ABSTRACT

-

The livestock producers in Japan continued to be exposed to the wave of the free trade such as TPP (Trans-Pacific Partnership) and EPA (Economic Partnership Agreement).

-

In the past, livestock producers in Japan was exposed to the competition against the low priced imported beef from North America and Oceania after reached agreements of the liberalization of U.S. and Australia in 1991 and liberalization of the beef by the agricultural Agreement of the Uruguay round reached in 1994.

-

As a result, the Ministry of Agriculture, Forestry and Fisheries of Japan attempted in differentiation for the legislation of WAGYU labeling requirement, as well as making it a brand beef and at the same time carried forward the food safety procedures such as the traceability of the domestic beef, in order to encourage the Japanese Cattle production should not compete with the import beef directly. As a result, Japanese Wagyu Cattle is becoming the major breed in Japanese beef production.

-

Specifically, however, a Wagyu Cattle is needed to be fed for an extended period (Almost more than 30 months) in order to make a marble beef and most of Japanese Cattle feeders are not able to make good profit for long time due to high price of feeder cattle as well as high price of grain feeds.

-

The reason for a higher cost of the Japanese beef is mainly due to expensive feeder cattle, high cost for long feeding, environment expenditures, materials and personnel costs expenses.

-

Under such a difficult environments, the Tokachi-Shimizu-cho Agricultural Cooperative (JA Tokachi-Shimizu) started the efforts establishing a new fattening business using castrated dairy breed (Holstein steer) in Tokachi area Hokkaido where is dairy farming district and tries the production of the low cost domestic beef against the low-priced imported beef.

-

As to the fattening of a dairy breed steer, there is not much seen apart from Japan, as far as I know.

-

While this report explains the world beef situation, as well as situations in Japan with the fact of trade deregulation surrounding Japan, I would like to report on the challenge of JA Tokachi-Shimizu against the intensively free trade wave.

-

Key words: Tokachi-Shimizu Agricultural Cooperative Hokkaido Beef Holstein Wagyu

INTRODUCTION

Undoubtedly, the wave of the deregulations of trade such as TPP and EPA are approaching closer and closer to the livestock and the dairy farming industries.

The livestock industry in Japan, specifically, the beef producer has been exposed to the competition with the low cost imported beef from the U.S. and Australia after the import liberalization of the beef by the Uruguay round agriculture Agreement (the Marrakech Agreement) 1994.

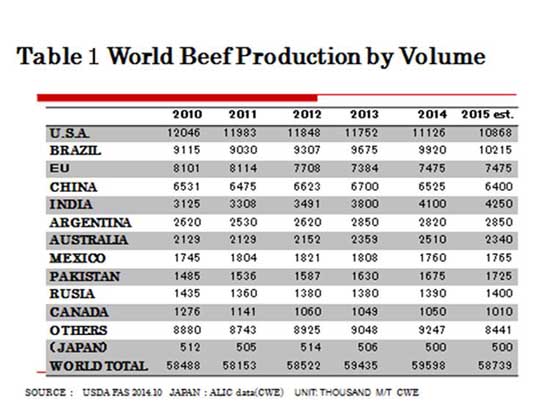

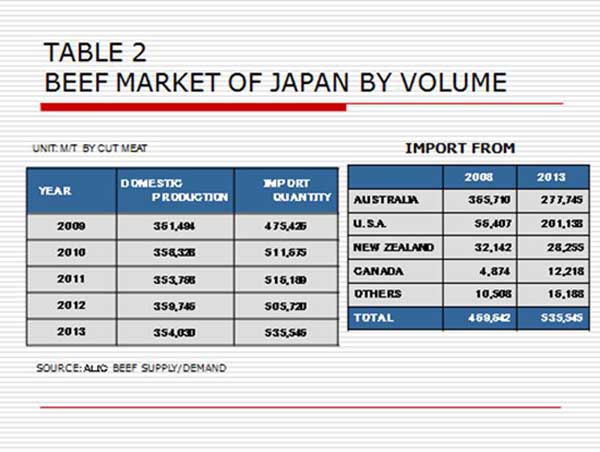

Table 1 shows the world beef production. Japan’s beef production is too small covering the domestic consumption, accordingly Japan need to import beef from North America and Oceania (Ref: Table 2, about 60% of the total demand quantity :).

