ABSTRACT

This paper illustrates the evolution trajectory of agri-food distribution channels, from the traditional system, --then the modernization of chain-store supermarkets and up to the recent surge of e-commerce. The merits and inadequacies of services are discussed on the current status of agri-food e-commerce. Following that the present developments are reviewed of agri-food e-commerce in Taiwan、U.S.、SEA and China, concentrating on the effect of COVID-19. In the summary section, three development strategies are proposed for the further improvement of the inadequacies of agri-food e-commerce service.

Keywords: agri-food e-commerce, international agri-food market, business model

INTRODUCTION

The rapid development of e-commerce and the massive lockdown resulting from the COVID-19 pandemic have been calling for further digitizing the agri-food distribution channels. This paper reviews the current status of the agri-food e-commerce market and the evolution of agri-food distribution channels. In summary this paper discusses the implications for government policy and business strategy to cope with the next-stage development of agri-food e-commerce.

THE EVOLUTION OF AGRI-FOOD DISTRIBUTION CHANNEL

This section explains the evolution trajectory of distribution channels in the agri-food market. Starting from the traditional wholesale/auction market to the recent burst of business in agri-food e-commerce. Amongst others, the transaction characters, consumption behaviors and the mechanisms of information exchange and trust building are discussed.

The traditional agri-food distribution channel and its modernization

The traditional distribution channel of agri-food consists of the wholesale and retail systems. The wholesale distribution system is centered around the auction market. Wholesalers buy produce from farmers and in Taiwan they need to have the license to put the produce in the public auction markets. The produce in auction markets is only processed in basic cleaning and quality classification. Individual packaging and the information of produce are absent. Distributors and retailers pick up the produce from the auction market and then deliver them to the traditional retail markets.

The traditional retail market is a geographic aggregation of stall vendors. The retail market is opened at fixed location and scheduled time. Consumers choose to buy agri-food from traditional markets (instead of the modern chain-store supermarket) because they perceive the traditional distribution system is more time efficient and thus the produce transacted there is “fresher.” Stall vendors are also preferred because they can provide information on food preparation and agri-food knowledge. The traditional market serves neighborhood shoppers, so the transactions heavily rely on inter-personal trust.

The modern agri-food distribution channel

The modernization of agri-food channel refers to the change of formation and structure from the traditional wholesale/retail system to the chain-store supermarket and warehouse. The modernization is accompanied with progress of urbanization of population and lifestyle. The agri-food prepared for the modern chain store needs to be single packaged with pre-defined product specification and price. The distribution and preparation service are provided by qualified wholesalers or contracted farmers of the chain store.

In the modern supermarket, shoppers obtain information from the shelf and package, rather than from the store staff. Furthermore, shoppers make purchase decision based on the trust upon the store or the brand of the agri-food. The agri-food sold in a modern chain store needs to meet the qualification standard of the store or its suppliers. Also, the agri-food needs to work on its packages and brand establishment to gain the shopper attention.

A strong push in fresh food e-commerce

Fresh food includes fresh fruits, vegetables, meats, seafood, baking cakes, dairy and cheese and it refers to primary products without cooking and other deep-processing procedure, selling via necessary preservation and simple preparation for the shelves. Fresh food e-commerce refers to transaction via internet platform, directly distributing fresh products to consumers by self-built logistics or through third-party logistics.

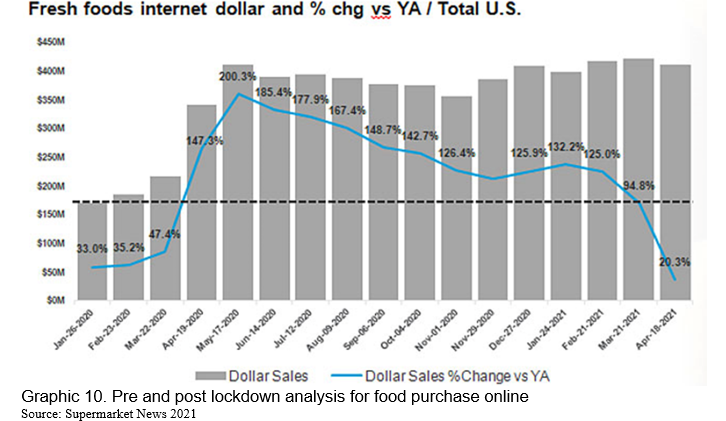

Fresh food e-commerce has experienced a meteoric breakthrough, of the order of 50% increase reported in the U.S. during the year 2021. This trend has affected all distributors who have set up drives, click and collect, home deliveries but also those manufacturers who have embarked on the Direct to Consumer (D2C) mode. Several manufacturers who have highly valued products like brand-name milk or mineral water reported unusual sales increase in e-commerce because their logistics cost / turnover ratio is lower.

