ABSTRACT

The intensification of rice production in Myanmar, especially in the Pyar Pon Township, Pyar Pon District, has led to many problems in the post-harvest phase, particularly in storage. This situation is further aggravated by the growing attention devoted to the maintenance of buffer stocks to continuously provide food security for the country. This study examines the profitability of rice storage by the traders in Pyar Pon District, Myanmar. The partial budget analysis was used to determine the profitability of storing rice. According to the financial source, traders who borrowed capital for rice storage earned additional profit of 47,405.2 Kyats (US$58.17) per ton while those who did not borrow capital for rice storage gained the additional profit of 50,656.23 Kyats (US$62.15) per ton. Based on storage duration for traders who borrowed capital, additional profit with at least five months of rice storage was 54,950.13 Kyats (US$67.42) per ton while those with three months of rice storage realized additional profit of 164.53 Kyats (US$0.21) per ton due to price instability of the trading time. However, for traders who used their own finance for rice storage, additional profit for at least five months of rice storage was 39,032.44 Kyats (US$ 47.89) per ton while those with four months of rice storage was 38,407.09 Kyats (US$47.13) per ton. Additionally, based on comparison of t- test by mean profit, the best time to sell rice for traders who borrowed capital and those who used their own finance was also at least five months after storage.

Key words: Partial Budget Analysis, Rice Storage, Storage Cost, Additional Profits, Pyar Pon District.

INTRODUCTION

According to rice production in Myanmar, Ayeyarwaddy Region is the largest producer of the staple crop, producing 6.78 million tons, which accounted for 34.2% of the Union’s rice production of 19.8 million tons (FAO, 2004). In terms of resource endowment, it has the highest share in population, which suggests abundant labor supply. Similarly, average rainfall is twice that of the national average hence, water supply is highly conducive to growing rice. Since Ayeyarwaddy Region is the rice bowl of the country for domestic rice supply and a strategic region for foreign export, sustainability of rice production in this region is vital for Myanmar. With respect to region-wise rice production, domestic utilization and surplus and deficit, the delta region had huge surplus of rice, the coastal region had smaller amount of rice surplus while the central dry zone and hilly area showed rice deficit (FAO, 2004). Therefore, at present, Ayeyarwaddy Region is a highly commercialized region.

Storage is an important component of the post-harvest handling operations of agricultural products. Under trade liberalization, the role of the marketing system and post-harvest activities become more important. Agricultural production can only be really efficient if the accompanying marketing and post-harvest systems are also efficient (FAO, 1999). Well-functioning marketing systems are thus essential to develop production, thereby increasing household income and promoting food security.

The intensification of rice production in Myanmar, especially in the Pyar Pon Township, Pyar Pon District, has led to many problems in the post-harvest phase, particularly in storage. This situation is further aggravated by the growing attention devoted to the maintenance of buffer stocks to continuously provide food security for the country. Furthermore, storage of seasonal or operational stocks is needed to meet seasonal demand and to stabilize prices which subsequently establish a strategic or long-term reserve against crop failure.

Like most agricultural products, rice is harvested within a short period of time but is consumed all-year round. The majority of the farmers sell rough rice right after harvest time but they also store certain amounts for home consumption, seed purposes and labor wages. Only farmers with large farms and more capital usually store the paddy to sell when the price of rice becomes higher. Therefore, storage will be performed by a trader only if there are enough incentives in doing it. That is, if there are relatively great price differences between the time of harvest and time of non-harvest.

Rice prices are influenced by the demand and supply situation during the harvest and non-harvest periods. The producers and consumers are faced with a situation wherein rice prices are low during the harvest periods and high during lean months when planting season begins. And since there is a continuous demand for rice all-year round, then a trader who chooses to store during the months when there is plenty of harvest and sell when prices reach its peak during the non-harvest periods, earns adequate incentive for performing the storage activity. In effect, the traders gain more benefits by storing some of their procurements, respectively during the time of harvest and selling after sometime when market supply declines and prices are high. Rice-millers, processors, and retailers on the other hand, will benefit from a continuous supply of rice in the market.

This study aims to assess the profitability of storing rice by traders based on financial sources and storage durations. Costs of storage and gross income of traders may be variably incurred and so the question of when to sell, when to buy, and when to store needs to be answered in order to gain the highest possible profit.

METHODOLOGY

The three villages namely Tha Main Taw, Khone Tan/Tein Khone and Maw Bi in Pyar Pon Township, Pyar Pon District, Ayeyarwaddy Region in Myanmar were chosen for the study sites due to the following: (1) the villages were major rice-producing and rice-trading areas; and (2) the traders from the villages have well-established storage practices. Each group of traders consisted of those who stored rice and those who did not. Enumerators collected the data from the households through stratified random sampling. Partial budgeting analysis was used to calculate the profitability of rice storage based on financial sources and storage durations.

