in February while the price begins to climb back around May. One reason for the decreasing price in March is due to the usual seasonal production peak in April. The private storage aid policy and the drought in some part of Europe help relieve the supply pressure to certain extent (New Zealand Foreign Affairs & Trade, 2020).

In the cattle and beef market, there have been issues for beef slaughterhouses in Ireland and Germany, accompanied by the infectious clusters leading to the closure or slow-down of processing activities and are associated with poor working and living environment (New Zealand Foreign Affairs & Trade, 2020). The price for carcasses goes down between 0.6 and 5.5% compared to the level last year. The price for young bovine, young bulls, and steers drops to the level of €356 per 100kg. The pig market in EU remains resilient in terms of price stability compared to the market in Brazil, U.S., and Canada, although the pig price decreases gradually from nearly €190 per 100kg at the end of February to €140 in October. At the same time, the price in other regions of the world starts to climb back. The EU poultry market actually experiences a more promising market trend in the first quarter this year compared to the level over the past 5 years. However, the broiler price reaches nearly the bottom level at €175 per 100kg in May and June. Both chicken and pork price drop to a record low level this May, compared to their upward trends in the price dynamic during the same period last year. In sheep market, a steep drop in price is observed for the light lamb both due to COVID-19 and the uncertainty resulting from Brexit while the lamb price remains unaffected and high under these two external factors’ influences. Both prices are recovering as the restrictions on the food service sector are gradually lifted.

In fruit and vegetable markets, apples, citrus fruits, and tomatoes are focused using the available data in the Agri-food portal. Compared to the 5-year average, the apple market in July-August experiences decrease in price in all major producing countries including EU except for France, where the price increases from €96 to €108 per 100kg. The citrus market this June experiences a stable upward trend in price movement compared to the 5-year average. The tomato and potato markets both experience a decline in price starting this February and March while the potato price movement in downward pattern experiences as early as in late January. And the potato market is closely interconnected with the near evaporation of demand within the food service industry, e.g., french fries in fast food restaurant.

