Dao The Anh[1]

Nguyen Van Son[2]

Abstract

There are many studies about the effects of FTA on Vietnam economy. However, the research on FTAs regarding its relationship with agriculture is limited. This study examines the relationship between FTAs in Asian region and the agricultural value chain. The result suggests that FTAs has positive effects on Vietnam’s economy as a whole but the effects on agriculture sector is not clear. The prices of Vietnamese products exported in the world markets are lower than the same products from other exporting countries and the share of value added in the agricultural value chains for producers is not high. Therefore, there is little incentives for farmer to expand their production. In addition, fruits and vegetables have potential in terms of export oriented production. FTAs also have positive impacts on poverty reduction in Vietnam but the investments in agriculture is small. As a consequence, to increase the value-added for agricultural value chains, potential products should follow the requirements from GI, AO and other food safety standards.

JEL: Q13, Q17, Q18

Keywords: FTA, value chain, agriculture, imports, exports

INTRODUCTION

The Doimoi policy in 1986 marked a new period in Vietnam, a transition from the closed to the market economy and integrating into the world economy. Vietnam has been pursuing the open economy and has actively participated in the globalization process. Consequently, Vietnam’s trade has achieved many successes in the last two decades and openness has rapidly increased. From a country which had to import food, Vietnam has become the second largest rice exporter in the world after India in 2012.

Since 1990, the Vietnamese economy has shown continuous improvement. The GDP has more than doubled in the last decade. In 2010, Vietnam reached a GDP per capita of US$1,160, attaining middle-income status according to World Bank criteria. The annual growth rate since 2000 has averaged 7.2%, second only to China in the Asia-Pacific region. Moreover, the integration of Vietnam into the global economy has accelerated sharply in recent years. Exported goods and services represented 68.3% of GDP in 2009, compared to 34% in 1994, and are concentrated in six product groups – crude oil, textiles and garments, footwear, seafood, wood products and electronic goods – which together, account for around two-thirds of total exports (BTI 2012).

The impact of trade liberalization on Vietnam’s economy is significant in terms of promoting exports, imports and economic growth in the country. The previous studies mostly focused on the effects of Free Trade Agreements (FTA) on Vietnam’s exports (Trung, 2002; Quan, 2005; and Bac, 2010). These show that the FTAs have positive influence on exports. In addition, there has been a rapid growth in agriculture due to the integration of Vietnam in the ASEAN and the world market through FTAs and WTO (Tuyen, 2003; Vanzetti et al., 2011).

However, there have been no studies focusing on the relationship between FTA and agricultural value chains in Vietnam. In the context of international integration, it is believed that FTAs, especially FTA in Asian region, promote the domestic production of export oriented agricultural value chains and poverty reduction. This study analyzes the relationship between the trade liberalization of Vietnam through FTAs and agricultural value chains developments, investments in agriculture and poverty decline in Vietnam as well as discuss opportunities for cooperation between Vietnam and its trading partners in the agricultural sector.

Section 2 provides context of FTAs and macro economy in Vietnam. Section 3 reviews trends in agricultural international trade. Section 4 describes investments in agriculture. Section 5 describes impact on poverty and agricultural production. Section 6 analyzes impact on intellectual property right protection and certification. In Section 7 some conclusions and recommendations are drawn.

Context of FTA and Macro economy in Vietnam

Trade liberalization in Vietnam

According to Anh (2012), Vietnam, together with ASEAN, has concluded and implemented 6 regional FTAs, namely ASEAN Free Trade Area (AFTA) in 2002; ASEAN-China Free Trade Agreement (CFTA) in 2002; Vietnam-Japan partnership economic agreement (VJPCA) and AJCF in 2008; ASEAN-Korea Free Trade Area (AKFTA) in 2006; ASEAN-India Free Trade Agreement (AIFTA) in 2010; ASEAN-Australia-New Zealand Free Trade Agreement (AANZFTA) in 2001 and Vietnam has also concluded more than 100 bilateral trade agreements with its trading partners.

Vietnam’s FTA commitments are consistent with the country’s WTO commitments while going beyond them in certain areas. These FTAs aim at a deeper integration and market access, providing at the same time the necessary instruments for domestic economic safety. They cover various sectors and fundamental principles on trade in goods, trade in services, investment, electronic commerce, movement of natural persons, dispute settlement mechanism, sanitary and phyto-sanitary measures, standards, technical regulations and conformity assessment procedures, intellectual property, competition and other trade-related issues. The most important commitment of trade in goods is the reduction and elimination of tariffs among contracting parties. With regard to trade in services, Vietnam’s commitments generally do not go beyond the level of WTO concessions. Investment provisions in FTAs reflect the standards of Vietnam’s investment promotion and protection agreements and provide further favorable conditions for investors of other parties.

It is clear that Vietnam is still in its early stage of integration through the conclusion of free trade agreements. Almost all FTAs signed by Vietnam are traditional agreements which cover only trade in goods, with separate agreements by sector (excluding AANZFTA). As a developing country with low competitiveness, the FTA policy followed by Vietnam is selective and is concluded with an appropriate timeframe, in accordance with the actual conditions of Vietnam’s economy. Agriculture bears a significant impact on the majority of the country’s population, and influences the socio-economic development its political stability. Thus, agriculture is always a sensitive area in bilateral and multilateral FTA negotiations. In the said negotiations, Vietnam has not separated agriculture into basic and processed products, as in the WTO‘s classification. However, the level of commitments of different agricultural products and between raw material and processed products are different depending on the level of sensitivity, such as high, medium, low, or the level of competitiveness. In addition, in its WTO commitments and bilateral and multilateral FTAs, tariff quotas are applicable to agricultural products.

Vietnam’s macroeconomics and agriculture

Agriculture plays an important role in Vietnam’s national economy, accounting for the livelihood of two-thirds of the population and for 22% of the total GDP. The total trade value of agricultural, forestry, and fishery products reached US$16.5 billion and US$15.6 billion in 2008 and 2009 respectively, accounting for 25% of total export value. Major agricultural products for exports are rice, coffee, rubber, tea, cashew nut, pepper, tropical vegetables and fruits. The ratio of export to production is high: pepper 95-98%, coffee and cashew nut 90%, rubber 85%, tea 75%, and rice 25% (BTI 2012).

The value of agricultural imports in 2008 was US$5.71 billion, an increase from the 2005 value of US$2.36 billion. The average growth rate of imports from 2005 to 2008 was 34.4%. The main agricultural imports in terms of value are cake of soybeans, palm oil, cotton lint, distilled alcoholic beverage and cigarettes (FAO 2011).

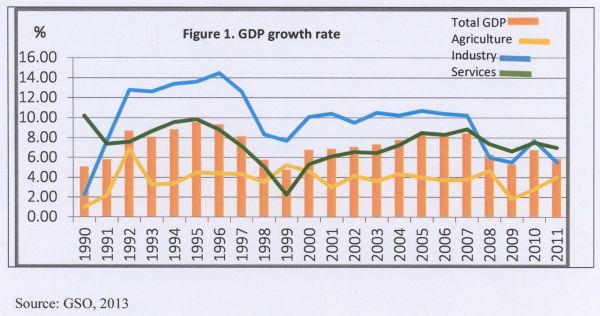

According to the General Statistics Office of Vietnam (GSO), the GDP growth rate of Vietnam fluctuated around 8% from 1990 to 2011. It reached a peak of almost 10% in 1995 and maintained high economic growth during the period 2002 – 2007 due to contribution of the high growth rate of industry and services before the Global financial crisis in 2008. However, agriculture grew at steady rate at approximately 4%. Therefore, the effect of FTA on Vietnam’s agriculture is not significant.

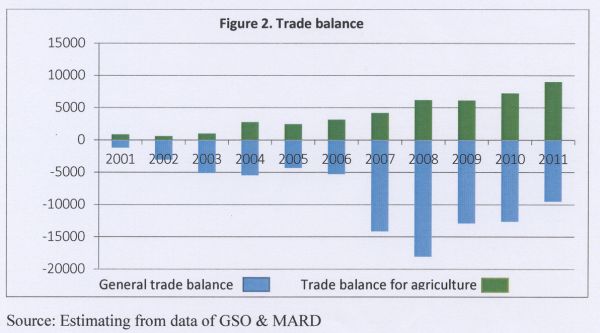

However, agriculture played an important role in trade balance of Vietnam. Agriculture remains the only sector generating net export surplus of over US$9 billion in 2011. This is outstanding achievement of the agriculture in the context of trade deficit of Vietnam from 2000 – 2011.

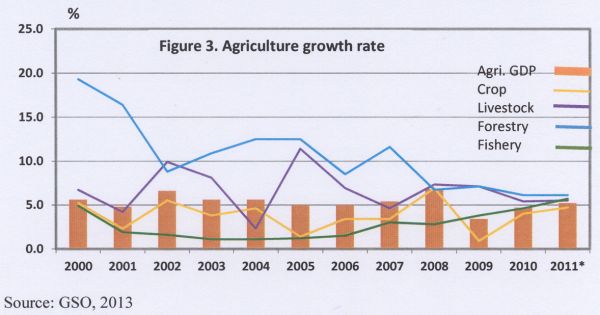

There were high fluctuations of growth rate of livestock and crops while forestry experienced a significant decrease from 2000 – 2011. In contrast, fishery grew slightly from 2% in 2002 to more than 5% in 2011.

