CONTENTS

I. Introduction

II. Agricultural Marketing System and Situation of Cooperative’s Food Distribution Centers in Korea

III. Evaluation of Efficiency in Agricultural Marketing System

IV. Development Strategies of Cooperative’s Food Distribution Centers

ABSTRACT

In Korea, agricultural cooperatives account for about 40 percent of total marketed agricultural products. There are 1,088 local agricultural cooperatives, 218 marketing cooperatives specialized in fruits, vegetables, and livestock products. While local cooperatives operate RPCs (Rice Milling and Processing Centers) and APCs (Agricultural Products Processing Centers), NACF (National Agricultural Cooperative Federation) operates various wholesale and retail businesses. NACF operates Ansung agro-food distribution center which is designed to carry out wholesaling functions exclusively. According to Korea Agro-fisheries & Food Trade Corporation (KAFTC), for 20 items, average marketing margin ratio of the distribution center channel was 6.7% point lower than that of the wholesale market channel in 2012 (45.5% versus 52.2%). Higher marketing efficiency of the distribution center channel can be explained by shortening marketing stages by the distribution center. While marketing stages of the wholesale market channel are five or six, those of the distribution center channel are less than four. The NACF distribution center carries out combined functions of corporate wholesalers (auctioneer) and jobbers. Development strategies for cooperatives’ distribution centers are suggested as follows. Firstly, agro-food distribution centers should perform excellent coordinating functions between retail customers and local cooperatives who supply agricultural products. Secondly, the food distribution centers have to provide not only good products, but also excellent services to customers. They need to provide high-quality retail support functions to retail buyers and to provide extension service to agricultural producers. Thirdly, they also have to provide state-of-art logistics services in the area of order fulfillment, delivery, operation, and etc. Fourthly, they have to devise ways to decrease logistics cost by adopting automation, standardization, scaling up, technologies reducing labor cost, and etc.

Key words: agricultural marketing, efficiency, distribution center, marketing margin, logistics

Introduction

Agricultural marketing, a bridge between producers and consumers, is related to the activities taken places in the whole process in which agricultural products move from producers to consumers. The effective agricultural marketing system ensures efficient connection between farmers and consumers, and rapid transfer of consumers’ needs to production process. Having efficient agricultural marketing system will then help to develop not only the agricultural sector but also national economy as a whole. Therefore, it is nationally an important task to establish an efficient food marketing system.

Having efficient agricultural marketing system is more important in developing countries than in developed countries, for two distinctive reasons. First, in fast-growing countries, urban areas develop rapidly due to a large migration of population from rural to urban areas. As urban areas grow, it becomes more important for a nation to efficiently supply food to urban people. Moreover, developing countries need to reduce marketing margin of agricultural goods in order to be competitive in international markets. The efficient agricultural marketing system will help reaching this goal by reducing distribution costs to overseas markets.

In Korea, National Agricultural Cooperatives Federation (NACF) operates food distribution centers whose operation system is different from that of agricultural wholesale markets. According to Korea Agro-fisheries & Food Trade Corporation (KAFTC), average marketing margin ratio of the distribution center channel was lower than that of the wholesale market channel. This implies that NACF food distribution centers are operated in a more efficient manner than agricultural wholesale markets. While marketing stages of the wholesale market channel are five or six, those of the distribution center channel are less than foour. NACF distribution centers carry out combined functions of corporate wholesalers (auctioneer) and jobbers.

This paper summarizes situation of cooperative’s food distribution centers, and compares marketing efficiency between cooperative’s food distribution centers and agricultural wholesale markets. Also suggested is development strategies of cooperative’s food distribution centers. The paper is organized as follows: Following introduction, sections two introduces agricultural marketing system and situation of cooperatives’ food distribution in Korea. Section three evaluates marketing efficiency of agro-food distribution centers operated by Korean agricultural cooperatives. Lastly, section four suggests development strategies of agro-food distribution centers

Agricultural Marketing System and Situation of Cooperative’s Food Distribution Centers

1. Agricultural Marketing System in Korea

Agricultural products in Korea have a complex distribution system due to their unique nature of small farming units and small food retailers.

Rice, the most common crop in Korea, follows a marketing process from farmers to final consumers through rice processing centers (RPCs) or milling complexes. While government procurement decreases, procurement by cooperatives increases. Unlike other products, wholesale markets in large urban area do not play an important role in distributing rice.

Fruits and vegetables are distributed through marketing stages of farmers → local shipping organization → wholesale markets→ retailers → consumers. Local shipping institutions are mostly agricultural cooperatives, farming associations, and local traders. In recent years packing plants of fruits and vegetable increase their numbers as Korean government invests a lot of money for the construction of such facilities in shipping areas.

Livestock products pass through marketing stages of farmers → slaughter houses → wholesale markets→ retailers → consumers. Modernized livestock processing centers (LPCs) are increasingly replacing old style slaughter houses.

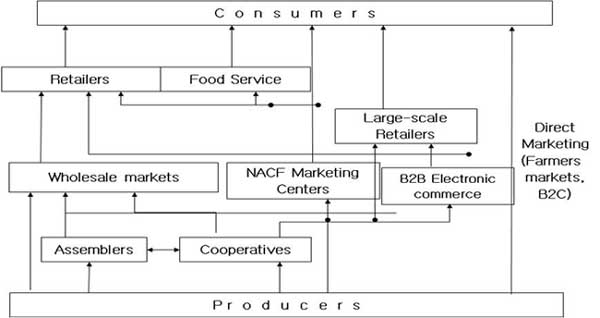

Fig. 1. Marketing Channels of Agricultural Products in Korea

At the first handler level, agricultural products are mainly distributed through local cooperatives, local assemblers, or local markets. It is estimated that about 43% of marketed fruits and vegetables are sold through local coops, 26% through assemblers, and 15% through local markets (Agricultural and Fishery Marketing Corporation, 2013). Some large-scale producers often ship their products directly to agricultural wholesale markets in urban areas.

There are 1,088 local agricultural cooperatives and 218 marketing cooperatives which are specialized in handling of fruits and vegetables or livestock products. Besides agricultural cooperatives, there are 10,792 farming associations and 3,760 corporate farms.

