ABSTRACT

Malaysia is one of the important countries for the world’s pineapple industry. In 2017, Malaysia was ranked number 19 as the top pineapple producing country, and number five as the top exporter of pineapples in the world. Every year Malaysia produces more than 350,000 Mt of pineapples. Around 30% of fresh pineapples and 95% of canned pineapples are exported to many countries. Singapore, Western Arabs, Brunei and Hong Kong are the traditional markets for Malaysia’s pineapples. The Malaysian government looks at Japan as a new potential market and has started to negotiate with Japan to get market access. On the other hand, Japan is one of the leading importers of fresh pineapples in the world. Japan imported more than US$130.3 million of pineapples in 2018, which is representing 4.8% of the world imported values (US$ 2.73 billion). Malaysia gets the approval to enter the Japanese market in 2015, and since then, started very aggressively to penetrate this market. This paper identifies the market scenario, consumer preferences and exports protocol quarantine, including post-harvest techniques that could create opportunities for fresh and value-added pineapples from Malaysia to Japan.

Keywords: Pineapple, Japanese market, Access market, consumer preference

INTRODUCTION

Pineapple (Ananas comosus L, Merr) is a non-seasonal tropical fruit. It is easy to be cultivated by using crown cutting or suckers, and will be fruiting in around 15-16 months before ready for harvest. Three main cultivars namely, Smooth Cayenne, Cayenne and Cayena Lisa (in Spanish) were the most cultivars (70%) used in the world which was introduced from Cayenne, French Guyana in 1820. These cultivars were grown for both canning and for fresh consumption. After decades, through research and development by research institutions around the world, there are many clones generated, such as Bumanguesa (Venezuela and Colombia), Giant Kew (India), Pernambuco (Brazil, Ecuador, Venezuela and Peru), MD2 (Hawaii) and Sarawak and Josapine (Malaysia). For many years, Malaysia exported Josapine pineapples to Singapore, Middle East Countries and Hong Kong. In response to the demand by consumers in the world markets, Malaysia started to cultivate MD2 pineapples for export markets in 2008. In the beginning, Malaysia bought 100,000 suckers from the Philippines. Currently, around 40% of pineapple areas are cultivated with MD2 pineapples, while the balance is cultivated with Josapine, Sarawak and other cultivars.

Pineapple is consumed as fresh or processed products. It is rich in vitamins, enzymes and antioxidants, which may help in boosting the human body’s immune system, build strong bones and aid in indigestion. Pineapple is also fat-free, cholesterol free and low in sodium. In fact, pineapple contains very high bromelain enzymes that could be used in food and processing industry such as gelatin-based dessert or gel capsules.

In Japan’s market, previously in the 1960s, Mandarin and orange were the major consumed fruits, but currently tropical fruits like banana, mango, papaya and pineapple are getting popular, and highly demanded by Japanese consumers. In sub-tropical areas of Japan, particularly in Okinawa and Southern Kyushu, tropical fruits such as pineapple, mango, honey dew and papaya can be planted. However, the domestic production is insufficient for local demand, and thus, imported fruits serve as alternative products or fill the tropical fruits gap. Currently, tropical fruits are imported from various countries. For instance, bananas are imported from the Philippines and Ecuador, pineapple from the Philippines, Taiwan and Malaysia, while mango are imported from Mexico and Thailand.

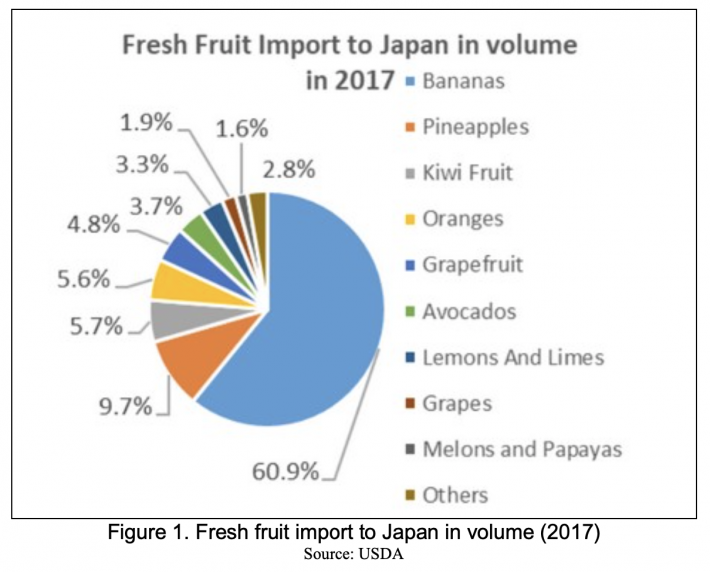

As of 2015, the demand for Japanese fresh fruit market is estimated at around 4.71 million MT. Currently, Japan imports one-third of its demanded fresh fruit at approximately 1.6 million MT in 2017. Banana is the most popular, and the highest imported tropical fruit (60%) followed by pineapple (10.3%), grapefruits (7%) and orange (5.83%). In 2016, Japan imports 959,000 Mt banana from the Philippines, which is represented 99% of the share market, and the volume had been increasing. In the same year, Japan imports about 151,000 Mt of pineapples from the same country. The Philippines supplies about 92.8% of the Japanese market requirements. Grapefruits and oranges are the non-tropical fruits which also have high demand in Japan, and they are mainly imported from temperate countries like New Zealand, South Africa and United States of America.

Malaysia gets the approval to market its pineapples to Japan in 2015. Since then, the Malaysian government sets strategies and action plans on how to penetrate this new market. Furthermore, the pineapple market has been dominated by the Philippines for decades, and the consumers are familiar with the Philippine brand. This paper highlights the market scenario; the challenges and opportunity should Malaysia choose to expand its pineapples to the Japanese market.

