ABSTRACT

Farmland Bank Program includes the following; Farmland Scale-up Project for strengthening agricultural competitiveness, Farm Household Revival Program Project aiming for revitalization of farm household under bankruptcy crisis due to debt, Trusting Farmland Lease Project and Reserving Farmland Purchases Project for efficient use of farmland, Farmland Pension Project aiming to solve the problem of insufficient living expenses in an aging society. Farmland bank program encourages for young generation of farmers to enter into agriculture and contributes for them to increase their farmland scale, also prevents essential labor from leaving the rural area by promoting professional farmers, and contributes to the maintenance and development of the local community in Korea.

Keyword: Professional Rice Farmers, Aging, Farmland

INTRODUCTION

Due to rapid industrialization in Korea, the number of farm household declined from 2,155 thousand in 1990 to 1,142 thousand in 2013. The size of farming population also shrank from 6,661 thousand in 1990 to 2,847 thousand in 2013. As aging in rural areas has progressed rapidly, aging rate (Aging Rate: proportion of population aged 65 and above among whole population) increased from 11.5% in 1990 to 37.3% in 2013, resulting in quantitative and qualitative decline of agricultural labor force. Another factor of agricultural production, farmland area showed a decline from 2,109 thousand ha in 1990 to 1,711 thousand ha in 2013. Rice paddy acreage meanwhile, also decreased from 1,345 thousand ha in 1990 to 964 thousand ha in 2013. In order to deal with current change of agricultural environment, policies to rear professional rice farmers and farmland bank program were introduced.

The policy of rearing professional rice farmers was introduced in 1995 in order to lead agriculture by making the income of professional rice farmers surpass that of urban workers, aiming to have young professional farmers engage in agriculture. This policy is to sell and rent the farmlands to professional rice farmers through Farmland Scale-up Project, Trusting Farmland Lease Project, and Reserving Farmland Purchases Project of farmland bank program, thereby enlarging the income of professional rice farmers through farm size expansion. To be chosen as a professional rice farmer, one must be a farmer of age 55 or below, with farming experience of more than 3 years and a farm size of 2.0ha or above. About 63,000 farm households have been selected until 2014.

The purposes of the farmland bank program are to achieve the optimal size of farmland scale, efficient usage of farmlands, improvement of the agricultural structure and the stabilization of the farmland market. Furthermore, diverse policies and projects in respect of farmland are to be launched to increase the profit of farmers and to achieve economic and social development in rural areas. Therefore the Farmland Bank in Korea supports farmers of young generation by rearing professional rice farmers.

Major Contents of the Projects

1. Farmland Scale-up Project

Farmland Scale-up Project was introduced in 1990, based on the Act on Korea Rural Community Corporation and Agricultural Land Management Fund, Article 18, 19, 22. The aim of this project is to raise enlarged and specialized farmers and to achieve “the land-to-the tiller principle” by farmland trading, long term lease, exchange, division or amalgamation. The project is to support the progress of enlarging households of young professional farmers and collectivization of farm management, in order to increase farmers’ profit and to comprehend stable supply of staple crop.

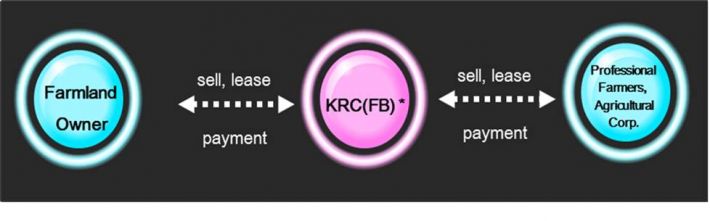

The project lets KRC buy or rent farmland from its owners, and sell or lease the farmland to professional farmers and agricultural corporations.

Fig. 1. The Diagram of Farmland Scale-up Project

*(hereinafter ‘KRC’: Korea Rural Community Corporation, ‘FB’: Farmland Bank)

The project includes Farmland Trade Project, Long-term Farmland Lease Project and Administrative Give-and-take and Division-and-junction of Farmland Project. Each Project is as described in the following.

(1) Farmland Trade Project

Farmland Trade Project includes buying the farmlands of non-farming households, those who changed their jobs or of the retirees from farming and selling their lands to professional farmers and agricultural corporations. Rice paddy and upland fields within the agricultural development region or being land-consolidated are targeted.

Persons in the following are eligible; selected as to be raised into professional farmers aged under 64 with more than 1.5 ha rice paddy fields or more than 1.0 ha upland fields, agricultural association corporations with more than 5ha rice paddy or upland fields, agricultural corporations with more than 10ha farmland and those who have been selected (within 5 years) as 20~30 years old farmer.

Repayment in installment must be done with annual interest of 1% for 15~30 years. The support has an upper limit of 10ha including existing area, 20ha in case of corporation. Monetary support limit is 10.6 US $/㎡ for rice paddy fields, and 10.6 US $/㎡ for upland fields.

(2) Long Term Farmland Lease Project

Long Term Farmland Lease Project focuses on long term (5~10years) leasing of farmlands, of those who changed their jobs or retired from farming to those selected as professional farmers. Target lands are rice paddy and upland fields in rural areas, and conditions for eligibility are the same as those of Farmland Trade Project. There must be a payback in installment, interest free for 5~10years, and there are no limits for areas being supported.

(3) Administrative Give-and-take and Division-and-junction of Farmland Project

Administrative Give-and-take and Division-and-junction of Farmland Project aims to support the settlement cost for the difference made by exchange, amalgamation, redevelopment, and group substitution. Payback in installment with annual interest of 1% for 10 years is conditioned.

Excellent case of Farmland Scale-up Project is as shown in Table 1. The owner of the exemplified farming household in Goheng-gun, Jeollanam-do is of age 52, and was chosen as a professional rice farmer in 1995. 15.8ha was supported through Farmland Scale-up Project since 1995. As a result, the size of the farm enlarged from 1.8ha to 28.3ha, and farm household income increased from 60 thousand US $ to 300 thousand US $.