Estimation of profitability of storing rice

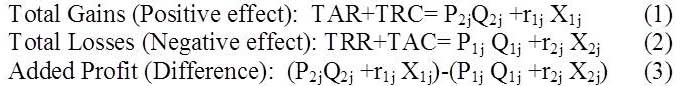

The costs and benefits derived by traders from rice storage were compared using the partial budgeting approach. Partial budgeting is a planning and decision-making framework used to compare the costs and benefits of alternatives faced by a trader. It looks at those revenue and expense items that are affected by the proposed change. This method is used for choosing storing or selling immediately after harvest by comparing the additional profits of each option (Compton, 1992; and Baldimino, 1996). Basically, a partial budget is made up of four components: two components identify changes in the operation that will increase profits (Total added return or TAR and Total reduced cost or TRC), and two components identify changes in the operation that will decrease profits (Total added cost or TAC and Total reduced return or TRR) (Robert, 2007; Billy et al., 2006). Interpreting the results of a partial budget is very simple. If total gains exceed total losses, then the change being considered is likely to be positive in terms of profitability. According to Roth (2002), a basic outline of a partial budget would look something like this:

Where:

TAR = Total Added Return

TRC = Total Reduced Cost

TRR = Total Reduced Return

TAC = Total Added Cost

Total gain is the sum of total added return and total reduced cost. Total losses are the sum of total reduced return and total added cost. If total gains are greater than total losses, this will result in additional profit from storage.

In calculating returns of storage and the cost of storage in partial budgeting framework for traders, volume of rice stored, price of rice before and after storage, hired labor, family labor, chemicals used, depreciation on warehouse, waterproof and lace, opportunity cost of capital if the trader used his own capital, interest in borrowing capital if the trader borrowed capital from other institutions, storage losses, procurement fee, and other expenses like maintenance, electric bill, sprayer and classifying costs, etc. were used.

Statistical test procedure

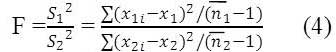

Statistical test was used to compare significant differences in indices among traders with and without decision in performing rice storage and in mean profit of traders’ category in rice storage. It can be presented as follows:

Test of equality between two sample means of efficiency. The F value is computed by the following formula:

Where:

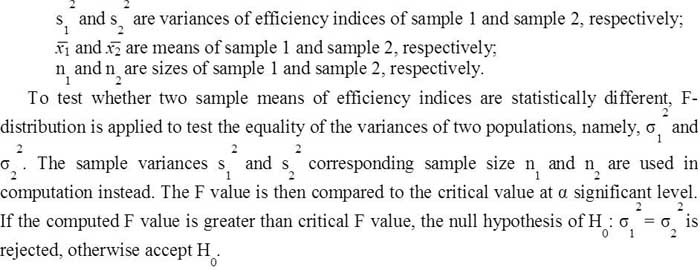

If the two populations have the same variance, the t-test will be used to test the difference between two sample means as follows:

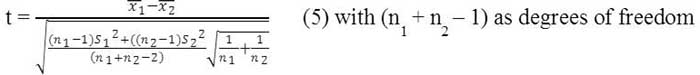

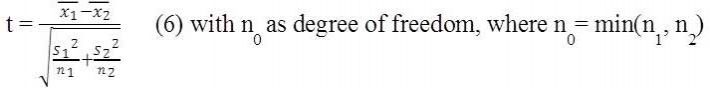

If the two population variances are not equal, the following t-test is used:

RESULTS AND DISCUSSION

Storage cost

For the traders who borrowed capital for rice trading per year, average storage costs per ton on various inputs used in rice storing were calculated. Data revealed that for the sampled households, the total non-cash cost was 7,982.02 Kyats (US$9.79) per ton, and the total storage cost was 9,642.44 Kyats (US$11.83) per ton. The total cash cost was 1,660.42 Kyats (US$2.04) per ton which was 17.22% of total storage cost. Storage loss of rice was the biggest contributor to the total cost (67.17%), followed by depreciation cost of plastic sacks (8.90%), interest rate on capital (7.49%), depreciation of warehouse (6.07%), and hired labor cost (6.02%). Therefore, an increase in the cost of any of three items would drastically increase the storage costs for rice. Storage rental fee, other costs (including electricity, building maintenance, sprayers, classifying), family labor cost, depreciation of waterproof and lace amounted to 2.76%, 0.94%, 0.42%, 0.12% and 0.09% of total storage cost, respectively, and the contribution to total costs incurred were minimal.

Considering the duration of storage of rice and borrowing capital, the average storage cost per ton for the traders who stored rice for at least five months and borrowed for capital was calculated. For the sampled households, the total non-cash cost was 7,753.77 Kyats (US$9.51) per ton, and the total cost was 12,153.97 Kyats (US$14.91) per ton. The total cash cost was 4,400.19 Kyats (US$5.40) per ton which was 36.20% of total storage cost. Storage loss of rice was the biggest contributor to the total cost incurred (55.97%), followed by interest rate on capital (30.39%), hired labor cost (4.36%), depreciation of plastic sacks (4.23%), and depreciation of warehouse (3.15%), respectively. Therefore, an increase in the cost of any of the five items would drastically increase the storage costs for rice. Storage rental fee, other costs (including electricity, building maintenance, sprayers, classifying), family labor cost, depreciation on waterproof contributed a minimal amount of the storage cost.

Based on storage duration and financial sources, the average storage cost per ton was calculated for the traders who stored rice for three to four months with borrowing capital. For the sampled households, the total non-cash cost was 4,455.58 Kyats (US$5.47) per ton, and the total storage cost was 6,600.84 Kyats (US$8.09) per ton. The total cash cost of 2,145.26 Kyats (US$2.63) per ton contributed 32.49% of the total storage cost. Storage loss of rice (60.85%) was the biggest contributor to the total cost, followed by interest rate on capital (21.43%), and hired labor cost (7.58%), respectively. Therefore, an increase in the cost of any of the three items would drastically increase the storage costs for rice. Depreciation on plastic sacks, other costs (include electricity, building maintenance, sprayers, classifying), depreciation of warehouse, storage rental fee, depreciation of waterproof and lace contributed a minimal share to the total storage cost.