Some producers sell agricultural products still in the field to local assemblers before harvesting. Selling by forward contract is more easily found in vegetable items than in fruit items. Vegetable items with a high share of forward selling are Chinese cabbage, radish, carrots, potatoes, and etc. Although forward contract arrangements help farmers to avoid risk due to price fluctuations and the problem of labor shortage, producers are sometimes unfairly treated by merchants. Because there are a limited number of local assemblers, bargaining power of farmers is generally weaker than that of merchants.

At the wholesale level, fruits and vegetables are distributed through wholesale markets, NACF (National Agricultural Cooperative Federation) distribution centers, and direct marketing between retailers and shippers.

Wholesale markets located in large urban areas play an important role in most of the agricultural products. Since direct marketing between supermarket chains and shippers takes a small share, most agricultural products are distributed through wholesale markets. However, as large-scale retailers and NACF increase the number of retail stores, the importance of agricultural wholesale markets has decreased in recent years. Especially NACF distribution centers engage in both large-scale retailing and wholesaling.

Major retail outlets of agricultural products are department stores, discount stores, supermarkets, and specialty shops. Since food stores are densely distributed in Korea, average size of food stores is small compared to those of the U.S. and European countries. In Korea, agricultural products are also sold at peddlers and street stalls. The work of peddlers and street stalls is more important for fruits and vegetables than other food items. However, as the number of discount stores and supermarkets increases, more fruits and vegetables are now sold at modernized retailers.

Large scale food retailers have strengthened their position in the retail market through economies of scales generated by chain operation system and direct purchasing of agricultural products from local shippers, such as local cooperative and farming associations.

Total annual sales of discount stores have increased sharply from 2.1 trillion won in 1996 to 47.5 trillion won in 2014. The number of discount stores surpassed 400 in 2008. Discount stores in Korea carry both food and non-food items. Food items account for 58.6 percent of total sales: fresh food 26.4% and processed food 27.3% (Table 1).

Supermarkets also increased total sales as the number of stores increased. Especially operators of discount stores, such as E-Mart, Homeplus, Lotte Mart, increased affiliated small and medium size supermarkets in recent years, replacing traditional small scale local groceries.

In contrast, market share of department stores decreased although their total sales increased from 12.5 trillion won in 1996 to 29.3 trillion won in 2014.

Table 1. Sales of Major Retail Formats in Korea

(Unit: Trillion Won)

.jpg)

Note: 1 US dollar is equivalent to 1,200 Korean Won in 2015.

2. Situation of Agricultural Wholesale Markets

Wholesale markets play an important role in distribution of agricultural products, especially fruits and vegetables. Wholesale markets have various functions including assembling and dis-assembling, price discovery, dissemination of market information, and etc.

There are two types of agricultural wholesale markets in Korea: public wholesale markets and private wholesale markets. Public wholesale markets are constructed using budgets of the central and local governments, and operated by the local governments. In 2014, there were 32 public wholesale markets in large cities. Public wholesale markets are operated by the rules specified in “the Law about Marketing and Price Stabilization of Agricultural and Marine Products.” The Law requires, in the public wholesale markets, all of fruits and vegetables should, in principle, be transacted by auctions in which registered jobbers and institutional buyers participate. Auctions are administered by wholesale corporations which are also in charge of clearing payment to shippers after auctions. Jobbers and institutional buyers usually clear their payment in 3∼15 days but the wholesale corporations mostly clear their payment to farmers or shippers within 2 days. Shippers pay 4∼7% of fees to the wholesale corporation for their services including administrating auctions and clearing payment.

Private wholesale markets, once a dominant form of agricultural wholesale markets, have become less important in agricultural marketing than before. As the number of public wholesale markets have increased, the number of private wholesale markets has decreased in recent years. Since private wholesale markets are owned and operated by private firms, there are no means to regulate merchants in private wholesale markets. Private wholesale markets consist of traditional commission dealers who operate on a consignment basis. They receive fruits and vegetables from farmers or shippers and sell to retailers or consumers, charging 8∼9% of consignment fee to the shippers. Traditional commission wholesalers have been often criticized as conducting unfair trade practices and evading taxes, justifying government’s involvement in the expansion of public wholesale markets.

At the wholesale markets, agricultural products often go through several hands of different wholesalers. Secondary market handlers are sometimes involved in procuring their products from jobbers to service small-volume accounts such as peddlers, small stores, and small restaurants.

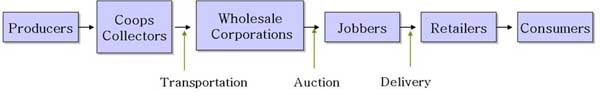

Fig. 2. Distribution Process in Agricultural Wholesale Markets

The Korean government financially supported construction of public wholesale markets. The first public wholesale market was established at Garak dong, Seoul city in 1985. Since then 32 public wholesale markets were built by the government..

Transactions in public wholesale markets are carried out in the form of auction, although private treaty between jobbers and shippers is allowed in special cases. Private treaty is allowed only for the products listed by market administrators, such as local governments.

Institutions in public wholesale markets are market administrators, wholesale corporations, jobbers, and related traders. Market administrators are in charge of managing facilities and monitoring unlawful and unfair trading practices by merchants. Wholesale corporations are in charge of auction by hiring auctioneers and of paying bills to shippers. When shippers or producers participate in auction, they have to pay commission charge by 4∼7% to wholesale corporations. Jobbers buy agricultural products by participating in auctions and sell them to retailers. Other market participants are various types of retailers, agricultural producers, and consumers. Besides various types of traders, there are many institutions supporting transactions in markets, such as truckers, loading and unloading crews, banks, and food safety inspectors.

Public wholesale markets have contributed to enhance efficient flow of agricultural products and to build stable sales outlets for agricultural producers. They have contributed to make price discovery process more transparent for agricultural products and to secure payments to farmers. Establishment of the auction system has enabled farmers to supply their products steadily in secure condition in payment settlement. Wholesale markets have also allowed consumers to get a steady supply of agricultural products despite the rapid urbanization of the nation.

Wholesale markets, however, have stagnated in recent years due to some limitations. First of all, wholesale markets do not react rapidly to changes in food retail structure. Wholesale markets do not perform well in supplying agricultural products to large scale retailers who want stable prices and standardized products. Agricultural products traded in wholesale markets are, in most cases, not well standardized in terms of quality and size. It is also argued that prices formed in wholesale markets have been excessively fluctuated. Because of these limitations, large scale retailers are increasing the share of direct purchase from producer organizations, such as agricultural cooperatives and farming associations. As the number of large scale retailers increased sharply since the late 1990s, the importance of wholesale markets has decreased significantly.