Table 1. Excellent case of Farmland Scale-up Project

|

Classification

|

Before Support

|

After Support

|

Note

|

|

Farm size(ha)

|

1.8

|

28.3

|

Support size of 15.8ha

(582 thousand US $)

|

|

Yearly income of farm Household(thousand US $)

|

60

|

300

|

|

Source: KRC. 2014. Excellent case of Farmland bank Program

2. Orchard Scale-up Project

Orchard Scale-up Project was introduced in 2004 based on the Special Act on Assistance to Farmers, Fishermen, etc. Following the Conclusion of Free Trade Agreements, Article 5. The project is focusing on purchasing and leasing orchard to scale-up and collectivize fruit-growing farms to strengthen competitiveness and adaptability of market opening.

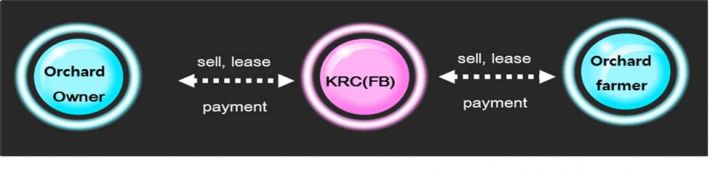

The project would also promote the community to be enlarged and collectivized through attracting young and able manpower to rural areas. The progress includes KRC buying or renting orchards from the owners, and selling or leasing them to the farmers.

Fig. 2. The Diagram of Orchard scale-up Project

The project includes Buying and Selling the Orchards and Orchard Lease Project. Each project is as described below.

(1) Buying and Selling the Orchards is to buy orchards from non-farmers, farmers who changed the job, want to retire, reduced the size of orchards and non-agricultural corporations owning orchards, and to sell the orchards to fruit farms. Orchards within rural areas are targeted.

To be eligible, one must be 64 years old or younger in the trial year of the project with the experience of fruit farming for more than 3 years, managing more than 0.3 ha of orchards (farmers, agricultural corporation, farming association corporations which are willing to raise or establish for raising the main product of the orchard).

The maximum limit for support is 5ha in case of fruit farming, 10ha in case of agricultural corporation (including the farmland owned beforehand), and 40 US $(including fruit trees)/3.3m2. This is conditioned with the annual interest of 2%, and payback period will be applied according to the applicant’s age (maximum 30~15 years).

(2) In the Orchard Lease Project, KRC would borrow the orchards from non-professional farmers, who want to change the job, retire and plan to strengthen their competitiveness through scaling-up. Orchards within rural areas are subjected, and maximum limit for support would be 5ha for fruit farms, 10ha for agricultural corporation, including originally owned farmlands. Conditions for eligibility are the same as above. The duration of lease is 5-10 years.

3. Trusting Farmland Lease Project

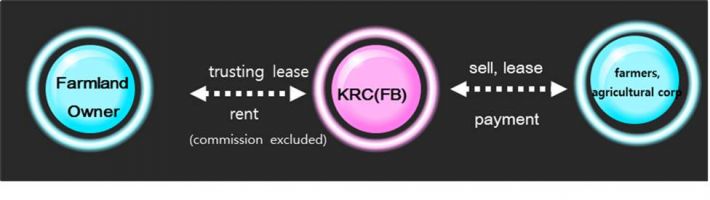

Trusting Farmland Lease Project was introduced in 2005, based on the Farmland Act Article 7, 23 and the Act on Korea Rural Community Corporation and Agricultural Land Management Fund Article 24-4. This project is to promote efficient usage and stable management of farmlands and to contribute to farmland scale-up for farmers by renting the trusted farmland to professional farmers. The project allows farmland owners to sell or lease their farmlands to KRC, and KRC to sell or lease the farmlands to other farmers or agricultural corporations.

Fig. 3. The Diagram of Trusting Farmland Lease Project

The subjects of the project are farmlands allowed for lease, and their affiliated farming facilities, which are unable to cultivate due to lack of labor force or health concerns after acquiring farmlands for farming. The entrusted period of 5 years may be extended after the end of the period, and the rent cost is decided upon mutual consent considering the market price. The payment would be done after deducting yearly commission of 5%. The lessee is selected among the applicants who are willing to lease the farmland from KRC for agricultural management purposes.

4. Reserving Farmland Purchases Project

Reserving Farmland Purchases Project was introduced in 2010, based on the Act on Korea Rural Community Corporation and Agricultural Land Management Fund, Article 24-2, paragraph 2. The farmland bank is to buy the farmlands owned by farmers willing to retire, leave or change jobs due to age or health concerns, in order to improve agricultural structure and to stabilize farmland market. The purchased lands will be used for long term lease and other purposes for more efficient usage.

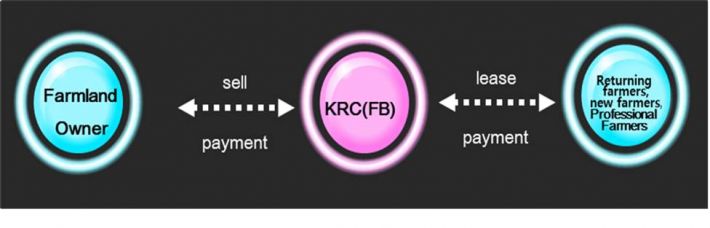

The project lets KRC buy and own quality farmlands and lease them to returning farmers, professional rice farmers, etc.

Fig. 4. The Diagram of Reserving Farmland Purchases Project

The Farmers who are willing to leave rural areas, change one’s job or retire due to age, and farmlands within agricultural development region (rice paddy, upland, orchard fields) are targeted. The price of farmlands is decided through appraisal and assessment. The maximum limit for purchase price is 25 US $/㎡. For Metropolitan city, Sejong Metropolitan Autonomous City, Gyeonggi-do, Gyeongsangnam-do city area, the limit is 50 US $/㎡, and for Chungcheongnam-do, Gyeongsangbuk-do city area, 35 US $/㎡.