ACCESS TO JAPANESE MARKET

Japan is one of the important trading partners of Malaysia. Trade with Japan totaled RM132.57 billion (US$31.6 billion), sustaining an annual value above RM100 billion (US$23.8 billion) for over a decade and remained as Malaysia’s 4th largest trading partner since 2015. Trade with Japan accounted for 7.1 % of Malaysia’s total trade. During January to September 2019, Malaysia exports more than US$17.11 billion to Japan, mainly minerals, oil and gas and distillation products (32%) and electronic and electric components (26%). However, the contribution of agriculture produce is relatively small. In 2018, Malaysia exports around US$674.46 million of agriculture produce and agro-based products to Japan.

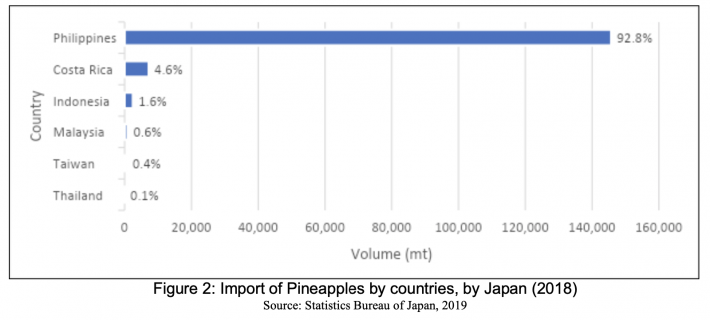

In 2018, Japan imports 158,000 Mt of pineapples, out of which, 92.8% came from the Philippines, followed by Costa Rica (4.6%), Indonesia (1.6%) and Malaysia (0.6%) (Figure 2). The consumption of pineapples in Japan has increased around 5% every year. The Philippines is the traditional supplier of pineapples, especially the MD2 variety. The relationship between the importers and exporters from these two countries has created a monopoly market for pineapples for decades. The share market of the Malaysian pineapples is very small in the Japan market.

Even though the Japan market for pineapples has been dominated by the Philippines for decades, there is still a great opportunity for Malaysia to increase the volume as the demand for pineapples in Japan is increasing every year. Malaysia needs an appropriate and strong strategy should it plan to penetrate the Japanese market.

Malaysia aims to increase the volume and value of the agricultural and agro-based products in the Japan market. Malaysia entered the agreements with Japan through the multilateral agreements between Japan and the ASEAN, or the special bilateral agreement between Malaysia and the Japanese government. Malaysia and Japan had established the Malaysia-Japan Economic Partnership Agreement (MJEPA) on 13 December 2005. The objective of the agreement is to liberalize and facilitate the trade between the two countries. The agricultural products that have been exported to Japan include palm oil, rubber, fishery products and edible fruits. From the total agricultural commodities exported to Japan, edible fruits and nuts rank number 10. In the bilateral negotiation between Malaysia and Japan, only eight types of fruits are given the access to the Japan market. The fruits are fresh pineapple, fresh banana, frozen chempedak or jackfruit, fresh coconut, frozen durian, fresh longan and fresh Harumanis mango. Other fruits are prohibited to be exported to Japan. At the same time, other frozen processed fruit products are allowed, but must be stored at -18℃ or below. Canning or dried processed fruits are also allowed to enter the Japan market on the condition that they follow the protocols of processed product monitored by the Ministry of Health Malaysia.

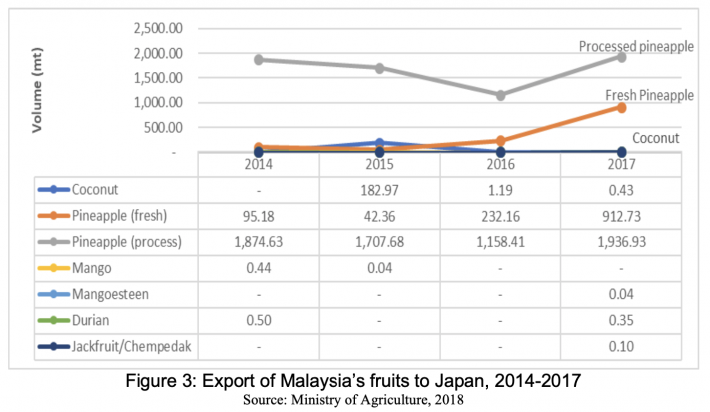

Report shows that between 2014 and 2017, pineapple is the most exported fruit to Japan either in their fresh or processed forms (Figure 3). Processed pineapple is in the form of canning or juice. While fresh pineapple is directly supplied from farm to end consumers. Although, the fresh volume is smaller than the processed products, export trend for fresh pineapple had increased significantly at around 293% from 232.16 mt (2016) to 912.73 mt (2017). This figure indicates that Malaysia’s pineapple is getting popular and received more demand from Japanese consumers. According to the custom’s record in 2018, export of pineapple to Japan is carried out by both maritime and air logistics. The export by ship is carried out at its two main ports, which are the Port Klang in Selangor or Port Tanjung Pelepas in Johor. The agricultural produce are sent directly to Port of Kobe in Kobe, or Port of Nagoya. While the export by air shipment is carried out from the International Airport in Kuala Lumpur or Senai, Johore to the International Airport of Narita, Kansai and Osaka.

Malaysia also exported fresh coconut, but in a small quantity. For example, Malaysia only exported around 430 kg of young coconut to Japan in 2017. Malaysia exported Harumanis mango in 2014 and 2015 which amounted to around 480 kg, before it stopped delivery due to lack of supply, and the price in the domestic market is better than the price offered by the Japanese consumers. Fresh durian and frozen jackfruit had also been exported to Japan in 2017, but in small quantity (less than 350 kg).