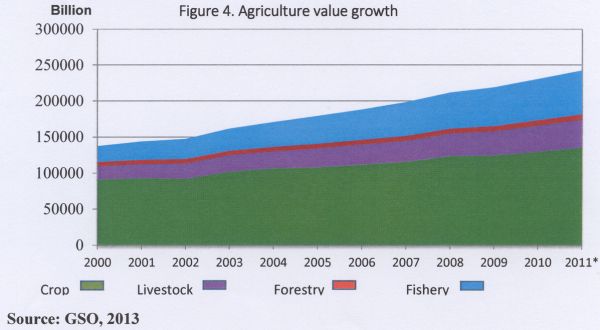

Despite the fluctuation in growth, crops mainly contributed to the value of agriculture in Vietnam compared with fishery, livestock and forestry. This explains the importance of crops such as rice, maize, coffee, tea, cashe in Vietnam’s agricultural development.

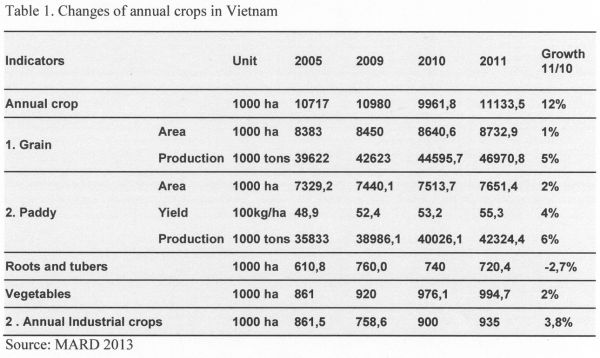

MARD (2013) shows that rice has dominated in terms of production area of crops. Paddy experienced increases not only in production area by 2% in 2011 but also 4% in terms of yield so that the total volume of paddy increased by 6% in 2011. Besides, the production areas of vegetables and annual industrial crops rose by 2% and 3.8% respectively in 2011 except a decrease for roots and tubes.

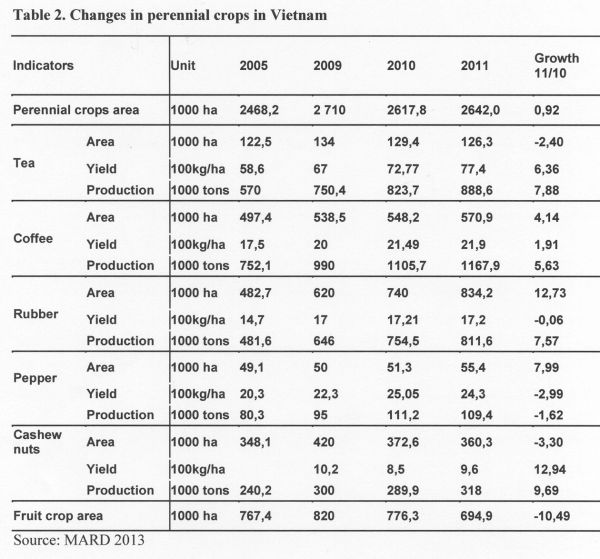

In addition, areas where rubber, coffee and pepper are planted have increased moderately, particularly rubber. Meanwhile areas planted to tea, cashew, as well as fruits have decreased.

The role of domestic market

In recent years, Vietnam has paid much attention to the export market and little attention to the potential of the domestic market, while the total value of domestic food market is always higher compared to exports.Mức thu nhập dân cư tăng kéo theo nhu cầu về chất lượng tăng tại các đô thị tăng lên. Income of people increase and this leads to the rise in quality demand in urban areas. Thị trường đô thị chiếm khoảng trên 40% giá trị của thị trường thực phẩm Việt nam (Moustier et all, 2009). Urban markets accounted for over 40% of the value of the food market of Vietnam (Moustier et al., 2009). Khảo sát một số thị trườ ng đô th ị cấp hai như Long xuyên, Quy nhơn, Đồng hới, Hà tĩnh cho thấy khoảng 20% gạo chất lượng cao thường được nhập từ ĐBSCL hay từ Thái lan, C ă mpuchia chứ không được sản xuất tại chỗ. The survey of some secondary market as Long Xuyen, Quy Nhon, Dong Hoi, Ha Tinh shows that about 20% of high quality rice is from Mekong Delta or imported from Thailand, Cambodia and is not a product of the abovementioned provinces. Như vậy thị trường gạo chất lượng trong nước còn bị bỏ ngỏ. V ụ Đông xuân 2012, lợi nhuận của nông dân trên 1 ha lúa xuất khẩu tại An giang là 16,5 triệu đồng (đạt tỷ lệ lợi nhuận/doanh thu là 46%), trong cùng thời vụ lợi nhuận của 1 ha lúa tẻ chất lượng bán trong nước tại Hải dương là 14,2 triệu đồng. Thus, the quality rice market in the country is not cared appropriately. In the spring –winter crop 2012, the farmers’ profit of 1 ha of exported rice in An Giang was VND16.5 million (profit/revenue rate is 46%), in the same crop time, profit of 1 ha of quality common paddy that was sold in domestic market in Hai Duong was VND14.2 million. Một số mô hình lúa nếp đặc sản của miền Bắc, nông dân có thể có mức lợi nhuận trên 17 triệu đồng/ha. With some models of sticky rice that are specialty of the North, farmers may have a profit of VND17 million/ha. Giá gạo xuất khẩu năm 2012 chỉ bằng 64% giá gạo tẻ chất lượng cao và bằng 90% giá gạo tẻ thường trên thị trường nội địa (Trung tâm HTNN, 2012). Exported rice price in 2012 only accounted for 64% of high quality common rice price and equal to 90% of common rice price in the domestic market (CASRAD, 2012).

Trend of international trade in agricultural sector

In the condition of trade liberalization, Vietnam’s export of agricultural products depends on the world market, especially international export prices.

Export value of agricultural products have increased dramatically, especially pepper, rubber and rubber mainly due to rapid increase in prices of commodities in the period from 2010 to 2011. However, the export prices of rice and tea were almost unchanged in that period because of increasing supply of those from key exporters such as Vietnam, Thailand, China, India... The stable export price and increase in quantity of rice produced in Vietnam lead to a decrease in selling price for Vietnamese farmers in 2013 (MARD 2013).

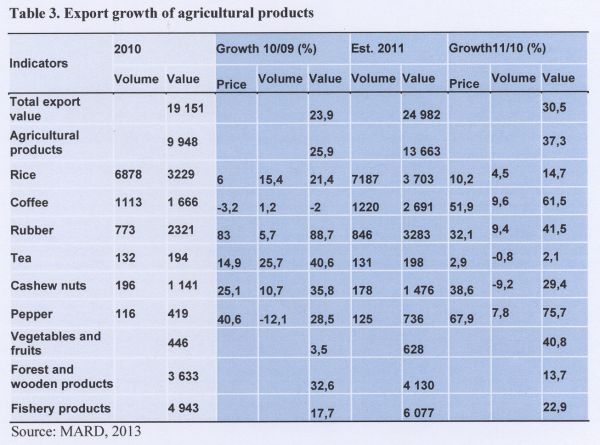

It is clear that rice still plays an important role in Vietnam’s export of agricultural products. In addition, rubber increasingly contributed to export value for Vietnam through high rapid growth of its exports (88% in 2010 and 41% in 2011). Interestingly, although there was a decline in the export growth of coffee in Vietnam 2010, it rose rapidly in 2011 by more than 60% compared with previous year. Recently, vegetables and fruits are also potential exported products recently. The exports of these increased sharply by about 41% in 2011 after a slight rise in 2010.

Rice value chain

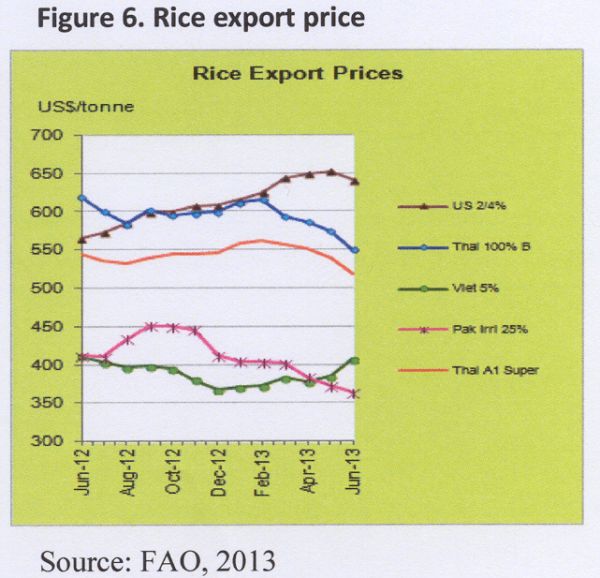

According to FAO 2013, the rice export price for Vietnam’s rice was always lower than that for the US and Thailand. The price for Vietnam’s rice fluctuated around US$ 400/ton while the US and Thailand rice reached US$ 650/ton in July 2013 and above US$ 600/ton in February 2013, respectively. However, the export price trend for US and Thailand’s rice has been decreasing in comparison with an increasing trend for Vietnam’s export price for rice. This is because it is expected that the supply of rice from exporters such as Vietnam, Thailand and India is increasing.