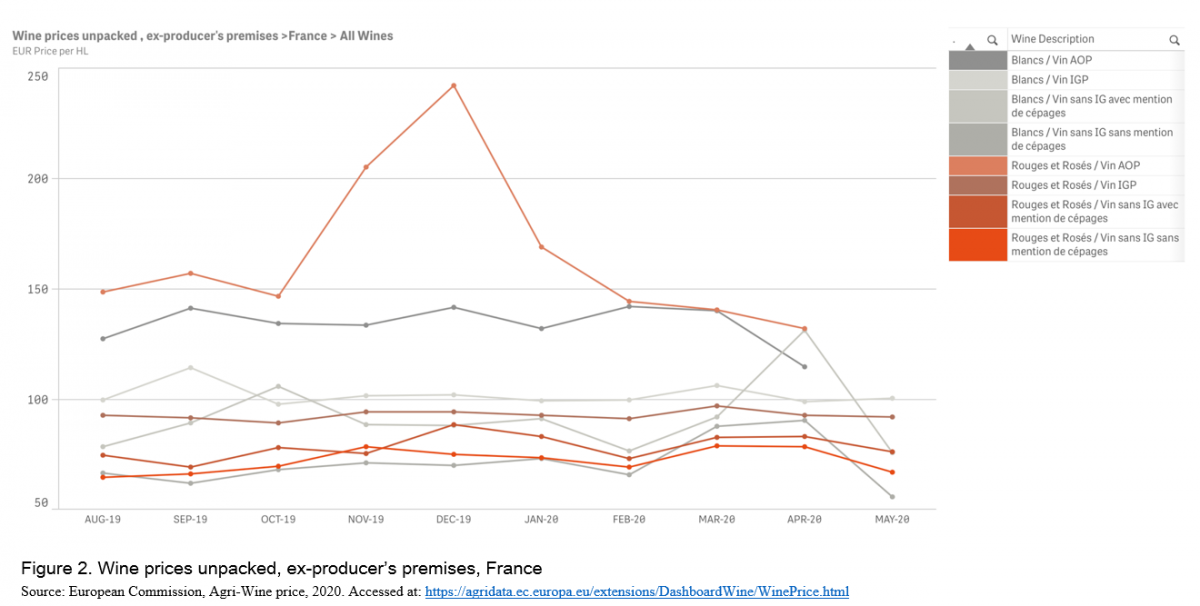

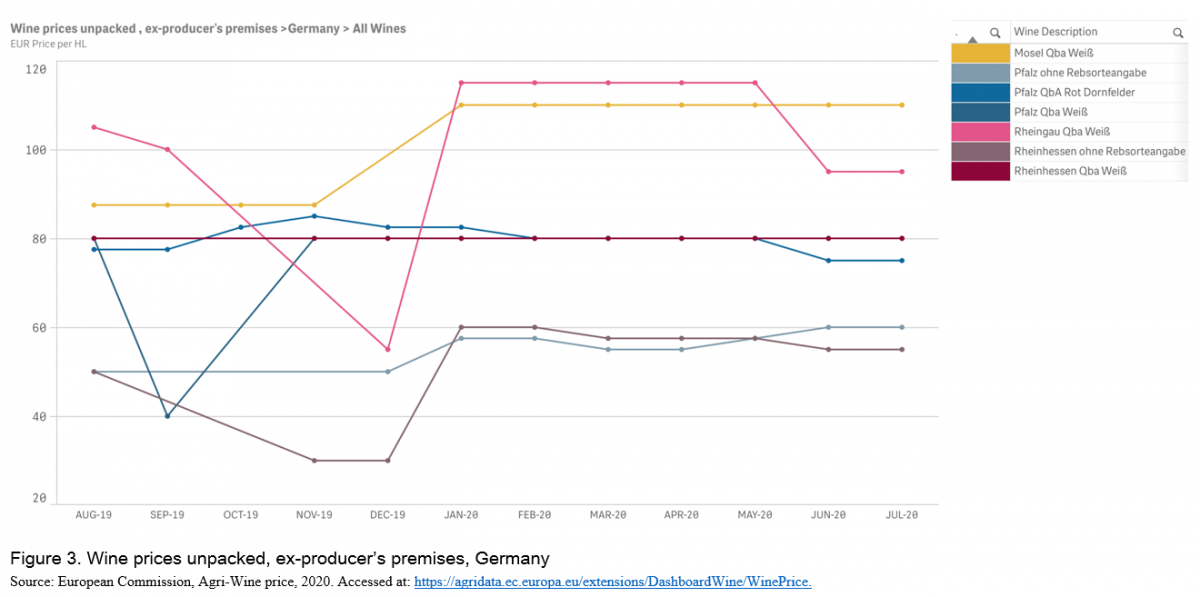

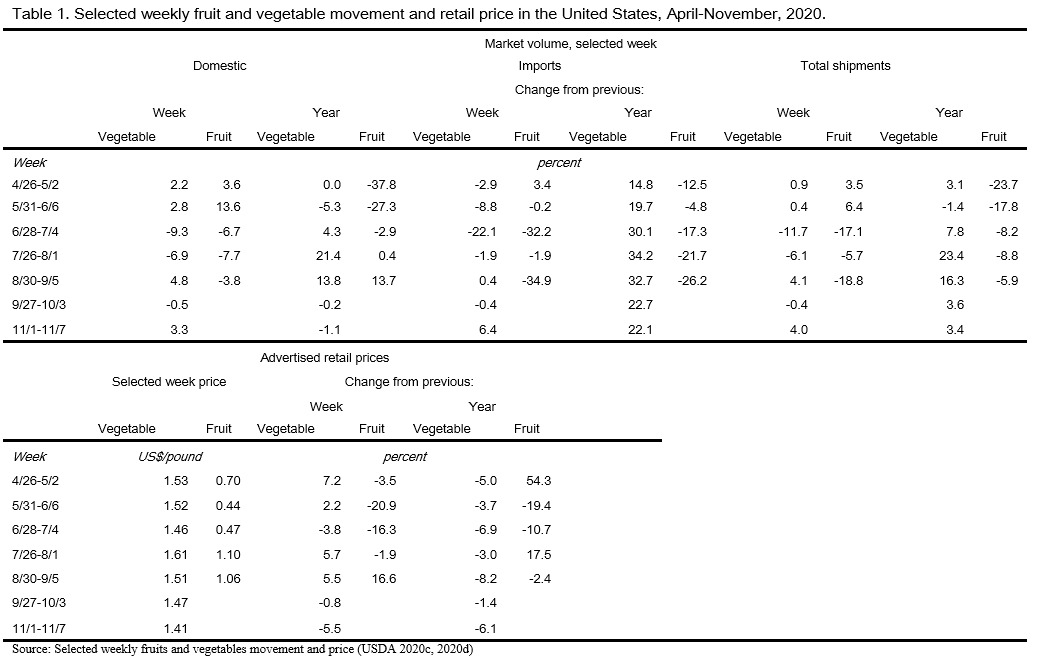

Compared to other industries, the wine market has been observing a degree of resilience and beyond. Figure 2 and 3 shows the bulk wine prices in 2019/2020 in two of the largest wine producing countries in Europe. In Germany, white wine usually goes with higher prices compared to red wine and rose. The price is stagnant starting this January, and starts to observe a decline in price in May, which is perhaps due to the return-to-normal demand in both on- and off-premise retail chains. In France, wine price with AOP and IGP are higher and red wine is usually more expensive than the white wine. The price remains flat starting this January, accompanied by two anomalies: The price for premium red wine with AOP continues to decrease in the beginning of this year. The price for white wine without GI but with the grape name jumps to the level as high as the premium red wine with AOP, which may be reflecting the change in consumer preferences during the lockdown order that drives up the price.

The European Union supports its agricultural and fisheries sector by providing higher advances of payments, allowing flexibility in fund use, establishing ‘green lanes’ program, and raising awareness for seasonal workers (European Commission, 2020b). Some EU policies in alleviating the negative impacts from pandemic target certain crop or livestock industry while others focus on different stakeholders along the supply chain. For fishers and aquaculture producers, support measures include compensation for temporary suspension of fishing activities, temporary cessation or reduction of aquaculture production and marketing services, and economic losses incurred from offshore fishing activities in the outmost regions by the Member States.

