Albert P. Aquino, Princess Alma B. Ani and Meliza A. Festejo

1. Introduction

Agriculture is a key sector of the Philippine economy. It produces food for a growing population. It supplies essential raw materials and products for the manufacturing sector and agro-related industries. It is a major link in the input and output value chain, and supplies surplus labor to the industry and service sectors.

However, all is not well in Philippine agriculture. Its contribution to the gross domestic product (GDP) had fallen below one-third since the 1960s, and has continuously dropped to one-eight since 2010 (Figure 1). Growth of agricultural output has substantially slowed down through the years from an annual average of 4% in the 1970s to about 2% in the 1980s and 1990s. Compared to service and manufacturing sectors, agriculture output was largely stagnant through the years.

In terms of labor share, its contribution to total employment has declined from 44% in 1990 to 33% in 2011 (Figure 2). It experienced consistently slower annual growth rate at 1.2% compared to total employment’s 2.5%.

Poverty incidence in the Philippines remains largely a rural phenomenon and is highest among Filipinos engaged in agriculture. As cited by Rapera et al. (2011), the International Fund for Agricultural Development (IFAD) report indicated that about half of the 91 million Filipinos (in 2009) lived in rural areas, and of this, 30% were considered poor. About 80% of the poor populace in the rural areas was dependent on subsistence agriculture. This highlights the irony in agriculture, farmers who are involved in food production, the building block of any agricultural supply chain, are among the poorest

These statistics are manifestations of the anemic performance of Philippine agriculture. Studies have shown that the lackluster performance of the sector was not due to the lack of good policies and programs but traces back to policy implementation failures which in turn, was attributed to lack of budgetary support, inappropriate allocation of meager resources and issues of weak governance.

This paper highlights the performance of Philippine agriculture and the policy environment within which it operates. The paper has two major parts. The first section describes the performance of Philippine agriculture. The second part provides an overview of the policy environment that influenced and shaped the agriculture sector, and the issues besetting the implementation of such policies.

2. Performance and productivity of Philippine agriculture

Crops dominates the sector accounting for 50% of the agricultural gross value added (GVA) while livestock and poultry, and fisheries are far second and third with value shares of 24% and 19%, respectively (Figure 3). Rice and corn led the growth of the crop sector which improved since 2010 at 4.5% compared to 2.4% over the period 2000-2010. Close to that level was poultry at 4.4% compared to 3.4% growth rate over the decade. On the contrary, livestock showed a declining growth rate from 2.0% to 1.5% during the same period. Fisheries, declining from 4.5% to negative 1.9%, experienced the same trend. For livestock, development through upgrading of the genetics of dairy/beef cattle and small ruminants are being implemented while the fisheries sector needs long-term sustainability to recover from the negative growth which is now being addressed through the enforcement of a “closed season” policy under the Fisheries Code of the Philippines (1998).

This section also focuses on land productivity of five major crops namely: rice, corn, coconut, sugarcane and banana. The growth rate for rice was fastest in the 1960s during the Green Revolution period until the early 1980s with the introduction of hybrid varieties. Growth rate of yield dramatically declined in the 1990s to 0.70% annually as the Green Revolution technologies matured, irrigation investments declined and technology transfer slowed due to devolution (Habito and Briones, 2005; Aragon et al., 2011).

Corn followed a similar pattern with that of rice, fast growth in the 1960s and slow growth in the 1970s. But unlike rice, corn yield has maintained its steady growth. Fastest growth in corn productivity was achieved during the period 2000-2009 (Aragon et al., 2011) mainly due to the widespread adoption of hybrid yellow corn, utilization of productive areas and withdrawal of marginal lands from subsistence farming of white corn (Habito and Briones, 2005). In terms of productivity in sugarcane, yield was erratic during the period 1990 to 2009. Production declined from 1992 while yield stabilized in 2003 to 2006 and in 2008. On the other hand, plantation crops such as coconut and banana witnessed growth during the period 1990 to 2009. However, while growth was observed in coconut, this proved slow at only 1.1% annually. The productivity improvement was dismal at 0.77 mt/ha. Productivity in banana grew at 3.2% annually from 11.4 mt/ha to 20.2 mt/ha from 1990 to 2009.

In terms of the livestock and poultry sector, growth has been consistent. Its contribution to GVA increased from 13.2% in 1990 to 19.7% in 2009 (NSCB, 2010 as cited by Aragon et al., 2011).

In comparison with other countries, the Philippines is considered an average performer in terms of land productivity. Msambichaka et al. (2010) described yield growth in developing Asia at an annual average of 3.8% from 1967 to 1995. Highest growth occurred in China at 4.36% while lowest in Sri Lanka at 1.53%. Yield growth in the Philippines is somewhat in the middle at 3.05% (Table 1).

It should be pointed out that agricultural development was not confined to cereals. Aside from rice and corn, the Ginintuang Masaganang Ani (Golden and Bountiful Harvest; GMA) in 2001 instituted programs for coconut, sugarcane, high-value commercial crops, livestock and fisheries. Likewise, the Agri-Pinoy programs of the Department of Agriculture also recognized the importance of these commodities. While focus is on traditional crops, quite notably, vegetable production in the past decade exhibited highest returns. Steadiest trend is also apparent in root crops and aquaculture.