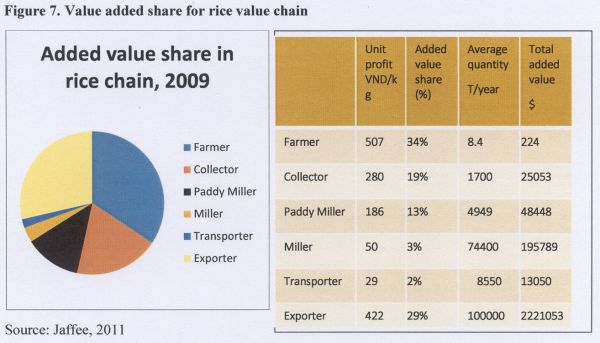

Although rice brings a large amount of foreign currency for Vietnam’s economy, the added value share for farmers is relatively small compared with that for other stakeholders in the chain. The World Bank (2010) shows that farmers can earn only 34% of the value added while the value in the chain has to share with many other stakeholders such as exporters (29%), collectors (19%), paddy miller (13%). However, the rice quantity of a farmer produced is about 8.5 tons so that the profit/farmer is only US$224/year, much less than that for others. Therefore, there is no incentive for farmers to expand their production.

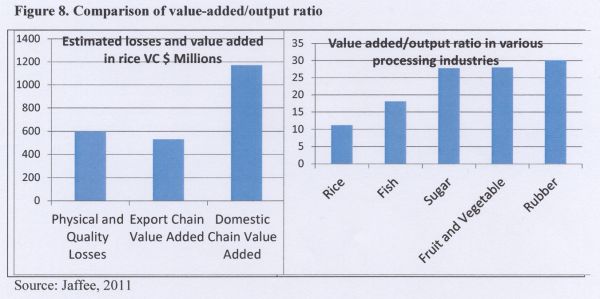

Moreover, Vietnam rice value chain brings about the least additional value in comparison with other products (Jaffee, 2011). Regarding the processing industry, rice creates only around 10% of value added while that number for fruits and vegetables, sugar and rubber is about 30%. Therefore, rice processing industry attracts low level of investments.

The current status of Vietnam rice value chain is represented by the following characteristics. First, the production is dispersed with two main producing regions in Red River Delta and Mekong River Delta. There are a lot of small stakeholders joining in but with little cooperation and coordination along the weak chain and there is not any long-term strategies for rice value chain development in Vietnam. Second, there is not any difference in rice quality because of the mixture between high quality variety and low quality, little brand, without its geographical origins. The provision for high quality market sector is still limited. Third, the innovation for rice production is weak because few successful innovative models in the field of modern technology innovation or efficient organizational institution in the value chain are applied and spread. Fourth, the chain has low-added value because it has high cost and much physical loss in the post-harvest stage. Therefore, it does not meet the quality demand for domestic and international consumers.

Coffee value chain

Apart from rice, coffee is also a key factor contributing to Vietnam’s export of agricultural products.

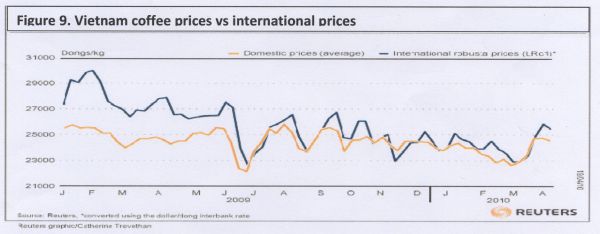

The domestic price of coffee is lower than the international price and tends to decrease recently. This is an opportunity for exporters to increase the Vietnam coffee by selling it to the international market.

Fruits and vegetables value chain

Fruits and vegetables are also potential products of Vietnam to export to the world market. China, Japan, Indonesia, Russia and Netherlands are the main importing markets of Vietnam’s fruits and vegetables. China is the largest imported markets for Vietnamese fruits and vegetables with the revenue of US$73.8 million in 2011 (Vinafruit, 2011). Total turnover for exporting these is US$628 million so there is so much potential for future development of these products.

.jpg)

However, there are some constraints in the fruits and vegetables value chain. First, export value growth is steady but the export of fruits and vegetables still occupy a very small proportion of the country’s exports. Second, the Government and concerned agencies do not have as much care and support for it as rice, seafood, rubber, tea and coffee. They lack investments for fruits and vegetables production and its post-harvest phase. Third, Vietnam does not have seedling centers while the seedling supply system is not very good. Fourth, farmers have limited knowledge in food safety and hygiene due to shortage of guidance. Finally, the processing and preserving sectors cannot handle all products during peak harvesting time. In order to exploit the potential of fruits and vegetables in Vietnam, a strategy is needed to upgrade and modernize the value chain of the while sector.

Therefore, although Vietnam has exported fruits and vegetable and other products to Korea, Japan to encourage the production and exportation of fruits and vegetables, it is necessary to implement contract farming between farmer organizations with foreign companies. Furthermore, to increase its value, it is necessary for export-driven fruits and vegetables to be treated in the following order of priority: Fresh - frozen - canned - juiced and dried. Production of fruits and vegetables should follow Vietnam’s and the international standards such as Participatory Guarantee System (PGS), VietGAP, GlobalGAP, together with promoting low cost certification.

Agricultural value chain and FDI.

FAO (2011) shows that MARD is emphasizing more investments in agriculture and the promotion of rice production, also to ensure the nation’s food security. In 2007, the ratio of foreign investment capital in the agriculture sector was 6.7% of the total FDI in Vietnam. Main investors are from neighboring Asian countries. Although the figure is not high, MARD claims that with over 700 ongoing projects, FDI in agriculture has generated annual revenue of about US$312 million and export turnover of more than US$100 million per year. Projects have also created job opportunities in factories and processing zones for approximately 75,000 people. Agriculture is an encouraged investment sector and, as such, subject to incentives.

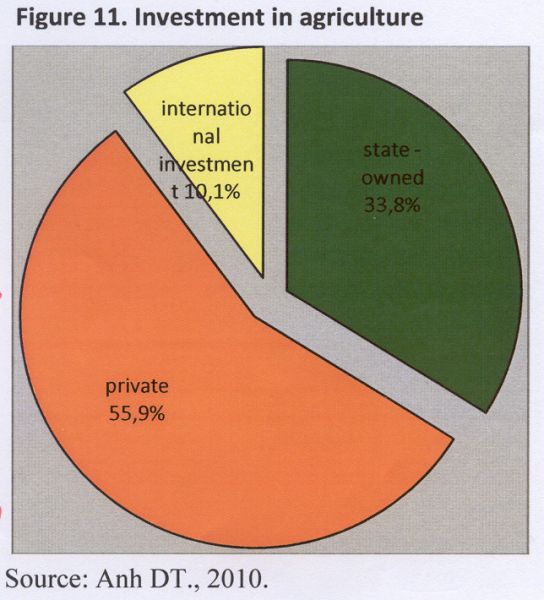

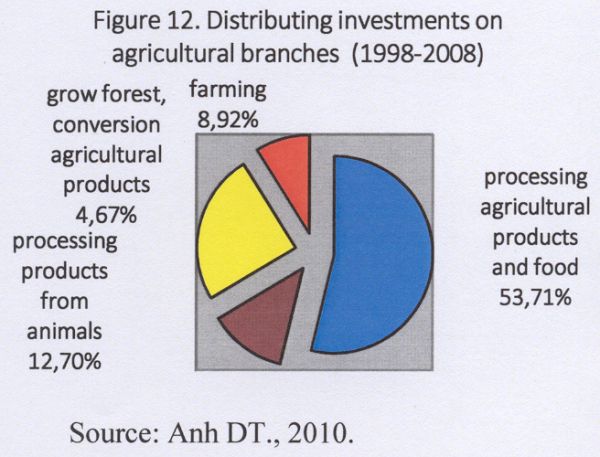

High risks from natural disasters, small-scale production and low profits were the major reasons for lack of interest from investors. Therefore, the investment level on agriculture is low. Most investment in agriculture in Vietnam comes from the private sector (55.9%) and state-owned capital (33.8%) while international investment in agriculture accounts for 10.1% in 2008.

The investment from Vietnamese government includes state-owned investment on agriculture accounting for 14 % the total budget of the nation in 2000 and 6,5 % in 2008; Only 13% invested in agriculture (including all 3 blocks : state-owned , private and FDI) in 2008 and the government invested mainly on infrastructure, irrigation (65%), new technology, training and the enlarging market.

The FDI on agriculture, forestry and the fish-breeding sector

FDI on agriculture accounted for 7% the total of investing capital in 2008.

FDI on agriculture: input services (providing materials, equipment ) and output (processing agricultural products ).

Low FDI on farming production: have many problems in the right of land using and property rights.

Promoting the investments in agriculture is very important to ensure food security and sustainable agricultural development in Vietnam. However, there are some challenges for FDI in agriculture. First, the trade policies overlap, and have lots of contradictions. Government development plans, policies and budget allocations typically give much more support to larger farmers and commercial enterprises, which are often state-owned. While small-scale farmers are not exactly ignored in government policies, in reality, a strong bias exists in favor of larger, low land-based and input-intensive production models (Oxfam 2012). Second, administrative procedure about land access is still complicated, for example, an item in the Land Law only allows farmers to use land within 20 years, which is too short period for agricultural investment. Third, high-skill labor resource is short due to industrialization which attracts most young workers in rural areas to industry zones. Fourth, the capability of diversifying products is controlled and finally, the tax system is not very competitive as the countries in the region.

