Introduction

Durian (Durio spp) or the “King of Fruits” is a seasonal fruit that is extensively grown in tropical regions, in Indonesia, Thailand, Malaysia and the Philippines. It also grows in northern Australia, some South American countries and in Africa. Known for its distinctive smell, spiky, and large size fruit, the durian pulp generally comprises 20% to 30% of the mass of the whole fruit depending on the variety. Although it is pungent in aroma, the durian has become extremely popular in Asian countries recently, due to its high nutritional value and the widespread acceptance of its processed products. Durian has been highlighted as one out of nine selected premium fruits in the Malaysian National Agro-food Policy (2011-2020). Durian has also been identified as a new source of agricultural wealth which includes the coconut and the pineapple. This paper focuses on the market potential of durian for export and on the strategies to empower this sector as a new source of Malaysian agricultural wealth.

Production of durian

Durian is rich in energy, vitamins and minerals. Durian flesh contains fiber, starch, sugar and fat. It is a complete diet but people are not encouraged to partake durian in large amount. It provides a positive impact on digestion, blood pressure and cardiovascular health, aging, insomnia, sexual dysfunction, cancer, bone health and anaemia. However, durian intake should be on a moderate scale and not excessive, as it is likely to bring about other illnesses.

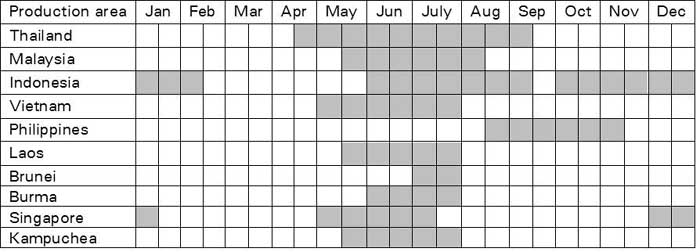

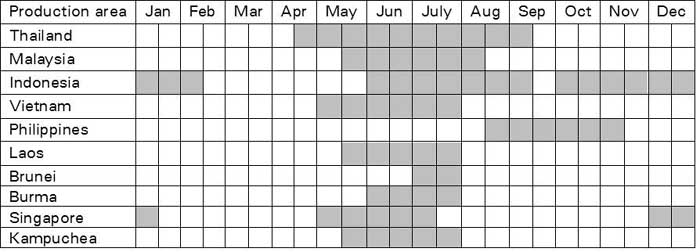

Durian production is greatly influenced by the seasons of the north-east and south-west monsoons. The tree requires a dry season for flowering (two to four weeks) and wet weather for fruit ripening. Table 1 shows the durian season for major producers like Thailand, Malaysia and Indonesia, which generally peaks in the middle of the year (June-July). The durian season is divided into three phases: early harvest, peak harvest and late harvest. The best time for harvesting the domestic and export markets is during the peak seasons. The peak season typically runs for three to four months for the harvest of fresh durians. During the peak season, pulp and paste durian can be substituted for fresh whole fruits and can retain its shelf-life for two years.

Table 1. Durian Seasons in Durian Growing Countries.

Source: Boosting Durian Productivity, 2009

The demand for durians increases extremely nowadays and it has become popular in the China market. Durian is sold worldwide, although consumption is centred on the Asian markets. Thailand, Malaysia and Indonesia are the top three global producers and exporters of the fruit. Total durian production for these countries are approximately at 800,000 to 900,000 MT per year, led by Thailand (± 600,000 MT), Malaysia (± 350,000 MT) and Indonesia (± 995 MT) (Table 2). In Thailand, the bulk of export-oriented fresh durian production takes place near the Gulf of Thailand in the south-eastern provinces of Chanthanburi, Rayong, Trat, and Prachinburi. Other durian production zones include the northern province of Uttaradit, as well as the southern provinces of Yala, Narathiwat and Surat Thani. The majority of export-oriented fresh durian production is in Peninsular Malaysia, mainly in the states of Perak, Pahang, Johor and Kelantan.

