ABSTRACT

During the COVID-19 pandemic, Malaysia has taken action to impose a Movement Control Order (MCO) to overcome the spreading of the pandemic. Due to the MCO, all activities either economic, social, agriculture and others were totally shut down. The action has caused disruption in the agriculture supply chain in Malaysia. Thus, a study was conducted to understand the impact of MCO toward agriculture food supply chain. The study was conducted in two phases during the 3rd MCO and 1st CMCO. The main concern from the agri-food producers during the early phase of MCO were marketing related where the disruption of conventional market channels which led to the difficulty in selling agricultural products (91%). Farmers lost their income and capital, although the majority of them were still operating during MCO (68%). The product selling price dropped at an average of 14.3%. But still, about 69% of the producers used e-commerce platform as an alternative channel throughout the MCO. In the 2nd survey, the market channel is getting better for the most agri-food producers. Those who were still running their business have increased to 78%, and the selling price has raised 31.3% on average. However, the usage of e-commerce is getting smaller at 27%. The study concluded that some actions need to been taken to ensure undisrupted domestic supply chain. The government needs to facilitate financial assistance to the producer to support their business since their production is at minimum capacity due to insufficient fund for roll-up capital. Also, there is a need to encourage the use of the digital platform to enhance product competitiveness and acquire additional profit.

Keyword: Agriculture supply chain, Movement Control Order (MCO), COVID-19 Pandemic

INTRODUCTION

The pandemic of coronavirus disease or COVID-19 has spread rapidly across the world shaking lives and livelihoods. The full effect of the virus on food security and agricultural food systems is not yet understood, nor is it likely to be known, for months to come, as the spread of the virus continues to vary across continents and nations. What has been true is that it will have, and already has, significant negative effects on people along the food supply chain – from producers to processors, marketers, transporters and consumers (FAO, 2020). During the COVID-19 pandemic it was noted that the agriculture sector also needs to be safeguarded to protect the well-being of farmers, breeders, fishermen and workers who are mostly low-income earners (Ahmad Ashraf Shaharudin, 2020).

Malaysia started to experience the COVID-19 pandemic in March 2020. In the rising of cases, the Malaysian government initiated the Movement Control Order (MCO) and later Conditional Movement Control Order (CMCO). Based on a report by the Department of Statistics Malaysia (2020) at the end of March 2020, 52.6 % of Malaysians had monetary difficulties and in agricultural sector where 21.9 % had lost their employment. At that time, the effect of MCO and CMCO on the economy is uncertain, even in the agro-food market. Malaysia’s Ministry of Agriculture and Food Industry (MAFI) is therefore taking the initiative to assess the impact of MCO and CMCO on the agricultural sector. Objectively, this study offers an overview of the current market situation during MCO and CMCO influencing the agricultural supply chain and food supply in their expectations following the introduction of MCO and CMCO.

METHODOLOGY

This study was carried out to understand the phenomena of COVID-19 in the agriculture sector, focusing on the supply chain effect. This study was conducted in two stages: Online during the 3rd MCO (17 April 2020 - 28 April 2020) and by a face-to-face survey (by the government agency under MAFI) during the 1st CMCO (20 May 2020 - 12 June 2020). The data were collected using the combination of an online and a conventional methods. The online survey was done using Google form during the 3rd MCO and later, using a questionnaire during the 1st CMCO. For the online survey, the question was distributed by the government agency through e-mail and WhatsApp application to various contacts that are related to the agriculture sector. The second survey was done by members of the agency to selected respondents based on the cluster. The survey was done in two phases because the first survey focused more on identifying what is the issue that happens during the MCO in general. Later, the second survey is to understand the effects of the current actions that in the short term had been done in finding what happened to our agriculture sector especially in the supply chain. Descriptive analysis was used to describe the percentages for demographic profiles, issues and problems faced by the respondents, people in business operations, selling methods and prices. Comparison of data of the 3rd MCO and 1st CMCO was done to see if there is any significant differences between the period toward the respondents that are affected by the supply chain and selling method during these two periods.

