INTRODUCTION

The system of agricultural cooperatives, known as the JA Group, plays a pivotal role in the structure and economics of Japan’s agricultural sector1 Although there is no legal requirement to join the JA Group, all Japanese farmers belong to the organization. JA Group has a hierarchical, nationwide network. The Central Union of Agricultural Cooperatives, known as Zenchu, has exercised leadership in nationwide activities of this Group.

The Japanese Prime Minister, Shinzo Abe, repeatedly argues that reforming the JA Group is a top priority in his new economic growth strategy. In this regard, Abe presents his reform plan of weakening the role of Zenchu. Namely, while Zenchu has been in charge of external audit for its member cooperatives (including their federations), Abe plans to introduce the auditing by audit corporations and certified public accountants, instead of Zenchu. According to this plan, a revision of the Agricultural Cooperatives Act (ACA) is currently being undertaken before the Diet.

There are both pros for and cons against Abe’s reform plan. Some support Abe’s plan as being a significant step to introduce more efficiency in the Japanese agricultural sector. Others disagree because they find no particular problems in the current system of Zenchu’s auditing.

The purpose of this paper is to describe the details of Zenchu’s current auditing system and not to present opinions to Abe’s reform. It is hoped that this information can form a foundation upon which to consider how Zenchu should be.

History of Japan’s external audit system

Before discussing Zenchu’s auditing system, it is useful to have a brief overview of Japan’s external audit system in general (i.e., auditing for private companies).

Accounting and auditing play a key role in business management in the current capitalist countries. The government is responsible for establishing and enforcing a public framework for accounting and auditing, to ensure proper market functioning. However, Japan’s framework for accounting and auditing lagged behind that of the European and North American countries before and during the Pacific War. For example, in 1927 the Japanese government authorized the social status of accountants for the first time. Even after 1927, accountants seldom worked for external auditing. Instead, contract works for preparation of financial statements, consultation for tax problems, and collections of loans were the major jobs of accountants. While the Commercial Law Act was established in 1899 and stipulated how to have internal audit, the law did not include any stipulation mentioning external audit by independent accountants.

The situation changed drastically when the occupied authorities initiated economic reforms after the Pacific War. Under their leadership, the Certified Public Accountants Act and the Securities and Exchange Act (SEA) were established in 1948. Accordingly, the Auditing Standards, the Working Rules of Auditing Procedure, and the Regulations for Financial Statements were announced in 1950. However, the reform was so drastic that Japanese business society found difficulties in adopting these rules, regulations, and standards. Thus, the government set a transition period till 1956. The Working Rules of Audit Reports were stipulated in 1956, and simultaneously, the transition period terminated as scheduled. As such, 1956 is recognized as the year when the formal system of external auditing started in Japan. In order to improve the efficiency and consistency of the external audit system, the Auditing Standards, the Working Rules of Auditing Procedure, and the Working Rules of Auditing Reports have been occasionally revised since then2.

In 1974, as a law for special cases for the Commercial Law Act, the Act on Special Provisions on the Commercial Code Concerning Audits, etc. of Stock Companies (ASPCCCA) was established. This was the first instance in Japan that large-sized companies were obliged to receive external auditing by independent accountants.

In establishing the ASPCCCA, the legal framework for auditing became a dualistic structure. One is the set of rules for the disclosure of financial conditions stipulated by the SEA. The other is the set of rules for auditing by external professional accountants as stipulated by the ASPCCCA.

In 2007, at the same time of the revision of the Commercial Law Act and the abolishment of the ASPCCCA, the Companies Act was established. This was considered a top accomplishment because various regulations on private companies’ activities were integrated into a comprehensive framework. Since then, instead of the ASPCCCA, the Companies Act stipulates the rules of external auditing. In 2008, the SEA was replaced by a new law—the Financial Instruments and Exchange Act (FIEA). However, these revisions did not affect the dualistic structure of the legal framework for external auditing: rules for the disclosure of financial conditions that became (and still are) stipulated by the FIEA, and those for auditing by external professional accountants that became (and still are) stipulated by the Companies Act.

