ABSTRACT

Despite small and quite recent, floriculture is a lucrative industry in Malaysia. This industry contributes more than RM500 million (US$119 million) every year from its export revenue. The demand for floriculture is increasing in the local and international markets. The usage of flowers for different occasions and events has motivated the industry players to diversify the supply of plant varieties that could meet the demand of customers. The Malaysian Agricultural Research and Development Institute (MARDI) has generated three new plant varieties namely Arundina Suria and Arundina Mentari orchids, multispecies plants for landscape garden, and Native decorative plants for interior decoration. This new variety of plants is expected to enhance the floriculture industry in Malaysia, as well as increase the value of export. This paper highlights the market potential of these new plant varieties, and its effects to the floriculture industry from the perspective of the operators. Local flower entrepreneurs play an important role in determining the direction of the floriculture industry, thus their perspectives are pivotal to be considered.

Keywords: Floriculture industry, production, marketing, new plant varieties

INTRODUCTION

Floriculture is an important and lucrative industry in Malaysia. It is one of the new sources of wealth for Malaysia’s economy. Malaysia's biodiversity and climate adaptability is capable of generating and increasing the contribution of the floriculture industry to national income. This industry contributes more than RM500 million (US$119.1 million) a year from its export markets, and provides more than 50,000 job opportunities for Malaysian people (Department of Statistics, 2018). Based on the National Agrofood Policy (NAP), the value of the floriculture exports is projected to increase from RM449 million (US$106.9 million) in 2010 to RM857 million (US$204.05 million) in 2020.

The government has recognized the importance of this industry, and developed many strategies that could enhance it to a better position. As a result, this industry grows steadily and is projected to register a compound annual growth rate (CAGR) of 3.1% during the year 2020-2021. This could be done through the increase in the production of cut flowers and potted plants. The National Agro-Food Policy (NAP, 2011-2020) projected that the total national flower production will increase from 468 million cuttings in 2010 to 892 million cuttings or pots by 2020, a growth of 6.2% per annum.

Floral businesses are seasonal, and tend to be driven by festive seasons, celebrations and ceremonies. They are used in worship ceremonies, for decoration purposes in special events, parties, and various events when something special is celebrated. The demand for flowers is much higher in the developed countries, and increases during celebrations such as on the Christmas Day, Easter, Valentine's Day, Mother's Day, as well as weddings and during funeral ceremonies. Local scenario also shows a high demand for cutflowers, especially during celebrations and festivals, as well as being widely used for religious ceremonies for certain races. In Malaysia, the demand is geared towards interior and landscape purposes, as well as widely used during flower exhibitions also known as the Royal Floria Putrajaya which is Malaysia’s leading annual flower and garden festival.

In general, the floriculture industry in Malaysia is still in its infancy stage and small compared to other countries. Market expansion is seen as one of the challenges faced by local flower operators. Hence, local floriculture entrepreneurs are encouraged to venture into export markets. However, Malaysia will have to compete with new, yet advanced producing countries in the floriculture industry within the ASEAN region such as Indonesia and Thailand. This situation creates competition for key players in the value chain of the local country's floriculture industry, especially entrepreneurs, nursery owners and exporters. Therefore, floriculture products need to be expanded by giving priority to varietal development, product attributes and value added technology in order to support the current market platforms.

FLORICULTURE INDUSTRY IN MALAYSIA

This paper highlights the potential of the floriculture industry from producer perspectives. Their views are important as these flower entrepreneurs have first-hand knowledge and vast experiences in the field and thus, play an important role in determining the direction of the floriculture industry, including aspects of product demand, business viability, and market expansion. Several issues and challenges faced by key industry players were identified whereby the information is expected to assist in developing strategies, approaches and policies for the way forward of the floriculture industry which includes development of varieties and expanding local and export markets.

Floriculture is the production of bedding and garden, foliage plants, potted flowering plants, cut flowers, cut cultivated greens and floriculture materials. Floriculture is an important industry in Malaysia as it offers employment, established businesses for entrepreneurs and generates income for economic development. Malaysia is the home of a wide variety of floriculture species and well-known as one of the most diverse floristic regions in the world. Thus, Malaysia has the advantage of developing this industry that could generate income to producers, as well as to the nation.

Production

Currently, around 2,700 hectares are cultivated with flowers and ornamental plants (Table 1). The land area recorded a marginal increase to 2,687 hectares in 2018, from 2,619 hectares in 2014. In general, the floriculture industry is centered in Peninsular of Malaysia. This region covers more than 98% of the land areas for the production of cut flower and potted plants. On the other hand, Sabah and Sarawak cover the balance 2% of production areas. The production of flowers is located at two different locations. The temperate flowers are cultivated on the highland. The temperate flowers include Chrysanthemum, Rosa, Carnation, Aster, Gerbera, and Lily. The chrysanthemum plantation in Cameroon Highlands has always been a major flower-producing area in Asia. Among the temperate flowers, Chrysanthemum accounted for 44.8%, followed by Rose with 25.8% and Carnation (12.1%) in 2018. These three temperate flower types contributed 82.7% of the total temperate cut flower production in 2018. On the other hand, the exotic flowers such as the orchids are cultivated on the lowland. The orchid species include Dendrobium, Aranda and Oncidium.

Table 1. Planted area for floriculture; 2014-2018

|

Item

|

2014

|

2015

|

2016

|

2017

|

2018a

|

|

Total

|

2,619

|

2,610

|

2,559

|

2,605

|

2,687

|

|

Peninsular Malaysia

|

2,482

|

2,469

|

2,421

|

2,464

|

2,542

|

|

Sabah

|

58

|

60

|

59

|

60

|

62

|

|

Sarawak

|

72

|

74

|

72

|

73

|

75

|

|

Labuan Federal Territory

|

7

|

8

|

8

|

8

|

8

|

a Estimated Value

Source: Department of Agriculture, Malaysia, 2017

The National Agrofood Policy (2011-2020) targeted the planting area for flowers and ornamental trees or plants to grow from 2,400 hectares in 2010 to 3,500 hectares by 2020, a growth of 3.8% per annum. In order to achieve this target, the government provides many incentives and initiatives that could encourage entrepreneurs to increase the production of flowers and potted plants. For example, the government encourages the collaboration between government research institutions and universities, and industry players. This initiative could speed up the process of technology transfer from R&D institutions to entrepreneurs.

Statistics show that the states of Selangor, Johor and Pahang are the major producers of floriculture products in Malaysia (MOA, 2016). The state of Johor produces over 48% of Malaysia's total production, equivalent to 245.6 million cuttings or pots, from 1,458 hectares of the total planted area. This is followed by Pahang state, which accounts for 28% of local production or 142.9 million flower cuttings or pots. Selangor produced 65.7 million cuttings or pots from 290 hectares of the total planted area (DOA, 2017). The value of cut flower production is increasing yearly from 2005 to 2016. This is due to an increase in planted area and increase in productivity (Table 2).

