ABSTRACT

Tropical fruits are important to Malaysia as they are the source of income for farmers, source of vitamins, minerals and dietary fibers for humans and generate revenue from the trading activities. Tropical fruits are also important in terms of land use after oil palm, rubber and paddy. The production of tropical fruits in Malaysia is increasing every year due to increase in land area and productivity. In 2017, more than 1.45 million tons of tropical fruits were produced and decreased to about 4.16% compared to 2013. The trade of tropical fruits also increased every year because of higher demand from domestic and global markets. In 2016, Malaysia exported US$259.77 million and imported about US$886.950 million worth of fruits. The trend of Malaysia’s export and import of tropical fruits is increasing, in favor of imports, thus, creating a negative balance of trade. Despite the increase in production and trading, the consumption of tropical fruits by Malaysian consumers indicates declining trends. The demand for tropical fruits in Malaysia is declining due to higher preferences toward temperate fruits, especially by generation Y. The Malaysian government needs to establish new strategic plans to ensure that the tropical fruit industry is sustainable and continues to contribute to Malaysia’s economy.

Keywords: Tropical fruits, import, export, production, consumption

INTRODUCTION

The cultivation of tropical and subtropical fruits is an important enterprise in many developing countries, including Malaysia. Tropical fruits are defined as fruits that are grown in hot and humid regions covering most of the tropical and subtropical areas of Asia, Africa, Central America, South America, the Caribbean and Oceania. This industry generates employment opportunities and incomes from both downstream and upstream activities. It also provides the opportunity for raising foreign exchange earnings and food security.

Tropical fruits are one of the main contributors to the agricultural gross domestic product (GDP). Every year, this industry contributes more than US$250 million in terms of income from export and creates more than 260,000 job opportunities to Malaysian people. The market for tropical fruits in the world is expected to increase due to increase in world population and the awareness toward the health benefit from part taking these commodities.

From the nutritional standpoint, fruits are one of the major sources of dietary requirements. Tropical fruits contain many vitamins, dietary fibers and minerals for health benefits. As a result, the consumption and trade also show a significant growth. This paper aims to provide an overview of the trend in the production, international trade and consumption of major tropical fruits in Malaysia during a five-year period from 2013 to 2017.

PRODUCTION TREND

Malaysia is a tropical country and very suitable for tropical fruit cultivation. In general, the cultivation of tropical fruits in Malaysia is carried out on a small-scale basis. The average farm size for tropical fruits in Malaysia is about 2.5 hectare per farmer. Only certain fruits are cultivated in larger or commercial scale, such as pineapple, papaya and durian. These farms are managed on a commercial scale and follow the good agricultural practices as most of the produce is mainly for export.

Tropical fruits can be categorized as seasonal and non-seasonal fruits. The seasonal fruits only produce fruits at specific times. The main season of tropical fruits in Malaysia is generally fall during June-August, while the off season is in December-February. Some famous seasonal tropical fruits in Malaysia include durian, mangosteen, rambutan, duku, langsat and pulasan. On the other hand, the non-seasonal fruits can be cultivated and harvested all-year round. Examples of non-seasonal tropical fruits include guava, papaya, banana and pineapple.

Tropical fruits are one of the important crops in Malaysia, after oil palm, rubber and paddy. In 2017, more than 202,400 hectares of land are planted to and cultivated with tropical fruits. In general, 64 varieties of tropical fruits are cultivated in Malaysia. However, the Ministry of Agriculture and Agrobased Industry has selected 21 varieties to be cultivated on a commercial scale, where as the others are planted in small areas or in the backyards. The list of major tropical fruits in Malaysia is as follows:

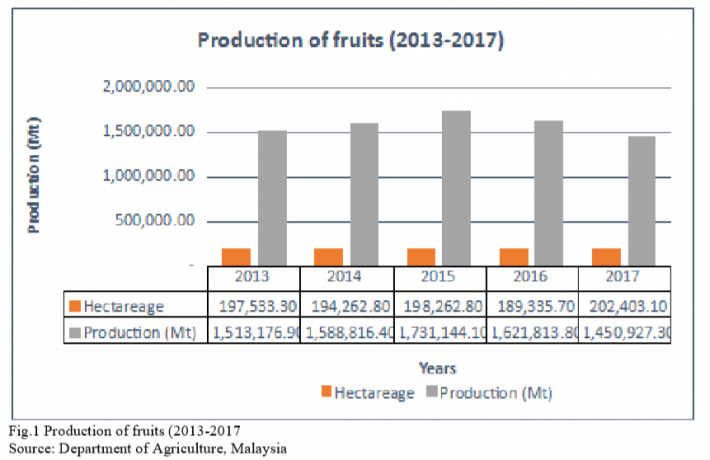

In general, the average yield of tropical fruits in Malaysia is around 11.8 tons per hectare. Despite the fact that the area has increased from 197,533 hectares in 2013 to 202,400 hectares (2017), the production of tropical fruits has decreased from 1.513 million tons in 2013 to 1.450 million tons in 2017, as shown in Figure 1. The production of tropical fruits has decreased around 4% in the last five years. The production shows an increasing trend between 2013 and 2015, before it dropped to around 6.3% between 2015 and 2016, and further dropped to around 10.5% in 2017. Despite the fact that the land area is sustainable, the production seems to drop. This is due to the replanting of old trees with new types or new varieties of crops. Tropical fruits take between three and seven years before they start fruiting.