Zenchu’s position in the JA Group

Before discussing Zenchu’s auditing, it is useful to review the structure of the JA Group and Zenchu’s position within it. The JA Group has a three-tier structure as shown in Figure 1. Unit cooperatives in villages, towns, and cities constitute the first level, and are in direct contact with farmers. The Prefectural Central Unions of Agricultural Cooperatives (PCUs) in the prefectures constitute the second level. Each prefecture has its own PCU, to which all the unit cooperatives in the prefecture belong. Zenchu constitutes the third and top level.

In addition, aiming to improve their bargaining power in the market, unit cooperatives form various federations, such as the Prefectural Economic Federations of Agricultural Cooperatives and the Prefectural Credit Federations of Agricultural Cooperatives. As the top organization of the JA Group, Zenchu supervises the activities of unit cooperatives and federations of agricultural cooperatives.

Outline of Zenchu’s auditing

Establishment of Zenkoku Kansa Kikou for Zenchu’s auditing

As a non-profitable organization, agricultural cooperatives of the JA Group have a unique auditing system, which has changed with time. For years, each PCU audited unit cooperatives in the prefecture, works in collaboration with Zenchu. However, this auditing system had two problems. First, the neutrality of auditing was sometimes questioned. For example, it was not seldom that a board member of unit cooperatives doubled that of a PCU. Second, since each PCU had its own auditing system, the standards for auditing were not unified among prefectures.

In 2002, as a solution to these problems, Zenchu established Zenkoku Kansa Kikou (which literallyt translates to “National Auditing Organization”), a new department specializing in auditing jobs. All the auditing jobs that Zenchu and PCUs had done earlier were then transferred to Zenkoku Kansa Kikou.

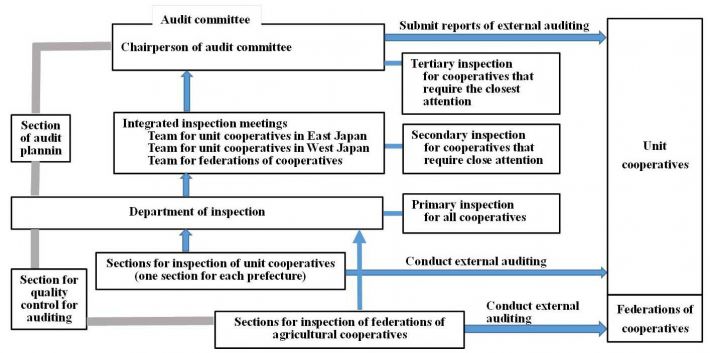

Zenchu’s auditing system is still in the process of improvement. The current auditing system is shown in Figure 2.

Number of unit cooperatives and federations that receive Zenchu’s auditing

Unit cooperatives with deposits worth over 20 billion yen and federations of agricultural cooperatives with debts over 20 billion yen are called “designated cooperatives,” and were required to receive Zenchu’s auditing. However, it is optional for unit cooperatives and federations of agricultural cooperatives not to meet the above-mentioned conditions regarding whether or not they receive Zenchu’s auditing. In reality, however, in order to maintain the transparency of the management, all unit cooperatives and federations receive Zenchu’s auditing.3

Difference of Zenchu’s auditing under the ACA from certified public accountants’ external auditing under the Companies Act and the FIEA

Zenchu’s objective is to promote steady development of cooperative activities, and its auditing is done as a means towards this. Thus, the expected role of Zenchu’s auditing is bigger than the certified public accountants’ external auditing for private companies.

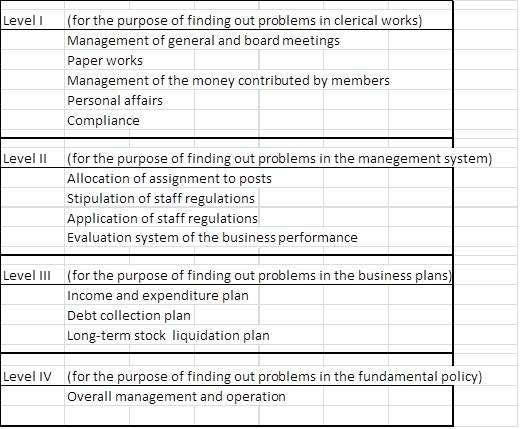

Zenchu’s auditing comprises two parts: Kaikei Kansa (literal translation is auditing of financial conditions) and Gyomu Kansa (literal translation is auditing of operations). Although agricultural cooperatives are non-profit foundations, their activities are similar to those of private companies. Thus, the basic idea and methodology of Kaikei Kansa is consistent with the certified public accountants’ external auditing under the Companies Act and the FIEA. In contrast, Gyomu Kansa is unique to Zenchu’s auditing. Through this, Zenchu has heavy commitments on agricultural cooperatives’ activities. According to the significance of guidance, Zenchu classifies the contents of Gyomu Kansa into four levels as shown in Table 1.

