Min-Hsien Yang,

Professor, Department of International Trade,

Feng Chia University, Taiwan

Abstract

Rice is the staple food and a major crop in Taiwan. Governments have historically emphasized rice self-sufficiency through market price support programs and import restrictions. However, the situation has been changing since the creation of the World Trade Organization (WTO) and the implementation of the Uruguay Round Agreement on Agriculture (URAA) in 1995. Market price support programs have been restricted or changed under URAA requirements.

Food security considerations could always provide a focus for policy adjustment, in a situation of rising world food prices. Taiwan continues to rely on a market price support policy to meet food security objectives. The purchased amount varies with market prices, but the system is not well-suited to stock-holding for food security purposes. In addition, there are often political pressures to raise guaranteed prices, which is not conducive to meeting WTO commitments or to policy reform.

Keywords:

Rice policy, Direct payment, Aggregate Measurement of Support (AMS), Uruguay Round Agreement on Agriculture (URAA), Doha draft modalities

JEL: Q18

Introduction

Rice is the staple food and a major crop in Asian countries. Governments have historically emphasized rice self-sufficiency through market price support programs and import restrictions (David and Huang, 1996). However, the situation has been changing since the creation of the World Trade Organization (WTO) and the implementation of the Uruguay Round Agreement on Agriculture (URAA) in 1995. Many Asian countries, which formerly prohibited imports of rice, were forced to relax this restriction and this has affected domestic rice policies. Market price support programs have been restricted or changed under URAA requirements. The URAA has contributed to policy reforms in many countries (Lim, 2007). Japan and Korea, for example, have terminated government purchases of rice at guaranteed prices and introduced direct payment programs to reduce Aggregate Measure of Support (AMS).

Since AMS was much lower than its bound level in 2010, Taiwan didn’t change rice policy at all. However, the government further raised guaranteed price in 2011 to support farmers’ income and this might result in rice AMS being higher than its limit. The product-specific AMS limits are proposed in the latest round of WTO negotiations under the Doha Development Agenda. Under requirement of reducing domestic support, the market price support program must be changed in the near future. Rice policy reforms from price support into direct payment

The Doha Development Agenda has been underway for over 10 years. It has been difficult to reach a final agreement on agriculture in the face of differing national perspectives on such issues as food security, environmental protection, and rural development (Anania, 2005). A 123-page draft text of modalities for a new agreement on agriculture was released on December 6, 2008 by the WTO agricultural negotiating committee.

The purposes of this paper are to examine Taiwanese rice policy under the Doha draft modalities for domestic support.

The Doha draft modalities for agriculture

The Doha draft modalities, which follow three pillars of the Uruguay Round Agreement on Agriculture (URAA) in 1995, involve modifications to the rules governing market access, export competition and domestic support. To some extent these impose additional restrictions, but also allow greater flexibility. Export subsidies and other forms of export assistance are targeted for elimination or control. Under the market access provisions, countries will be allowed to declare a certain number of tariff lines as “sensitive products” for which they can choose to make smaller tariff reductions in exchange for a TRQ expansion. Developing countries can identify a certain percentage of tariff lines as “special products” exempt from tariff reductions.

With respect to domestic support, Chad and Beghin (2004) examined the current definition of agricultural domestic support used by the WTO, focusing on the AMS and other forms of support that are less to least distorting (Blue and Green Box payments). They investigated the possible effects of changing the definition of the AMS so that it better reflects current support conditioned by market forces. However, since the structure of recent support varies considerably by country, a new concept of Overall Trade-Distorting Domestic Support (OTDS) in the Doha draft modalities is defined as the sum of the Total AMS (TAMS), de minimis and blue box. A tiered reduction formula is proposed from a base OTDS level. Tiered reductions also apply to the TAMS in addition to a binding on total blue box support and reductions in de minimis.

There are product-specific limits on the AMS and blue box payments. Certainly the development of product-specific limits on the AMS and the blue box represent a significant improvement over the Uruguay Round (Gifford and Montemayor, 2008). Special and differential treatment is provided for developing countries and there are provisions for recently-acceded members (RAMs) with differences in required reductions, base and implementation periods. The draft modalities for agriculture are summarized in Table 1.