3. Agricultural policy environment

3.1 Agriculture and fisheries modernization law

In the Philippines, the Agriculture and Fisheries Modernization Act (AFMA) or Republic Act 8435, which was signed into law in December 1997, is the primary policy in the development of the agriculture and fisheries sector. It is considered a landmark law where major programs and policies in developing the sector are anchored. AFMA is based on seven core principles, namely: poverty alleviation and social equity, food security, rational use of resources, global competitiveness, sustainable development, people empowerment and protection from unfair competition.

Many Filipinos expected the AFMA to usher in the much needed investments that could spur the development of the sector. Investment is required to also address the growing list of expectations, from rural poverty reduction to food security, equitable distribution of income and wealth, stewardship of natural resources, and resilience to climate change. Investments should be strategically targeted to enhance agricultural productivity, improve infrastructure in the countryside and increase competitiveness both in production and distribution.

Recognizing the principles in the development of agriculture, AFMA’s objectives include modernizing the sector through the following initiatives:

a. transforming the sectors into a technology-based industries;

b. enhancing levels of profits and income through equitable access to assets, resources and services and promoting high-value crops, value-adding and agro-industrialization;

c. ensuring accessibility, availability and stable supply of food;

d. encouraging horizontal and vertical integration, consolidation and expansion of agriculture and fisheries activities;

e. empowering people by strengthening people’s organizations, cooperatives and non-government organizations (NGOs);

f. increasing comparative advantage by pursuing market-driven approach;

g. promoting industry dispersal and rural industrialization; and

h. increasing productivity and improve market efficiency.

AFMA is implemented through the Agriculture and Fisheries Modernization Program (AFMP) which provides the strategic framework to harmonize and unify the various agriculture and fishery development programs, projects and activities in the country. AFMA focuses on improving and modernizing production and marketing services, infrastructure services and facilities in the rural areas such as irrigation and farm machineries and equipment, human development programs, research development and extension, and trade policies. For budgeting purposes, the AFMA was supposed to be implemented for six years (1999-2004).

In terms of budget allocation, AFMA is one of the major agricultural policies included in the General Appropriations Act (GAA), the official document indicating the funds for the operation of the Philippine government. As mandated in its Implementing Rules and Regulations (IRR), AFMA has an appropriation of PHP20 billion on its first year of implementation (1999) and a continuing appropriation of PHP17 billion annually in the next six years. The budget is allocated and shall be disbursed as follows:

In 2004, AFMA’s extension dubbed as Republic Act 9281 or the act to strengthen agriculture and fisheries modernization in the Philippines was signed into law. RA 9281 specifically stipulated amendments on payment of duties and tariff of agricultural imports and provided continuing appropriation of P17 billion for the implementation of AFMA up to the year 2015.

3.2 Policy issues in agricultural investment

3.2.1 Underinvestment in agriculture

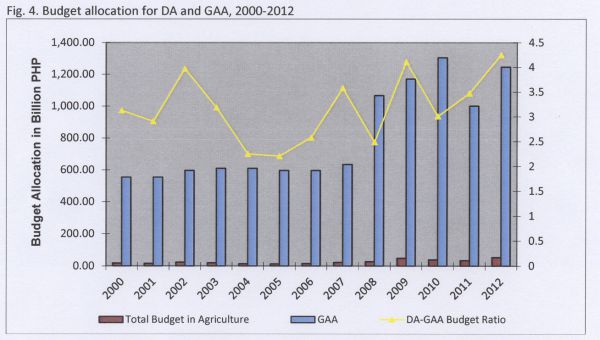

The AFMA should have been an avenue for significant increases in investments to improve the performance of the sector. But underinvestment haunted Philippine agriculture. Public expenditure in agriculture was fairly low relative to the size of total government spending (Aquino et al., 2005, Briones, 2013). The budget for the Department of Agriculture (DA) registered lowest at PHP 13.1B in 2005 and peaked in 2012 at PHP 52.9B. However, the percentage allocation for DA from the total government appropriation remained at a dismal average rate of 3.16% from 2000 to 2012 (Fig. 4).

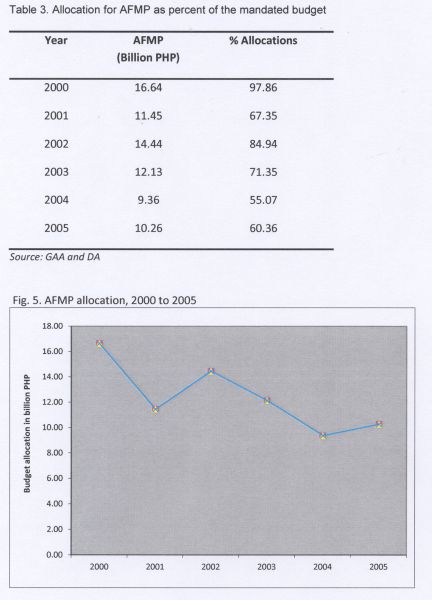

Unfortunately, the AFMA’s mandated budget of PHP20 billion for its initial year of implementation and PHP17 billion annually, thereafter, did not materialize. For the period 1999-2005, annual allocation averaged only about 71% of the mandated yearly budget of PHP 17B (Table 3). Not only was the budget inadequate, it declined from 2000 to 2005 at a rate of 6.85% annually (Fig. 5). Sharp decline was observed in 2004, the end of its initial implementation period.

