ABSTRACT

Hanoi is one of topped pig production as well as consumption in Vietnam. However, the pig is mainly produced by small scale producers. The large scale farms which raised over 500 pigs accounted for only 0.15% while the small-scale producers with less than 100 pigs account for 62%. Even though large-scale farm seems to be an indispensable trend as the industry becomes more integrated, but the large-scale farms are challenged by vulnerability outbreak of diseases and price shocks risks. Moreover, the current regulatory system is unable to help consumer distinguish pig production and pork product safety. The aim of this paper is to understand the pig supply chain in Hanoi and suggest a recommendation for improving the livestock industry. Using government data and documentation, this research is adapted to the Rapid Appraisal approach to analyze the pig chain in Hanoi and the SWOT analysis for the small-scale producers. To convey the issues of major concerns about food safety, it was recommended that creating inclusiveness for small-scale producers into the system through collective economic mechanisms such as product association and cooperatives were important first steps and the government should create an enabling conditions for enhancing the food safety management.

Keywords: Pig supply chain, smallholders, Hanoi

INTRODUCTION

Vietnam ranks fifth in the world in terms of the total number of pigs and ranks sixth in the world in terms of porker production. However, Vietnam's porker production is mainly for domestic consumption and export of pork and porker is negligible. Hanoi is on the top list of both the largest pig production and high consumer demand in the country. In particular, the total number of pigs reached over 1,589,000 and 10,000 for consumption per day (IPSARD- Vietnam Institute of policy and agriculture research development). However, the percentage of smallholder and small-scale farms in Hanoi are bigger than medium-scale and large-scale farms. In Hanoi, the number of small-scale with less than30 porkers accounts for 90.84%; contributing 41.26% of the total pig population. But the trend in the past few years has been shifted from small-scale to a larger scale. In particular, the number of pig smallholders in 2011 decreased sharply from 4,132 thousand smallholders to 3,441 thousand smallholders in 2016 (Vietnam agro-census, 2011 and 2016). It can be said that smallholders are less competitive than others There were nearly one thousands of smallholder disappeared during five years from 2011 to 2016.

Regarding a large number of small smallholder scales, the pig industry in Vietnam faces several forms of competition which is are considered disadvantageous such as high production cost, environmental pollution, and food safety management.

The research question is “should small farm smallholders continuously develop together with others? If yes, what are the solutions for small-scale producers?”. This research will provide an overview of the pork industry in Hanoi to identify and analyze the pig value chain in Hanoi for improvement and inclusiveness for small-scales producers.

LITERATURE REVIEW

Regard to production volume and economic value, pig raising is the largest sub-sector, followed by poultry (Dinh, 2017). Besides, pork accounted for about 74 percent of total meat in Vietnam in 2012 (Agro-census). In the past, pig producer scale classifies in two types which are a commercial farm and smallholder, the commercial farm is breeding producer with above 20 sows or fattening pig more than 100 pig per batch (Dinh, 2017). In the contrast, there are four types of pig production in Vietnam — smallholder or backyard with 1-10 pigs, small medium with 5-20 sows or 30-100 fattening, medium with 20-500 sows or 100-4,000 fattening, and large with more than 500 sows or 4,000 fattening pig (Lapar, 2014).

In 2011, Government defined a commercial farm as one its profit over VND 1 billion, thus there are two possible cases here, one is a commercial farm which whole profit is from pigs, equivalent to the number of pigs sold more than 500 pigs. Other is commercial mix farms, and the number of pigs sold is less than 500 but the total profit in a year including other products is greater than 1 billion. In this paper, the classification of pig farms is based on either the "number of fattener pigs" and “number of sows”. It means that the commercial pig farm equivalent to fattening pig of more than 500 sold in a year.

Along the supply chain, pigs are produced as piglets, weaner/ growers/ porkers and pig fatteners, slaughter pigs, pig meat/pork (all types), offal, and processed pork products. The piglets normally weigh from 10–15 kg at 40–45 days old (Nga, Ninh, Van Hung, & Lapar, 2014). Growers usually weigh from 20–35 kg at 70–80 days old (Nga et al., 2014) and finished pig/ pork weigh 80-130kg.

Porker is transformed into meat after slaughtering process, and both pig meat and offal are edible products for human consumption (Nga et al., 2014). Pork can be frozen meat, chilled meat, warm meat or processed pork products depend on human purposed. In this paper, the flow of pigs and pig products along the supply chain is described in the district and particular supply chain.

METHODOLOGY

The data uses secondary data from General Statistics Office of Vietnam, Institute of Policy and Strategy for Agriculture and Rural Development, and Rapid Appraisal Methods (World Bank) with a group discussion of representatives from Livestock department of Hanoi, Extension department of Hanoi, IPSARD and group discussion of farmers.

Yearly, General Statistics Office of Vietnam (GSO) together with Ministry of Agriculture and Rural Development MARD collect data about the total number of pigs, piglets, porkers, breeding boars and sows in April and one time in five years they collect the data of smallholders in July. The full dataset consists of around 17 million smallholders of 79,898 villages in Vietnam by the Government, and we used the subset of the 132,349 of pig producers in Hanoi in July 2016 as the sampling frame. Twelve samples in each village were selected randomly from the list of farmers in the sampling frame on an excel file. The random samples were selected through the following formulation (Vietnam agro-census):

(1) Select the first sample from the list:

Number of the first sample on list = RANDBETWEEN (1, number of smallholder)

Space of each samples = total smallholder/ 12

(2) Generate the 11 remaining samples:

Sample (n+1) = n * space of each sample + number of the first sample on list

The questionnaire includes general information such as “name”, “address”, “education” and other detailed information such as “how many cows, buffalos, chickens, and pigs do you have?”; “the number of pigs, porks, porkers, and breeding pigs that are available on 1st July 2016” (Vietnam agro-census).

In addition, the mapping of the value chain and SWOT table are done by Rapid Appraisal Methods (of World Bank). Rapid appraisal method is a timely and cost-effective approach with five key rapid data collection methods such as informant interviews, focus group discussions, group interviews, structured observations, and informal surveys (Kumar K., World Bank). The data of IPSARD from focus group discussion, administration interview and structure observation of 85 respondents are used in F-test analysis, value chain mapping and SWOT analysis of pig value.

RESULTS AND DISCUSSION

1.1.Overview of the pig supply chain in Hanoi

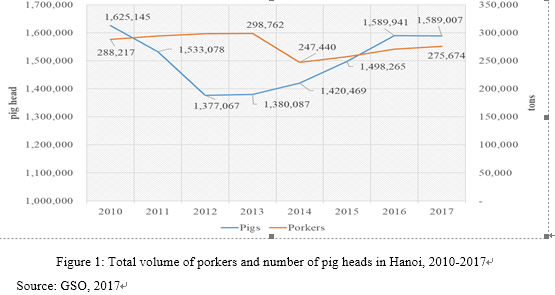

From 2010 to 2013, the number of pigs in Hanoi decreased slightly from 1,625 thousand to 1,380 thousand. From 2013 to 2016, the number of pigs in Hanoi increased gradually, and reached 1,589 thousand in 2017. After the period of excess crisis in 2016, although the number of pigs in the country has been reduced sharply in 2017 but the number of pigs in Hanoi remained stable. The reasons are due to the psychology of livestock farmers waiting for the increase in pork prices to compensate for their losses and that demand for pork consumption increases as prices fall, so farmers in Hanoi still have market for their products.

Dividing by purpose of raising, in 2017 Hanoi has a total pig around 1.6 million pig heads, of which the porkers are about 1.4 million pig head, the sows are 0.18 million pig head and the breeding boars are around 2.6 thousand pig head. (GSO, 2017). As figure 1, the pork production in Hanoi from 2010 to 2017 ranged from 250 thousand tons/year to 300 thousand tons/year. The decline in meat yields in 2014, from 299 thousand tons in 2013 to 247 thousand tons in 2014, is due to the impact of the disease situation, which became serious in 2013. In the period 2014-2017, although the output of pork in Hanoi increased gradually but only reached about 270 thousand tons per year as consumers have moved from pork to alternative meat products, especially chicken and beef.

