INTRODUCTION

Ananas comosus, or pineapple is a one of the most popular tropical fruits in Malaysia. It is categorized in a group of major fruit because that has a great potential to generate incomes for farmers, as well as countries. Its popularity is due to its multi-forms in consumption. Matured pineapples can be eaten fresh as dessert or salads; cooked as mostly found in local delicacies; or processed into juice and jams, among others. The juice from young pineapples is believed to be suitable for treatment of various diseases because it is rich in nutrients such as bromelain and vitamin A and B1. In addition, pineapple also contains citric acid that can effectively eliminate fat and help in reducing weight.

MALAYSIAN PINEAPPLE INDUSTRY

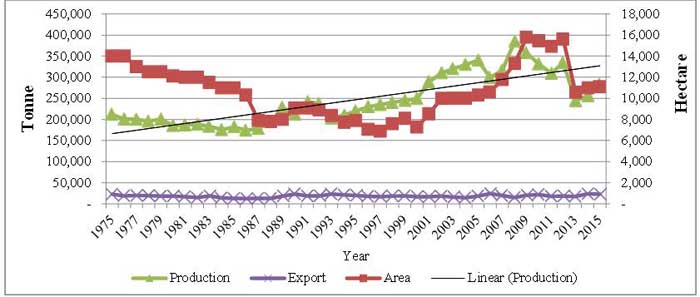

Pineapples are mostly planted in the states of Johor, Sarawak, Sabah, Kedah, Selangor, Penang, and Kelantan. Among the varieties of pineapples planted in Malaysia are MORIS, MORIS Gajah, Josapine, Yankee, Gandul, N36, and MD2. However, only two local varieties namely Josapine and N36 have been successfully exported, mainly to Singapore and the United Arab Emirates (UAE) because these varieties have a long shelf-life (Abu Kasim et al., 2010). Currently, the MD2 variety, which originated from Hawaii is also planted and marketed in local as well as for international markets. Pineapple uses 6.3% agrofood area in Malaysia, which is the fourth largest area after durian (41.3%), banana (18.0%), and rambutan (9.8%). In Malaysia, pineapples are grown in area of around 10,847 hectares with an estimated production of 272,570 metric tons in 2015 (DOA, 2016). Figure 1 shows the trends of production, export, and area of pineapple industry from 1975 to 2015. Within 40 years, the production trend of Malaysia’s pineapples slightly grew upward compared to areas planted. This is due to the application of technology such as high density planting system, mechanization during planting and use of better fertilizers. However, the exports of Malaysian fresh pineapples showed a constant trend even though the production is increasing since 1975 until 2015, (DOA, 2016 and Raziah, 2009). This is due to higher demand from local consumption.

Fig. 1. Production, Export, and Area Trends of Pineapple Industry in Malaysia, 1975–2015

Source: MOA (2016c)

Malaysia is a net exporter of pineapples. The self-sufficiency level (SSL) of pineapples was recorded around 106.7% in 2014, showing a reduction by 0.3% from the previous year. Even though the production of pineapples exceeded the local demand, Malaysia still imports fresh pineapples from neighboring countries such as Thailand and Indonesia. The import dependency ratio (IDR) of pineapples however, showed an increase of 0.1% compared to 2013 (0.7%). Increase in population and preferences are among the reasons for the increase in uses of fresh pineapples on a per capita basis. For example, the consumption per capita has increased by 35% in 2014, compared to 2013, which is 5.8 kg per person per year (DOSM, 2016).

Supplier of pineapple

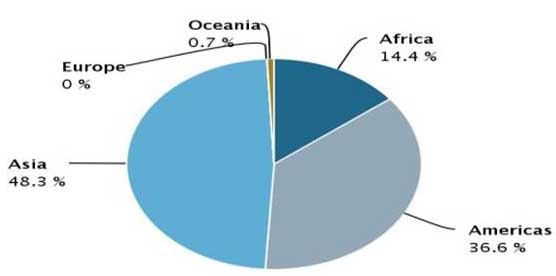

The Asian region is a major supplier of pineapples in the world. Fig. 2 shows the Asian region which contributed almost 50% of the world pineapple production during the 2005-2014, and accounted for around 48%, followed by Americas (36.6%) and Africa (14.4%) (FAO, 2016).

