ABSTRACT

This study explores the impact of non-tariff measures (NTMs) on the agricultural exports of Lao PDR, with a focus on the coffee sector. As a key agricultural product with substantial export potential, Lao coffee faces several challenges, particularly related to sanitary and phytosanitary measures (SPS) and technical barriers to trade. By analyzing the NTMs imposed by key markets such as Thailand, Vietnam, the EU, and Japan, this research highlights the variations in the intensity of these measures and their effects on Lao coffee exporters. Thailand emerges as a particularly restrictive market due to its stringent SPS measures and export-related requirements, while Vietnam despite its broad application of NTMs, offers a relatively more accessible market. The study emphasizes the importance of more enhanced trade facilitation, streamlined regulatory frameworks, and closer cooperation between Lao PDR and its trading partners to mitigate the burden of NTMs. Key policy recommendations include strengthening compliance with international standards, simplifying export procedures, and pursuing favorable trade negotiations. These strategies are essential for unlocking Lao coffee's full export potential, improving competitiveness, and fostering sustainable economic growth within the agricultural sector.

Keywords: Non-Tariff Measure, Sanitary and Phytosanitary, Technical Barrier on Trade, Generalized System of Preferences

INTRODUCTION

Non-tariff measures (NTMs) have become an increasing concern in international trade as tariff rates have significantly declined over the past decade due to various international, regional, and bilateral free trade agreements. While Lao PDR benefits from several trade preferences with its partners, its major exports remain concentrated in electricity, minerals, and garments. Although agricultural products constitute only 10% of the country's total exports, the agricultural sector is crucial, supporting over 60% of the population. NTMs, particularly those related to sanitary and phytosanitary (SPS) measures, are predominantly imposed on agricultural products, posing significant challenges to exporters and farmers in Lao PDR.

Several research works have been discussed on NTMs in Lao PDR (De et al., 2016; Sayasenh, 2016; Chanthanasinh&Wongpit, 2023, Phonvisay, 2023), but none of them are focused on coffee. Sayasenh (2016) overviewed the NTMs and showed that NTMs are high in Laos, there are many non-technical measures such as price control and export-related measures. De et al. (2016) surveyed NTMs faced by exporters from Lao PDR and found that 80% of exporters encounter challenges. Specifically, 87% of agricultural exporters and 76% of manufacturing exporters face NTM-related challenges. Among Lao PDR's trading partners, China and Vietnam were the most trade-friendly due to their relatively low processing requirements and less documentation. In contrast, coffee exporters faced high barriers when exporting to the EU and medium barriers when exporting to the Thai market, particularly due to SPS measures.

Chanthanasinh and Wongpit (2023) analyzed the impact of NTMs on intra-ASEAN imports using the gravity model. Their findings show that Singapore imposes the highest number of import NTMs within ASEAN. Interestingly, the study found a positive relationship between NTMs and imports, which contradicts the initial hypothesis. This is not surprising, as most products traded within ASEAN are industrial goods, while agricultural products constitute a relatively small share of total trade. NTMs are primarily imposed on agricultural products, especially in the form of SPS and TBT. Although the number of NTMs in ASEAN has increased, their impact on overall imports within the region remains minor. The study also focused on the agricultural sector, particularly examining the impact of NTMs on agricultural exports from Lao PDR to China, with a focus on SPS measures. Their analysis revealed that the frequency index and coverage ratio of NTMs significantly decreased between 2016 and 2020, largely due to special trade preferences granted by China. However, the study also found that a higher frequency index and coverage ratio of NTMs had a negative effect on Lao PDR's agricultural exports to China, suggesting that increased NTMs led to lower export volumes from Lao PDR (Chanthanasinh & Wongpit, 2023).

Coffee is one of the significant agricultural production and exports of Lao PDR. It is the third largest agricultural export product for Laos following cassava and banana, of which the main exporting country is China. Coffee is the dominant farming system on the Bolaven Plateau, known for its volcanic fields in the southern part of the Lao PDR. The Ministry of Agriculture and Forestry (MAF) aims to increase coffee production to 280,000 tons by 2025 and improve quality along the value chain. To meet the goals, many activities must be improved. Coffee producers must expand the plantation area and production. Production groups should be established in many places. Market price should be determined among the middlemen. The government should negotiate with trading partners for an export quota and remove NTMs for coffee exports.

This paper aims to analyze the impact of NTMs on the agricultural exports of Lao PDR, with a particular focus on coffee, a high-potential export product. The study includes a case study of coffee exports to Thailand, examining the specific NTMs that affect this trade flow and their implications for exporters. The findings of this study are intended to generate policy recommendations to enhance the competitiveness and growth of the coffee sector in Lao PDR, by addressing existing barriers and creating a more favorable trade environment for agricultural exports.

LAOS’S COFFEE MARKET IN THE WORLD

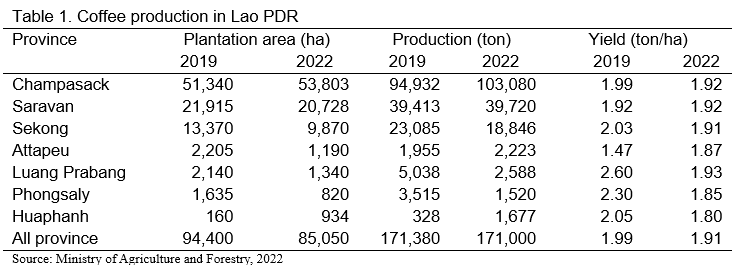

The Lao coffee sector presents a promising market opportunity, driven by growing demand in both domestic and export markets. In 2022, coffee production in Lao PDR ranks the fifth in the plantation area, following rice, cassava, maize, and sugarcane (Ministry of Agriculture and Forestry, 2022). However, the coffee plantation area has decreased significantly from 94,400 hectares in 2019 to 85,050 hectares in 2022, primarily due to the expansion of cassava cultivation (Wongpit et al., 2023) and coffee production also experienced a slight decline, from 171,380 tons in 2019 to 171,000 tons in 2022.

Most coffee production is concentrated in the Bolaven Plateau, particularly in the provinces of Champasak, Saravan, Sekong, and Attapeu. In 2022, Champasak province produced approximately 103,080 tons of coffee, accounting for over 60% of the country’s total production. Sekong province, however, saw a significant reduction in both plantation and production areas as many farmers shifted to cassava cultivation. In contrast, despite a reduction in plantation area, Attapeu province experienced a notable increase in coffee productivity.

Coffee is also grown in the northern regions, including Luang Prabang, Phongsaly, and Houaphanh provinces. Luang Prabang remains the leading coffee producer in the north, though both plantation area and production have declined in recent years. Meanwhile, Houaphanh province has made significant progress in expanding coffee plantations and production, thanks to initiatives like the United Nations Office on Drugs and Crime (UNODC) supporting coffee groups to replace opium cultivation, the French Development Agency (AFD) supporting coffee development in the Bolaven Plateau and northern provinces (Luang Prabang, Houaphanh, Phongsaly, and Champasak), and the United States Department of Agriculture (USDA), with Winrock International managing a project to support coffee cultivation in the Bolaven Plateau and northern Lao.