In addition, agricultural wholesale markets incur more marketing cost than other marketing channels because agricultural products go through many marketing stages. Higher fees and logistics costs are also charged in agricultural wholesale markets.

3. Situation of Cooperative Marketing in Korea

Cooperative marketing in agricultural products implies participation of marketing and processing functions by farmers or producers as a form of forward integration.

Benefits of cooperatives are a decrease in transaction costs, an increase in bargaining power by cartelization, an increase in counter-veiling power against monopolized marketing and processing firms (competitive yardstick), and diversification of agricultural producers to processing or marketing as new income sources.

Cooperative marketing plays an important role in connecting farmers with consumers. While bargaining coops are formed for bargaining for price and other terms of trade, general marketing coops perform full marketing functions, such as grading, processing, packaging, labeling, storage, distribution, merchandising, etc. Especially marketing cooperatives may improve quality by adequate sorting and grading, and have stronger bargaining power by pooling of members’ products and marketing agreement with producers.

In Korea, agricultural cooperatives account for about 40 percent of total marketed agricultural products. There are 1,088 local agricultural cooperatives, 218 marketing cooperatives for fruits, vegetables, and livestock products. The Korean government has nurtured agricultural cooperatives by providing low interest rate operating funds and subsidizing construction cost of marketing facilities in rural areas. In particular the Korean government is subsidizing 30∼40% of total construction cost of marketing facilities for agricultural cooperatives.

Characteristics of agricultural cooperatives in Korea are as follows: Korean agricultural cooperatives are multi-function cooperatives which carry out several functions of credit, insurance, marketing, supply, and other services. They also have two stage organizational structures: local cooperatives and a national federation (NACF, National Agricultural Cooperative Federation). While local cooperatives operate RPCs (Rice Milling and Processing Centers) and APCs (Agricultural Products Processing Centers), NACF operates various wholesale and retail businesses. Korean agricultural cooperatives participates various PPP (Public and Private Partnership) programs in the form of participation in various governmental marketing programs, such as buffer stock programs, price stabilization programs, and etc.

-

Integrated Food Distribution Centers of NACF

NACF (National Agricultural Cooperatives Federation) currently operate 15 integrated food distribution centers all over the country. While integrated food distribution centers in Korea carry out both wholesaling and retailing at one place, retail is more emphasized in some centers. As a trading method, NACF integrated food distribution centers adopt private treaty unlike wholesale markets, which adopt the auction system. Functions of distribution centers are unloading, unpacking, inspecting, receiving, handling, storing, consolidation, picking, retrieving, replenishing, packing, sorting, palletizing, loading/shipping, order processing, documentation, cycle counting, inventory control, tracking, and etc (Figure 3).

Total sales of NACF integrated food distribution centers are 2.9 trillion won in 2013. While retail sales account for 60.7% of total sales, wholesale sales account for about 39.3%. The share of total sales accounted for by agricultural products, such as rice, fruits and vegetables, livestock products, and fishery products is about 60 percent. Processed food and non-food items account for remaining 40 percent of total sales.

It is often argued that wholesale food distribution centers have lower marketing margin and higher efficiency than wholesale markets because they can reduce marketing stages of agricultural products. However, it is criticized that NACF distribution centers focus more on retailing rather than wholesaling which is supposed to be the main business.

Fig. 3. Functions of Food Distribution Centers of NACF

.jpg)

-

Ansung Agro-food Distribution Centers of NACF

In order to focus more on wholesaling, NACF constructed and opened Ansung agro-food distribution center in 2013. Ansung distribution center is designed to carry out wholesaling functions exclusively. Therefore, 100% of sales of Ansung distribution center are related to wholesaling. However, about 90% of wholesale sales are generated by NACF stores, such as wholesale distribution centers, and retail stores operated by NACF and local cooperatives. Remaining 10% are accounted for by non NACF stores, such as discount store and supermarket chains, small size grocery, school lunch, and etc.

Currently, Ansung agro-food distribution center carries only fruits and vegetables. Fruits and vegetables account for 46% and 45.4% of total sales, respectively. Ansung distribution center also carries eco-friendly agricultural products, such as organic or non-pesticide fruits and vegetables. Eco-friendly products account for 8.4% of total sales.

As for sourcing, Ansung distribution center purchases fruits and vegetables mainly from local agricultural cooperatives, and federation of local cooperatives. Ansung distribution center operates consumer packaging and fresh cut facilities. Consumer packages and fresh cut products account for about 7% of total sales.

Fig. 4. Scene of Ansung Agro-food Distribution Center

Evaluation of Efficiency in Agricultural Marketing System

1. Goals of Agricultural Marketing Policies

Enhancing efficiency is one the most important goals of agricultural marketing policies as shown below.

a. Physical efficiency

Physical efficiency relates to costs incurred in the process of food marketing. One of the government’s goals is to minimize food marketing costs or, in other words, to maximize physical efficiency of food marketing. In order to increase physical efficiency of food marketing, it is necessary not only to abolish unnecessary marketing functions or stages, but also to increase the size of wholesalers and retailers for utilizing economies of scale.

b. Pricing efficiency

Pricing efficiency relates to keeping market prices to be competitive. It is desirable for the government to have fair pricing schemes without any unfair influence from particular traders. Such pricing efficiency can be attained by having competitive selling and buying structure. When the market operates under perfectly competitive environment, pricing efficiency can be fully reached.

c. Stability

It is also desirable that prices of agricultural products are stabilized. Stability refers to pricing mechanism which makes prices of agricultural products stable. Maintaining stable prices of agricultural products is quite crucial for stabilizing farmers’ income.

d. Transaction cost

It is important to have low transaction costs, such as monitoring cost, enforcement cost, and so forth. Transaction costs can be defined as costs generated by opportunistic behaviors of market participants. It is more common to have higher transaction costs under spot market transactions than under long-term contract relationship. Therefore, it is suggested that market participants adopt contracting or vertical integration rather spot market transactions.

e. Accessibility

In order to increase accessibility, the government needs to have marketing systems without foreclosing participation of small farmers. Nowadays, as direct trade between farmer organizations and large-scale retailers has increased, small farmers may not have places to sell their products and accessibility problem of small farmers have emerged. In order to solve these problems, the government should provide market places for small farmers by establishing alternative market outlets, such as farmers markets or some other types of direct marketing.