In 2017, seasonal fruits were planted in around 125,235 hectares of land, where as the non-seasonal fruits cover around 77,853 hectares. However, the non-seasonal fruits produce around 1.1 million tons value at RM2.017 billion (US$480 million). On the other hand, the seasonal fruits produce 345,348 tons valued at around RM3.286 billion (US$782 million). These data indicate that the non-seasonal fruits generate more income to the nation compared to seasonal fruits.

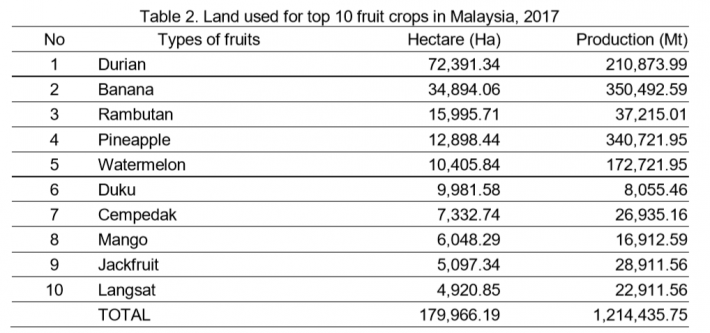

Banana continues to be the dominant tropical fruit variety produced by farmers, followed by pineapple, durian and watermelon. In 2017, Malaysia produced 350,492.6 tons of banana, 340,721.95 tons of pineapples and 210,873 tons of durian (Table 2).

Table 2 shows that durian is cultivated in around 40.2% of the total area of fruit production in Malaysia, followed by banana (19.4%) and rambutan (8.9%). On the other hand, banana contributes around 26.4% of the total production of fresh tropical fruits, follow by pineapple (25.6%), durian (15.9%), watermelon (13.0%), guava (6.3%), papaya (6.3%) and rambutan (2.8%). This data shows that the non-seasonal fruits produce higher yield than the seasonal one. In terms of value, the non-seasonal fruits also generate more income.

The production trend shows that banana has increased continually from 288,676.90 tons in 2013 to 350,592.59 tons in 2017, an increase around 21.4% in five years. The production of pineapple has increased from 244,352.70 tons in 2013 to 340,721 tons in 2017, an increase of around 39.4%. On the other hand, the production of durian has decreased from 373,082.95 tons to 210,873.99 tons in the same duration. Despite higher demand, the production of durian has dropped significantly within five years time.

The production of durian is still low because of new plantation. Farmers started to re-plant durian trees with new varieties when the demand from the People’s Republic of China is increasing due to the change in the China policy on imported durian from Malaysia. The Chinese government has allowed frozen whole fruits from Malaysia to be exported directly to China. The agreement and export protocol have been signed between the Malaysian and China governments in December 2018. Before this period, the Chinese authorities only allowed processed frozen durian from Malaysia to enter the China markets. The Chinese consumers give higher preferences toward Malaysian durian because of its taste, aroma and features. When the Malaysian government introduced a new variety of durian called “Musang King” or literally translated as the king of fox, it attracted the consumers and became phenomenal in China. The aroma, the taste and feature of the Musang King durian suits the consumers’ preference. As a result, farmers in Malaysia started to replant their durian trees with the new variety.

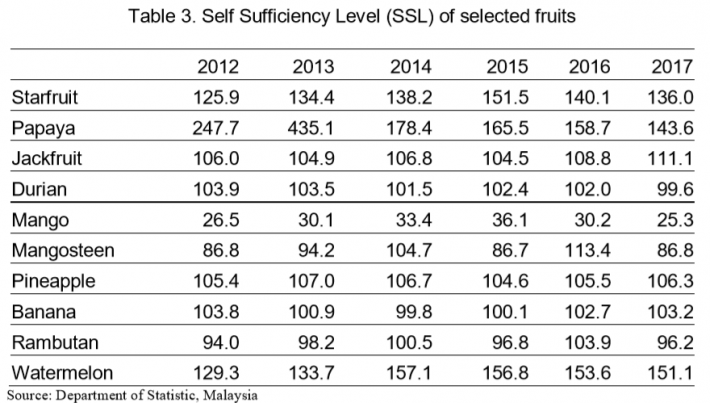

In general, the production of all tropical fruits in Malaysia is sufficient for local consumption. Report by the Statistic Department of Malaysia in 2018 shows that out of 11 fruit varieties, seven of them recorded self-sufficiency level (SSR) of more than 100% in 2017, as in the list in Table 3. Report by the Ministry of Agriculture and Agrobased Industry shows that the production of many fruits is more than what is consumed by consumers (Table 3).