FINDINGS AND DISCUSSION

Demographic profile

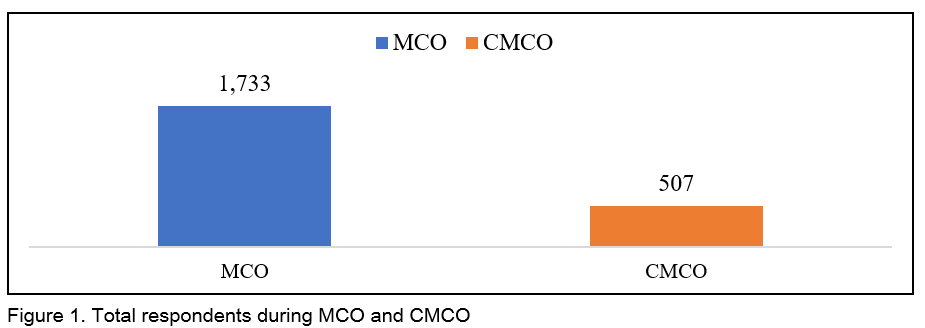

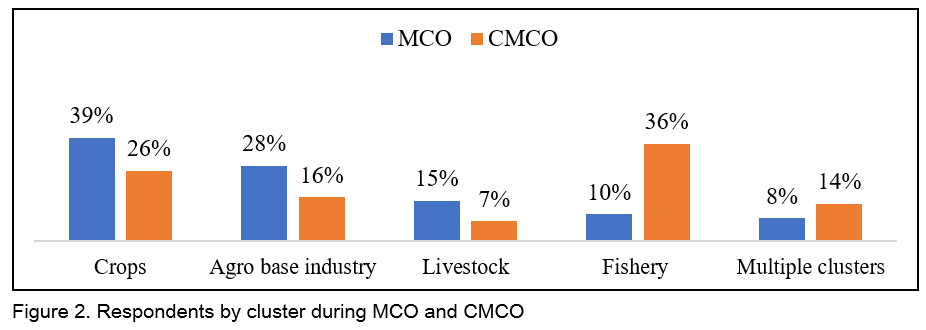

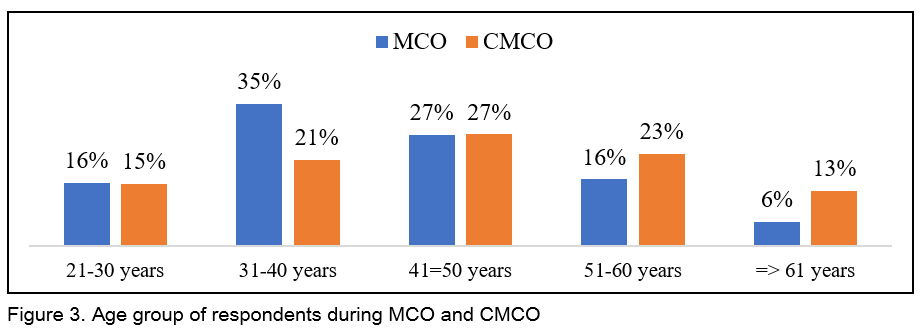

There was a total of 1,733 respondents and 507 respondents for the first and second survey, respectively (Figure 1). Respondents are categorized into four clusters: Crops (39%), Processed foods (28%), livestock (15%), Fisheries (10%) and some of the respondents (8%) involved in multiple clusters (e.g. crops and livestock clusters or livestock and processed foods). Most respondents come from the crop cluster (39%) in the 1st survey compared to 36% of the respondents who are from the fishery cluster in the 2nd survey, followed by 26% from crop cluster, processed foods (16%), livestock (7%) and multiple clusters (14%) (Figure 2). The majority of the respondents engaged in the study were youth between 20 and 40 years old (50.5%) in the 1st survey, 41 to 60 years old (50%) in the 2nd survey (Figure 3).