2. Comparison of Marketing Efficiency between Wholesale Markets and Distribution Centers

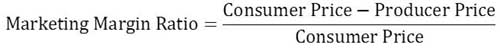

Efficiency of the food marketing system may be evaluated by ratio of marketing margin to consumer prices. The ratio of marketing margin to consumer prices is calculated by the below formula. Marketing margin consists of costs and profits incurred during marketing of agricultural products.

Korea Agro-fisheries & Food Trade Corporation (KAFTC) analyzes and publishes marketing margins of major agricultural products every year. An average marketing margin ratio of 48 agricultural products is 43.9%, which consists of 14.1% of direct cost, 14.9% of indirect cost, and 14.9% of profit. According to Korea Agro-fisheries & Food Trade Corporation, marketing margin ratio of the agro-food distribution center channel is, on average, lower than those of the wholesale market channel. When comparing 20 items, average marketing margin ratio of the distribution center channel was 6.7% point lower than that of the wholesale market channel in 2012 (45.5% versus 52.2%) (Table 2).

Lower marketing margin ratio of the distribution center channel can be explained by shortening marketing stages by the distribution center. While marketing stages of the wholesale market channel are five or six, those of the distribution center channel are less than four. NACF distribution centers carry out combined functions of corporate wholesalers (auctioneer) and jobbers.

Table 2. Differences in Marketing Margin Ratios between the Wholesale Market Channel and the Distribution Center Channel (2012)

(unit: %)

.jpg)

Source: Korea Agro-fisheries & Food Trade Corporation, 2013.

Development Strategies of Cooperative’s Food Distribution Centers

Although the NACF agro-food distribution center is operated more efficiently than agricultural wholesale markets, its sales are below than the break-even point level. Therefore, the Ansung agro-food distribution center needs to think about various ways to improve its competitiveness and to increase its sales.

As a wholesale institution, the agro-food distribution center has to think about below key success factors (KSFs).

Firstly, agro-food distribution centers should perform excellent coordinating functions between retail customers and local cooperatives who supply agricultural products. The distribution center has to satisfy interests of both parties equally and efficiently.

Secondly, the food distribution centers have to provide not only good products, but also excellent services to customers. They need to provide high-quality retail support functions to retail buyers and to provide extension service to agricultural producers.

Thirdly, they also have to provide state-of-art logistic services in the area of order fulfillment, delivery, operation, and etc.

Fourthly, they has to devise ways to decrease logistics cost by automation, standardization, scaling up, reducing labor cost, and etc.

Based on the key success factors of distribution centers, eight development strategies are suggested for the Ansung agro-food distribution center as follows:

1. Strengthening fresh cut product business

Although the Ansung agro-food distribution center operates fresh cut processing facilities, sales of those products are much less than the break- even point level and there is a room for increasing sales. Above all, Ansung center should increase sales through diversifying sales outlets of fresh cut products to large discount stores, supermarkets, school lunch, and etc.

2. Provision of retail support services

Providing retail support service to customers is quite crucial for the success of the distribution center business. Defined as the activities which can help to increase competitiveness of retail customers, retail support services (RSS) include education and training, consulting services to the retail customers. Therefore the Ansung agro-food distribution center has to provide various education and consulting services to its retail customers.

3. Integrated supply of various products, including rice and livestock products

To increase convenience of retail customers, it is desirable to supply rice and livestock products together with fruits and vegetables which the Ansung distribution center currently supplies.

4. Expanding various sales outlets

Currently, sales of Ansung agro-food distribution center rely too much on retail stores operated by NACF or local cooperatives. In order to increase sales, the distribution center should increase sales to discount store and supermarket chains which are operated by large scale retailers, such as E-Mart, Lotte Mart, and Homeplus. It also needs to diversity marketing channels to small scale retailers and other types of retailers. In particular, it is recommended for the Ansung distribution center to organize small scale retailers as the voluntary chain.

5. Strengthening Education and Training of Employees

For the success of the distribution center business, it is essential to secure sufficient experts in wholesaling, such as merchandising managers, logistics managers, sales managers, and so forth. Because NACF is not familiar with the new type of wholesaling business like the Ansung distribution center, experts for wholesaling are not sufficiently prepared. Therefore, the NACF is recommended to strengthen education and training programs to nurture experts in the wholesale distribution business.

6. Establishment of supply chain management system

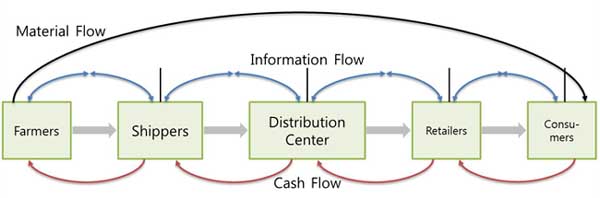

For the success of the distribution center business, it is necessary to adopt the supply chain management system (SCM). The SCM is a logistics skill to help the distribution center efficiently connect the suppliers as well as the retail customers utilizing advanced information and communication technology (ICT) (Figure 6). Utilizing the SCM system, retail customers can order merchandise on line to the distribution center, and successively the distribution center can order merchandise on line to the shippers. In addition, the distribution center can adopt advanced SCM technology such as VMI (Vendor Managed Inventory), which makes the distribution center manage inventory itself using inventory data provided by retail customers.

7. Improvement of logistics service

Quality of logistics service is crucial for the success of the agro-food distribution center. In particular, the distribution center needs to improve logistics accuracy of order fulfillment and delivery time. It is also necessary to save logistics cost by using labor saving logistics equipment, such as forklifts, conveyers, and the digital assortment system.

Fig. 6. Concept of Supply Chain Management

References

Cho, Byung Chan, History of Korea’s Wholesale Markets of Agricultural and Fishery Products, Dongguk Univ. Press., 2003. (in Korea)

Kim, Dong Hwan, "The Effects of Foreign Distributors on the Food Marketing System in Korea, The Korean Journal of Agricultural Economics Vol. 43(4): 141-61, 2002.

Kim, Dong Hwan, "The Effects of Structural Changes in Food Retailing on Agricultural Producers: The Case of Korea,” The Korean Journal of Agricultural Economics Vol. 48(3): 85-112, 2007.

Kim, Dong Hwan et al., A study on Establishing Action Plans of the Ansung Agro-food Distribution Center, Agro-food New Marketing Institute, 2012. (in Korean).