Table 1. Summary of domestic support proposals in the draft Doha modalities for developed, and developing countries and RAMs

|

Component

|

Developed Countries

|

Developing Countries and RAMs

|

|

Overall Trade-Distorting Domestic Support

(OTDS)

|

Sum of:

(1) the Final Bound Total AMS

(2) 10% of the average of total value of agricultural production (base period=1995-2000)

(3) max{average blue box payments or 5% of the average total value of agricultural production}

|

Sum of:

(1) the Final Bound Total AMS

(2) 20% the average of total value of agricultural production (base period=1995-2000 or 1995-2004)

(3) max{average blue box payments or 5% of the average total value of agricultural production}

|

|

OTDS: Tiered reduction formula

|

l If OTDS>60 billion, a reduction rate of 80%.

l If 10

l If OTDS≦10 billion, a reduction rate of 55%.

l Reductions implemented in six steps over five years.

|

l If OTDS>60 billion, reduction rate of 80%×2/3.

l If 10

l If OTDS≦10 billion, then reduction rate of 55%×2/3.

l Reductions implemented in nine steps over eight years.

l Developing country Members with no Final Bound Total AMS commitments are not required to undertake reduction commitments in their Base OTDS.

|

|

Total AMS: Tiered reduction formula

|

l If AMS>40 billion, reduction rate of 70%.

l If 15

l If OTDS≦15 billion, reduction rate of 45%.

l Reductions implemented in six steps over five years.

|

l If AMS>40 billion, reduction rate of 70%×2/3.

l If 15

l If OTDS≦15 billion, reduction rate of 45%×2/3.

l Reductions implemented in nine steps over eight years.

|

|

Product-Specific AMS Limits

|

Average of the product-specific AMS during the Uruguay Round implementation period, 1995-2000.

|

A choice of one of the following methods:

(a) the average product-specific AMS during the base period; or

(b) two times the Member's product-specific de minimis level; or

(c) 20 % of the Annual Bound Total AMS

|

|

de minimis

|

Reduced by no less than 50% effective on the first day of the implementation period.

|

l Reduced by at least two-thirds of the 50% rate in three years from the first day of implementation.

l Developing country Members with no Final Bound Total AMS commitments continue to have the same access as under their existing WTO obligations to the limits provided for product-specific and non-product-specific de minimis.

l Other RAMs with Final Bound Total AMS commitments and which have existing de minimis levels of 5% reduce such levels by at least one-third of the 50% reduction rate with the timeframe for implementation being five years longer.

|

Source: WTO (2008a).

Analysis of WTO notifications under domestic support commitments

In Taiwan, government purchases of rice at guaranteed prices are based on a three-tier system: planned purchases, supplementary purchases, and additional purchases, with different prices and quantities. The weighted average of guaranteed prices is NT$ 20.25 and 20.22 respectively for the 1st and 2nd crop plantings in a single year. Recently, the government purchased quantity has been below 15% of domestic production, plus 65% of the TRQ imported by the government, which accounts for 8% of consumption. The sum of these two sources annually for government stock-holdings for food security should be equal to three months consumption, which is the level set in the Law of Food Management.

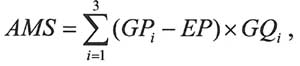

Farmers sell rice to the government if the guaranteed price is higher than the market price and government absorbs production at the margin, so this has the effect of supporting market prices. Consequently, the market price is usually located around the supplementary purchases guaranteed price level. In other words, the formula for market price support in the rice AMS is:

where GPi is the ith guaranteed price component for planned, supplementary, and additional purchases, respectively; EP is the external reference price of NT$ 8.92 per kg, which was based on the CIF price of rice imported by Hong Kong in 1990-1992; GQi is the actual purchase quantity under the ith guaranteed price program, equivalent to the definition of “eligible production” in the URAA. In fact, GQi is determined by farmers who sold paddy rice to the government based on the difference between the guaranteed price and the market price. The larger the price difference, the larger the quantity of government purchases kept as stocks for food security purposes, and the larger the increase in the rice AMS. The purchased quantity was 191 thousand tons in 2010, which was 13% of production.

Support provided to agriculture is supposed to be notified annually to the WTO. However, there are often time lags. In this discussion we follow WTO notifications of domestic support by Taiwan through 2010.