Crisis management measures encompass flexibilities and deregulatory rules on certain crops and products. Dairy (skimmed milk powder, butter, cheese) and meat (beef, sheep and goat meat) products, as well as fishery products, are allowed for private storage to restrain the foreseeable oversupply and to withhold the production. The Commission will provide the aid to deal with the withdrawal of such perishable animal products from the market for a maximum of up to 6 months. Derogation from organizational regulation on market competition for potato, milk, and flower sector is authorized. Operators can choose to collectively plan for the overall production or to drop their current production without legal considerations. Commission also implement market support programs that limit the availability and reorient funding priorities for wine, fruits & vegetables, olive products, apiculture, as well as the EU school meal scheme.

Financial instrument such as loans or guarantees for operating expenses of up to €200,000 is available for farmers and rural development beneficiaries. The new state aid under Commission’s temporary framework provides a maximum of €120,000 per farm and of €800,000(?) per food processing and marketing company. Advances of direct payments and rural development payments are raised to increase the cash flow for farmers at the level between 70 and 85%. Any remaining financial aids under rural development funds could be channeled towards farmers and small and medium-sized enterprises for emergency assistance by the Member States, up to €7,000 and €50,000 for these two groups respectively.

In spite of travel restriction, transportation of goods across borders among EU countries is now facilitated by the “Green Lanes” program to ensure the sufficient supply of the agri-food products. Border crossing is expected take no more than 15 minutes at the check points. Seasonal workers are now qualified as “critical” workers who are recognized as indispensable for the agricultural sector, particularly at the harvest season.

CONCLUSION

This article focuses on current market trends and policy responses in the United States and European Union. We provide a brief overview of selected crop, livestock, and food markets across these two continents. The vulnerable market hit around early this Spring starts to climb back to its normal point into Summer and later this Fall and perhaps the upcoming Holiday season around the end of year. Policy recommendations and implementations by the public sector are presented parallel with the observations on the ongoing development and changes in the marketplace. Convergence on the support measures adopted in the U.S. and E.U. land on granting the flexibilities and expediting the lengthy administrative process for various types of application on current market and risk management programs for agricultural, ranching, and fishing sector. Dairy and meat industry receive more attention and production adjustment supports due to its supply chain challenges. Migrant and seasonal farm worker availability remains one of the bottlenecks that block a well-functioning agricultural supply chain, particularly for the horticultural crop and meat industry.

The common thread across these various issues in and outside the U.S. and E.U. is that fixing the demand shock will help restore the supply chain. Both the public and private sector can and should work together to sort out alternatives to minimize the losses incurred from the significant change in the food service landscape and to facilitate the coordination between different marketing channels. Timely response, logistic efficiency, a sound economy, as well as identifying certain vulnerable aspects rooted in some of the agricultural and food industries would contribute to building a more resilient agri-food industry in the future, which serves as a critical buffer for the whole society facing another crisis or disaster at the global scale across national borders in the long run. While during the pandemic and into the post-pandemic times, it would be worthwhile to investigate the potential irreversible and permanent changes taking place in the agriculture and food markets. Developed habits for online grocery shopping when sheltering in place, the mature food delivery service, adjustment of e-commerce platform to accommodate the surge in demand during the lockdown, and demand for safety and local attributes might all continue as a “new normal” and sustain the future of daily life across the United States, European Union, and the Asian countries.

REFERENCES

Agricultural Marketing Information System (AMIS). 2020. Food commodity prices in times of COVID-19. Access at: http://www.amis-outlook.org/news/detail/en/c/1152702/

European Commission. 2020a. Agri-Food Data Portal, Agri-food Markets. Access at: https://agridata.ec.europa.eu/extensions/DataPortal/agricultural_markets.html

European Commission. 2020b. Coronavirus: Emergency response to support the agricultural and food sector. Available at: https://ec.europa.eu/info/sites/info/files/food-farming-fisheries/farming/documents/factsheet-covid19-agriculture-food-sectors_en.pdf

Food and Nutrition Service. 2020. U.S. Department of Agriculture. FNS Responds to COVID-19. Access at: https://www.fns.usda.gov/coronavirus

Lusk, J. L., Tonsor, G. T., & Schulz, L. L. (2020). Beef and Pork Marketing Margins and Price Spreads during COVID‐19. Applied Economic Perspectives and Policy. DOI:10.1002/aepp.13101

Maples, J. G., Thompson, J. M., Anderson, J. D., & Anderson, D. P. (2020). Estimating COVID‐19 Impacts on the Broiler Industry. Applied Economic Perspectives and Policy. DOI:10.1002/aepp.13089

McDonald, Delaney. 2020. “The Data: Wine DtC Shipments and Off-Premise Retail”. SOVOS ShipCompliant. Access at: https://www.sovos.com/shipcompliant/blog/2020/11/17/the-data-wine-dtc-shipments-and-off-premise-retail-october-2020-special-report/

Melo, Grace. 2020. "The Path Forward: U.S. Consumer and Food Retail Responses to COVID-19." Choices. Quarter 3. Available online: https://www.choicesmagazine.org/choices-magazine/theme-articles/covid-19-and-the-agriculture-industry-labor-supply-chains-and-consumer-behavior/the-path-forward-us-consumer-and-food-retail-responses-to-covid-19