Professional farmers, new farmers, returning farmers, agricultural corporations, general farmers and other individuals or corporations willing to do farming are eligible, but there is a priority for 20~30 years old farmers. There is duration for lease of 5 years; there is to be a renewal every 5 years after evaluation. Rent cost is to be decided between the lessor and the lessee considering the market price.

5. Direct Payment Project for Early Retirement of Aged Farmers

Direct Payment Project for Early Retirement of Aged Farmers was introduced in 1997 based on the Special Act on the Implementations of the Agreement Establishing the World Trade Organization Article 11, paragraph 2, sub-paragraph 5. This project aims to support the retirees who are planning to transfer farming, and to promote enlargement of professional farmers.

Those who are 65~70 years old are eligible, and the applicants should have at least 10 consecutive years of farming experience (in case of farmers with illness or an experience of an accident and therefore not being able to manage the farm, 8 years of farming experience required).

Target lands are the following; lands under 3 consecutive years of ownership, rice paddy, upland, orchard field within agricultural development region or collectivized rice paddy, upland, orchard field outside agricultural development region with complete redevelopment and agricultural infrastructure. The lands are sold to professional farmers younger than 60 years old and to general farmers younger than 45 years old, having at least 3 consecutive years of farming experience upon the date of transfer. The lands are also sold or leased (including trusting the lease) to the KRC.

The standard payment in this project is 0.3 US $/㎡ yearly(3,000US $/ha yearly), and there is a maximum limit of 2.0 ha, applied in case of purchase and lease. Paying duration ranges from 6 years(70 years old) to 10 years(66 years old or younger), and payment can be done with monthly installments.

6. Farmland Pension Project

Farmland Pension Project was introduced in 2011, based on the Act on Korea Rural Community Corporation and Agricultural Land Management Fund Article 24-5. The farmland pension project is to secure farmlands owned by aged farmers and provide them with monthly pension to support their living. Furthermore, fluidized farmland asset would support aged farmers in order to expand and strengthen the social stability of rural area.

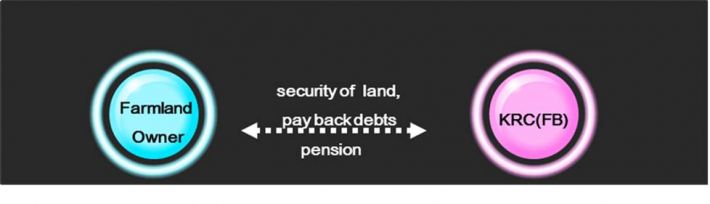

The project lets KRC to set a collateral security to farmlands of elderly farm households, and to pay fixed amount of money monthly like pension.

Fig. 5. The Diagram of Farmland Pension Project

Farmers over 65 years old with more than 5 years farming experience, and owning less than 3 ha farmlands are eligible to register. Actual farmlands which are officially recorded as upland, rice paddy, or an orchard field are targeted. The amount of pension depends on the price of the farmland and the recipient’s age, applying based on the age of the younger between the married couple. The price of the farmland can be calculated by multiplying officially assessed individual land price by farmland area. There are two ways in receiving pension; fixed type of 5, 10, or 15 years, and lifetime type until death.

Excellent case of Farmland Pension Project is as shown in Table 3. The farmland owner in Goyang-si, Gyeonggi-do is 74 years old, with a yearly income of 5 thousand US $ before application. 34 thousand US $ was needed for money to live on, but 29 thousand US $ was in short of. The owner applied to fixed type farmland pension of five years with owning farmland of 4,193m2(price 595 thousand US $) in 2013, and is receiving 29 thousand US $ every year as a money for living.

Table 2. Excellent case of Farmland Pension Project

Unit : thousand US $

|

Classification

|

Before Application

|

After Application

|

Note

|

|

Farm household income

|

5

|

5

|

|

|

Money for living in need

|

34

|

34

|

|

|

The amount of farmland pension

|

0

|

29

|

|

|

The amount in short

|

-29

|

0

|

|

Source: KRC. 2014. Excellent case of Farmland bank Program

7. Farm Household Revival Project

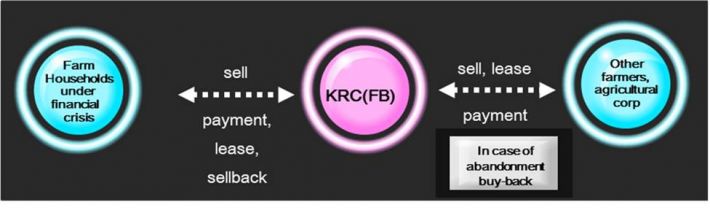

Farm Household Revival Project was introduced in 2006, based on the Act on Korea Rural Community Corporation and Agricultural Land Management Fund Article 24-3. The farmland bank purchases the farmlands owned by farmers under financial crisis due to natural disaster or debts, in order to redeem the debts and normalize the management. The purchased lands will be leased to the farmers on long-term bases (7~10years) with the right to buy back assured.

The project allows KRC to buy farmlands of a farm household under management crisis, rent them to the farm household, and sell or lease them to other households when repurchase is unavailable.

Fig. 6. The Diagram of Farm Household Revival Project

Farmers or agricultural corporations having more than 40 % debts of total assets with being suffered from 50% damage caused by natural disaster, or having debts over 30 thousand US $ are eligible.

The target lands are farmlands and agricultural facilities (fixed greenhouse, animal facilities). Lands are purchased for appraisal and assessment price, and for facilities, residual appraisal price would be applied at the end of the lease. The maximum limit for purchase price is 60 US $/ m2, and that for support is decided within the amount of debts, but under 1 million US $ for farmers and 1.5 million US $ for agricultural corporations.