Table 2. Summary of notifications of domestic support by Taiwan, 2002-2010

Units: million NT$

|

|

2002

|

2003

|

2004

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

|

Green box

|

26,009

|

26,974

|

31,767

|

35,277

|

28,964

|

32,198

|

32,160

|

44,065

|

41,428

|

|

Blue box

|

|

|

|

|

|

|

|

|

|

|

Final Bound Total AMS

|

14,165

|

14,165

|

14,165

|

14,165

|

14,165

|

14,165

|

14,165

|

14,165

|

14,165

|

|

Current Total AMS

|

7,057

|

7,534

|

4,758

|

4,043

|

4,180

|

3,650

|

4,015

|

3,854

|

3,881

|

|

Rice AMS

|

4,539

|

5,332

|

2,978

|

2,418

|

2,883

|

2,485

|

2,768

|

2,550

|

2,638

|

|

Total value of rice production

|

32,018

|

28,342

|

27,511

|

28,140

|

29,380

|

26,091

|

31,363

|

33,775

|

30,356

|

|

Rice AMS/production value (%)

|

14.18

|

18.81

|

10.82

|

8.59

|

9.81

|

9.52

|

8.83

|

7.55

|

8.69

|

|

Product-specific AMS de minimis

|

406

|

367

|

318

|

321

|

320

|

294

|

305

|

341

|

324

|

|

Non-product-specific AMS de minimis

|

1,173

|

510

|

625

|

1,220

|

2,512

|

3,043

|

8,258

|

9,211

|

6,186

|

|

Amber Box

|

8,637

|

8,411

|

5,701

|

5,585

|

7,012

|

6,986

|

12,578

|

13,406

|

10,391

|

Source: WTO (2013)

Although Taiwan was not a Member of the WTO in 1995, it began to implement the URAA in that year. However, it did not notify support until it joined the WTO in 2002. The framework of agricultural policy in Taiwan has remained unchanged. Rice policies are still based on government purchases at guaranteed prices and a set-aside program, which has been used to solve the problem of over production stimulated by the guaranteed price.

Domestic support payments under the guaranteed price and set-aside are notified under the amber and green boxes, respectively. In 2002, total domestic support was NT$ 35 billion, of which 25% was amber box. Total green box payments were NT$ 26 billion which mainly consisted of infrastructure services (NT$ 11 billion), the set-aside payment (NT$ 7 billion), technological improvement (NT$ 3 billion), and general research (NT$ 2 billion), but did not include payments for public stock-holding for food security purposes unlike Japan and Korea. After subtracting de minimis of NT$ 1.6 billion from amber box, the Current Total AMS (CTAMS) was NT$ 7.1 billion, which was lower than the Final Bound Total AMS (FBTAMS) of NT$ 12.2 billion. The CTAMS is required not to exceed the FBTAMS, the assumption being that there will be an incentive to reform policies in a less distorting direction if the FBTAMS is likely to be exceeded.

By 2008, the CTAMS had declined to NT$ 4 billion or 28% of the bound level. This situation was quite different from Japan and Korea: their percentages were 77% and 94%, respectively, before they changed their rice policies(WTO, 2008b; WTO, 2008c). Godo and Takahashi(2012) said Japan’s CTAMS was closest to its commitment level, when approximately 70% of the budget was utilized during 1995~1997. This might explain why Taiwan has been able to keep the same rice policy. In addition, the amber box increased to over NT$ 12 billion in that year, because of a large subsidy for fertilizer. The non-product-specific de minimis was about 2.5% of the total value of agricultural production.

The rice AMS in 2008 was NT$2.77 billion or 70% of the CTAMS. Although the government added an additional purchase program in 2003 and raised guaranteed prices by NT$ 2 per kg in 2008, the rice AMS did not increase significantly since the market price increased and the quantity purchased did not rise.

However, in 2011, the government under presidential election pressure further raised guaranteed price by NT$ 3 per kilogram. This caused a significant increase in the quantity purchased and the rice AMS. According to the formula to estimate AMS, it had jumped to NT$ 5.61 billion in 2011and NT$ 6.06 billion in 2012, respectively, was higher than rice AMS limit. The rice AMS limit is NT$ 4.28 billion which is calculated from the average rice AMS during the base period 2002-2004 as notified to the Committee on Agriculture.