Table 2. Durian Production (MT) in Malaysia, Thailand and Indonesia (2012-2016)

Source: Multiple sources from national statistic publications

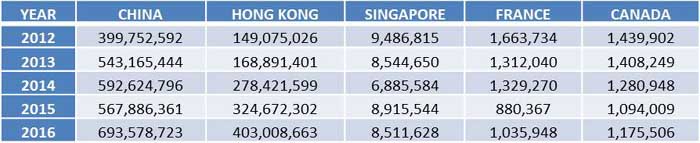

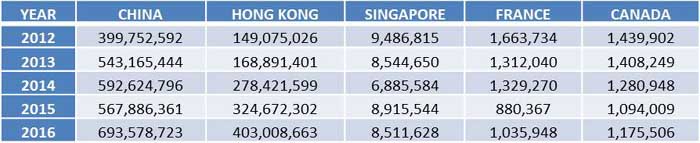

Depending on market demand, durian is sold either fresh or processed. Whole durian is sold fresh for local markets while processed durian is sold as paste or pulp for the export markets. Frozen pulp and paste are primarily utilized as ingredients by food processors, restaurants, and hotels. Table 3 shows the export value of fresh durian to the world from the three major exporters. In general, the trend shows double increments (200%) in export value from 2012 to 2016. Thailand holds a monopoly for freshly exported durians (95% - US$ 500 million in 2016), followed by Malaysia (3% - US$ 17 million) and Indonesia (<1% - US$21,000). There are several varieties used for the export market from Thailand such as the Golden Pillow (Monthong), Kanyou (Long Stem) and Chanee (Gibbon). Malaysia’s varieties include Mountain Cat King (Mao Shan Wang/Musang King) and D24 (Sultan Durian). Export destinations of durian are mainly to the Asian market and to some non-Asian markets (France and Canada). China, Hong Kong and Singapore are the main traditional export destination markets for Thailand and Malaysia.

Table 3. Export Value of Fresh Durian to the World (2012-2016).

Source: UNCOMTRADE, 2018

The export and import trends increase accordingly as shown in Table 4, whereby the import trend is also increasing every year. The total import from Thailand and Malaysia is approximately US$ 693 million in 2016.

Table 4. Import Value (US $) of Fresh Durian to the World (2011-2016).

Sources: UNCOMTRADE Databases, 2018

Malaysian Durian to the World

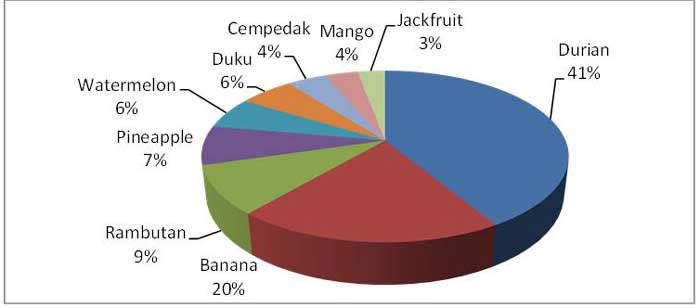

The total planted area for Malaysian fruit crops (21 in total) is about 208,590 ha in 2017 but only 60.4% (126,005 ha) is used for production. There were 1.49 million metric tonnes of local fruits produced with an average production of 11.8 mt/ha last year. Figure 1 shows the percentage area planted with nine selected fruits. Durian is the most popular crop planted in Malaysia making up 41% of the land cultivated or about 73,000 hectares. This is followed by bananas (20% - 35,000 t hectares), Rambutans (9%), Pineapples (7%) and others fruits (below 6%). The main durian plantations are found in East (Pahang) and South (Johor) of Peninsular Malaysia. Durian has achieved full self-sufficiency level (SSL) of more than 100%, and is currently at 102.7%.The per capita consumption has also increased from 9.1 kg/year (2015) to 10.8 kg/year (2016), indicating an increased demand for durian.