Fig. 2. Average share pineapple production by region in 2005–2014

Fig. 2. Average share pineapple production by region in 2005–2014

Source: FAO (2016)

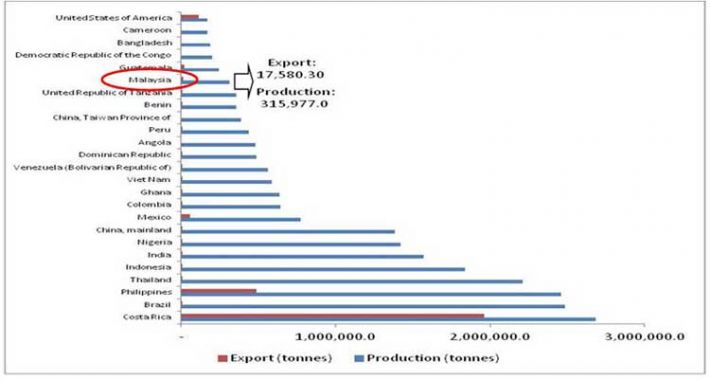

Malaysia was one of the big players in the pineapple industry. It was one of the three main pineapple producing countries during the 1960s and 1970s, after Costa Rica and the Philippines. However, Malaysia's position as the main pineapple exporter in the world has been taken over by other countries. In 2013, Costa Rica, Brazil, the Philippines, Thailand, Indonesia, India, Nigeria, China, Mexico, and Colombia are the top 10 pineapple producers supplying around 70.5% output of pineapples to the world (Fig. 3). Other important producers are Ghana and other countries including Malaysia which provides most of the remaining outputs (29.5%) (Comtrade, 2016).

Fig. 3. Production and Export Trends of Pineapple from Major Origin in 2013 (in tones)

Source: Comtrade & FAO (2016)

Fig. 3 shows that Malaysia's position in the world pineapple production has dropped to number 20. However, Malaysia still plays a major role in the world pineapple trade. Malaysian Pineapple Industry Board (MPIB, 2016) reported that Malaysia exports about 20,278.9 tons of fresh pineapples to several countries, particularly to its traditional destination Singapore, followed by processed products such as canned pineapples (8,853.4 tons), pineapple slips (8,356.4 tons), and pineapple juice (1,461.6 tons), in 2015. The current pineapples export trend shows a potential to enter the new markets such as China and Europe, in addition to improve its existing markets in Singapore, UAE, Egypt, and Saudi Arabia.

POLICY IMPLEMENTATIONS RELATED TO FRUITS INDUSTRY

The intervention by the Malaysian government towards the industry has been very significant. The policies imposed by the government provide an impact to achieve the self-sufficiency target, improving farmers’ income, and attaining marketing efficiency. Among the policies developed by the government to enhance the market potential of fruits, including pineapples, are as follows:

I. Third National Agricultural Policy (NAP3, 1998–2010)

This policy was formulated to promote agriculture as the third engine of growth for the Malaysian economy. Fruits were identified as one of the potential sectors that could reduce the food import bills, besides increasing export earnings. The government focuses on eight (8) types of fruits for export market, including pineapples. Regulations, good agricultural practices (GAP), farm accreditations, and the Malaysian Best program were introduced to ensure full compliance of the international trade and regulations. This policy was also imposed to ensure an adequate supply of fresh fruits for fresh consumption and industrial processing. Besides that, the policy was imposed to promote the selected fruit industry with a strategic advantage for export (MOA, 2016a).

II. National Agro-Food Policy (2011–2020)

The local fruit industry is given more emphasis to meet the growing demands for fruits. Under the policy, the market potential of exotic or rare fruits will be tapped especially in fulfilling export demands. The demands for local fruits are expected to increase from 2.7 million tons in 2010 to 3.4 million tons in 2020 with a growth rate of 2.3% per annum. Besides that, fruit production is also expected to increase from 1.8 million tons in 2010 to 2.6 million tons by 2020 with an annual growth rate of 3.8%, and the fruit exports are expected to increase from 830,000 tons in 2010 to 1.04 million tons in 2020. This policy was crafted to develop strategies to strengthen the fruit industry especially the fruits for export. The National Agro-Food Policy focuses on expanding the production areas for commercial fruits, such as pineapples, by opening new area of 7,120 hectares by 2020. The policy also aims at strengthening the marketing network for fruits through the establishment of the National Fruit Council to coordinate the production of fruit clusters, marketing, and promotional activities in domestic and export markets. Besides that, three fruit production strategies on export markets are developed as follows (MOA, 2016b):

- Intensifying the development of fruit varieties and clones that meet global market demands;

- Taking advantage of the difference in the export market production season with competing countries, and

- Ensuring the quality of fresh fruits which are exported through minimal processing technology, freezing, and altered environment packaging.

