ABSTRACT

This report focuses on the Trans-Pacific Partnership Agreement (TPP) and the corresponding analyses regarding opportunities and challenges that it brings to Vietnam’s agricultural sector. Overall, Vietnam has many advantages in agriculture, forestry and fishery export (commonly referred as agricultural commodities) over TPP member countries with increasing trade surplus. For the group of major agricultural commodities affected by TPP, rice, seafood (fish, shrimp), vegetables, and wood & wood products are seen to be positively impacted by lower tariffs and better market openness. For industrial crops such as pepper, cashew, coffee and rubber, the TPP’s rule of origin can also be a factor to promote export and reduce material cost. However, the livestock sector is expected to face with many difficulties when Vietnamese products have to compete with countries having strengths on this sector, especially pork and chicken from the US and Canada – countries that Vietnam is imposing high import duties. Besides the impact on trade due to tariff reduction, this report also points out the positive impact of foreign investments, the potential to move a large amount of labor out of agriculture by developing light industry and the challenges of Technical Barriers to Trade (TBT) and Sanitary and Phytosanitary (SPS) of TPP countries for Vietnamese exported products. To diminish the negative impacts and take advantage of the opportunities brought by TPP, the research recommends two policy categories. For the the short term basis, it is recommended to (i) raise the awareness of integration, (ii) boost trade promotion and market development in order to establish a global value chain of Vietnamese trademark on key agricultural commodities, and (iii) review vulnerable sector to issue timely policy support. For the medium and long term basis, it is advised to (i) accelerate the process of restructuring the domestic agricultural sector in accordance with international integration, and (ii) harmonize Vietnam’s regulations or quality standards to those of the TPP. Finally, the report proposes several research ideas that should be considered in the future, with particular emphasis on the systemic assessment of TPP’s impact to the agricultural sector, quantitative analysis of the impact channels such as reducing tariffs, increasing investments, and mobilizing labor.

INTRODUCTION

After more than five years of negotiations, the Trans-Pacific Partnership (TPP) Agreement was officially signed on October 6th 2015 with the full text published on November 5th 2015. This Agreement includes 12 member countries, namely Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, the US and Vietnam. Apart from tariff commitments, the TPP also covers a broad range of contentious issues including intellectual property, foreign investment law, environmental standards and labor regulations, procurement policy, competition and state-owned enterprises and the process of dispute settlement.

When the TPP is enforced, it will cover 40% of the global economy and contribute nearly US$300 billion to the world’s GDP per year. The population of the 12 member countries is about 800 million people, around 11% of the world population, and twice European Union (EU)’s (World Bank 2015). Moreover, many TPP member countries are among those whose GDP per capita are highest in the world, such as the US, Canada, Japan, Australia, Brunei and Singapore. This is a great opportunity for the Vietnamese export in general and the Vietnamese agricultural products in particular, especially now that the partnership allows broader access to the US and Japan’s market – the two largest economies in the world.

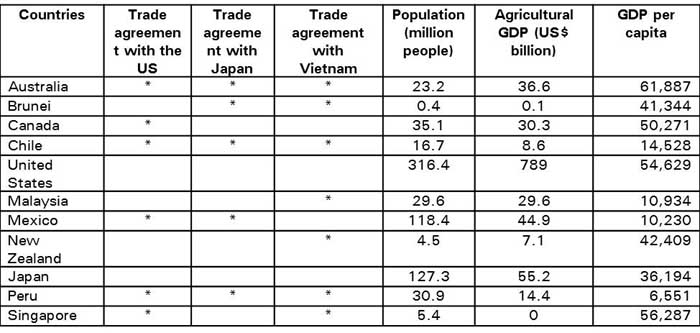

Table 1. TPP Features of TPP member countries

Source: Summary of the World Bank’s data and the national websites of the countries (2015).

If the previous trade agreements often focus on tariff reduction, the TPP is seen as a comprehensive trade agreement, taking into account the establishment of high commercial standard codes and solving problems of the global economy in the 21st century, then promoting growth and employment opportunity in the Asia – Pacific region. TPP is expected to boost the economic growth, create more well-paid jobs, promote breakthroughs, productivity and competitiveness and improve the quality of life, reduce the poverty as well as increase transparency, governance and environmental protection (Petri et al. 2011).

This report will analyze the opportunities and challenges for Vietnam’s agricultural sector when the country joins the agreement and propose several policy recommendations.

Agricultural Trade between Vietnam and other countries under TPP

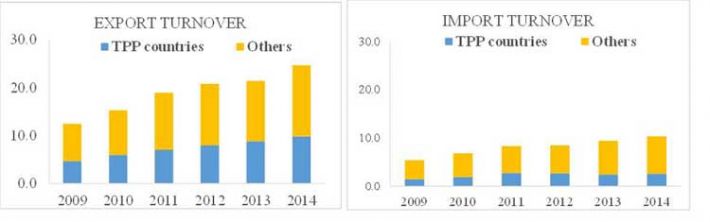

Overall, import and export relations with countries under TPP play an important role in the international trade of Vietnam. Both export and import turnover between Vietnam and TPP countries have increased sharply in recent years. However, export turnover of Vietnam in TPP has larger and faster growth than imports turnover. This shows that Vietnam has comparative advantage in agricultural production over most TPP countries. If the country can take advantage of expanding market opportunities from TPP, Vietnam’s agricultural sector can continue to maintain its level of trade surplus, promoting a positive contribution of agriculture to the overall growth and social stability in Vietnam.

Fig. 1. Agricultural trade value between Vietnam – ROW[2] and TPP countries (bill. USD)

Source: Calculation from data of General Department of Vietnam Customs (2015)

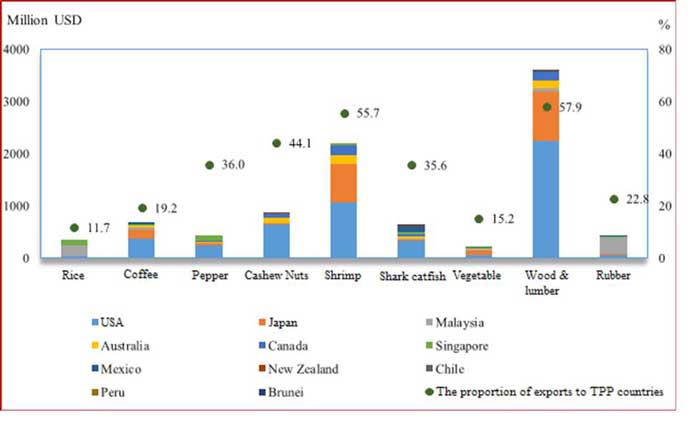

Wood & wood products and seafood (mainly from shrimp and catfish) are Vietnam’s main agricultural export to TPP countries with the export turnover of US$7.3 billion. The proportion of wood and wood products export to TPP accounts for 57.9% of total export turnover of Vietnam's wood. The proportion of shrimp and catfish export to TPP accounts for 55.7% and 35.6% of total export of Vietnam’s fishery products, respectively.

Fig. 2. The main Vietnam agricultural export to TPP countries in 2014 (mil USD)

Source: General Department of Vietnam Customs (2015)

The second major agricultural export group is industrial crops (such as coffee, cashew, pepper, rubber). The US and Japan are the two largest trading partners of wood & wood products, fisheries and industrial crops. At the same time, rice and vegetables have relatively modest import export turnover. Notably, Malaysia is also a major trading partner of Vietnam in the rice and rubber sectors. Currently, agricultural exports from Vietnam to other TPP countries only have focused on some key commodities and a few large customers. Participation in TPP is a good opportunity for Vietnam to expand exports to other major markets such as Mexico, Australia and Canada as well as diversify its export of agricultural products.