Fig. 1. Percentage of Planted Areas for nine fruits in Malaysia, 2017.

Malaysia is the second largest exporter of durian in the world. Figure 2 shows the export market of Malaysian durians (2015). Malaysia has been exporting durians to 18 destinations including the Asian and non-Asian markets (New Zealand, United States, Canada, and Australia). The traditional export markets are Singapore (49%), Hong Kong (12%), China (36%) and others. Malaysia has acquired full market access for fresh and processed durian products to Singapore and Hong Kong. However, only frozen pulp and paste durian are allowed for the China market. Malaysia has also been negotiating with China for acquiring the export of fresh whole durian, but permission has yet to be granted. The total export of Malaysian durians in 2015 amounted to US$ 16.5 million, an increase of 61% from the previous year (US$ 10.3 million). Durian has been identified in the Malaysian National Agro-food Policy (2011-2020) in the premium fruits group, together with nine others. It has great potential and projected to be in high demand in future. Thus, in the new Budget for 2018, durian, pineapple and coconut have been highlighted to be fruits with the fullest potential to contribute to the national income. The Malaysian government aims to develop durian as a new industry by its own and generate income for farmers as well as for the nation. The Ministry of Agriculture and Agrobased Industry has been mandated to strategize plan of actions so that all efforts are focused toward the development of this industry.

Fig. 2. Malaysian Durian Exports (2016)

Source: GTIS, 2017

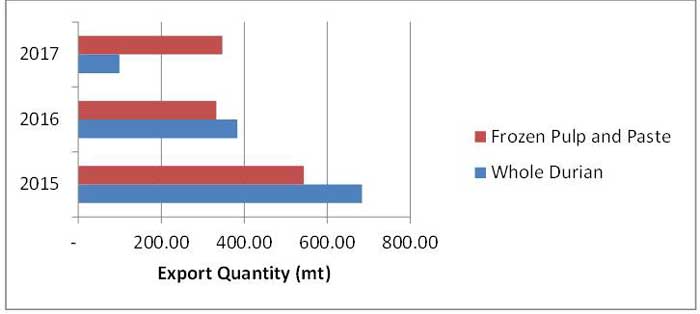

Malaysian durians are always harvested when they are fully ripe. Previously in the 1990s, durian is eaten fresh. Currently, however, many value-added durians have been established. Durian paste is highly demanded by the industry: food processors, restaurants and hotels. A steady and stable supply throughout the year is required. As shown in figure 3, in 2017 the export of frozen pulp and paste is higher than that of the whole fruit. Pulp and paste are not only pricey but they also retain their long shelf-life.

Fig. 3. Export of fresh durian (whole, frozen and paste), 2015-2017

Source: Malaysian Quarantine and Inspection Services (MAQIS), 2018

Strategies and the way forward

To strengthen the durian industry in Malaysia as a new source of wealth, strategic planning is needed. Through the collaboration between government related agencies and private institutions, the durian industry should increase the production, retain the quality, and establish new downstream products. Safety and value for money to the consumers should also be examined. The new strategies highlighted are as follows:

- Premium Durian Seed Production (target production: 240,000 new trees). Famers’ initiative, effective irrigation system and agriculture inputs. Malaysia will introduce new varieties of durian to meet the higher demand by domestic and international markets. The new varieties of durian include Musang King, Black Thorn, Traka and Udang Merah. These varieties have tick flesh, very aromatic and good colour.

- Farm transformation (target hectarage: 880 ha). Replanting 350 ha current planted area and open 530 ha new area. Malaysia aims to plant 500,000 durian trees as to ensure sustainable production for local as well as export markers. The Ministry of Agriculture and Agrobased Industry provides some incentives for replanting old trees with new varieties.

- Empowering technology application. One Stop Solution for commercial trading (collection centre, nursery and referral centre). The government aims to modernise this industry. All processing plants for export markets will follow the International Standard and this effort will help the exporters to process their commodity before exported to China and other destinations.