In 2022, Lao PDR exported approximately US$149 million in coffee, which decreased to US$74 million in 2023. These export levels are relatively modest compared to the world's largest coffee exporters, such as Brazil, with exports valued at US$25 billion, and Vietnam, at US$7.3 billion. Notably, a portion of Vietnamese coffee exports includes coffee sourced from Laos.

Despite a decline to US$76.6 million in 2023, Lao PDR's coffee exports grew significantly from US$64.3 million in 2019 to a peak of US$153.1 million in 2022, driven by rising global market prices. The country primarily exports coffee to ASEAN markets. In 2021, exports to Vietnam totaled approximately US$48.2 million, while exports to other ASEAN countries, including Thailand (US$14 million), Cambodia (US$5 million), and Singapore (US$0.03 million), reached around US$20 million (Trade Map, 2024). Exports to the EU market under the Generalized System of Preferences (GSP) amounted to US$11.39 million, with Belgium importing approximately US$5.92 million worth of Lao coffee and Germany importing around US$3.1 million. Additionally, under the GSP, Japan and the USA imported Lao coffee, which was valued at US$2.67 million and US$1.22 million, respectively (Ministry of Industry and Commerce, 2022).

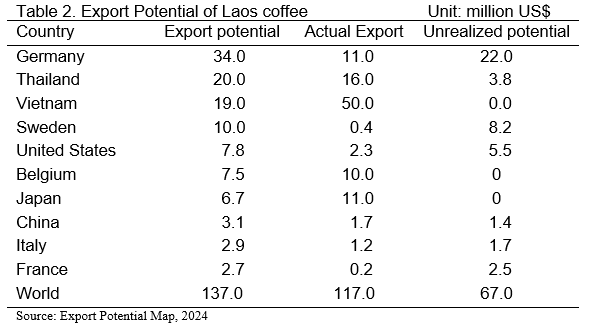

Table 2 presents the export potential of Lao coffee. The Export Potential Indicator estimates the potential export value for an exporter in a specific product and target market using an economic model that integrates the exporter’s supply capacity, target market demand, market access conditions, and bilateral ties between the two countries. For existing export products, supply is assessed using historical export performance data. Comparing potential export values with actual export figures helps identify exporters, products, and markets with growth opportunities (Internationa Trade Centre, 2024). Lao PDR has an export potential of approximately US$137 million, while the actual export value is US$117 million, leaving an unrealized export potential of US$67 million. This indicates that Lao PDR can export more coffee if there is increased demand or if existing trade barriers in importing countries are reduced.

Germany represents the highest export potential market for Lao coffee, but current exports are only valued at US$11 million, highlighting a significant untapped opportunity. Similarly, there is considerable unrealized export potential in markets such as Sweden, Thailand, and the USA. Conversely, Lao PDR’s actual coffee exports to Vietnam, Japan, and Belgium exceed their respective export potentials. This suggests that Laos has already maximized its export capacity to these markets, making it challenging to increase coffee exports further to these countries.

NON-TARIFF MEASURES AND LAO COFFEE EXPORT

NTMs are gaining increasing attention from trade policymakers and analysts. However, analyzing NTMs is challenging due to their complex nature and the lack of readily available data and evidence. Unlike tariffs, NTMs are not easily quantifiable, difficult to model, and the necessary information is hard to collect. Despite these challenges, NTMs are a critical aspect of trade negotiations and remain a key part of the ongoing World Trade Organization (WTO) agenda. The most used NTMs are technical barriers to trade (TBT) and SPS measures (Fugazza and Maur, 2008).

Globally, nearly 60% of imported products are subject to at least one NTM, representing about 80% of the total value of these goods. On average, each imported product must comply with more than three NTMs. In comparison, almost half of all exported goods face an average of 1.3 NTMs. Certain sectors, such as animal, vegetable, and food products, are among the most heavily regulated, with these products subject to an average of 12 NTMs each. The agri-food sector experiences the highest level of technical measures. Interestingly, developing countries tend to impose slightly more technical NTMs than developed countries, with developing nations averaging 5.2 technical NTMs per product compared to 4.8 in developed countries (World Trade Organization, 2021).

NTMs pose significant challenges for exporters, especially in developing countries like Lao PDR, which rely heavily on agricultural exports. In 2022, agricultural exports from Lao PDR generated US$1.2 billion, with US$997 million coming from produce and agricultural products (MOIC, 2022). The primary export markets for Lao products are Thailand, China, Vietnam, Australia, Singapore, and the European Union, which together account for 89.5% of the total export market. Agricultural commodities such as cassava, bananas, coffee, cattle, fruits, rubber, rice, and maize make up 16.23% of total exports. Notably, China, Thailand, and Vietnam account for 90% of Lao PDR's agricultural exports (Food and Agriculture Organization, 2022).

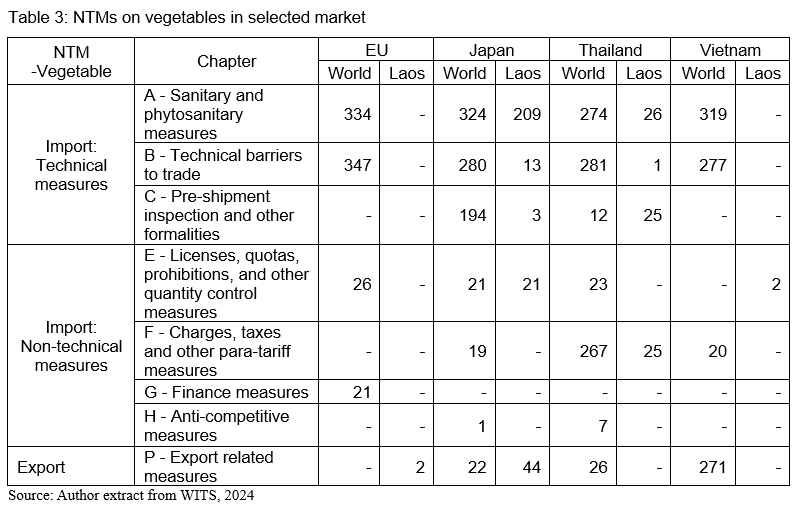

Coffee, classified under Chapter 09: Coffee, Tea, Mate, and Spices in Section II: Vegetable Products of the Harmonized System, is a key export for Lao PDR. Table 3 provides an analysis of NTMs imposed on vegetable imports and exports in key markets, including the EU, Japan, Thailand, and Vietnam, with a specific focus on regulations affecting Lao exports. The NTMs are categorized into technical, non-technical, and export-related measures, highlighting the regulatory challenges Lao exporters face in these markets.