Technology advancement and shopping behavior change under the COVID-19 pandemic both drive the shift of sales from brick-and-mortar to e-commerce. Agri food product needs different preparation for e-commerce than for modern supermarkets. E-commerce shoppers seldom buy single product. To satisfy the diversity consumption of daily diary, agri-food products are usually provided on e-commerce platform in a form of mix-up basket consisted of vegetables, meat/protein, fruit, grains…etc. As a consequence, e-commerce business needs to conduct the assortment for the consumers, and the warehouse operators need to pick up various individual agri-food products and put them in the shipping box. The warehouse is a cooling environment for the preservation need of the agri-food products with the temperature of 0-5 degree Celsius, which is not suitable for long-hour work. This is why pick-up mistakes are commonly seen in fresh food e-commerce delivery. The operating environment needs to be improved for the better.

The Overview OF DOMESTIC AND INTERNATIONAL AGRI-FOOD E-COMMERCE MARKET

Status of fresh food e-commerce in Taiwan

Fresh food e-commerce in Taiwan is in the exploratory stage of development, facing many problems and challenges. However, more and more brick-and-mortar retail players have invested or are going to invest heavily to integrate their online and offline resources to provide consumers with a more user-friendly fresh food shopping environment. They included Welcome, PX Mart, 7-Eleven, Families, Simple Mart, City’ Super, RT Mart, Ai Mai, Costco, Carrefour and Taiwan Fresh Supermarkets, have all expanded their e-retail platforms to serve their clients both offline and online rapidly.

Not only e-retail platforms in the food and beverage sector such as Famicloud, Wonderfulfood, i3Fresh and related local operators are fast growing, but also PChome Online and Momo Shop both Taiwan’s giant e-commerce companies have implemented logistics to provide fresh food delivery. In addition, according to a report from the USDA, Taiwan’s e-retail market size has grown from US$6.9 billion in 2019 to US$8.3 billion in 2020 as Taiwanese consumers have preferred ‘no-contact’ shopping options to prevent the spread of COVID-19. This has been shown particularly important in the growing trend of the fresh food e-commerce in Taiwan.

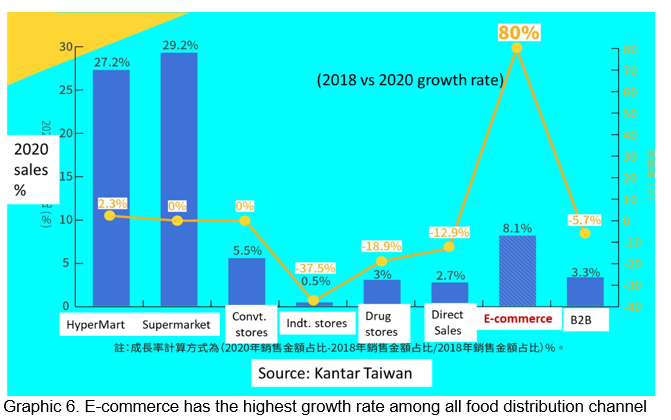

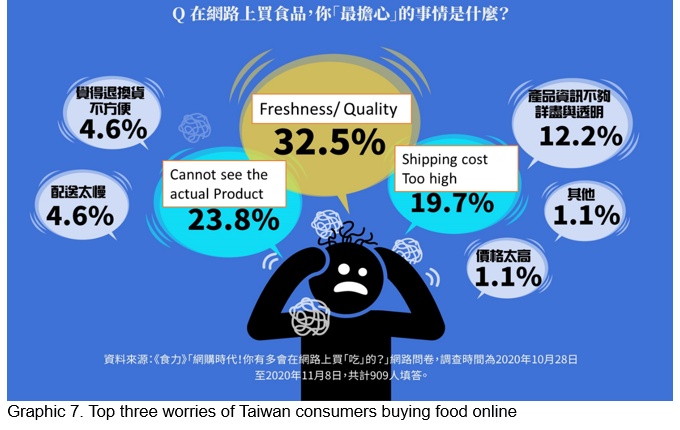

The graphic below (Graphic 6) shows the survey result conducted by Food Next and Kantar Taiwan in 2020. The result shows that e-commerce experienced the highest growth rate of 80% among all the sales channels of fresh food in Taiwan. Also the top three worries that consumers have toward buying fresh food online are: Food freshness/ quality(32.5%); Cannot see the actual product (23.8%); and High shipping cost (19.7%) (Graphic 7).