New Zealand Foreign Affairs & Trade. August, 2020. MFAT Market Report. European Union: The Impact of Covid-19 on Agricultural Markets. Available at: https://www.mfat.govt.nz/en/trade/mfat-market-reports/market-reports-europe/european-union-the-impact-of-covid-19-on-agricultural-markets-27-august-2020/

Norwood, F. B., and Peel, D. 2020 Supply Chain Mapping to Prepare for Future Pandemics. Applied Economic Perspectives and Policy. DOI: https://doi.org/10.1002/aepp.13125

OECD. 2020. COVID-19 and International Trade: Issues and Actions. Available at:

https://read.oecd-ilibrary.org/view/?ref=128_128542-3ijg8kfswh&title=COV...

Peña-Lévano, L., S. Burney, G. Melo, and C. Escalante. 2020. COVID-19: Effects on U.S. Labor, Supply Chains and Consumption. Choices. Quarter 3. Available at: https://www.choicesmagazine.org/choices-magazine/theme-articles/covid-19-and-the-agriculture-industry-labor-supply-chains-and-consumer-behavior/covid-19-effects-on-us-labor-supply-chains-and-consumption

Ridley, W., & Devadoss, S. (2020). The Effects of COVID‐19 on Fruit and Vegetable Production. Applied Economic Perspectives and Policy. https://doi.org/10.1002/aepp.13107

United States Department of Agriculture, USDA. 2020a. Coronavirus and USDA Assistance for Farmers. Available at: https://www.farmers.gov/coronavirus

United States Department of Agriculture, Economic Research Service, USDA. 2020b. Food Expenditure Series. Accessed on November, 2020: https://www.ers.usda.gov/data-products/food-expenditure-series

United States Department of Agriculture, Economic Research Service, USDA. 2020c. Selected Weekly Fruit Movement and Price. Access on November, 2020: https://www.ers.usda.gov/data-products/fruit-and-tree-nuts-data/selected-weekly-fruit-movement-and-price/

United States Department of Agriculture, Economic Research Service, USDA. 2020d. Selected Weekly Fresh-Market Vegetable Movement and Price. Accessed on November, 2020: https://www.ers.usda.gov/data-products/vegetables-and-pulses-data/selected-weekly-fresh-market-vegetable-movement-and-price/

Agricultural and Food Sector in U.S. and E.U. under COVID-19: Market Prospects and Implications for Asian Countries

ABSTRACT

The COVID-19 pandemic shakes nearly all industries and sectors across the globe. The very reason that the agricultural and food sector is recognized as the essential business also make it comparatively vulnerable to the strike of the pandemic that requires limited movement regulation and stringent social distancing measure to contain the spread of virus. This paper attempts to provide a bird’s-eye view of the trends and evolution in the agriculture and food market as well as the impacted stakeholders along the supply chain under the pandemic in the United States and the European Union. Focus industries include dairy, meat, fruits, vegetables, and wine. We present various policy responses and implementations across these two continents on the same page in this article, parallel with the fluctuations in the marketplace, which aim to help correct or adjust both the short-run and structural issues facing producers, distributors, retailers, and consumers. We expect to bring in further discussions and reflections on the market dynamics and shed lights on both developed and under-developed effective strategies used to revive and sustain the economy, within and beyond the agri-food sector.

Keyword: COVID-19, agricultural production, supply chain, meat, produce, wine, policy response

INTRODUCTION

The COVID-19 pandemic has drastically changed the way the society and economy function. And the Corona virus does not spare any nation and industry, even the highly developed countries with predictably the most resources and capital to tackle this urgent issue. In essence, the COVID-19 pandemic differs from financial crisis in 2008-09 and Great depression back in the 1930s. The nearly unstoppable spread of SARS-Cov-2 and the consequent lockdown order on large swath of areas hit almost every aspect of lives and business operations, imposing challenges on food service and processing sector that require face-to-face contact. This article focuses on the impacts of COVID-19 on agricultural and food sector in the United States and European Union, where its well-developed service sector grounds to a halt that further influences the upstream agricultural production and downstream food provision and availability.

Facing the ongoing and imminent living threats posed by the virus, various interventions such as social-distancing practices, facial mask wearing, shelter-in-place or lockdown, suspension of all non-essential businesses and social activities, and international travel bans are used by governments and public sectors as their best attempt to relieve the stress on the health care systems as well as mitigating the associated significant economic and societal losses. Here we briefly categorize the chain effects of COVID-19 on food and agriculture into two likely channels: The strict top-down regulations and orders to flatten the curve hit the food retail and service sector and consumers first. Then it ripples out to the relevant agricultural production environment. Second, the labor supply shortage and working environment inducing high transmission risks facing agricultural producers also weigh in at the beginning, resulting in the disruption in food supply and the availability for consumers at the later stage. Impacted dimension across production, processing, and retail includes issues and public discourse in food security and safety, food distribution and logistics, changes in consumer behavior, as well as food loss and waste.

