ABSTRACT

The negative impacts of global climate change have been enormously affecting the performance of agricultural production lately. Rice farmers and other food crops producers have also been suffered from flood, drought, and pest and disease infestations caused by such natural disaster phenomena. As a main crop and staple food for majority of Indonesian, the government plays a very important role to increase rice production amid the small-scale landholdings employed by the farmers. Achieving self-sufficiency in rice, reducing dependency on import, and improving farmer’s income are among the goals of food security development program for which the government has launched many relevant activities. The introduction of agricultural insurance is one of the appropriate activities to protect the farmer’s interests. With the issuance of farmer’s protection and empowerment law in 2013, rice crop insurance has been, to some extent successfully conducted although its implementation mechanism need some improvement. The extension of rice crop insurance coverage to encompass larger area since 2015/2016 planting season has been materialized on the ground of farmer’s acceptance and enthusiasm to participate. Experience to close rice crop insurance due to natural disaster and synthesizing indemnity-based insurance with public-private partnerships scheme are among the lesson learned and discussed in this paper. Challenges to carry out different insurance models for rice crop and opportunity to implement insurance programs on other agricultural commodities are also outlined.

Keywords: Crop Protection, Farmer’s Participation, Government Subsidy, Partnerships, Rice Production

INTRODUCTION

Agricultural sector plays an important role in the overall Indonesian economy. Indonesian agriculture is characterized by smallholding farm size with low level of farmer’s education. Most of the farmers are considered as household engaged in various agricultural businesses. Based on the 2013 agricultural census data, the number of farmers working in agriculture has reduced by 16.32% from 31,23 million households (2003) to 26.14 million households (2013) due to some reasons (Badan Pusat Statistik, 2013). Land conversion from agriculture to non-agriculture use and the rapid development of technology are arguable among the factors affecting the decreasing trend of farmers working in agricuoltural sector.

With various problems associated with agriculture, the Indonesian government is in a strategic position to manage the dynamic development of agricultural sector amid the increasing demand of food crops and other agricultural commodities following the steadily increase of population growth. Increasing agricultural production and improving farmer’s welfare, sppecifically those who are living in rural areas have been included in the national agricultural development strategic programs and used as the basis of its short-term food and agriculture development activities. In the context of national food security, the development of major crops should be prioritized. The government is in its endeavor to maintain self-sufficiency in rice and to keep increase the production of corn and soybean while encourage the production of sugarcane, beef, shallot, and chilli (2015-2019). Rice is the Indonesian staple food and the sufficient supply of this crop in the market should lead to socially, economically and politically stability. It has been for sustainable target that the government takes every initiatives to make this commodity availabile, easy to access, and with affordable price.

Although the government confronted with multidimensional problems, however, efforts to increase crop productions through many launched programs, such as adoption of new technology, farm management improvement, and enhancing water management. All of these activities are directed to improve farmer’s income while learning and adapting the impact of global climate change, specifically in managing food crops toward sustainable food security. FAO Food Outlook biannual report (FAO, 2015) revealed that the increase of rice production in Indonesia (increased by 3.1% in 2015 compared to that of in 2014) as well as higher production in other major producing countries was particularly caused by a return to more normal weather conditions. Some producing countries, however could still experienced lower production, such as Bangladesh and Vietnam (- 0.8 and - 0.4 percent change in 2015 over 2014).

In the implementation stages, however, the agricultural development programs should confront the impact of global climate change and deal with unpredictable price fluctuations. The global warming effect and the massive change of international trade are among the major problems associated with agricultural sector. In recent years, many countries experienced the harvest failure of their respective major food crops and the community were suffered from the skyrocketed prices of such food crops. The shortage supply of food crops, such as rice, corn, and soybean should enforce the government to increase the import that in turn could affect the domestic economic instability. Indonesia is in the middle of this situation and need to safeguard the farmers from huge loss because of such unavoidable risk while gradually improve farmer’s capability. Uncertainty risks covering farm damage and harvest failure should encourage farmers to shift their respective farm from rice (paddy) to oher less risks crops. If this is happen, the impact would immediately instabilize national food security, specifically the availability of and accessibility to rice (Kementerian Pertanian, 2013). Agricultural insurance is one of the policy instruments to meet the farmer’s interests, a tool to prevent farmers from harvest failure, and a program to educate the farmers on agricultural risk management.

Basically, insurance is one of the tools that farmers and other stakeholders can use to manage risks that are too large to manage on their own. Part of that risks are transfered to another party, the insurance companies who takes it in return for a fee or premium. In many countries, crop insurance is largely subsidized by the government, including premium payment, administrative expenses, reinsurance, technical guidance, etc. (Pasaribu and Sudiyanto, 2016). The experience of the USA, Canada, the Philippines, and Spain to apply high subsidy of premium rate (respectively, 60%, 70%, 50-60%, and 58%) should indicate a strong role of the autorities in the implementation of agricultural insurance (Raju and Chand, 2008). In 2003, the estimate value of world insurance premiums is amounted to USD 7.1 billion or about 0.6% of agricultural production value at farmer’s level. The concentration of agricultural insurance are spread out in North America (69%), West Europe (21%), Latin America (5%), Asia (3%), Australia (1%), and Africa (1%) (Roberts, 2005). It was reported that agricultural insurance could influence the use of chemical fertilizers and pesticides in the USA (Horowitz and Lichtenberg, 1993). This is interesting, taking into account its linkage with the campaign of friendly environment and encouragement of local specific farm management. Moreover, agricultural insurance could significantly suggest the reduction of loan/working capital for farm among the small-scale farmers in India (Mishra, 1994). Hazell (1992) emphasized that agricultural sector need to be insured because of risks and uncertainty faced by the farmers that require the intervention of government through appropriate subsidy.

Agricultural protection is required in facing the dynamic of natural phenomena. The variation of farm risks caused by natural disaster has encourage stakeholders to find out some strategies to reduce the effect of ntural calamity to the lowest possible and avoid great loss. Agricultural insurance could divide agricultural risks in the form of financial mechanism and lead the benefit to the farmers.

Where available and affordable, agriculture insurance will provide great benefits to farm households to compliment other risk management approaches. Farmers can rely on informal household and community level strategies such as crop and labor diversification to manage small to moderate risks. In the event of natural disaster, such as flood or drought and infestations of pest and desease, insurance can be designed to protect against cost of production, revenue or consumption losses. This enables households to avoid selling livelihood assets or drawing on savings.

Insurance can also assist farmers in accessing new opportunities by improving their ability to borrow either money or in-linked credits. By doing so, farm households may potentially experience safe and possibly higher return. In this regard, policy in agricultural financial support is essential that it could bring some benefits to the farmers. Considering the low financial ability of small-scale landholding farmers, applied micro financial policy is strategic and the government is suggested to continuously take initiative to introduce, advocate, and socialize new financial scheme to support agricultural insurance program (Pasaribu and Syukur, 2010). Agricultural insurance is also directed to help the farmers to provide their own working capital obtained from the crop insurance claim and could avoid the high interest rate money lenders. The farmers may not pay any cash for premium if there is a program to integrate premium value within the bank loan (farm credit package). The farmers, in this regard, could increase their farm risk management and at the same time encourage investment in agriculture (Pasaribu, 2010; Dick and Wang, 2010).

INDEMNITY-BASED RICE CROP INSURANCE

Rice crop insurance scheme is considered as part of mitigation efforts in response to global climate change. The responses would be materialized through the implementation of various adaptive and adjusted activities to the greater benefits of the farmers. Rice crop insurance is very important to avoid great losses and ensure that the farmers are protected as shown by the availability of cash obtained from insurance claim approval to be used as working capital for their respective farms. This is the immediate effect of having registered as one of the crop insurance participants/ beneficiaries.