Sanitary and Phytosanitary Requirements

The Japanese government imposed stringent regulations for countries that wanted to access the Japan market. Producers wishing to sell their products to Japan must meet eight requirements aimed towards protecting the health of the Japanese citizens and preventing the entry of pests into the country. The eight requirements which refer to the producer’s establishment, the quality of the raw materials and the additives included in the product, among others, must be met. They are as follows:

- Hygiene and sanitary control of establishment;

- Raw material quality control;

- Hygiene in manufacturing and processing;

- Hygiene in product storage, transportation and distribution;

- JAS Certification;

- Maximum limits for chemicals and contamination;

- No prohibited additives; and

- Traceability

In order to fulfill the export protocol, sanitary and phytosanitary requirements for pineapples is compulsory. Exporting fruits to Japan requires stringent phytosanitary measures, and exporters are responsible for checking the export regulatory requirements for their commodities to ensure that diseases and insect-pests are not carried together by the commodity before exporting. The exporting regulatory requirements may include the use of approved quarantine treatment, farm and packing house registration requirements as well as other requirements on food safety and traceability for the export of Malaysian horticultural produce (DOA, 2019). For example, the exportation of fresh MD2 pineapples from Malaysia required the producer to present the phytosanitary certificates from the Department of Agriculture, Malaysia. At the same time, the Japanese government does not allow any chemical treatment such as fungicide or other chemicals. In other words, the agriculture produce must be free from any pests and diseases. Therefore, for the Japan market, MD2 pineapples are usually harvested early in the morning, before they are delivered to the exporter’s packinghouse for cleaning and grading purposes within the same day. The fruits are cleaned attentively by trained workers by applying the high-pressured air jet for ten minutes to remove dirt and mealy bugs.

Distribution channel from farm to export

Pineapple is non-climacteric and would not ripen after harvest. For the export market, in order to achieve the optimum eating quality, MD2 pineapples are usually harvested at 145-150 days after flowering induction. At this stage, MD2 pineapples reached an appropriate degree of fruit development in terms of size, shape and ripeness. The development and condition of the harvested fruits enable them to withstand handling and transportation so that the fruits could arrive in satisfactory condition at the place of destination. According to the Malaysian Standard MS 1041:2018, the MD2 variety that are harvested at this stage should have cylindrical shape, green color on skin and crown, flat eyes and golden- yellow flesh. The harvested fruits should have brix of more than 12% with good and favorable aroma.

To realize the distribution export channel of pineapples from Malaysia to Japan, Figure 4 explained the export process. Pineapples are harvested from farms that are mostly located in the southern part of Peninsular Malaysia. Harvesting time is normally early in the morning and may take one and two days, depending on the order. There are two types of containers used for sea shipment, which is the 20-footer or 40-footer. To satisfy the 40-footer container, it is estimated that around 8,650 fresh pineapples are to be loaded. While for the 20-footer, container should be half of that. Thus, the total number of fruits harvested in the farm is estimated at around 9,100 fresh fruits, including 5% discarded due to post harvest deterioration and export standard. The producers usually exported the Grade A pineapples to Japan. The other grades are sold at local markets as fresh produce or to processing industries. Fruits are manually loaded onto a lorry, and then, transported to the packing house for cleaning, sorting, and packing. Cleaning is aimed to remove soil and dust to prevent contamination along the export process. The cleaning process could be done manually or using air-blowing. There is no treatment required for fresh pineapples to Japan, but the fruits must be free from any plant pests and diseases. For export requirement, corrugated box is used. In a box, the total weight is around 12 kg, which contain either 5, 6, 7 or 8 fruit depending on its individual weight (normally 1.2 – 1.5 kg per fruit). Fruits are stored in refrigerated container at 7 °C and are ready for sea transport from Port of Tanjung Pelepas or Klang.

Transportation from Malaysia to Japan generally takes 11-13 days, based on the stopover destination and waiting duration of the vessel. Delay in delivery may arise from many situations, such as weather conditions (storms) or technical glitch. Fruits will be retained in the Japan port for 1-2 days for customs clearance and then directly being transferred to importer’s warehouse. From there, fruits are ready to be distributed to wholesalers and retailers for selling. Overall, the process of exporting pineapples from farms in Malaysia to Japan’s retailer shelf will take almost 20 days in a maximum condition. The fastest time arriving is better in order to maintain the quality and freshness of the pineapple.

.png)

Consumers preferences

Japan is known globally as the first non-Western great power after the Second World War, when it recovered fast to become the world’s third largest economy. Majority of the people are in the middle-class level with more disposable income, high preference toward quality products and have high expectations. Japanese people are also close to their cultural beliefs. In terms of purchasing food, Japanese consumers are demanding of high quality, high value and safe products. They are willing to pay more if the products have more value compared to others. Intrinsically, in the fruits business, appearance is the most important criteria to show the quality, freshness and safety of the product. The Japanese people are becoming more cautious about the effect of radiation and the source of location, particularly after the disaster in Fukushima in 2011. As a result, any food exported to Japan should have the Good Agricultural Practices (GAPs) certification and must not undergo any chemical treatment. Strict treatment technique is imposed for certain fruits to avoid pests and diseases.

Japanese people are also high spirit in their nationalities. They prefer domestic products rather than the imported one. Thus, it gives an impact to the product’s price at the retail level. It means that the imported products are not necessarily more expensive than the domestic products. For example, imported mangoes from Thailand (Nam doc mai) are sold around JPY 500 (US$4.50) per piece while domestic mango (Miyazaki) at JPY 3,600 (US33.12) per piece. By the way, Miyazaki mango is a premium fruit, have good appearance, very well packed and widely known as special mango among Japanese people (Figure 5).