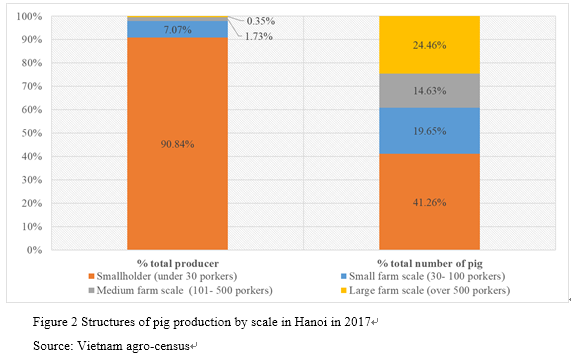

Regarding figure 2, the 90.84% of total producers in Hanoi is smallholder but only get 41.26% of total number of pig head; on the other hand, the large farm scale with over 500 pigs have only 0.35% of total producers but accounts for 24.46% in total number of pigs.

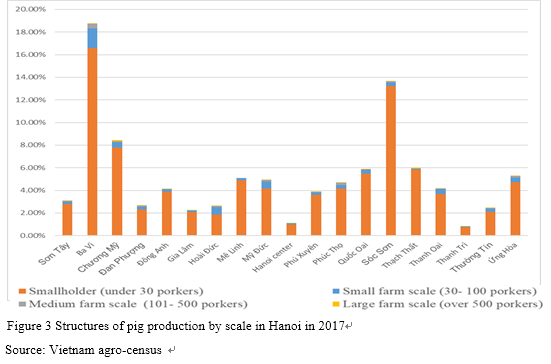

In Figure 3, among Hanoi center and 18 districts, the ones with the highest percentage of smallholders are Ba Vi, Soc Son, Chuong My, which account for 16.57%, 13.57% and 7,8% in Hanoi, following Dong Anh, Me Linh, My Duc, Phu Xuyen, Phuc Tho, Quoc Oai, Thach That, Thanh Oai and Ung Hoa. Even though Chuong My and Thach that have the biggest percentage of large farm scale in Hanoi, the number are still small with 0.09% in Chuong My and 0.07% in Thach That.

1.2.Mapping of pig supply chain in Hanoi

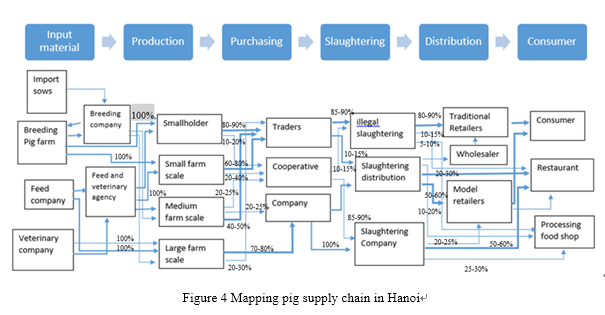

Within the framework, actors involved in the pig supply chain in Hanoi are described in the form of linkage and scale, as follows:

Breeding farms: The breeding pig farms are the individual breeding pig farms or domestic enterprises, FDI enterprises.

Breeding companies: They are domestic or foreign companies (FDI), which import and produce breeding pigs, commercial breeding farms or outsource commercial piglet production.

Livestock feed companies: They are domestic or foreign companies (FDI), which supply animal feeds to porker or breeding pig raising establishments, and business agents of agricultural materials.

Veterinary drug companies: They are domestic or foreign companies (FDI), which sell animal feeds at wholesale prices to porker and breeding pig producers, and agricultural material business agents.

Animal feed and veterinary agents: These are agents specializing in selling animal feeds and veterinary drugs to livestock establishments at retail prices.

Smallholder scale: They include livestock establishments with less than 30 pigs.

Small-scale farms: These are livestock farms from 30 to 100 porkers. They may be members of cooperatives, cooperative groups, production groups, or non-linkage, including livestock establishments that meet the criteria of "farm scale" but the number of pigs is less than 30 sows or 100 porkers.

Medium-scale farms with more than 100 porkers to less than 500 porkers: These are pig farms with a scale ranging from 100 porkers to 500 porkers or more than 300 breeding pigs. This includes farms that meet the criteria of "farm scale" according to the Ministry of Agriculture and Rural Development (MARD), and have the number of porkers over 500 or the number of commercial breeding pigs is over 300.

Large-scale farm with more than 300 sows or more than 500 porkers: They have characteristics of using imported breeds, industrial feeds, and good implementation of animal disease prevention. Often these large-scale pig production establishments are mainly involved in market linkages with large companies specializing in livestock feeds such as CP Livestock Joint Stock Company, Deheus Company.

Traders: They are those who buy live pigs from livestock farms at the price of live porker or carcass. Traders can be district traders, inter-district traders or inter-provincial traders.

Cooperatives: They are the cooperatives producing, trading piglets and porkers; operating according to the Cooperative Law "a cooperative is a collective economic organization, co-ownership, has the legal entity status, which is established voluntarily by at least seven members to coordinate and support each other in the production, to create jobs in order to meet the mutual needs of the members, on the basis of self-control, self-responsibility, equality and democracy in the management of cooperatives".

Slaughter company: They are domestic or foreign companies that purchase porkers from livestock farms; directly slaughtering, processing or hiring another slaughtering agency and selling pork as well as processed pork products.

Illegal slaughters or small slaughters: They slaught poker at smallholders’ house with less than 10 porkers per times without slaughtering permit of Government.

Slaughter distribution: They adapt the standards of slaughter of MARD and the Government's regulations on veterinary hygiene conditions for large-scale pig slaughterhouse[1]; They can be semi-industrial or traditional slaughterhouses or modern industrial slaughtering in large-scale. Modern industrial slaughtering meets the standards of MARD and the Government's regulations on veterinary hygiene conditions for pig slaughterhouses[2], cold storages and slaughtering by hanging lines.

Products of the value chain

Pigs: In the pig value chain, porkers are the products that are raised and fattened from commercial piglets by the farmer. After about 20 weeks of raising and fattening, the average live weight of a live porker reaches 100-125 kg, which is the average weight of a live porker for sale.

Commercial piglets: Commercial piglets are traded for large-scale and fattening after 3 weeks (about 20 days) to 8-12 kg.

Pork carcass: It is porker after slaughtered which includes either pork meat or internal organs are products from slaughtering and used as food. The rate of pork carcass compared to porker in slaughterhouses is usually 65 to 80% depending on the variety and feeding process.

Pork meat of all kinds: They are part of the carcass which will dissect it into many pieces with different names such as loin, shoulder, belly, ribs, and ham and shank, excludes offal.

Chilled meat: they are pork meat which after slaughtering will be stored in cool condition before shipping to retailers and consumers.

Frozen meat: Pork after slaughtered will be frozen and put in cold storage. Frozen meat is often sold in supermarkets and modern food stores.

Processed pork products: they are processing food made from pork such as ham, sausage, brawn.

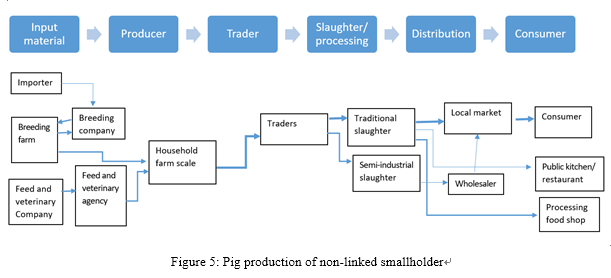

1.3.Evaluation of pig supply chain of non-linked smallholders

Products: live pigs, carcass, offal, blood, pig meat and processed pork products

Describe the product along the chain: The breeding facilities of this chain often buy inputs such as feeds, piglets, and veterinary drugs at the dealers at retail prices. Feed dealers sell at prices that are based on purchase prices plus costs and profits. Usually, smallholders in Hanoi buy feeds at prices 10% higher than the direct purchase price. For example, the same amount of purchase, if the price of feeds at the second agent is 25,000VND*[3]/kg, the price of the company will be 22,500VND*/kg. In recent years, prices of feeds and vaccines have fluctuated or decreased slightly in the short term, but tend to increase in the last few years. Farmers either produce the piglets on farm or buy from various sources, such as small farmers, who keep only a few piglets to raise from litters they produce. Piglets normally weigh from 10–15 kg at 40–45 days old. Piglets are also supplied by large commercial farms, state breeding centers, and nucleus farms of animal feed/food companies such as C.P., DABACO and ANCO.