Internal auditing and Zenchu’s auditing

The ACA requires each agricultural cooperative to have its own auditor(s), who is (are) responsible for internal audit.

The assignment of auditor(s) is different according to whether the agricultural cooperative is a designated cooperative or not. In the case of designated cooperatives, Zenchu plays the core role of auditing. Zenchu reports results from its auditing to the board members and an auditor (or auditors) of the agricultural cooperatives. The auditor judges (or the auditors judge) whether methodologies and results of Zenchu’s auditing are appropriate. If an auditor finds (or auditors find) any problem in Zenchu’s auditing, he or she is (or they are) responsible for requesting Zenchu to repeat the audit after making necessary improvements.

In the case of non-designated cooperatives, Zenchu’s auditing is not compulsory, and only auditors owe primal responsibility for auditing. However, even in non-designated cooperatives, auditors are allowed to receive Zenchu’s support in auditing. As mentioned before, in reality, all the non-designated cooperatives receive Zenchu’s auditing voluntarily, and use its results in auditors’ auditing.

Special license for auditing agricultural cooperatives

Those who conduct Zenchu’s auditing need a strong law-abiding spirit and high-level knowledge of accounting. Thus, they are required to obtain a special license, called “agricultural cooperative auditor.” The license is given to those who satisfy the following three conditions.

(i) Pass the examination for “agricultural cooperative auditor” conducted by Zenchu.

(ii) Work for more than one year at the section of Zenchu’s auditing and receive training for auditing agricultural cooperatives.

(iii) Satisfy at least one of the following three conditions

(a) Work for more than two years at a PCU’s or Zenchu’s section of auditing as an assistant to those who have the license.

(b) Work for more than two years at some of Zenchu’s positions to give guidance to the top management of unit cooperatives.

(c) Work for more than two years at some of a unit cooperative’s sections for financial management of the banking businesses, cost accounting, financial analysis, and/or internal auditing.

Role of audit corporations and certified public accountants

Zenchu itself is a part of the JA Group. This implies the risk of losing neutrality of its auditing for agricultural cooperatives. In order to minimize such a risk, the ACA requires Zenchu to include audit corporations and certified public accountants in its auditing for agricultural cooperatives.

REFERENCES

Godo, Y., “Estimating Agricultural Cooperatives’ Share of Agricultural Input and Output Market,” FFTC-AP Agricultural Policy Platform (Food & Fertilizer Technology Center for the Asian and Pacific Region) March 2, 2015. Available at http://ap.fftc.agnet.org/ap_db.php?id= 389

Godo, Y., “The Japanese Agricultural Cooperative System: An Outline,” FFTC-AP Agricultural Policy Platfrom (Food & Fertilizer Technology Center for the Asian and Pacific Region) May 30, 2014. Available at http://ap.fftc.agnet.org/ap_db.php?id=248

Godo, Y., “The Changing Economic Performance and Political Significance of Japan’s Agricultural Cooperatives,” Pacific Economic Papers (Australia-Japan Research Centre, Australian National University), No 318, August 2001. Available at http://www.crawford.anu.edu.au/pdf/pep/pep-318.pdf

Central Union of Agricultural Cooperatives, Kansa no Riron to JA no Kansa Jitsumu (9th version), April 2014.

Footnotes

1The function and characteristics of the JA Group are discussed in Godo (2001, 2014, and 2015).

2In restructuring the legal framework of auditing, the Working Rules of Auditing Procedure and the Working Rules of Auditing Reports were abolished in 2002.

3When Zenkoku Kansa Kikou started in 2002, 62 % of unit cooperatives received Zenchu’s auditing. The percentage increased to 100 in 2005. Since then, all unit cooperatives have been receiving Zenchu’s auditing.