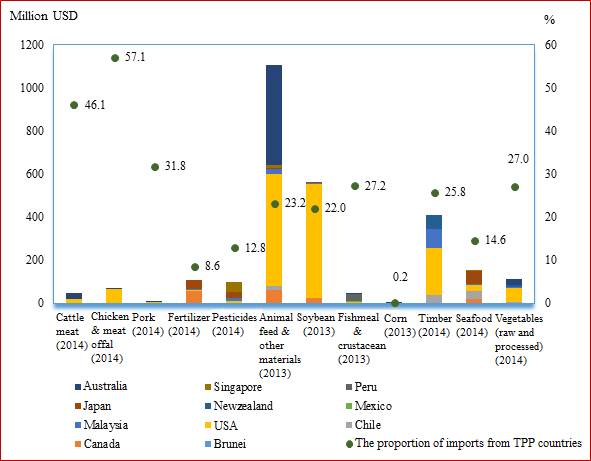

Fig. 3. The agricultural import of Vietnam from TPP countries in 2014 (mil USD)

Source: General Department of Vietnam Customs (2015)

Agricultural imports from TPP countries to Vietnam can be divided into three main groups: (i) livestock and related products including animal feed products, raw materials for animal feed products (such as soybean, fishmeal) and meat (chicken, beef, pork) - accounts for the largest proportion (more than US$ 1.6 billion), (ii) lumber, seafood and vegetables, and (iii) inputs for agricultural production (such as fertilizer, pesticide). To Vietnam, TPP countries are important sources to import animal feed products. When Vietnam joins the TPP, this trend is likely to continue and accelerate. For animal feeds, Vietnam seems to import more products from the US - the leading producer of corn and soybeans. For beef, Australia and New Zealand would continue to be an important trading partner of Vietnam.

Impact of tariff reduction on some major agricultural commodities in Vietnam

This section aims to evaluate the impact of the tariff reduction in Vietnam and other TPP countries on different commodities. Specifically, this section explores the potential of tariff reduction on Vietnam’s agricultural commodities in these markets. Accordingly, those countries that are applying high tariffs on Vietnam agricultural commodities are considered as high potential markets. In contrast, the countries that adopted low tariffs on Vietnam’s agricultural commodities are considered as low potential markets. It means that Vietnam may not benefit much from tariff reduction in the framework of the TPP commitments. Similarly, Vietnam’s tariffs on TPP agricultural commodities are also used to analyze the impacts of the TPP to vulnerable sectors such as livestock production, and benefits from reduction of manufacturing costs due to the inputs for agricultural production.

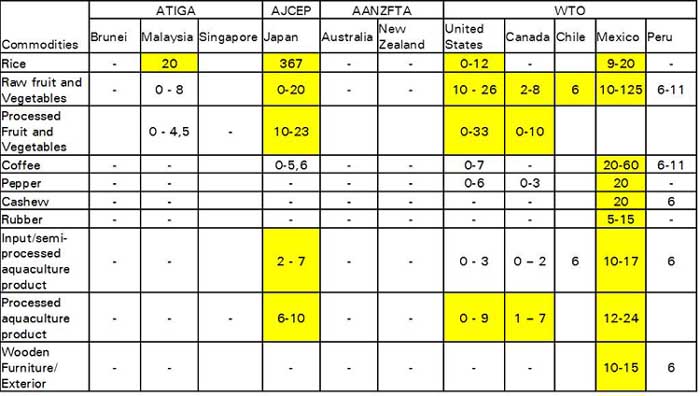

Regarding import tariff of the TPP countries on agricultural products, Table 2 shows that Vietnamese highest agricultural tariffs are in rice, fruits and aquaculture, while industrial crops and forestry products do not have much potential for tariff reduction. Regarding export market, since Japan, USA and Mexico still have high agricultural tariffs, they can be potential market for Vietnamese agricultural product when tariffs are reduced.

Table 2. Current import tariffs of the TPP countries on agricultural products (%)

Source: Summary of the participated trade agreements of Vietnam (2015).

Table 3. Current import tariff of Vietnam on agricultural products (%)

.jpg)

Source: Summary of the participated trade agreements of Vietnam (2015).

Fruits and vegetables

In recent years, Vietnam’s fruits and vegetables export to TPP countries grow rapidly. Recently, dragon fruit has been exported to New Zealand and Australia while lychee, longan and mango are exported to the US market. However, the export turnover of these products to the TPP countries (estimated at US$200 million) accounts only a small proportion (approximately 10%) of Vietnam’s total vegetable export turnover.

Benefits of tariff reduction on Vietnam’s fruits and vegetables on countries under TPP are expectedly high. There is potential for tariff reduction for both raw and processed vegetables in Vietnam. Three potential markets for Vietnam’s vegetables export are Japan, United States and Mexico.

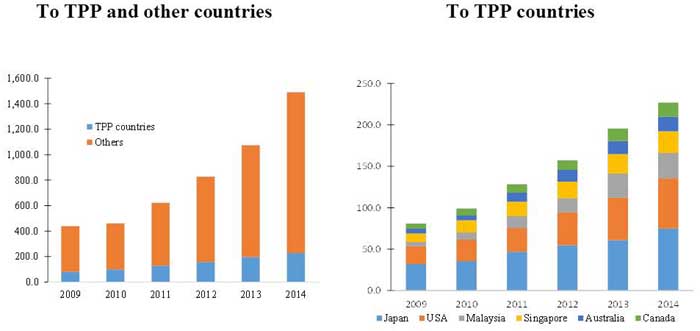

Fig. 4. Vietnam’s fruits and vegetables export to TPP and other countries (mil.USD)

Source: Calculation from data of General Department of Vietnam Customs (2015).

The official announcement of Japan’s TPP commitments shows that the Japanese tariff on fruits and juices will drop to 0% immediately. It is noteworthy that there is a roadmap of tariff reduction for some commodities which Japan currently imported mainly from Vietnam. Firstly, for potato, current tariff is 40% for quota and 2796 Japanese yen per kg for out of quota volume. In-quota tariff rate will remain while out-of-quota tariff rate will be reduced by 15% after six years. Over the last three years, the volume of potato imports from Vietnam to Japan was estimated on average at 200 tons per year. Secondly, for tea, current out-of-quota tariff rate is 17%. The tariff rate will be reduced to 0% in 2024. Currently, on average, 300 tons of Vietnamese tea is exported to Japan annually. Thirdly, for pineapple juice, out-of-quota tariff will be at 33 Japanese yen per kg, out-of-quota tariff will be reduced by 15% in 2024. On average, Vietnam exports pineapple juice to Japan at 40 tons per year. Therefore, Japan would be a potential market for Vietnam’s fruits and vegetable products.

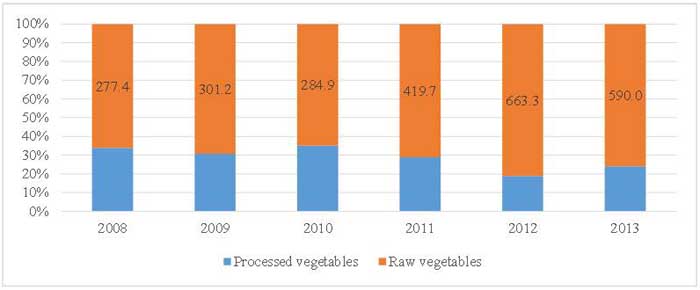

However, Vietnam is not likely to be ready to take advantage of this opportunity. Many fresh fruits and vegetable products of Vietnam are still not able to be exported to TPP markets such as Japan and the United States because of SPS regulations of importing countries. Meanwhile, the proportion of Vietnam’s processed fruit and vegetable products is still very low compared to its total export of fruits and vegetables.

Fig. 5. The ratio of processed vegetable of Vietnam in 2014 (%)

Source: Uncomtrade (2015).

Vegetables worth US$100 million is imported to Vietnam from TPP countries, mainly from USA and Australia. When TPP takes effect, it brings great opportunities for vegetable products of TPP countries by exporting to Vietnam because of large potential of tariff reduction (40%). Currently the majority of imported fruits and vegetable products from TPP countries have to compete with Vietnam in the high-end market segment (mainly in supermarkets and high-class restaurants). In the future, the price of imported fruit and vegetable will decrease due to lower tariffs as Vietnam commits to TPP agreement. This can create a fierce competition between Vietnamese products and foreign products not only in high-end market but also in the low-end market segment. Therefore, there is an urgent need to improve quality, design, and food safety, to reduce production costs for Vietnam’s fruit and vegetable products, in order to improve the competitiveness of this sector.

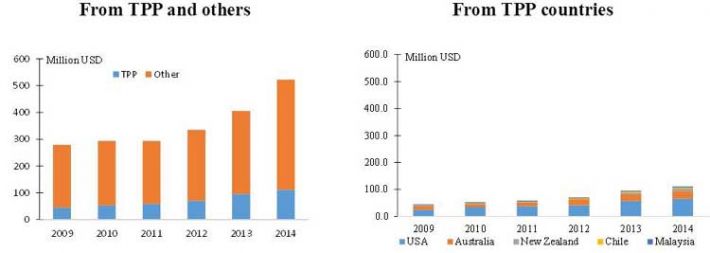

Fig. 6. Vietnam’s vegetable import

Source: Calculation from data of General Department of Vietnam Customs (2015).