According to the Doha draft modalities, product-specific AMS limits can be chosen one from (a) the average product-specific AMS during the base period; or (b) two times the Member's product-specific de minimis level; or (c) 20 % of the Annual Bound Total AMS, where (a) is exactly current AMS limit, (b) is equal to NT$ 2.93 billion of 10% of average production value during the base period, and (c) is equal to NT$ 2.93 billion of 20% of FBTAMS.

Obviously, the current limit, NT$ 4.28 billion, is the best choice for the rice AMS limit. However, the current rice policy has been impossible to meet the draft modalities. It needs to be changed from market support program into direct payment, and it would have different implications depending on whether production-limiting measures were used. As in Korea, a variable payment applied to total production with no production-limiting measures is likely to qualify as AMS. In contrast, as in Japan a variable payment with a production limitation could be notified under the blue box.

Implications of the draft modalities for domestic agricultural support

The Doha draft modalities follow the basic framework of the URAA by requiring further reductions in the FBTAMS. However, they also require a reduction in the OTDS as well as the imposition of product-specific AMS and blue box limits. We assess the implications of the proposals for domestic support in Taiwan.

Taiwan is expected to qualify as a recently acceded member (RAM) and entitled to apply the conditions for developing country members in the draft modalities. The average total value of agricultural production in the 1995-2000 base period was NT$ 295 billion and the Base OTDS is NT$ 88 billion. After the required reduction, the Final Bound OTDS is NT$ 56 billion, which is higher than the sum of CTAMS and de minimis (NT$ 10.39 billion) in 2010. This means that current domestic agricultural support policies would not have to change to meet the new WTO commitments. In addition, the reduced FBTAMS is NT$ 9.92 billion. The 2012 CTAMS was almost half of this level. However, the rice AMS of NT$ 6.06 billion in 2012 was much higher than its limit. If market prices were to increase, the rice AMS would fall but government purchases quantities would also decline, meaning that the government might not be able to acquire sufficient stocks to meet its food security obligations.

In sum, the government would face a dilemma between a higher AMS in meeting its food security obligations or difficulty in meeting these obligations under a lower AMS with lower purchases.

Conclusion

Rice is a major food staple in Taiwan. Government uses a range of policies to ensure that sufficient supplies of this important commodity are available to their people. Membership of the WTO and its Agreement on Agriculture has already caused some rice policy changes. In Japan, government purchases of rice under a guaranteed price were replaced by direct payments with fixed and variable components, notified as green box and blue box, respectively. Box shifting has also occurred through changes in Korean rice policy as it came close to its Total AMS commitment. A direct payment has been substituted for purchases at a guaranteed price, resulting in the likely transfer of some payments to the green box in future notifications. A guaranteed price policy continues to apply in Taiwan. The main reason is that the rice AMS is less than 30% of the FBTAMS.

The proposed domestic support modalities in the Doha negotiations, while limiting the room for maneuver to some extent in the provision of domestic support for rice, would not seem to require major changes in policies in the short run. However, increases in imports under market access provisions in the proposed agreement could exert downward pressure on domestic prices. This factor and domestic considerations of food security and income stabilization are arguments for policy reform.

References

Anania, G., 2005, The Negotiations on Agriculture in the Doha Development Agenda Round: Current Status and Future Prospects, European Review of Agricultural Economics, 32(4), pp. 539-574.

Blandford, D., 2001, Are Disciplines Required on Domestic Support? The Estey Centre Journal of International Law and Trade Policy, 2(1), pp. 35-59.

Blandford, D., I. Gaasland, R. Garcia and E. Vårdal, 2010, How Effective are WTO Disciplines on Domestic Support and Market Access for Agriculture? The World Economy, 33(11), pp. 1470-1485.

Council of Agriculture (COA), 2013, Agricultural Statistics Yearbook. .

Hart, C. E. and J. C. Beghin, 2006, Rethinking Agricultural Domestic Support under the World Trade Organization, in Agricultural Trade Reform and the Doha Development Agenda by K. Anderson and W. Martin Eds., World Bank: Washington, 221-241.

Orden, D., D. Blandford and T. Josling, 2011, WTO Disciplines on Domestic Support: Seeking a Fair Basis for Trade, Cambridge University Press, Cambridge.

World Trade Organization (WTO), 2008a, Revised draft modalities for agriculture. Document no. TN?AG?W? 4. .