In principle, indemnity insurance organize the payment mechanism of insured items. This means that indemnity-based insurance is an insurance policy that aims to protect certain items that could prevent the owners from any losses when they are found to be at fault for a specific event. The crop insurance in Indonesia was designed as indemnity-based insurance as it will cover the risk of certain type of events causing harvest failure over one period of the crop planting season.

Indemnity-based rice crop insurance currently implemented in Indonesia is set to fully cover the total amount of the insured value against the farmer’s farm damage caused by flood, drought, and or pest and disease infestations. Prior to the claim payment, the farm damage should be investigated and when meet the harvest failure criteria, the claim will be approved by loss adjuster (insurance company representative) along with the government official (represented by field extension officer). The claim should follow certain procedures of agreed claim mechanism.

Flood, drought, and pests and diseases have been intentionally choosen and categorized as three types of natural disasters frequently experienced by the farmers. Specific pests and diseases are named in favor of the farmers in each region to ensure that such common threats are included. Five each of the latter is specified and listed in the insurance policy.

Indemnity-based insurance products determine claim payment based on the actual loss incurred by the policy holder. If an insured event occurs, an assessment of the loss and a determination of the indemnity are made at the level of the insured party. The classification is often divided into two subclasses, named peril and multiple peril agriculture insurance (Pasaribu and Sudiyanto, 2016):

Named peril agricultural insurance products (damaged-based products). Named peril (damage based), as the name suggests, provides indemnity against those adverse events that are expicitly listed in the policy. This subclass has a number of distinctive features:

- The sum insured is agreed at the inception of the contract and may be based on production cost, or on the expected crop revenue.

- The loss is determined as a percentage of the damage incurred by the insured party as established by a loss adjuster as soon as after the damage occures;

- The indemnity is calculated as the product of the percentage of the damage and the sum insured;

- Deductibles and franchise are normally applied to reduce the incidence of false clains and to encourage improvement in risk management.

Named peril is a popular type of insurance and accounts for a significant portion of the agriculture premiums worlwide. From the perspective of the insured parties, it appeals where firms are located in areas frequently subjected to one of the perils covered, from the insurer’s point of view it is suitable to situations where the damages caused by the named perils are both measurable and have sudden impact.

Multiple peril agriculture insurance products (yield-based products). Multiple peril (yield based or MPCI) provides insurance against all perils that affect production unless specific perils have been explicitly excluded in the contract of insurance. Under this type of insurance, the sum insured is defined in terms of the expected yield to the farmer. Cover is normally set in the range of 50% to 70% of the expected yield. In turn, the expected yield is determined on the basis on the actual production history of the farmer or the area in which the farmer operates.

The sum insured can be based on the future market price of the guaranteed yield if the farmer has an insurable interest or alternatively, if the farmer has taken a loan to finance the crop, the sum insured may be based on the amount of the loan, if the financier has an insurable interest in the crop. The calculation of the payout is based on the extent to which the actual yield falls short of the guaranteed yield at the agreed price or as the shortfall in yield as a percentage of the guaranteed yield applied to the sum insured.

POLICY INITIATIVES FOR RICE CROP INSURANCE APPLICATION

Policy on Agricultural Protection

Indonesian agriculture, particularly food farming is characterized by small landholding and employed by farmer`s household with the average land size at around 0.3 ha per household. Given this small land ownership and the objective to increase rice production, the Ministry of Agriculture (MoA) is responsible to encourage the farmers to steadily improve their respective farm performance. Various adaptive technologies and innovations have been introduced and applied along with government facilities to help the farmers, specifically food crops farmers in the attempt to provide sufficient foods for the people.

The benefits of rice crop insurance program for farmers are: (a) To increase awareness on the risks that threaten agricultural or farming activities and to find ways of coping and mitigation; (b) To promote increased knowledge, skills and improved farm management and risk management; (c) To relieve dependency of farmers on capital from other sources if they can get compensation from the insurance company; and (d) To increase the income and welfare out of the success and sustainability of the farming business. With these benefits, the government took initiative to initially established a task force, Agricultural Insurance Working Group (AIWG) with main role to prepare all necessary requirements to implement agricultural insurance/rice crop insurance in the country.

The vision, mission, and objective and purpose of rice crop insurance are key elements in the implementation of agricultural insurance. Adjusted to the objectives of national agricultural development, these key elements have been formulated as the basic implementation safeguard of rice crop insurance in Indonesia (Pasaribu and Sudiyanto, 2016).

The vision of the rice crop insurance program is to support the achievement of sustainability of rice farming within the national framework of agricultural development. The mission is to provide compensation (indemnity) of losses caused by the named perils (floods, drought, pests, and disease), to promote productivity, increase farmers’ income and welfare, while maintaining environmental sustainability within the national framework of agricultural development. Meanwhile, the objective of rice crop insurance is to establish partnership and cooperation on the basis of principle of utmost good faith among farmers as the insured and an insurance company as an underwriter, in light of supporting the sustainability of agricultural activities amid efforts to improve the competitiveness of agricultural products. The purpose is to maintain the income and welfare of farmers obtained from the provision of production costs through indemnity payment in the event of a claim for damage caused by the above named perils.

The Indonesian MoA set up a special task force in agricultural insurance (AIWG in 2011) with main assignments (a) to formulate agriculture insurance related policies; (b) to identify problems and find solutions in agriculture insurance; and (c) to monitor and evaluate the implementation of agriculture insurance. MoA administers and is responsible to manage 4 (four) directorate general offices, high level administration within the MoA, with each responsible for food crops, horticultures, livestocks, and plantations. I is obvious that within food crops production, rice is the most important staple food for people and largely produced in the country. Rice farming is very vulnerable to the impacts of climate changes and weather anomaly. Rice farmers are categorized as marginal farmers and mostly low income villagers with minimum access to financial institutions. Taking into account the abovementioned reasons, rice is decided to be the first priority subject in crop protection.

The working group had concluded a set of studies on rice crop insurance scheme based on indemnity in the early 2012 and had fairly successfully implemented it on a pilot project in several locations of different agro-ecosystem. This is one of the main reasons to design an indemnity-based rice crop insurance model in order to match with the then, direct compensation scheme of harvest failure. The direct compensation scheme was conducted to compensate rice farmers who suffer from farm damage and/or loss to their rice farm due to flood, drought and pests and deaseas measured using certain parameters. The scheme provide direct compensation in amount of approximately USD 300 in cash for 1 (one) hectare of farm damage. The compensation amount is basically intended to provide the farmers with sufficient initial capital to resume their farm activities during the next planting season. The direct compensation scheme proved to be financially beneficial in protecting suffered rice farmers against harvest failures. However, there has been drawbacks attributable to iregularities in its handling at the low level administration which result eventually in delay and inffective payment.

On legal aspect, the issuance of the law number 19/2013 on Farmer’s Protection and Empowerment and Protection should allow the implementation of agricultural insurance with all related activities. In particular, article 37 of the law clearly mentioned the obligation of central and local government to protect farmers against harvest failure in the form of agriculture insurance. This obligation, should specifically facilitate (a) registration to participate in insurance program; (b) access to insurance company; (c) socialization on insurance program; and (d) premiums payment. The law stated that all aspects related to the execution of the agriculture insurance scheme should be incorporated into minister of agriculture decrees and regulations.

Following this law, the rice crop insurance program has been prepared and conducted in 2012 planting season in several selected rice producing regions in the form of pilot project. This scheme was implemented with the support of state-owned agricultural companies to financially provide 80% of premium rate. The indemnity-based rice crop insurance scheme was relatively successful as a pilot study at which the farmers responded positively and accepted as a way to protect their farm from risks. The implementation report was also discussed among the higher officials and with the endorsement of the parliament, the government was given a mandate to implement rice crop insurance as a initial program to protect rice farmers. The consequence of this approval is that starting in 2014, the government allocated a certain amount of state budget and incorporated in the annual national agricultural development expenditures.