International market

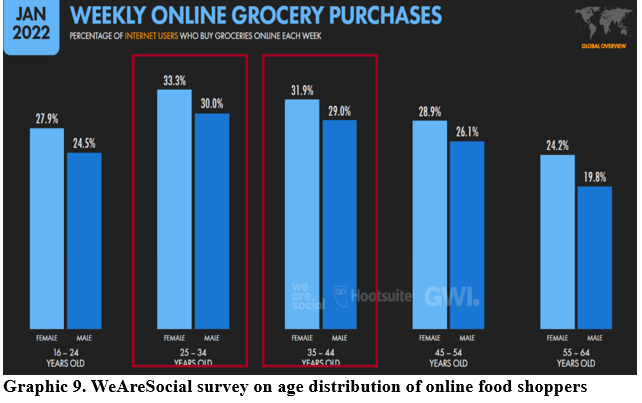

In this post-COVID time of 2022, worldwide consumers still report high spending of US$376 online for food to reach a market size of US$376.6 billion (+38% Y to Y), based on the survey conducted periodically by WeAreSocial in 144 countries (Graphic 8). The same survey also reports the age of 25-34 and 35-44 are the most frequent online shoppers for food. These are young adults and families with small children (Graphic 9).

The impact of e-commerce and COVID-19

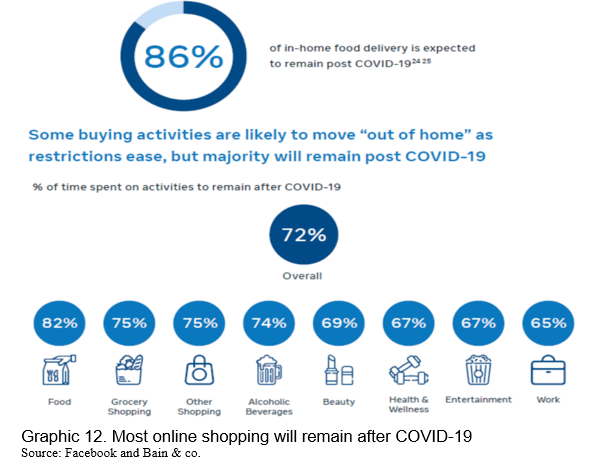

COVID-19 drives eating occasions into the home. The implementation of social distancing policies and city (or country) wide lockdowns mean many out-of-home options are off the table. In addition, institutions such as schools have closed, and some consumers believe that home-prepared food is safer, shifting millions of eating occasions into the home and driving growth of food through the retail channel.

There has been extreme growth in e-commerce grocery retailing, with governments pushing its use and consumers switching to comply with social distancing/quarantine or in order to actually secure groceries that they cannot be sure will be available in stores. Retailers are betting that the change will hold once restrictions are lifted, with many expanding their operations. Prior to the outbreak, e-commerce was the channel with the fastest growth rate; this forced acceleration could result in a paradigm shift in some markets.

The agri-food sector as a whole was not among those which suffered the most from the health crisis, it was greatly upset. 210 Analytics’ research shows that the core online grocery shoppers are the older Millennials and younger Gen X-ers – shoppers right around age 40 who tend to be in their family-rearing and career-building years. Grocery e-commerce is best developed in urban areas in cities along the two coasts and is clustered among high-income households. That part is unchanged from pre-pandemic.

The items purchased online are changing too. Branded item sales in the fresh categoriesare higher online than offline, at +2% for fresh foods overall. The biggest difference is meat, where brands are 22% more likely to be in online versus offline baskets, followed by baked goods.