- Research and Development activities. Focus on R&D is on agronomic practices, improving productivity, quality of fresh and processed products, post-harvest handling.

- Standardization of Durian quality and traceability elements. Geospatial and Geoinformation system to be examined. New market access protocol for quality and standard.

- Expansion and promotion program: Training and consultation with regard to myGAP certification, and establishing road shows locally and internationally. Malaysia will ensure that all durians come from this country are safe for consumption and of high quality. Malaysia will also establish applications that can trace the source or origin of the fruits. This approach will ensure that farmers follow the good agriculture practice and the enforcement officer will monitor the production of fruits especially for export markets.

CONCLUSION

Durian is a legacy fruit among others and needs more attention to its potential. Nowadays, durian is considered as a gold commodity and a new source of wealth for farmers as well as new source of income for Malaysia. It is very potent and is getting very popular with its high demand in the domestic and export markets. Hence, with new strategies and their implementation at present, it is expected to have good impact for the next ten years.

REFERENCES

Global Trade Information Services (GTIS) (2017) Malaysian exports durian 2017. Online data source, retrace from https:gtis.com/gta

Malaysian Quarantine and Inspection Services (MAQIS), 2018 Export of fresh durian from Malaysia

Wannarat and Nattapon (2018), Thai Export of Durian to China, Retrieved from http://www.ide.go.jp/library/English/Publish/Download/Brc/pdf/21_05.pdf

Parichatnon, Maichum and Peng (2017), International Journal of Business Marketing and Management (IJBMM): Application of the Malmquist Productivity Index on Measurement of Productivity Trend of Durian Production in Thailand, Vol. 2, Retrieved from https://www.ijbmm.com/paper/Apr2017/459147691.pdf

Boosting Durian Productivity (2009), Rural Industries Research and Development Corporation, Retrieved from file:///C:/Users/User/Downloads/97-001W%20(1).pdf

Salleh and Rokiah (2006), Fruits and Vegetables for Health Workshop, Tropical fruits and vegetables in Malaysia: Production and impact on health, Retrieved from http://www.fao.org/fileadmin/templates/agphome/documents/horticulture/WH...

UNCOMTRADE Database (2018), Retrieved from https://comtrade.un.org/data

|

Date submitted: Aug. 13, 2018

Reviewed, edited and uploaded: Oct. 15, 2018

|

Durian as New Source of Malaysia’s Agricultural Wealth

Introduction

Durian (Durio spp) or the “King of Fruits” is a seasonal fruit that is extensively grown in tropical regions, in Indonesia, Thailand, Malaysia and the Philippines. It also grows in northern Australia, some South American countries and in Africa. Known for its distinctive smell, spiky, and large size fruit, the durian pulp generally comprises 20% to 30% of the mass of the whole fruit depending on the variety. Although it is pungent in aroma, the durian has become extremely popular in Asian countries recently, due to its high nutritional value and the widespread acceptance of its processed products. Durian has been highlighted as one out of nine selected premium fruits in the Malaysian National Agro-food Policy (2011-2020). Durian has also been identified as a new source of agricultural wealth which includes the coconut and the pineapple. This paper focuses on the market potential of durian for export and on the strategies to empower this sector as a new source of Malaysian agricultural wealth.

Production of durian

Durian is rich in energy, vitamins and minerals. Durian flesh contains fiber, starch, sugar and fat. It is a complete diet but people are not encouraged to partake durian in large amount. It provides a positive impact on digestion, blood pressure and cardiovascular health, aging, insomnia, sexual dysfunction, cancer, bone health and anaemia. However, durian intake should be on a moderate scale and not excessive, as it is likely to bring about other illnesses.