Pilot Project Implementation

Partnerships

In principle, partnership offers many advantages, it is define in a relative scale and distinguished from other relationship types, such as contracting and extension. Partnership, in this regard is to help and advocate partners to achieve certain level of value-added (Brinkerhoff, 2002). Partnership also indicates a growing business responsibility for the environment to achieve “win-win” opportunitiesand for the companies in responding to various forms development dynamics from the society organizations. Government at this point take a lead in preparing many related facilities (Murphy and Bendell, 1999).

In terms of crop insurance, partnerships relation among the stakeholders play a significant role to link the interest of farmers and the objective of insurance company. Meanwhile, the other stakeholders, such as NGO or other local goverment officials take their respective function to encourage insurance application.

Participants

The rice crop insurance program is basically applicable to marginal or small farmers. The pilot is directed to farmers who meet this general criterion. Additional requirements to be eigible are:

(i) The farmers should be registered as member of Farmers Group (Kelompok Tani) with active management administration.

(ii) The farmers should adhere to good agricultural practices as directed by MoA office at district level.

(iii) The farmers should comply with terms and conditions of insurance contract

Locations

The subject matter of rice crop insurance is basically the rice farm laying within the Indonesian rice land territory. However not all rice farm is eligible for the insurance program, unless they meet the following criteria:

(i) Location area meets the standard requirement for rice plantation particularly in irrigation system.

(ii) Location area lies in a relatively large acreage with clear boundaries.

(iii) Eligible farmers are those of marginal farmers with rice farm ownership or rice farm planted not more than 2 ha, irrespective of location split.

Risks covered

The rice crop insurance program covers specific perils namely: flood, drought, and named pests and deseases. As far as pest and desease are concerned, these include 5 kinds of pests and 5 kinds of deseases which generally found and exist in most or everywhere rice farms. Certain areas or locations farmers may claim to have experienced certain threatening pest or desease. Such claims are not enternained by reason of the fact that said pest and desease normally do not account for serious threat and do not cause severe damage.

Risks excluded

There are exclusions in the policy which include general or standard exclusions and specific exclusions. Basically the rice crop insurance policy does not cover loss of or damage to rice farms due to fire and other natural calamities such as earthquake, volcanic eruption, lanslide, tsunami, wind storms and others as specified under the policy.

Premium tariff

Premium tariff is offered to insurers at 3% flat without taking into account the different variation in the degree of risk. The 3% rate is derived from a studies on 10 years historical data on harvest failures due to flood, drought and pest and desease infestations as filed at the MoA. From the historical data, a pure burning cost rate was obtained and allowances for loadings of insurer’s administration and operational expenses and contingency for catastrophe losses were made to arrive at a gross premium rate.

Insurance policy period

There are 2 planting seasons every year, one is wet planting season, normally starting from October to March, and another one is dry planting season, starting from April to September. The rice crop insurance policy therefore applies to every season of which risk coverage starts from first day of planting and expires on date of harvest. However, the pilot study was conducted during the wet planting season.

There is a time excess being applied for the first 10 days of insurance coverage for reasons that the investment cost is relatively low during that moment and it is considered necessary that the insured farmers should take prudential care and exercise prudential skill in managing their early stages of rice plant growth. As by nature, rice plant is growing during the planting period from none to some value, only one claim can be made under this insurance, namely the harvest failures caused by any of the named perils as specified under the policy.

Claims calculation

On the occurence of flood, drought and pest or desease, specialist officers from local agricultural office will carry out site inspection on the affected areas and take actions as applicable to control. These specialist officers with work jointly with claim officers of the insurers or appointed independent loss adjusters. The loss adjustment report of this join team shall be endorsed by local agricultural office for submission to insurers.

The loss claimable under the policy is stipulated as damage to rice farm on each natural rice terrace whereby:

(i) The damage “intensity” reached level of 75% or above.

(ii) The “extent” of damage reaches minimum 75% of total acreage of each natural rice terrace.

Claim payment

Upon verification of claim reports and agreement of the loss amount, insurers will send letter of confirmation to the policyholders (farmer’s groups) detailing the name of insured farmers whose claim is coverable. Within 14 days from the confirmation date, the insurers will settle the claim by way of a inter-bank tranfser or by other means as applicable.

The Application

Following the partnerships definition above mentioned, the first pilot project of rice crop insurance scheme (wet planting season of 2012/2013) was conducted in Tuban and Gresik regencies of East Java Province covering 470.87 ha and employed by 25 farmer’s groups and in Ogan Komering Ulu Timur regency of South Sumatera Province on 152.25 ha (employed by 17 farmer’s groups). The second pilot study was carried out in Jombang and Nganjuk regencies in East Java Province covering 2,970 ha of rice farm. These locations were specifically under collaboration with JICA who contributed to pay 80% of the premiums on behalf of the insured farmers. The MoA at central level provide general guide book to carry out rice crop insurance, while local government support deploy field extension officers to take part in the actual implementation.

The implementation of rice crop insurance was featured by the indemnity-based insurance during the first pilot project (2012/2013 planting season) and the second (2013/2014 planting season) working together with state-owned fertilizers companies and Japan International Cooperation Agency (JICA). Starting 2014/2015 planting season, the government, represented by the MoA was fully in charged and financed the implementation of such insurance. The state-owned insurance company was involved in the implementation of this pilot insurance scheme.

This pilot project in fact was parallelized with the support of state-owned fertilizers companies to help address the burden of a premium of 80% as planned to be a state subsidy. With the sum insured of USD 500 per ha, the insurance premium is USD 15/ha. The 20% or USD 3 shall be paid by the farmers and the 80% or IDR 12 shall be paid by the state-owned companies/JICA.

Based on the extent of pilot project that has been carried out, the amount of each premium in the province of East Java and South Sumatera is USD 1,412 and USD 456.75 against the overall aggregate exposure of liability up to USD 234,435 from the rice farm area of 470.87 hectares, and aggregate exposure of USD 76,125 from the rice farm areas of 152.25 hectares. The insurance policy was issued to each farmer groups collectively as any one insured to avoid the hassle of administration.

Some farmers in the two provinces were suffered from floods. The insurance policy states that each farmer of 1 ha rice farm is entitled to indemnity compensation of USD 500 should it totally damage. The insurance policy also stipulates that insurance claims will be processed immediately after being reported and will get a cash compensation within 14 working days. The data show that approximately 87 ha of the total 623 ha or almost 14% of the land area of the insured suffer harvest failure and thus they filed insurance claims.

The Results

Experience shows that the incidence of harvest failures due to flood were reported to be processed and insurance compensation was received in cash (by bank transfer) within 14 days. However, some among the farmers also had no filed this claim properly and immediately which caused delay in claim settlement (more than 14 days).

Among the factors affecting the implementation of rice crop insurance are: (a) Communication among the stakeholders; (b) Socialization to understand all about agricultural/rice crop insurance systems; (c) Improvement of insurance policy to adjust to the local conditions and farmer’s farm experiences; (d) Institutional gap on regional agricultural development program to be improved for harmonious activities; and (e) Priority on development activities to support farm protection require stakeholder’s political will on decision making process at any level of development.

Rice crop insurance model currently applied is based on cost of production and is proposed to cover risks due to flood, drought, and or pest and disease infestation. In the future, other models, such as yield-based insurance, weather-based insurance, or damage field-based using satellite image data would be potentials to develop and promote at certain agro-ecosystems in the country. This is considered as the dynamic of this agricultural insurance scheme.

Some aspects to be considered to protect farms and the farmers, include (a) Ability to read and interpret weather information and other climate data in its linkage with farm activities (time determination of land preparation, planting time, duration of irrigation, etc); (b) Ability to respond to climate change with adaptive technology application (seed variety resistant to climate change, mutual benefit created by the farmers in their respective groups, etc); and (c) Institutional empowerment to anticipate climate change through different type of training and hands-on practices.