EFFECTS ON THE SUPPLY CHAIN

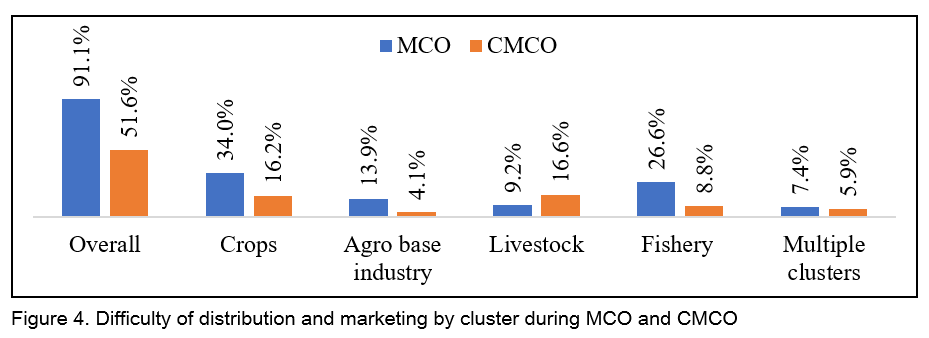

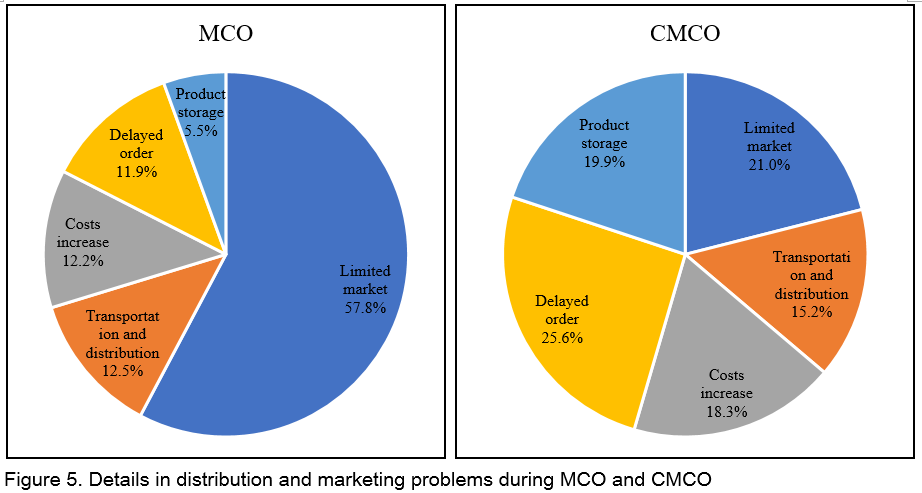

For the most part, MCO and CMCO have affected the supply chain flow for most farmers and entrepreneurs. Results of the study revealed that the producers had difficulty in marketing their agricultural produce and products, specifically those involved in the Crop & Processed food clusters (91.1%) (Figure 4). Such respondents typically had a problem in selling these agricultural products and products were due to limited market issues (57.8%), transportation and distribution issues (12.5%), increased marketing management costs (12.2%), delayed orders (11.9%) and product storage (5.5%). Results from the 2nd survey showed that the market situation is getting better. Fewer percentage of the respondents have reported the difficulty in selling agricultural products (51% compared to 91% in the 1st survey), and for others also are getting better (Figure 5).