Kim, Dong Hwan, "Situation and Development Strategies of Agricultural Marketing System in Vietnam," The Journal of the Korean Society of International Agriculture Vol 26(2): 98-106, 2014.

Korea Agro-fisheries & Food Trade Corporation, Situation of Marketing of Major Agricultural Products, 2013. (in Korean).

National Agricultural Cooperative Federation of Korea, Situation of Ansung Agro-food Distribution Center, 2015. (in Korean)

Stiegert, Kyle W. and Dong Hwan Kim (ed.), Structural Changes in Food Retailing, FSRG Monograph #22, Department of Agricultural and Applied Economics, University of Wisconsin-Madison, 2009.

|

Submitted as a resource paper for the FFTC-NACF International Seminar on Improving Food Marketing Efficiency—the Role of Agricultural Cooperatives, Sept. 14-18, NACF, Seoul, Korea |

Evaluation of Marketing Efficiency and Development Strategies of Cooperative’s Food Distribution Centers

CONTENTS

I. Introduction

II. Agricultural Marketing System and Situation of Cooperative’s Food Distribution Centers in Korea

III. Evaluation of Efficiency in Agricultural Marketing System

IV. Development Strategies of Cooperative’s Food Distribution Centers

ABSTRACT

In Korea, agricultural cooperatives account for about 40 percent of total marketed agricultural products. There are 1,088 local agricultural cooperatives, 218 marketing cooperatives specialized in fruits, vegetables, and livestock products. While local cooperatives operate RPCs (Rice Milling and Processing Centers) and APCs (Agricultural Products Processing Centers), NACF (National Agricultural Cooperative Federation) operates various wholesale and retail businesses. NACF operates Ansung agro-food distribution center which is designed to carry out wholesaling functions exclusively. According to Korea Agro-fisheries & Food Trade Corporation (KAFTC), for 20 items, average marketing margin ratio of the distribution center channel was 6.7% point lower than that of the wholesale market channel in 2012 (45.5% versus 52.2%). Higher marketing efficiency of the distribution center channel can be explained by shortening marketing stages by the distribution center. While marketing stages of the wholesale market channel are five or six, those of the distribution center channel are less than four. The NACF distribution center carries out combined functions of corporate wholesalers (auctioneer) and jobbers. Development strategies for cooperatives’ distribution centers are suggested as follows. Firstly, agro-food distribution centers should perform excellent coordinating functions between retail customers and local cooperatives who supply agricultural products. Secondly, the food distribution centers have to provide not only good products, but also excellent services to customers. They need to provide high-quality retail support functions to retail buyers and to provide extension service to agricultural producers. Thirdly, they also have to provide state-of-art logistics services in the area of order fulfillment, delivery, operation, and etc. Fourthly, they have to devise ways to decrease logistics cost by adopting automation, standardization, scaling up, technologies reducing labor cost, and etc.

Key words: agricultural marketing, efficiency, distribution center, marketing margin, logistics

Introduction

Agricultural marketing, a bridge between producers and consumers, is related to the activities taken places in the whole process in which agricultural products move from producers to consumers. The effective agricultural marketing system ensures efficient connection between farmers and consumers, and rapid transfer of consumers’ needs to production process. Having efficient agricultural marketing system will then help to develop not only the agricultural sector but also national economy as a whole. Therefore, it is nationally an important task to establish an efficient food marketing system.

Having efficient agricultural marketing system is more important in developing countries than in developed countries, for two distinctive reasons. First, in fast-growing countries, urban areas develop rapidly due to a large migration of population from rural to urban areas. As urban areas grow, it becomes more important for a nation to efficiently supply food to urban people. Moreover, developing countries need to reduce marketing margin of agricultural goods in order to be competitive in international markets. The efficient agricultural marketing system will help reaching this goal by reducing distribution costs to overseas markets.

In Korea, National Agricultural Cooperatives Federation (NACF) operates food distribution centers whose operation system is different from that of agricultural wholesale markets. According to Korea Agro-fisheries & Food Trade Corporation (KAFTC), average marketing margin ratio of the distribution center channel was lower than that of the wholesale market channel. This implies that NACF food distribution centers are operated in a more efficient manner than agricultural wholesale markets. While marketing stages of the wholesale market channel are five or six, those of the distribution center channel are less than foour. NACF distribution centers carry out combined functions of corporate wholesalers (auctioneer) and jobbers.

This paper summarizes situation of cooperative’s food distribution centers, and compares marketing efficiency between cooperative’s food distribution centers and agricultural wholesale markets. Also suggested is development strategies of cooperative’s food distribution centers. The paper is organized as follows: Following introduction, sections two introduces agricultural marketing system and situation of cooperatives’ food distribution in Korea. Section three evaluates marketing efficiency of agro-food distribution centers operated by Korean agricultural cooperatives. Lastly, section four suggests development strategies of agro-food distribution centers

Agricultural Marketing System and Situation of Cooperative’s Food Distribution Centers

1. Agricultural Marketing System in Korea

Agricultural products in Korea have a complex distribution system due to their unique nature of small farming units and small food retailers.

Rice, the most common crop in Korea, follows a marketing process from farmers to final consumers through rice processing centers (RPCs) or milling complexes. While government procurement decreases, procurement by cooperatives increases. Unlike other products, wholesale markets in large urban area do not play an important role in distributing rice.

Fruits and vegetables are distributed through marketing stages of farmers → local shipping organization → wholesale markets→ retailers → consumers. Local shipping institutions are mostly agricultural cooperatives, farming associations, and local traders. In recent years packing plants of fruits and vegetable increase their numbers as Korean government invests a lot of money for the construction of such facilities in shipping areas.

Livestock products pass through marketing stages of farmers → slaughter houses → wholesale markets→ retailers → consumers. Modernized livestock processing centers (LPCs) are increasingly replacing old style slaughter houses.

Fig. 1. Marketing Channels of Agricultural Products in Korea

At the first handler level, agricultural products are mainly distributed through local cooperatives, local assemblers, or local markets. It is estimated that about 43% of marketed fruits and vegetables are sold through local coops, 26% through assemblers, and 15% through local markets (Agricultural and Fishery Marketing Corporation, 2013). Some large-scale producers often ship their products directly to agricultural wholesale markets in urban areas.

There are 1,088 local agricultural cooperatives and 218 marketing cooperatives which are specialized in handling of fruits and vegetables or livestock products. Besides agricultural cooperatives, there are 10,792 farming associations and 3,760 corporate farms.

