INTRODUCTION

The international trade of agricultural products is projected to sustain its strong growth. The growing world demand on agricultural produce creates an opportunity for Malaysia to expand its export markets and contribute to the Gross National Income since international trade is a significant component of the Malaysian economy. Subsequently, the main objective of the Malaysian third Industrial Master Plan (IMP) (2006–2020) is to achieve global trade competitiveness through transformation and innovation of the manufacturing and service sectors, including agri-based industries. One of the IMP strategic thrusts is to enhance Malaysia’s position as a trading nation through the development and promotion of Malaysian brands, products that comply with international standards and enhance the SMEs to become globally competitive companies (Ministry of International Trade and Industry 2015).

For decades, Malaysia relied on Singapore as its traditional export market. Malaysia needs to penetrate new potential markets instead of relying only on selected regular markets. In line with the government aspirations, it is timely for Malaysia to enhance the competitiveness of agricultural products in the global markets. Malaysia recognized Vietnam as a new potential market for its agricultural produce. Hence, this paper assesses Vietnam’s profile and proposed some strategies for penetrating this market.

PROFILE OF VIETNAM’S MARKET

Vietnam is a developing economy in Southeast Asia. It is bordered by China to the north, Laos to the northwest, Cambodia to the southwest, Thailand across the Gulf of Thailand to the Southwest, and the Philippines, Malaysia and Indonesia across the South China Sea to the east and southeast. The population was estimated around 92.7 million in 2016, becoming the world's 14th-most-populous country and the 9th-most-populous within the Asian countries. Vietnam is the 24th largest export economy in the world and the 93rd the most complex economy according to the Economic Complexity Index (ECI).

Vietnam is one of the most important economies in the world. The economy of Vietnam is the 47th-largest economy in the world measured by nominal gross domestic product (GDP) and 35th-largest in the world measured by purchasing power parity (PPP). Vietnam has been transformed from a centralized to a liberalized country. Since the mid-1980s, the economy has experienced rapid growth. Vietnam is in a period of being integrated into the global economy. Almost all Vietnamese enterprises are small and medium enterprises (SMEs).

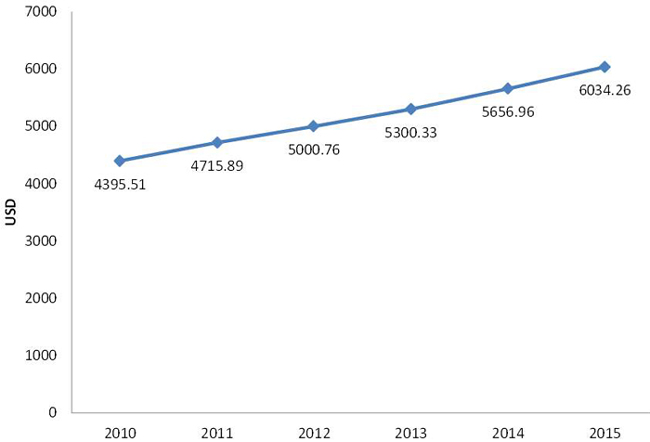

Vietnam has experienced tremendous growth for the past 25 years, from a dominant central controlled economy to a more liberal and market focused economy. Recent reports regarding Vietnam’s GDP per capita, indicated a growth of US$4,395.51 in 2010 to US$6,034.26 in 2015 (Fig. 1). This indicates that the country is gradually improving its economic performance with the expansion of the middle class and increasing in income levels. It was also estimated that the GDP annual growth rate until 2020 hovers between 6.5 – 6.8% (World Bank, 2016). This positive trend makes Vietnam an attractive place to do business, when opportunities arise.

Fig. 1. Vietnam’s GDP per capita, PPP

Source: World Bank, 2016

Vietnam has become a leading agricultural exporter and served as an attractive destination for foreign investments in Southeast Asia.This development has obviously been proven when Vietnam became a member of the World Trade Organization (WTO), the ASEAN Free Trade Agreement (AFTA) and joined various trade agreements with other countries. Vietnam followed through its international integration initiatives through its participation in the ASEAN Economic Community (AEC), the Trans Pacific Partnership Agreement (TPPA) and in signing several free trade agreements (FTAs) with South Korea, Eurasian Economic Union and the EU. After joining the WTO, Vietnam’s trade has experienced many positive changes. The amount of direct investments continue to increase over the years. Over that period, the economy has experienced rapid growth. Vietnam has become a leading agricultural exporter and served as an attractive destination for foreign investments in South-East Asia. Vietnam's major agricultural products include rice, cashew nuts, black pepper, coffee, tea, fishery products and rubber. The other industries include manufacturing, information technology and high-tech industries constitute a fast-growing part of its economy. Vietnam is also one of the largest oil producers in the region.