Among the technical measures, SPS measures (Chapter A) are most prevalent in the EU, with 334 measures to all countries, followed by Japan with 324 measures to all countries, 209 of which apply to Lao products. Thailand enforces 274 SPS measures to all countries, with 26 directed at Lao exports, while Vietnam has 319 measures to all countries, none of which specifically target Laos. TBT (Chapter B) are significant in all markets, with the EU enforcing 347 measures, Japan imposing 280 (13 specific to Laos), and Thailand and Vietnam implementing 281 and 277 measures, respectively, with minimal or no specific focus on Lao exports. Pre-shipment Inspections and Other Formalities (Chapter C) are required primarily by Japan (194 to all countries, 3 applicable to Laos) and Thailand (12 to all countries, 25 specifics to Laos), while these formalities are absent in the EU and Vietnam.

In terms of non-technical measures, Licenses, Quotas, and Quantity Control Measures (Chapter E) are enforced at low levels across the board. For instance, Japan imposes 21 specific license or quota requirements on Lao exports, while Thailand requires no such restrictions. Vietnam imposes only two such measures on Lao vegetables. Regarding Charges and Taxes (Chapter F), Thailand stands out with 267 measures to all countries, of which 25 specifically affect Laos, while Vietnam has 20 measures to all countries but none targeting Lao exports. Finance Measures (Chapter G) and Anti-competitive Measures (Chapter H) are relatively minimal across all countries.

Although Thailand and Vietnam are both ASEAN members alongside Laos, their approaches to NTMs on Lao vegetable exports differ significantly. Thailand imposes a detailed and stringent set of NTMs that present substantial challenges for Lao exporters, despite shared regional trade agreements within ASEAN. Thailand’s regulations are particularly strict, especially in terms of SPS measures, with 26 specific SPS requirements for Lao vegetables, along with significant pre-shipment inspections and para-tariff measures, including 25 different charges and taxes on Lao imports. This indicates a stringent regulatory environment where Thai NTMs seem to disproportionately target Lao products, making compliance and market entry difficult for Lao exporters.

In contrast, Vietnam, despite having a high total number of NTMs, applies these regulations more uniformly across all trading partners, without singling out Laos. Vietnam enforces many export-related measures (271 to all countries) and general regulations, but these are not specifically designed to restrict Lao exports. The absence of direct SPS or TBT measures on Lao vegetables further underscores Vietnam’s more open and less discriminatory regulatory environment. Consequently, Lao exporters face fewer specific barriers in Vietnam, though the overall regulatory framework remains complex.

Coffee, including both roasted (decaffeinated and non-decaffeinated) and unroasted varieties, reveals that Vietnam, Thailand, the EU, and Japan each have NTMs targeting coffee imports. Vietnam leads with the highest number of NTMs (28), followed by Thailand (25), the EU (22), and Japan (12). Notably, Japan is the only country that imposes a specific SPS prohibition on coffee imports from Lao PDR, whereas Thailand applies similar measures uniformly to all coffee imports, not specifically targeting Laos.

NTMs in key markets pose significant obstacles for Lao coffee exporters. Both the EU and Japan establish complex regulatory environments with extensive SPS and TBT measures, demanding significant compliance efforts. Thailand’s strict regulations, including numerous SPS measures, pre-shipment inspections, and various charges, create particularly high barriers for Lao coffee exporters. In contrast, Vietnam’s regulatory framework, though comprehensive, is consistently applied across all partners, resulting in a relatively less restrictive environment. Overall, Thailand presents the most intricate and costly challenges for Lao coffee exporters, even though regulatory barriers are considerable across all major markets.

NTMs on the export of coffee to Thailand

In 2021, Lao PDR exported approximately 38,113 tons of coffee beans, valued at roughly US$87.87 million. Despite this, nearly all Laotian coffee exports are routed through Thailand, with only 13% of the quantity (or 17% of the value) exported directly to Thailand. Vietnam, which receives 61% of Lao PDR's coffee exports by quantity (or 55% by value), is not used as a gateway for re-exporting Laotian coffee to the global market (World Integrated Trade Solution, 2024).

The export process for Lao PDR's coffee to Thailand can be divided into three key stages: BUY, SHIP, and PAY. This process involves multiple steps, documentation requirements, and coordination between Lao and Thai authorities. Each stage presents potential challenges, including NTMs that exporters may face (De et al., 2016).

The first stage of the export process begins with an on-site inspection and sample collection by the Thai importer or their representative. During this step, the importer evaluates the coffee's quality before proceeding with the purchase. Once satisfied, both parties sign a contract formalizing the trade agreement. While NTMs are unlikely to arise during this stage, strict product quality requirements or preferences from the Thai importer can indirectly act as barriers to trade.

The second stage involves the logistical and regulatory aspects of exporting coffee from Lao PDR to Thailand. This is where most NTMs are likely to arise, particularly related to certification and inspection processes. Exporters must obtain a Certificate of Origin (COO) from the Provincial Chamber of Commerce and Industry, a phyto-sanitary certificate from the Provincial Agriculture and Forestry Office, and a tax certificate from the Provincial Tax Section. Additionally, the Provincial Department of Science and Technology conducts quality-control tests and issues a report. If Thailand imposes specific TBT, such as product standards that differ from those in Laos, exporters may face challenges ensuring that the coffee meets Thai quality requirements. After completing the documentation, the coffee is transported to the border, where it undergoes inspection by the quarantine authority to verify compliance with Thailand's import regulations. Once cleared by Lao Customs, the coffee is released into the Thai market.

The final stage involves the financial transaction between the buyer and seller. After the coffee is released into Thailand, the Lao exporter receives payment from the Thai importer through their respective banks. This stage typically does not involve NTMs. A focus group discussion with Lao PDR exporters revealed that they perceive Thailand's NTMs as challenging and burdensome. These NTMs, including technical regulations, product standards, customs procedures, and inspection requirements, are seen as protectionist measures that hinder Lao exporters' ability to access the Thai market and comply with foreign regulations. Exporters reported difficulties with the compliance process, including delays in testing or certification, lack of transparency in the requirements, and limited information availability. These procedural obstacles increase compliance costs for Lao exporters, impacting the competitiveness of Lao exports to Thailand and other markets. Despite these challenges, Lao exporters expressed optimism that the ease of meeting standards will improve in the future, potentially boosting Lao's exports to Thailand and other markets.

Moreover, a 2019 report submitted by Lao PDR to the Coordinating Committee on the Implementation of the ASEAN Trade in Goods Agreement highlights several of these barriers. Lao coffee producers have struggled to export coffee beans to Thailand using the ASEAN Free Trade Area Form D, resulting in the loss of the 5% tariff privilege under ATIGA and the imposition of a 90% tariff under the WTO. Additionally, Lao producers frequently depend on Thai partners to manage the complicated export processes to comply with Thailand's strict rules and regulations. Even with Thai partners, exporters may face challenges if the Thai authorities do not approve or suspend further quantities. The primary regulation causing these issues is the 'Notice from the Department of International Trade, Ministry of Commerce of Thailand regarding Principles, Methods, and Criteria to seek request and issuing letter demonstrating the granting of rights to get the tariff exemption by whole tariff or partial tariff for coffee, tea, milk importing into Thailand under AFTA (CCA, 2019). Despite taking nearly four years, only some NTM-related issues have been resolved. In 2023, Thailand announced that the issue regarding the application of preferential tariff rates under the ATIGA has now been addressed.