Durian production is greatly influenced by the seasons of the north-east and south-west monsoons. The tree requires a dry season for flowering (two to four weeks) and wet weather for fruit ripening. Table 1 shows the durian season for major producers like Thailand, Malaysia and Indonesia, which generally peaks in the middle of the year (June-July). The durian season is divided into three phases: early harvest, peak harvest and late harvest. The best time for harvesting the domestic and export markets is during the peak seasons. The peak season typically runs for three to four months for the harvest of fresh durians. During the peak season, pulp and paste durian can be substituted for fresh whole fruits and can retain its shelf-life for two years.

Table 1. Durian Seasons in Durian Growing Countries.

Source: Boosting Durian Productivity, 2009

The demand for durians increases extremely nowadays and it has become popular in the China market. Durian is sold worldwide, although consumption is centred on the Asian markets. Thailand, Malaysia and Indonesia are the top three global producers and exporters of the fruit. Total durian production for these countries are approximately at 800,000 to 900,000 MT per year, led by Thailand (± 600,000 MT), Malaysia (± 350,000 MT) and Indonesia (± 995 MT) (Table 2). In Thailand, the bulk of export-oriented fresh durian production takes place near the Gulf of Thailand in the south-eastern provinces of Chanthanburi, Rayong, Trat, and Prachinburi. Other durian production zones include the northern province of Uttaradit, as well as the southern provinces of Yala, Narathiwat and Surat Thani. The majority of export-oriented fresh durian production is in Peninsular Malaysia, mainly in the states of Perak, Pahang, Johor and Kelantan.

Table 2. Durian Production (MT) in Malaysia, Thailand and Indonesia (2012-2016)

Source: Multiple sources from national statistic publications

Depending on market demand, durian is sold either fresh or processed. Whole durian is sold fresh for local markets while processed durian is sold as paste or pulp for the export markets. Frozen pulp and paste are primarily utilized as ingredients by food processors, restaurants, and hotels. Table 3 shows the export value of fresh durian to the world from the three major exporters. In general, the trend shows double increments (200%) in export value from 2012 to 2016. Thailand holds a monopoly for freshly exported durians (95% - US$ 500 million in 2016), followed by Malaysia (3% - US$ 17 million) and Indonesia (<1% - US$21,000). There are several varieties used for the export market from Thailand such as the Golden Pillow (Monthong), Kanyou (Long Stem) and Chanee (Gibbon). Malaysia’s varieties include Mountain Cat King (Mao Shan Wang/Musang King) and D24 (Sultan Durian). Export destinations of durian are mainly to the Asian market and to some non-Asian markets (France and Canada). China, Hong Kong and Singapore are the main traditional export destination markets for Thailand and Malaysia.

Table 3. Export Value of Fresh Durian to the World (2012-2016).

Source: UNCOMTRADE, 2018

The export and import trends increase accordingly as shown in Table 4, whereby the import trend is also increasing every year. The total import from Thailand and Malaysia is approximately US$ 693 million in 2016.

Table 4. Import Value (US $) of Fresh Durian to the World (2011-2016).

Sources: UNCOMTRADE Databases, 2018

Malaysian Durian to the World

The total planted area for Malaysian fruit crops (21 in total) is about 208,590 ha in 2017 but only 60.4% (126,005 ha) is used for production. There were 1.49 million metric tonnes of local fruits produced with an average production of 11.8 mt/ha last year. Figure 1 shows the percentage area planted with nine selected fruits. Durian is the most popular crop planted in Malaysia making up 41% of the land cultivated or about 73,000 hectares. This is followed by bananas (20% - 35,000 t hectares), Rambutans (9%), Pineapples (7%) and others fruits (below 6%). The main durian plantations are found in East (Pahang) and South (Johor) of Peninsular Malaysia. Durian has achieved full self-sufficiency level (SSL) of more than 100%, and is currently at 102.7%.The per capita consumption has also increased from 9.1 kg/year (2015) to 10.8 kg/year (2016), indicating an increased demand for durian.

Fig. 1. Percentage of Planted Areas for nine fruits in Malaysia, 2017.