For the traders who did not borrow capital for rice trading per year, the average storage cost per ton for various inputs used in rice storage was calculated. The total non-cash cost of the sample households was 82.05% of total storage cost while the total cash cost was 17.95% of total storage cost, which were 9,759.13 Kyats (US$11.97) per ton and 2,135.16 Kyats (US$2.62) per ton, respectively. Storage loss of rice was the biggest contributor to the total cost (71.77%), followed by hired labor cost (11.44%) and storage rental fee (5.79%). The contribution of other factors to total cost was minimal.

For traders who stored rice for at least five months without borrowing capital, average storage costs per ton on various inputs used in the rice storing was calculated. The result reveals that for the sampled households, the total non-cash cost was 84.17% of total storage cost, and total cash cost was 17.95% of total storage cost. Storage loss of rice was the biggest contributor to total cost (77.06%), followed by hired labor cost (8.88%) and storage rental fee (6.27%).

For traders who stored rice for three to four months without borrowing capital, the average storage costs per ton on various inputs used in rice storage was 20,810.54 Kyats (US$ 25.53) per ton. For the sampled households, the total non-cash cost was 71.78% of total storage cost and total cash cost contributed 28.22% of total storage cost. Storage loss of rice was the biggest contributor to the total cost (67.35%), followed by hired labor cost (15.79%) and other costs including electricity, building maintenance, sprayers and classifying (10.46%), respectively. These ‘other costs’ was relatively high because of building maintenance.

Returns on rice storage of traders

Rice traders derived their income from storing rice for a period of time after purchasing from the farmers. Additional returns from rice storage are simply the differences in revenue between the traders who sold rice immediately after harvest and the traders who kept rice in storage. In estimating their annual additional returns, separate computations were done according to the different categories of the traders in the survey areas, which are financial source and duration of rice storage. The sum of the values obtained from different categories determined the additional returns. Computations were also done on a per ton basis.

The gross incomes of 20 traders who sold rice immediately and 18 traders, who stored rice with borrowing capital are 247,130.20 Kyats (US$303.23) per ton and 304,177.80 Kyats (US$373.23) per ton each. Therefore, the additional gross returns by storing rice are 57,047.64 Kyats (US$70) per ton. Based on storage length, for 20 traders who sold rice immediately and 15 traders, who stored rice for at least five months with borrowing capital, the additional gross returns by storage are 67,104.10 Kyats (US$82.34) per ton while the additional gross returns by storage between the two groups of the 20 traders who sold rice immediately and three traders, who stored rice for three months with borrowing capital, is 6,765.36 Kyats (US$8.30) per ton.

According to financial resources, the additional gross returns gained by storage between the two groups of 20 traders who sold rice immediately and 12 traders, who stored rice without borrowing capital is 62,874.94 Kyats (US$77.14) per ton. Based on financial sources and storage duration, the additional gross returns by storage between the two groups of 20 traders who sold rice immediately and 10 traders who stored rice for at least five months with borrowing capital are 63,519.04 Kyats (US$77.94)per ton. For comparison of gross income of 20 traders who sold rice immediately and two traders, who stored rice for four months with borrowing capital, the additional gross returns is 59,654.63 Kyats (US$73.20) per ton.

Additional profits of traders

To determine whether the traders who stored rice gained profits or not, or simply stated, whether storing rice is more profitable than selling it immediately after harvest, partial budget analysis was used. The table is divided into four categories: added returns, added costs, reduced returns and reduced cost. Based on financial resources and storage length, the partial budgets for traders who stored rice were analyzed. The study revealed that on the average, the income received by the traders increased due to storage. Therefore, storing rice was profitable for traders.

Subtracting the total losses (B) from the total gains (A) would determine the additional profits from rice storage. On the average, for the traders who borrowed capital, the additional profit obtained was 47,405.20 Kyats (US$58.17) per ton year per. For the traders who stored rice for at least five months, the additional profit was 54,950.13 Kyats (US$67.42) per ton. The additional profit for those who stored rice for three months was 164.53 Kyats (US$0.20) per ton.

For traders without borrowed capital, the additional profit was 50,656.23 Kyats (US$62.15) per ton. For traders who stored for at least five months without borrowing capital, the additional profit obtained was 39,032.44 Kyats (US$47.89) per ton. Traders who stored rice for four months without borrowing capital earned 38,407.09 Kyats (US$47.13) per ton of additional profit.

Overall, the traders who did not borrow capital received more additional profit than those who borrowed capital. The additional profit of the traders with borrowing capital with at least five months duration of storage was greater than those who did not borrow capital because the average volume of rice storage was less than those who borrowed capital. However, additional profit of traders who stored for four months without borrowing capital was higher than those traders who borrowed capital for three months rice storage duration.

In terms of costs in aggregate terms, the traders paid higher cost in their storage operations mainly because of their large volume procurement and storage. Similarly, additional profit was also much higher for the traders as a result of larger sales volume. For the farmers, they earned less additional profit because of their small sales volume.