The sharply dropped air and sea cargo that arises after January in 2020 poses unpredictable challenges on the food supply chain (OECD, 2020). Delays in handling and transporting bring additional layer of logistics concerns to ensure the safety of food and agricultural products where sanitary and phytosanitary standards are required. Intention of several Central Asia and Southeast Asia countries to enforce export restrictions of key commodities including rice raises fear and influences the expectation among the international markets. The global staple crop markets remain relatively stable and optimistic while the perishable produce is more vulnerable to such trade flow restrictions (AMIS, 2020). Likely disruptions to labor and input supply such as seeds and fertilizers could have significant impacts on the crop production and farm management well into the next year, therefore increasing the uncertainty in the sufficiency of food availability.

Two specialized supply chains constitute the downstream of the food industry: One serves households. Another reaches the food-service industry. When the shelter-in-place order makes restaurants close business and most people begin to work from home, both the food and agricultural system experienced unprecedented disruptions. The collapse in demand from institutions including restaurants, schools, hospitals, and hotels shocks the produce and dairy supply. The supply chains in these two dimensions are also very much specialized that it’s challenging to convert the tremendous losses from food service industry into the potential gains which might possibly be fully absorbed by the grocery store chain, which would also help sustain the production capacity without being forced to dump the excess supply (Norwood and Peel, 2020).

This paper is structured by examining the impacts through several layer of lens on key commodities or crops and the stakeholders along the value chain. Agricultural production includes crops, livestock, and fishery as well as the impacts on labor market. Food industry dimension will take a closer look at the evolution of the marketplace under the pandemic. Combining the production and value chain perspectives towards the current situation of agricultural and food markets in U.S. and Europe, we also aim to highlight potential development in the future and implications for Asian countries.

OBSERVATIONS AND POLICY RESPONSES IN THE U.S.

Treating April as the cut-off period to look at the pattern of labor disruption, from February to April, the unemployment rate in food services and processing sector increases nearly 30% and 4.4% respectively. While after May, all the food services, food processing, and food production sector rebound with decrease in unemployment rate at 13.5%, 4.4%, and 0.9% respectively. Shipments of fresh produce for food services could be reduced up to the level of 50%. Panic shopping due to the fear of shortage leads to grocery spending rising for more than 50%. (Pena-Levano, 2020). Such emotion-driven purchasing behavior also leads to the unavailability of some food items for consumers in their regular shopping: 13% say they “often” found that foods are out-of-stock while 44% say they “sometimes” (Norwood and Peel, 2020).

In terms of value for all purchases across different outlets, more of overall food expenditures go to grocery stores and other similar outlets which makes up the bulk share of food-at-home spending, compared to that goes to restaurants, drinking places, and schools. The difference is approximately $50 billion dollars, as shown in Figure 1 (USDA, 2020b). The long-lasting impact on the consumer side could be the shift in their preference and purchase willingness further toward safety and local food attributes (Melo, 2020).

This article takes deeper look into certain crop and food markets while those that are not covered here are still worthwhile for further examination. Table 2 shows the price and shipment movement of aggregated fruit and vegetable crops. In vegetable markets, for selected weeks from April to November, the total shipments including domestic and imports increase between 15-25% in July and August while around 3.5% since September compared to the same week in the last year. The price declines between 3-8% since April and reaches the greatest difference at 8.2% compared to the last-year level. In fruit markets, the change in total shipment shows a negative direction compared to the level last year but the gap reduces from April to August. At the peak of pandemic, the fruit price increases by more than 50% at the end of April compared to the same period last year while decreases by more than 10% in the beginning of June and July. One recent empirical study estimates the impact of COVID-19 on fruit and vegetable production due to the pandemic-induced disruption in the labor market. Major crop losses are taking place in main production states such as California, Arizona, Washington, and Florida and the crop-specific losses range from $5 million for apples to $16 million for lettuce (Ridley and Devadoss, 2020).

For the livestock and meat sector, the broiler industry is less affected by the COVID-19 compared to pork and beef. The daily processing capacity for beef and pork was 40% lower than the prior year level at the end of April (Lusk et al., 2020). However, there is one key policy difference facing different livestock and meat industry: Producers of cattle and hogs receive direct payments based on actual losses while poultry producers do not receive such relief since they don’t own the birds themselves and do not have full control of the bird management system (Maple et al., 2020).

The wine market experiences a surge in demand at the off-premise stores and direct-to-consumer channels during the pandemic times (McDonald, 2020). To begin with the price evolution, the average price per 750 ML at direct-to-consumer shipment is lower throughout this year compared to the last-year level: In October, the price is at US$45.67, around US$5 lower than the level last October. The decline in retail prices is caused by the much smaller increase in shipment value than the increase in volume (9L cases). In April, the shipment value is 18% higher and the volume is 45% higher compared to its counterpart last year. The story is different in the price evolution in the retail off-premise channel. The price is higher this year and the gap in price between this and last year gets larger as the season moves into Winter. At the end of October, the off-premise price is US$11.33, greater than the last year price by less than US$1. The value and volume at retail off-premise channel reach its peak in May this year, one month later compared to that observed within the direct-to-consumer channel, along with the 34% and 29% greater in the magnitude than the performance last year.