III. Eleventh Malaysian Plan (11MP)

Generally, the Malaysia's eleventh Plan (11MP) aims is to increase the production of food for local consumption and exports of industrial commodity. During the 11MP,the agriculture sector is expected to grow at 3.5% per year and accounted for 7.8% of GDP in 2020. Efforts will focus on strengthening food security, increasing productivity, improving the skills of farmers, fishermen and small farmers, improving delivery services and support, strengthening the supply chain, and ensuring the compliance of requirements with the international market. Among the approaches and strategies used in the 11MP to enhance the fruits’ industry including pineapples are: (EPU, 2016):

- Use of information and communication technology (ICT) and agricultural technology that can improve production efficiency and increase productivity, and besides, using the technologies that can reduce production costs. These technologies can help disseminate the information on market demand and prices as well as providing an interactive platform for seeking and giving advices;

- Preservation and optimal use of agricultural land through the “Taman Kekal Pengeluaran Makanan” (TKPM), literally translated as Permanent Food Production Park . In the 10MP, TKPM was able to provide benefits to more than 453 farmers, of which 171 farmers earned more than RM3000 per month;

- Research and development and commercialization (R, D & C) that particularly focus on the development of new varieties of, particularly in this context, fruits;

- Improving the integrated management of pests and disease;.

- Improving the product development;

- Providing training to improve farmers’ skills;

- Development of Young Agropreneur Program to promote young entrepreneurs. The facilities and priority in obtaining grants and loans can promote more young entrepreneurs to be involved in fruit-based and food-product businesses;

- Strengthening cooperatives and agricultural organizations throughout the supply chain to ensure farmers could get higher incomes on an ongoing basis through cluster-based approach by production, quality control, processing, and marketing; and

- Improving the market access through online marketing, promotion, and branding to help increase sales.

IV. Economic Transformation Program (ETP)

Under the ETP, the government sets the National Key Economic Area (NKEA), which is an important driver of economic activities that potentially and directly contributes to the Malaysian economic growth which is measured by the National Gross Income (GNI). The target of GNI from the agrifood sector is RM21.44 billion in 2020. The NKEA agriculture focuses on 17 key performance indicators with a high growth potential, including premium fruits and vegetables under the Entry Point Project number 7 (EPP 7). Six high-value non-seasonal tropical fruits (rock melon, starfruit, papaya, banana, pineapple and jackfruit) and three high-value highland vegetables (lettuce, tomato and capsicum) have been identified as target produce for this EPP. In the NKEA agriculture under the East Coast Economic Region (ECER), an anchor company, the Rompin Integrated Pineapple Industries (RIPI) Sdn. Bhd. has achieved its first planting of the MD2 pineapples in a project that involves the participation of local aborigines as contract farmers (PEMANDU, 2016). The RIPI’s project is expected to produce 50,000 metric tons of fresh pineapples annually, create 3,000 jobs and 50 industrial opportunities along the value chain until 2020. The objectives of this project, is mainly to bring about socioeconomic development within the surrounding area, in addition to promote the Malaysian pineapple industry. This project offers the community an opportunity to increase their income with the use of high technologies and large scale commercial farming (ECER, 2016).

V. Rural Transformation Center (RTC)

This center implements the initiatives introduced by the government under the National Blue Ocean Strategy 4 (NBOS4). Eight initiatives led and supported by various ministries and organizations have been implemented. These initiatives will be implemented at the center itself and within 100 km radius of the RTC. Some initiatives at the RTC are aimed at developing entrepreneurs in the field of food processing with an emphasis on the development and improvement of the quality of products for the local and global markets. These initiatives also focus on value-added activities in developing the national agro-based industry, besides increasing the income of farmers via the production and marketing of fruits-based products such as fruits pickles, cordial, sauces, and chips (KKLW, 2016).