According to Aragon et al. (2011), public spending in agriculture was not only considered inadequate but also burdened with many problems. Component expenditure items under AFMA did not receive mandated allocation. R&D budget under AFMA was short of 5.7% of the actual 10% mandated allocation while irrigation budget ranged from 31% to as high as 52%. This exceeded the mandated budget share of 30% for irrigation. The component on production support which included input procurement (e.g. seed and fertilizer subsidies), was plagued with underutilization, substandard quality, late delivery and overpricing (Habito and Briones, 2005).

Balisacan et al. in 2011 as cited by Briones (2013) found that among the public goods that show evidence of impact on agricultural incomes and productivity, irrigation is found to be not significant. The public goods found to have quite significant returns are infrastructure such as roads, ports, electrification, regulatory services, R&D technological change and agricultural modernization.

The distribution of infrastructure investments is also uneven. In a recent study made by the Organization for Economic Cooperation and Development (OECD), it found out that the pattern of gross regional domestic product (GRDP) in the country has always been biased towards the urban areas. The National Capital Region (NCR) already accounts for 35% of the GRDP while the other 15 regions split the remaining share. AFMA’s Agriculture and Fisheries Infrastructure Support could have closed the gap but infrastructure support in rural areas decreased in recent years because of the decision to increase the already hefty irrigation budget.

3.2.2 Public investment in staple food

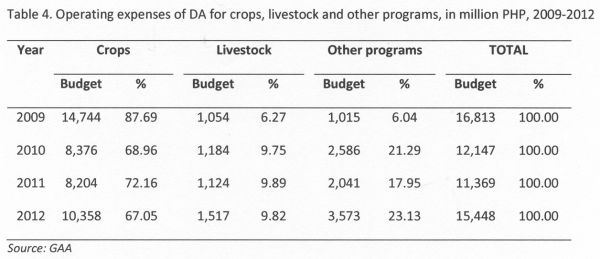

In terms of budget in the agricultural sub-sectors, the operating expenditures of DA indicated that support is heavily allocated to the crop sub-sector (Table 4). Within the crop sub-sector, there is apparent bias for staple food especially rice. The average budget allocation for rice programs from 2009-2012 is equivalent to about 60% of the total operating expenses of DA for the crop sub-sector during the same period.

As mandated by AFMA, sufficiency in rice and white corn should be pursued if food security is to be achieved. It is considered the single most important political commodity in the country, prompting bias in terms of investment towards its development. However, spending on rice has dwarfed other major commodities. The government’s push for rice self-sufficiency gives disproportionate share to rice production. A World Bank study in 2007 found that rice expenditures from 2001 to 2005 constituted about 60% of the budget compared to less than 10% received by other agricultural commodities.

Large shares of government spending on rice were allocated to production support which includes outlay for rural credit, market infrastructure, post-harvest equipment and facilities, seeds, fertilizers, and farm machineries. According to David (2006) as cited by Cororaton and Corong (2009), the Hybrid Rice Commercialization Program (HRCP) relied heavily on government subsidies for the procurement of seeds, support to seed growers, subsidies for other inputs, research and development, techno-demo farms, salary for local government unit (LGU) staff and other expenses. Between 2001 and 2005, expenses for HRCP were estimated at a staggering PHP 10B with sizeable amount coming from funds which were pre-allocated to other agricultural programs (e.g. Agrarian Reform). Conversely, even with various subsidies, adoption rate of hybrid rice was very low due to higher cost of hybrid seeds and higher cost of labor. In addition, profit advantage becomes significant only during dry season. The immense interventions from the government have distorted farmer’s ability to make informed choice between hybrid and other rice varieties.

Still in pursuit of self-sufficiency, special treatment has been given to rice. The government through the NFA set up a system of price supports and price ceilings to encourage rice production while making retail prices affordable to consumers. However, these price policies have been detrimental to public finances. The agency has been operating at a loss since 2000s, as reflected in the NFA’s growing financial deficit (Cororaton and Corong, 2009). NFA’s “buy high, sell low” scheme to achieve price stability cost billions of pesos in debts and losses for the agency, hitting PHP 30B in 2009 (Briones and Parel, 2011). Due to budgetary constraint, domestic procurement of NFA has been decreasing. The average farm prices of palay or rice grains have also been kept below the support prices while average retail prices have approximated the price ceiling.

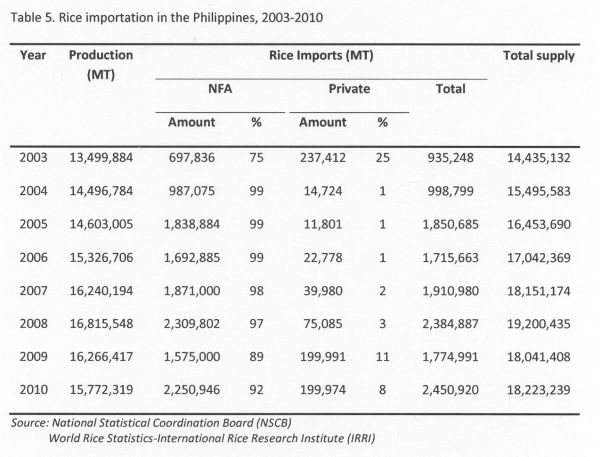

The NFA is able to source cheaper rice from abroad for domestic contribution which requires lower subsidies. The growing demand for rice in the country has resulted to substantial rice imports even prompting partial deregulation since 2002 to meet the country’s food security requirement (NFA, 2013). On average, the country is importing about 11.3% of its total supply, more than 93% of which were imported by NFA (Table 5).