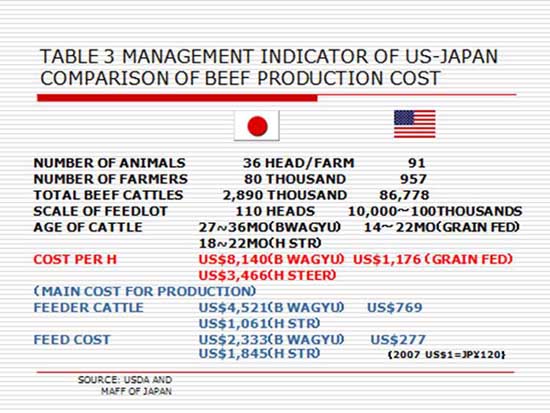

As shown in Table 3, Costs between Japanese beef and U.S. beef are mainly due to Japan’s expensive feeder cattle, high feed costs for long feeding, environment expenditures, material costs, and personnel expenses. Because of limited land and pasture for cattle grazing in Japan, our farmers are not able to produce beef in quantities at low cost like the U.S. and Australia.

In Japan, majority of cattle farmers need to use imported feed-crops and even hays by very high delivery cost from North America and Australia. There are the major reasons why the production cost of beef in Japan becomes quite high. Livestock industry in Korea and Taiwan are seemed to be in similar conditions as Japan heavily relaying on imported feed grains.

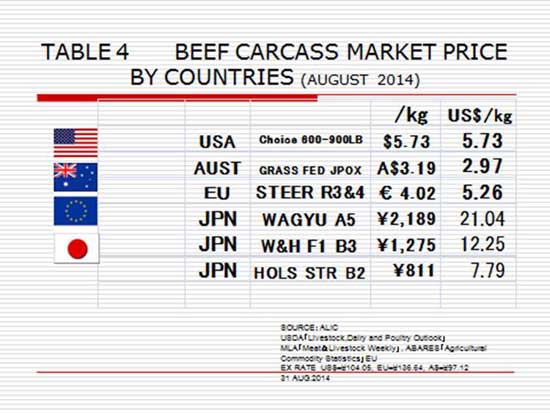

Here, I would like to describe how high cost Japanese beef has competed and been managed to survive against much lower prices (Ref. Table 4) US Beef and Ausie beef after the Uruguay round.

After the Uruguay round (the Marrakech Agreement) in 1994, Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) felt a Crisis Atmosphere. It decided Japan specializing to produce expensive well-marbled beef targeted to the niche market, by doing the long-range fattening of the Japanese Wagyu Cattle (more than 30 months of age) by expending import duty income in imported beef to support Japanese beef producers. This strategy is seemed to have succeeded to a certain degree.

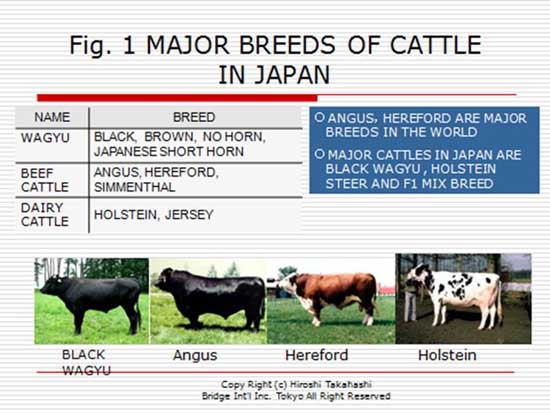

Incidentally, beef cattle fattened in Japan are mainly Wagyu Cattle, Wagyu-Holstein F1, and Holstein Steers, different from the beef cattle breeds in North America and Oceania. (Ref. Fig. 1).

Photo: Japan National Beef Promotion fund Association

However, it resulted in oversupplying situation due to the too many participants of classy marble beef production. The deflation economy in Japan at that time also made market price flounder for long period. Then after, running parallel with the producer aging, the number of the Japanese Cattle producers continued declining, lower to the level of 57500 houses (6% down over the previous years for straight 4 years) in July 2014 from 80,000 houses in 2007.