.jpg)

Fig. 1. Three-tier structure of the JA Group

Note: If a prefecture has its own prefectural economic federation of agricultural cooperatives

(or its own prefectural credit federation of agricultural cooperatives),

all unit cooperatives in the prefecture belong to it. If not, unit cooperatives directly

beong to Zen-no (or Norinchukin Bank)

Fig. 2. The system of Zenkoku Kansa Kikou (Zenchu’s external audit system for agricultural cooperatives)

Source: Central Union of Agricultural Cooperatives (2014) with the author’s modification and translation.

Table 1. Contents of Gyomu Kansa

Source: Central Union of Agricultural Cooperatives (2014) with the author’s modification and translation.

|

Date submitted: July 27, 2015

Reviewed, edited and uploaded: July 28, 2015

|

External Audit System of Japanese Agricultural Cooperatives

INTRODUCTION

The system of agricultural cooperatives, known as the JA Group, plays a pivotal role in the structure and economics of Japan’s agricultural sector1 Although there is no legal requirement to join the JA Group, all Japanese farmers belong to the organization. JA Group has a hierarchical, nationwide network. The Central Union of Agricultural Cooperatives, known as Zenchu, has exercised leadership in nationwide activities of this Group.

The Japanese Prime Minister, Shinzo Abe, repeatedly argues that reforming the JA Group is a top priority in his new economic growth strategy. In this regard, Abe presents his reform plan of weakening the role of Zenchu. Namely, while Zenchu has been in charge of external audit for its member cooperatives (including their federations), Abe plans to introduce the auditing by audit corporations and certified public accountants, instead of Zenchu. According to this plan, a revision of the Agricultural Cooperatives Act (ACA) is currently being undertaken before the Diet.

There are both pros for and cons against Abe’s reform plan. Some support Abe’s plan as being a significant step to introduce more efficiency in the Japanese agricultural sector. Others disagree because they find no particular problems in the current system of Zenchu’s auditing.

The purpose of this paper is to describe the details of Zenchu’s current auditing system and not to present opinions to Abe’s reform. It is hoped that this information can form a foundation upon which to consider how Zenchu should be.

History of Japan’s external audit system

Before discussing Zenchu’s auditing system, it is useful to have a brief overview of Japan’s external audit system in general (i.e., auditing for private companies).

Accounting and auditing play a key role in business management in the current capitalist countries. The government is responsible for establishing and enforcing a public framework for accounting and auditing, to ensure proper market functioning. However, Japan’s framework for accounting and auditing lagged behind that of the European and North American countries before and during the Pacific War. For example, in 1927 the Japanese government authorized the social status of accountants for the first time. Even after 1927, accountants seldom worked for external auditing. Instead, contract works for preparation of financial statements, consultation for tax problems, and collections of loans were the major jobs of accountants. While the Commercial Law Act was established in 1899 and stipulated how to have internal audit, the law did not include any stipulation mentioning external audit by independent accountants.

The situation changed drastically when the occupied authorities initiated economic reforms after the Pacific War. Under their leadership, the Certified Public Accountants Act and the Securities and Exchange Act (SEA) were established in 1948. Accordingly, the Auditing Standards, the Working Rules of Auditing Procedure, and the Regulations for Financial Statements were announced in 1950. However, the reform was so drastic that Japanese business society found difficulties in adopting these rules, regulations, and standards. Thus, the government set a transition period till 1956. The Working Rules of Audit Reports were stipulated in 1956, and simultaneously, the transition period terminated as scheduled. As such, 1956 is recognized as the year when the formal system of external auditing started in Japan. In order to improve the efficiency and consistency of the external audit system, the Auditing Standards, the Working Rules of Auditing Procedure, and the Working Rules of Auditing Reports have been occasionally revised since then2.

In 1974, as a law for special cases for the Commercial Law Act, the Act on Special Provisions on the Commercial Code Concerning Audits, etc. of Stock Companies (ASPCCCA) was established. This was the first instance in Japan that large-sized companies were obliged to receive external auditing by independent accountants.

In establishing the ASPCCCA, the legal framework for auditing became a dualistic structure. One is the set of rules for the disclosure of financial conditions stipulated by the SEA. The other is the set of rules for auditing by external professional accountants as stipulated by the ASPCCCA.

