ABSTRACT

Thailand is ranked as the second-largest net exporter of sugar in the global market. The sugarcane and sugar industry in Thailand plays a major role in its economy in terms of job-creation for Thai citizens and international trade. Therefore, the Thai government has promoted this sector along the supply chain. However, since 2013, Thai sugarcane farmers have faced several challenges: dropping sugarcane prices, increasing production and transportation costs and low productivity. This results in the suffering of some Thai sugarcane farmers especially those with small-scale farms. To increase the competitiveness of this sector, the challenges are to improve sugarcane production efficiency, to increase sugarcane productivity and to improve the sugarcane transportation and loading systems from farm to mill.

OVERVIEW OF THE THAI SUGAR SECTOR

The sugarcane and sugar sector in Thailand was first developed several decades ago. The first mill, established in 1938, is located in Lampang Province in Northern Thailand. This mill is still in operation. From 1952–1957, the sector was operated under a capitalist monopoly. Today, the industry has become more privatized; there are currently 57 sugar millers with a total sugarcane production area of about 1.75 million hectares (ha), or 7.36% of the agricultural land in the whole Kingdom of Thailand. This sector plays a crucial role in the Thai economy. It generates around 7.81 billion US dollars per year and employs 1.5 million people (Preecha et al., 2017). Approximately only 30% of Thailand’s sugar products are used for domestic consumption, whereas the rest are exported to the global market. At present, Thailand itself has become the second-largest exporter of sugar in the global market (Athipanyakul, 2018).

In order to stabilize the sector, the Thai government has promoted the sector along its value chain. The Thai government issued the Cane and Sugar Act of 1984 (B.E. 2527). The Act was related to the systems of exportation and importation of sugar, sugar distribution, benefit-sharing and sugar price calculation, instability prevention and research and development, and sugar and sugarcane production.

The study conducted by Kasetsart University and the Office of the Cane and Sugar Board (2005) showed that from 1982–2003, the importation of sugar into the kingdom was controlled to prevent the disturbance of foreign sugar in the local market. The sugar distribution system was operated under the quota system as a guarantee of food security for domestic consumption. Quota A was white sugar produced for domestic consumption. The distribution of quota A was operated under the pricing scheme of the Ministry of Commerce. The price set the wholesale sugar price floor and eliminated the special 5 baht/kg tax on domestic sugar sales. Quota B is for the exportation and it operated under the Thai Sugar and Sugarcane Company, which had a committee composed of representatives of government, sugar mills, and farmers. Finally, quota C was raw, white, refined sugar for the exportation, but the mills can export those sugars after the amount of quota A and B were fulfilled quota A and quota B. The exportation of quota C was done by the sugar mills. This quota was operated under competition with the commodity futures exchange market.

Sugar prices were calculated in Thailand using the pooling systems between revenue from sugar sold in the domestic market (quota A) that was protected from the governmental fixed prices plus revenue from the sugar exported (quotas B and C). Thereafter, these revenues were used to calculate the sugarcane price at the final destination or at a sugar mill instead of at the farm level. For the quality control, sugarcane pricing is set according to Commercial Cane Sugar (CCS) that represent sugar content of the cane. It is measured at the mill by a representative of the government. Moreover, the price of burned sugarcane will be lower than that of green sugarcane

The sugar and sugarcane production systems are provided by the Cane and Sugar Act of 1984. At the farm level, the sugarcane production system is run under the system of contract farming. The sugarcane farmers must register via the sugar mills, which are under control of the Ministry of Industry. Under this system, the government controls the sugarcane production promotion zone, sugarcane harvesting and transfer processes. The sugarcane price is calculated under the benefit-sharing and price calculation system. It is the price at the mill that already includes the transportation cost. At the mill level, the quality and quantity of sugar production is controlled by the committees from farmers, government, and sugar millers (Kasetsart University and the Office of the Cane and Sugar Board, 2005).

The Cane and Sugar Act of 1984 likewise guides the creation of a benefit-sharing system to ensure fairness in income distribution between sugarcane farmers and sugar millers. Total income is divided, with 70% allocated to sugarcane farmers, and 30% allotted for sugar millers. The process underlying this system was approved by the relevant commission and cabinet division (Kasetsart University and the Office of the Cane and Sugar Board, 2005). This system appears to help farmers in terms of income sustainability (Chuasuwan, 2018) and helps reduce the risk presented by fluctuations in sugarcane prices. The benefit-sharing system guarantees security in raw material supply for sugar mills and advances the development of the upstream segment of the supply chain. Therefore, the system appears to be more beneficial to sugar mills than farmers given that the revenue earned under benefit sharing is calculated only from the income earned by selling sugar and molasses. Income from other co-products generated along the supply chain, such as ethanol and electric power, are disregarded in revenue computation. This process is stipulated in the Cane and Sugar Act of 1984.