Rent cost is to be within 1% of the purchase price of farmland and facilities, with the lease period of 7 years and its extension available for 3 years after evaluation. For farmland, buyback price is decided as a smaller amount between appraisal and assessment price and price with the 3% interest. For facilities, originally purchased price would be the buyback price.

Excellent case of Farm Household Revival Project is as shown in Table 2. The 51-year-old owner of the exemplified farming household in Pyeongchang-gun, Gangwon-do faced a management crisis due to flood damage in 2006, but was able to overcome through this project. Before support, the income of the farm household was 100 thousand US $, but the amount of debt was 307 thousand US $ on an increasing trend. Through this project in 2006, farmland 3.1ha was sold for 368 thousand US $, not leaving any debt behind. Current income of the household is 200 thousand US $, earned by cultivating disposed farmland.

Table 3. Excellent case of Farm Household Revival Project

Unit : thousand US $

|

Classification

|

Before Support

|

After Support

|

Note

|

|

Farm Household Debt

|

307

|

0

|

Monetary Support of 368 thousand US $

|

|

Yearly Income of Farm Household

|

100

|

200

|

|

Source: KRC. 2014. Excellent case of Farmland bank Program

Record of Support and Accomplishments until 2014

1. Records of Support

10,214 million US $ for 254 thousand ha have been used for supporting farmland bank program in total. Accomplishments for each project are in the following.

(1) Farmland Scale-up Project

6,960 million US $ (169.5 thousand ha) have been used for supporting farmland bank. This project has contributed to strengthening the foundation of rice supply by enlarging the management area of professional rice farmers. The management area percentage has risen from 30% in 2005(297,000ha/ nationwide rice cultivation acreage 980,000ha) to 50% in 2014(419,000ha/816,000ha). The management scale of each professional rice farmer increase from 2.5ha in 1995 to 6.0ha in 2014.

(2) Reserving Farmland Purchase Project

This project has bought 3,192ha (686 million US $) of the farmlands within the agricultural development region and thereby supported a smooth selling of farmlands owned by retirees, those leaving rural areas and those changing jobs. The project then leased 3,178ha of farmland to 3,636 households and thereby supporting on average 0.9ha of farmland per each household.

(3) Farm Household Revival Project

The program helped out 1 billion 684 million US $ to 6,845 households in crisis due to bankruptcy, aiming to provide a chance for revival. The project aimed to prevent the loss of farm household assets caused by auctioning, and to reduce farmers’ burden by low rent instead of interest on debt.

(4) Farmland Pension Project

3,963 cases with aged farmers have been supported by monthly pension with secured farmlands (average 850 US $ per household monthly).

(5) Trusting Farmland Lease Project

Leasing 77,652 ha (average 0.58 ha per each farmer) to 44,701 professional farmers (33%) and 88,997 general famers (67%) in order to support enlargement (0.9 ha for professional rice farmers, 0.4ha for general farmers). The long term lease (5 years) was provided in order to ensure a stable farming plan. As a result, the project promoted legal lease and efficient usage of the farmland.

Table 4. Record of Support and Accomplishments until 2014

unit: ha, million US$

|

Title

|

Area

|

Amount of Money

|

Misc.

|

|

Total

|

253,806

|

10,214

|

|

|

Farmland Enlargement Project

|

169,519

|

6,960

|

|

|

- Purchase

|

78,073

|

4,966

|

|

|

- Lease

|

89,655

|

1,918

|

|

|

- Exchange & Amalgamation

|

1,791

|

76

|

|

|

Reserving Farmland Purchases

|

3,192

|

686

|

|

|

Orchard Enlargement Project

|

3,443

|

315

|

|

|

Farm Household Revival Project

|

6,845(persons)

|

1,684

|

|

|

Farmland Pension

|

3,963(cases)

|

74

|

|

|

Direct Payment Project for Early Retirement of Aged Farmers

|

101,624(persons)

|

495

|

|

|

Trusting Farmland Lease Project

|

77,652

|

-

|

Non budget project

|

Source: KRC. 2014. Analysis Report of Farmland Program

2. Major Accomplishments

(1) Effects of Rearing Professional Rice Farmers

This policy has contributed on strengthening the foundation of rice supply by enlarging the management area of rice professional farmers. The production cost was saved, by increasing the management scale of each rice professional farmer from 2.5 ha in 1995 to 6.0ha in 2014. Farm households with more than 5ha have saved 22.1% of direct cost compared to the nationwide cost; the direct cost of nationwide Farm households was 447 US $, and that of households owning more than 5 ha was 366US $, allowing 81 US $ to be saved.

The average income of professional rice-farming household is 63,090 US $, reaching 114% of urban workers’ income of 55,270 US $ and 183% of the average farm household’s income of 34,520 US $.

73% of rice professional farmers are less than 50 years old and thereby preventing essential manpower from leaving the rural area and contributing to the maintenance and development of the local community. percentage of nationwide farm manager above 60 years old is 67.3%

(2) Farm Household Revival Project

The project aimed to prevent the loss of farm household assets caused by auctioning and to reduce farmers’ burden by low rent rather than interest on debt.

First, by preventing auctioning, 555.6 million US $ (81 thousand US $ per each household) worth of assets were saved from being lost; 555.6 million US $ = 1,683.5 million US $ (supporting fee) – 1,127.9 million US $ (applying farmland auction price 67%).

Secondly, the cost of interest showed a decline of 202.1 million US $ yearly (30 thousand US $ per household) by offering relatively cheaper farmland rent instead of using high interest debt. Through the project, the cost of interest declined from *218.9 million US $ to **16.8 million US $.