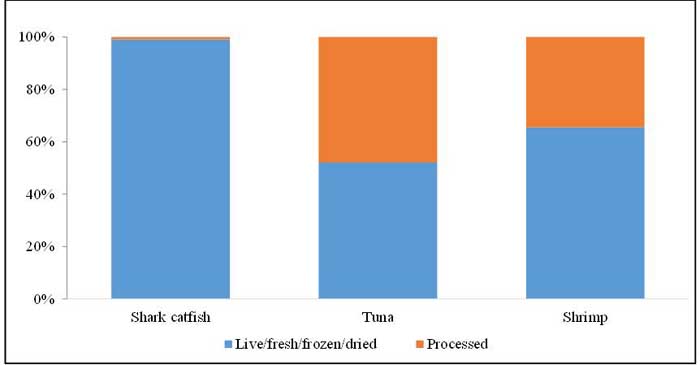

3.2. Fishery products

Currently, most of the import tariff rates for fishery products of TPP member countries in the form of raw or semi-processed are quite low (0-5%), except Mexico. Therefore, the tariff reduction from the TPP commitments is not very meaningful in the promotion of this exported commodity. However, there is still much potential for processed products with high value- added in the following markets: the United States, Japan and Canada. Now, the main issue is that the processing of Vietnam’s fishery products is still very weak. Most of the fishery products remain in the form of fresh, frozen or dry. There is a lack of technology to create high value-added products, such as smoked or biologic technology. Therefore, in order to take advantage of the expected tariff potential, Vietnam should upgrade its processing products in the fishery value chain.

Fig. 7. The ratio of processed fishery products of Vietnam in 2014 (%)

Source: Vietnam Association of Seafood Exporters and Producer (2015)

One of the considerable challenges for the export of agricultural products of Vietnam is that the TPP member countries may reduce or eliminate their tariff but increase the strictness of their non-tariff barriers. To enter and dominate the high value market at a large scale (such as the US and Japan), the Vietnam’s key export commodities (such as seafood) have to overcome the technical barriers to trade (TBT) and sanitary and phyto-sanitary measures (SPS) to dominate these markets. Moreover, the current shrimp imports in large quantities for processing and exporting to the US market and Japan may also break the rules of origin in TPP.

Rice

Given the current high import tariff rates of rice in Japan, the US, Mexico and Malaysia, it seems that there is a big room for reducing tariff rates in these countries. Nevertheless, it seems that it is extremely difficult to export agricultural products into two markets namely Japan and the US. The adoption of rice import tariff rates up to approximately 400% shows that Japan always considers rice as an important crop with political significance and this country will always find ways to protect the crop. According to the official announcement regarding the Japanese government’s TPP commitments, although Japan will increase the annual rice import from 87,000 tons to 850,000 tons, it allows to import rice from two countries (the US and Australia). Therefore, Vietnam is unlikely to export into this market.

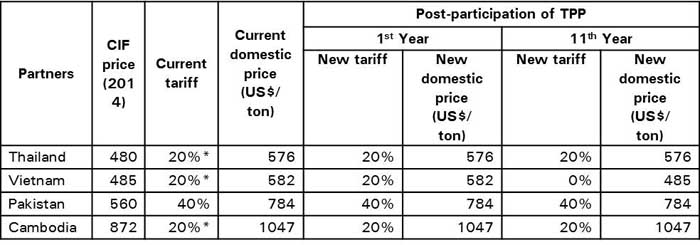

Table 4. Forecast of rice price in the Mexican market

Source: Author’s calculation based on data from UN Comtrade and roadmap of tariff reduction in TPP’s commitments

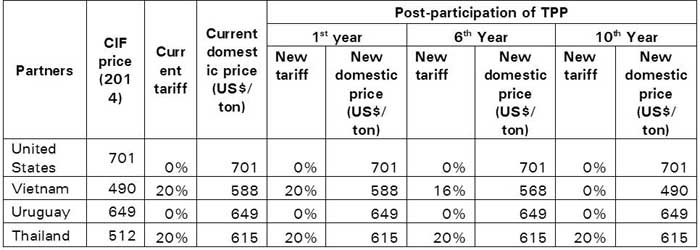

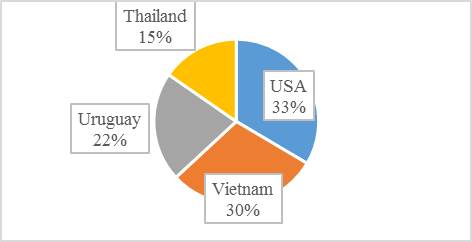

Mexico is another potential market for the Vietnamese rice. Currently, Mexico is importing grain rice from the US and Uruguay at the tariff rate of 0%. Additionally, Mexico also imports long grain rice from Thailand at the tariff rate of 20%. In 2014, the FOB price of Vietnam’s rice was US$ 453 / ton while that of Thailand’s rice was U$S 417 / ton. Therefore, given that Mexico’s tariff reduces from 20% to 0%, Vietnam’s rice will have a great opportunity to dominate Thailand's rice (which currently holds 15% market share in Mexico). However, there is the Mexico’s tariff elimination roadmap on imported rice (HS.1006.30 code) within 10 years, which basically maintains the original tariff at the rate of 20% in the first five years, equally reducing for next five years and totally exempts the tariff on 1/1 of the 10th year. This will not easily facilitate Vietnam’s rice export to the Mexican market in the short term.

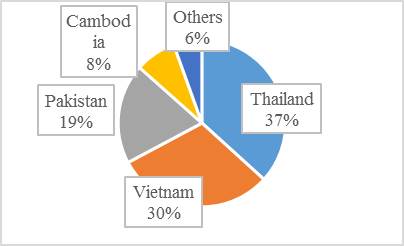

Fig. 8. Malaysia’s rice import in 2014

Fig. 9. Mexico’s market share of rice import in 2014

Source: ITC Trademap (2015).

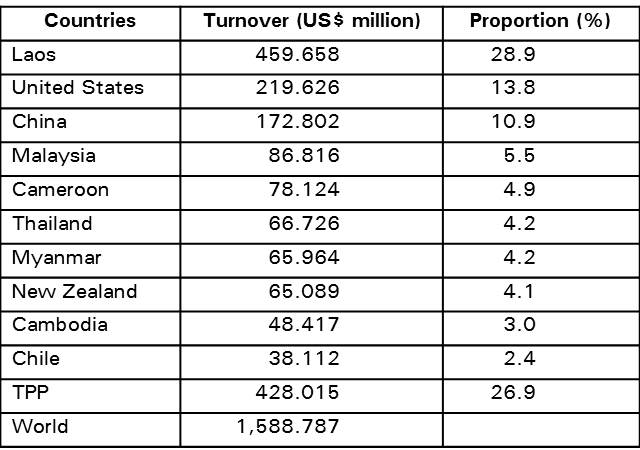

Table 5. Forecast of rice price in the Malaysia market

Source: Author’s calculation based on data from UN Comtrade and roadmap of tariff reduction in TPP’s commitments

*: tariff rate of 20% is specified in ATIGA

In addition, Malaysia is also a great potential market for Vietnam’s rice products. With the advantage of reducing import tariffs, Vietnam can gain market share from Thailand and Pakistan as both countries are subject to import tariff at the rate of 20% for Thailand and 40% for Pakistan.

Industrial crops

Industrial crop exports can also benefit indirectly from the tariff reduction commitment of TPP, but the benefit is not high. For coffee, the current tariff in Mexico is still very high. For Robusta Unroasted beans, the tariff rate is 20%. According to TPP commitment, Mexico has a very long roadmap on tariff reduction from five to 13 years.

Table 6: Import tariff reduction roadmap on coffee in Mexico

Source: Ministry of Foreign Affairs and Trade of New Zealand (2015).

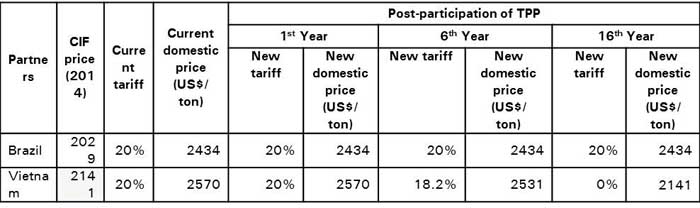

In 2014, Mexico imported around US$6 million of Vietnamese Robusta coffee to blend with Mexican Arabica coffee for export. Therefore, when tariff is reduced, Vietnam will likely gain the market share of Brazilian Robusta coffee (about 38%). However, it is in the long term, because with this roadmap, in the short term, it is very difficult for Vietnam's coffee to compete in the Mexican market, as well as in the US market.