VI. Third Industrial Master Plan (IMP3, 2006–2020)

This policy is expected to drive the industrial sector to a higher level of global competitiveness through transformation and innovation. The agriculture sector has the potential to be the source of economic growth and is expected to benefit from the efforts, including the application of technology and R&D for commercialization. This sector will be transformed to be more commercialized with technology-intensive sector through R&D activities, among others, food processing, seed development, and health products. This policy also promotes the linkages between the industry and the agents residing in urban and rural areas through the “feeder input” concept, i.e., supply from rural areas to improve the urban industry. The establishment of sales networks and marketing for entrepreneurs helps to promote the industry in the market for fresh and downstream products of fruits especially pineapples (e.g., juice, canning, candy, snacks/chips, pickles, sauces, and cordial) (MITI, 2016).

CONCLUSION

The prospects of the pineapple industry for the next 10 years is bright, in line with the various strategies that have been identified and implemented to strengthen the value chain. Several policies intervention helped to achieve the self-sufficiency target, thus improving the income of local residents through programs that are executed either in the National Agricultural Policy (NAP), Eleventh Malaysia Plan (11thMP), Economic Transformation Program (ETP) and others. Programs and projects implemented by the Government seems to be effective and resulted with a stronger industry. The continuous explorations of new markets and attaining marketing efficiency from the existing ones as well as the production of downstream products have provided new opportunities for the huge pineapple markets. Therefore, policy interventions have an impact to promote the Malaysian pineapple industry globally.

REFERENCES

Abu Kasim, A. et al. (2010). Potensi dan Strategi Pemasaran Buah-buahan Tempatan. Institut Penyelidikan dan Kemajuan Pertanian Malaysia: 60-70

Ahmad Zairy, Z.A. dan Rozhan, A.D. (2010). Pasaran nanas di Malaysia, Agromedia. Bil. 31: 11.

Comtrade. (2016). Retrieve from http://comtrade.un.org/data/ on 1 August 2016.

DOA. (2016). Fruit Crops Statistic 2015. Department of Agriculture, Malaysia.

DOSM. (2016). Supply and Utilization Accounts Selected Agricultural Commodities (2010-2014). Department of Statistic, Malaysia.

ECER. (2016). East Coast Economic Region Development Council (ECERDC), Malaysia. Retrieve from http://www.ecerdc.com.my/en/economic_post/rompin-integrated-pineapple-plantation-in-rompin-pahang/ on 31 October 2016.

FAO. (2016a). Retrieve from www.faostat.fao.org on 1 August 2016.

____. (2016b). Retrieve from http://www.fao.org/countryprofiles/index/en/?iso3=MYS on 1August 2016

____. (2016c). Retrieve from http://faostat3.fao.org/browse/Q/QC/E on 1 August 2016

KKLW. (2016). Rural Transformation Centre (RTC). Ministry of Rural and Regional Development, Malaysia. Retrieve from www.rurallink.gov.my on 10 August 2016.

MITI. (2016). Third Industrial Master Plan (IMP3) 2006-2020. Ministry of International Trade and Industry, Malaysia. Retrieve from www.miti.gov.my on 10 August 2016.

MOA. (2016a). Third National Agricultural Policy (1998-2010). Ministry of Agriculture and Agro-based Industry, Malaysia.

____. (2016b). National Agro Food Policy (2011-2020). Ministry of Agriculture and Agro-based Industry, Malaysia.

____. (2016c). Agro-food Statistic. Ministry of Agriculture and Agro-based Industry, Malaysia.

MPIB. (2016). Laporan Eksport Industri Nanas, 2015. Malaysian Pineapples Industry Board, Malaysia.

Retrieve from http://www.mpib.gov.my/documents/10124/618618/LAPORAN-EKSPORT-INDUSTRI-NANAS-MALAYSIA-2015.pdf on 10 August 2016

PEMANDU. (2015). Economic Transformation Programme Annual Report (2014). Prime Minister’s Office, Putrajaya, Malaysia. Retrieve from http://etp.pemandu.gov.my/annualreport2014/National_Key_Economic_Areas_(NKEAs)-@-National_Key_Economic_Areas_(NKEAs).aspx on 10 August 2016

Raziah, M.L. (2009). Senario dan prospek industri nanas Malaysia. Economic and Technology Management Review. Vol. 5: 11–24.

|

Date submitted: Nov. 11, 2016

Reviewed, edited and uploaded: Nov. 11, 2016

|

Policy Intervention for the Development of the Pineapple Industry in Malaysia

INTRODUCTION

Ananas comosus, or pineapple is a one of the most popular tropical fruits in Malaysia. It is categorized in a group of major fruit because that has a great potential to generate incomes for farmers, as well as countries. Its popularity is due to its multi-forms in consumption. Matured pineapples can be eaten fresh as dessert or salads; cooked as mostly found in local delicacies; or processed into juice and jams, among others. The juice from young pineapples is believed to be suitable for treatment of various diseases because it is rich in nutrients such as bromelain and vitamin A and B1. In addition, pineapple also contains citric acid that can effectively eliminate fat and help in reducing weight.