Changes in the marketing channels and prices

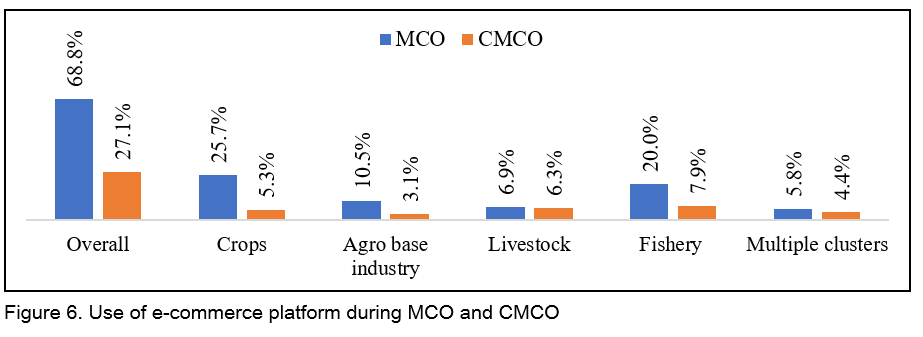

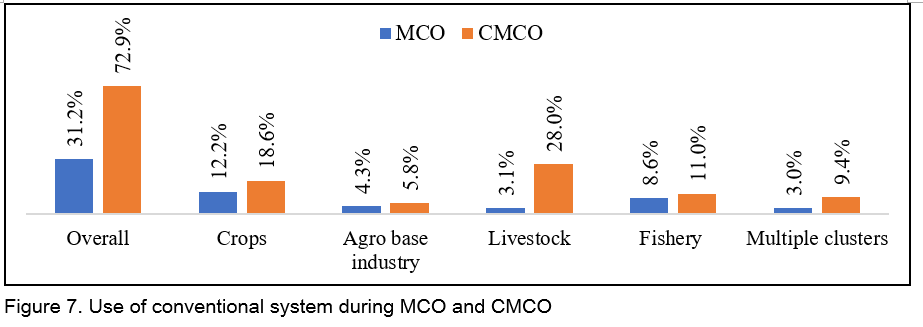

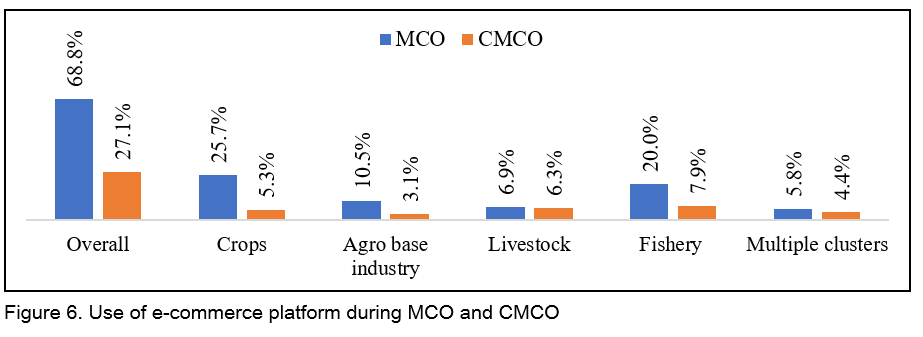

During the MCO, it was found that the use of the online platform was the consumer's option to buy their items. The producer was actively involved in online marketing (68.8%) using Shopee and Lazada platforms or cash-on-delivery methods to survive in a calamity situation. Although the use of e-commerce has gone up and helped the agri-food producers in sustaining their businesses in the early phase of MCO, the e-commerce users among them are getting smaller (69% to only 27% during CMCO) because they have reverted to the traditional marketing channels (Figure 6). Those interested in pursuing the use of traditional marketing channels have increased from 31.2% to 72.9% during CMCO (Figure 7).

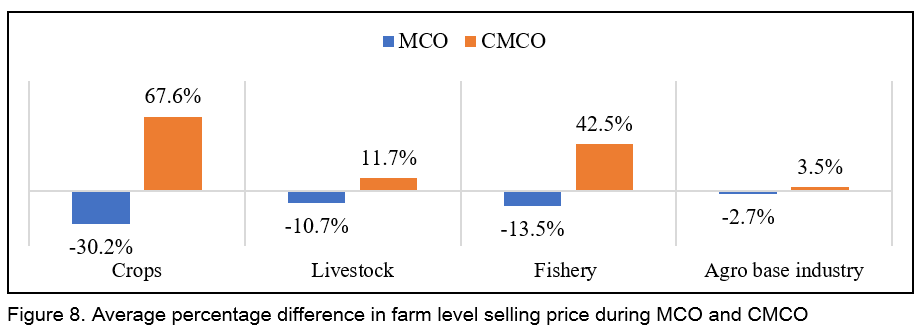

Price adjustments were taking place during the MCO and CMCO. Farmers and entrepreneurs have been advised to share prices during this period. During MCO, the product selling price was dropped at the highest rate (30%) for the crop-based products, followed by fisheries (13%), livestock (11%) and processed foods (3%). But the price has raised 67% on average during CMCO for crop cluster, compared to the early phase of MCO, followed by fishery (42%), livestock (11%) and 3.5% for processed food cluster (Figure 8). The average price is shown for contrast.