T-test for traders

T-test was done for comparing the mean profit of each category of traders. The difference between average profit of traders from storing rice with borrowing capital and average profit of traders from selling immediately after purchase is statistically significant at 5% level. And also the difference between average profit of traders from storing rice without borrowed capital and average profit of traders selling immediately after purchase is statistically significant at 5% level.

Based on storage duration, the different between the average profit of traders from storing rice for at least five months with borrowed capital and the average profit of traders who sold their procured rice immediately is statistically significant at 1% level. The average profit of the traders from storing rice for three months with borrowed capital was greater than the average profit of traders who sold rice immediately. However, the difference is not statistically significant. The reason can be that the time of rice procurement for the traders who sold immediately was not done on the same months. Therefore, price of rice at every month can be considered for those who sold rice immediately.

The average profit of traders from storing rice for at least five months with borrowed capital was greater than the average profit of traders from storing rice for three months, also with borrowed capital. The statistical result indicated that the mean profit is statistically significant at 10% level. Based on storage duration, the difference between the average profit of traders from storing rice for at least five months without borrowed capital and the average profit of traders who sold rice immediately is statistically significant at 5 % level. The average profit of traders by storing rice for four months without borrowed capital is greater than the average profit of traders who sold rice immediately. However, the difference in mean profit is not statistically significant. The reason can be that the time of rice procurement for the traders who sold immediately was not done on the same months. Therefore, price of rice every month can be considered for those who sold rice immediately.

The average profit of traders by storing rice for at least five months without borrowed capital was less than the average profit of traders by storing rice for four months without borrowed capital. The statistical result indicated that this indicator is not statistically significant. Due to comparison of mean profit based on duration of storage, the best time to sell rice for traders without borrowing capital is at five months after storage.

CONCLUSION AND RECOMMENDATIONS

The study was conducted primarily to assess the profitability of storing rice by the farmers; and suggest policy recommendations to improve the rice storage in research sites.

For the trader group, according to finance source, traders who did not borrow capital for rice storage gained more profit than those who borrowed capital for rice storage. According to the duration of storage for traders who borrowed capital, the traders who stored rice for at least five months had higher storage costs than those who stored rice for only three months, increasing more profit of those who stored rice for at least five months than those with only three months storage. Similarly, for the traders without borrowed capital, the group with at least five months was more profitable than the group with four months storage of rice. It also means that there was economies-of-scale in larger operations of rice storage. It was observed that approximately 85% of the total storage costs for each category were due to the hired labor, storage losses, and depreciation cost of warehouses.

Based on the financial source, traders who borrowed capital for rice storage earned additional profit of 47,405.20 Kyats (US$58.17) per ton while those who did not borrow capital for rice storage gained the additional profit of 50,656.23 Kyats (US$62.15) per ton. Based on storage duration for traders who borrowed capital, additional profit with at least five months of rice storage was 54,950.13 Kyats (US$67.42) per ton while those with three months of rice storage realized additional profit of 164.53 Kyats (US$0.20) per ton due to price instability of the trading time. However, for traders who used own finance for rice storage, additional profit for at least five months of rice storage was 39,032.44 Kyats (US$47.89) per ton while those with 4 months of rice storage was 38,407.09 Kyats (US$47.13) per ton. Additionally, based on comparison of t- test by mean profit, the best time to sell rice for traders who borrowed capital and those who used their own finance was also at least five months after storage.

Given the above findings, the most relevant ingredients to ensuring increased rice storage are incentive public programs that can encourage rice traders to engage in long-term rice storage. It is clear from this study that the traders will store more rice until the end of non-harvest periods only in response to positive incentives or opportunities in storage. The success of rice storing for traders will therefore require government programs that help traders to overcome the constraints they face as well as creating incentives that will encourage them to change their current storage practices in order to improve their income as well as eliminate the rice availability-gap in the non-harvest periods.

While most of the interventional activities may be provided by local traders themselves, there will be a need for a complementary role of the government. Access to the trader’s decision on rice storage, easy access to inventory capital, improvements in communication infrastructure to assist in effective dissemination of market information and predicting future prices and extension training are factors that national policies can play a key role in encouraging rice storage among traders. Therefore, in order to improve the rice trader’s income in Pyar Pon Township, and whole country in general, government policies should give top priority to the following recommendations: such as improvement in the delivery of extension services to improve their access to storage facilities and provide the possibilities for reducing storage costs, increase access to credit for promoting or encouraging rice storage among traders, improvement of transportation to create better market access for local people meaning cheaper transportation cost may create the more profit on their stocks, and improving the pre-processing operation which is critical for improving the terms of trade of small and poor traders.

Exchange Rate (1 US$= 815Kyats)

REFERENCES

BALDIMINO, O. 1996. Economic Analysis of Corn Storage Operations at the Traders’ Level in Lucena. B.S. Thesis. Unpublished Undergraduate Thesis. College of Economics and Management, UPLB. Philippines.

BILLY, V.L., M.J. DALE and C.H. JAMES. 2006. Using the Partial Budget to Analyze Farm Change. Available online at http://www.smallfarmsuccess.info/management /print_547.cfm. Data Accessed.

COMPTON, J.A.F. 1992. Reducing Losses in Small Farm Grain Storage in the Tropics. Chatham: NRI. DPP Working Paper No. 6. Dhaka: Development Policy and Practice Research Group.