* 218.9 million US $ = 1,683.5 million US $ (debt of the supported households) x 13% (interest)

** 16.8 million US $ = annual rent cost (1% of the farmland price)

(3) Farmland Pension Project

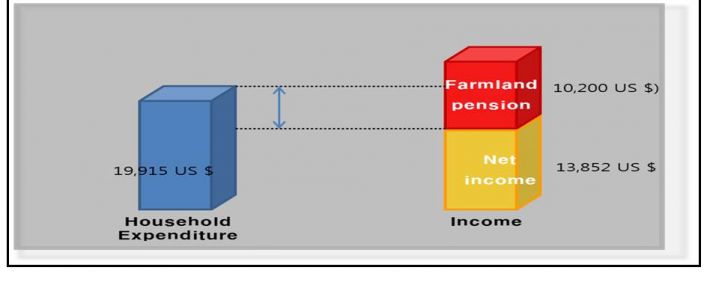

The project aims to contribute to stable retirement by supporting farmland pension to elderly farming households in short of money for living. In 2013, the average family budget expenditures of elderly farming households aged 70 and above was 19,915 US $, the net income was 13,852 US $. The shortage of 6,063 US $ was preserved with farmland pension of 10,200 US $.

Fig. 7. The Effect of Farmland Pension Project

Further Progress Direction

There’s a concern of decentralization followed by retirements of professional farmers formerly supported. Farming households in the age of 50s, supported in the early 1990s, have met the age of retirement, as more than 20 years have passed. There’s a concern for decentralization as the supported farmlands are inherited (the right of inheritance is equal among the children).

Therefore, to maintain current accomplishments, policies to prevent allotment of farmlands should be introduced. Methods to prevent allotment are the following; first, to give preference in tax rate in inheritance to a specific person in farming industry, and second, aiming to keep the success through preferential support for purchase of siblings’ quota in order to make one-person-inheritance possible.

REFERENCES

Statistics Korea. 1980-2013. Farm Household Economy Survey (In Korean)

Statistics Korea. 1980-2013. Survey of Agriculture, Foresty And Fisheries (In Korean)

Statistics Korea. 2014. Agriculture, Forest, Fishing Industry Investigation (In Korean)

KRC. 2014. Analysis Report of Farmland Bank Program (In Korean)

KRC. 2014. Guide Book of Farmland Bank Program (In Korean)

KRC. Explaining material of Farmland Bank Program (In Korean)

KRC. 2014. Excellent case of Farmland bank Program (In Korean)

| Submitted as a country paper for the FFTC-MARDI International Seminar on Cultivating the Young Generation of Farmers with Farmland Policy Implications, May 25-29, MARDI, Serdang, Selangor, Malaysia |

Farmland Bank and Young Generation of Farmers in Korea

ABSTRACT

Farmland Bank Program includes the following; Farmland Scale-up Project for strengthening agricultural competitiveness, Farm Household Revival Program Project aiming for revitalization of farm household under bankruptcy crisis due to debt, Trusting Farmland Lease Project and Reserving Farmland Purchases Project for efficient use of farmland, Farmland Pension Project aiming to solve the problem of insufficient living expenses in an aging society. Farmland bank program encourages for young generation of farmers to enter into agriculture and contributes for them to increase their farmland scale, also prevents essential labor from leaving the rural area by promoting professional farmers, and contributes to the maintenance and development of the local community in Korea.

Keyword: Professional Rice Farmers, Aging, Farmland

INTRODUCTION

Due to rapid industrialization in Korea, the number of farm household declined from 2,155 thousand in 1990 to 1,142 thousand in 2013. The size of farming population also shrank from 6,661 thousand in 1990 to 2,847 thousand in 2013. As aging in rural areas has progressed rapidly, aging rate (Aging Rate: proportion of population aged 65 and above among whole population) increased from 11.5% in 1990 to 37.3% in 2013, resulting in quantitative and qualitative decline of agricultural labor force. Another factor of agricultural production, farmland area showed a decline from 2,109 thousand ha in 1990 to 1,711 thousand ha in 2013. Rice paddy acreage meanwhile, also decreased from 1,345 thousand ha in 1990 to 964 thousand ha in 2013. In order to deal with current change of agricultural environment, policies to rear professional rice farmers and farmland bank program were introduced.

The policy of rearing professional rice farmers was introduced in 1995 in order to lead agriculture by making the income of professional rice farmers surpass that of urban workers, aiming to have young professional farmers engage in agriculture. This policy is to sell and rent the farmlands to professional rice farmers through Farmland Scale-up Project, Trusting Farmland Lease Project, and Reserving Farmland Purchases Project of farmland bank program, thereby enlarging the income of professional rice farmers through farm size expansion. To be chosen as a professional rice farmer, one must be a farmer of age 55 or below, with farming experience of more than 3 years and a farm size of 2.0ha or above. About 63,000 farm households have been selected until 2014.

The purposes of the farmland bank program are to achieve the optimal size of farmland scale, efficient usage of farmlands, improvement of the agricultural structure and the stabilization of the farmland market. Furthermore, diverse policies and projects in respect of farmland are to be launched to increase the profit of farmers and to achieve economic and social development in rural areas. Therefore the Farmland Bank in Korea supports farmers of young generation by rearing professional rice farmers.

Major Contents of the Projects

1. Farmland Scale-up Project

Farmland Scale-up Project was introduced in 1990, based on the Act on Korea Rural Community Corporation and Agricultural Land Management Fund, Article 18, 19, 22. The aim of this project is to raise enlarged and specialized farmers and to achieve “the land-to-the tiller principle” by farmland trading, long term lease, exchange, division or amalgamation. The project is to support the progress of enlarging households of young professional farmers and collectivization of farm management, in order to increase farmers’ profit and to comprehend stable supply of staple crop.

The project lets KRC buy or rent farmland from its owners, and sell or lease the farmland to professional farmers and agricultural corporations.

Fig. 1. The Diagram of Farmland Scale-up Project

*(hereinafter ‘KRC’: Korea Rural Community Corporation, ‘FB’: Farmland Bank)

The project includes Farmland Trade Project, Long-term Farmland Lease Project and Administrative Give-and-take and Division-and-junction of Farmland Project. Each Project is as described in the following.