Some producers sell agricultural products still in the field to local assemblers before harvesting. Selling by forward contract is more easily found in vegetable items than in fruit items. Vegetable items with a high share of forward selling are Chinese cabbage, radish, carrots, potatoes, and etc. Although forward contract arrangements help farmers to avoid risk due to price fluctuations and the problem of labor shortage, producers are sometimes unfairly treated by merchants. Because there are a limited number of local assemblers, bargaining power of farmers is generally weaker than that of merchants.

At the wholesale level, fruits and vegetables are distributed through wholesale markets, NACF (National Agricultural Cooperative Federation) distribution centers, and direct marketing between retailers and shippers.

Wholesale markets located in large urban areas play an important role in most of the agricultural products. Since direct marketing between supermarket chains and shippers takes a small share, most agricultural products are distributed through wholesale markets. However, as large-scale retailers and NACF increase the number of retail stores, the importance of agricultural wholesale markets has decreased in recent years. Especially NACF distribution centers engage in both large-scale retailing and wholesaling.

Major retail outlets of agricultural products are department stores, discount stores, supermarkets, and specialty shops. Since food stores are densely distributed in Korea, average size of food stores is small compared to those of the U.S. and European countries. In Korea, agricultural products are also sold at peddlers and street stalls. The work of peddlers and street stalls is more important for fruits and vegetables than other food items. However, as the number of discount stores and supermarkets increases, more fruits and vegetables are now sold at modernized retailers.

Large scale food retailers have strengthened their position in the retail market through economies of scales generated by chain operation system and direct purchasing of agricultural products from local shippers, such as local cooperative and farming associations.

Total annual sales of discount stores have increased sharply from 2.1 trillion won in 1996 to 47.5 trillion won in 2014. The number of discount stores surpassed 400 in 2008. Discount stores in Korea carry both food and non-food items. Food items account for 58.6 percent of total sales: fresh food 26.4% and processed food 27.3% (Table 1).

Supermarkets also increased total sales as the number of stores increased. Especially operators of discount stores, such as E-Mart, Homeplus, Lotte Mart, increased affiliated small and medium size supermarkets in recent years, replacing traditional small scale local groceries.

In contrast, market share of department stores decreased although their total sales increased from 12.5 trillion won in 1996 to 29.3 trillion won in 2014.

Table 1. Sales of Major Retail Formats in Korea

(Unit: Trillion Won)

Note: 1 US dollar is equivalent to 1,200 Korean Won in 2015.

2. Situation of Agricultural Wholesale Markets

Wholesale markets play an important role in distribution of agricultural products, especially fruits and vegetables. Wholesale markets have various functions including assembling and dis-assembling, price discovery, dissemination of market information, and etc.

There are two types of agricultural wholesale markets in Korea: public wholesale markets and private wholesale markets. Public wholesale markets are constructed using budgets of the central and local governments, and operated by the local governments. In 2014, there were 32 public wholesale markets in large cities. Public wholesale markets are operated by the rules specified in “the Law about Marketing and Price Stabilization of Agricultural and Marine Products.” The Law requires, in the public wholesale markets, all of fruits and vegetables should, in principle, be transacted by auctions in which registered jobbers and institutional buyers participate. Auctions are administered by wholesale corporations which are also in charge of clearing payment to shippers after auctions. Jobbers and institutional buyers usually clear their payment in 3∼15 days but the wholesale corporations mostly clear their payment to farmers or shippers within 2 days. Shippers pay 4∼7% of fees to the wholesale corporation for their services including administrating auctions and clearing payment.

Private wholesale markets, once a dominant form of agricultural wholesale markets, have become less important in agricultural marketing than before. As the number of public wholesale markets have increased, the number of private wholesale markets has decreased in recent years. Since private wholesale markets are owned and operated by private firms, there are no means to regulate merchants in private wholesale markets. Private wholesale markets consist of traditional commission dealers who operate on a consignment basis. They receive fruits and vegetables from farmers or shippers and sell to retailers or consumers, charging 8∼9% of consignment fee to the shippers. Traditional commission wholesalers have been often criticized as conducting unfair trade practices and evading taxes, justifying government’s involvement in the expansion of public wholesale markets.

At the wholesale markets, agricultural products often go through several hands of different wholesalers. Secondary market handlers are sometimes involved in procuring their products from jobbers to service small-volume accounts such as peddlers, small stores, and small restaurants.

Fig. 2. Distribution Process in Agricultural Wholesale Markets

The Korean government financially supported construction of public wholesale markets. The first public wholesale market was established at Garak dong, Seoul city in 1985. Since then 32 public wholesale markets were built by the government..

Transactions in public wholesale markets are carried out in the form of auction, although private treaty between jobbers and shippers is allowed in special cases. Private treaty is allowed only for the products listed by market administrators, such as local governments.

Institutions in public wholesale markets are market administrators, wholesale corporations, jobbers, and related traders. Market administrators are in charge of managing facilities and monitoring unlawful and unfair trading practices by merchants. Wholesale corporations are in charge of auction by hiring auctioneers and of paying bills to shippers. When shippers or producers participate in auction, they have to pay commission charge by 4∼7% to wholesale corporations. Jobbers buy agricultural products by participating in auctions and sell them to retailers. Other market participants are various types of retailers, agricultural producers, and consumers. Besides various types of traders, there are many institutions supporting transactions in markets, such as truckers, loading and unloading crews, banks, and food safety inspectors.

Public wholesale markets have contributed to enhance efficient flow of agricultural products and to build stable sales outlets for agricultural producers. They have contributed to make price discovery process more transparent for agricultural products and to secure payments to farmers. Establishment of the auction system has enabled farmers to supply their products steadily in secure condition in payment settlement. Wholesale markets have also allowed consumers to get a steady supply of agricultural products despite the rapid urbanization of the nation.

Wholesale markets, however, have stagnated in recent years due to some limitations. First of all, wholesale markets do not react rapidly to changes in food retail structure. Wholesale markets do not perform well in supplying agricultural products to large scale retailers who want stable prices and standardized products. Agricultural products traded in wholesale markets are, in most cases, not well standardized in terms of quality and size. It is also argued that prices formed in wholesale markets have been excessively fluctuated. Because of these limitations, large scale retailers are increasing the share of direct purchase from producer organizations, such as agricultural cooperatives and farming associations. As the number of large scale retailers increased sharply since the late 1990s, the importance of wholesale markets has decreased significantly.