USDA provides two platforms for all the stakeholders along the food supply chain including consumers to tackle consequent food and agricultural sectoral problems during the pandemic. One designates FAQ sections for the timely policy responses to several key aspects including Farmer Resources, Food Assistance, Loans, School Meals, Food Supply Chain, Animals and Plants, and National Forests. Another one sketches out more focused themes, particularly the Farmer Resources, on current USDA flexibilities and programs including Coronavirus Food Assistance Program (CFAP), Dumped milk, Crop insurance flexibilities, Farm loan and Commodity loan flexibilities, Crop acreage reporting, Animal mortality, as well as Small Business Administration Programs for Farmers (USDAa, 2020). Here we present the takeaway messages for selected programs in both platforms.

Included in the CFPA in Phase I, USDA had planned to procure an estimated $3 billion in fresh fruits & vegetables, dairy, and meat products to distribute to food pantries and food banks to ensure the sufficient food available for disadvantaged communities. Several food and nutritional programs have been implemented underway to guarantee the secure and healthy status for American families (FNS, 2020): States provide free meals for children, SNAP benefits increase along with expanded access to buy online, and state and local agencies provide food directly to households under disaster household distribution program. Coronavirus Food Assistance Program was renewed in September into its second phase (CFAP 2) with additional US$14 billion dollars to assist producers to overcome the associated adjustment and marketing costs resulting from the market disruptions such as abrupt reduction in demand and short-run oversupply. CFAP 2 supports row crops, livestock, specialty crops, dairy, and aquaculture, which are then categorized into three broader groups receiving payments based on different criteria through Farm Service Agency (FSA).

Price trigger commodities are major commodities that met a minimum 5% price decline over the specified period, including barley, corn, sorghum, soybeans, sunflowers, upland cotton, wheat, broilers, eggs, milk, and livestock. For commodities, the payment is based on the 2020 planted acres multiplied by either $15/acre or by the adjustment of crop-specific rate and approved yield from the individual- or county-level production history. For broilers and eggs, payments are based on 75% of last year production. Payments for dairy and livestock are based on actual production and maximum own inventory between this April and August, respectively. Flat-rate crops are those which do not encounter such trigger-level price decline or do not have available data. Including alfalfa, extra long staple cotton, oats, peanuts, rice, hemp, millet, mustard, safflower, sesame, triticale, rapeseed, this category receives payments based on 2020 acres and rate at US$15/acre. The third category, Sales Commodities, includes specialty crops, aquaculture, nursery crops, floriculture, and other commodities not included in the first two categories. Payment calculation uses a sales-based approach, associated with 2019 sales.

For crop insurance program, several flexibilities are provided in response to the COVID-19, including allowing the electronic submission of reports and notifications, production date extension, extended time for premium payment and acreage reports, and allowing alternative transaction format for 2021 crop year sales. Risk Management Agency also works closely with approved insurance provider (API) to introduce more flexibilities for certain crop industry such as dairy, nursery, perennial crop, and organic acreage report. Dumped milk is counted as milk marketing for Dairy Revenue Protection or actual marketing for Livestock Gross Margin for Dairy programs. Farmers will not be inappropriately penalized by the dumping behavior; the insurance indemnity and payment schedule will not be affected by this type of non-natural disaster leading to production losses.

Regarding loan flexibility programs, USDA’s Farm Service Agency is providing farmers more credit options to sustain, particularly in tough times, annual operating and living expenses, term investments, emergency needs, and stable cash flow. Deadlines are extended for producers who have to respond to application for direct loans. Foreclosure or eviction is temporarily suspended. More flexibility in servicing guaranteed loans now allow Standard Eligible Lenders and Certified Lender Program to certify that they have met the requirement for emergency advances and FSA written approval is no longer needed.

OBSERVATIONS AND POLICY RESPONSES IN E.U.

In the Europe, the supply side of the agricultural market stays comparatively resilient despite the drastic drop in the retailing and food service sector. However, risk remains. Restrictions on the mobility of the seasonal workers dampen the prospects of good harvest for horticultural crops and the processing capacity in the packing facilities for the meat products. Cramped working and living environment and condition for seasonal and migrant workers pose challenges as the tasks required for their jobs would be the least possible to fully enforce social-distancing and good hygiene practices. We use the European Commission Agri-Food Data Portal (European Commission, 2020) for the following analysis across various sectors.

In the dairy sector, raw milk price in EU at the beginning of this year is as strong as the level in 2019, at about €35 per 100kg. All the main production countries, Germany, France, Italy, Netherlands, and Poland, including EU as a whole experience the drop in milk prices starting in February while the price begins to climb back around May. One reason for the decreasing price in March is due to the usual seasonal production peak in April. The private storage aid policy and the drought in some part of Europe help relieve the supply pressure to certain extent (New Zealand Foreign Affairs & Trade, 2020).