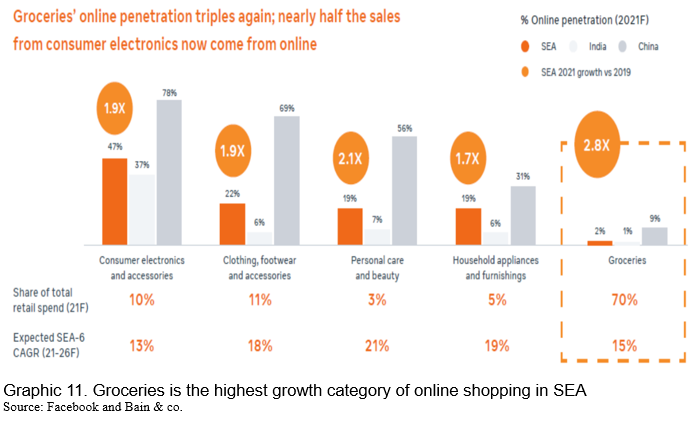

As the first region hit by the COVID-19 outbreak, the reaction of SEA consumers is instructive: there is now more e-commerce grocery shopping, increased use of smaller, local stores, greater purchase of food with immunity-boosting claims, and use of delivery for (previously unavailable) foodservice options. Food supply is being tested with the key problems of border closures and absence of workers. In the future, localism is likely to gain prominence as the ‘need’ for produce from around the world comes into question, given COVID-19’s demonstration of how interlinked and vulnerable different markets are.

OPPORTUNITIES AND CHALLENGS OF AGRI-FOOD E-COMMERCE

The current challenges that fresh food ecommerce confronts primarily lies within the effort trying to accommodate the unique characters of agriculture produce into the e-commerce world. In particular, there are five primary peculiarities in the consumption and supply of agricultural produce requiring different technology or business model than conventional e-commerce:

The unique characteristics of fresh produce cause conflicts with the operation of traditional e-commerce. In this section we will discuss how the introduction of social commerce and related technology can reconcile these conflicts and thus help the future development of fresh food e-commerce. Several strategies of applying social commerce and interactive technologies are proposed as follows:

Applying more of social platform and live-streaming technologies

Social platforms include open/public platforms like Facebook, Instagram or Twitter and closed/communicative ones like LINE (Taiwan, Japan, Thailand) or WeChat (China) or Zalo (Vietnam). The open kind of social platforms are meant for individuals to interact with the general public while the closed ones are more for the convenient communication with friends and family. The highly interactive nature of social platforms is enabling product sales through a channel built among people.

Lots of interactive technologies are being introduced to social commerce in order to enhance the influence power of KOL over their follower’s purchase decision. For example, the live-streaming function is now commonly seen on social platforms and a wide spectrum of cosmetic camera software is available. The order management integrated solutions for logistics and online payment are also mature. In the above section we discussed the purchase decision of fresh food requires abundant information other than the product appearance such as recipes or peer experience on the taste/texture. Online KOLs are the ideal channel for the information and with the interactive technologies, the efficacy of communication is highly increased. Many successful cases of selling seafood or seasonal fruits by fisherman / farmer/ online celebrity demonstrate the instant interaction with the person you trust (KOLs) result in quick purchase decision. For the future, the possible development can be discussed of an aggregated marketplace for FB live-streaming channels selling fresh produce. A centralized marketplace, like a TV station with all-day produce-selling channels, can provide scalable back station service and integrated brand management and customer care.

Building the online version of farmer’s markets

When consumers shop for fresh food, they want to see the actual product. From time to time, they may not know the correct name/term for the “thing” they have in mind, but when they see it, they know. These unique shopping habits demand a product presentation system based on not text/pictures but on videos, which present the authentic and real-time stocks and appearance of the produce.

A pure video can let consumers see the “actual thing” but lack necessary transaction information and functions such as price, quantity, delivery address, and payment. So, an embedded AR technology in video/film becomes important if the goal is to mimic the shopping experience of “what you see is what you get”.

Farmer’s market has been long existed for farmers across country to directly sell to the consumers. The merits include the trust and information exchange directly built between farmers and consumers, and the consumers get to see the actual produce they buy and do their shopping in one place. The merit can all be kept in the web version of farmer’s market where all the farmers do live streaming from their fields can be aggregated in one web place and at the same time the web place also provide e-commerce transaction fulfillment service like payment and logistics. The best advantage of online farmer’s market is to overcome the handicap of time and space while maintaining the merits of brick-and-mortar vendor markets.