Table 2. Trend of planted area, production and production value for floriculture, 2005-2016

|

Year

|

Planted Area (Ha)

|

Production

(million cutting/pot/plant)

|

Total

Production Value

(RM '000)

|

|

2005

|

1,780

|

135.145

|

93,702

|

|

2006

|

1,837

|

146.100

|

126,782

|

|

2007

|

1,843

|

153.122

|

131,853

|

|

2008

|

1,941

|

316.721

|

219,260

|

|

2009

|

2,181

|

410.872

|

281,310

|

|

2010

|

2,192

|

414.244

|

255,511

|

|

2011

|

2,213

|

417.066

|

252,349

|

|

2012

|

2,227

|

419.990

|

257,896

|

|

2013

|

2,570

|

484.434

|

321,335

|

|

2014

|

2,619

|

498.967

|

330,975

|

|

2015

|

2,610

|

510.290

|

338,485

|

|

2016

|

2,559

|

500.084

|

331,716

|

|

2017

|

2,605

|

509.086

|

341,857

|

Source: Department of Agriculture, Malaysia, 2017 (1US$=RM4.20)

Marketing

In general, floriculture market in Malaysia is relatively small. Almost 84% of flowers in Malaysia are for the domestic markets, while the balance of 16% are for export markets. The domestic market is generally concentrated in urban areas, such as Kuala Lumpur, Penang, and Johor Baharu. The major buyers of flowers are institutional buyers such as universities, hotels and hospitals. Kuala Lumpur is the largest market for cut flowers and ornamental plants.

Thus, the entrepreneurs expand their marketing efforts to the global markets. Malaysia is one of the major exporters of cut flowers in the world. The major exports for temperate flowers are chrysanthemum, rose and carnation. While the main export for exotic flowers are Dendrobium, Aranda and Mokara. The main export markets of floriculture are Japan, followed by Thailand, Singapore, Australia and the United Arab Emirates. The export value of fresh-cut-flowers reaches more than RM500 million (US$109 million) a year in 2017. Malaysia has been the largest exporter for the Japanese market for chrysanthemum since 2004, and its value reaching US$72.58 million in 2017. The type of flowers and export destinations are varied as presented in Table 3.

Table 3. Type of flower and export destination, 2017

|

Type of flower

|

Value (’000 RM)

|

Countries

|

|

Rose

|

357.74

|

Japan, Brunei, Thailand, Pakistan

|

|

Orchid

|

10,678.47

|

Singapore, Japan, Australia, Greece

|

|

Carnations

|

21.40

|

Brunei

|

|

Chrysanthemum

|

377,389.10

|

Japan, Thailand, Australia, United Arab Emirate

|

|

Cut leaves

|

59,829.62

|

Japan, Australia, New Zealand

|

|

Dried flower

|

1,424.26

|

Japan, Taiwan, Pakistan, Indonesia

|

|

Other flowers

|

43,925.67

|

Thailand, Japan, Singapore, United Arab Emirate

|

|

Total

|

493,626.26

|

|

Source: Department of Agriculture, Malaysia, 2017 (1US$=RM4.20)

Malaysia also imports flowers from other countries. In 2017, Malaysia imported flowers worth more than RM23.86 million (US$5.68 million). The type of flower and country of origin are presented in Table 4.

Table 4. Import of cut flower, 2017

|

Type

|

Value (‘000 RM)

|

Country of origin

|

|

Rose

|

8,774.84

|

India, China, Thailand, Netherlands

|

|

Orchid

|

187.39

|

Thailand, China, Singapore

|

|

Carnations

|

2,256.31

|

China

|

|

Chrysanthemum

|

996.75

|

Singapore, China, Japan, VietNam

|

|

Cut leaves

|

2,003.75

|

China, Indonesia, Thailand, Pakistan

|

|

Dried flower

|

617.40

|

China, Hong Kong, Thailand

|

|

Other flowers

|

9,032.40

|

China, India, Indonesia, Taiwan

|

|

Total

|

23,868.84

|

|

Source: Department of Agriculture, Malaysia, 2017 (1US$=RM4.20)

The major source of imported flowers to Malaysia is China, followed by Singapore and Indonesia. Indonesia will play a greater role as the source of flowers to Malaysia as the production cost is cheaper and this country has a bigger land area for cultivation of flowers.

Development of native and exotic varieties

One of the main challenges faced by this industry is related to plant varieties. The demand for flowers and ornamental plants is varied according to regions and countries. For example, the Japanese markets prefer tiny flowers with bright colors, whereas the European markets prefer big petals with pale color. The demand for flowers is also determined by the events. There is a plethora of reasons for using flowers, from arrangements during weddings and festivals to gifts during birthdays, anniversaries, and other special occasions. There are also sympathy flowers, which are usually used during mourning or funerals. In the traditional Asian funerals, white or yellow mums are appreciated. In China, Japan and Korea, white chrysanthemums are symbolic of grief. Yellow chrysanthemum is also a traditional funeral flower. However, for Hinduism it is considered poor funeral etiquette if red flowers are used. The different of preference by consumers require knowledge, information and research and development by the producers.

Since the industry in Malaysia is small, the entrepreneurs are not all capable to conduct research and development (R&D), to provide market intelligence or come out with different varieties for different markets. The R&D for the development of new varieties is carried out by government research institutions such as the Malaysian Agricultural Research and Development Institute (MARDI). MARDI is a statutory body that is mandated to carry out research and development for the national agriculture industry which includes the floriculture industry. This is where research on plant breeding, modern technology innovations, pest and disease management, post-harvest handling, economics and marketing take place.

MARDI is playing a key role in the breeding of new varieties of floriculture plants. This research institute has taken an initiative to develop new native and exotic flower varieties. The newly developed species are orchids, multispecies plants for landscape, and native decorative plants. The development of new orchid aims to produce plant that is resistant to the sun, and the flower is bloom easily under the hot weather. Orchid is popularly known as a type of flowering plant, but could not withstand the hot weather. This plant also requires intensive care so that it can last longer. These characteristics cause many people who actually love orchid plants, but are not willing to grow these fragile orchid varieties.

The new orchids released by MARDI are Arundina Suria and Arundina Mentari that have the characteristics of being heat resistant. These orchids are hybrid through a crossbreeding of three orchid species, Arundina Graminifolia from Malaysia, Vietnam and India. These three orchids from different country were chosen because they have special characteristics that are durable, blooming all the time and are suitable for landscape gardening. The photos of Arundina Suria and Arundina Mentari orchids are presented in figure 1 and 2.

Another variety introduced by MARDI is called Multispecies plants for landscape garden. From the landscape management point of view, the practice of seasonal flower cultivation in nurseries, and then the seedlings are transferred to the landscaping area requires careful maintenance, high cost and non-sustainable plant materials. Thus, MARDI has introduced another approach of improving the existing plant cultivation and maintenance practices through the multispecies technology. The multispecies technology is developed through the incorporation of several species of plants that have different flowering periods and stages; early, mid and late flowering in a community of landscape plants. Seasonal flowers such as Celosia and Gomphrena have been identified as early- flowering species while species such as Cosmos, Tagetes and Tithonia are late-flowering plants. The seeds of these flowers are mixed together and then, planted directly in the landscape area. When the flowers are blooming, the landscape garden will be filled with colorful crop community and looks natural. The landscape is also dynamic because the flowers are blooming in different time, and thus, it requires less maintenance. These plants were chosen among exotic ornamental plants originating from abroad, and were introduced to this country. Typically, exotic plants have attractive morphological criteria, beautiful flowers and are very attractive to the local consumers. They grow in habitats that are similar to the climatology of this country, and are adapted to the environment. They are introduced as ornamental plants to enhance biodiversity and to provide new ideas in the design of garden landscape. The photo of the multispesies plants is presented in Figure 3.

Native decorative plants, on the other hand, are not usually used as landscape ornamental plants because they have no bright flowers or color and are mostly leafy. In addition, the nature of the natives that often require shading has limited its use for garden landscaping or exterior decorations. MARDI aims to identify native indigenous plants that can potentially be used as mini interior decoration plants. Among the potential native varieties identified are scindaptus pictus, piper porphyrophyllum, schismatoglottis calyptrate, and medinilla scortechinii.