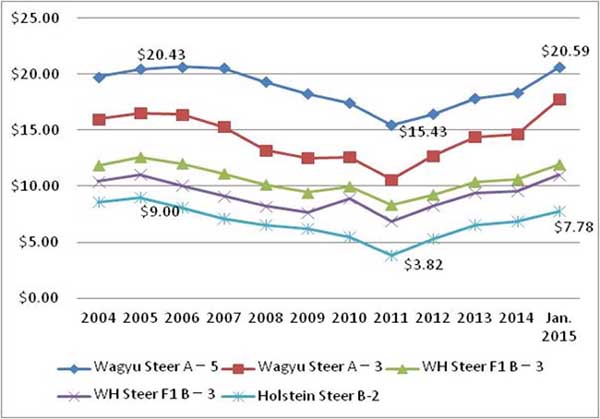

As a result, the price of the Japanese Cattle is rising from 2012 from the decrement of the production. (Fig. 2).

Fig. 2. Japanese Beef Market (Carcass)

Unit: US$/kg

ex rate JP120

Source: ALIC beef market report graphed by author

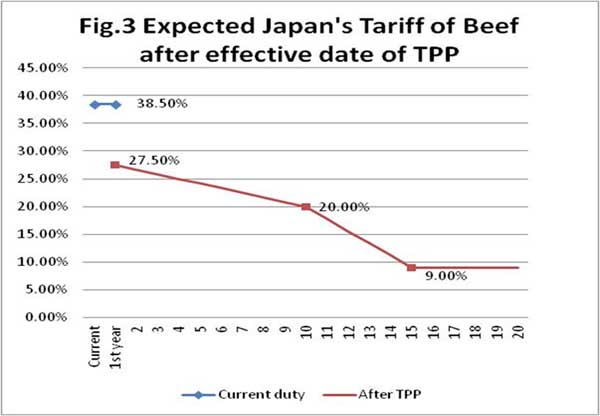

Now it’s about the TPP of which negotiations are stopped at present, however the import duties of the beef in the final adjustment plan after the effectuation of TPP is expected to be following, according to the News paper reports.

-

It comes down to 27.5% from current 38.5% at the time of the effectuation.

-

Then after, tariff is scheduled to be cut down to the level of 9%, in the 15th year. (Ref. Fig. 3 Expected Japan’s Tariff for Beef after effective date of TPP).

DATA SOURCE:JAPAN AGRI NEWS 2015/8/14 GRAPHED BY AUTHOR

Accordingly, Japanese beef producers will have to face difficulties by to the further low-cost imported beef resulting from expected sharp cut in import duties. In addition, currently available beef producer’s subsidies funding from about US$1200million revenue from beef import duty, will most likely be reduced by about 50% 10 years later, and further cut down to 25% in 15 years later.

Namely, the wave of trade liberalizations with TPP in the lead, Japanese beef producers will have to face with double severe situation, while suffering from declining beef prices and decreasing subsidies due to the lowered import tariff.

Under such an environment, there is an agricultural cooperative in Hokkaido, Japan, producing a high quality beef at low cost over 15 years. It is intended to introduce precisely on the efforts and achievements performed by the agricultural cooperative.

Case of TOKACHI WAKAUSHI (TOKACHI Yearling Beef) of the Tokachi-Shimizu agricultural cooperative

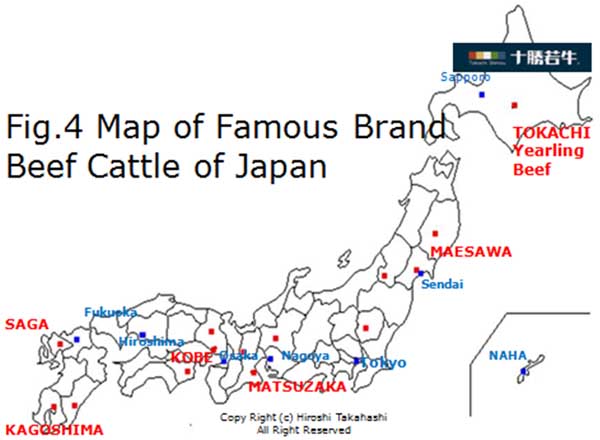

Tokachi-Shimizu is a beautiful small town with 9900 populations, situated on the center in Hokkaido Japan, 3 hours by a car from Sapporo. The climate is cool and average temperature in January is -6.4°C and in August, even the warmest month, is average 20.1°C. The main industry is a dairy farming, a livestock producing and upland field cropping such as the asparagus etc. (Ref. Fig. 4 Japan map).