MALAYSIAN PINEAPPLE INDUSTRY

Pineapples are mostly planted in the states of Johor, Sarawak, Sabah, Kedah, Selangor, Penang, and Kelantan. Among the varieties of pineapples planted in Malaysia are MORIS, MORIS Gajah, Josapine, Yankee, Gandul, N36, and MD2. However, only two local varieties namely Josapine and N36 have been successfully exported, mainly to Singapore and the United Arab Emirates (UAE) because these varieties have a long shelf-life (Abu Kasim et al., 2010). Currently, the MD2 variety, which originated from Hawaii is also planted and marketed in local as well as for international markets. Pineapple uses 6.3% agrofood area in Malaysia, which is the fourth largest area after durian (41.3%), banana (18.0%), and rambutan (9.8%). In Malaysia, pineapples are grown in area of around 10,847 hectares with an estimated production of 272,570 metric tons in 2015 (DOA, 2016). Figure 1 shows the trends of production, export, and area of pineapple industry from 1975 to 2015. Within 40 years, the production trend of Malaysia’s pineapples slightly grew upward compared to areas planted. This is due to the application of technology such as high density planting system, mechanization during planting and use of better fertilizers. However, the exports of Malaysian fresh pineapples showed a constant trend even though the production is increasing since 1975 until 2015, (DOA, 2016 and Raziah, 2009). This is due to higher demand from local consumption.

Fig. 1. Production, Export, and Area Trends of Pineapple Industry in Malaysia, 1975–2015

Source: MOA (2016c)

Malaysia is a net exporter of pineapples. The self-sufficiency level (SSL) of pineapples was recorded around 106.7% in 2014, showing a reduction by 0.3% from the previous year. Even though the production of pineapples exceeded the local demand, Malaysia still imports fresh pineapples from neighboring countries such as Thailand and Indonesia. The import dependency ratio (IDR) of pineapples however, showed an increase of 0.1% compared to 2013 (0.7%). Increase in population and preferences are among the reasons for the increase in uses of fresh pineapples on a per capita basis. For example, the consumption per capita has increased by 35% in 2014, compared to 2013, which is 5.8 kg per person per year (DOSM, 2016).

Supplier of pineapple

The Asian region is a major supplier of pineapples in the world. Fig. 2 shows the Asian region which contributed almost 50% of the world pineapple production during the 2005-2014, and accounted for around 48%, followed by Americas (36.6%) and Africa (14.4%) (FAO, 2016).

Source: FAO (2016)

Malaysia was one of the big players in the pineapple industry. It was one of the three main pineapple producing countries during the 1960s and 1970s, after Costa Rica and the Philippines. However, Malaysia's position as the main pineapple exporter in the world has been taken over by other countries. In 2013, Costa Rica, Brazil, the Philippines, Thailand, Indonesia, India, Nigeria, China, Mexico, and Colombia are the top 10 pineapple producers supplying around 70.5% output of pineapples to the world (Fig. 3). Other important producers are Ghana and other countries including Malaysia which provides most of the remaining outputs (29.5%) (Comtrade, 2016).

Source: Comtrade & FAO (2016)

Fig. 3 shows that Malaysia's position in the world pineapple production has dropped to number 20. However, Malaysia still plays a major role in the world pineapple trade. Malaysian Pineapple Industry Board (MPIB, 2016) reported that Malaysia exports about 20,278.9 tons of fresh pineapples to several countries, particularly to its traditional destination Singapore, followed by processed products such as canned pineapples (8,853.4 tons), pineapple slips (8,356.4 tons), and pineapple juice (1,461.6 tons), in 2015. The current pineapples export trend shows a potential to enter the new markets such as China and Europe, in addition to improve its existing markets in Singapore, UAE, Egypt, and Saudi Arabia.