The selling price of pig live weight or carcass was decided by the trader-cum-slaughterer. After reaching an agreement on prices, they will usually catch with about from 5 to 15 pigs at a time. They will come directly farmers’ houses in the afternoon and transport to slaughterhouses that the trader-cum-slaughterer rent at, about 30,000VND*/pig. And slaughterers will earn 150,000VND* to 250,000VND*/pig (IPSARD, 2018). Slaughterer-cum-trader will sell whole slaughter pigs or sell types of meat, blood, offal for wholesalers, retailers, collective kitchens (semi-industrial). Sometimes pig meat will be transported by motorbike to retailers at traditional markets and temporary markets.

The price of pork meat to consumers varies depending on not only the type of pork (head meat, shoulder meat, loin, bacon, leg and ham, etc.) but also the location of the sellers and the retailers. Normally the retailers set the price according to preference of the consumers, especially the bacon, shoulder meat and rib, chooses meat. Other meats will be sold to collective kitchens, restaurants or sausage processors. The selling price to consumers is usually higher than the purchase price of retailers from 12,000-20,000VND[4]*/kg.

Smallholder-scale producers use natural food sources so they have high feed conversion ratios and low livestock productivity, low carcass rates and higher feed prices than commercial pig farms, which resulted in lower returns per head. With the price of pig live weight reaching a peak in June 2018 is 52,000VND*/kg, the carcass price is 66,000VND*/kg, with each pigs weighs 130kg corresponding to 100kg of carcass, the farmer collected 6.3 million/pig. After deducting the cost for 170 days, smallholder earns about 3 million VND per head, accounts for 18% of the total value of the chain.

The main constraint of the chain: the linkage and exchange of information in the chain is very weak, especially in the production stage. They have no direction in production, exchange of experience to improve the production process, no investment, and no voice in deciding the price of the product or input price. When prices of pork fall, value adding decreases most in production (small producers), but not at all stages of the chain. Conversely, when pig prices rise, value-added traders, slaughterers, retailers and suppliers of inputs are the highest; the value added of smallholder farmers is the lowest.

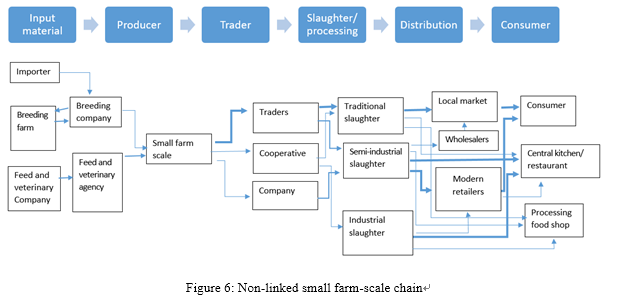

1.4.Evaluation pig supply chain of non-linked small farm scale

Products: live pigs, carcass, offal, blood, pig meat and processed pork products

Describe the product line: Farm-scale pig producer is also quite popular. Typically, these facilities usually combine pig production in the V.A.C model with fish, poultry and fruit orchards.

The price of pig live weight or carcass is determined by the trader-cum-slaughterer. After reaching a price agreement, pigs will be divided into different catches depending on the needs of them. If more than 10 pigs, they will pick up and transport to the slaughterhouse. If less than 10 pigs, they catch pigs in the early morning and the price is the price of the carcass after the slaughter without the organ, the slaughter is carried out at the slaughterhouse where the trader rents with the price, about 30,000VND*/head. For slaughter pigs, the trader-cum-slaughterer will earn 150,000VND* to 250,000VND* for a pig (IPSARD, 2018). These traders decide on the price for wholesalers, collective kitchens, and customer. With the price reaching a peak in June 2018 at 55,000 VND*/kg live weight, the profit of a pig farm is approximately 2 million to 2.8 million VND*/pig. The difficulties faced by these smallholders are the lack of capital to expand production, access to preferential loans, and buying food agents with cash immediately. Without contract farming, the price depends on the traders. With value added accounting for 15% - 18% of the total value of the chain, the farm-scale producers will profit from 13,000 to 16,000VND*[5]/kg live weight. The main constraint of the chain is similar to the smallholder value chain, the vertical and horizontal linking and exchange of information between are still very limit.

1.5.Comparing the effectiveness of pig supply chains of smallholder to others and suggesting improvement of smallholder.

Small-scale with lesser 30 porkers still plays a major role in the livestock sector in contributing 41.26% of the total pig population. The positivity of small scale production is to take advantage of smallholder labor, land, food, especially agricultural by-products; however, no capital or high technology. According to the Hanoi Department of Agriculture and Rural Development, small-scale producer supplies around 40% for the Hanoi market and nearly 70% of the warm meats market. Meanwhile, large-scale commercial production, modern technologies, and high food safety have provided only over 15% of meat for consumption (according to the Vietnam Agriculture and Rural Development Census). In 2016, there were 120,232 livestock smallholders, create jobs for 721 regular workers and seasonal workers of nearly 800 people; it has become the main source of income for local people in addition to other agricultural activities, with an average income of 964,000VND* per person.

According to the table 1, the total cost of production 1kg of pig live weight of large farms scale was the lowest with 31,989VND*/kg, followed by linkage producers of Dong Tam cooperative and medium scales with 34,684VND*/kg and 35,533VND*/kg. This group has lower production cost than two others, because they always buy directly animal feed from company with competitive price. The highest production cost is from Non linkage mall farm scale with 37,212 VND*/kg and Non linkage smallholder with 36,867VND*[6]/kg. The production cost of Non linkage mall farm scale is less than the Non linkage mall farm scale because they combine human food wastes of restaurants for pig feeding.

One of the reasons for the lowest cost of livestock production is the high productivity is the number of batches per year with 2.4 batches/ year higher than the others (average 2 batches/ year); The amount of livestock also has competition electricity and water costs as well as the labor efficiency is higher than other scales.

Table 1: Production cost (VND* / kg live weight) by livestock scale, Hanoi, 2018

|

Average cost per kilogram

|

Large scale farm

|

Medium scale farm

|

Linkage small farm scale

|

Non linkage small scale

|

Non linkage smallholder

|

F

|

|

Infrastructure

|

144

|

196

|

210

|

206

|

222

|

1.28

|

|

Breeding cost

|

6,841

|

9,477

|

9,231

|

8,478

|

9,354

|

4.16**

|

|

Animal feed

|

22,154

|

22,421

|

23,385

|

26,722

|

26,236

|

4.73**

|

|

Veterinary Medicine

|

1,710

|

1,759

|

1,038

|

1,413

|

913

|

3.11

|

|

Electricity/ water

|

817

|

89

|

128

|

79

|

107

|

102.8***

|

|

Hired labor

|

618

|

641

|

1,923

|

485

|

-

|

3.7**

|

|

Others cost (interested rate, etc.)

|

204

|

16

|

-

|

17

|

71

|

0.56

|

|

Total cost / kg

|

31,989

|

35,533

|

34,684

|

37,212

|

36,867

|

4.5**

|

|

Pig production cycle (days)

|

175

|

177

|

180

|

163

|

180

|

3.81**

|

|

Number of litters per year

|

2.09

|

2.07

|

2.03

|

2.23

|

2.03

|

4.07**

|

*** P< 0.01; ** P<0.05; * P<0.1

Source: Center of Agriculture Policy of Vietnam, 2018

In addition, the number of litters per year and animal feeds are different from each scale size, because of different pig feed source along with pig production cycle (days). Linkage small scale producers buy bio-animal feeds directly from feed companies while Non linkage smallholders add human food waste from restaurants for pig feeding. The large and medium scale are supply animal feeds directly from companies with competitive price. And Non linkage Small scale farm has the biggest animal feed cost and number of litters per year because they buy feeds from agencies with awareness risk of food safety.