Programs under AFMA have also been partial towards rice. As indicated in earlier discussion, excessive budget for irrigation was allocated since this is a critical component for rice production. The largest component in AFMA consequently, was irrigation services accounting for 30% of the committed budget per year. However, the high cost of irrigation maintenance and development even pressed the government to further increase appropriations which is now set at about 49.4% (Table 6). In addition, the Ginuntuang Masaganang Ani (GMA) and the National Rice Program budget accounted an average of 14% of the total DA budget in 2009 to 2012. This is understandably due to the country’s adoption of a rice self-sufficiency timeline by 2013.

The current administration’s pronouncement in achieving rice self sufficiency in 2013 is stated in Proclamation No. 494 declaring 2013 as the national year of rice and directing the DA to lead its celebration. In support of Proclamation No. 9, the DA crafted the Food Staples Sufficiency Program (FSSP) 2011-2016. FSSP outlines the plan and strategies in achieving its main goal of producing the country’s domestic requirement for rice by 2013. Beyond 2013, the plan aims to strengthen the national resilience to impacts of climate change through the production of staple foods.

3.2.3 R&D investment in agriculture

The AFMA and Executive Order (EO) 127 s. 1999 constituting the Council for Extension, Research and Development in Agriculture and Fisheries (CERDAF) and EO 338 s. 2001 mandating the Department of Agriculture to undertake R&D programs, affirm and strengthen the role of R&D in modernizing agriculture in the Philippines. Globalization and increasing need for food security in the country need R&D to develop necessary technologies that promote sustainability to increase productivity and global competitiveness while giving emphasis on small farm management to transform subsistence farmers into viable agribusiness entrepreneurs. However, in current structural setting in R&D, a concerted effort has always been a challenge since resources, responsibilities, and accountabilities are spread across many government departments and agencies (Faylon and Cardona 2005).

There is also serious underinvestment in research and development despite studies showing its significant economic rates of return. When AFMA was crafted, R&D was set to receive 10% of the annual budget allocation in agriculture. More than a decade has passed since its implementation and R&D spending remains low in priority. AFMA’s investment on R&D averaged about 4.34% annually, way below AFMA’s mandated allocation of 10% (Aragon et al., 2011).

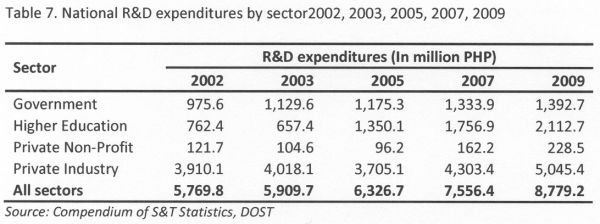

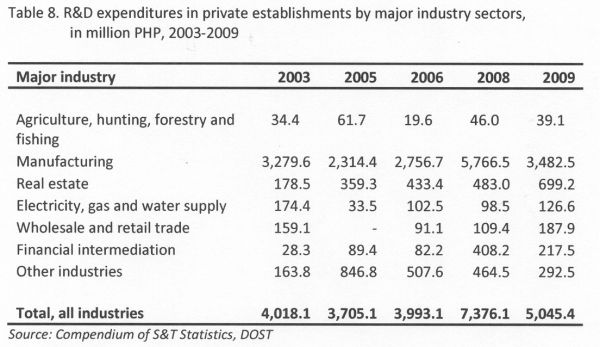

Table 7 shows the patterns of R&D investment among the different sectors in the country. Private industry accounted for more than half of the national expenditures emphasizing the dismal allocation from the public sector. Of the total R&D expenditures in private industry, expenditures in agriculture, hunting, forestry and fishing was very low ranging from 0.5% to 1.7% (Table 8). This highlighted the severity of underinvestment in R&D in the sector. Manufacturing industry exhibited the highest R&D expenditures accounting for 62.5% to 81.6%. To address this gap, the Board of Investments (BOI) through the Omnibus Investment Law has offered incentives to private sector for R&D undertakings. Incentives include income tax holiday, duty free importation of capital equipment and spare parts, deduction from taxable income for the necessary and major infrastructure facilities in less developed areas, and employment of foreign nationals.