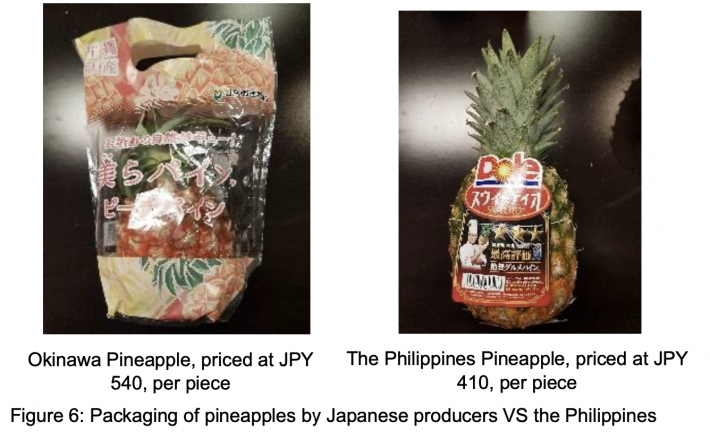

In the case of pineapples, the common fruit available in Japan market is from the Philippines some are locally, from Okinawa. The imported pineapples are sold at around JPY 410 per piece, while local pineapples are priced at JPY 540 per piece (Figure 6). Malaysian pineapples are also sold at the same price or slightly lower. Packaging and labeling also plays an important role in the distribution of the product. The packaging will represent the high quality, clean, safe and of the premium kind.

Packaging and labeling are other important preferences by Japanese consumers. Fruits which are packed with clean, unique or attractive packaging will represent the products as premium and of high quality and safety. It can be sold at the premium market and at a premium price. For instance, fresh Okinawa pineapples are packed in elongated plastic on a single piece basis around 1.0 to 1.2 kg per piece, while the pineapples from Malaysia and the Philippines are sold without wrapping.

Many Japanese consumers (>80%) used mobile phones as their main source of information and evaluation. The Japanese people will find information about products being sold in the Japanese markets, and they will make decisions based on the information gathered. Good or bad information can easily be disseminated to many people; therefore, suppliers and country activities are always monitored by consumers.

CHALLENGES AND OPPORTUNITY

Japan is a developed country, with complex consumers. Japan has a unique culture, and its people are well-known as patriotic and nationalists who give preference toward local products. There is the tendency for the Japanese consumers to prefer domestically produced products. However, the domestic production are unable to supply sufficient requirements. Domestic trends indicate that more than 90% of the population resides in the urban area. The situation has changed the profile of the Japanese consumers. They are more likely to shop at modern retail stores where imported products are sold. Currently, Japanese consumers are open to high-quality products from other countries. This is especially true when the import of agricultural products is increasing every year. The value of food imports to Japan almost doubled from $36 billion in 1990 to $61 billion in 2013, rising on average 4.2% a year over the period, about two percentage points faster than domestic production. In 2017, Japan is the world’s 4th largest importer of agricultural goods, reaching US$51.9 billion in sales.

The Japanese market is very competitive due to the high volume of foreign products coming from all over the world. Thus, consumers will seek high value but cheaper products. At the same time, some consumers are willing to buy expensive products if they are offered good quality and safe products. Japanese consumers are generally health-conscious, and thus, the preferences are on healthy and nutritious products. In other words, products that are known to be safely consumed (contains no chemicals) will receive high preference by the Japanese consumers.

Even though Japan is a net importer of agricultural products, the Japanese government maintains high tariffs, restrictive and complex safeguard, and technical barriers to trade. Japan imposes many sets of border measures such as tariffs, safeguards, tariff-rate quota, state trading, markups, variable duties, sanitary and phytosanitary requirements, and other non-tariff barriers. The non-tariff measure includes trademark, copyright and patent protection. These trade measures are used to support the domestic agriculture.

Opportunities exist for a range of agricultural products, in particular, processed and consumer-ready foods. This is true because Japan is heavily dependent on imported agricultural products, the domestic production is small-scale and unable to meet the local demand, small family size and increase in women participation in labor force and a rapidly aging population. In order to succeed in the Japanese markets, Malaysian potentioal exporters must understand and learn more about the Japanese culture and abide by all trade measures imposed by the Japanese Authorities. At the same time, producers must maintain quality and safety of the products. Quality could relate to physical and non-physical characteristics such as taste, shelf life and eating convenience. To maintain the fruit quality and its freshness, post-harvest treatment and handling are a main requirement that should be focused on. Fruits transportation using air logistics will cut short the export duration and more secured in terms of quality, however the cost is high. Sea logistics, on the other hand, need longer time but low in cost.

The certification of Good Agricultural Practices (GAP) is an additional competitive advantage for companies to market their agricultural produce to Japan. The GAP certification will ensure that all agricultural produce follows the quality standard and sustains the reliability and traceability of the agricultural input used in the production system. Most agricultural produce exported by Malaysia follows the GAP standards and thus, create an advantage in the Japanese market. In the context of pineapples, Malaysia has the opportunity to export pineapples to Japan market due to the increasing demand. However, Malaysia has to deal with the stiff competition among others producers like the Philippines, Indonesia, Thailand and Taiwan. Therefore, Malaysia’s pineapples must have value added either in terms of quality, safety or in terms of price. Or else, exporters must increase in doing value-added activfioties for their products such as doing minimal processing, fresh juice or in the desert category. Malaysia can also export its pineapples when there is a short supply in the Philippines, such as during the monsoon or typhoon season between August and October.

CONCLUSION

Japan is a potential market for agricultural produce from all over the world, including Malaysia. The consumption of agricultural produce by the Japanese consumers is increasing every year. At the same time, the local production is insufficient to supply the domestic requirements. Japan is a net importer of agricultural products and is totally dependent on the supply by foreign producers. As a result, Japanese consumers are open to imported products.