The Cane and Sugar Fund was established to stabilize Thailand’s sugar and sugarcane industry and support research and development for sugar and sugarcane production. The fund is a collection of income from revenues generated through sugar sales in the domestic market (quota A). As mandated by the Cane and Sugar Act of 1984, sugar price in the domestic market is the factory gate price of refined sugar and the fixed rate set by the Ministry of Commerce in 2012. The prices of white refined sugar and pure refined sugar were set at 20.30 and 21.40 THB/kg, respectively. Sugar producers must allot the 5 THB/kg tax that they pay to the fund. This income intended to subsidize sugarcane production and stabilize sugar prices when such prices fluctuate in the global market.

As previously stated, Thailand has a long history with the subsidization of sugar exportation and stabilizing domestic sugar prices. However, this system was also implemented around the world, for example, in European communities. In the past decade (the sugar crop year 2003–2004), sugar in the global market dropped below the total cost of production because of the heavy subsidization in developed countries, such as those in the European Union (EU). At this time, this subsidization had a negative effect on the Thai economy of around 154.60 million dollars, since Thailand’s economy heavily depends on the agricultural trade that brings in foreign income to overcome the trade deficit due to the importing of non-agricultural products (Chanhom, n.d.). Therefore, in 2003, Thailand, Brazil and Australia submitted documents to the World Trade Organization (WTO) as complainants against the EU, and they had a successful case. This outcome enabled Thailand to produce and export a large amount of sugar to the global market. From 2011–2014, even though global sugar prices dropped by 40%, Thailand’s sugar exportation rose by 70% (Meriot, 2015). However, the euphoria did not last long. In 2016, the WTO requested that Thailand join consultations with the Brazilian delegation over Thailand’s subsidization of sugarcane farmers, which resulted in a successful challenge to the Thai sugar sector. On January 15, 2018, the Thai government decided to temporarily deregulate and cancel the quota system, implying that the domestic sugar price would depend on sugar prices in the global market (Office of the Cane and Sugar Board, n.d.), and also that the Thai government would not be allowed to keep imposing subsidies on its sugar industry.

The Thai government’s response to sugarcane farmers after the cancellation of the quota system is to reform the Cane and Sugar Act of 1984. The major change being negotiated between farmers and sugar mills is related to source of income under the benefit-sharing system. The Cane and Sugar Act of 1984 states that income from the benefit-sharing system should come from revenue generated through sugar and molasses sales. However, farmers also want to acquire benefits from ethanol products. To date, the process is not yet completed.

Under the situation of risk in term of government policy and of more competition among net sugar exporters, such as Brazil, India and the USA, as well as the heavy price drop in the global market, Thailand no longer has a high competitiveness or an advantage over other sugar net exporters in the global market. This has especially affected the sustainability of the sugar growers, who are farmers and the country’s backbone. It is important to first understand Thai sugarcane growers’ characteristics. Therefore, this paper will focus on this issue.

SITUATION OF SUGARCANE PRODUCTION IN THAILAND

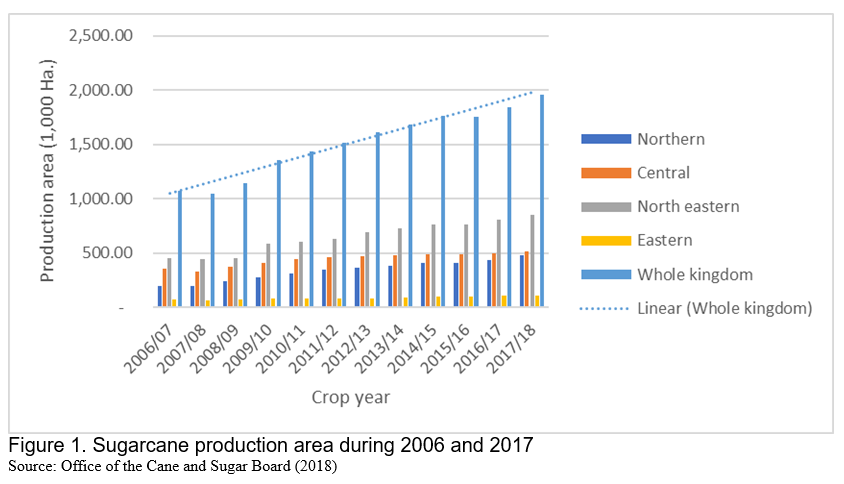

The sugarcane production area is distributed along different regions of Thailand, except for the southern region. The north-eastern region accounts for around 43% of total sugarcane cultivation, which is the largest proportion compared to other regions. The second- and third-most productive regions are the central region and the northern region (Figure 1), where the first sugar mill was established 80 years ago.