In 2007, at the same time of the revision of the Commercial Law Act and the abolishment of the ASPCCCA, the Companies Act was established. This was considered a top accomplishment because various regulations on private companies’ activities were integrated into a comprehensive framework. Since then, instead of the ASPCCCA, the Companies Act stipulates the rules of external auditing. In 2008, the SEA was replaced by a new law—the Financial Instruments and Exchange Act (FIEA). However, these revisions did not affect the dualistic structure of the legal framework for external auditing: rules for the disclosure of financial conditions that became (and still are) stipulated by the FIEA, and those for auditing by external professional accountants that became (and still are) stipulated by the Companies Act.

Zenchu’s position in the JA Group

Before discussing Zenchu’s auditing, it is useful to review the structure of the JA Group and Zenchu’s position within it. The JA Group has a three-tier structure as shown in Figure 1. Unit cooperatives in villages, towns, and cities constitute the first level, and are in direct contact with farmers. The Prefectural Central Unions of Agricultural Cooperatives (PCUs) in the prefectures constitute the second level. Each prefecture has its own PCU, to which all the unit cooperatives in the prefecture belong. Zenchu constitutes the third and top level.

In addition, aiming to improve their bargaining power in the market, unit cooperatives form various federations, such as the Prefectural Economic Federations of Agricultural Cooperatives and the Prefectural Credit Federations of Agricultural Cooperatives. As the top organization of the JA Group, Zenchu supervises the activities of unit cooperatives and federations of agricultural cooperatives.

Outline of Zenchu’s auditing

Establishment of Zenkoku Kansa Kikou for Zenchu’s auditing

As a non-profitable organization, agricultural cooperatives of the JA Group have a unique auditing system, which has changed with time. For years, each PCU audited unit cooperatives in the prefecture, works in collaboration with Zenchu. However, this auditing system had two problems. First, the neutrality of auditing was sometimes questioned. For example, it was not seldom that a board member of unit cooperatives doubled that of a PCU. Second, since each PCU had its own auditing system, the standards for auditing were not unified among prefectures.

In 2002, as a solution to these problems, Zenchu established Zenkoku Kansa Kikou (which literallyt translates to “National Auditing Organization”), a new department specializing in auditing jobs. All the auditing jobs that Zenchu and PCUs had done earlier were then transferred to Zenkoku Kansa Kikou.

Zenchu’s auditing system is still in the process of improvement. The current auditing system is shown in Figure 2.

Number of unit cooperatives and federations that receive Zenchu’s auditing

Unit cooperatives with deposits worth over 20 billion yen and federations of agricultural cooperatives with debts over 20 billion yen are called “designated cooperatives,” and were required to receive Zenchu’s auditing. However, it is optional for unit cooperatives and federations of agricultural cooperatives not to meet the above-mentioned conditions regarding whether or not they receive Zenchu’s auditing. In reality, however, in order to maintain the transparency of the management, all unit cooperatives and federations receive Zenchu’s auditing.3

Difference of Zenchu’s auditing under the ACA from certified public accountants’ external auditing under the Companies Act and the FIEA

Zenchu’s objective is to promote steady development of cooperative activities, and its auditing is done as a means towards this. Thus, the expected role of Zenchu’s auditing is bigger than the certified public accountants’ external auditing for private companies.

Zenchu’s auditing comprises two parts: Kaikei Kansa (literal translation is auditing of financial conditions) and Gyomu Kansa (literal translation is auditing of operations). Although agricultural cooperatives are non-profit foundations, their activities are similar to those of private companies. Thus, the basic idea and methodology of Kaikei Kansa is consistent with the certified public accountants’ external auditing under the Companies Act and the FIEA. In contrast, Gyomu Kansa is unique to Zenchu’s auditing. Through this, Zenchu has heavy commitments on agricultural cooperatives’ activities. According to the significance of guidance, Zenchu classifies the contents of Gyomu Kansa into four levels as shown in Table 1.

Internal auditing and Zenchu’s auditing

The ACA requires each agricultural cooperative to have its own auditor(s), who is (are) responsible for internal audit.