Table 7. Forecast price of robusta unroasted coffee in the Mexican market (HS0901.11.01)

Source: Author’s calculation based on data from UN Comtrade and roadmap of tariff reduction in TPP’s commitments

Fig. 10. Mexico’s coffee import market in 2014

Source: ITC Trademap (2015).

For cashew nuts, currently Vietnam imports US$ 485 million of raw cashew nuts from Africa in total 589 million of cashew nuts import to Vietnam. Currently, under the TPP, Australia is also exporting raw cashew nuts to Vietnam with the tariff adoption of 10%. With TPP commitment, this tariff is likely to decrease. As a result, Vietnam may boost cashew nuts import from Australia to reduce production costs.

For rubber, Malaysia currentlty imports raw rubber from Vietnam to process and then export to the US. In order to qualify for the US tariff reduction according to TPP commitment, Malaysia will have to ensure the localization of rubber within TPP. Vietnam is the only country under the TPP that exports raw rubber to Malaysia. Since rubber is a strategic commodity of Malaysia and the US is an important market, it is likely that Malaysia will increase import of raw rubber from Vietnam.

Wood and wood products

Currently, among the countries under the TPP, Vietnam mainly exports two main products (interior furniture and exterior furniture) to the US and Japan. The tariff rate of these two groups of products in the major markets is already at 0%. Therefore, there is not much impact from tariff reduction under the TPP commitment for wood products.

Within TPP, Vietnam imported timber mainly from the US and Malaysia, and a small amount from Australia. Currently, because Vietnam’s import tariff on these products is already 0%, the impact from TPP commitments will not reduce the cost of wood products.

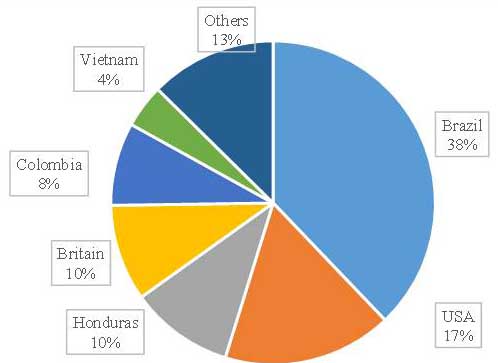

When joining TPP, Vietnamese businesses can enjoy the tariff concessions of TPP countries; Vietnam's products must satisfy two main criteria. Firstly, 55% of timber must originate from TPP. Secondly, the wood products must ensure the legality in land, timber, transportation, processing, export, finance and social security (labor). Currently, Vietnam imports timber from the Southeast Asian countries (such as Laos, Myanmar, Malaysia and Cambodia), China and the US. In particular, value of imports of wood products from Laos made up 28.9% of total wood products’ import turnover of Vietnam in 2014. Meanwhile, the proportion of wood products import from TPP countries in 2013 accounted for 26.9% of Vietnam’s wood products import-export turnover. This is a challenge since Vietnam cannot guarantee to have 55% of its timber originating from TPP countries. Moreover, it is still difficult to prove the legality of wood products import from Southeast Asian countries.

Table 8. Vietnam’s Import turnover of wooden materials in 2014

Source: ITC Trademap (2015)

Therefore, Vietnam should shift its wood imports from TPP countries such as Australia and New Zealand, as well as limit wood imports from non-TPP countries such as Laos, Cambodia and Myanmar to meet the legality and origin requirement of wood. The potential for expanding wood imports from Malaysia is not large, because Malaysian wood is increasingly becoming scarce. The Malaysian government has been taking measures to limit the wood export in order to ensure inputs for domestic production.

Livestock production

Overall, the livestock sector will face many difficulties as Vietnam participates in TPP. Currently, although tariff for livestock products is quite high, the import value of these products has increased rapidly in recent years. The main reasons are (i) the domestic production capacity does not meet consumer demand and (ii) quality and price of domestic products cannot compete with imported products. In the future, if the tariff barriers is eliminated, the Vietnamese livestock products would be subjected to more intensive competition from beef and dairy products of Australia and New Zealand, pork and chicken of the US and Canada.

According to IPSARD survey, currently, pork and chicken imports are mainly frozen products and by-products, which are distributed through supermarkets, canteens, and fast food restaurants. Customers of these products are mainly young and belong to the low-income level of the social strata. These products are complementary and do not compete directly with hot and fresh meat products from Vietnamese producers. Vietnamese still have the habit of consuming fresh and hot meat, and this habit may take several years to change. The tariff reduction roadmap will be from five to 10 years. This is an important period for the livestock industry to restructure and improve its competitiveness.

Regarding beef, most of the import tariffs have been reduced to 0% from Australia and New Zealand (under the 2009 ASEAN – Australia - New Zealand trade agreements). Unlike pork and chicken imports which are mainly frozen products, a large amount of carcass beef is imported from Australia and then slaughtered in Vietnam. Thus, “natural” barriers of consumption habits have no effect on beef. In other words, Vietnamese beef has to compete right away, and it is very disadvantageous compared to imported products.

Other opportunities and challenges of Vietnam’s agricultural sector in TPP

regulations on foreign investments

Apart from promoting trade, another opportunity for Vietnam after its participation in TPP is the increase in foreign investments inflow which is attached to the development of science and technology and the enhancement of its labor skill. Signing TPP with the cutting and elimination of agricultural protection, some countries that are disadvantageous in agricultural production may divert their investments from home countries’ agricultural sector into Vietnam’s. Foreign investments inflow may bring to Vietnam an increase in employment and income. And more importantly, the domestic agricultural sector may absorb new scientific and technological advancement to change its current inefficient traditional method. For instance, Japanese investors are coming to Vietnam to produce high-quality and hygienic rice and ensure food safety for exporting to their home country. It is a very good condition for Vietnam to integrate in the global value chains of agricultural products and increase the country’s export of those goods. Provided that the investments are promoted and oriented well, Vietnam’s domestic agricultural sector, when taken advantage of the country’s current golden population structure will achieve significant breakthroughs. In order to know the incidence of foreign investments opportunity in quantitative measurement, more insightful research should be undertaken.

Aside from the opportunities cited above, TPP also brings challenges in investments. Domestic enterprises will have to face difficulties in competing with FDI enterprises, which have financial and technological advantages. In addition, the investment of FDI enterprises in the distribution and retail chain will create the risk of small Vietnamese agricultural producers being excluded from high value agricultural chain.

Labor movement from the rural sector

The fact that farmers are stuck in the agricultural sector and the accumulation of land use for production in large scale cannot be achieved are among the most difficult issues to contend with in improving the efficiency of Vietnam’s agricultural production. TPP creates a good opportunity to resolve this issue. Quantitative assessments show that Vietnam’s garment and footwear sectors boosted significantly, thanks to TPP (Petri et al. 2011, VEPR 2015, Minor et al. 2015, Petri and Blummer 2016). These sectors will attract a large number of labors moving out of the agricultural sector (estimated at around two million laborers). Provided that the government has good development strategies and policies that ensure labor’s benefits, the laborers will leave the agricultural sector. This will facilitate the process of land accumulation for good farmers and allow them to transform themselves into professional farmers.

Technical Barriers to Trade (TBT) and Sanitary and Phyto-sanitary (SPS) Measures

One of the most challenging issues in Vietnam’s export of agricultural products is that under the TPP agreement, the member countries may reduce or eliminate their tariff but they should also increase the strictness of their non-tariff barriers. In order to enter and dominate the high-value market (such as the US and Japan), Vietnam’s agricultural products that are advantageous in exporting, namely rice, coffee, pepper, cashew, aquaculture products need to meet the TBT and SPS standards. Otherwise, even though tariff rates in these markets are lowered to zero, those Vietnam’s commodities cannot access to the high value markets. In addition, other TPP’s commitments in protecting copyright (of breeds, agricultural chemicals, animal veterinary, etc.), labor issues, and origin are strong. Meanwhile, Vietnam current regulations on these contents are limited. If the country cannot resolve this weakness, both Vietnamese farmers and export enterprises will meet difficulties as they access the international markets.

Aside from the above challenges, the application of common standard in TBT and SPS will create pressure for businesses and household producers to apply high food safety standards. Domestic consumers will benefit from these changes. In the long term, competition will help increase the quality of Vietnamese agriculture.