Building W/TaaS as the infrastructure for agri-food ecommerce

WaaS stands for Warehouse as a Service, and TaaS for Transportation as a Service. Both consumers and ecommerce business identify the cost of logistics to be the top concern when buying/selling agri-food. Due to the unique transaction characters of agri-food including low purchase volume, high order frequency and necessity of cold-chain transportation, the reduction of transportation and delivery cost is the key to further develop agri-food ecommerce. If every ecommerce business investing in their own produce collection, preparation, warehousing and transportation system, the possibility of cost reduction is dim. Instead, in order to reach the economy of scale, there should be a role of infrastructure operators who build the warehouse and transportation system for the industry and then provide the (WaaS and TaaS) service to farmers and agri-food ecommerce business. In this way for a small fee of service, every farmer、small farm or e-commerce business can leverage a scalable system that can service country-wide farm collection and door-to-door delivery.

Overview of Domestic and International Agri-food E-commerce: Challenges and Opportunities for Asian and Pacific Countries

ABSTRACT

This paper illustrates the evolution trajectory of agri-food distribution channels, from the traditional system, --then the modernization of chain-store supermarkets and up to the recent surge of e-commerce. The merits and inadequacies of services are discussed on the current status of agri-food e-commerce. Following that the present developments are reviewed of agri-food e-commerce in Taiwan、U.S.、SEA and China, concentrating on the effect of COVID-19. In the summary section, three development strategies are proposed for the further improvement of the inadequacies of agri-food e-commerce service.

Keywords: agri-food e-commerce, international agri-food market, business model

INTRODUCTION

The rapid development of e-commerce and the massive lockdown resulting from the COVID-19 pandemic have been calling for further digitizing the agri-food distribution channels. This paper reviews the current status of the agri-food e-commerce market and the evolution of agri-food distribution channels. In summary this paper discusses the implications for government policy and business strategy to cope with the next-stage development of agri-food e-commerce.

THE EVOLUTION OF AGRI-FOOD DISTRIBUTION CHANNEL

This section explains the evolution trajectory of distribution channels in the agri-food market. Starting from the traditional wholesale/auction market to the recent burst of business in agri-food e-commerce. Amongst others, the transaction characters, consumption behaviors and the mechanisms of information exchange and trust building are discussed.

The traditional agri-food distribution channel and its modernization

The traditional distribution channel of agri-food consists of the wholesale and retail systems. The wholesale distribution system is centered around the auction market. Wholesalers buy produce from farmers and in Taiwan they need to have the license to put the produce in the public auction markets. The produce in auction markets is only processed in basic cleaning and quality classification. Individual packaging and the information of produce are absent. Distributors and retailers pick up the produce from the auction market and then deliver them to the traditional retail markets.

The traditional retail market is a geographic aggregation of stall vendors. The retail market is opened at fixed location and scheduled time. Consumers choose to buy agri-food from traditional markets (instead of the modern chain-store supermarket) because they perceive the traditional distribution system is more time efficient and thus the produce transacted there is “fresher.” Stall vendors are also preferred because they can provide information on food preparation and agri-food knowledge. The traditional market serves neighborhood shoppers, so the transactions heavily rely on inter-personal trust.

The modern agri-food distribution channel

The modernization of agri-food channel refers to the change of formation and structure from the traditional wholesale/retail system to the chain-store supermarket and warehouse. The modernization is accompanied with progress of urbanization of population and lifestyle. The agri-food prepared for the modern chain store needs to be single packaged with pre-defined product specification and price. The distribution and preparation service are provided by qualified wholesalers or contracted farmers of the chain store.

In the modern supermarket, shoppers obtain information from the shelf and package, rather than from the store staff. Furthermore, shoppers make purchase decision based on the trust upon the store or the brand of the agri-food. The agri-food sold in a modern chain store needs to meet the qualification standard of the store or its suppliers. Also, the agri-food needs to work on its packages and brand establishment to gain the shopper attention.

A strong push in fresh food e-commerce

Fresh food includes fresh fruits, vegetables, meats, seafood, baking cakes, dairy and cheese and it refers to primary products without cooking and other deep-processing procedure, selling via necessary preservation and simple preparation for the shelves. Fresh food e-commerce refers to transaction via internet platform, directly distributing fresh products to consumers by self-built logistics or through third-party logistics.

Fresh food e-commerce has experienced a meteoric breakthrough, of the order of 50% increase reported in the U.S. during the year 2021. This trend has affected all distributors who have set up drives, click and collect, home deliveries but also those manufacturers who have embarked on the Direct to Consumer (D2C) mode. Several manufacturers who have highly valued products like brand-name milk or mineral water reported unusual sales increase in e-commerce because their logistics cost / turnover ratio is lower.