FAO. 1999. A Guide to Maize Marketing for Extension Officers. Food and Agriculture Organization of United Nations. Rome.

FAO. 2004. Integration of Myanmar Agriculture into ASEAN, TCP/MYA/2902.

ROBERT, T. 2007. Partial Budgeting: A Tool to Analyze Farm Business Changes. Available online at http://www.extension.iastate.edu/AGDM/wholefarm/html/c1-50. html.

ROTH, S. 2002. Partial Budgeting for Agricultural Business. The Pennsylvania State University. Dairy alliance. CAT, UA366, 5M2/02, pp: 4486.

|

Date submitted: Aug. 9, 2018

Reviewed, edited and uploaded: Oct. 18, 2018

|

8

Profitability Analysis of Rice Storage by the Traders in the Selected Areas of Ayeyarwaddy Region, Myanmar

ABSTRACT

The intensification of rice production in Myanmar, especially in the Pyar Pon Township, Pyar Pon District, has led to many problems in the post-harvest phase, particularly in storage. This situation is further aggravated by the growing attention devoted to the maintenance of buffer stocks to continuously provide food security for the country. This study examines the profitability of rice storage by the traders in Pyar Pon District, Myanmar. The partial budget analysis was used to determine the profitability of storing rice. According to the financial source, traders who borrowed capital for rice storage earned additional profit of 47,405.2 Kyats (US$58.17) per ton while those who did not borrow capital for rice storage gained the additional profit of 50,656.23 Kyats (US$62.15) per ton. Based on storage duration for traders who borrowed capital, additional profit with at least five months of rice storage was 54,950.13 Kyats (US$67.42) per ton while those with three months of rice storage realized additional profit of 164.53 Kyats (US$0.21) per ton due to price instability of the trading time. However, for traders who used their own finance for rice storage, additional profit for at least five months of rice storage was 39,032.44 Kyats (US$ 47.89) per ton while those with four months of rice storage was 38,407.09 Kyats (US$47.13) per ton. Additionally, based on comparison of t- test by mean profit, the best time to sell rice for traders who borrowed capital and those who used their own finance was also at least five months after storage.

Key words: Partial Budget Analysis, Rice Storage, Storage Cost, Additional Profits, Pyar Pon District.

INTRODUCTION

According to rice production in Myanmar, Ayeyarwaddy Region is the largest producer of the staple crop, producing 6.78 million tons, which accounted for 34.2% of the Union’s rice production of 19.8 million tons (FAO, 2004). In terms of resource endowment, it has the highest share in population, which suggests abundant labor supply. Similarly, average rainfall is twice that of the national average hence, water supply is highly conducive to growing rice. Since Ayeyarwaddy Region is the rice bowl of the country for domestic rice supply and a strategic region for foreign export, sustainability of rice production in this region is vital for Myanmar. With respect to region-wise rice production, domestic utilization and surplus and deficit, the delta region had huge surplus of rice, the coastal region had smaller amount of rice surplus while the central dry zone and hilly area showed rice deficit (FAO, 2004). Therefore, at present, Ayeyarwaddy Region is a highly commercialized region.

Storage is an important component of the post-harvest handling operations of agricultural products. Under trade liberalization, the role of the marketing system and post-harvest activities become more important. Agricultural production can only be really efficient if the accompanying marketing and post-harvest systems are also efficient (FAO, 1999). Well-functioning marketing systems are thus essential to develop production, thereby increasing household income and promoting food security.

The intensification of rice production in Myanmar, especially in the Pyar Pon Township, Pyar Pon District, has led to many problems in the post-harvest phase, particularly in storage. This situation is further aggravated by the growing attention devoted to the maintenance of buffer stocks to continuously provide food security for the country. Furthermore, storage of seasonal or operational stocks is needed to meet seasonal demand and to stabilize prices which subsequently establish a strategic or long-term reserve against crop failure.

Like most agricultural products, rice is harvested within a short period of time but is consumed all-year round. The majority of the farmers sell rough rice right after harvest time but they also store certain amounts for home consumption, seed purposes and labor wages. Only farmers with large farms and more capital usually store the paddy to sell when the price of rice becomes higher. Therefore, storage will be performed by a trader only if there are enough incentives in doing it. That is, if there are relatively great price differences between the time of harvest and time of non-harvest.

Rice prices are influenced by the demand and supply situation during the harvest and non-harvest periods. The producers and consumers are faced with a situation wherein rice prices are low during the harvest periods and high during lean months when planting season begins. And since there is a continuous demand for rice all-year round, then a trader who chooses to store during the months when there is plenty of harvest and sell when prices reach its peak during the non-harvest periods, earns adequate incentive for performing the storage activity. In effect, the traders gain more benefits by storing some of their procurements, respectively during the time of harvest and selling after sometime when market supply declines and prices are high. Rice-millers, processors, and retailers on the other hand, will benefit from a continuous supply of rice in the market.

This study aims to assess the profitability of storing rice by traders based on financial sources and storage durations. Costs of storage and gross income of traders may be variably incurred and so the question of when to sell, when to buy, and when to store needs to be answered in order to gain the highest possible profit.

METHODOLOGY

The three villages namely Tha Main Taw, Khone Tan/Tein Khone and Maw Bi in Pyar Pon Township, Pyar Pon District, Ayeyarwaddy Region in Myanmar were chosen for the study sites due to the following: (1) the villages were major rice-producing and rice-trading areas; and (2) the traders from the villages have well-established storage practices. Each group of traders consisted of those who stored rice and those who did not. Enumerators collected the data from the households through stratified random sampling. Partial budgeting analysis was used to calculate the profitability of rice storage based on financial sources and storage durations.