It is can be said that, at the time when the selling price is higher than the production price; the economic efficiency of large scale farms is the biggest, followed by medium farm production, small-scale farms and smallholder. During selling, prices lower than production price and large-scale farms, which has over 500 porkers, get the main source of income from pig production, has the riskiest chances of going bankrupt. Small-scale farms and smallholder in Hanoi often have diverse sources of income including those from fishponds, poultry and fruit orchards, thus after the crisis period, most farm-scale producers recover easily. And almost small-scale farm owners respond in focus group discussions saying that they do not want to upgrade themselves to large farm scale operations.

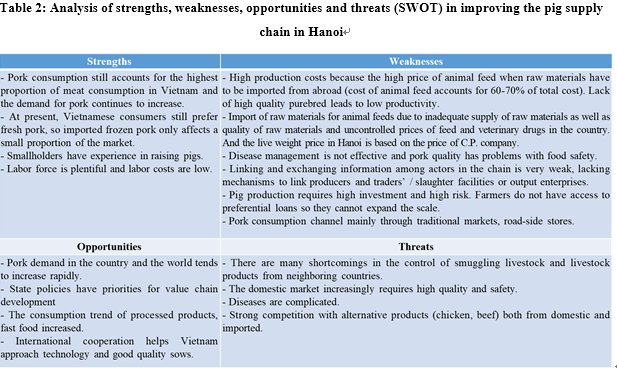

By using SWOT to analysis the pig supply chain of smallholders and small-scale farms, the short list of strengths, weakness, opportunities and threats are mentioned in table 2, this reaserch recommend following solusions for improvement and conclussive for small scale producer in pig supply chain in Hanoi.

1.6.Overview of Government supporting in pig industry

On January 16, 2008, the Prime Minister issued Decision No. 10/2008 / QD-TTg approving the strategy for livestock development to 2020. The Decision indicated that pig production had to rapidly develop the scale in the direction of farms and industries where they have preferable land conditions, fresh water sources and ecological environment. Especially, medium and large enterprises in breeding, slaughtering, preserving and industrial processing need to be developed immediately and suitably to the market.

To achieve the goal of improving efficiency and competitiveness, there should be an increase in productivity, quality and added value, consumers' needs and tastes, and sustainable development. In May 2014, the Ministry of Agriculture and Rural Development (MARD) issued Decision 984 / QD-BNN-CN approved the project "Livestock re-structuring in the direction of enhancing added value and sustainable development". The restructuring of the value chain was most notable. Enterprises play a central role in linking production organizations, cooperative groups, associations, and business associations and branding to organize the link between the production chain and the market. Furthermore, the decision also clearly oriented animal husbandry restructures by region, kind of livestock and way of breeding. Moreover, the policy in Pig industry can be divided by “direct policy support for farmers” and “policy support for others sectors”, such as prevention of disease policy, Pork price stabilization policy through retail price; the model of linking farmers - enterprises - market support policy, etc.

Policy support to prevent disease: In order to provide direct support to livestock producers in the prevention of foot-and-mouth disease and blue-ear disease through the Decision No. 719 / QD-TTg dated 5 June 2008 of the Prime Minister. Pigs infected with disease must be destroyed at the level equivalent to 70% of the value and receive a financial support of 25,000VND*[7]/ kg of liveweight. Credit policy: Decision No. 23/2017 / QD-TTg amended and supplemented a number of articles of Decision No. 246/2006 / QD-TTg on the establishment of the Cooperative Development Assistance Fund and promulgating the Regulation on credit guarantee and support activities Post-investment interest subsidy of the Development Assistance Fund. According to this Decision, the loan projects are evaluated by the Funds for repaying in accordance with the conditions for the Credit Guarantee Fund to provide loans; In the case of post-investment interest rate support, at the interest rate regulated in Article 24, Chapter III "The maximum post-investment support interest rate of the Fund for co-operatives and unions of cooperatives shall be equal to the gap between the commercial lending rate and the preferential loan interest rate of the Fund. Commercial loan rates are determined on the basis of the lowest loan interest rates in the medium and long term loan interest rates for normal business sector of state commercial banks (state owned 100% of charter capital) and joint stock commercial banks (state owned more than 50% of charter capital) announced periodically by the State Bank of Vietnam.

Policy to improve the efficiency of small farm and smallholders in 2015-2020: In order to improve the efficiency of smallholder production and environmental protection, the Prime Minister issued Decision 50/2014 / QD-TTg dated 4 September 2014. Smallholders that directly raise pigs will benefit from a number of support policies for artificial insemination, breeding and waste treatment.

Science and technology policy: In order to improve product quality and food hygiene and safety, the Ministry of Agriculture and Rural Development (MARD) has issued good practices for safe pig raising, such as Decision 1506 / QD-BNN-KHCN issued on 15 May 2008 and Decision 1947 / QD-BNN-CN on the process of good husbandry practice for safe pig raising in the smallholder. The decisions set out a full production process from the choice of site, the way to build and design the breeding facilities, the management of breeding stock, feed, drinking water, blanket hygiene farming and disease management.

Breeding stock management is a very important part of the production process. Regard the importance of this issue, the Ministry of Agriculture and Rural Development has also promulgated specific regulations on the management and use of breeds through Decision 07/2005 / QD-BNN dated January 31, 2005 on the management and use of male breeding hog, Circular No. 31/2013 / TT-BNNPTNT dated 12 June 2013 on national technical standards on breed testing.

CONCLUSIONS

Overall, the pork industry in Hanoi is sufficient to meet the domestic demand and has enough factors for sustainable development instead of the sensitive situation easily affected by external factors. Although small-scale production is currently facing many difficulties and challenges: environmental pollution; there are no sufficient resources to participate in vertical linkages between material supply, processing and marketing but they have strong recovery after the crisis compared to those of large-scale pig production. Therefore, some proposed recommendations to help promote the development of sustainable pig industry towards a comprehensive growth, including: Reorganizing production; enhancing efficiency of public services and optimizing inputs for livestock sectors; creating linkages with cooperation between smallholders, farms, setting up collective groups, cooperatives and policies to encourage investments in pig enterprises.

Reorganize production: The production should be produce following VietGAP standard and focus on premium quality such as organic pork, biological pigs, indigenous … to meet the demand of safe food store chain in Hanoi.

Enhance efficiency of public services and optimize inputs for livestock sectors

Feed ingredients areas should be improved together with productivity and quality as well as reduce the cost of inputs. Furthermore, the conversion of areas having low yield in rice fields to maize and soybean is necessary to raise the ability to supply feed ingredients in the country.

Legalizing the reduction of VAT on feeds creates fair competition between domestic feed manufacturers, encourages domestic livestock enterprises to invest heavily in feed production.

The efficiency of the veterinary service system should be improved to control disease outbreaks, feed quality as well as quality of veterinary drugs. It is necessary to review and eliminate poor quality veterinary drugs. The role of information and dissemination of knowledge in the public health service system should be enhanced. It is important to tighten up registration and control the introduction of new veterinary drugs.

Training for veterinary staff, training courses on VietGAP for producers should be strengthened. Contents of trainings and seminars of feed and veterinary companies need to be monitored. They should focus on improving the understanding, the mechanism of animal diseases rather than advertising and drug introduction.

Create linkages among smallholder, farms and set up farmer groups or cooperatives with collecting points or distribution

The establishment of groups and cooperatives to increase the total size of groups over 500 pigs that helps members access to input supplies companies at lower around 10% prices than retail prices at agents. In addition to state support policies for smallholders and small-scale farms, the government also needs preferential policies for agricultural collective groups and cooperatives such as capital support, facilities, land, human resources training and especially information on production and market forecast in the future.

Create linkages among actors in the entire pig and pork value chain in Hanoi:

Pig information management system should be established for each smallholder and farm. Accordingly, the smallholders, farms can exchange information including price, the number of piglets as well as the number of finished pigs. Traders and slaughters are also informed farmer group the production plans.

Policy on development of export market and domestic market:

Government should develop a program to support enterprises / livestock co-operatives to build and develop the trademark, trademark registration, geographical indications for key livestock products. In the domestic market, it is necessary to study consumption tastes in big cities and provide market analysis for cooperatives to enhance competitiveness in the context of global integration.