In addition, agricultural wholesale markets incur more marketing cost than other marketing channels because agricultural products go through many marketing stages. Higher fees and logistics costs are also charged in agricultural wholesale markets.

3. Situation of Cooperative Marketing in Korea

Cooperative marketing in agricultural products implies participation of marketing and processing functions by farmers or producers as a form of forward integration.

Benefits of cooperatives are a decrease in transaction costs, an increase in bargaining power by cartelization, an increase in counter-veiling power against monopolized marketing and processing firms (competitive yardstick), and diversification of agricultural producers to processing or marketing as new income sources.

Cooperative marketing plays an important role in connecting farmers with consumers. While bargaining coops are formed for bargaining for price and other terms of trade, general marketing coops perform full marketing functions, such as grading, processing, packaging, labeling, storage, distribution, merchandising, etc. Especially marketing cooperatives may improve quality by adequate sorting and grading, and have stronger bargaining power by pooling of members’ products and marketing agreement with producers.

In Korea, agricultural cooperatives account for about 40 percent of total marketed agricultural products. There are 1,088 local agricultural cooperatives, 218 marketing cooperatives for fruits, vegetables, and livestock products. The Korean government has nurtured agricultural cooperatives by providing low interest rate operating funds and subsidizing construction cost of marketing facilities in rural areas. In particular the Korean government is subsidizing 30∼40% of total construction cost of marketing facilities for agricultural cooperatives.

Characteristics of agricultural cooperatives in Korea are as follows: Korean agricultural cooperatives are multi-function cooperatives which carry out several functions of credit, insurance, marketing, supply, and other services. They also have two stage organizational structures: local cooperatives and a national federation (NACF, National Agricultural Cooperative Federation). While local cooperatives operate RPCs (Rice Milling and Processing Centers) and APCs (Agricultural Products Processing Centers), NACF operates various wholesale and retail businesses. Korean agricultural cooperatives participates various PPP (Public and Private Partnership) programs in the form of participation in various governmental marketing programs, such as buffer stock programs, price stabilization programs, and etc.

NACF (National Agricultural Cooperatives Federation) currently operate 15 integrated food distribution centers all over the country. While integrated food distribution centers in Korea carry out both wholesaling and retailing at one place, retail is more emphasized in some centers. As a trading method, NACF integrated food distribution centers adopt private treaty unlike wholesale markets, which adopt the auction system. Functions of distribution centers are unloading, unpacking, inspecting, receiving, handling, storing, consolidation, picking, retrieving, replenishing, packing, sorting, palletizing, loading/shipping, order processing, documentation, cycle counting, inventory control, tracking, and etc (Figure 3).

Total sales of NACF integrated food distribution centers are 2.9 trillion won in 2013. While retail sales account for 60.7% of total sales, wholesale sales account for about 39.3%. The share of total sales accounted for by agricultural products, such as rice, fruits and vegetables, livestock products, and fishery products is about 60 percent. Processed food and non-food items account for remaining 40 percent of total sales.

It is often argued that wholesale food distribution centers have lower marketing margin and higher efficiency than wholesale markets because they can reduce marketing stages of agricultural products. However, it is criticized that NACF distribution centers focus more on retailing rather than wholesaling which is supposed to be the main business.

Fig. 3. Functions of Food Distribution Centers of NACF

In order to focus more on wholesaling, NACF constructed and opened Ansung agro-food distribution center in 2013. Ansung distribution center is designed to carry out wholesaling functions exclusively. Therefore, 100% of sales of Ansung distribution center are related to wholesaling. However, about 90% of wholesale sales are generated by NACF stores, such as wholesale distribution centers, and retail stores operated by NACF and local cooperatives. Remaining 10% are accounted for by non NACF stores, such as discount store and supermarket chains, small size grocery, school lunch, and etc.

Currently, Ansung agro-food distribution center carries only fruits and vegetables. Fruits and vegetables account for 46% and 45.4% of total sales, respectively. Ansung distribution center also carries eco-friendly agricultural products, such as organic or non-pesticide fruits and vegetables. Eco-friendly products account for 8.4% of total sales.

As for sourcing, Ansung distribution center purchases fruits and vegetables mainly from local agricultural cooperatives, and federation of local cooperatives. Ansung distribution center operates consumer packaging and fresh cut facilities. Consumer packages and fresh cut products account for about 7% of total sales.

Fig. 4. Scene of Ansung Agro-food Distribution Center

Evaluation of Efficiency in Agricultural Marketing System

1. Goals of Agricultural Marketing Policies

Enhancing efficiency is one the most important goals of agricultural marketing policies as shown below.

a. Physical efficiency

Physical efficiency relates to costs incurred in the process of food marketing. One of the government’s goals is to minimize food marketing costs or, in other words, to maximize physical efficiency of food marketing. In order to increase physical efficiency of food marketing, it is necessary not only to abolish unnecessary marketing functions or stages, but also to increase the size of wholesalers and retailers for utilizing economies of scale.

b. Pricing efficiency

Pricing efficiency relates to keeping market prices to be competitive. It is desirable for the government to have fair pricing schemes without any unfair influence from particular traders. Such pricing efficiency can be attained by having competitive selling and buying structure. When the market operates under perfectly competitive environment, pricing efficiency can be fully reached.

c. Stability

It is also desirable that prices of agricultural products are stabilized. Stability refers to pricing mechanism which makes prices of agricultural products stable. Maintaining stable prices of agricultural products is quite crucial for stabilizing farmers’ income.

d. Transaction cost

It is important to have low transaction costs, such as monitoring cost, enforcement cost, and so forth. Transaction costs can be defined as costs generated by opportunistic behaviors of market participants. It is more common to have higher transaction costs under spot market transactions than under long-term contract relationship. Therefore, it is suggested that market participants adopt contracting or vertical integration rather spot market transactions.

e. Accessibility

In order to increase accessibility, the government needs to have marketing systems without foreclosing participation of small farmers. Nowadays, as direct trade between farmer organizations and large-scale retailers has increased, small farmers may not have places to sell their products and accessibility problem of small farmers have emerged. In order to solve these problems, the government should provide market places for small farmers by establishing alternative market outlets, such as farmers markets or some other types of direct marketing.

2. Comparison of Marketing Efficiency between Wholesale Markets and Distribution Centers

Efficiency of the food marketing system may be evaluated by ratio of marketing margin to consumer prices. The ratio of marketing margin to consumer prices is calculated by the below formula. Marketing margin consists of costs and profits incurred during marketing of agricultural products.

Korea Agro-fisheries & Food Trade Corporation (KAFTC) analyzes and publishes marketing margins of major agricultural products every year. An average marketing margin ratio of 48 agricultural products is 43.9%, which consists of 14.1% of direct cost, 14.9% of indirect cost, and 14.9% of profit. According to Korea Agro-fisheries & Food Trade Corporation, marketing margin ratio of the agro-food distribution center channel is, on average, lower than those of the wholesale market channel. When comparing 20 items, average marketing margin ratio of the distribution center channel was 6.7% point lower than that of the wholesale market channel in 2012 (45.5% versus 52.2%) (Table 2).

Lower marketing margin ratio of the distribution center channel can be explained by shortening marketing stages by the distribution center. While marketing stages of the wholesale market channel are five or six, those of the distribution center channel are less than four. NACF distribution centers carry out combined functions of corporate wholesalers (auctioneer) and jobbers.

Table 2. Differences in Marketing Margin Ratios between the Wholesale Market Channel and the Distribution Center Channel (2012)

(unit: %)

Source: Korea Agro-fisheries & Food Trade Corporation, 2013.

Development Strategies of Cooperative’s Food Distribution Centers

Although the NACF agro-food distribution center is operated more efficiently than agricultural wholesale markets, its sales are below than the break-even point level. Therefore, the Ansung agro-food distribution center needs to think about various ways to improve its competitiveness and to increase its sales.

As a wholesale institution, the agro-food distribution center has to think about below key success factors (KSFs).

Firstly, agro-food distribution centers should perform excellent coordinating functions between retail customers and local cooperatives who supply agricultural products. The distribution center has to satisfy interests of both parties equally and efficiently.

Secondly, the food distribution centers have to provide not only good products, but also excellent services to customers. They need to provide high-quality retail support functions to retail buyers and to provide extension service to agricultural producers.

Thirdly, they also have to provide state-of-art logistic services in the area of order fulfillment, delivery, operation, and etc.

Fourthly, they has to devise ways to decrease logistics cost by automation, standardization, scaling up, reducing labor cost, and etc.

Based on the key success factors of distribution centers, eight development strategies are suggested for the Ansung agro-food distribution center as follows:

1. Strengthening fresh cut product business

Although the Ansung agro-food distribution center operates fresh cut processing facilities, sales of those products are much less than the break- even point level and there is a room for increasing sales. Above all, Ansung center should increase sales through diversifying sales outlets of fresh cut products to large discount stores, supermarkets, school lunch, and etc.

2. Provision of retail support services

Providing retail support service to customers is quite crucial for the success of the distribution center business. Defined as the activities which can help to increase competitiveness of retail customers, retail support services (RSS) include education and training, consulting services to the retail customers. Therefore the Ansung agro-food distribution center has to provide various education and consulting services to its retail customers.

3. Integrated supply of various products, including rice and livestock products

To increase convenience of retail customers, it is desirable to supply rice and livestock products together with fruits and vegetables which the Ansung distribution center currently supplies.

4. Expanding various sales outlets

Currently, sales of Ansung agro-food distribution center rely too much on retail stores operated by NACF or local cooperatives. In order to increase sales, the distribution center should increase sales to discount store and supermarket chains which are operated by large scale retailers, such as E-Mart, Lotte Mart, and Homeplus. It also needs to diversity marketing channels to small scale retailers and other types of retailers. In particular, it is recommended for the Ansung distribution center to organize small scale retailers as the voluntary chain.

5. Strengthening Education and Training of Employees

For the success of the distribution center business, it is essential to secure sufficient experts in wholesaling, such as merchandising managers, logistics managers, sales managers, and so forth. Because NACF is not familiar with the new type of wholesaling business like the Ansung distribution center, experts for wholesaling are not sufficiently prepared. Therefore, the NACF is recommended to strengthen education and training programs to nurture experts in the wholesale distribution business.

6. Establishment of supply chain management system

For the success of the distribution center business, it is necessary to adopt the supply chain management system (SCM). The SCM is a logistics skill to help the distribution center efficiently connect the suppliers as well as the retail customers utilizing advanced information and communication technology (ICT) (Figure 6). Utilizing the SCM system, retail customers can order merchandise on line to the distribution center, and successively the distribution center can order merchandise on line to the shippers. In addition, the distribution center can adopt advanced SCM technology such as VMI (Vendor Managed Inventory), which makes the distribution center manage inventory itself using inventory data provided by retail customers.

7. Improvement of logistics service

Quality of logistics service is crucial for the success of the agro-food distribution center. In particular, the distribution center needs to improve logistics accuracy of order fulfillment and delivery time. It is also necessary to save logistics cost by using labor saving logistics equipment, such as forklifts, conveyers, and the digital assortment system.

Fig. 6. Concept of Supply Chain Management

References

Cho, Byung Chan, History of Korea’s Wholesale Markets of Agricultural and Fishery Products, Dongguk Univ. Press., 2003. (in Korea)

Kim, Dong Hwan, "The Effects of Foreign Distributors on the Food Marketing System in Korea, The Korean Journal of Agricultural Economics Vol. 43(4): 141-61, 2002.

Kim, Dong Hwan, "The Effects of Structural Changes in Food Retailing on Agricultural Producers: The Case of Korea,” The Korean Journal of Agricultural Economics Vol. 48(3): 85-112, 2007.

Kim, Dong Hwan et al., A study on Establishing Action Plans of the Ansung Agro-food Distribution Center, Agro-food New Marketing Institute, 2012. (in Korean).

Kim, Dong Hwan, "Situation and Development Strategies of Agricultural Marketing System in Vietnam," The Journal of the Korean Society of International Agriculture Vol 26(2): 98-106, 2014.

Korea Agro-fisheries & Food Trade Corporation, Situation of Marketing of Major Agricultural Products, 2013. (in Korean).

National Agricultural Cooperative Federation of Korea, Situation of Ansung Agro-food Distribution Center, 2015. (in Korean)

Stiegert, Kyle W. and Dong Hwan Kim (ed.), Structural Changes in Food Retailing, FSRG Monograph #22, Department of Agricultural and Applied Economics, University of Wisconsin-Madison, 2009.