Technology advancement and shopping behavior change under the COVID-19 pandemic both drive the shift of sales from brick-and-mortar to e-commerce. Agri food product needs different preparation for e-commerce than for modern supermarkets. E-commerce shoppers seldom buy single product. To satisfy the diversity consumption of daily diary, agri-food products are usually provided on e-commerce platform in a form of mix-up basket consisted of vegetables, meat/protein, fruit, grains…etc. As a consequence, e-commerce business needs to conduct the assortment for the consumers, and the warehouse operators need to pick up various individual agri-food products and put them in the shipping box. The warehouse is a cooling environment for the preservation need of the agri-food products with the temperature of 0-5 degree Celsius, which is not suitable for long-hour work. This is why pick-up mistakes are commonly seen in fresh food e-commerce delivery. The operating environment needs to be improved for the better.

The Overview OF DOMESTIC AND INTERNATIONAL AGRI-FOOD E-COMMERCE MARKET

Status of fresh food e-commerce in Taiwan

Fresh food e-commerce in Taiwan is in the exploratory stage of development, facing many problems and challenges. However, more and more brick-and-mortar retail players have invested or are going to invest heavily to integrate their online and offline resources to provide consumers with a more user-friendly fresh food shopping environment. They included Welcome, PX Mart, 7-Eleven, Families, Simple Mart, City’ Super, RT Mart, Ai Mai, Costco, Carrefour and Taiwan Fresh Supermarkets, have all expanded their e-retail platforms to serve their clients both offline and online rapidly.

Not only e-retail platforms in the food and beverage sector such as Famicloud, Wonderfulfood, i3Fresh and related local operators are fast growing, but also PChome Online and Momo Shop both Taiwan’s giant e-commerce companies have implemented logistics to provide fresh food delivery. In addition, according to a report from the USDA, Taiwan’s e-retail market size has grown from US$6.9 billion in 2019 to US$8.3 billion in 2020 as Taiwanese consumers have preferred ‘no-contact’ shopping options to prevent the spread of COVID-19. This has been shown particularly important in the growing trend of the fresh food e-commerce in Taiwan.

The graphic below (Graphic 6) shows the survey result conducted by Food Next and Kantar Taiwan in 2020. The result shows that e-commerce experienced the highest growth rate of 80% among all the sales channels of fresh food in Taiwan. Also the top three worries that consumers have toward buying fresh food online are: Food freshness/ quality(32.5%); Cannot see the actual product (23.8%); and High shipping cost (19.7%) (Graphic 7).

International market

In this post-COVID time of 2022, worldwide consumers still report high spending of US$376 online for food to reach a market size of US$376.6 billion (+38% Y to Y), based on the survey conducted periodically by WeAreSocial in 144 countries (Graphic 8). The same survey also reports the age of 25-34 and 35-44 are the most frequent online shoppers for food. These are young adults and families with small children (Graphic 9).

The impact of e-commerce and COVID-19

COVID-19 drives eating occasions into the home. The implementation of social distancing policies and city (or country) wide lockdowns mean many out-of-home options are off the table. In addition, institutions such as schools have closed, and some consumers believe that home-prepared food is safer, shifting millions of eating occasions into the home and driving growth of food through the retail channel.

There has been extreme growth in e-commerce grocery retailing, with governments pushing its use and consumers switching to comply with social distancing/quarantine or in order to actually secure groceries that they cannot be sure will be available in stores. Retailers are betting that the change will hold once restrictions are lifted, with many expanding their operations. Prior to the outbreak, e-commerce was the channel with the fastest growth rate; this forced acceleration could result in a paradigm shift in some markets.

The agri-food sector as a whole was not among those which suffered the most from the health crisis, it was greatly upset. 210 Analytics’ research shows that the core online grocery shoppers are the older Millennials and younger Gen X-ers – shoppers right around age 40 who tend to be in their family-rearing and career-building years. Grocery e-commerce is best developed in urban areas in cities along the two coasts and is clustered among high-income households. That part is unchanged from pre-pandemic.

The items purchased online are changing too. Branded item sales in the fresh categoriesare higher online than offline, at +2% for fresh foods overall. The biggest difference is meat, where brands are 22% more likely to be in online versus offline baskets, followed by baked goods.