Government should develop a potential export market research program for pork products such as China, Hong Kong in terms of both market size and consumer tastes. Trade promotion programs should be developed to promote livestock products (pigs, ducks and duck eggs) to new markets.

REFERENCES

B., H. N. (2015). Risks and solution in pig production of smallholders in Chuong My district Hanoi. Vietnam Journal of Forest Science and Technology, 110 – 118

Da Silva, C. A., & de Souza Filho, H. M. (2007). Guidelines for rapid appraisals of agrifood chain performance in developing countries: Food and Agriculture Organization of the United Nations Rome.

Dinh, T. X. (2017). An Overview of Agricultural Pollution in Vietnam: The Livestock Sector: World Bank.

K., K. Đ. (2016). Study the impact of Vietnam's participation in trade agreements with the domestic animal husbandry sector: IPSARD.

Kumar, K. (1993). Rapid appraisal methods: World Bank.

Lapar, M. (2014). Review of the pig sector in Vietnam: CGIAR.

Nga, N. T. D., Ninh, H. N., Van Hung, P., & Lapar, M. (2014). Smallholder pig value chain development in Vietnam: Situation analysis and trends (CGIAR Ed.).

Vietnam, G. S. O. o. (2010-2017). database of Agriculture - Forestry and Fishery. GSO Vietnam

Vietnam, M. o. (2015). VietGAP standard – 4653/QĐ-BNN-CN.

[1] Circular No. 60/2010/TT-BNNPTNT on veterinary hygiene conditions for pig slaughterhouses; Circular No. 05/LB-TT "Guiding the conditions of slaughter, trading and transport of pigs, cattle” and Decree 66/2016/NĐ-CP

[2] Circular No. 60/2010/TT-BNNPTNT on veterinary hygiene conditions for pig slaughterhouses; Circular No. 05/LB-TT "Guiding the conditions of slaughter, trading and transport of pigs, cattle” and Decree 66/2016/NĐ-CP

[3]* Exchange Rates 1USD= 23,350VND, 22nd of June 2019, Vietcombank-Vietnam

[4]* Exchange Rates 1USD= 23,350VND, 22nd of June 2019, Vietcombank-Vietnam

[5]* Exchange Rates 1USD= 23,350VND, 22nd of June 2019, Vietcombank-Vietnam

[7]* Exchange Rates 1USD= 23,350VND, 22nd of June 2019, Vietcombank-Vietnam

Date submitted: May. 18, 2019

Reviewed, edited and uploaded: July 11, 2019

Pig supply chain analysis for improvement and inclusiveness for small-scale producers in Hanoi, Vietnam

ABSTRACT

Hanoi is one of topped pig production as well as consumption in Vietnam. However, the pig is mainly produced by small scale producers. The large scale farms which raised over 500 pigs accounted for only 0.15% while the small-scale producers with less than 100 pigs account for 62%. Even though large-scale farm seems to be an indispensable trend as the industry becomes more integrated, but the large-scale farms are challenged by vulnerability outbreak of diseases and price shocks risks. Moreover, the current regulatory system is unable to help consumer distinguish pig production and pork product safety. The aim of this paper is to understand the pig supply chain in Hanoi and suggest a recommendation for improving the livestock industry. Using government data and documentation, this research is adapted to the Rapid Appraisal approach to analyze the pig chain in Hanoi and the SWOT analysis for the small-scale producers. To convey the issues of major concerns about food safety, it was recommended that creating inclusiveness for small-scale producers into the system through collective economic mechanisms such as product association and cooperatives were important first steps and the government should create an enabling conditions for enhancing the food safety management.

Keywords: Pig supply chain, smallholders, Hanoi

INTRODUCTION

Vietnam ranks fifth in the world in terms of the total number of pigs and ranks sixth in the world in terms of porker production. However, Vietnam's porker production is mainly for domestic consumption and export of pork and porker is negligible. Hanoi is on the top list of both the largest pig production and high consumer demand in the country. In particular, the total number of pigs reached over 1,589,000 and 10,000 for consumption per day (IPSARD- Vietnam Institute of policy and agriculture research development). However, the percentage of smallholder and small-scale farms in Hanoi are bigger than medium-scale and large-scale farms. In Hanoi, the number of small-scale with less than30 porkers accounts for 90.84%; contributing 41.26% of the total pig population. But the trend in the past few years has been shifted from small-scale to a larger scale. In particular, the number of pig smallholders in 2011 decreased sharply from 4,132 thousand smallholders to 3,441 thousand smallholders in 2016 (Vietnam agro-census, 2011 and 2016). It can be said that smallholders are less competitive than others There were nearly one thousands of smallholder disappeared during five years from 2011 to 2016.

Regarding a large number of small smallholder scales, the pig industry in Vietnam faces several forms of competition which is are considered disadvantageous such as high production cost, environmental pollution, and food safety management.

The research question is “should small farm smallholders continuously develop together with others? If yes, what are the solutions for small-scale producers?”. This research will provide an overview of the pork industry in Hanoi to identify and analyze the pig value chain in Hanoi for improvement and inclusiveness for small-scales producers.

LITERATURE REVIEW

Regard to production volume and economic value, pig raising is the largest sub-sector, followed by poultry (Dinh, 2017). Besides, pork accounted for about 74 percent of total meat in Vietnam in 2012 (Agro-census). In the past, pig producer scale classifies in two types which are a commercial farm and smallholder, the commercial farm is breeding producer with above 20 sows or fattening pig more than 100 pig per batch (Dinh, 2017). In the contrast, there are four types of pig production in Vietnam — smallholder or backyard with 1-10 pigs, small medium with 5-20 sows or 30-100 fattening, medium with 20-500 sows or 100-4,000 fattening, and large with more than 500 sows or 4,000 fattening pig (Lapar, 2014).

In 2011, Government defined a commercial farm as one its profit over VND 1 billion, thus there are two possible cases here, one is a commercial farm which whole profit is from pigs, equivalent to the number of pigs sold more than 500 pigs. Other is commercial mix farms, and the number of pigs sold is less than 500 but the total profit in a year including other products is greater than 1 billion. In this paper, the classification of pig farms is based on either the "number of fattener pigs" and “number of sows”. It means that the commercial pig farm equivalent to fattening pig of more than 500 sold in a year.

Along the supply chain, pigs are produced as piglets, weaner/ growers/ porkers and pig fatteners, slaughter pigs, pig meat/pork (all types), offal, and processed pork products. The piglets normally weigh from 10–15 kg at 40–45 days old (Nga, Ninh, Van Hung, & Lapar, 2014). Growers usually weigh from 20–35 kg at 70–80 days old (Nga et al., 2014) and finished pig/ pork weigh 80-130kg.

Porker is transformed into meat after slaughtering process, and both pig meat and offal are edible products for human consumption (Nga et al., 2014). Pork can be frozen meat, chilled meat, warm meat or processed pork products depend on human purposed. In this paper, the flow of pigs and pig products along the supply chain is described in the district and particular supply chain.

METHODOLOGY

The data uses secondary data from General Statistics Office of Vietnam, Institute of Policy and Strategy for Agriculture and Rural Development, and Rapid Appraisal Methods (World Bank) with a group discussion of representatives from Livestock department of Hanoi, Extension department of Hanoi, IPSARD and group discussion of farmers.

Yearly, General Statistics Office of Vietnam (GSO) together with Ministry of Agriculture and Rural Development MARD collect data about the total number of pigs, piglets, porkers, breeding boars and sows in April and one time in five years they collect the data of smallholders in July. The full dataset consists of around 17 million smallholders of 79,898 villages in Vietnam by the Government, and we used the subset of the 132,349 of pig producers in Hanoi in July 2016 as the sampling frame. Twelve samples in each village were selected randomly from the list of farmers in the sampling frame on an excel file. The random samples were selected through the following formulation (Vietnam agro-census):

(1) Select the first sample from the list:

Number of the first sample on list = RANDBETWEEN (1, number of smallholder)

Space of each samples = total smallholder/ 12

(2) Generate the 11 remaining samples:

Sample (n+1) = n * space of each sample + number of the first sample on list

The questionnaire includes general information such as “name”, “address”, “education” and other detailed information such as “how many cows, buffalos, chickens, and pigs do you have?”; “the number of pigs, porks, porkers, and breeding pigs that are available on 1st July 2016” (Vietnam agro-census).