Impact on poverty and agricultural production

Heo and Doanh (2009) suggest that an important feature is the decelerated pace of poverty reduction between1998 and 2002. During the period 1993–98, poverty was falling at an average of more than four percentage points per year, while this figure was reduced by only two percentage points per year between 1998 and 2002. However, Vietnam regained the momentum during the period 2002–2004.

In addition, poverty also seems related to low education, being in a household whose head is a woman and being from an ethnic minority. As regards activity, poverty is linked to being a farmer, growing main export crops (coffee, cashew, nuts, tea, pepper), as well as import-competing crops or rice. Again, poverty drops most among farmers growing export crops. It also dropped hugely for households in non-traded services, while it actually increased in 2004-2006 for households involved in import competing industries. These descriptive correlations seem to be in line with the expected effects of trade liberalization (Coello et al. 2010).

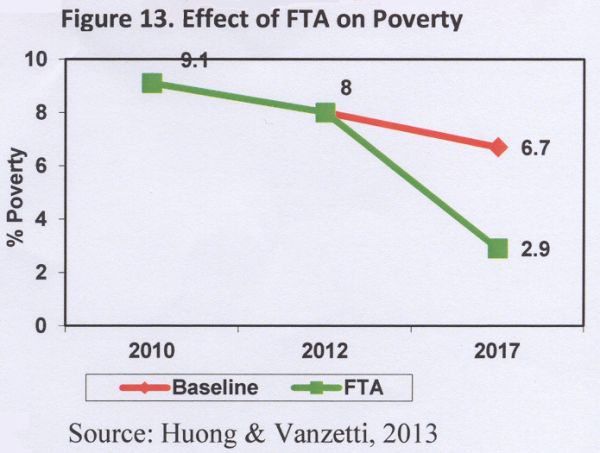

Furthermore, Huong and Vanzetti (2013) show that FTA implementation accelerates poverty reduction. More jobs created for unskilled labor (> 3% points), its wages increase faster. The industry which has the highest growth (textiles, garments, footwear, forestry, livestock, cereals, vegetables and fruits) are agricultral low-skill and labor intensive. Although arable land decreased, the use is more efficient (rate of return increases by > 30 % points). They also predict that the poverty proportion of Vietnam will reduce to 2.9% in 2017 due to the effects from FTAs compared with 6.7% without trade liberalization from Vietnam.

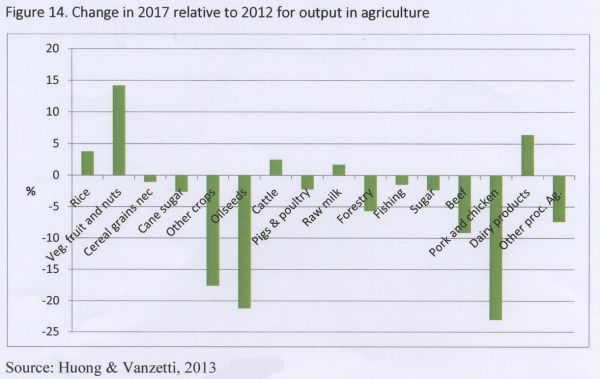

Huong and Vanzetti use the GTAP model to analyze the change in agricultural outputs of Vietnam if there is an FTA shock. The result implies that there is a positive impact of FTA on rice, fruits and vegetables, cattle, raw milk and dairy products. In which, there will be an increase by approximately 15% of fruits and vegetables production. However, other products, especially, pork and chicken, oilseeds and other crops are expected to decrease significantly.

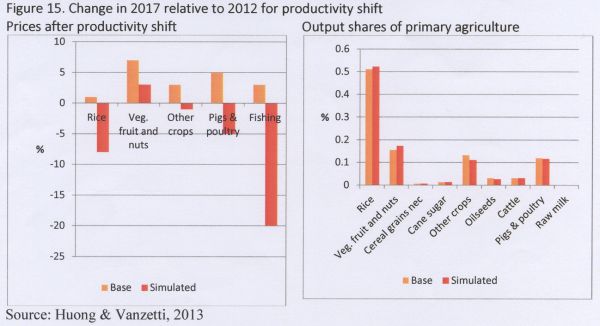

After a shock of an increase in productivity, it is expected that the price of all goods will fall. The price of fishing and rice decline sharply by 20% and under 10% respectively. In the simulated model, prices of all products decrease except that of fruits and vegetables. The reason may be the increase in their supply being offset by their higher increase in demand. Rice is the key factor contributing to the share of primary agriculture (approximately 0.5%).

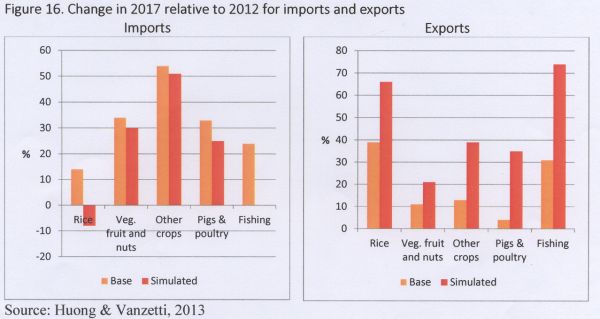

The import and export of agricultural products are also affected by an increasing productivity. While import and export of those rise for both based and simulated data, the import of rice is expected to decrease by nearly 10%. There will be a sharp increase in the demand for fruits and vegetables, other crops and pigs and poultry by 30%, 50% and 25%, respectively. This is a great opportunity for Vietnam’s trading partners exporting these products, especially for fruits and vegetables.

In addition, the simulated data shows higher increases for exports of agricultural products. Rice and fish exports in the simulated data rise much higher than in the based data with 65% and 75% compared with around 40% and 30%. Therefore, the government should have supporting policies for these products toward export oriented production.

Impact on IP protection and certification

Preferential rules of origin are used to determine whether a product qualifies for preferential treatment under an FTA on importation into a partner country. They are necessary to restrict reciprocally negotiated benefits to economic operators of the parties concerned. As a minimum, such rules ensure that goods which are merely trans-shipped or subject to minimal processing in the territories of the parties will not qualify for tariff preferences under the FTA.

Vietnam is a member of the World Intellectual Property Rights Organization (WIPO) and a signatory to a series of international conventions in this field, such as the Paris and Berne Conventions, the Madrid Protocol, the Patent Cooperation Treaty, the Rome Convention, the Geneva Convention (1971) and the UPOV Convention. As a member of the WTO, Vietnam commits to implement the WTO Agreement on Trade - Related Aspects of Intellectual Property Rights (TRIPS). A new Law on Intellectual Property was adopted in 2005 and amended in 2009, bringing Vietnam’s legal system on intellectual property into compliance with international standards, particularly TRIPS/WTO, creating a fair and competitive environment and strengthening the creation and exploitation of specific types of IPRS, such as copyright and related rights, industrial design, trademarks, trade names, geographical indications (GI). However, so far there has been no proven research in Vietnam on the positive effects of the Intellectual Property Law on foreign investments, technology transfer and innovative activities (NOIP 2013).

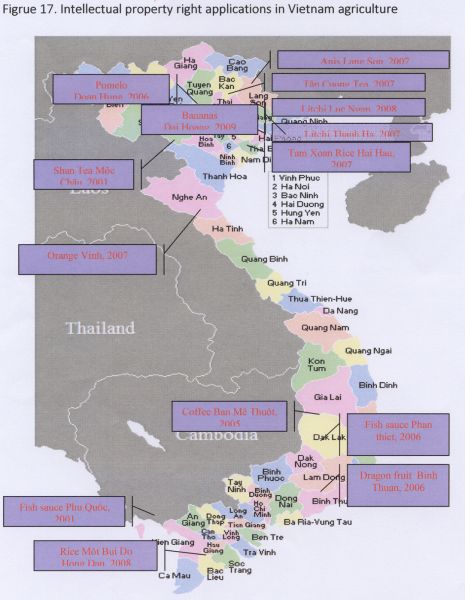

The intellectual property rights (IPR) is applied in Vietnam’s agriculture by Community brand related to geographical area like Geographic Indications (GI), Collective Brand Name and Certified Brand name. Until 2013, there have been 35 products in Vietnam protected by GI. Most of these are agricultural products and few are processed products. For examples, Phu Quoc fish sauces and Moc Chau shan tea were registered as AO protection in 2001, Binh Thuan dragon fruits in 2006, Thanh Ha litchi in 2007. Those products have been sold in high quality markets such as supermarkets or exported to foreign countries with expensive prices. Therefore, the income of farmers have improved. Besides, there are also two foreigner products protected by GI in Vietnam. The GI protection can contribute to Vietnam’s biodiversity protection.

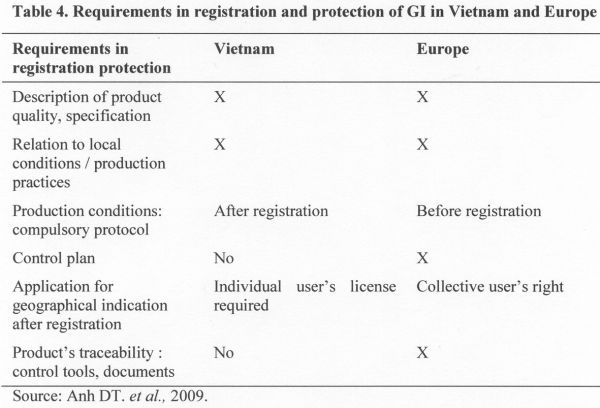

There are almost same requirements in registration protection of GI in Vietnam and Europe except compulsory protocol and application for GI after registration. While Vietnam requires compulsory protocol after registration and applying GI for individual users, compulsory protocol is required before registration and GI applied for collective user’s right in the EU. There are some arrangements that Vietnam can also protect their GI in other nations in order to facilitate the exportation of Vietnamese products, among them a lot of valuable rice and fruit products.

