Introduction

Although rice covered 48.70% of the total cultivable land (FAOa, 2011) in the country, the yield was low compared with other countries which occupied a small arable land for rice due to natural disasters. Furthermore, the agriculture sector only contributes 8.6% to the GDP while industry and services contribute 39% and 52.4%, respectively (CIA, 2011). Therefore, there were efforts by the government and the relevant public and private organizations to establish an insurance for major crops mainly to the farmers who faced many risks over the last many decades. However, those programmes were not completely successful (Duangmanee and Fransen, 2013).

At present, in Thailand, crop insurance is considered voluntary and is in its initial development stage of implementation. The coverage of agricultural insurance mainly focuses on the farmers who are faced with natural disasters namely floods or heavy rains, droughts, storms or typhoons, cold weather or frosts, hailstorms and fires. The main objectives of crop insurance in Thailand are:

1. to reduce the impacts of natural disasters on the farmers; and

2. to generate agricultural farm income by securing farms and farm products

Delivery channel

Bank for Agriculture and Agricultural Cooperatives BAAC is the major delivery channel between the farmers and the insurance companies nationwide in the development of maize and rice weather insurance index. Moreover, it is also the indirect supporter for the costs of program development. It conducted extension activities, and educated farmers in the process of program implementation. It also got involved in the crop insurance programs since 1980s (FAOb, 2011).

Evolution of the crop insurance in Thailand

In Thailand, the crop insurance program was initiated since 1978. That indemnity insurance policy cover for all natural risks such as floods and droughts for cotton. And then, indemnity insurance for all risks was provided for maize, sorghum and soybean in 1990 (Jeerachaipaisarn, 2012). Manuamorn (2009) also pointed out that the government collaborated with private insurance companies to develop agricultural insurance during the late 1970s and the early 1980s. However the program was not totally successful because the collected premiums were less than the indemnity payments.

Skees (2008) reported that crop insurance program has been employed based on the weather index in many developed and developing countries, for example, India, Mexico, Peru and the United States.

In 2005, the World Bank started to implement a weather index insurance pilot in Thailand and supported the technical advice. Moreover, it provides advice concerning administrative procedures, pilot program monitoring and international experiences. In this pilot, Bank for Agriculture and Agricultural Cooperatives (BAAC), the General Insurance Association (GIA), the Commodity Risk Management Group (CRMG) of the World Bank’s Agricultural and Rural Development (ARD) Department and the Department of Insurance (now the Office of Insurance Commissioners (OIC)) were involved in the implementation of its operational, technical, financial and legal aspects. Moreover, the Ministry of Agriculture and Agricultural Cooperatives (MOAC) and the Thai Meteorological Department (TMD) also cooperated in that pilot to provide data, policy advice, technical and operational advice and to support the setting up of additional weather station during the first year of the pilot. The main target crop in that pilot was maize which is the major crop in Pak Chong District of the Nakorn Ratchasrima Province of Thailand and especially focused on drought risk. The two major findings from that pilot were to make the contract design more suited with the climatic patterns of Asia. The other thing was that the trust among farmers and institutions played a vital role to introduce the insurance product Manuamorn (2009).

Weather index insurance for maize

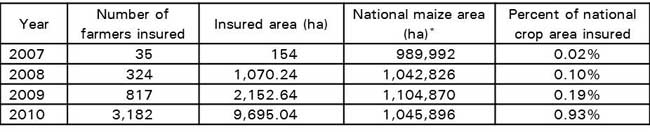

Food and Agriculture Organization (FAO) (2011) reported that the weather index insurance for maize was innovated in 2007 in one province. In 2010, the insurance program covered 15 weather stations in 7 provinces. That program covered only in small areas to meet the needs of a specific reinsurance program. In the insurance program, BAAC served as the main actor and the pool of nine insurance companies (seven at present) and one reinsurer operating under co-insurance arrangement which was involved in the program. BAAC linked the farmers with those insurers. Within 4 years, the selling rate of insurance product has been increased from 154 hectares to 9,695.04 hectares which is about 1% of the national maize sown area (Table 1).

Table 1. Maize weather index insurance uptake (2007-2010)

Source: General Insurance Association, 12 July 2010 (FAO/APRACA survey 2010)

*FAO maize area statisticsSource: General Insurance Association, 12 July 2010 (FAO/APRACA survey 2010)

Weather index insurance for rice

In 2007, the state-owned Bank for Agriculture and Agricultural Cooperatives (BAAC) and the Japan Bank for International Cooperation (JBIC), Sompo Japan Insurance cooperated for weather insurance index on rice crop to reduce the impacts of natural disasters. That insurance program started in the north-eastern region of Thailand because that region is the drought prone area. Moreover, rice is the major source of livelihood of the farmers from that region and was cultivated as a monocrop under rainfed condition in that region. The farmers who take loan from BAAC received the products. The insurance premiums was defined based on the amount of loans. The farmers have to pay 15-40% of their loan for their insurance premium. That insurance program has been developed in 2010 and can be started in only one province by selling the product during the early part of the year. However, in 2014, it can be expanded in 17 provinces by adjusting the best policy which was sought by the Sompo Japan strategy (Hongo, 2015).

Jeerachaipaisarn (2012) reported that micro-insurance scheme was provided for rice in 2011. That scheme covers six natural disasters such as flood, drought, windstorm, frost, hail and bush fire. The main objectives of that scheme are to accompany and replenish Natural Disaster Relief Program. The said program was provided by the government and was designed to reimburse the farmers who faced losses due to the impacts of catastrophes. After the compensation of the government to the farmers, the insurance companies will reimburse the additional loss. In that insurance scheme, Bank for Agriculture and Agricultural Cooperation BAAC is the main channel between the farmers and pool of the local insurance companies which retain 10.7% of the risks and shares 89.3% with the International Reinsurance Market reinsurer especially Swiss Re which is the leading reinsurer.

The amount of compensation was US$109.37 per hectare for total losses due to natural disasters. However, it depends on the growth stages of the rice. If the rice field is hit by natural disasters before 60 days after sowing, the total insurance will be US$109.37 per hectare while the total insurance will be US$252.67 if the field was ravaged by natural disasters 60 days after sowing. Under that insurance program, the crop insurance net premiums was US$216.6 per hectare and the costs of premiums are shared by the farmers and government equally. The loss ratio got to 453% after 45 days of insurance selling period. Nevertheless, Jeerachaipaisarn (2012) reported that there will be cooperation among five organizations: Fiscal Policy Office under Ministry of Finance (FPO), General Insurance Association (GIA), Bank for Agriculture and Agricultural Cooperation (BAAC), Office of Insurance Commission (OIC) and Ministry of Agriculture (MOA).

According to the report of Thailand (2016), there was no temporary direct public support for weather index insurance program. It was supported by the Japan International Cooperation Agency and the World Bank. In 2014, a new program for rice insurance was introduced. The coverage doubled within two years and accounted for 128,000 hectares to 240,000 hectares which is one-fourth of the total cultivated land throughout the country. In that insurance program, the government contributed the costs of the premiums with the farmers. If the areas of coverage increased, it make low premium costs for farmers. Additionally, it will reduce the burden for the subsidies costs of the government. That program achieved a success to some extent. The Bank for Agriculture and Agricultural Cooperative (BAAC) played as a channel distributor to endorse the product and compromise the financial incentives like discount if farmers pay their premiums on time. The farmers have the willingness to purchase the insurance especially for drought risk management.

Catastrophe fund

In 2012, National Catastrophe Insurance Fund (NCIF) was established after the floods in 2011. The main objectives of NCIF are to reduce the losses which causes the economic problems, to cover the production cost effectively and to provide the long-term foreign investments for certain aspects of the impacts of disasters. The coverage of commercial insurance companies for the natural disaster risks was between 0.5% and 1% while the rest was provided for by the fund that redistributes the risk to the international reinsurance market.

According to the report of Thailand (2016), there are seven insurance companies that provide the rice crop insurance in 2015. BAAC is the main channel between the farmers and the insurers. In that program, the technical advice was supported to BAAC by the GIZ, a global service provider of internal cooperation for sustainable development from Germany via its ASEAN Sustainable Agrifood Systems project. Local insurers said that if NCIF will contribute in the rice crop insurance program with insures, it will have less provisions to the farmers by the government and less for international reinsurance.

The government already provided subsidies to compensate the farmers if their fields have been devastated by the natural disasters. For 4.8 hectare, the government pays US$200.87 to compensate for one farmer whose crops are exposed with natural disasters. If government compensates for the crops ravaged by the natural disasters have been reduced to US$144.38 from US$200.87, the crop insurance compensation could be increased to US$270.72. Moreover, the Fiscal Policy Office (FPO) stated in Agroinsurance websites (2015) that seven insurers in the country have faced losses accounting to about US$57.75 million within two years ago due to the small coverage areas for crop insurance. Therefore, the government should decrease the compensation to expand the coverage areas of the crop insurance. Subsequently, the crop insurance can be increased. Moreover, the cost for crop insurance premiums will be dramatically reduced if the coverage areas increase. If the crop insurance coverage area is 1.6 million hectares, the insurance premium will fall to US$54.14 per hectare from US$72.19 for each farmer from the most affected areas. It will be US$36.10 per hectare if the insurance coverage area is up to 3.2 million hectares.

Based on the intense of the risk effects, farmlands are divided into five areas for the insurance program. The insurance premium ranged from US$22.38 to 87.35 per hectare depending on the risk of the location. This program is a pilot project and later other agricultural crops could be diverse.

Economic impact of crop insurance

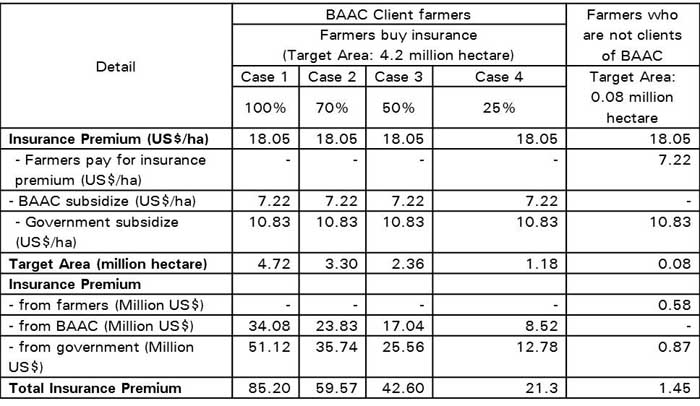

In the 2015-2016 agricultural production year, the following data are forecasted for the analysis of the economic impacts on the major stakeholders in the crop insurance scheme such as government, BAAC, insurance companies and farmers.

Table 2. Insurance premium from farmers, BAAC and Government

Source: Calculated by KU-OAE Foresight Center: KOFC, 2016.

According to the data from Table 1, farmers from the natural disaster risk areas pay for crop insurance premium US$18.05 per hectare. If the farmers are the clients of BAAC, US$7.22 out of total US$18.05 per hectare is paid by BAAC while farmers who are not the clients of BAAC have to pay US$7.22. Whether farmers are the clients of BAAC or not, the government will support US$10.83 per hectare for each farmer who will encounter the unexpected losses from the effects of natural disasters. Therefore, the total costs for crop insurance premium paid by government will be US$51.99 million for both types of farmers ( US$51.12 million for farmers under BAAC insurance conditions and US$0.87million for non-client farmers). BAAC will make a provision of US$34.08 million for the farmers under their insurance scheme. That amount will cover for all target areas under BAAC. Insurance companies will get the total insurance premiums of US$85.20 million from all farmers if they face the catastrophic events in all target areas. Out of total US$85.20 million, US$51.99 million will be supported by the government, US$34.08 million by the BAAC and US$0.58 million by the non-client farmers.

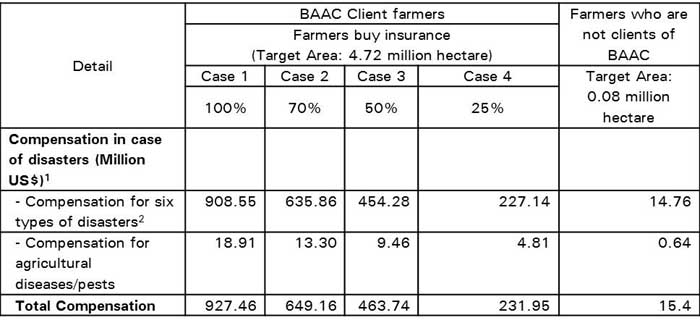

Table 3. Compensation for farmers from 2016 crop insurance

Source: Calculated by KU-OAE Foresight Center: KOFC, 2016.

Note: 1Damaged paddy area from natural disasters are 96% from 6 types of disaster and 4% from agricultural diseases/pests. Compensation is US$200.51/ha for 6 types of disasters and US$100.17/ha for agricultural diseases/pests.Source: Calculated by KU-OAE Foresight Center: KOFC, 2016.

26 types of disasters comprise floods, dry spells, windstorms, droughts, winter/hails and fires

According to the analysis of compensation, in case 1, the compensation for all farmers under 4.72 million hectare will be US$927.46 million. Out of total amount, the amount of US$908.55 million will be compensated for the farmers who suffered one of the impacts among 6 types of disasters and US$18.91 million for agricultural diseases/pests. The amount of compensation for the farmers will vary depending on the percent of target areas which are devastated by natural disasters. For non-client farmers, the compensation will be US$14.76 million for disasters and US$0.64 million for agricultural diseases/pests (KOFC, 2016).

CONCLUSION

In Thailand, agriculture directly contributes only 8.6 % of the country’s GDP. In agricultural production, natural disasters make yield losses leading to a financial problems. Therefore, the government and relevant public and private organizations implemented a crop insurance program since 1978 to protect the farmers from their crop losses due to natural disasters like floods or heavy rains, droughts, storms or typhoons, cold weather or frosts, hailstorms and fires. In the early years, the implementation of the program was not successful. However, at present day, it has achieved a certain level of success to some extent.

Bank for Agriculture and Agricultural Cooperatives (BAAC) played a major role since the crop insurance started. It distributes the insurance products to the farmers, educates farmers, implements the process of the insurance program. At the start of the crop insurance program, there were nine insurance companies. Nevertheless, nowadays there are only seven insurers.

In 1978, the indemnity insurance program was initiated for cotton growers who exposed the losses from all natural disasters. In 1990, the government provided the indemnity insurance for maize, sorghum and soybean. However, that insurance program did not achieve a success because the insurance premiums were less than the indemnity payments. Weather index insurance started as a pilot with technical support from the World Bank in 2005. BAAC collaborated with the General Insurance Association (GIA), the Commodity Risk Management Group (CRMG) of the World Bank’s Agricultural and Rural Development (ARD) Department and the Department of Insurance (now the Office of Insurance Commissioners (OIC)). For that pilot, maize crop was chosen as target crop for drought risks. The outcomes of the pilot was to make the contract design more suited for Asia and to build the trust between the farmers and the institution to distribute the insurance product. In 2007, weather index insurance for maize was developed. The coverage of the insurance product expanded to 7 provinces within 4 years although it started in one province at the early stage.

By collaborating with Japan Bank for International Cooperation (JBIC) and Sompo Japan Insurance Co. Ltd., BAAC implemented weather index insurance for rice in the north-eastern part of the country in 2007. That insurance program covered in one province. After developing the program in 2010, it has expanded to 17 provinces in 2014. A new program for rice insurance covered all natural disasters was introduced in 2014. The insurance premium was shared by the farmers and the government. The insurance premium was defined depending on the location and the intense of the risks. If the farmers take loans from BAAC, the insurance premiums will be shared by BAAC instead of farmers. According to the analysis of the economic impact, the insurance premiums can be reduced if the coverage areas for crop insurance are increased. Moreover, the compensation to the farmers who encountered the losses due to natural disasters will be higher under the large coverage scheme.

REFERENCES

Central Intelligence Agency (CIA). (2011). Publications, The World Factbook. Retrieved on 29 April, 2013 from https://www.cia.gov/library/publications/the-world-factbook/index.html

Duangmanee, K and Fransen, E. (2013). Adaptation of Thai Insurance in Light of Natural Disasters: an Investigation of Developments in Major Rice Crop Insurance Applying the Area-Yield Approach. Vol. 4, no.17, 2013.

Fiscal Policy Office (FPO). (2015). Agroinsurance – Portal on Agricultural Insurance and Risk Management » Thailand – FPO pushes wider crop insurance cover . Retrieved on 18 August, 2016 from http://agroinsurance.com/en/thailand-fpo-pushes-wider-crop-insurance-cover/

Food and Agriculture Organization of the United Nations (FAOa). (2011). Production. Retireved on 6 February, 2013 from http://faostat.fao.org/site/339/default.aspx

Food and Agriculture Organization of the United Nations (FAOb). (2011). Agricultural insurance in Asia and the Pacific region. Food and Agriculture Organization of the United Nations Regional Office for Asia and the Pacific Bangkok, 2011. Retrieved on 18 August, 2016 from http://www.fao.org/docrep/015/i2344e/i2344e00.pdf

Hongo,T. (2015). Climate Insurance for Crops: Case Study of Weather Index Insurance for Agriculture in Thailand. Retrieved on 1 September, 2016 from http://www.uncapsa.org/article/climate-insurance-crops-case-study-weather-index-insurance-agriculture-thailand

Jeerachaipaisarn, T. (2012). Recent Developments of Crop Insurance in Thailand. 26th January 2012. Retrieved on August 18, 2016 from https://www.oecd.org/daf/fin/49657525.pdf

Kasetsart University - Office of Agricultural Economics Foresight Center (KOFC). (2016). เกาะติดผลกระทบเศรษฐกิจจากโครงการประกันภัยข้าวนาปี ปีการผลิต 2559/60. (Economics impacts from crop insurance: production year 2015/2016). Retireved on 25 August, 2016 from http://www.oae.go.th/ewt_news.php?nid=22977&filename=index

Manuamorn, O. (2009). Rainfall Index‐Based Insurance for Maize Farmers in Thailand: Review of Pilot Program 2006‐2008. Experiential briefing note prepared by Ornsaran Pomme Manuamorn, Agriculture and Rural Development Department, the World Bank, January 2009.

Office of Agricultural Economics (OAE). (2011). Land used. Retrieved on 29 April, 2013 from http://www.oae.go.th/more_news.php?cid=262

Skees, J.R. (2008). Challenges for use of index-based weather insurance in lower income countries. Agricultural Finance Review, 68, 197-217.

Thailand. (2016). The Report: Thailand. Agricultural insurance in Thailand shifts focus to crop protection. Retrieved on August 18, 2016 from file:///C:/Users/User/Documents/CAER/Crop%20insurance%20in%20Thailand/Agricultural%20insurance%20in%20Thailand%20shifts%20focus%20to%20crop%20protection%20_%20Thailand%202016%20_%20Oxford%20Business%20Group.html

|

Date submitted: Sept. 7, 2016

Reviewed, edited and uploaded: Sept. 7, 2016

|

Crop Insurance in Thailand

Introduction

Although rice covered 48.70% of the total cultivable land (FAOa, 2011) in the country, the yield was low compared with other countries which occupied a small arable land for rice due to natural disasters. Furthermore, the agriculture sector only contributes 8.6% to the GDP while industry and services contribute 39% and 52.4%, respectively (CIA, 2011). Therefore, there were efforts by the government and the relevant public and private organizations to establish an insurance for major crops mainly to the farmers who faced many risks over the last many decades. However, those programmes were not completely successful (Duangmanee and Fransen, 2013).

At present, in Thailand, crop insurance is considered voluntary and is in its initial development stage of implementation. The coverage of agricultural insurance mainly focuses on the farmers who are faced with natural disasters namely floods or heavy rains, droughts, storms or typhoons, cold weather or frosts, hailstorms and fires. The main objectives of crop insurance in Thailand are:

1. to reduce the impacts of natural disasters on the farmers; and

2. to generate agricultural farm income by securing farms and farm products

Delivery channel

Bank for Agriculture and Agricultural Cooperatives BAAC is the major delivery channel between the farmers and the insurance companies nationwide in the development of maize and rice weather insurance index. Moreover, it is also the indirect supporter for the costs of program development. It conducted extension activities, and educated farmers in the process of program implementation. It also got involved in the crop insurance programs since 1980s (FAOb, 2011).

Evolution of the crop insurance in Thailand

In Thailand, the crop insurance program was initiated since 1978. That indemnity insurance policy cover for all natural risks such as floods and droughts for cotton. And then, indemnity insurance for all risks was provided for maize, sorghum and soybean in 1990 (Jeerachaipaisarn, 2012). Manuamorn (2009) also pointed out that the government collaborated with private insurance companies to develop agricultural insurance during the late 1970s and the early 1980s. However the program was not totally successful because the collected premiums were less than the indemnity payments.

Skees (2008) reported that crop insurance program has been employed based on the weather index in many developed and developing countries, for example, India, Mexico, Peru and the United States.

In 2005, the World Bank started to implement a weather index insurance pilot in Thailand and supported the technical advice. Moreover, it provides advice concerning administrative procedures, pilot program monitoring and international experiences. In this pilot, Bank for Agriculture and Agricultural Cooperatives (BAAC), the General Insurance Association (GIA), the Commodity Risk Management Group (CRMG) of the World Bank’s Agricultural and Rural Development (ARD) Department and the Department of Insurance (now the Office of Insurance Commissioners (OIC)) were involved in the implementation of its operational, technical, financial and legal aspects. Moreover, the Ministry of Agriculture and Agricultural Cooperatives (MOAC) and the Thai Meteorological Department (TMD) also cooperated in that pilot to provide data, policy advice, technical and operational advice and to support the setting up of additional weather station during the first year of the pilot. The main target crop in that pilot was maize which is the major crop in Pak Chong District of the Nakorn Ratchasrima Province of Thailand and especially focused on drought risk. The two major findings from that pilot were to make the contract design more suited with the climatic patterns of Asia. The other thing was that the trust among farmers and institutions played a vital role to introduce the insurance product Manuamorn (2009).

Weather index insurance for maize

Food and Agriculture Organization (FAO) (2011) reported that the weather index insurance for maize was innovated in 2007 in one province. In 2010, the insurance program covered 15 weather stations in 7 provinces. That program covered only in small areas to meet the needs of a specific reinsurance program. In the insurance program, BAAC served as the main actor and the pool of nine insurance companies (seven at present) and one reinsurer operating under co-insurance arrangement which was involved in the program. BAAC linked the farmers with those insurers. Within 4 years, the selling rate of insurance product has been increased from 154 hectares to 9,695.04 hectares which is about 1% of the national maize sown area (Table 1).

Table 1. Maize weather index insurance uptake (2007-2010)

Source: General Insurance Association, 12 July 2010 (FAO/APRACA survey 2010)

*FAO maize area statisticsSource: General Insurance Association, 12 July 2010 (FAO/APRACA survey 2010)

Weather index insurance for rice

In 2007, the state-owned Bank for Agriculture and Agricultural Cooperatives (BAAC) and the Japan Bank for International Cooperation (JBIC), Sompo Japan Insurance cooperated for weather insurance index on rice crop to reduce the impacts of natural disasters. That insurance program started in the north-eastern region of Thailand because that region is the drought prone area. Moreover, rice is the major source of livelihood of the farmers from that region and was cultivated as a monocrop under rainfed condition in that region. The farmers who take loan from BAAC received the products. The insurance premiums was defined based on the amount of loans. The farmers have to pay 15-40% of their loan for their insurance premium. That insurance program has been developed in 2010 and can be started in only one province by selling the product during the early part of the year. However, in 2014, it can be expanded in 17 provinces by adjusting the best policy which was sought by the Sompo Japan strategy (Hongo, 2015).

Jeerachaipaisarn (2012) reported that micro-insurance scheme was provided for rice in 2011. That scheme covers six natural disasters such as flood, drought, windstorm, frost, hail and bush fire. The main objectives of that scheme are to accompany and replenish Natural Disaster Relief Program. The said program was provided by the government and was designed to reimburse the farmers who faced losses due to the impacts of catastrophes. After the compensation of the government to the farmers, the insurance companies will reimburse the additional loss. In that insurance scheme, Bank for Agriculture and Agricultural Cooperation BAAC is the main channel between the farmers and pool of the local insurance companies which retain 10.7% of the risks and shares 89.3% with the International Reinsurance Market reinsurer especially Swiss Re which is the leading reinsurer.

The amount of compensation was US$109.37 per hectare for total losses due to natural disasters. However, it depends on the growth stages of the rice. If the rice field is hit by natural disasters before 60 days after sowing, the total insurance will be US$109.37 per hectare while the total insurance will be US$252.67 if the field was ravaged by natural disasters 60 days after sowing. Under that insurance program, the crop insurance net premiums was US$216.6 per hectare and the costs of premiums are shared by the farmers and government equally. The loss ratio got to 453% after 45 days of insurance selling period. Nevertheless, Jeerachaipaisarn (2012) reported that there will be cooperation among five organizations: Fiscal Policy Office under Ministry of Finance (FPO), General Insurance Association (GIA), Bank for Agriculture and Agricultural Cooperation (BAAC), Office of Insurance Commission (OIC) and Ministry of Agriculture (MOA).

According to the report of Thailand (2016), there was no temporary direct public support for weather index insurance program. It was supported by the Japan International Cooperation Agency and the World Bank. In 2014, a new program for rice insurance was introduced. The coverage doubled within two years and accounted for 128,000 hectares to 240,000 hectares which is one-fourth of the total cultivated land throughout the country. In that insurance program, the government contributed the costs of the premiums with the farmers. If the areas of coverage increased, it make low premium costs for farmers. Additionally, it will reduce the burden for the subsidies costs of the government. That program achieved a success to some extent. The Bank for Agriculture and Agricultural Cooperative (BAAC) played as a channel distributor to endorse the product and compromise the financial incentives like discount if farmers pay their premiums on time. The farmers have the willingness to purchase the insurance especially for drought risk management.

Catastrophe fund

In 2012, National Catastrophe Insurance Fund (NCIF) was established after the floods in 2011. The main objectives of NCIF are to reduce the losses which causes the economic problems, to cover the production cost effectively and to provide the long-term foreign investments for certain aspects of the impacts of disasters. The coverage of commercial insurance companies for the natural disaster risks was between 0.5% and 1% while the rest was provided for by the fund that redistributes the risk to the international reinsurance market.

According to the report of Thailand (2016), there are seven insurance companies that provide the rice crop insurance in 2015. BAAC is the main channel between the farmers and the insurers. In that program, the technical advice was supported to BAAC by the GIZ, a global service provider of internal cooperation for sustainable development from Germany via its ASEAN Sustainable Agrifood Systems project. Local insurers said that if NCIF will contribute in the rice crop insurance program with insures, it will have less provisions to the farmers by the government and less for international reinsurance.

The government already provided subsidies to compensate the farmers if their fields have been devastated by the natural disasters. For 4.8 hectare, the government pays US$200.87 to compensate for one farmer whose crops are exposed with natural disasters. If government compensates for the crops ravaged by the natural disasters have been reduced to US$144.38 from US$200.87, the crop insurance compensation could be increased to US$270.72. Moreover, the Fiscal Policy Office (FPO) stated in Agroinsurance websites (2015) that seven insurers in the country have faced losses accounting to about US$57.75 million within two years ago due to the small coverage areas for crop insurance. Therefore, the government should decrease the compensation to expand the coverage areas of the crop insurance. Subsequently, the crop insurance can be increased. Moreover, the cost for crop insurance premiums will be dramatically reduced if the coverage areas increase. If the crop insurance coverage area is 1.6 million hectares, the insurance premium will fall to US$54.14 per hectare from US$72.19 for each farmer from the most affected areas. It will be US$36.10 per hectare if the insurance coverage area is up to 3.2 million hectares.

Based on the intense of the risk effects, farmlands are divided into five areas for the insurance program. The insurance premium ranged from US$22.38 to 87.35 per hectare depending on the risk of the location. This program is a pilot project and later other agricultural crops could be diverse.

Economic impact of crop insurance

In the 2015-2016 agricultural production year, the following data are forecasted for the analysis of the economic impacts on the major stakeholders in the crop insurance scheme such as government, BAAC, insurance companies and farmers.

Table 2. Insurance premium from farmers, BAAC and Government

Source: Calculated by KU-OAE Foresight Center: KOFC, 2016.

According to the data from Table 1, farmers from the natural disaster risk areas pay for crop insurance premium US$18.05 per hectare. If the farmers are the clients of BAAC, US$7.22 out of total US$18.05 per hectare is paid by BAAC while farmers who are not the clients of BAAC have to pay US$7.22. Whether farmers are the clients of BAAC or not, the government will support US$10.83 per hectare for each farmer who will encounter the unexpected losses from the effects of natural disasters. Therefore, the total costs for crop insurance premium paid by government will be US$51.99 million for both types of farmers ( US$51.12 million for farmers under BAAC insurance conditions and US$0.87million for non-client farmers). BAAC will make a provision of US$34.08 million for the farmers under their insurance scheme. That amount will cover for all target areas under BAAC. Insurance companies will get the total insurance premiums of US$85.20 million from all farmers if they face the catastrophic events in all target areas. Out of total US$85.20 million, US$51.99 million will be supported by the government, US$34.08 million by the BAAC and US$0.58 million by the non-client farmers.

Table 3. Compensation for farmers from 2016 crop insurance

Source: Calculated by KU-OAE Foresight Center: KOFC, 2016.

Note: 1Damaged paddy area from natural disasters are 96% from 6 types of disaster and 4% from agricultural diseases/pests. Compensation is US$200.51/ha for 6 types of disasters and US$100.17/ha for agricultural diseases/pests.Source: Calculated by KU-OAE Foresight Center: KOFC, 2016.

26 types of disasters comprise floods, dry spells, windstorms, droughts, winter/hails and fires

According to the analysis of compensation, in case 1, the compensation for all farmers under 4.72 million hectare will be US$927.46 million. Out of total amount, the amount of US$908.55 million will be compensated for the farmers who suffered one of the impacts among 6 types of disasters and US$18.91 million for agricultural diseases/pests. The amount of compensation for the farmers will vary depending on the percent of target areas which are devastated by natural disasters. For non-client farmers, the compensation will be US$14.76 million for disasters and US$0.64 million for agricultural diseases/pests (KOFC, 2016).

CONCLUSION

In Thailand, agriculture directly contributes only 8.6 % of the country’s GDP. In agricultural production, natural disasters make yield losses leading to a financial problems. Therefore, the government and relevant public and private organizations implemented a crop insurance program since 1978 to protect the farmers from their crop losses due to natural disasters like floods or heavy rains, droughts, storms or typhoons, cold weather or frosts, hailstorms and fires. In the early years, the implementation of the program was not successful. However, at present day, it has achieved a certain level of success to some extent.

Bank for Agriculture and Agricultural Cooperatives (BAAC) played a major role since the crop insurance started. It distributes the insurance products to the farmers, educates farmers, implements the process of the insurance program. At the start of the crop insurance program, there were nine insurance companies. Nevertheless, nowadays there are only seven insurers.