In addition, the mapping of the value chain and SWOT table are done by Rapid Appraisal Methods (of World Bank). Rapid appraisal method is a timely and cost-effective approach with five key rapid data collection methods such as informant interviews, focus group discussions, group interviews, structured observations, and informal surveys (Kumar K., World Bank). The data of IPSARD from focus group discussion, administration interview and structure observation of 85 respondents are used in F-test analysis, value chain mapping and SWOT analysis of pig value.

RESULTS AND DISCUSSION

1.1.Overview of the pig supply chain in Hanoi

From 2010 to 2013, the number of pigs in Hanoi decreased slightly from 1,625 thousand to 1,380 thousand. From 2013 to 2016, the number of pigs in Hanoi increased gradually, and reached 1,589 thousand in 2017. After the period of excess crisis in 2016, although the number of pigs in the country has been reduced sharply in 2017 but the number of pigs in Hanoi remained stable. The reasons are due to the psychology of livestock farmers waiting for the increase in pork prices to compensate for their losses and that demand for pork consumption increases as prices fall, so farmers in Hanoi still have market for their products.

Dividing by purpose of raising, in 2017 Hanoi has a total pig around 1.6 million pig heads, of which the porkers are about 1.4 million pig head, the sows are 0.18 million pig head and the breeding boars are around 2.6 thousand pig head. (GSO, 2017). As figure 1, the pork production in Hanoi from 2010 to 2017 ranged from 250 thousand tons/year to 300 thousand tons/year. The decline in meat yields in 2014, from 299 thousand tons in 2013 to 247 thousand tons in 2014, is due to the impact of the disease situation, which became serious in 2013. In the period 2014-2017, although the output of pork in Hanoi increased gradually but only reached about 270 thousand tons per year as consumers have moved from pork to alternative meat products, especially chicken and beef.

Regarding figure 2, the 90.84% of total producers in Hanoi is smallholder but only get 41.26% of total number of pig head; on the other hand, the large farm scale with over 500 pigs have only 0.35% of total producers but accounts for 24.46% in total number of pigs.

In Figure 3, among Hanoi center and 18 districts, the ones with the highest percentage of smallholders are Ba Vi, Soc Son, Chuong My, which account for 16.57%, 13.57% and 7,8% in Hanoi, following Dong Anh, Me Linh, My Duc, Phu Xuyen, Phuc Tho, Quoc Oai, Thach That, Thanh Oai and Ung Hoa. Even though Chuong My and Thach that have the biggest percentage of large farm scale in Hanoi, the number are still small with 0.09% in Chuong My and 0.07% in Thach That.

1.2.Mapping of pig supply chain in Hanoi

Within the framework, actors involved in the pig supply chain in Hanoi are described in the form of linkage and scale, as follows:

Breeding farms: The breeding pig farms are the individual breeding pig farms or domestic enterprises, FDI enterprises.

Breeding companies: They are domestic or foreign companies (FDI), which import and produce breeding pigs, commercial breeding farms or outsource commercial piglet production.

Livestock feed companies: They are domestic or foreign companies (FDI), which supply animal feeds to porker or breeding pig raising establishments, and business agents of agricultural materials.

Veterinary drug companies: They are domestic or foreign companies (FDI), which sell animal feeds at wholesale prices to porker and breeding pig producers, and agricultural material business agents.

Animal feed and veterinary agents: These are agents specializing in selling animal feeds and veterinary drugs to livestock establishments at retail prices.

Smallholder scale: They include livestock establishments with less than 30 pigs.

Small-scale farms: These are livestock farms from 30 to 100 porkers. They may be members of cooperatives, cooperative groups, production groups, or non-linkage, including livestock establishments that meet the criteria of "farm scale" but the number of pigs is less than 30 sows or 100 porkers.

Medium-scale farms with more than 100 porkers to less than 500 porkers: These are pig farms with a scale ranging from 100 porkers to 500 porkers or more than 300 breeding pigs. This includes farms that meet the criteria of "farm scale" according to the Ministry of Agriculture and Rural Development (MARD), and have the number of porkers over 500 or the number of commercial breeding pigs is over 300.

Large-scale farm with more than 300 sows or more than 500 porkers: They have characteristics of using imported breeds, industrial feeds, and good implementation of animal disease prevention. Often these large-scale pig production establishments are mainly involved in market linkages with large companies specializing in livestock feeds such as CP Livestock Joint Stock Company, Deheus Company.

Traders: They are those who buy live pigs from livestock farms at the price of live porker or carcass. Traders can be district traders, inter-district traders or inter-provincial traders.

Cooperatives: They are the cooperatives producing, trading piglets and porkers; operating according to the Cooperative Law "a cooperative is a collective economic organization, co-ownership, has the legal entity status, which is established voluntarily by at least seven members to coordinate and support each other in the production, to create jobs in order to meet the mutual needs of the members, on the basis of self-control, self-responsibility, equality and democracy in the management of cooperatives".

Slaughter company: They are domestic or foreign companies that purchase porkers from livestock farms; directly slaughtering, processing or hiring another slaughtering agency and selling pork as well as processed pork products.

Illegal slaughters or small slaughters: They slaught poker at smallholders’ house with less than 10 porkers per times without slaughtering permit of Government.

Slaughter distribution: They adapt the standards of slaughter of MARD and the Government's regulations on veterinary hygiene conditions for large-scale pig slaughterhouse[1]; They can be semi-industrial or traditional slaughterhouses or modern industrial slaughtering in large-scale. Modern industrial slaughtering meets the standards of MARD and the Government's regulations on veterinary hygiene conditions for pig slaughterhouses[2], cold storages and slaughtering by hanging lines.

Products of the value chain

Pigs: In the pig value chain, porkers are the products that are raised and fattened from commercial piglets by the farmer. After about 20 weeks of raising and fattening, the average live weight of a live porker reaches 100-125 kg, which is the average weight of a live porker for sale.

Commercial piglets: Commercial piglets are traded for large-scale and fattening after 3 weeks (about 20 days) to 8-12 kg.

Pork carcass: It is porker after slaughtered which includes either pork meat or internal organs are products from slaughtering and used as food. The rate of pork carcass compared to porker in slaughterhouses is usually 65 to 80% depending on the variety and feeding process.

Pork meat of all kinds: They are part of the carcass which will dissect it into many pieces with different names such as loin, shoulder, belly, ribs, and ham and shank, excludes offal.

Chilled meat: they are pork meat which after slaughtering will be stored in cool condition before shipping to retailers and consumers.

Frozen meat: Pork after slaughtered will be frozen and put in cold storage. Frozen meat is often sold in supermarkets and modern food stores.

Processed pork products: they are processing food made from pork such as ham, sausage, brawn.

1.3.Evaluation of pig supply chain of non-linked smallholders

Products: live pigs, carcass, offal, blood, pig meat and processed pork products

Describe the product along the chain: The breeding facilities of this chain often buy inputs such as feeds, piglets, and veterinary drugs at the dealers at retail prices. Feed dealers sell at prices that are based on purchase prices plus costs and profits. Usually, smallholders in Hanoi buy feeds at prices 10% higher than the direct purchase price. For example, the same amount of purchase, if the price of feeds at the second agent is 25,000VND*[3]/kg, the price of the company will be 22,500VND*/kg. In recent years, prices of feeds and vaccines have fluctuated or decreased slightly in the short term, but tend to increase in the last few years. Farmers either produce the piglets on farm or buy from various sources, such as small farmers, who keep only a few piglets to raise from litters they produce. Piglets normally weigh from 10–15 kg at 40–45 days old. Piglets are also supplied by large commercial farms, state breeding centers, and nucleus farms of animal feed/food companies such as C.P., DABACO and ANCO.