Vietnam launched its Vietnamese Good Agricultural Practices (VietGAP) in 2008. The implementation of VietGap is to ensure agricultural products from this country can compete against other products in the international market. Furthermore, multinational importers started to put emphasis and priority to products that abide by international standards. VietGAP is a food safety inspection program that covers the whole production line from A to Z. It begins from land preparation, planting, harvesting, post-harvest storage, including factors related to the environment, chemicals, plant protection products, packaging and working conditions and welfare of workers in the farms. Fresh agriculture products and agri-based industries that are being imported into Vietnam must get approval from the Vietnam Food Administration (VFA) to be analyzed in terms of food safety and in obtaining a certificate of approval.

THE VIETNAM MARKET SCENARIO

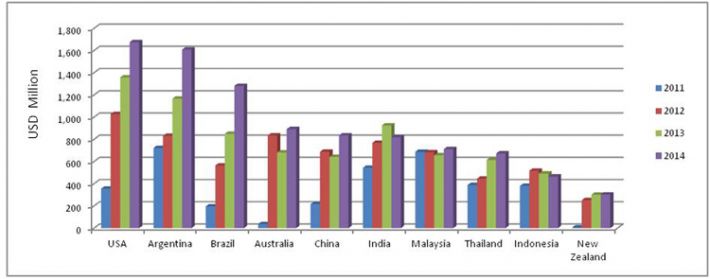

Vietnam is one of the most active trading nations in the world. This country traded with many countries across the regions, and the value is increasing every year. Vietnam imported many fresh agriculture produce from many countries such as USA, Argentina, Brazil, Australia, China, India and Malaysia (Fig. 2).

Fig. 2. Vietnam’s trading partners and import value of agricultural produce by countries

Source: FAOStat, 2015

Fig. 2 shows Vietnam’s trading partner from 2011 to 2014. Malaysia was ranked number seven trading partner for exporting agricultural products to Vietnam, after the United States of America, Argentina, Brazil, Australia, China and India in 2014. The value of agricutural produce from Malaysia is increasing every year. This indicates the potential for agriculture and agriculture-based products from Malaysia to enter the Vietnam market. Malaysia and Vietnam participated in the bilateral agreements with the ASEAN Free Trade Agreement (AFTA) which gives privilege in terms of import duties, to make Malaysian products more competitive than the ones from other countries outside South-East Asia. AFTA and the ASEAN Economic Community (AEC) provide lower barriers to trade and facilitate Malaysian companies to enter the Vietnam market, thus giving advantage to Malaysian entrepreneurs and exporters. Furthermore, Malaysia will enjoy the benefit through TPPA because of the tariffs that will be reduced or abolished, and thus the price of Malaysian products in the Vietnam market will inevitably decrease.

Most of the tariffs imposed on agricultural exports will be eliminated under the TPPA. Vietnam will eliminate tariffs immediately on 28.5% of agricultural products once TPPA is implemented. The balance of up to 99.1% products will be reduced within 15 years. Export taxes are prohibited under the TPPA. Vietnam imposed export taxes on some of their agricultural goods. Therefore, after the TPPA enters into force, all the export taxes should be abolished within the agreed time period.

According to the Malaysia External Trade Development Corporation (MATRADE), Malaysian food products are well accepted and widely available in most supermarkets in this region. Agriculture-based food products such as palm oil-based products, beverages, food ingredients, confectioneries, sauces and paste, frozen foods and bakery products are available in most of ASEAN countries as they are well accepted by consumers.