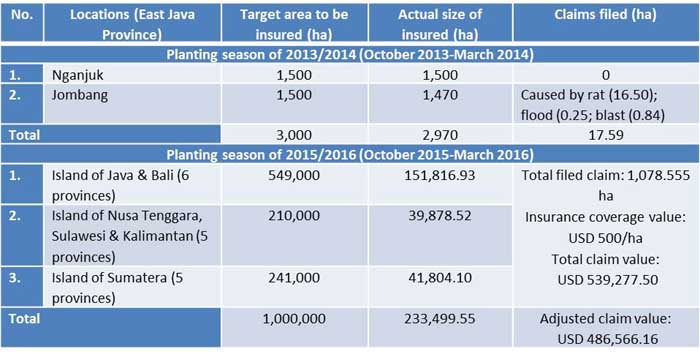

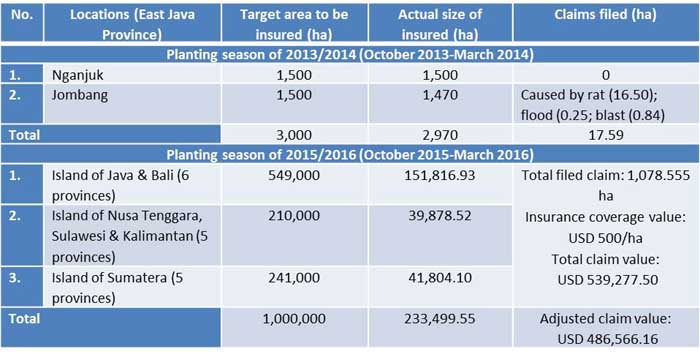

Similar practice was conducted during the wet planting season of 2013/2014. This second pilot project was also carried out in rice producing center in East Java Province. The next pilot study (wet planting season of 2015/2016) was conducted in 16 provinces covering 1 million ha of rice farm. There is no pilot study during the 2014/2015 planting season as this time, the overall evaluation was made to prepare larger coveage of crop insurance with government full financial support. The summary of the pilot rice crop insurance implementation is illustrated in Table 1.

Table 1. Results of the rice crop insurance pilot study by planting season

CLOSING REMARKS AND WAY FORWARD

Closing Remarks

Indemnity-based rice crop insurance is considered as suitable to protect farmers from losses due to flood, drought, and or pests and diseases infestations. This insurance model is well accepted by the farmers and they are willing to follow the guideline set by the government with financial and technical support.

A pilot project of indemnity-based rice crop insurance was introduced in two rice producing provinces (East Java and South Sumatera) in the wet season of 2012/2013. Farmers are positively accepted the scheme as shown during the implementation of the pilot project. The pilot project has successfully worked and there is no reason that similar pilot project should not be expanded and conducted in many locations. Wider coverage of rice crop insurance could provide better learning process of the scheme.

Agricultural insurance in Indonesia includes four sub-sectors: crops, horticulture, livestock, and plantation. Rice crop and livestock insurances have been applied in pilot studies since 2012, and an expansion of the rice crop insurance program has been conducted during the wet planting season of October 2015 to March 2016 (covering 1 million ha at 16 provinces of rice producing centers in the country). Application of indemnity-based rice crop insurance in Indonesia has included pilot studies. A state-owned general insurance company was the sole underwriter in the pilot project implementation. Thus, the partnership model has also been introduced with the support of government facilities to help the farmers to avoid great loss due to farm risks.

The criteria of participants are membership in a farmer’s group that adheres to good agricultural practices, compliance with the terms and conditions of the insurance policy contract, and the rice cultivators, rather than necessarily the farm owners, as the insured. Furthermore, the farms had to be irrigated rice farms with clear boundaries with an area of not more than two hectares, irrespective of location split. The risks covered included the named perils of flood, drought, and five named pests and diseases. The premium tariff was offered to insurers at 3% of the total cost of production (IDR 6 million/ha or USD 500).

Lessons learned from the pilot study include the following:

- Indemnity-based rice crop insurance is working with intensive communication, cooperation and coordination among the stakeholders is required to develop good relations with other stakeholders (public-private partnerships application).

- Government intervention is necessary during the introduction of indemnity-based rice crop insurance scheme (premium support, inputs availability at local level, and farm management)

- Government role in such schemes would be gradually reduced to allow close cooperation between the private sectors (insurers) and the farmers (the insured) towards a commercial transaction.

- Lack of infrastructure—limited availability of accurate and reliable data necessary to formulate appropriate insurance model and rating or pricing structure.

- Low risk awareness—farmers are very aware of production risks but underestimate severity of catastrophic events, thus encouraging them to only buy agricultural insurance against extreme losses.

- Lack of insurance cultures—insurance is regarded as a non-viable investment, as a privilege of the rich, especially for agricultural insurance. Low demand for agricultural insurance has therefore been due to limited understanding of its benefits.

- Low affordability (buying power)—low buying power contributes to lack of demand for insurance. Low incomes hamper the development of the insurance market as income is absorbed by basic needs.

Way Forward

The goal of agricultural insurance program apart from being a mean of risk transfer and protection is to promote better risk management in farming and to ensure increase in productivity. Having insurance securing their farming activities, farmers will hopefully obtain better access to financing from bank and financial institution. This is inevitably important where the partnership of farmers, insurance companies and banking institution would be expectedly boost the food production and productivity.

Indonesia will continue to develop agricultural insurance program to cover various high economic value commodities by applying different insurance models, such as indemnity based, weather-index based, and yield-index based models. Protection of farmer’s interest is highly considered in the overall agricultural development plan. Food crops, in this concern would be prioritized. In several Africa nations, crop index insurance for food crops was introduced on the basis of the impact of global climate change causing crop damage and need protection (Robertson, 2013). However, the farmers would continue to face high risks even with the application of adaptive technology in the efforts of the farmers to adapt to the climate change.

The two types of insurance index products could be further elaborate as follows:

Yield index insurance. The indemnity in this model is based on the realized average yield of an area such as a county or district, not the actual yield of the insured party. The insured yield is established as a percentage of the average yield for the area. An indemnity is paid if the realized yield for the area is less than the insured yield regardless of the actual yield on the policyholder’s farm. This type of index insurance requires historical area yield data.

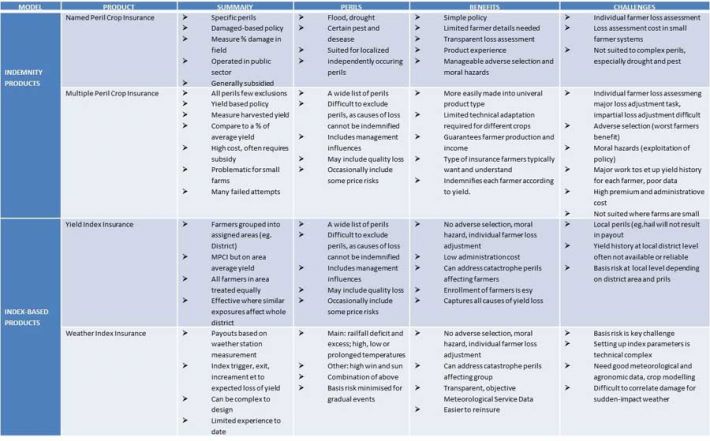

Weather index insurance. The indemnity in this model is based on realizations of a specific weather parameters measured over pre-specified period of time at a particular weather station. The insurance can be structured to protect against index realizations that are either very high or too low that they are expected to cause crop losses. For example, the insurance can be structured to protect against either too much rainfall or too little. The indemnity is paid whenever the realized value of the index exceeds a pre-specified threshold (when protecting against too much rainfall or when protecting against too little rainfall). The indemnity is calculated based on a pre-agreed sum insured per unit of the index. To have more detail about these insurance models, Table 2 summarizes the main features, benefits, and challenges of such crop insurance products.