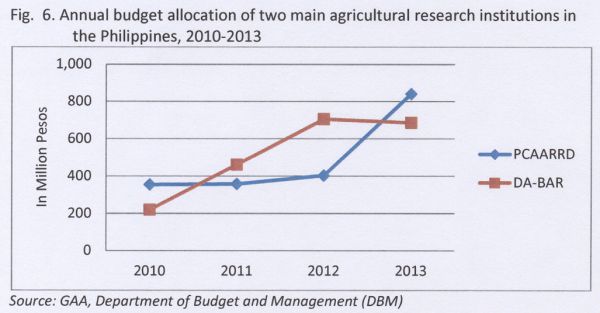

While government spending for R&D accounted only for 17.6% of the national R&D expenditures, in recent years, the government has recognized the need for investment in R&D. Realizing R&D importance in the development of the agriculture sector, the Philippine Council for Agriculture, Aquatic and Natural Resources Research and Development (PCAARRD) and the DA-Bureau of Agricultural Research (DA-BAR), two of the country’s top institutions for agricultural researches, have received significant increase in budget allocation from 2010 to 2013. On average, the budget appropriation for PCAARRD and DA-BAR significantly increased at a rate of 41% and 53% annually, respectively, during the same period (Figure 6). For PCAARRD, the dramatic increase in budget allocation was able to augment its budget for R&D and technology delivery services, from 57.77% in 2010 to 65.30% in 2012. On the other hand, DA-BAR was able to augment funding for the national programs on rice, corn, high value commercial crops and promotion and development of organic agriculture.

3.3 Trade policies and globalization

Trade is essential to agricultural development. One of the major policies affecting the Philippine agriculture sector is on the Uruguay Round Agreement on Agriculture under the General Agreements on Tariffs and Trade (GATT) - World Trade Organization (WTO).

The WTO requires agricultural quantitative import restrictions (QRs) to be removed and converted to tariffs (WTO, 2013). All GATT member countries, which include the Philippines, committed to maintain a tariff initially set at high rates but scheduled to decline over time with option to exempt staple food. Republic Act 8178 also known as Agriculture Tariffication Act of 1996 implemented the tariffication commitment for all crops in the Philippines except rice, for which QR is retained. Non-tariffication of rice until 2005 was negotiated to protect the local rice sector from any imbalances that may arise from trade liberalization. After 2005, the country negotiated another extension of the special treatment for rice until 2012, in exchange for lower tariff rates on other agricultural products and increased minimum access volume for rice.

Another important aspect of global trade is the country’s participation in Free Trade Agreements (FTAs). FTA is a trade policy instrument on reduction and elimination of tariffs, import quotas, and preferences on most (if not all) goods and services traded among countries belonging to a free-trade block or a regional zone. Its main objectives include liberalizing regional trade, widening global market access, and creating stable and transparent trading and investment environment (Wignaraja et al., 2010; WTO, 2013; ASEAN, 2013)

The Philippines has FTAs with the ASEAN-member countries, Japan, Korea, China, India, Australia, New Zealand, and the European Union. These agreements give Philippine exporters access to global market with preferential tariff rates (PIA, 2013). In general, the FTAs aim to establish a free-trade area that seeks to be a competitive production base in the world through reduction and elimination of tariffs and non-tariff barriers. Following are the commitments of the Philippines to the various FTAs.

Policy issues on trade

The Philippines has undertaken trade policy reforms to include protection on agricultural commodities through imposition of tariffs both on imports and exports. However, Piadozo et al. (2011) reported that the protection remained biased for importables. Traditional intermediate commodities such as sugar and corn were heavily favored. High protection on sugar dramatically hurts consuming public as well as processing industries. Relative inefficiency of the broiler sector has its root in the protection that was provided to both output and domestic corn producers.

The country acceded to the World Trade Organization (WTO) towards greater market access and increased exports. However, structural biases are given to traditional exports such as coconut oil, banana, shrimp and prawns, pineapple and pineapple products, tuna, desiccated coconut, seaweed and carrageenan (SEPO, 2009). However, studies have shown that there are no major changes in the market destinations of the country’s export goods despite membership to the General Agreement on Tariffs and Trade (GATT– WTO). Tariff-quotas have often been allocated to countries through preferential tariffs under bilateral and regional agreements, thereby limiting market access by other countries.

In fact membership to WTO does not inhibit the Philippines from abiding to stricter product standards of importing countries. The agriculture export performance of the country was hindered by the WTO-Agreement on Agriculture specifically on market access, domestic support, export competition and restrictions and sanitary and phytosanitary (SPS) measures. The export competitiveness of Philippine agricultural exports has been declining in certain processed foods, carrageenan and seaweeds, coconut products, abaca, tobacco, and tuna (Piadozo et al., 2011). The adoption of international standards for SPS such as Hazard Analysis Critical Control Point (HACCP) in the country has been moving slowly due to resistance of local industry that finds the guidelines too restrictive and costly (Catelo 2003 as cited by Faylon and Cardona 2005). As a result, traded agricultural products become less competitive because of the inability to conform to international standards.

3.4 Policies on asset reform

Asset reform is founded on a premise that a major cause of poverty is the unequal distribution of natural resources and productive assets in the country (Habito, 2008). It redistributes resources providing marginalized sector ownership or security of tenure for productive use complemented by support services for resource management to maximize benefits. Currently, there are asset reform policies in the Philippines targeting asset-deprived small farmer and fisherfolk as embodied in the Comprehensive Agrarian Reform Law (CARL) or R.A. 6657 of 1988 and the Fisheries Code of the Philippines or R.A. 8550 of 1998.

