INTRODUCTION

Since the middle of the 1990s, Vietnam has integrated intensely with the global economy. In 1995, Vietnam became an official member of the Association of South-East Asian Nations (ASEAN) and in 2007, participated in the World Trade Organization. Since that time until now, Vietnam signed a lot of bilateral and multilateral free trade agreements (FTAs). In 2015, Vietnam-EU free trade agreement affirmed Vietnam’s international integration determination.

One of the important points of the intense international economic integration in the near future is that Vietnam’s import tariff barrier will be reduced and eliminated. This will inflict severe impacts on Vietnam’s good trade, especially on livestock products. Vietnam’s livestock products are assessed as low competitive products and will be affected significantly from the tariff reduction and elimination.

To assess the impact of tariff elimination on the livestock sector, the research group of the Institute of Policy and Strategy for Agriculture and Rural Development (IPSARD) has used the Global Trade Analysis Project (GTAP) database to form an analytical model of global trade prediction (GTAP model). This GTAP model is based on the Static Computable General Equilibrium with multilateral regions (the maximum’s 140 countries or regions), mulilateral sectors (57 sectors at the maximum), with the hypotheses of perfect competition and constant efficiency at any scale. Another input data of the GTAP model is the Input-Output table in 2011 which reflects the connection among sectors and regions.

There are six simulation scenarios in this research, including: (i) Baseline scenario (Vietnam will not implement any of agreements including Trans-Pacific Partnership Agreement - TPP, EU-Vietnam free trade agreement - EVFTA, ASEAN Economic Community - AEC and Regional Comprehensive Economic Partnership - RCEP) known as KCS (KCS scenario); (ii) 4 scenarios corresponding to Vietnam’s implementation each of the four FTAs individually above, abbreviated as TPP, EVFTA, AEC and RCEP as same name as what FTA will enter into force; and (iii) the general scenario (Vietnam will implement all of these four FTAs) known as ALL (ALL scenario).

1.Impacts on Vietnam’s pig and chicken sectors

1.1.Impact on production

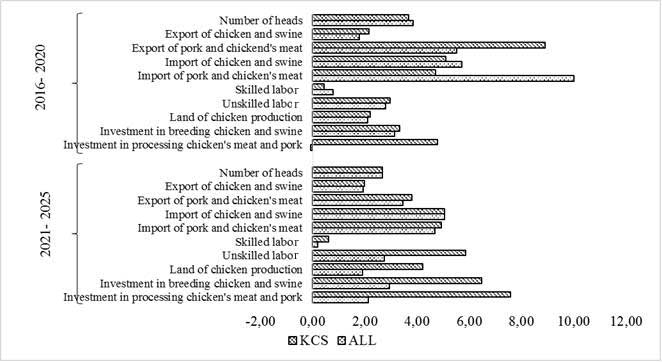

All of the five scenarios (except KCS) above shows that there is a negligible change in the number of pig and the chicken heads compared to the KCS scenario (Fig. 1). The period of 2016-2020 will take larger impact than the period of 2021-2025. This may be because the tariff elimination happens stronger in the earlier stage. As a result, in 2020, in the ALL scenario, the number of chicken and pig heads will reach 446.3 million heads, comparing to 442.6 million heads in the KCS scenario and in 2025, this number is 580.8 million heads in the ALL scenario and 446.3 million heads in the KCS scenario.

Fig. 1. Impacts of FTAs to pig and chicken sector 2016-2025

Source: IPSARD (2016)

1.2.Impact on international trade

The result of the GTAP model shows that the impact of the FTAs is quite clear. In the import aspect, in the ALL scenario, the turnover of frozen and chilled meat will increase significantly, by 5.29% point compared to KCS scenario (equivalent to US$259.5 million in 2025). This is a signal showing that domestic farmers and producers may lose the domestic chicken and pig market by the foreign producers and importers in the period of 2016-2020, while the youth increasingly tend to consume fastfood. Nevertheless, this impact in the period 2021-2025 will be smaller than the earlier period and the growth rate of chicken and pig sector will be more stable. The average growth of the import turnover will increase by 0.01%, compared to KCS scenario.

All of GTAP model scenarios points out that the growth rate of import turnover is higher than exported ones. Specifically, comparing to the KCS scenario, the average growth of live chicken and pig export turnover in the ALL scenario will decrease 0.36% point in the period of 2016-2020, equivalent to US$17.9 million.