World Trade Organization (WTO), 2013, The Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu: Notification of domestic support commitments for 2002-2007. Documents no. G/AG/N/TPKM/32, G/AG/N/TPKM/48, G/AG/N/TPKM/61, G/AG/N/TPKM/68, G/AG/N/TPKM/79, G/AG/N/TPKM/106.

|

Date submitted: March 26, 2015

Reviewed, edited and uploaded: March 27, 2015

|

The Taiwanese Price Support Program under the Doha Development Agenda in WTO

Min-Hsien Yang,

Professor, Department of International Trade,

Feng Chia University, Taiwan

Abstract

Rice is the staple food and a major crop in Taiwan. Governments have historically emphasized rice self-sufficiency through market price support programs and import restrictions. However, the situation has been changing since the creation of the World Trade Organization (WTO) and the implementation of the Uruguay Round Agreement on Agriculture (URAA) in 1995. Market price support programs have been restricted or changed under URAA requirements.

Food security considerations could always provide a focus for policy adjustment, in a situation of rising world food prices. Taiwan continues to rely on a market price support policy to meet food security objectives. The purchased amount varies with market prices, but the system is not well-suited to stock-holding for food security purposes. In addition, there are often political pressures to raise guaranteed prices, which is not conducive to meeting WTO commitments or to policy reform.

Keywords:

Rice policy, Direct payment, Aggregate Measurement of Support (AMS), Uruguay Round Agreement on Agriculture (URAA), Doha draft modalities

JEL: Q18

Introduction

Rice is the staple food and a major crop in Asian countries. Governments have historically emphasized rice self-sufficiency through market price support programs and import restrictions (David and Huang, 1996). However, the situation has been changing since the creation of the World Trade Organization (WTO) and the implementation of the Uruguay Round Agreement on Agriculture (URAA) in 1995. Many Asian countries, which formerly prohibited imports of rice, were forced to relax this restriction and this has affected domestic rice policies. Market price support programs have been restricted or changed under URAA requirements. The URAA has contributed to policy reforms in many countries (Lim, 2007). Japan and Korea, for example, have terminated government purchases of rice at guaranteed prices and introduced direct payment programs to reduce Aggregate Measure of Support (AMS).

Since AMS was much lower than its bound level in 2010, Taiwan didn’t change rice policy at all. However, the government further raised guaranteed price in 2011 to support farmers’ income and this might result in rice AMS being higher than its limit. The product-specific AMS limits are proposed in the latest round of WTO negotiations under the Doha Development Agenda. Under requirement of reducing domestic support, the market price support program must be changed in the near future. Rice policy reforms from price support into direct payment

The Doha Development Agenda has been underway for over 10 years. It has been difficult to reach a final agreement on agriculture in the face of differing national perspectives on such issues as food security, environmental protection, and rural development (Anania, 2005). A 123-page draft text of modalities for a new agreement on agriculture was released on December 6, 2008 by the WTO agricultural negotiating committee.

The purposes of this paper are to examine Taiwanese rice policy under the Doha draft modalities for domestic support.

The Doha draft modalities for agriculture

The Doha draft modalities, which follow three pillars of the Uruguay Round Agreement on Agriculture (URAA) in 1995, involve modifications to the rules governing market access, export competition and domestic support. To some extent these impose additional restrictions, but also allow greater flexibility. Export subsidies and other forms of export assistance are targeted for elimination or control. Under the market access provisions, countries will be allowed to declare a certain number of tariff lines as “sensitive products” for which they can choose to make smaller tariff reductions in exchange for a TRQ expansion. Developing countries can identify a certain percentage of tariff lines as “special products” exempt from tariff reductions.

With respect to domestic support, Chad and Beghin (2004) examined the current definition of agricultural domestic support used by the WTO, focusing on the AMS and other forms of support that are less to least distorting (Blue and Green Box payments). They investigated the possible effects of changing the definition of the AMS so that it better reflects current support conditioned by market forces. However, since the structure of recent support varies considerably by country, a new concept of Overall Trade-Distorting Domestic Support (OTDS) in the Doha draft modalities is defined as the sum of the Total AMS (TAMS), de minimis and blue box. A tiered reduction formula is proposed from a base OTDS level. Tiered reductions also apply to the TAMS in addition to a binding on total blue box support and reductions in de minimis.