In the cattle and beef market, there have been issues for beef slaughterhouses in Ireland and Germany, accompanied by the infectious clusters leading to the closure or slow-down of processing activities and are associated with poor working and living environment (New Zealand Foreign Affairs & Trade, 2020). The price for carcasses goes down between 0.6 and 5.5% compared to the level last year. The price for young bovine, young bulls, and steers drops to the level of €356 per 100kg. The pig market in EU remains resilient in terms of price stability compared to the market in Brazil, U.S., and Canada, although the pig price decreases gradually from nearly €190 per 100kg at the end of February to €140 in October. At the same time, the price in other regions of the world starts to climb back. The EU poultry market actually experiences a more promising market trend in the first quarter this year compared to the level over the past 5 years. However, the broiler price reaches nearly the bottom level at €175 per 100kg in May and June. Both chicken and pork price drop to a record low level this May, compared to their upward trends in the price dynamic during the same period last year. In sheep market, a steep drop in price is observed for the light lamb both due to COVID-19 and the uncertainty resulting from Brexit while the lamb price remains unaffected and high under these two external factors’ influences. Both prices are recovering as the restrictions on the food service sector are gradually lifted.

In fruit and vegetable markets, apples, citrus fruits, and tomatoes are focused using the available data in the Agri-food portal. Compared to the 5-year average, the apple market in July-August experiences decrease in price in all major producing countries including EU except for France, where the price increases from €96 to €108 per 100kg. The citrus market this June experiences a stable upward trend in price movement compared to the 5-year average. The tomato and potato markets both experience a decline in price starting this February and March while the potato price movement in downward pattern experiences as early as in late January. And the potato market is closely interconnected with the near evaporation of demand within the food service industry, e.g., french fries in fast food restaurant.

Compared to other industries, the wine market has been observing a degree of resilience and beyond. Figure 2 and 3 shows the bulk wine prices in 2019/2020 in two of the largest wine producing countries in Europe. In Germany, white wine usually goes with higher prices compared to red wine and rose. The price is stagnant starting this January, and starts to observe a decline in price in May, which is perhaps due to the return-to-normal demand in both on- and off-premise retail chains. In France, wine price with AOP and IGP are higher and red wine is usually more expensive than the white wine. The price remains flat starting this January, accompanied by two anomalies: The price for premium red wine with AOP continues to decrease in the beginning of this year. The price for white wine without GI but with the grape name jumps to the level as high as the premium red wine with AOP, which may be reflecting the change in consumer preferences during the lockdown order that drives up the price.

The European Union supports its agricultural and fisheries sector by providing higher advances of payments, allowing flexibility in fund use, establishing ‘green lanes’ program, and raising awareness for seasonal workers (European Commission, 2020b). Some EU policies in alleviating the negative impacts from pandemic target certain crop or livestock industry while others focus on different stakeholders along the supply chain. For fishers and aquaculture producers, support measures include compensation for temporary suspension of fishing activities, temporary cessation or reduction of aquaculture production and marketing services, and economic losses incurred from offshore fishing activities in the outmost regions by the Member States.

Crisis management measures encompass flexibilities and deregulatory rules on certain crops and products. Dairy (skimmed milk powder, butter, cheese) and meat (beef, sheep and goat meat) products, as well as fishery products, are allowed for private storage to restrain the foreseeable oversupply and to withhold the production. The Commission will provide the aid to deal with the withdrawal of such perishable animal products from the market for a maximum of up to 6 months. Derogation from organizational regulation on market competition for potato, milk, and flower sector is authorized. Operators can choose to collectively plan for the overall production or to drop their current production without legal considerations. Commission also implement market support programs that limit the availability and reorient funding priorities for wine, fruits & vegetables, olive products, apiculture, as well as the EU school meal scheme.

Financial instrument such as loans or guarantees for operating expenses of up to €200,000 is available for farmers and rural development beneficiaries. The new state aid under Commission’s temporary framework provides a maximum of €120,000 per farm and of €800,000(?) per food processing and marketing company. Advances of direct payments and rural development payments are raised to increase the cash flow for farmers at the level between 70 and 85%. Any remaining financial aids under rural development funds could be channeled towards farmers and small and medium-sized enterprises for emergency assistance by the Member States, up to €7,000 and €50,000 for these two groups respectively.

In spite of travel restriction, transportation of goods across borders among EU countries is now facilitated by the “Green Lanes” program to ensure the sufficient supply of the agri-food products. Border crossing is expected take no more than 15 minutes at the check points. Seasonal workers are now qualified as “critical” workers who are recognized as indispensable for the agricultural sector, particularly at the harvest season.

CONCLUSION

This article focuses on current market trends and policy responses in the United States and European Union. We provide a brief overview of selected crop, livestock, and food markets across these two continents. The vulnerable market hit around early this Spring starts to climb back to its normal point into Summer and later this Fall and perhaps the upcoming Holiday season around the end of year. Policy recommendations and implementations by the public sector are presented parallel with the observations on the ongoing development and changes in the marketplace. Convergence on the support measures adopted in the U.S. and E.U. land on granting the flexibilities and expediting the lengthy administrative process for various types of application on current market and risk management programs for agricultural, ranching, and fishing sector. Dairy and meat industry receive more attention and production adjustment supports due to its supply chain challenges. Migrant and seasonal farm worker availability remains one of the bottlenecks that block a well-functioning agricultural supply chain, particularly for the horticultural crop and meat industry.