A study was carried out to identify the market potential of these new varieties in the local and international markets. The study was done in 2018 involving floriculture operators in Malaysia. Local flower entrepreneurs play an important role in determining the direction of the floriculture industry, thus their perspectives are pivotal to be considered. The study aims to find out whether the new variety of crops adds value and will be well accepted in the local or international markets.

MARKET POTENTIAL OF LOCAL FLORICULTURE INDUSTRY

Malaysia is one of the important exporters in the global floriculture markets. The share of Malaysia’s flowers in the global market was 1% in 2019. The export value has reduced around -2.9% compared to 2018. As a result, its rank was dropped to number eight in 2019 from number seven in 2018. In order to determine the position of Malaysia among other selected countries for floriculture products, an index of Revealed Comparative Advantage (RCA) was calculated. RCA is an index used in international markets for calculating the relative advantage or disadvantage of certain products as evidenced by trade flows. It is based on the Ricardian trade theory (UNCTAD, 2020). Such productivity differences may be difficult to observe, but the RCA metric can be readily calculated by using trade data to reveal such differences. The index can provide a general indication and first approximation of a country's competitive export strengths and has been proven to be a useful tool in identifying comparative advantages of Malaysia in the fruits industry (Suntharalingam et al., 2011; Nik Rozana et al., 2017).

Revealed comparative advantage analysis for flowers

Nik Rozana et al. (2011) in their report on Malaysia’s competitive advantage in the floriculture industry, has calculated the RCA index value for five years (2010-2015) consecutively. In the five years under review for roses, Malaysia has the advantage against Indonesia, Japan and the United Kingdom, in 2010. In the following years, Malaysia began to lose its edge in the export market of roses. However, Malaysia is seen as having the advantage over Thailand in the carnation flower market in 2012, 2014 and 2015.

In contrary, Malaysia has had a significant advantage in the global orchid market. It has significant advantages over exporting orchids compared to Indonesia, China, India, Japan, United Kingdom and the United States of America (USA). Compared to the European Union (EU), Malaysia also has the advantage despite its relatively small index value. However, Malaysia needs to continue its ongoing efforts to maintain its competitive position in the orchid market, especially with China as the results show that competition between Malaysia and China is narrowing each year.

Malaysia also ranks first in the chrysanthemum market, where Malaysia has the advantage over all the competing countries studied. Significant advantages are seen in the export markets of chrysanthemum compared to India, Indonesia, Thailand, Singapore, United Kingdom, USA and Japan. According to a study by Latifah (2009), around 30% of the chrysanthemum flower market in Japan is dominated by Malaysia. In addition to its color and species, the beautiful and quality floral structure makes Malaysian chrysanthemums to be the people’s choice. Malaysia also has a moderate advantage over China, and a relatively small advantage over the EU and South Korea.

Lilies are a relatively new flower commodity entering the export market. Trading data for lily flowers only started in 2013. Not many countries are involved in the lily export market. For example, Japan does not produce lily flowers for the world export market. For the past three years, Malaysia has shown a relatively good record with a positive index value compared to India. However, Malaysia lost to China, the EU, and South Korea for the lily flower category.

The results of this RCA indicate to Malaysia that benchmarks can be made with certain countries. A closer look at each flower commodity has identified that the EU and South Korea are leading in the export of roses. China, the EU and South Korea are ahead of Malaysia in exporting lilies. Opportunely, there is a bright future for Malaysia to maintain its position in the global market of chrysanthemums and orchids.

Market potential from the perspective of producers

A field survey was conducted involving growers and exporters on the demand for Arundina, multispesies plants, and native decorative plants, which are among the newly introduced floriculture plants listed in Table 5. They were asked to indicate the potential demand based on the trend recorded for similar flower range, as well as based on their experience and knowledge in the floriculture market. Most growers provide their views based on the similar variety of crops they sell or export. For example, three of the respondents said that ornamental pineapples have a higher demand from the world market. The three respondents were among the largest producers and exporters of ornamental pineapples representing 80% of the export market of ornamental pineapple exports worldwide.

Table 5. Producers' (growers and exporters) indication on the demand for selected plants and flowers

|

Plant/Variety

|

Mode (n=104)

|

|

High Demand

|

Medium Demand

|

Low Demand

|

|

Ornamental Pine

|

3

|

14

|

52

|

|

Heliconia

|

23

|

25

|

21

|

|

Orchid Arundina

|

19

|

28

|

23

|

|

Gomphrena Red

|

3

|

24

|

43

|

|

Gomphrena Pink

|

5

|

19

|

46

|

|

Hibiscus Red

|

15

|

27

|

28

|

|

Hibiscus Pink

|

21

|

25

|

24

|

|

Zinnia

|

12

|

26

|

32

|

|

Asclepias

|

10

|

15

|

44

|

|

Celosia

|

17

|

18

|

34

|

|

Scindapsus

|

13

|

28

|

28

|

|

Piper

|

9

|

21

|

39

|

|

Eugenia

|

22

|

20

|

27

|

|

Schismatoglottis

|

10

|

26

|

33 *

|

*Note: Numbers in the table refer to the number of producer

Source: Field survey (2018).

The entrepreneur's view is also based on their regional-based operation. For example, orchid growers in Johor mostly responded on high demand for orchids. Contrary to the responses of plant growers in Cameron Highlands and Selangor, because orchid cultivation area is concentrated in Johor, receiving a high demand for exports to Singapore and other countries.

In addition, there is also seasonal, unexpected demand influenced by government policy. For example, demand has increased dramatically following the increase in the national transportation system such as the mass rapid transit (MRT) construction that increases the use of landscape plants. Local demand for flowers and ornamental plants also increased in line with the implementation of national agricultural and tourism programs such as the Malaysia Agriculture, Horticulture, and Agro-Tourism (MAHA) and Floria Putrajaya Festival. Individual consumers play a role as well. Nowadays, there is a growing tendency for people’s preference of the potted flower as a present because of the longer period of life and interior decorative functions. The growing demand for ornamentals is related to the development of the landscaping industry.

Specifically on the multispecies plants, they were developed through the approach of ecological landscape research through the incorporation of several species of plants that have different flowering periods in a community of landscape plants. Celosia and Gomphrena are among the variety forming the multispesies plants. It is a substitute for single-species varieties. The majority of floral entrepreneurs (88.9%) stated that they tend to choose multispecies as landscaping components, and 89.9% have chosen multispecies plants to replace single-species flowers.

Regarding the overall industry, the majority of producers acknowledge the growing importance of networking and cooperation of the value chain’s stakeholders in logistics, marketing, innovation, research and development. A quite efficient supply-chain management is already in place for the existing industry players. Small producers have network with their bigger counterparts as to ensure their produces are able to reach the number of minimum supply for export purposes. Although the trading scenario favors the bigger players, nevertheless, each individual grower plays an important role to contribute to the export demand. While the large floral establishment has a big chunk of the export market, the smaller producers have the opportunity to also cater for local florists and fulfill the local demand.

Information that has been collected from interviews with some successful floral traders from Selangor, Johor and Pahang states of Malaysia discloses that the challenging task today is climate change, land used area, increased labor charges, socioeconomic and lifestyle changes. Another set of challenges is posed by the expanding products variety in the global market, short product life cycle, globalization of the business processes, and continuous advancement in information and communications technology (ICT). While keeping up with the fast pace of change is difficult, development of the ICT has contributed a lot to the improved supply-chain management. It enabled actors in the supply chain to enjoy a continuous flow of information and knowledge sharing, reducing the cost of transactions, and serving customer needs in a more direct manner.