The selling price of pig live weight or carcass was decided by the trader-cum-slaughterer. After reaching an agreement on prices, they will usually catch with about from 5 to 15 pigs at a time. They will come directly farmers’ houses in the afternoon and transport to slaughterhouses that the trader-cum-slaughterer rent at, about 30,000VND*/pig. And slaughterers will earn 150,000VND* to 250,000VND*/pig (IPSARD, 2018). Slaughterer-cum-trader will sell whole slaughter pigs or sell types of meat, blood, offal for wholesalers, retailers, collective kitchens (semi-industrial). Sometimes pig meat will be transported by motorbike to retailers at traditional markets and temporary markets.

The price of pork meat to consumers varies depending on not only the type of pork (head meat, shoulder meat, loin, bacon, leg and ham, etc.) but also the location of the sellers and the retailers. Normally the retailers set the price according to preference of the consumers, especially the bacon, shoulder meat and rib, chooses meat. Other meats will be sold to collective kitchens, restaurants or sausage processors. The selling price to consumers is usually higher than the purchase price of retailers from 12,000-20,000VND[4]*/kg.

Smallholder-scale producers use natural food sources so they have high feed conversion ratios and low livestock productivity, low carcass rates and higher feed prices than commercial pig farms, which resulted in lower returns per head. With the price of pig live weight reaching a peak in June 2018 is 52,000VND*/kg, the carcass price is 66,000VND*/kg, with each pigs weighs 130kg corresponding to 100kg of carcass, the farmer collected 6.3 million/pig. After deducting the cost for 170 days, smallholder earns about 3 million VND per head, accounts for 18% of the total value of the chain.

The main constraint of the chain: the linkage and exchange of information in the chain is very weak, especially in the production stage. They have no direction in production, exchange of experience to improve the production process, no investment, and no voice in deciding the price of the product or input price. When prices of pork fall, value adding decreases most in production (small producers), but not at all stages of the chain. Conversely, when pig prices rise, value-added traders, slaughterers, retailers and suppliers of inputs are the highest; the value added of smallholder farmers is the lowest.

1.4.Evaluation pig supply chain of non-linked small farm scale

Products: live pigs, carcass, offal, blood, pig meat and processed pork products

Describe the product line: Farm-scale pig producer is also quite popular. Typically, these facilities usually combine pig production in the V.A.C model with fish, poultry and fruit orchards.

The price of pig live weight or carcass is determined by the trader-cum-slaughterer. After reaching a price agreement, pigs will be divided into different catches depending on the needs of them. If more than 10 pigs, they will pick up and transport to the slaughterhouse. If less than 10 pigs, they catch pigs in the early morning and the price is the price of the carcass after the slaughter without the organ, the slaughter is carried out at the slaughterhouse where the trader rents with the price, about 30,000VND*/head. For slaughter pigs, the trader-cum-slaughterer will earn 150,000VND* to 250,000VND* for a pig (IPSARD, 2018). These traders decide on the price for wholesalers, collective kitchens, and customer. With the price reaching a peak in June 2018 at 55,000 VND*/kg live weight, the profit of a pig farm is approximately 2 million to 2.8 million VND*/pig. The difficulties faced by these smallholders are the lack of capital to expand production, access to preferential loans, and buying food agents with cash immediately. Without contract farming, the price depends on the traders. With value added accounting for 15% - 18% of the total value of the chain, the farm-scale producers will profit from 13,000 to 16,000VND*[5]/kg live weight. The main constraint of the chain is similar to the smallholder value chain, the vertical and horizontal linking and exchange of information between are still very limit.

1.5.Comparing the effectiveness of pig supply chains of smallholder to others and suggesting improvement of smallholder.

Small-scale with lesser 30 porkers still plays a major role in the livestock sector in contributing 41.26% of the total pig population. The positivity of small scale production is to take advantage of smallholder labor, land, food, especially agricultural by-products; however, no capital or high technology. According to the Hanoi Department of Agriculture and Rural Development, small-scale producer supplies around 40% for the Hanoi market and nearly 70% of the warm meats market. Meanwhile, large-scale commercial production, modern technologies, and high food safety have provided only over 15% of meat for consumption (according to the Vietnam Agriculture and Rural Development Census). In 2016, there were 120,232 livestock smallholders, create jobs for 721 regular workers and seasonal workers of nearly 800 people; it has become the main source of income for local people in addition to other agricultural activities, with an average income of 964,000VND* per person.

According to the table 1, the total cost of production 1kg of pig live weight of large farms scale was the lowest with 31,989VND*/kg, followed by linkage producers of Dong Tam cooperative and medium scales with 34,684VND*/kg and 35,533VND*/kg. This group has lower production cost than two others, because they always buy directly animal feed from company with competitive price. The highest production cost is from Non linkage mall farm scale with 37,212 VND*/kg and Non linkage smallholder with 36,867VND*[6]/kg. The production cost of Non linkage mall farm scale is less than the Non linkage mall farm scale because they combine human food wastes of restaurants for pig feeding.

One of the reasons for the lowest cost of livestock production is the high productivity is the number of batches per year with 2.4 batches/ year higher than the others (average 2 batches/ year); The amount of livestock also has competition electricity and water costs as well as the labor efficiency is higher than other scales.

Table 1: Production cost (VND* / kg live weight) by livestock scale, Hanoi, 2018

Average cost per kilogram

Large scale farm

Medium scale farm

Linkage small farm scale

Non linkage small scale

Non linkage smallholder

F

Infrastructure

144

196

210

206

222

1.28

Breeding cost

6,841

9,477

9,231

8,478

9,354

4.16**

Animal feed

22,154

22,421

23,385

26,722

26,236

4.73**

Veterinary Medicine

1,710

1,759

1,038

1,413

913

3.11

Electricity/ water

817

89

128

79

107

102.8***

Hired labor

618

641

1,923

485

-

3.7**

Others cost (interested rate, etc.)

204

16

-

17

71

0.56

Total cost / kg

31,989

35,533

34,684

37,212

36,867

4.5**

Pig production cycle (days)

175

177

180

163

180

3.81**

Number of litters per year

2.09

2.07

2.03

2.23

2.03

4.07**

*** P< 0.01; ** P<0.05; * P<0.1

Source: Center of Agriculture Policy of Vietnam, 2018

In addition, the number of litters per year and animal feeds are different from each scale size, because of different pig feed source along with pig production cycle (days). Linkage small scale producers buy bio-animal feeds directly from feed companies while Non linkage smallholders add human food waste from restaurants for pig feeding. The large and medium scale are supply animal feeds directly from companies with competitive price. And Non linkage Small scale farm has the biggest animal feed cost and number of litters per year because they buy feeds from agencies with awareness risk of food safety.

It is can be said that, at the time when the selling price is higher than the production price; the economic efficiency of large scale farms is the biggest, followed by medium farm production, small-scale farms and smallholder. During selling, prices lower than production price and large-scale farms, which has over 500 porkers, get the main source of income from pig production, has the riskiest chances of going bankrupt. Small-scale farms and smallholder in Hanoi often have diverse sources of income including those from fishponds, poultry and fruit orchards, thus after the crisis period, most farm-scale producers recover easily. And almost small-scale farm owners respond in focus group discussions saying that they do not want to upgrade themselves to large farm scale operations.

By using SWOT to analysis the pig supply chain of smallholders and small-scale farms, the short list of strengths, weakness, opportunities and threats are mentioned in table 2, this reaserch recommend following solusions for improvement and conclussive for small scale producer in pig supply chain in Hanoi.

1.6.Overview of Government supporting in pig industry

On January 16, 2008, the Prime Minister issued Decision No. 10/2008 / QD-TTg approving the strategy for livestock development to 2020. The Decision indicated that pig production had to rapidly develop the scale in the direction of farms and industries where they have preferable land conditions, fresh water sources and ecological environment. Especially, medium and large enterprises in breeding, slaughtering, preserving and industrial processing need to be developed immediately and suitably to the market.

To achieve the goal of improving efficiency and competitiveness, there should be an increase in productivity, quality and added value, consumers' needs and tastes, and sustainable development. In May 2014, the Ministry of Agriculture and Rural Development (MARD) issued Decision 984 / QD-BNN-CN approved the project "Livestock re-structuring in the direction of enhancing added value and sustainable development". The restructuring of the value chain was most notable. Enterprises play a central role in linking production organizations, cooperative groups, associations, and business associations and branding to organize the link between the production chain and the market. Furthermore, the decision also clearly oriented animal husbandry restructures by region, kind of livestock and way of breeding. Moreover, the policy in Pig industry can be divided by “direct policy support for farmers” and “policy support for others sectors”, such as prevention of disease policy, Pork price stabilization policy through retail price; the model of linking farmers - enterprises - market support policy, etc.