Table 3 shows that most of non-seasonal fruits produced more than what is required by domestic consumers. Six out of 10 commercial fruits are produced more than 100% or demanded by local consumers. This is because farmers can plan their cultivation and harvesting time. Watermelon leads the commodity that has the highest SSL (151.1%) in 2017, followed by papaya (143.6%), starfruit (136%) and jackfruits (111.1%). The higher production of these commodity enable Malaysia to export them continually all-year round.

TRENDS IN INTERNATIONAL TRADE

Asia is the world’s largest tropical fruit producing region, followed by the American region (Central and South America). During the past five years, the production of tropical fruits in Asia has increased by 24.9% from 142.6 million tons in 2013 to 35.2 million tons in 2017. Within this region, China is the largest producer, followed by India, Philippines, Indonesia and Taiwan. Malaysia ranks number 13. The competition in terms of exporting the tropical fruits becomes intense due to higher output produced by these countries. As a result, countries that have competitive advantages in terms of price or better quality will succeed.

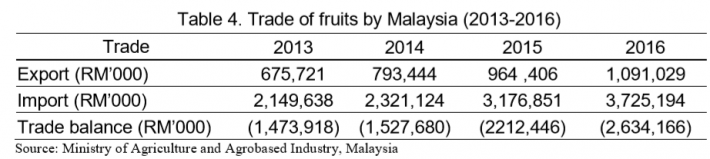

In general, Malaysia is a net importer of fruits. In 2016, Malaysia imported 847,135 tons of fruits (tropical and sub-tropical) valued around RM3.725 billion (US$886.95 million). At the same time, Malaysia exported 345,092 tons of fruits valued around RM1.09 billion (US$259.77 million) to make a trade deficit about RM2.635 billion (US$627.18 million) (Table 4).

However, the export shows an increasing trend for the past four years. The export value has increased from US$160,885.95 million in 2013 to US$259,768.81 in 2016. In tandem with increased in export value, the import value for fruits also increased significantly. Report shows that the import value has increased from US$511,818.57 million in 2013 to US$886,950.95 in 2016. The value of import is higher than the export value. As a result, the balance of trade becomes bigger, from US$350,930 in 2013 to more than US$627,000 in 2016. The higher import of fruits is mainly contributed by temperate fruits. Malaysia imports almost all temperate fruits because the weather in this country is not suitable for these crops. The highest volumes of temperate fruits imported by Malaysia are apples, oranges and grapes. In 2017, Malaysia imported 148,747.6 tons of fresh apples, 11,067 tons of orange and orange juice, and 79,158 tons of grape and grape juice.

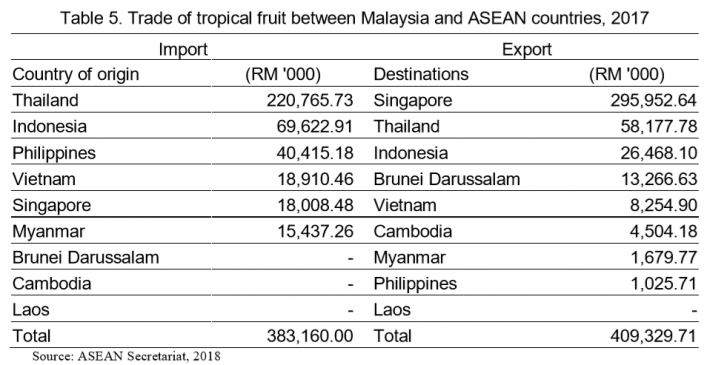

The trading of tropical fruits within the ASEAN countries are very important to Malaysia. In 2017, the value of tropical fruits traded in this region has reached RM792.5 million (US$188.69 million). The destinations, country of origins and the volume of tropical fruits traded in the ASEAN countries are presented in Table 5.

The top exported fruits by Malaysia in 2017 are watermelon, banana, pineapple, and papaya. In 2017, Malaysia exported 71,221 tons of watermelon, 24,832 tons of banana, 24,470 tons of papaya, 22,437 tons of pineapple and 17,705 tons of durian. All commodities show an increasing trend and are expected to continue as indicated by higher demand by the world markets. For the past four years, Singapore, Hong Kong/China and United Arab Emirate are three most important buyers for these commodities. Singapore is the main buyer of watermelon, pineapple, papaya and banana; followed by Hong Kong/China and United Arab Emirate. Besides these marketplaces, fruits from Malaysia are also exported to European Unions (EU) through Amsterdam.