As the first region hit by the COVID-19 outbreak, the reaction of SEA consumers is instructive: there is now more e-commerce grocery shopping, increased use of smaller, local stores, greater purchase of food with immunity-boosting claims, and use of delivery for (previously unavailable) foodservice options. Food supply is being tested with the key problems of border closures and absence of workers. In the future, localism is likely to gain prominence as the ‘need’ for produce from around the world comes into question, given COVID-19’s demonstration of how interlinked and vulnerable different markets are.

OPPORTUNITIES AND CHALLENGS OF AGRI-FOOD E-COMMERCE

The current challenges that fresh food ecommerce confronts primarily lies within the effort trying to accommodate the unique characters of agriculture produce into the e-commerce world. In particular, there are five primary peculiarities in the consumption and supply of agricultural produce requiring different technology or business model than conventional e-commerce:

The unique characteristics of fresh produce cause conflicts with the operation of traditional e-commerce. In this section we will discuss how the introduction of social commerce and related technology can reconcile these conflicts and thus help the future development of fresh food e-commerce. Several strategies of applying social commerce and interactive technologies are proposed as follows:

Applying more of social platform and live-streaming technologies

Social platforms include open/public platforms like Facebook, Instagram or Twitter and closed/communicative ones like LINE (Taiwan, Japan, Thailand) or WeChat (China) or Zalo (Vietnam). The open kind of social platforms are meant for individuals to interact with the general public while the closed ones are more for the convenient communication with friends and family. The highly interactive nature of social platforms is enabling product sales through a channel built among people.

Lots of interactive technologies are being introduced to social commerce in order to enhance the influence power of KOL over their follower’s purchase decision. For example, the live-streaming function is now commonly seen on social platforms and a wide spectrum of cosmetic camera software is available. The order management integrated solutions for logistics and online payment are also mature. In the above section we discussed the purchase decision of fresh food requires abundant information other than the product appearance such as recipes or peer experience on the taste/texture. Online KOLs are the ideal channel for the information and with the interactive technologies, the efficacy of communication is highly increased. Many successful cases of selling seafood or seasonal fruits by fisherman / farmer/ online celebrity demonstrate the instant interaction with the person you trust (KOLs) result in quick purchase decision. For the future, the possible development can be discussed of an aggregated marketplace for FB live-streaming channels selling fresh produce. A centralized marketplace, like a TV station with all-day produce-selling channels, can provide scalable back station service and integrated brand management and customer care.

Building the online version of farmer’s markets

When consumers shop for fresh food, they want to see the actual product. From time to time, they may not know the correct name/term for the “thing” they have in mind, but when they see it, they know. These unique shopping habits demand a product presentation system based on not text/pictures but on videos, which present the authentic and real-time stocks and appearance of the produce.

A pure video can let consumers see the “actual thing” but lack necessary transaction information and functions such as price, quantity, delivery address, and payment. So, an embedded AR technology in video/film becomes important if the goal is to mimic the shopping experience of “what you see is what you get”.

Farmer’s market has been long existed for farmers across country to directly sell to the consumers. The merits include the trust and information exchange directly built between farmers and consumers, and the consumers get to see the actual produce they buy and do their shopping in one place. The merit can all be kept in the web version of farmer’s market where all the farmers do live streaming from their fields can be aggregated in one web place and at the same time the web place also provide e-commerce transaction fulfillment service like payment and logistics. The best advantage of online farmer’s market is to overcome the handicap of time and space while maintaining the merits of brick-and-mortar vendor markets.

Building W/TaaS as the infrastructure for agri-food ecommerce

WaaS stands for Warehouse as a Service, and TaaS for Transportation as a Service. Both consumers and ecommerce business identify the cost of logistics to be the top concern when buying/selling agri-food. Due to the unique transaction characters of agri-food including low purchase volume, high order frequency and necessity of cold-chain transportation, the reduction of transportation and delivery cost is the key to further develop agri-food ecommerce. If every ecommerce business investing in their own produce collection, preparation, warehousing and transportation system, the possibility of cost reduction is dim. Instead, in order to reach the economy of scale, there should be a role of infrastructure operators who build the warehouse and transportation system for the industry and then provide the (WaaS and TaaS) service to farmers and agri-food ecommerce business. In this way for a small fee of service, every farmer、small farm or e-commerce business can leverage a scalable system that can service country-wide farm collection and door-to-door delivery.