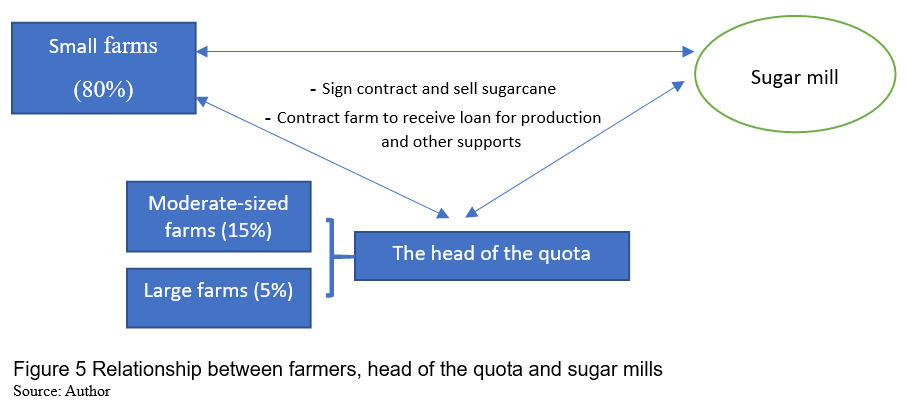

In Thailand, more than 80% of all sugarcane farmers are small-scale farmers; only 15% have moderate-sized farms and 5% have large farms (Sriroth, 2016). A small farm is considered to be 0.16–9.44 ha, a moderate-sized farm is 9.6–31.84 ha and a large farm is greater than 31.84 ha. The proportion of small-scale farms is higher in the north-eastern region than in other regions. Almost all moderate-sized and large farms are in the northern and central regions, where sugar mills have been established for more than eight decades.