The higher demand and higher purchasing power of the Japanese consumers have created a great opportunity for exporters from Malaysia to expand their market to Japan. The Malaysian products are highly competitive as they are produced in systematic and follow the GAP standards, safely for consumption and reasonable in price. On the hand, Japan imposed strict trade barriers as a measure to protect the domestic industries. The exporters from Malaysia must learn and understand the Japanese culture, rules and regulations before investing on business ventures in Japan. Proper planning and strategies should be the key to succeed in penetrating the Japan market.

REFERENCES

Agriculture Department Malaysia. (2019). Phytosanitary Requirements for Exportation of Horticulture Produce From Malaysia 2019. Putrajaya: DOA

Amber, P. (2018). Top Pineapple Producing Countries. Retrieved on October 16, 2019 from https://www.worldatlas.com/articles/top-pineapple-producing-countries.html

Daniel, W. (2019). Pineapples Import by Country. Retrieved on October 17, 2019 from http://www.worldstopexports.com/pineapples-imports-by-country/

Hina, K. (2018). Top 10 Largest Pineapple Producing Countries in the World. Retrieved on October 14, 2019 from https://www.worldblaze.in/pineapple-producing-countries/

International Tropical Fruits Network. (2016). Pineapple-Common Varieties. Retrieved on October 16, 2019 from https://www.itfnet.org/v1/2016/05/pineapple-common varieties/#targetText=Distribution%20and%20cultivars%3A,byThailand%2C%20Phillipines%2C%20andCosta%20Rica.

Jessie, S. (2019). Pineapple: Nutrition Facts and Health Benefits. Retrieved on October 15, 2019 from https://www.livescience.com/45487-pineapple-nutrition.html

Shinji, O. (2015). Overview of tropical fruits industry in Japan. FFTC. Retrieved on October 15, 2019 from http://www.fftc.agnet.org/library.php?func=view&style=type&id=20150804084713

USDA (2018) https://www.freshplaza.com/article/9040791/japan-fresh-fruit-imports-1-62-million-tons-in-2017/

|

Date submitted: November 15, 2019

Reviewed, edited and uploaded: December 9, 2019

|

Japan as a New Market for Malaysian Pineapples

ABSTRACT

Malaysia is one of the important countries for the world’s pineapple industry. In 2017, Malaysia was ranked number 19 as the top pineapple producing country, and number five as the top exporter of pineapples in the world. Every year Malaysia produces more than 350,000 Mt of pineapples. Around 30% of fresh pineapples and 95% of canned pineapples are exported to many countries. Singapore, Western Arabs, Brunei and Hong Kong are the traditional markets for Malaysia’s pineapples. The Malaysian government looks at Japan as a new potential market and has started to negotiate with Japan to get market access. On the other hand, Japan is one of the leading importers of fresh pineapples in the world. Japan imported more than US$130.3 million of pineapples in 2018, which is representing 4.8% of the world imported values (US$ 2.73 billion). Malaysia gets the approval to enter the Japanese market in 2015, and since then, started very aggressively to penetrate this market. This paper identifies the market scenario, consumer preferences and exports protocol quarantine, including post-harvest techniques that could create opportunities for fresh and value-added pineapples from Malaysia to Japan.

Keywords: Pineapple, Japanese market, Access market, consumer preference

INTRODUCTION

Pineapple (Ananas comosus L, Merr) is a non-seasonal tropical fruit. It is easy to be cultivated by using crown cutting or suckers, and will be fruiting in around 15-16 months before ready for harvest. Three main cultivars namely, Smooth Cayenne, Cayenne and Cayena Lisa (in Spanish) were the most cultivars (70%) used in the world which was introduced from Cayenne, French Guyana in 1820. These cultivars were grown for both canning and for fresh consumption. After decades, through research and development by research institutions around the world, there are many clones generated, such as Bumanguesa (Venezuela and Colombia), Giant Kew (India), Pernambuco (Brazil, Ecuador, Venezuela and Peru), MD2 (Hawaii) and Sarawak and Josapine (Malaysia). For many years, Malaysia exported Josapine pineapples to Singapore, Middle East Countries and Hong Kong. In response to the demand by consumers in the world markets, Malaysia started to cultivate MD2 pineapples for export markets in 2008. In the beginning, Malaysia bought 100,000 suckers from the Philippines. Currently, around 40% of pineapple areas are cultivated with MD2 pineapples, while the balance is cultivated with Josapine, Sarawak and other cultivars.

Pineapple is consumed as fresh or processed products. It is rich in vitamins, enzymes and antioxidants, which may help in boosting the human body’s immune system, build strong bones and aid in indigestion. Pineapple is also fat-free, cholesterol free and low in sodium. In fact, pineapple contains very high bromelain enzymes that could be used in food and processing industry such as gelatin-based dessert or gel capsules.

In Japan’s market, previously in the 1960s, Mandarin and orange were the major consumed fruits, but currently tropical fruits like banana, mango, papaya and pineapple are getting popular, and highly demanded by Japanese consumers. In sub-tropical areas of Japan, particularly in Okinawa and Southern Kyushu, tropical fruits such as pineapple, mango, honey dew and papaya can be planted. However, the domestic production is insufficient for local demand, and thus, imported fruits serve as alternative products or fill the tropical fruits gap. Currently, tropical fruits are imported from various countries. For instance, bananas are imported from the Philippines and Ecuador, pineapple from the Philippines, Taiwan and Malaysia, while mango are imported from Mexico and Thailand.