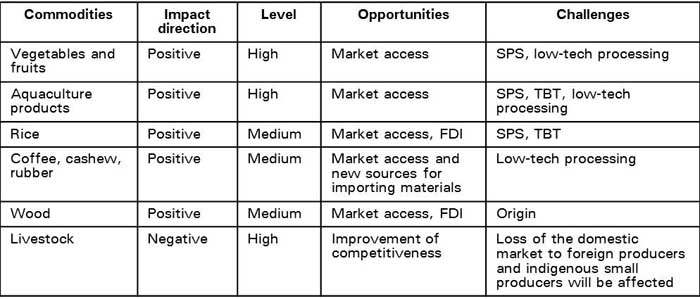

Table 9. Summary TPP’s impacts on some Vietnam’s major agricultural commodities

Source: Authors (2015).

Policy recommendations

5.1. Short term

Group 1. Improve the awareness and understanding of different actors in the agricultural sector about global integration, focusing on managers of different levels including provinces, districts, communes, enterprises, cooperatives, and small and medium producers. It is necessary to implement activities of quickly spreading information about contents of TPPs and other FTAs and their impacts on the domestic agricultural sector.

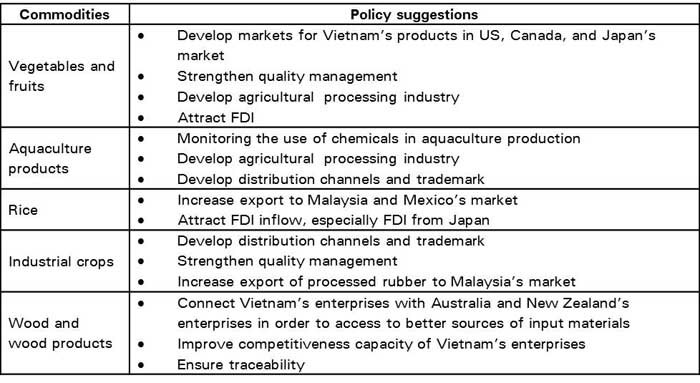

Group 2. For the advantageous export product, strengthen activities for trade and investment promotion for investors in TPP’s member countries to know about Vietnam and for Vietnam’s investors to know about the other countries. This is to seek opportunities for cooperation in taking advantages that TPP may bring to, create global value chains for Vietnam, and national trademark for its agricultural products. The orientations for some major agricultural commodities are summarized as follows:

Table 10. Some policy suggestion for developing markets and trade and investment promotion in several Vietnam’s major agricultural commodities

Activities for trade and investment promotion can be oriented as follows:

-

Organize conferences and festival in cooperation with embassies of other TPP member countries in Vietnam and Vietnam’s embassies in those countries. These conferences and festival should aim to advertise information and picture of quality of Vietnam’s agricultural commodities with focus on the advantages of tropical products

-

Organize conferences and forums to attract foreign investment in TPP member countries with the purpose of sharing information and searching for investment opportunities (concentrating on following commodities: wood and wood products, vegetables and fruits, aquaculture products, and rice)

-

Create a website administrated by the Ministry of Industry and Trade, the Ministry of Agriculture and Rural Development, the Ministry of Science and Technology, and the Ministry of Foreign Affairs to transparently publish information on SPS, TBT and other TPP contents of Vietnam and other TPP’s member countries. This is to facilitate trade and investment in agricultural sector

Group 3. Review vulnerable sectors (such as livestock and sugar cane sectors), evaluate their priorities and issue supporting policies timely to help producers cope with more rival competition due to penetration of imported goods from TPP member countries, or at least mitigate the producers’ losses and damages caused by that competition. The key solution is to improve the competitiveness of Vietnam’s agricultural products and step by step developing closed value chains - which have tightly linked processes (from production to consumption) - of Vietnam’s products with the purpose of enhancing their quality and sanitary conditions. Another solution is to promote the development of products whose markets are less impacted by imported goods. For instance, in the livestock sector, suckling pigs, traditional chickens, waterfowls, and fattening imported cows may be developed. In some cases, urgent subsidy packages should also be considered as a way to stabilize the public’s attitude.

Medium and long terms

Group 4. Strengthen the pace of agricultural sector restructuring towards high value added chains and sustainable development of domestic production, mitigation of its dependence on imported materials, and closely linked with technical, sanitary and quality standards specified in international commitments. The general policy is to create concentrated production zones; to promote the application of scientific and technological advancements; to quickly form global value chains led by established enterprises; to connect different cooperative organizations of farmers with each other with the purpose of creating the trademark for Vietnam’s hygienic and high-quality agricultural products, helping Vietnamese farmers join in high value-added chains

Group 5. Quickly complete policy environment and enhance the capacity of policy implementation in accordance with commitments in TPP and other international protocols

Group 6. Improve the capacity of utilizing commitments and the measures that are allowed in the FTAs. Step by step improvement to create an effective SPS and TBT measures for Vietnam.

Group 7. Complete the scheme for restructuring the whole national economy in the manner of close linkages to Vietnam’s international integration. The strategies for developing different industries should connect and complement each other. The development of light industries like garment and footwear, whose markets can be promoted significantly by TPP implementation, should be closely linked with the process of withdrawing labors from rural sectors and sustainable land accumulation for agricultural production. In addition, improving institution in the TPP framework should be implemented using the right roadmaps which allow the avoidance of shocks due to macroeconomic imbalances or frictions in input markets and the chaos in rural residents’ livelihoods and attitude.

REFERENCES

Minor. P, Walmsley. T, & Strutt. A, 2015, ‘The Vietnamese Economy through 2035: Alternative Baseline Growth, State-Owned Enterprise Reform, a Trans-Pacific Partnership and a Free Trade Area of Asia and the Pacific’, World Bank working paper.

Petri, P. A., & Plummer, M. G., 2016. The Economic Effects of the rans-Pacific Partnership: New Estimates. Peterson Institute for International Economics Working Paper, (16-2).

Petri, P. A., Plummer, M. G., & Zhai, F., 2012. The Trans-pacific partnership and Asia-pacific integration: A quantitative Assessment (Vol. 98). Peterson Institute.

Vietnam Institute for Economic and Policy Research (VEPR), 2015. ‘The impact of TPP and AEC on the Vietnamese Economy: Macroeconomic Aspects and the case of Livestock Sector’, Working paper.

World Bank, 2015. Data from the World Bank’s World Development Indicators database, http://databank.worldbank.org/data/reports.aspx?source=2&Topic=21 (accessed on October 25, 2015).

[1] Institute of Policy and Strategy for Agriculture and Rural Development (IPSARD)

[2] The rest of the world

|

Date submitted: May 20, 2016

Reviewed, edited and uploaded: May 23, 2016

|

Impacts of TPP on Vietnam’s Domestic Agriculture and its Commensurate Adjustment Policies

ABSTRACT

This report focuses on the Trans-Pacific Partnership Agreement (TPP) and the corresponding analyses regarding opportunities and challenges that it brings to Vietnam’s agricultural sector. Overall, Vietnam has many advantages in agriculture, forestry and fishery export (commonly referred as agricultural commodities) over TPP member countries with increasing trade surplus. For the group of major agricultural commodities affected by TPP, rice, seafood (fish, shrimp), vegetables, and wood & wood products are seen to be positively impacted by lower tariffs and better market openness. For industrial crops such as pepper, cashew, coffee and rubber, the TPP’s rule of origin can also be a factor to promote export and reduce material cost. However, the livestock sector is expected to face with many difficulties when Vietnamese products have to compete with countries having strengths on this sector, especially pork and chicken from the US and Canada – countries that Vietnam is imposing high import duties. Besides the impact on trade due to tariff reduction, this report also points out the positive impact of foreign investments, the potential to move a large amount of labor out of agriculture by developing light industry and the challenges of Technical Barriers to Trade (TBT) and Sanitary and Phytosanitary (SPS) of TPP countries for Vietnamese exported products. To diminish the negative impacts and take advantage of the opportunities brought by TPP, the research recommends two policy categories. For the the short term basis, it is recommended to (i) raise the awareness of integration, (ii) boost trade promotion and market development in order to establish a global value chain of Vietnamese trademark on key agricultural commodities, and (iii) review vulnerable sector to issue timely policy support. For the medium and long term basis, it is advised to (i) accelerate the process of restructuring the domestic agricultural sector in accordance with international integration, and (ii) harmonize Vietnam’s regulations or quality standards to those of the TPP. Finally, the report proposes several research ideas that should be considered in the future, with particular emphasis on the systemic assessment of TPP’s impact to the agricultural sector, quantitative analysis of the impact channels such as reducing tariffs, increasing investments, and mobilizing labor.