Moreover, the informants also stress that the sustainable competitive advantage does not necessarily come from any country’s natural resources alone, but from the capacity of the industries to innovate and upgrade constantly. Some of the big players actually do their own small-scale R&D to come out with new crossings and varieties, or a different way of farming, and innovations in terms of modern farm practices to boost the quality and services of their floral and ornamental production needs.

Distribution and marketing channel of native and exotic flowers

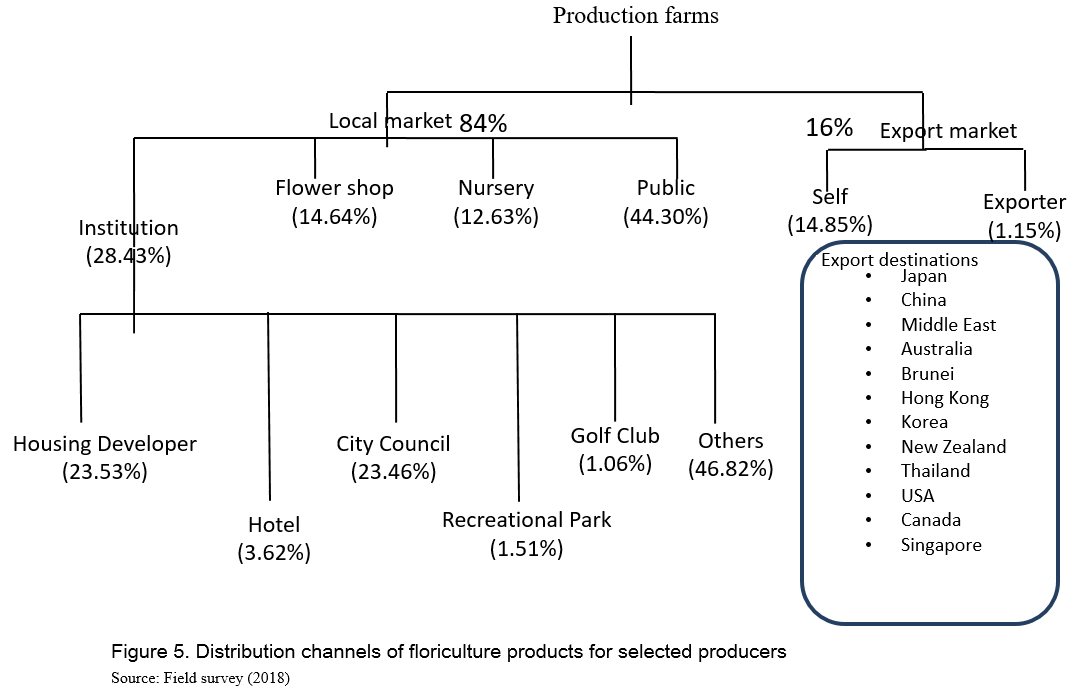

Two major market categories generally involve distribution channels to local and international markets. Local markets include flower nurseries, flower shops or florists, public users and institutional users. Institutional users include housing developers, hotels, golf clubs, supermarkets, municipalities, recreation parks and so on. The international market involves the export procedures of ornamental plants and flowers to be marketed abroad.

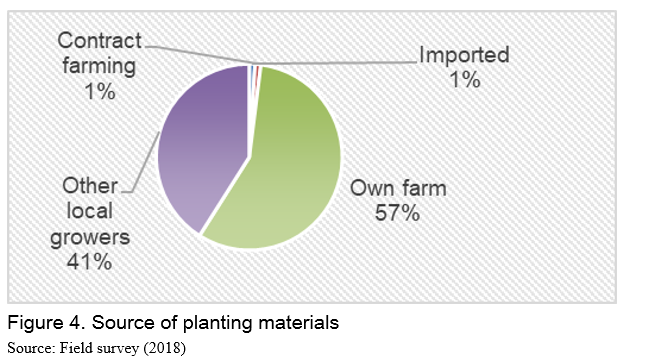

The result of a field survey carried out in 2018 revealed that around 57% of the planting materials are obtained from their own farm, 41% from other local growers and 1% are imported (Figure 4).

In general, many big companies play the role of producer, retailer at local market and exporter. This company produces their own planting materials and outsources some of the products from other small growers. However, the large company monitors the quality of the produce and carries out the packaging process. Around 84% of the produces are sold in the local market. Local markets accounted for 28.43% of institutional consumers, flower shops (14.64%), flower nurseries (12.63%), and direct to the public consumers (44.30%). Figure 5 shows the current marketing channels of ornamental plants and flowers.

Among these institutional buyers, city councils and housing developers are two major buyers of flowers and landscape plants, and mainly used for landscape garden. They represented 23.53% and 23.46% of the institutional share markets respectively. On the other hand, other institutional buyers such as government offices, hospitals and universities also contributed a large portion of the local market of orchids and landscape plants.

The profit margins obtained from local sales range between 30% and 50% for sales made to flower shops and nurseries, 15% for sales to the public, while the highest margin is the sales to institutions such as hotels, municipalities or housing developers, which can reach between 50% and 100%. However, not many producers are able to make sales to institutional consumers due to the difficulty of meeting the required amount continuously, as well as the late payment received. This is where collaboration to merge their production between small, medium and large producers takes place to provide a win-win situation.

A notable challenge faced currently is the depreciation of Malaysian Ringgit, and less participation from youths. The depreciation of ringgit contributes to higher imported input price, leading to higher production cost. The value of Malaysian Ringgit has depreciated from RM3.4 in 2010, to RM4.2 for one US dollar in 2020. As a result, the cost of buying inputs such as fertilizers, chemicals and equipment from overseas has increased between 30% and 40%. On top of that, the price of flowers is very much volatile. Price always moves up and down daily, also due to seasonal or occasional events considering the supply and consumer demand of the flowers. The price of roses, for example, can rise to double digits during Valentine’s Day. Accordingly, they follow demand-based pricing as pricing decision depends on the demand and supply of the flowers. The traders usually charge premium price when the demand of flowers is high and offer very competitive price when the demand goes down. Price of flowers and other ornamental plants also increases when competition to rent lorry to deliver the flowers arise. This is usually happened when the demand is high during festivals and events.

Looking at the bright side, Malaysia has a hot and wet climate which is suitable for agriculture activities and therefore, offers an attractive incentive package and a business-friendly environment. These are the factors that will attract foreign investments into the country. In fact, Malaysia’s neighboring countries, especially Singapore had invested millions of dollar to open floriculture farms in Johor, due to the close proximity and ease of entry for floriculture products.

Previous policies have provided much support and incentives for the players in this industry. The National Agrofood Policy (2011-2020), listed floriculture as one of its high-value industries. The policy outlined six strategies to drive its development; expand areas for commercial cultivation of flowers, strengthen the support services of the floriculture industry, encourage private investments, diversify floriculture products, expand markets of floriculture products, and strengthen R&D activities. Producers are optimistic that the country’s agricultural policies will assist to overcome the issues and challenges, improve marketing and trade, as well as continue research and development activities to develop new varieties and produce high-quality yields.

CONCLUSION

The floriculture industry has a great potential in Malaysia. The demand from domestic and international markets is increasing, and promises a better return on investment for producers and marketers. The industry is expected to be far from saturation and has a market niche for native and exotic varieties. Floral businesses need to stay up to date with new products in this industry because modern practices are growing and evolving and shaping the industry. Collaboration between the small and large-scale producers, along with international alliances will make market access and export easier. In other words, strategic partnership among producers raises the competitiveness of final floral products on the market.