Business operational status

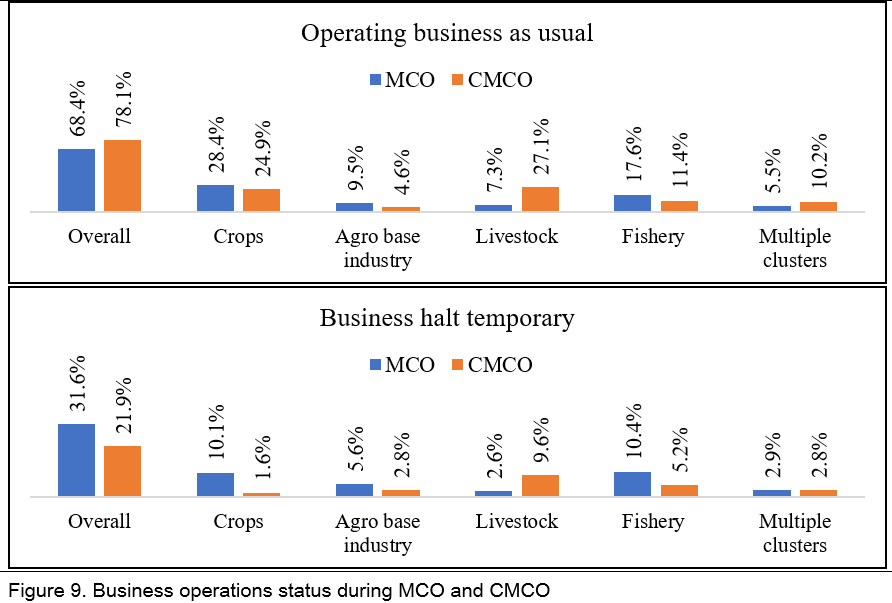

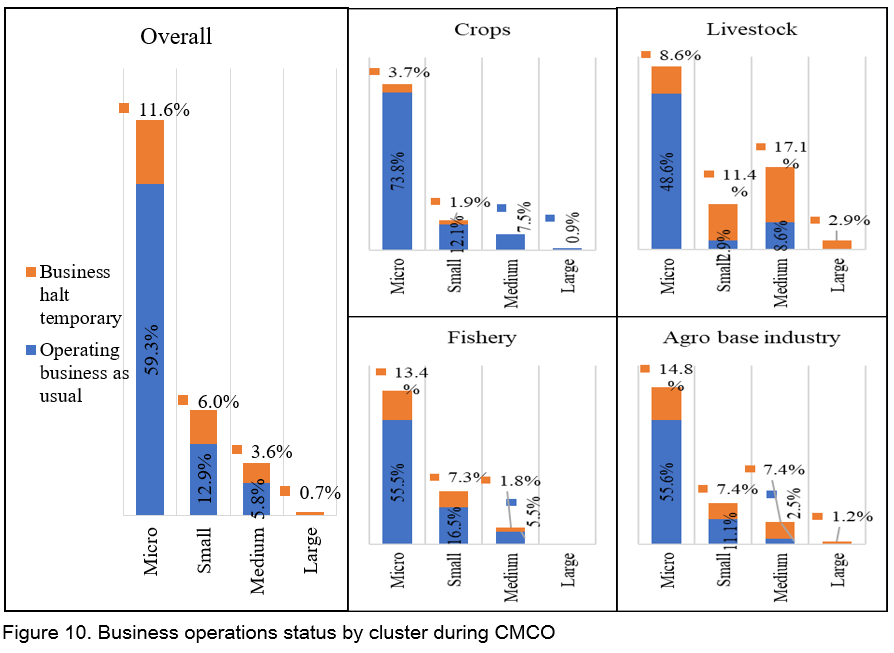

In the course of the MCO and CMCO, the company operator still has to work but with difficulties. While the manufacturer was faced with the marketing problem during the MCO, 68.4% of them were able to continue their business as usual and 31.6% of them seem to be unable to continue their business. In the 2nd survey, those who were still running their business have increased to 78.1%, compared to 68.4% in the MCO (Figure 9). The majority of them who temporarily closed their businesses were from small & micro category of SME. Despite the difficulty in sustaining their businesses, most of the producers who closed their businesses temporarily will resume activity after MCO phase (Figure 10).