INTRODUCTION

After more than five years of negotiations, the Trans-Pacific Partnership (TPP) Agreement was officially signed on October 6th 2015 with the full text published on November 5th 2015. This Agreement includes 12 member countries, namely Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, the US and Vietnam. Apart from tariff commitments, the TPP also covers a broad range of contentious issues including intellectual property, foreign investment law, environmental standards and labor regulations, procurement policy, competition and state-owned enterprises and the process of dispute settlement.

When the TPP is enforced, it will cover 40% of the global economy and contribute nearly US$300 billion to the world’s GDP per year. The population of the 12 member countries is about 800 million people, around 11% of the world population, and twice European Union (EU)’s (World Bank 2015). Moreover, many TPP member countries are among those whose GDP per capita are highest in the world, such as the US, Canada, Japan, Australia, Brunei and Singapore. This is a great opportunity for the Vietnamese export in general and the Vietnamese agricultural products in particular, especially now that the partnership allows broader access to the US and Japan’s market – the two largest economies in the world.

Table 1. TPP Features of TPP member countries

Source: Summary of the World Bank’s data and the national websites of the countries (2015).

If the previous trade agreements often focus on tariff reduction, the TPP is seen as a comprehensive trade agreement, taking into account the establishment of high commercial standard codes and solving problems of the global economy in the 21st century, then promoting growth and employment opportunity in the Asia – Pacific region. TPP is expected to boost the economic growth, create more well-paid jobs, promote breakthroughs, productivity and competitiveness and improve the quality of life, reduce the poverty as well as increase transparency, governance and environmental protection (Petri et al. 2011).

This report will analyze the opportunities and challenges for Vietnam’s agricultural sector when the country joins the agreement and propose several policy recommendations.

Agricultural Trade between Vietnam and other countries under TPP

Overall, import and export relations with countries under TPP play an important role in the international trade of Vietnam. Both export and import turnover between Vietnam and TPP countries have increased sharply in recent years. However, export turnover of Vietnam in TPP has larger and faster growth than imports turnover. This shows that Vietnam has comparative advantage in agricultural production over most TPP countries. If the country can take advantage of expanding market opportunities from TPP, Vietnam’s agricultural sector can continue to maintain its level of trade surplus, promoting a positive contribution of agriculture to the overall growth and social stability in Vietnam.

Fig. 1. Agricultural trade value between Vietnam – ROW[2] and TPP countries (bill. USD)

Source: Calculation from data of General Department of Vietnam Customs (2015)

Wood & wood products and seafood (mainly from shrimp and catfish) are Vietnam’s main agricultural export to TPP countries with the export turnover of US$7.3 billion. The proportion of wood and wood products export to TPP accounts for 57.9% of total export turnover of Vietnam's wood. The proportion of shrimp and catfish export to TPP accounts for 55.7% and 35.6% of total export of Vietnam’s fishery products, respectively.

Fig. 2. The main Vietnam agricultural export to TPP countries in 2014 (mil USD)

Source: General Department of Vietnam Customs (2015)

The second major agricultural export group is industrial crops (such as coffee, cashew, pepper, rubber). The US and Japan are the two largest trading partners of wood & wood products, fisheries and industrial crops. At the same time, rice and vegetables have relatively modest import export turnover. Notably, Malaysia is also a major trading partner of Vietnam in the rice and rubber sectors. Currently, agricultural exports from Vietnam to other TPP countries only have focused on some key commodities and a few large customers. Participation in TPP is a good opportunity for Vietnam to expand exports to other major markets such as Mexico, Australia and Canada as well as diversify its export of agricultural products.

Fig. 3. The agricultural import of Vietnam from TPP countries in 2014 (mil USD)

Source: General Department of Vietnam Customs (2015)

Agricultural imports from TPP countries to Vietnam can be divided into three main groups: (i) livestock and related products including animal feed products, raw materials for animal feed products (such as soybean, fishmeal) and meat (chicken, beef, pork) - accounts for the largest proportion (more than US$ 1.6 billion), (ii) lumber, seafood and vegetables, and (iii) inputs for agricultural production (such as fertilizer, pesticide). To Vietnam, TPP countries are important sources to import animal feed products. When Vietnam joins the TPP, this trend is likely to continue and accelerate. For animal feeds, Vietnam seems to import more products from the US - the leading producer of corn and soybeans. For beef, Australia and New Zealand would continue to be an important trading partner of Vietnam.

Impact of tariff reduction on some major agricultural commodities in Vietnam

This section aims to evaluate the impact of the tariff reduction in Vietnam and other TPP countries on different commodities. Specifically, this section explores the potential of tariff reduction on Vietnam’s agricultural commodities in these markets. Accordingly, those countries that are applying high tariffs on Vietnam agricultural commodities are considered as high potential markets. In contrast, the countries that adopted low tariffs on Vietnam’s agricultural commodities are considered as low potential markets. It means that Vietnam may not benefit much from tariff reduction in the framework of the TPP commitments. Similarly, Vietnam’s tariffs on TPP agricultural commodities are also used to analyze the impacts of the TPP to vulnerable sectors such as livestock production, and benefits from reduction of manufacturing costs due to the inputs for agricultural production.

Regarding import tariff of the TPP countries on agricultural products, Table 2 shows that Vietnamese highest agricultural tariffs are in rice, fruits and aquaculture, while industrial crops and forestry products do not have much potential for tariff reduction. Regarding export market, since Japan, USA and Mexico still have high agricultural tariffs, they can be potential market for Vietnamese agricultural product when tariffs are reduced.

Table 2. Current import tariffs of the TPP countries on agricultural products (%)

Source: Summary of the participated trade agreements of Vietnam (2015).

Table 3. Current import tariff of Vietnam on agricultural products (%)

Source: Summary of the participated trade agreements of Vietnam (2015).

Fruits and vegetables

In recent years, Vietnam’s fruits and vegetables export to TPP countries grow rapidly. Recently, dragon fruit has been exported to New Zealand and Australia while lychee, longan and mango are exported to the US market. However, the export turnover of these products to the TPP countries (estimated at US$200 million) accounts only a small proportion (approximately 10%) of Vietnam’s total vegetable export turnover.

Benefits of tariff reduction on Vietnam’s fruits and vegetables on countries under TPP are expectedly high. There is potential for tariff reduction for both raw and processed vegetables in Vietnam. Three potential markets for Vietnam’s vegetables export are Japan, United States and Mexico.

Fig. 4. Vietnam’s fruits and vegetables export to TPP and other countries (mil.USD)

Source: Calculation from data of General Department of Vietnam Customs (2015).

The official announcement of Japan’s TPP commitments shows that the Japanese tariff on fruits and juices will drop to 0% immediately. It is noteworthy that there is a roadmap of tariff reduction for some commodities which Japan currently imported mainly from Vietnam. Firstly, for potato, current tariff is 40% for quota and 2796 Japanese yen per kg for out of quota volume. In-quota tariff rate will remain while out-of-quota tariff rate will be reduced by 15% after six years. Over the last three years, the volume of potato imports from Vietnam to Japan was estimated on average at 200 tons per year. Secondly, for tea, current out-of-quota tariff rate is 17%. The tariff rate will be reduced to 0% in 2024. Currently, on average, 300 tons of Vietnamese tea is exported to Japan annually. Thirdly, for pineapple juice, out-of-quota tariff will be at 33 Japanese yen per kg, out-of-quota tariff will be reduced by 15% in 2024. On average, Vietnam exports pineapple juice to Japan at 40 tons per year. Therefore, Japan would be a potential market for Vietnam’s fruits and vegetable products.

However, Vietnam is not likely to be ready to take advantage of this opportunity. Many fresh fruits and vegetable products of Vietnam are still not able to be exported to TPP markets such as Japan and the United States because of SPS regulations of importing countries. Meanwhile, the proportion of Vietnam’s processed fruit and vegetable products is still very low compared to its total export of fruits and vegetables.

Fig. 5. The ratio of processed vegetable of Vietnam in 2014 (%)

Source: Uncomtrade (2015).