For future implementation, the introduction to agricultural/rice crop insurance is suggested through socialization activities at central, provincial, and regency/village levels. This activity is required to disseminate information and knowledge about agricultural insurance. Information dissemination is not only for the farmers, but also for other concerned stakeholders, including local government officials (extension officers, pest and disease observers, insurance loss adjusters, etc).

Training and any means of informal educations are recommended to increase the farmer’s capacity, specifically in relation to global climate change. Various knowledge aspects on climate change could be designed as training/education materials to increase the farmer’s capability.

The adjusted insurance scheme to specific conditions at certain locations is expected to perform better insurance applications. The following are among the proposed studies: (a) Identify factors affecting agricultural insurance scheme and variables to determine scope of insurance coverage and premium rate; (b) Structure insurance tariff rate for rice crop at specific agro-ecosystem; and (c) Insurance premium rate and calculation technique for specific high-economic value crops at certain agro-ecosystem.

Terms and conditions listed in the insurance policy are also subject to provision and improvement, including the calculation of plant/farm damage and duration of claim process and closing insurance compensation. Agricultural/crop insurance scheme is suggested as one of the national agricultural development priorities in effort to improve agricultural performance and specifically shield the farm from damage risks within the impact of global climate change.

Agricultural development has played an instrumental and strategic role in the overall national economy of Indonesia. Food productivity and food security issues are increasing in importance, affected by world population growth, the influence of the global market economy, and dramatic effect of climate change. Crop insurance, in this context is very much relevant to provide sufficient food for all people.

Table 2. Main features of crop insurance

REFERENCES

Badan Pusat Statistik. 2013. Laporan Hasil Sensus Pertanian 2013 (Report on Agricultural Census Results). Badan Pusat Statistik. Jakarta.

Brinkerhoff, J. M. 2002. Government-nonprofit Partnership: A Defining Framework. Public Administration and Development 22 (1): 19–30.

Dick W.J.A. and W. Wang. 2010. Government Interventions in Agricultural Insurance. Agric. and Agric. Sci. Procedia 1 (2010) 4–12. Elsevier B.V.

FAO. 2015. Food Outlook: Biannual Report on Global Food Markets. May 2015. UN-FAO. Rome.

Hazell, P. 1992. The Appropriate Role of Insurance in Developing Countries. J. of Int. Dev. 4 (6): 567-81.

Horowitz, J.K. and E. Lichtenberg. 1993. Insurance, Moral Hazard, and Chemical Use in Agriculture. Am. J. of Agric. Econ. 75 (4): 926-35.

Kementerian Pertanian. 2013. Pedoman Pelaksanaan Asuransi Usahatani Padi (Rice Crop Insurance Guide Book). Kementerian Pertanian. Jakarta.

Mishra, P.K. 1994. Crop Insurance and Crop Credit: Impact of the Comprehensive Crop Insurance Scheme on Cooperative Credit in Gujarat. J. of Int. Dev. 6 (5): 529-68.

Murphy, D. F., and J. Bendell. 1999. Partners in Time? Business, NGOs and Sustainable Development. UNRISD Discussion Paper No. 109. Geneva: United Nations Research Institute for Social Development.

Pasaribu, SM and A. Sudiyanto. 2016. Agricultural Risk Management: Lesson Learned from the Application of Rice Crop Insurance in Indonesia. In: S. Kaneko and M. Kawanishi (Eds.), Chapter 14: Climate Change Policies and Challenges in Indonesia. DOI 10.1007/978-4-431-55994-8_14. Springer Japan. Tokyo.

Pasaribu, S.M. 2010. Developing Rice Insurance Farm Insurance in Indonesia. Agric. and Agric. Sci. Procedia 1 (2010) 33–41. Elsevier B.V.

Pasaribu, SM and M. Syukur. 2010. Policy Support for Climate Risk Adaptation: The Role of Microfinance. Analisis Kebijakan Pertanian 8: 1 (1-11). ISSN: 1693-2021.

Raju, S.S. and R. Chand. 2008. Agricultural Insurance in India: Problems and Prospects. Indian Council of Agricultural Research. NCAP Working Paper No. 8. New Delhi.

Roberts, R. 2005. Insurance of Crops in Developing Countries. FAO Agric. Service Bull. No. 159.

Robertson, A. W. 2013. Developing Climate Services for Climate Risk Management: Role of Science and Technology. Makalah dipresentasikan dalam “Workshop on Sustained Partnerships and Capacity for Climate Risk Management”. Bogor, 18 Desember 2013. Cooperation between PERHIMPI, USAID, Columbia University, CCROM, and IPB, Bogor.

| Submitted as a country paper for the FFTC-RDA International Seminar on Implementing and Improving Crop Natural Disaster Insurance Program, June 14-16, 2016, Jeonju, Korea |

Implementation of Indemnity-Based Rice Crop Insurance in Indonesia

ABSTRACT

The negative impacts of global climate change have been enormously affecting the performance of agricultural production lately. Rice farmers and other food crops producers have also been suffered from flood, drought, and pest and disease infestations caused by such natural disaster phenomena. As a main crop and staple food for majority of Indonesian, the government plays a very important role to increase rice production amid the small-scale landholdings employed by the farmers. Achieving self-sufficiency in rice, reducing dependency on import, and improving farmer’s income are among the goals of food security development program for which the government has launched many relevant activities. The introduction of agricultural insurance is one of the appropriate activities to protect the farmer’s interests. With the issuance of farmer’s protection and empowerment law in 2013, rice crop insurance has been, to some extent successfully conducted although its implementation mechanism need some improvement. The extension of rice crop insurance coverage to encompass larger area since 2015/2016 planting season has been materialized on the ground of farmer’s acceptance and enthusiasm to participate. Experience to close rice crop insurance due to natural disaster and synthesizing indemnity-based insurance with public-private partnerships scheme are among the lesson learned and discussed in this paper. Challenges to carry out different insurance models for rice crop and opportunity to implement insurance programs on other agricultural commodities are also outlined.

Keywords: Crop Protection, Farmer’s Participation, Government Subsidy, Partnerships, Rice Production

INTRODUCTION

Agricultural sector plays an important role in the overall Indonesian economy. Indonesian agriculture is characterized by smallholding farm size with low level of farmer’s education. Most of the farmers are considered as household engaged in various agricultural businesses. Based on the 2013 agricultural census data, the number of farmers working in agriculture has reduced by 16.32% from 31,23 million households (2003) to 26.14 million households (2013) due to some reasons (Badan Pusat Statistik, 2013). Land conversion from agriculture to non-agriculture use and the rapid development of technology are arguable among the factors affecting the decreasing trend of farmers working in agricuoltural sector.

With various problems associated with agriculture, the Indonesian government is in a strategic position to manage the dynamic development of agricultural sector amid the increasing demand of food crops and other agricultural commodities following the steadily increase of population growth. Increasing agricultural production and improving farmer’s welfare, sppecifically those who are living in rural areas have been included in the national agricultural development strategic programs and used as the basis of its short-term food and agriculture development activities. In the context of national food security, the development of major crops should be prioritized. The government is in its endeavor to maintain self-sufficiency in rice and to keep increase the production of corn and soybean while encourage the production of sugarcane, beef, shallot, and chilli (2015-2019). Rice is the Indonesian staple food and the sufficient supply of this crop in the market should lead to socially, economically and politically stability. It has been for sustainable target that the government takes every initiatives to make this commodity availabile, easy to access, and with affordable price.