Estimation of profitability of storing rice

The costs and benefits derived by traders from rice storage were compared using the partial budgeting approach. Partial budgeting is a planning and decision-making framework used to compare the costs and benefits of alternatives faced by a trader. It looks at those revenue and expense items that are affected by the proposed change. This method is used for choosing storing or selling immediately after harvest by comparing the additional profits of each option (Compton, 1992; and Baldimino, 1996). Basically, a partial budget is made up of four components: two components identify changes in the operation that will increase profits (Total added return or TAR and Total reduced cost or TRC), and two components identify changes in the operation that will decrease profits (Total added cost or TAC and Total reduced return or TRR) (Robert, 2007; Billy et al., 2006). Interpreting the results of a partial budget is very simple. If total gains exceed total losses, then the change being considered is likely to be positive in terms of profitability. According to Roth (2002), a basic outline of a partial budget would look something like this:

Where:

TAR = Total Added Return

TRC = Total Reduced Cost

TRR = Total Reduced Return

TAC = Total Added Cost

Total gain is the sum of total added return and total reduced cost. Total losses are the sum of total reduced return and total added cost. If total gains are greater than total losses, this will result in additional profit from storage.

In calculating returns of storage and the cost of storage in partial budgeting framework for traders, volume of rice stored, price of rice before and after storage, hired labor, family labor, chemicals used, depreciation on warehouse, waterproof and lace, opportunity cost of capital if the trader used his own capital, interest in borrowing capital if the trader borrowed capital from other institutions, storage losses, procurement fee, and other expenses like maintenance, electric bill, sprayer and classifying costs, etc. were used.

Statistical test procedure

Statistical test was used to compare significant differences in indices among traders with and without decision in performing rice storage and in mean profit of traders’ category in rice storage. It can be presented as follows:

Test of equality between two sample means of efficiency. The F value is computed by the following formula:

Where:

If the two populations have the same variance, the t-test will be used to test the difference between two sample means as follows:

If the two population variances are not equal, the following t-test is used:

RESULTS AND DISCUSSION

Storage cost

For the traders who borrowed capital for rice trading per year, average storage costs per ton on various inputs used in rice storing were calculated. Data revealed that for the sampled households, the total non-cash cost was 7,982.02 Kyats (US$9.79) per ton, and the total storage cost was 9,642.44 Kyats (US$11.83) per ton. The total cash cost was 1,660.42 Kyats (US$2.04) per ton which was 17.22% of total storage cost. Storage loss of rice was the biggest contributor to the total cost (67.17%), followed by depreciation cost of plastic sacks (8.90%), interest rate on capital (7.49%), depreciation of warehouse (6.07%), and hired labor cost (6.02%). Therefore, an increase in the cost of any of three items would drastically increase the storage costs for rice. Storage rental fee, other costs (including electricity, building maintenance, sprayers, classifying), family labor cost, depreciation of waterproof and lace amounted to 2.76%, 0.94%, 0.42%, 0.12% and 0.09% of total storage cost, respectively, and the contribution to total costs incurred were minimal.

Considering the duration of storage of rice and borrowing capital, the average storage cost per ton for the traders who stored rice for at least five months and borrowed for capital was calculated. For the sampled households, the total non-cash cost was 7,753.77 Kyats (US$9.51) per ton, and the total cost was 12,153.97 Kyats (US$14.91) per ton. The total cash cost was 4,400.19 Kyats (US$5.40) per ton which was 36.20% of total storage cost. Storage loss of rice was the biggest contributor to the total cost incurred (55.97%), followed by interest rate on capital (30.39%), hired labor cost (4.36%), depreciation of plastic sacks (4.23%), and depreciation of warehouse (3.15%), respectively. Therefore, an increase in the cost of any of the five items would drastically increase the storage costs for rice. Storage rental fee, other costs (including electricity, building maintenance, sprayers, classifying), family labor cost, depreciation on waterproof contributed a minimal amount of the storage cost.

Based on storage duration and financial sources, the average storage cost per ton was calculated for the traders who stored rice for three to four months with borrowing capital. For the sampled households, the total non-cash cost was 4,455.58 Kyats (US$5.47) per ton, and the total storage cost was 6,600.84 Kyats (US$8.09) per ton. The total cash cost of 2,145.26 Kyats (US$2.63) per ton contributed 32.49% of the total storage cost. Storage loss of rice (60.85%) was the biggest contributor to the total cost, followed by interest rate on capital (21.43%), and hired labor cost (7.58%), respectively. Therefore, an increase in the cost of any of the three items would drastically increase the storage costs for rice. Depreciation on plastic sacks, other costs (include electricity, building maintenance, sprayers, classifying), depreciation of warehouse, storage rental fee, depreciation of waterproof and lace contributed a minimal share to the total storage cost.

For the traders who did not borrow capital for rice trading per year, the average storage cost per ton for various inputs used in rice storage was calculated. The total non-cash cost of the sample households was 82.05% of total storage cost while the total cash cost was 17.95% of total storage cost, which were 9,759.13 Kyats (US$11.97) per ton and 2,135.16 Kyats (US$2.62) per ton, respectively. Storage loss of rice was the biggest contributor to the total cost (71.77%), followed by hired labor cost (11.44%) and storage rental fee (5.79%). The contribution of other factors to total cost was minimal.