PHOTO1 “FARM IN TOKACHI”

© JA TOKACHI SHIMIZU

An overview of the project

Tokachi-Shimizu Agriculture cooperative (JA Tokachi-Shimizu) succeeded in making its farmers group to produce high quality Holstein steers (castrated dairy breed). Usually Holstein steers are by-products from dairy industry.

The Tokachi-Shimizu Holstein steer farmers shortened its period of the cereals fatting, making lower cost and better cash flow while keeping high quality. Through their own unique marketing, they established “TOKACHI WAKAUSHI” brand in the major markets such as Tokyo and Osaka Japan.

The production project for TOKACHI WAKAUSHI (TOKACHI yearling beef) is started in 1996 and 6 years later (2002), 4 farmers supplied 1400 heads of Tokachi Yearling Beef, and 12years later (2014) 6 farmers supplied 5500 steers.

PHOTO 2: Holstein Yearling Steer “TOKACHI WAKA USHI”

© JA TOKACHI SHIMIZU

Also, 12years ago, Tokachi Yearling Beef was average 14months old, with average live weight: 600kgs and average carcass weight: 320kgs, however they have now succeeded in gaining more live weight and carcass weight while reducing feeding period i.e. average age: 13.5months, average live weight: 620~630kg, average carcass weight: 330~340kg. These KAIZEN (improvement) were mainly done in improving its feeds components. Tokachi Yearling Beef is more profitable than regular 20 months old Holstein steer.

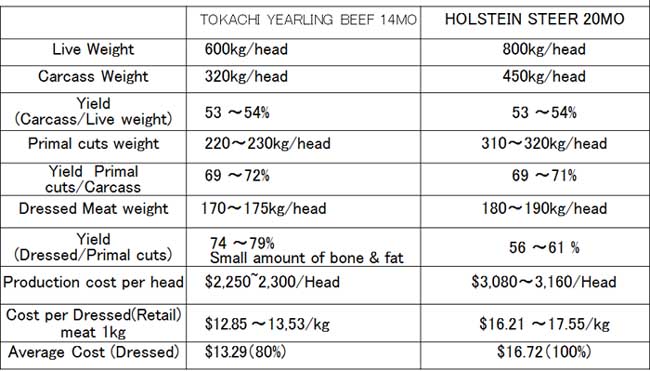

Table 5. Comparison of Tokachi Yearling beef (140 months) and ordinary Holstein steer (20 months)

Source: For the value chain construction of the TOKACHI WAKAUSHI, 2013 JMI ALIC

Translated by Author.

Dressed (Retail) meat weight of regular Holstein steer is worse than TOKACHI Yearling beef as shown on the table 5. The reason is that regular Holstein steers has much weight of a bone and a fat. Therefore, the production cost of TOKACHI Yearling beef is 20% lower than 20months age regular Holstein steer.

Photo 3. Carcass of Tokachi Yearling Beef

Photo © Kenji Yamamoto

On top of that, the characteristic of the TOKACHI Yearling beef (TOKACHI WAKAUSHI) is keeping even carcass size, with weight uniformity, as for the flesh color, they are brightly as a whole, and the change of meat color is slow and remaining steady. The biggest feature of this beef is “Tenderness” of every cut with little fat content, thus resulting in very healthy beef, easy-to- eat even for anyone from children to aged people.

Photo 4. TOKACHI Yearling Beef Loins. © JA TOKACHI-SHIMIZU

This project has not simply shortened fattening periods of the Tokachi yearling beef to 13 to 14 months. In order to shorten the fattening period, while maintaining a certain degree of quality, JA Tokachishimizu repeated long-term trial and error over long period feeding method by age and recipe of the feed.

Also JA Tokachi-Shimizu advocated in establishing TOKACHI WAKAUSHI (TOKACHI Yearling Beef) Council comprising of the Beef producers, University, Tokachi-Shimizu Food Service (Meat processor, founded by JA Tokachi-Shimizu) and ZEFCO (Meat distributor) and Advisers. The Council has set up Advisors Board, comprising 6 experts for scientific verification and marketing.

Fig. 5. TOKACHI WAKAUSHI COUNSIL

Obihiro University of Agriculture and Veterinary Medicine

↓

↓ ← Advisory Board (6 specialists)

↓ (Marketing, Processing, QC etc.)