Although the government confronted with multidimensional problems, however, efforts to increase crop productions through many launched programs, such as adoption of new technology, farm management improvement, and enhancing water management. All of these activities are directed to improve farmer’s income while learning and adapting the impact of global climate change, specifically in managing food crops toward sustainable food security. FAO Food Outlook biannual report (FAO, 2015) revealed that the increase of rice production in Indonesia (increased by 3.1% in 2015 compared to that of in 2014) as well as higher production in other major producing countries was particularly caused by a return to more normal weather conditions. Some producing countries, however could still experienced lower production, such as Bangladesh and Vietnam (- 0.8 and - 0.4 percent change in 2015 over 2014).

In the implementation stages, however, the agricultural development programs should confront the impact of global climate change and deal with unpredictable price fluctuations. The global warming effect and the massive change of international trade are among the major problems associated with agricultural sector. In recent years, many countries experienced the harvest failure of their respective major food crops and the community were suffered from the skyrocketed prices of such food crops. The shortage supply of food crops, such as rice, corn, and soybean should enforce the government to increase the import that in turn could affect the domestic economic instability. Indonesia is in the middle of this situation and need to safeguard the farmers from huge loss because of such unavoidable risk while gradually improve farmer’s capability. Uncertainty risks covering farm damage and harvest failure should encourage farmers to shift their respective farm from rice (paddy) to oher less risks crops. If this is happen, the impact would immediately instabilize national food security, specifically the availability of and accessibility to rice (Kementerian Pertanian, 2013). Agricultural insurance is one of the policy instruments to meet the farmer’s interests, a tool to prevent farmers from harvest failure, and a program to educate the farmers on agricultural risk management.

Basically, insurance is one of the tools that farmers and other stakeholders can use to manage risks that are too large to manage on their own. Part of that risks are transfered to another party, the insurance companies who takes it in return for a fee or premium. In many countries, crop insurance is largely subsidized by the government, including premium payment, administrative expenses, reinsurance, technical guidance, etc. (Pasaribu and Sudiyanto, 2016). The experience of the USA, Canada, the Philippines, and Spain to apply high subsidy of premium rate (respectively, 60%, 70%, 50-60%, and 58%) should indicate a strong role of the autorities in the implementation of agricultural insurance (Raju and Chand, 2008). In 2003, the estimate value of world insurance premiums is amounted to USD 7.1 billion or about 0.6% of agricultural production value at farmer’s level. The concentration of agricultural insurance are spread out in North America (69%), West Europe (21%), Latin America (5%), Asia (3%), Australia (1%), and Africa (1%) (Roberts, 2005). It was reported that agricultural insurance could influence the use of chemical fertilizers and pesticides in the USA (Horowitz and Lichtenberg, 1993). This is interesting, taking into account its linkage with the campaign of friendly environment and encouragement of local specific farm management. Moreover, agricultural insurance could significantly suggest the reduction of loan/working capital for farm among the small-scale farmers in India (Mishra, 1994). Hazell (1992) emphasized that agricultural sector need to be insured because of risks and uncertainty faced by the farmers that require the intervention of government through appropriate subsidy.

Agricultural protection is required in facing the dynamic of natural phenomena. The variation of farm risks caused by natural disaster has encourage stakeholders to find out some strategies to reduce the effect of ntural calamity to the lowest possible and avoid great loss. Agricultural insurance could divide agricultural risks in the form of financial mechanism and lead the benefit to the farmers.

Where available and affordable, agriculture insurance will provide great benefits to farm households to compliment other risk management approaches. Farmers can rely on informal household and community level strategies such as crop and labor diversification to manage small to moderate risks. In the event of natural disaster, such as flood or drought and infestations of pest and desease, insurance can be designed to protect against cost of production, revenue or consumption losses. This enables households to avoid selling livelihood assets or drawing on savings.

Insurance can also assist farmers in accessing new opportunities by improving their ability to borrow either money or in-linked credits. By doing so, farm households may potentially experience safe and possibly higher return. In this regard, policy in agricultural financial support is essential that it could bring some benefits to the farmers. Considering the low financial ability of small-scale landholding farmers, applied micro financial policy is strategic and the government is suggested to continuously take initiative to introduce, advocate, and socialize new financial scheme to support agricultural insurance program (Pasaribu and Syukur, 2010). Agricultural insurance is also directed to help the farmers to provide their own working capital obtained from the crop insurance claim and could avoid the high interest rate money lenders. The farmers may not pay any cash for premium if there is a program to integrate premium value within the bank loan (farm credit package). The farmers, in this regard, could increase their farm risk management and at the same time encourage investment in agriculture (Pasaribu, 2010; Dick and Wang, 2010).

INDEMNITY-BASED RICE CROP INSURANCE

Rice crop insurance scheme is considered as part of mitigation efforts in response to global climate change. The responses would be materialized through the implementation of various adaptive and adjusted activities to the greater benefits of the farmers. Rice crop insurance is very important to avoid great losses and ensure that the farmers are protected as shown by the availability of cash obtained from insurance claim approval to be used as working capital for their respective farms. This is the immediate effect of having registered as one of the crop insurance participants/ beneficiaries.

In principle, indemnity insurance organize the payment mechanism of insured items. This means that indemnity-based insurance is an insurance policy that aims to protect certain items that could prevent the owners from any losses when they are found to be at fault for a specific event. The crop insurance in Indonesia was designed as indemnity-based insurance as it will cover the risk of certain type of events causing harvest failure over one period of the crop planting season.

Indemnity-based rice crop insurance currently implemented in Indonesia is set to fully cover the total amount of the insured value against the farmer’s farm damage caused by flood, drought, and or pest and disease infestations. Prior to the claim payment, the farm damage should be investigated and when meet the harvest failure criteria, the claim will be approved by loss adjuster (insurance company representative) along with the government official (represented by field extension officer). The claim should follow certain procedures of agreed claim mechanism.

Flood, drought, and pests and diseases have been intentionally choosen and categorized as three types of natural disasters frequently experienced by the farmers. Specific pests and diseases are named in favor of the farmers in each region to ensure that such common threats are included. Five each of the latter is specified and listed in the insurance policy.

Indemnity-based insurance products determine claim payment based on the actual loss incurred by the policy holder. If an insured event occurs, an assessment of the loss and a determination of the indemnity are made at the level of the insured party. The classification is often divided into two subclasses, named peril and multiple peril agriculture insurance (Pasaribu and Sudiyanto, 2016):

Named peril agricultural insurance products (damaged-based products). Named peril (damage based), as the name suggests, provides indemnity against those adverse events that are expicitly listed in the policy. This subclass has a number of distinctive features:

Named peril is a popular type of insurance and accounts for a significant portion of the agriculture premiums worlwide. From the perspective of the insured parties, it appeals where firms are located in areas frequently subjected to one of the perils covered, from the insurer’s point of view it is suitable to situations where the damages caused by the named perils are both measurable and have sudden impact.

Multiple peril agriculture insurance products (yield-based products). Multiple peril (yield based or MPCI) provides insurance against all perils that affect production unless specific perils have been explicitly excluded in the contract of insurance. Under this type of insurance, the sum insured is defined in terms of the expected yield to the farmer. Cover is normally set in the range of 50% to 70% of the expected yield. In turn, the expected yield is determined on the basis on the actual production history of the farmer or the area in which the farmer operates.

The sum insured can be based on the future market price of the guaranteed yield if the farmer has an insurable interest or alternatively, if the farmer has taken a loan to finance the crop, the sum insured may be based on the amount of the loan, if the financier has an insurable interest in the crop. The calculation of the payout is based on the extent to which the actual yield falls short of the guaranteed yield at the agreed price or as the shortfall in yield as a percentage of the guaranteed yield applied to the sum insured.

POLICY INITIATIVES FOR RICE CROP INSURANCE APPLICATION

Policy on Agricultural Protection

Indonesian agriculture, particularly food farming is characterized by small landholding and employed by farmer`s household with the average land size at around 0.3 ha per household. Given this small land ownership and the objective to increase rice production, the Ministry of Agriculture (MoA) is responsible to encourage the farmers to steadily improve their respective farm performance. Various adaptive technologies and innovations have been introduced and applied along with government facilities to help the farmers, specifically food crops farmers in the attempt to provide sufficient foods for the people.