The private sector plays an important role in floriculture industry, especially in production and marketing aspects. On the other hand, government support through policies and directions shall benefit the industry as well as the nation. At the same time, the government should take immediate steps to alleviate constraints, and address the issues faced by the industry. Properly nurtured, the industry carries huge opportunity to trade globally with a greater margin and sustainability.

REFERENCES

Department of Agriculture, Malaysia (DOA) (2017). Booklet Statistik Tanaman (Subsektor Tanaman Makanan) 2017.

Ministry of Agriculture and Agrobased Industry, Malaysia (MOA) (2014). Buku Perangkaan Agromakanan. Kementerian Pertanian dan Industri Asas Tani, Malaysia.

Ministry of Agriculture and Agrobased Industry, Malaysia (MOA) (2011). National Agrofood Industry 2011-2020.

Nik Rozana N.M., Mohd Fairuz, O., Noorlidawati, A.H., Suntharalingam, C., et al. (2016). Kajian Industri Florikultur Malaysia: Analisis Kelebihan Daya Saing dan Kecenderungan Pengguna Tempatan. Laporan Kajian Sosioekonomi. MARDI, Serdang.

Nik Rozana, N.M., Suntharalingam, C. and Othman, M.F. (2017). Competitiveness of Malaysia’s Fruits in The Global Market: Revealed Comparative Advantage Analysis. Malaysian Journal of Mathematical Sciences, 11(S) February, 143-157.

Suntharalingam, C., Tengku Ariff, T.A., Abu Kasim, A., Rawaida, R. and Noorlidawati, A.H. (2011). Competitiveness of Malaysia’s fruits in the global agricultural and selected export markets: Analyses of revealed comparative advantage and comparative export performance. Economic and Technology Management Review 6: 1-17.

Statistics Department Malaysia (2018). Labor Force Report 2017. Department of Statistics Malaysia.

United Nations Conference on Trade and Development (UNCTAD) (n.d.). Revealed Comparative Advantage. Retrieved on 4 May 2020 from https://unctadstat.unctad.org/EN/RcaRadar.html

Zakaria, H., Rusli, R. Dan Dardak, R.A. (2009). Penggunaan dan Kecenderungan Pengguna terhadap Makanan Sejuk Beku. Economic and Technology Management Review. 4, 13-22.

Producer’s Perspective on the Potential of Malaysia’s Floriculture Industry

ABSTRACT

Despite small and quite recent, floriculture is a lucrative industry in Malaysia. This industry contributes more than RM500 million (US$119 million) every year from its export revenue. The demand for floriculture is increasing in the local and international markets. The usage of flowers for different occasions and events has motivated the industry players to diversify the supply of plant varieties that could meet the demand of customers. The Malaysian Agricultural Research and Development Institute (MARDI) has generated three new plant varieties namely Arundina Suria and Arundina Mentari orchids, multispecies plants for landscape garden, and Native decorative plants for interior decoration. This new variety of plants is expected to enhance the floriculture industry in Malaysia, as well as increase the value of export. This paper highlights the market potential of these new plant varieties, and its effects to the floriculture industry from the perspective of the operators. Local flower entrepreneurs play an important role in determining the direction of the floriculture industry, thus their perspectives are pivotal to be considered.

Keywords: Floriculture industry, production, marketing, new plant varieties

INTRODUCTION

Floriculture is an important and lucrative industry in Malaysia. It is one of the new sources of wealth for Malaysia’s economy. Malaysia's biodiversity and climate adaptability is capable of generating and increasing the contribution of the floriculture industry to national income. This industry contributes more than RM500 million (US$119.1 million) a year from its export markets, and provides more than 50,000 job opportunities for Malaysian people (Department of Statistics, 2018). Based on the National Agrofood Policy (NAP), the value of the floriculture exports is projected to increase from RM449 million (US$106.9 million) in 2010 to RM857 million (US$204.05 million) in 2020.

The government has recognized the importance of this industry, and developed many strategies that could enhance it to a better position. As a result, this industry grows steadily and is projected to register a compound annual growth rate (CAGR) of 3.1% during the year 2020-2021. This could be done through the increase in the production of cut flowers and potted plants. The National Agro-Food Policy (NAP, 2011-2020) projected that the total national flower production will increase from 468 million cuttings in 2010 to 892 million cuttings or pots by 2020, a growth of 6.2% per annum.

Floral businesses are seasonal, and tend to be driven by festive seasons, celebrations and ceremonies. They are used in worship ceremonies, for decoration purposes in special events, parties, and various events when something special is celebrated. The demand for flowers is much higher in the developed countries, and increases during celebrations such as on the Christmas Day, Easter, Valentine's Day, Mother's Day, as well as weddings and during funeral ceremonies. Local scenario also shows a high demand for cutflowers, especially during celebrations and festivals, as well as being widely used for religious ceremonies for certain races. In Malaysia, the demand is geared towards interior and landscape purposes, as well as widely used during flower exhibitions also known as the Royal Floria Putrajaya which is Malaysia’s leading annual flower and garden festival.

In general, the floriculture industry in Malaysia is still in its infancy stage and small compared to other countries. Market expansion is seen as one of the challenges faced by local flower operators. Hence, local floriculture entrepreneurs are encouraged to venture into export markets. However, Malaysia will have to compete with new, yet advanced producing countries in the floriculture industry within the ASEAN region such as Indonesia and Thailand. This situation creates competition for key players in the value chain of the local country's floriculture industry, especially entrepreneurs, nursery owners and exporters. Therefore, floriculture products need to be expanded by giving priority to varietal development, product attributes and value added technology in order to support the current market platforms.

FLORICULTURE INDUSTRY IN MALAYSIA

This paper highlights the potential of the floriculture industry from producer perspectives. Their views are important as these flower entrepreneurs have first-hand knowledge and vast experiences in the field and thus, play an important role in determining the direction of the floriculture industry, including aspects of product demand, business viability, and market expansion. Several issues and challenges faced by key industry players were identified whereby the information is expected to assist in developing strategies, approaches and policies for the way forward of the floriculture industry which includes development of varieties and expanding local and export markets.

Floriculture is the production of bedding and garden, foliage plants, potted flowering plants, cut flowers, cut cultivated greens and floriculture materials. Floriculture is an important industry in Malaysia as it offers employment, established businesses for entrepreneurs and generates income for economic development. Malaysia is the home of a wide variety of floriculture species and well-known as one of the most diverse floristic regions in the world. Thus, Malaysia has the advantage of developing this industry that could generate income to producers, as well as to the nation.

Production

Currently, around 2,700 hectares are cultivated with flowers and ornamental plants (Table 1). The land area recorded a marginal increase to 2,687 hectares in 2018, from 2,619 hectares in 2014. In general, the floriculture industry is centered in Peninsular of Malaysia. This region covers more than 98% of the land areas for the production of cut flower and potted plants. On the other hand, Sabah and Sarawak cover the balance 2% of production areas. The production of flowers is located at two different locations. The temperate flowers are cultivated on the highland. The temperate flowers include Chrysanthemum, Rosa, Carnation, Aster, Gerbera, and Lily. The chrysanthemum plantation in Cameroon Highlands has always been a major flower-producing area in Asia. Among the temperate flowers, Chrysanthemum accounted for 44.8%, followed by Rose with 25.8% and Carnation (12.1%) in 2018. These three temperate flower types contributed 82.7% of the total temperate cut flower production in 2018. On the other hand, the exotic flowers such as the orchids are cultivated on the lowland. The orchid species include Dendrobium, Aranda and Oncidium.