The cross-border trading activities with neighboring countries such as Indonesia, Brunei and Thailand are carried out when the fruiting seasons are different. The difference in fruiting season with these countries is an advantage to Malaysia. For example, the fruiting season for rambutan in Thailand is in (May - September), durian (April - August), mangosteen (May - September) and mango (April - June). Whereas, the fruiting season for rambutan in Malaysia is in (June - August), durian (June - August), mangosteen (June - August) and mango (April - November). In other words, the trading of tropical fruits between Malaysia and the ASEAN countries can be done almost all-year round. The late fruiting and harvesting season in Malaysia stabilize the price of fruits in both the domestic and region.

CONSUMPTION TREND

Fruits have been recognized for their health benefits, as they contain vitamins minerals and dietary fiber for the human body. Most fruits are naturally low in fat, sodium, and calories. They have no cholesterol, but have many essential nutrients that are under consumed, including potassium, dietary fiber, vitamin C, and folic acid. Tropical fruits also play the important role of providing balanced diet to curb obesity and other ailments. This is in line with the Millennium Development Goals in mitigating hidden hunger.

Consumers in Malaysia are aware of the health benefits, and it is one of the factors that lead to a higher consumption of fruits in Malaysia. The demand for fruits in the local market has increased from time to time. Many studies revealed that consumers in Malaysia have recognized the importance of health benefits and its relationship with the increasing demand for fresh and processed tropical fruits. The Federal Agriculture Marketing Authority of Malaysia (FAMA) reported that the per capita consumption for fruits has increased from 80.4kg in 2006 to 93kg in 2010. The increase in demand can be attributed to the following reasons:

- There is an increasing demand for exotic fruits for their tastes and flavors.

- There is an increasing consumer awareness of the health benefits due to their nutritional values such as high in fiber, phytochemicals and vitamin contents.

- The enhancement in post-harvest handling technologies, such as better storage, packaging and transportation services.

- The development of modern processing technologies.

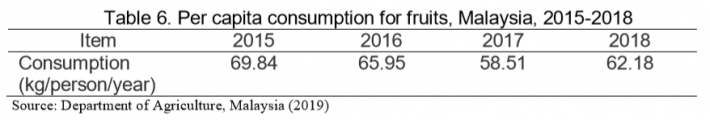

However, record shows that the tropical fruits consumption started to decrease after that period. Report by the Department of Agriculture, Malaysia presented a decreasing trend between 2015 and 2018, from 69.84kg to 62.18 kg respectively (Table 6) The trend indicates that the consumption pattern is toward a declining level.

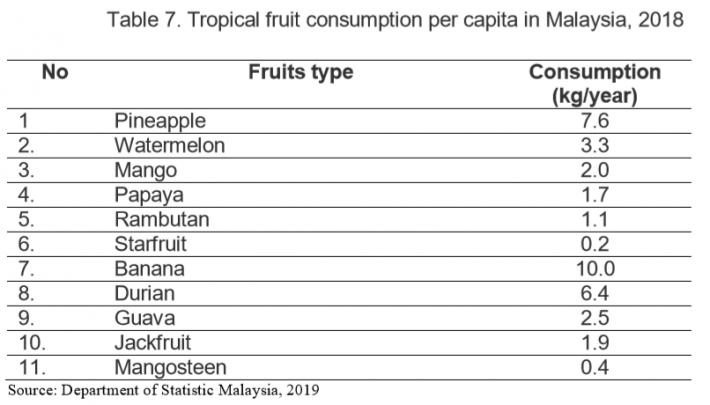

Report by the Department of Statistic Malaysia in 2018 presented the specific fruit consumption per capita as in Table 7:

Table 7 shows that consumers in Malaysia eat more bananas compared with other fruits. Every year, a consumer part takes around ten kg of banana, followed by pineapple (7.6 kg) and durian (6.4 kg). Durian is considered as the king of fruits and highly demanded during the season. The price of durian in the domestic market has increased significantly after they are exported to China. Despite its being expensive, the demand for durian is increasing every year.

The consumption trend will determine the supply and demand of fruits in Malaysia. The higher the demand from domestic market, the higher the supply because farmers see the opportunities from the higher price.

PLAN OF ACTIONS

The government has a special plan of actions for the development of tropical fruit industry in Malaysia. The government has set two objectives to chart the new direction of this industry; firstly, to ensure that the supply of fresh tropical fruits is sufficient for domestic consumption and processing industry. The second objective is to enhance the production of selected commodities that have strategic advantages for export. The selected commodities for export markets include pineapple, watermelon, starfruit, jack fruit, durian, banana, guava, mangosteen and rambutan.