CONCLUSION

The study concluded that some action needs to been taken to ensure undisrupted domestic supply chain and to avoid unnecessary product disposal from the producers as a way to overcome the issue of the local supply chain. The need to facilitate financial assistance to the producers to support their business since their production is at minimum capacity due to insufficient fund for roll-up capital. The producers are encouraged to continue using the digital platform to explore new markets since the private sectors have started to be involved in providing e-commerce platform, thus allowing them to enhance product competitiveness and acquire additional profit.

The government has implemented various programs and assistance to minimize the impact of MCO, at the same time, the situation seems to recover at the CMCO phase, so additional measures need to be undertaken to ensure the sustainability of the agricultural and food sector:

- Assure the domestic food supply chain is undisrupted under any circumstances to avoid the issue of product dumping or unnecessary disposal. Thus, agricultural products can be sold to wholesalers and consumers;

- Facilitate financial assistance to the producers, specifically on the revolving capital for fishery and crop clusters, to remain competitive after the MCO as there are plenty of them who are only able to operate at minimum production levels or closed their businesses. Some of the reasons for not running their business are due to insufficient roll-up capital to continue running their businesses in the same situation prior to MCO.

- Encourage and convince the producers to continue using the digital platform or the online sales channel to provide opportunities for them in exploring new markets, in line with the Industrial Revolution 4.0, which focused on digital technology. The e-commerce platform provided by the government and the private sectors should be exploited by the target group to enhance product competitiveness, reduce dependency on the middlemen, and thus acquire additional profit; and

- Establish a special committee that will act as an Immediate Action Unit that is capable of dealing with market chain issues, particularly in the agricultural sector. This Immediate Action Unit is in a position to determine and enforce immediate and medium-term action to resolve any issues that may occur in the future.

REFERENCES

Ahmad Ashraf Shaharudin (2020), Protecting the Agriculture Sector During the COVID-19 Crisis. Khazanah Research Institute (KRI) Views. http://www.krinstitute.org/Views-@-Protecting_the_Agriculture_Sector_During_the_COVID-19_Crisis.aspx

FAO (2020), Coronavirus disease 2019 (COVID-19) Addressing the impacts of COVID-19 in food crises (April–December 2020), FAO’s component of the Global COVID-19 Humanitarian Response Plan. http://www.fao.org/3/ca9192en/ca9192en.pdf

MARDI (2020), Laporan Kesan PKP dan PKPB terhadap golongan sasar industri pertanian dan makanan, Kementerian Pertanian dan Industri Makanan (MAFI). Unpublish report.

Department of Statistics Malaysia (2020), Laporan Survei Khas Kesan COVID-19 Kepada Ekonomi Dan Individu (Pusingan 1). https://www.dosm.gov.my/v1/uploads/files/COVID-19/Analisis_Survei_Khas_Kesan_COVID-19_Kepada_Ekonomi_dan_Individu-Laporan_Penuh.pdf

Agriculture Food Supply Chain Scenario during the COVID-19 Pandemic in Malaysia

ABSTRACT

During the COVID-19 pandemic, Malaysia has taken action to impose a Movement Control Order (MCO) to overcome the spreading of the pandemic. Due to the MCO, all activities either economic, social, agriculture and others were totally shut down. The action has caused disruption in the agriculture supply chain in Malaysia. Thus, a study was conducted to understand the impact of MCO toward agriculture food supply chain. The study was conducted in two phases during the 3rd MCO and 1st CMCO. The main concern from the agri-food producers during the early phase of MCO were marketing related where the disruption of conventional market channels which led to the difficulty in selling agricultural products (91%). Farmers lost their income and capital, although the majority of them were still operating during MCO (68%). The product selling price dropped at an average of 14.3%. But still, about 69% of the producers used e-commerce platform as an alternative channel throughout the MCO. In the 2nd survey, the market channel is getting better for the most agri-food producers. Those who were still running their business have increased to 78%, and the selling price has raised 31.3% on average. However, the usage of e-commerce is getting smaller at 27%. The study concluded that some actions need to been taken to ensure undisrupted domestic supply chain. The government needs to facilitate financial assistance to the producer to support their business since their production is at minimum capacity due to insufficient fund for roll-up capital. Also, there is a need to encourage the use of the digital platform to enhance product competitiveness and acquire additional profit.