Tokachi Farmers →JA Tokachi Shimizu ← Tokachi Shimizu Food Service

(Executive Secretariat) (Processing)

↑

ZEFUCO

(Sales, Marketing)

Photo 5. TOKACHI Yearling Beef Logo and Sukiyaki sliced Beef

© JA TOKACHI SHIMIZU (Left), © Kenji Yamamoto (Right)

JA Tokachishimizu established Tokachi food service Company by investing 100% for boning, processing, cooking and selling by themselves.

JA Tokachishimizu is selling their yearling beef not only via ZEFUCO, but also directly selling to the end user such as restaurants and meat shops, through which they can collect comments, needs directly for a further improvement. As result of their effort has been raising the brand value of the TOKACHI Yearling beef, they succeeded raising 10~15% higher sales price for TOKACHI Yearling Beef than other regular Holstein steers. JA Tokachishimizu is aiming to export their Yearling beef to Asian countries in future.

CONCLUSION

In case of Japanese traditional type agricultural cooperative, its role is to collect farmer’s products and selling them at public markets. Therefore, not many agricultural cooperative did direct marketing to consumers. As a result, a number of agricultural cooperatives are exposed to the wave of the free trade without making appropriate improvement to follow the changes in the market.

However, in case of the TOKACHI Yearling Beef, an Agricultural cooperative has consistently achieved a business using Holstein steers, which was not valued world-widely before, as a high quality beef cattle at low production cost for a further processing and distribution to the market.

Currently they are successfully competing against the U.S. and Australian beef by conducting market survey and promotional activities by themselves, as well as participating in various events for further increasing consumer recognition and brand image, through which they have expanded sales routes and increasing returns.

I shall be more than happy if this report covering various activities developed by JA Tokachi-Shimizu for further giving additional value for Holstein Yearling Steers should be of any reference for the other every Asian country.

REFERENCES

-

ALIC (2014). Livestock and Livestock Products Statistical data Web: http://lin.alic.go.jp/alic/statis/dome/data2/e_nstatis.htm

-

Japan Agri News (2015/8/14) “Tariff of Beef will be 9% for all TPP participating Nations”. TPP News update 3. Nippon Nogyo Shimbun

-

Kenji Yamamoto (2012). “Do you know TOKACHI WAKAUSHI ?”. Yamaken food & restaurant diary. Web: http://www.yamaken.org/mt/kuidaore/archives/2012/04/ja_2.html

-

Masayoshi Honma, Kazuhiko Hotta, Hiroshi Takahashi, Tetsuhide Mikamo, Seiji Mitsuishi (2014). “Food 2040 report” Report on Japan’s Contribution to Growing Food Markets in Asia U.S. Grain Counsil Web: http://grainsjp.org/cms/wp-content/uploads/Report-final_E.pdf

-

Satoru Sasaki (2014). For the value chain construction of the TOKACHI WAKAUSHI, 2013 Challenge to new demand creation for domestic beef. 27-35, Japan Meat Information Service Center.

-

Shigeru Okada (2002). About producing and marketing of "TOKACHI WAKAUSHI". ALIC Monthly “Livestock Information” 2002.12, Agriculture & Livestock Industries Corporation, Japan.

-

USDA FAS (2014) Beef and Veal Selected Countries Summary - Production / Consumption.

-

|

Submitted as a resource paper for the FFTC-NACF International Seminar on Improving Food Marketing Efficiency—the Role of Agricultural Cooperatives, Sept. 14-18, NACF, Seoul, Korea |

A new vision of growth for the beef industry and the expected roles of agricultural cooperatives in Hokkaido, Japan

ABSTRACT

Key words: Tokachi-Shimizu Agricultural Cooperative Hokkaido Beef Holstein Wagyu

INTRODUCTION

Undoubtedly, the wave of the deregulations of trade such as TPP and EPA are approaching closer and closer to the livestock and the dairy farming industries.

The livestock industry in Japan, specifically, the beef producer has been exposed to the competition with the low cost imported beef from the U.S. and Australia after the import liberalization of the beef by the Uruguay round agriculture Agreement (the Marrakech Agreement) 1994.

Table 1 shows the world beef production. Japan’s beef production is too small covering the domestic consumption, accordingly Japan need to import beef from North America and Oceania (Ref: Table 2, about 60% of the total demand quantity :).