For traders who stored rice for at least five months without borrowing capital, average storage costs per ton on various inputs used in the rice storing was calculated. The result reveals that for the sampled households, the total non-cash cost was 84.17% of total storage cost, and total cash cost was 17.95% of total storage cost. Storage loss of rice was the biggest contributor to total cost (77.06%), followed by hired labor cost (8.88%) and storage rental fee (6.27%).

For traders who stored rice for three to four months without borrowing capital, the average storage costs per ton on various inputs used in rice storage was 20,810.54 Kyats (US$ 25.53) per ton. For the sampled households, the total non-cash cost was 71.78% of total storage cost and total cash cost contributed 28.22% of total storage cost. Storage loss of rice was the biggest contributor to the total cost (67.35%), followed by hired labor cost (15.79%) and other costs including electricity, building maintenance, sprayers and classifying (10.46%), respectively. These ‘other costs’ was relatively high because of building maintenance.

Returns on rice storage of traders

Rice traders derived their income from storing rice for a period of time after purchasing from the farmers. Additional returns from rice storage are simply the differences in revenue between the traders who sold rice immediately after harvest and the traders who kept rice in storage. In estimating their annual additional returns, separate computations were done according to the different categories of the traders in the survey areas, which are financial source and duration of rice storage. The sum of the values obtained from different categories determined the additional returns. Computations were also done on a per ton basis.

The gross incomes of 20 traders who sold rice immediately and 18 traders, who stored rice with borrowing capital are 247,130.20 Kyats (US$303.23) per ton and 304,177.80 Kyats (US$373.23) per ton each. Therefore, the additional gross returns by storing rice are 57,047.64 Kyats (US$70) per ton. Based on storage length, for 20 traders who sold rice immediately and 15 traders, who stored rice for at least five months with borrowing capital, the additional gross returns by storage are 67,104.10 Kyats (US$82.34) per ton while the additional gross returns by storage between the two groups of the 20 traders who sold rice immediately and three traders, who stored rice for three months with borrowing capital, is 6,765.36 Kyats (US$8.30) per ton.

According to financial resources, the additional gross returns gained by storage between the two groups of 20 traders who sold rice immediately and 12 traders, who stored rice without borrowing capital is 62,874.94 Kyats (US$77.14) per ton. Based on financial sources and storage duration, the additional gross returns by storage between the two groups of 20 traders who sold rice immediately and 10 traders who stored rice for at least five months with borrowing capital are 63,519.04 Kyats (US$77.94)per ton. For comparison of gross income of 20 traders who sold rice immediately and two traders, who stored rice for four months with borrowing capital, the additional gross returns is 59,654.63 Kyats (US$73.20) per ton.

Additional profits of traders

To determine whether the traders who stored rice gained profits or not, or simply stated, whether storing rice is more profitable than selling it immediately after harvest, partial budget analysis was used. The table is divided into four categories: added returns, added costs, reduced returns and reduced cost. Based on financial resources and storage length, the partial budgets for traders who stored rice were analyzed. The study revealed that on the average, the income received by the traders increased due to storage. Therefore, storing rice was profitable for traders.

Subtracting the total losses (B) from the total gains (A) would determine the additional profits from rice storage. On the average, for the traders who borrowed capital, the additional profit obtained was 47,405.20 Kyats (US$58.17) per ton year per. For the traders who stored rice for at least five months, the additional profit was 54,950.13 Kyats (US$67.42) per ton. The additional profit for those who stored rice for three months was 164.53 Kyats (US$0.20) per ton.

For traders without borrowed capital, the additional profit was 50,656.23 Kyats (US$62.15) per ton. For traders who stored for at least five months without borrowing capital, the additional profit obtained was 39,032.44 Kyats (US$47.89) per ton. Traders who stored rice for four months without borrowing capital earned 38,407.09 Kyats (US$47.13) per ton of additional profit.

Overall, the traders who did not borrow capital received more additional profit than those who borrowed capital. The additional profit of the traders with borrowing capital with at least five months duration of storage was greater than those who did not borrow capital because the average volume of rice storage was less than those who borrowed capital. However, additional profit of traders who stored for four months without borrowing capital was higher than those traders who borrowed capital for three months rice storage duration.

In terms of costs in aggregate terms, the traders paid higher cost in their storage operations mainly because of their large volume procurement and storage. Similarly, additional profit was also much higher for the traders as a result of larger sales volume. For the farmers, they earned less additional profit because of their small sales volume.

T-test for traders

T-test was done for comparing the mean profit of each category of traders. The difference between average profit of traders from storing rice with borrowing capital and average profit of traders from selling immediately after purchase is statistically significant at 5% level. And also the difference between average profit of traders from storing rice without borrowed capital and average profit of traders selling immediately after purchase is statistically significant at 5% level.

Based on storage duration, the different between the average profit of traders from storing rice for at least five months with borrowed capital and the average profit of traders who sold their procured rice immediately is statistically significant at 1% level. The average profit of the traders from storing rice for three months with borrowed capital was greater than the average profit of traders who sold rice immediately. However, the difference is not statistically significant. The reason can be that the time of rice procurement for the traders who sold immediately was not done on the same months. Therefore, price of rice at every month can be considered for those who sold rice immediately.