Among the programs and strategies set out by the government are as follows:

1. Develop and improve infrastructures such as farm roads, irrigation and electric supply in the new agricultural development area. This program aims to increase production and speed up the transportation of fresh produce from farm to processing area;

2. Develop new agricultural areas, specifically for tropical fruit production that have great potential for export. These new farms will follow the good agricultural practices and international standards for marketing practices. The projects under this program include:

- Taman Kekal Pengeluaran Pertanian ( Permanent Park for Agricultural Production)

- Modern Agricultural Park

- Mini estate for tropical fruits that will be carried out by farmers associations

3. Develop new technologies for tropical fruits, such as new varieties that are more tolerant to pests and diseases, postharvest technology for export markets ( packaging, transportation and traceability)

4. Promote and encourage farmers to follow the good agricultural practices and register with the Department of Agriculture Malaysia to get the Malaysian GAP certification.

5. Introduce new incentives for investors who are interested to invest and developed the fruit industry, such as free tax for certain period and incentive for exploring new markets.

A special project for the development of tropical fruit industry was approved in 2016 and implemented by the Department of Agriculture, Malaysia. The special project called the replanting of selected fruits for export markets. This project aims to increase the production of selected fruits from 14,000 ton in 2016 to 70,000 tons in 2020. The second objective is to increase the income of farmers (from fruit cultivation), from RM2,500 (US$600) a month in 2016 to RM3,000 (US$700) a month in 2020. Under this project, farmers who apply to participate in this project are required to replant specific tropical fruits, which are determined by the DOA. As an incentive, they are given input subsidy (fertilizers, seedlings and pesticide) amounted to RM6000/ha (US$1430/ha). The wider they open the land for cultivation of tropical fruits, the more they receive the input subsidy. The selected tropical fruits for this project are durian, jack fruit, mango, Pomelo, mango, duku, rambutan and orange.

CONCLUSION

The fruit industry remains a major contributor to the agricultural GDP of Malaysia. This industry will continue as one of the players in Malaysia’s economy. The demand for the tropical fruits in the world market also indicates an increasing trend, and thus, has a great opportunity for the fruit industry in Malaysia.

However, the openness of Malaysia’s door towards fruits from other countries is also a threat to the fruit industry in Malaysia. The implementation of trade liberalization in the regions opens the opportunity for the producing countries in the regions to export their tropical fruits to Malaysia market because of higher purchasing power of Malaysian consumers. Malaysia should balance its policy on opening a wider door to foreign exporter and protecting the local industry for the benefit of its farmers. In other words, this country needs strategic plans and directions that will develop this industry to be a dynamic, progressive and sustainable; and at the same time, consistent with the international initiatives for the development of tropical fruit markets in the world.

REFERENCES

New Agricultural Policy (2010). Ministry of Agriculture and Agrobased Industry.

Comtrade (2018). International Trade Statistics Database. (http://comtrade.in.org)

FAMA (2018). Monthly report on production, consumption and marketing of fruits and vegetable. FAMA, Malaysia.

Jabatan Pertanian Malaysia (2018). Booklet Statistik Tanaman 2018. Kementerian Pertanian dan Industri Asas Tani.

The Statistical Portal (2017). (https://www.statistic.com)

Date submitted: July 24, 2019

Reviewed, edited and uploaded: August 26, 2019 |

Trends in Production, Trade, and Consumption of Tropical Fruit in Malaysia

ABSTRACT

Tropical fruits are important to Malaysia as they are the source of income for farmers, source of vitamins, minerals and dietary fibers for humans and generate revenue from the trading activities. Tropical fruits are also important in terms of land use after oil palm, rubber and paddy. The production of tropical fruits in Malaysia is increasing every year due to increase in land area and productivity. In 2017, more than 1.45 million tons of tropical fruits were produced and decreased to about 4.16% compared to 2013. The trade of tropical fruits also increased every year because of higher demand from domestic and global markets. In 2016, Malaysia exported US$259.77 million and imported about US$886.950 million worth of fruits. The trend of Malaysia’s export and import of tropical fruits is increasing, in favor of imports, thus, creating a negative balance of trade. Despite the increase in production and trading, the consumption of tropical fruits by Malaysian consumers indicates declining trends. The demand for tropical fruits in Malaysia is declining due to higher preferences toward temperate fruits, especially by generation Y. The Malaysian government needs to establish new strategic plans to ensure that the tropical fruit industry is sustainable and continues to contribute to Malaysia’s economy.

Keywords: Tropical fruits, import, export, production, consumption

INTRODUCTION

The cultivation of tropical and subtropical fruits is an important enterprise in many developing countries, including Malaysia. Tropical fruits are defined as fruits that are grown in hot and humid regions covering most of the tropical and subtropical areas of Asia, Africa, Central America, South America, the Caribbean and Oceania. This industry generates employment opportunities and incomes from both downstream and upstream activities. It also provides the opportunity for raising foreign exchange earnings and food security.

Tropical fruits are one of the main contributors to the agricultural gross domestic product (GDP). Every year, this industry contributes more than US$250 million in terms of income from export and creates more than 260,000 job opportunities to Malaysian people. The market for tropical fruits in the world is expected to increase due to increase in world population and the awareness toward the health benefit from part taking these commodities.