Table 1. Planted area for floriculture; 2014-2018

Item

2014

2015

2016

2017

2018a

Total

2,619

2,610

2,559

2,605

2,687

Peninsular Malaysia

2,482

2,469

2,421

2,464

2,542

Sabah

58

60

59

60

62

Sarawak

72

74

72

73

75

Labuan Federal Territory

7

8

8

8

8

a Estimated Value

Source: Department of Agriculture, Malaysia, 2017

The National Agrofood Policy (2011-2020) targeted the planting area for flowers and ornamental trees or plants to grow from 2,400 hectares in 2010 to 3,500 hectares by 2020, a growth of 3.8% per annum. In order to achieve this target, the government provides many incentives and initiatives that could encourage entrepreneurs to increase the production of flowers and potted plants. For example, the government encourages the collaboration between government research institutions and universities, and industry players. This initiative could speed up the process of technology transfer from R&D institutions to entrepreneurs.

Statistics show that the states of Selangor, Johor and Pahang are the major producers of floriculture products in Malaysia (MOA, 2016). The state of Johor produces over 48% of Malaysia's total production, equivalent to 245.6 million cuttings or pots, from 1,458 hectares of the total planted area. This is followed by Pahang state, which accounts for 28% of local production or 142.9 million flower cuttings or pots. Selangor produced 65.7 million cuttings or pots from 290 hectares of the total planted area (DOA, 2017). The value of cut flower production is increasing yearly from 2005 to 2016. This is due to an increase in planted area and increase in productivity (Table 2).

Table 2. Trend of planted area, production and production value for floriculture, 2005-2016

Year

Planted Area (Ha)

Production

(million cutting/pot/plant)

Total

Production Value

(RM '000)

2005

1,780

135.145

93,702

2006

1,837

146.100

126,782

2007

1,843

153.122

131,853

2008

1,941

316.721

219,260

2009

2,181

410.872

281,310

2010

2,192

414.244

255,511

2011

2,213

417.066

252,349

2012

2,227

419.990

257,896

2013

2,570

484.434

321,335

2014

2,619

498.967

330,975

2015

2,610

510.290

338,485

2016

2,559

500.084

331,716

2017

2,605

509.086

341,857

Source: Department of Agriculture, Malaysia, 2017 (1US$=RM4.20)

Marketing

In general, floriculture market in Malaysia is relatively small. Almost 84% of flowers in Malaysia are for the domestic markets, while the balance of 16% are for export markets. The domestic market is generally concentrated in urban areas, such as Kuala Lumpur, Penang, and Johor Baharu. The major buyers of flowers are institutional buyers such as universities, hotels and hospitals. Kuala Lumpur is the largest market for cut flowers and ornamental plants.

Thus, the entrepreneurs expand their marketing efforts to the global markets. Malaysia is one of the major exporters of cut flowers in the world. The major exports for temperate flowers are chrysanthemum, rose and carnation. While the main export for exotic flowers are Dendrobium, Aranda and Mokara. The main export markets of floriculture are Japan, followed by Thailand, Singapore, Australia and the United Arab Emirates. The export value of fresh-cut-flowers reaches more than RM500 million (US$109 million) a year in 2017. Malaysia has been the largest exporter for the Japanese market for chrysanthemum since 2004, and its value reaching US$72.58 million in 2017. The type of flowers and export destinations are varied as presented in Table 3.

Table 3. Type of flower and export destination, 2017

Type of flower

Value (’000 RM)

Countries

Rose

357.74

Japan, Brunei, Thailand, Pakistan

Orchid

10,678.47

Singapore, Japan, Australia, Greece

Carnations

21.40

Brunei

Chrysanthemum

377,389.10

Japan, Thailand, Australia, United Arab Emirate

Cut leaves

59,829.62

Japan, Australia, New Zealand

Dried flower

1,424.26

Japan, Taiwan, Pakistan, Indonesia

Other flowers

43,925.67

Thailand, Japan, Singapore, United Arab Emirate

Total

493,626.26

Source: Department of Agriculture, Malaysia, 2017 (1US$=RM4.20)

Malaysia also imports flowers from other countries. In 2017, Malaysia imported flowers worth more than RM23.86 million (US$5.68 million). The type of flower and country of origin are presented in Table 4.

Table 4. Import of cut flower, 2017

Type

Value (‘000 RM)

Country of origin

Rose

8,774.84

India, China, Thailand, Netherlands

Orchid

187.39

Thailand, China, Singapore

Carnations

2,256.31

China

Chrysanthemum

996.75

Singapore, China, Japan, VietNam

Cut leaves

2,003.75

China, Indonesia, Thailand, Pakistan

Dried flower

617.40

China, Hong Kong, Thailand

Other flowers

9,032.40

China, India, Indonesia, Taiwan

Total

23,868.84

Source: Department of Agriculture, Malaysia, 2017 (1US$=RM4.20)

The major source of imported flowers to Malaysia is China, followed by Singapore and Indonesia. Indonesia will play a greater role as the source of flowers to Malaysia as the production cost is cheaper and this country has a bigger land area for cultivation of flowers.

Development of native and exotic varieties

One of the main challenges faced by this industry is related to plant varieties. The demand for flowers and ornamental plants is varied according to regions and countries. For example, the Japanese markets prefer tiny flowers with bright colors, whereas the European markets prefer big petals with pale color. The demand for flowers is also determined by the events. There is a plethora of reasons for using flowers, from arrangements during weddings and festivals to gifts during birthdays, anniversaries, and other special occasions. There are also sympathy flowers, which are usually used during mourning or funerals. In the traditional Asian funerals, white or yellow mums are appreciated. In China, Japan and Korea, white chrysanthemums are symbolic of grief. Yellow chrysanthemum is also a traditional funeral flower. However, for Hinduism it is considered poor funeral etiquette if red flowers are used. The different of preference by consumers require knowledge, information and research and development by the producers.

Since the industry in Malaysia is small, the entrepreneurs are not all capable to conduct research and development (R&D), to provide market intelligence or come out with different varieties for different markets. The R&D for the development of new varieties is carried out by government research institutions such as the Malaysian Agricultural Research and Development Institute (MARDI). MARDI is a statutory body that is mandated to carry out research and development for the national agriculture industry which includes the floriculture industry. This is where research on plant breeding, modern technology innovations, pest and disease management, post-harvest handling, economics and marketing take place.

MARDI is playing a key role in the breeding of new varieties of floriculture plants. This research institute has taken an initiative to develop new native and exotic flower varieties. The newly developed species are orchids, multispecies plants for landscape, and native decorative plants. The development of new orchid aims to produce plant that is resistant to the sun, and the flower is bloom easily under the hot weather. Orchid is popularly known as a type of flowering plant, but could not withstand the hot weather. This plant also requires intensive care so that it can last longer. These characteristics cause many people who actually love orchid plants, but are not willing to grow these fragile orchid varieties.

The new orchids released by MARDI are Arundina Suria and Arundina Mentari that have the characteristics of being heat resistant. These orchids are hybrid through a crossbreeding of three orchid species, Arundina Graminifolia from Malaysia, Vietnam and India. These three orchids from different country were chosen because they have special characteristics that are durable, blooming all the time and are suitable for landscape gardening. The photos of Arundina Suria and Arundina Mentari orchids are presented in figure 1 and 2.