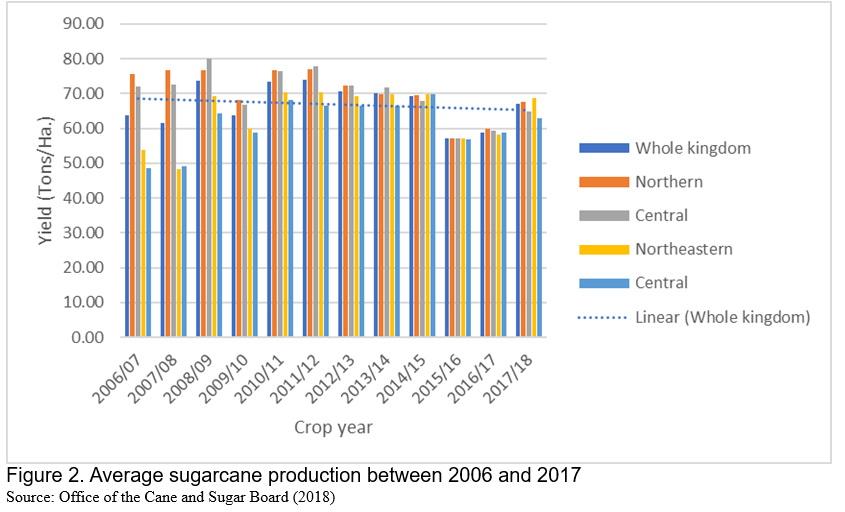

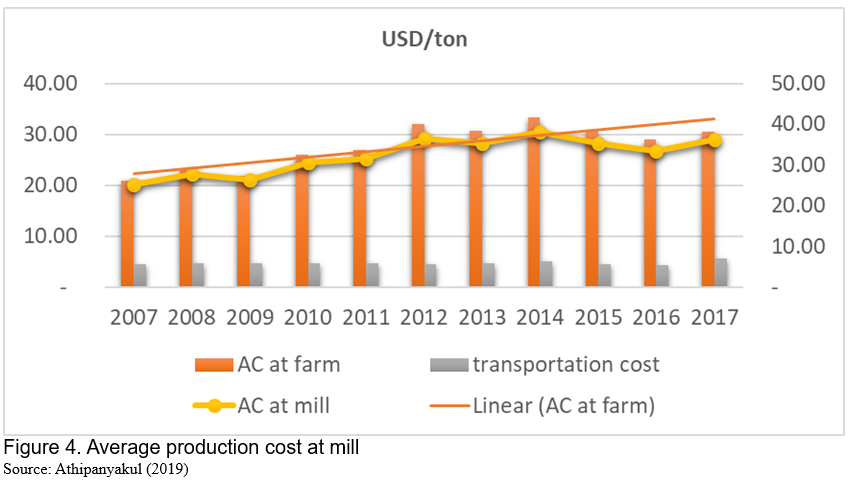

In the last decade, the expansion of sugarcane production in Thailand sharply increased from 1,076.35 ha to 1,957.77 ha (Figure 1); however, in the crop year 2015–2016, Thailand produced a low quantity of sugarcane due to the impact of drought. During this time, the average production of sugarcane decreased (Figure 2). It seems that the expansion of Thai sugarcane production is due to the expansion of the production area instead of yield improvement. Considering that the trend of sugar prices in the global market has been decreasing, this implies declining sugarcane prices in Thailand (Figure 3). This may make farmers suffer because of low income, especially when the average cost of sugarcane has increased (Figure 4). The proportions of the average production costs are higher in labour costs and material costs. More than 50% of the total costs went to labour costs, which was confirmed in the study by Athipanyakul et al. (2015).

In Thailand, the price of sugarcane production is the price at the mill destination. Therefore, farmers have to be responsible for the transportation costs. Figure 4 shows that the transportation costs of bringing sugarcane from farms to mills have increased. This is caused by a problem of inbound logistics management; i.e. almost no sugar mills in Thailand use queuing systems. Trucks will load sugarcane on a first come, first served basis. Some trucks had to wait for around 30 hours to load sugarcane (Chetthamrongchai et al., 2001); the maximum waiting time for loading in last year was 48 hours (Athipanyakul, 2019). This means that farmers must pay more for the drivers’ wages and truck rental. Moreover, transportation policy was reformed in 2016. The loading limit for 10-wheeler trucks is only 15 tons, whereas in the past, it was 25 tons. A solution to reduce the impact of increasing farmers’ transportation costs is to increase the management efficiency of the queuing system (Athipanyakul, 2019).

QUOTA MARKETING SYSTEM

Under the Cane and Sugar Act of 1984, farmers gain the price at the mill destination, and farmers who want to sell sugarcane to a mill must make a futures market contract as well as register as sugarcane farmers with the government. This system was established in order to manage the supply of sugarcane for the mills and to manage the quantity of sugarcane in the country.

To ensure a sufficient sugarcane supply, the sugar mills often directly enter into a futures market contract with farmers. However, in some regions where the majority of sugarcane farms are small, farms are located far away from sugar mills and farmers have no ability to invest in either any agricultural machinery or a truck for transportation; therefore, the mill prefer to do a contract with both moderate-sized farms and large farms instead of small farms. Those farms are called the “head of the quota.” With this system, the head of the quota can be both a farmer and a collector at the same time. To increase their ability to collect sugarcane, the mills will support giving credit to either farmers or the head of the quota. Thereafter, the head of the quota will lend the money to the small-scale farmers for investment in sugarcane production (Figure 5).

THE CHALLENGE FOR THAI SUGARCANE FARME

Under the situations of surplus supply, drops in global sugar prices, climate vulnerability, labor shortages leading to increasing labor costs and the lack of a strong public policy, Thai sugarcane farmers have suffered more in terms of increasing in production costs and have a lower income compared to four years ago. The challenge to make Thailand more competitive is to improve sugarcane production efficiency in order to reduce the production costs and increase sugarcane productivity. Unfortunately, as Athipanyakul’s 2018 study on sugarcane production efficiency in Thailand reported, the returns to scale in sugarcane production for small-scale farmers showed that 60.64% of observed sugarcane farms were in increasing returns to scale, implying that smaller operations contend with diseconomies of scale. Only 34.04% of observed sugarcane farms operated at an optimal scale, whereas 5.32% operated at decreasing returns to scale (i.e. larger operations). The results were consistent with the findings of Baliero et al. (2016) that Thai sugarcane farmers face high average production costs in the long run due to improper production plant size. To make farmers more competitive, inefficiency in sugarcane production can be eliminated via the adoption of sustainable practices at the farm level (Athipanyakul, 2018) and increasing the efficiency of the queuing system at the sugar mill destination. Moreover, labor-saving technologies, such as sugarcane harvester, and other farm machineries, would be used with the optimal farm size. The operation of farm machinery for small-scale farms would be done using a group management system.

REFERENCES

Athipanyakul, T., Jaisil, P., Ketanan, P., & Auengthaworn, K. (2015). Research and development of sugarcane farm business for sustainable cane and sugar industry. Report to Thailand Research Fund. Bangkok, Thailand.

Athipanyakul, T. (2018). Sugarcane production efficiency of small-scale farmers in Thailand. International Sugar Journal. 120(1434), 470–475.

Athipanyakul, T. (2019). Sugarcane transportation system and Impact of Transportation regulation toward yield of sugar and cane. Report to Thailand Research Fund. Bangkok, Thailand.

Balieiro, S., de Witte, T., & Weerathaworn, P. (2016). Using production cost analysis to understand the competitiveness of sugarcane production: a comparison among Thailand, Vietnam, South Africa and Brazil. Proceeding of the International Journal of Sugar Cane Technologists 20, 1–10.

Chanhom, K. (n.d.). WTO ruling to strengthen world’s export on sugar. Thai Law Forum. Accessed 25 October 2019. Retrieved from: http://www.thailawforum.com/articles/wto-ruling-strengthen-world-export-sugar-thailand.html.

Kasetsart University and the Office of the Cane and Sugar Board. (2005). Project to reform the benefit sharing system of sugar and sugarcane industry. Ministry of Industry, Thailand.

Trade Statistics for International Business Development (TSI). (2016). List of exporters for the selected product. Product: 1701 cane and beet sugar. Online database. Accessed 25 October 2019. Retrieved from: http://www.trademap.org/tradestat/CountrySelProductTS.aspx.

Meriot, A. (2015). Thailand’s sugar policy: Government drives production and export expansion. Sugar Expertise LLC, for the American Sugar Alliance.

Office of the Cane and Sugar Board (OCSB). (2018). Report of Sugarcane Production in Thailand. Online database. Accessed 25 October 2019 http://www.ocsb.go.th/upload/journal/fileupload/923-3254.pdf

Preecha, R., Jungtrakool, M., Srikongpetch, K., & Ratavetchakul, W. (2017). New Outlook of Thai Sugar and Cane Industries. Khon Kaen, Thailand: Bank of Thailand Symposium.

Reardon, T., & Barrett, C. B. (2000). Agroindustrialization, globalization, and international development an overview of issues, patterns, and determinants. Agricultural Economics 23, 195–205.

Sriroth, K. (2016). Thai crop production where is it heading to?, presentated at Cash Crop Conference 2016, Bangkok, Thailand, 30 June 2016.

The Challenge for Thai Sugarcane Farmers

ABSTRACT

Thailand is ranked as the second-largest net exporter of sugar in the global market. The sugarcane and sugar industry in Thailand plays a major role in its economy in terms of job-creation for Thai citizens and international trade. Therefore, the Thai government has promoted this sector along the supply chain. However, since 2013, Thai sugarcane farmers have faced several challenges: dropping sugarcane prices, increasing production and transportation costs and low productivity. This results in the suffering of some Thai sugarcane farmers especially those with small-scale farms. To increase the competitiveness of this sector, the challenges are to improve sugarcane production efficiency, to increase sugarcane productivity and to improve the sugarcane transportation and loading systems from farm to mill.

OVERVIEW OF THE THAI SUGAR SECTOR

The sugarcane and sugar sector in Thailand was first developed several decades ago. The first mill, established in 1938, is located in Lampang Province in Northern Thailand. This mill is still in operation. From 1952–1957, the sector was operated under a capitalist monopoly. Today, the industry has become more privatized; there are currently 57 sugar millers with a total sugarcane production area of about 1.75 million hectares (ha), or 7.36% of the agricultural land in the whole Kingdom of Thailand. This sector plays a crucial role in the Thai economy. It generates around 7.81 billion US dollars per year and employs 1.5 million people (Preecha et al., 2017). Approximately only 30% of Thailand’s sugar products are used for domestic consumption, whereas the rest are exported to the global market. At present, Thailand itself has become the second-largest exporter of sugar in the global market (Athipanyakul, 2018).

In order to stabilize the sector, the Thai government has promoted the sector along its value chain. The Thai government issued the Cane and Sugar Act of 1984 (B.E. 2527). The Act was related to the systems of exportation and importation of sugar, sugar distribution, benefit-sharing and sugar price calculation, instability prevention and research and development, and sugar and sugarcane production.