From the nutritional standpoint, fruits are one of the major sources of dietary requirements. Tropical fruits contain many vitamins, dietary fibers and minerals for health benefits. As a result, the consumption and trade also show a significant growth. This paper aims to provide an overview of the trend in the production, international trade and consumption of major tropical fruits in Malaysia during a five-year period from 2013 to 2017.

PRODUCTION TREND

Malaysia is a tropical country and very suitable for tropical fruit cultivation. In general, the cultivation of tropical fruits in Malaysia is carried out on a small-scale basis. The average farm size for tropical fruits in Malaysia is about 2.5 hectare per farmer. Only certain fruits are cultivated in larger or commercial scale, such as pineapple, papaya and durian. These farms are managed on a commercial scale and follow the good agricultural practices as most of the produce is mainly for export.

Tropical fruits can be categorized as seasonal and non-seasonal fruits. The seasonal fruits only produce fruits at specific times. The main season of tropical fruits in Malaysia is generally fall during June-August, while the off season is in December-February. Some famous seasonal tropical fruits in Malaysia include durian, mangosteen, rambutan, duku, langsat and pulasan. On the other hand, the non-seasonal fruits can be cultivated and harvested all-year round. Examples of non-seasonal tropical fruits include guava, papaya, banana and pineapple.

Tropical fruits are one of the important crops in Malaysia, after oil palm, rubber and paddy. In 2017, more than 202,400 hectares of land are planted to and cultivated with tropical fruits. In general, 64 varieties of tropical fruits are cultivated in Malaysia. However, the Ministry of Agriculture and Agrobased Industry has selected 21 varieties to be cultivated on a commercial scale, where as the others are planted in small areas or in the backyards. The list of major tropical fruits in Malaysia is as follows:

In general, the average yield of tropical fruits in Malaysia is around 11.8 tons per hectare. Despite the fact that the area has increased from 197,533 hectares in 2013 to 202,400 hectares (2017), the production of tropical fruits has decreased from 1.513 million tons in 2013 to 1.450 million tons in 2017, as shown in Figure 1. The production of tropical fruits has decreased around 4% in the last five years. The production shows an increasing trend between 2013 and 2015, before it dropped to around 6.3% between 2015 and 2016, and further dropped to around 10.5% in 2017. Despite the fact that the land area is sustainable, the production seems to drop. This is due to the replanting of old trees with new types or new varieties of crops. Tropical fruits take between three and seven years before they start fruiting.

In 2017, seasonal fruits were planted in around 125,235 hectares of land, where as the non-seasonal fruits cover around 77,853 hectares. However, the non-seasonal fruits produce around 1.1 million tons value at RM2.017 billion (US$480 million). On the other hand, the seasonal fruits produce 345,348 tons valued at around RM3.286 billion (US$782 million). These data indicate that the non-seasonal fruits generate more income to the nation compared to seasonal fruits.

Banana continues to be the dominant tropical fruit variety produced by farmers, followed by pineapple, durian and watermelon. In 2017, Malaysia produced 350,492.6 tons of banana, 340,721.95 tons of pineapples and 210,873 tons of durian (Table 2).

Table 2 shows that durian is cultivated in around 40.2% of the total area of fruit production in Malaysia, followed by banana (19.4%) and rambutan (8.9%). On the other hand, banana contributes around 26.4% of the total production of fresh tropical fruits, follow by pineapple (25.6%), durian (15.9%), watermelon (13.0%), guava (6.3%), papaya (6.3%) and rambutan (2.8%). This data shows that the non-seasonal fruits produce higher yield than the seasonal one. In terms of value, the non-seasonal fruits also generate more income.

The production trend shows that banana has increased continually from 288,676.90 tons in 2013 to 350,592.59 tons in 2017, an increase around 21.4% in five years. The production of pineapple has increased from 244,352.70 tons in 2013 to 340,721 tons in 2017, an increase of around 39.4%. On the other hand, the production of durian has decreased from 373,082.95 tons to 210,873.99 tons in the same duration. Despite higher demand, the production of durian has dropped significantly within five years time.

The production of durian is still low because of new plantation. Farmers started to re-plant durian trees with new varieties when the demand from the People’s Republic of China is increasing due to the change in the China policy on imported durian from Malaysia. The Chinese government has allowed frozen whole fruits from Malaysia to be exported directly to China. The agreement and export protocol have been signed between the Malaysian and China governments in December 2018. Before this period, the Chinese authorities only allowed processed frozen durian from Malaysia to enter the China markets. The Chinese consumers give higher preferences toward Malaysian durian because of its taste, aroma and features. When the Malaysian government introduced a new variety of durian called “Musang King” or literally translated as the king of fox, it attracted the consumers and became phenomenal in China. The aroma, the taste and feature of the Musang King durian suits the consumers’ preference. As a result, farmers in Malaysia started to replant their durian trees with the new variety.