The common thread across these various issues in and outside the U.S. and E.U. is that fixing the demand shock will help restore the supply chain. Both the public and private sector can and should work together to sort out alternatives to minimize the losses incurred from the significant change in the food service landscape and to facilitate the coordination between different marketing channels. Timely response, logistic efficiency, a sound economy, as well as identifying certain vulnerable aspects rooted in some of the agricultural and food industries would contribute to building a more resilient agri-food industry in the future, which serves as a critical buffer for the whole society facing another crisis or disaster at the global scale across national borders in the long run. While during the pandemic and into the post-pandemic times, it would be worthwhile to investigate the potential irreversible and permanent changes taking place in the agriculture and food markets. Developed habits for online grocery shopping when sheltering in place, the mature food delivery service, adjustment of e-commerce platform to accommodate the surge in demand during the lockdown, and demand for safety and local attributes might all continue as a “new normal” and sustain the future of daily life across the United States, European Union, and the Asian countries.

REFERENCES

Agricultural Marketing Information System (AMIS). 2020. Food commodity prices in times of COVID-19. Access at: http://www.amis-outlook.org/news/detail/en/c/1152702/

European Commission. 2020a. Agri-Food Data Portal, Agri-food Markets. Access at: https://agridata.ec.europa.eu/extensions/DataPortal/agricultural_markets.html

European Commission. 2020b. Coronavirus: Emergency response to support the agricultural and food sector. Available at: https://ec.europa.eu/info/sites/info/files/food-farming-fisheries/farming/documents/factsheet-covid19-agriculture-food-sectors_en.pdf

Food and Nutrition Service. 2020. U.S. Department of Agriculture. FNS Responds to COVID-19. Access at: https://www.fns.usda.gov/coronavirus

Lusk, J. L., Tonsor, G. T., & Schulz, L. L. (2020). Beef and Pork Marketing Margins and Price Spreads during COVID‐19. Applied Economic Perspectives and Policy. DOI:10.1002/aepp.13101

Maples, J. G., Thompson, J. M., Anderson, J. D., & Anderson, D. P. (2020). Estimating COVID‐19 Impacts on the Broiler Industry. Applied Economic Perspectives and Policy. DOI:10.1002/aepp.13089

McDonald, Delaney. 2020. “The Data: Wine DtC Shipments and Off-Premise Retail”. SOVOS ShipCompliant. Access at: https://www.sovos.com/shipcompliant/blog/2020/11/17/the-data-wine-dtc-shipments-and-off-premise-retail-october-2020-special-report/

Melo, Grace. 2020. "The Path Forward: U.S. Consumer and Food Retail Responses to COVID-19." Choices. Quarter 3. Available online: https://www.choicesmagazine.org/choices-magazine/theme-articles/covid-19-and-the-agriculture-industry-labor-supply-chains-and-consumer-behavior/the-path-forward-us-consumer-and-food-retail-responses-to-covid-19

New Zealand Foreign Affairs & Trade. August, 2020. MFAT Market Report. European Union: The Impact of Covid-19 on Agricultural Markets. Available at: https://www.mfat.govt.nz/en/trade/mfat-market-reports/market-reports-europe/european-union-the-impact-of-covid-19-on-agricultural-markets-27-august-2020/

Norwood, F. B., and Peel, D. 2020 Supply Chain Mapping to Prepare for Future Pandemics. Applied Economic Perspectives and Policy. DOI: https://doi.org/10.1002/aepp.13125

OECD. 2020. COVID-19 and International Trade: Issues and Actions. Available at:

https://read.oecd-ilibrary.org/view/?ref=128_128542-3ijg8kfswh&title=COV...

Peña-Lévano, L., S. Burney, G. Melo, and C. Escalante. 2020. COVID-19: Effects on U.S. Labor, Supply Chains and Consumption. Choices. Quarter 3. Available at: https://www.choicesmagazine.org/choices-magazine/theme-articles/covid-19-and-the-agriculture-industry-labor-supply-chains-and-consumer-behavior/covid-19-effects-on-us-labor-supply-chains-and-consumption

Ridley, W., & Devadoss, S. (2020). The Effects of COVID‐19 on Fruit and Vegetable Production. Applied Economic Perspectives and Policy. https://doi.org/10.1002/aepp.13107

United States Department of Agriculture, USDA. 2020a. Coronavirus and USDA Assistance for Farmers. Available at: https://www.farmers.gov/coronavirus

United States Department of Agriculture, Economic Research Service, USDA. 2020b. Food Expenditure Series. Accessed on November, 2020: https://www.ers.usda.gov/data-products/food-expenditure-series

United States Department of Agriculture, Economic Research Service, USDA. 2020c. Selected Weekly Fruit Movement and Price. Access on November, 2020: https://www.ers.usda.gov/data-products/fruit-and-tree-nuts-data/selected-weekly-fruit-movement-and-price/

United States Department of Agriculture, Economic Research Service, USDA. 2020d. Selected Weekly Fresh-Market Vegetable Movement and Price. Accessed on November, 2020: https://www.ers.usda.gov/data-products/vegetables-and-pulses-data/selected-weekly-fresh-market-vegetable-movement-and-price/