DISCUSSIONS

The discussion section delves into the challenges and opportunities associated with the NTMs faced by Lao PDR’s agricultural exports, particularly coffee, and draws insights from the findings presented in the study. The study reaffirms that NTMs, especially SPS and TBT measures, are significant hurdles for Lao coffee exporters, particularly in markets like Thailand and the EU (De et al., 2016; Wongpit et al., 2023; Phonvisay, 2023). Lao PDR, despite its preferential access to some trading partners through regional agreements, continues to face high regulatory burdens that hinder its export potential. Thailand, a key trading partner within ASEAN, exemplifies a complex regulatory environment where NTMs such as stringent SPS measures and pre-shipment inspections disproportionately affect Lao coffee exporters. These barriers not only add complexity but also increase compliance costs, reducing competitiveness in the Thai market. Despite coffee's high export potential (Thipphavong et al., 2022), the coffee value chain faces several obstacles. Many farmers lack the technical knowledge needed to manage pests and diseases effectively (Wongpit et al., 2023). They also have a limited understanding of how to improve coffee varieties and processing techniques, which directly impact on the quality of the products. Additionally, many factories face financial constraints that prevent them from enhancing both the quantity and quality of coffee required by importing countries. The lack of properly equipped laboratories further limits the country's ability to certify compliance with SPS standards in certain markets.

The findings reveal a key distinction between the approaches of Thailand and Vietnam. While both are important markets for Lao coffee, Vietnam imposes fewer discriminatory non-tariff measures (NTMs) than Thailand. Vietnam’s regulatory framework is more consistent and less targeted, resulting in fewer specific barriers for Lao products. This relative openness makes Vietnam a less restrictive market for Lao coffee exports, despite the overall high number of NTMs.

The study also highlights that Lao PDR has yet to fully tap into its export potential in major markets such as Germany, Sweden, and the United States, with significant opportunities still unrealized. This indicates that overcoming NTMs and improving market access could drive higher export volumes and enhance the international competitiveness of the Lao coffee sector. Notably, the case of Germany stands out, with an estimated unrealized export potential of US$22 million, signaling a considerable growth opportunity. Reducing NTMs in these key markets could unlock new pathways for expansion and development.

Lao PDR will face significant challenges related to its graduation from Least Developed Country (LDC) status in 2026 (Wongpit, 2023). One major issue is that coffee exports will be subject to higher tariffs from developed and developing countries, as the Generalized System of Preferences (GSP) will be terminated. However, there is an opportunity for negotiation during the transition period from 2026 to 2029. Lao PDR could potentially join the GSP+ scheme for access to the EU market. While coffee tariffs remain unchanged, compliance with GSP+ standards—particularly regarding quality—will be mandatory.

In terms of rules of origin, both standard GSP and GSP+ follow the same criteria, whereas the Everything But Arms (EBA) initiative offers more flexible rules. For both roasted and unroasted coffee beans, there will be no changes in tariff rates under GSP and GSP+ schemes. However, coffee exporters will still face challenges in meeting SPS and TBT requirements, as well as obtaining organic certification. For exports to the EU, many Laos agri-food firms operate on Free on-board (FOB) terms at Laem Chabang Port in Thailand or Da Nang Port in Vietnam. Their business partners in importing countries are responsible for all costs from that point onward, including customs declarations at the destination. However, Lao exporters bear significant in-land transportation costs, which are relatively high—around LAK15,000,000 (approximately US$1,500) per shipment, particularly for coffee and sugar exports.

CONCLUSION

This study highlights the significant impact of NTMs on the agricultural exports of Lao PDR, with a specific focus on coffee, a vital sector for the country's economy. While the Lao coffee industry holds substantial export potential, particularly in high-demand markets like Germany, Sweden, and the United States, the prevalence of NTMs—especially SPS measures and TBT—presents substantial challenges for Lao exporters. Among Lao PDR's key markets, Thailand, Vietnam, the EU, and Japan each impose a complex array of NTMs that vary in intensity, with Thailand standing out for its stringent SPS measures and export-related requirements, which create significant hurdles for Lao coffee exports.

Although Vietnam imposes a broad set of NTMs, it applies these regulations uniformly without disproportionately targeting Lao products, making it a relatively easier market for Lao exporters compared to Thailand and the EU. The findings of this study suggest that the Lao coffee sector could greatly benefit from enhanced trade facilitation measures, clearer regulatory frameworks, and strengthened cooperation between the Lao government and its key trading partners. By reducing or simplifying NTMs, particularly in markets like Thailand, Lao PDR could unlock its unrealized export potential, increase its competitiveness in the global coffee market, and foster greater economic resilience.

Ultimately, policy recommendations that focus on improving compliance with international standards, enhancing export processes, and negotiating more favorable trade agreements are crucial to overcoming the barriers posed by NTMs. Addressing these challenges will enable Lao PDR to capitalize on its agricultural strengths and increase the global market share of its coffee exports, contributing to sustainable economic growth and rural development.

REFERENCES

De, P., Phetmany, T., Phimmavong, B., Phommathan, A., Pathoumvanhm A., Sayyavongsa, V., Thongpathoum, A. & Inthachack, T. (2016). Non-Tariff Measures (NTMs) Faced by Exporters of Lao PDR: A Field Survey Report, Second Trade Development Facility.

Chanthanasinh, V. & Wongpit, P. (2022). The Impact of Non-Tariff Measures to Intra-Association of Southeast Asian Nations Import. Souphanouvong University Journal Multidisciplinary Research and Development, 8(1), 171-284.

Chanthanasinh, V., & Wongpit, P. (2023). Impact of Non-tariff Measures of the People's Republic of China on the Export of Agricultural Products of Lao People's Democratic Republic. In Comparative Analysis of Trade and Finance in Emerging Economies (Vol. 31, pp. 131-149). Emerald Publishing Limited.

Food and Agriculture Organization. (2022). Maximizing benefits from agricultural exports for Lao smallholder farmers: Policy brief. Rome: Food and Agriculture Organization of the United Nations.

International Trade Centre. (2024). Export Potential Map: Spot export opportunities for trade development. Rertrived from: https://exportpotential.intracen.org/en/about/export-potential-map

Ministry of Agriculture and Forestry. (2022). Agricultural Statistics Yearbook 2022, Department of Planning and Cooperation.

Ministry of Industry and Commerce. (2022). Summary report on target set for industry and trade sector of the first six-month and last six-month of 2022. Vientiane: Ministry of Industry and Commerce, Lao PDR.

Sayasenh, A. (2016), Non-tariff Measures in the Lao People’s Democratic Republic, in Ing, L.Y., S. F. de Cordoba and. O. Cadot (eds.), Non-Tariff Measures in ASEAN. ERIA Research Project Report 2015-1, Jakarta: ERIA, pp.77-85.