There are product-specific limits on the AMS and blue box payments. Certainly the development of product-specific limits on the AMS and the blue box represent a significant improvement over the Uruguay Round (Gifford and Montemayor, 2008). Special and differential treatment is provided for developing countries and there are provisions for recently-acceded members (RAMs) with differences in required reductions, base and implementation periods. The draft modalities for agriculture are summarized in Table 1.

Table 1. Summary of domestic support proposals in the draft Doha modalities for developed, and developing countries and RAMs

Component

Developed Countries

Developing Countries and RAMs

Overall Trade-Distorting Domestic Support

(OTDS)

Sum of:

(1) the Final Bound Total AMS

(2) 10% of the average of total value of agricultural production (base period=1995-2000)

(3) max{average blue box payments or 5% of the average total value of agricultural production}

Sum of:

(1) the Final Bound Total AMS

(2) 20% the average of total value of agricultural production (base period=1995-2000 or 1995-2004)

(3) max{average blue box payments or 5% of the average total value of agricultural production}

OTDS: Tiered reduction formula

l If OTDS>60 billion, a reduction rate of 80%.

l If 10

l If OTDS≦10 billion, a reduction rate of 55%.

l Reductions implemented in six steps over five years.

l If OTDS>60 billion, reduction rate of 80%×2/3.

l If 10

l If OTDS≦10 billion, then reduction rate of 55%×2/3.

l Reductions implemented in nine steps over eight years.

l Developing country Members with no Final Bound Total AMS commitments are not required to undertake reduction commitments in their Base OTDS.

Total AMS: Tiered reduction formula

l If AMS>40 billion, reduction rate of 70%.

l If 15

l If OTDS≦15 billion, reduction rate of 45%.

l Reductions implemented in six steps over five years.

l If AMS>40 billion, reduction rate of 70%×2/3.

l If 15

l If OTDS≦15 billion, reduction rate of 45%×2/3.

l Reductions implemented in nine steps over eight years.

Product-Specific AMS Limits

Average of the product-specific AMS during the Uruguay Round implementation period, 1995-2000.

A choice of one of the following methods:

(a) the average product-specific AMS during the base period; or

(b) two times the Member's product-specific de minimis level; or

(c) 20 % of the Annual Bound Total AMS

de minimis

Reduced by no less than 50% effective on the first day of the implementation period.

l Reduced by at least two-thirds of the 50% rate in three years from the first day of implementation.

l Developing country Members with no Final Bound Total AMS commitments continue to have the same access as under their existing WTO obligations to the limits provided for product-specific and non-product-specific de minimis.

l Other RAMs with Final Bound Total AMS commitments and which have existing de minimis levels of 5% reduce such levels by at least one-third of the 50% reduction rate with the timeframe for implementation being five years longer.

Source: WTO (2008a).

Analysis of WTO notifications under domestic support commitments

In Taiwan, government purchases of rice at guaranteed prices are based on a three-tier system: planned purchases, supplementary purchases, and additional purchases, with different prices and quantities. The weighted average of guaranteed prices is NT$ 20.25 and 20.22 respectively for the 1st and 2nd crop plantings in a single year. Recently, the government purchased quantity has been below 15% of domestic production, plus 65% of the TRQ imported by the government, which accounts for 8% of consumption. The sum of these two sources annually for government stock-holdings for food security should be equal to three months consumption, which is the level set in the Law of Food Management.

Farmers sell rice to the government if the guaranteed price is higher than the market price and government absorbs production at the margin, so this has the effect of supporting market prices. Consequently, the market price is usually located around the supplementary purchases guaranteed price level. In other words, the formula for market price support in the rice AMS is:

where GPi is the ith guaranteed price component for planned, supplementary, and additional purchases, respectively; EP is the external reference price of NT$ 8.92 per kg, which was based on the CIF price of rice imported by Hong Kong in 1990-1992; GQi is the actual purchase quantity under the ith guaranteed price program, equivalent to the definition of “eligible production” in the URAA. In fact, GQi is determined by farmers who sold paddy rice to the government based on the difference between the guaranteed price and the market price. The larger the price difference, the larger the quantity of government purchases kept as stocks for food security purposes, and the larger the increase in the rice AMS. The purchased quantity was 191 thousand tons in 2010, which was 13% of production.

Support provided to agriculture is supposed to be notified annually to the WTO. However, there are often time lags. In this discussion we follow WTO notifications of domestic support by Taiwan through 2010.