Another variety introduced by MARDI is called Multispecies plants for landscape garden. From the landscape management point of view, the practice of seasonal flower cultivation in nurseries, and then the seedlings are transferred to the landscaping area requires careful maintenance, high cost and non-sustainable plant materials. Thus, MARDI has introduced another approach of improving the existing plant cultivation and maintenance practices through the multispecies technology. The multispecies technology is developed through the incorporation of several species of plants that have different flowering periods and stages; early, mid and late flowering in a community of landscape plants. Seasonal flowers such as Celosia and Gomphrena have been identified as early- flowering species while species such as Cosmos, Tagetes and Tithonia are late-flowering plants. The seeds of these flowers are mixed together and then, planted directly in the landscape area. When the flowers are blooming, the landscape garden will be filled with colorful crop community and looks natural. The landscape is also dynamic because the flowers are blooming in different time, and thus, it requires less maintenance. These plants were chosen among exotic ornamental plants originating from abroad, and were introduced to this country. Typically, exotic plants have attractive morphological criteria, beautiful flowers and are very attractive to the local consumers. They grow in habitats that are similar to the climatology of this country, and are adapted to the environment. They are introduced as ornamental plants to enhance biodiversity and to provide new ideas in the design of garden landscape. The photo of the multispesies plants is presented in Figure 3.

Native decorative plants, on the other hand, are not usually used as landscape ornamental plants because they have no bright flowers or color and are mostly leafy. In addition, the nature of the natives that often require shading has limited its use for garden landscaping or exterior decorations. MARDI aims to identify native indigenous plants that can potentially be used as mini interior decoration plants. Among the potential native varieties identified are scindaptus pictus, piper porphyrophyllum, schismatoglottis calyptrate, and medinilla scortechinii.

A study was carried out to identify the market potential of these new varieties in the local and international markets. The study was done in 2018 involving floriculture operators in Malaysia. Local flower entrepreneurs play an important role in determining the direction of the floriculture industry, thus their perspectives are pivotal to be considered. The study aims to find out whether the new variety of crops adds value and will be well accepted in the local or international markets.

MARKET POTENTIAL OF LOCAL FLORICULTURE INDUSTRY

Malaysia is one of the important exporters in the global floriculture markets. The share of Malaysia’s flowers in the global market was 1% in 2019. The export value has reduced around -2.9% compared to 2018. As a result, its rank was dropped to number eight in 2019 from number seven in 2018. In order to determine the position of Malaysia among other selected countries for floriculture products, an index of Revealed Comparative Advantage (RCA) was calculated. RCA is an index used in international markets for calculating the relative advantage or disadvantage of certain products as evidenced by trade flows. It is based on the Ricardian trade theory (UNCTAD, 2020). Such productivity differences may be difficult to observe, but the RCA metric can be readily calculated by using trade data to reveal such differences. The index can provide a general indication and first approximation of a country's competitive export strengths and has been proven to be a useful tool in identifying comparative advantages of Malaysia in the fruits industry (Suntharalingam et al., 2011; Nik Rozana et al., 2017).

Revealed comparative advantage analysis for flowers

Nik Rozana et al. (2011) in their report on Malaysia’s competitive advantage in the floriculture industry, has calculated the RCA index value for five years (2010-2015) consecutively. In the five years under review for roses, Malaysia has the advantage against Indonesia, Japan and the United Kingdom, in 2010. In the following years, Malaysia began to lose its edge in the export market of roses. However, Malaysia is seen as having the advantage over Thailand in the carnation flower market in 2012, 2014 and 2015.

In contrary, Malaysia has had a significant advantage in the global orchid market. It has significant advantages over exporting orchids compared to Indonesia, China, India, Japan, United Kingdom and the United States of America (USA). Compared to the European Union (EU), Malaysia also has the advantage despite its relatively small index value. However, Malaysia needs to continue its ongoing efforts to maintain its competitive position in the orchid market, especially with China as the results show that competition between Malaysia and China is narrowing each year.

Malaysia also ranks first in the chrysanthemum market, where Malaysia has the advantage over all the competing countries studied. Significant advantages are seen in the export markets of chrysanthemum compared to India, Indonesia, Thailand, Singapore, United Kingdom, USA and Japan. According to a study by Latifah (2009), around 30% of the chrysanthemum flower market in Japan is dominated by Malaysia. In addition to its color and species, the beautiful and quality floral structure makes Malaysian chrysanthemums to be the people’s choice. Malaysia also has a moderate advantage over China, and a relatively small advantage over the EU and South Korea.

Lilies are a relatively new flower commodity entering the export market. Trading data for lily flowers only started in 2013. Not many countries are involved in the lily export market. For example, Japan does not produce lily flowers for the world export market. For the past three years, Malaysia has shown a relatively good record with a positive index value compared to India. However, Malaysia lost to China, the EU, and South Korea for the lily flower category.

The results of this RCA indicate to Malaysia that benchmarks can be made with certain countries. A closer look at each flower commodity has identified that the EU and South Korea are leading in the export of roses. China, the EU and South Korea are ahead of Malaysia in exporting lilies. Opportunely, there is a bright future for Malaysia to maintain its position in the global market of chrysanthemums and orchids.

Market potential from the perspective of producers

A field survey was conducted involving growers and exporters on the demand for Arundina, multispesies plants, and native decorative plants, which are among the newly introduced floriculture plants listed in Table 5. They were asked to indicate the potential demand based on the trend recorded for similar flower range, as well as based on their experience and knowledge in the floriculture market. Most growers provide their views based on the similar variety of crops they sell or export. For example, three of the respondents said that ornamental pineapples have a higher demand from the world market. The three respondents were among the largest producers and exporters of ornamental pineapples representing 80% of the export market of ornamental pineapple exports worldwide.

Table 5. Producers' (growers and exporters) indication on the demand for selected plants and flowers

Plant/Variety

Mode (n=104)

High Demand

Medium Demand

Low Demand

Ornamental Pine

3

14

52

Heliconia

23

25

21

Orchid Arundina

19

28

23

Gomphrena Red

3

24

43

Gomphrena Pink

5

19

46

Hibiscus Red

15

27

28

Hibiscus Pink

21

25

24

Zinnia

12

26

32

Asclepias

10

15

44

Celosia

17

18

34

Scindapsus

13

28

28

Piper

9

21

39

Eugenia

22

20

27

Schismatoglottis

10

26

33 *

*Note: Numbers in the table refer to the number of producer

Source: Field survey (2018).

The entrepreneur's view is also based on their regional-based operation. For example, orchid growers in Johor mostly responded on high demand for orchids. Contrary to the responses of plant growers in Cameron Highlands and Selangor, because orchid cultivation area is concentrated in Johor, receiving a high demand for exports to Singapore and other countries.

In addition, there is also seasonal, unexpected demand influenced by government policy. For example, demand has increased dramatically following the increase in the national transportation system such as the mass rapid transit (MRT) construction that increases the use of landscape plants. Local demand for flowers and ornamental plants also increased in line with the implementation of national agricultural and tourism programs such as the Malaysia Agriculture, Horticulture, and Agro-Tourism (MAHA) and Floria Putrajaya Festival. Individual consumers play a role as well. Nowadays, there is a growing tendency for people’s preference of the potted flower as a present because of the longer period of life and interior decorative functions. The growing demand for ornamentals is related to the development of the landscaping industry.

Specifically on the multispecies plants, they were developed through the approach of ecological landscape research through the incorporation of several species of plants that have different flowering periods in a community of landscape plants. Celosia and Gomphrena are among the variety forming the multispesies plants. It is a substitute for single-species varieties. The majority of floral entrepreneurs (88.9%) stated that they tend to choose multispecies as landscaping components, and 89.9% have chosen multispecies plants to replace single-species flowers.