The benefits of rice crop insurance program for farmers are: (a) To increase awareness on the risks that threaten agricultural or farming activities and to find ways of coping and mitigation; (b) To promote increased knowledge, skills and improved farm management and risk management; (c) To relieve dependency of farmers on capital from other sources if they can get compensation from the insurance company; and (d) To increase the income and welfare out of the success and sustainability of the farming business. With these benefits, the government took initiative to initially established a task force, Agricultural Insurance Working Group (AIWG) with main role to prepare all necessary requirements to implement agricultural insurance/rice crop insurance in the country.

The vision, mission, and objective and purpose of rice crop insurance are key elements in the implementation of agricultural insurance. Adjusted to the objectives of national agricultural development, these key elements have been formulated as the basic implementation safeguard of rice crop insurance in Indonesia (Pasaribu and Sudiyanto, 2016).

The vision of the rice crop insurance program is to support the achievement of sustainability of rice farming within the national framework of agricultural development. The mission is to provide compensation (indemnity) of losses caused by the named perils (floods, drought, pests, and disease), to promote productivity, increase farmers’ income and welfare, while maintaining environmental sustainability within the national framework of agricultural development. Meanwhile, the objective of rice crop insurance is to establish partnership and cooperation on the basis of principle of utmost good faith among farmers as the insured and an insurance company as an underwriter, in light of supporting the sustainability of agricultural activities amid efforts to improve the competitiveness of agricultural products. The purpose is to maintain the income and welfare of farmers obtained from the provision of production costs through indemnity payment in the event of a claim for damage caused by the above named perils.

The Indonesian MoA set up a special task force in agricultural insurance (AIWG in 2011) with main assignments (a) to formulate agriculture insurance related policies; (b) to identify problems and find solutions in agriculture insurance; and (c) to monitor and evaluate the implementation of agriculture insurance. MoA administers and is responsible to manage 4 (four) directorate general offices, high level administration within the MoA, with each responsible for food crops, horticultures, livestocks, and plantations. I is obvious that within food crops production, rice is the most important staple food for people and largely produced in the country. Rice farming is very vulnerable to the impacts of climate changes and weather anomaly. Rice farmers are categorized as marginal farmers and mostly low income villagers with minimum access to financial institutions. Taking into account the abovementioned reasons, rice is decided to be the first priority subject in crop protection.

The working group had concluded a set of studies on rice crop insurance scheme based on indemnity in the early 2012 and had fairly successfully implemented it on a pilot project in several locations of different agro-ecosystem. This is one of the main reasons to design an indemnity-based rice crop insurance model in order to match with the then, direct compensation scheme of harvest failure. The direct compensation scheme was conducted to compensate rice farmers who suffer from farm damage and/or loss to their rice farm due to flood, drought and pests and deaseas measured using certain parameters. The scheme provide direct compensation in amount of approximately USD 300 in cash for 1 (one) hectare of farm damage. The compensation amount is basically intended to provide the farmers with sufficient initial capital to resume their farm activities during the next planting season. The direct compensation scheme proved to be financially beneficial in protecting suffered rice farmers against harvest failures. However, there has been drawbacks attributable to iregularities in its handling at the low level administration which result eventually in delay and inffective payment.

On legal aspect, the issuance of the law number 19/2013 on Farmer’s Protection and Empowerment and Protection should allow the implementation of agricultural insurance with all related activities. In particular, article 37 of the law clearly mentioned the obligation of central and local government to protect farmers against harvest failure in the form of agriculture insurance. This obligation, should specifically facilitate (a) registration to participate in insurance program; (b) access to insurance company; (c) socialization on insurance program; and (d) premiums payment. The law stated that all aspects related to the execution of the agriculture insurance scheme should be incorporated into minister of agriculture decrees and regulations.

Following this law, the rice crop insurance program has been prepared and conducted in 2012 planting season in several selected rice producing regions in the form of pilot project. This scheme was implemented with the support of state-owned agricultural companies to financially provide 80% of premium rate. The indemnity-based rice crop insurance scheme was relatively successful as a pilot study at which the farmers responded positively and accepted as a way to protect their farm from risks. The implementation report was also discussed among the higher officials and with the endorsement of the parliament, the government was given a mandate to implement rice crop insurance as a initial program to protect rice farmers. The consequence of this approval is that starting in 2014, the government allocated a certain amount of state budget and incorporated in the annual national agricultural development expenditures.

Pilot Project Implementation

Partnerships

In principle, partnership offers many advantages, it is define in a relative scale and distinguished from other relationship types, such as contracting and extension. Partnership, in this regard is to help and advocate partners to achieve certain level of value-added (Brinkerhoff, 2002). Partnership also indicates a growing business responsibility for the environment to achieve “win-win” opportunitiesand for the companies in responding to various forms development dynamics from the society organizations. Government at this point take a lead in preparing many related facilities (Murphy and Bendell, 1999).

In terms of crop insurance, partnerships relation among the stakeholders play a significant role to link the interest of farmers and the objective of insurance company. Meanwhile, the other stakeholders, such as NGO or other local goverment officials take their respective function to encourage insurance application.

Participants

The rice crop insurance program is basically applicable to marginal or small farmers. The pilot is directed to farmers who meet this general criterion. Additional requirements to be eigible are:

(i) The farmers should be registered as member of Farmers Group (Kelompok Tani) with active management administration.

(ii) The farmers should adhere to good agricultural practices as directed by MoA office at district level.

(iii) The farmers should comply with terms and conditions of insurance contract

Locations

The subject matter of rice crop insurance is basically the rice farm laying within the Indonesian rice land territory. However not all rice farm is eligible for the insurance program, unless they meet the following criteria:

(i) Location area meets the standard requirement for rice plantation particularly in irrigation system.

(ii) Location area lies in a relatively large acreage with clear boundaries.

(iii) Eligible farmers are those of marginal farmers with rice farm ownership or rice farm planted not more than 2 ha, irrespective of location split.

Risks covered

The rice crop insurance program covers specific perils namely: flood, drought, and named pests and deseases. As far as pest and desease are concerned, these include 5 kinds of pests and 5 kinds of deseases which generally found and exist in most or everywhere rice farms. Certain areas or locations farmers may claim to have experienced certain threatening pest or desease. Such claims are not enternained by reason of the fact that said pest and desease normally do not account for serious threat and do not cause severe damage.

Risks excluded

There are exclusions in the policy which include general or standard exclusions and specific exclusions. Basically the rice crop insurance policy does not cover loss of or damage to rice farms due to fire and other natural calamities such as earthquake, volcanic eruption, lanslide, tsunami, wind storms and others as specified under the policy.

Premium tariff

Premium tariff is offered to insurers at 3% flat without taking into account the different variation in the degree of risk. The 3% rate is derived from a studies on 10 years historical data on harvest failures due to flood, drought and pest and desease infestations as filed at the MoA. From the historical data, a pure burning cost rate was obtained and allowances for loadings of insurer’s administration and operational expenses and contingency for catastrophe losses were made to arrive at a gross premium rate.

Insurance policy period

There are 2 planting seasons every year, one is wet planting season, normally starting from October to March, and another one is dry planting season, starting from April to September. The rice crop insurance policy therefore applies to every season of which risk coverage starts from first day of planting and expires on date of harvest. However, the pilot study was conducted during the wet planting season.

There is a time excess being applied for the first 10 days of insurance coverage for reasons that the investment cost is relatively low during that moment and it is considered necessary that the insured farmers should take prudential care and exercise prudential skill in managing their early stages of rice plant growth. As by nature, rice plant is growing during the planting period from none to some value, only one claim can be made under this insurance, namely the harvest failures caused by any of the named perils as specified under the policy.