POLICY IMPLEMENTATIONS RELATED TO FRUITS INDUSTRY

The intervention by the Malaysian government towards the industry has been very significant. The policies imposed by the government provide an impact to achieve the self-sufficiency target, improving farmers’ income, and attaining marketing efficiency. Among the policies developed by the government to enhance the market potential of fruits, including pineapples, are as follows:

I. Third National Agricultural Policy (NAP3, 1998–2010)

This policy was formulated to promote agriculture as the third engine of growth for the Malaysian economy. Fruits were identified as one of the potential sectors that could reduce the food import bills, besides increasing export earnings. The government focuses on eight (8) types of fruits for export market, including pineapples. Regulations, good agricultural practices (GAP), farm accreditations, and the Malaysian Best program were introduced to ensure full compliance of the international trade and regulations. This policy was also imposed to ensure an adequate supply of fresh fruits for fresh consumption and industrial processing. Besides that, the policy was imposed to promote the selected fruit industry with a strategic advantage for export (MOA, 2016a).

II. National Agro-Food Policy (2011–2020)

The local fruit industry is given more emphasis to meet the growing demands for fruits. Under the policy, the market potential of exotic or rare fruits will be tapped especially in fulfilling export demands. The demands for local fruits are expected to increase from 2.7 million tons in 2010 to 3.4 million tons in 2020 with a growth rate of 2.3% per annum. Besides that, fruit production is also expected to increase from 1.8 million tons in 2010 to 2.6 million tons by 2020 with an annual growth rate of 3.8%, and the fruit exports are expected to increase from 830,000 tons in 2010 to 1.04 million tons in 2020. This policy was crafted to develop strategies to strengthen the fruit industry especially the fruits for export. The National Agro-Food Policy focuses on expanding the production areas for commercial fruits, such as pineapples, by opening new area of 7,120 hectares by 2020. The policy also aims at strengthening the marketing network for fruits through the establishment of the National Fruit Council to coordinate the production of fruit clusters, marketing, and promotional activities in domestic and export markets. Besides that, three fruit production strategies on export markets are developed as follows (MOA, 2016b):

III. Eleventh Malaysian Plan (11MP)

Generally, the Malaysia's eleventh Plan (11MP) aims is to increase the production of food for local consumption and exports of industrial commodity. During the 11MP,the agriculture sector is expected to grow at 3.5% per year and accounted for 7.8% of GDP in 2020. Efforts will focus on strengthening food security, increasing productivity, improving the skills of farmers, fishermen and small farmers, improving delivery services and support, strengthening the supply chain, and ensuring the compliance of requirements with the international market. Among the approaches and strategies used in the 11MP to enhance the fruits’ industry including pineapples are: (EPU, 2016):

IV. Economic Transformation Program (ETP)

Under the ETP, the government sets the National Key Economic Area (NKEA), which is an important driver of economic activities that potentially and directly contributes to the Malaysian economic growth which is measured by the National Gross Income (GNI). The target of GNI from the agrifood sector is RM21.44 billion in 2020. The NKEA agriculture focuses on 17 key performance indicators with a high growth potential, including premium fruits and vegetables under the Entry Point Project number 7 (EPP 7). Six high-value non-seasonal tropical fruits (rock melon, starfruit, papaya, banana, pineapple and jackfruit) and three high-value highland vegetables (lettuce, tomato and capsicum) have been identified as target produce for this EPP. In the NKEA agriculture under the East Coast Economic Region (ECER), an anchor company, the Rompin Integrated Pineapple Industries (RIPI) Sdn. Bhd. has achieved its first planting of the MD2 pineapples in a project that involves the participation of local aborigines as contract farmers (PEMANDU, 2016). The RIPI’s project is expected to produce 50,000 metric tons of fresh pineapples annually, create 3,000 jobs and 50 industrial opportunities along the value chain until 2020. The objectives of this project, is mainly to bring about socioeconomic development within the surrounding area, in addition to promote the Malaysian pineapple industry. This project offers the community an opportunity to increase their income with the use of high technologies and large scale commercial farming (ECER, 2016).

V. Rural Transformation Center (RTC)

This center implements the initiatives introduced by the government under the National Blue Ocean Strategy 4 (NBOS4). Eight initiatives led and supported by various ministries and organizations have been implemented. These initiatives will be implemented at the center itself and within 100 km radius of the RTC. Some initiatives at the RTC are aimed at developing entrepreneurs in the field of food processing with an emphasis on the development and improvement of the quality of products for the local and global markets. These initiatives also focus on value-added activities in developing the national agro-based industry, besides increasing the income of farmers via the production and marketing of fruits-based products such as fruits pickles, cordial, sauces, and chips (KKLW, 2016).