Phonvisay, A. (2023). Assessment of Non-Tariff Measures (NTMs) and their Impacts on International Trade and Competitiveness of Thailand and Lao PDR. sujournal, 9(4), 272-279.

Thipphavong, V., Vanhnalat, B., Vidavong, C., & Bodhisane, S. (2022). The Export Potential of Laos Agri-Food to the EU Market, Food Security Policy Research, Capacity and Influence Research Paper 9. Retrieved from https://ageconsearch.umn.edu/record/324028?ln=en&v=pdf

Wongpit, P. (2023). Evaluating the Effects of Trade on Lao PDR’s LDC Graduation. RMUTT Global Business and Economics Review, 18(2), 93-104.

Wongpit, P., Syphoxay, P., Sisoumang, B., & Sykhanthong, S. (2023). Mapping the Coffee Value Chain in Lao PDR: Issues, Insights, and Strategies. Research on World Agricultural Economy, 4(4), 1-9.

World Integrated Trade Solution. (2024). Trade Statistics. Retrieved from https://wits.worldbank.org/

World Trade Organization (WTO). (2021). World Tariff Profiles 2021. Retrieved from https://www.wto.org/english/res_e/statis_e/wtp2021_special_topic_e.pdf

Non-Tariff Measures: A Threat to Coffee Exports of Lao PDR

ABSTRACT

This study explores the impact of non-tariff measures (NTMs) on the agricultural exports of Lao PDR, with a focus on the coffee sector. As a key agricultural product with substantial export potential, Lao coffee faces several challenges, particularly related to sanitary and phytosanitary measures (SPS) and technical barriers to trade. By analyzing the NTMs imposed by key markets such as Thailand, Vietnam, the EU, and Japan, this research highlights the variations in the intensity of these measures and their effects on Lao coffee exporters. Thailand emerges as a particularly restrictive market due to its stringent SPS measures and export-related requirements, while Vietnam despite its broad application of NTMs, offers a relatively more accessible market. The study emphasizes the importance of more enhanced trade facilitation, streamlined regulatory frameworks, and closer cooperation between Lao PDR and its trading partners to mitigate the burden of NTMs. Key policy recommendations include strengthening compliance with international standards, simplifying export procedures, and pursuing favorable trade negotiations. These strategies are essential for unlocking Lao coffee's full export potential, improving competitiveness, and fostering sustainable economic growth within the agricultural sector.

Keywords: Non-Tariff Measure, Sanitary and Phytosanitary, Technical Barrier on Trade, Generalized System of Preferences

INTRODUCTION

Non-tariff measures (NTMs) have become an increasing concern in international trade as tariff rates have significantly declined over the past decade due to various international, regional, and bilateral free trade agreements. While Lao PDR benefits from several trade preferences with its partners, its major exports remain concentrated in electricity, minerals, and garments. Although agricultural products constitute only 10% of the country's total exports, the agricultural sector is crucial, supporting over 60% of the population. NTMs, particularly those related to sanitary and phytosanitary (SPS) measures, are predominantly imposed on agricultural products, posing significant challenges to exporters and farmers in Lao PDR.

Several research works have been discussed on NTMs in Lao PDR (De et al., 2016; Sayasenh, 2016; Chanthanasinh&Wongpit, 2023, Phonvisay, 2023), but none of them are focused on coffee. Sayasenh (2016) overviewed the NTMs and showed that NTMs are high in Laos, there are many non-technical measures such as price control and export-related measures. De et al. (2016) surveyed NTMs faced by exporters from Lao PDR and found that 80% of exporters encounter challenges. Specifically, 87% of agricultural exporters and 76% of manufacturing exporters face NTM-related challenges. Among Lao PDR's trading partners, China and Vietnam were the most trade-friendly due to their relatively low processing requirements and less documentation. In contrast, coffee exporters faced high barriers when exporting to the EU and medium barriers when exporting to the Thai market, particularly due to SPS measures.

Chanthanasinh and Wongpit (2023) analyzed the impact of NTMs on intra-ASEAN imports using the gravity model. Their findings show that Singapore imposes the highest number of import NTMs within ASEAN. Interestingly, the study found a positive relationship between NTMs and imports, which contradicts the initial hypothesis. This is not surprising, as most products traded within ASEAN are industrial goods, while agricultural products constitute a relatively small share of total trade. NTMs are primarily imposed on agricultural products, especially in the form of SPS and TBT. Although the number of NTMs in ASEAN has increased, their impact on overall imports within the region remains minor. The study also focused on the agricultural sector, particularly examining the impact of NTMs on agricultural exports from Lao PDR to China, with a focus on SPS measures. Their analysis revealed that the frequency index and coverage ratio of NTMs significantly decreased between 2016 and 2020, largely due to special trade preferences granted by China. However, the study also found that a higher frequency index and coverage ratio of NTMs had a negative effect on Lao PDR's agricultural exports to China, suggesting that increased NTMs led to lower export volumes from Lao PDR (Chanthanasinh & Wongpit, 2023).

Coffee is one of the significant agricultural production and exports of Lao PDR. It is the third largest agricultural export product for Laos following cassava and banana, of which the main exporting country is China. Coffee is the dominant farming system on the Bolaven Plateau, known for its volcanic fields in the southern part of the Lao PDR. The Ministry of Agriculture and Forestry (MAF) aims to increase coffee production to 280,000 tons by 2025 and improve quality along the value chain. To meet the goals, many activities must be improved. Coffee producers must expand the plantation area and production. Production groups should be established in many places. Market price should be determined among the middlemen. The government should negotiate with trading partners for an export quota and remove NTMs for coffee exports.

This paper aims to analyze the impact of NTMs on the agricultural exports of Lao PDR, with a particular focus on coffee, a high-potential export product. The study includes a case study of coffee exports to Thailand, examining the specific NTMs that affect this trade flow and their implications for exporters. The findings of this study are intended to generate policy recommendations to enhance the competitiveness and growth of the coffee sector in Lao PDR, by addressing existing barriers and creating a more favorable trade environment for agricultural exports.

LAOS’S COFFEE MARKET IN THE WORLD

The Lao coffee sector presents a promising market opportunity, driven by growing demand in both domestic and export markets. In 2022, coffee production in Lao PDR ranks the fifth in the plantation area, following rice, cassava, maize, and sugarcane (Ministry of Agriculture and Forestry, 2022). However, the coffee plantation area has decreased significantly from 94,400 hectares in 2019 to 85,050 hectares in 2022, primarily due to the expansion of cassava cultivation (Wongpit et al., 2023) and coffee production also experienced a slight decline, from 171,380 tons in 2019 to 171,000 tons in 2022.

Most coffee production is concentrated in the Bolaven Plateau, particularly in the provinces of Champasak, Saravan, Sekong, and Attapeu. In 2022, Champasak province produced approximately 103,080 tons of coffee, accounting for over 60% of the country’s total production. Sekong province, however, saw a significant reduction in both plantation and production areas as many farmers shifted to cassava cultivation. In contrast, despite a reduction in plantation area, Attapeu province experienced a notable increase in coffee productivity.