The assignment of auditor(s) is different according to whether the agricultural cooperative is a designated cooperative or not. In the case of designated cooperatives, Zenchu plays the core role of auditing. Zenchu reports results from its auditing to the board members and an auditor (or auditors) of the agricultural cooperatives. The auditor judges (or the auditors judge) whether methodologies and results of Zenchu’s auditing are appropriate. If an auditor finds (or auditors find) any problem in Zenchu’s auditing, he or she is (or they are) responsible for requesting Zenchu to repeat the audit after making necessary improvements.

In the case of non-designated cooperatives, Zenchu’s auditing is not compulsory, and only auditors owe primal responsibility for auditing. However, even in non-designated cooperatives, auditors are allowed to receive Zenchu’s support in auditing. As mentioned before, in reality, all the non-designated cooperatives receive Zenchu’s auditing voluntarily, and use its results in auditors’ auditing.

Special license for auditing agricultural cooperatives

Those who conduct Zenchu’s auditing need a strong law-abiding spirit and high-level knowledge of accounting. Thus, they are required to obtain a special license, called “agricultural cooperative auditor.” The license is given to those who satisfy the following three conditions.

(i) Pass the examination for “agricultural cooperative auditor” conducted by Zenchu.

(ii) Work for more than one year at the section of Zenchu’s auditing and receive training for auditing agricultural cooperatives.

(iii) Satisfy at least one of the following three conditions

(a) Work for more than two years at a PCU’s or Zenchu’s section of auditing as an assistant to those who have the license.

(b) Work for more than two years at some of Zenchu’s positions to give guidance to the top management of unit cooperatives.

(c) Work for more than two years at some of a unit cooperative’s sections for financial management of the banking businesses, cost accounting, financial analysis, and/or internal auditing.

Role of audit corporations and certified public accountants

Zenchu itself is a part of the JA Group. This implies the risk of losing neutrality of its auditing for agricultural cooperatives. In order to minimize such a risk, the ACA requires Zenchu to include audit corporations and certified public accountants in its auditing for agricultural cooperatives.

REFERENCES

Godo, Y., “Estimating Agricultural Cooperatives’ Share of Agricultural Input and Output Market,” FFTC-AP Agricultural Policy Platform (Food & Fertilizer Technology Center for the Asian and Pacific Region) March 2, 2015. Available at http://ap.fftc.agnet.org/ap_db.php?id= 389

Godo, Y., “The Japanese Agricultural Cooperative System: An Outline,” FFTC-AP Agricultural Policy Platfrom (Food & Fertilizer Technology Center for the Asian and Pacific Region) May 30, 2014. Available at http://ap.fftc.agnet.org/ap_db.php?id=248

Godo, Y., “The Changing Economic Performance and Political Significance of Japan’s Agricultural Cooperatives,” Pacific Economic Papers (Australia-Japan Research Centre, Australian National University), No 318, August 2001. Available at http://www.crawford.anu.edu.au/pdf/pep/pep-318.pdf

Central Union of Agricultural Cooperatives, Kansa no Riron to JA no Kansa Jitsumu (9th version), April 2014.

Footnotes

1The function and characteristics of the JA Group are discussed in Godo (2001, 2014, and 2015).

2In restructuring the legal framework of auditing, the Working Rules of Auditing Procedure and the Working Rules of Auditing Reports were abolished in 2002.

3When Zenkoku Kansa Kikou started in 2002, 62 % of unit cooperatives received Zenchu’s auditing. The percentage increased to 100 in 2005. Since then, all unit cooperatives have been receiving Zenchu’s auditing.

Fig. 1. Three-tier structure of the JA Group

Note: If a prefecture has its own prefectural economic federation of agricultural cooperatives

(or its own prefectural credit federation of agricultural cooperatives),

all unit cooperatives in the prefecture belong to it. If not, unit cooperatives directly

beong to Zen-no (or Norinchukin Bank)

Fig. 2. The system of Zenkoku Kansa Kikou (Zenchu’s external audit system for agricultural cooperatives)

Source: Central Union of Agricultural Cooperatives (2014) with the author’s modification and translation.

Table 1. Contents of Gyomu Kansa

Source: Central Union of Agricultural Cooperatives (2014) with the author’s modification and translation.

Date submitted: July 27, 2015

Reviewed, edited and uploaded: July 28, 2015