Table 2. Summary of notifications of domestic support by Taiwan, 2002-2010

Units: million NT$

2002

2003

2004

2005

2006

2007

2008

2009

2010

Green box

26,009

26,974

31,767

35,277

28,964

32,198

32,160

44,065

41,428

Blue box

Final Bound Total AMS

14,165

14,165

14,165

14,165

14,165

14,165

14,165

14,165

14,165

Current Total AMS

7,057

7,534

4,758

4,043

4,180

3,650

4,015

3,854

3,881

Rice AMS

4,539

5,332

2,978

2,418

2,883

2,485

2,768

2,550

2,638

Total value of rice production

32,018

28,342

27,511

28,140

29,380

26,091

31,363

33,775

30,356

Rice AMS/production value (%)

14.18

18.81

10.82

8.59

9.81

9.52

8.83

7.55

8.69

Product-specific AMS de minimis

406

367

318

321

320

294

305

341

324

Non-product-specific AMS de minimis

1,173

510

625

1,220

2,512

3,043

8,258

9,211

6,186

Amber Box

8,637

8,411

5,701

5,585

7,012

6,986

12,578

13,406

10,391

Source: WTO (2013)

Although Taiwan was not a Member of the WTO in 1995, it began to implement the URAA in that year. However, it did not notify support until it joined the WTO in 2002. The framework of agricultural policy in Taiwan has remained unchanged. Rice policies are still based on government purchases at guaranteed prices and a set-aside program, which has been used to solve the problem of over production stimulated by the guaranteed price.

Domestic support payments under the guaranteed price and set-aside are notified under the amber and green boxes, respectively. In 2002, total domestic support was NT$ 35 billion, of which 25% was amber box. Total green box payments were NT$ 26 billion which mainly consisted of infrastructure services (NT$ 11 billion), the set-aside payment (NT$ 7 billion), technological improvement (NT$ 3 billion), and general research (NT$ 2 billion), but did not include payments for public stock-holding for food security purposes unlike Japan and Korea. After subtracting de minimis of NT$ 1.6 billion from amber box, the Current Total AMS (CTAMS) was NT$ 7.1 billion, which was lower than the Final Bound Total AMS (FBTAMS) of NT$ 12.2 billion. The CTAMS is required not to exceed the FBTAMS, the assumption being that there will be an incentive to reform policies in a less distorting direction if the FBTAMS is likely to be exceeded.

By 2008, the CTAMS had declined to NT$ 4 billion or 28% of the bound level. This situation was quite different from Japan and Korea: their percentages were 77% and 94%, respectively, before they changed their rice policies(WTO, 2008b; WTO, 2008c). Godo and Takahashi(2012) said Japan’s CTAMS was closest to its commitment level, when approximately 70% of the budget was utilized during 1995~1997. This might explain why Taiwan has been able to keep the same rice policy. In addition, the amber box increased to over NT$ 12 billion in that year, because of a large subsidy for fertilizer. The non-product-specific de minimis was about 2.5% of the total value of agricultural production.

The rice AMS in 2008 was NT$2.77 billion or 70% of the CTAMS. Although the government added an additional purchase program in 2003 and raised guaranteed prices by NT$ 2 per kg in 2008, the rice AMS did not increase significantly since the market price increased and the quantity purchased did not rise.

However, in 2011, the government under presidential election pressure further raised guaranteed price by NT$ 3 per kilogram. This caused a significant increase in the quantity purchased and the rice AMS. According to the formula to estimate AMS, it had jumped to NT$ 5.61 billion in 2011and NT$ 6.06 billion in 2012, respectively, was higher than rice AMS limit. The rice AMS limit is NT$ 4.28 billion which is calculated from the average rice AMS during the base period 2002-2004 as notified to the Committee on Agriculture.

According to the Doha draft modalities, product-specific AMS limits can be chosen one from (a) the average product-specific AMS during the base period; or (b) two times the Member's product-specific de minimis level; or (c) 20 % of the Annual Bound Total AMS, where (a) is exactly current AMS limit, (b) is equal to NT$ 2.93 billion of 10% of average production value during the base period, and (c) is equal to NT$ 2.93 billion of 20% of FBTAMS.