(1) Farmland Trade Project

Farmland Trade Project includes buying the farmlands of non-farming households, those who changed their jobs or of the retirees from farming and selling their lands to professional farmers and agricultural corporations. Rice paddy and upland fields within the agricultural development region or being land-consolidated are targeted.

Persons in the following are eligible; selected as to be raised into professional farmers aged under 64 with more than 1.5 ha rice paddy fields or more than 1.0 ha upland fields, agricultural association corporations with more than 5ha rice paddy or upland fields, agricultural corporations with more than 10ha farmland and those who have been selected (within 5 years) as 20~30 years old farmer.

Repayment in installment must be done with annual interest of 1% for 15~30 years. The support has an upper limit of 10ha including existing area, 20ha in case of corporation. Monetary support limit is 10.6 US $/㎡ for rice paddy fields, and 10.6 US $/㎡ for upland fields.

(2) Long Term Farmland Lease Project

Long Term Farmland Lease Project focuses on long term (5~10years) leasing of farmlands, of those who changed their jobs or retired from farming to those selected as professional farmers. Target lands are rice paddy and upland fields in rural areas, and conditions for eligibility are the same as those of Farmland Trade Project. There must be a payback in installment, interest free for 5~10years, and there are no limits for areas being supported.

(3) Administrative Give-and-take and Division-and-junction of Farmland Project

Administrative Give-and-take and Division-and-junction of Farmland Project aims to support the settlement cost for the difference made by exchange, amalgamation, redevelopment, and group substitution. Payback in installment with annual interest of 1% for 10 years is conditioned.

Excellent case of Farmland Scale-up Project is as shown in Table 1. The owner of the exemplified farming household in Goheng-gun, Jeollanam-do is of age 52, and was chosen as a professional rice farmer in 1995. 15.8ha was supported through Farmland Scale-up Project since 1995. As a result, the size of the farm enlarged from 1.8ha to 28.3ha, and farm household income increased from 60 thousand US $ to 300 thousand US $.

Table 1. Excellent case of Farmland Scale-up Project

Classification

Before Support

After Support

Note

Farm size(ha)

1.8

28.3

Support size of 15.8ha

(582 thousand US $)

Yearly income of farm Household(thousand US $)

60

300

Source: KRC. 2014. Excellent case of Farmland bank Program

2. Orchard Scale-up Project

Orchard Scale-up Project was introduced in 2004 based on the Special Act on Assistance to Farmers, Fishermen, etc. Following the Conclusion of Free Trade Agreements, Article 5. The project is focusing on purchasing and leasing orchard to scale-up and collectivize fruit-growing farms to strengthen competitiveness and adaptability of market opening.

The project would also promote the community to be enlarged and collectivized through attracting young and able manpower to rural areas. The progress includes KRC buying or renting orchards from the owners, and selling or leasing them to the farmers.

Fig. 2. The Diagram of Orchard scale-up Project

The project includes Buying and Selling the Orchards and Orchard Lease Project. Each project is as described below.

(1) Buying and Selling the Orchards is to buy orchards from non-farmers, farmers who changed the job, want to retire, reduced the size of orchards and non-agricultural corporations owning orchards, and to sell the orchards to fruit farms. Orchards within rural areas are targeted.

To be eligible, one must be 64 years old or younger in the trial year of the project with the experience of fruit farming for more than 3 years, managing more than 0.3 ha of orchards (farmers, agricultural corporation, farming association corporations which are willing to raise or establish for raising the main product of the orchard).

The maximum limit for support is 5ha in case of fruit farming, 10ha in case of agricultural corporation (including the farmland owned beforehand), and 40 US $(including fruit trees)/3.3m2. This is conditioned with the annual interest of 2%, and payback period will be applied according to the applicant’s age (maximum 30~15 years).

(2) In the Orchard Lease Project, KRC would borrow the orchards from non-professional farmers, who want to change the job, retire and plan to strengthen their competitiveness through scaling-up. Orchards within rural areas are subjected, and maximum limit for support would be 5ha for fruit farms, 10ha for agricultural corporation, including originally owned farmlands. Conditions for eligibility are the same as above. The duration of lease is 5-10 years.

3. Trusting Farmland Lease Project

Trusting Farmland Lease Project was introduced in 2005, based on the Farmland Act Article 7, 23 and the Act on Korea Rural Community Corporation and Agricultural Land Management Fund Article 24-4. This project is to promote efficient usage and stable management of farmlands and to contribute to farmland scale-up for farmers by renting the trusted farmland to professional farmers. The project allows farmland owners to sell or lease their farmlands to KRC, and KRC to sell or lease the farmlands to other farmers or agricultural corporations.

Fig. 3. The Diagram of Trusting Farmland Lease Project

The subjects of the project are farmlands allowed for lease, and their affiliated farming facilities, which are unable to cultivate due to lack of labor force or health concerns after acquiring farmlands for farming. The entrusted period of 5 years may be extended after the end of the period, and the rent cost is decided upon mutual consent considering the market price. The payment would be done after deducting yearly commission of 5%. The lessee is selected among the applicants who are willing to lease the farmland from KRC for agricultural management purposes.

4. Reserving Farmland Purchases Project

Reserving Farmland Purchases Project was introduced in 2010, based on the Act on Korea Rural Community Corporation and Agricultural Land Management Fund, Article 24-2, paragraph 2. The farmland bank is to buy the farmlands owned by farmers willing to retire, leave or change jobs due to age or health concerns, in order to improve agricultural structure and to stabilize farmland market. The purchased lands will be used for long term lease and other purposes for more efficient usage.

The project lets KRC buy and own quality farmlands and lease them to returning farmers, professional rice farmers, etc.