Competitiveness of fresh agricultural produce

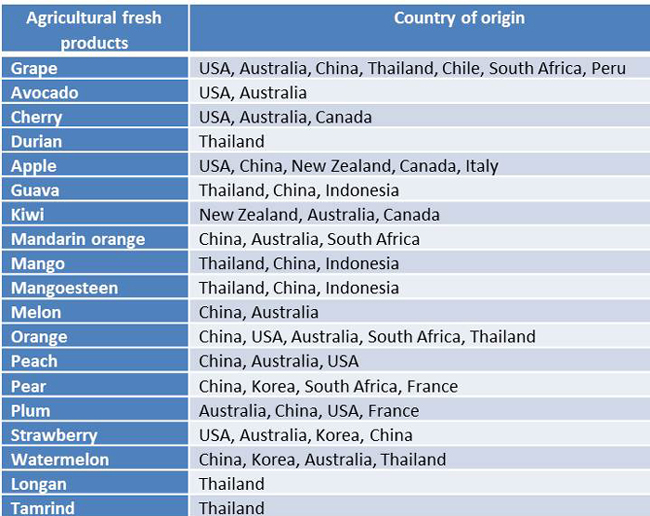

Vietnam liberalized its trading with other countries since it participated in the WTO more than two decades ago. Vietnam imported fresh agriculture produce from USA, Australia, Argentina and Brazil. Whereas the tropical fresh agricultural products come from Thailand, China and Indonesia. Vietnam imported many fresh agricultural products from many regions. Among the fresh tropical agriculture products marketed in Vietnam are presented in Table 1.

Table 1. Fresh Agricultural Products Imported by Vietnam

Sources: Survey and FAOStat (2015)

POTENTIAL OF MALAYSIA’S AGRICULTURAL PRODUCTS IN VIETNAM

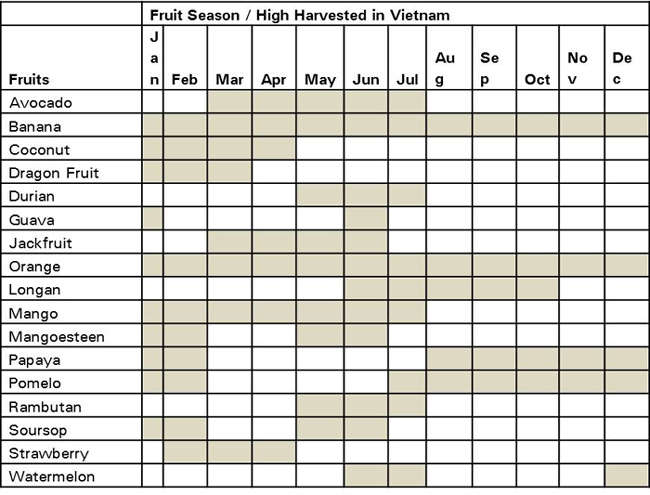

In general, Vietnam is self sufficient for most of agricultural produce. Almost 85% of the fresh agricultural products are produced in the country. Self-sufficient level of agriculture products in Vietnam already meets the needs of its population except during important events and festivals such as Chinese New Year and Christmas. During Chinese New Year celebration, demand for pineapples and barley increased sharply. Malaysian entrepreneur could capture this opportunity to export highly demanded fruits before and during the festive season. Vietnam also has to import certain fruits like durian, guava, apple, watermelon, mango, mangosteen, rambutan from Thailand. At the same time, Vietnam imports some fruits from Europe like grapes, apple, kiwi, cherry and avocado to meet the demand or when the productions of local fruits are off season. For example, the harvesting season for rambutan in Malaysia is between June and October, while in Vietnam it is between May and July every year. Malaysia can take the opportunity to supply rambutans to Vietnam during its off-season to meet their demand. Similarly, durian season in Malaysia is between June and November, while in Vietnam is between May and July, thus creating an opportunity for entrepreneurs to market Malaysian produce to Vietnam. The fruiting and harvesting season of fruits in Vietnam is shown in Table 2.

Table 2. Fruiting and harvesting season of tropical fruit in Vietnam

Source: FAOStat, 2015

Potential of functional foods

Malaysia exports its processed food products to more than 100 countries in the world, including Vietnam. In general, products from Malaysia are competitive than other products from developed countries such as USA, Europe and Japan. Price of agri-based products from Malaysia is cheaper than the products from Japan, Korea, EU, Australia and the United States. Vietnam is a potential market for healthy foods such as low-sugar, low glycaemic, nutritious and functional foods. Malaysia could position its products as health-food products. Vietnamese are becoming more concerned with health factors in their daily diets. For example, "energy bars" from the USA and Australia, are on high demand in Vietnam.

Processed foods must be approved by the Vietnam Food Administration (VFA) for safety analysis and for obtaining a health certificate. Malaysia has been listed as one of the countries that can export agri-based products to Vietnam without going through a complicated process for products made from plants and animals. Malaysia should take the advantage of this simplified market access.

Promotion of functional foods should be held at retail stores and supermarkets in Vietnam. Promotion is very important because consumers are hesitant and afraid to try new products without initially tasting them. Promotion and marketing can be done via ‘sensory tests’ or 'samples giveaways of the newly introduced products.

Potential of halal products

The word Halal means persimissible to Islamic law. Over the past five years, Vietnam’s halal industry is growing in line with the increase of tourists from Muslim countries. Halal products gained a place in the Vietnam market, and the acceptance of halal processed foods has increased mainly in supermarkets. Most of the leading halal products are from other countries such as Thailand and Malaysia. Thailand placed its halal logo on their products exported to the global market. Since the majority of products from Malaysia are halal and its halal logo is globally recognized, producers and exporters should view this as an advantage to expand their market access in Vietnam.

Institutional users such as restaurants and hotels are currently starting to introduce the term 'Halal kitchen' to attract Muslim tourists in visiting their place. Furthermore, Vietnam has now begun to collaborate with countries in the Middle East to expand their agricultural markets there. Halal products and the concept of halal should be highlighted to give exposure to the Vietnamese in order for them to have a deeper understanding of the true halal context. This is important because the Vietnamese also emphasize that the food that they consume should be clean, pure and healthy, which is in line with the concept of halal.

WAY FORWARD

The Vietnam government has set a policy where importation of agricultural products is minimized and that at least 90% of products in the supermarkets are locally supplied. This is quite apparent, where imported products are only those that are not produced or too expensive to produce such as dairy products, temperate fruits, and some beverages. However, there are rooms for fresh agricultural produce from Malaysia, especially during the off-season in Vietnam. Malaysian exporters should take the opportunities during this off seasons and religion festivals like Chinese New Year and Christmas.

Processed products (agri-based products)

Malaysian producers need to increase the campaign and take the opportunity from halal recognition to promote products from Malaysia. Malaysia should establish the Malaysia Agro-bazaar in Vietnam in order to promote products from Malaysia.

Dairy products, meat and beverages

These products are already marketed in Vietnam. Thus, there is a great potential to increase the volume.

Halal products

Despite small and limited to Muslim consumers, halal industry is growing positively in Vietnam. In the past five years, the development of the halal industry in Vietnam is in line with the increase in travelers and immigrants from Muslim countries such as Malaysia, Indonesia and the Middle East through tourism. In order to position Malaysian products in Vietnam, halal logo is an important element in the packaging of a product.

CONCLUSION

There is a great potential for Malaysia’s products in Vietnam markets. This is especially true after Vietnam liberalized its market under the WTO, AFTA and TPPA. TPPA is a good start for Malaysians to introduce and promote fresh agricultural and processed products to Vietnam. Malaysia must be ready to increase its efforts to maximize the preferential treatment received by trade agreements. Agriculture producers, entrepreneurs and exporters should be well-informed and know the procedures involved to benefit from preferential treatment, which would boost the competitiveness of Malaysian agricultural and agri-based products in the global market.

REFERENCES

Luong Ngoc Trung Lap-Dr. Division of Fruit Marketing, Vietnam Academy of Agricultural Science, Southern Horticultural Research Institute (SOFRI), (2016, April 12). Personal interview with Zakaria H.

Faizal Izany Mastor. MATRADE, Consulate General of Malaysia, Vietnam, (2016, April 15). Personal interview with Zakaria H.

FAOStat (2015). Retrieve form http://www.fao.org/faostat/en/#data Ministry of Agriculture and Agrobased Industry (2015). Impact of on Agrofood Sector: A cost and benefit analysis. Unpublished government report.

Ministry of Agriculture and Agrobased Industry (2016). Report of Studies on the market in the Development Institute (MARDI).

MITI (2016). Trans-Pacific Partnership Agreement. Retrieve from http://fta.miti.gov.my. index.php/pages/view/267

Peter A. Petri and Michael G. Plummer (2016). The economic effects of the Trans-Pacific Partnership. Peterson Institute for International Economic. World Bank (2016). Retrieve form http://data.worldbank.org

|

Date submitted: May 1, 2017

Reviewed, edited and uploaded: May 26, 2017

|

The Potential of Malaysian Fresh Agriculture Products in Vietnam Market

INTRODUCTION

The international trade of agricultural products is projected to sustain its strong growth. The growing world demand on agricultural produce creates an opportunity for Malaysia to expand its export markets and contribute to the Gross National Income since international trade is a significant component of the Malaysian economy. Subsequently, the main objective of the Malaysian third Industrial Master Plan (IMP) (2006–2020) is to achieve global trade competitiveness through transformation and innovation of the manufacturing and service sectors, including agri-based industries. One of the IMP strategic thrusts is to enhance Malaysia’s position as a trading nation through the development and promotion of Malaysian brands, products that comply with international standards and enhance the SMEs to become globally competitive companies (Ministry of International Trade and Industry 2015).

For decades, Malaysia relied on Singapore as its traditional export market. Malaysia needs to penetrate new potential markets instead of relying only on selected regular markets. In line with the government aspirations, it is timely for Malaysia to enhance the competitiveness of agricultural products in the global markets. Malaysia recognized Vietnam as a new potential market for its agricultural produce. Hence, this paper assesses Vietnam’s profile and proposed some strategies for penetrating this market.

PROFILE OF VIETNAM’S MARKET

Vietnam is a developing economy in Southeast Asia. It is bordered by China to the north, Laos to the northwest, Cambodia to the southwest, Thailand across the Gulf of Thailand to the Southwest, and the Philippines, Malaysia and Indonesia across the South China Sea to the east and southeast. The population was estimated around 92.7 million in 2016, becoming the world's 14th-most-populous country and the 9th-most-populous within the Asian countries. Vietnam is the 24th largest export economy in the world and the 93rd the most complex economy according to the Economic Complexity Index (ECI).

Vietnam is one of the most important economies in the world. The economy of Vietnam is the 47th-largest economy in the world measured by nominal gross domestic product (GDP) and 35th-largest in the world measured by purchasing power parity (PPP). Vietnam has been transformed from a centralized to a liberalized country. Since the mid-1980s, the economy has experienced rapid growth. Vietnam is in a period of being integrated into the global economy. Almost all Vietnamese enterprises are small and medium enterprises (SMEs).

Vietnam has experienced tremendous growth for the past 25 years, from a dominant central controlled economy to a more liberal and market focused economy. Recent reports regarding Vietnam’s GDP per capita, indicated a growth of US$4,395.51 in 2010 to US$6,034.26 in 2015 (Fig. 1). This indicates that the country is gradually improving its economic performance with the expansion of the middle class and increasing in income levels. It was also estimated that the GDP annual growth rate until 2020 hovers between 6.5 – 6.8% (World Bank, 2016). This positive trend makes Vietnam an attractive place to do business, when opportunities arise.

Fig. 1. Vietnam’s GDP per capita, PPP

Source: World Bank, 2016

Vietnam has become a leading agricultural exporter and served as an attractive destination for foreign investments in Southeast Asia.This development has obviously been proven when Vietnam became a member of the World Trade Organization (WTO), the ASEAN Free Trade Agreement (AFTA) and joined various trade agreements with other countries. Vietnam followed through its international integration initiatives through its participation in the ASEAN Economic Community (AEC), the Trans Pacific Partnership Agreement (TPPA) and in signing several free trade agreements (FTAs) with South Korea, Eurasian Economic Union and the EU. After joining the WTO, Vietnam’s trade has experienced many positive changes. The amount of direct investments continue to increase over the years. Over that period, the economy has experienced rapid growth. Vietnam has become a leading agricultural exporter and served as an attractive destination for foreign investments in South-East Asia. Vietnam's major agricultural products include rice, cashew nuts, black pepper, coffee, tea, fishery products and rubber. The other industries include manufacturing, information technology and high-tech industries constitute a fast-growing part of its economy. Vietnam is also one of the largest oil producers in the region.

Vietnam launched its Vietnamese Good Agricultural Practices (VietGAP) in 2008. The implementation of VietGap is to ensure agricultural products from this country can compete against other products in the international market. Furthermore, multinational importers started to put emphasis and priority to products that abide by international standards. VietGAP is a food safety inspection program that covers the whole production line from A to Z. It begins from land preparation, planting, harvesting, post-harvest storage, including factors related to the environment, chemicals, plant protection products, packaging and working conditions and welfare of workers in the farms. Fresh agriculture products and agri-based industries that are being imported into Vietnam must get approval from the Vietnam Food Administration (VFA) to be analyzed in terms of food safety and in obtaining a certificate of approval.

THE VIETNAM MARKET SCENARIO

Vietnam is one of the most active trading nations in the world. This country traded with many countries across the regions, and the value is increasing every year. Vietnam imported many fresh agriculture produce from many countries such as USA, Argentina, Brazil, Australia, China, India and Malaysia (Fig. 2).

Fig. 2. Vietnam’s trading partners and import value of agricultural produce by countries

Source: FAOStat, 2015

Fig. 2 shows Vietnam’s trading partner from 2011 to 2014. Malaysia was ranked number seven trading partner for exporting agricultural products to Vietnam, after the United States of America, Argentina, Brazil, Australia, China and India in 2014. The value of agricutural produce from Malaysia is increasing every year. This indicates the potential for agriculture and agriculture-based products from Malaysia to enter the Vietnam market. Malaysia and Vietnam participated in the bilateral agreements with the ASEAN Free Trade Agreement (AFTA) which gives privilege in terms of import duties, to make Malaysian products more competitive than the ones from other countries outside South-East Asia. AFTA and the ASEAN Economic Community (AEC) provide lower barriers to trade and facilitate Malaysian companies to enter the Vietnam market, thus giving advantage to Malaysian entrepreneurs and exporters. Furthermore, Malaysia will enjoy the benefit through TPPA because of the tariffs that will be reduced or abolished, and thus the price of Malaysian products in the Vietnam market will inevitably decrease.

Most of the tariffs imposed on agricultural exports will be eliminated under the TPPA. Vietnam will eliminate tariffs immediately on 28.5% of agricultural products once TPPA is implemented. The balance of up to 99.1% products will be reduced within 15 years. Export taxes are prohibited under the TPPA. Vietnam imposed export taxes on some of their agricultural goods. Therefore, after the TPPA enters into force, all the export taxes should be abolished within the agreed time period.

According to the Malaysia External Trade Development Corporation (MATRADE), Malaysian food products are well accepted and widely available in most supermarkets in this region. Agriculture-based food products such as palm oil-based products, beverages, food ingredients, confectioneries, sauces and paste, frozen foods and bakery products are available in most of ASEAN countries as they are well accepted by consumers.

Competitiveness of fresh agricultural produce

Vietnam liberalized its trading with other countries since it participated in the WTO more than two decades ago. Vietnam imported fresh agriculture produce from USA, Australia, Argentina and Brazil. Whereas the tropical fresh agricultural products come from Thailand, China and Indonesia. Vietnam imported many fresh agricultural products from many regions. Among the fresh tropical agriculture products marketed in Vietnam are presented in Table 1.

Table 1. Fresh Agricultural Products Imported by Vietnam

Sources: Survey and FAOStat (2015)

POTENTIAL OF MALAYSIA’S AGRICULTURAL PRODUCTS IN VIETNAM

In general, Vietnam is self sufficient for most of agricultural produce. Almost 85% of the fresh agricultural products are produced in the country. Self-sufficient level of agriculture products in Vietnam already meets the needs of its population except during important events and festivals such as Chinese New Year and Christmas. During Chinese New Year celebration, demand for pineapples and barley increased sharply. Malaysian entrepreneur could capture this opportunity to export highly demanded fruits before and during the festive season. Vietnam also has to import certain fruits like durian, guava, apple, watermelon, mango, mangosteen, rambutan from Thailand. At the same time, Vietnam imports some fruits from Europe like grapes, apple, kiwi, cherry and avocado to meet the demand or when the productions of local fruits are off season. For example, the harvesting season for rambutan in Malaysia is between June and October, while in Vietnam it is between May and July every year. Malaysia can take the opportunity to supply rambutans to Vietnam during its off-season to meet their demand. Similarly, durian season in Malaysia is between June and November, while in Vietnam is between May and July, thus creating an opportunity for entrepreneurs to market Malaysian produce to Vietnam. The fruiting and harvesting season of fruits in Vietnam is shown in Table 2.

Table 2. Fruiting and harvesting season of tropical fruit in Vietnam

Source: FAOStat, 2015

Potential of functional foods

Malaysia exports its processed food products to more than 100 countries in the world, including Vietnam. In general, products from Malaysia are competitive than other products from developed countries such as USA, Europe and Japan. Price of agri-based products from Malaysia is cheaper than the products from Japan, Korea, EU, Australia and the United States. Vietnam is a potential market for healthy foods such as low-sugar, low glycaemic, nutritious and functional foods. Malaysia could position its products as health-food products. Vietnamese are becoming more concerned with health factors in their daily diets. For example, "energy bars" from the USA and Australia, are on high demand in Vietnam.