Coffee is also grown in the northern regions, including Luang Prabang, Phongsaly, and Houaphanh provinces. Luang Prabang remains the leading coffee producer in the north, though both plantation area and production have declined in recent years. Meanwhile, Houaphanh province has made significant progress in expanding coffee plantations and production, thanks to initiatives like the United Nations Office on Drugs and Crime (UNODC) supporting coffee groups to replace opium cultivation, the French Development Agency (AFD) supporting coffee development in the Bolaven Plateau and northern provinces (Luang Prabang, Houaphanh, Phongsaly, and Champasak), and the United States Department of Agriculture (USDA), with Winrock International managing a project to support coffee cultivation in the Bolaven Plateau and northern Lao.

In 2022, Lao PDR exported approximately US$149 million in coffee, which decreased to US$74 million in 2023. These export levels are relatively modest compared to the world's largest coffee exporters, such as Brazil, with exports valued at US$25 billion, and Vietnam, at US$7.3 billion. Notably, a portion of Vietnamese coffee exports includes coffee sourced from Laos.

Despite a decline to US$76.6 million in 2023, Lao PDR's coffee exports grew significantly from US$64.3 million in 2019 to a peak of US$153.1 million in 2022, driven by rising global market prices. The country primarily exports coffee to ASEAN markets. In 2021, exports to Vietnam totaled approximately US$48.2 million, while exports to other ASEAN countries, including Thailand (US$14 million), Cambodia (US$5 million), and Singapore (US$0.03 million), reached around US$20 million (Trade Map, 2024). Exports to the EU market under the Generalized System of Preferences (GSP) amounted to US$11.39 million, with Belgium importing approximately US$5.92 million worth of Lao coffee and Germany importing around US$3.1 million. Additionally, under the GSP, Japan and the USA imported Lao coffee, which was valued at US$2.67 million and US$1.22 million, respectively (Ministry of Industry and Commerce, 2022).

Table 2 presents the export potential of Lao coffee. The Export Potential Indicator estimates the potential export value for an exporter in a specific product and target market using an economic model that integrates the exporter’s supply capacity, target market demand, market access conditions, and bilateral ties between the two countries. For existing export products, supply is assessed using historical export performance data. Comparing potential export values with actual export figures helps identify exporters, products, and markets with growth opportunities (Internationa Trade Centre, 2024). Lao PDR has an export potential of approximately US$137 million, while the actual export value is US$117 million, leaving an unrealized export potential of US$67 million. This indicates that Lao PDR can export more coffee if there is increased demand or if existing trade barriers in importing countries are reduced.

Germany represents the highest export potential market for Lao coffee, but current exports are only valued at US$11 million, highlighting a significant untapped opportunity. Similarly, there is considerable unrealized export potential in markets such as Sweden, Thailand, and the USA. Conversely, Lao PDR’s actual coffee exports to Vietnam, Japan, and Belgium exceed their respective export potentials. This suggests that Laos has already maximized its export capacity to these markets, making it challenging to increase coffee exports further to these countries.

NON-TARIFF MEASURES AND LAO COFFEE EXPORT

NTMs are gaining increasing attention from trade policymakers and analysts. However, analyzing NTMs is challenging due to their complex nature and the lack of readily available data and evidence. Unlike tariffs, NTMs are not easily quantifiable, difficult to model, and the necessary information is hard to collect. Despite these challenges, NTMs are a critical aspect of trade negotiations and remain a key part of the ongoing World Trade Organization (WTO) agenda. The most used NTMs are technical barriers to trade (TBT) and SPS measures (Fugazza and Maur, 2008).

Globally, nearly 60% of imported products are subject to at least one NTM, representing about 80% of the total value of these goods. On average, each imported product must comply with more than three NTMs. In comparison, almost half of all exported goods face an average of 1.3 NTMs. Certain sectors, such as animal, vegetable, and food products, are among the most heavily regulated, with these products subject to an average of 12 NTMs each. The agri-food sector experiences the highest level of technical measures. Interestingly, developing countries tend to impose slightly more technical NTMs than developed countries, with developing nations averaging 5.2 technical NTMs per product compared to 4.8 in developed countries (World Trade Organization, 2021).

NTMs pose significant challenges for exporters, especially in developing countries like Lao PDR, which rely heavily on agricultural exports. In 2022, agricultural exports from Lao PDR generated US$1.2 billion, with US$997 million coming from produce and agricultural products (MOIC, 2022). The primary export markets for Lao products are Thailand, China, Vietnam, Australia, Singapore, and the European Union, which together account for 89.5% of the total export market. Agricultural commodities such as cassava, bananas, coffee, cattle, fruits, rubber, rice, and maize make up 16.23% of total exports. Notably, China, Thailand, and Vietnam account for 90% of Lao PDR's agricultural exports (Food and Agriculture Organization, 2022).

Coffee, classified under Chapter 09: Coffee, Tea, Mate, and Spices in Section II: Vegetable Products of the Harmonized System, is a key export for Lao PDR. Table 3 provides an analysis of NTMs imposed on vegetable imports and exports in key markets, including the EU, Japan, Thailand, and Vietnam, with a specific focus on regulations affecting Lao exports. The NTMs are categorized into technical, non-technical, and export-related measures, highlighting the regulatory challenges Lao exporters face in these markets.

Among the technical measures, SPS measures (Chapter A) are most prevalent in the EU, with 334 measures to all countries, followed by Japan with 324 measures to all countries, 209 of which apply to Lao products. Thailand enforces 274 SPS measures to all countries, with 26 directed at Lao exports, while Vietnam has 319 measures to all countries, none of which specifically target Laos. TBT (Chapter B) are significant in all markets, with the EU enforcing 347 measures, Japan imposing 280 (13 specific to Laos), and Thailand and Vietnam implementing 281 and 277 measures, respectively, with minimal or no specific focus on Lao exports. Pre-shipment Inspections and Other Formalities (Chapter C) are required primarily by Japan (194 to all countries, 3 applicable to Laos) and Thailand (12 to all countries, 25 specifics to Laos), while these formalities are absent in the EU and Vietnam.

In terms of non-technical measures, Licenses, Quotas, and Quantity Control Measures (Chapter E) are enforced at low levels across the board. For instance, Japan imposes 21 specific license or quota requirements on Lao exports, while Thailand requires no such restrictions. Vietnam imposes only two such measures on Lao vegetables. Regarding Charges and Taxes (Chapter F), Thailand stands out with 267 measures to all countries, of which 25 specifically affect Laos, while Vietnam has 20 measures to all countries but none targeting Lao exports. Finance Measures (Chapter G) and Anti-competitive Measures (Chapter H) are relatively minimal across all countries.