Fig. 4. The Diagram of Reserving Farmland Purchases Project

The Farmers who are willing to leave rural areas, change one’s job or retire due to age, and farmlands within agricultural development region (rice paddy, upland, orchard fields) are targeted. The price of farmlands is decided through appraisal and assessment. The maximum limit for purchase price is 25 US $/㎡. For Metropolitan city, Sejong Metropolitan Autonomous City, Gyeonggi-do, Gyeongsangnam-do city area, the limit is 50 US $/㎡, and for Chungcheongnam-do, Gyeongsangbuk-do city area, 35 US $/㎡.

Professional farmers, new farmers, returning farmers, agricultural corporations, general farmers and other individuals or corporations willing to do farming are eligible, but there is a priority for 20~30 years old farmers. There is duration for lease of 5 years; there is to be a renewal every 5 years after evaluation. Rent cost is to be decided between the lessor and the lessee considering the market price.

5. Direct Payment Project for Early Retirement of Aged Farmers

Direct Payment Project for Early Retirement of Aged Farmers was introduced in 1997 based on the Special Act on the Implementations of the Agreement Establishing the World Trade Organization Article 11, paragraph 2, sub-paragraph 5. This project aims to support the retirees who are planning to transfer farming, and to promote enlargement of professional farmers.

Those who are 65~70 years old are eligible, and the applicants should have at least 10 consecutive years of farming experience (in case of farmers with illness or an experience of an accident and therefore not being able to manage the farm, 8 years of farming experience required).

Target lands are the following; lands under 3 consecutive years of ownership, rice paddy, upland, orchard field within agricultural development region or collectivized rice paddy, upland, orchard field outside agricultural development region with complete redevelopment and agricultural infrastructure. The lands are sold to professional farmers younger than 60 years old and to general farmers younger than 45 years old, having at least 3 consecutive years of farming experience upon the date of transfer. The lands are also sold or leased (including trusting the lease) to the KRC.

The standard payment in this project is 0.3 US $/㎡ yearly(3,000US $/ha yearly), and there is a maximum limit of 2.0 ha, applied in case of purchase and lease. Paying duration ranges from 6 years(70 years old) to 10 years(66 years old or younger), and payment can be done with monthly installments.

6. Farmland Pension Project

Farmland Pension Project was introduced in 2011, based on the Act on Korea Rural Community Corporation and Agricultural Land Management Fund Article 24-5. The farmland pension project is to secure farmlands owned by aged farmers and provide them with monthly pension to support their living. Furthermore, fluidized farmland asset would support aged farmers in order to expand and strengthen the social stability of rural area.

The project lets KRC to set a collateral security to farmlands of elderly farm households, and to pay fixed amount of money monthly like pension.

Fig. 5. The Diagram of Farmland Pension Project

Farmers over 65 years old with more than 5 years farming experience, and owning less than 3 ha farmlands are eligible to register. Actual farmlands which are officially recorded as upland, rice paddy, or an orchard field are targeted. The amount of pension depends on the price of the farmland and the recipient’s age, applying based on the age of the younger between the married couple. The price of the farmland can be calculated by multiplying officially assessed individual land price by farmland area. There are two ways in receiving pension; fixed type of 5, 10, or 15 years, and lifetime type until death.

Excellent case of Farmland Pension Project is as shown in Table 3. The farmland owner in Goyang-si, Gyeonggi-do is 74 years old, with a yearly income of 5 thousand US $ before application. 34 thousand US $ was needed for money to live on, but 29 thousand US $ was in short of. The owner applied to fixed type farmland pension of five years with owning farmland of 4,193m2(price 595 thousand US $) in 2013, and is receiving 29 thousand US $ every year as a money for living.

Table 2. Excellent case of Farmland Pension Project

Unit : thousand US $

Classification

Before Application

After Application

Note

Farm household income

5

5

Money for living in need

34

34

The amount of farmland pension

0

29

The amount in short

-29

0

Source: KRC. 2014. Excellent case of Farmland bank Program

7. Farm Household Revival Project

Farm Household Revival Project was introduced in 2006, based on the Act on Korea Rural Community Corporation and Agricultural Land Management Fund Article 24-3. The farmland bank purchases the farmlands owned by farmers under financial crisis due to natural disaster or debts, in order to redeem the debts and normalize the management. The purchased lands will be leased to the farmers on long-term bases (7~10years) with the right to buy back assured.

The project allows KRC to buy farmlands of a farm household under management crisis, rent them to the farm household, and sell or lease them to other households when repurchase is unavailable.

Fig. 6. The Diagram of Farm Household Revival Project

Farmers or agricultural corporations having more than 40 % debts of total assets with being suffered from 50% damage caused by natural disaster, or having debts over 30 thousand US $ are eligible.

The target lands are farmlands and agricultural facilities (fixed greenhouse, animal facilities). Lands are purchased for appraisal and assessment price, and for facilities, residual appraisal price would be applied at the end of the lease. The maximum limit for purchase price is 60 US $/ m2, and that for support is decided within the amount of debts, but under 1 million US $ for farmers and 1.5 million US $ for agricultural corporations.

Rent cost is to be within 1% of the purchase price of farmland and facilities, with the lease period of 7 years and its extension available for 3 years after evaluation. For farmland, buyback price is decided as a smaller amount between appraisal and assessment price and price with the 3% interest. For facilities, originally purchased price would be the buyback price.

Excellent case of Farm Household Revival Project is as shown in Table 2. The 51-year-old owner of the exemplified farming household in Pyeongchang-gun, Gangwon-do faced a management crisis due to flood damage in 2006, but was able to overcome through this project. Before support, the income of the farm household was 100 thousand US $, but the amount of debt was 307 thousand US $ on an increasing trend. Through this project in 2006, farmland 3.1ha was sold for 368 thousand US $, not leaving any debt behind. Current income of the household is 200 thousand US $, earned by cultivating disposed farmland.

Table 3. Excellent case of Farm Household Revival Project

Unit : thousand US $

Classification

Before Support

After Support

Note

Farm Household Debt

307

0

Monetary Support of 368 thousand US $

Yearly Income of Farm Household

100

200

Source: KRC. 2014. Excellent case of Farmland bank Program

Record of Support and Accomplishments until 2014

1. Records of Support

10,214 million US $ for 254 thousand ha have been used for supporting farmland bank program in total. Accomplishments for each project are in the following.