3.4.1 Agrarian reform

Agrarian reform has been part of the Philippine agricultural system since the colonial rule of Spain. However, the most comprehensive agrarian reform initiative in the country was implemented through Republic Act (R.A.) 6657 or the Comprehensive Agrarian Reform Law (CARL) in 1988. This law aims to improve equity and productivity in the agriculture sector by establishing owner cultivatorship of economic-sized farms to landless farmers, farm workers and tenants. Land, being more than an economic resource, bears a social function in the Philippines. “For us, paradise is our land (“Para sa amin, ang langit ay lupa”),” is how people would describe their attachment to land, not only as farms where income is derived but also their connection to the community and affirmation of their values (PA 2020, 2011).

The Comprehensive Agrarian Reform Program (CARP) was enacted through R.A. 6657. This program was operationalized through two components: Land Tenure Improvement (LTI) and Program Beneficiaries Development (PBD). In specific terms, LTI involves land acquisition and distribution (LAD) while PBD is undertaken through the establishment of agrarian reform communities (ARC) where beneficiaries are given access to support services provided by the government.

Similar to AFMA, CARP has been burdened with numerous implementation issues. The CARP was also underfunded and was considered a continuing saga for the beneficiaries, the land owners and the implementers. Gordoncillio and Quicoy (2011) indicated CARP as an “unfinished business” since its implementation has gone to several extension. The first extension was implemented through Republic Act 8532 or an act strengthening CARP implementation from 1998 to 2008. When the extension has expired, Republic Act 9700 or the Comprehensive Agrarian Reform Program Extension with Reforms (CARPER) was passed into law. In essence, CARPER was able to extend the land acquisition and distribution component of CARP including reforms to aid the program’s implementation such as better support services and access to credit for farmers. Additional funding of PHP 150B was also provided for CARP implementation until 2014.

CARP’s policy approach is fragmented. It caused growing number of small farms managed by single families engaged in subsistence production. In a performance review of asset reform policies conducted by Habito (2008) covering 92 municipalities in 30 provinces, he found out that only 44% of beneficiary-respondents were able to access credit, with only 7% provided by the government. Similarly, more than half did not have access to post-harvest facilities and more than one-tenth experienced threats pertaining to their tenure or occupancy. After the lapse of five years from its award, lands may be converted or reclassified based on economic value. The Local Government Code (LGC) of 1991 mandates local government units (LGU) to reclassify lands according to criteria set by CARL. As LGUs and landowners perceived industrial and real estate developments as more economically viable, lands were veered away from agricultural purposes (SEPO, 2013)

Thus, land conversion of agricultural lands to non-agricultural lands has increased over the years. A study (Kaisahan 2012) advocating for the passage of the National Land Use and Management Act stated that more than 40,000 hectares of agricultural lands were converted to non-agricultural uses from 1988-1993, not including lands illegally converted. However, this legislation on comprehensive land use management which intends to address policy gaps and harmonize existing land policies is still pending in Congress and has been slow in becoming a law.

In the absence of the National Land Use Act, the AFMA has instituted in its policy the establishment of the Strategic Agriculture and Fisheries Development Zones (SAFDZ) within the Network of Protected Areas for Agriculture and Agro-Industrial Development (NPAAAD). SAFDZ aims to ensure that lands are efficiently utilized for agricultural purposes. Under SAFDZ, lands with existing or potential for growing high value crops, irrigated lands, and irrigable lands already covered in irrigation projects are not negotiable for conversion. Based on the 2012 status report of activities under AFMA, SAFDZ and NPAAAD areas have already been identified and maps for the entire country are available. However, guidelines on using SAFDZ and institutionalizing it to the LGU system are yet to be accomplished.

3.4.2 Aquatic resources reform

The Philippine Fisheries Code Act (R.A. 8550) of 1998 promotes sustainable development of the country’s fishery resources and protects the rights of fisherfolk. It marks a shift in fisheries policy from production and exploitation orientation to stewardship and protection (Habito, 2008). It also mandates that all fishing grounds 10 kilometers from the coastline be exclusively reserved for small fisherfolk. Moreover, it is stipulated in the code that the government shall provide fisherfolk settlements areas near the fishing grounds and support services such as access to credit, construction of post-harvest facilities, marketing assistance and extension services. Municipal Fishery Grant Funds, Fishery Loan and Guarantee Fund, Fishing Vessels Development Fund, Special Fisheries Science and Approfishtech Fund, and the Aquaculture Investment Fund were instituted to support the sector.

In the same performance review study, Habito (2008) found out that majority (78.3%) of the respondents do not have adequate housing provided by the government. There are fisherfolk living in foreshore areas (i.e. areas exposed during low tide and submerged during high tide) and informal settlers are endangered of being evicted. This status of settlements manifests the incapacity of concerned government agencies to protect tenure of fisherfolk.

The status of support services is not even better. Only one-third (32.6%) had access to post-harvest facilities and less than two-thirds (56.5%) have access to credit where government has provided only a little over one-third (35.9%) of its credit fund. More than half of the respondents (56.8%) said that commercial fishing vessels intrude on municipal waters supposedly reserved for them. The same issue of lack of budgetary support is prevailing. The total fund allocated pursuant to the Code is gravely insufficient at PHP 600 million, which is to be distributed to 92 coastal municipalities.