There are also some food safety and private standards applied in Vietnam such as vegetable safety, Vietnam Good Agriculture Practices (VietGAPs), Global Good Agriculture Practices (GlobalGAP), Organic Participatory Guarantee Systems (PGS) and other standards (MetroGAPs). This effort to change the legislative framework for food safety control and quality management is remarkable in the short time since 2010, when the new Food safety Law issued. These are key indicators for Vietnam’s agricultural products selling in exports or was high quality markets.

CONCLUSION

Vietnam participated in many FTAs within THE ASEAN and its trading partners. FTAs have positive effects on Vietnam’s economy as a whole but the effect on agriculture sector is not clear. There are some key exporting products such as rice, coffee, rubber, tea which may gain from FTAs through tariff reductions. However, the prices of Vietnamese products exported in the world markets are lower than the same products from other exporting countries and the share of value added in the agricultural value chains for producers is not that high. In addition, fruits and vegetables have huge potentials in terms of export oriented production and cooperation between Vietnam and its trading countries. The difference in terms of agro-ecological conditions among ASEAN countries (plus 3) is the comparative advantage of Vietnam for agricultural products. FTAs also positively impacts on poverty reduction in Vietnam but the investment in agriculture is small due to low rate of return and risks of agricultural production. Therefore, to increase the value added for agricultural value chains, potential products should follow the requirements from GI and other food safety standards. The agricultural value chain modernization with a high logistic level and innovative management scheme is the challenge for Vietnam in the short term. But there are also opportunities for FDI from ASEAN (plus 3 regions), particularly in the sector of fruits and vegetables.

There are opportunities for cooperation in agriculture within ASEAN (plus 3) in the future. Regarding upgrading of agricultural value chains, supporting policies should be recommended such as: promoting the seed supply, mostly for vegetable diversification, public-private partnership in the processing, storage, applying international certification, applying modern packaging technology and traceability systems, applying technology in market information and agricultural product marketing. For value chain upgrading, investments should be integrated in the logistic chain as well as institutions in the chain.

REFERENCES

Anh, DD, 2012, ‘Trade Liberalization and Institutional Quality: Evidence from Vietnam’, Munich Personal RePEc Archive (MPRA), Paper No. 38740, 2012.

Anh DT., Binh TV, Minh BV, Huan DD, Sautier D., 2009. Models of geographical indication protection in Vietnam: facts, difficulties and prospects. Presentation at The XXVII International Conference of Agricultural Economists, 16 – 22 August 2009, Beijing International Convention Center, Beijing, China. Mini symposium “Geographical indications in the landscape of global agriculture”. 11 p.

Anh DT., 2010. The challenge of food security: towards new food policy in Vietnam. RCSD International Conference "Revisiting Agrarian Transformations in Southeast Asia: Empirical, Theoretical and Applied Perspectives". 13-15 May 2010. Chiang Mai, Thailand. 8 p.

Bac, NX. 2010, ‘The determinants of Vietnamese export flows: static and dynamic panel gravity approaches’, International Journal of Economics and Finance, viewed 10th May 2012, < http://www.ccsenet.org/journal/index.php/ijef/article/download/4853/5926>.

BTI, 2012, ‘Bertelsmann Stiftung, BTI 2012 — Vietnam Country Report’, Gütersloh: Bertelsmann Stiftung, 2012.

Bo NV, Anh DT. 2012. Nâng cao giá trị gia tăng trong chuỗi giá trị nông sản ở Việt NamUpgrading the adding value in the agricultural value chain in Vietnam. CASRAD working paper.8 p.

Coello, B et all 2010, ‘Trade liberalization and poverty dynamics in Vietnam 2002-2006’, Paris School of Economics, Working Paper, No. 13, 2010.

FAO, 2011, ‘Foreign Agricultural Investment Country Profile – Vietnam’, FAO Investment Policy Support, 2011.

FAO, 2013, ‘FAO rice price update’, viewed 6 August 2013, .

GSO, 2013, ‘General Statistics Office of Vietnam’, viewed 2 August 2013, .

Heo, Y & Doanh, NK, 2009, ‘Trade Liberalization and Poverty Reduction in Vietnam’, The World Economy, 2009.

Huong, PL. & Vanzetti, D. 2013, ‘Impact of international economics integration on poverty: results from global trade analysis model GTAP and micro simulations’, Report on evaluating impact of WTO commitments of Vietnam on agriculture and rural development’, Hanoi, 2013.

MARD, 2013, ‘Ministry of Agriculture and Rural Development of Vietnam’, .

Moustier, P & Tam, PTG & Anh, DT & Binh, VT & Loc, NTT2009. The role of farmer organization in supplying supermarkets with quality food in Vietnam. 2009, ‘The role of farmer organization in supplying Supermarkets with quality food in Vietnam’, In Food Policy, vol. Food Policy, vol. 35, pp 69-78. doi: 10.1016/j.foodpol.2009.08.003. 35, pp. 69-78. Doi: 10.1016/j.foodpol.2009.08.003.

NOIP, 2013, ‘National Office of Intellectual Property Rights’, Ministry of Science Technology, Vietnam, < http://www.noip.gov.vn/>.

Oxfam, 2012, ‘Growing a better future - Expanding rights, voices and choices for small-scale farmers in Vietnam’, Oxfam, 2012.

Quan, NT 2005, ‘Capacity for Vietnam-Japan free trade agreement: a gravity model analysis’, Discussion Paper, Research Seminar in International Economics, no. 494.

Tuyen, TV, 2003, ‘Integrated assessment of trade liberalization in rice sector, Vietnam’, UNEP Country Project, Hue University of Agriculture and Forestry, 2003.

Trung, NT 2002, ‘Vietnam trade liberalization in the context of ASEAN and AFTA’, Discussion Paper, Centre for Asian Studies, Centre for International Management and Development, Antwerp.

Vanzetti, D 2011, ‘A comparison of Indonesian and Vietnamese approaches to agriculture in the ASEAN-China FTA’, Contributed paper at the 55th AARES Annual Conference, Melbourne, Victoria, 8-llth February 2011.

Vinafruit, 2011, ‘Overview of current Vietnamese fruits and vegetables exports’, viewed 6 August 2013, < http://bizlinkmedia.com.vn/download/tinh_hinh_xuat_khau_rau_qua_viet_nam....

S. Jaffee và cộng sự . 2011. World Bank . Vietnam rice, Farmer and Rural development. et al. 2011. World Bank. Vietnam rice, Farmer and Rural development. From successful growth to sustainable prosperity. From Sustainable prosperity to successful growth. 100 p. 100 p.

[1] Phd. Dao The Anh – Director of Centre for Agrarian System Research and Development (CASRAD), Email: daotheanh@gmail.com

[2] Msc. Nguyen Van Son – Department of Agricultural Economics and value chain, Email: vanson2000@gmail.com

| Submitted as a country paper for the FFTC.NACF International Seminar on Threats and Opportunities of the Free Trade Agreements in the Asian Region, Sept. 29-Oct. 3, 2013, Seoul, Korea |

Vietnam Agricultural Value Chain in the FTA of Asian Region

Dao The Anh[1]

Nguyen Van Son[2]

Abstract

There are many studies about the effects of FTA on Vietnam economy. However, the research on FTAs regarding its relationship with agriculture is limited. This study examines the relationship between FTAs in Asian region and the agricultural value chain. The result suggests that FTAs has positive effects on Vietnam’s economy as a whole but the effects on agriculture sector is not clear. The prices of Vietnamese products exported in the world markets are lower than the same products from other exporting countries and the share of value added in the agricultural value chains for producers is not high. Therefore, there is little incentives for farmer to expand their production. In addition, fruits and vegetables have potential in terms of export oriented production. FTAs also have positive impacts on poverty reduction in Vietnam but the investments in agriculture is small. As a consequence, to increase the value-added for agricultural value chains, potential products should follow the requirements from GI, AO and other food safety standards.

JEL: Q13, Q17, Q18

Keywords: FTA, value chain, agriculture, imports, exports

INTRODUCTION

The Doimoi policy in 1986 marked a new period in Vietnam, a transition from the closed to the market economy and integrating into the world economy. Vietnam has been pursuing the open economy and has actively participated in the globalization process. Consequently, Vietnam’s trade has achieved many successes in the last two decades and openness has rapidly increased. From a country which had to import food, Vietnam has become the second largest rice exporter in the world after India in 2012.

Since 1990, the Vietnamese economy has shown continuous improvement. The GDP has more than doubled in the last decade. In 2010, Vietnam reached a GDP per capita of US$1,160, attaining middle-income status according to World Bank criteria. The annual growth rate since 2000 has averaged 7.2%, second only to China in the Asia-Pacific region. Moreover, the integration of Vietnam into the global economy has accelerated sharply in recent years. Exported goods and services represented 68.3% of GDP in 2009, compared to 34% in 1994, and are concentrated in six product groups – crude oil, textiles and garments, footwear, seafood, wood products and electronic goods – which together, account for around two-thirds of total exports (BTI 2012).