1.3. Impact on labor, land and investment

As a result of GTAP model, the impact of FTAs to the skilled labor and the non-skilled labor in the pig and chicken sector is quite large. Especially in the period of 2020-2025, in the ALL scenario, the average growth rate of non-skilled labor is 3.13% point lower than in the KCS scenario.

As to the impact on land conversion, in the period of 2016-2020, the ALL scenario will be barely different to the KCS scenario, but in the later period of 2021-2025, the growth rate in ALL scenario will decrease by 2.31% point lower than one in the KCS scenario. Land area used to raise pig and chicken will decrease in the period of 2021-2025 because the livestock will be concentrated on the production models with large scale for higher efficiency; and the small-scale farming of livestock in residential areas will decrease.

The capital investment and its growth rate in the pig and chicken sector is in the ALL scenario are 3.5% point lower than in the KCS one in the period of 2021-2025. The main reason may be that investment cost will be cut thanks to larger production scale and more concentrated instead of scattered investments. In addition, the increase of importing live chickens and pigs will reduce the investment demand in livestock production.

2. Impacts on the cattle sector of Vietnam

2.1. Impact on production

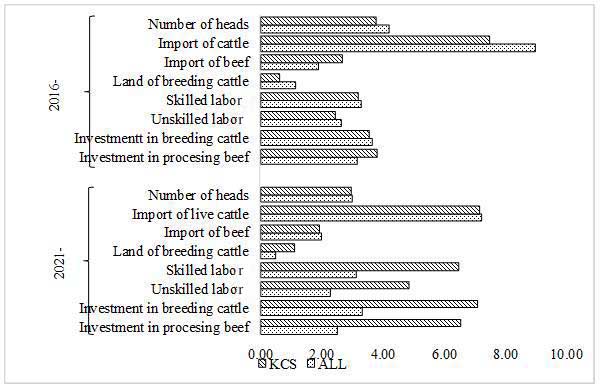

As same as chicken and pig production, those above FTAs will not be affected significantly to the domestic cattle production in both of the two periods (Fig. 2). In the ALL scenario, the growth rate of production will get higher (0.42% point in the first period and 0.03% point in the second one) and the production will reach 9.7 million heads in 2020 and 13.05 million heads in 2025. The increase of growth rate in cattle production may be mainly caused by the development of the beef demand due to the growth of population and income.

2.2. Impact on international trade

As the result of the GTAP model in the Fig. 2, the turnover of the imported live cattle in the ALL scenario will grow 1.52% point stronger than that in the KCS one in the period of 2016-2020. In the next period, all of the above FTAs will have little impact and, the ALL scenario will not differ significantly from the KCS one (only 0.05% difference) because the import tariff of live cattle will almost be eliminated in the period of 2016-2020.

2.3. Impact on labor, land and investments

In terms of investments, in the period of 2016-2020, the ALL scenario will give a little difference compared to the KCS one and there is a small decrease of 0.09% of the cattle investment growth. In the next period of 2021-2025, the FTAs’ will continuously cause negative effects and, the growth rate of investment in the ALL scenario will be 3.75% point lower than that in the KCS.

Because of all of the scenarios in which at least one FTA will enter into force, the land area used to raise cattle will increase in the future, but not much. The growth rate of land area in all of the period will not be significantly different between the ALL scenario and the KCS. In the ALL scenario, this growth rate will be higher 0.54% and 0.61% point than the one in the KCS scenario in the periods of 2016-2020 and 2021-2025 respectively. This trend shows that the raising area and scale will be stable and the demand and supply of the domestic market will be stable.

Fig. 2. Impact of the FTAs on the domestic cattle sector in the period 2016-2025

*** Baseline scenario abbreviated as KCS in the figure

Source: IPSARD, 2016.

REFERENCES

Claudio Dordi and colleagues (2014), ‘Assess the impact of the Regional Comprehensive Economic Partnership (RCEP) to Vietnam’s economy’, EU-MUTRAP project

Nguyen Duc Thanh and colleagues (2015), ‘Impact of TPP and AEC to Vietnam’s economy: macro economic and the case of Vietnam’s livestock’, Publisher: Hanoi National Uneversity.

Nin, A., Lapar, M. L., & Ehui, S. (2003). ‘Globalization, trade liberalization and poverty ALLeviation in Southeast Asia: the case of the livestock sector in Vietnam’, Presented at the 6th Annual Conference on Global Economic Analysis, June 12 - 14, 2003. Scheveningen, The Hague, The Netherlands.