Although Thailand and Vietnam are both ASEAN members alongside Laos, their approaches to NTMs on Lao vegetable exports differ significantly. Thailand imposes a detailed and stringent set of NTMs that present substantial challenges for Lao exporters, despite shared regional trade agreements within ASEAN. Thailand’s regulations are particularly strict, especially in terms of SPS measures, with 26 specific SPS requirements for Lao vegetables, along with significant pre-shipment inspections and para-tariff measures, including 25 different charges and taxes on Lao imports. This indicates a stringent regulatory environment where Thai NTMs seem to disproportionately target Lao products, making compliance and market entry difficult for Lao exporters.

In contrast, Vietnam, despite having a high total number of NTMs, applies these regulations more uniformly across all trading partners, without singling out Laos. Vietnam enforces many export-related measures (271 to all countries) and general regulations, but these are not specifically designed to restrict Lao exports. The absence of direct SPS or TBT measures on Lao vegetables further underscores Vietnam’s more open and less discriminatory regulatory environment. Consequently, Lao exporters face fewer specific barriers in Vietnam, though the overall regulatory framework remains complex.

Coffee, including both roasted (decaffeinated and non-decaffeinated) and unroasted varieties, reveals that Vietnam, Thailand, the EU, and Japan each have NTMs targeting coffee imports. Vietnam leads with the highest number of NTMs (28), followed by Thailand (25), the EU (22), and Japan (12). Notably, Japan is the only country that imposes a specific SPS prohibition on coffee imports from Lao PDR, whereas Thailand applies similar measures uniformly to all coffee imports, not specifically targeting Laos.

NTMs in key markets pose significant obstacles for Lao coffee exporters. Both the EU and Japan establish complex regulatory environments with extensive SPS and TBT measures, demanding significant compliance efforts. Thailand’s strict regulations, including numerous SPS measures, pre-shipment inspections, and various charges, create particularly high barriers for Lao coffee exporters. In contrast, Vietnam’s regulatory framework, though comprehensive, is consistently applied across all partners, resulting in a relatively less restrictive environment. Overall, Thailand presents the most intricate and costly challenges for Lao coffee exporters, even though regulatory barriers are considerable across all major markets.

NTMs on the export of coffee to Thailand

In 2021, Lao PDR exported approximately 38,113 tons of coffee beans, valued at roughly US$87.87 million. Despite this, nearly all Laotian coffee exports are routed through Thailand, with only 13% of the quantity (or 17% of the value) exported directly to Thailand. Vietnam, which receives 61% of Lao PDR's coffee exports by quantity (or 55% by value), is not used as a gateway for re-exporting Laotian coffee to the global market (World Integrated Trade Solution, 2024).

The export process for Lao PDR's coffee to Thailand can be divided into three key stages: BUY, SHIP, and PAY. This process involves multiple steps, documentation requirements, and coordination between Lao and Thai authorities. Each stage presents potential challenges, including NTMs that exporters may face (De et al., 2016).

The first stage of the export process begins with an on-site inspection and sample collection by the Thai importer or their representative. During this step, the importer evaluates the coffee's quality before proceeding with the purchase. Once satisfied, both parties sign a contract formalizing the trade agreement. While NTMs are unlikely to arise during this stage, strict product quality requirements or preferences from the Thai importer can indirectly act as barriers to trade.

The second stage involves the logistical and regulatory aspects of exporting coffee from Lao PDR to Thailand. This is where most NTMs are likely to arise, particularly related to certification and inspection processes. Exporters must obtain a Certificate of Origin (COO) from the Provincial Chamber of Commerce and Industry, a phyto-sanitary certificate from the Provincial Agriculture and Forestry Office, and a tax certificate from the Provincial Tax Section. Additionally, the Provincial Department of Science and Technology conducts quality-control tests and issues a report. If Thailand imposes specific TBT, such as product standards that differ from those in Laos, exporters may face challenges ensuring that the coffee meets Thai quality requirements. After completing the documentation, the coffee is transported to the border, where it undergoes inspection by the quarantine authority to verify compliance with Thailand's import regulations. Once cleared by Lao Customs, the coffee is released into the Thai market.

The final stage involves the financial transaction between the buyer and seller. After the coffee is released into Thailand, the Lao exporter receives payment from the Thai importer through their respective banks. This stage typically does not involve NTMs. A focus group discussion with Lao PDR exporters revealed that they perceive Thailand's NTMs as challenging and burdensome. These NTMs, including technical regulations, product standards, customs procedures, and inspection requirements, are seen as protectionist measures that hinder Lao exporters' ability to access the Thai market and comply with foreign regulations. Exporters reported difficulties with the compliance process, including delays in testing or certification, lack of transparency in the requirements, and limited information availability. These procedural obstacles increase compliance costs for Lao exporters, impacting the competitiveness of Lao exports to Thailand and other markets. Despite these challenges, Lao exporters expressed optimism that the ease of meeting standards will improve in the future, potentially boosting Lao's exports to Thailand and other markets.

Moreover, a 2019 report submitted by Lao PDR to the Coordinating Committee on the Implementation of the ASEAN Trade in Goods Agreement highlights several of these barriers. Lao coffee producers have struggled to export coffee beans to Thailand using the ASEAN Free Trade Area Form D, resulting in the loss of the 5% tariff privilege under ATIGA and the imposition of a 90% tariff under the WTO. Additionally, Lao producers frequently depend on Thai partners to manage the complicated export processes to comply with Thailand's strict rules and regulations. Even with Thai partners, exporters may face challenges if the Thai authorities do not approve or suspend further quantities. The primary regulation causing these issues is the 'Notice from the Department of International Trade, Ministry of Commerce of Thailand regarding Principles, Methods, and Criteria to seek request and issuing letter demonstrating the granting of rights to get the tariff exemption by whole tariff or partial tariff for coffee, tea, milk importing into Thailand under AFTA (CCA, 2019). Despite taking nearly four years, only some NTM-related issues have been resolved. In 2023, Thailand announced that the issue regarding the application of preferential tariff rates under the ATIGA has now been addressed.

DISCUSSIONS

The discussion section delves into the challenges and opportunities associated with the NTMs faced by Lao PDR’s agricultural exports, particularly coffee, and draws insights from the findings presented in the study. The study reaffirms that NTMs, especially SPS and TBT measures, are significant hurdles for Lao coffee exporters, particularly in markets like Thailand and the EU (De et al., 2016; Wongpit et al., 2023; Phonvisay, 2023). Lao PDR, despite its preferential access to some trading partners through regional agreements, continues to face high regulatory burdens that hinder its export potential. Thailand, a key trading partner within ASEAN, exemplifies a complex regulatory environment where NTMs such as stringent SPS measures and pre-shipment inspections disproportionately affect Lao coffee exporters. These barriers not only add complexity but also increase compliance costs, reducing competitiveness in the Thai market. Despite coffee's high export potential (Thipphavong et al., 2022), the coffee value chain faces several obstacles. Many farmers lack the technical knowledge needed to manage pests and diseases effectively (Wongpit et al., 2023). They also have a limited understanding of how to improve coffee varieties and processing techniques, which directly impact on the quality of the products. Additionally, many factories face financial constraints that prevent them from enhancing both the quantity and quality of coffee required by importing countries. The lack of properly equipped laboratories further limits the country's ability to certify compliance with SPS standards in certain markets.