In general, the production of all tropical fruits in Malaysia is sufficient for local consumption. Report by the Statistic Department of Malaysia in 2018 shows that out of 11 fruit varieties, seven of them recorded self-sufficiency level (SSR) of more than 100% in 2017, as in the list in Table 3. Report by the Ministry of Agriculture and Agrobased Industry shows that the production of many fruits is more than what is consumed by consumers (Table 3).

Table 3 shows that most of non-seasonal fruits produced more than what is required by domestic consumers. Six out of 10 commercial fruits are produced more than 100% or demanded by local consumers. This is because farmers can plan their cultivation and harvesting time. Watermelon leads the commodity that has the highest SSL (151.1%) in 2017, followed by papaya (143.6%), starfruit (136%) and jackfruits (111.1%). The higher production of these commodity enable Malaysia to export them continually all-year round.

TRENDS IN INTERNATIONAL TRADE

Asia is the world’s largest tropical fruit producing region, followed by the American region (Central and South America). During the past five years, the production of tropical fruits in Asia has increased by 24.9% from 142.6 million tons in 2013 to 35.2 million tons in 2017. Within this region, China is the largest producer, followed by India, Philippines, Indonesia and Taiwan. Malaysia ranks number 13. The competition in terms of exporting the tropical fruits becomes intense due to higher output produced by these countries. As a result, countries that have competitive advantages in terms of price or better quality will succeed.

In general, Malaysia is a net importer of fruits. In 2016, Malaysia imported 847,135 tons of fruits (tropical and sub-tropical) valued around RM3.725 billion (US$886.95 million). At the same time, Malaysia exported 345,092 tons of fruits valued around RM1.09 billion (US$259.77 million) to make a trade deficit about RM2.635 billion (US$627.18 million) (Table 4).

However, the export shows an increasing trend for the past four years. The export value has increased from US$160,885.95 million in 2013 to US$259,768.81 in 2016. In tandem with increased in export value, the import value for fruits also increased significantly. Report shows that the import value has increased from US$511,818.57 million in 2013 to US$886,950.95 in 2016. The value of import is higher than the export value. As a result, the balance of trade becomes bigger, from US$350,930 in 2013 to more than US$627,000 in 2016. The higher import of fruits is mainly contributed by temperate fruits. Malaysia imports almost all temperate fruits because the weather in this country is not suitable for these crops. The highest volumes of temperate fruits imported by Malaysia are apples, oranges and grapes. In 2017, Malaysia imported 148,747.6 tons of fresh apples, 11,067 tons of orange and orange juice, and 79,158 tons of grape and grape juice.

The trading of tropical fruits within the ASEAN countries are very important to Malaysia. In 2017, the value of tropical fruits traded in this region has reached RM792.5 million (US$188.69 million). The destinations, country of origins and the volume of tropical fruits traded in the ASEAN countries are presented in Table 5.

The top exported fruits by Malaysia in 2017 are watermelon, banana, pineapple, and papaya. In 2017, Malaysia exported 71,221 tons of watermelon, 24,832 tons of banana, 24,470 tons of papaya, 22,437 tons of pineapple and 17,705 tons of durian. All commodities show an increasing trend and are expected to continue as indicated by higher demand by the world markets. For the past four years, Singapore, Hong Kong/China and United Arab Emirate are three most important buyers for these commodities. Singapore is the main buyer of watermelon, pineapple, papaya and banana; followed by Hong Kong/China and United Arab Emirate. Besides these marketplaces, fruits from Malaysia are also exported to European Unions (EU) through Amsterdam.

The cross-border trading activities with neighboring countries such as Indonesia, Brunei and Thailand are carried out when the fruiting seasons are different. The difference in fruiting season with these countries is an advantage to Malaysia. For example, the fruiting season for rambutan in Thailand is in (May - September), durian (April - August), mangosteen (May - September) and mango (April - June). Whereas, the fruiting season for rambutan in Malaysia is in (June - August), durian (June - August), mangosteen (June - August) and mango (April - November). In other words, the trading of tropical fruits between Malaysia and the ASEAN countries can be done almost all-year round. The late fruiting and harvesting season in Malaysia stabilize the price of fruits in both the domestic and region.

CONSUMPTION TREND

Fruits have been recognized for their health benefits, as they contain vitamins minerals and dietary fiber for the human body. Most fruits are naturally low in fat, sodium, and calories. They have no cholesterol, but have many essential nutrients that are under consumed, including potassium, dietary fiber, vitamin C, and folic acid. Tropical fruits also play the important role of providing balanced diet to curb obesity and other ailments. This is in line with the Millennium Development Goals in mitigating hidden hunger.