Keyword: Agriculture supply chain, Movement Control Order (MCO), COVID-19 Pandemic

INTRODUCTION

The pandemic of coronavirus disease or COVID-19 has spread rapidly across the world shaking lives and livelihoods. The full effect of the virus on food security and agricultural food systems is not yet understood, nor is it likely to be known, for months to come, as the spread of the virus continues to vary across continents and nations. What has been true is that it will have, and already has, significant negative effects on people along the food supply chain – from producers to processors, marketers, transporters and consumers (FAO, 2020). During the COVID-19 pandemic it was noted that the agriculture sector also needs to be safeguarded to protect the well-being of farmers, breeders, fishermen and workers who are mostly low-income earners (Ahmad Ashraf Shaharudin, 2020).

Malaysia started to experience the COVID-19 pandemic in March 2020. In the rising of cases, the Malaysian government initiated the Movement Control Order (MCO) and later Conditional Movement Control Order (CMCO). Based on a report by the Department of Statistics Malaysia (2020) at the end of March 2020, 52.6 % of Malaysians had monetary difficulties and in agricultural sector where 21.9 % had lost their employment. At that time, the effect of MCO and CMCO on the economy is uncertain, even in the agro-food market. Malaysia’s Ministry of Agriculture and Food Industry (MAFI) is therefore taking the initiative to assess the impact of MCO and CMCO on the agricultural sector. Objectively, this study offers an overview of the current market situation during MCO and CMCO influencing the agricultural supply chain and food supply in their expectations following the introduction of MCO and CMCO.

METHODOLOGY

This study was carried out to understand the phenomena of COVID-19 in the agriculture sector, focusing on the supply chain effect. This study was conducted in two stages: Online during the 3rd MCO (17 April 2020 - 28 April 2020) and by a face-to-face survey (by the government agency under MAFI) during the 1st CMCO (20 May 2020 - 12 June 2020). The data were collected using the combination of an online and a conventional methods. The online survey was done using Google form during the 3rd MCO and later, using a questionnaire during the 1st CMCO. For the online survey, the question was distributed by the government agency through e-mail and WhatsApp application to various contacts that are related to the agriculture sector. The second survey was done by members of the agency to selected respondents based on the cluster. The survey was done in two phases because the first survey focused more on identifying what is the issue that happens during the MCO in general. Later, the second survey is to understand the effects of the current actions that in the short term had been done in finding what happened to our agriculture sector especially in the supply chain. Descriptive analysis was used to describe the percentages for demographic profiles, issues and problems faced by the respondents, people in business operations, selling methods and prices. Comparison of data of the 3rd MCO and 1st CMCO was done to see if there is any significant differences between the period toward the respondents that are affected by the supply chain and selling method during these two periods.

FINDINGS AND DISCUSSION

Demographic profile

There was a total of 1,733 respondents and 507 respondents for the first and second survey, respectively (Figure 1). Respondents are categorized into four clusters: Crops (39%), Processed foods (28%), livestock (15%), Fisheries (10%) and some of the respondents (8%) involved in multiple clusters (e.g. crops and livestock clusters or livestock and processed foods). Most respondents come from the crop cluster (39%) in the 1st survey compared to 36% of the respondents who are from the fishery cluster in the 2nd survey, followed by 26% from crop cluster, processed foods (16%), livestock (7%) and multiple clusters (14%) (Figure 2). The majority of the respondents engaged in the study were youth between 20 and 40 years old (50.5%) in the 1st survey, 41 to 60 years old (50%) in the 2nd survey (Figure 3).