The findings reveal a key distinction between the approaches of Thailand and Vietnam. While both are important markets for Lao coffee, Vietnam imposes fewer discriminatory non-tariff measures (NTMs) than Thailand. Vietnam’s regulatory framework is more consistent and less targeted, resulting in fewer specific barriers for Lao products. This relative openness makes Vietnam a less restrictive market for Lao coffee exports, despite the overall high number of NTMs.

The study also highlights that Lao PDR has yet to fully tap into its export potential in major markets such as Germany, Sweden, and the United States, with significant opportunities still unrealized. This indicates that overcoming NTMs and improving market access could drive higher export volumes and enhance the international competitiveness of the Lao coffee sector. Notably, the case of Germany stands out, with an estimated unrealized export potential of US$22 million, signaling a considerable growth opportunity. Reducing NTMs in these key markets could unlock new pathways for expansion and development.

Lao PDR will face significant challenges related to its graduation from Least Developed Country (LDC) status in 2026 (Wongpit, 2023). One major issue is that coffee exports will be subject to higher tariffs from developed and developing countries, as the Generalized System of Preferences (GSP) will be terminated. However, there is an opportunity for negotiation during the transition period from 2026 to 2029. Lao PDR could potentially join the GSP+ scheme for access to the EU market. While coffee tariffs remain unchanged, compliance with GSP+ standards—particularly regarding quality—will be mandatory.

In terms of rules of origin, both standard GSP and GSP+ follow the same criteria, whereas the Everything But Arms (EBA) initiative offers more flexible rules. For both roasted and unroasted coffee beans, there will be no changes in tariff rates under GSP and GSP+ schemes. However, coffee exporters will still face challenges in meeting SPS and TBT requirements, as well as obtaining organic certification. For exports to the EU, many Laos agri-food firms operate on Free on-board (FOB) terms at Laem Chabang Port in Thailand or Da Nang Port in Vietnam. Their business partners in importing countries are responsible for all costs from that point onward, including customs declarations at the destination. However, Lao exporters bear significant in-land transportation costs, which are relatively high—around LAK15,000,000 (approximately US$1,500) per shipment, particularly for coffee and sugar exports.

CONCLUSION

This study highlights the significant impact of NTMs on the agricultural exports of Lao PDR, with a specific focus on coffee, a vital sector for the country's economy. While the Lao coffee industry holds substantial export potential, particularly in high-demand markets like Germany, Sweden, and the United States, the prevalence of NTMs—especially SPS measures and TBT—presents substantial challenges for Lao exporters. Among Lao PDR's key markets, Thailand, Vietnam, the EU, and Japan each impose a complex array of NTMs that vary in intensity, with Thailand standing out for its stringent SPS measures and export-related requirements, which create significant hurdles for Lao coffee exports.

Although Vietnam imposes a broad set of NTMs, it applies these regulations uniformly without disproportionately targeting Lao products, making it a relatively easier market for Lao exporters compared to Thailand and the EU. The findings of this study suggest that the Lao coffee sector could greatly benefit from enhanced trade facilitation measures, clearer regulatory frameworks, and strengthened cooperation between the Lao government and its key trading partners. By reducing or simplifying NTMs, particularly in markets like Thailand, Lao PDR could unlock its unrealized export potential, increase its competitiveness in the global coffee market, and foster greater economic resilience.

Ultimately, policy recommendations that focus on improving compliance with international standards, enhancing export processes, and negotiating more favorable trade agreements are crucial to overcoming the barriers posed by NTMs. Addressing these challenges will enable Lao PDR to capitalize on its agricultural strengths and increase the global market share of its coffee exports, contributing to sustainable economic growth and rural development.

REFERENCES

De, P., Phetmany, T., Phimmavong, B., Phommathan, A., Pathoumvanhm A., Sayyavongsa, V., Thongpathoum, A. & Inthachack, T. (2016). Non-Tariff Measures (NTMs) Faced by Exporters of Lao PDR: A Field Survey Report, Second Trade Development Facility.

Chanthanasinh, V. & Wongpit, P. (2022). The Impact of Non-Tariff Measures to Intra-Association of Southeast Asian Nations Import. Souphanouvong University Journal Multidisciplinary Research and Development, 8(1), 171-284.

Chanthanasinh, V., & Wongpit, P. (2023). Impact of Non-tariff Measures of the People's Republic of China on the Export of Agricultural Products of Lao People's Democratic Republic. In Comparative Analysis of Trade and Finance in Emerging Economies (Vol. 31, pp. 131-149). Emerald Publishing Limited.

Food and Agriculture Organization. (2022). Maximizing benefits from agricultural exports for Lao smallholder farmers: Policy brief. Rome: Food and Agriculture Organization of the United Nations.

International Trade Centre. (2024). Export Potential Map: Spot export opportunities for trade development. Rertrived from: https://exportpotential.intracen.org/en/about/export-potential-map

Ministry of Agriculture and Forestry. (2022). Agricultural Statistics Yearbook 2022, Department of Planning and Cooperation.

Ministry of Industry and Commerce. (2022). Summary report on target set for industry and trade sector of the first six-month and last six-month of 2022. Vientiane: Ministry of Industry and Commerce, Lao PDR.

Sayasenh, A. (2016), Non-tariff Measures in the Lao People’s Democratic Republic, in Ing, L.Y., S. F. de Cordoba and. O. Cadot (eds.), Non-Tariff Measures in ASEAN. ERIA Research Project Report 2015-1, Jakarta: ERIA, pp.77-85.

Phonvisay, A. (2023). Assessment of Non-Tariff Measures (NTMs) and their Impacts on International Trade and Competitiveness of Thailand and Lao PDR. sujournal, 9(4), 272-279.

Thipphavong, V., Vanhnalat, B., Vidavong, C., & Bodhisane, S. (2022). The Export Potential of Laos Agri-Food to the EU Market, Food Security Policy Research, Capacity and Influence Research Paper 9. Retrieved from https://ageconsearch.umn.edu/record/324028?ln=en&v=pdf

Wongpit, P. (2023). Evaluating the Effects of Trade on Lao PDR’s LDC Graduation. RMUTT Global Business and Economics Review, 18(2), 93-104.

Wongpit, P., Syphoxay, P., Sisoumang, B., & Sykhanthong, S. (2023). Mapping the Coffee Value Chain in Lao PDR: Issues, Insights, and Strategies. Research on World Agricultural Economy, 4(4), 1-9.

World Integrated Trade Solution. (2024). Trade Statistics. Retrieved from https://wits.worldbank.org/

World Trade Organization (WTO). (2021). World Tariff Profiles 2021. Retrieved from https://www.wto.org/english/res_e/statis_e/wtp2021_special_topic_e.pdf