Claims calculation

On the occurence of flood, drought and pest or desease, specialist officers from local agricultural office will carry out site inspection on the affected areas and take actions as applicable to control. These specialist officers with work jointly with claim officers of the insurers or appointed independent loss adjusters. The loss adjustment report of this join team shall be endorsed by local agricultural office for submission to insurers.

The loss claimable under the policy is stipulated as damage to rice farm on each natural rice terrace whereby:

(i) The damage “intensity” reached level of 75% or above.

(ii) The “extent” of damage reaches minimum 75% of total acreage of each natural rice terrace.

Claim payment

Upon verification of claim reports and agreement of the loss amount, insurers will send letter of confirmation to the policyholders (farmer’s groups) detailing the name of insured farmers whose claim is coverable. Within 14 days from the confirmation date, the insurers will settle the claim by way of a inter-bank tranfser or by other means as applicable.

The Application

Following the partnerships definition above mentioned, the first pilot project of rice crop insurance scheme (wet planting season of 2012/2013) was conducted in Tuban and Gresik regencies of East Java Province covering 470.87 ha and employed by 25 farmer’s groups and in Ogan Komering Ulu Timur regency of South Sumatera Province on 152.25 ha (employed by 17 farmer’s groups). The second pilot study was carried out in Jombang and Nganjuk regencies in East Java Province covering 2,970 ha of rice farm. These locations were specifically under collaboration with JICA who contributed to pay 80% of the premiums on behalf of the insured farmers. The MoA at central level provide general guide book to carry out rice crop insurance, while local government support deploy field extension officers to take part in the actual implementation.

The implementation of rice crop insurance was featured by the indemnity-based insurance during the first pilot project (2012/2013 planting season) and the second (2013/2014 planting season) working together with state-owned fertilizers companies and Japan International Cooperation Agency (JICA). Starting 2014/2015 planting season, the government, represented by the MoA was fully in charged and financed the implementation of such insurance. The state-owned insurance company was involved in the implementation of this pilot insurance scheme.

This pilot project in fact was parallelized with the support of state-owned fertilizers companies to help address the burden of a premium of 80% as planned to be a state subsidy. With the sum insured of USD 500 per ha, the insurance premium is USD 15/ha. The 20% or USD 3 shall be paid by the farmers and the 80% or IDR 12 shall be paid by the state-owned companies/JICA.

Based on the extent of pilot project that has been carried out, the amount of each premium in the province of East Java and South Sumatera is USD 1,412 and USD 456.75 against the overall aggregate exposure of liability up to USD 234,435 from the rice farm area of 470.87 hectares, and aggregate exposure of USD 76,125 from the rice farm areas of 152.25 hectares. The insurance policy was issued to each farmer groups collectively as any one insured to avoid the hassle of administration.

Some farmers in the two provinces were suffered from floods. The insurance policy states that each farmer of 1 ha rice farm is entitled to indemnity compensation of USD 500 should it totally damage. The insurance policy also stipulates that insurance claims will be processed immediately after being reported and will get a cash compensation within 14 working days. The data show that approximately 87 ha of the total 623 ha or almost 14% of the land area of the insured suffer harvest failure and thus they filed insurance claims.

The Results

Experience shows that the incidence of harvest failures due to flood were reported to be processed and insurance compensation was received in cash (by bank transfer) within 14 days. However, some among the farmers also had no filed this claim properly and immediately which caused delay in claim settlement (more than 14 days).

Among the factors affecting the implementation of rice crop insurance are: (a) Communication among the stakeholders; (b) Socialization to understand all about agricultural/rice crop insurance systems; (c) Improvement of insurance policy to adjust to the local conditions and farmer’s farm experiences; (d) Institutional gap on regional agricultural development program to be improved for harmonious activities; and (e) Priority on development activities to support farm protection require stakeholder’s political will on decision making process at any level of development.

Rice crop insurance model currently applied is based on cost of production and is proposed to cover risks due to flood, drought, and or pest and disease infestation. In the future, other models, such as yield-based insurance, weather-based insurance, or damage field-based using satellite image data would be potentials to develop and promote at certain agro-ecosystems in the country. This is considered as the dynamic of this agricultural insurance scheme.

Some aspects to be considered to protect farms and the farmers, include (a) Ability to read and interpret weather information and other climate data in its linkage with farm activities (time determination of land preparation, planting time, duration of irrigation, etc); (b) Ability to respond to climate change with adaptive technology application (seed variety resistant to climate change, mutual benefit created by the farmers in their respective groups, etc); and (c) Institutional empowerment to anticipate climate change through different type of training and hands-on practices.

Similar practice was conducted during the wet planting season of 2013/2014. This second pilot project was also carried out in rice producing center in East Java Province. The next pilot study (wet planting season of 2015/2016) was conducted in 16 provinces covering 1 million ha of rice farm. There is no pilot study during the 2014/2015 planting season as this time, the overall evaluation was made to prepare larger coveage of crop insurance with government full financial support. The summary of the pilot rice crop insurance implementation is illustrated in Table 1.

Table 1. Results of the rice crop insurance pilot study by planting season

CLOSING REMARKS AND WAY FORWARD

Closing Remarks

Indemnity-based rice crop insurance is considered as suitable to protect farmers from losses due to flood, drought, and or pests and diseases infestations. This insurance model is well accepted by the farmers and they are willing to follow the guideline set by the government with financial and technical support.

A pilot project of indemnity-based rice crop insurance was introduced in two rice producing provinces (East Java and South Sumatera) in the wet season of 2012/2013. Farmers are positively accepted the scheme as shown during the implementation of the pilot project. The pilot project has successfully worked and there is no reason that similar pilot project should not be expanded and conducted in many locations. Wider coverage of rice crop insurance could provide better learning process of the scheme.

Agricultural insurance in Indonesia includes four sub-sectors: crops, horticulture, livestock, and plantation. Rice crop and livestock insurances have been applied in pilot studies since 2012, and an expansion of the rice crop insurance program has been conducted during the wet planting season of October 2015 to March 2016 (covering 1 million ha at 16 provinces of rice producing centers in the country). Application of indemnity-based rice crop insurance in Indonesia has included pilot studies. A state-owned general insurance company was the sole underwriter in the pilot project implementation. Thus, the partnership model has also been introduced with the support of government facilities to help the farmers to avoid great loss due to farm risks.

The criteria of participants are membership in a farmer’s group that adheres to good agricultural practices, compliance with the terms and conditions of the insurance policy contract, and the rice cultivators, rather than necessarily the farm owners, as the insured. Furthermore, the farms had to be irrigated rice farms with clear boundaries with an area of not more than two hectares, irrespective of location split. The risks covered included the named perils of flood, drought, and five named pests and diseases. The premium tariff was offered to insurers at 3% of the total cost of production (IDR 6 million/ha or USD 500).

Lessons learned from the pilot study include the following:

Way Forward

The goal of agricultural insurance program apart from being a mean of risk transfer and protection is to promote better risk management in farming and to ensure increase in productivity. Having insurance securing their farming activities, farmers will hopefully obtain better access to financing from bank and financial institution. This is inevitably important where the partnership of farmers, insurance companies and banking institution would be expectedly boost the food production and productivity.

Indonesia will continue to develop agricultural insurance program to cover various high economic value commodities by applying different insurance models, such as indemnity based, weather-index based, and yield-index based models. Protection of farmer’s interest is highly considered in the overall agricultural development plan. Food crops, in this concern would be prioritized. In several Africa nations, crop index insurance for food crops was introduced on the basis of the impact of global climate change causing crop damage and need protection (Robertson, 2013). However, the farmers would continue to face high risks even with the application of adaptive technology in the efforts of the farmers to adapt to the climate change.

The two types of insurance index products could be further elaborate as follows: