INTRODUCTION

Trans-Pacific Partnership Agreement (TPPA) is a comprehensive trade agreement among 12 counties in the Asia Pacific region. The countries which participated in the agreement are United States of America, Peru, Mexico, Canada, New Zealand, Chile, Japan, Australia, Vietnam, Singapore, Brunei and Malaysia. The agreement was signed on 4 February 2016 in Auckland, New Zealand. It will however, enter into force after all countries or at least six of the member countries which signed the agreement ratify within two years or before 4 February 2018. The agreement aims to promote economic growth of the countries through a more liberalise trade between member countries. The TPPA contains measures that reduce or abolish trade barriers, the management and protection of environment, good governance, human rights, intellectual property rights, labor standards, and investor-state dispute settlement.

Malaysia started the negotiations to participate in the TPPA on October 2010. The Ministry of International Trade and Investment was mandated to coordinate Malaysia's participation in the TPPA negotiations. There are 21 areas of negotiations that include market access in goods, technical barriers to trade, competition, rules of origin, custom cooperation, e-commerce, capacity building and trade remedies. This paper focuses on the potential benefit of participating the TPPA on the agro-food sector in Malaysia.

Trading between TPP countries

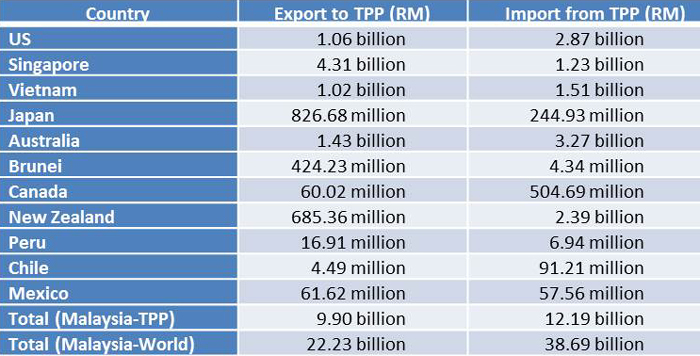

Malaysia was recognized as one of the most 20 active trading nations in the world in 2011and continues to be an active player (OECD, 2011). The value of trade by Malaysia was RM1.466 trillion in 2015, an increase of 1.2% compared to the previous year. Agro-food trade between Malaysia and TPP countries reached RM22.09 billion, or 36.3% of the total trade of agro-food in the world in 2014 (Table 1).

Table 1. Agro food trade between Malaysia and TPP countries in 2014

Source: Ministry of International Trade and Investment (2015)

Table 1 shows that Singapore was the most important trading partner of Malaysia in 2014, followed by United States of America(USA), Australia and New Zealand. Malaysia exported most of its agro-food products to Singapore, followed by USA and Vietnam. On the other hand, Malaysia imported most of its agro-food products from Australia, followed by USA, New Zealand, and Vietnam. In total, Malaysia has a trade deficit of RM16.46 billion in 2014. Source: Ministry of International Trade and Investment (2015)

Potential benefit of TPPA

In general, the TPPA is a market of 800 million people with a combined GDP of US$27.5 trillion. It is huge market for agro-based products from Malaysia. Furthermore, prior to this agreement Malaysia has no free trade agreement with USA, Mexico, Peru and Canada. Thus, the TPPA creates or opens the markets to these countries. The TPPA will also create a greater economic integration between Malaysia and other countries in the Asia Pacific Region.

The potential benefits of TPPA towards Malaysia's agro-food sector is determined by monetary as well as socio-economic benefits to farmers and entrepreneurs. Malaysia is committed towards the implementation of the agreement. The discussion focuses on the potential benefits created from the seven measures related to agro-food as follows:

- Sanitary and phytosanitary (SPS) measures

- Discipline on quota administration

- Plant Variety protection (UPOV 1991)

- Marine fishery sustainability

- Government procurement in agro-food subsidies

- Prohibition on export subsidies

- prohibition on export taxes

1. Sanitary and phytosanitary (SPS) measures

‘SPS’ refer to measures to protect human, animal and plant health with regards to the importation of goods. For example, SPS measures include audits, import checks quarantine and emergency measures.

Commitment by member countries:

|

Before TPP

|

After TPP

|

- On-site audit required. ‘System-based’ (based on document) approach is encouraged.

|

- Audits must be ‘system-based’.

|

- The cost of audit to be borne by the importer / exporter of the exporting country.

|

- The cost of audits to be borne by the auditing party (the Government).

|

Potential benefits:

- Under the TPP agreement, SPS measures are carried out in a more transparent, limited to what is necessary to protect human, animal and plant health, based on scientific justifications and evidence, and allow communication between interested parties to facilitate clearance of consignments. These provide predictability and minimize the risks of unclear and discriminatory import restriction.

- Under this measure, Halal is not included in this chapter. Thus, Malaysia is able to conduct on-side audit at the premise of the exporters before they are allowed to use the Halal certificate and export mainly food products to Malaysia.

2. Discipline on quota administration

Quota system is imposed to limit the amount of import of certain goods to a ‘tolerable’ quantity with the aim to protect the domestic industry. Products imported within the quota quantity will enjoy preferential treatment (zero) or low duty) while products imported exceeding the quota quantity will pay normal (higher) duties.

Commitment of member countries:

|

Before TPP

|

After TPP

|

|

No disciplines on quota administration

|

Disciplines on quota administration including specific timelines to open and accept application for the quota, transparency in quota utilization and reallocation of unused quota.

|

Potential benefit :

This measure will improve efficiency, transparency and certainty on quota management system set by member countries. The measure will enable sufficient time for the opening of, application for and utilization of the quota. Unused quota shall also be reopened for interested party to export such goods to another party.

3. Plant Variety Protection – UPOV 1991

The international Union for the Protection of New Varieties of Plants (UPOV) provides and promotes an effective system of plant variety protection, to encourage the development of new varieties of plants. UPOV provides the basis for members to encourage plant breeding by granting breeders of new varieties an intellectual property right – the breeder’s right.

Commitment of member countries:

|

Before TPP

|

After TPP

|

- member country has the choice to comply to UPOV

|

- All TPP member countries must comply to UPOV 1991

|

Potential benefit :

- The UPOV 1991 will strengthen breeder’s rights and encourage registration of new plant varieties in Malaysia. This will benefit farmers by getting the access to the new registered plant variety, which is usually aimed to increase the yield, become resistant to pest and diseases and easy to manage. At the same time, scientists will receive incentives in term of royalties and recognition from the authority.

- Malaysia received a 4-year transition period from the date of entry into force of the TPPA to join UPOV 1991. This enables the Department of Agriculture to complete the amendment of the Protection of New Plant Variety (PNPV) Act 2004.

4. Marine fishery sustainability

Marine fishery covers three key areas: operating efficient fishery management system, combating illegal, unreported and unregulated (IUU) fishing and preventing overfishing.

Commitment by member countries:

|

Before TPP

|

After TPP

|

- No prohibition on programs or support for fishery industry that leads to overfishing.

|

- Provision of fishery subsidy is prohibited if the subsidy program negatively affects fish stock in an overfished condition.

|

Potential benefit :

- TPPA encourages parties to strengthen cooperation and support monitoring, control and surveillance to address IUU fishing at national, regional and international level. This measure will ensure that Malaysia could determine its fish stock status. At the same time Malaysia could manage its environment more efficiently.

5. Government procurement in agrofood subsidies

TPP agreement set a standard that the government procurement must be transparent and non-discriminatory to all companies from TPP member countries. Under this measure, all foreign companies from the TPP member countries must get equal opportunity to bid Government projects.

Commitment of member countries:

|

Before TPP

|

After TPP

|

- No discipline on Government Procurement

|

- Disciplines on Government Procurement including providing opportunity for foreign companies from TPP Parties to apply.

|

Potential benefit :

Malaysia is allowed to exclude the following from the government procurement disciplines:

- All government procurement on paddy and rice;

- All government procurement below RM615,000; and

- All government procurement made by statutory bodies;

Malaysia excluded the application of the TPP discipline on all procurement and distribution of input for agro-food production in Malaysia. This exclusion safeguarded the Ministry of Agriculture and Agrobased Industry ability to continue procuring agriculture input such as fertilizers, agro-chemicals that encourage production of agrofood products.

6. Prohibition on export subsidies

Before the TPPA, countries are allowed to provide subsidies for exportation of agrofood products. This subsidies will lower the price of goods and enable them to compete in the international markets. After the TPPA, all member countries are not allowed to provide subsidies for exportation. This will enable the agrofood products to compete in a free market condition.

Commitment of member countries:

|

Before TPP

|

After TPP

|

- Export subsidies are allowed by WTO while its trade distorting effects are being addressed progressively.

|

- Export subsidies are not allowed to be used on export to TPP parties.

|

Potential benefit :

This measure is in line with the commitment under WTO agreement to progressively eliminate export subsidies for agriculture products. Malaysia will be able to compete with developed countries such as the US that provides a lot of subsidies to its agriculture products

7. Prohibition on export taxes

Export taxes are a measure allowed by WTO but often perceived as a form of export restriction by many TPP member countries. Malaysia applies export taxes to petroleum, crude palm oil, live animals, minerals, vegetable seeds, natural rubber and wood products.

Commitment of member countries:

|

Before TPP

|

After TPP

|

- No disciplines on export taxes.

|

- Export taxes and any charges of equivalent effect are prohibited and cannot be reintroduced in any form.

|

Potential benefit :

Under the TPP agreement, only export taxes on live animals were removed. For other products, all export taxes and cess charges (on logs) which have the same effect are allowed to be retained. Malaysia gets an exemption on these taxes under TPP.

The potential benefits of TPPA on selected agrofood products

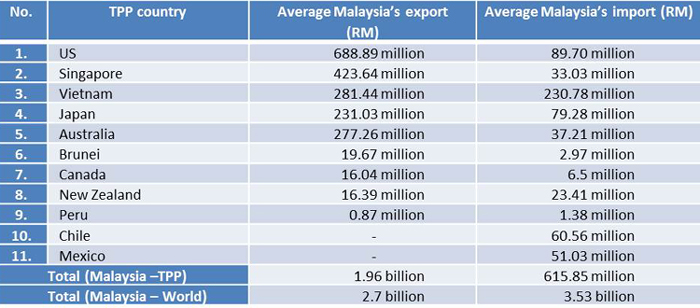

Malaysia is a net importer of fishery products. In 2014, Malaysia imported RM3.53 billion, and exported RM 2.7 billion of fishery products. However, the balance of trade (BOT) between Malaysia and TPP in fishery products is in favor of Malaysia by RM1.34 billion. From Malaysia’s total export of fish and fish products in 2014, 72.6% goes to TPP countries. Malaysia’s import of fish and fish products from TPP parties represent only 17.45% from Malaysia’ total imports.

Table 2. Malaysia's trade of fishery products, 2014

Source: Ministry of Agriculture and Agro based Industry, Malaysia

The potential benefit from TPPA on fishery products are as follows:

Table 3. The potential benefit from TPPA on fishery products

Source: TPPA

TPP Countries offer Malaysia 100% duty elimination for all fish and fish products. For example, seven TPP countries offer Malaysia 100% duty elimination on EIF, while four other TPP countries offer Malaysia 100% duty elimination within 15 years.

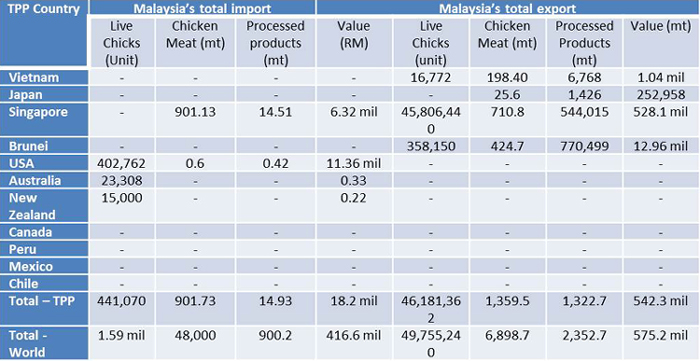

Table 4. Malaysia's trade on live chicken and processed products

Source: Ministry of Agriculture and Agrobased Industry, Malaysia

Potential benefit :

Under the TPP agreement, all countries will remove or reduce their duties on live chicks, chicken meat and processed poultry products. Malaysia is an net-exporter of chicken, and its traditional market is Singapore. The TPP agreement will provide greater opportunity to further export poultry products to other TPP countries such as Brunei, Vietnam and Australia.

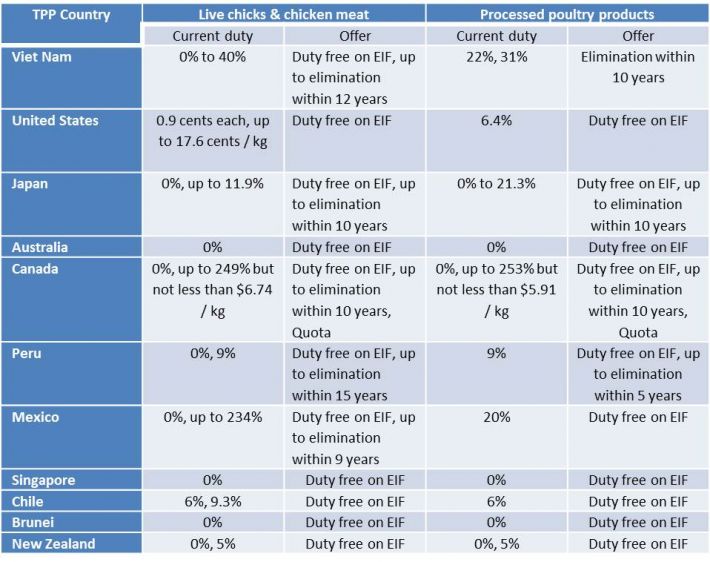

Table 5. Tax and duty reduction on live chicken and processed poultry products

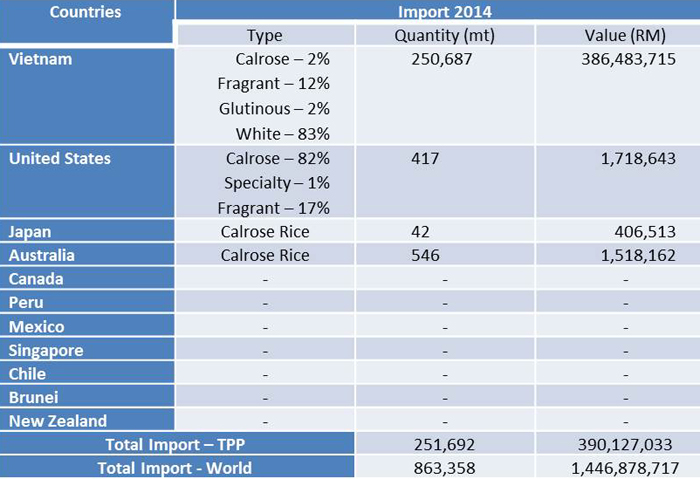

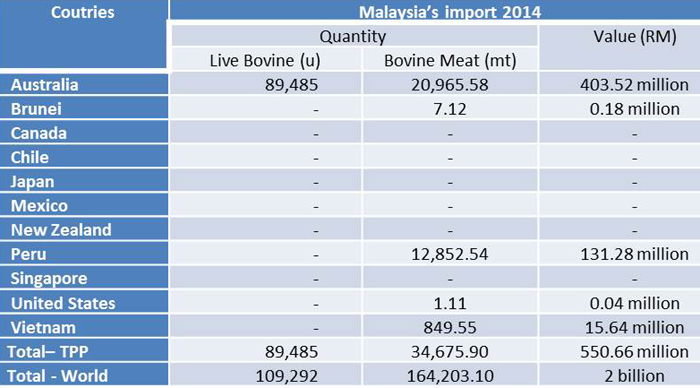

Malaysia is a net importing country for rice. Malaysia import around 700,000 MT of rice or 32% of local requirement every year. The main source of rice are Vietnam, Thailand, Pakistan and India. Import of rice from TPP countries represents only 29.1% of the total quantity of Malaysia’s total rice import in 2014, namely, from Vietnam (29%), Australia (0.06%), the United States (0.05%) and Japan (0.005%)..

Table 6. Malaysia’s import of rice from TPP - 2014

Table 7. The benefit from trade liberalization of rice to Malaysia are:

The implementation of TPPA hopefully will reduce the price of rice from Vietnam and this will benefit the consumers in Malaysia. At the same time, the TPP has agreed to carve out mechanism for importation and distribution of rice in Malaysia. This enables Malaysia to continue any policies related to importation and distribution of rice. Only Malaysia can enjoy this flexibility.

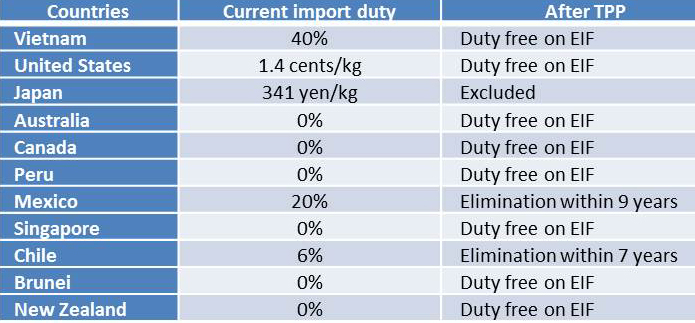

Malaysia is a net importer of beef and mutton. Malaysia is only capable of producing around 28% of its meat every year. In 2014, around 82% and 21% of live bovine and meat comes from TPP member countries such as Australia and New Zealand respectively.

Table 8. Malaysia's source of live bovine and bovine meat, 2014

Potential benefit

Most TPP member countries do not impose import duty on live bovine, hence the duty elimination on this product may not provide significant impact on trade. Malaysia will benefit from this measure because it exports a lot of processed products to TPP member countries, especially to Singapore and Brunei. Malaysia also exports a small amount of meat based products

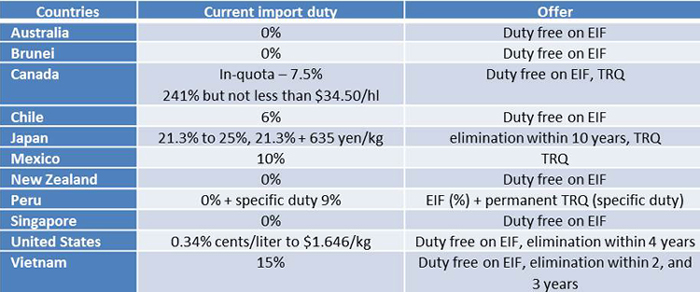

Liquid milk

Malaysia is a net importer of milk. Every year, Malaysia imports more than 18.1 million litre of milk from all over the world. The main source of milk are Australia, followed by New Zealand and Singapore. Malaysia’s import of liquid milk from TPP countries represents 85% of its total liquid milk imports in 2014. In terms of value, the import is worth RM68.25 million.

Table 9.

Potential benefit :

Malaysia is not an exporting country for liquid milk, hence it does not have strong interest on milk exports in the near future. However, Malaysia will still benefit from the TPP offers, particularly in exporting value-added milk products, i.e., flavored milk.

CONCLUSION

The agreement and commitment of all TPPA member countries indicates that the participation of Malaysia in the TPPA will benefit the agrofood sector. Malaysia will get greater access to new markets, especially in countries that it does not have free trade agreement (FTA). The elimination of import duty will also benefit Malaysia as it has better competitive edge as compared to those developed countries such as USA and Japan. At the same time, Malaysia is still allowed to continue with the existing taxes regime such as rice and livestock industries. TPP not only provides a transparent trade environment but also opportunities for Malaysia agrofood industry to penetrate into bigger markets more competitively.

However, the impact of TPPA on agrofood sector is still uncertain until the agreement is put into force in 2018. Malaysia needs to prepare and formulate a right strategy to ensure that the impact will be very minimal and Malaysia will have a better position in the global markets.

REFERENCES

ISIS, 2015.National interest analysis of Malaysia participation in the Trans Pacific Agreement. Report presented to the Government of Malaysia. Available at http://fta.miti.gov.my/miti-fta/resources/ISIS_The_Grand_Finale.pdf

Ministry of Agriculture and Agrobased Industry (2015). Impact of TPPA on Agrofood Sector: A cost and benefit analysis. Unpublished paper.

OECD 2011. Global Forum on Transparency and Exchange of Information for Tax Purposes (Malaysia). OECD.

MITI, 2016. Trans-Pacific Partnership Agreement. Available at http://fta.miti.gov.my/index.php/pages/view/267

Price Waterhouse Corporation, 2015. Study on potential economic impact of TPPA on the Malaysian economy and selected key economic sectors. Report prepared for MITI. Available at http://fta.miti.gov.my/index.php/pages/view/tppa

Peter A. Petri and Michael G.Plummer, 2016. The economic effects of the Trans-Pacific Partnership. Peterson Institute for International Economic.

|

Date submitted: Sept. 1, 2016

Reviewed, edited and uploaded: Sept. 1, 2016

|

Potential Benefits of TPPA On Malaysia's Agrofood Sector

INTRODUCTION

Trans-Pacific Partnership Agreement (TPPA) is a comprehensive trade agreement among 12 counties in the Asia Pacific region. The countries which participated in the agreement are United States of America, Peru, Mexico, Canada, New Zealand, Chile, Japan, Australia, Vietnam, Singapore, Brunei and Malaysia. The agreement was signed on 4 February 2016 in Auckland, New Zealand. It will however, enter into force after all countries or at least six of the member countries which signed the agreement ratify within two years or before 4 February 2018. The agreement aims to promote economic growth of the countries through a more liberalise trade between member countries. The TPPA contains measures that reduce or abolish trade barriers, the management and protection of environment, good governance, human rights, intellectual property rights, labor standards, and investor-state dispute settlement.

Malaysia started the negotiations to participate in the TPPA on October 2010. The Ministry of International Trade and Investment was mandated to coordinate Malaysia's participation in the TPPA negotiations. There are 21 areas of negotiations that include market access in goods, technical barriers to trade, competition, rules of origin, custom cooperation, e-commerce, capacity building and trade remedies. This paper focuses on the potential benefit of participating the TPPA on the agro-food sector in Malaysia.

Trading between TPP countries

Malaysia was recognized as one of the most 20 active trading nations in the world in 2011and continues to be an active player (OECD, 2011). The value of trade by Malaysia was RM1.466 trillion in 2015, an increase of 1.2% compared to the previous year. Agro-food trade between Malaysia and TPP countries reached RM22.09 billion, or 36.3% of the total trade of agro-food in the world in 2014 (Table 1).

Table 1. Agro food trade between Malaysia and TPP countries in 2014

Source: Ministry of International Trade and Investment (2015)

Table 1 shows that Singapore was the most important trading partner of Malaysia in 2014, followed by United States of America(USA), Australia and New Zealand. Malaysia exported most of its agro-food products to Singapore, followed by USA and Vietnam. On the other hand, Malaysia imported most of its agro-food products from Australia, followed by USA, New Zealand, and Vietnam. In total, Malaysia has a trade deficit of RM16.46 billion in 2014. Source: Ministry of International Trade and Investment (2015)

Potential benefit of TPPA

In general, the TPPA is a market of 800 million people with a combined GDP of US$27.5 trillion. It is huge market for agro-based products from Malaysia. Furthermore, prior to this agreement Malaysia has no free trade agreement with USA, Mexico, Peru and Canada. Thus, the TPPA creates or opens the markets to these countries. The TPPA will also create a greater economic integration between Malaysia and other countries in the Asia Pacific Region.

The potential benefits of TPPA towards Malaysia's agro-food sector is determined by monetary as well as socio-economic benefits to farmers and entrepreneurs. Malaysia is committed towards the implementation of the agreement. The discussion focuses on the potential benefits created from the seven measures related to agro-food as follows:

1. Sanitary and phytosanitary (SPS) measures

‘SPS’ refer to measures to protect human, animal and plant health with regards to the importation of goods. For example, SPS measures include audits, import checks quarantine and emergency measures.

Commitment by member countries:

Before TPP

After TPP

Potential benefits:

2. Discipline on quota administration

Quota system is imposed to limit the amount of import of certain goods to a ‘tolerable’ quantity with the aim to protect the domestic industry. Products imported within the quota quantity will enjoy preferential treatment (zero) or low duty) while products imported exceeding the quota quantity will pay normal (higher) duties.

Commitment of member countries:

Before TPP

After TPP

No disciplines on quota administration

Disciplines on quota administration including specific timelines to open and accept application for the quota, transparency in quota utilization and reallocation of unused quota.

Potential benefit :

This measure will improve efficiency, transparency and certainty on quota management system set by member countries. The measure will enable sufficient time for the opening of, application for and utilization of the quota. Unused quota shall also be reopened for interested party to export such goods to another party.

3. Plant Variety Protection – UPOV 1991

The international Union for the Protection of New Varieties of Plants (UPOV) provides and promotes an effective system of plant variety protection, to encourage the development of new varieties of plants. UPOV provides the basis for members to encourage plant breeding by granting breeders of new varieties an intellectual property right – the breeder’s right.

Commitment of member countries:

Before TPP

After TPP

Potential benefit :

4. Marine fishery sustainability

Marine fishery covers three key areas: operating efficient fishery management system, combating illegal, unreported and unregulated (IUU) fishing and preventing overfishing.

Commitment by member countries:

Before TPP

After TPP

Potential benefit :

5. Government procurement in agrofood subsidies

TPP agreement set a standard that the government procurement must be transparent and non-discriminatory to all companies from TPP member countries. Under this measure, all foreign companies from the TPP member countries must get equal opportunity to bid Government projects.

Commitment of member countries:

Before TPP

After TPP

Potential benefit :

Malaysia is allowed to exclude the following from the government procurement disciplines:

Malaysia excluded the application of the TPP discipline on all procurement and distribution of input for agro-food production in Malaysia. This exclusion safeguarded the Ministry of Agriculture and Agrobased Industry ability to continue procuring agriculture input such as fertilizers, agro-chemicals that encourage production of agrofood products.

6. Prohibition on export subsidies

Before the TPPA, countries are allowed to provide subsidies for exportation of agrofood products. This subsidies will lower the price of goods and enable them to compete in the international markets. After the TPPA, all member countries are not allowed to provide subsidies for exportation. This will enable the agrofood products to compete in a free market condition.

Commitment of member countries:

Before TPP

After TPP

Potential benefit :

This measure is in line with the commitment under WTO agreement to progressively eliminate export subsidies for agriculture products. Malaysia will be able to compete with developed countries such as the US that provides a lot of subsidies to its agriculture products

7. Prohibition on export taxes

Export taxes are a measure allowed by WTO but often perceived as a form of export restriction by many TPP member countries. Malaysia applies export taxes to petroleum, crude palm oil, live animals, minerals, vegetable seeds, natural rubber and wood products.

Commitment of member countries:

Before TPP

After TPP

Potential benefit :

Under the TPP agreement, only export taxes on live animals were removed. For other products, all export taxes and cess charges (on logs) which have the same effect are allowed to be retained. Malaysia gets an exemption on these taxes under TPP.

The potential benefits of TPPA on selected agrofood products

Malaysia is a net importer of fishery products. In 2014, Malaysia imported RM3.53 billion, and exported RM 2.7 billion of fishery products. However, the balance of trade (BOT) between Malaysia and TPP in fishery products is in favor of Malaysia by RM1.34 billion. From Malaysia’s total export of fish and fish products in 2014, 72.6% goes to TPP countries. Malaysia’s import of fish and fish products from TPP parties represent only 17.45% from Malaysia’ total imports.

Table 2. Malaysia's trade of fishery products, 2014

Source: Ministry of Agriculture and Agro based Industry, Malaysia

The potential benefit from TPPA on fishery products are as follows:

Table 3. The potential benefit from TPPA on fishery products

Source: TPPA

TPP Countries offer Malaysia 100% duty elimination for all fish and fish products. For example, seven TPP countries offer Malaysia 100% duty elimination on EIF, while four other TPP countries offer Malaysia 100% duty elimination within 15 years.

Table 4. Malaysia's trade on live chicken and processed products

Source: Ministry of Agriculture and Agrobased Industry, Malaysia

Potential benefit :

Under the TPP agreement, all countries will remove or reduce their duties on live chicks, chicken meat and processed poultry products. Malaysia is an net-exporter of chicken, and its traditional market is Singapore. The TPP agreement will provide greater opportunity to further export poultry products to other TPP countries such as Brunei, Vietnam and Australia.

Table 5. Tax and duty reduction on live chicken and processed poultry products

Malaysia is a net importing country for rice. Malaysia import around 700,000 MT of rice or 32% of local requirement every year. The main source of rice are Vietnam, Thailand, Pakistan and India. Import of rice from TPP countries represents only 29.1% of the total quantity of Malaysia’s total rice import in 2014, namely, from Vietnam (29%), Australia (0.06%), the United States (0.05%) and Japan (0.005%)..

Table 6. Malaysia’s import of rice from TPP - 2014

Table 7. The benefit from trade liberalization of rice to Malaysia are:

The implementation of TPPA hopefully will reduce the price of rice from Vietnam and this will benefit the consumers in Malaysia. At the same time, the TPP has agreed to carve out mechanism for importation and distribution of rice in Malaysia. This enables Malaysia to continue any policies related to importation and distribution of rice. Only Malaysia can enjoy this flexibility.

Malaysia is a net importer of beef and mutton. Malaysia is only capable of producing around 28% of its meat every year. In 2014, around 82% and 21% of live bovine and meat comes from TPP member countries such as Australia and New Zealand respectively.

Table 8. Malaysia's source of live bovine and bovine meat, 2014

Potential benefit

Most TPP member countries do not impose import duty on live bovine, hence the duty elimination on this product may not provide significant impact on trade. Malaysia will benefit from this measure because it exports a lot of processed products to TPP member countries, especially to Singapore and Brunei. Malaysia also exports a small amount of meat based products

Liquid milk

Malaysia is a net importer of milk. Every year, Malaysia imports more than 18.1 million litre of milk from all over the world. The main source of milk are Australia, followed by New Zealand and Singapore. Malaysia’s import of liquid milk from TPP countries represents 85% of its total liquid milk imports in 2014. In terms of value, the import is worth RM68.25 million.

Table 9.

Potential benefit :

Malaysia is not an exporting country for liquid milk, hence it does not have strong interest on milk exports in the near future. However, Malaysia will still benefit from the TPP offers, particularly in exporting value-added milk products, i.e., flavored milk.

CONCLUSION

The agreement and commitment of all TPPA member countries indicates that the participation of Malaysia in the TPPA will benefit the agrofood sector. Malaysia will get greater access to new markets, especially in countries that it does not have free trade agreement (FTA). The elimination of import duty will also benefit Malaysia as it has better competitive edge as compared to those developed countries such as USA and Japan. At the same time, Malaysia is still allowed to continue with the existing taxes regime such as rice and livestock industries. TPP not only provides a transparent trade environment but also opportunities for Malaysia agrofood industry to penetrate into bigger markets more competitively.

However, the impact of TPPA on agrofood sector is still uncertain until the agreement is put into force in 2018. Malaysia needs to prepare and formulate a right strategy to ensure that the impact will be very minimal and Malaysia will have a better position in the global markets.

REFERENCES

ISIS, 2015.National interest analysis of Malaysia participation in the Trans Pacific Agreement. Report presented to the Government of Malaysia. Available at http://fta.miti.gov.my/miti-fta/resources/ISIS_The_Grand_Finale.pdf

Ministry of Agriculture and Agrobased Industry (2015). Impact of TPPA on Agrofood Sector: A cost and benefit analysis. Unpublished paper.

OECD 2011. Global Forum on Transparency and Exchange of Information for Tax Purposes (Malaysia). OECD.

MITI, 2016. Trans-Pacific Partnership Agreement. Available at http://fta.miti.gov.my/index.php/pages/view/267

Price Waterhouse Corporation, 2015. Study on potential economic impact of TPPA on the Malaysian economy and selected key economic sectors. Report prepared for MITI. Available at http://fta.miti.gov.my/index.php/pages/view/tppa

Peter A. Petri and Michael G.Plummer, 2016. The economic effects of the Trans-Pacific Partnership. Peterson Institute for International Economic.

Date submitted: Sept. 1, 2016

Reviewed, edited and uploaded: Sept. 1, 2016