The impact of trade liberalization on Vietnam’s economy is significant in terms of promoting exports, imports and economic growth in the country. The previous studies mostly focused on the effects of Free Trade Agreements (FTA) on Vietnam’s exports (Trung, 2002; Quan, 2005; and Bac, 2010). These show that the FTAs have positive influence on exports. In addition, there has been a rapid growth in agriculture due to the integration of Vietnam in the ASEAN and the world market through FTAs and WTO (Tuyen, 2003; Vanzetti et al., 2011).

However, there have been no studies focusing on the relationship between FTA and agricultural value chains in Vietnam. In the context of international integration, it is believed that FTAs, especially FTA in Asian region, promote the domestic production of export oriented agricultural value chains and poverty reduction. This study analyzes the relationship between the trade liberalization of Vietnam through FTAs and agricultural value chains developments, investments in agriculture and poverty decline in Vietnam as well as discuss opportunities for cooperation between Vietnam and its trading partners in the agricultural sector.

Section 2 provides context of FTAs and macro economy in Vietnam. Section 3 reviews trends in agricultural international trade. Section 4 describes investments in agriculture. Section 5 describes impact on poverty and agricultural production. Section 6 analyzes impact on intellectual property right protection and certification. In Section 7 some conclusions and recommendations are drawn.

Context of FTA and Macro economy in Vietnam

Trade liberalization in Vietnam

According to Anh (2012), Vietnam, together with ASEAN, has concluded and implemented 6 regional FTAs, namely ASEAN Free Trade Area (AFTA) in 2002; ASEAN-China Free Trade Agreement (CFTA) in 2002; Vietnam-Japan partnership economic agreement (VJPCA) and AJCF in 2008; ASEAN-Korea Free Trade Area (AKFTA) in 2006; ASEAN-India Free Trade Agreement (AIFTA) in 2010; ASEAN-Australia-New Zealand Free Trade Agreement (AANZFTA) in 2001 and Vietnam has also concluded more than 100 bilateral trade agreements with its trading partners.

Vietnam’s FTA commitments are consistent with the country’s WTO commitments while going beyond them in certain areas. These FTAs aim at a deeper integration and market access, providing at the same time the necessary instruments for domestic economic safety. They cover various sectors and fundamental principles on trade in goods, trade in services, investment, electronic commerce, movement of natural persons, dispute settlement mechanism, sanitary and phyto-sanitary measures, standards, technical regulations and conformity assessment procedures, intellectual property, competition and other trade-related issues. The most important commitment of trade in goods is the reduction and elimination of tariffs among contracting parties. With regard to trade in services, Vietnam’s commitments generally do not go beyond the level of WTO concessions. Investment provisions in FTAs reflect the standards of Vietnam’s investment promotion and protection agreements and provide further favorable conditions for investors of other parties.

It is clear that Vietnam is still in its early stage of integration through the conclusion of free trade agreements. Almost all FTAs signed by Vietnam are traditional agreements which cover only trade in goods, with separate agreements by sector (excluding AANZFTA). As a developing country with low competitiveness, the FTA policy followed by Vietnam is selective and is concluded with an appropriate timeframe, in accordance with the actual conditions of Vietnam’s economy. Agriculture bears a significant impact on the majority of the country’s population, and influences the socio-economic development its political stability. Thus, agriculture is always a sensitive area in bilateral and multilateral FTA negotiations. In the said negotiations, Vietnam has not separated agriculture into basic and processed products, as in the WTO‘s classification. However, the level of commitments of different agricultural products and between raw material and processed products are different depending on the level of sensitivity, such as high, medium, low, or the level of competitiveness. In addition, in its WTO commitments and bilateral and multilateral FTAs, tariff quotas are applicable to agricultural products.

Vietnam’s macroeconomics and agriculture

Agriculture plays an important role in Vietnam’s national economy, accounting for the livelihood of two-thirds of the population and for 22% of the total GDP. The total trade value of agricultural, forestry, and fishery products reached US$16.5 billion and US$15.6 billion in 2008 and 2009 respectively, accounting for 25% of total export value. Major agricultural products for exports are rice, coffee, rubber, tea, cashew nut, pepper, tropical vegetables and fruits. The ratio of export to production is high: pepper 95-98%, coffee and cashew nut 90%, rubber 85%, tea 75%, and rice 25% (BTI 2012).

The value of agricultural imports in 2008 was US$5.71 billion, an increase from the 2005 value of US$2.36 billion. The average growth rate of imports from 2005 to 2008 was 34.4%. The main agricultural imports in terms of value are cake of soybeans, palm oil, cotton lint, distilled alcoholic beverage and cigarettes (FAO 2011).

According to the General Statistics Office of Vietnam (GSO), the GDP growth rate of Vietnam fluctuated around 8% from 1990 to 2011. It reached a peak of almost 10% in 1995 and maintained high economic growth during the period 2002 – 2007 due to contribution of the high growth rate of industry and services before the Global financial crisis in 2008. However, agriculture grew at steady rate at approximately 4%. Therefore, the effect of FTA on Vietnam’s agriculture is not significant.

However, agriculture played an important role in trade balance of Vietnam. Agriculture remains the only sector generating net export surplus of over US$9 billion in 2011. This is outstanding achievement of the agriculture in the context of trade deficit of Vietnam from 2000 – 2011.

There were high fluctuations of growth rate of livestock and crops while forestry experienced a significant decrease from 2000 – 2011. In contrast, fishery grew slightly from 2% in 2002 to more than 5% in 2011.

Despite the fluctuation in growth, crops mainly contributed to the value of agriculture in Vietnam compared with fishery, livestock and forestry. This explains the importance of crops such as rice, maize, coffee, tea, cashe in Vietnam’s agricultural development.

MARD (2013) shows that rice has dominated in terms of production area of crops. Paddy experienced increases not only in production area by 2% in 2011 but also 4% in terms of yield so that the total volume of paddy increased by 6% in 2011. Besides, the production areas of vegetables and annual industrial crops rose by 2% and 3.8% respectively in 2011 except a decrease for roots and tubes.

In addition, areas where rubber, coffee and pepper are planted have increased moderately, particularly rubber. Meanwhile areas planted to tea, cashew, as well as fruits have decreased.

The role of domestic market

In recent years, Vietnam has paid much attention to the export market and little attention to the potential of the domestic market, while the total value of domestic food market is always higher compared to exports.Mức thu nhập dân cư tăng kéo theo nhu cầu về chất lượng tăng tại các đô thị tăng lên. Income of people increase and this leads to the rise in quality demand in urban areas. Thị trường đô thị chiếm khoảng trên 40% giá trị của thị trường thực phẩm Việt nam (Moustier et all, 2009). Urban markets accounted for over 40% of the value of the food market of Vietnam (Moustier et al., 2009). Khảo sát một số thị trườ ng đô th ị cấp hai như Long xuyên, Quy nhơn, Đồng hới, Hà tĩnh cho thấy khoảng 20% gạo chất lượng cao thường được nhập từ ĐBSCL hay từ Thái lan, C ă mpuchia chứ không được sản xuất tại chỗ. The survey of some secondary market as Long Xuyen, Quy Nhon, Dong Hoi, Ha Tinh shows that about 20% of high quality rice is from Mekong Delta or imported from Thailand, Cambodia and is not a product of the abovementioned provinces. Như vậy thị trường gạo chất lượng trong nước còn bị bỏ ngỏ. V ụ Đông xuân 2012, lợi nhuận của nông dân trên 1 ha lúa xuất khẩu tại An giang là 16,5 triệu đồng (đạt tỷ lệ lợi nhuận/doanh thu là 46%), trong cùng thời vụ lợi nhuận của 1 ha lúa tẻ chất lượng bán trong nước tại Hải dương là 14,2 triệu đồng. Thus, the quality rice market in the country is not cared appropriately. In the spring –winter crop 2012, the farmers’ profit of 1 ha of exported rice in An Giang was VND16.5 million (profit/revenue rate is 46%), in the same crop time, profit of 1 ha of quality common paddy that was sold in domestic market in Hai Duong was VND14.2 million. Một số mô hình lúa nếp đặc sản của miền Bắc, nông dân có thể có mức lợi nhuận trên 17 triệu đồng/ha. With some models of sticky rice that are specialty of the North, farmers may have a profit of VND17 million/ha. Giá gạo xuất khẩu năm 2012 chỉ bằng 64% giá gạo tẻ chất lượng cao và bằng 90% giá gạo tẻ thường trên thị trường nội địa (Trung tâm HTNN, 2012). Exported rice price in 2012 only accounted for 64% of high quality common rice price and equal to 90% of common rice price in the domestic market (CASRAD, 2012).

Trend of international trade in agricultural sector

In the condition of trade liberalization, Vietnam’s export of agricultural products depends on the world market, especially international export prices.

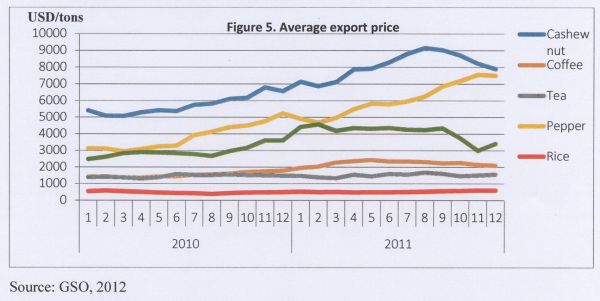

Export value of agricultural products have increased dramatically, especially pepper, rubber and rubber mainly due to rapid increase in prices of commodities in the period from 2010 to 2011. However, the export prices of rice and tea were almost unchanged in that period because of increasing supply of those from key exporters such as Vietnam, Thailand, China, India... The stable export price and increase in quantity of rice produced in Vietnam lead to a decrease in selling price for Vietnamese farmers in 2013 (MARD 2013).