The average profit of traders from storing rice for at least five months with borrowed capital was greater than the average profit of traders from storing rice for three months, also with borrowed capital. The statistical result indicated that the mean profit is statistically significant at 10% level. Based on storage duration, the difference between the average profit of traders from storing rice for at least five months without borrowed capital and the average profit of traders who sold rice immediately is statistically significant at 5 % level. The average profit of traders by storing rice for four months without borrowed capital is greater than the average profit of traders who sold rice immediately. However, the difference in mean profit is not statistically significant. The reason can be that the time of rice procurement for the traders who sold immediately was not done on the same months. Therefore, price of rice every month can be considered for those who sold rice immediately.

The average profit of traders by storing rice for at least five months without borrowed capital was less than the average profit of traders by storing rice for four months without borrowed capital. The statistical result indicated that this indicator is not statistically significant. Due to comparison of mean profit based on duration of storage, the best time to sell rice for traders without borrowing capital is at five months after storage.

CONCLUSION AND RECOMMENDATIONS

The study was conducted primarily to assess the profitability of storing rice by the farmers; and suggest policy recommendations to improve the rice storage in research sites.

For the trader group, according to finance source, traders who did not borrow capital for rice storage gained more profit than those who borrowed capital for rice storage. According to the duration of storage for traders who borrowed capital, the traders who stored rice for at least five months had higher storage costs than those who stored rice for only three months, increasing more profit of those who stored rice for at least five months than those with only three months storage. Similarly, for the traders without borrowed capital, the group with at least five months was more profitable than the group with four months storage of rice. It also means that there was economies-of-scale in larger operations of rice storage. It was observed that approximately 85% of the total storage costs for each category were due to the hired labor, storage losses, and depreciation cost of warehouses.

Based on the financial source, traders who borrowed capital for rice storage earned additional profit of 47,405.20 Kyats (US$58.17) per ton while those who did not borrow capital for rice storage gained the additional profit of 50,656.23 Kyats (US$62.15) per ton. Based on storage duration for traders who borrowed capital, additional profit with at least five months of rice storage was 54,950.13 Kyats (US$67.42) per ton while those with three months of rice storage realized additional profit of 164.53 Kyats (US$0.20) per ton due to price instability of the trading time. However, for traders who used own finance for rice storage, additional profit for at least five months of rice storage was 39,032.44 Kyats (US$47.89) per ton while those with 4 months of rice storage was 38,407.09 Kyats (US$47.13) per ton. Additionally, based on comparison of t- test by mean profit, the best time to sell rice for traders who borrowed capital and those who used their own finance was also at least five months after storage.

Given the above findings, the most relevant ingredients to ensuring increased rice storage are incentive public programs that can encourage rice traders to engage in long-term rice storage. It is clear from this study that the traders will store more rice until the end of non-harvest periods only in response to positive incentives or opportunities in storage. The success of rice storing for traders will therefore require government programs that help traders to overcome the constraints they face as well as creating incentives that will encourage them to change their current storage practices in order to improve their income as well as eliminate the rice availability-gap in the non-harvest periods.

While most of the interventional activities may be provided by local traders themselves, there will be a need for a complementary role of the government. Access to the trader’s decision on rice storage, easy access to inventory capital, improvements in communication infrastructure to assist in effective dissemination of market information and predicting future prices and extension training are factors that national policies can play a key role in encouraging rice storage among traders. Therefore, in order to improve the rice trader’s income in Pyar Pon Township, and whole country in general, government policies should give top priority to the following recommendations: such as improvement in the delivery of extension services to improve their access to storage facilities and provide the possibilities for reducing storage costs, increase access to credit for promoting or encouraging rice storage among traders, improvement of transportation to create better market access for local people meaning cheaper transportation cost may create the more profit on their stocks, and improving the pre-processing operation which is critical for improving the terms of trade of small and poor traders.

Exchange Rate (1 US$= 815Kyats)

REFERENCES

BALDIMINO, O. 1996. Economic Analysis of Corn Storage Operations at the Traders’ Level in Lucena. B.S. Thesis. Unpublished Undergraduate Thesis. College of Economics and Management, UPLB. Philippines.

BILLY, V.L., M.J. DALE and C.H. JAMES. 2006. Using the Partial Budget to Analyze Farm Change. Available online at http://www.smallfarmsuccess.info/management /print_547.cfm. Data Accessed.

COMPTON, J.A.F. 1992. Reducing Losses in Small Farm Grain Storage in the Tropics. Chatham: NRI. DPP Working Paper No. 6. Dhaka: Development Policy and Practice Research Group.

FAO. 1999. A Guide to Maize Marketing for Extension Officers. Food and Agriculture Organization of United Nations. Rome.

FAO. 2004. Integration of Myanmar Agriculture into ASEAN, TCP/MYA/2902.

ROBERT, T. 2007. Partial Budgeting: A Tool to Analyze Farm Business Changes. Available online at http://www.extension.iastate.edu/AGDM/wholefarm/html/c1-50. html.

ROTH, S. 2002. Partial Budgeting for Agricultural Business. The Pennsylvania State University. Dairy alliance. CAT, UA366, 5M2/02, pp: 4486.

Date submitted: Aug. 9, 2018

Reviewed, edited and uploaded: Oct. 18, 2018

8