Purdue University, 2016. GTAP Data Base. https://www.gtap.agecon.purdue.edu/databases/ (Accessed at 11/12/2016).

Shantayanan Devarajan and coleagues (1997), ‘Simple General Equilibrium Modeling’. https://www.researchgate.net/publication/253813991_Simple_General_Equilibrium_Modeling. (Accessed at 10/12/2016).

Institute of Policy and Strategy for Agriculture and Rural Development, 2016, ‘Assess impacts of Vietnam’s participation in the free trade agreement to the domestic livestock sector’.

|

Date submitted: March 1, 2017

Reviewed, edited and uploaded: April 11, 2017

|

Impact of Tariff Elimination under the Free Trade Agreements to Animal Meat in Vietnam

INTRODUCTION

Since the middle of the 1990s, Vietnam has integrated intensely with the global economy. In 1995, Vietnam became an official member of the Association of South-East Asian Nations (ASEAN) and in 2007, participated in the World Trade Organization. Since that time until now, Vietnam signed a lot of bilateral and multilateral free trade agreements (FTAs). In 2015, Vietnam-EU free trade agreement affirmed Vietnam’s international integration determination.

One of the important points of the intense international economic integration in the near future is that Vietnam’s import tariff barrier will be reduced and eliminated. This will inflict severe impacts on Vietnam’s good trade, especially on livestock products. Vietnam’s livestock products are assessed as low competitive products and will be affected significantly from the tariff reduction and elimination.

To assess the impact of tariff elimination on the livestock sector, the research group of the Institute of Policy and Strategy for Agriculture and Rural Development (IPSARD) has used the Global Trade Analysis Project (GTAP) database to form an analytical model of global trade prediction (GTAP model). This GTAP model is based on the Static Computable General Equilibrium with multilateral regions (the maximum’s 140 countries or regions), mulilateral sectors (57 sectors at the maximum), with the hypotheses of perfect competition and constant efficiency at any scale. Another input data of the GTAP model is the Input-Output table in 2011 which reflects the connection among sectors and regions.

There are six simulation scenarios in this research, including: (i) Baseline scenario (Vietnam will not implement any of agreements including Trans-Pacific Partnership Agreement - TPP, EU-Vietnam free trade agreement - EVFTA, ASEAN Economic Community - AEC and Regional Comprehensive Economic Partnership - RCEP) known as KCS (KCS scenario); (ii) 4 scenarios corresponding to Vietnam’s implementation each of the four FTAs individually above, abbreviated as TPP, EVFTA, AEC and RCEP as same name as what FTA will enter into force; and (iii) the general scenario (Vietnam will implement all of these four FTAs) known as ALL (ALL scenario).

1.Impacts on Vietnam’s pig and chicken sectors

1.1.Impact on production

All of the five scenarios (except KCS) above shows that there is a negligible change in the number of pig and the chicken heads compared to the KCS scenario (Fig. 1). The period of 2016-2020 will take larger impact than the period of 2021-2025. This may be because the tariff elimination happens stronger in the earlier stage. As a result, in 2020, in the ALL scenario, the number of chicken and pig heads will reach 446.3 million heads, comparing to 442.6 million heads in the KCS scenario and in 2025, this number is 580.8 million heads in the ALL scenario and 446.3 million heads in the KCS scenario.

Fig. 1. Impacts of FTAs to pig and chicken sector 2016-2025

Source: IPSARD (2016)

1.2.Impact on international trade

The result of the GTAP model shows that the impact of the FTAs is quite clear. In the import aspect, in the ALL scenario, the turnover of frozen and chilled meat will increase significantly, by 5.29% point compared to KCS scenario (equivalent to US$259.5 million in 2025). This is a signal showing that domestic farmers and producers may lose the domestic chicken and pig market by the foreign producers and importers in the period of 2016-2020, while the youth increasingly tend to consume fastfood. Nevertheless, this impact in the period 2021-2025 will be smaller than the earlier period and the growth rate of chicken and pig sector will be more stable. The average growth of the import turnover will increase by 0.01%, compared to KCS scenario.

All of GTAP model scenarios points out that the growth rate of import turnover is higher than exported ones. Specifically, comparing to the KCS scenario, the average growth of live chicken and pig export turnover in the ALL scenario will decrease 0.36% point in the period of 2016-2020, equivalent to US$17.9 million.