As of 2015, the demand for Japanese fresh fruit market is estimated at around 4.71 million MT. Currently, Japan imports one-third of its demanded fresh fruit at approximately 1.6 million MT in 2017. Banana is the most popular, and the highest imported tropical fruit (60%) followed by pineapple (10.3%), grapefruits (7%) and orange (5.83%). In 2016, Japan imports 959,000 Mt banana from the Philippines, which is represented 99% of the share market, and the volume had been increasing. In the same year, Japan imports about 151,000 Mt of pineapples from the same country. The Philippines supplies about 92.8% of the Japanese market requirements. Grapefruits and oranges are the non-tropical fruits which also have high demand in Japan, and they are mainly imported from temperate countries like New Zealand, South Africa and United States of America.

Malaysia gets the approval to market its pineapples to Japan in 2015. Since then, the Malaysian government sets strategies and action plans on how to penetrate this new market. Furthermore, the pineapple market has been dominated by the Philippines for decades, and the consumers are familiar with the Philippine brand. This paper highlights the market scenario; the challenges and opportunity should Malaysia choose to expand its pineapples to the Japanese market.

ACCESS TO JAPANESE MARKET

Japan is one of the important trading partners of Malaysia. Trade with Japan totaled RM132.57 billion (US$31.6 billion), sustaining an annual value above RM100 billion (US$23.8 billion) for over a decade and remained as Malaysia’s 4th largest trading partner since 2015. Trade with Japan accounted for 7.1 % of Malaysia’s total trade. During January to September 2019, Malaysia exports more than US$17.11 billion to Japan, mainly minerals, oil and gas and distillation products (32%) and electronic and electric components (26%). However, the contribution of agriculture produce is relatively small. In 2018, Malaysia exports around US$674.46 million of agriculture produce and agro-based products to Japan.

In 2018, Japan imports 158,000 Mt of pineapples, out of which, 92.8% came from the Philippines, followed by Costa Rica (4.6%), Indonesia (1.6%) and Malaysia (0.6%) (Figure 2). The consumption of pineapples in Japan has increased around 5% every year. The Philippines is the traditional supplier of pineapples, especially the MD2 variety. The relationship between the importers and exporters from these two countries has created a monopoly market for pineapples for decades. The share market of the Malaysian pineapples is very small in the Japan market.

Even though the Japan market for pineapples has been dominated by the Philippines for decades, there is still a great opportunity for Malaysia to increase the volume as the demand for pineapples in Japan is increasing every year. Malaysia needs an appropriate and strong strategy should it plan to penetrate the Japanese market.

Malaysia aims to increase the volume and value of the agricultural and agro-based products in the Japan market. Malaysia entered the agreements with Japan through the multilateral agreements between Japan and the ASEAN, or the special bilateral agreement between Malaysia and the Japanese government. Malaysia and Japan had established the Malaysia-Japan Economic Partnership Agreement (MJEPA) on 13 December 2005. The objective of the agreement is to liberalize and facilitate the trade between the two countries. The agricultural products that have been exported to Japan include palm oil, rubber, fishery products and edible fruits. From the total agricultural commodities exported to Japan, edible fruits and nuts rank number 10. In the bilateral negotiation between Malaysia and Japan, only eight types of fruits are given the access to the Japan market. The fruits are fresh pineapple, fresh banana, frozen chempedak or jackfruit, fresh coconut, frozen durian, fresh longan and fresh Harumanis mango. Other fruits are prohibited to be exported to Japan. At the same time, other frozen processed fruit products are allowed, but must be stored at -18℃ or below. Canning or dried processed fruits are also allowed to enter the Japan market on the condition that they follow the protocols of processed product monitored by the Ministry of Health Malaysia.

Report shows that between 2014 and 2017, pineapple is the most exported fruit to Japan either in their fresh or processed forms (Figure 3). Processed pineapple is in the form of canning or juice. While fresh pineapple is directly supplied from farm to end consumers. Although, the fresh volume is smaller than the processed products, export trend for fresh pineapple had increased significantly at around 293% from 232.16 mt (2016) to 912.73 mt (2017). This figure indicates that Malaysia’s pineapple is getting popular and received more demand from Japanese consumers. According to the custom’s record in 2018, export of pineapple to Japan is carried out by both maritime and air logistics. The export by ship is carried out at its two main ports, which are the Port Klang in Selangor or Port Tanjung Pelepas in Johor. The agricultural produce are sent directly to Port of Kobe in Kobe, or Port of Nagoya. While the export by air shipment is carried out from the International Airport in Kuala Lumpur or Senai, Johore to the International Airport of Narita, Kansai and Osaka.

Malaysia also exported fresh coconut, but in a small quantity. For example, Malaysia only exported around 430 kg of young coconut to Japan in 2017. Malaysia exported Harumanis mango in 2014 and 2015 which amounted to around 480 kg, before it stopped delivery due to lack of supply, and the price in the domestic market is better than the price offered by the Japanese consumers. Fresh durian and frozen jackfruit had also been exported to Japan in 2017, but in small quantity (less than 350 kg).

Sanitary and Phytosanitary Requirements

The Japanese government imposed stringent regulations for countries that wanted to access the Japan market. Producers wishing to sell their products to Japan must meet eight requirements aimed towards protecting the health of the Japanese citizens and preventing the entry of pests into the country. The eight requirements which refer to the producer’s establishment, the quality of the raw materials and the additives included in the product, among others, must be met. They are as follows:

In order to fulfill the export protocol, sanitary and phytosanitary requirements for pineapples is compulsory. Exporting fruits to Japan requires stringent phytosanitary measures, and exporters are responsible for checking the export regulatory requirements for their commodities to ensure that diseases and insect-pests are not carried together by the commodity before exporting. The exporting regulatory requirements may include the use of approved quarantine treatment, farm and packing house registration requirements as well as other requirements on food safety and traceability for the export of Malaysian horticultural produce (DOA, 2019). For example, the exportation of fresh MD2 pineapples from Malaysia required the producer to present the phytosanitary certificates from the Department of Agriculture, Malaysia. At the same time, the Japanese government does not allow any chemical treatment such as fungicide or other chemicals. In other words, the agriculture produce must be free from any pests and diseases. Therefore, for the Japan market, MD2 pineapples are usually harvested early in the morning, before they are delivered to the exporter’s packinghouse for cleaning and grading purposes within the same day. The fruits are cleaned attentively by trained workers by applying the high-pressured air jet for ten minutes to remove dirt and mealy bugs.