Vegetables worth US$100 million is imported to Vietnam from TPP countries, mainly from USA and Australia. When TPP takes effect, it brings great opportunities for vegetable products of TPP countries by exporting to Vietnam because of large potential of tariff reduction (40%). Currently the majority of imported fruits and vegetable products from TPP countries have to compete with Vietnam in the high-end market segment (mainly in supermarkets and high-class restaurants). In the future, the price of imported fruit and vegetable will decrease due to lower tariffs as Vietnam commits to TPP agreement. This can create a fierce competition between Vietnamese products and foreign products not only in high-end market but also in the low-end market segment. Therefore, there is an urgent need to improve quality, design, and food safety, to reduce production costs for Vietnam’s fruit and vegetable products, in order to improve the competitiveness of this sector.

Fig. 6. Vietnam’s vegetable import

Source: Calculation from data of General Department of Vietnam Customs (2015).

3.2. Fishery products

Currently, most of the import tariff rates for fishery products of TPP member countries in the form of raw or semi-processed are quite low (0-5%), except Mexico. Therefore, the tariff reduction from the TPP commitments is not very meaningful in the promotion of this exported commodity. However, there is still much potential for processed products with high value- added in the following markets: the United States, Japan and Canada. Now, the main issue is that the processing of Vietnam’s fishery products is still very weak. Most of the fishery products remain in the form of fresh, frozen or dry. There is a lack of technology to create high value-added products, such as smoked or biologic technology. Therefore, in order to take advantage of the expected tariff potential, Vietnam should upgrade its processing products in the fishery value chain.

Fig. 7. The ratio of processed fishery products of Vietnam in 2014 (%)

Source: Vietnam Association of Seafood Exporters and Producer (2015)

One of the considerable challenges for the export of agricultural products of Vietnam is that the TPP member countries may reduce or eliminate their tariff but increase the strictness of their non-tariff barriers. To enter and dominate the high value market at a large scale (such as the US and Japan), the Vietnam’s key export commodities (such as seafood) have to overcome the technical barriers to trade (TBT) and sanitary and phyto-sanitary measures (SPS) to dominate these markets. Moreover, the current shrimp imports in large quantities for processing and exporting to the US market and Japan may also break the rules of origin in TPP.

Rice

Given the current high import tariff rates of rice in Japan, the US, Mexico and Malaysia, it seems that there is a big room for reducing tariff rates in these countries. Nevertheless, it seems that it is extremely difficult to export agricultural products into two markets namely Japan and the US. The adoption of rice import tariff rates up to approximately 400% shows that Japan always considers rice as an important crop with political significance and this country will always find ways to protect the crop. According to the official announcement regarding the Japanese government’s TPP commitments, although Japan will increase the annual rice import from 87,000 tons to 850,000 tons, it allows to import rice from two countries (the US and Australia). Therefore, Vietnam is unlikely to export into this market.

Table 4. Forecast of rice price in the Mexican market

Source: Author’s calculation based on data from UN Comtrade and roadmap of tariff reduction in TPP’s commitments

Mexico is another potential market for the Vietnamese rice. Currently, Mexico is importing grain rice from the US and Uruguay at the tariff rate of 0%. Additionally, Mexico also imports long grain rice from Thailand at the tariff rate of 20%. In 2014, the FOB price of Vietnam’s rice was US$ 453 / ton while that of Thailand’s rice was U$S 417 / ton. Therefore, given that Mexico’s tariff reduces from 20% to 0%, Vietnam’s rice will have a great opportunity to dominate Thailand's rice (which currently holds 15% market share in Mexico). However, there is the Mexico’s tariff elimination roadmap on imported rice (HS.1006.30 code) within 10 years, which basically maintains the original tariff at the rate of 20% in the first five years, equally reducing for next five years and totally exempts the tariff on 1/1 of the 10th year. This will not easily facilitate Vietnam’s rice export to the Mexican market in the short term.

Fig. 8. Malaysia’s rice import in 2014

Fig. 9. Mexico’s market share of rice import in 2014

Source: ITC Trademap (2015).

Table 5. Forecast of rice price in the Malaysia market

Source: Author’s calculation based on data from UN Comtrade and roadmap of tariff reduction in TPP’s commitments

*: tariff rate of 20% is specified in ATIGA

In addition, Malaysia is also a great potential market for Vietnam’s rice products. With the advantage of reducing import tariffs, Vietnam can gain market share from Thailand and Pakistan as both countries are subject to import tariff at the rate of 20% for Thailand and 40% for Pakistan.

Industrial crops

Industrial crop exports can also benefit indirectly from the tariff reduction commitment of TPP, but the benefit is not high. For coffee, the current tariff in Mexico is still very high. For Robusta Unroasted beans, the tariff rate is 20%. According to TPP commitment, Mexico has a very long roadmap on tariff reduction from five to 13 years.

Table 6: Import tariff reduction roadmap on coffee in Mexico

In 2014, Mexico imported around US$6 million of Vietnamese Robusta coffee to blend with Mexican Arabica coffee for export. Therefore, when tariff is reduced, Vietnam will likely gain the market share of Brazilian Robusta coffee (about 38%). However, it is in the long term, because with this roadmap, in the short term, it is very difficult for Vietnam's coffee to compete in the Mexican market, as well as in the US market.

Table 7. Forecast price of robusta unroasted coffee in the Mexican market (HS0901.11.01)

Source: Author’s calculation based on data from UN Comtrade and roadmap of tariff reduction in TPP’s commitments

Fig. 10. Mexico’s coffee import market in 2014

Source: ITC Trademap (2015).

For cashew nuts, currently Vietnam imports US$ 485 million of raw cashew nuts from Africa in total 589 million of cashew nuts import to Vietnam. Currently, under the TPP, Australia is also exporting raw cashew nuts to Vietnam with the tariff adoption of 10%. With TPP commitment, this tariff is likely to decrease. As a result, Vietnam may boost cashew nuts import from Australia to reduce production costs.

For rubber, Malaysia currentlty imports raw rubber from Vietnam to process and then export to the US. In order to qualify for the US tariff reduction according to TPP commitment, Malaysia will have to ensure the localization of rubber within TPP. Vietnam is the only country under the TPP that exports raw rubber to Malaysia. Since rubber is a strategic commodity of Malaysia and the US is an important market, it is likely that Malaysia will increase import of raw rubber from Vietnam.

Wood and wood products

Currently, among the countries under the TPP, Vietnam mainly exports two main products (interior furniture and exterior furniture) to the US and Japan. The tariff rate of these two groups of products in the major markets is already at 0%. Therefore, there is not much impact from tariff reduction under the TPP commitment for wood products.

Within TPP, Vietnam imported timber mainly from the US and Malaysia, and a small amount from Australia. Currently, because Vietnam’s import tariff on these products is already 0%, the impact from TPP commitments will not reduce the cost of wood products.

When joining TPP, Vietnamese businesses can enjoy the tariff concessions of TPP countries; Vietnam's products must satisfy two main criteria. Firstly, 55% of timber must originate from TPP. Secondly, the wood products must ensure the legality in land, timber, transportation, processing, export, finance and social security (labor). Currently, Vietnam imports timber from the Southeast Asian countries (such as Laos, Myanmar, Malaysia and Cambodia), China and the US. In particular, value of imports of wood products from Laos made up 28.9% of total wood products’ import turnover of Vietnam in 2014. Meanwhile, the proportion of wood products import from TPP countries in 2013 accounted for 26.9% of Vietnam’s wood products import-export turnover. This is a challenge since Vietnam cannot guarantee to have 55% of its timber originating from TPP countries. Moreover, it is still difficult to prove the legality of wood products import from Southeast Asian countries.

Table 8. Vietnam’s Import turnover of wooden materials in 2014

Source: ITC Trademap (2015)

Therefore, Vietnam should shift its wood imports from TPP countries such as Australia and New Zealand, as well as limit wood imports from non-TPP countries such as Laos, Cambodia and Myanmar to meet the legality and origin requirement of wood. The potential for expanding wood imports from Malaysia is not large, because Malaysian wood is increasingly becoming scarce. The Malaysian government has been taking measures to limit the wood export in order to ensure inputs for domestic production.

Livestock production

Overall, the livestock sector will face many difficulties as Vietnam participates in TPP. Currently, although tariff for livestock products is quite high, the import value of these products has increased rapidly in recent years. The main reasons are (i) the domestic production capacity does not meet consumer demand and (ii) quality and price of domestic products cannot compete with imported products. In the future, if the tariff barriers is eliminated, the Vietnamese livestock products would be subjected to more intensive competition from beef and dairy products of Australia and New Zealand, pork and chicken of the US and Canada.