It is clear that rice still plays an important role in Vietnam’s export of agricultural products. In addition, rubber increasingly contributed to export value for Vietnam through high rapid growth of its exports (88% in 2010 and 41% in 2011). Interestingly, although there was a decline in the export growth of coffee in Vietnam 2010, it rose rapidly in 2011 by more than 60% compared with previous year. Recently, vegetables and fruits are also potential exported products recently. The exports of these increased sharply by about 41% in 2011 after a slight rise in 2010.

Rice value chain

According to FAO 2013, the rice export price for Vietnam’s rice was always lower than that for the US and Thailand. The price for Vietnam’s rice fluctuated around US$ 400/ton while the US and Thailand rice reached US$ 650/ton in July 2013 and above US$ 600/ton in February 2013, respectively. However, the export price trend for US and Thailand’s rice has been decreasing in comparison with an increasing trend for Vietnam’s export price for rice. This is because it is expected that the supply of rice from exporters such as Vietnam, Thailand and India is increasing.

Although rice brings a large amount of foreign currency for Vietnam’s economy, the added value share for farmers is relatively small compared with that for other stakeholders in the chain. The World Bank (2010) shows that farmers can earn only 34% of the value added while the value in the chain has to share with many other stakeholders such as exporters (29%), collectors (19%), paddy miller (13%). However, the rice quantity of a farmer produced is about 8.5 tons so that the profit/farmer is only US$224/year, much less than that for others. Therefore, there is no incentive for farmers to expand their production.

Moreover, Vietnam rice value chain brings about the least additional value in comparison with other products (Jaffee, 2011). Regarding the processing industry, rice creates only around 10% of value added while that number for fruits and vegetables, sugar and rubber is about 30%. Therefore, rice processing industry attracts low level of investments.

The current status of Vietnam rice value chain is represented by the following characteristics. First, the production is dispersed with two main producing regions in Red River Delta and Mekong River Delta. There are a lot of small stakeholders joining in but with little cooperation and coordination along the weak chain and there is not any long-term strategies for rice value chain development in Vietnam. Second, there is not any difference in rice quality because of the mixture between high quality variety and low quality, little brand, without its geographical origins. The provision for high quality market sector is still limited. Third, the innovation for rice production is weak because few successful innovative models in the field of modern technology innovation or efficient organizational institution in the value chain are applied and spread. Fourth, the chain has low-added value because it has high cost and much physical loss in the post-harvest stage. Therefore, it does not meet the quality demand for domestic and international consumers.

Coffee value chain

Apart from rice, coffee is also a key factor contributing to Vietnam’s export of agricultural products.

The domestic price of coffee is lower than the international price and tends to decrease recently. This is an opportunity for exporters to increase the Vietnam coffee by selling it to the international market.

Fruits and vegetables value chain

Fruits and vegetables are also potential products of Vietnam to export to the world market. China, Japan, Indonesia, Russia and Netherlands are the main importing markets of Vietnam’s fruits and vegetables. China is the largest imported markets for Vietnamese fruits and vegetables with the revenue of US$73.8 million in 2011 (Vinafruit, 2011). Total turnover for exporting these is US$628 million so there is so much potential for future development of these products.

However, there are some constraints in the fruits and vegetables value chain. First, export value growth is steady but the export of fruits and vegetables still occupy a very small proportion of the country’s exports. Second, the Government and concerned agencies do not have as much care and support for it as rice, seafood, rubber, tea and coffee. They lack investments for fruits and vegetables production and its post-harvest phase. Third, Vietnam does not have seedling centers while the seedling supply system is not very good. Fourth, farmers have limited knowledge in food safety and hygiene due to shortage of guidance. Finally, the processing and preserving sectors cannot handle all products during peak harvesting time. In order to exploit the potential of fruits and vegetables in Vietnam, a strategy is needed to upgrade and modernize the value chain of the while sector.

Therefore, although Vietnam has exported fruits and vegetable and other products to Korea, Japan to encourage the production and exportation of fruits and vegetables, it is necessary to implement contract farming between farmer organizations with foreign companies. Furthermore, to increase its value, it is necessary for export-driven fruits and vegetables to be treated in the following order of priority: Fresh - frozen - canned - juiced and dried. Production of fruits and vegetables should follow Vietnam’s and the international standards such as Participatory Guarantee System (PGS), VietGAP, GlobalGAP, together with promoting low cost certification.

Agricultural value chain and FDI.

FAO (2011) shows that MARD is emphasizing more investments in agriculture and the promotion of rice production, also to ensure the nation’s food security. In 2007, the ratio of foreign investment capital in the agriculture sector was 6.7% of the total FDI in Vietnam. Main investors are from neighboring Asian countries. Although the figure is not high, MARD claims that with over 700 ongoing projects, FDI in agriculture has generated annual revenue of about US$312 million and export turnover of more than US$100 million per year. Projects have also created job opportunities in factories and processing zones for approximately 75,000 people. Agriculture is an encouraged investment sector and, as such, subject to incentives.

High risks from natural disasters, small-scale production and low profits were the major reasons for lack of interest from investors. Therefore, the investment level on agriculture is low. Most investment in agriculture in Vietnam comes from the private sector (55.9%) and state-owned capital (33.8%) while international investment in agriculture accounts for 10.1% in 2008.

The investment from Vietnamese government includes state-owned investment on agriculture accounting for 14 % the total budget of the nation in 2000 and 6,5 % in 2008; Only 13% invested in agriculture (including all 3 blocks : state-owned , private and FDI) in 2008 and the government invested mainly on infrastructure, irrigation (65%), new technology, training and the enlarging market.

The FDI on agriculture, forestry and the fish-breeding sector

FDI on agriculture accounted for 7% the total of investing capital in 2008.

FDI on agriculture: input services (providing materials, equipment ) and output (processing agricultural products ).

Low FDI on farming production: have many problems in the right of land using and property rights.

Promoting the investments in agriculture is very important to ensure food security and sustainable agricultural development in Vietnam. However, there are some challenges for FDI in agriculture. First, the trade policies overlap, and have lots of contradictions. Government development plans, policies and budget allocations typically give much more support to larger farmers and commercial enterprises, which are often state-owned. While small-scale farmers are not exactly ignored in government policies, in reality, a strong bias exists in favor of larger, low land-based and input-intensive production models (Oxfam 2012). Second, administrative procedure about land access is still complicated, for example, an item in the Land Law only allows farmers to use land within 20 years, which is too short period for agricultural investment. Third, high-skill labor resource is short due to industrialization which attracts most young workers in rural areas to industry zones. Fourth, the capability of diversifying products is controlled and finally, the tax system is not very competitive as the countries in the region.

Impact on poverty and agricultural production

Heo and Doanh (2009) suggest that an important feature is the decelerated pace of poverty reduction between1998 and 2002. During the period 1993–98, poverty was falling at an average of more than four percentage points per year, while this figure was reduced by only two percentage points per year between 1998 and 2002. However, Vietnam regained the momentum during the period 2002–2004.

In addition, poverty also seems related to low education, being in a household whose head is a woman and being from an ethnic minority. As regards activity, poverty is linked to being a farmer, growing main export crops (coffee, cashew, nuts, tea, pepper), as well as import-competing crops or rice. Again, poverty drops most among farmers growing export crops. It also dropped hugely for households in non-traded services, while it actually increased in 2004-2006 for households involved in import competing industries. These descriptive correlations seem to be in line with the expected effects of trade liberalization (Coello et al. 2010).

Furthermore, Huong and Vanzetti (2013) show that FTA implementation accelerates poverty reduction. More jobs created for unskilled labor (> 3% points), its wages increase faster. The industry which has the highest growth (textiles, garments, footwear, forestry, livestock, cereals, vegetables and fruits) are agricultral low-skill and labor intensive. Although arable land decreased, the use is more efficient (rate of return increases by > 30 % points). They also predict that the poverty proportion of Vietnam will reduce to 2.9% in 2017 due to the effects from FTAs compared with 6.7% without trade liberalization from Vietnam.

Huong and Vanzetti use the GTAP model to analyze the change in agricultural outputs of Vietnam if there is an FTA shock. The result implies that there is a positive impact of FTA on rice, fruits and vegetables, cattle, raw milk and dairy products. In which, there will be an increase by approximately 15% of fruits and vegetables production. However, other products, especially, pork and chicken, oilseeds and other crops are expected to decrease significantly.

After a shock of an increase in productivity, it is expected that the price of all goods will fall. The price of fishing and rice decline sharply by 20% and under 10% respectively. In the simulated model, prices of all products decrease except that of fruits and vegetables. The reason may be the increase in their supply being offset by their higher increase in demand. Rice is the key factor contributing to the share of primary agriculture (approximately 0.5%).

The import and export of agricultural products are also affected by an increasing productivity. While import and export of those rise for both based and simulated data, the import of rice is expected to decrease by nearly 10%. There will be a sharp increase in the demand for fruits and vegetables, other crops and pigs and poultry by 30%, 50% and 25%, respectively. This is a great opportunity for Vietnam’s trading partners exporting these products, especially for fruits and vegetables.