VI. Third Industrial Master Plan (IMP3, 2006–2020)

This policy is expected to drive the industrial sector to a higher level of global competitiveness through transformation and innovation. The agriculture sector has the potential to be the source of economic growth and is expected to benefit from the efforts, including the application of technology and R&D for commercialization. This sector will be transformed to be more commercialized with technology-intensive sector through R&D activities, among others, food processing, seed development, and health products. This policy also promotes the linkages between the industry and the agents residing in urban and rural areas through the “feeder input” concept, i.e., supply from rural areas to improve the urban industry. The establishment of sales networks and marketing for entrepreneurs helps to promote the industry in the market for fresh and downstream products of fruits especially pineapples (e.g., juice, canning, candy, snacks/chips, pickles, sauces, and cordial) (MITI, 2016).

CONCLUSION

The prospects of the pineapple industry for the next 10 years is bright, in line with the various strategies that have been identified and implemented to strengthen the value chain. Several policies intervention helped to achieve the self-sufficiency target, thus improving the income of local residents through programs that are executed either in the National Agricultural Policy (NAP), Eleventh Malaysia Plan (11thMP), Economic Transformation Program (ETP) and others. Programs and projects implemented by the Government seems to be effective and resulted with a stronger industry. The continuous explorations of new markets and attaining marketing efficiency from the existing ones as well as the production of downstream products have provided new opportunities for the huge pineapple markets. Therefore, policy interventions have an impact to promote the Malaysian pineapple industry globally.

REFERENCES

Abu Kasim, A. et al. (2010). Potensi dan Strategi Pemasaran Buah-buahan Tempatan. Institut Penyelidikan dan Kemajuan Pertanian Malaysia: 60-70

Ahmad Zairy, Z.A. dan Rozhan, A.D. (2010). Pasaran nanas di Malaysia, Agromedia. Bil. 31: 11.

Comtrade. (2016). Retrieve from http://comtrade.un.org/data/ on 1 August 2016.

DOA. (2016). Fruit Crops Statistic 2015. Department of Agriculture, Malaysia.

DOSM. (2016). Supply and Utilization Accounts Selected Agricultural Commodities (2010-2014). Department of Statistic, Malaysia.

ECER. (2016). East Coast Economic Region Development Council (ECERDC), Malaysia. Retrieve from http://www.ecerdc.com.my/en/economic_post/rompin-integrated-pineapple-plantation-in-rompin-pahang/ on 31 October 2016.

FAO. (2016a). Retrieve from www.faostat.fao.org on 1 August 2016.

____. (2016b). Retrieve from http://www.fao.org/countryprofiles/index/en/?iso3=MYS on 1August 2016

____. (2016c). Retrieve from http://faostat3.fao.org/browse/Q/QC/E on 1 August 2016

KKLW. (2016). Rural Transformation Centre (RTC). Ministry of Rural and Regional Development, Malaysia. Retrieve from www.rurallink.gov.my on 10 August 2016.

MITI. (2016). Third Industrial Master Plan (IMP3) 2006-2020. Ministry of International Trade and Industry, Malaysia. Retrieve from www.miti.gov.my on 10 August 2016.

MOA. (2016a). Third National Agricultural Policy (1998-2010). Ministry of Agriculture and Agro-based Industry, Malaysia.

____. (2016b). National Agro Food Policy (2011-2020). Ministry of Agriculture and Agro-based Industry, Malaysia.

____. (2016c). Agro-food Statistic. Ministry of Agriculture and Agro-based Industry, Malaysia.

MPIB. (2016). Laporan Eksport Industri Nanas, 2015. Malaysian Pineapples Industry Board, Malaysia.

Retrieve from http://www.mpib.gov.my/documents/10124/618618/LAPORAN-EKSPORT-INDUSTRI-NANAS-MALAYSIA-2015.pdf on 10 August 2016

PEMANDU. (2015). Economic Transformation Programme Annual Report (2014). Prime Minister’s Office, Putrajaya, Malaysia. Retrieve from http://etp.pemandu.gov.my/annualreport2014/National_Key_Economic_Areas_(NKEAs)-@-National_Key_Economic_Areas_(NKEAs).aspx on 10 August 2016

Raziah, M.L. (2009). Senario dan prospek industri nanas Malaysia. Economic and Technology Management Review. Vol. 5: 11–24.

Date submitted: Nov. 11, 2016

Reviewed, edited and uploaded: Nov. 11, 2016