The study conducted by Kasetsart University and the Office of the Cane and Sugar Board (2005) showed that from 1982–2003, the importation of sugar into the kingdom was controlled to prevent the disturbance of foreign sugar in the local market. The sugar distribution system was operated under the quota system as a guarantee of food security for domestic consumption. Quota A was white sugar produced for domestic consumption. The distribution of quota A was operated under the pricing scheme of the Ministry of Commerce. The price set the wholesale sugar price floor and eliminated the special 5 baht/kg tax on domestic sugar sales. Quota B is for the exportation and it operated under the Thai Sugar and Sugarcane Company, which had a committee composed of representatives of government, sugar mills, and farmers. Finally, quota C was raw, white, refined sugar for the exportation, but the mills can export those sugars after the amount of quota A and B were fulfilled quota A and quota B. The exportation of quota C was done by the sugar mills. This quota was operated under competition with the commodity futures exchange market.

Sugar prices were calculated in Thailand using the pooling systems between revenue from sugar sold in the domestic market (quota A) that was protected from the governmental fixed prices plus revenue from the sugar exported (quotas B and C). Thereafter, these revenues were used to calculate the sugarcane price at the final destination or at a sugar mill instead of at the farm level. For the quality control, sugarcane pricing is set according to Commercial Cane Sugar (CCS) that represent sugar content of the cane. It is measured at the mill by a representative of the government. Moreover, the price of burned sugarcane will be lower than that of green sugarcane

The sugar and sugarcane production systems are provided by the Cane and Sugar Act of 1984. At the farm level, the sugarcane production system is run under the system of contract farming. The sugarcane farmers must register via the sugar mills, which are under control of the Ministry of Industry. Under this system, the government controls the sugarcane production promotion zone, sugarcane harvesting and transfer processes. The sugarcane price is calculated under the benefit-sharing and price calculation system. It is the price at the mill that already includes the transportation cost. At the mill level, the quality and quantity of sugar production is controlled by the committees from farmers, government, and sugar millers (Kasetsart University and the Office of the Cane and Sugar Board, 2005).

The Cane and Sugar Act of 1984 likewise guides the creation of a benefit-sharing system to ensure fairness in income distribution between sugarcane farmers and sugar millers. Total income is divided, with 70% allocated to sugarcane farmers, and 30% allotted for sugar millers. The process underlying this system was approved by the relevant commission and cabinet division (Kasetsart University and the Office of the Cane and Sugar Board, 2005). This system appears to help farmers in terms of income sustainability (Chuasuwan, 2018) and helps reduce the risk presented by fluctuations in sugarcane prices. The benefit-sharing system guarantees security in raw material supply for sugar mills and advances the development of the upstream segment of the supply chain. Therefore, the system appears to be more beneficial to sugar mills than farmers given that the revenue earned under benefit sharing is calculated only from the income earned by selling sugar and molasses. Income from other co-products generated along the supply chain, such as ethanol and electric power, are disregarded in revenue computation. This process is stipulated in the Cane and Sugar Act of 1984.

The Cane and Sugar Fund was established to stabilize Thailand’s sugar and sugarcane industry and support research and development for sugar and sugarcane production. The fund is a collection of income from revenues generated through sugar sales in the domestic market (quota A). As mandated by the Cane and Sugar Act of 1984, sugar price in the domestic market is the factory gate price of refined sugar and the fixed rate set by the Ministry of Commerce in 2012. The prices of white refined sugar and pure refined sugar were set at 20.30 and 21.40 THB/kg, respectively. Sugar producers must allot the 5 THB/kg tax that they pay to the fund. This income intended to subsidize sugarcane production and stabilize sugar prices when such prices fluctuate in the global market.