As shown in Table 3, Costs between Japanese beef and U.S. beef are mainly due to Japan’s expensive feeder cattle, high feed costs for long feeding, environment expenditures, material costs, and personnel expenses. Because of limited land and pasture for cattle grazing in Japan, our farmers are not able to produce beef in quantities at low cost like the U.S. and Australia.

In Japan, majority of cattle farmers need to use imported feed-crops and even hays by very high delivery cost from North America and Australia. There are the major reasons why the production cost of beef in Japan becomes quite high. Livestock industry in Korea and Taiwan are seemed to be in similar conditions as Japan heavily relaying on imported feed grains.

Here, I would like to describe how high cost Japanese beef has competed and been managed to survive against much lower prices (Ref. Table 4) US Beef and Ausie beef after the Uruguay round.

After the Uruguay round (the Marrakech Agreement) in 1994, Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) felt a Crisis Atmosphere. It decided Japan specializing to produce expensive well-marbled beef targeted to the niche market, by doing the long-range fattening of the Japanese Wagyu Cattle (more than 30 months of age) by expending import duty income in imported beef to support Japanese beef producers. This strategy is seemed to have succeeded to a certain degree.

Incidentally, beef cattle fattened in Japan are mainly Wagyu Cattle, Wagyu-Holstein F1, and Holstein Steers, different from the beef cattle breeds in North America and Oceania. (Ref. Fig. 1).

Photo: Japan National Beef Promotion fund Association

However, it resulted in oversupplying situation due to the too many participants of classy marble beef production. The deflation economy in Japan at that time also made market price flounder for long period. Then after, running parallel with the producer aging, the number of the Japanese Cattle producers continued declining, lower to the level of 57500 houses (6% down over the previous years for straight 4 years) in July 2014 from 80,000 houses in 2007.

As a result, the price of the Japanese Cattle is rising from 2012 from the decrement of the production. (Fig. 2).

Fig. 2. Japanese Beef Market (Carcass)

Unit: US$/kg

ex rate JP120

Source: ALIC beef market report graphed by author

Now it’s about the TPP of which negotiations are stopped at present, however the import duties of the beef in the final adjustment plan after the effectuation of TPP is expected to be following, according to the News paper reports.

DATA SOURCE:JAPAN AGRI NEWS 2015/8/14 GRAPHED BY AUTHOR

Accordingly, Japanese beef producers will have to face difficulties by to the further low-cost imported beef resulting from expected sharp cut in import duties. In addition, currently available beef producer’s subsidies funding from about US$1200million revenue from beef import duty, will most likely be reduced by about 50% 10 years later, and further cut down to 25% in 15 years later.

Namely, the wave of trade liberalizations with TPP in the lead, Japanese beef producers will have to face with double severe situation, while suffering from declining beef prices and decreasing subsidies due to the lowered import tariff.

Under such an environment, there is an agricultural cooperative in Hokkaido, Japan, producing a high quality beef at low cost over 15 years. It is intended to introduce precisely on the efforts and achievements performed by the agricultural cooperative.

Case of TOKACHI WAKAUSHI (TOKACHI Yearling Beef) of the Tokachi-Shimizu agricultural cooperative

Tokachi-Shimizu is a beautiful small town with 9900 populations, situated on the center in Hokkaido Japan, 3 hours by a car from Sapporo. The climate is cool and average temperature in January is -6.4°C and in August, even the warmest month, is average 20.1°C. The main industry is a dairy farming, a livestock producing and upland field cropping such as the asparagus etc. (Ref. Fig. 4 Japan map).

PHOTO1 “FARM IN TOKACHI”

© JA TOKACHI SHIMIZU

An overview of the project

Tokachi-Shimizu Agriculture cooperative (JA Tokachi-Shimizu) succeeded in making its farmers group to produce high quality Holstein steers (castrated dairy breed). Usually Holstein steers are by-products from dairy industry.

The Tokachi-Shimizu Holstein steer farmers shortened its period of the cereals fatting, making lower cost and better cash flow while keeping high quality. Through their own unique marketing, they established “TOKACHI WAKAUSHI” brand in the major markets such as Tokyo and Osaka Japan.

The production project for TOKACHI WAKAUSHI (TOKACHI yearling beef) is started in 1996 and 6 years later (2002), 4 farmers supplied 1400 heads of Tokachi Yearling Beef, and 12years later (2014) 6 farmers supplied 5500 steers.