1.3. Impact on labor, land and investment

As a result of GTAP model, the impact of FTAs to the skilled labor and the non-skilled labor in the pig and chicken sector is quite large. Especially in the period of 2020-2025, in the ALL scenario, the average growth rate of non-skilled labor is 3.13% point lower than in the KCS scenario.

As to the impact on land conversion, in the period of 2016-2020, the ALL scenario will be barely different to the KCS scenario, but in the later period of 2021-2025, the growth rate in ALL scenario will decrease by 2.31% point lower than one in the KCS scenario. Land area used to raise pig and chicken will decrease in the period of 2021-2025 because the livestock will be concentrated on the production models with large scale for higher efficiency; and the small-scale farming of livestock in residential areas will decrease.

The capital investment and its growth rate in the pig and chicken sector is in the ALL scenario are 3.5% point lower than in the KCS one in the period of 2021-2025. The main reason may be that investment cost will be cut thanks to larger production scale and more concentrated instead of scattered investments. In addition, the increase of importing live chickens and pigs will reduce the investment demand in livestock production.

2. Impacts on the cattle sector of Vietnam

2.1. Impact on production

As same as chicken and pig production, those above FTAs will not be affected significantly to the domestic cattle production in both of the two periods (Fig. 2). In the ALL scenario, the growth rate of production will get higher (0.42% point in the first period and 0.03% point in the second one) and the production will reach 9.7 million heads in 2020 and 13.05 million heads in 2025. The increase of growth rate in cattle production may be mainly caused by the development of the beef demand due to the growth of population and income.

2.2. Impact on international trade

As the result of the GTAP model in the Fig. 2, the turnover of the imported live cattle in the ALL scenario will grow 1.52% point stronger than that in the KCS one in the period of 2016-2020. In the next period, all of the above FTAs will have little impact and, the ALL scenario will not differ significantly from the KCS one (only 0.05% difference) because the import tariff of live cattle will almost be eliminated in the period of 2016-2020.

2.3. Impact on labor, land and investments

In terms of investments, in the period of 2016-2020, the ALL scenario will give a little difference compared to the KCS one and there is a small decrease of 0.09% of the cattle investment growth. In the next period of 2021-2025, the FTAs’ will continuously cause negative effects and, the growth rate of investment in the ALL scenario will be 3.75% point lower than that in the KCS.

Because of all of the scenarios in which at least one FTA will enter into force, the land area used to raise cattle will increase in the future, but not much. The growth rate of land area in all of the period will not be significantly different between the ALL scenario and the KCS. In the ALL scenario, this growth rate will be higher 0.54% and 0.61% point than the one in the KCS scenario in the periods of 2016-2020 and 2021-2025 respectively. This trend shows that the raising area and scale will be stable and the demand and supply of the domestic market will be stable.

Fig. 2. Impact of the FTAs on the domestic cattle sector in the period 2016-2025

*** Baseline scenario abbreviated as KCS in the figure

Source: IPSARD, 2016.

REFERENCES

Claudio Dordi and colleagues (2014), ‘Assess the impact of the Regional Comprehensive Economic Partnership (RCEP) to Vietnam’s economy’, EU-MUTRAP project

Nguyen Duc Thanh and colleagues (2015), ‘Impact of TPP and AEC to Vietnam’s economy: macro economic and the case of Vietnam’s livestock’, Publisher: Hanoi National Uneversity.

Nin, A., Lapar, M. L., & Ehui, S. (2003). ‘Globalization, trade liberalization and poverty ALLeviation in Southeast Asia: the case of the livestock sector in Vietnam’, Presented at the 6th Annual Conference on Global Economic Analysis, June 12 - 14, 2003. Scheveningen, The Hague, The Netherlands.

Purdue University, 2016. GTAP Data Base. https://www.gtap.agecon.purdue.edu/databases/ (Accessed at 11/12/2016).

Shantayanan Devarajan and coleagues (1997), ‘Simple General Equilibrium Modeling’. https://www.researchgate.net/publication/253813991_Simple_General_Equilibrium_Modeling. (Accessed at 10/12/2016).

Institute of Policy and Strategy for Agriculture and Rural Development, 2016, ‘Assess impacts of Vietnam’s participation in the free trade agreement to the domestic livestock sector’.

Date submitted: March 1, 2017

Reviewed, edited and uploaded: April 11, 2017