As previously stated, Thailand has a long history with the subsidization of sugar exportation and stabilizing domestic sugar prices. However, this system was also implemented around the world, for example, in European communities. In the past decade (the sugar crop year 2003–2004), sugar in the global market dropped below the total cost of production because of the heavy subsidization in developed countries, such as those in the European Union (EU). At this time, this subsidization had a negative effect on the Thai economy of around 154.60 million dollars, since Thailand’s economy heavily depends on the agricultural trade that brings in foreign income to overcome the trade deficit due to the importing of non-agricultural products (Chanhom, n.d.). Therefore, in 2003, Thailand, Brazil and Australia submitted documents to the World Trade Organization (WTO) as complainants against the EU, and they had a successful case. This outcome enabled Thailand to produce and export a large amount of sugar to the global market. From 2011–2014, even though global sugar prices dropped by 40%, Thailand’s sugar exportation rose by 70% (Meriot, 2015). However, the euphoria did not last long. In 2016, the WTO requested that Thailand join consultations with the Brazilian delegation over Thailand’s subsidization of sugarcane farmers, which resulted in a successful challenge to the Thai sugar sector. On January 15, 2018, the Thai government decided to temporarily deregulate and cancel the quota system, implying that the domestic sugar price would depend on sugar prices in the global market (Office of the Cane and Sugar Board, n.d.), and also that the Thai government would not be allowed to keep imposing subsidies on its sugar industry.

The Thai government’s response to sugarcane farmers after the cancellation of the quota system is to reform the Cane and Sugar Act of 1984. The major change being negotiated between farmers and sugar mills is related to source of income under the benefit-sharing system. The Cane and Sugar Act of 1984 states that income from the benefit-sharing system should come from revenue generated through sugar and molasses sales. However, farmers also want to acquire benefits from ethanol products. To date, the process is not yet completed.

Under the situation of risk in term of government policy and of more competition among net sugar exporters, such as Brazil, India and the USA, as well as the heavy price drop in the global market, Thailand no longer has a high competitiveness or an advantage over other sugar net exporters in the global market. This has especially affected the sustainability of the sugar growers, who are farmers and the country’s backbone. It is important to first understand Thai sugarcane growers’ characteristics. Therefore, this paper will focus on this issue.

SITUATION OF SUGARCANE PRODUCTION IN THAILAND

The sugarcane production area is distributed along different regions of Thailand, except for the southern region. The north-eastern region accounts for around 43% of total sugarcane cultivation, which is the largest proportion compared to other regions. The second- and third-most productive regions are the central region and the northern region (Figure 1), where the first sugar mill was established 80 years ago.

In Thailand, more than 80% of all sugarcane farmers are small-scale farmers; only 15% have moderate-sized farms and 5% have large farms (Sriroth, 2016). A small farm is considered to be 0.16–9.44 ha, a moderate-sized farm is 9.6–31.84 ha and a large farm is greater than 31.84 ha. The proportion of small-scale farms is higher in the north-eastern region than in other regions. Almost all moderate-sized and large farms are in the northern and central regions, where sugar mills have been established for more than eight decades.

In the last decade, the expansion of sugarcane production in Thailand sharply increased from 1,076.35 ha to 1,957.77 ha (Figure 1); however, in the crop year 2015–2016, Thailand produced a low quantity of sugarcane due to the impact of drought. During this time, the average production of sugarcane decreased (Figure 2). It seems that the expansion of Thai sugarcane production is due to the expansion of the production area instead of yield improvement. Considering that the trend of sugar prices in the global market has been decreasing, this implies declining sugarcane prices in Thailand (Figure 3). This may make farmers suffer because of low income, especially when the average cost of sugarcane has increased (Figure 4). The proportions of the average production costs are higher in labour costs and material costs. More than 50% of the total costs went to labour costs, which was confirmed in the study by Athipanyakul et al. (2015).

In Thailand, the price of sugarcane production is the price at the mill destination. Therefore, farmers have to be responsible for the transportation costs. Figure 4 shows that the transportation costs of bringing sugarcane from farms to mills have increased. This is caused by a problem of inbound logistics management; i.e. almost no sugar mills in Thailand use queuing systems. Trucks will load sugarcane on a first come, first served basis. Some trucks had to wait for around 30 hours to load sugarcane (Chetthamrongchai et al., 2001); the maximum waiting time for loading in last year was 48 hours (Athipanyakul, 2019). This means that farmers must pay more for the drivers’ wages and truck rental. Moreover, transportation policy was reformed in 2016. The loading limit for 10-wheeler trucks is only 15 tons, whereas in the past, it was 25 tons. A solution to reduce the impact of increasing farmers’ transportation costs is to increase the management efficiency of the queuing system (Athipanyakul, 2019).

QUOTA MARKETING SYSTEM

Under the Cane and Sugar Act of 1984, farmers gain the price at the mill destination, and farmers who want to sell sugarcane to a mill must make a futures market contract as well as register as sugarcane farmers with the government. This system was established in order to manage the supply of sugarcane for the mills and to manage the quantity of sugarcane in the country.