(1) Farmland Scale-up Project

6,960 million US $ (169.5 thousand ha) have been used for supporting farmland bank. This project has contributed to strengthening the foundation of rice supply by enlarging the management area of professional rice farmers. The management area percentage has risen from 30% in 2005(297,000ha/ nationwide rice cultivation acreage 980,000ha) to 50% in 2014(419,000ha/816,000ha). The management scale of each professional rice farmer increase from 2.5ha in 1995 to 6.0ha in 2014.

(2) Reserving Farmland Purchase Project

This project has bought 3,192ha (686 million US $) of the farmlands within the agricultural development region and thereby supported a smooth selling of farmlands owned by retirees, those leaving rural areas and those changing jobs. The project then leased 3,178ha of farmland to 3,636 households and thereby supporting on average 0.9ha of farmland per each household.

(3) Farm Household Revival Project

The program helped out 1 billion 684 million US $ to 6,845 households in crisis due to bankruptcy, aiming to provide a chance for revival. The project aimed to prevent the loss of farm household assets caused by auctioning, and to reduce farmers’ burden by low rent instead of interest on debt.

(4) Farmland Pension Project

3,963 cases with aged farmers have been supported by monthly pension with secured farmlands (average 850 US $ per household monthly).

(5) Trusting Farmland Lease Project

Leasing 77,652 ha (average 0.58 ha per each farmer) to 44,701 professional farmers (33%) and 88,997 general famers (67%) in order to support enlargement (0.9 ha for professional rice farmers, 0.4ha for general farmers). The long term lease (5 years) was provided in order to ensure a stable farming plan. As a result, the project promoted legal lease and efficient usage of the farmland.

Table 4. Record of Support and Accomplishments until 2014

unit: ha, million US$

Title

Area

Amount of Money

Misc.

Total

253,806

10,214

Farmland Enlargement Project

169,519

6,960

- Purchase

78,073

4,966

- Lease

89,655

1,918

- Exchange & Amalgamation

1,791

76

Reserving Farmland Purchases

3,192

686

Orchard Enlargement Project

3,443

315

Farm Household Revival Project

6,845(persons)

1,684

Farmland Pension

3,963(cases)

74

Direct Payment Project for Early Retirement of Aged Farmers

101,624(persons)

495

Trusting Farmland Lease Project

77,652

-

Non budget project

Source: KRC. 2014. Analysis Report of Farmland Program

2. Major Accomplishments

(1) Effects of Rearing Professional Rice Farmers

This policy has contributed on strengthening the foundation of rice supply by enlarging the management area of rice professional farmers. The production cost was saved, by increasing the management scale of each rice professional farmer from 2.5 ha in 1995 to 6.0ha in 2014. Farm households with more than 5ha have saved 22.1% of direct cost compared to the nationwide cost; the direct cost of nationwide Farm households was 447 US $, and that of households owning more than 5 ha was 366US $, allowing 81 US $ to be saved.

The average income of professional rice-farming household is 63,090 US $, reaching 114% of urban workers’ income of 55,270 US $ and 183% of the average farm household’s income of 34,520 US $.

73% of rice professional farmers are less than 50 years old and thereby preventing essential manpower from leaving the rural area and contributing to the maintenance and development of the local community. percentage of nationwide farm manager above 60 years old is 67.3%

(2) Farm Household Revival Project

The project aimed to prevent the loss of farm household assets caused by auctioning and to reduce farmers’ burden by low rent rather than interest on debt.

First, by preventing auctioning, 555.6 million US $ (81 thousand US $ per each household) worth of assets were saved from being lost; 555.6 million US $ = 1,683.5 million US $ (supporting fee) – 1,127.9 million US $ (applying farmland auction price 67%).

Secondly, the cost of interest showed a decline of 202.1 million US $ yearly (30 thousand US $ per household) by offering relatively cheaper farmland rent instead of using high interest debt. Through the project, the cost of interest declined from *218.9 million US $ to **16.8 million US $.

* 218.9 million US $ = 1,683.5 million US $ (debt of the supported households) x 13% (interest)

** 16.8 million US $ = annual rent cost (1% of the farmland price)

(3) Farmland Pension Project

The project aims to contribute to stable retirement by supporting farmland pension to elderly farming households in short of money for living. In 2013, the average family budget expenditures of elderly farming households aged 70 and above was 19,915 US $, the net income was 13,852 US $. The shortage of 6,063 US $ was preserved with farmland pension of 10,200 US $.

Fig. 7. The Effect of Farmland Pension Project

Further Progress Direction

There’s a concern of decentralization followed by retirements of professional farmers formerly supported. Farming households in the age of 50s, supported in the early 1990s, have met the age of retirement, as more than 20 years have passed. There’s a concern for decentralization as the supported farmlands are inherited (the right of inheritance is equal among the children).

Therefore, to maintain current accomplishments, policies to prevent allotment of farmlands should be introduced. Methods to prevent allotment are the following; first, to give preference in tax rate in inheritance to a specific person in farming industry, and second, aiming to keep the success through preferential support for purchase of siblings’ quota in order to make one-person-inheritance possible.

REFERENCES

Statistics Korea. 1980-2013. Farm Household Economy Survey (In Korean)

Statistics Korea. 1980-2013. Survey of Agriculture, Foresty And Fisheries (In Korean)

Statistics Korea. 2014. Agriculture, Forest, Fishing Industry Investigation (In Korean)

KRC. 2014. Analysis Report of Farmland Bank Program (In Korean)

KRC. 2014. Guide Book of Farmland Bank Program (In Korean)

KRC. Explaining material of Farmland Bank Program (In Korean)

KRC. 2014. Excellent case of Farmland bank Program (In Korean)