Conclusion

The report provided an overview of Philippine agriculture in terms of its importance to aggregate income and employment. Historical data show a diminishing contribution to both gross domestic product and employment.

The right mix of policies is needed to improve the performance and productivity of the sector since policies drive public sector investments. However, even with agricultural policies in place, the policy implementation phase was beset by major challenges. The Philippine experience with AFMA, a landmark law to achieve full development of the agricultural sector, highlights some of these challenges in implementing the law. Besides, under-investment by the government, some issues raised were related to over/under allocation to some sub-sectors/programs and delays in implementation.

WTO-based trade policies were enacted but the full benefits from globalization are still to make a significant dent on Philippine agriculture. To date, the Philippines still rely on its traditional agricultural exports products. Further, the WTO provided stringent environment for its local products to compete in the world market.

Lastly, lessons from the country’s asset (land and common fishing grounds) reform policies point succinctly that these policies alone cannot improve the lot of farmers/farm workers and fisher folk. Complementary policies and programs designed to support these asset reform policies should also be funded and implemented.

References

- Aquino, A., Brown, E., Aranas, M., Ani, P. and Faylon, P. 2012. Innovative Institutional Arrangements to Revitalize Rural Communities: The Case of Abaca Supply Chains in Rural Philippines. Resource paper presented at the International Workshop on “Enhancement of Rural Community Revitalization in the Asian and Pacific Region”, National Training Institute for Farmers' Organizations, Taipei, Taiwan, October 1-5, 2012.

- Aquino, A., Daite, R. and De Villa, L. 2005. Globalization, Domestic Policies, and Small-hold Agriculture: The Case of Corn Farming in Northern Philippines. Journal of Far Eastern Business and Economy Vol. 2, No.2: 1-87.

- Aragon, C., Salazar, A., Quilloy, A. and Carnaje, G. 2011. Increasing Agricultural Productivity in the Philippines. Policy Paper 2. University of the Philippines Los Baños (UPLB) – College of Economics and Management (CEM),Laguna Philippines.

- Briones, R. 2012. Rice self-sufficiency: is it feasible?. Policy Notes 2012-12. Philippine Institute for Development Studies (PIDS), Makati City, Philippines.

- Briones, R. 2013. Impact Assessment of the Agricultural Production Support Services of the Department of Agriculture (DA) on the Income of Poor Farmers/Fisherfolk: Review of the Evidence. Philippine Institute for Development Studies (PIDS), Makati City, Philippines.

- Briones, R. 2013. Philippine Agriculture to 2020: Threats and Opportunities from Global Trade. Discussion Paper 2013-14. Philippine Institute for Development Studies (PIDS), Makati City, Philippines.

- Briones, R. and Parel, D. 2011. Putting rice on the table: rice policy, the WTO, and food security. Policy Notes 2011-11. Philippine Institute for Development Studies (PIDS), Makati City, Philippines.

- Bureau of Agricultural Statistics. Various years. CountrySTAT, Philippines. Accessed in July 2013. .

- Catelo, S. and Pabuayon, I. 2011. Overview of Philippine Agriculture, 1990-2009. Policy Paper 1. University of the Philippines Los Baños (UPLB) – College of Economics and Management (CEM), Laguna, Philippines.

- S&T Resource Assessment and Evaluation Division. 2012. Compendium of Science and Technology Statistics. Department of Science and Technology (DOST), Manila Philippines.

- Cororaton, C. 1999. R&D Gaps in the Philippines. Discussion Paper 1999-16. Philippine Institute for Development Studies (PIDS), Makati City, Philippines.

- Cororaton, C. and Corong, E. 2009. Philippine Agricultural and Food Policies: Implications for Poverty and Income Distribution. Research Report 161. International Food Policy Research Institute (IFPRI), Washington DC, USA.

- Corpuz, P. and Verzani W. 2011. Agricultural Biotechnology Annual: Philippine Biotechnology Situation and Outlook. USDA GAIN Report. Accessed in July 2013.

- Corpuz, P. and Wolf D. 2010. Biotechnology – GE Plants and Animals: Philippine Biotechnology Situation and Outlook. USDA GAIN Report.Accessed in July 2013

- David, C. 1997. Agricultural Policy and the WTO Agreement: The Philippine Case. Discussion Paper 1997-13. Philippine Institute for Development Studies (PIDS), Makati City, Philippines.

- Department of Agriculture. 2012. Accessed in July 2013.

- Executive Order 129 s. 1999. Constituting the Council for Extension, Research and Development in Agriculture and Fisheries. Accessed in July 2013. www.gov.ph/1999/07/24/executive-order-no-129-s-1999/

- Executive Order 338 s. 2000. Restructuring the Department of Agriculture, Providing Funds Therefore, and for Other Purposes. Accessed in July 2013. www.gov.ph/2001/01/10/executive-order-no-338-s-2001/

- Faylon P. and Cardona, E. 2005. Philippine Agriculture: Retrospect and Prospects in Good Agricultural Practices and Globalization. Philippine Council for Agriculture, Aquatic and Natural Resources Research and Development (PCAARRD), Laguna, Philippines. Accessed in July 2013. http://www.agnet.org/htmlarea_file/library/20110721142241/bc54006.pdf

- Gordoncillo, P. and Quicoy, C. 2011. Philippine Agrarian Reform: Recent Experiences and Policy Directions. Policy Paper 4. University of the Philippines Los Baños (UPLB) – College of Economics and Management (CEM), Laguna, Philippines.