Consumers in Malaysia are aware of the health benefits, and it is one of the factors that lead to a higher consumption of fruits in Malaysia. The demand for fruits in the local market has increased from time to time. Many studies revealed that consumers in Malaysia have recognized the importance of health benefits and its relationship with the increasing demand for fresh and processed tropical fruits. The Federal Agriculture Marketing Authority of Malaysia (FAMA) reported that the per capita consumption for fruits has increased from 80.4kg in 2006 to 93kg in 2010. The increase in demand can be attributed to the following reasons:

However, record shows that the tropical fruits consumption started to decrease after that period. Report by the Department of Agriculture, Malaysia presented a decreasing trend between 2015 and 2018, from 69.84kg to 62.18 kg respectively (Table 6) The trend indicates that the consumption pattern is toward a declining level.

Report by the Department of Statistic Malaysia in 2018 presented the specific fruit consumption per capita as in Table 7:

Table 7 shows that consumers in Malaysia eat more bananas compared with other fruits. Every year, a consumer part takes around ten kg of banana, followed by pineapple (7.6 kg) and durian (6.4 kg). Durian is considered as the king of fruits and highly demanded during the season. The price of durian in the domestic market has increased significantly after they are exported to China. Despite its being expensive, the demand for durian is increasing every year.

The consumption trend will determine the supply and demand of fruits in Malaysia. The higher the demand from domestic market, the higher the supply because farmers see the opportunities from the higher price.

PLAN OF ACTIONS

The government has a special plan of actions for the development of tropical fruit industry in Malaysia. The government has set two objectives to chart the new direction of this industry; firstly, to ensure that the supply of fresh tropical fruits is sufficient for domestic consumption and processing industry. The second objective is to enhance the production of selected commodities that have strategic advantages for export. The selected commodities for export markets include pineapple, watermelon, starfruit, jack fruit, durian, banana, guava, mangosteen and rambutan.

Among the programs and strategies set out by the government are as follows:

1. Develop and improve infrastructures such as farm roads, irrigation and electric supply in the new agricultural development area. This program aims to increase production and speed up the transportation of fresh produce from farm to processing area;

2. Develop new agricultural areas, specifically for tropical fruit production that have great potential for export. These new farms will follow the good agricultural practices and international standards for marketing practices. The projects under this program include:

3. Develop new technologies for tropical fruits, such as new varieties that are more tolerant to pests and diseases, postharvest technology for export markets ( packaging, transportation and traceability)

4. Promote and encourage farmers to follow the good agricultural practices and register with the Department of Agriculture Malaysia to get the Malaysian GAP certification.

5. Introduce new incentives for investors who are interested to invest and developed the fruit industry, such as free tax for certain period and incentive for exploring new markets.

A special project for the development of tropical fruit industry was approved in 2016 and implemented by the Department of Agriculture, Malaysia. The special project called the replanting of selected fruits for export markets. This project aims to increase the production of selected fruits from 14,000 ton in 2016 to 70,000 tons in 2020. The second objective is to increase the income of farmers (from fruit cultivation), from RM2,500 (US$600) a month in 2016 to RM3,000 (US$700) a month in 2020. Under this project, farmers who apply to participate in this project are required to replant specific tropical fruits, which are determined by the DOA. As an incentive, they are given input subsidy (fertilizers, seedlings and pesticide) amounted to RM6000/ha (US$1430/ha). The wider they open the land for cultivation of tropical fruits, the more they receive the input subsidy. The selected tropical fruits for this project are durian, jack fruit, mango, Pomelo, mango, duku, rambutan and orange.

CONCLUSION

The fruit industry remains a major contributor to the agricultural GDP of Malaysia. This industry will continue as one of the players in Malaysia’s economy. The demand for the tropical fruits in the world market also indicates an increasing trend, and thus, has a great opportunity for the fruit industry in Malaysia.

However, the openness of Malaysia’s door towards fruits from other countries is also a threat to the fruit industry in Malaysia. The implementation of trade liberalization in the regions opens the opportunity for the producing countries in the regions to export their tropical fruits to Malaysia market because of higher purchasing power of Malaysian consumers. Malaysia should balance its policy on opening a wider door to foreign exporter and protecting the local industry for the benefit of its farmers. In other words, this country needs strategic plans and directions that will develop this industry to be a dynamic, progressive and sustainable; and at the same time, consistent with the international initiatives for the development of tropical fruit markets in the world.

REFERENCES

New Agricultural Policy (2010). Ministry of Agriculture and Agrobased Industry.

Comtrade (2018). International Trade Statistics Database. (http://comtrade.in.org)

FAMA (2018). Monthly report on production, consumption and marketing of fruits and vegetable. FAMA, Malaysia.

Jabatan Pertanian Malaysia (2018). Booklet Statistik Tanaman 2018. Kementerian Pertanian dan Industri Asas Tani.

The Statistical Portal (2017). (https://www.statistic.com)

Reviewed, edited and uploaded: August 26, 2019