Distribution channel from farm to export

Pineapple is non-climacteric and would not ripen after harvest. For the export market, in order to achieve the optimum eating quality, MD2 pineapples are usually harvested at 145-150 days after flowering induction. At this stage, MD2 pineapples reached an appropriate degree of fruit development in terms of size, shape and ripeness. The development and condition of the harvested fruits enable them to withstand handling and transportation so that the fruits could arrive in satisfactory condition at the place of destination. According to the Malaysian Standard MS 1041:2018, the MD2 variety that are harvested at this stage should have cylindrical shape, green color on skin and crown, flat eyes and golden- yellow flesh. The harvested fruits should have brix of more than 12% with good and favorable aroma.

To realize the distribution export channel of pineapples from Malaysia to Japan, Figure 4 explained the export process. Pineapples are harvested from farms that are mostly located in the southern part of Peninsular Malaysia. Harvesting time is normally early in the morning and may take one and two days, depending on the order. There are two types of containers used for sea shipment, which is the 20-footer or 40-footer. To satisfy the 40-footer container, it is estimated that around 8,650 fresh pineapples are to be loaded. While for the 20-footer, container should be half of that. Thus, the total number of fruits harvested in the farm is estimated at around 9,100 fresh fruits, including 5% discarded due to post harvest deterioration and export standard. The producers usually exported the Grade A pineapples to Japan. The other grades are sold at local markets as fresh produce or to processing industries. Fruits are manually loaded onto a lorry, and then, transported to the packing house for cleaning, sorting, and packing. Cleaning is aimed to remove soil and dust to prevent contamination along the export process. The cleaning process could be done manually or using air-blowing. There is no treatment required for fresh pineapples to Japan, but the fruits must be free from any plant pests and diseases. For export requirement, corrugated box is used. In a box, the total weight is around 12 kg, which contain either 5, 6, 7 or 8 fruit depending on its individual weight (normally 1.2 – 1.5 kg per fruit). Fruits are stored in refrigerated container at 7 °C and are ready for sea transport from Port of Tanjung Pelepas or Klang.

Transportation from Malaysia to Japan generally takes 11-13 days, based on the stopover destination and waiting duration of the vessel. Delay in delivery may arise from many situations, such as weather conditions (storms) or technical glitch. Fruits will be retained in the Japan port for 1-2 days for customs clearance and then directly being transferred to importer’s warehouse. From there, fruits are ready to be distributed to wholesalers and retailers for selling. Overall, the process of exporting pineapples from farms in Malaysia to Japan’s retailer shelf will take almost 20 days in a maximum condition. The fastest time arriving is better in order to maintain the quality and freshness of the pineapple.

Consumers preferences

Japan is known globally as the first non-Western great power after the Second World War, when it recovered fast to become the world’s third largest economy. Majority of the people are in the middle-class level with more disposable income, high preference toward quality products and have high expectations. Japanese people are also close to their cultural beliefs. In terms of purchasing food, Japanese consumers are demanding of high quality, high value and safe products. They are willing to pay more if the products have more value compared to others. Intrinsically, in the fruits business, appearance is the most important criteria to show the quality, freshness and safety of the product. The Japanese people are becoming more cautious about the effect of radiation and the source of location, particularly after the disaster in Fukushima in 2011. As a result, any food exported to Japan should have the Good Agricultural Practices (GAPs) certification and must not undergo any chemical treatment. Strict treatment technique is imposed for certain fruits to avoid pests and diseases.

Japanese people are also high spirit in their nationalities. They prefer domestic products rather than the imported one. Thus, it gives an impact to the product’s price at the retail level. It means that the imported products are not necessarily more expensive than the domestic products. For example, imported mangoes from Thailand (Nam doc mai) are sold around JPY 500 (US$4.50) per piece while domestic mango (Miyazaki) at JPY 3,600 (US33.12) per piece. By the way, Miyazaki mango is a premium fruit, have good appearance, very well packed and widely known as special mango among Japanese people (Figure 5).

In the case of pineapples, the common fruit available in Japan market is from the Philippines some are locally, from Okinawa. The imported pineapples are sold at around JPY 410 per piece, while local pineapples are priced at JPY 540 per piece (Figure 6). Malaysian pineapples are also sold at the same price or slightly lower. Packaging and labeling also plays an important role in the distribution of the product. The packaging will represent the high quality, clean, safe and of the premium kind.

Packaging and labeling are other important preferences by Japanese consumers. Fruits which are packed with clean, unique or attractive packaging will represent the products as premium and of high quality and safety. It can be sold at the premium market and at a premium price. For instance, fresh Okinawa pineapples are packed in elongated plastic on a single piece basis around 1.0 to 1.2 kg per piece, while the pineapples from Malaysia and the Philippines are sold without wrapping.

Many Japanese consumers (>80%) used mobile phones as their main source of information and evaluation. The Japanese people will find information about products being sold in the Japanese markets, and they will make decisions based on the information gathered. Good or bad information can easily be disseminated to many people; therefore, suppliers and country activities are always monitored by consumers.