To ensure a sufficient sugarcane supply, the sugar mills often directly enter into a futures market contract with farmers. However, in some regions where the majority of sugarcane farms are small, farms are located far away from sugar mills and farmers have no ability to invest in either any agricultural machinery or a truck for transportation; therefore, the mill prefer to do a contract with both moderate-sized farms and large farms instead of small farms. Those farms are called the “head of the quota.” With this system, the head of the quota can be both a farmer and a collector at the same time. To increase their ability to collect sugarcane, the mills will support giving credit to either farmers or the head of the quota. Thereafter, the head of the quota will lend the money to the small-scale farmers for investment in sugarcane production (Figure 5).

THE CHALLENGE FOR THAI SUGARCANE FARME

Under the situations of surplus supply, drops in global sugar prices, climate vulnerability, labor shortages leading to increasing labor costs and the lack of a strong public policy, Thai sugarcane farmers have suffered more in terms of increasing in production costs and have a lower income compared to four years ago. The challenge to make Thailand more competitive is to improve sugarcane production efficiency in order to reduce the production costs and increase sugarcane productivity. Unfortunately, as Athipanyakul’s 2018 study on sugarcane production efficiency in Thailand reported, the returns to scale in sugarcane production for small-scale farmers showed that 60.64% of observed sugarcane farms were in increasing returns to scale, implying that smaller operations contend with diseconomies of scale. Only 34.04% of observed sugarcane farms operated at an optimal scale, whereas 5.32% operated at decreasing returns to scale (i.e. larger operations). The results were consistent with the findings of Baliero et al. (2016) that Thai sugarcane farmers face high average production costs in the long run due to improper production plant size. To make farmers more competitive, inefficiency in sugarcane production can be eliminated via the adoption of sustainable practices at the farm level (Athipanyakul, 2018) and increasing the efficiency of the queuing system at the sugar mill destination. Moreover, labor-saving technologies, such as sugarcane harvester, and other farm machineries, would be used with the optimal farm size. The operation of farm machinery for small-scale farms would be done using a group management system.

REFERENCES

Athipanyakul, T., Jaisil, P., Ketanan, P., & Auengthaworn, K. (2015). Research and development of sugarcane farm business for sustainable cane and sugar industry. Report to Thailand Research Fund. Bangkok, Thailand.

Athipanyakul, T. (2018). Sugarcane production efficiency of small-scale farmers in Thailand. International Sugar Journal. 120(1434), 470–475.

Athipanyakul, T. (2019). Sugarcane transportation system and Impact of Transportation regulation toward yield of sugar and cane. Report to Thailand Research Fund. Bangkok, Thailand.

Balieiro, S., de Witte, T., & Weerathaworn, P. (2016). Using production cost analysis to understand the competitiveness of sugarcane production: a comparison among Thailand, Vietnam, South Africa and Brazil. Proceeding of the International Journal of Sugar Cane Technologists 20, 1–10.

Chanhom, K. (n.d.). WTO ruling to strengthen world’s export on sugar. Thai Law Forum. Accessed 25 October 2019. Retrieved from: http://www.thailawforum.com/articles/wto-ruling-strengthen-world-export-sugar-thailand.html.

Kasetsart University and the Office of the Cane and Sugar Board. (2005). Project to reform the benefit sharing system of sugar and sugarcane industry. Ministry of Industry, Thailand.

Trade Statistics for International Business Development (TSI). (2016). List of exporters for the selected product. Product: 1701 cane and beet sugar. Online database. Accessed 25 October 2019. Retrieved from: http://www.trademap.org/tradestat/CountrySelProductTS.aspx.

Meriot, A. (2015). Thailand’s sugar policy: Government drives production and export expansion. Sugar Expertise LLC, for the American Sugar Alliance.

Office of the Cane and Sugar Board (OCSB). (2018). Report of Sugarcane Production in Thailand. Online database. Accessed 25 October 2019 http://www.ocsb.go.th/upload/journal/fileupload/923-3254.pdf

Preecha, R., Jungtrakool, M., Srikongpetch, K., & Ratavetchakul, W. (2017). New Outlook of Thai Sugar and Cane Industries. Khon Kaen, Thailand: Bank of Thailand Symposium.

Reardon, T., & Barrett, C. B. (2000). Agroindustrialization, globalization, and international development an overview of issues, patterns, and determinants. Agricultural Economics 23, 195–205.

Sriroth, K. (2016). Thai crop production where is it heading to?, presentated at Cash Crop Conference 2016, Bangkok, Thailand, 30 June 2016.