- Greenpeace Southeast Asia. 2007. The state of water resources in the Philippines. Accessed in July 2013.

- Habito, C. and Briones, R. 2005. Philippine Agriculture over the Years: Performance, Policies and Pitfalls. Paper presented at the conference entitled “Policies to Strengthen Productivity in the Philippines”. Makati City, Philippines, June 27, 2005.

- Habito, C. 2008. Philippine Asset Reform Report Card. Philippine Partnership for the Development of Human Resources in Rural Areas (PhilDHRRA), Quezon City, Philippines.

- Halos, S. 2000. Defining the Agricultural Biotechnology Policy of the Philippines. Policy Notes 2000-06.Philippine Institute for Development Studies (PIDS), Makati City, Philippines.

- Kaisahan. 2012. The National Land Use and Management Act: Managing our Land Resources to Secure Our Future. Policy Brief. Campaign for Land Use Policy Now (CLUP Now!)

- Msambichaka,L., Luvanda, E., Mashindano, O. and Ruhinduka, R. 2010. Analysis Of The Performance Of Agriculture Sector And Its Contribution To Economic Growth And Poverty Reduction. Department of Economics, University of Dar-es-Salaam, Tanzania.

- National Academy of Science and Technology (NAST). 2011. Philippine Agriculture in 2020 (PA 2020). Accessed in July 2013.National Agriculture and Fishery Council. 2012. Accessed in July 2013. < http://nafc.da.gov.ph>

- National Statistics Office. 2012. Accessed in July 2013. < www.census.gov.ph>

- Organisation for Economic Co-operation and Development (OECD). 2012. Southeast Asian Economic Outlook 2011/2012. Accessed in July 2013. < http://www.oecd.org>

- Piadozo, M., Paris T. and Ramirez, P. 2011. Philippine Agriculture Trade Policies. Policy Paper 11. University of the Philippines Los Baños (UPLB) – College of Economics and Management (CEM), Laguna, Philippines.

- Republic Act 10068. Organic Act of 2010.Accessed in July 2013. http://www.lawphil.net/statutes/repacts/ra2010/ra_10068_2010.html

- Republic Act 7006. Magna Carta for Small Farmers. Accessed in July 2013. http://www.chanrobles.com/republicactno7607.htm#.Ue4-r9JHKyo

- Republic Act 7308. Seed Law. Accessed in July 2013. http://www.chanrobles.com/republicactno7308.htm#.Ue4_QtJHKyo

- Republic Act 8435. Agriculture and Fisheries Modernization Act (AFMA). Accessed in July 2013. http://www.da.gov.ph/images/PDFFiles/LawsIssuances/RA/afma.pdf

- Republic Act 8178. Agriculture Tarrification Act of 1996. Accessed in July 2013. http://www.chanrobles.com/republicactno8178.htm#.Ue5AB9JHKyo

- Schwab, K. 2011. The Global Competitiveness Report 2010-2011. World Economic Forum, Geneva.

- Schwab, K. 2012. The Global Competitiveness Report 2012-2013. World Economic Forum, Geneva.

- Stads, G., Faylon P. and Buendia L. 2007. Agricultural R&D in the Philippines: Policy, Investments, and Institutional Profile. ASTI Country Report. International Food Policy Research Institute (IFPRI) and Philippine Council for Agriculture, Forestry and Natural Resources Research and Development (PCARRD).

- Senate of the Philippines Economic Planning Office (SEPO). 2009. Financing Agriculture Modernization: Risks and Opportunities. Policy Brief 2009-01. Pasay City, Philippines.

- Senate of the Philippines Economic Planning Office (SEPO). 2013. Breaking New Ground: Enacting a Land Use Policy. Policy Brief 2013-01. Pasay City, Philippines.

- Senate of the Philippines Economic Planning Office (SEPO). 2008. Broadening and Reinforcing the Benefits of Land Reform in the Philippines. Policy Brief 2008-04. Pasay City, Philippines.

- Senate of the Philippines Economic Planning Office (SEPO). 2009. Financing Agriculture Modernization: Risks and Opportunities. Policy Brief 2009-01. Pasay City, Philippines.

- Wignaraja, G., D. Lazaro, and G. De Guzman. 2010. FTAs and Philippine Business: Evidence from Transport, Food, and Electronics Firms. ADBI Working Paper 185. Tokyo: Asian Development Bank Institute. Accessed in July 2013.

- World Bank (2007). Agriculture Public Expenditure Review. World Bank, Washington, DC.

- World Trade Organization (2013). A Summary of the Final Act of the Uruguay Round. Accessed in July 2013 http://www.wto.org

|

Date submitted: July 26, 2013

Reviewed, edited and uploaded: July 30, 2013

|

An Overview of Policies and Public Sector Investments in Philippine Agriculture

Date submitted: July 26, 2013

Reviewed, edited and uploaded: July 30, 2013