Regarding the overall industry, the majority of producers acknowledge the growing importance of networking and cooperation of the value chain’s stakeholders in logistics, marketing, innovation, research and development. A quite efficient supply-chain management is already in place for the existing industry players. Small producers have network with their bigger counterparts as to ensure their produces are able to reach the number of minimum supply for export purposes. Although the trading scenario favors the bigger players, nevertheless, each individual grower plays an important role to contribute to the export demand. While the large floral establishment has a big chunk of the export market, the smaller producers have the opportunity to also cater for local florists and fulfill the local demand.

Information that has been collected from interviews with some successful floral traders from Selangor, Johor and Pahang states of Malaysia discloses that the challenging task today is climate change, land used area, increased labor charges, socioeconomic and lifestyle changes. Another set of challenges is posed by the expanding products variety in the global market, short product life cycle, globalization of the business processes, and continuous advancement in information and communications technology (ICT). While keeping up with the fast pace of change is difficult, development of the ICT has contributed a lot to the improved supply-chain management. It enabled actors in the supply chain to enjoy a continuous flow of information and knowledge sharing, reducing the cost of transactions, and serving customer needs in a more direct manner.

Moreover, the informants also stress that the sustainable competitive advantage does not necessarily come from any country’s natural resources alone, but from the capacity of the industries to innovate and upgrade constantly. Some of the big players actually do their own small-scale R&D to come out with new crossings and varieties, or a different way of farming, and innovations in terms of modern farm practices to boost the quality and services of their floral and ornamental production needs.

Distribution and marketing channel of native and exotic flowers

Two major market categories generally involve distribution channels to local and international markets. Local markets include flower nurseries, flower shops or florists, public users and institutional users. Institutional users include housing developers, hotels, golf clubs, supermarkets, municipalities, recreation parks and so on. The international market involves the export procedures of ornamental plants and flowers to be marketed abroad.

The result of a field survey carried out in 2018 revealed that around 57% of the planting materials are obtained from their own farm, 41% from other local growers and 1% are imported (Figure 4).

In general, many big companies play the role of producer, retailer at local market and exporter. This company produces their own planting materials and outsources some of the products from other small growers. However, the large company monitors the quality of the produce and carries out the packaging process. Around 84% of the produces are sold in the local market. Local markets accounted for 28.43% of institutional consumers, flower shops (14.64%), flower nurseries (12.63%), and direct to the public consumers (44.30%). Figure 5 shows the current marketing channels of ornamental plants and flowers.

Among these institutional buyers, city councils and housing developers are two major buyers of flowers and landscape plants, and mainly used for landscape garden. They represented 23.53% and 23.46% of the institutional share markets respectively. On the other hand, other institutional buyers such as government offices, hospitals and universities also contributed a large portion of the local market of orchids and landscape plants.

The profit margins obtained from local sales range between 30% and 50% for sales made to flower shops and nurseries, 15% for sales to the public, while the highest margin is the sales to institutions such as hotels, municipalities or housing developers, which can reach between 50% and 100%. However, not many producers are able to make sales to institutional consumers due to the difficulty of meeting the required amount continuously, as well as the late payment received. This is where collaboration to merge their production between small, medium and large producers takes place to provide a win-win situation.

A notable challenge faced currently is the depreciation of Malaysian Ringgit, and less participation from youths. The depreciation of ringgit contributes to higher imported input price, leading to higher production cost. The value of Malaysian Ringgit has depreciated from RM3.4 in 2010, to RM4.2 for one US dollar in 2020. As a result, the cost of buying inputs such as fertilizers, chemicals and equipment from overseas has increased between 30% and 40%. On top of that, the price of flowers is very much volatile. Price always moves up and down daily, also due to seasonal or occasional events considering the supply and consumer demand of the flowers. The price of roses, for example, can rise to double digits during Valentine’s Day. Accordingly, they follow demand-based pricing as pricing decision depends on the demand and supply of the flowers. The traders usually charge premium price when the demand of flowers is high and offer very competitive price when the demand goes down. Price of flowers and other ornamental plants also increases when competition to rent lorry to deliver the flowers arise. This is usually happened when the demand is high during festivals and events.

Looking at the bright side, Malaysia has a hot and wet climate which is suitable for agriculture activities and therefore, offers an attractive incentive package and a business-friendly environment. These are the factors that will attract foreign investments into the country. In fact, Malaysia’s neighboring countries, especially Singapore had invested millions of dollar to open floriculture farms in Johor, due to the close proximity and ease of entry for floriculture products.

Previous policies have provided much support and incentives for the players in this industry. The National Agrofood Policy (2011-2020), listed floriculture as one of its high-value industries. The policy outlined six strategies to drive its development; expand areas for commercial cultivation of flowers, strengthen the support services of the floriculture industry, encourage private investments, diversify floriculture products, expand markets of floriculture products, and strengthen R&D activities. Producers are optimistic that the country’s agricultural policies will assist to overcome the issues and challenges, improve marketing and trade, as well as continue research and development activities to develop new varieties and produce high-quality yields.

CONCLUSION

The floriculture industry has a great potential in Malaysia. The demand from domestic and international markets is increasing, and promises a better return on investment for producers and marketers. The industry is expected to be far from saturation and has a market niche for native and exotic varieties. Floral businesses need to stay up to date with new products in this industry because modern practices are growing and evolving and shaping the industry. Collaboration between the small and large-scale producers, along with international alliances will make market access and export easier. In other words, strategic partnership among producers raises the competitiveness of final floral products on the market.

The private sector plays an important role in floriculture industry, especially in production and marketing aspects. On the other hand, government support through policies and directions shall benefit the industry as well as the nation. At the same time, the government should take immediate steps to alleviate constraints, and address the issues faced by the industry. Properly nurtured, the industry carries huge opportunity to trade globally with a greater margin and sustainability.

REFERENCES

Department of Agriculture, Malaysia (DOA) (2017). Booklet Statistik Tanaman (Subsektor Tanaman Makanan) 2017.

Ministry of Agriculture and Agrobased Industry, Malaysia (MOA) (2014). Buku Perangkaan Agromakanan. Kementerian Pertanian dan Industri Asas Tani, Malaysia.

Ministry of Agriculture and Agrobased Industry, Malaysia (MOA) (2011). National Agrofood Industry 2011-2020.

Nik Rozana N.M., Mohd Fairuz, O., Noorlidawati, A.H., Suntharalingam, C., et al. (2016). Kajian Industri Florikultur Malaysia: Analisis Kelebihan Daya Saing dan Kecenderungan Pengguna Tempatan. Laporan Kajian Sosioekonomi. MARDI, Serdang.

Nik Rozana, N.M., Suntharalingam, C. and Othman, M.F. (2017). Competitiveness of Malaysia’s Fruits in The Global Market: Revealed Comparative Advantage Analysis. Malaysian Journal of Mathematical Sciences, 11(S) February, 143-157.

Suntharalingam, C., Tengku Ariff, T.A., Abu Kasim, A., Rawaida, R. and Noorlidawati, A.H. (2011). Competitiveness of Malaysia’s fruits in the global agricultural and selected export markets: Analyses of revealed comparative advantage and comparative export performance. Economic and Technology Management Review 6: 1-17.

Statistics Department Malaysia (2018). Labor Force Report 2017. Department of Statistics Malaysia.

United Nations Conference on Trade and Development (UNCTAD) (n.d.). Revealed Comparative Advantage. Retrieved on 4 May 2020 from https://unctadstat.unctad.org/EN/RcaRadar.html

Zakaria, H., Rusli, R. Dan Dardak, R.A. (2009). Penggunaan dan Kecenderungan Pengguna terhadap Makanan Sejuk Beku. Economic and Technology Management Review. 4, 13-22.