CHALLENGES AND OPPORTUNITY

Japan is a developed country, with complex consumers. Japan has a unique culture, and its people are well-known as patriotic and nationalists who give preference toward local products. There is the tendency for the Japanese consumers to prefer domestically produced products. However, the domestic production are unable to supply sufficient requirements. Domestic trends indicate that more than 90% of the population resides in the urban area. The situation has changed the profile of the Japanese consumers. They are more likely to shop at modern retail stores where imported products are sold. Currently, Japanese consumers are open to high-quality products from other countries. This is especially true when the import of agricultural products is increasing every year. The value of food imports to Japan almost doubled from $36 billion in 1990 to $61 billion in 2013, rising on average 4.2% a year over the period, about two percentage points faster than domestic production. In 2017, Japan is the world’s 4th largest importer of agricultural goods, reaching US$51.9 billion in sales.

The Japanese market is very competitive due to the high volume of foreign products coming from all over the world. Thus, consumers will seek high value but cheaper products. At the same time, some consumers are willing to buy expensive products if they are offered good quality and safe products. Japanese consumers are generally health-conscious, and thus, the preferences are on healthy and nutritious products. In other words, products that are known to be safely consumed (contains no chemicals) will receive high preference by the Japanese consumers.

Even though Japan is a net importer of agricultural products, the Japanese government maintains high tariffs, restrictive and complex safeguard, and technical barriers to trade. Japan imposes many sets of border measures such as tariffs, safeguards, tariff-rate quota, state trading, markups, variable duties, sanitary and phytosanitary requirements, and other non-tariff barriers. The non-tariff measure includes trademark, copyright and patent protection. These trade measures are used to support the domestic agriculture.

Opportunities exist for a range of agricultural products, in particular, processed and consumer-ready foods. This is true because Japan is heavily dependent on imported agricultural products, the domestic production is small-scale and unable to meet the local demand, small family size and increase in women participation in labor force and a rapidly aging population. In order to succeed in the Japanese markets, Malaysian potentioal exporters must understand and learn more about the Japanese culture and abide by all trade measures imposed by the Japanese Authorities. At the same time, producers must maintain quality and safety of the products. Quality could relate to physical and non-physical characteristics such as taste, shelf life and eating convenience. To maintain the fruit quality and its freshness, post-harvest treatment and handling are a main requirement that should be focused on. Fruits transportation using air logistics will cut short the export duration and more secured in terms of quality, however the cost is high. Sea logistics, on the other hand, need longer time but low in cost.

The certification of Good Agricultural Practices (GAP) is an additional competitive advantage for companies to market their agricultural produce to Japan. The GAP certification will ensure that all agricultural produce follows the quality standard and sustains the reliability and traceability of the agricultural input used in the production system. Most agricultural produce exported by Malaysia follows the GAP standards and thus, create an advantage in the Japanese market. In the context of pineapples, Malaysia has the opportunity to export pineapples to Japan market due to the increasing demand. However, Malaysia has to deal with the stiff competition among others producers like the Philippines, Indonesia, Thailand and Taiwan. Therefore, Malaysia’s pineapples must have value added either in terms of quality, safety or in terms of price. Or else, exporters must increase in doing value-added activfioties for their products such as doing minimal processing, fresh juice or in the desert category. Malaysia can also export its pineapples when there is a short supply in the Philippines, such as during the monsoon or typhoon season between August and October.

CONCLUSION

Japan is a potential market for agricultural produce from all over the world, including Malaysia. The consumption of agricultural produce by the Japanese consumers is increasing every year. At the same time, the local production is insufficient to supply the domestic requirements. Japan is a net importer of agricultural products and is totally dependent on the supply by foreign producers. As a result, Japanese consumers are open to imported products.

The higher demand and higher purchasing power of the Japanese consumers have created a great opportunity for exporters from Malaysia to expand their market to Japan. The Malaysian products are highly competitive as they are produced in systematic and follow the GAP standards, safely for consumption and reasonable in price. On the hand, Japan imposed strict trade barriers as a measure to protect the domestic industries. The exporters from Malaysia must learn and understand the Japanese culture, rules and regulations before investing on business ventures in Japan. Proper planning and strategies should be the key to succeed in penetrating the Japan market.

REFERENCES

Agriculture Department Malaysia. (2019). Phytosanitary Requirements for Exportation of Horticulture Produce From Malaysia 2019. Putrajaya: DOA

Amber, P. (2018). Top Pineapple Producing Countries. Retrieved on October 16, 2019 from https://www.worldatlas.com/articles/top-pineapple-producing-countries.html

Daniel, W. (2019). Pineapples Import by Country. Retrieved on October 17, 2019 from http://www.worldstopexports.com/pineapples-imports-by-country/

Hina, K. (2018). Top 10 Largest Pineapple Producing Countries in the World. Retrieved on October 14, 2019 from https://www.worldblaze.in/pineapple-producing-countries/

International Tropical Fruits Network. (2016). Pineapple-Common Varieties. Retrieved on October 16, 2019 from https://www.itfnet.org/v1/2016/05/pineapple-common varieties/#targetText=Distribution%20and%20cultivars%3A,byThailand%2C%20Phillipines%2C%20andCosta%20Rica.

Jessie, S. (2019). Pineapple: Nutrition Facts and Health Benefits. Retrieved on October 15, 2019 from https://www.livescience.com/45487-pineapple-nutrition.html

Shinji, O. (2015). Overview of tropical fruits industry in Japan. FFTC. Retrieved on October 15, 2019 from http://www.fftc.agnet.org/library.php?func=view&style=type&id=20150804084713

USDA (2018) https://www.freshplaza.com/article/9040791/japan-fresh-fruit-imports-1-62-million-tons-in-2017/

Date submitted: November 15, 2019

Reviewed, edited and uploaded: December 9, 2019