According to IPSARD survey, currently, pork and chicken imports are mainly frozen products and by-products, which are distributed through supermarkets, canteens, and fast food restaurants. Customers of these products are mainly young and belong to the low-income level of the social strata. These products are complementary and do not compete directly with hot and fresh meat products from Vietnamese producers. Vietnamese still have the habit of consuming fresh and hot meat, and this habit may take several years to change. The tariff reduction roadmap will be from five to 10 years. This is an important period for the livestock industry to restructure and improve its competitiveness.

Regarding beef, most of the import tariffs have been reduced to 0% from Australia and New Zealand (under the 2009 ASEAN – Australia - New Zealand trade agreements). Unlike pork and chicken imports which are mainly frozen products, a large amount of carcass beef is imported from Australia and then slaughtered in Vietnam. Thus, “natural” barriers of consumption habits have no effect on beef. In other words, Vietnamese beef has to compete right away, and it is very disadvantageous compared to imported products.

Other opportunities and challenges of Vietnam’s agricultural sector in TPP

regulations on foreign investments

Apart from promoting trade, another opportunity for Vietnam after its participation in TPP is the increase in foreign investments inflow which is attached to the development of science and technology and the enhancement of its labor skill. Signing TPP with the cutting and elimination of agricultural protection, some countries that are disadvantageous in agricultural production may divert their investments from home countries’ agricultural sector into Vietnam’s. Foreign investments inflow may bring to Vietnam an increase in employment and income. And more importantly, the domestic agricultural sector may absorb new scientific and technological advancement to change its current inefficient traditional method. For instance, Japanese investors are coming to Vietnam to produce high-quality and hygienic rice and ensure food safety for exporting to their home country. It is a very good condition for Vietnam to integrate in the global value chains of agricultural products and increase the country’s export of those goods. Provided that the investments are promoted and oriented well, Vietnam’s domestic agricultural sector, when taken advantage of the country’s current golden population structure will achieve significant breakthroughs. In order to know the incidence of foreign investments opportunity in quantitative measurement, more insightful research should be undertaken.

Aside from the opportunities cited above, TPP also brings challenges in investments. Domestic enterprises will have to face difficulties in competing with FDI enterprises, which have financial and technological advantages. In addition, the investment of FDI enterprises in the distribution and retail chain will create the risk of small Vietnamese agricultural producers being excluded from high value agricultural chain.

Labor movement from the rural sector

The fact that farmers are stuck in the agricultural sector and the accumulation of land use for production in large scale cannot be achieved are among the most difficult issues to contend with in improving the efficiency of Vietnam’s agricultural production. TPP creates a good opportunity to resolve this issue. Quantitative assessments show that Vietnam’s garment and footwear sectors boosted significantly, thanks to TPP (Petri et al. 2011, VEPR 2015, Minor et al. 2015, Petri and Blummer 2016). These sectors will attract a large number of labors moving out of the agricultural sector (estimated at around two million laborers). Provided that the government has good development strategies and policies that ensure labor’s benefits, the laborers will leave the agricultural sector. This will facilitate the process of land accumulation for good farmers and allow them to transform themselves into professional farmers.

Technical Barriers to Trade (TBT) and Sanitary and Phyto-sanitary (SPS) Measures

One of the most challenging issues in Vietnam’s export of agricultural products is that under the TPP agreement, the member countries may reduce or eliminate their tariff but they should also increase the strictness of their non-tariff barriers. In order to enter and dominate the high-value market (such as the US and Japan), Vietnam’s agricultural products that are advantageous in exporting, namely rice, coffee, pepper, cashew, aquaculture products need to meet the TBT and SPS standards. Otherwise, even though tariff rates in these markets are lowered to zero, those Vietnam’s commodities cannot access to the high value markets. In addition, other TPP’s commitments in protecting copyright (of breeds, agricultural chemicals, animal veterinary, etc.), labor issues, and origin are strong. Meanwhile, Vietnam current regulations on these contents are limited. If the country cannot resolve this weakness, both Vietnamese farmers and export enterprises will meet difficulties as they access the international markets.

Aside from the above challenges, the application of common standard in TBT and SPS will create pressure for businesses and household producers to apply high food safety standards. Domestic consumers will benefit from these changes. In the long term, competition will help increase the quality of Vietnamese agriculture.

Table 9. Summary TPP’s impacts on some Vietnam’s major agricultural commodities

Source: Authors (2015).

Policy recommendations

5.1. Short term

Group 1. Improve the awareness and understanding of different actors in the agricultural sector about global integration, focusing on managers of different levels including provinces, districts, communes, enterprises, cooperatives, and small and medium producers. It is necessary to implement activities of quickly spreading information about contents of TPPs and other FTAs and their impacts on the domestic agricultural sector.

Group 2. For the advantageous export product, strengthen activities for trade and investment promotion for investors in TPP’s member countries to know about Vietnam and for Vietnam’s investors to know about the other countries. This is to seek opportunities for cooperation in taking advantages that TPP may bring to, create global value chains for Vietnam, and national trademark for its agricultural products. The orientations for some major agricultural commodities are summarized as follows:

Table 10. Some policy suggestion for developing markets and trade and investment promotion in several Vietnam’s major agricultural commodities

Activities for trade and investment promotion can be oriented as follows:

Group 3. Review vulnerable sectors (such as livestock and sugar cane sectors), evaluate their priorities and issue supporting policies timely to help producers cope with more rival competition due to penetration of imported goods from TPP member countries, or at least mitigate the producers’ losses and damages caused by that competition. The key solution is to improve the competitiveness of Vietnam’s agricultural products and step by step developing closed value chains - which have tightly linked processes (from production to consumption) - of Vietnam’s products with the purpose of enhancing their quality and sanitary conditions. Another solution is to promote the development of products whose markets are less impacted by imported goods. For instance, in the livestock sector, suckling pigs, traditional chickens, waterfowls, and fattening imported cows may be developed. In some cases, urgent subsidy packages should also be considered as a way to stabilize the public’s attitude.

Medium and long terms

Group 4. Strengthen the pace of agricultural sector restructuring towards high value added chains and sustainable development of domestic production, mitigation of its dependence on imported materials, and closely linked with technical, sanitary and quality standards specified in international commitments. The general policy is to create concentrated production zones; to promote the application of scientific and technological advancements; to quickly form global value chains led by established enterprises; to connect different cooperative organizations of farmers with each other with the purpose of creating the trademark for Vietnam’s hygienic and high-quality agricultural products, helping Vietnamese farmers join in high value-added chains

Group 5. Quickly complete policy environment and enhance the capacity of policy implementation in accordance with commitments in TPP and other international protocols

Group 6. Improve the capacity of utilizing commitments and the measures that are allowed in the FTAs. Step by step improvement to create an effective SPS and TBT measures for Vietnam.

Group 7. Complete the scheme for restructuring the whole national economy in the manner of close linkages to Vietnam’s international integration. The strategies for developing different industries should connect and complement each other. The development of light industries like garment and footwear, whose markets can be promoted significantly by TPP implementation, should be closely linked with the process of withdrawing labors from rural sectors and sustainable land accumulation for agricultural production. In addition, improving institution in the TPP framework should be implemented using the right roadmaps which allow the avoidance of shocks due to macroeconomic imbalances or frictions in input markets and the chaos in rural residents’ livelihoods and attitude.

REFERENCES

Minor. P, Walmsley. T, & Strutt. A, 2015, ‘The Vietnamese Economy through 2035: Alternative Baseline Growth, State-Owned Enterprise Reform, a Trans-Pacific Partnership and a Free Trade Area of Asia and the Pacific’, World Bank working paper.

Petri, P. A., & Plummer, M. G., 2016. The Economic Effects of the rans-Pacific Partnership: New Estimates. Peterson Institute for International Economics Working Paper, (16-2).

Petri, P. A., Plummer, M. G., & Zhai, F., 2012. The Trans-pacific partnership and Asia-pacific integration: A quantitative Assessment (Vol. 98). Peterson Institute.

Vietnam Institute for Economic and Policy Research (VEPR), 2015. ‘The impact of TPP and AEC on the Vietnamese Economy: Macroeconomic Aspects and the case of Livestock Sector’, Working paper.

World Bank, 2015. Data from the World Bank’s World Development Indicators database, http://databank.worldbank.org/data/reports.aspx?source=2&Topic=21 (accessed on October 25, 2015).

[1] Institute of Policy and Strategy for Agriculture and Rural Development (IPSARD)

[2] The rest of the world

Date submitted: May 20, 2016

Reviewed, edited and uploaded: May 23, 2016