PHOTO 2: Holstein Yearling Steer “TOKACHI WAKA USHI”

© JA TOKACHI SHIMIZU

Also, 12years ago, Tokachi Yearling Beef was average 14months old, with average live weight: 600kgs and average carcass weight: 320kgs, however they have now succeeded in gaining more live weight and carcass weight while reducing feeding period i.e. average age: 13.5months, average live weight: 620~630kg, average carcass weight: 330~340kg. These KAIZEN (improvement) were mainly done in improving its feeds components. Tokachi Yearling Beef is more profitable than regular 20 months old Holstein steer.

Table 5. Comparison of Tokachi Yearling beef (140 months) and ordinary Holstein steer (20 months)

Source: For the value chain construction of the TOKACHI WAKAUSHI, 2013 JMI ALIC

Translated by Author.

Dressed (Retail) meat weight of regular Holstein steer is worse than TOKACHI Yearling beef as shown on the table 5. The reason is that regular Holstein steers has much weight of a bone and a fat. Therefore, the production cost of TOKACHI Yearling beef is 20% lower than 20months age regular Holstein steer.

Photo 3. Carcass of Tokachi Yearling Beef

Photo © Kenji Yamamoto

On top of that, the characteristic of the TOKACHI Yearling beef (TOKACHI WAKAUSHI) is keeping even carcass size, with weight uniformity, as for the flesh color, they are brightly as a whole, and the change of meat color is slow and remaining steady. The biggest feature of this beef is “Tenderness” of every cut with little fat content, thus resulting in very healthy beef, easy-to- eat even for anyone from children to aged people.

Photo 4. TOKACHI Yearling Beef Loins. © JA TOKACHI-SHIMIZU

This project has not simply shortened fattening periods of the Tokachi yearling beef to 13 to 14 months. In order to shorten the fattening period, while maintaining a certain degree of quality, JA Tokachishimizu repeated long-term trial and error over long period feeding method by age and recipe of the feed.

Also JA Tokachi-Shimizu advocated in establishing TOKACHI WAKAUSHI (TOKACHI Yearling Beef) Council comprising of the Beef producers, University, Tokachi-Shimizu Food Service (Meat processor, founded by JA Tokachi-Shimizu) and ZEFCO (Meat distributor) and Advisers. The Council has set up Advisors Board, comprising 6 experts for scientific verification and marketing.

Fig. 5. TOKACHI WAKAUSHI COUNSIL

Obihiro University of Agriculture and Veterinary Medicine

↓

↓ ← Advisory Board (6 specialists)

↓ (Marketing, Processing, QC etc.)

Tokachi Farmers →JA Tokachi Shimizu ← Tokachi Shimizu Food Service

(Executive Secretariat) (Processing)

↑

ZEFUCO

(Sales, Marketing)

Photo 5. TOKACHI Yearling Beef Logo and Sukiyaki sliced Beef

© JA TOKACHI SHIMIZU (Left), © Kenji Yamamoto (Right)

JA Tokachishimizu established Tokachi food service Company by investing 100% for boning, processing, cooking and selling by themselves.

JA Tokachishimizu is selling their yearling beef not only via ZEFUCO, but also directly selling to the end user such as restaurants and meat shops, through which they can collect comments, needs directly for a further improvement. As result of their effort has been raising the brand value of the TOKACHI Yearling beef, they succeeded raising 10~15% higher sales price for TOKACHI Yearling Beef than other regular Holstein steers. JA Tokachishimizu is aiming to export their Yearling beef to Asian countries in future.

CONCLUSION

In case of Japanese traditional type agricultural cooperative, its role is to collect farmer’s products and selling them at public markets. Therefore, not many agricultural cooperative did direct marketing to consumers. As a result, a number of agricultural cooperatives are exposed to the wave of the free trade without making appropriate improvement to follow the changes in the market.

However, in case of the TOKACHI Yearling Beef, an Agricultural cooperative has consistently achieved a business using Holstein steers, which was not valued world-widely before, as a high quality beef cattle at low production cost for a further processing and distribution to the market.

Currently they are successfully competing against the U.S. and Australian beef by conducting market survey and promotional activities by themselves, as well as participating in various events for further increasing consumer recognition and brand image, through which they have expanded sales routes and increasing returns.

I shall be more than happy if this report covering various activities developed by JA Tokachi-Shimizu for further giving additional value for Holstein Yearling Steers should be of any reference for the other every Asian country.

REFERENCES