Processed foods must be approved by the Vietnam Food Administration (VFA) for safety analysis and for obtaining a health certificate. Malaysia has been listed as one of the countries that can export agri-based products to Vietnam without going through a complicated process for products made from plants and animals. Malaysia should take the advantage of this simplified market access.

Promotion of functional foods should be held at retail stores and supermarkets in Vietnam. Promotion is very important because consumers are hesitant and afraid to try new products without initially tasting them. Promotion and marketing can be done via ‘sensory tests’ or 'samples giveaways of the newly introduced products.

Potential of halal products

The word Halal means persimissible to Islamic law. Over the past five years, Vietnam’s halal industry is growing in line with the increase of tourists from Muslim countries. Halal products gained a place in the Vietnam market, and the acceptance of halal processed foods has increased mainly in supermarkets. Most of the leading halal products are from other countries such as Thailand and Malaysia. Thailand placed its halal logo on their products exported to the global market. Since the majority of products from Malaysia are halal and its halal logo is globally recognized, producers and exporters should view this as an advantage to expand their market access in Vietnam.

Institutional users such as restaurants and hotels are currently starting to introduce the term 'Halal kitchen' to attract Muslim tourists in visiting their place. Furthermore, Vietnam has now begun to collaborate with countries in the Middle East to expand their agricultural markets there. Halal products and the concept of halal should be highlighted to give exposure to the Vietnamese in order for them to have a deeper understanding of the true halal context. This is important because the Vietnamese also emphasize that the food that they consume should be clean, pure and healthy, which is in line with the concept of halal.

WAY FORWARD

The Vietnam government has set a policy where importation of agricultural products is minimized and that at least 90% of products in the supermarkets are locally supplied. This is quite apparent, where imported products are only those that are not produced or too expensive to produce such as dairy products, temperate fruits, and some beverages. However, there are rooms for fresh agricultural produce from Malaysia, especially during the off-season in Vietnam. Malaysian exporters should take the opportunities during this off seasons and religion festivals like Chinese New Year and Christmas.

Processed products (agri-based products)

Malaysian producers need to increase the campaign and take the opportunity from halal recognition to promote products from Malaysia. Malaysia should establish the Malaysia Agro-bazaar in Vietnam in order to promote products from Malaysia.

Dairy products, meat and beverages

These products are already marketed in Vietnam. Thus, there is a great potential to increase the volume.

Halal products

Despite small and limited to Muslim consumers, halal industry is growing positively in Vietnam. In the past five years, the development of the halal industry in Vietnam is in line with the increase in travelers and immigrants from Muslim countries such as Malaysia, Indonesia and the Middle East through tourism. In order to position Malaysian products in Vietnam, halal logo is an important element in the packaging of a product.

CONCLUSION

There is a great potential for Malaysia’s products in Vietnam markets. This is especially true after Vietnam liberalized its market under the WTO, AFTA and TPPA. TPPA is a good start for Malaysians to introduce and promote fresh agricultural and processed products to Vietnam. Malaysia must be ready to increase its efforts to maximize the preferential treatment received by trade agreements. Agriculture producers, entrepreneurs and exporters should be well-informed and know the procedures involved to benefit from preferential treatment, which would boost the competitiveness of Malaysian agricultural and agri-based products in the global market.

REFERENCES

Luong Ngoc Trung Lap-Dr. Division of Fruit Marketing, Vietnam Academy of Agricultural Science, Southern Horticultural Research Institute (SOFRI), (2016, April 12). Personal interview with Zakaria H.

Faizal Izany Mastor. MATRADE, Consulate General of Malaysia, Vietnam, (2016, April 15). Personal interview with Zakaria H.

FAOStat (2015). Retrieve form http://www.fao.org/faostat/en/#data Ministry of Agriculture and Agrobased Industry (2015). Impact of on Agrofood Sector: A cost and benefit analysis. Unpublished government report.

Ministry of Agriculture and Agrobased Industry (2016). Report of Studies on the market in the Development Institute (MARDI).

MITI (2016). Trans-Pacific Partnership Agreement. Retrieve from http://fta.miti.gov.my. index.php/pages/view/267

Peter A. Petri and Michael G. Plummer (2016). The economic effects of the Trans-Pacific Partnership. Peterson Institute for International Economic. World Bank (2016). Retrieve form http://data.worldbank.org

Date submitted: May 1, 2017

Reviewed, edited and uploaded: May 26, 2017