EFFECTS ON THE SUPPLY CHAIN

For the most part, MCO and CMCO have affected the supply chain flow for most farmers and entrepreneurs. Results of the study revealed that the producers had difficulty in marketing their agricultural produce and products, specifically those involved in the Crop & Processed food clusters (91.1%) (Figure 4). Such respondents typically had a problem in selling these agricultural products and products were due to limited market issues (57.8%), transportation and distribution issues (12.5%), increased marketing management costs (12.2%), delayed orders (11.9%) and product storage (5.5%). Results from the 2nd survey showed that the market situation is getting better. Fewer percentage of the respondents have reported the difficulty in selling agricultural products (51% compared to 91% in the 1st survey), and for others also are getting better (Figure 5).

Changes in the marketing channels and prices

During the MCO, it was found that the use of the online platform was the consumer's option to buy their items. The producer was actively involved in online marketing (68.8%) using Shopee and Lazada platforms or cash-on-delivery methods to survive in a calamity situation. Although the use of e-commerce has gone up and helped the agri-food producers in sustaining their businesses in the early phase of MCO, the e-commerce users among them are getting smaller (69% to only 27% during CMCO) because they have reverted to the traditional marketing channels (Figure 6). Those interested in pursuing the use of traditional marketing channels have increased from 31.2% to 72.9% during CMCO (Figure 7).

Price adjustments were taking place during the MCO and CMCO. Farmers and entrepreneurs have been advised to share prices during this period. During MCO, the product selling price was dropped at the highest rate (30%) for the crop-based products, followed by fisheries (13%), livestock (11%) and processed foods (3%). But the price has raised 67% on average during CMCO for crop cluster, compared to the early phase of MCO, followed by fishery (42%), livestock (11%) and 3.5% for processed food cluster (Figure 8). The average price is shown for contrast.

Business operational status

In the course of the MCO and CMCO, the company operator still has to work but with difficulties. While the manufacturer was faced with the marketing problem during the MCO, 68.4% of them were able to continue their business as usual and 31.6% of them seem to be unable to continue their business. In the 2nd survey, those who were still running their business have increased to 78.1%, compared to 68.4% in the MCO (Figure 9). The majority of them who temporarily closed their businesses were from small & micro category of SME. Despite the difficulty in sustaining their businesses, most of the producers who closed their businesses temporarily will resume activity after MCO phase (Figure 10).

CONCLUSION

The study concluded that some action needs to been taken to ensure undisrupted domestic supply chain and to avoid unnecessary product disposal from the producers as a way to overcome the issue of the local supply chain. The need to facilitate financial assistance to the producers to support their business since their production is at minimum capacity due to insufficient fund for roll-up capital. The producers are encouraged to continue using the digital platform to explore new markets since the private sectors have started to be involved in providing e-commerce platform, thus allowing them to enhance product competitiveness and acquire additional profit.

The government has implemented various programs and assistance to minimize the impact of MCO, at the same time, the situation seems to recover at the CMCO phase, so additional measures need to be undertaken to ensure the sustainability of the agricultural and food sector:

REFERENCES

Ahmad Ashraf Shaharudin (2020), Protecting the Agriculture Sector During the COVID-19 Crisis. Khazanah Research Institute (KRI) Views. http://www.krinstitute.org/Views-@-Protecting_the_Agriculture_Sector_During_the_COVID-19_Crisis.aspx

FAO (2020), Coronavirus disease 2019 (COVID-19) Addressing the impacts of COVID-19 in food crises (April–December 2020), FAO’s component of the Global COVID-19 Humanitarian Response Plan. http://www.fao.org/3/ca9192en/ca9192en.pdf

MARDI (2020), Laporan Kesan PKP dan PKPB terhadap golongan sasar industri pertanian dan makanan, Kementerian Pertanian dan Industri Makanan (MAFI). Unpublish report.

Department of Statistics Malaysia (2020), Laporan Survei Khas Kesan COVID-19 Kepada Ekonomi Dan Individu (Pusingan 1). https://www.dosm.gov.my/v1/uploads/files/COVID-19/Analisis_Survei_Khas_Kesan_COVID-19_Kepada_Ekonomi_dan_Individu-Laporan_Penuh.pdf