Obviously, the current limit, NT$ 4.28 billion, is the best choice for the rice AMS limit. However, the current rice policy has been impossible to meet the draft modalities. It needs to be changed from market support program into direct payment, and it would have different implications depending on whether production-limiting measures were used. As in Korea, a variable payment applied to total production with no production-limiting measures is likely to qualify as AMS. In contrast, as in Japan a variable payment with a production limitation could be notified under the blue box.

Implications of the draft modalities for domestic agricultural support

The Doha draft modalities follow the basic framework of the URAA by requiring further reductions in the FBTAMS. However, they also require a reduction in the OTDS as well as the imposition of product-specific AMS and blue box limits. We assess the implications of the proposals for domestic support in Taiwan.

Taiwan is expected to qualify as a recently acceded member (RAM) and entitled to apply the conditions for developing country members in the draft modalities. The average total value of agricultural production in the 1995-2000 base period was NT$ 295 billion and the Base OTDS is NT$ 88 billion. After the required reduction, the Final Bound OTDS is NT$ 56 billion, which is higher than the sum of CTAMS and de minimis (NT$ 10.39 billion) in 2010. This means that current domestic agricultural support policies would not have to change to meet the new WTO commitments. In addition, the reduced FBTAMS is NT$ 9.92 billion. The 2012 CTAMS was almost half of this level. However, the rice AMS of NT$ 6.06 billion in 2012 was much higher than its limit. If market prices were to increase, the rice AMS would fall but government purchases quantities would also decline, meaning that the government might not be able to acquire sufficient stocks to meet its food security obligations.

In sum, the government would face a dilemma between a higher AMS in meeting its food security obligations or difficulty in meeting these obligations under a lower AMS with lower purchases.

Conclusion

Rice is a major food staple in Taiwan. Government uses a range of policies to ensure that sufficient supplies of this important commodity are available to their people. Membership of the WTO and its Agreement on Agriculture has already caused some rice policy changes. In Japan, government purchases of rice under a guaranteed price were replaced by direct payments with fixed and variable components, notified as green box and blue box, respectively. Box shifting has also occurred through changes in Korean rice policy as it came close to its Total AMS commitment. A direct payment has been substituted for purchases at a guaranteed price, resulting in the likely transfer of some payments to the green box in future notifications. A guaranteed price policy continues to apply in Taiwan. The main reason is that the rice AMS is less than 30% of the FBTAMS.

The proposed domestic support modalities in the Doha negotiations, while limiting the room for maneuver to some extent in the provision of domestic support for rice, would not seem to require major changes in policies in the short run. However, increases in imports under market access provisions in the proposed agreement could exert downward pressure on domestic prices. This factor and domestic considerations of food security and income stabilization are arguments for policy reform.

References

Anania, G., 2005, The Negotiations on Agriculture in the Doha Development Agenda Round: Current Status and Future Prospects, European Review of Agricultural Economics, 32(4), pp. 539-574.

Blandford, D., 2001, Are Disciplines Required on Domestic Support? The Estey Centre Journal of International Law and Trade Policy, 2(1), pp. 35-59.

Blandford, D., I. Gaasland, R. Garcia and E. Vårdal, 2010, How Effective are WTO Disciplines on Domestic Support and Market Access for Agriculture? The World Economy, 33(11), pp. 1470-1485.

Council of Agriculture (COA), 2013, Agricultural Statistics Yearbook..

Hart, C. E. and J. C. Beghin, 2006, Rethinking Agricultural Domestic Support under the World Trade Organization, in Agricultural Trade Reform and the Doha Development Agenda by K. Anderson and W. Martin Eds., World Bank: Washington, 221-241.

Orden, D., D. Blandford and T. Josling, 2011, WTO Disciplines on Domestic Support: Seeking a Fair Basis for Trade, Cambridge University Press, Cambridge.

World Trade Organization (WTO), 2008a, Revised draft modalities for agriculture. Document no. TN?AG?W? 4..

World Trade Organization (WTO), 2013, The Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu: Notification of domestic support commitments for 2002-2007. Documents no. G/AG/N/TPKM/32, G/AG/N/TPKM/48, G/AG/N/TPKM/61, G/AG/N/TPKM/68, G/AG/N/TPKM/79, G/AG/N/TPKM/106.

Date submitted: March 26, 2015

Reviewed, edited and uploaded: March 27, 2015