Malaysia is the second largest exporter of durian in the world. Figure 2 shows the export market of Malaysian durians (2015). Malaysia has been exporting durians to 18 destinations including the Asian and non-Asian markets (New Zealand, United States, Canada, and Australia). The traditional export markets are Singapore (49%), Hong Kong (12%), China (36%) and others. Malaysia has acquired full market access for fresh and processed durian products to Singapore and Hong Kong. However, only frozen pulp and paste durian are allowed for the China market. Malaysia has also been negotiating with China for acquiring the export of fresh whole durian, but permission has yet to be granted. The total export of Malaysian durians in 2015 amounted to US$ 16.5 million, an increase of 61% from the previous year (US$ 10.3 million). Durian has been identified in the Malaysian National Agro-food Policy (2011-2020) in the premium fruits group, together with nine others. It has great potential and projected to be in high demand in future. Thus, in the new Budget for 2018, durian, pineapple and coconut have been highlighted to be fruits with the fullest potential to contribute to the national income. The Malaysian government aims to develop durian as a new industry by its own and generate income for farmers as well as for the nation. The Ministry of Agriculture and Agrobased Industry has been mandated to strategize plan of actions so that all efforts are focused toward the development of this industry.

Fig. 2. Malaysian Durian Exports (2016)

Source: GTIS, 2017

Malaysian durians are always harvested when they are fully ripe. Previously in the 1990s, durian is eaten fresh. Currently, however, many value-added durians have been established. Durian paste is highly demanded by the industry: food processors, restaurants and hotels. A steady and stable supply throughout the year is required. As shown in figure 3, in 2017 the export of frozen pulp and paste is higher than that of the whole fruit. Pulp and paste are not only pricey but they also retain their long shelf-life.

Fig. 3. Export of fresh durian (whole, frozen and paste), 2015-2017

Source: Malaysian Quarantine and Inspection Services (MAQIS), 2018

Strategies and the way forward

To strengthen the durian industry in Malaysia as a new source of wealth, strategic planning is needed. Through the collaboration between government related agencies and private institutions, the durian industry should increase the production, retain the quality, and establish new downstream products. Safety and value for money to the consumers should also be examined. The new strategies highlighted are as follows:

CONCLUSION

Durian is a legacy fruit among others and needs more attention to its potential. Nowadays, durian is considered as a gold commodity and a new source of wealth for farmers as well as new source of income for Malaysia. It is very potent and is getting very popular with its high demand in the domestic and export markets. Hence, with new strategies and their implementation at present, it is expected to have good impact for the next ten years.

REFERENCES

Global Trade Information Services (GTIS) (2017) Malaysian exports durian 2017. Online data source, retrace from https:gtis.com/gta

Malaysian Quarantine and Inspection Services (MAQIS), 2018 Export of fresh durian from Malaysia

Wannarat and Nattapon (2018), Thai Export of Durian to China, Retrieved from http://www.ide.go.jp/library/English/Publish/Download/Brc/pdf/21_05.pdf

Parichatnon, Maichum and Peng (2017), International Journal of Business Marketing and Management (IJBMM): Application of the Malmquist Productivity Index on Measurement of Productivity Trend of Durian Production in Thailand, Vol. 2, Retrieved from https://www.ijbmm.com/paper/Apr2017/459147691.pdf

Boosting Durian Productivity (2009), Rural Industries Research and Development Corporation, Retrieved from file:///C:/Users/User/Downloads/97-001W%20(1).pdf

Salleh and Rokiah (2006), Fruits and Vegetables for Health Workshop, Tropical fruits and vegetables in Malaysia: Production and impact on health, Retrieved from http://www.fao.org/fileadmin/templates/agphome/documents/horticulture/WH...

UNCOMTRADE Database (2018), Retrieved from https://comtrade.un.org/data

Date submitted: Aug. 13, 2018

Reviewed, edited and uploaded: Oct. 15, 2018