Policy support to prevent disease: In order to provide direct support to livestock producers in the prevention of foot-and-mouth disease and blue-ear disease through the Decision No. 719 / QD-TTg dated 5 June 2008 of the Prime Minister. Pigs infected with disease must be destroyed at the level equivalent to 70% of the value and receive a financial support of 25,000VND*[7]/ kg of liveweight. Credit policy: Decision No. 23/2017 / QD-TTg amended and supplemented a number of articles of Decision No. 246/2006 / QD-TTg on the establishment of the Cooperative Development Assistance Fund and promulgating the Regulation on credit guarantee and support activities Post-investment interest subsidy of the Development Assistance Fund. According to this Decision, the loan projects are evaluated by the Funds for repaying in accordance with the conditions for the Credit Guarantee Fund to provide loans; In the case of post-investment interest rate support, at the interest rate regulated in Article 24, Chapter III "The maximum post-investment support interest rate of the Fund for co-operatives and unions of cooperatives shall be equal to the gap between the commercial lending rate and the preferential loan interest rate of the Fund. Commercial loan rates are determined on the basis of the lowest loan interest rates in the medium and long term loan interest rates for normal business sector of state commercial banks (state owned 100% of charter capital) and joint stock commercial banks (state owned more than 50% of charter capital) announced periodically by the State Bank of Vietnam.

Policy to improve the efficiency of small farm and smallholders in 2015-2020: In order to improve the efficiency of smallholder production and environmental protection, the Prime Minister issued Decision 50/2014 / QD-TTg dated 4 September 2014. Smallholders that directly raise pigs will benefit from a number of support policies for artificial insemination, breeding and waste treatment.

Science and technology policy: In order to improve product quality and food hygiene and safety, the Ministry of Agriculture and Rural Development (MARD) has issued good practices for safe pig raising, such as Decision 1506 / QD-BNN-KHCN issued on 15 May 2008 and Decision 1947 / QD-BNN-CN on the process of good husbandry practice for safe pig raising in the smallholder. The decisions set out a full production process from the choice of site, the way to build and design the breeding facilities, the management of breeding stock, feed, drinking water, blanket hygiene farming and disease management.

Breeding stock management is a very important part of the production process. Regard the importance of this issue, the Ministry of Agriculture and Rural Development has also promulgated specific regulations on the management and use of breeds through Decision 07/2005 / QD-BNN dated January 31, 2005 on the management and use of male breeding hog, Circular No. 31/2013 / TT-BNNPTNT dated 12 June 2013 on national technical standards on breed testing.

CONCLUSIONS

Overall, the pork industry in Hanoi is sufficient to meet the domestic demand and has enough factors for sustainable development instead of the sensitive situation easily affected by external factors. Although small-scale production is currently facing many difficulties and challenges: environmental pollution; there are no sufficient resources to participate in vertical linkages between material supply, processing and marketing but they have strong recovery after the crisis compared to those of large-scale pig production. Therefore, some proposed recommendations to help promote the development of sustainable pig industry towards a comprehensive growth, including: Reorganizing production; enhancing efficiency of public services and optimizing inputs for livestock sectors; creating linkages with cooperation between smallholders, farms, setting up collective groups, cooperatives and policies to encourage investments in pig enterprises.

Reorganize production: The production should be produce following VietGAP standard and focus on premium quality such as organic pork, biological pigs, indigenous … to meet the demand of safe food store chain in Hanoi.

Enhance efficiency of public services and optimize inputs for livestock sectors

Feed ingredients areas should be improved together with productivity and quality as well as reduce the cost of inputs. Furthermore, the conversion of areas having low yield in rice fields to maize and soybean is necessary to raise the ability to supply feed ingredients in the country.

Legalizing the reduction of VAT on feeds creates fair competition between domestic feed manufacturers, encourages domestic livestock enterprises to invest heavily in feed production.

The efficiency of the veterinary service system should be improved to control disease outbreaks, feed quality as well as quality of veterinary drugs. It is necessary to review and eliminate poor quality veterinary drugs. The role of information and dissemination of knowledge in the public health service system should be enhanced. It is important to tighten up registration and control the introduction of new veterinary drugs.

Training for veterinary staff, training courses on VietGAP for producers should be strengthened. Contents of trainings and seminars of feed and veterinary companies need to be monitored. They should focus on improving the understanding, the mechanism of animal diseases rather than advertising and drug introduction.

Create linkages among smallholder, farms and set up farmer groups or cooperatives with collecting points or distribution

The establishment of groups and cooperatives to increase the total size of groups over 500 pigs that helps members access to input supplies companies at lower around 10% prices than retail prices at agents. In addition to state support policies for smallholders and small-scale farms, the government also needs preferential policies for agricultural collective groups and cooperatives such as capital support, facilities, land, human resources training and especially information on production and market forecast in the future.

Create linkages among actors in the entire pig and pork value chain in Hanoi:

Pig information management system should be established for each smallholder and farm. Accordingly, the smallholders, farms can exchange information including price, the number of piglets as well as the number of finished pigs. Traders and slaughters are also informed farmer group the production plans.

Policy on development of export market and domestic market:

Government should develop a program to support enterprises / livestock co-operatives to build and develop the trademark, trademark registration, geographical indications for key livestock products. In the domestic market, it is necessary to study consumption tastes in big cities and provide market analysis for cooperatives to enhance competitiveness in the context of global integration.

Government should develop a potential export market research program for pork products such as China, Hong Kong in terms of both market size and consumer tastes. Trade promotion programs should be developed to promote livestock products (pigs, ducks and duck eggs) to new markets.

REFERENCES

B., H. N. (2015). Risks and solution in pig production of smallholders in Chuong My district Hanoi. Vietnam Journal of Forest Science and Technology, 110 – 118

Da Silva, C. A., & de Souza Filho, H. M. (2007). Guidelines for rapid appraisals of agrifood chain performance in developing countries: Food and Agriculture Organization of the United Nations Rome.

Dinh, T. X. (2017). An Overview of Agricultural Pollution in Vietnam: The Livestock Sector: World Bank.

K., K. Đ. (2016). Study the impact of Vietnam's participation in trade agreements with the domestic animal husbandry sector: IPSARD.

Kumar, K. (1993). Rapid appraisal methods: World Bank.

Lapar, M. (2014). Review of the pig sector in Vietnam: CGIAR.

Nga, N. T. D., Ninh, H. N., Van Hung, P., & Lapar, M. (2014). Smallholder pig value chain development in Vietnam: Situation analysis and trends (CGIAR Ed.).

Vietnam, G. S. O. o. (2010-2017). database of Agriculture - Forestry and Fishery. GSO Vietnam

Vietnam, M. o. (2015). VietGAP standard – 4653/QĐ-BNN-CN.

[1] Circular No. 60/2010/TT-BNNPTNT on veterinary hygiene conditions for pig slaughterhouses; Circular No. 05/LB-TT "Guiding the conditions of slaughter, trading and transport of pigs, cattle” and Decree 66/2016/NĐ-CP

[2] Circular No. 60/2010/TT-BNNPTNT on veterinary hygiene conditions for pig slaughterhouses; Circular No. 05/LB-TT "Guiding the conditions of slaughter, trading and transport of pigs, cattle” and Decree 66/2016/NĐ-CP

[3]* Exchange Rates 1USD= 23,350VND, 22nd of June 2019, Vietcombank-Vietnam

[4]* Exchange Rates 1USD= 23,350VND, 22nd of June 2019, Vietcombank-Vietnam

[5]* Exchange Rates 1USD= 23,350VND, 22nd of June 2019, Vietcombank-Vietnam

[7]* Exchange Rates 1USD= 23,350VND, 22nd of June 2019, Vietcombank-Vietnam

Date submitted: May. 18, 2019

Reviewed, edited and uploaded: July 11, 2019