In addition, the simulated data shows higher increases for exports of agricultural products. Rice and fish exports in the simulated data rise much higher than in the based data with 65% and 75% compared with around 40% and 30%. Therefore, the government should have supporting policies for these products toward export oriented production.

Impact on IP protection and certification

Preferential rules of origin are used to determine whether a product qualifies for preferential treatment under an FTA on importation into a partner country. They are necessary to restrict reciprocally negotiated benefits to economic operators of the parties concerned. As a minimum, such rules ensure that goods which are merely trans-shipped or subject to minimal processing in the territories of the parties will not qualify for tariff preferences under the FTA.

Vietnam is a member of the World Intellectual Property Rights Organization (WIPO) and a signatory to a series of international conventions in this field, such as the Paris and Berne Conventions, the Madrid Protocol, the Patent Cooperation Treaty, the Rome Convention, the Geneva Convention (1971) and the UPOV Convention. As a member of the WTO, Vietnam commits to implement the WTO Agreement on Trade - Related Aspects of Intellectual Property Rights (TRIPS). A new Law on Intellectual Property was adopted in 2005 and amended in 2009, bringing Vietnam’s legal system on intellectual property into compliance with international standards, particularly TRIPS/WTO, creating a fair and competitive environment and strengthening the creation and exploitation of specific types of IPRS, such as copyright and related rights, industrial design, trademarks, trade names, geographical indications (GI). However, so far there has been no proven research in Vietnam on the positive effects of the Intellectual Property Law on foreign investments, technology transfer and innovative activities (NOIP 2013).

The intellectual property rights (IPR) is applied in Vietnam’s agriculture by Community brand related to geographical area like Geographic Indications (GI), Collective Brand Name and Certified Brand name. Until 2013, there have been 35 products in Vietnam protected by GI. Most of these are agricultural products and few are processed products. For examples, Phu Quoc fish sauces and Moc Chau shan tea were registered as AO protection in 2001, Binh Thuan dragon fruits in 2006, Thanh Ha litchi in 2007. Those products have been sold in high quality markets such as supermarkets or exported to foreign countries with expensive prices. Therefore, the income of farmers have improved. Besides, there are also two foreigner products protected by GI in Vietnam. The GI protection can contribute to Vietnam’s biodiversity protection.

There are almost same requirements in registration protection of GI in Vietnam and Europe except compulsory protocol and application for GI after registration. While Vietnam requires compulsory protocol after registration and applying GI for individual users, compulsory protocol is required before registration and GI applied for collective user’s right in the EU. There are some arrangements that Vietnam can also protect their GI in other nations in order to facilitate the exportation of Vietnamese products, among them a lot of valuable rice and fruit products.

There are also some food safety and private standards applied in Vietnam such as vegetable safety, Vietnam Good Agriculture Practices (VietGAPs), Global Good Agriculture Practices (GlobalGAP), Organic Participatory Guarantee Systems (PGS) and other standards (MetroGAPs). This effort to change the legislative framework for food safety control and quality management is remarkable in the short time since 2010, when the new Food safety Law issued. These are key indicators for Vietnam’s agricultural products selling in exports or was high quality markets.

CONCLUSION

Vietnam participated in many FTAs within THE ASEAN and its trading partners. FTAs have positive effects on Vietnam’s economy as a whole but the effect on agriculture sector is not clear. There are some key exporting products such as rice, coffee, rubber, tea which may gain from FTAs through tariff reductions. However, the prices of Vietnamese products exported in the world markets are lower than the same products from other exporting countries and the share of value added in the agricultural value chains for producers is not that high. In addition, fruits and vegetables have huge potentials in terms of export oriented production and cooperation between Vietnam and its trading countries. The difference in terms of agro-ecological conditions among ASEAN countries (plus 3) is the comparative advantage of Vietnam for agricultural products. FTAs also positively impacts on poverty reduction in Vietnam but the investment in agriculture is small due to low rate of return and risks of agricultural production. Therefore, to increase the value added for agricultural value chains, potential products should follow the requirements from GI and other food safety standards. The agricultural value chain modernization with a high logistic level and innovative management scheme is the challenge for Vietnam in the short term. But there are also opportunities for FDI from ASEAN (plus 3 regions), particularly in the sector of fruits and vegetables.

There are opportunities for cooperation in agriculture within ASEAN (plus 3) in the future. Regarding upgrading of agricultural value chains, supporting policies should be recommended such as: promoting the seed supply, mostly for vegetable diversification, public-private partnership in the processing, storage, applying international certification, applying modern packaging technology and traceability systems, applying technology in market information and agricultural product marketing. For value chain upgrading, investments should be integrated in the logistic chain as well as institutions in the chain.

REFERENCES

Anh, DD, 2012, ‘Trade Liberalization and Institutional Quality: Evidence from Vietnam’, Munich Personal RePEc Archive (MPRA), Paper No. 38740, 2012.

Anh DT., Binh TV, Minh BV, Huan DD, Sautier D., 2009. Models of geographical indication protection in Vietnam: facts, difficulties and prospects. Presentation at The XXVII International Conference of Agricultural Economists, 16 – 22 August 2009, Beijing International Convention Center, Beijing, China. Mini symposium “Geographical indications in the landscape of global agriculture”. 11 p.

Anh DT., 2010. The challenge of food security: towards new food policy in Vietnam. RCSD International Conference "Revisiting Agrarian Transformations in Southeast Asia: Empirical, Theoretical and Applied Perspectives". 13-15 May 2010. Chiang Mai, Thailand. 8 p.

Bac, NX. 2010, ‘The determinants of Vietnamese export flows: static and dynamic panel gravity approaches’, International Journal of Economics and Finance, viewed 10th May 2012, < http://www.ccsenet.org/journal/index.php/ijef/article/download/4853/5926>.

BTI, 2012, ‘Bertelsmann Stiftung, BTI 2012 — Vietnam Country Report’, Gütersloh: Bertelsmann Stiftung, 2012.

Bo NV, Anh DT. 2012. Nâng cao giá trị gia tăng trong chuỗi giá trị nông sản ở Việt NamUpgrading the adding value in the agricultural value chain in Vietnam. CASRAD working paper.8 p.

Coello, B et all 2010, ‘Trade liberalization and poverty dynamics in Vietnam 2002-2006’, Paris School of Economics, Working Paper, No. 13, 2010.

FAO, 2011, ‘Foreign Agricultural Investment Country Profile – Vietnam’, FAO Investment Policy Support, 2011.

FAO, 2013, ‘FAO rice price update’, viewed 6 August 2013,.

GSO, 2013, ‘General Statistics Office of Vietnam’, viewed 2 August 2013,.

Heo, Y & Doanh, NK, 2009, ‘Trade Liberalization and Poverty Reduction in Vietnam’, The World Economy, 2009.

Huong, PL. & Vanzetti, D. 2013, ‘Impact of international economics integration on poverty: results from global trade analysis model GTAP and micro simulations’, Report on evaluating impact of WTO commitments of Vietnam on agriculture and rural development’, Hanoi, 2013.

MARD, 2013, ‘Ministry of Agriculture and Rural Development of Vietnam’,.

Moustier, P & Tam, PTG & Anh, DT & Binh, VT & Loc, NTT2009. The role of farmer organization in supplying supermarkets with quality food in Vietnam. 2009, ‘The role of farmer organization in supplying Supermarkets with quality food in Vietnam’, In Food Policy, vol. Food Policy, vol. 35, pp 69-78. doi: 10.1016/j.foodpol.2009.08.003. 35, pp. 69-78. Doi: 10.1016/j.foodpol.2009.08.003.

NOIP, 2013, ‘National Office of Intellectual Property Rights’, Ministry of Science Technology, Vietnam, < http://www.noip.gov.vn/>.

Oxfam, 2012, ‘Growing a better future - Expanding rights, voices and choices for small-scale farmers in Vietnam’, Oxfam, 2012.

Quan, NT 2005, ‘Capacity for Vietnam-Japan free trade agreement: a gravity model analysis’, Discussion Paper, Research Seminar in International Economics, no. 494.

Tuyen, TV, 2003, ‘Integrated assessment of trade liberalization in rice sector, Vietnam’, UNEP Country Project, Hue University of Agriculture and Forestry, 2003.

Trung, NT 2002, ‘Vietnam trade liberalization in the context of ASEAN and AFTA’, Discussion Paper, Centre for Asian Studies, Centre for International Management and Development, Antwerp.

Vanzetti, D 2011, ‘A comparison of Indonesian and Vietnamese approaches to agriculture in the ASEAN-China FTA’, Contributed paper at the 55th AARES Annual Conference, Melbourne, Victoria, 8-llth February 2011.

Vinafruit, 2011, ‘Overview of current Vietnamese fruits and vegetables exports’, viewed 6 August 2013, < http://bizlinkmedia.com.vn/download/tinh_hinh_xuat_khau_rau_qua_viet_nam....

S. Jaffee và cộng sự . 2011. World Bank . Vietnam rice, Farmer and Rural development. et al. 2011. World Bank. Vietnam rice, Farmer and Rural development. From successful growth to sustainable prosperity. From Sustainable prosperity to successful growth. 100 p. 100 p.

[1] Phd. Dao The Anh – Director of Centre for Agrarian System Research and Development (CASRAD), Email: daotheanh@gmail.com

[2] Msc. Nguyen Van Son – Department of Agricultural Economics and value chain, Email: vanson2000@gmail.com