In 1978, the indemnity insurance program was initiated for cotton growers who exposed the losses from all natural disasters. In 1990, the government provided the indemnity insurance for maize, sorghum and soybean. However, that insurance program did not achieve a success because the insurance premiums were less than the indemnity payments. Weather index insurance started as a pilot with technical support from the World Bank in 2005. BAAC collaborated with the General Insurance Association (GIA), the Commodity Risk Management Group (CRMG) of the World Bank’s Agricultural and Rural Development (ARD) Department and the Department of Insurance (now the Office of Insurance Commissioners (OIC)). For that pilot, maize crop was chosen as target crop for drought risks. The outcomes of the pilot was to make the contract design more suited for Asia and to build the trust between the farmers and the institution to distribute the insurance product. In 2007, weather index insurance for maize was developed. The coverage of the insurance product expanded to 7 provinces within 4 years although it started in one province at the early stage.

By collaborating with Japan Bank for International Cooperation (JBIC) and Sompo Japan Insurance Co. Ltd., BAAC implemented weather index insurance for rice in the north-eastern part of the country in 2007. That insurance program covered in one province. After developing the program in 2010, it has expanded to 17 provinces in 2014. A new program for rice insurance covered all natural disasters was introduced in 2014. The insurance premium was shared by the farmers and the government. The insurance premium was defined depending on the location and the intense of the risks. If the farmers take loans from BAAC, the insurance premiums will be shared by BAAC instead of farmers. According to the analysis of the economic impact, the insurance premiums can be reduced if the coverage areas for crop insurance are increased. Moreover, the compensation to the farmers who encountered the losses due to natural disasters will be higher under the large coverage scheme.

REFERENCES

Central Intelligence Agency (CIA). (2011). Publications, The World Factbook. Retrieved on 29 April, 2013 from https://www.cia.gov/library/publications/the-world-factbook/index.html

Duangmanee, K and Fransen, E. (2013). Adaptation of Thai Insurance in Light of Natural Disasters: an Investigation of Developments in Major Rice Crop Insurance Applying the Area-Yield Approach. Vol. 4, no.17, 2013.

Fiscal Policy Office (FPO). (2015). Agroinsurance – Portal on Agricultural Insurance and Risk Management » Thailand – FPO pushes wider crop insurance cover . Retrieved on 18 August, 2016 from http://agroinsurance.com/en/thailand-fpo-pushes-wider-crop-insurance-cover/

Food and Agriculture Organization of the United Nations (FAOa). (2011). Production. Retireved on 6 February, 2013 from http://faostat.fao.org/site/339/default.aspx

Food and Agriculture Organization of the United Nations (FAOb). (2011). Agricultural insurance in Asia and the Pacific region. Food and Agriculture Organization of the United Nations Regional Office for Asia and the Pacific Bangkok, 2011. Retrieved on 18 August, 2016 from http://www.fao.org/docrep/015/i2344e/i2344e00.pdf

Hongo,T. (2015). Climate Insurance for Crops: Case Study of Weather Index Insurance for Agriculture in Thailand. Retrieved on 1 September, 2016 from http://www.uncapsa.org/article/climate-insurance-crops-case-study-weather-index-insurance-agriculture-thailand

Jeerachaipaisarn, T. (2012). Recent Developments of Crop Insurance in Thailand. 26th January 2012. Retrieved on August 18, 2016 from https://www.oecd.org/daf/fin/49657525.pdf

Kasetsart University - Office of Agricultural Economics Foresight Center (KOFC). (2016). เกาะติดผลกระทบเศรษฐกิจจากโครงการประกันภัยข้าวนาปี ปีการผลิต 2559/60. (Economics impacts from crop insurance: production year 2015/2016). Retireved on 25 August, 2016 from http://www.oae.go.th/ewt_news.php?nid=22977&filename=index

Manuamorn, O. (2009). Rainfall Index‐Based Insurance for Maize Farmers in Thailand: Review of Pilot Program 2006‐2008. Experiential briefing note prepared by Ornsaran Pomme Manuamorn, Agriculture and Rural Development Department, the World Bank, January 2009.

Office of Agricultural Economics (OAE). (2011). Land used. Retrieved on 29 April, 2013 from http://www.oae.go.th/more_news.php?cid=262

Skees, J.R. (2008). Challenges for use of index-based weather insurance in lower income countries. Agricultural Finance Review, 68, 197-217.

Thailand. (2016). The Report: Thailand. Agricultural insurance in Thailand shifts focus to crop protection. Retrieved on August 18, 2016 from file:///C:/Users/User/Documents/CAER/Crop%20insurance%20in%20Thailand/Agricultural%20insurance%20in%20Thailand%20shifts%20focus%20to%20crop%20protection%20_%20Thailand%202016%20_%20Oxford%20Business%20Group.html

Date submitted: Sept. 7, 2016

Reviewed, edited and uploaded: Sept. 7, 2016